CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO RULE 83

In 1998, the rise in international interest rates that followed the Russian default led to large outflows of capital from Peru, resulting in a 15.8% depreciation of the nuevo sol. The strong depreciation of the nuevo sol, coupled with the strong dollarization of the Peruvian Banking system prevalent at that time (81% of the loans were denominated in U.S. dollars) led to a sharp deterioration of the Peruvian banking system’s loan portfolio quality and to a contraction in total loans. Past-due loans in the system peaked at 9.4% of total gross loans as of January 31, 2000, resulting in increased provisions and large capital losses for financial institutions.

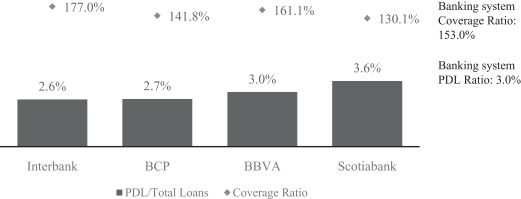

However, from 2001 onwards, as macroeconomic conditions improved, the general banking industry indicators in Peru began also to improve. Past-due loans dropped from 9.0% of total gross loans as of December 31, 2001 to 3.7% as of December 31, 2004, and loan reserves over past-due loans increased from 118.9% as of December 31, 2001 to 176.5% as of December 31, 2004 according to the SBS.

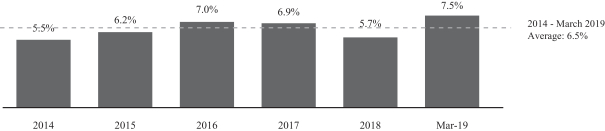

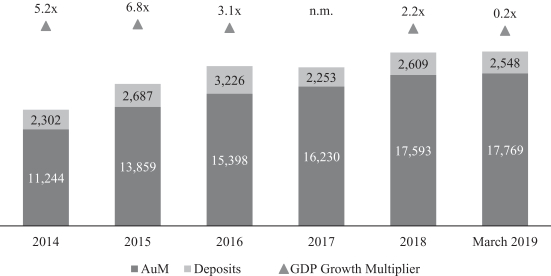

From 2005 to 2008, fostered by a steady and sustained improvement in Peru’s macroeconomic indicators, credit expanded again, with performing loans growing 25.2% in 2005, 18.0% in 2006, 34.7% in 2007 and 38.2% in 2008. The global financial crisis that started in late 2008 temporarily reduced credit growth as performing loans remained flat in 2009. Growth returned following the crisis, with the banking system in Peru experiencing a significant expansion of credit from December 31, 2008 to December 31, 2013. During this period, gross loans in the Peruvian banking system grew at a five-year CAGR of 13.0% and banking penetration in Peru, measured as the ratio of loans-to-GDP, rose from 24.8% to 30.4%, according to the SBS and the Central Reserve Bank of Peru.

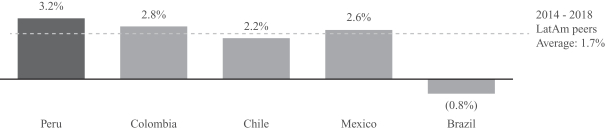

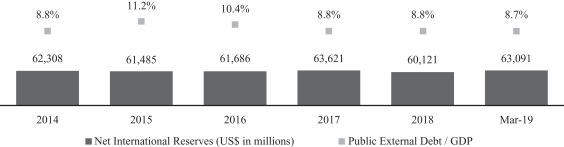

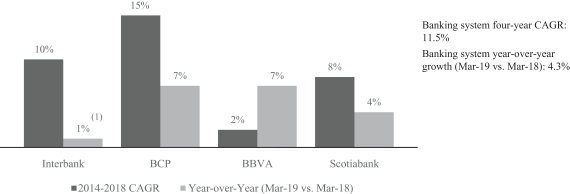

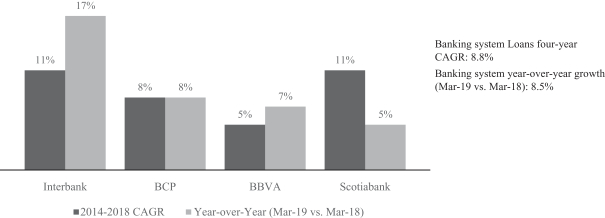

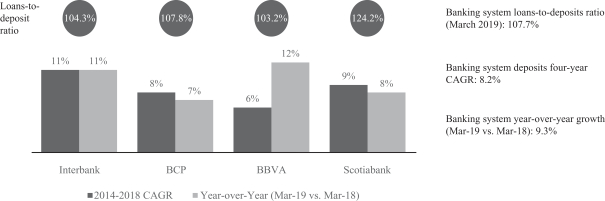

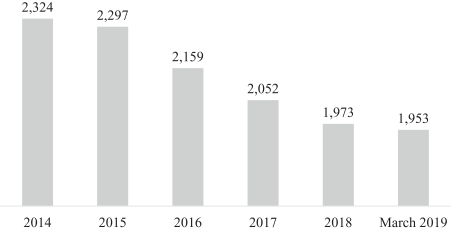

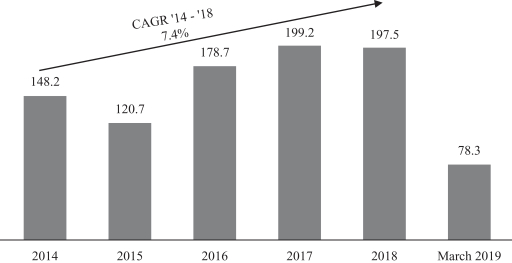

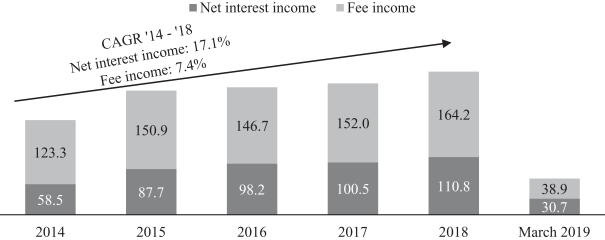

From December 31, 2014 to December 31, 2018, the banking system in Peru continued to grow steadily, with gross loans expanding at a four-year CAGR of 8.8% and banking penetration in Peru rising from 33.6% to 36.6%, according to the SBS and the BCRP. A significant part of the growth experienced by the Peruvian financial system since 2014 has been generated by the retail banking sector. Retail loans (including consumer loans and mortgages) grew at a four-year CAGR of 9.5% for the period ended December 31, 2018.

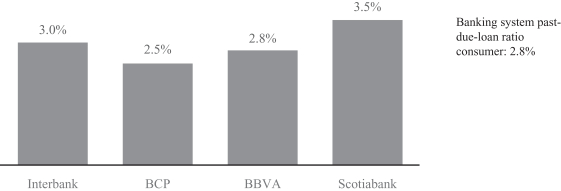

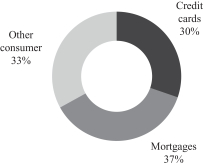

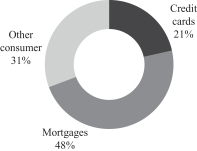

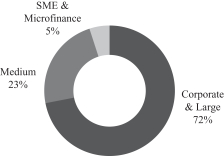

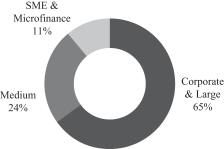

As of March 31, 2019, approximately 35.7% of the Peruvian banking sector’s total loans were retail loans, up from 34.2% as of December 31, 2014. In particular, consumer loans, in which Interbank is one of the leading banks, grew at a four-year CAGR of 10.6% for the period ended December 31, 2018.

According to the SBS, the total number of credit cards issued in Peru as of March 31, 2019 was approximately 8.3 million, of which approximately 28.7% were issued by non-banking entities, including store-branded cards. For the period ended December 31, 2018, the Peruvian banking system’s credit card loans grew at a four-year CAGR of 11.2%, while credit cards loans grew 11.3% between March 31, 2018 and March 31, 2019, as a result of high economic growth and increased consumer spending. During the same period, Interbank’s credit card loans grew at a four-year CAGR of 11.3%, and grew 26.0% between March 31, 2018 and March 31, 2019.

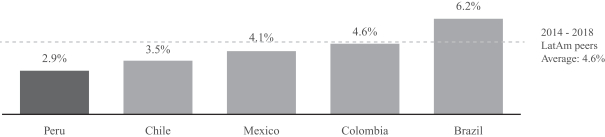

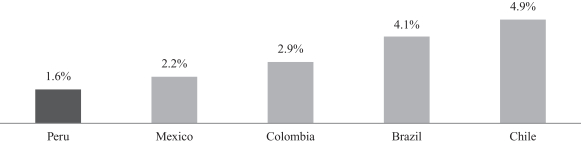

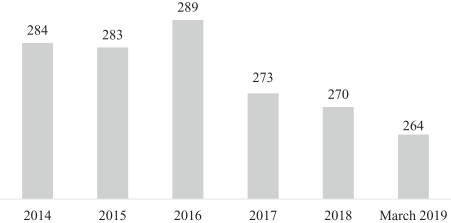

Although the number of mortgages of the Peruvian banking system also grew at a four-year CAGR of 2.9% for the period ended December 31, 2018 and 4.2% between March 31, 2018 and March 31, 2019, there is still substantial room for growth, with only approximately 0.2 million mortgages outstanding in Peru among a population of approximately 32.2 million, compared to approximately 1.6 million mortgages outstanding in Chile for a population of 18.2 million each as of December 31, 2018. Peru’s mortgage penetration, calculated as the ratio of mortgage loans to GDP, was 6.2% as of December 31, 2018 compared to 26.1% for Chile. A stable macroeconomic environment and the promotion of housing programs over the past four years have been the main drivers of mortgage loan growth in Peru and are expected to continue fueling mortgage lending.

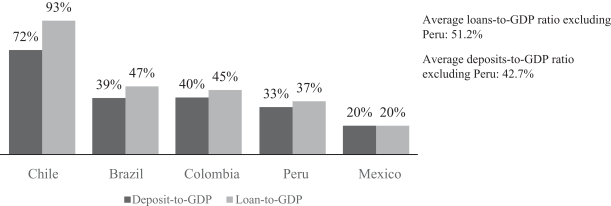

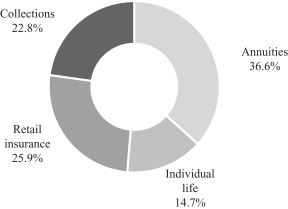

Despite this growth, the Peruvian banking system remains underpenetrated in comparison to the banking systems from the group of peer countries in Latin America. As of December 31, 2018, Peru’s loans-to-GDP ratio was 36.6%, below the average ratio of 51.2% for the group of peer countries in Latin America and less than half the ratio of 93.0% for Chile, according to the BCRP, the EIU, the SBS and other local regulators.

162