As filed with the U.S. Securities and Exchange Commission on July 9, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23024

Pacer Funds Trust

(Exact name of registrant as specified in charter)

500 Chesterfield Parkway

Malvern, PA 19355

(Address of principal executive offices) (Zip code)

Joe M. Thomson, President

500 Chesterfield Parkway

Malvern, PA 19355

(Name and address of agent for service)

610-644-8100

Registrant's telephone number, including area code

Date of fiscal year end: April 30

Date of reporting period: May 1, 2023 to April 30, 2024

Item 1. Reports to Stockholders.

Pacer Funds

TABLE OF CONTENTS

| | Page |

Letter to Shareholders | 1 |

Portfolio Allocation | 22 |

Performance Summary | 36 |

Expense Example | 68 |

Schedules of Investments | 71 |

Statements of Assets & Liabilities | 168 |

Statements of Operations | 174 |

Statements of Changes in Net Assets | 180 |

Financial Highlights | 197 |

Notes to Financial Statements | 226 |

Report of Independent Registered Public Accounting Firm | 253 |

Additional Information | 257 |

Pacer Funds

Dear Shareholder,

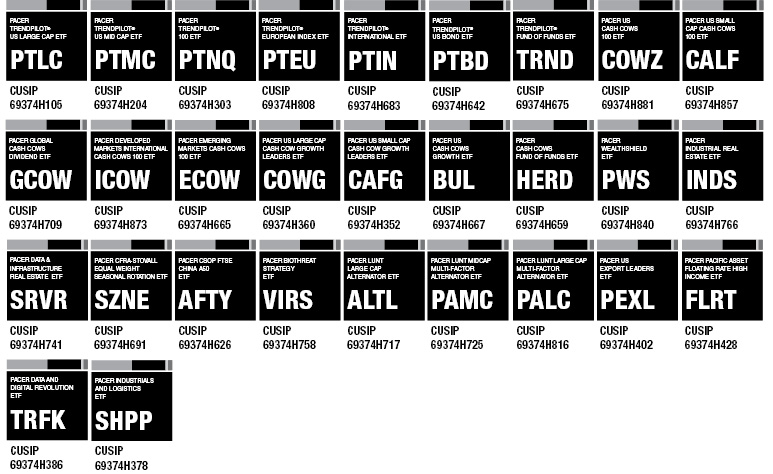

We celebrate our accomplishments over the last year and anticipate the promising ventures that lie ahead for Pacer as our network grows. We seek to continuously provide a broad and diverse line up of funds that allows investors to achieve their financial goals by offering unique, innovative, and disruptive investment solutions.

Pacer has experienced tremendous growth this year in assets under management, surpassing $43 billion, as of April 30th, 2024. The Pacer Cash Cows ETF™ Series was a lead contributor, with over $36 billion, an 80.8% increase in AUM since April 30th of last year.

By building out the growth side of the Cash Cows series, we hope to replicate the success we have with our Cash Cows value series which focuses on free cash flow yield. The launch of the Pacer Developed Markets Cash Cows Growth Leaders ETF (EAFG) coincides with a new partnership between Pacer and MSCI, as EAFG is the first of Pacer’s funds to screen equity names using an MSCI Index. EAFG’s strategy tracks the Pacer Developed Markets Cash Cows Growth Leaders Index, pulling the top 100 international large- and mid-cap securities in developed markets with above-average free cash flow margin from the MSCI EAFE Index. EAFG joins COWG (large-cap U.S.) and CAFG (small-cap U.S.) in the Cash Cows growth series.

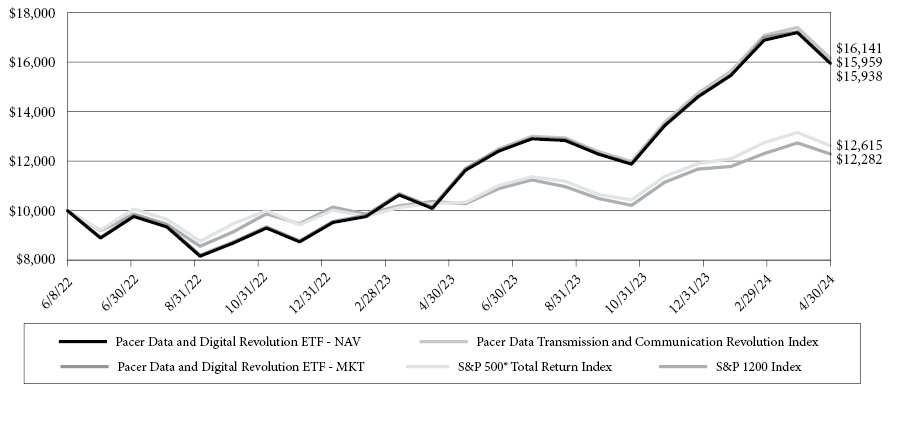

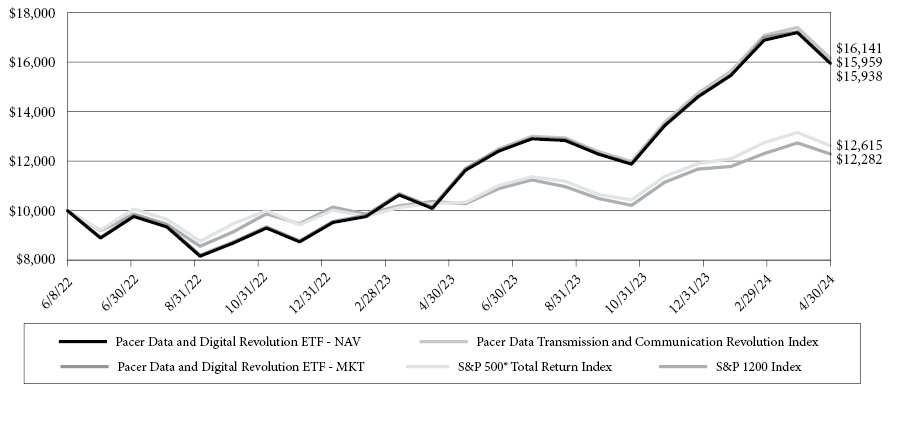

As technology increasingly permeates every aspect of our daily lives, the Pacer Data and Digital Revolution ETF (ticker: TRFK) provides exposure to the companies driving the ongoing digital and technological revolution; also, having been our strongest performing fund in 2023.

We deeply value the strong relationships we have built and the trust our partners, financial advisors, and investors have placed in us. Pacer remains committed to delivering long-term value to help investors reach their goals.

Joe M. Thomson,

Chairman, Pacer Funds Trust

1

Pacer Funds

From 5/1/2023 to 4/30/2024, the S&P 500 gained 22.66%, the Nasdaq-100 gained 32.77%, and the Dow Jones Industrial Average gained 13.41%.

From 5/1/2023 to the end of the year, the market was positive, with the S&P 500 gaining 15.72%, the Nasdaq-100 gaining 27.92%, and the Dow Jones Industrial Average gaining 13.38%.

While inflation decreased, ending 2023 with a Consumer Price Index (CPI) of 3.4%, it remained above the Federal Reserve’s (the “Fed”) 2.0% target, prompting two additional 25 basis point rate hikes in the second half of 2023, one in May and one in June. However, the progress in moderating price pressures allowed the Fed to refrain from further interest rate hikes since July. Raising interest rates helped drive down inflation but also cooled the housing market. Rising interest rates pushed mortgage rates higher, peaking at about 8.0% in October, more than double the rate during the pandemic and well above pre-pandemic levels. Higher mortgage rates led to fewer buyers, but home prices climbed year over year due to diminishing inventory. Fortunately, mortgage rates fell by more than a full point over the last few months of the year, settling at about 6.61% at the end of December 2023.

While the number of new jobs trended lower during the second half of the year, job growth averaged 225,000 through December. There were 6.3 million unemployed in December 2023, compared to 6.0 million a year earlier. The unemployment rate was 3.7% and remained within a range of 3.5%-3.8% for most of the year. Average hourly earnings increased by 4.0% in 2023. The number of job openings decreased during the year but remained solid at 8.7 million.

One of the primary factors in the drop in overall inflation was a decline in energy prices. According to the Consumer Price Index, energy prices fell 6.4% over the 12 months ended in December. Gasoline prices dropped 10.9% over the same period. Food prices, on the other hand, rose 5.8%, while prices for shelter increased 7.9%.

Inflation fell in most major countries during the last quarter of the year. Declining prices for food, energy, and goods, coupled with tightened monetary policies, helped reduce inflation. Several countries saw consumer prices, as measured by the Consumer Price Index, trend lower in December, including Canada, the Eurozone, the United Kingdom, and Japan. For 2023, the STOXX Europe 600 Index rose 12.7%; the United Kingdom’s FTSE advanced 3.8%; Japan’s Nikkei 225 Index gained 28.2%; and China’s Shanghai Composite Index lost 3.7%.

At the start of 2024, investors entered the first quarter optimistic that a soft landing was in store for the economy, expecting a recession to be avoided, inflation to continue improving, and the Fed to start cutting interest rates in March. The economy not only avoided recession but also performed stronger than expected. However, inflation turned sticky again, with April inflation at 3.4%. Consequently, Fed rate cuts have been pushed out to at least June. Investors had previously priced in five cuts for 2024, but expectations now center on two cuts later on the year.

The bull market continued into early 2024. Even the threat of higher interest rates for a longer period didn’t hinder its strong performance. Stocks staged impressive returns in the first quarter, gaining over 10%, bringing total returns to just shy of 30% over the last 12 months.

Stock prices rose in the first quarter despite diminished expectations for Federal Reserve rate cuts in 2024. Gains were led by technology stocks, particularly those expected to benefit from the artificial intelligence boom. Value stocks also joined in the rally. Meanwhile, the bond market’s performance was dented by the prospect of the Fed delaying rate cuts until the middle of the year.

2

Pacer Funds

The Pacer Trendpilot™ Series

The Pacer Trendpilot series is based on a trend following strategy that alternates exposure between a Benchmark Index and 3-Month US T-Bills using three indicators. It is designed to participate in the market when it is trending up, maintain some exposure during short term market declines and exit the market when it is trending down. The period referenced in this section for all Trendpilot Funds is for the fiscal year end of April 30, 2024.

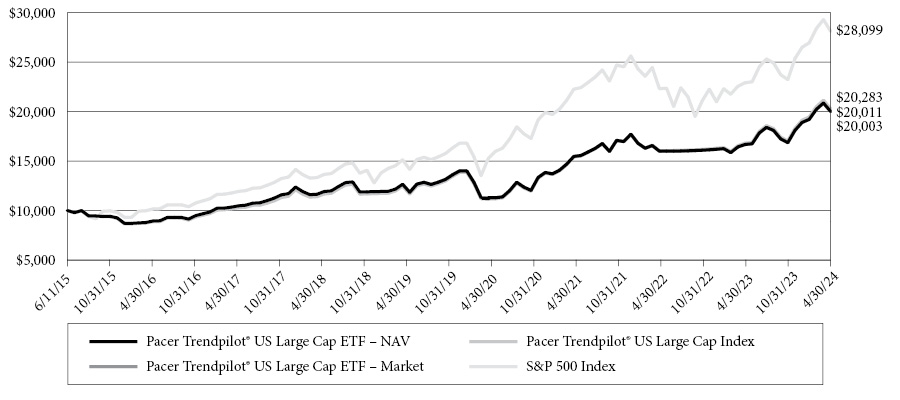

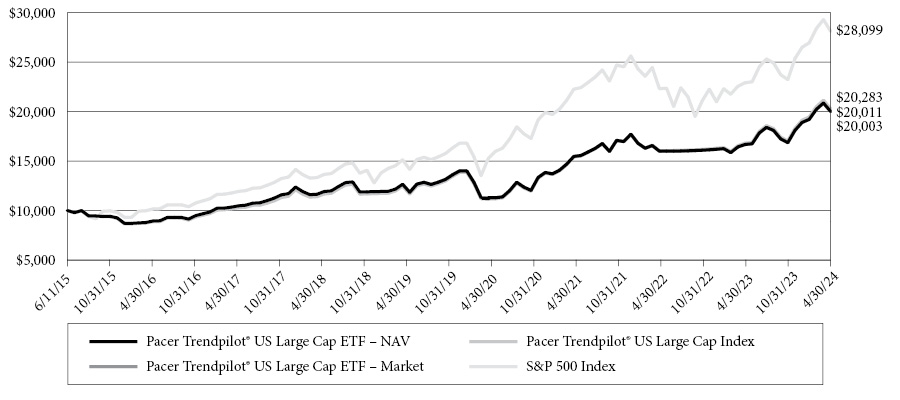

Pacer Trendpilot® US Large Cap ETF

The Pacer Trendpilot® US Large Cap ETF (the “Fund”) is an exchange traded fund that seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot® US Large Cap Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the S&P 500 Index, (ii) 50% to the S&P 500 Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the S&P 500 Total Return Index and its 200-business day historical simple moving average.

The S&P 500 Total Return Index is a total return version of the S&P 500 Index and reflects the reinvestment of dividends paid by the securities in the S&P 500 Index. The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 80% of the U.S. equity market capitalization.

The Fund

The Fund had a NAV total return of 19.96%. The Index had a total return of 20.68%. The S&P 500 Index had a total return of 22.66%.

Since the end of the previous fiscal year, the Fund switched from Equities to 50/50 in November 1, 2023. From there the Fund switched to equities a week later in November 8, 2023. During this time (11/1/2023 – 11/8/2023), the U.S. Treasury 3-Month Yield was relatively unchanged, from 5.4511% to 5.4223%, due to Fed’s rate policy.

PTLC EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasury 3-Month Yield |

November 1, 2023 | 50/50 | 5.4511% |

November 8, 2023 | Equities | 5.4223 |

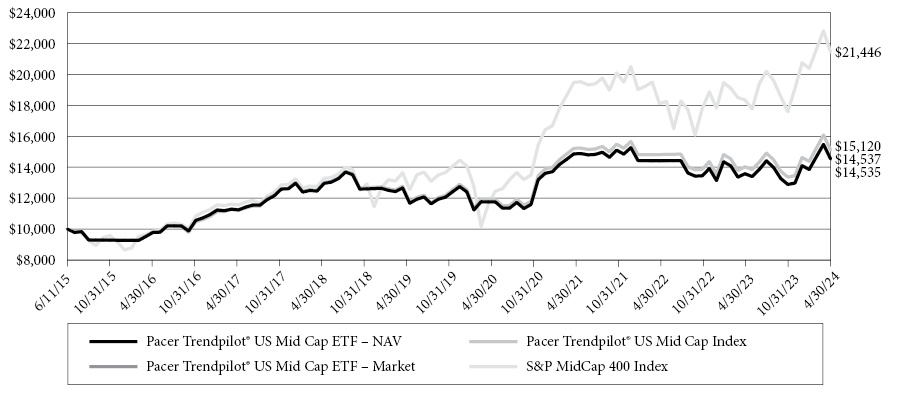

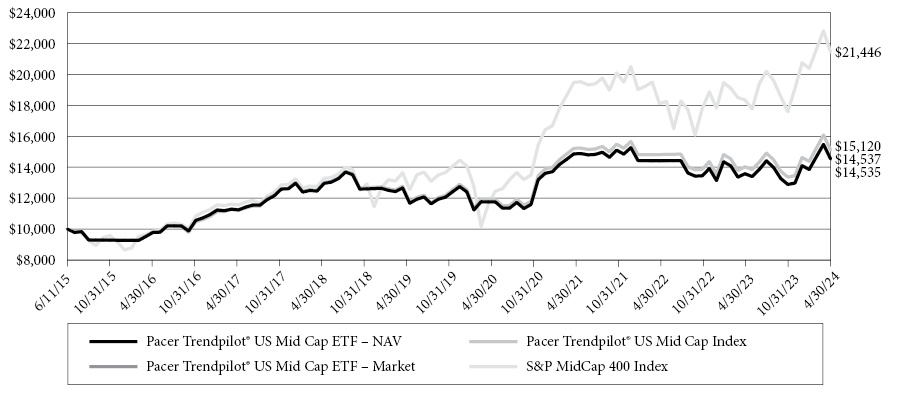

Pacer Trendpilot® US Mid Cap ETF

The Pacer Trendpilot® US Mid Cap ETF (the “Fund”) is an exchange traded fund that seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot US Mid Cap Trendpilot Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the S&P MidCap 400 Index, (ii) 50% to the S&P MidCap 400 Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the S&P MidCap 400 Total Return Index and its 200-business day historical simple moving average.

The S&P MidCap 400 Total Return Index is a total return version of the S&P MidCap 400 Index and reflects the reinvestment of dividends paid by the securities in the S&P MidCap 400 Index. The S&P Midcap 400 measures the performance of mid-capitalization stocks in the United States.

The Fund

The Fund had a NAV total return of 7.02%. The Index had a total return of 7.77% The S&P MidCap 400 Index had a total return of 16.82%.

3

Pacer Funds

The Fund had the following exposure changes during the fiscal year. Summary details of these changes are presented in the following table.

PTMC EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasury 3-Month Yield |

5/9/2023 | 50/50 | 5.1819% |

5/19/2023 | T-Bills | 5.2172 |

6/9/2023 | Equities | 5.2354 |

9/28/2023 | 50/50 | 5.4616 |

10/25/2023 | T-Bills | 5.4596 |

11/27/2023 | Equities | 5.3979 |

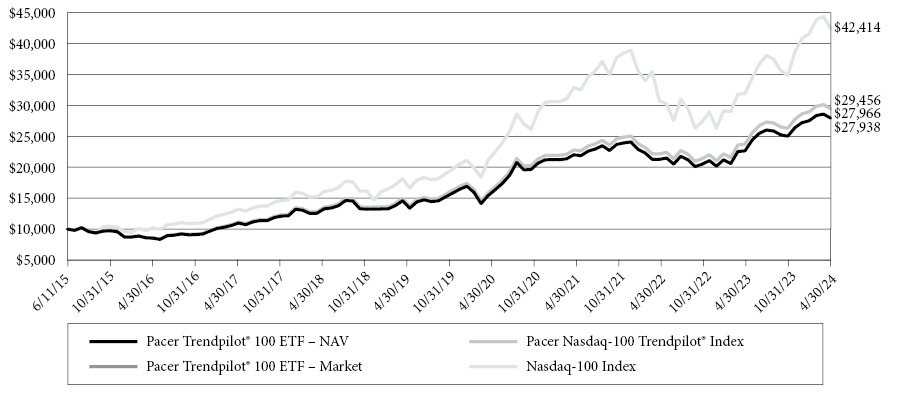

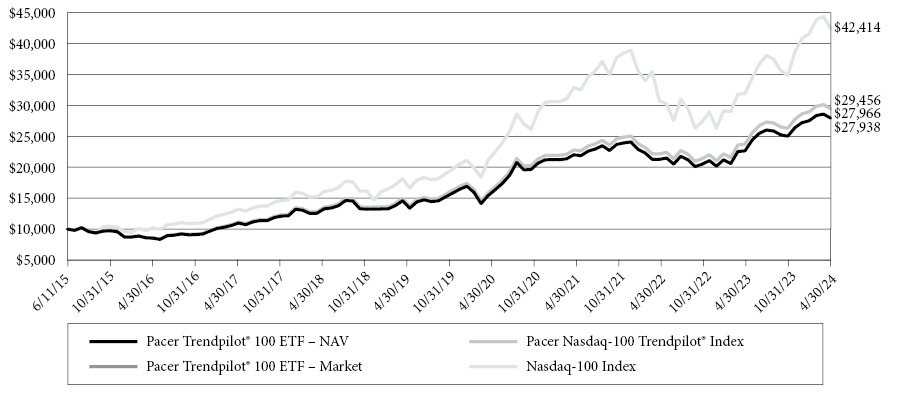

Pacer Trendpilot® 100 ETF

The Pacer Trendpilot® 100 ETF (the “Fund”) seeks to track the total return performance, before fees and expenses, of the Pacer NASDAQ-100 Trendpilot™ Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the Nasdaq-100 Index, (ii) 50% to the Nasdaq-100 Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the Nasdaq-100 Total Return Index and its 200-business day historical simple moving average.

The Nasdaq-100 Total Return Index is a total return version of the Nasdaq-100 Index and reflects the reinvestment of dividends paid by the securities in the Nasdaq-100 Index. The Nasdaq-100 Index includes approximately 100 of the largest non-financial securities listed on The Nasdaq Stock Market based on market capitalization. The Nasdaq-100 Index comprises securities of companies across major industry groups, including computer, biotechnology, healthcare, telecommunications and transportation. However, it does not contain securities of financial companies, including investment companies. The Nasdaq-100 Index was developed by Nasdaq OMX. There is no minimum market capitalization requirement for inclusion in the Nasdaq-100 Index. Inclusion is determined based on the top 100 largest issuers based on market capitalization meeting all other eligibility requirements.

The Fund

The Fund had a NAV total return of 23.36%. The Index had a total return of 24.13%. The NASDAQ-100 Index had a total return of 32.77%.

The Fund had the following exposure changes during the fiscal year. Summary details of these changes are presented in the following table.

PTNQ EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasury 3-Month Yield |

6/5/2023 | 50/50 | 5.2828% |

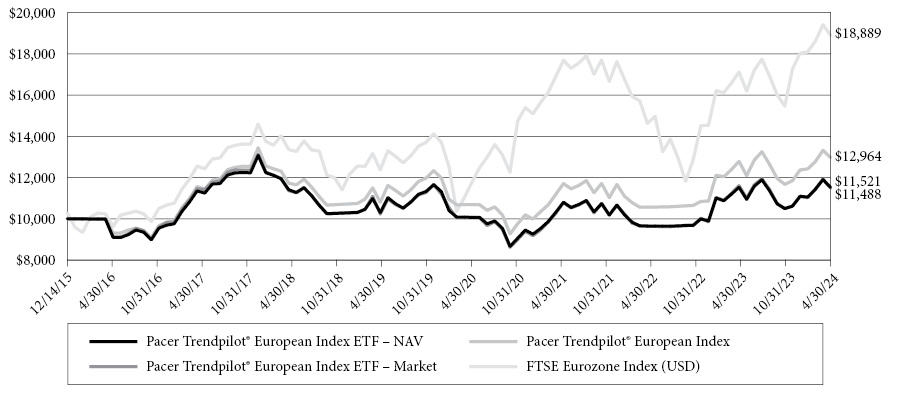

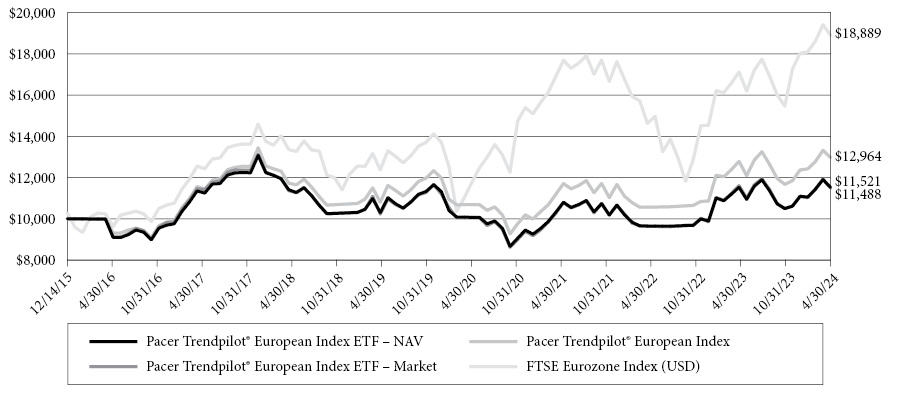

Pacer Trendpilot® European Index ETF

The Pacer Trendpilot® European Index ETF (the “Fund”) seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot European Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the FTSE Eurozone Index, (ii) 50% to the FTSE Eurozone Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the FTSE Eurozone Total Return Index and its 200-business day historical simple moving average.

The FTSE Eurozone Index is a rules-based, float-adjusted, market capitalization weighted index comprised of large- and mid-capitalization stocks providing coverage of the developed markets in the euro zone, including primarily France, Germany, Spain, the Netherlands and Italy. The FTSE Eurozone Index is a subset of the FTSE Global Equity Index Series, which covers 98% of the world’s investable market capitalization. The FTSE Eurozone Total Return Index is a total return version of the FTSE Eurozone Index and reflects the reinvestment of dividend paid by the securities in the FTSE Eurozone Index.

4

Pacer Funds

The Fund

The Fund had a NAV total return of -0.02%. The Index had a total return of 1.40%. The FTSE Eurozone Index (USD) had a total return of 10.33%.

The Fund had the following exposure changes during the fiscal year. Summary details of these changes are presented in the following table.

PTEU EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasury 3-Month Yield |

10/2/2023 | 50/50 | 5.4555% |

10/31/2023 | T-Bills | 5.4623 |

11/21/2023 | Equities | 5.3849 |

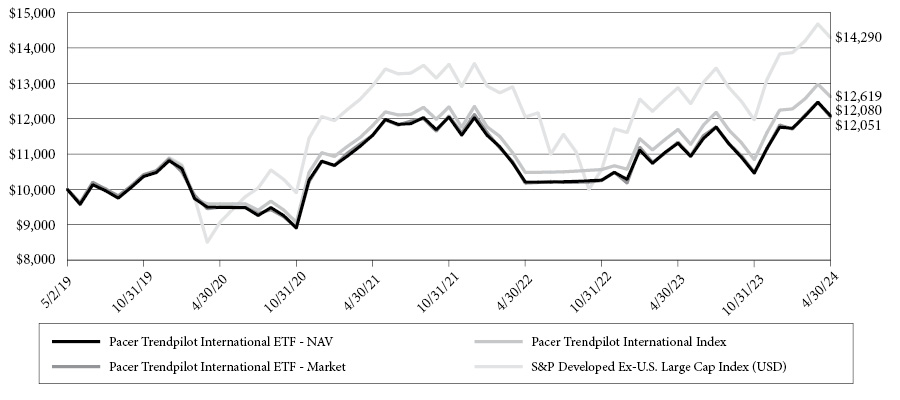

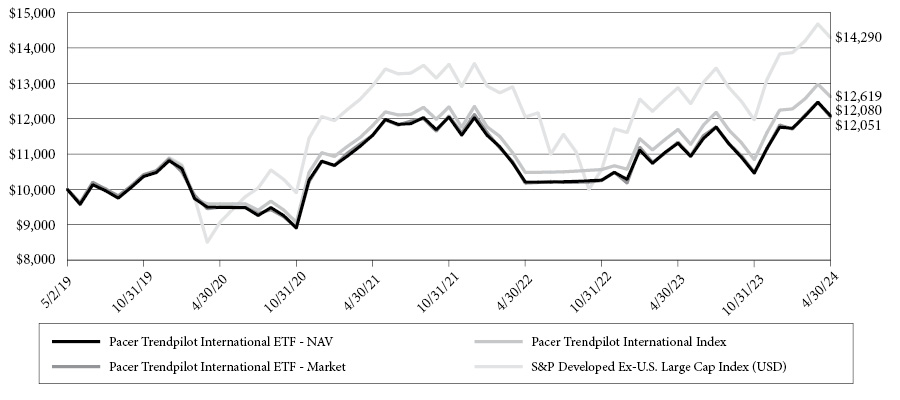

Pacer Trendpilot® International ETF

The Pacer Trendpilot® International ETF is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot International Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the S&P Developed Ex-U.S. LargeCap Index, (ii) 50% to the S&P Developed Ex-U.S. LargeCap Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the S&P Developed Ex-U.S. LargeCap Index and its 200-business day historical simple moving average (the “200-day moving average”). The calculation of the 200-day moving average for the S&P Developed Ex-U.S. LargeCap Index is based on the total return version of the S&P Developed Ex-U.S. LargeCap Local Currency Index and reflects the reinvestment of dividends paid by the securities in the S&P Developed Ex-U.S. LargeCap Index. The Index is expected to be predominantly invested in the components of the S&P Developed Ex-U.S. LargeCap Index over most short- and long-term periods and is only expected to invest in 3-Month US Treasury bills from time to time in response to adverse market conditions as defined by the “50/50 Indicator” and “T-Bill Indicator” below.

The S&P Developed Ex-U.S. LargeCap Index is a rules-based, float-adjusted, market capitalization-weighted index comprised of large-capitalization stocks providing coverage of the developed markets excluding the United States. The S&P Developed Ex-U.S. LargeCap Index is a subset of the S&P Global BMI, a comprehensive, rules-based index measuring global stock market performance.

The Fund

The Fund had a NAV total return of 6.85%. The Index had a total return of 7.91%. The S&P Developed Ex-US Large Cap Index had a total return of 10.97%.

The Fund had the following exposure changes during the fiscal year. Summary details of these changes are presented in the following table.

PTIN EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasury 3-Month Yield |

10/26/2023 | 50/50 | 5.4484% |

11/9/2023 | Equities | 5.4241% |

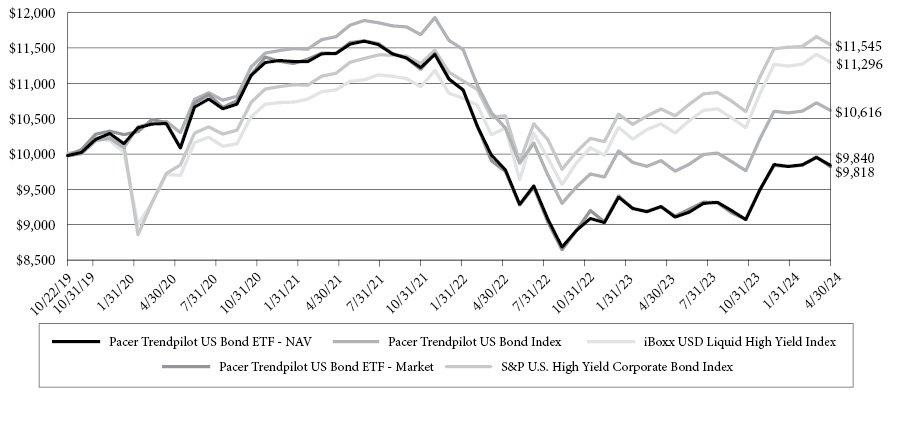

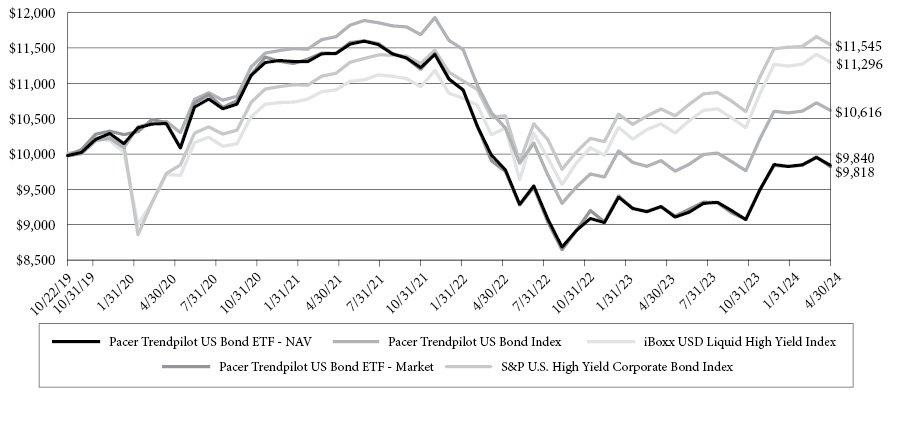

Pacer Trendpilot® US Bond ETF

The Pacer Trendpilot US Bond ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot US Bond Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure to one of the following positions: (i) 100% to the iBoxx® USD Liquid High Yield Index, (ii) 50% to the iBoxx USD Liquid High Yield Index and 50% to the iBoxx® USD Treasuries 7-10 Year Index or (iii) 100% to iBoxx USD Treasuries 7-10 Year Index, depending on the “Risk Ratio,” described below.

The iBoxx USD Liquid High Yield Index is designed to track the performance of U.S. dollar-denominated, high-yield corporate bonds issued in the U.S. The iBoxx USD Treasuries 7-10 Year Index is designed to measure the performance of U.S. Treasury bonds maturing in 7 to 10 years. The Index uses a “Risk Ratio” to signal a change in the position of the Index. The Risk Ratio is calculated by dividing the value of the iBoxx USD Liquid High Yield Index by the value of the iBoxx USD Treasuries 7-10 Year Index.

5

Pacer Funds

The Index, and consequently the Fund, may stay in any of its three possible positions for an extended period of time. As described below, the Index will change its position based on the following indicators, and each change will become effective by the close of business on the sixth business day after the indicator for the change is triggered. The Index will be in a new position effective on the seventh business day.

The Fund

The Fund had a NAV total return of 6.30%. The Index had a total return of 7.16%. The iBoxx USD Liquid High Yield Index had a total return of 8.32%.

PTBD had one exposure change initiated on May 30, 2023. This was to switch from T-Bills to Equities, the rate at the time was 5.252.

The Fund had the following exposure changes during the fiscal year. Summary details of these changes are presented in the following table.

PTBD EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasury 10-Year Yield |

May 30, 2023 | Equities | 5.252% |

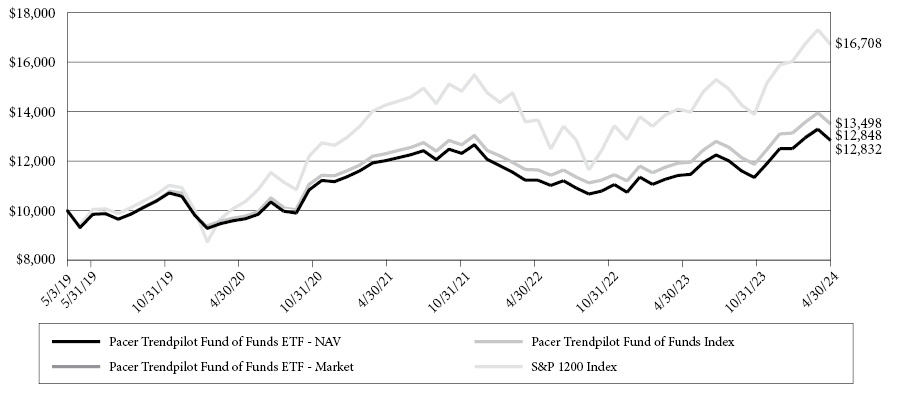

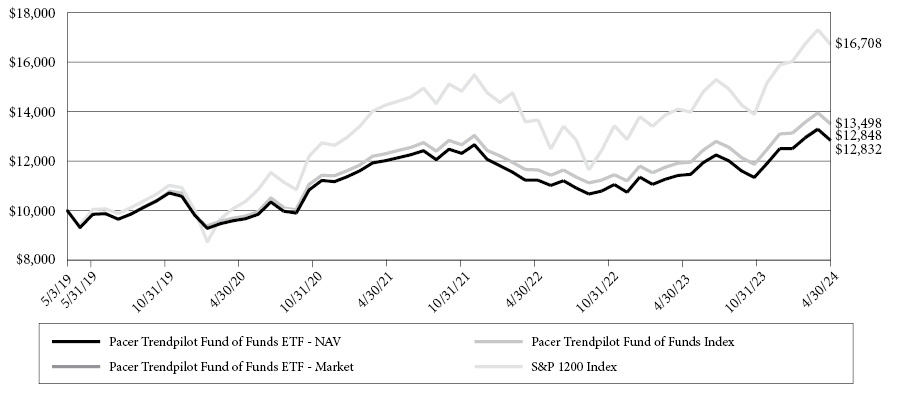

Pacer Trendpilot® Fund of Funds ETF

The Pacer Trendpilot Fund of Funds ETF is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot Fund of Funds Index (the “Index” or the “Fund of Funds Index”).

The Fund of Funds Index uses an objective, rules-based approach to construct a portfolio that, as of each quarterly rebalance, is composed of the ETFs listed in the following table, each advised by the Adviser (collectively, the “Trendpilot ETFs”). Each of the Trendpilot ETFs is an index-based ETF that seeks to track the total return performance, before fees and expenses, of the underlying index listed in the following table (collectively, the “Trendpilot Indexes”). Each Trendpilot Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the “Equity Component” specified in the table below, (ii) 50% to the applicable Equity Component and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the Equity Component and its 200- business day historical simple moving average (the “200-day moving average”). The calculation of the 200-day moving average for each Equity Component is based on the total return version of such Equity Component and reflects the reinvestment of dividends paid by the securities in such Equity Component.

Weight | Trendpilot ETF | Trendpilot Index | Equity Universe |

20% | Pacer Trendpilot® US Large Cap ETF | Pacer Trendpilot US Large Cap Index S | S&P 500® Index |

20% | Pacer Trendpilot® US Mid Cap ETF | Pacer Trendpilot US Mid Cap Index | S&P MidCap 400® Index |

20% | Pacer Trendpilot® 100 ETF | Pacer NASDAQ-100 Trendpilot Index | NASDAQ-100® Index |

20% | Pacer Trendpilot® International ETF | Pacer Trendpilot International Index | S&P Developed Ex-U.S. LargeCap Index |

20% | Pacer Trendpilot® US Bond ETF | Pacer Trendpilot US Bond Index | iBoxx USD Liquid High Yield Index |

The Fund

The Fund had a NAV total return of 12.39%. The Index had a return of 13.30%. The S&P 1200 Index had a total return of 18.45%.

The Pacer Cash Cows Index® ETF Series

The Pacer Cash Cows ETFs aim to provide capital appreciation over time by screening broad based indexes to identify quality companies with high free cash flow yield. The period referenced in this section for all Cash Cows Funds is for the fiscal year end of April 30, 2024.

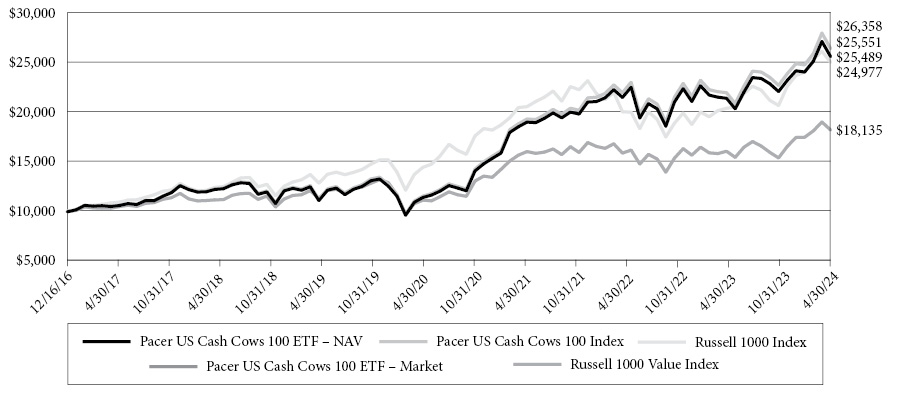

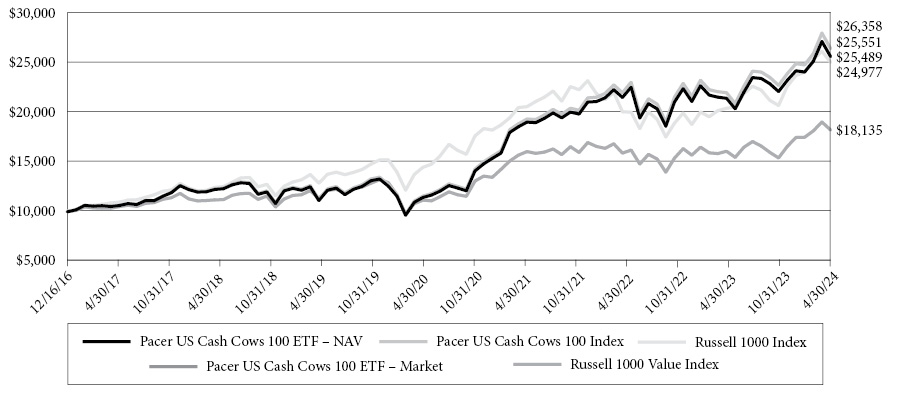

Pacer US Cash Cows 100 ETF

The Pacer US Cash Cows 100 ETF (the “Fund”) seeks to track the total return performance, before fees and expenses, of the Pacer US Cash Cows 100 Index (the “Index”).

The Index uses an objective, rules-based methodology to provide exposure to large and mid-capitalization U.S. companies with high free cash flow yields. The initial index universe is derived from the component companies of the Russell 1000 Index. The initial universe of companies is screened based on their average projected free cash flows and earnings over each of the next two fiscal years. Companies with no forward year estimates available for free cash flows or earnings will remain in the Index universe. Companies with negative average projected free cash

6

Pacer Funds

flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts, are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve-month period. The equity securities of the 100 companies with the highest free cash flow yield are included in the Index.

The Russell 1000 Index is a market-capitalization weighted index representing the top 1,000 large-cap stocks in the Russell 3000 Index. The Russell 1000 Total Return Index is a total return version of the Russell 1000 Index that reflects the reinvestment of dividends paid by the securities in the Russell 1000 Index.

The Fund

The Fund had a NAV total return of 19.70%. The Index had a total return of 20.34%. The Russell 1000 Value Index had a total return of 13.37%. The Russell 1000 Index had a total return of 22.82%.

During the fiscal year, the top three sectors for contribution to performance were Consumer Discretionary 6.62%, Energy at 6.58%, and Industrials at 2.99%. The three sectors with the lowest contribution to performance were Consumer Staples at -0.46%, Health Care at -0.01%, and Communication Services at 0.27%. These return numbers reflect the contribution to the total return of the fund.

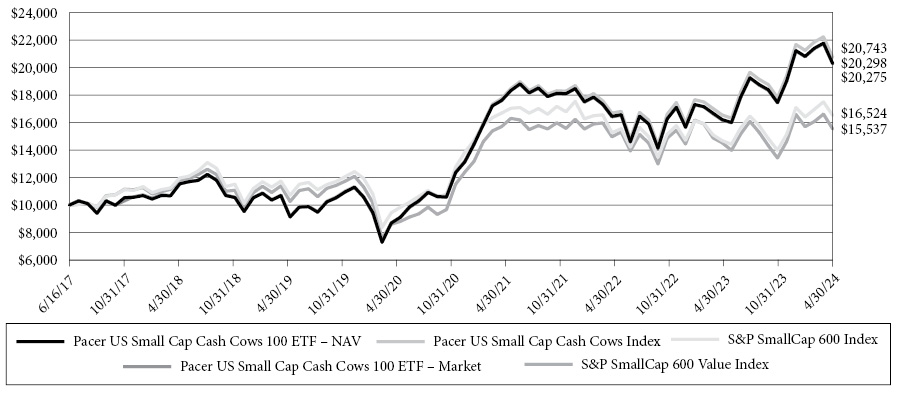

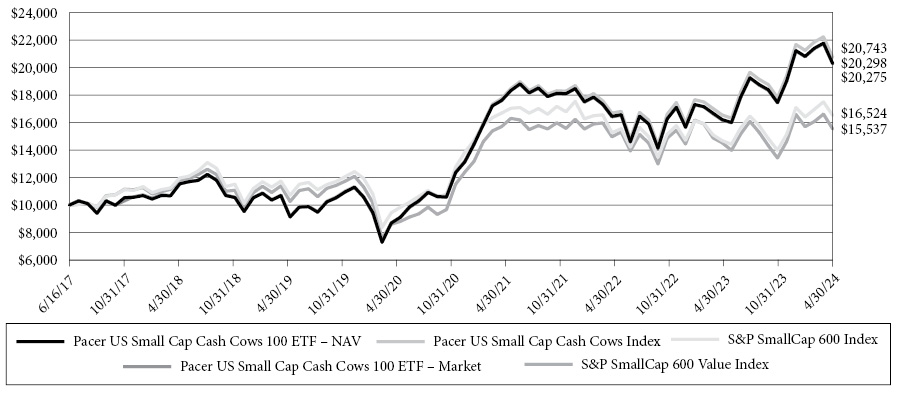

Pacer US Small Cap Cash Cows 100 ETF

The Pacer US Small Cap Cash Cows 100 ETF (the “Fund”) seeks to track the total performance, before fees and expenses, of the Pacer US Small Cap Cash Cows 100 Index (the “Index”).

The Index uses an objective, rules-based methodology to provide exposure to small-capitalization U.S. companies with high free cash flow yields. The initial index universe is derived from the component companies of the S&P Small Cap 600 Index. The initial universe of companies is screened based on their average projected free cash flows and earnings over each of the next two fiscal years. Companies with no forward year estimates available for free cash flows or earnings will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts, are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve-month period. The equity securities of the 100 companies with the highest free cash flow yield are included in the Index.

The S&P SmallCap 600 Index measures the performance of 600 small sized companies in the US equity market, with market capitalization ranging from $450 million to $2.1 billion USD. The Index does not overlap holdings with the S&P 500 or S&P MidCap 400.

The Fund

The Fund had a NAV total return of 25.18%. The Index had a total return of 25.37%. The S&P Small Cap 600 Value Index had a total return of 6.95%. The S&P Small Cap 600 Index had a total return of 12.55%.

During the fiscal year, the top three sectors for contribution to performance were Consumer Discretionary 11.48%, Industrials at 8.34%, and Energy at 6.37%. The three sectors with the lowest contribution to performance were Health Care at -0.62%, Consumer Staples at -0.36%, and Real Estate at -0.05%. These return numbers reflect the contribution to the total return of the Fund.

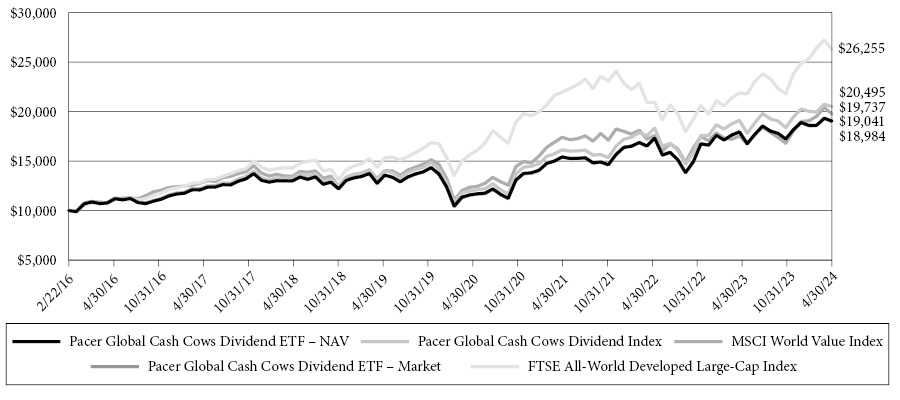

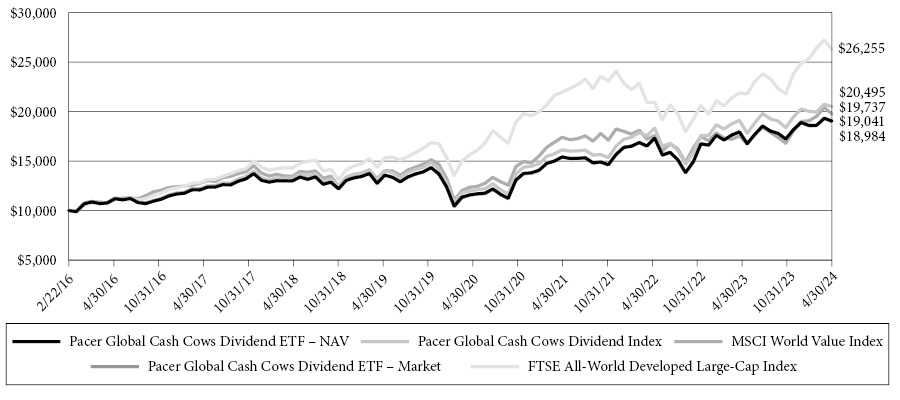

Pacer Global Cash Cows Dividend ETF

The Pacer Global Cash Cows Dividend ETF (the “Fund”) seeks to track the total return performance, before fees and expenses, of the Pacer Global Cash Cows Dividend Index (the “Index”).

The Index uses an objective, rules-based methodology to provide exposure to global companies with high dividend yield backed by a high free cash flow yield. The initial index universe is derived from the component companies of the FTSE Developed Large Cap Index. The initial universe of companies is screened based on their average projected free cash flows and earnings over each of the next two fiscal years. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts, are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve-month period. The 300 companies with the highest free cash flow yield are then ranked by their dividend yield. The equity securities of the 100 companies with the highest dividend yield are included in the Index.

The FTSE Developed Large-Cap Index is a market-capitalization weighted index representing the performance of large-cap stocks in developed markets. The FTSE Developed Large-Cap Total Return Index is a total return version of the FTSE Developed Large-Cap Index and reflects the reinvestment of dividends paid by the securities in the FTSE Developed Large-Cap Index.

7

Pacer Funds

The Fund

The Fund had a NAV total return of 6.17%. The Index had a total return of 7.19%. The MSCI World Value Index had a total return of 12.54%. The FTSE Developed Large-Cap Index had a total return of 20.05%.

During the fiscal year, the top three sectors for contribution to performance were Energy 3.48%, Consumer Discretionary at 2.25%, and Materials at 1.76%. The three sectors with the lowest contribution to performance were Utilities at -0.18%, Consumer Staples at 0.09%, and Communication Services at 0.11%. These return numbers reflect the contribution to the total return of the Fund.

During the fiscal year, the top three countries for contribution to performance were the United States at 3.51%, Japan at 2.21%, and Italy at 0.99%. The three countries with the lowest contribution to performance were Denmark at -0.27%, Hong Kong at -0.27%, and Switzerland at -0.26%. These return numbers reflect the contribution to the total return of the Fund.

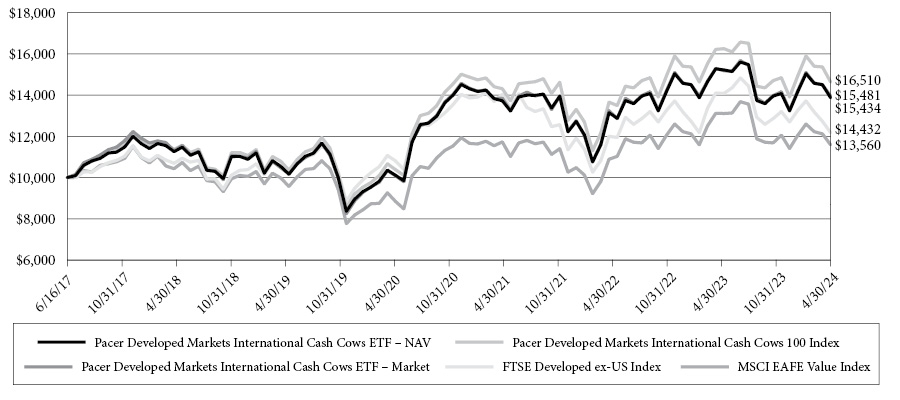

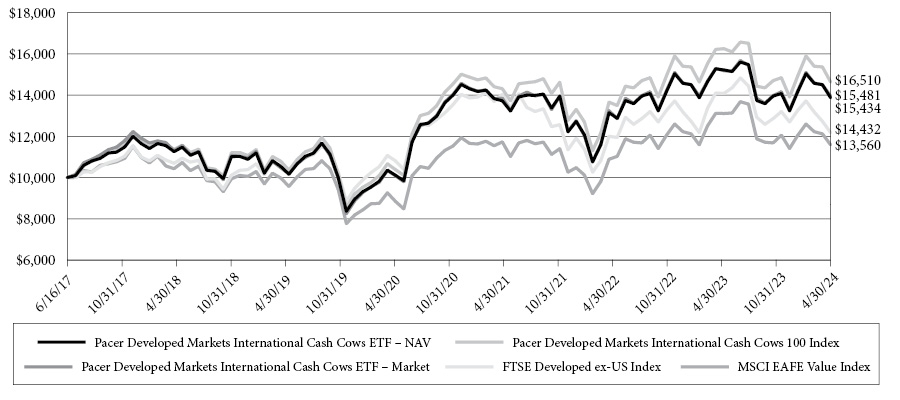

Pacer Developed Markets International Cash Cows 100 ETF

The Pacer Developed Markets International Cash Cows 100 ETF (the “Fund”) seeks to track the total performance, before fees and expenses, of the Pacer Developed Markets International Cash Cows 100 Index (the “Index”).

The Index uses an objective, rules-based methodology to provide exposure to large and mid-capitalization non-U.S. companies in developed markets with high free cash flow yields. The initial index universe is derived from the component companies of the FTSE Developed ex US Index. The initial universe of companies is screened based on their average projected free cash flows and earnings over each of the next two fiscal years. Companies with no forward year estimates available for free cash flows or earnings will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts and companies with a market capitalization of less than $3 billion are excluded from the Index universe. The remaining companies are ranked by their average daily trading value (“ADTV”) for the prior three months. The 500 companies with the highest ADTV are then ranked by their free cash flow yield for the trailing twelve-month period. The equity securities of the 100 companies with the highest free cash flow yield are included in the Index.

The FTSE Developed ex-US Index is comprised of Large (85%) and Mid (15%) cap stocks providing coverage of Developed markets (24 countries) excluding the US. The index is derived from the FTSE Global Equity Index Series, which covers over 99% of the world’s investable market capitalization.

The Fund

The Fund had a NAV total return of 10.00%. The Index had a total return of 11.26%. The MSCI EAFE Value Index had a total return of 12.44%. The FTSE Developed ex-US Index had a total return of 9.31%.

During the fiscal year, the top three sectors for contribution to performance were Energy 3.92%, Consumer Discretionary at 3.47%, and Industrials at 3.17%. The three sectors with the lowest contribution to performance were Health Care at -0.26%, Utilities at -0.20%, and Consumer Staples at -0.03%. These return numbers reflect the contribution to the total return of the Fund.

During the fiscal year, the top three countries for contribution to performance were Japan at 6.28%, Italy at 1.32%, and South Korea at 0.98%. The three countries with the lowest contribution to performance were Denmark at -0.47%, Netherlands at -0.32%, and Singapore at -0.19%. These return numbers reflect the contribution to the total return of the Fund.

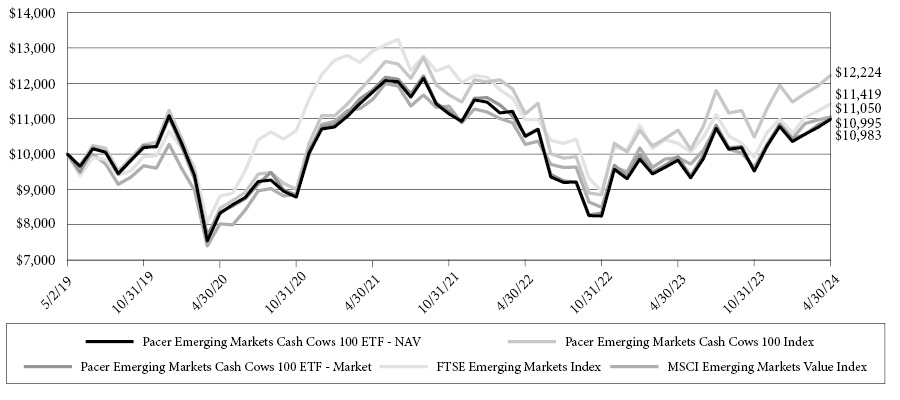

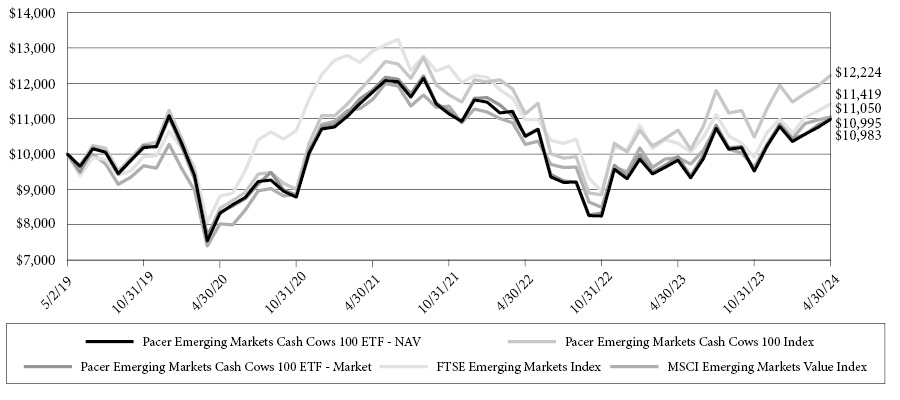

Pacer Emerging Markets Cash Cows 100 ETF

The Pacer Emerging Markets Cash Cows 100 ETF is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer Emerging Markets Cash Cows 100 Index (the “Index”).

The Index uses an objective, rules-based methodology to provide exposure to large and mid-capitalization companies in emerging markets with high free cash flow yields. Companies with high free cash flow yields are commonly referred to as “cash cows”. The initial index universe is derived from the component companies of the FTSE Emerging Markets Index. The Fund defines emerging markets countries as those countries included in the FTSE Emerging Markets Index. The initial universe of companies is screened based on their average projected free cash flows and earnings (if available) over each of the next two fiscal years. Companies with no forward year estimates available for free cash flows or earnings will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts (“REITs”), companies with a market capitalization of less than $2 billion, and companies whose average daily trading value (“ADTV”) for the prior 90 days does not exceed $5 million are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve-month

8

Pacer Funds

period. The equity securities of the 100 companies with the highest free cash flow yield (the “Top 100 Companies”) are included in the Index, subject to the exceptions described below. At the time of each rebalance of the Index, the companies included in the Index are weighted in proportion to their trailing twelve-month free cash flow, and weightings are capped at 2% of the weight of the Index for any individual company. Additionally, the Index is limited to a maximum of twenty companies from any individual country and any sector. If the Top 100 Companies include more than 20 companies from an individual country or sector (the “Exposure Limit”), the Index will exclude the companies with the lowest free cash flow yield from each country and/or sector needed to meet the Exposure Limit and will include companies outside the Top 100 Companies based on their free cash flow yield until the Index includes 100 companies and satisfies the Exposure Limit. The Index is reconstituted and rebalanced semi-annually as of the close of business on the 3rd Friday of June and December based on data as of the 1st Friday of the applicable rebalance month.

The Fund

The Fund had a NAV total return of 11.79%. The Index had a total return of 14.50%. The MSCI Emerging Markets Value Index had a total return of 11.60%. The FTSE Emerging Market Index had a total return of 10.80%.

During the fiscal year, the top three sectors for contribution to performance were Information Technology 7.54%, Energy at 4.83%, and Industrials at 4.10%. The three sectors with the lowest contribution to performance were Communication Services at -1.07%, Health Care at -0.58%, and Consumer Discretionary at 0.50%. These return numbers reflect the contribution to the total return of the Fund.

During the fiscal year, the top three countries for contribution to performance were Taiwan at 8.70%, Turkey at 4.38%, and Brazil at 2.61%. The three countries with the lowest contribution to performance were South Africa at -1.96%, Indonesia at -1.54%, and Thailand at -0.46%. These return numbers reflect the contribution to the total return of the Fund.

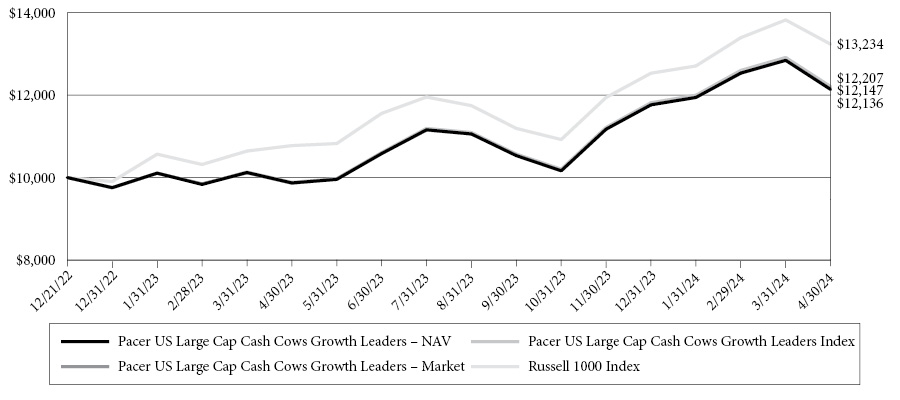

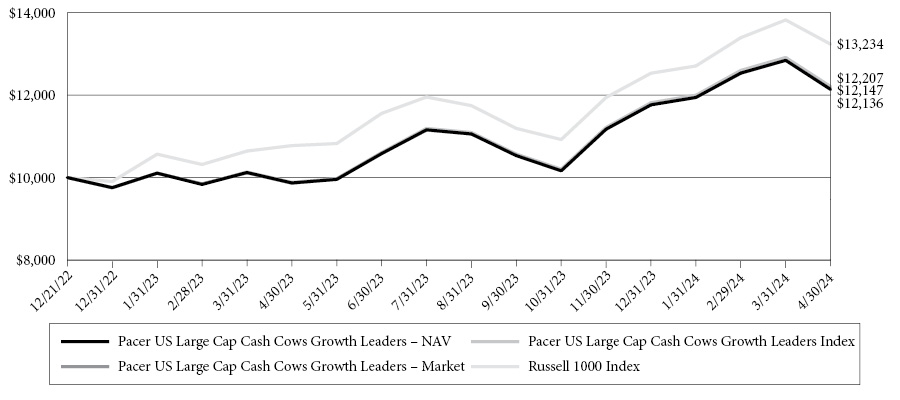

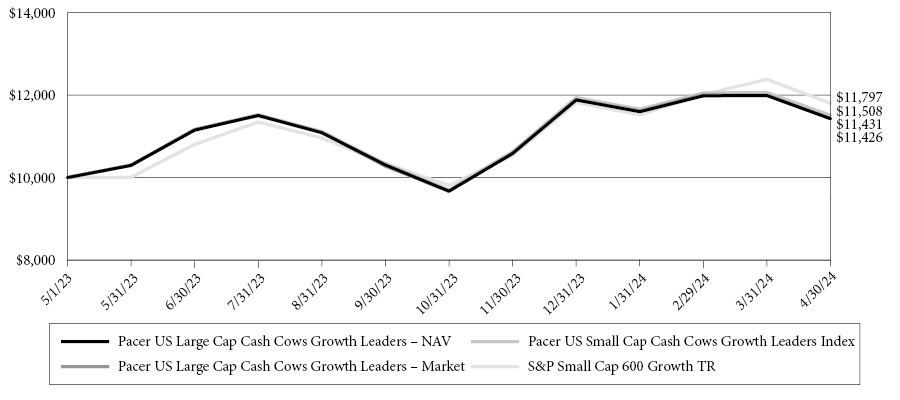

Pacer US Large Cap Cash Cows Growth Leaders ETF

The Pacer US Large Cap Cash Cows Growth Leaders ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the performance, before fees and expenses, of the Pacer US Large Cap Cash Cows Growth Leaders Index (the “Index”).

The Index uses a rules-based methodology that seeks to provide exposure to large capitalization U.S. companies with above average free cash flow margins. Companies with above average free cash flow margins are commonly referred to as “cash cows.” The initial Index universe is typically derived from the component companies of the Russell 1000 Index®. The initial universe of companies is typically screened based on their average projected free cash flows and earnings (if available) over each of the next two fiscal years. Companies for which information on their projected free cash flows or earnings is not available will typically remain in the Index universe. A company’s projected free cash flows and earnings are typically determined by the Index Provider. Companies with negative average projected free cash flows or earnings are typically removed from the Index universe. Additionally, companies in the financial or real estate sectors are typically excluded from the Index universe.

The Fund

The Fund had a NAV total return of 22.96%. The Index had a total return of 23.49%. The Russell 1000 Growth Index had a total return of 31.80%. The Russell 1000 Index had a total return of 22.82%.

During the fiscal year, the top three sectors for contribution to performance were Information Technology 21.92%, Energy at 1.39%, and Industrials at 1.09%. The three sectors with the lowest contribution to performance were Health Care at -1.46%, Consumer Staples at -0.31%, and Utilities at -0.02%. These return numbers reflect the contribution to the total return of the Fund.

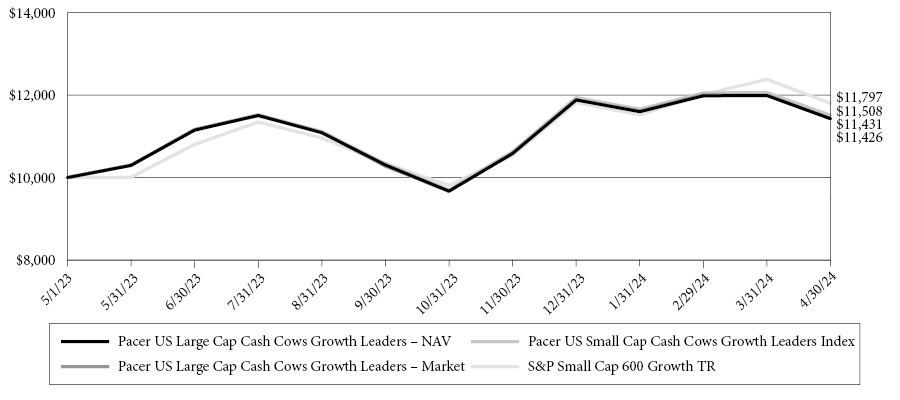

Pacer US Small Cap Cash Cows Growth Leaders ETF

The Pacer US Small Cap Cash Cows Growth Leaders ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the performance, before fees and expenses, of the Pacer US Small Cap Cash Cows Growth Leaders Index (the “Index”).

The Index uses a rules-based methodology that seeks to provide exposure to small-capitalization U.S. companies with above average free cash flow margins. Companies with above average free cash flow margins are commonly referred to as “cash cows.” The Fund considers a company to be a small-capitalization at the time of purchase if it was included in the S&P SmallCap 600® Index (the “S&P SmallCap 600”) at any time within the prior six months. The initial Index universe is derived from the component companies of the S&P SmallCap 600. The initial universe of companies is screened based on their average projected free cash flows and earnings (if available) over each of the next two fiscal years. Companies for which information on their projected free cash flows or earnings is not available will remain in the Index universe. A

9

Pacer Funds

company’s projected free cash flows and earnings are determined by the Index Provider. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, companies in the financial or real estate sectors are excluded from the Index universe.

The Fund

The Fund’s inception occurred during the fiscal year on 5/1/2023. Since inception, it had a NAV total return of 14.26%. The Index had a total return of 15.08%. The S&P SmallCap 600 Index had a total return of 12.55%.

During the fiscal year, the top three sectors for contribution to performance were Information Technology 5.79%, Consumer Discretionary at 5.56%, and Industrials at 5.55%. The three sectors with the lowest contribution to performance were Health Care at -2.57%, Communication Services at -1.04%, and Utilities at 0.01%. These return numbers reflect the contribution to the total return of the Fund.

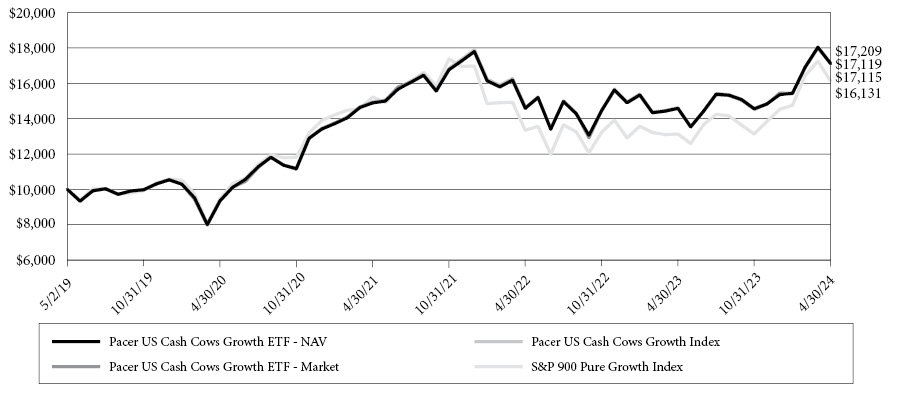

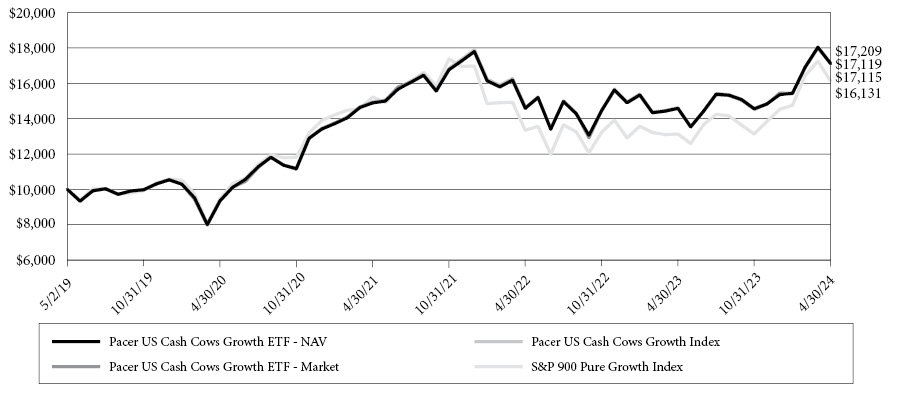

Pacer US Cash Cows Growth ETF

The Pacer US Cash Cows Growth ETF is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer US Cash Cows Growth Index (the “Index”).

The Fund employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index. The Index is based on a proprietary methodology developed and maintained by Index Design Group, an affiliate of Pacer Advisors, Inc., the Fund’s investment adviser (the “Adviser”). The Index uses an objective, rules-based methodology to provide exposure to mid- and large-capitalization U.S. companies with high free cash flow yields. Companies with high free cash flow yields are commonly referred to as “cash cows”. The initial Index universe is derived from the component companies of the S&P 900® Pure Growth Index. The initial universe of companies is screened based on their average projected free cash flows and earnings (if available) over each of the next two fiscal years. Companies for which information on their projected free cash flows or earnings is not available will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts (“REITs”), are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve month period. The equity securities of the 50 companies with the highest free cash flow yield are included in the Index. At the time of each rebalance of the Index, the companies included in the Index are weighted in proportion to their current market capitalization, and weightings are capped at 5% of the weight of the Index for any individual company. Weight above the 5% limitation is redistributed among the other Index constituents in proportion to their weights. The Index is reconstituted and rebalanced quarterly as of the close of business on the 3nd Friday of March, June, September, and December based on data as of the 2nd Friday of the applicable rebalance month.

The Fund

The Fund had a NAV total return of 17.34%. The Index had a total return of 17.31%. The S&P 900 Pure Growth Index had a total return of 22.79%.

During the fiscal year, the top three sectors for contribution to performance were Industrials 4.75%, Information Technology at 4.05%, and Energy at 4.01%. The three sectors with the lowest contribution to performance were Health Care at -2.95%, Consumer Staples at -0.03%, and Utilities at 1.58%. These return numbers reflect the contribution to the total return of the Fund.

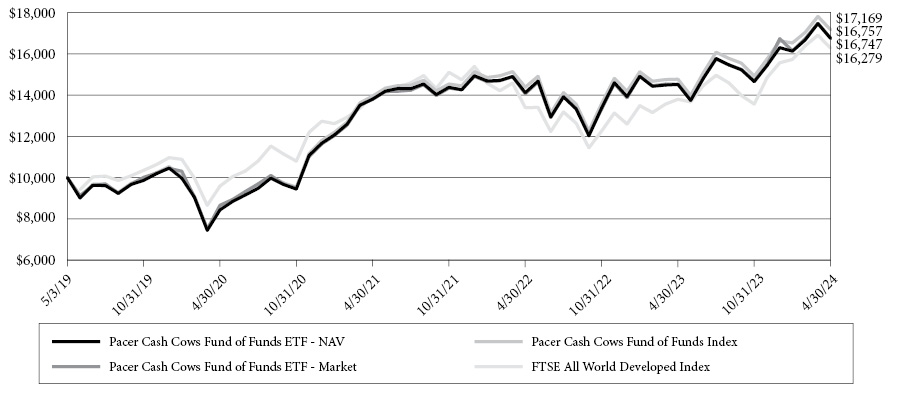

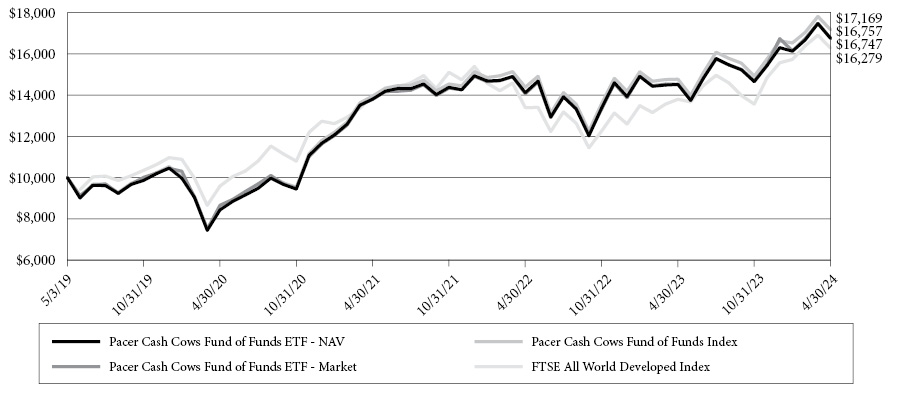

Pacer Cash Cows Fund of Funds ETF

The Pacer Cash Cows Fund of Funds ETF is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer Cash Cows Fund of Funds Index (the “Index” or the “Fund of Funds Index”).

The Fund employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index. The Index is based on a proprietary methodology developed and maintained by Index Design Group, an affiliate of Pacer Advisors, Inc., the Fund’s investment adviser (the “Adviser”). The Fund of Funds Index uses an objective, rules-based approach to construct a portfolio that, as of each quarterly rebalance, is composed of the ETFs listed in the following table, each advised by the Adviser (collectively, the “Cash Cows ETFs”). Each of the Cash Cows ETFs is an index-based ETF that seeks to track the total return performance,

10

Pacer Funds

before fees and expenses, of the applicable underlying index listed in the following table (collectively, the “Cash Cows Indexes”). Each Cash Cows Index uses an objective, rules-based methodology to provide exposure to companies with high free cash flow yields (commonly referred to as “cash cows”) selected from the applicable “Equity Universe” as indicated in the following table.

Weight | Cash Cows ETF | Cash Cows Index | Equity Universe |

20% | Pacer US Cash Cows 100 ETF | Pacer US Cash Cows 100 Index | Russell 1000 Index |

20% | Pacer Global Cash Cows Dividend ETF | Pacer Global Cash Cows Dividend Index | FTSE Developed Large Cap Index |

20% | Pacer US Small Cap Cash Cows 100 ETF | Pacer US Small Cap Cash Cows Index | S&P Small Cap 600® Index |

20% | Pacer US Cash Cows Growth ETF | Pacer US Cash Cows Growth Index | S&P 900® Pure Growth Index |

20% | Pacer Developed Markets International Cash Cows 100 ETF | Pacer Developed Markets International Cash Cows 100 Index | FTSE Developed ex US Index |

The Fund

The Fund had a NAV total return of 15.38%. The Index had a total return of 16.25%. The FTSE All-World Developed Index had a total return of 17.95%.

The Fund’s top contributor to its return was Pacer US Small Cap Cash Cows ETF at 5.41%. The Fund’s bottom contributor to its return was Pacer Global Cash Cows Dividend ETF at 1.07%. These return numbers reflect the contribution to the total return of the Fund.

The Pacer Custom ETF Series

The Pacer Custom ETFs are strategy-driven, rules-based and are each designed to offer a specific investment focus. The period referenced in this section for all custom funds is for the fiscal year end of April 30, 2024.

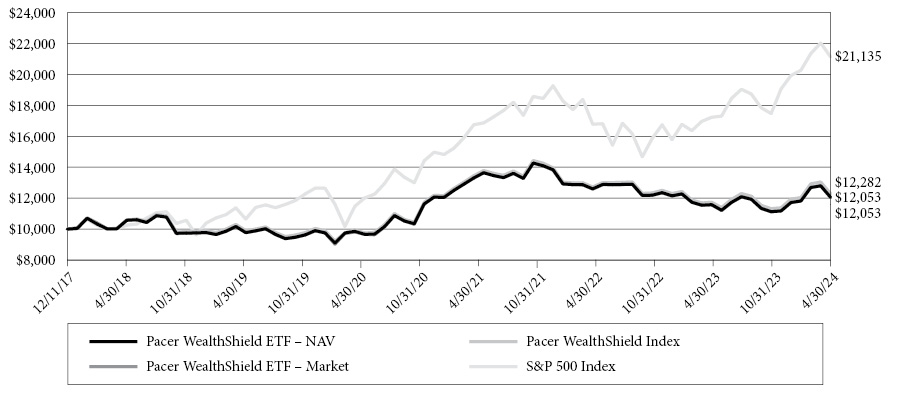

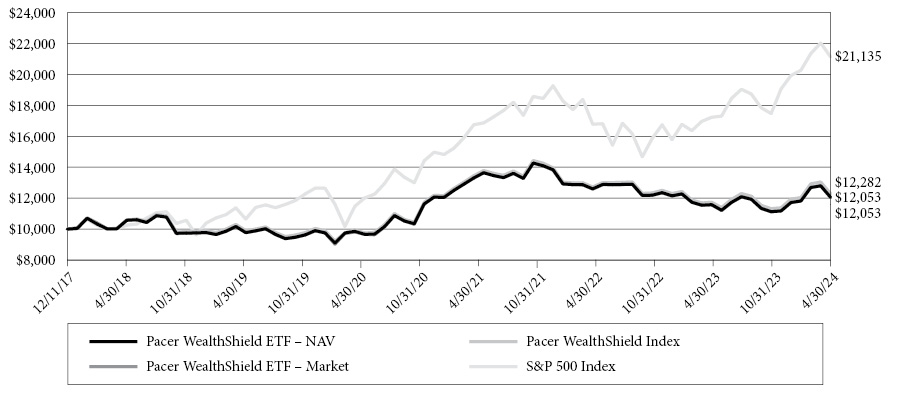

Pacer WealthShield ETF

The Pacer WealthShield ETF (the “Fund”) seeks to track the total performance, before fees and expenses, of the Pacer WealthShield Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a trend-following strategy that directs some or all of the Index’s exposure to (i) U.S. equity securities or (ii) U.S. Treasury securities depending on the strength of the high yield corporate (“junk”) bond market relative to U.S. Treasury bonds and the momentum of certain U.S. equity sectors or industries and of long-term U.S. Treasury bonds.

The Fund

The Fund had a NAV total return of 4.06%. The Index had a total return of 4.65%. The S&P 500 Index had a total return of 22.66%.

The fund was “risk on” for the entire fiscal year 2024.

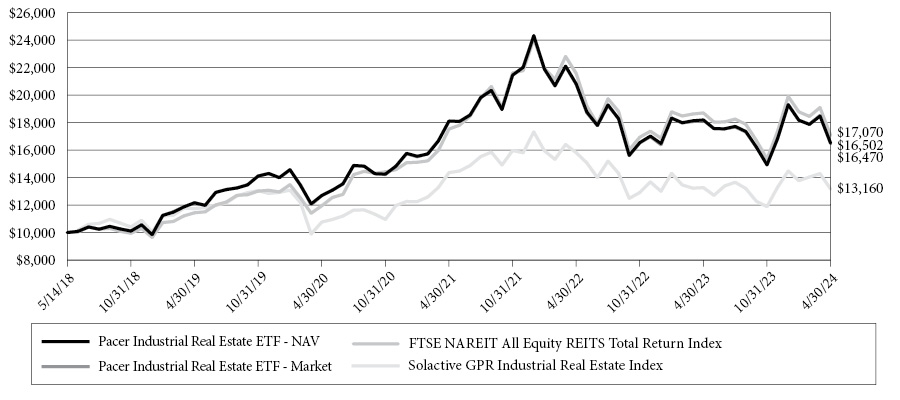

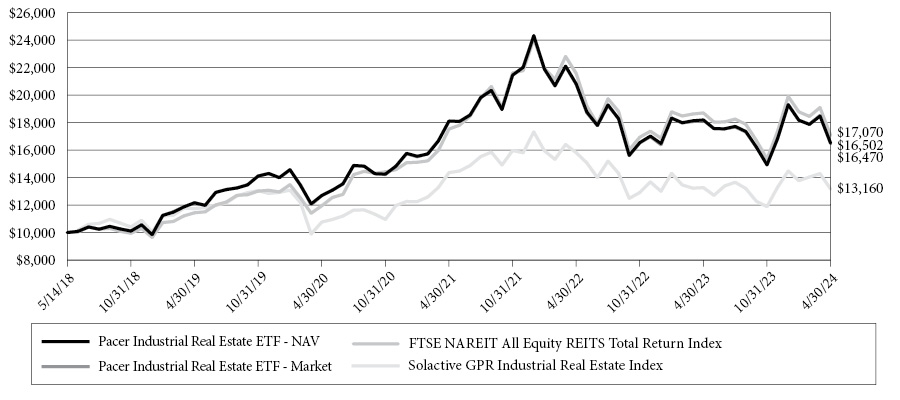

Pacer Industrial Real Estate ETF

The Pacer Industrial Real Estate ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Solactive GPR Industrial Real Estate Index (the “Index”).

The Index is generally composed of the equity securities of developed markets companies that derive at least 85% of their earnings or revenues from real estate operations in the industrial real estate sector (“Industrial Companies”), including companies that derive at least 85% of their earnings or revenues from self-storage real estate operations (“Self-Storage Companies”). At the time of each reconstitution of the Index, Industrial Companies with a market capitalization of more than $200 million and average daily traded volume of at least 10,000 shares that are part of the GPR 250 Index are included in the Index (the “Index Constituents”). A significant portion of the Index is expected to be composed of real estate investment trusts (“REITs”). The real estate companies included in the Index may utilize leverage, and some may be highly leveraged. Additionally, such companies may include significant business operations outside of the United States.

The Fund

The Fund had a NAV total return of -9.31%. The Solactive GPR Industrial Real Estate Index had a total return of -8.72%.

11

Pacer Funds

The Fund’s top three contributors to its return were SEGRO plc at 4.67% total return and a contribution of 0.37%, AB Sagax Class B at 4.85% total return and a contribution of 0.35%, and STAG Industrial at 5.77% total return and a contribution of 0.28%. The Fund’s bottom three contributors to its return were Prologis, Inc. at -16.21% total return and a contribution of -2.41%, Public storage at -8.17% total return and a contribution of -1.46%, and Rexford Industries Reality at -20.90% total return and a contribution of -0.98%.

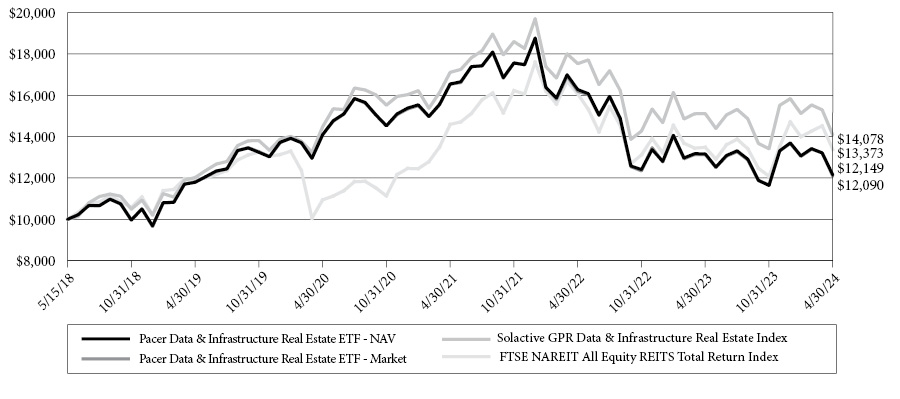

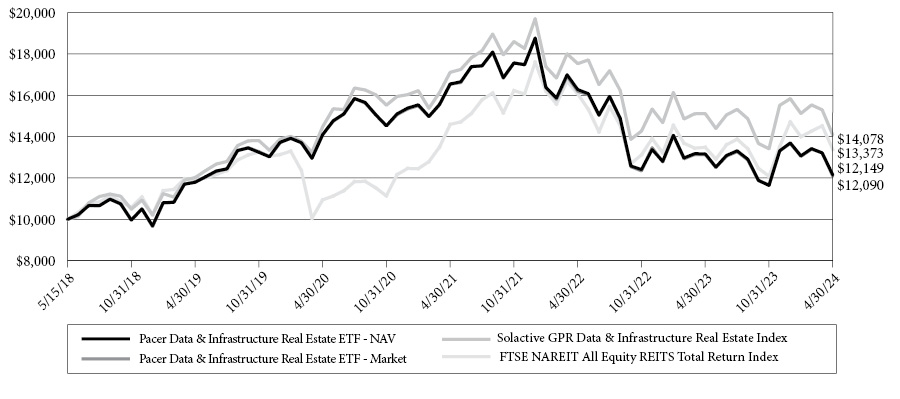

Pacer Data & Infrastructure Real Estate ETF

The Pacer Data & Infrastructure Real Estate ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Solactive GPR Data & Infrastructure Real Estate Index (the “Index”).

The Index is generally composed of equity securities of developed markets companies that derive at least 85% of their earnings or revenues from real estate operations in the data and infrastructure real estate sectors (“Eligible Companies”). At the time of each reconstitution of the Index, Eligible Companies with a market capitalization of more than $500 million and average daily traded volume of at least 10,000 shares that are part of the GPR 250 Index and the GPR Pure Infrastructure Index are included in the Index (the “Index Constituents”). A significant portion of the Index is expected to be composed of real estate investment trusts (“REITs”). The real estate companies included in the Index may utilize leverage, and some may be highly leveraged. Additionally, such companies may include significant business operations outside of the United States.

The Fund

The Fund had a NAV total return of -7.74%. The Solactive GPR Data & Infrastructure Real Estate Index had a total return of -6.85%.

The Fund’s top three contributors to its return Uniti Group Inc at 88.43% total return and a contribution of 2.25%, Digital Reality Trust at 45.48% total return and a contribution of 2.12%, and Iron Mountain at 45.87% total return with a contribution of 1.70%. The Fund’s bottom three contributors to its return were Crown Castle at -19.30% total return and a contribution of -3.10%, American Tower Corporation at -13.07% total return and a contribution of -2.15, and Eutelsat Communications SA at -39.14% total return and a contribution of -1.37%.

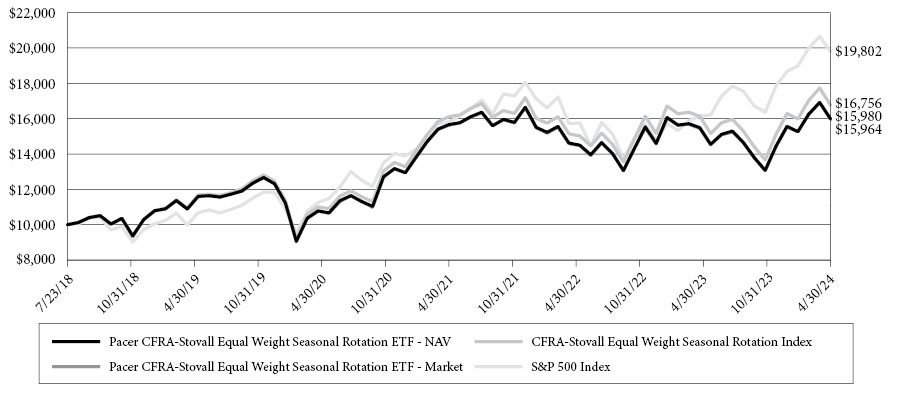

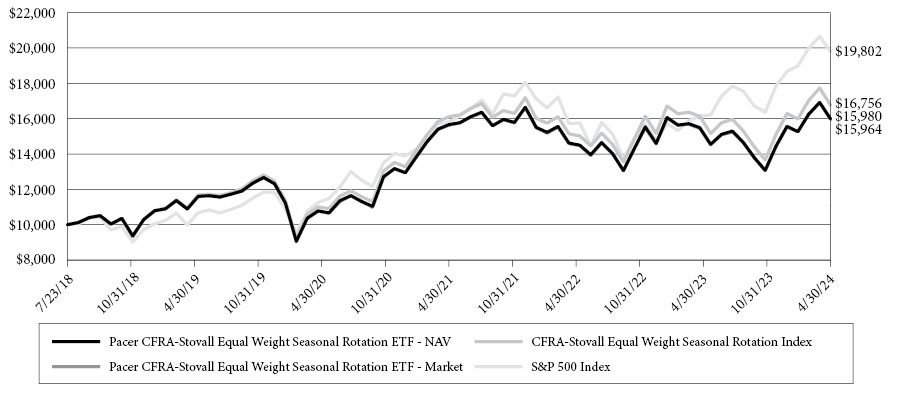

Pacer CFRA-Stovall Equal Weight Seasonal Rotation ETF

The Pacer CFRA-Stovall Equal Weight Seasonal Rotation ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer CFRA-Stovall Equal Weight Seasonal Rotation Index (the “Index”).

The Index uses an objective, rules-based methodology to track the performance of a semi-annual rotation of certain sectors within the S&P 500 Equal Weight Index (“EWI”). The S&P 500 EWI is an equal-weighted version of the S&P 500®, which measures the performance of the large-cap segment of the U.S. equity market. The S&P 500 EWI includes stocks covering all 11 Global Industry Classification Standard (“GICS®”) sectors, six of which are eligible for inclusion in the Index.

The Fund

The Fund had a NAV total return of 3.13%. The Index had a total return of 3.83%. The S&P 500 Index had a total return of 22.66%.

Between 5/1/2024 and 4/30/2024, the fund’s returns were influenced by Information Technology which contributed 6.29%, Industrials which contributed 6.22%, and Consumer Discretionary which contributed 5.61%.

Conversely, the bottom three contributors to the Fund’s return were Real Estate which did not contribute to the performance of the fund, Health Care which contributed -8.97%, and Consumer Staples which contributed -10.04% to the fund’s performance.

These return numbers reflect the contribution to the total return of the Fund.

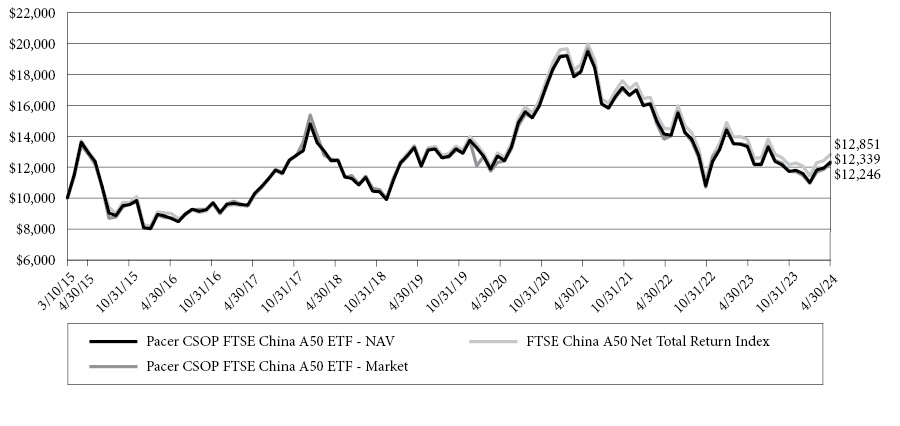

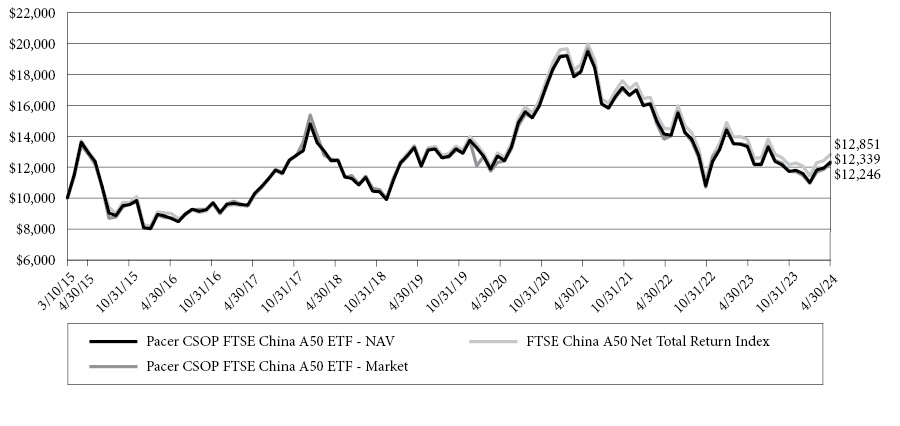

Pacer CSOP FTSE China A50 ETF

The Pacer CSOP FTSE China A50 ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to provide investment results that, before fees and expenses, track the performance for the FTSE China A50 Net Total Return Index (the “Index.”)

The Fund employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index. The Index is comprised of A-Shares issued by the 50 largest companies in the China A-Shares market. The Index is a net total return index, which means that the performance of the Index assumes that dividends paid by the Index constituents, net of any withholding taxes, are reinvested in additional shares of such Index constituents. The Index is a free float-adjusted market capitalization-weighted index compiled and published by FTSE International Limited (“FTSE” or the “Index Provider”), which is not affiliated with the Fund, Pacer Advisors, Inc. (the “Adviser”), CSOP Asset Management Limited (the “Sub-Adviser”), or the Fund’s distributor. The Index is

12

Pacer Funds

a real-time, tradable index comprising the largest 50 China A-Share companies by full market capitalization of the FTSE China AAll Cap Free Index. The Index is a subset of the FTSE China AAll Cap Free Index, FTSE’s most comprehensive benchmark for the Chinese A-Share market. It is denominated and quoted in Chinese Yuan (“CNY”) and comprised of stocks listed on the Shanghai Stock and Shenzhen Stock Exchange main markets, the Shenzhen SME Board and/or the Shenzhen ChiNext Board. The Index Provider determines the composition of the Index and relative weightings of the Index constituents based on the Index’s methodology and publishes information regarding the market value of the Index.

The Fund

The Fund had a NAV total return of -7.50%. The FTSE China A50 Index had a total return of -6.95%.

During the fiscal year, the top three sectors for contribution to performance were Energy, which contributed 1.15%, Utilities which contributed 0.72%, and Material which contributed 0.66% to the performance of the fund.

Conversely, the bottom three contributors to the Fund’s return were Consumer staples which contributed -3.47%, Industrial which contributed -2.09%, and Consumer Discretionary which contributed -1.43% to the performance of the fund.

These return numbers reflect the contribution to the total return of the Fund.

The Pacer Factor ETF Series

The Pacer Factor ETFs invest in equities based on certain shared characteristics (factors) and seeks to outperform the market over time. Three of these funds, the Pacer Lunt funds, have the ability to rotate their factor exposures on a monthly basis based on certain signals in an effort to realize greater returns than the overall market. The period referenced in this section for all factor funds is for the fiscal year end of April 30, 2024.

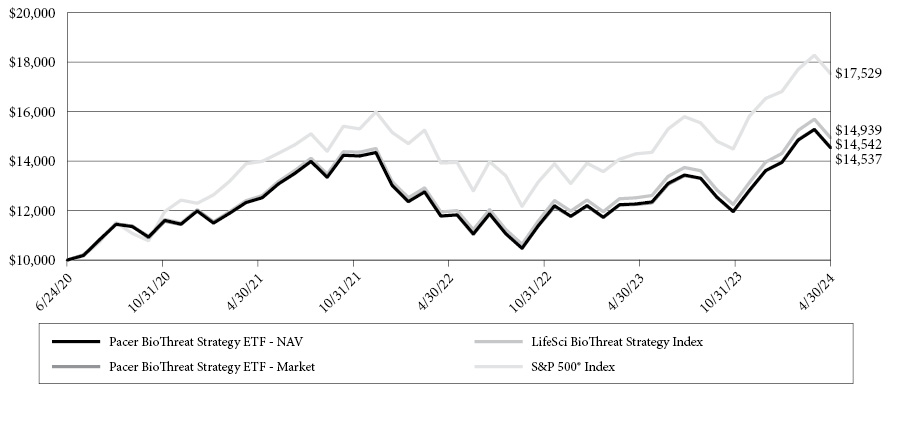

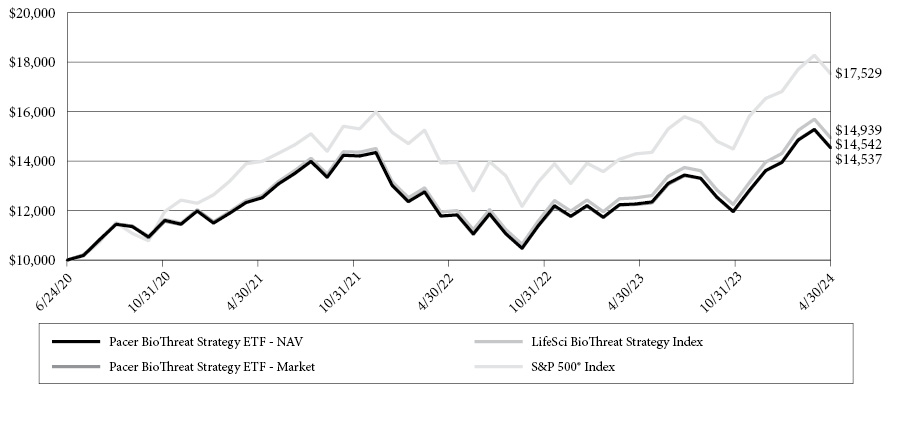

Pacer BioThreat Strategy ETF

The Pacer BioThreat Strategy ETF employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index.

The Index is based on a proprietary methodology developed by LifeSci Index Partners, LLC, the Fund’s Index Provider (the “Index Provider”), which is not affiliated with the Fund, its distributor, or Pacer Advisors, Inc., the Fund’s investment adviser (the “Adviser”). The Index is generally composed of U.S.-listed stocks of companies whose products or services help protect against, endure, or recover from biological threats to human health. Companies helping to protect against such threats include those that conduct research to identify or anticipate such threats and those developing or producing the tools necessary to detect them. Companies helping to endure biological threats include those offering goods or services to help individuals, organizations, businesses, and governments adapt to requirements for social distancing or remote connectivity. Such companies may reflect a variety of industries, ranging from the provision of consumer staples that may be stockpiled in an emergency to critical healthcare supplies to basic energy resources. Companies helping to recover from a biological threat include those that support the treatment of diseases or responses to chemical or biological attacks. The Index selects companies based on a proprietary, multi-step research process. First, the Index Provider conducts fundamental research to identify the most important current and emerging biological threats to human health. Such threats may include pandemic diseases, biological warfare, food and water safety, environmental safety, and natural disasters. Next, the Index Provider utilizes publicly available information such as financial reports and screens, corporate websites, news reports, and interviews with key opinion leaders to identify publicly traded companies which protect against and prepare for recovering from these threats. These companies have products, technologies, and services that seek to: ● research or combat pandemic diseases such as the novel coronavirus (COVID-19), Zika, H1N1, Ebola, avian flu, and MERS; ● combat agents of biological or chemical warfare such as anthrax, sarin gas, variola virus, and brucellosis; ● detect the presence of biological or chemical threats; ● enable social distancing and increased productivity for working and shopping at home; ● secure national borders and ports and strengthen homeland security; ● aid in stockpiling of products in times of natural disasters and disease outbreaks, such as canned foods, power sources, consumer first aid kits, anti-microbial agents, gas masks, and sterilization supplies and services; and ● test and improve food and water safety and purity. Finally, the Index Provider only includes those companies with a minimum market capitalization of $1 billion and a minimum average daily value traded for the last six months of at least $2 million. Index components are weighted based on their market capitalization, subject to a maximum weight of 4.9% at the time of rebalance. The Index is reconstituted (i.e., components are added or removed and weights are reset based on the Index methodology) on the third Friday of each January and rebalanced (i.e., weights are reset based on the Index methodology, but no components are added or removed) semi-annually as of the close of business on the third Friday of each January and July. The weights are fixed as of closing prices on the second Friday in each January and July. As of April 30, 2024, the Index was made up of 50 companies and included significant allocations to companies in the health care and industrial sectors.

13

Pacer Funds

The Fund

The Fund had a NAV total return of 18.52%. The Index had a total return of 19.38%. The S&P 500 Index had a total return of 22.66%.

During the fiscal year (5/1/2024 – 4/30/2024) the top three sectors for contribution to performance were Information Technology, which contributed 11.09%, Consumer Discretionary which contributed 4.58%, and Communication Services which contributed 3.35% to the total return of the funds performance.

Conversely, the bottom three contributors to the Fund’s return were Health Care, which contributed -1.15%, Consumer Staples which contributed 0.25%, and Material which contributed 0.70% to the total return of the fund’s performance.

These return numbers reflect the contribution to the total return of the Fund.

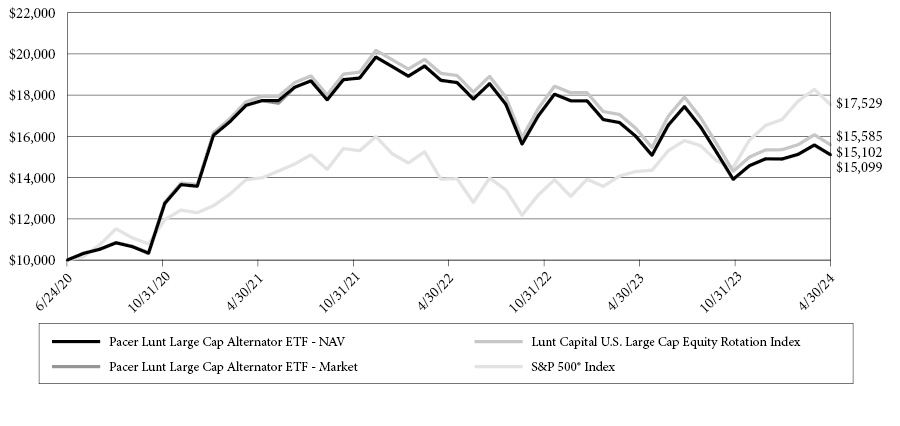

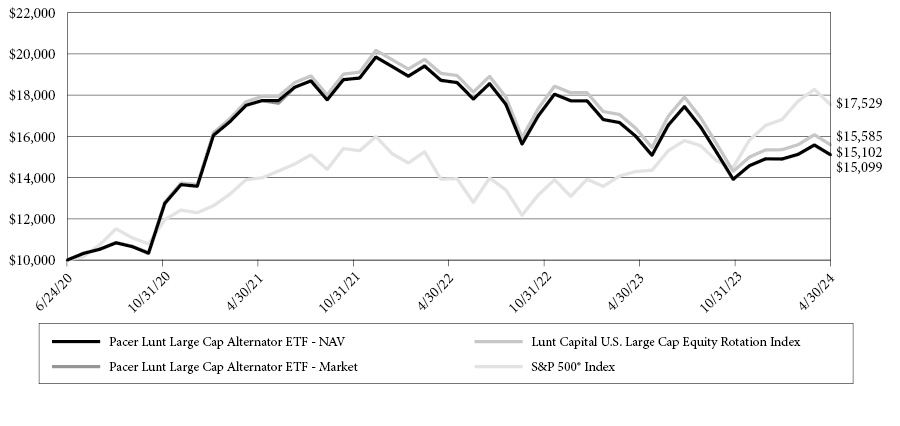

Pacer Lunt Large Cap Alternator ETF

The Pacer Lunt Large Cap Alternator ETF employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index.

The Index is based on a proprietary methodology developed by Lunt Capital Management, Inc. (“Lunt Capital” or the “Index Provider”). The Index uses an objective, rules-based methodology to provide exposure to large-capitalization U.S. companies. The Index uses Lunt Capital’s proprietary relative strength methodology to rotate between the holdings of one of two sub-indices, the S&P 500 Low Volatility Index and the S&P 500 High Beta Index (each, a “Sub-Index,” and together, the “Sub-Indices”), that seek to identify the 100 components of the S&P 500 Index that most strongly exhibit a particular trait (e.g., low volatility or high beta). Each Sub-Index is composed of the 100 securities comprising the S&P 500 Index that most strongly exhibit the characteristic screened for by the Sub-Index. The S&P 500 is a free-float weighted index that measures the performance of the large-cap segment of the U.S. equity market. The S&P500 includes approximately 500 leading companies and captures approximately 80% of the U.S. market capitalization. Accordingly, each Sub-Index is composed of large-capitalization equity 4 securities. S&P Opco LLC (a subsidiary of S&P Dow Jones Indices, LLC) compiles, maintains, and calculates the S&P 500 Index and the Sub-Indices. The S&P 500 Low Volatility Index is composed of the 100 securities comprising the S&P 500 Index that have exhibited the lowest realized volatility over the prior 12 months. Each stock comprising the S&P 500 Low Volatility Index is weighted by the inverse of its volatility with the least volatile stocks receiving the highest weights. Volatility is a statistical measurement of the magnitude of price fluctuations in a stock’s price over time. The S&P 500 High Beta Index is composed of the 100 securities comprising the S&P 500 Index that have exhibited the highest sensitivity to market movements, or “beta,” over the prior 12 months. The weight of each stock in the S&P 500 High Beta Index is proportionate to its beta, rather than to its market capitalization. Beta is a measure of relative risk and is the rate of change of a security’s price. The Index utilizes Lunt Capital’s proprietary relative strength analysis in its attempt to determine which Sub-Index is likely to exhibit better price performance than the other Sub-Index. Pursuant to this methodology, the Index Provider calculates the “Risk Adjusted Score” for each Sub-Index. Each Sub-Index’s “Risk-Adjusted Score” is calculated using the Sub-Index’s standard deviation of returns over the prior 12 months. On the final trading day of each month, the Index Provider computes the relative strength of each Sub-Index by comparing each Sub-Index’s Risk-Adjusted Score. The Index Provider considers the Sub-Index with the higher Risk-Adjusted Score to have the higher relative strength. The Index is composed of the securities comprising the Sub-Index demonstrating the greater relative strength. The Index is reconstituted and rebalanced monthly, except when the Index methodology would not result in a change in the Sub-Index comprising the Index at such time.

The Fund

The Fund had a NAV total return of -5.65%. The Index had a total return of -4.91%. The S&P 500 Index had a total return of 22.66%.

During the fiscal year, the top three sectors for contribution to performance were Consumer Staples which contributed 1.52%, Industrials which contributed 1.07%, and Energy which contributed 0.53% to the fund’s total performance.

Conversely, the bottom three contributors to the Fund’s return were Consumer Discretionary which contributed -2.17%, Health Care which contributed -0.96%, and Financial which contributed -0.73% to the fund’s total performance.

These return numbers reflect the contribution to the total return of the fund.

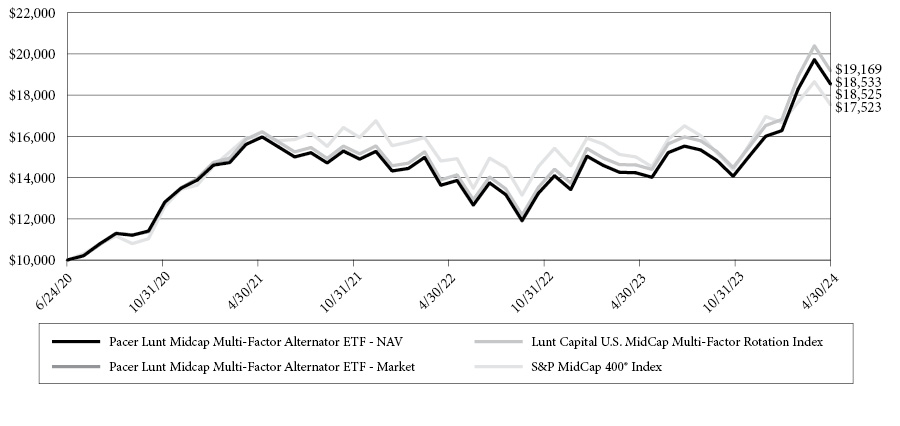

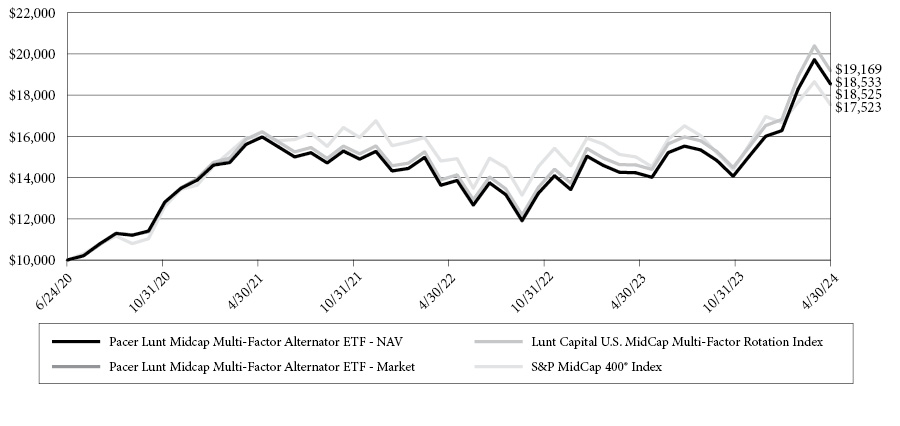

Pacer Lunt Midcap Multi-Factor Alternator ETF

The Pacer Lunt Midcap Multi-Factor Alternator ETF employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index.

14

Pacer Funds

The Index is based on a proprietary methodology developed by Lunt Capital Management, Inc. (“Lunt Capital” or the “Index Provider”). The Index uses an objective, rules-based methodology to provide exposure to mid-capitalization U.S. companies. The Index uses Lunt Capital’s proprietary relative strength methodology to rotate between the holdings of the highest and lowest quintile components of four factor-based indices of the S&P MidCap 400 Index (each, a “Sub-Index,” and together, the “Sub-Indices”), that seek to identify the components of the S&P MidCap 400 Index that most strongly exhibit a particular factor. The four factor groups are Momentum, Quality, Value, and Volatility. 9 The Index will include holdings for two of the following eight Sub-Indices: Momentum Quality Value Volatility Highest Quintile S&P MidCap 400 Momentum Index S&P MidCap 400 Quality Index S&P MidCap 400 Enhanced Value Index S&P MidCap 400 Volatility - Highest Quintile Index Lowest Quintile S&P MidCap 400 Momentum - Lowest Quintile Index S&P MidCap 400 Quality - Lowest Quintile Index S&P MidCap 400 Enhanced Value - Lowest Quintile Index S&P MidCap 400 Low Volatility Index Each Sub-Index is composed of the 80 securities (a quintile) comprising the S&P MidCap 400 Index that most strongly exhibit the characteristic screened for by the Sub-Index. The S&P MidCap 400 Index is a market-weighted index and measures the performance of mid-capitalization stocks in the United States. S&P Opco LLC (a subsidiary of S&P Dow Jones Indices, LLC) compiles, maintains, and calculates the S&P MidCap 400 Index and the Sub-Indices. The Index utilizes Lunt Capital’s proprietary relative strength analysis in its attempt to determine which two Sub-Indices are likely to exhibit better price performance than the other Sub-Indices. Pursuant to this methodology, the Index Provider calculates the “Risk Adjusted Score” for each Sub-Index. On the final trading day of each month, the Index Provider computes the relative strength of each Sub-Index by comparing each Sub-Index’s Risk-Adjusted Score. The Index Provider considers a higher Risk-Adjusted Score to indicate greater relative strength. The Index is composed of the securities comprising the two Sub-Indices demonstrating the greatest relative strength unless such Sub-Indices include both the highest and lowest quintile from the same factor group, in which case only the Sub-Indices with the highest and third-highest Risk-Adjusted Score would be selected. The Index is reconstituted and rebalanced monthly, except when the Index methodology would not result in a change in the Sub-Indices comprising the Index at such time.

The Fund

The Fund had a NAV total return of 30.16%. The Index had a total return of 31.19%. The S&P MidCap 400 Index had a total return of 16.82%.

During the fiscal year, the top three sectors for contribution to performance were Information Technology which contributed 8.81%, Industrials which contributed 7.63%, and Consumer Discretionary which contributed 6.97% to the total performance of the fund.

Conversely, the bottom three contributors to the Fund’s return were Health Care which contributed -0.38%, Communication Service which contributed -0.17%, and Utilities which contributed 0.04% to the total returns of the fund’s performance.

These return numbers reflect the contribution to the total return of the fund.

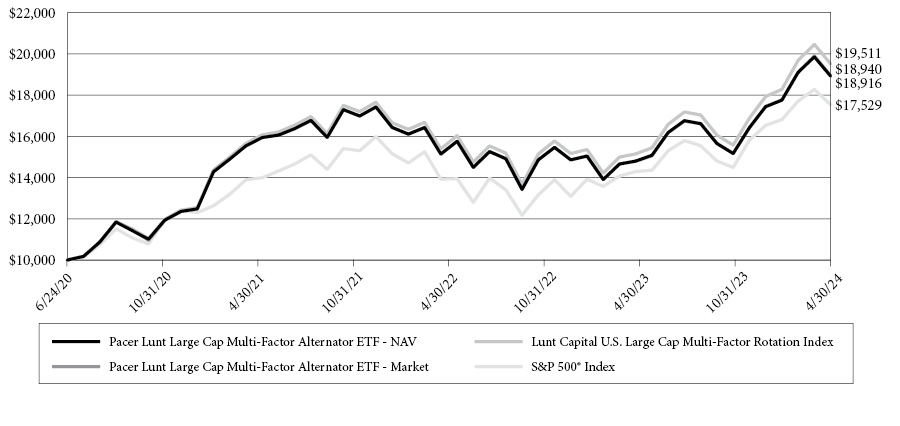

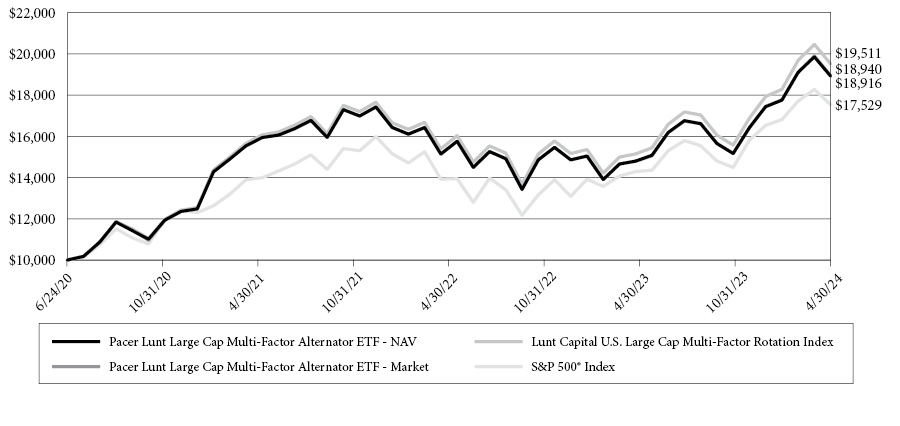

Pacer Lunt Large Cap Multi-Factor Alternator ETF

The Pacer Lunt Large Cap Multi-Factor Alternator ETF employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index. The Index is based on a proprietary methodology developed by Lunt Capital Management, Inc. (“Lunt Capital” or the “Index Provider”). The Index uses an objective, rules-based methodology to provide exposure to large-capitalization U.S. companies. The Index uses Lunt Capital’s proprietary relative strength methodology to rotate between the holdings of the highest and lowest quintile components of four factor-based indices of the S&P 500 Index (each, a “Sub-Index,” and together, the “Sub-Indices”), that seek to identify the components of the S&P 500 Index that most strongly exhibit a particular factor. The four factor groups are Momentum, Quality, Value, and Volatility. 14 The Index will include holdings for two of the following eight Sub-Indices: Momentum Quality Value Volatility Highest Quintile S&P 500 Momentum Index S&P 500 Quality Index S&P 500 Enhanced Value Index S&P 500 Volatility - Highest Quintile Index Lowest Quintile S&P 500 Momentum - Lowest Quintile Index S&P 500 Quality - Lowest Quintile Index S&P 500 Enhanced Value - Lowest Quintile Index S&P 500 Low Volatility Index Each Sub-Index is composed of the 100 securities (a quintile) comprising the S&P 500 Index that most strongly exhibit the characteristic screened for by the Sub-Index. The S&P 500 is a free-float weighted index that measures the performance of the large-cap segment of the U.S. equity market. The S&P 500 includes approximately 500 leading companies and captures approximately 80% of the U.S. market capitalization. S&P Opco LLC (a subsidiary of S&P Dow Jones Indices, LLC) compiles, maintains, and calculates the S&P 500 Index and the Sub-Indices. The Index utilizes Lunt Capital’s proprietary relative strength analysis in its attempt to determine which two Sub-Indices are likely to exhibit better price performance than the other Sub-Indices. Pursuant to this methodology, the Index Provider calculates the “Risk Adjusted Score” for each Sub-Index. On the final trading day of each month, the Index Provider computes the relative strength of each Sub-Index by comparing each Sub-Index’s Risk-Adjusted Score. The Index Provider considers a higher Risk-Adjusted Score to indicate greater relative strength. The Index is composed of the securities comprising the two Sub-Indices demonstrating the greatest relative strength unless such Sub-Indices include both the highest and lowest quintile from the same factor group, in which case only the Sub-Indices with the highest and third-highest Risk-Adjusted Score

15

Pacer Funds

would be selected. The Index is reconstituted and rebalanced monthly, except when the Index methodology would not result in a change in the Sub-Indices comprising the Index at such time. The Fund’s Investment Strategy Under normal circumstances, at least 80% of the Fund’s total assets (exclusive of collateral held from securities lending) will be invested in the component securities of the Fund’s underlying Index or in one or more ETFs that track the performance of all or a portion of such component securities in the same approximate proportion as in the Fund’s underlying Index. The Fund’s investment adviser expects that, over time, the correlation between the Fund’s performance and that of the Index, before fees and expenses, will be 95% or better. The Fund will generally use a “replication” strategy to achieve its investment objective, meaning it will invest in all of the component securities of the Index. The Fund is considered to be non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund.

The Fund

The Fund had a NAV total return of 27.83%. The Index had a total return of 28.83%. The S&P 500 Index had a total return of 22.66%

During the fiscal year, the top three sectors for contribution to performance were Consumer Staples which contributed 1.52%, Industrials which contributed 1.07%, and Energy which contributed 0.53% to the total return performance of the fund.

Conversely, the bottom three contributors to the Fund’s return were Consumer Discretionary which contributed -2.17%, Health Care which contributed -0.96%, and Financial which contributed -0.73% to the total return performance of the fund.

These return numbers reflect the contribution to the total return of the fund.

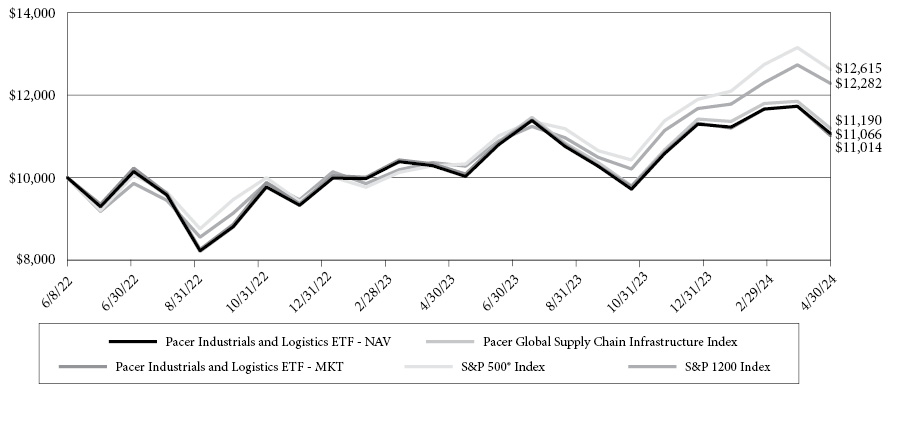

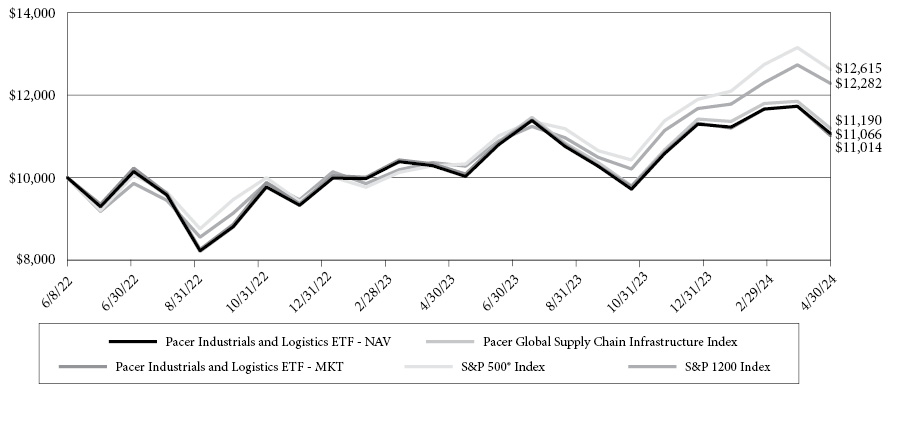

The Pacer Leaders ETF Series

The Pacer Leaders ETFs are strategy-driven, rules-based and are each designed to offer exposure to leaders in specific themes. The period referenced in this section for all custom funds is for the fiscal year end of April 30, 2024.

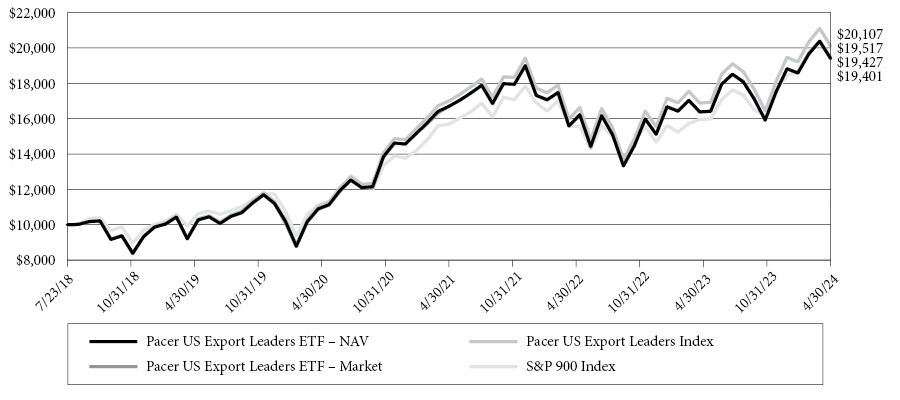

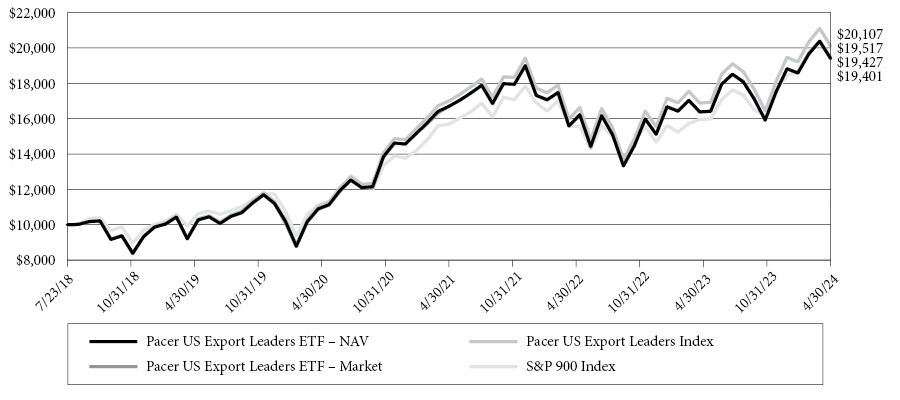

Pacer US Export Leaders ETF

The Pacer US Export Leaders ETF (the “Fund”) is an exchange traded fund that seeks to track the total return performance, before fees and expenses, of the Pacer US Export Leaders Index (the “Index”).

The Index uses an objective, rules-based methodology to measure the performance of an equal weight portfolio of approximately 100 large- and mid-capitalization U.S. companies with a high percentage of foreign sales and high free cash flow growth. Free cash flow is a company’s cash flow from operations minus its capital expenditures. Construction of the Index begins with an initial universe of the 200 companies across the S&P 900® Index (which is comprised of the S&P 500® Index (“S&P 500”) and S&P MidCap 400® Index (“S&P MidCap 400”)) that have the highest annual foreign sales as a percentage of total sales. The 200 companies are then narrowed to the 100 companies with the highest change in free cash flow growth over the past five years, and those 100 companies are equally weighted to create the Index. The Index is reconstituted and rebalanced to equal-weight quarterly. From time to time, the Index may include more or less than 100 companies as a result of events such as acquisitions, spin-offs and other corporate actions. The S&P 500 consists of approximately 500 leading U.S.-listed companies representing approximately 80% of the U.S. equity market capitalization. The S&P MidCap 400 measures the performance of mid-capitalization stocks in the United States.

The Fund

The Fund had a NAV total return of 18.40%. The Index had a total return of 19.11%. The S&P 900 Index had a total return of 22.32%.

During the fiscal year, the top three sectors for contribution to performance were Information Technology which contributed 13.17%, Industrial which contributed 4.51%, and Communication Services which contributed 1.10% to the total return of the fun’s performance.

Conversely, the bottom three contributors to the Fund’s return were Health Care which contributed -1.33%, Consumer Staples which contributed -0.45%, and Real Estate which contributed 0.07% to the fund’s total return performance.

These return numbers reflect the contribution to the total return of the fund.

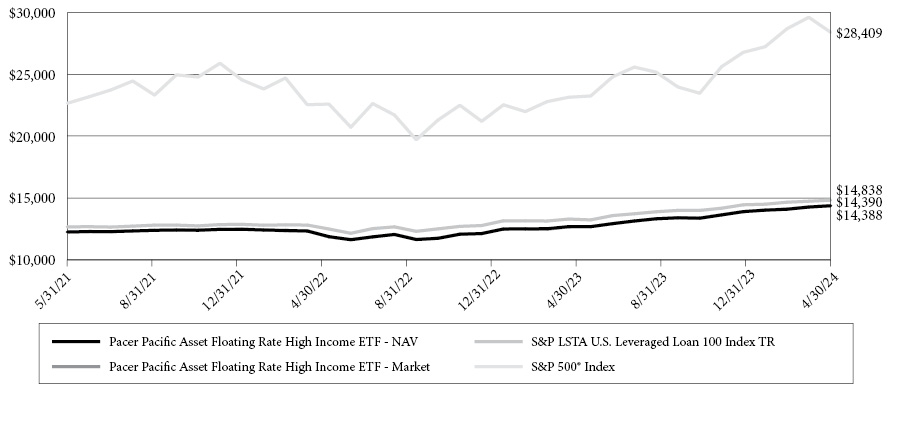

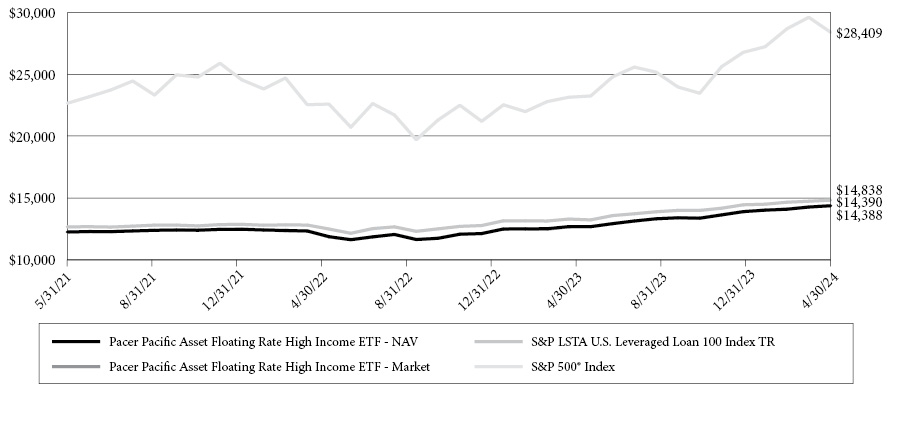

Pacer Pacific Asset Floating Rate High Income ETF

Aristotle Pacific Capital, LLC (the “Sub-Adviser”) seeks to achieve the Fund’s investment objective by selecting a focused portfolio comprised primarily of income-producing adjustable rate securities. Under normal circumstances, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in senior secured floating rate loans and other adjustable rate securities. Other adjustable rate securities will typically include collateralized loan obligations (“CLOs”), asset-backed securities (“ABS”), and commercial mortgage

16

Pacer Funds

backed securities (“CMBS”) (collectively, “Adjustable Rate Securities”). The Fund is expected to invest primarily in loans and Adjustable Rate Securities that are rated below investment grade (i.e., high yield securities, sometimes called “junk bonds” or non-investment grade securities) or, if unrated, of comparable quality as determined by the Sub-Adviser. The Fund may invest in U.S.-dollar denominated senior floating rate loans and Adjustable Rate Securities of domestic and foreign issuers. Senior floating rate loans are debt instruments that may have a right to payment that is senior to most other debts of borrowers. Borrowers may include corporations, partnerships and other entities that operate in a variety of industries and geographic regions, which may from time to time prepay their loan obligations in response, for example, to changes in interest rates. Senior loans in which the Fund may invest include secured and unsecured loans. Generally, secured floating rate loans are secured by specific assets of the borrower. An adjustable rate security includes any fixed income security that requires periodic changes in its interest rate based upon changes in a recognized index interest rate or another method of determining prevailing interest rates. The Fund invests in various types of ABS, such as auto loan and student loan ABS. The Fund is actively managed. The Fund may invest up to 20% of its assets in certain other types of debt instruments or securities, including corporate bonds (including floating rate investment grade bonds) and secured or unsecured second lien floating rate loans. Second lien loans generally are second in line behind senior loans in terms of prepayment priority with respect to pledged collateral and therefore have a lower credit quality as compared to senior loans but may produce a higher yield to compensate for the additional risk. The secondary market on which high yield securities are traded may be less liquid than the market for investment-grade securities. Less liquidity in the secondary trading market could adversely affect the ability of the Fund to sell a high yield security or the price at which the Fund could sell a high yield security, and could adversely affect the daily NAV of Fund shares. When secondary markets for high yield securities are less liquid than the market for investment-grade securities, it may be more difficult to value the securities because such valuation may require more research, and elements of judgment may play a greater role in the valuation because there is less reliable, objective data available. The Fund may invest up to an aggregate amount of 15% of its net assets in illiquid investments, as such term is defined by Rule 22e-4 under the Investment Company Act of 1940, as amended (the “1940 Act”). When the Sub-Adviser believes that current market, economic, political or other conditions are unsuitable and would impair the pursuit of the Fund’s investment objectives, the Fund may invest some or all of its assets in cash or cash equivalents, including but not limited to obligations of the U.S. government, money market fund shares, commercial paper, certificates of deposit and/or bankers acceptances, as well as other interest bearing or discount obligations or debt instruments that carry an investment grade rating by a national rating agency. When the Fund takes a temporary defensive position, the Fund may not achieve its investment objectives. The Fund may invest from time to time more heavily in one or more sectors of the economy than in other sectors.

The Fund

The Fund had a NAV total return of 13.25%. The S&P/LSTA Leveraged Loan Total Return Index had a total return of 11.47%.

The Fund’s top three performers in the fund were Neuberger Berman Loan Advisers CLO 48 Ltd with a total return of 14.08% and a contribution to the return of the fund of 0.14%. Harbor Park CLO 18-1 Ltd with a total return of 18.56% and a contribution of 0.14% to the return of the fund. And Goldentree Loan Management US CLO 1 Ltd with a total return of 20.03% which was a contribution to the return of the fund of 0.11%.

The Fund’s bottom three contributors to its return were Altice France Societe Anonyme Term Loan 15-aug-2028 with a total return of -15.63% and a contribution of -0.06%, ROCKLAND OK CLO 2021 with a total return of -1.06% and a contribution of -0.01%, and ELMWOOD CLO LTD 2021-12 with a total return of -2.00% and a contribution of -0.01% to the total return of the fund.

Pacer Data and Digital Revolution ETF

The Pacer Data and Digital Revolution ETF (the “Fund”) employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Pacer Data Transmission and Communication Revolution Index (the “Index”).

The Index is based on a proprietary methodology developed and maintained by Index Design Group, an affiliate of Pacer Advisors, Inc., the Fund’s investment adviser (the “Adviser”). The Index is a rules-based index that consists of globally-listed stocks and depositary receipts of companies that, at the time of being added to the Index, derive at least 50% of their revenues from one of the following activities related to the use, manipulation, transmission, or storage of data (i.e., information that is stored in a digital or electronic format) and the ancillary services that enable these processes (i.e., services that enable companies to use, manipulate, transmit, or store data): electrical equipment and component manufacturing; automatic environmental control or heating and cooling equipment; computer storage device manufacturing; computer systems design services; computer equipment or telephone 3 equipment manufacturing; custom computer programming or record reproducing services; data processing and hosting services; software publishing; semiconductor manufacturing; wireless communications equipment manufacturing; communication and energy wire or wiring device manufacturing or producers of raw materials; cybersecurity systems and data protection services; power and distribution transformer manufacturing; satellite and digital telecommunications; electrical

17

Pacer Funds