As filed with the U.S. Securities and Exchange Commission on [date]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23024

Pacer Funds Trust

(Exact name of registrant as specified in charter)

500 Chesterfield Parkway

Malvern, PA 19355

(Address of principal executive offices) (Zip code)

Joe M. Thomson, President

500 Chesterfield Parkway

Malvern, PA 19355

(Name and address of agent for service)

610-644-8100

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: November 1, 2021 to October 31, 2022

Item 1. Reports to Stockholders.

Pacer Funds

TABLE OF CONTENTS

| | Page |

Letter to Shareholders | 1 |

Portfolio Allocation | 7 |

Performance Summary | 10 |

Expense Example | 26 |

Schedules of Investments | 28 |

Statements of Assets & Liabilities | 46 |

Statements of Operations | 50 |

Statements of Changes in Net Assets | 56 |

Financial Highlights | 65 |

Notes to Financial Statements | 81 |

Report of Independent Registered Public Accounting Firm | 102 |

Additional Information | 104 |

Pacer Funds

Dear Shareholder,

Seemingly in a blink, it’s the end of the year again. And I can only look back on 2022 with a tremendous sense of thankfulness and pride when I look at what this company achieved over the past year. In a year where normalcy returned, global geopolitical tensions and rising interest rates disrupted the markets, creating one of the most challenging market environments in decades. Despite this, the Pacer team persevered. And I can once again inform you that for the second year in a row, we were able to almost double our assets under management, growing from $10.2 billion at the end of 2021 to nearly $20 billion at the end of 2022.

This year, The Cash Cows Series became a standout in the value investing space. It became our most popular series growing from $2 billion in assets to $13 billion this year. We are now in a higher interest rate investing era, and the series’ usage of free cash flow yield as a screen proved relevant for many investors this year. As we enter the new year, we are adding to the series by launching the Pacer US Large Cap Cash Cows Growth Leaders ETF, COWG, which will apply a Free Cash Flow Margin strategy to growth names. Over the past year, we also introduced four new funds inside our new thematic ETF series: Pacer Industrials and Logistics ETF (SHPP), Pacer Data and Digital Revolution ETF (TRFK), Pacer BlueStar Digital Entertainment ETF (ODDS), and Pacer BlueStar Engineering the Future ETF (BULD).

Thank you to all the investors, financial advisors, and partners for entrusting us with your assets for another year. And as we move into 2023, we look forward to growing with you once again.

Joe M. Thomson, Chairman, Pacer Funds Trust

Market Environment Overview

2022 was a year of increased inflation, tightening monetary policy, strong labor markets, continued supply chain disruptions, and volatile markets. Most major indices declined substantially from the all-time highs set in 2021, with the S&P 500 falling 14.61% from 11/01/21 to 10/31/22.

As economies across the globe continued to reopen, demand for commodities increased further and strained already tight markets. Supply demand imbalances in key energy markets like oil and natural gas were exacerbated by the Russian invasion of Ukraine, which put upward pressure on energy and commodity prices, accelerating an already high inflation rate. As a result, the energy sector continued its winning streak, returning 61.66%, by far the highest of any sector. The only other sectors that were positive in the year ending 10/31/22 were Consumer Staples, Utilities, and Healthcare, which returned 4.78%, 2.46%, and .95%, respectively.

The primary focus of markets in 2022 was historically high inflation, which caused negative shocks to both equity and fixed income markets. Consensus expectations heading into the year were for inflation to moderate rapidly. Instead, inflation continued to climb higher, reaching levels which hadn’t been seen since the ‘Great Inflation’ period of 1967 – 1982. Unexpectedly high inflation put pressure on global central banks to tighten monetary policy swiftly and aggressively. As a result, a traditional portfolio of 60% stocks and 40% bonds had the worst year-to-date performance ever (adjusted for inflation) through the end of Q3 2022. US inflation averaged 8.0% for the year ended 10/31/22 and peaked at 9.1% in June 2022. The yield on a 10-year US Treasury spiked from 1.55% to a peak of 4.24% on 10/24/22. Higher than expected inflation caused the Fed to hike interest rates significantly faster than expected. Heading into 2022, consensus expectations were for three interest rate hikes in 2022, or an increase of 75 basis points in the Fed Funds Rate. Instead, the FFR increased to 3.0% - 3.25%, and the Fed hiked the overnight rate by 75 basis points on three separate occasions in 2022. Higher discount rates in the form of higher interest rates and higher inflation put downward pressure on stock prices, which entered the year at some of the highest valuation levels since the dot-com bubble.

Systemic shocks to supply chains persisted in 2022, with the primary shocks coming from the Russian invasion of Ukraine in February, and the continuation of lockdowns in China from their Zero-Covid policies. The Russian invasion of Ukraine caused NATO nations to impose sanctions on Russia. The primary effects of the shock caused by the invasion and the subsequent sanctions were higher energy and food costs across the globe, but especially in European nations, which were highly reliant on Russian energy. Following the invasion in February, energy costs in Europe spiked at never-before-seen rates, which worsened inflation in Europe, and forced the Bank of England, and the ECB to increase interest rates faster than expected, following in the footsteps of the Fed in the US.

Bad news from record high inflation was offset by good news in the labor market, with the US unemployment rate decreasing to 50-year lows in 2022 at 3.5% in July and September. Tightness in the labor market continues to put pressure on the Fed to increase rates and cool off an overheating economy. Earnings remained resilient through the year ended 10/31/22, though forward-looking guidance has become increasingly more negative as companies anticipate the delayed effects of rate hikes and tighter financial conditions on the broader economy.

1

Pacer Funds

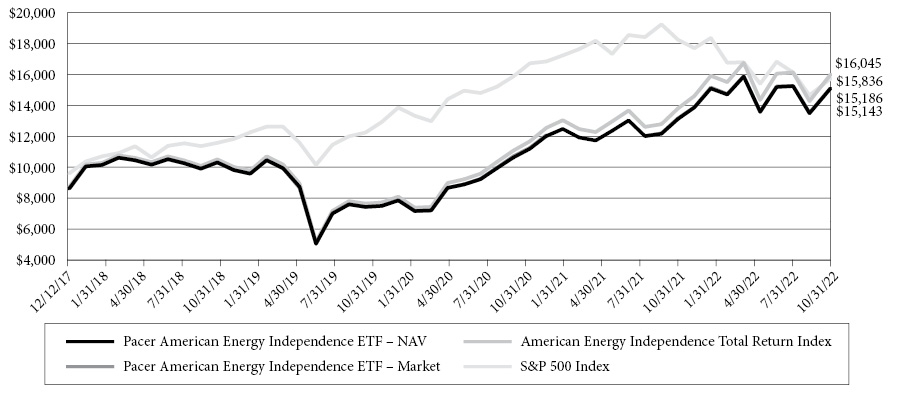

Pacer American Energy Independence ETF

The Pacer American Energy Independence ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the performance, before fees and expenses, of the American Energy Independence Index (the “Index”).

For the fiscal year, the Fund had a NAV total return of 16.26%. The Index had a total return of 17.39%. The S&P 500 had a total return of -14.61%.

The Fund’s top three contributors to its return were Cheniere Energy at 69.27%, New Fortress Energy Inc. Class A at 77.58%, and PBF Logistics LP at 67.23%. The Fund’s bottom three contributors to return were Tellurian Inc. -35.41%, TC Energy Corporation at -14.96%, and Equitrans Midstream Corporation at -14.06%.

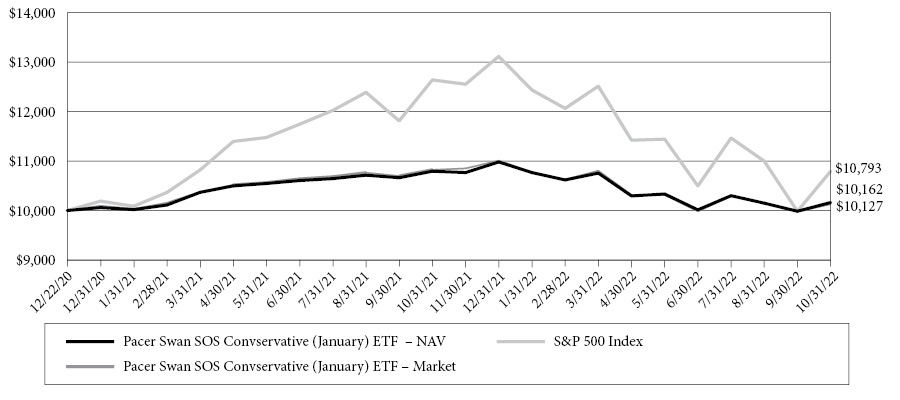

Pacer Swan SOS Conservative (January) ETF

The Pacer Swan SOS Conservative (January) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 8.60% (before fees and expenses of the Fund) and 7.85% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from December 20, 2021 to December 31, 2022.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: December 20, 2021

Investment Period End: December 31, 2022

Cap (after Fund fees and expenses): 8.60%

Cap (after Fund fees and expenses): 7.85%

Year-To-Date, the Fund had a NAV total return of -5.85%. The S&P 500 Index had a price return of -14.61%.

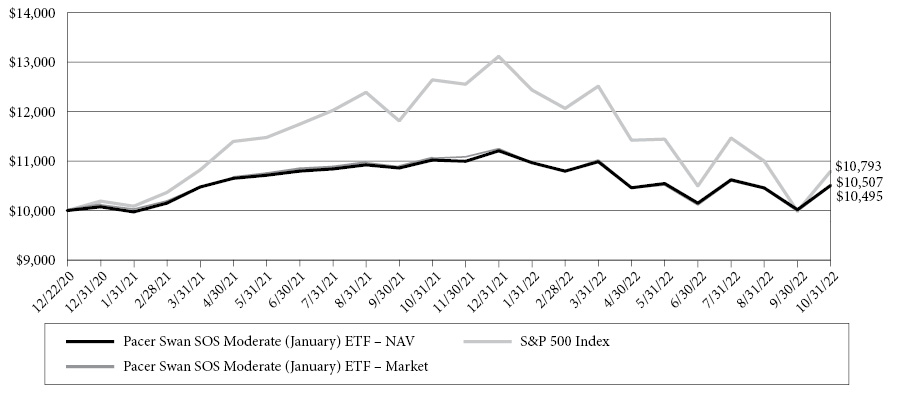

Pacer Swan SOS Moderate (January) ETF

The Pacer Swan SOS Moderate (January) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a a predetermined upside cap of 10.30% (before fees and expenses of the Fund) and 9.55% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from December 20, 2021 to December 31, 2022.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: December 20, 2021

Investment Period End: December 31, 2022

Cap (before Fund fees and expenses): 10.30%

Cap (after Fund fees and expenses): 9.55%

Year-To-Date, the Fund had a NAV total return of -4.65%. The S&P 500 Index had a price return of -14.61%.

Pacer Swan SOS Flex (January) ETF

The Pacer Swan SOS Flex (January) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 14.70% (before fees and expenses of the Fund) and 13.95% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from December 20, 2021 to December 31, 2022.

2

Pacer Funds

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: December 20, 2021

Investment Period End: December 31, 2022

Cap (before Fund fees and expenses): 14.70%

Cap (after Fund fees and expenses): 13.95%

Year-To-Date, the Fund had a NAV total return of -3.74%. The S&P 500 Index had a price return of -14.61%.

Pacer Swan SOS Fund of Funds ETF

The Pacer Swan SOS Fund of Funds ETF (the “Fund”) seeks capital appreciation with downside protection

Year-To-Date, the Fund had a NAV total return of -4.12%. The S&P 500 Index had a price return of -14.61%.

Pacer Swan SOS Conservative (April) ETF

The Pacer Swan SOS Conservative (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 10.23% (before fees and expenses of the Fund) and 9.48% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from April 1, 2022 to March 31, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: April 1, 2022

Investment Period End: March 31, 2023

Cap (before Fund fees and expenses): 10.23%

Cap (after Fund fees and expenses): 9.48%

Year-To-Date, the Fund had a NAV total return of -4.52%. The S&P 500 Index had a price return of -14.61%.

Pacer Swan SOS Moderate (April) ETF

The Pacer Swan SOS Moderate (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 11.31% (before fees and expenses of the Fund) and 10.56% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from April 1, 2022 to March 31, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: April 1, 2022

Investment Period End: March 31, 2023

Cap (before Fund fees and expenses): 11.31%

Cap (after Fund fees and expenses): 10.56%

Year-To-Date, the Fund had a NAV total return of -3.92%. The S&P 500 Index had a price return of -14.61%.

3

Pacer Funds

Pacer Swan SOS Flex (April) ETF

The Pacer Swan SOS Flex (April) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 14.88% (before fees and expenses of the Fund) and 14.13% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from April 1, 2022 to March 31, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: April 1, 2022

Investment Period End: March 31, 2023

Cap (before Fund fees and expenses): 14.88%

Cap (after Fund fees and expenses): 14.13%

Year-To-Date, the Fund had a NAV total return of -5.15%. The S&P 500 Index had a price return of -14.61%.

Pacer Swan SOS Conservative (July) ETF

The Pacer Swan SOS Conservative (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 15.30% (before fees and expenses of the Fund) and 14.55% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from July 1, 2022 to June 30, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: July 1, 2022

Investment Period End: June 30, 2023

Cap (before Fund fees and expenses): 15.30%

Cap (after Fund fees and expenses): 14.55%

Year-To-Date, the Fund had a NAV total return of -6.88%. The S&P 500 Index had a price return of -14.61%.

Pacer Swan SOS Moderate (July) ETF

The Pacer Swan SOS Moderate (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 17.10% (before fees and expenses of the Fund) and 16.35% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from July 1, 2022 to June 30, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: July 1, 2022

Investment Period End: June 30, 2023

Cap (before Fund fees and expenses): 17.10%

Cap (after Fund fees and expenses): 16.35%

Year-To-Date, the Fund had a NAV total return of -1.74%. The S&P 500 Index had a price return of -14.61%.

4

Pacer Funds

Pacer Swan SOS Flex (July) ETF

The Pacer Swan SOS Flex (July) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 22.28% (before fees and expenses of the Fund) and 21.53% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from July 1, 2022 to June 30, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: July 1, 2022

Investment Period End: June 30, 2023

Cap (before Fund fees and expenses): 22.28%

Cap (after Fund fees and expenses): 21.553%

Year-To-Date, the Fund had a NAV total return of -2.49%. The S&P 500 Index had a price return of -14.61%.

Pacer Swan SOS Conservative (October) ETF

The Pacer Swan SOS Conservative (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 18.44% (before fees and expenses of the Fund) and 17.69% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from October 1, 2022 to September 30, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: October 1, 2022

Investment Period End: September 30, 2023

Cap (before Fund fees and expenses): 18.44%

Cap (after Fund fees and expenses): 17.69%

Year-To-Date, the Fund had a NAV total return of -4.67%. The S&P 500 Index had a price return of -14.61%.

Pacer Swan SOS Moderate (October) ETF

The Pacer Swan SOS Moderate (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 20.60% (before fees and expenses of the Fund) and 19.85% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from October 1, 2022 to September 30, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: October 1, 2022

Investment Period End: September 30, 2023

Cap (before Fund fees and expenses): 20.60%

Cap (after Fund fees and expenses): 19.85%

Year-To-Date, the Fund had a NAV total return of -1.40%. The S&P 500 Index had a price return of -14.61%.

5

Pacer Funds

Pacer Swan SOS Flex (October) ETF

The Pacer Swan SOS Flex (October) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 26.30% (before fees and expenses of the Fund) and 25.55% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from October 1, 2022 to September 30, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: October 1, 2022

Investment Period End: September 30, 2023

Cap (before Fund fees and expenses): 26.30%

Cap (after Fund fees and expenses): 25.55%

Year-To-Date, the Fund had a NAV total return of 0.31%. The S&P 500 Index had a price return of -14.61%.

Pacer BlueStar Digital Entertainment ETF

The Pacer BlueStar Digital Entertainment ETF (the “Fund”) employs a “passive management”(or indexing) investment approach designed to track the total return performance, before fees and expenses, of the BlueStar Global Online Gambling, Video Gaming, and eSports Index (the Index).

For the fiscal period, the Fund had a NAV total return of -21.58%. The Index had a total return of -22.26%. The S&P 500 had a total return of -13.18%.

The Fund’s top three contributors to its return were: LeoVegas AB +35.53%, Betsson AB Class B +27.26% and NeoGames SA +26.38%. The Fund’s bottom three contributors to return were: Bilibili Inc ADR -67.65%, Unity Software, Inc -67.41% and 888 holdings -61.64%.

Pacer BlueStar Engineering the Future ETF

The Pacer BlueStar Engineering the Future ETF (the “Fund”) employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the BlueStar Robotics and 3D Printing Index (the“Index”).

For the fiscal period, the Fund had a NAV total return of -17.14%. The Index had a total return of -17.18%. The S&P 500 had a total return of -9.19%.

The Fund’s top three contributors to its return were: PTC, Inc +16.25%, AVEVA Group, PLC +15.11% and ANDRITZ AG +14.43%. The Fund’s bottom three contributors to return were: BICO Group AB Class B -78.53%, Nemetschek SE -46.36% and Desktop Meta, Inc Class A – 43.40.

6

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2022

Pacer American Energy Independence ETF

Sector(a) | | Percentage of

Net Assets | |

Energy | | | 99.4 | % |

Short-Term Investments | | | 0.0 | %(b) |

Investments Purchased With Proceeds From Securities Lending | | | 14.0 | % |

Liabilities in Excess of Other Assets | | | -13.4 | % |

| | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the American Energy Independence Index. |

Pacer Swan SOS Conservative (January) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 99.8 | % |

Short-Term Investments | | | 0.6 | % |

Liabilities in Excess of Other Assets | | | -0.4 | % |

| | | | 100.0 | % |

Pacer Swan SOS Moderate (January) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 103.8 | % |

Short-Term Investments | | | 0.2 | % |

Liabilities in Excess of Other Assets | | | -4.0 | % |

| | | | 100.0 | % |

Pacer Swan SOS Flex (January) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 103.6 | % |

Short-Term Investments | | | 0.2 | % |

Liabilities in Excess of Other Assets | | | -3.8 | % |

| | | | 100.0 | % |

Pacer Swan SOS Fund of Funds ETF

Sector | | Percentage of

Net Assets | |

Affiliated Exchange-Traded Funds | | | 99.2 | % |

Short-Term Investments | | | 0.8 | % |

Liabilities in Excess of Other Assets | | | 0.0 | %(a) |

| | | | 100.0 | % |

Pacer Swan SOS Conservative (April) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 100.7 | % |

Short-Term Investments | | | 0.7 | % |

Liabilities in Excess of Other Assets | | | -1.4 | % |

| | | | 100.0 | % |

7

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2022 (Continued)

Pacer Swan SOS Moderate (April) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 104.8 | % |

Short-Term Investments | | | 0.3 | % |

Liabilities in Excess of Other Assets | | | -5.1 | % |

| | | | 100.0 | % |

Pacer Swan SOS Flex (April) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 106.3 | % |

Short-Term Investments | | | 0.3 | % |

Liabilities in Excess of Other Assets | | | -6.6 | % |

| | | | 100.0 | % |

Pacer Swan SOS Conservative (July) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 103.4 | % |

Short-Term Investments | | | 0.8 | % |

Liabilities in Excess of Other Assets | | | -4.2 | % |

| | | | 100.0 | % |

Pacer Swan SOS Moderate (July) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 104.3 | % |

Short-Term Investments | | | 0.9 | % |

Liabilities in Excess of Other Assets | | | -5.2 | % |

| | | | 100.0 | % |

Pacer Swan SOS Flex (July) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 104.0 | % |

Short-Term Investments | | | 1.1 | % |

Liabilities in Excess of Other Assets | | | -5.1 | % |

| | | | 100.0 | % |

Pacer Swan SOS Conservative (October) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 105.6 | % |

Short-Term Investments | | | 1.7 | % |

Liabilities in Excess of Other Assets | | | -7.3 | % |

| | | | 100.0 | % |

8

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2022 (Continued)

Pacer Swan SOS Moderate (October) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 106.7 | % |

Short-Term Investments | | | 1.3 | % |

Liabilities in Excess of Other Assets | | | -8.0 | % |

| | | | 100.0 | % |

Pacer Swan SOS Flex (October) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 106.3 | % |

Short-Term Investments | | | 1.1 | % |

Liabilities in Excess of Other Assets | | | -7.4 | % |

| | | | 100.0 | % |

Pacer BlueStar Digital Entertainment ETF

Sector(a) | | Percentage of

Net Assets | |

Consumer Durables & Apparel | | | 1.7 | % |

Consumer Services | | | 54.5 | % |

Media & Entertainment | | | 32.6 | % |

Semiconductors & Semiconductor | | | 5.5 | % |

Software & Services | | | 1.1 | % |

Exchange Traded Funds | | | 4.5 | % |

Short-Term Investments | | | 0.0 | %(b) |

Other Assets in Excess of Liabilities | | | 0.1 | % |

Total | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the BlueStar Global Online Gambling, Video Gaming, and eSports Index. |

Pacer BlueStar Engineering the Future ETF

Sector(a) | | Percentage of

Net Assets | |

Automobiles & Components | | | 1.8 | % |

Capital Goods | | | 25.9 | % |

Pharmaceuticals, Biotechnology | | | 0.6 | % |

Semiconductors & Semiconductor | | | 24.3 | % |

Software & Services | | | 29.6 | % |

Technology Hardware & Equipmen | | | 17.6 | % |

Short-Term Investments | | | 0.1 | % |

Other Assets in Excess of Liabilities | | | 0.1 | % |

Total | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the BlueStar Robotics and 3D Printing Index. |

9

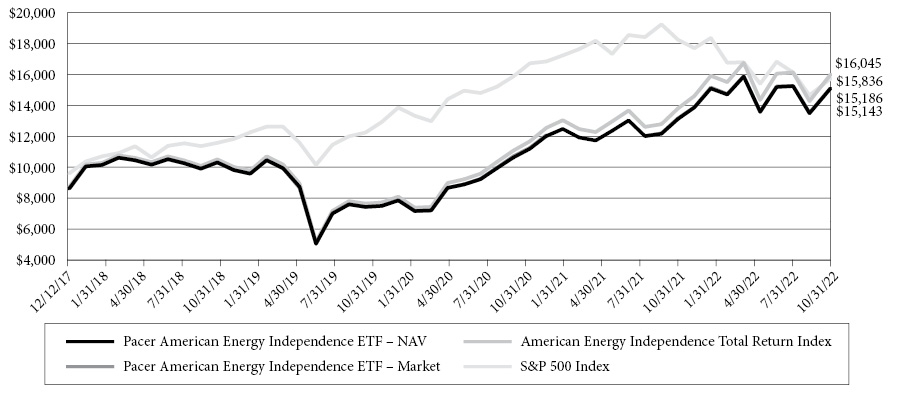

Pacer American Energy Independence ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 12, 2017, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The American Energy Independence Total Return (the “Index”) uses a proprietary, rules-based methodology to measure the performance of a portfolio of U.S. and Canadian exchange-listed equity securities of companies that generate a majority of their cash flow from certain qualifying “midstream” energy infrastructure activities. The companies in the Index are expected to benefit from regulatory policies favoring and industry trends toward American energy independence (i.e., a reduced or eliminated need for the United States to import fuels, such as coal, crude oil, or natural gas). Midstream energy infrastructure refers to the processing, storage, transportation, and distribution of crude oil, natural gas, refined products, and their related products, as well as the transmission or storage of renewable energy. The following activity segments are considered qualifying midstream energy infrastructure activities: gathering & processing, compression, fractionation, logistics, midstream services, pipeline transportation, storage and terminaling of oil, gas, natural gas liquids, and refined products, as well as operating liquid natural gas facilities. The following activity segments are not qualifying activities: refining, shipping, exploration, production, retail distribution, or oil services. The Index may include small-, mid-, and large-capitalization companies.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Three Year | Since Inception(2) |

Pacer American Energy Independence ETF - NAV | 16.26% | 15.53% | 8.87% |

Pacer American Energy Independence ETF - Market | 16.74% | 15.66% | 8.93% |

American Energy Independence Total Return Index (3) | 17.39% | 16.99% | 10.16% |

S&P 500 Index (3) | -14.61% | 10.22% | 9.87% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 supplemented June 10, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 12, 2017. The Fund is the sucessor to the investment performance of the American Energy Independence ETF (the “Predecessor USAI”) as a result of the reorganization of the Predecessor USAI Fund into the Fund on December 16, 2019. Accordingly, the performance information shown in the chart and table above for periods prior to December 16, 2019 is that of the Predecessor USAI Fund’s Shares for the Fund. The Predecessor USAI Fund was advised by SL Advisors, LLC and sub-advised by Penserra Capital Management LLC and had substantially the same investment objectives, policies, and strategies as the Fund. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

10

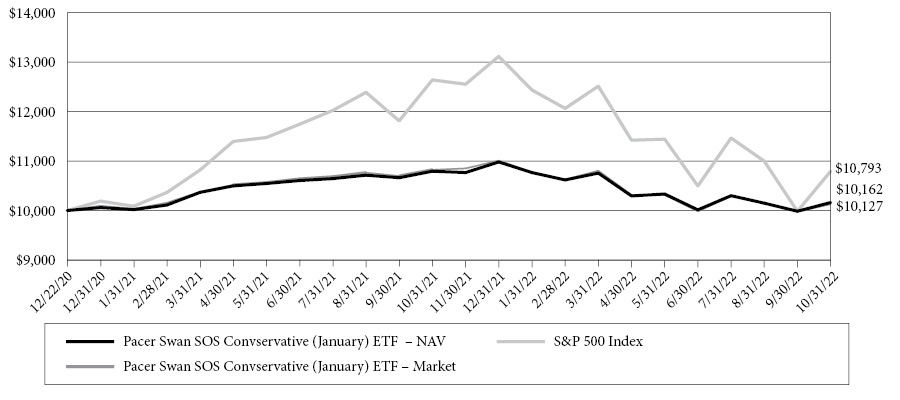

Pacer Swan SOS Conservative (January) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (January) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 8.60% (before fees and expenses of the Fund) and 7.85% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from December 20, 2021 to December 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Conservative (January) ETF - NAV | -5.85% | 0.87% |

Pacer Swan SOS Conservative (January) ETF - Market | -6.43% | 0.68% |

S&P 500 Index (3) | -14.61% | 4.19% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

11

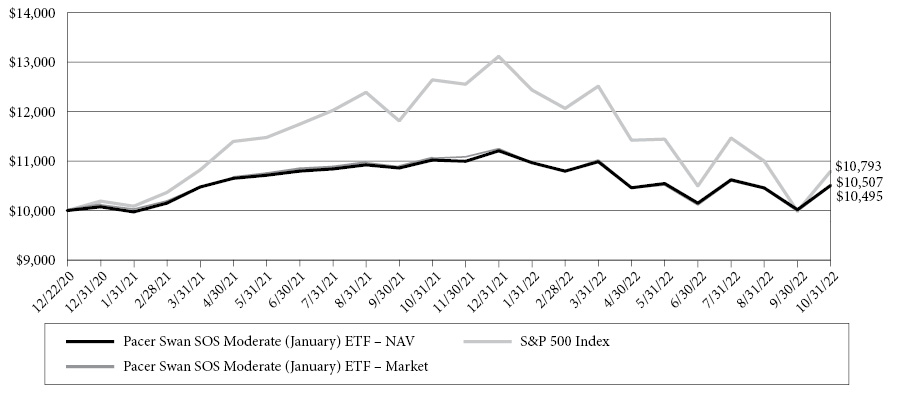

Pacer Swan SOS Moderate (January) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (January) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 10.30% (before fees and expenses of the Fund) and 9.55% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from December 20, 2021 to December 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Moderate (January) ETF - NAV | -4.65% | 2.70% |

Pacer Swan SOS Moderate (January) ETF - Market | -5.07% | 2.64% |

S&P 500 Index (3) | -14.61% | 4.19% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

12

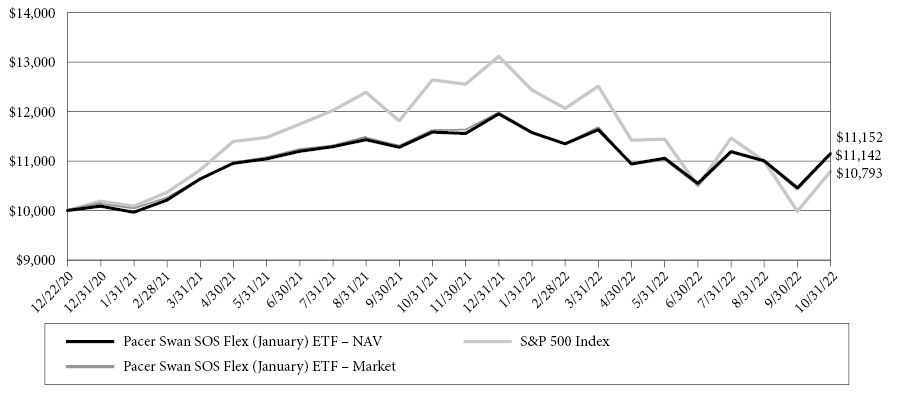

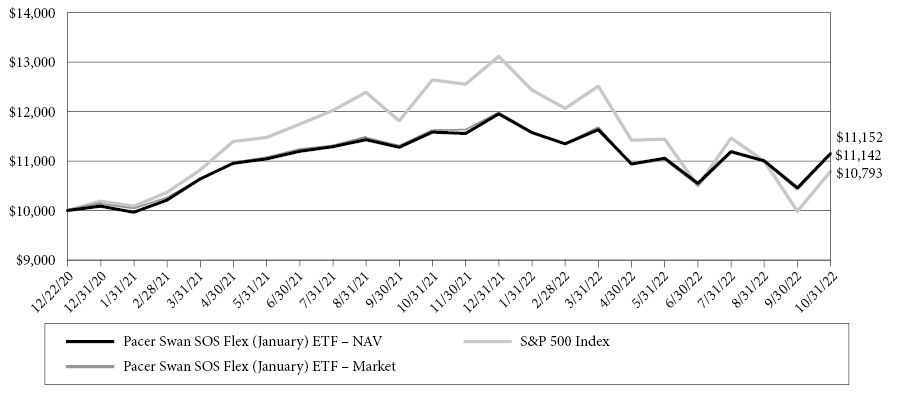

Pacer Swan SOS Flex (January) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (January) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 14.70% (before fees and expenses of the Fund) and 13.95% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from December 20, 2021 to December 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Flex (January) ETF - NAV | -3.74% | 6.04% |

Pacer Swan SOS Flex (January) ETF - Market | -4.17% | 5.99% |

S&P 500 Index (3) | -14.61% | 4.19% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

13

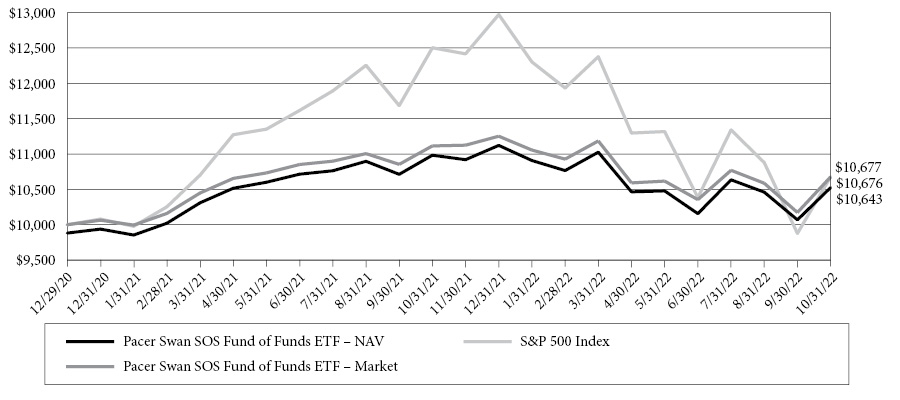

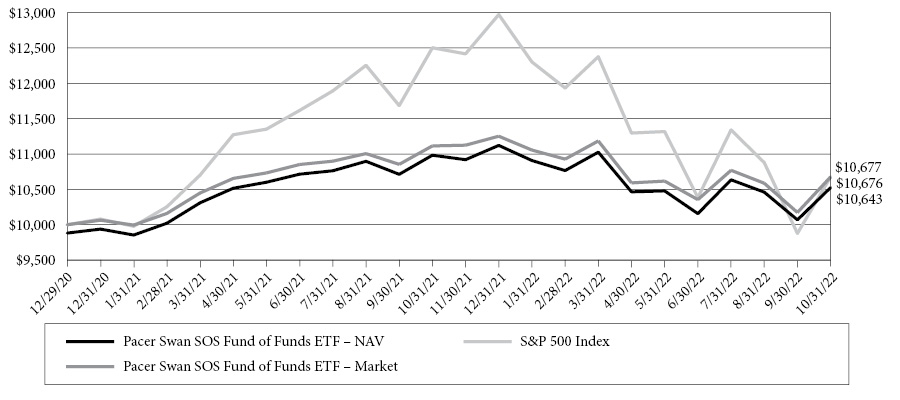

Pacer Swan SOS Fund of Funds ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 29, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Fund of Funds ETF (the “Fund”) seeks capital appreciation with downside protection.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Fund of Funds ETF - NAV | -4.12% | 3.45% |

Pacer Swan SOS Fund of Funds ETF - Market | -3.94% | 3.62% |

S&P 500 Index (3) | -14.61% | 3.63% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.93%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 29, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

14

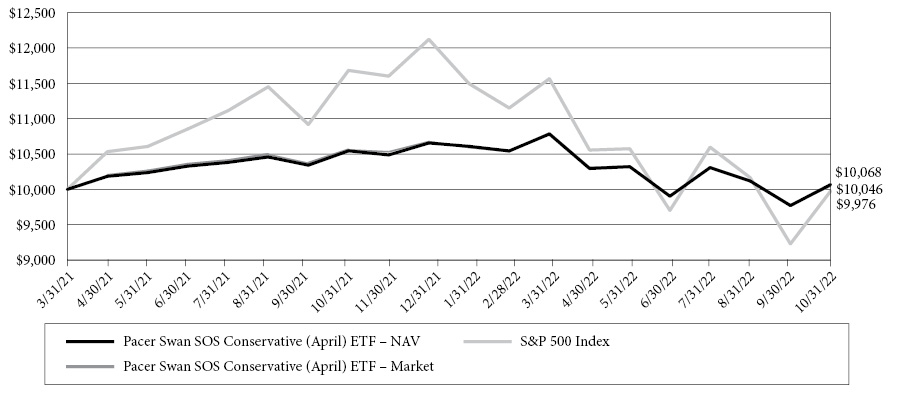

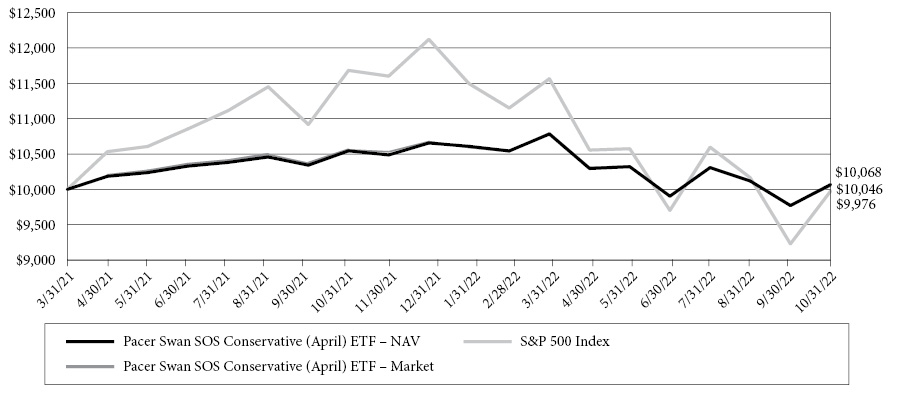

Pacer Swan SOS Conservative (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 10.23% (before fees and expenses of the Fund) and 9.48% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from April 1, 2022 to March 31, 2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Conservative (April) ETF - NAV | -4.52% | 0.43% |

Pacer Swan SOS Conservative (April) ETF - Market | -4.85% | 0.29% |

S&P 500 Index (3) | -14.61% | -0.15% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

15

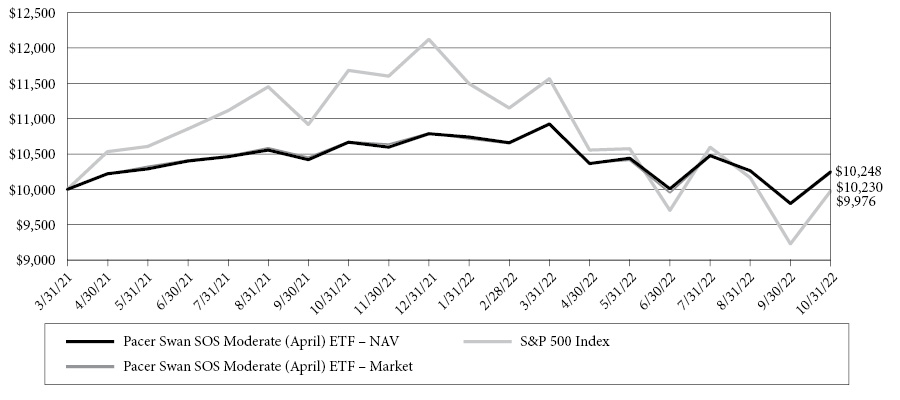

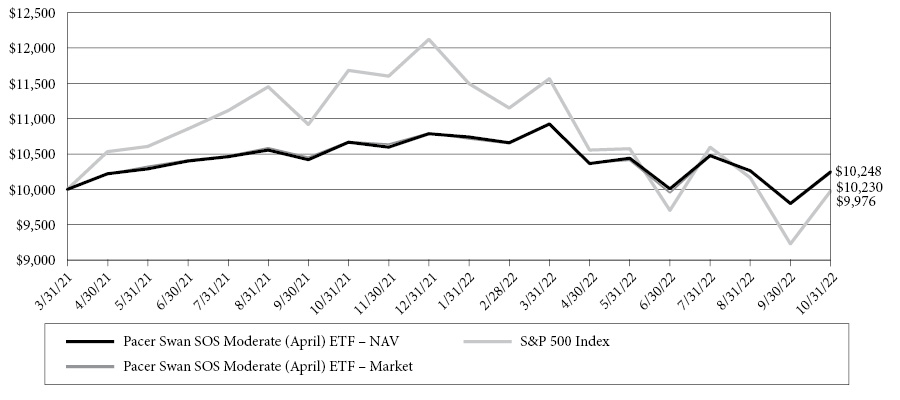

Pacer Swan SOS Moderate (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 11.31% (before fees and expenses of the Fund) and 10.56% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from April 1, 2022 to March 31, 2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Moderate (April) ETF - NAV | -3.92% | 1.56% |

Pacer Swan SOS Moderate (April) ETF - Market | -4.18% | 1.44% |

S&P 500 Index (3) | -14.61% | -0.15% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

16

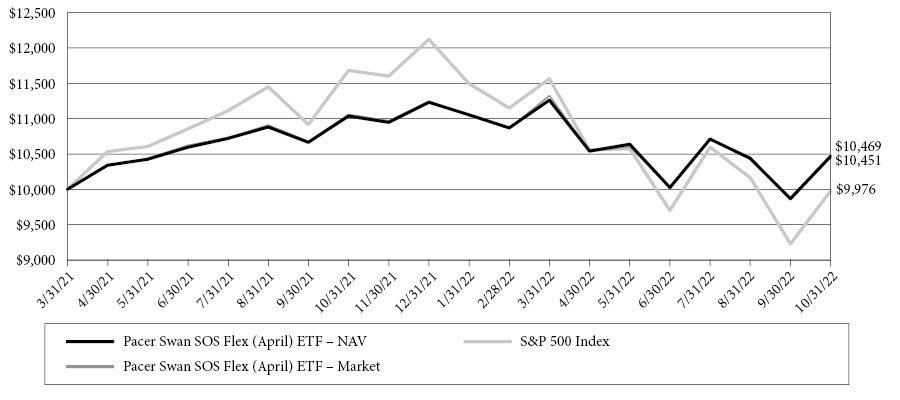

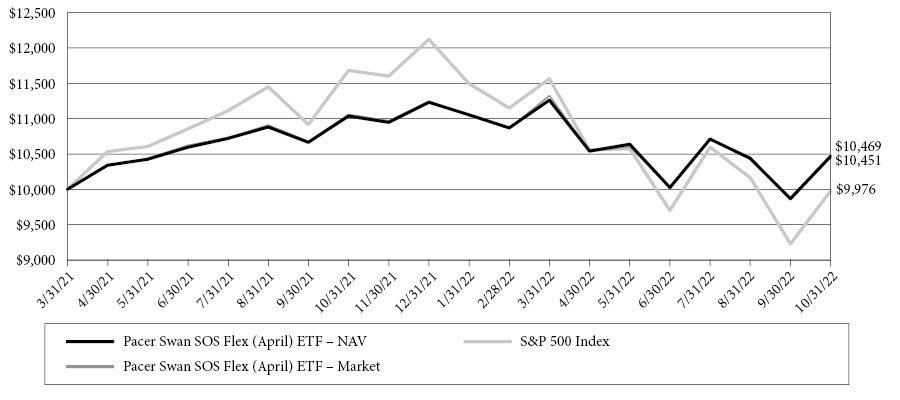

Pacer Swan SOS Flex (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (April) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 14.88% (before fees and expenses of the Fund) and 14.13% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from April 1, 2022 to March 31, 2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Flex (April) ETF - NAV | -5.15% | 2.93% |

Pacer Swan SOS Flex (April) ETF - Market | -5.49% | 2.82% |

S&P 500 Index (3) | -14.61% | -0.15% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

17

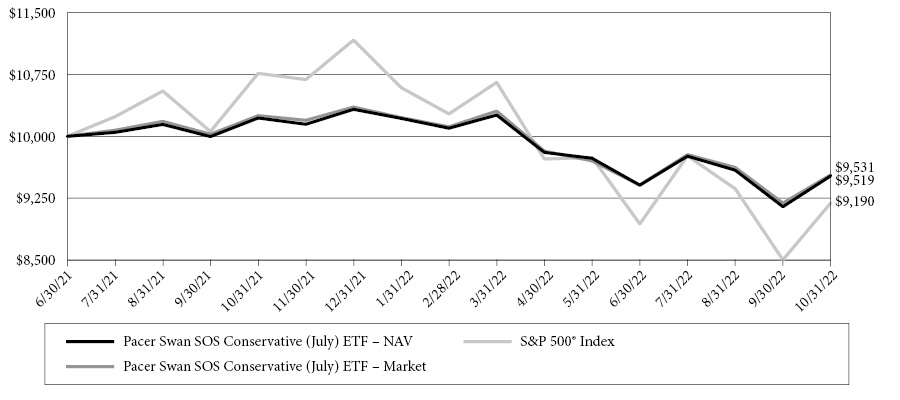

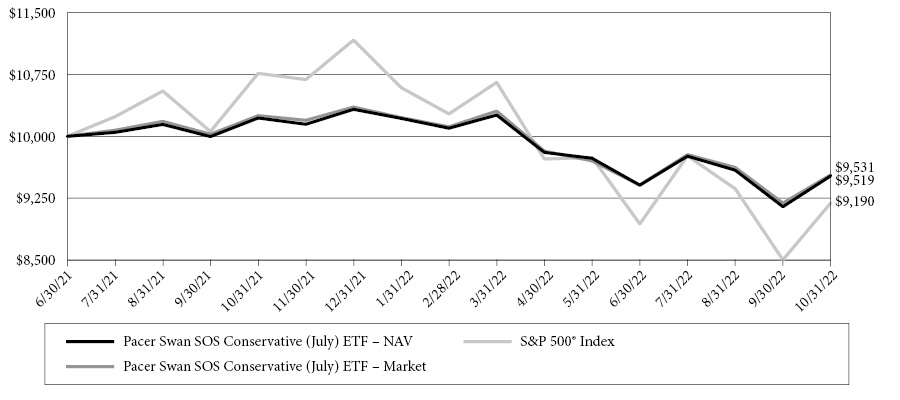

Pacer Swan SOS Conservative (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 15.30% (before fees and expenses of the Fund) and 14.55% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from July 1, 2022 to June 30, 2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Conservative (July) ETF - NAV | -6.88% | -3.62% |

Pacer Swan SOS Conservative (July) ETF - Market | -7.02% | -3.53% |

S&P 500 Index (3) | -14.61% | -6.12% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated July 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

18

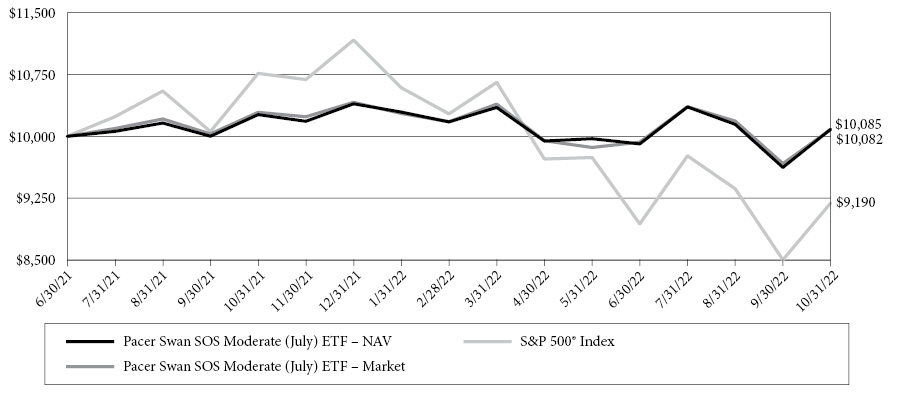

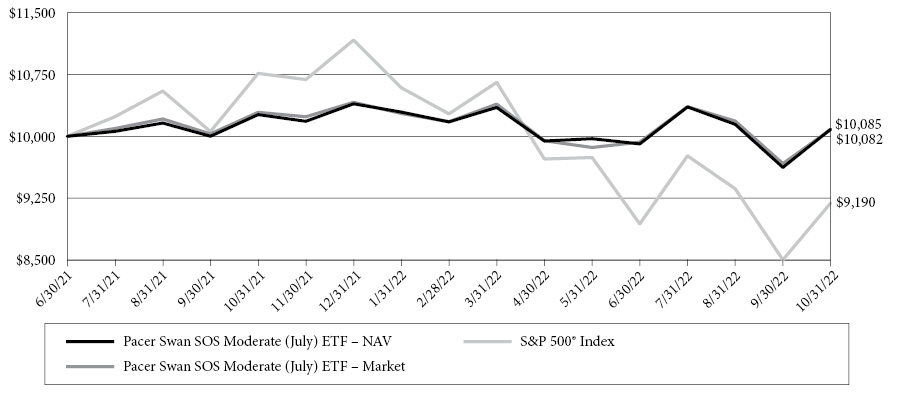

Pacer Swan SOS Moderate (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 17.10% (before fees and expenses of the Fund) and 16.35% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from July 1, 2022 to June 30, 2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Moderate (July) ETF - NAV | -1.74% | 0.63% |

Pacer Swan SOS Moderate (July) ETF - Market | -2.02% | 0.61% |

S&P 500 Index (3) | -14.61% | -6.12% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated July 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

19

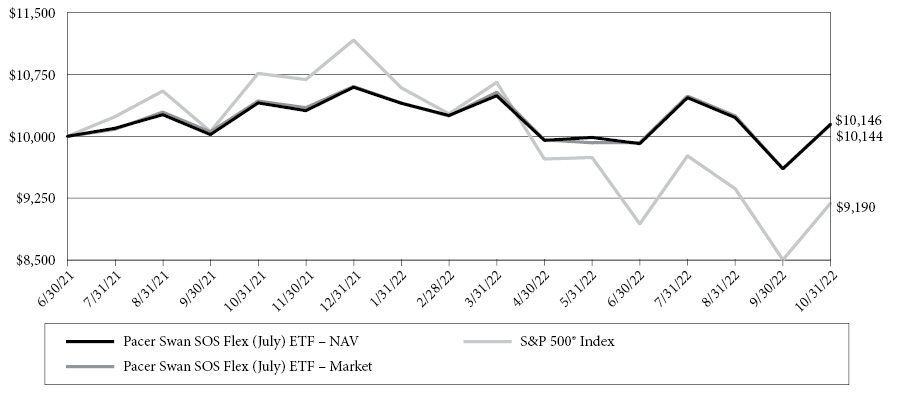

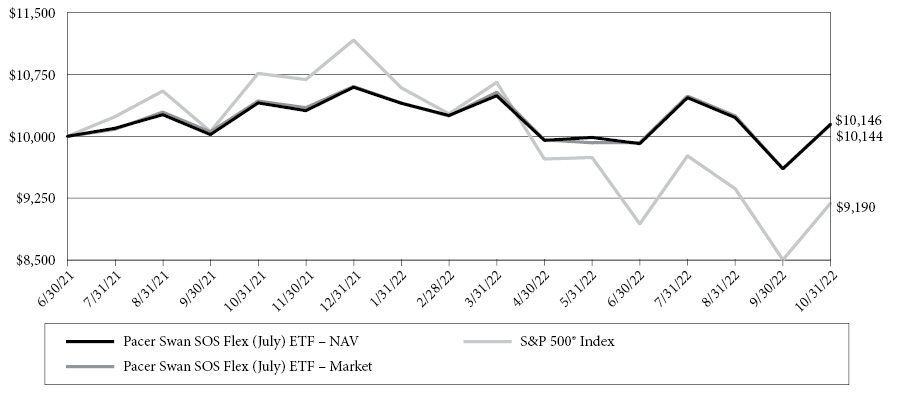

Pacer Swan SOS Flex (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (July) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 22.28% (before fees and expenses of the Fund) and 21.53% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from July 1, 2022 to June 30, 2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Flex (July) ETF - NAV | -2.49% | 1.09% |

Pacer Swan SOS Flex (July) ETF - Market | -2.71% | 1.08% |

S&P 500 Index (3) | -14.61% | -6.12% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated July 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

20

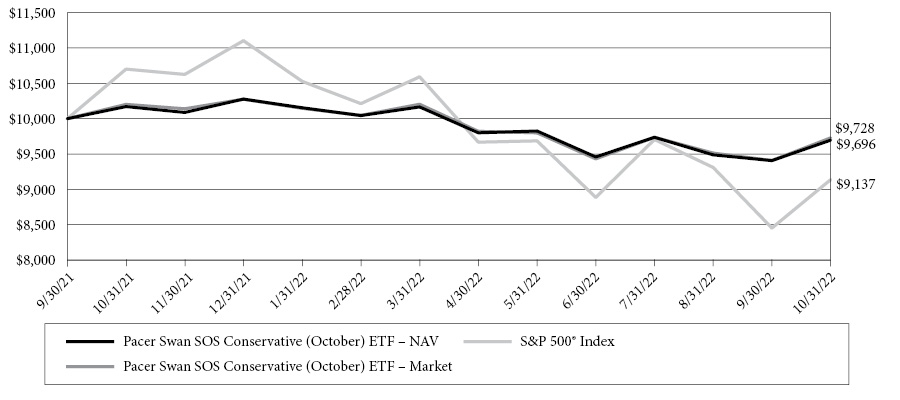

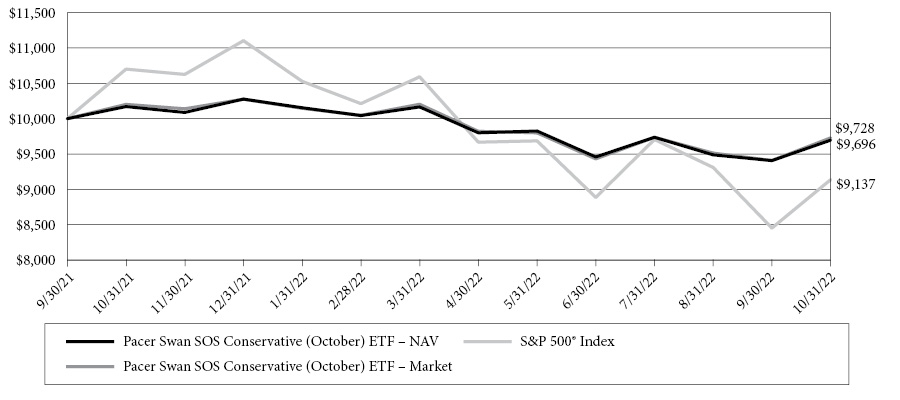

Pacer Swan SOS Conservative (October) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on September 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 18.44% (before fees and expenses of the Fund) and 17.69% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from October 1, 2022 to September 30, 2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Conservative (October) ETF - NAV | -4.67% | -2.81% |

Pacer Swan SOS Conservative (October) ETF - Market | -4.65% | -2.51% |

S&P 500 Index (3) | -14.61% | -7.98% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated October 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is September 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

21

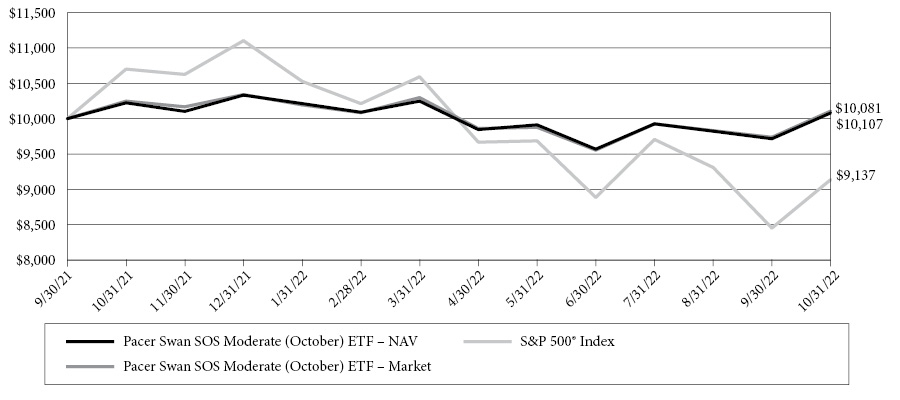

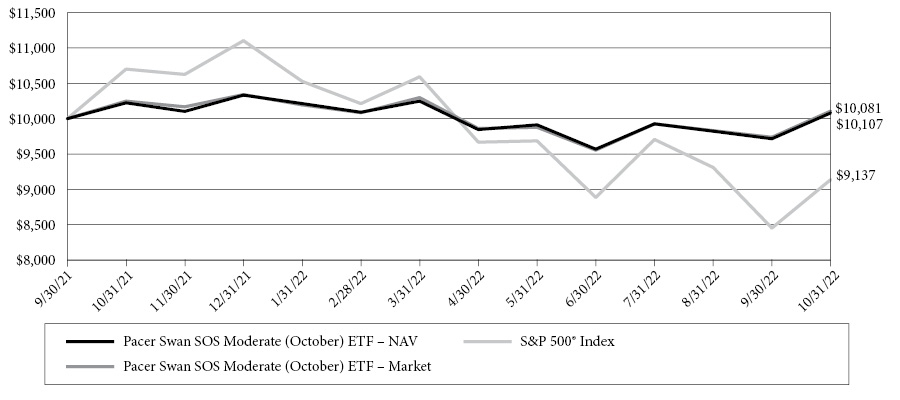

Pacer Swan SOS Moderate (October) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on September 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 20.60% (before fees and expenses of the Fund) and 19.85% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from October 1, 2022 to September 30, 2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Moderate (October) ETF - NAV | -1.40% | 0.75% |

Pacer Swan SOS Moderate (October) ETF - Market | -1.37% | 0.99% |

S&P 500 Index (3) | -14.61% | -7.98% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated October 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is September 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

22

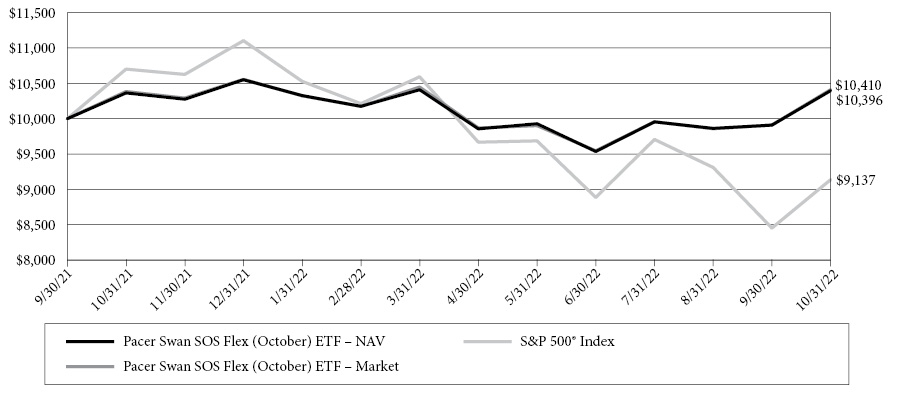

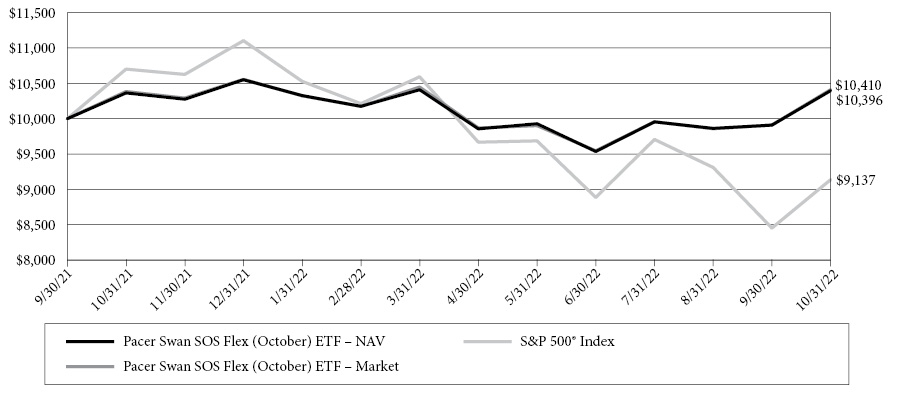

Pacer Swan SOS Flex (October) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on September 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (October) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 26.30% (before fees and expenses of the Fund) and 25.55% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from October 1, 2022 to September 30, 2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended October 31, 2022)

| | One Year | Since Inception(2) |

Pacer Swan SOS Flex (October) ETF - NAV | 0.31% | 3.65% |

Pacer Swan SOS Flex (October) ETF - Market | 0.25% | 3.77% |

S&P 500 Index (3) | -14.61% | -7.98% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated October 1, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is September 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

23

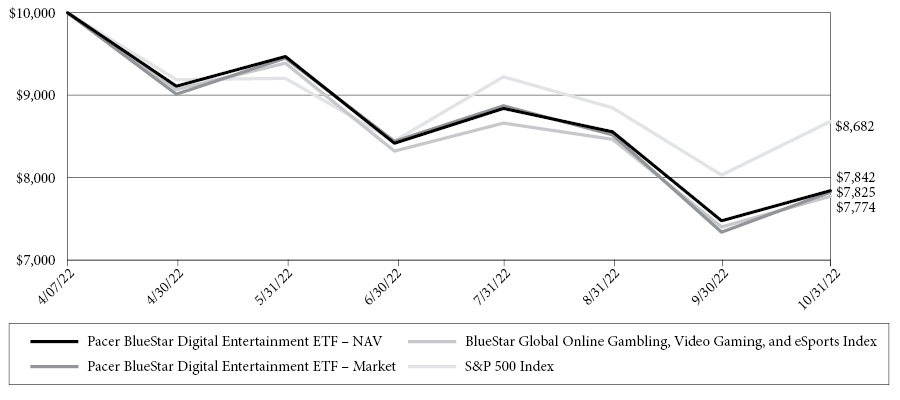

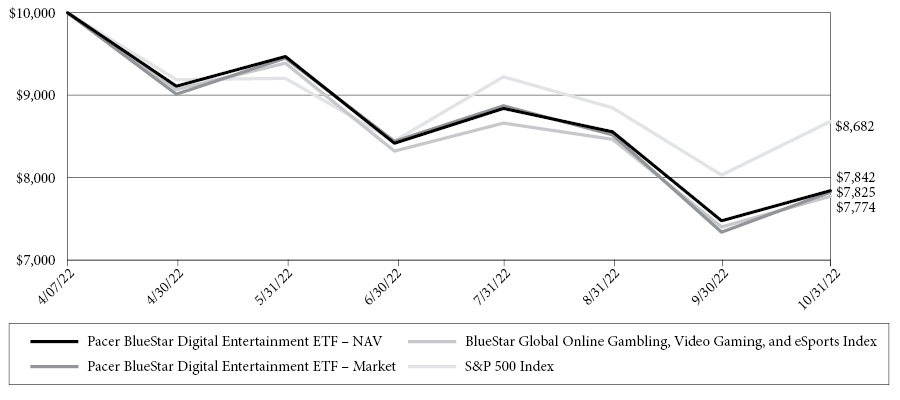

Pacer BlueStar Digital Entertainment ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on April 7, 2022, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The BlueStar Global Online Gambling, Video Gaming, and eSports Index (the “Index”) is a rules-based index that consists of globally-listed stocks and depositary receipts of digital entertainment companies. Companies eligible to be added to the Index are those that derive at least 50% of their revenues from the following activities: online gambling platforms or software related to online gambling; video game development and software related to the development of video games or hardware such as computer processors and graphics cards used in video gaming systems, controllers, headsets, and gaming consoles; and streaming services or video games and/or hardware for use in eSports events or that are involved in eSports events such as league operators, teams, distributors and platforms, (collectively, “Digital Entertainment”) as determined by MV Index Solutions (the “Index Provider”).

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the periods ended October 31, 2022)

| | Six Months | Since Inception(2) |

Pacer BlueStar Digital Entertainment ETF - NAV | -13.90% | -21.58% |

Pacer BlueStar Digital Entertainment ETF - Market | -13.16% | -21.75% |

BlueStar Global Online Gambling, Video Gaming, and eSports Index | -14.26% | -22.26% |

S&P 500 Index (3) | -5.50% | -13.18% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated April 6, 2022 as supplemented April 27, 2022, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is April 7, 2022. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

24

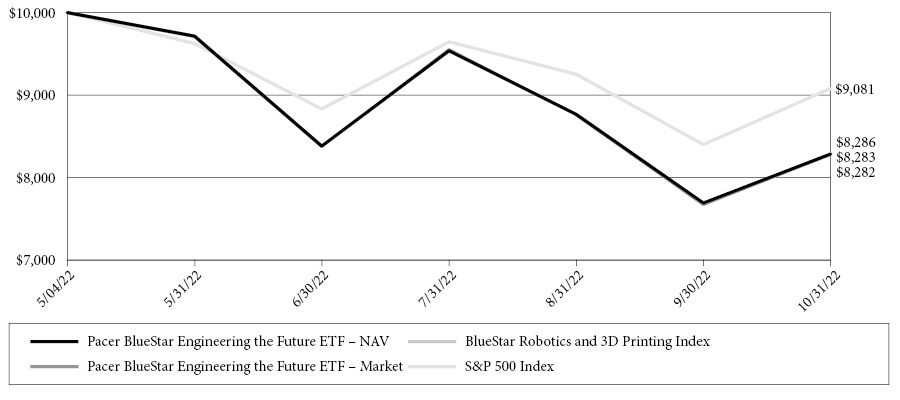

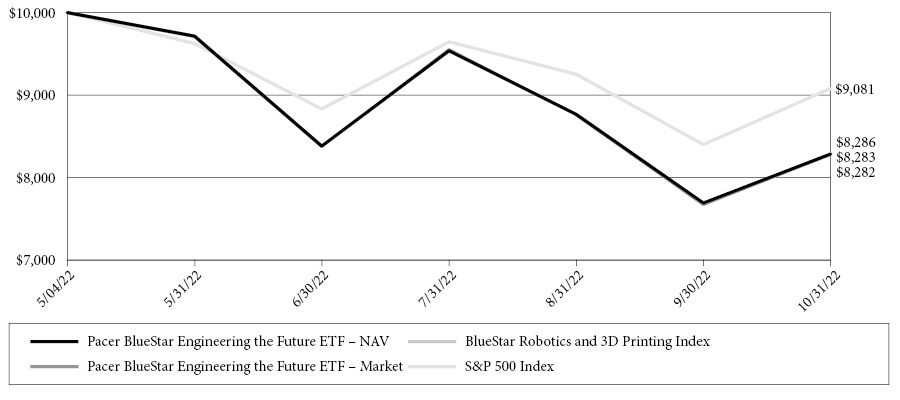

Pacer BlueStar Engineering the Future ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on May 4, 2022, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The BlueStar Robotics and 3D Printing Index (the “Index”) is a rules-based index that consists of globally-listed stocks and depositary receipts of companies that, at the time of being added to the Index, derive at least 50% of their revenues (25% for current Index components) from robots or manufacturing automation equipment (“robotics”); computer aided design (“CAD”) software; or 3D printing centers, 3D printing hardware, 3D printing simulation software, 3D scanning and measurement software, and 3D printing materials (collectively, “Robotics and 3D Printing Companies”), as determined by MV Index Solutions (the “Index Provider”).

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the periods ended October 31, 2022)

| | Since Inception(2) |

Pacer BlueStar Engineering the Future ETF - NAV | -17.14% |

Pacer BlueStar Engineering the Future ETF - Market | -17.17% |

BlueStar Robotics and 3D Printing Index | -17.18% |

S&P 500 Index (3) | -9.19% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated April 6, 2022 as supplemented April 27, 2022, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is May 4, 2022. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

25

Pacer Funds

EXPENSE EXAMPLE

For the Period Ended October 31, 2022 (Unaudited)

As a shareholder of a Fund, you pay ongoing expenses, such as advisory fees, and other Fund expenses. The following examples are intended to help you understand the ongoing cost (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds. Please note, the expenses shown in the tables are meant to highlight ongoing costs only and do not reflect any transactional costs. You may pay brokerage commissions on your purchase and sale of Fund shares, which are not reflected in the following examples. Each example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The columns under the heading entitled “Actual” help you estimate the actual expenses you paid over the period. The “Actual Ending Account Value” shown is derived from a Fund’s actual return and the “Actual Expenses Paid During Period” show the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. To estimate the expenses you paid on your account during this period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the column under the heading untitled “Actual Expenses Paid During Period”.

Hypothetical Example for Comparison Purposes

The columns under the heading entitled “Hypothetical” provide information about hypothetical account value and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s return. The hypothetical account value and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs which may be applicable to your account. Therefore, the last column of the table (Hypothetical Expenses Paid During Period) is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Fund’s Annual

Expense Ratio | Beginning

Account Value

05/01/22 | Ending

Account Value

10/31/22 | Expenses Paid

During Period(a) |

Pacer American Energy Independence ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 1,030.00 | $ 3.84 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer Swan SOS Conservative (January) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 987.10 | $ 3.76 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer Swan SOS Moderate (January) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 1,004.50 | $ 3.79 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer Swan SOS Flex (January) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 1,019.20 | $ 3.82 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer Swan SOS Fund of Funds ETF | | | | |

Actual | 0.18% | $ 1,000.00 | $ 1,005.70 | $ 0.91 |

Hypothetical(b) | 0.18% | $ 1,000.00 | $ 1,024.30 | $ 0.92 |

Pacer Swan SOS Conservative (April) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 977.90 | $ 3.74 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer Swan SOS Moderate (April) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 988.80 | $ 3.76 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer Swan SOS Flex (April) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 993.08 | $ 3.77 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

26

Pacer Funds

EXPENSE EXAMPLE

For the Period Ended October 31, 2022 (Unaudited) (Continued)

| | Fund’s Annual

Expense Ratio | Beginning

Account Value

05/01/22 | Ending

Account Value

10/31/22 | Expenses Paid

During Period(a) |

Pacer Swan SOS Conservative (July) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 970.80 | $ 3.73 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer Swan SOS Moderate (July) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 1,014.30 | $ 3.81 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer Swan SOS Flex (July) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 1,019.70 | $ 3.82 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer Swan SOS Conservative (October) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 989.30 | $ 3.76 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer Swan SOS Moderate (October) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 1,023.80 | $ 3.83 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer Swan SOS Flex (October) ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 1,054.90 | $ 3.88 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.42 | $ 3.82 |

Pacer BlueStar Digital Entertainment ETF | | | | |

Actual | 0.60% | $ 1,000.00 | $ 861.00 | $ 2.81 |

Hypothetical(b) | 0.60% | $ 1,000.00 | $ 1,022.18 | $ 3.06 |

(a) | The dollar amounts shown as expenses paid during the period are equal to the annualized six-month expense ratio multiplied by the average account value during the period, multiplied by the number of days (184) in the most recent six-month period and divided by the number of days in the most recent twelve-month period (365). |

(b) | Assumes 5% return before expenses. |

| | Fund’s Annual

Expense Ratio | Beginning

Account Value

05/04/22(a) | Ending

Account Value

10/31/22 | Expenses Paid

During Period |

Pacer BlueStar Engineering the Future ETF | | | | |

Actual | 0.60% | $ 1,000.00 | $ 828.60 | $ 2.71(b) |

Hypothetical(d) | 0.60% | $ 1,000.00 | $ 1,022.18 | $ 3.06(c) |

(a) | Inception Date of the Fund. |

(b) | The dollar amounts shown as expenses paid during the period are equal to the annualized six-month expense ratio multiplied by the average account value during the period, multiplied by the number of days (180) in the most recent period and divided by the number of days in the most recent twelve-month period (365). |

(c) | The dollar amounts shown as expenses paid during the period are equal to the annualized six-month expense ratio multiplied by the average account value during the period, multiplied by the number of days (184) in the most recent sixth-month period and divided by the number of days in the most recent twelve-month period (365). |

(d) | Assumes 5% return before expenses. |

27

Pacer American Energy Independence ETF