As filed with the U.S. Securities and Exchange Commission on January 5, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23024

Pacer Funds Trust

(Exact name of registrant as specified in charter)

500 Chesterfield Parkway

Malvern, PA 19355

(Address of principal executive offices) (Zip code)

Joe M. Thomson, President

500 Chesterfield Parkway

Malvern, PA 19355

(Name and address of agent for service)

610-644-8100

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: November 1, 2022 to October 31, 2023

Updated May 5, 2021

Item 1. Reports to Stockholders.

Pacer Funds

TABLE OF CONTENTS

| | Page |

Letter to Shareholders | 1 |

Portfolio Allocation | 9 |

Performance Summary | 14 |

Expense Example | 32 |

Schedules of Investments | 34 |

Statements of Assets & Liabilities | 65 |

Statements of Operations | 70 |

Statements of Changes in Net Assets | 77 |

Financial Highlights | 88 |

Notes to Financial Statements | 106 |

Report of Independent Registered Public Accounting Firm | 129 |

Additional Information | 132 |

Pacer Funds

Dear Shareholder,

It is hard to believe that we find ourselves at the year’s end once more. As we reflect on 2023, I can’t help but feel an overwhelming sense of appreciation for your confidence and commitment to Pacer. Amid discussions of potential increases in fed rates, concerns about a looming recession, and the persistent drag of inflation, many investors found themselves grappling with uncertainty. Pacer (ETFs/Financial) has shown resilience and adaptability when navigating these challenging market conditions. We have been able to grow our assets under management substantially from $20 Billion to $30 Billion, in just 12 short months.

Yet again, our Cash Cows Series has been the leader of the pack this year. Our large cap fund, COWZ is just shy of $16 Billion, while our small cap fund, CALF is quickly rising, currently standing at $4 Billion. CALF has shown success through screening the S&P SmallCap 600 for high-quality companies which are trading at attractive valuations whether in a broad or narrow market. The why now for international has been prominent with ICOW and GCOW offering access to high-income potential and cheap valuations with over $1.5 Billion combined. Last year we added two growth funds to the series, COWG and CAFG; which follow free cash flow margin rather than free cash flow yield. We believe free cash flow margin proves to be a better predictor of earnings growth than excess returns.

We look forward to your continued partnership and eagerly await what the new year has to offer.

Best regards,

Joe M. Thomson, Chairman, Pacer Funds Trust

Market Environment Overview

2023 began positively, witnessing the S&P 500’s most robust performance since 2019, with a notable 16.89% ascent by June. The tech sector, led by the Nasdaq, surged impressively by 39.35%, driven by renewed interest in artificial intelligence.

During this period, inflation significantly improved, decreasing from 6.4% in January to a welcome 3% by July, marking relief compared to the peak of 8.5% in July 2022. Despite this positive trajectory, the Federal Reserve considered additional interest rate hikes to achieve its 2% inflation target.

In July, the S&P 500 entered a bull market, gaining 20%, while interest rates increased by a quarter-point to 5.25% - 5.5%. The job market thrived with a historic low unemployment rate of 3.4%, and women’s workforce participation reached a record 77.8%. August saw a temporary market pause after a strong summer rally, with indices fluctuating and positive performances in commodities like gold, sugar, and cotton. However, October brought challenges, with stocks declining for the third consecutive month: Dow Jones fell 1.3%, S&P 500 slipped 2.1%, and Nasdaq dropped 2.04%.

Globally, Emerging Markets started the year strongly but experienced a recent decline, with the MSCI Emerging Markets Index down by 1.43%. In contrast, the MSCI EAFE Index demonstrated a positive performance, up by 2.94% year-to-date as of October 31, 2023.

The housing market faced headwinds as mortgage rates surged, surpassing 7% for the 15-year Mortgage Rate for the first time since 2000, and nearing 8% for the 30-year Mortgage Rate. Consequently, housing prices declined, with the Median Sales Price of Existing Homes falling below $430,000 from the beginning-of-year figure of $480,000.

Inflation remained stable between September and October, with Core Inflation experiencing a slight decrease. Notably, oil prices sank in October, contributing to a 36-cent reduction in the average price of regular gas to $3.60 per gallon. Presently, inflation stands at 3.2%.

In the realm of fixed income, the yield curve displayed signs of normalcy in October, with double-digit increases in yields on treasuries. Both the 20-year and 30-year crossed the 5% mark for the first time since July 2007, concluding the month at 5.21% and 5.04%, respectively. On the international stage, Italy’s Long Term Bond Interest Rate was surpassed by the US 10-year, and Japan’s 10 Year Government Bond Interest Rate approached 1% in October.

Sector-wise, Communication Services distinguished itself with a robust 36.64% year-to-date return. Information Technology emerged as a driving force, experiencing a substantial 33.67% year-to-date rally, propelled by the new AI push. Consumer Discretionary exhibited commendable return of 20.04% year-to-date, indicative of sustained consumer confidence. Conversely, Energy faced headwinds, witnessing a decline of -3.02% year-to-date, attributed to factors such as an economic slowdown in China, a push for electric vehicles, and oversupply by oil-producing countries, notably the United States. Real Estate experienced a downturn, with a decrease of -10.68% year-to-date, possibly influenced by rising interest rates and changing housing market conditions.

1

Pacer Funds

The “Magnificent Seven” tech giants that spearheaded the 2023 stock market rally experienced divergent fortunes in October. Composing of Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla, these stocks constitute approximately 29% of the S&P 500. They contributed nearly 10.67% to the total performance of the S&P 500 Index year to date as of October 2023.

In October, Amazon (AMZN) and Microsoft (MSFT) thrived with 4.7% and 7.1% gains from strong cloud growth. Conversely, Alphabet (GOOG, GOOGL) fell 5% due to disappointing cloud results, Nvidia (NVDA) dropped 6% on AI chip export concerns, Tesla (TSLA) plunged nearly 20% on weak profits, Meta Platforms (META) gave cautious guidance, and Apple (AAPL) slipped 0.3% post an 8% September drop.

Amid market fluctuations, long-term investors are advised to stay disciplined, stick to their plans, and focus on goals, as market sentiment can change swiftly. A sensible long-term investment strategy coupled with discipline remains key to success.

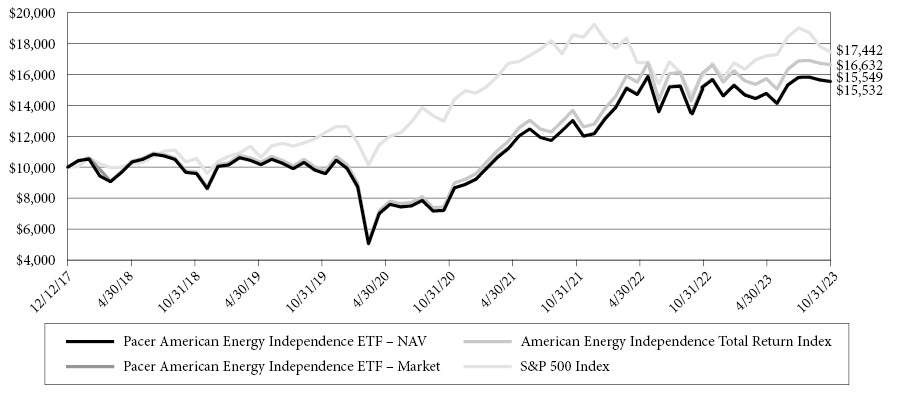

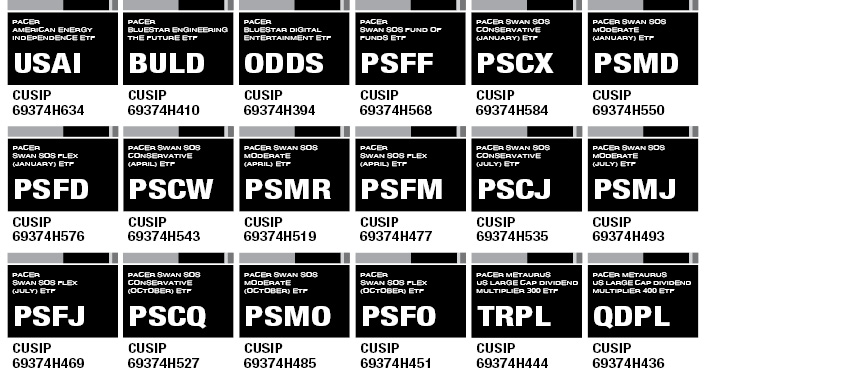

Pacer American Energy Independence ETF

The Pacer American Energy Independence ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the performance, before fees and expenses, of the American Energy Independence Index (the “Index”).

The Fund had a NAV total return of 2.68%. The Index had a total return of 3.66%. The S&P 500 had a total return of 10.14%.

The following return is the stock’s total return while it was held in the Fund during this period. The Fund’s top three contributors to its return were Archrock Inc. at 79.12%, Equitrans Midstream Corporation at 14.74%, and Targa Resources Crop. at 25.21%. The Fund’s bottom three contributors to return were Tellurian Inc. at -55.56%, TC Energy Corporation at -15.78%, and Excelerate Energy, Inc. Class A at -44.77%.

Pacer Swan SOS Conservative (January) ETF

The Pacer Swan SOS Conservative (January) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 17.10% (before fees and expenses of the Fund) and 16.35% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from January 3, 2023 to December 29, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: January 3, 2023

Investment Period End: December 29, 2023

Cap (before Fund fees and expenses): 17.10%

Cap (after Fund fees and expenses): 16.35%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 8.79%. The S&P 500 Index had a price return of 10.14%.

Pacer Swan SOS Moderate (January) ETF

The Pacer Swan SOS Moderate (January) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 18.25% (before fees and expenses of the Fund) and 17.50% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from January 3, 2023 to December 29, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: January 3, 2023

Investment Period End: December 29, 2023

2

Pacer Funds

Cap (before Fund fees and expenses): 18.25%

Cap (after Fund fees and expenses): 17.50%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 11.21%. The S&P 500 Index had a price return of 10.14%.

Pacer Swan SOS Flex (January) ETF

The Pacer Swan SOS Flex (January) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 21.90% (before fees and expenses of the Fund) and 21.15% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from January 3, 2023 to December 29, 2023.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: January 3, 2023

Investment Period End: December 29, 2023

Cap (before Fund fees and expenses): 21.90%

Cap (after Fund fees and expenses): 21.15%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 13.05%. The S&P 500 Index had a price return of 10.14%.

Pacer Swan SOS Fund of Funds ETF

The Pacer Swan SOS Fund of Funds ETF (the “Fund”) seeks capital appreciation while providing downside protection.

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 10.42%. The S&P 500 Index had a price return of 10.14%.

Pacer Swan SOS Conservative (April) ETF

The Pacer Swan SOS Conservative (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 14.43% (before fees and expenses of the Fund) and 13.68% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from April 3, 2023 to March 28, 2024.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: April 3, 2023

Investment Period End: March 28, 2024

Cap (before Fund fees and expenses): 14.43%

Cap (after Fund fees and expenses): 13.68%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 3.13%. The S&P 500 Index had a price return of 10.14%.

Pacer Swan SOS Moderate (April) ETF

The Pacer Swan SOS Moderate (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 14.95% (before fees and expenses of the Fund) and 14.20% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from April 3, 2023 to March 28, 2024.

3

Pacer Funds

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: April 3, 2023

Investment Period End: March 28, 2024

Cap (before Fund fees and expenses): 14.95%

Cap (after Fund fees and expenses): 14.20%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 8.70%. The S&P 500 Index had a price return of 10.14%.

Pacer Swan SOS Flex (April) ETF

The Pacer Swan SOS Flex (April) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 17.80% (before fees and expenses of the Fund) and 17.05% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from April 3, 2023 to March 28, 2024.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: April 3, 2023

Investment Period End: March 28, 2024

Cap (before Fund fees and expenses): 17.80%

Cap (after Fund fees and expenses): 17.05%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 9.80%. The S&P 500 Index had a price return of 10.14%.

Pacer Swan SOS Conservative (July) ETF

The Pacer Swan SOS Conservative (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 14.73% (before fees and expenses of the Fund) and 13.98% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from July 3, 2023 to June 28, 2024.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: July 3, 2023

Investment Period End: June 28, 2024

Cap (before Fund fees and expenses): 14.73%

Cap (after Fund fees and expenses): 13.98%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 9.16% The S&P 500 Index had a price return of 10.14%.

Pacer Swan SOS Moderate (July) ETF

The Pacer Swan SOS Moderate (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 14.52% (before fees and expenses of the Fund) and 13.77% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from July 3, 2023 to June 28, 2024.

4

Pacer Funds

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: July 3, 2023

Investment Period End: June 28, 2024

Cap (before Fund fees and expenses): 14.52%

Cap (after Fund fees and expenses): 13.77%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 11.19%. The S&P 500 Index had a price return of 10.14%.

Pacer Swan SOS Flex (July) ETF

The Pacer Swan SOS Flex (July) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 16.72% (before fees and expenses of the Fund) and 15.97% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from July 3, 2023 to June 28, 2024.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: July 3, 2023

Investment Period End: June 28, 2024

Cap (before Fund fees and expenses): 16.72%

Cap (after Fund fees and expenses): 15.97%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 10.49%. The S&P 500 Index had a price return of 10.14%.

Pacer Swan SOS Conservative (October) ETF

The Pacer Swan SOS Conservative (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 15.95% (before fees and expenses of the Fund) and 15.20% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from October 2, 2023 to September 30, 2024.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: October 2, 2023

Investment Period End: September 30, 2024

Cap (before Fund fees and expenses): 15.95%

Cap (after Fund fees and expenses): 15.20%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 12.54%. The S&P 500 Index had a price return of 10.14%.

Pacer Swan SOS Moderate (October) ETF

The Pacer Swan SOS Moderate (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 15.50% (before fees and expenses of the Fund) and 14.75% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from October 2, 2023 to September 30, 2024.

5

Pacer Funds

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: October 2, 2023

Investment Period End: September 30, 2024

Cap (before Fund fees and expenses): 15.50%

Cap (after Fund fees and expenses): 14.75%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 13.22%. The S&P 500 Index had a price return of 10.14%.

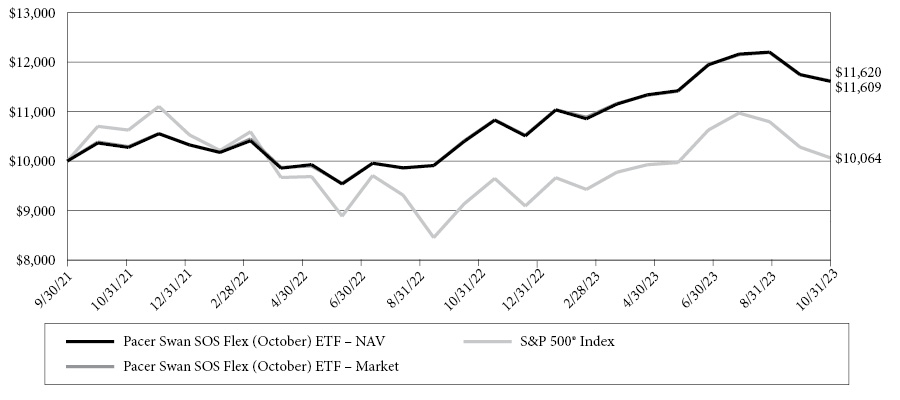

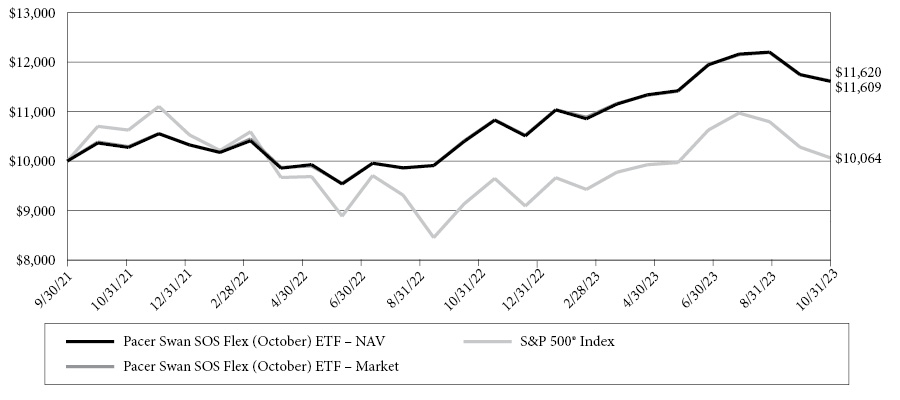

Pacer Swan SOS Flex (October) ETF

The Pacer Swan SOS Flex (October) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 17.65% (before fees and expenses of the Fund) and 16.90% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from October 2, 2023 to September 30, 2024.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: October 2, 2023

Investment Period End: September 30, 2024

Cap (before Fund fees and expenses): 17.65%

Cap (after Fund fees and expenses): 16.90%

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 11.66%. The S&P 500 Index had a price return of 10.14%.

Pacer BlueStar Digital Entertainment ETF

The Pacer BlueStar Digital Entertainment ETF (the “Fund”) employs a “passive management”(or indexing) investment approach designed to track the total return performance, before fees and expenses, of the BlueStar Global Online Gambling, Video Gaming, and eSports Index (the Index).

The Fund had a NAV total return of 13.74%. The Index had a total return of 12.94%. The S&P 500 had a total return of 10.14%.

The following return is the stock’s total return while it was held in the Fund during this period. The Fund’s top three contributors to its return were NVIDIA Corporation at +202.32%, Tencent Holdings Ltd. At +49.54% and DraftKings, Inc. Class A at +74.81%. The Fund’s bottom three contributors to return were Everi Holdings, Inc. at -43.15%, Bally’s Corporation at -59.54% and Skillz Inc, Class A at -75.15%.

Pacer BlueStar Engineering the Future ETF

The Pacer BlueStar Engineering the Future ETF (the “Fund”) employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the BlueStar Robotics and 3D Printing Index (the“Index”).

The Fund had a NAV total return of 4.18%. The Index had a total return of 3.97%. The S&P 500 had a total return of 10.14%.

The following return is the stock’s total return while it was held in the Fund during this period. The Fund’s top three contributors to its return were ASML Holding NV ADR at +27.88%, Applied Materials, Inc. at +51.34% and Siemens Aktiengesellschaft at +24.31%. The Fund’s bottom three contributors to return were 3D Systems Corporation at -57.76%, Desktop Metal, Inc. Class A at -65.75% and Proto Labs, Inc. at -38.18%.

6

Pacer Funds

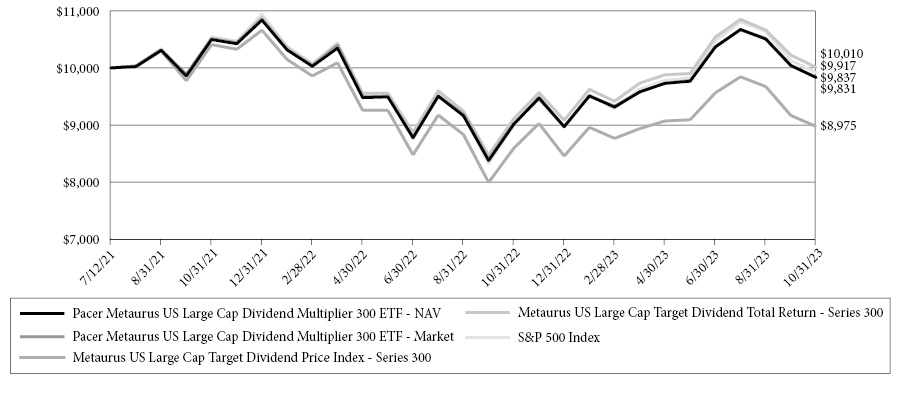

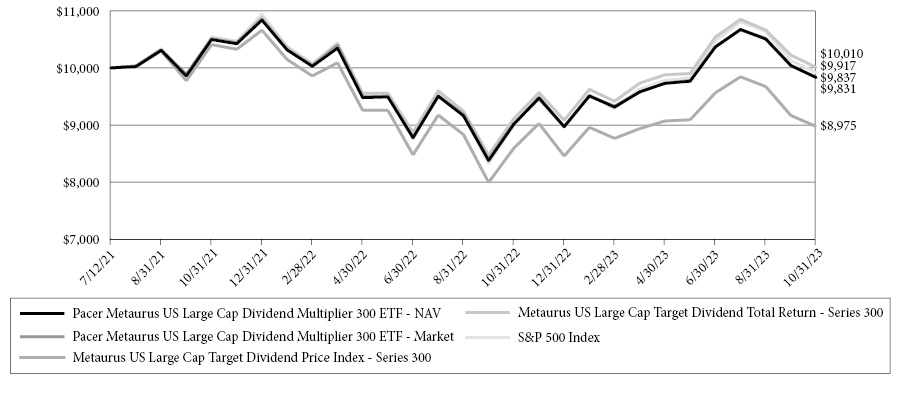

Pacer Metaurus US Large Cap Dividend Multiplier 300 ETF

The Pacer Metaurus US Large Cap Dividend Multiplier 300 ETF employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Metaurus US Large Cap Dividend Multiplier Index - Series 300 (the “Index”). The Index is based on a proprietary methodology developed by Metaurus Advisors LLC (“Metaurus”), the Fund’s sub-adviser and the Fund’s index provider. All or a portion of the methodologies and algorithms used to calculate the Index are covered by one or more granted or pending U.S. patents owned by Metaurus.

The Index, as designed, has two components: (i) an S&P 500 Index component (the “S&P 500 Component”) and (ii) a dividend component (the “Dividend Component”) consisting of long positions in annual futures contracts that provide exposure to ordinary dividends paid on the common stocks of companies included in the S&P 500 (“S&P Dividend Futures”). The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 80% of the U.S. equity market capitalization. The Dividend Component is designed to give the Fund exposure to approximately 300% of the ordinary dividends the Fund would otherwise have expected to receive from its investment in the S&P 500 Component. The Dividend Component consists of annual futures contracts whose value represents the market’s expectation of the amount of ordinary dividends to be paid by S&P 500 companies during the term of the futures contract. As of October 31, 2023, the S&P 500 Component comprised approximately 94% of the Index.

S&P Dividend Futures seek to allow investors in these instruments to obtain exposure to the actual dividend value that will be paid by the S&P 500 constituent companies over a period of time. The amount of such futures contracts will generally result in exposure to such dividends that is significantly greater than the amount of dividends that the Fund would normally receive from its direct investment in S&P 500 constituent companies (i.e., approximately 300% of such dividends that the Fund would normally have received). S&P Dividend Futures provide for the future sale by one party and purchase by another party of a specified dividend value of the S&P 500 at a specified future time and at a specified price. S&P Dividend Futures are standardized contracts traded on a recognized exchange. The Fund’s investment in S&P Dividend Futures will generally include the three most current annual S&P Dividend Futures contracts (e.g., in April 2022, the Fund would invest in the 2022, 2023, and 2024 contracts. The Index is typically rebalanced each December, at the end of the trading day on which the current year’s S&P Dividend Futures expire. At each rebalancing date, the current year’s annual S&P Dividend Futures will be replaced by the then closest maturing contract in three years. On each Index rebalancing date, the composition of the Index is expected to change.

The Fund

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 9.08%. The Index had a total return of 9.87%. The S&P 500 Index had a total return of 10.14%.

During the fiscal year, the top three sectors for contribution to performance were Information Technology at 6.90%, Communication Services at 2.24, and Consumer Discretionary at 0.72%. The three sectors with the lowest contribution to performance were Health Care at -0.65%, Financials at -0.19%, and Energy at -0.19%. Sector performance numbers reflect their total return during the period.

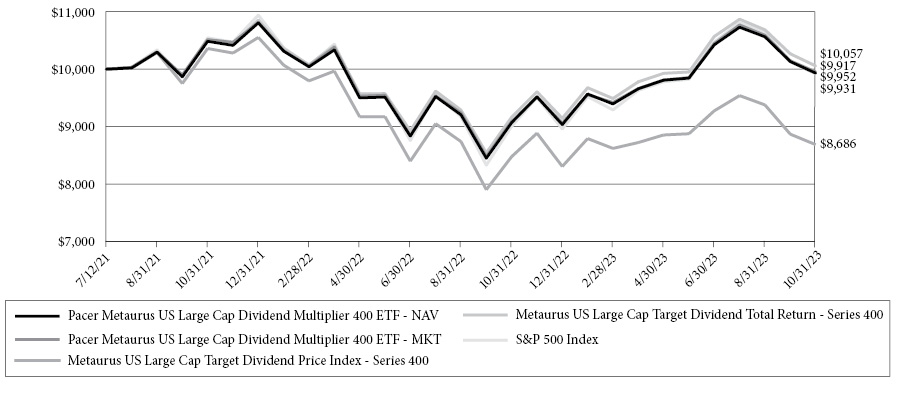

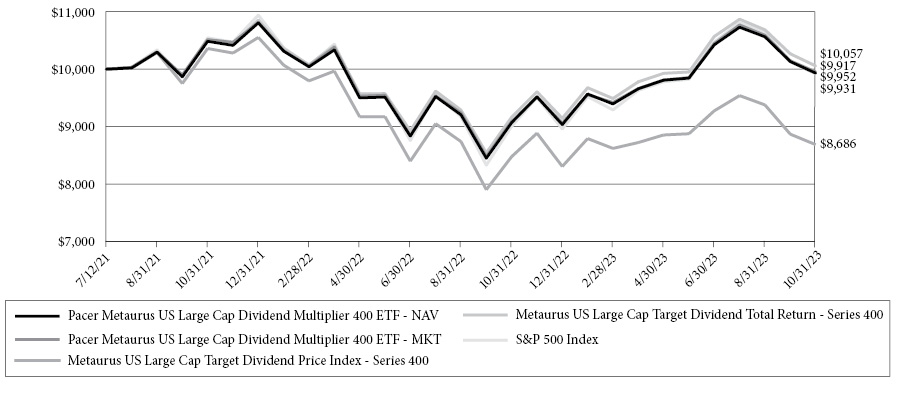

Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF

The Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Metaurus US Large Cap Dividend Multiplier Index - Series 400 (the “Index”). The Index is based on a proprietary methodology developed by Metaurus Advisors LLC (“Metaurus”), the Fund’s sub-adviser and the Fund’s index provider. All or a portion of the methodologies and algorithms used to calculate the Index are covered by one or more granted or pending U.S. patents owned by Metaurus

The Index, as designed, has two components: (i) an S&P 500 Index component (the “S&P 500 Component”) and (ii) a dividend component (the “Dividend Component”) consisting of long positions in annual futures contracts that provide exposure to ordinary dividends paid on the common stocks of companies included in the S&P 500 (“S&P Dividend Futures”). The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 80% of the U.S. equity market capitalization. The Dividend Component is designed to give the Fund exposure to approximately 400% of the ordinary dividends the Fund would otherwise have expected to receive from its investment in the S&P 500 Component. The Dividend Component consists of annual futures contracts whose value represents the market’s expectation of the amount of ordinary dividends to be paid by S&P 500 companies during the term of the futures contract. As of October 31, 2023, the S&P 500 Component comprised approximately 88% of the Index.

S&P Dividend Futures seek to allow investors in these instruments to obtain exposure to the actual dividend value that will be paid by the S&P 500 constituent companies over a period of time. The amount of such futures contracts will generally result in exposure to such dividends that is significantly greater than the amount of dividends that the Fund would normally receive from its direct investment in S&P 500 constituent companies (i.e., approximately 400% of such dividends that the Fund would normally have received). S&P Dividend Futures

7

Pacer Funds

provide for the future sale by one party and purchase by another party of a specified dividend value of the S&P 500 at a specified future time and at a specified price. S&P Dividend Futures are standardized contracts traded on a recognized exchange. The Fund’s investment in S&P Dividend Futures will generally include the three most current annual S&P Dividend Futures contracts (e.g., in April 2022, the Fund would invest in the 2022, 2023, and 2024 contracts. The Index is typically rebalanced each December, at the end of the trading day on which the current year’s S&P Dividend Futures expire. At each rebalancing date, the current year’s annual S&P Dividend Futures will be replaced by the then closest maturing contract in three years. On each Index rebalancing date, the composition of the Index is expected to change.

The Fund

During the year (11/1/2022 – 10/31/2023), the Fund had a NAV total return of 9.53%. The Index had a total return of 9.74%. The S&P 500 Index had a total return of 10.14%.

During the fiscal year, the top three sectors for contribution to performance were Information Technology at 7.07%, Communication Services at 2.32%, and Consumer Discretionary at 0.70%. The three sectors with the lowest contribution to performance were Health Care at -0.65%, Financials at -0.19%, and Energy at -0.19%. Sector performance numbers reflect their total return during the period.

8

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2023

Pacer American Energy Independence ETF

Sector(a) | | Percentage of

Net Assets | |

Energy | | | 99.2 | % |

Investments Purchased With Proceeds From Securities Lending | | | 8.6 | % |

Liabilities in Excess of Other Assets | | | -7.8 | % |

| | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the American Energy Independence Index. |

Pacer BlueStar Engineering the Future ETF

Sector(a) | | Percentage of

Net Assets | |

Automobiles & Components | | | 1.9 | % |

Capital Goods | | | 21.0 | % |

Pharmaceuticals, Biotechnology & Life Sciences | | | 1.0 | % |

Semiconductors & Semiconductor Equipment | | | 30.1 | % |

Software & Services | | | 29.0 | % |

Technology Hardware & Equipment | | | 17.0 | % |

Other Assets in Excess of Liabilities | | | 0.0 | %(b) |

| | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the BlueStar Robotics and 3D Printing Index. |

Pacer BlueStar Digital Entertainment ETF

Sector(a) | | Percentage of

Net Assets | |

Consumer Discretionary Distribution & Retail | | | 1.2 | % |

Consumer Durables & Apparel | | | 1.7 | % |

Consumer Services | | | 50.2 | % |

Media & Entertainment | | | 33.7 | % |

Semiconductors & Semiconductor Equipment | | | 6.2 | % |

Software & Services | | | 2.6 | % |

Exchange Traded Funds | | | 4.3 | % |

Other Assets in Excess of Liabilities | | | 0.1 | % |

| | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the BlueStar Global Online Gambling, Video Gaming, and eSports Index. |

Pacer Swan SOS Fund of Funds ETF

Sector | | Percentage of

Net Assets | |

Affiliated Exchange-Traded Funds | | | 99.4 | % |

Other Assets in Excess of Liabilities | | | 0.6 | % |

| | | | 100.0 | % |

Pacer Swan SOS Conservative (January) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 99.7 | % |

Other Assets in Excess of Liabilities | | | 0.3 | % |

| | | | 100.0 | % |

9

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2023 (Continued)

Pacer Swan SOS Moderate (January) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 99.4 | % |

Other Assets in Excess of Liabilities | | | 0.6 | % |

| | | | 100.0 | % |

Pacer Swan SOS Flex (January) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 99.3 | % |

Other Assets in Excess of Liabilities | | | 0.7 | % |

| | | | 100.0 | % |

Pacer Swan SOS Conservative (April) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 99.6 | % |

Other Assets in Excess of Liabilities | | | 0.4 | % |

| | | | 100.0 | % |

Pacer Swan SOS Moderate (April) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 100.2 | % |

Liabilities in Excess of Other Assets | | | -0.2 | % |

| | | | 100.0 | % |

Pacer Swan SOS Flex (April) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 100.0 | % |

Liabilities in Excess of Other Assets | | | 0.0 | %(a) |

| | | | 100.0 | % |

Pacer Swan SOS Conservative (July) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 99.8 | % |

Other Assets in Excess of Liabilities | | | 0.2 | % |

| | | | 100.0 | % |

Pacer Swan SOS Moderate (July) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 101.2 | % |

Liabilities in Excess of Other Assets | | | -1.2 | % |

| | | | 100.0 | % |

10

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2023 (Continued)

Pacer Swan SOS Flex (July) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 102.2 | % |

Liabilities in Excess of Other Assets | | | -2.2 | % |

| | | | 100.0 | % |

Pacer Swan SOS Conservative (October) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 100.7 | % |

Liabilities in Excess of Other Assets | | | -0.7 | % |

| | | | 100.0 | % |

Pacer Swan SOS Moderate (October) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 102.1 | % |

Liabilities in Excess of Other Assets | | | -2.1 | % |

| | | | 100.0 | % |

Pacer Swan SOS Flex (October) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 102.9 | % |

Liabilities in Excess of Other Assets | | | -2.9 | % |

| | | | 100.0 | % |

11

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2023 (Continued)

Pacer Metaurus US Large Cap Dividend Multiplier 300 ETF

Industry(a) | | Percentage of

Net Assets | |

Automobiles & Components | | | 1.7 | % |

Banks | | | 2.8 | % |

Capital Goods | | | 5.2 | % |

Commercial & Professional Services | | | 1.2 | % |

Consumer Discretionary Distribution & Retail | | | 5.2 | % |

Consumer Durables & Apparel | | | 0.8 | % |

Consumer Services | | | 2.1 | % |

Consumer Staples Distribution & Retail | | | 1.8 | % |

Energy | | | 4.3 | % |

Equity Real Estate Investment | | | 2.1 | % |

Financial Services | | | 7.1 | % |

Food, Beverage & Tobacco | | | 3.0 | % |

Health Care Equipment & Services | | | 5.3 | % |

Household & Personal Products | | | 1.5 | % |

Insurance | | | 2.2 | % |

Materials | | | 2.3 | % |

Media & Entertainment | | | 7.3 | % |

Pharmaceuticals, Biotechnology & Life Sciences | | | 7.1 | % |

Real Estate Management & Development | | | 0.1 | % |

Semiconductors & Semiconductor Equipment | | | 6.7 | % |

Software & Services | | | 11.4 | % |

Technology Hardware & Equipment | | | 8.3 | % |

Telecommunication Services | | | 0.9 | % |

Transportation | | | 1.4 | % |

Utilities | | | 2.4 | % |

Other Assets in Excess of Liabilities | | | 5.8 | % |

| | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the Metaurus US Large Cap Dividend Multiplier Total Return - Series 300. |

12

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2023 (Continued)

Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF

Industry(a) | | Percentage of

Net Assets | |

Automobiles & Components | | | 1.7 | % |

Banks | | | 2.6 | % |

Capital Goods | | | 4.9 | % |

Commercial & Professional Services | | | 1.1 | % |

Consumer Discretionary Distribution & Retail | | | 5.0 | % |

Consumer Durables & Apparel | | | 0.8 | % |

Consumer Services | | | 1.8 | % |

Consumer Staples Distribution & Retail | | | 1.6 | % |

Energy | | | 4.0 | % |

Equity Real Estate Investment | | | 1.9 | % |

Financial Services | | | 6.6 | % |

Food, Beverage & Tobacco | | | 2.8 | % |

Health Care Equipment & Services | | | 4.9 | % |

Household & Personal Products | | | 1.4 | % |

Insurance | | | 2.0 | % |

Materials | | | 2.1 | % |

Media & Entertainment | | | 6.8 | % |

Pharmaceuticals, Biotechnology & Life Sciences | | | 6.5 | % |

Real Estate Management & Development | | | 0.1 | % |

Semiconductors & Semiconductor Equipment | | | 6.3 | % |

Software & Services | | | 10.5 | % |

Technology Hardware & Equipment | | | 7.8 | % |

Telecommunication Services | | | 0.8 | % |

Transportation | | | 1.3 | % |

Utilities | | | 2.2 | % |

Government Notes/Bonds | | | 10.1 | % |

Other Assets in Excess of Liabilities | | | 2.4 | % |

| | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the Metaurus US Large Cap Dividend Multiplier Total Return - Series 400. |

13

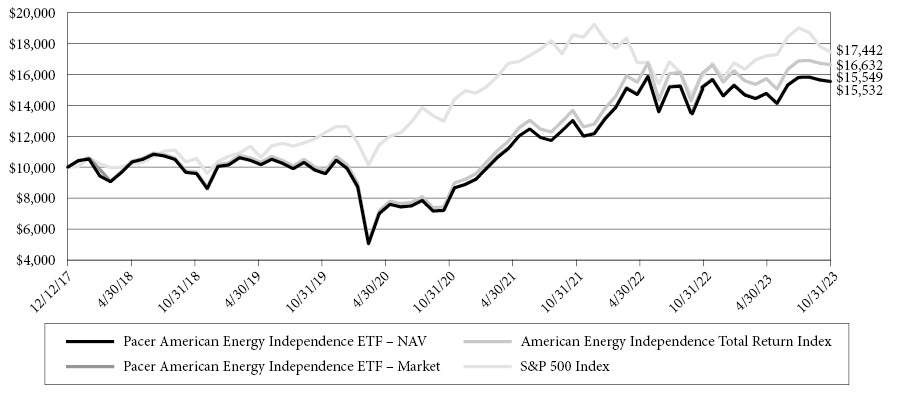

Pacer American Energy Independence ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 12, 2017, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The American Energy Independence Total Return (the “Index”) uses a proprietary, rules-based methodology to measure the performance of a portfolio of U.S. and Canadian exchange-listed equity securities of companies that generate a majority of their cash flow from certain qualifying “midstream” energy infrastructure activities. The companies in the Index are expected to benefit from regulatory policies favoring and industry trends toward American energy independence (i.e., a reduced or eliminated need for the United States to import fuels, such as coal, crude oil, or natural gas). Midstream energy infrastructure refers to the processing, storage, transportation, and distribution of crude oil, natural gas, refined products, and their related products, as well as the transmission or storage of renewable energy. The following activity segments are considered qualifying midstream energy infrastructure activities: gathering & processing, compression, fractionation, logistics, midstream services, pipeline transportation, storage and terminaling of oil, gas, natural gas liquids, and refined products, as well as operating liquid natural gas facilities. The following activity segments are not qualifying activities: refining, shipping, exploration, production, retail distribution, or oil services. The Index may include small-, mid-, and large-capitalization companies.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Three Year | Five Year | Since Inception(2) |

Pacer American Energy Independence ETF - NAV | 2.68% | 29.21% | 9.98% | 7.79% |

Pacer American Energy Independence ETF - Market | 2.28% | 29.19% | 9.91% | 7.77% |

American Energy Independence Total Return Index (3) | 3.66% | 30.78% | 11.25% | 9.03% |

S&P 500 Index (3) | 10.14% | 10.36% | 11.01% | 9.91% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 12, 2017. The Fund is the sucessor to the investment performance of the American Energy Independence ETF (the “Predecessor USAI”) as a result of the reorganization of the Predecessor USAI Fund into the Fund on December 16, 2019. Accordingly, the performance information shown in the chart and table above for periods prior to December 16, 2019 is that of the Predecessor USAI Fund’s Shares for the Fund. The Predecessor USAI Fund was advised by SL Advisors, LLC and sub-advised by Penserra Capital Management LLC and had substantially the same investment objectives, policies, and strategies as the Fund. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

14

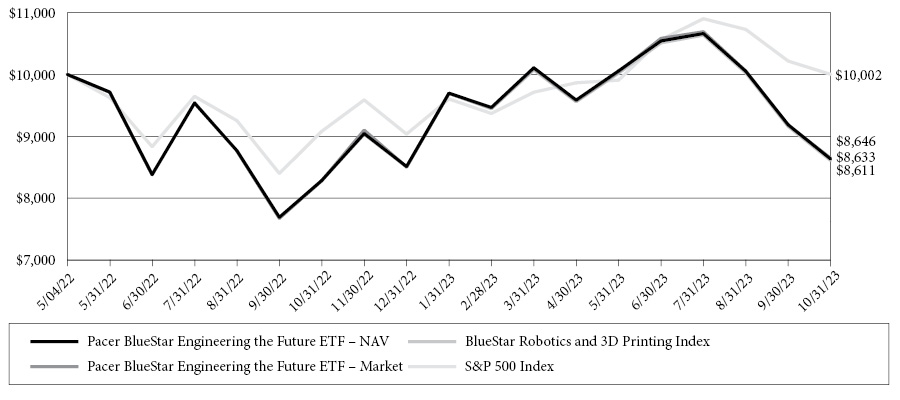

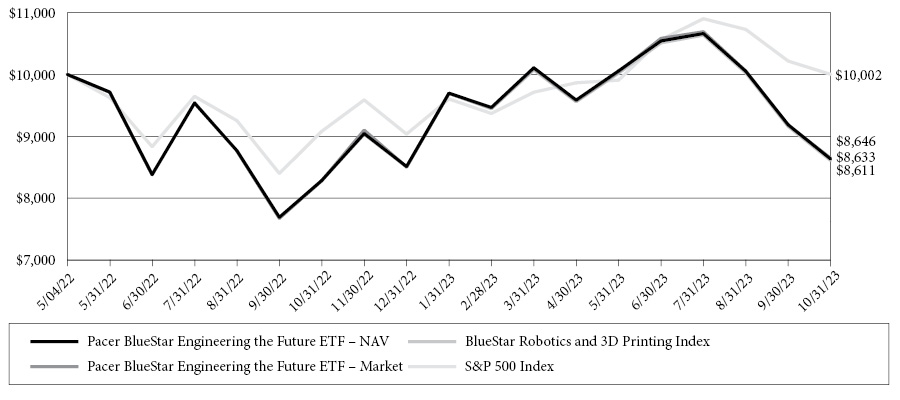

Pacer BlueStar Engineering the Future ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on May 4, 2022, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The BlueStar Robotics and 3D Printing Index (the “Index”) is a rules-based index that consists of globally-listed stocks and depositary receipts of companies that, at the time of being added to the Index, derive at least 50% of their revenues (25% for current Index components) from robots or manufacturing automation equipment (“robotics”); computer aided design (“CAD”) software; or 3D printing centers, 3D printing hardware, 3D printing simulation software, 3D scanning and measurement software, and 3D printing materials (collectively, “Robotics and 3D Printing Companies”), as determined by MV Index Solutions (the “Index Provider”).

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer BlueStar Engineering the Future ETF - NAV | 4.18% | -9.37% |

Pacer BlueStar Engineering the Future ETF - Market | 4.37% | -9.29% |

BlueStar Robotics and 3D Printing Index | 3.97% | -9.53% |

S&P 500 Index (3) | 10.14% | 0.01% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2023, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is May 4, 2022. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

15

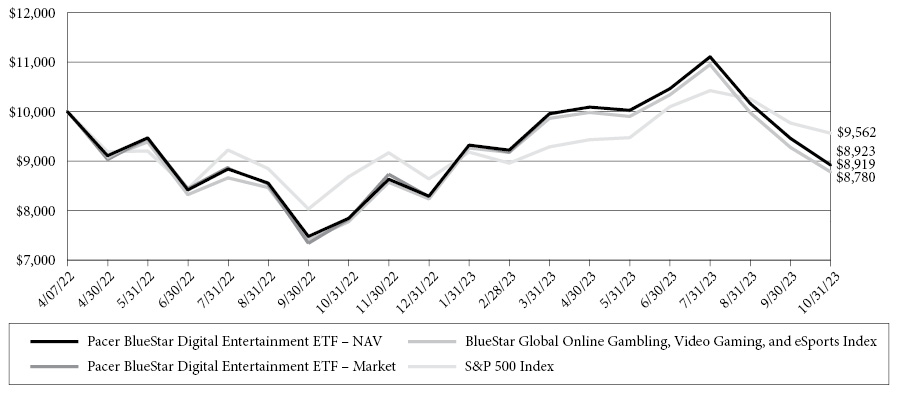

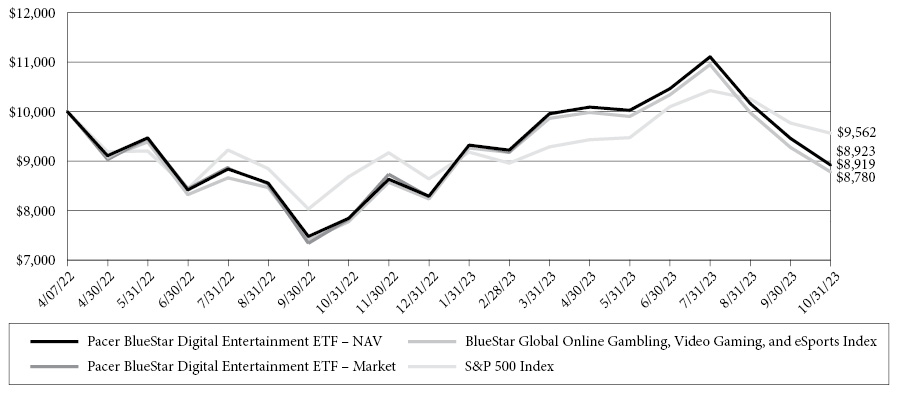

Pacer BlueStar Digital Entertainment ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on April 7, 2022, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The BlueStar Global Online Gambling, Video Gaming, and eSports Index (the “Index”) is a rules-based index that consists of globally-listed stocks and depositary receipts of digital entertainment companies. Companies eligible to be added to the Index are those that derive at least 50% of their revenues from the following activities: online gambling platforms or software related to online gambling; video game development and software related to the development of video games or hardware such as computer processors and graphics cards used in video gaming systems, controllers, headsets, and gaming consoles; and streaming services or video games and/or hardware for use in eSports events or that are involved in eSports events such as league operators, teams, distributors and platforms, (collectively, “Digital Entertainment”) as determined by MV Index Solutions (the “Index Provider”).

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer BlueStar Digital Entertainment ETF - NAV | 13.74% | -7.04% |

Pacer BlueStar Digital Entertainment ETF - Market | 14.04% | -7.01% |

BlueStar Global Online Gambling, Video Gaming, and eSports Index | 12.94% | -7.97% |

S&P 500 Index (3) | 10.14% | -2.82% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2023, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is April 7, 2022. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

16

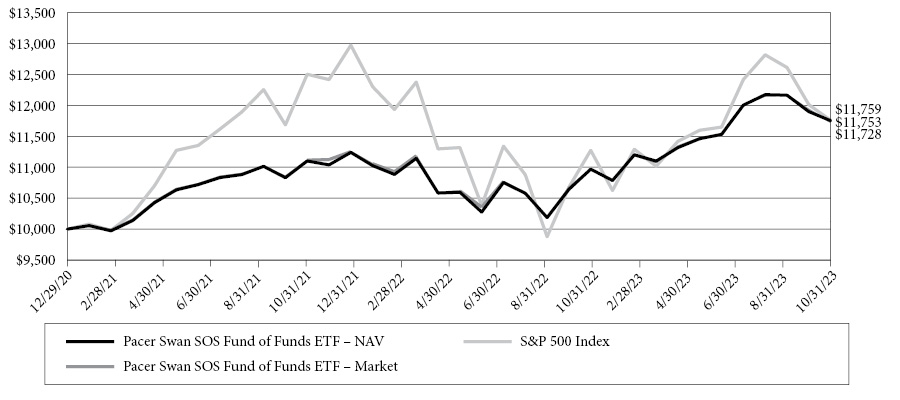

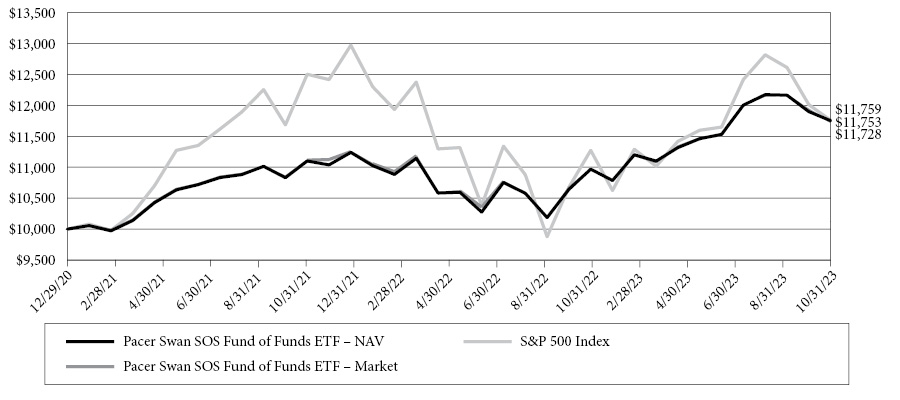

Pacer Swan SOS Fund of Funds ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 29, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Fund of Funds ETF (the “Fund”) seeks capital appreciation with downside protection.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Fund of Funds ETF - NAV | 10.42% | 5.86% |

Pacer Swan SOS Fund of Funds ETF - Market | 9.85% | 5.78% |

S&P 500 Index (3) | 10.14% | 5.88% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2023 as supplemented April 3, 2023, is 0.93%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 29, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

17

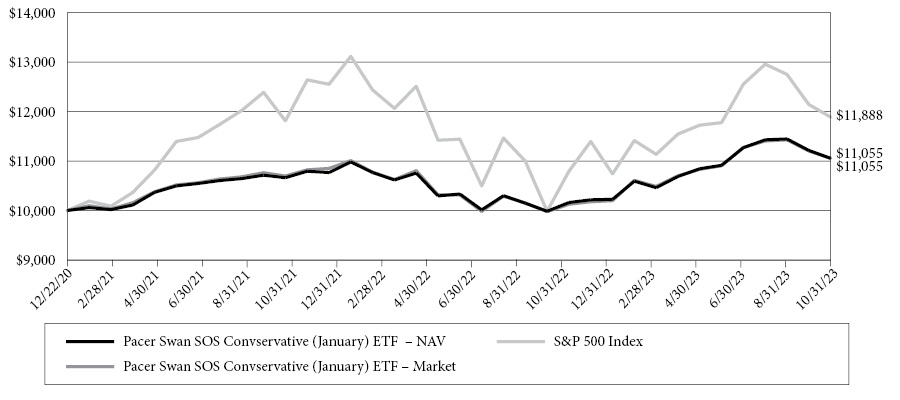

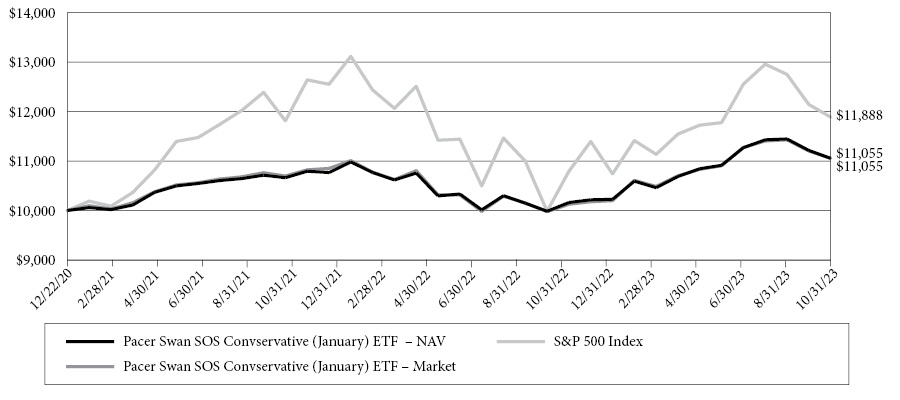

Pacer Swan SOS Conservative (January) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (January) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 17.10% (before fees and expenses of the Fund) and 16.35% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from January 3, 2023 to December 29, 2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Conservative (January) ETF - NAV | 8.79% | 3.57% |

Pacer Swan SOS Conservative (January) ETF - Market | 9.17% | 3.57% |

S&P 500 Index (3) | 10.14% | 6.24% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

18

Pacer Swan SOS Moderate (January) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (January) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 18.25% (before fees and expenses of the Fund) and 17.50% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from January 3, 2023 to December 29,2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Moderate (January) ETF - NAV | 11.21% | 5.60% |

Pacer Swan SOS Moderate (January) ETF - Market | 11.29% | 5.59% |

S&P 500 Index (3) | 10.14% | 6.24% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

19

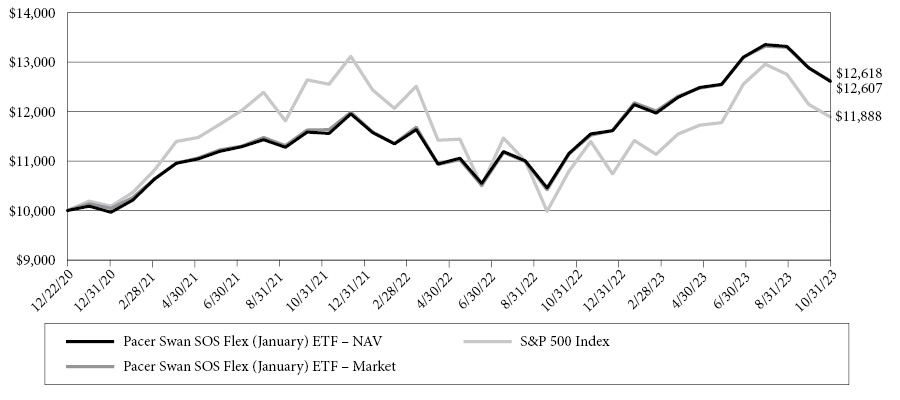

Pacer Swan SOS Flex (January) ETF

PERFORMANCE SUMMARY

(Unaudited)

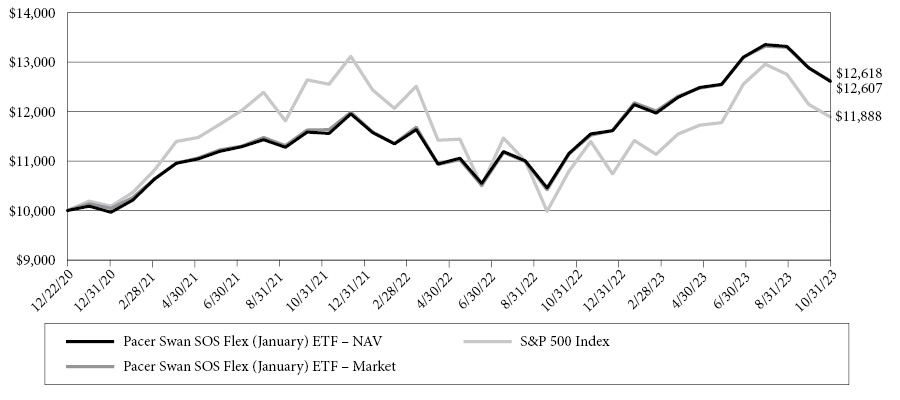

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (January) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 21.90% (before fees and expenses of the Fund) and 21.15% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from January 3, 2023 to December 29, 2023.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Flex (January) ETF - NAV | 13.05% | 8.44% |

Pacer Swan SOS Flex (January) ETF - Market | 13.25% | 8.48% |

S&P 500 Index (3) | 10.14% | 6.24% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

20

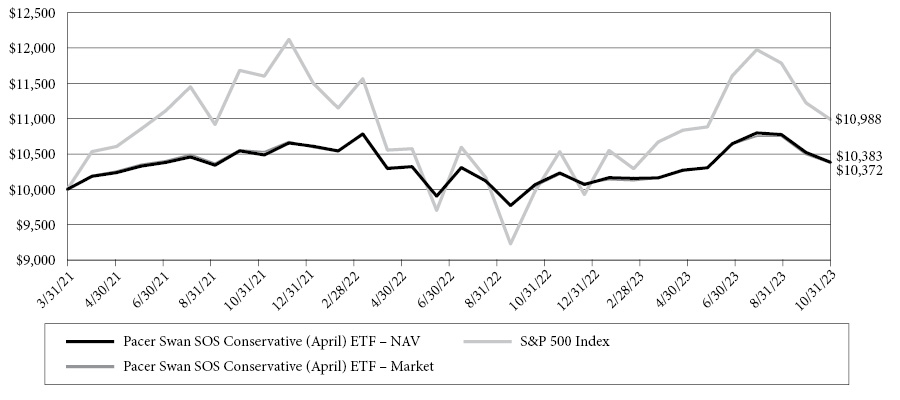

Pacer Swan SOS Conservative (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

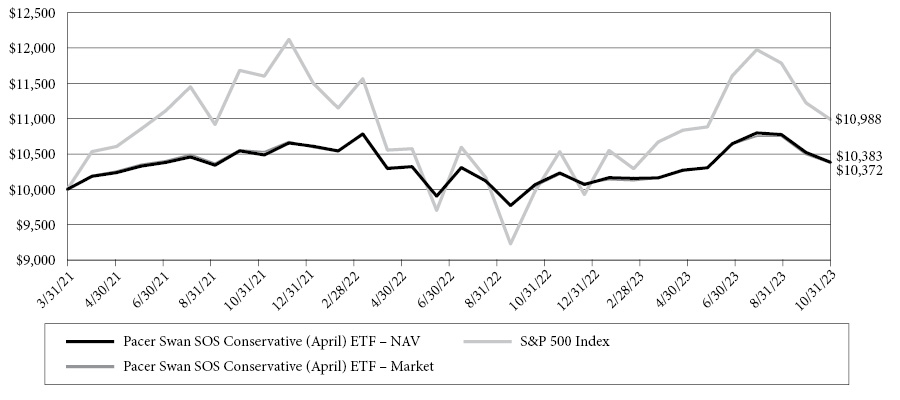

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 14.43% (before fees and expenses of the Fund) and 13.68% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from April 3, 2023 to March 28, 2024.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Conservative (April) ETF - NAV | 3.13% | 1.46% |

Pacer Swan SOS Conservative (April) ETF - Market | 3.24% | 1.42% |

S&P 500 Index (3) | 10.14% | 3.71% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2023 as supplemented April 3, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

21

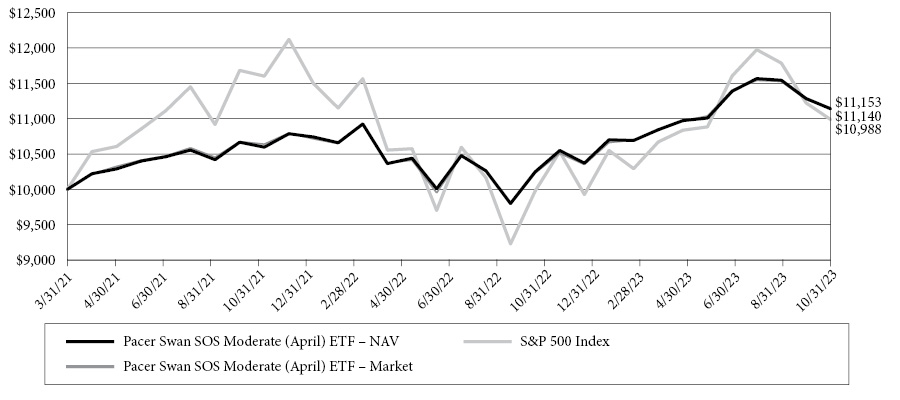

Pacer Swan SOS Moderate (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

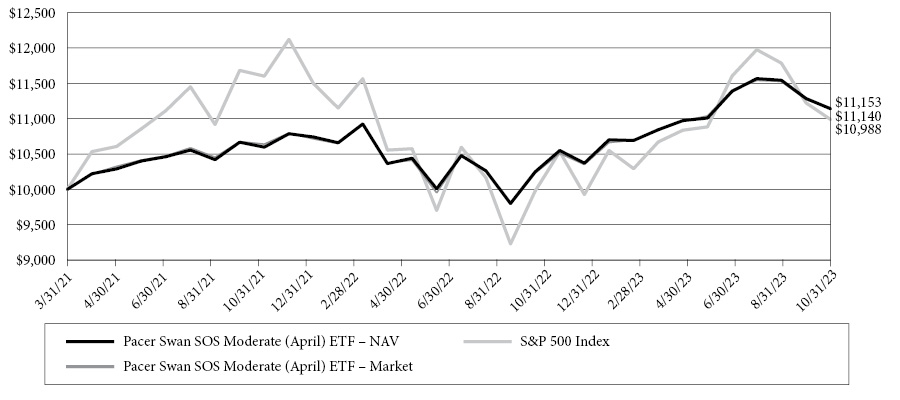

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 14.95% (before fees and expenses of the Fund) and 14.20% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from April 3, 2023 to March 28, 2024.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Moderate (April) ETF - NAV | 8.70% | 4.26% |

Pacer Swan SOS Moderate (April) ETF - Market | 9.02% | 4.31% |

S&P 500 Index (3) | 10.14% | 3.71% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2023 as supplemented April 3, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

22

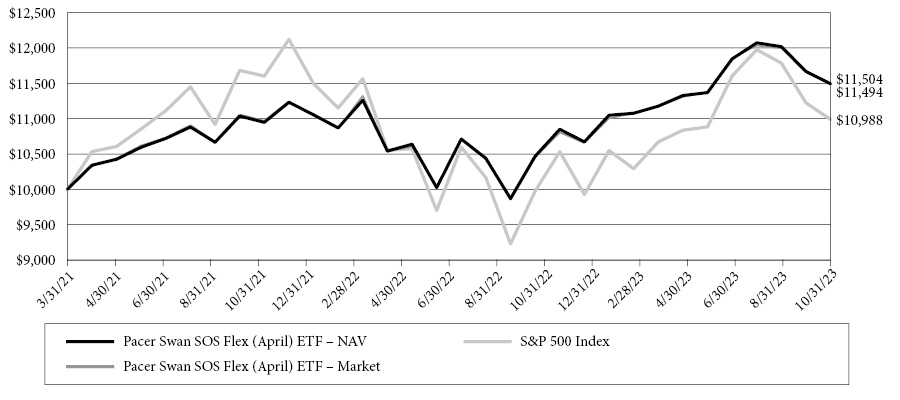

Pacer Swan SOS Flex (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

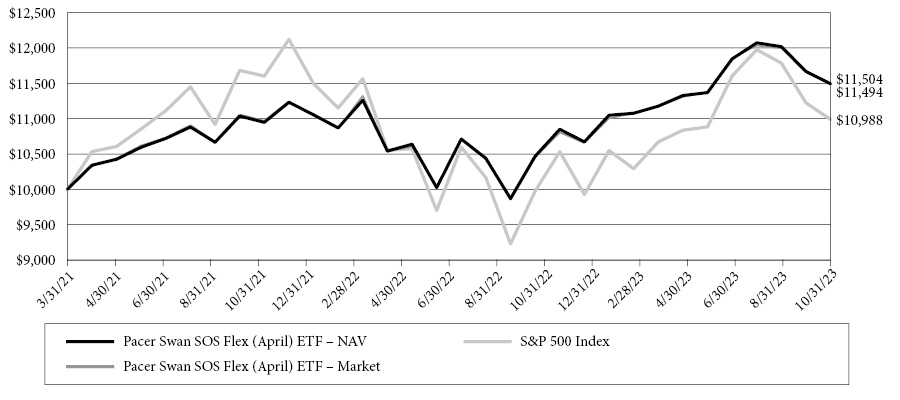

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (April) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 17.80% (before fees and expenses of the Fund) and 17.05% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from April 3, 2023 to March 28, 2024.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Flex (April) ETF - NAV | 9.80% | 5.53% |

Pacer Swan SOS Flex (April) ETF - Market | 10.07% | 5.57% |

S&P 500 Index (3) | 10.14% | 3.71% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2023 as supplemented April 3, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

23

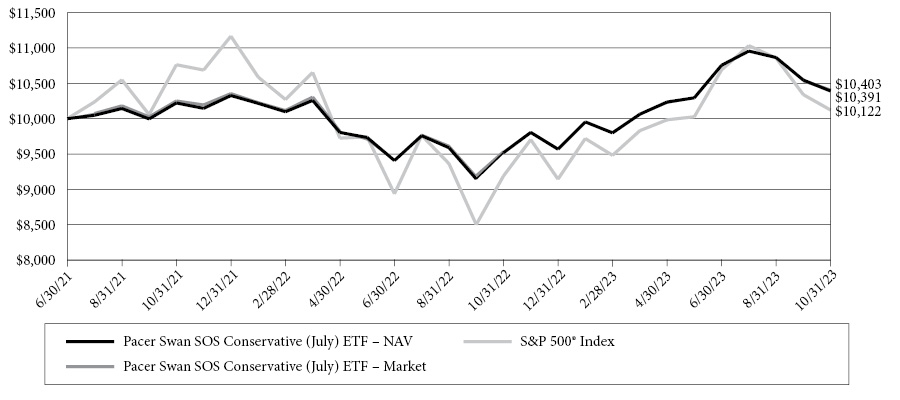

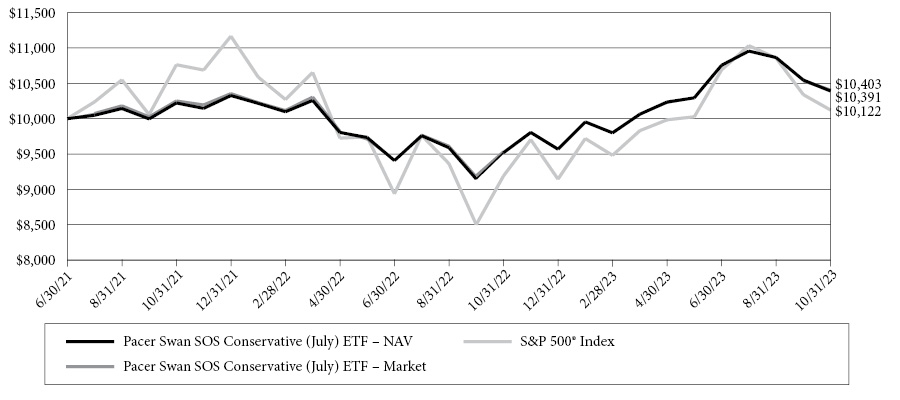

Pacer Swan SOS Conservative (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 14.73% (before fees and expenses of the Fund) and 13.98% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from July 3, 2023 to June 28, 2024.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Conservative (July) ETF - NAV | 9.16% | 1.65% |

Pacer Swan SOS Conservative (July) ETF - Market | 9.15% | 1.71% |

S&P 500 Index (3) | 10.14% | 0.52% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated July 3, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

24

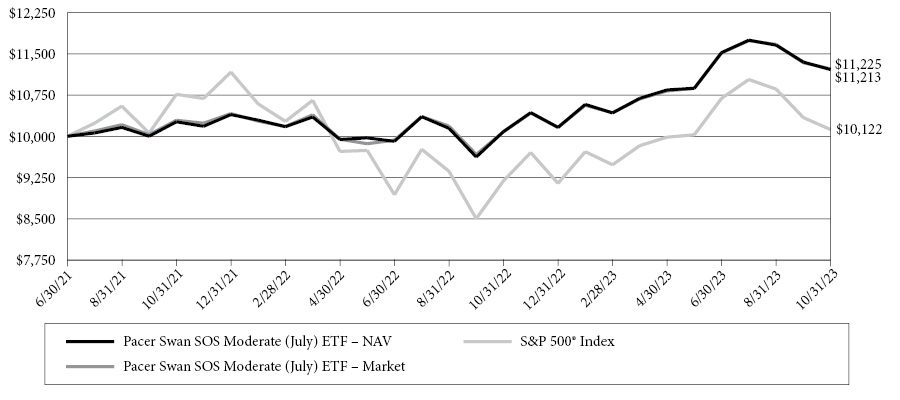

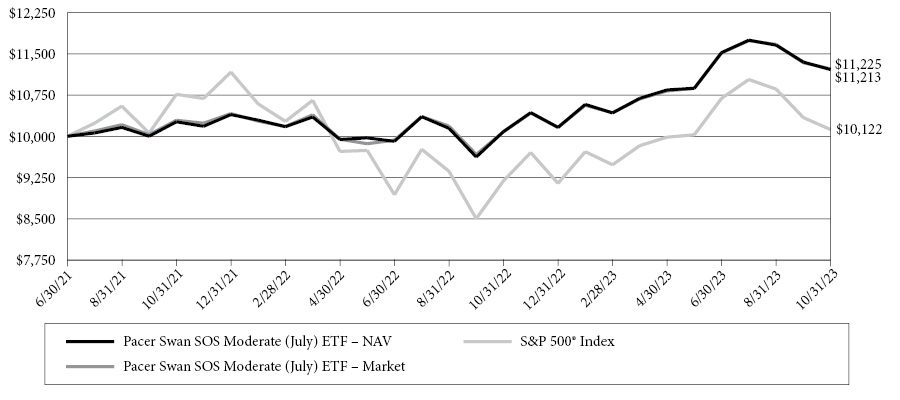

Pacer Swan SOS Moderate (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 14.52% (before fees and expenses of the Fund) and 13.77% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from July 3, 2023 to June 28, 2024.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Moderate (July) ETF - NAV | 11.19% | 5.02% |

Pacer Swan SOS Moderate (July) ETF - Market | 11.33% | 5.07% |

S&P 500 Index (3) | 10.14% | 0.52% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated July 3, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

25

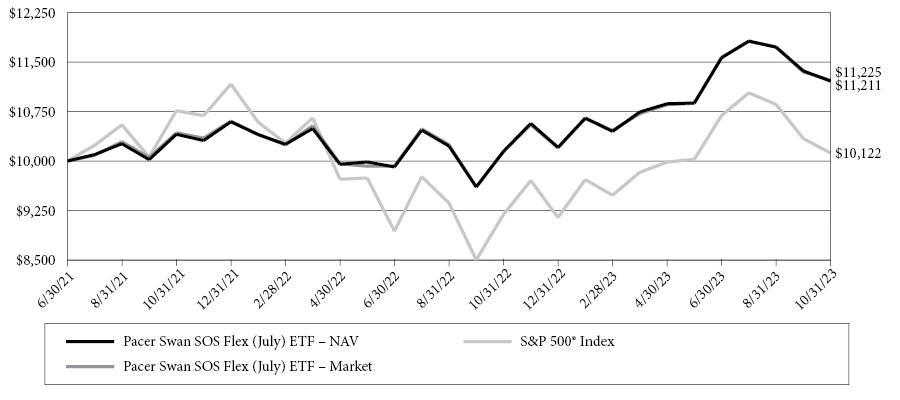

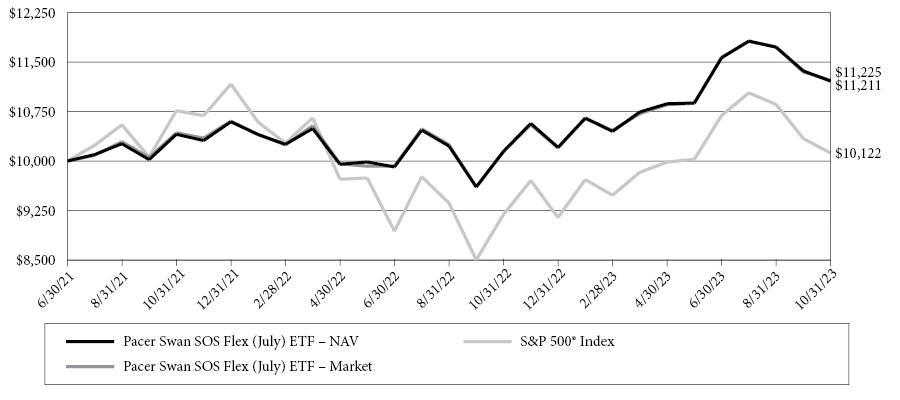

Pacer Swan SOS Flex (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (July) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 16.72% (before fees and expenses of the Fund) and 15.97% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from July 3, 2023 to June 28, 2024.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Flex (July) ETF - NAV | 10.49% | 5.01% |

Pacer Swan SOS Flex (July) ETF - Market | 10.65% | 5.07% |

S&P 500 Index (3) | 10.14% | 0.52% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated July 3, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

26

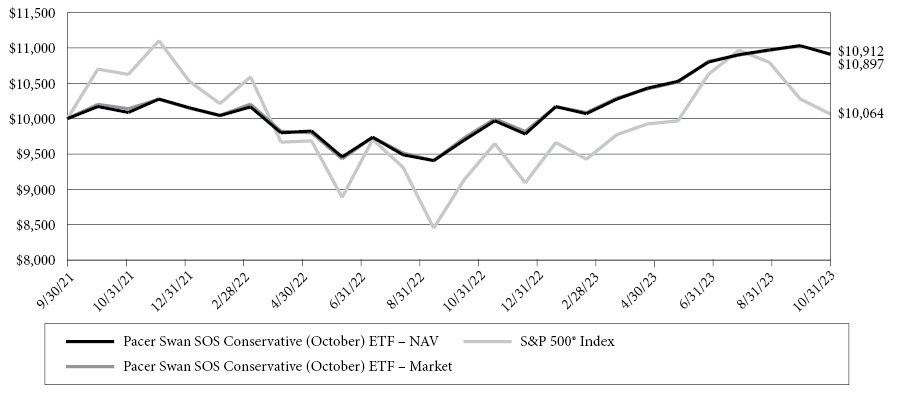

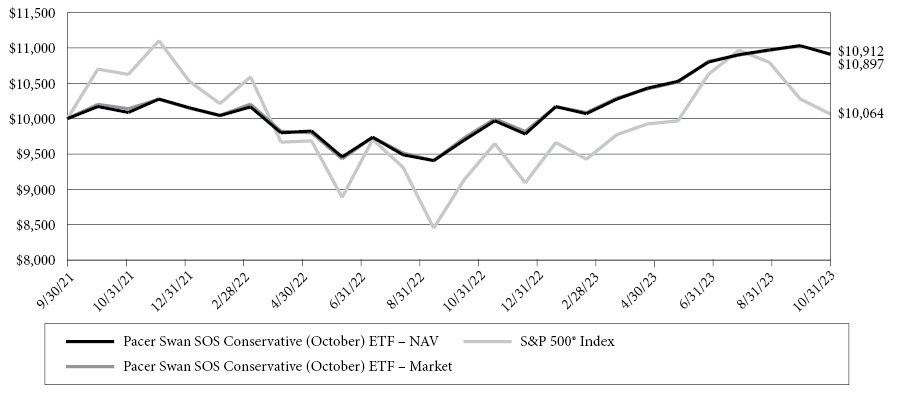

Pacer Swan SOS Conservative (October) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on September 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 15.95% (before fees and expenses of the Fund) and 15.20% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from October 2, 2023 to September 30, 2024.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Conservative (October) ETF - NAV | 12.54% | 4.27% |

Pacer Swan SOS Conservative (October) ETF - Market | 12.01% | 4.20% |

S&P 500 Index (3) | 10.14% | 0.31% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated October 2, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is September 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

27

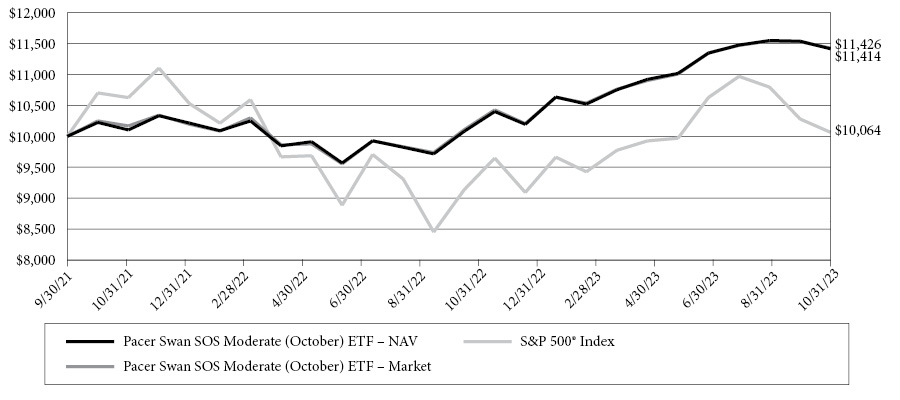

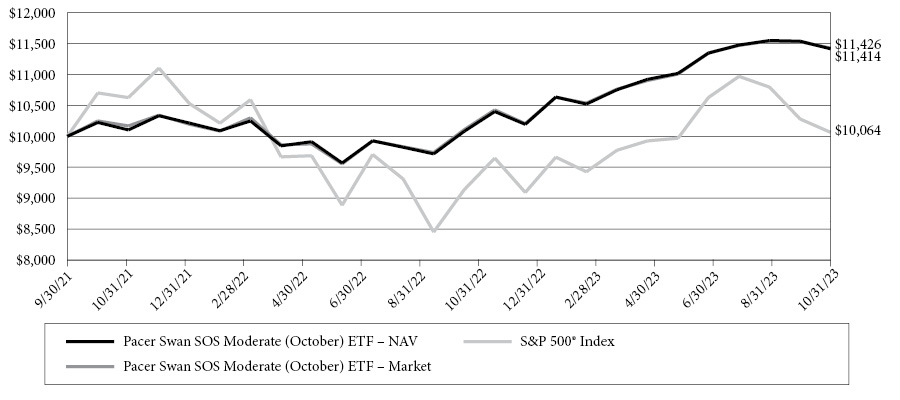

Pacer Swan SOS Moderate (October) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on September 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 15.50% (before fees and expenses of the Fund) and 14.75% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from October 2, 2023 to September 30, 2024.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies.

Annualized Returns (1)

(For the periods ended October 31, 2023)

| | One Year | Since Inception(2) |

Pacer Swan SOS Moderate (October) ETF - NAV | 13.22% | 6.55% |

Pacer Swan SOS Moderate (October) ETF - Market | 13.05% | 6.60% |

S&P 500 Index (3) | 10.14% | 0.31% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated October 2, 2023, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |