100 F Street, N.E.

Washington, D.C. 20549

Dear Mr. Orlic:

We refer to the letter dated September 4, 2014 (the “Comment Letter”), from the U.S. Securities and Exchange Commission (the “SEC” or the “Commission”) to Mr. Michael S. Rubinoff of Grupo Safra S.A., setting forth the comments of the staff of the SEC (the “Staff”) with respect to the Definitive Additional Soliciting Materials filed by Cavendish Global Limited and Cavendish Acquisition Corporation, et al. (collectively, “Cutrale-Safra”) on August 26, 2014, Commission File No. 001-01550, relating to the solicitation of proxies by Cutrale-Safra to be used at the special meeting (the “Special Meeting”) of shareholders of Chiquita Brands International, Inc., a New Jersey corporation (“Chiquita”), to be held on September 17, 2014.

Concurrently with this response letter, Cutrale-Safra is electronically transmitting an amended Definitive Proxy Statement (the “Amended Proxy Statement”) in response to the comments of the Staff in the Comment Letter.

The numbered paragraph and heading below correspond to the paragraph and heading set forth in the Comment Letter. The Staff’s comment is set forth in bold, followed by Cutrale-Safra’s response to the comment.

General

1. Please tell us whether you are required to provide advance notice for Proposal 6 in the proxy statement pursuant to Article 7 of the Third Restated Certificate of Incorporation of Chiquita.

Response: We respectfully inform the Staff that we do not believe that we are required to provide advance notice pursuant to Article 7 of the Third Restated Certificate of Incorporation of Chiquita with respect to proposal 6 on the Cutrale-Safra proxy card.

First, Cutrale-Safra has clearly disclosed that it will not make a motion for proposal 6 (the Cutrale-Safra Negotiation Proposal) at the Special Meeting unless the Chiquita Board has publicly announced on or prior to the date of the Special Meeting that it will engage with Cutrale-Safra with respect to the Cutrale-Safra Proposal. Therefore, the motion for proposal 6 will not be made except in a situation in which the Chiquita Board has determined to engage with Cutrale-Safra. The Chiquita Board has the authority to bring matters, or direct matters to be brought, at a meeting without any advance notice pursuant to Section 2(b) of Article 7 of the Third Restated Certificate of Incorporation of Chiquita. Cutrale-Safra anticipates that the Chiquita Board would allow its motion to be made if it has determined to engage with Cutrale-Safra and Cutrale-Safra hold proxies sufficient to defeat Chiquita's proposals.

Secondly, Cutrale-Safra respectfully informs the Staff of its view that a motion to adjourn is not a new business, but a motion that is incidental to, or relates to, the business of the meeting. As a matter of parliamentary procedure, no objection can be made to the consideration of a motion incidental to the business of a meeting, such as a motion for adjourn. Accordingly, Cutrale-Safra does not believe that the motion for adjournment set forth its proposal 6 is the type of business that must be brought in compliance with Article 7 of the Third Restated Certificate of Incorporation of Chiquita.

2. The disclosure in the proxy statement appears to state that the Chiquita shareholders should vote against the Fyffes Transaction Proposal to preserve “optionality” and that such proxy will not risk the Fyffes transaction. In the event that the Cutrale-Safra Negotiation Proposal is adopted and the Chiquita board of directors terminates the Transaction Agreement after negotiations with Cutrale-Safra, clarify that the Chiquita shareholders may not have the opportunity to vote on the Fyffes Transaction Proposal again. We believe that this information should be disseminated to shareholders together with the disclosure added to your definitive revised proxy statement in response to our prior comment 4.

Response: Cutrale-Safra respectfully informs the Staff that it is no longer seeking proxies for the Cutrale-Safra Negotiation Proposal and Cutrale-Safra has revised the Amended Proxy Statement to reflect the latest developments. In response to the Staff’s comment on the ability of Chiquita shareholders to vote on the Fyffes Transaction Proposal after an adjournment, Cutrale-Safra has revised the disclosure on page 7 of the Amended Proxy Statement.

Slides 2 and 27

3. We note your response to our prior comment 6. Please provide support for the assertion, that Chiquita has made “strategic blunders” and has a “poor track record of strategic decisions.” Your support for this proposition in the presentation appears limited to the Fresh Express acquisition.

Response: We believe the Fresh Express acquisition is the clearest examples of Chiquita’s poor strategic decisions which is why we highlighted this fact in the presentation. However, the following also support Cutrale-Safra's assertions, all of which are disclosed in Chiquita's public disclosures.

1. In May 2010, Chiquita sold 51% of its European smoothie business to Danone, S.A. to form a joint venture to sell fruit smoothies in Europe for $18 million. At that time, Chiquita recognized a gain of $32.4 million. Only two years later, in the third quarter of 2012, Chiquita recorded a $28 million loss to fully impair its investment in the joint venture and to record estimates of probable cash obligations to the joint venture. See Note 3 of Chiquita’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2012.

2. We believe Chiquita demonstrated poor strategic judgment for not recognizing and reacting to customers conversions from branded to private label in the Salad segment thereby allowing declines in sales beginning from the fourth quarter of 2009 until early 2012. In late 2011 Chiquita finally reversed its focus on branded product offerings to include private label in order to be more competitive. See page 23 of Chiquita’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2012.

3. Chiquita’s public disclosure shows that it explored various kinds of whole fresh produce in their Other Produce segment, but ultimately Chiquita had to exit this segment entirely in 2012 after continuing declines in net sales. See page 5 of Chiquita’s Annual Report on Form 10-K for the year ended December 31, 2012.

4. Finally, Cutrale-Safra believes it was a strategic mistake for Chiquita not to run a more robust sales process. Cutrale-Safra finds it surprising that Chiquita never contacted Cutrale, which is in many ways is a natural owner of Chiquita, even while it was looking for strategic alternatives for its business. Cutrale-Safra also believes that the lopsided terms of the proposed Fyffes agreement further evidence poor strategic choices by Chiquita’s management and its board.

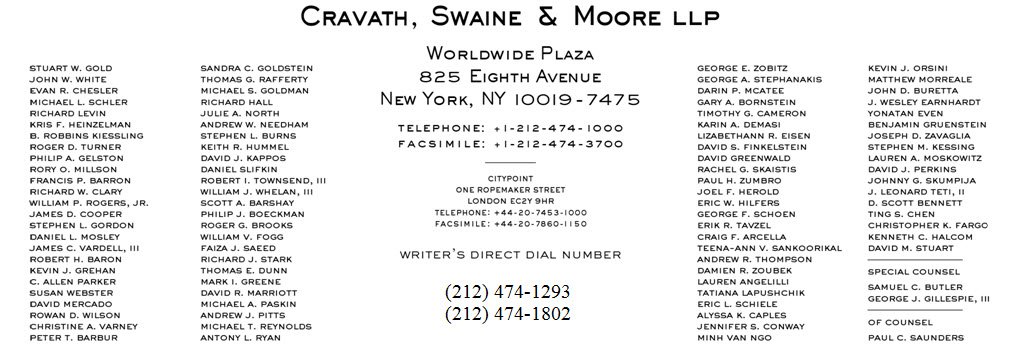

If the Staff has any questions concerning this response letter or requires further information, please do not hesitate to contact Richard Hall at (212) 474-1293 and Andrew R. Thompson at (212) 474-1802