August 27, 2014

| Securities and Exchange Commission | |

| Division of Corporation Finance | |

| 100 F Street, N.E. | |

| Washington, D.C. 20549 | |

| Attention: | David L. Orlic | |

| cc: | Donald Field | |

| cc: | Loan Lauren Nguyen | |

| | Re: | Chiquita Brands International, Inc. | |

| | | Preliminary Proxy Statement on Schedule 14A filed by Cavendish Global Limited and Cavendish Acquisition Corporation | |

| | | Filed August 15, 2014 | |

| | | File No. 001-01550 | |

Dear Mr. Orlic:

We refer to the letter dated August 22, 2014 (the “Comment Letter”), from the U.S. Securities and Exchange Commission (the “SEC” or the “Commission”) to Mr. Michael S. Rubinoff of Grupo Safra S.A., setting forth the comments of the staff of the SEC (the “Staff”) with respect to the Preliminary Proxy Statement on Schedule 14A (“Preliminary Proxy Statement”) filed by Cavendish Global Limited and Cavendish Acquisition Corporation (collectively with all participants in the solicitation, “Cutrale-Safra”) on August 15, 2014, Commission File No. 001-01550, relating to the solicitation of proxies by Cutrale-Safra to be used at the special meeting (the “Special Meeting”) of shareholders of Chiquita Brands International, Inc., a New Jersey corporation (“Chiquita”), to be held on September 17, 2014.

Concurrently with this response letter, Cutrale-Safra is electronically transmitting an amended Preliminary Proxy Statement (the “Amended Proxy Statement”) in response to the comments of the Staff in the Comment Letter.

The numbered paragraph and heading below correspond to the paragraph and heading set forth in the Comment Letter. The Staff’s comment is set forth in bold, followed by Cutrale-Safra’s response to the comment.

General

| 1. | We note that you have listed only Cavendish Global Limited and Cavendish Acquisition Corporation on the cover of the proxy statement and on the form of proxy. Please advise why you have not included the Cutrale Group and the Safra Group as participants in the solicitation. |

Response: We have reviewed the definition of “participants” and “participants in a solicitation” as defined in Instruction 3 of Item 4 of Statement 14A and respectfully submit that the Cutrale Group and the Safra Group are not participants or participants in a solicitation as defined therein. Cavendish Global Limited and Cavendish Acquisition Corporation (the “Cavendish Entities”) and their respective directors and officers, as disclosed in the Amended Proxy Statement, are the only persons that are soliciting proxies from the shareholders of Chiquita in connection with the Special Meeting. We have revised the cover page of the Amended Proxy Statement to include Burlingtown UK LTD and Erichton Investments Ltd. as participants in the solicitation of proxies in connection with the Special Meeting by the Cavendish Entities as they are the entities which will be making capital contributions to Cavendish Global Limited so that the Cavendish Entities can engage in solicitation activities. The Cavendish Entities will directly bear the cost of solicitation of proxies in connection with the Special Meeting. For further information on Burlingtown UK LTD and Erichton Investment Ltd., we respectfully direct the Staff to the supplemental disclosure on page 14 of the Amended Proxy Statement and Schedule I to the Amended Proxy Statement.

| 2. | We note the information regarding Burlington UK LTD and Erichton Investments Ltd. on page 13. Please disclose how these entities are affiliated with the participants. Please also provide your analysis as to whether these entities are participants. |

Response: In response to the Staff’s comment, Cutrale-Safra has supplemented the disclosure on page 14 of the Amended Proxy Statement and Schedule I to the Amended Proxy Statement. We have revised the Amended Proxy Statement to include Burlingtown UK LTD and Erichton Investments Ltd. as participants solely on the basis that these entities are making capital contributions to Cavendish Global Limited to finance the solicitation of proxies by Cavendish Global Limited and Cavendish Acquisition Corporation. Neither Burlingtown UK LTD nor Erichton Investments Ltd., nor any of their respective directors or officers, are involved in soliciting or otherwise participating in the solicitation of proxies in connection with the Special Meeting other than to make such capital contributions.

Proxy Statement Cover Page

| 3. | We note the reference to Cavendish Global Limited and Cavendish Acquisition Corporation as “Cutrale-Safra.” Please explain here the relationship between the Cavendish entities and the Cutrale Group and the Safra Group. |

Response: We respectfully refer the Staff to our response to our supplemental disclosure on page 14 of the Amended Proxy Statement and Schedule I to the Amended Proxy Statement.

Reasons to Vote “Against” the Fyffes Transaction Proposal, page 1

| 4. | Please revise to clarify that the Chiquita shareholders will receive cash for their respective shares but will no longer hold shares in Chiquita if the Cutrale-Safra Proposal is approved. |

Response: In response to the Staff’s comment, Cutrale-Safra has revised the disclosure on page 1 of the Amended Proxy Statement.

| 5. | We note that you refer to Chiquita and Fyffes’ stock prices throughout the proxy statement. Please include disclosure acknowledging the various factors that may impact stock prices during the referenced periods. Please also provide disclosure clarifying that your valuation methodology assumes that the market has correctly and fully incorporated the value of the Proposed Fyffes Combination into the stock price of Chiquita. |

Response: In response to the Staff’s comment, Cutrale-Safra has added disclosure on page 2 of the Amended Proxy Statement.

| 6. | Please revise to characterize it as your opinion that the Cutrale-Safra Proposal is “far superior” to the Proposed Fyffes Combination and “would provide significantly greater value to Chiquita shareholders than the Proposed Fyffes Combination.” Please likewise revise any similar statements appearing throughout your document. |

Response: In response to the Staff’s comment, Cutrale-Safra has revised the disclosure on pages ii, 1, 4, 5, 11 of the Amended Proxy Statement.

| 7. | Please clarify the last paragraph on page 2 to include the members of Chiquita’s senior management who will have senior management roles at ChiquitaFyffes, including as directors, chairman of the board and the chief operating officer of the salads and healthy snacks division. |

Response: In response to the Staff’s comment, Cutrale-Safra has added disclosure on page 3 of the Amended Proxy Statement.

| 8. | Please revise the second paragraph on page 4 to clarify that the Fyffes Transaction Agreement prohibits the Chiquita board of directors from communications with Cutrale-Safra unless the Chiquita board of directors determines in good faith that a failure to do so would be reasonably likely to be inconsistent with the directors’ fiduciary duties. |

Response: In response to the Staff’s comment, Cutrale-Safra has revised the disclosure on page 5 of the Amended Proxy Statement.

Background of the Solicitation, page 7

| 9. | We note that the Cutrale-Safra transaction would be financed by “equity” provided by the Cutrale Group and the Safra Group and that such proposal will not be subject to any financing conditions. Please provide additional details regarding the financing for the Cutrale-Safra transaction and clarify whether the Cutrale Group and the Safra Group would finance the cash contribution or provide all necessary funds from cash on hand. |

Response: In response to the Staff’s comment, Cutrale-Safra has revised the disclosure on page 3 of the Amended Proxy Statement.

| 10. | We note that the Cutrale-Safra Proposal contains no financing contingency and that Cutrale-Safra will provide additional capital, if needed, for the redemptions of the Chiquita 7.875% Senior Secured Notes due 2021 and the Chiquita 4.25% Convertible Senior Notes due 2016. Please revise to address the asset based lending credit facility, dated February 5, 2013, with certain financial institutions as lenders, and Wells Fargo Bank, National Association, as administrative agent, and whether the Cutrale-Safra transaction would constitute a change of control under such facility. |

Response: In response to the Staff’s comment, Cutrale-Safra has revised the disclosure on page 3 of the Amended Proxy Statement.

| 11. | Please revise throughout to clarify that it is Cutrale-Safra’s belief that the Cutrale-Safra transaction will be in a position to close before the end of the year. |

Response: In response to the Staff’s comment, Cutrale-Safra has revised the disclosure on page 3 of the Amended Proxy Statement.

Shareholder of Record, page 15

| 12. | Please clarify disclosure in this paragraph as to whether shares will be voted “against” or “abstain” with respect to the Related Fyffes Proposals, if a shareholder returns a proxy card without marking it with respect thereto. |

Response: In response to the Staff’s comment, Cutrale-Safra has added disclosure on page 16 of the Amended Proxy Statement.

Form of Proxy

| 13. | Please revise the form of proxy to state that the proxy is not solicited on behalf of the registrant’s board of directors. Refer to Rule 14a-4(a)(1). |

Response: In response to the Staff’s comment, Cutrale-Safra has revised the form of proxy.

The filing persons’ acknowledgment of the statements for which you requested acknowledgment in the penultimate paragraph of the Comment Letter is set forth in Annex A to this response letter.

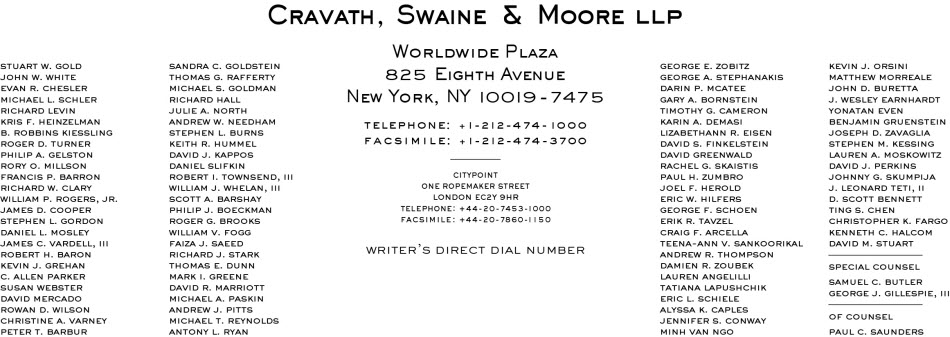

We hope that these responses adequately address the Staff’s comments. If the Staff has any questions concerning this response letter or requires further information, please do not hesitate to contact Richard Hall at (212) 474-1293 and Andrew R. Thompson at (212) 474-1802

| | | |

| | | Very truly yours, | |

| | | | |

| | | /s/ Richard Hall | |

| | | Richard Hall | |

| | | | |

| | | /s/ Andrew R. Thompson | |

| | | Andrew R. Thompson | |

ANNEX A

August 27, 2014

| Securities and Exchange Commission | |

| Division of Corporation Finance | |

| 100 F Street, N.E. | |

| Washington, D.C. 20549 | |

| Attention: | David L. Orlic | |

| cc: | Donald Field | |

| cc: | Loan Lauren Nguyen | |

| | Re: | Chiquita Brands International, Inc. | |

| | | Preliminary Proxy Statement on Schedule 14A filed by Cavendish Global Limited and Cavendish Acquisition Corporation | |

| | | Filed August 15, 2014 | |

| | | File No. 001-01550 | |

Dear Mr. Orlic:

In response to the request of the staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) contained in your letter dated August 22, 2014 to Mr. Michael S. Rubinoff of Grupo Safra S.A. setting forth the comments of the Staff with respect to the Preliminary Proxy Statement on Schedule 14A (“Preliminary Proxy Statement”) filed by Cavendish Global Limited and Cavendish Acquisition Corporation (collectively with all participants of the solicitation, “Cutrale-Safra”) on August 15, 2014, Commission File No. 001-01550 relating to the solicitation of proxies by Cutrale-Safra to be used at the special meeting (the “Special Meeting”) of shareholders of Chiquita Brands International, Inc., a New Jersey corporation (“Chiquita”), to be held on September 17, 2014, each of the undersigned hereby acknowledges that:

| | · | the undersigned is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | · | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| | · | the undersigned may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

cc: Richard Hall (Cravath, Swaine & Moore LLP)

Andrew R. Thompson (Cravath, Swaine & Moore LLP)

[signature pages follow]

| | CAVENDISH ACQUISITION CORPORATION, | |

| | | | |

| | by: | /s/ Michael Rubinoff | |

| | | Name: Michael Rubinoff | |

| | | Title: Authorized Signatory | |

| | | | |

| | CAVENDISH GLOBAL LIMITED, | |

| | | | |

| | by: | /s/ Graziela Cutrale | |

| | | Name: Graziela Cutrale | |

| | | Title: Authorized Signatory | |

| | | | |

| | | |

| | | | |

| | by: | /s/ Daniel Wainberg | |

| | | Name: Daniel Wainberg | |

| | | Title: Authorized Signatory | |

| | | | |

| | | |

| | | | |

| | by: | /s/ Graziela Cutrale | |

| | | Name: Graziela Cutrale | |

| | | Title: Authorized Signatory | |

| | | | |

| | ERICHTON INVESTMENTS LTD., | |

| | | | |

| | by: | /s/ Fernando Batista | |

| | | Name: Fernando Batista | |

| | | Title: Authorized Signatory | |

| | | | |

| | | |

| | | | |

| | by: | /s/ Daniel Wainberg | |

| | | Name: Daniel Wainberg | |

| | | Title: Authorized Signatory | |

| | | | |