it has agreed to perform to affiliated managers (such as Shanghai Costamare), V.Ships Greece or, subject to our consent, other third-party managers, either through subcontracting or by directing the applicable manager to enter into a direct ship management agreement with the relevant containership- owning subsidiary, then, in the case of subcontracting, Costamare Shipping will be responsible for paying the management fee charged by the relevant sub-manager for providing such services and, in the case of a direct ship management agreement, the fee received by Costamare Shipping will be reduced by the fee payable to the applicable manager under the relevant direct ship management agreement. As a result, these arrangements will not result in any increase in the aggregate management fees we pay. In addition to management fees, we will pay for any capital expenditures, financial costs, operating expenses and any general and administrative expenses, including the salaries of the officers and employees of our general partner and payments to third parties in accordance with the partnership management agreement and the relevant separate ship management agreements or, if we enter into any ship building contracts, supervision agreements. We will also pay to Costamare Shipping a flat fee of $787,405 per newbuild vessel for the supervision of the construction of any newbuild vessel that we may contract. Such fee will be subject to annual negotiation subsequent to the expiry of the initial term of the partnership management agreement and may be further adjusted to reflect any strengthening of the Euro against the U.S. dollar and/or material unforeseen cost increases. Costamare Shipping also receives a fee of 0.75% on all gross freight, demurrage, charter hire, ballast bonus or other income earned with respect to each containership in our fleet.

Pursuant to the terms of our partnership management agreement and the related separate ship management agreements and supervision agreements, liability of our managers to us or our general partner is limited to instances of gross negligence or willful misconduct on the part of the managers. Further, we are required to indemnify the managers for liabilities incurred by the managers in performance of the partnership management agreement and the related ship management agreements and supervision agreements, except in instances of gross negligence or willful misconduct on the part of the managers.

A time charter is a contract to charter a vessel for a fixed period of time at a set daily rate and can last from a few days up to several years. Under our time charters the charterer pays for most voyage expenses, which generally include, among other things, fuel costs, port and canal charges, pilotages, towages, agencies, commissions, extra war risks insurance and any other expenses related to the cargoes, and we pay for vessel operating expenses, which generally include, among other costs, costs for crewing, provisions, stores, lubricants, insurance, maintenance and repairs, dry-docking and intermediate and special surveys.

The following discussion describes the material terms of the time charters for our ships.

Initial Term, Extensions and Redelivery

The initial terms of the time charters for theCosco Beijing, theMSC Athens, theMSC Athosand theValuebegan upon delivery of the ships in June 2006, March 2013, April 2013 and June 2013, respectively, and will terminate between April 2018 and February 2023, as applicable. The charters have a fixed term and do not include any extension options, except for the charter on theValue, which grants each party an option to extend the charter for two additional one-year periods. Our time charters provide for redelivery of the ship to us at the expiration of the term, as such term may be extended upon charterer’s or our exercise of the extension option, or upon earlier termination of the charter (as described below), plus or minus 45 days or 60 days, as applicable. Under the charters for theCosco Beijingand theValue, the charterer has the right to extend the term for most periods in which the vessel is off-hire, as described below. If we exercise our option to sell theValueduring the charter term, the charterer has a right of first refusal to the sale. Our charter contracts do not provide the charterers with options to purchase our ships upon expiration of the charter term.

Hire Rate Provisions

“Hire” rate refers to the basic payment from the customer for use of the ship. Under all of our time charters, the hire rate is payable to us every 15 days in advance in U.S. dollars. Our charters contain fixed daily hire rate provisions that apply during the fixed term of the charters and, in the case of theValue, any option periods.

Off-Hire

When a ship is “off-hire”, or not available for service, a time charterer generally is not required to pay the hire rate, and we remain responsible for all costs. A ship generally will be deemed off-hire under our time charters if there is a specified time outside of the annual allowance period when the ship is not available for the charterer’s use due to, among other things, operational deficiencies (including the failure to maintain a certain guaranteed speed), dry-docking for examination or painting bottom, maintenance or inspection, equipment breakdowns, deficiency of personnel or neglect of duty by the ship’s officers or crew, deviation from course, or delays due to arrests, requisition, ship detentions or similar problems.

All ships are dry-docked at least once every five years as required by the ship’s classification society for a special survey. Our ships are considered to be off-hire under our time charters during such periods.

Ship Management and Maintenance

Under the charters, we are responsible for the technical management of our vessels, including engaging and providing qualified crews, maintaining the vessel, arranging supply of stores and equipment, periodic dry-docking, cleaning and painting and ensuring compliance with applicable regulations, including licensing and certification requirements. The vessels in our initial fleet will be managed by Costamare’s affiliated manager, Costamare Shipping, unless Costamare Shipping decides to subcontract or delegate certain of its management services to an affiliated manager (such as Shanghai Costamare), V.Ships Greece or, subject to our consent, other third party managers. Our

165

obligations and performance under the charters for theCosco Beijingand theValueare guaranteed by Costamare in favor of the respective charterers.

Termination and Cancellation

Under our time charters, each party has the right to cancel the charter under certain circumstances, which include, among other things, our right to withdraw the vessel from the service of the charterers for failure to make punctual and regular payment of the hire. Under theCosco Beijingcharter, the charterer has an option to cancel the charter in the event of a requisition or a failure of the vessel to maintain certain minimum speed, and either party may cancel the charter in the event of an outbreak of war involving two or more specified nations, which include the United States and the People’s Republic of China. Under the charters for theMSC Athensand theMSC Athos, the charterers have the option to cancel the charter if loss of time due to boycott or government restrictions caused by the vessel’s flag, ownership, crew or employment terms is not remedied within 96 working hours. Under theValuecharter, if the vessel is blocked or trapped in an area exposed to war risks for a period of 365 days, the charter is automatically terminated. In addition, the charterer of theCosco Beijinghas the option to terminate the charter if the vessel is off-hire for any reason other than scheduled dry- docking for a period exceeding 45 days on a cumulative basis in any 365-day period. The charterer of theValuealso has the option to terminate the charter if the vessel is off-hire for any reason other than scheduled dry-docking for more than one period of 60 consecutive full days during the course of the charter.

Technical and Operational Management

Pursuant to the ship management agreements, through Costamare Shipping and, as applicable, any other managers, we manage the day-to-day aspects of ship operations, including crewing, training, insurance, maintenance and repair, procurement of supplies, regulatory and classification compliance and HSSE management and reporting, for our initial fleet. In connection with the offering, we expect to enter into an addendum for each of the existing ship management agreements for our initial fleet such that our operating subsidiaries will continue to be party to such agreements pursuant to the partnership management agreement.

Management of Our Fleet

Costamare Shipping will provide us with general administrative services, certain commercial services, director and officer, or “D&O”, related insurance services and the services of our general partner’s executive officers pursuant to the partnership management agreement to be entered into by Costamare Shipping, our general partner and us at the time of the closing of this offering. The partnership management agreement permits Costamare Shipping to subcontract certain of its obligations or to direct our subsidiaries to enter into direct management agreement with other third-party managers with respect to such obligations. Costamare Shipping, itself or through Shanghai Costamare, V.Ships Greece, or, in certain cases, subject to our consent, other third-party managers, will provide our current fleet of containerships with technical, crewing, commercial, provisioning, bunkering, sale and purchase, chartering, accounting, insurance and administrative services pursuant to the partnership management agreement and the related ship management agreements between each of our containership-owning subsidiaries and Costamare Shipping or, in certain cases, V.Ships Greece. As described below, the Cell under V.Ships Greece is the exclusive third-party manager of Costamare Shipping (except for a limited number of vessels in Costamare’s fleet, which does not currently include any of the vessels in our initial fleet, that may be managed by other third-party managers). The Cell also actively seeks opportunities to manage vessels for third parties. Upon the closing of the offering, the vessels in our initial fleet are expected to be managed by Costamare Shipping without any subcontracting or delegation arrangements.

In return for these services, we and our general partner pay the management fees described below in this section and elsewhere in this prospectus. Our affiliated managers, Costamare Shipping and Shanghai Costamare, control the selection and employment of seafarers for our containerships, directly through their crewing offices in Athens, Greece and Shanghai, China, and indirectly through

166

a crewing agent in the Philippines, C-Man Maritime, and independent manning agents in Romania and Bulgaria. The seafarers for our containerships managed by V.Ships Greece are arranged in part through C-Man Maritime and in part through V.Ships Greece (which utilizes the global V.Group network) under the Co-operation Agreement. As discussed below and elsewhere in this prospectus, these arrangements will not result in any increase in the aggregate amount of management fees we and our general partner pay. We believe that having multiple management companies provides us with a deep pool of operational management in multiple locations with market-specific experience and relationships, as well as the geographic flexibility needed to manage and crew our fleet so as to provide a high level of service, while remaining cost-effective. For example, Shanghai Costamare employs Chinese nationals with the language skills and local knowledge we believe are necessary to grow and establish meaningful relationships with Chinese shipyards, charterers, ship-owners, financial institutions and containership service providers. The Cell under V.Ships Greece provides added operational flexibility and economies of scale while maintaining a high level of management services.

Costamare Shipping and Shanghai Costamare are controlled by the chairman and chief executive officer of our general partner. The chairman and chief executive officer and chief financial officer of our general partner supervise, in conjunction with the board of directors of our general partner, the services provided by our managers. Costamare Shipping reports to our general partner through its chairman and chief executive officer and chief financial officer, each of whom is appointed by Costamare. Under the partnership management agreement, we and our general partner are responsible for the cost of the compensation and benefits for our general partner’s executive officers. We could request that Costamare Shipping provide the services of additional officers or employees to us and our general partner pursuant to the partnership management agreement, in which case we and our general partner would be responsible for the cost of their compensation and benefits.

Costamare Shipping, which was established in 1975, is a ship management company which was owned by Vasileios Konstantakopoulos until June 2010, at which point ownership was transferred to the chairman and chief executive officer of our general partner. Costamare Shipping has 41 years of experience in managing containerships of all sizes, developing specifications for newbuild vessels and supervising the construction of such newbuild vessels in reputable shipyards in the Far East. Costamare Shipping has long established relationships with major liner companies, financial institutions and suppliers and we believe is recognized in the containership shipping industry as a leading containership manager. Costamare Shipping provides commercial services and insurance services to all our containerships. Costamare Shipping also provides, either directly or through another manager, as applicable, technical, crewing, provisioning, bunkering, sale and purchase and accounting services to our containerships. For the vessels in our initial fleet, all of these ship management services are provided by Costamare Shipping pursuant to separate ship management agreements between Costamare Shipping and each of our containership-owning subsidiaries. In connection with the offering, we expect to enter into an addendum for each of the existing ship management agreements for our initial fleet such that our operating subsidiaries will continue to be party to such agreements pursuant to the partnership management agreement.

Shanghai Costamare, which was established in February 2005, is owned (indirectly) 70% by our general partner’s chairman and chief executive officer, and (indirectly) 30% by Shen Xiao Dong, a Chinese national who is Shanghai Costamare’s general manager. Shanghai Costamare will be able to service the needs of our containerships when operating in the Far East and South East Asia regions in an efficient and cost-effective manner by providing dedicated on-shore support and manning services in China, and provide a valuable interface with Chinese shipyards, charterers, ship-owners, financial institutions and containership service providers. While none of the vessels in our initial fleet is currently managed by Shanghai Costamare, Costamare may subcontract certain of its obligations to Shanghai Costamare. Any vessels managed by Shanghai Costamare may be exclusively manned by Chinese crews, which means that the Chinese on-shore personnel of Shanghai Costamare can communicate and provide integrated services and support to these containerships in the most efficient manner. Shanghai Costamare provides these services for a fixed daily fee, pursuant to separate ship management agreements between Costamare Shipping and Shanghai Costamare.

167

On January 7, 2013, Costamare Shipping entered into a Co-operation Agreement with V.Ships Greece, a member of V.Group, pursuant to which the two companies established the Cell within V.Ships Greece to provide management services to certain of our containerships. The Cell also offers ship management services to third-party owners, including one JV vessel in Costamare’s fleet. The net profit from the operation of the Cell relating to the Partnership’s containerships is passed on to Costamare Shipping to the extent it exceeds $20,000 per vessel while the net profit from the operation of the Cell related to third-party owners is split equally between V.Ships Greece and Costamare Shipping. No such profit was passed to our Predecessor in 2013. Costamare Shipping has certain control rights regarding the employment and dismissal of the Cell’s personnel, the appointment of the Cell’s senior managers and the management of vessels owned by third parties. Costamare Shipping or V.Ships Greece may terminate the Co-operation Agreement upon six months’ notice.

Although the Cell will be operated pursuant to the Co-operation Agreement between Costamare Shipping and V.Ships Greece, it is not controlled by Costamare Shipping and we do not consider it to be an affiliated manager.

We believe that our affiliated managers, Costamare Shipping and Shanghai Costamare, are well regarded in the industry and have used innovative practices and technological advancement to maximize efficiency in the operation of our fleet of containerships. V.Ships Greece is a member of V.Group, one of the largest providers of ship management services worldwide. ISM certification is in place for our fleet of containerships and our affiliated managers, with Costamare Shipping, our head manager under the partnership management agreement, having obtained such certification in 1998, three years ahead of the deadline set by the IMO. Costamare Shipping, Shanghai Costamare and V.Ships Greece are also certified in accordance with ISO 9001-2008 and ISO 14001-2004 relating to quality management and environmental standards. In 2013, Costamare received the Lloyd’s List Greek shipping award for Dry Cargo Company of the Year. Costamare Shipping received that same award in 2004. Additionally, in 2014, Costamare received the Lloyd’s List Company of the Year award. As of December 31, 2014, our affiliated managers did not manage containerships other than those owned by Costamare, which included the four containerships in our initial fleet, and by vessel-owning entities formed under the Framework Agreement. Costamare Shipping is expected to provide commercial and insurance services as well as technical, crewing, provisioning, bunkering, sale and purchase and accounting services to all of the containerships in our initial fleet.

Costamare Shipping has agreed that, during the term of the partnership management agreement, it will not provide any management services to any other entity without our prior written approval. We have consented to Costamare Shipping providing management services to the Costamare fleet, including JV vessels. The partnership management agreement does not prohibit Shanghai Costamare from providing services to third parties. In the past, Shanghai Costamare has only provided services to third parties on a limited basis and there is no current plan to change that practice. The Co-operation Agreement anticipates that the Cell will continue to actively seek to provide ship management services to third-party owners in order to capitalize on the ship management expertise of the Cell and the economies of scale brought by the affiliation with V.Group.

Under the restrictive covenant agreement between Costamare and Konstantinos Konstantakopoulos, during the period of his employment or service with Costamare and for six months thereafter, he has agreed to restrictions on his ownership of any containerships or the acquisition, investment in or control of any business involved in the ownership or operation of containerships, subject to certain exceptions. Konstantinos Konstantakopoulos has also agreed that if one of Costamare’s containerships and a containership owned by him are both available and meet the criteria for an available charter, Costamare’s containerships will receive such charter. Under the omnibus agreement, Costamare has agreed that if Konstantinos Konstantakopoulos is required to offer a vessel or business to Costamare that Costamare in turn would be required to offer to us under the non-competition provisions of that agreement, our general partner can require Costamare to exercise its right under the restrictive covenant agreement and cause such vessel or business to be offered to us, in accordance with the non-competition provisions of the omnibus agreement. See “Certain Relationships and Related Party Transactions—Agreements Governing the Transactions—Restrictive Covenant Agreement”.

168

Costamare Shipping receives a fee in 2015 of $956 per day or, in the case of a containership subject to a bareboat charter, $478 per day, for each containership, pro rated for the calendar days we own each containership, for providing us and our general partner with general administrative services, certain commercial services, D&O related insurance services and the services of our general partner’s officers (but not for providing funds for the compensation or benefits of such officers) and for providing the relevant containership-owning subsidiaries with technical, commercial, insurance, accounting, provisioning, chartering, sale and purchase, crewing, bunkering and administrative services. In 2014 such amounts were $919 and $460, respectively. In the event that Costamare Shipping decides to delegate certain or all of the services it has agreed to perform, either through subcontracting or by directing such manager to enter into a direct ship management agreement with the relevant containership-owning subsidiary, then, in the case of subcontracting, Costamare Shipping will be responsible for paying the management fee charged by the relevant sub-manager for providing such services and, in the case of a direct ship management agreement, the fee received by Costamare Shipping will be reduced by the fee payable to the applicable manager under the relevant direct ship management agreement. As a result, these arrangements will not result in any increase in the aggregate management fees we pay.

In addition to management fees, we pay for any capital expenditures, financial costs, operating expenses and any general and administrative expenses, including the salaries of our general partner’s officers and employees and payments to third parties, including specialist providers, in accordance with the partnership management agreement and the relevant separate ship management agreements or supervision agreements. We also pay to Costamare Shipping a flat fee of $787,405 per newbuild vessel for the supervision of the construction of any newbuild vessel for which we may contract. Such fee will be subject to annual negotiation subsequent to the expiry of the initial term of the partnership management agreement and may be further adjusted to reflect any strengthening of the Euro against the U.S. dollar and/or material unforeseen cost increases. Costamare Shipping also receives a fee of 0.75% on all gross freight, demurrage, charter hire and ballast bonus or other income earned with respect to each containership in our fleet. The initial term of the partnership management agreement expires on December 31, 2015. The partnership management agreement automatically renews for five consecutive one-year periods until December 31, 2020, at which point the partnership management agreement will expire. Subsequent to the expiry of the initial term of the partnership management agreement, the daily management fee for each containership will be subject to annual negotiation and may be further adjusted to reflect any strengthening of the Euro against the U.S. dollar and/or material unforeseen cost increases. After the initial term expires on December 31, 2015, we will be able to terminate the partnership management agreement, subject to a termination fee, by providing written notice to Costamare Shipping at least 12 months before the end of the subsequent one-year term. The termination fee is equal to (a) the lesser of (i) five and (ii) the number of full years remaining prior to December 31, 2020, times (b) the aggregate fees due and payable to Costamare Shipping during the 12- month period ending on the date of termination (without taking into account any reduction in fees to reflect that certain obligations have been delegated to a sub-manager);providedthat the termination fee will always be at least two times the aggregate fees over the 12-month period described above. Information about other termination events under the partnership management agreement is set forth in “Certain Relationships and Related Party Transactions—Agreements Governing the Transactions—Partnership Management Agreement—Term and Termination Rights”.

Pursuant to the terms of our partnership management agreement and separate ship management agreements and supervision agreements, liability of our managers to us is limited to instances of gross negligence or willful misconduct on the part of the managers. Further, we are required to indemnify the managers for liabilities incurred by the managers in performance of the partnership management agreement and separate ship management agreements and supervision agreements, except in instances of gross negligence or willful misconduct on the part of the managers. See “Certain Relationships and Related Party Transactions—Agreements Governing the Transactions—Partnership Management Agreement”.

169

Competition

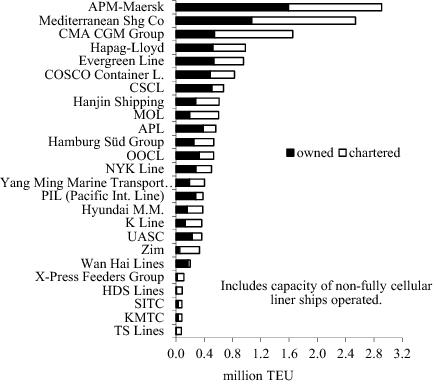

We operate in markets that are highly competitive and based primarily on supply and demand. Generally, we compete for charters based upon charter rate, customer relationships, operating expertise, professional reputation and containership specifications, size, age and condition. Competition for providing containership services comes from a number of experienced shipping companies, including state-sponsored entities. In addition, in recent years, there have been other entrants in the market, such as leasing companies and private equity firms who have significant capital to invest in vessel ownership, which has provided for additional competition in the sector.

Participants in the container shipping industry include “liner” shipping companies, who operate container shipping services and own containerships, containership owners, often known as “charter owners”, who own containerships and charter them out to liner companies, and shippers who require the seaborne movement of containerized goods. Historically, a significant share of the world’s containership capacity has been owned by the liner companies, but since the 1990s there has been an increasing trend for the liner companies to charter-in a larger proportion of the capacity that they operate as a way of retaining some degree of flexibility with regard to capital spending levels over time given the significant costs associated with purchasing vessels.

We believe that the containership sector of the international shipping industry is characterized by the significant time required to develop the operating expertise and professional reputation necessary to obtain and retain customers. We believe our relationship with Costamare will give us access to Costamare’s relationships with leading liner companies, shipbuilders, financing sources and suppliers and to its technical, commercial and managerial expertise, which we believe will allow us to compete more effectively when seeking additional customers and expanding our fleet. In addition, in the past, Costamare has been able to address the periodic scarcity of secondhand containerships available for acquisition in the open market though the acquisition of containerships mainly from liner company customers in privately negotiated sales. In connection with these acquisitions, the vessel is typically chartered back to these customers. We believe Costamare has been able to pursue these privately negotiated acquisitions because of its long-standing customer relations, which we do not believe new entrants have. We believe we will be able to leverage our relationship with Costamare to exploit such acquisition opportunities. We also believe that our focus on customer service and reliability will enhance our relationships with our charterers.

Inspection by Classification Societies

Every seagoing vessel must be “classed” by a classification society. The classification society certifies that the vessel is “in class”, signifying that the vessel has been built and maintained in accordance with the rules of the classification society and complies with applicable rules and regulations of the vessel’s country of registry and the international conventions of which that country is a member. In addition, where surveys are required by international conventions and corresponding laws and ordinances of a flag state, the classification society will undertake them on application or by official order, acting on behalf of the authorities concerned.

The classification society also undertakes on request other surveys and checks that are required by regulations and requirements of the flag state. These surveys are subject to agreements made in each individual case and/or to the regulations of the country concerned.

For maintenance of the class, regular and extraordinary surveys of hull and machinery, including the electrical plant and any special equipment classed, are required to be performed as follows:

Annual Surveys.For seagoing ships, annual surveys are conducted for the hull and the machinery, including the electrical plant, and where applicable, on special equipment classed at intervals of 12 months from the date of commencement of the class period indicated in the certificate.

Intermediate Surveys.Extended annual surveys are referred to as intermediate surveys and typically are conducted two and one-half years after commissioning and each class renewal. Intermediate surveys may be carried out on the occasion of the second or third annual survey.

170

Class Renewal Surveys.Class renewal surveys, also known as special surveys, are carried out on the ship’s hull and machinery, including the electrical plant, and on any special equipment classed at the intervals indicated by the character of classification for the hull. During the special survey, the vessel is thoroughly examined, including audio-gauging to determine the thickness of the steel structures. Should the thickness be found to be less than class requirements, the classification society would prescribe steel renewals. The classification society may grant a one-year grace period for completion of the special survey. Substantial amounts of funds may have to be spent for steel renewals to pass a special survey if the vessel experiences excessive wear and tear. In lieu of the special survey every four or five years, depending on whether a grace period is granted, a ship-owner has the option of arranging with the classification society for the vessel’s hull or machinery to be on a continuous survey cycle, in which every part of the vessel would be surveyed within a five-year cycle. At a ship-owner’s application, the surveys required for class renewal may be split according to an agreed schedule to extend over the entire period of class. This process is referred to as continuous class renewal. All areas subject to surveys as defined by the classification society are required to be surveyed at least once per class period, unless shorter intervals between surveys are otherwise prescribed. The period between two consecutive surveys of each area must not exceed five years.

All vessels are also dry-docked at least once every five years for inspection of their underwater parts and for repairs related to such inspections. If any defects are found, the classification surveyor will issue a “recommendation” which must be rectified by the ship-owner within prescribed time limits.

Insurance underwriters make it a condition for insurance coverage that a vessel be certified as “in class” by a classification society which is a member of the International Association of Classification Societies, or “IACS”. All of our vessels are certified as being “in class” by members of IACS.

The following table lists the dates by which we expect to carry out the next dry-dockings and special surveys for the vessels in our current vessel fleet:

| | |

Ship Name | | Dry-docking and

Special Survey |

COSCO BEIJING | | | | 2016 | |

MSC ATHENS | | | | 2018 | |

MSC ATHOS | | | | 2018 | |

VALUE | | | | 2018 | |

Crewing and Shore Employees

We will not directly employ any on-shore employees or seagoing employees. As of the closing of this offering, we expect to have two shore-based officers of our general partner, its chief executive officer and chief financial officer. In each case their services are provided under the partnership management agreement with Costamare Shipping. As of December 31, 2014, Costamare Shipping and the applicable managers (such as Shanghai and V.Ships Greece) had approximately 2,000 people serving in a pool of personnel who rotate their service onboard the containerships managed by Costamare Shipping, which includes the vessels in our initial fleet. Costamare Shipping and Shanghai Costamare each employed approximately 90 and 30 people, respectively, all of whom were shore-based. In addition, our affiliated managers are responsible for recruiting, either directly or through a crewing agent, the senior officers and all other crew members for our containerships that they manage. Recruiting is arranged directly through our managers’ crewing offices in Athens, Greece and Shanghai, China, and indirectly through a crewing agent related to Costamare, C- Man Maritime Inc., or “C-Man Maritime”, in the Philippines, and independent manning agents in Romania and Bulgaria. The senior officers and other crew members for any containerships managed by V.Ships Greece will be arranged in part through C-Man Maritime and in part through V.Ships Greece (which utilizes the global V.Group network) under the Co-operation Agreement. We believe the streamlining of crewing arrangements through our managers ensures that all of our vessels will be crewed with experienced crews that have the qualifications and licenses required by international

171

regulations and shipping conventions. Costamare has not experienced any material work stoppages due to labor disagreements during the past three years.

Although our managers have historically experienced a high retention rate for our seafarers, the demand for technically skilled officers and crews to serve on containerships has been increasing as the global fleet of containerships continues to grow. In recent years, the limited supply of and increased demand for well-qualified crew, due to the increase in the size of the global shipping fleet, has created upward pressure on crewing costs, which we generally bear under our time charters.

Risk of Loss, Liability Insurance and Risk Management

The operation of any vessel includes risks such as mechanical failure, collision, property loss or damage, cargo loss or damage and business interruption due to a number of reasons, including political circumstances in foreign countries, hostilities and labor strikes. In addition, there is always an inherent possibility of marine disaster, including oil spills and other environmental mishaps, as well as other liabilities arising from owning and operating vessels in international trade. The U.S. Oil Pollution Act of 1990, or “OPA 90”, which imposes under certain circumstances, unlimited liability upon owners, operators and demise charterers of vessels trading in the United States exclusive economic zone for certain oil pollution accidents in the United States, has made liability insurance more expensive for ship-owners and operators trading in the United States market.

We maintain hull and machinery marine risks insurance and hull and machinery war risks insurance for our fleet of containerships to cover normal risks in our operations and in amounts that we believe to be prudent to cover such risks. In addition, we maintain protection and indemnity insurance up to the maximum insurable limit available at any given time. While we believe that our insurance coverage will be adequate, not all risks can be insured, and there can be no guarantee that we will always be able to obtain adequate insurance coverage at reasonable rates or at all, or that any specific claim we may make under our insurance coverage will be paid.

Hull & Machinery Marine Risks Insurance, Hull & Machinery War Risks Insurance and Loss of Hire Insurance

We maintain hull and machinery marine risks insurance and hull and machinery war risks insurance, which cover the risk of particular average, general average, 4/4ths collision liability, contact with fixed and floating objects and actual or constructive total loss in accordance with the Nordic Marine Insurance Plan. Each of our containerships is insured up to what we believe to be at least its fair market value, after meeting certain deductibles.

We do not and will not obtain loss of hire insurance (or any other kind of business interruption insurance) covering the loss of revenue during off-hire periods for any of our vessels because we believe that this type of coverage is not economical and is of limited value to us, in part because historically our vessels have had a very limited number of off-hire days.

Protection and Indemnity Insurance—Pollution Coverage

Protection and indemnity insurance is usually provided by a protection and indemnity association (a “P&I association”) and covers third-party liability, crew liability and other related expenses resulting from the injury or death of crew, passengers and other third parties, the loss or damage to cargo, third-party claims arising from collisions with other vessels (to the extent not recovered by the hull and machinery policies), damage to other third-party property, pollution arising from oil or other substances and salvage, towing and other related costs, including wreck removal.

Our protection and indemnity insurance is provided by a P&I association which is a member of the International Group of P&I Clubs, or “International Group”. The 13 P&I associations that comprise the International Group insure approximately 90% of the world’s commercial blue-water tonnage and have entered into a pooling agreement to reinsure each association’s liabilities. Insurance provided by a P&I association is a form of mutual indemnity insurance.

172

Our protection and indemnity insurance coverage is currently subject to a limit of about $5 billion per vessel per incident, except that for pollution the limit is set at $1 billion per vessel per incident, and for war risks the limit is set at $500 million per vessel per incident.

As a member of a P&I association, which is a member of the International Group, we will be subject to calls payable to the P&I association based on the International Group’s claim records as well as the claim records of all other members of the P&I association of which we are a member.

Environmental and Other Regulations

Government regulation affects the ownership and operation of our vessels in a significant manner. We are subject to international conventions and national, port state and local laws and regulations applicable to international waters and/or territorial waters of the countries in which our vessels may operate or are registered, including those governing the management and disposal of hazardous substances and wastes, the cleanup of oil spills and the management of other contamination, air emissions, and grey water and ballast water discharges. These laws and regulations include OPA 90, the U.S. Comprehensive Environmental Response, Compensation, and Liability Act, or “CERCLA”, the U.S. Clean Water Act, or “CWA”, the U.S. Clean Air Act, or “CAA”, and regulations adopted by the IMO, including the International Convention for Prevention of Pollution from Ships, or “MARPOL”, and the International Convention for Safety of Life at Sea, or “SOLAS”, as well as regulations enacted by the European Union and other international, national and local regulatory bodies. Compliance with these laws, regulations and other requirements entails significant expense, including vessel modifications and implementation of certain operating procedures.

A variety of governmental and private entities subject our vessels to both scheduled and unscheduled inspections. These entities include the local port authorities Port State Control (such as the U.S. Coast Guard, harbor master or equivalent), classification societies, flag state administration (country of registry) and charterers. Certain of these entities require us to obtain permits, licenses, financial assurances and certificates for the operation of our vessels. Failure to maintain necessary permits or approvals could require us to incur substantial costs or result in the temporary suspension of operation of one or more of our vessels in one or more ports.

We believe that the heightened level of environmental and quality concerns among insurance underwriters, regulators and charterers is leading to greater inspection and safety requirements for all vessels and may accelerate the scrapping of older vessels throughout the container shipping industry. Increasing environmental concerns have created a demand for vessels that conform to the strictest environmental standards. We will be required to maintain operating standards for all of our vessels that emphasize operational safety, quality maintenance, continuous training of our officers and crews and compliance with U.S. and international regulations. Our affiliated managers and V.Ships Greece are certified in accordance with ISO 9001-2008 and ISO 14001-2004 (relating to quality management and environmental standards, respectively). We believe that operation of our vessels will be in substantial compliance with applicable environmental laws and regulations and that our vessels will have all material permits, licenses, certificates and other authorizations necessary for their operation.

Our containerships are subject to standards imposed by the IMO, the United Nations agency for maritime safety and the prevention of pollution by ships. The IMO has adopted regulations that are designed to reduce pollution in international waters, both from accidents and from routine operations, and has negotiated international conventions that impose liability for oil pollution in international waters and a signatory’s territorial waters. For example, Annex VI to MARPOL, which became effective on May 19, 2005, sets limits on sulfur oxide and nitrogen oxide emissions from vessel exhausts and prohibits deliberate emissions of ozone depleting substances, such as chlorofluorocarbons. Annex VI also includes a global cap on the sulfur content of fuel oil. In addition, amendments to Annex VI that entered into force in July 2010 seek to reduce air pollution from vessels by, among other things, establishing a series of progressive requirements to further limit the sulfur content of fuel oil that will be phased in through 2020 and by establishing new tiers of nitrogen oxide emission standards for new marine diesel engines, depending on their date of

173

installation. Annex VI also provides for the establishment of special areas known as Emission Control Areas where more stringent controls on sulfur and other emissions apply. Currently, the Baltic Sea, certain coastal areas of North America and the U.S. Caribbean Sea are within designated Emission Control Areas, and additional Emission Control Areas could be established in the future. All the vessels in our initial fleet are compliant with current Annex VI requirements. However, if new Emission Control Areas are approved by the IMO or other new or more stringent air emission requirements are adopted by the IMO or the states where we expect to operate, compliance with these requirements could entail significant additional capital expenditures, operational changes or otherwise increase the costs of our operations.

The International Convention on Civil Liability for Bunker Oil Pollution Damage (the “Bunker Convention”), which became effective in November 2008, imposes strict liability on vessel owners for pollution damage in jurisdictional waters of ratifying states caused by discharges of bunker fuel. The Bunker Convention also requires registered owners of vessels over 1,000 gross tons to maintain insurance in specified amounts to cover liability for bunker fuel pollution damage. Each of our containerships has been issued a certificate attesting that insurance is in force in accordance with the Bunker Convention.

In 2004, the IMO also adopted the International Convention for the Control and Management of Ships’ Ballast Water and Sediments (the “BWM Convention”). The BWM Convention’s implementing regulations call for a phased introduction of mandatory ballast water exchange requirements, to be replaced in time with mandatory concentration limits. The BWM Convention will not enter into force until 12 months after it has been ratified by 30 states, the combined merchant fleets of which represent not less than 35% of the gross tonnage of the world’s merchant shipping. To date, the BWM Convention has not yet entered into force because it has not been ratified by a sufficient number of countries to meet this threshold.

The operation of our vessels is also based on the requirements set forth in the ISM Code. The ISM Code requires vessel owners, bareboat charterers and management companies to develop and maintain an extensive Safety Management System, or “SMS”, that includes the adoption of a safety and environmental protection policy, sets forth instructions and procedures for safe operation and describes procedures for dealing with emergencies. The ISM Code requires that vessel operators obtain a “Safety Management Certificate” for each vessel they operate from the government of the vessel’s flag state. The certificate verifies that the vessel operates in compliance with its approved SMS. No vessel can obtain a certificate unless the flag state has issued a document of compliance with the ISM Code to the vessel’s manger. Noncompliance by a vessel owner, manager or bareboat charterer with the ISM Code may subject such party to increased liability, invalidate existing insurance or decrease available insurance coverage for the affected vessels and result in a denial of access to, or detention in, certain ports. Our managers and each of our containerships are ISM Code-certified.

United States Requirements

OPA 90 established an extensive regulatory and liability regime for the protection of the environment from oil spills and cleanup of oil spills. OPA 90 applies to discharges of any oil from a vessel, including discharges of fuel and lubricants. OPA 90 affects all owners and operators whose vessels trade in the United States, its territories and possessions or whose vessels operate in U.S. waters, which include the United States’ territorial sea and its two hundred nautical mile exclusive economic zone. While we do not carry oil as cargo, we do carry fuel in our containerships, making them subject to the requirements of OPA 90.

Under OPA 90, vessel owners, operators and bareboat charterers are “responsible parties” and are jointly, severally and strictly liable (unless the discharge of pollutants results solely from the act or omission of a third party, an act of God or an act of war) for all containment and clean-up costs and other damages arising from discharges or threatened discharges, of pollutants from their vessels, including bunkers. OPA 90 defines these other damages broadly to include:

| | • | | natural resource damages and the costs of assessment thereof; |

174

| | • | | real and personal property damage; |

| | • | | net loss of taxes, royalties, rents, fees and other lost revenues; |

| | • | | lost profits or impairment of earning capacity due to property or natural resource damages; and |

| | • | | net cost of public services necessitated by a spill response, such as protection from fire, safety or health hazards, and loss of subsistence use of natural resources. |

OPA 90 preserves the right to recover damages under other existing laws, including maritime tort law.

U.S. Coast Guard regulations limit OPA 90 liability to the greater of $1,000 per gross ton or $854,400 per incident for non-tank vessels, subject to periodic adjustments of such limits. These limits of liability do not apply if an incident was directly caused by violation of applicable U.S. safety, construction or operating regulations or by a responsible party’s gross negligence or willful misconduct, or if the responsible party fails or refuses to report the incident or to cooperate and assist in connection with oil removal activities.

CERCLA applies to spills or releases of hazardous substances other than petroleum or petroleum products whether on land or at sea. CERCLA imposes joint and several liability, without regard to fault, on the owner or operator of a vessel, vehicle or facility from which there has been a release, along with other specified parties. Costs recoverable under CERCLA include cleanup and removal costs, natural resource damages and governmental oversight costs. Liability under CERCLA is generally limited to the greater of $300 per gross ton or $5.0 million for vessels carrying any hazardous substances, such as cargo or residue, or $0.5 million for any other vessel, per release of or incident involving hazardous substances. These limits of liability do not apply if the incident is caused by gross negligence, willful misconduct or a violation of certain regulations, in which case liability is unlimited.

All owners and operators of vessels over 300 gross tons are required to establish and maintain with the U.S. Coast Guard evidence of financial responsibility sufficient to meet their potential liabilities under OPA 90 and CERCLA. Under the U.S. Coast Guard regulations, vessel owners and operators may evidence their financial responsibility by providing proof of insurance, surety bond, guarantee, letter of credit or self-insurance. An owner or operator of a fleet of vessels is required only to demonstrate evidence of financial responsibility in an amount sufficient to cover the vessel in the fleet having the greatest maximum liability under OPA 90 and CERCLA. Under the self-insurance provisions, the vessel owner or operator must have a net worth and working capital, measured in assets located in the United States against liabilities located anywhere in the world, that exceeds the applicable amount of financial responsibility. We have received certificates of financial responsibility from the U.S. Coast Guard for each of the vessels in our initial fleet.

OPA 90 specifically permits individual states to impose their own liability regimes with regard to oil pollution incidents occurring within their boundaries, and some states have enacted legislation providing for unlimited liability for oil spills. In some cases, states which have enacted such legislation have not yet issued implementing regulations defining vessels owners’ responsibilities under these laws. We intend to comply with all applicable state regulations in the ports where our vessels call.

We will maintain, for each of our containerships, oil pollution liability coverage insurance in the amount of $1.0 billion per vessel per incident. In addition, we carry hull and machinery and protection and indemnity insurance to cover the risks of fire and explosion. Although our containerships will only carry bunker fuel, a spill of oil from one of our vessels could be catastrophic under certain circumstances. Losses as a result of fire or explosion could also be catastrophic under some conditions. While we believe that our present insurance coverage is adequate, not all risks can be insured, and if the damages from a catastrophic spill exceeded our insurance coverage, the payment of those damages could have an adverse effect on our business or the results of our operations.

Title VII of the Coast Guard and Maritime Transportation Act of 2004 (the “CGMTA”) amended OPA 90 to require the owner or operator of any non-tank vessel of 400 gross tons or

175

more that carries oil of any kind as a fuel for main propulsion, including bunker fuel, to prepare and submit a response plan for each vessel. These vessel response plans include detailed information on actions to be taken by vessel personnel to prevent or mitigate any discharge or substantial threat of such a discharge of oil from the vessel due to operational activities or casualties. Each of the vessels in our initial fleet has an approved response plan.

The CWA prohibits the discharge of oil or hazardous substances in navigable waters and imposes liability in the form of penalties for any unauthorized discharges. It also imposes substantial liability for the costs of removal, remediation and damages and complements the remedies available under the more recently enacted OPA 90 and CERCLA, discussed above. The U.S. Environmental Protection Agency (the “EPA”) regulates the discharge of ballast water and other substances under the CWA. EPA regulations require vessels 79 feet in length or longer (other than commercial fishing vessels) to obtain coverage under a Vessel General Permit, or “VGP”, authorizing discharges of ballast waters and other wastewaters incidental to the operation of vessels when operating within the three-mile territorial waters or inland waters of the United States. The VGP requires vessel owners and operators to comply with a range of best management practices and reporting and other requirements for a number of incidental discharge types. The EPA issued a new VGP, which became effective in December 2013, that contains more stringent requirements, including numeric ballast water discharge limits (that generally align with the most recent U.S. Coast Guard standards issued in 2012), requirements to ensure that the ballast water treatment systems are functioning correctly, and more stringent effluent limits for oil to sea interfaces and exhaust gas scrubber wastewater. We have obtained coverage under the current version of the VGP for all of the vessels in our initial fleet. We do not believe that any material costs associated with meeting the requirements under the VGP will be material.

U.S. Coast Guard regulations adopted under the 1996 U.S. National Invasive Species Act, or “NISA”, also impose mandatory ballast water management practices for all vessels equipped with ballast water tanks entering or operating in U.S. waters. Amendments to these regulations that became effective in June 2012 established maximum acceptable discharge limits for various invasive species and/or requirements for active treatment of ballast water. The U.S. Coast Guard ballast water standards are consistent with requirements under the BWM Convention. Several states, including Michigan and California, have adopted legislation or regulations relating to the permitting and management of ballast water discharges. California has extended its ballast water management program to the regulation of “hull fouling” organisms attached to vessels and adopted regulations limiting the number of organisms in ballast water discharges. Other states could adopt similar requirements that could increase the costs of operation in state waters.

The EPA has adopted standards under the CAA that pertain to emissions from vessel vapor control and recovery and other operations in regulated port areas and emissions from model year 2004 and later large marine diesel engines. Several states also regulate emissions from vapor control and recovery under authority of State Implementation Plans adopted under the CAA. On April 30, 2010, the EPA promulgated regulations that impose more stringent standards for emissions of particulate matter, sulfur oxides and nitrogen oxides from new Category 3 marine diesel engines on vessels constructed on or after January 1, 2016 and registered or flagged in the U.S. and implement the new MARPOL Annex VI requirements for U.S. and foreign flagged ships entering U.S. ports or operating in U.S. internal waters. The EPA is also considering a petition from a number of environmental groups that requests the EPA to impose more stringent emissions limits on foreign-flagged vessels operating in U.S. waters. California has adopted emission limits for auxiliary diesel engines of ocean-going vessels operating within 24 miles of the California coast and requires operators to use low sulfur content fuel. If new or more stringent regulations relating to emissions from marine diesel engines or port operations by ocean-going vessels are adopted by the EPA or states, these requirements could require significant capital expenditures or otherwise increase the costs of our operations.

176

European Union Requirements

The European Union has also adopted legislation that (1) requires member states to refuse access to their ports to certain sub-standard vessels, according to vessel type, flag and number of previous detentions, (2) obliges member states to inspect at least 25% of foreign vessels using their ports annually and provides for increased surveillance of vessels posing a high risk to maritime safety or the marine environment, (3) provides the European Union with greater authority and control over classification societies, including the ability to seek to suspend or revoke the authority of negligent societies, and (4) requires member states to impose criminal sanctions for certain pollution events, such as the unauthorized discharge of tank washings.

Other Regional Requirements

The environmental protection regimes in certain other countries, such as Canada, resemble those of the United States. To the extent we operate in the territorial waters of such countries or enter their ports, our containerships would typically be subject to the requirements and liabilities imposed in such countries. Other regions of the world also have the ability to adopt requirements or regulations that may impose additional obligations on our containerships and may entail significant expenditures on our part and may increase the costs of our operations. These requirements, however, would apply to the industry operating in those regions as a whole and would also affect our competitors.

Greenhouse Gas Regulations

Currently, emissions of greenhouse gases from international shipping are not subject to the Kyoto Protocol to the United Nations Framework Convention on Climate Change, which entered into force in 2005 and required adopting countries to implement national programs to reduce greenhouse gas emissions. The Kyoto Protocol was extended to 2020 at the 2012 United Nations Climate Change Conference, with the hope that a new climate change treaty would be adopted by 2015 and enter into force by 2020.

International or multinational bodies or individual countries may adopt climate change initiatives. For example, the MEPC of the IMO adopted two new sets of mandatory requirements to address greenhouse gas emissions from ships at its July 2011 meeting. The Energy Efficiency Design Index requires a minimum energy efficiency level per capacity mile and is applicable to new vessels, and the Ship Energy Efficiency Management Plan is applicable to currently operating vessels. The requirements entered into force in January 2013 and could cause us to incur additional compliance costs. The IMO is also considering the development of a market-based mechanism for greenhouse gas emissions from ships, but it is difficult to accurately predict the likelihood that such a standard might be adopted or its potential impact on our operations at this time.

In June 2013, the European Commission developed a strategy to integrate maritime emissions into the overall European Union Strategy to reduce greenhouse gas emissions. If the strategy is adopted by the European Parliament and Council large vessels entering European Union ports would be required to monitor, report and verify their carbon dioxide emissions beginning in January 2018. In December 2013, the European Union environmental ministers discussed draft rules to implement monitoring and reporting of carbon dioxide emissions from ships. In the United States, the EPA has issued a finding that greenhouse gases endanger the public health and safety and has adopted regulations under the CAA to limit greenhouse gas emissions from certain mobile sources and proposed regulations to limit greenhouse gas emissions from large stationary sources. Although the mobile source emissions do not apply to greenhouse gas emissions from ships, the EPA may, in the future, decide to regulate greenhouse gas emissions from ocean-going vessels. Any passage of climate control legislation or other regulatory initiatives by the IMO, the European Union, the United States or other countries where we operate, or any treaty adopted at the international level to succeed the Kyoto Protocol, that restrict emissions of greenhouse gases could require us to make significant financial expenditures that we cannot predict with certainty at this time. Even in the absence of climate control legislation and regulations, our business and operations may be materially

177

affected to the extent that climate change results in sea level changes or more intense weather events.

The State of California has mandated that ships, instead of relying on their shipboard power, must use shore power while breathed through a process known as Cold Ironing or Alternative Maritime Power. The regulation is being phased in starting in 2014. Vessels in our initial fleet built after 2012 and our option vessels have or will have the necessary installation. It is expected that the cost of modifications needed for older vessels will be borne in part by the charterers of each vessel, but it is difficult to predict the exact impact on our operations.

Vessel Security Regulations

A number of initiatives have been introduced in recent years intended to enhance vessel security. On November 25, 2002, the Maritime Transportation Security Act of 2002 (the “MTSA”) was signed into law. To implement certain portions of the MTSA, the U.S. Coast Guard issued regulations in July 2003 requiring the implementation of certain security requirements aboard vessels operating in waters subject to the jurisdiction of the United States. Similarly, in December 2002, amendments to SOLAS created a new chapter of the convention dealing specifically with maritime security. This new chapter came into effect in July 2004 and imposes various detailed security obligations on vessels and port authorities, most of which are contained in the newly created International Ship and Port Facilities Security Code (the “ISPS Code”). Among the various requirements are:

| | • | | on-board installation of automatic information systems to enhance vessel-to-vessel and vessel-to-shore communications; |

| | • | | on-board installation of ship security alert systems; |

| | • | | the development of ship security plans; and |

| | • | | compliance with flag state security certification requirements. |

The U.S. Coast Guard regulations, intended to align with international maritime security standards, exempt non-U.S. vessels from MTSA vessel security measures;providedsuch vessels have on board a valid “International Ship Security Certificate” that attests to the vessel’s compliance with SOLAS security requirements and the ISPS Code. We have implemented the various security measures required by the IMO, SOLAS and the ISPS Code and have approved ISPS certificates and plans certified by the applicable flag state on board all our containerships.

Permits and Authorizations

We are required by various governmental and other agencies to obtain certain permits, licenses, certificates and financial assurances with respect to each of our vessels. The kinds of permits, licenses, certificates and financial assurances required by governmental and other agencies depend upon several factors, including the commodity being transported, the waters in which the vessel operates, the nationality of the vessel’s crew and the type and age of the vessel. All permits, licenses, certificates and financial assurances currently required to operate our vessels have been obtained (exclusive of cargo- specific documentation, for which charterers or shippers are responsible). Additional laws and regulations, environmental or otherwise, may be adopted which could limit our ability to do business or increase the cost of doing business.

Properties

We have no freehold or material leasehold interest in any real property. We occupy office space at 60 Zephyrou Street & Syngrou Avenue, 17564 Athens, Greece, that is provided to us as part of the services we receive under the partnership management agreement. Other than our vessels, we do not have any material property. Our vessels are subject to priority mortgages, which secure our obligations under our credit facilities. In certain cases, we may finance the ownership of vessels through finance lease arrangements with purchase options in our favor, rather than secured loans.

178

Legal Proceedings

We have not been involved in any legal proceedings that we believe may have a significant effect on our business, financial position, results of operations or liquidity, and we are not aware of any proceedings that are pending or threatened that may have a material effect on our business, financial position, results of operations or liquidity. From time to time, we may be subject to legal proceedings and claims in the ordinary course of business, principally property damage and personal injury claims. We expect that these claims would be covered by insurance, subject to customary deductibles. However, those claims, even if lacking merit, could result in the expenditure of significant financial and managerial resources.

Taxation of the Partnership

Marshall Islands

The following discussion represents the opinion of Cozen O’Connor, our counsel as to matters of the laws of the Republic of the Marshall Islands. Because we and our subsidiaries do not and will not conduct business or operations in the Republic of the Marshall Islands, neither we nor our subsidiaries will be subject to income, capital gains, profits or other taxation under current Marshall Islands law, and we do not expect this to change in the future. As a result, distributions we receive from the operating subsidiaries are not expected to be subject to Marshall Islands taxation.

Liberia

The following discussion represents the opinion of Cozen O’Connor, our counsel as to matters of the laws of the Republic of Liberia. The Republic of Liberia enacted a new income tax act effective as of January 1, 2001 (the “New Act”). In contrast to the income tax law previously in effect since 1977, the New Act does not distinguish between the taxation of “non-resident” Liberian corporations, such as our Liberian subsidiaries, which conduct no business in Liberia and were wholly exempt from taxation under the prior law, and “resident” Liberian corporations, which conduct business in Liberia and are (and were under the prior law) subject to taxation.

The New Act was amended by the Consolidated Tax Amendments Act of 2011, which was published and became effective on November 1, 2011 (the “Amended Act”). The Amended Act specifically exempts from taxation non-resident Liberian corporations such as our Liberian subsidiaries that engage in international shipping (and are not engaged in shipping exclusively within Liberia) and that do not engage in other business or activities in Liberia other than those specifically enumerated in the Amended Act. In addition, the Amended Act made such exemption from taxation retroactive to the effective date of the New Act. Accordingly, neither we nor our subsidiaries will be subject to Liberian taxation under the Amended Act so long as the conditions for the exemption from taxation of the Amended Act are satisfied.

If our Liberian subsidiaries were subject to Liberian income tax under the Amended Act, they would be subject to tax at a rate of 35% on their worldwide income. As a result, their, and subsequently our, net income and cash flow would be materially reduced. In addition, as the ultimate stockholder of the Liberian subsidiaries, we would be subject to Liberian withholding tax on dividends paid by our Liberian subsidiaries at rates ranging from 15% to 20%.

United States

The following discussion represents the opinion of Cravath, Swaine & Moore LLP, our U.S. counsel, regarding the material U.S. federal income tax consequences to us of our activities. It is based on the Code, judicial decisions, administrative pronouncements, and existing and proposed regulations issued by the U.S. Department of the Treasury, all of which are subject to change, possibly with retroactive effect. In addition, the opinion of our U.S. counsel is not binding on the IRS or any court. This discussion does not address any U.S. state or local taxes. You are encouraged to consult your own tax advisor regarding the particular U.S. federal, state and local and foreign

179

income and other tax consequences of acquiring, owning and disposing of our common units that may be applicable to you.

In General

We have elected to be treated as a corporation for U.S. federal income tax purposes. As such, except as provided below, we will be subject to U.S. federal income tax on our income to the extent such income is from U.S. sources or is otherwise effectively connected with the conduct of a trade or business in the United States.

U.S. Taxation of Our Subsidiaries

Our subsidiaries have elected (or are in the process of electing) to be treated as disregarded entities for U.S. federal income tax purposes. As a result, for purposes of the discussion below, our subsidiaries are treated (or will be treated) as branches rather than as separate corporations.

U.S. Taxation of Shipping Income

We expect that substantially all of our gross income will be attributable to income derived from chartering our containerships to our customers. Gross income attributable to transportation exclusively between non-U.S. ports is considered to be 100% derived from sources outside the United States and generally not subject to any U.S. federal income tax. Gross income attributable to transportation that both begins and ends in the United States, or “U.S. Source Domestic Transportation Income”, is considered to be 100% derived from sources within the United States and generally will be subject to U.S. federal income tax. Although there can be no assurance, we do not expect to engage in transportation that gives rise to U.S. Source Domestic Transportation Income.

Gross income attributable to transportation, including shipping income, that either begins or ends, but that does not both begin and end, in the United States is considered to be 50% derived from sources within the United States (such 50% being “U.S. Source International Transportation Income”). Subject to the discussion of “effectively connected” income below, Section 887 of the Code would impose on us a 4% U.S. income tax in respect of our U.S. Source International Transportation Income (without the allowance for deductions) unless we are exempt from U.S. federal income tax on such income under the rules contained in Section 883 of the Code. The other 50% of the income described in the first sentence of this paragraph would not be subject to U.S. income tax.

For this purpose, “shipping income” means income that is derived from:

(i) the use of ships;

(ii) the hiring or leasing of ships for use on a time, operating or bareboat charter basis;

(iii) the participation in a pool, partnership, strategic alliance, joint operating agreement or other joint venture we directly or indirectly own or participate in that generates such income; or

(iv) the performance of services directly related to those uses.

Under Section 883 of the Code and the regulations thereunder, we will be exempt from U.S. federal income tax on our U.S. Source International Transportation Income if:

(i) we are organized in a foreign country (the “country of organization”) that grants an “equivalent exemption” to corporations organized in the United States with respect to the types of U.S. Source International Transportation Income that we may earn (an “Equivalent Exemption”);

(ii) we satisfy the Publicly-Traded Test (as described below) or the 50% Ownership Test (as described below); and

(iii) we meet certain substantiation, reporting and other requirements.

180

In order for a foreign corporation to meet the Publicly-Traded Test, its equity interests must be “primarily traded” and “regularly traded” on an established securities market in the United States or in a foreign jurisdiction that grants an Equivalent Exemption. The Treasury regulations under Section 883 of the Code provide, in pertinent part, that equity of a foreign corporation will be considered to be “primarily traded” on an established securities market in a country if, with respect to the class or classes of equity relied upon to meet the “regularly traded” requirement described below, the number of units of such class of equity that is traded during any taxable year on all established securities markets in that country exceeds the number of equity interests in each such class that is traded during that year on established securities markets in any other single country. We believe that our common units will be the sole class of our equity that will be traded, and that such class will be “primarily traded” on the New York Stock Exchange, which is an established securities market for these purposes.

The Publicly-Traded Test also requires equity interests in a foreign corporation to be “regularly traded” on an established securities market. The Treasury regulations under Section 883 of the Code provide that equity interests in a foreign corporation are considered to be “regularly traded” on an established securities market if one or more classes of such equity interests that, in the aggregate, represent more than 50% of the combined vote and value of all outstanding equity interests in the foreign corporation satisfy certain listing and trading volume requirements. These listing and trading volume requirements will be satisfied with respect to a class of equity interests if (i) such equity interests are traded on the market, other than in minimal quantities, on at least 60 days during the taxable year (or 1/6 of the days in a short taxable year) and (ii) the aggregate number of equity interests in such class traded on such market during the taxable year is at least 10% of the average number of equity interests outstanding in that class during such year (as appropriately adjusted in the case of a short taxable year), provided, that if a class of equity interests is traded on an established securities market in the United States and is regularly quoted by dealers making a market in such equity interests then tests (i) and (ii) will be deemed satisfied.

Notwithstanding the foregoing, a class of equity interests may fail the regularly traded test if, for more than half the number of days during the taxable year, persons who each own, either actually or constructively under certain attribution rules, 5% or more of the vote and value of the outstanding shares of the class of equity interests, or “5% Unitholders,” own in the aggregate 50% or more of the vote and value of the class of equity interests (which is referred to as the “Closely Held Block Exception”). The Closely Held Block Exception does not apply, however, if the foreign corporation can establish that a sufficient proportion of such 5% Unitholders are Qualified Shareholders (as defined below) so as to preclude the non-qualified 5% Unitholders from owning 50% or more of the total value of the class of equity interests for more than half the number of days during the taxable year. If 50% or more of the vote and value of a class of equity interests is owned, in the aggregate, by 5% Unitholders, then a sufficient number of 5% Unitholders must verify that they are Qualified Shareholders by providing certain information to the foreign corporation, including information about their countries of residence for tax purposes and their actual and/or constructive ownership of such equity interests.

As an alternative to satisfying the Publicly-Traded Test, a foreign corporation may qualify for an exemption under Section 883 of the Code by satisfying the 50% Ownership Test. A corporation generally will satisfy the 50% Ownership Test if more than 50% of the value of its outstanding equity interests is owned, or treated as owned after applying certain attribution rules, for at least half the number of days in the taxable year by individual residents of jurisdictions that grant an Equivalent Exemption, foreign corporations organized in jurisdictions that grant an Equivalent Exemption and that meet the Publicly-Traded Test, or certain other qualified persons described in the Treasury regulations under Section 883 (which are referred to collectively as “Qualified Shareholders”).

The Marshall Islands, the jurisdiction in which we are organized, grants an Equivalent Exemption with respect to the type of U.S. Source International Transportation Income we expect to earn. Therefore, we will be eligible for the exemption under Section 883 of the Code if we satisfy either the Publicly-Traded Test or the 50% Ownership Test and we satisfy certain substantiation, reporting or other requirements.

181