` Exhibit 99.2

1

2

To Our Shareholders The first quarter of 2022 was another exceptionally strong quarter for ZipRecruiter. We generated $227 million in revenue, up 81% y/y and 3% above the midpoint of our guidance. We posted net income of $8 million and Adjusted EBITDA of $37 million, equating to a net income margin of 4% and an Adjusted EBITDA margin of 16%. This exceeds the Adjusted EBITDA guidance we provided in March, even as we made significant long-term investments in building our marketplace. In light of this quarter’s results, the momentum in our business, and - despite some macroeconomic choppiness - a strong hiring environment, we are raising guidance (detailed below) for both revenue and Adjusted EBITDA for the full year. We finish the first quarter of 2022 as the U.S. labor market continues its record-setting run. The U.S. economy added over 400 thousand1 new jobs for the past eleven months in a row. We are also experiencing the tightest labor market in history - with approximately one unemployed person for every two job openings2. Employers are struggling to find talent and need all the help they can get to widen the reach of their job postings and find great matches. We are also witnessing high turnover in the U.S. labor force, with over 4 million3 workers quitting their jobs every month for the past nine months. Job seekers are looking for better matches, higher wages, and more flexible schedules, in a market with over 60% more job openings4 than before the pandemic. This creates an opportunity for employers who use the best technology to find talent. While rising labor costs, inflation rates and global tensions remain a concern among employers, we believe that the combination of surging demand for talent, high turnover, and low unemployment means hiring will remain a top priority for employers in the months to come. Employers’ willingness to pay has never been higher, and reflects the ever-increasing value ZipRecruiter continues to deliver. Below, we outline the significant progress we are making against the three pillars of our strategy. We believe ZipRecruiter is perfectly positioned to achieve our mission: to actively connect people to their next great opportunity. 4 Per U.S. Bureau of Labor Statistics, Job Openings and Labor Turnover Survey, comparing job openings from February 2020 to March 2022. 3 Per Federal Reserve Economic Data, total non-farm quits, seasonally adjusted, as of March 2022. 2 Per U.S. Bureau of Labor Statistics, Number of unemployed persons per job opening, seasonally adjusted, as of March 2022, showing 0.5 unemployed persons per job opening as of March 2022. 1 Per U.S. Bureau of Labor Statistics, Current Employment Statistics, as of March 2022, calculated as net change in total non-farm employment per calendar month. 3

First Quarter 2022 Key Results Revenue $227 million 81% y/y Quarterly Paid Employers5 150.2K 31% y/y Revenue per Paid Employer5 $1,513 38% y/y Gross Margin 91% Net Income $8 million Net Income Margin 4% Adjusted EBITDA5 $37 million Adjusted EBITDA Margin5 16% Financial Outlook Q2’22 FY’22 FY’22 (prior guidance) Revenue $231 - $237 million 26% - 30% y/y $908 - $922 million 23% - 24% y/y $878 - $892 million 18% - 20% y/y Adjusted EBITDA5 Adjusted EBITDA margin $34 - $40 million 15% - 17% $142 - $156 million 16% - 17% $123 - $137 million 14% - 15% 5 See “Key Operating Metrics and Non-GAAP Financial Measures” below for additional information regarding key operating metrics and non-GAAP measures used in this shareholder letter and a reconciliation of GAAP net income (loss) to Adjusted EBITDA. 4

Growth Strategies and Recent Progress In Q1’22 we continued to make progress against the three key pillars of our strategy: 1) increase the number of employers in our marketplace, 2) increase the number of job seekers in our marketplace, and 3) make our matching technology smarter over time. Growth Strategy #1: Increase the number of employers in our marketplace Total paid employers increased to 150 thousand in Q1’22 from 147 thousand in Q4’21. Prior to the pandemic, typical seasonality generally drove a modest sequential decrease in paid employers in the first quarter. However, at the start of 2022, employer hiring needs remained at record levels with more than ten million6 open jobs across the country. To lean into the sustained demand, we continued to aggressively market to employers while simultaneously growing our sales team by 11% during the first quarter. The combination of these factors led to a 2% sequential increase in paid employers vs. Q4’21 - bucking the historical pattern of a Q1 decline. Revenue per Paid Employer was an all-time high of $1,513 in Q1’22, up 38% y/y and 1% q/q. ZipRecruiter fundamentally functions as an auction-based marketplace with employers able to choose from a variety of premium options where they may pay more to get more. The ZipRecruiter sales team introduces customers to those premium options which, when utilized, drive up Revenue per Paid Employer. We have a multi-year track record of Revenue per Paid Employer increasing and we believe this trend will continue. Growth Strategy #2: Increase the number of job seekers in our marketplace 2021 ended as one of the tightest labor markets in U.S. history. Q1’22 continued this trend, with only 0.5 unemployed persons for every job opening. Given this unique labor market backdrop, it’s more important than ever to understand how job seekers feel about their employment prospects. In Q1’22, we launched the ZipRecruiter Job Seeker Confidence Survey7. This nationally representative survey of U.S. job seekers measures how optimistic or pessimistic they are about their ability to land jobs they want. Now available on our website, we plan to update this survey on a monthly basis and believe it will be a valuable resource as we continue to track the labor market in 2022 and years to come. 7 https://www.ziprecruiter.com/job-seeker-confidence 6 Per U.S. Bureau of Labor Statistics, Job Openings and Labor Turnover Survey, as of March 2022. 5

Based on the survey results so far this year, job seekers’ confidence is high, believing that they have considerable bargaining power. 50% of employed job seekers said they expect that their current employer will ask them to stay and make a counteroffer if they resign. In another survey we conducted in February 2022 of over 2,000 Americans hired in the last 6 months, an astonishingly high 37%8 said they had been recruited to their current jobs. That’s up from 18%9 of all workers in 2019 and 4%10 in 1991. Increasingly we live in a world where work finds you. Further, 62%11 of active job seekers now say they prefer, or only want, remote work. These are fundamental changes to how the labor market has traditionally worked. To compete in this new macroeconomic reality, ZipRecruiter has a simple product philosophy. We are a matchmaker - not a job board. The manifestation of this philosophy is Phil, an AI personal recruiter who works with every job seeker. Phil learns who you are, curates great opportunities for you to consider, and even pitches you to employers so that they recruit you. Our last letter described the growing impact of Phil on the job seeker experience. Phil’s introduction to onboarding in Q4’21 generated a 29%12 increase in onboarding completion rate. Continuing his path to ubiquity across our job seeker products, in Q1’22 we officially introduced Phil into our Android™ mobile app13 to further improve our already #1 rated job search mobile app14. In Q1’22, we also released several new TV spots featuring Phil. These “Thank you, Phil” TV spots showcase the gratitude our job seekers feel after being matched with great job opportunities by our personal recruiter. 14 Based on job seeker app ratings, Jan 2021 to Jan 2022 from AppFollow for ZipRecruiter, CareerBuilder, Glassdoor, Indeed, LinkedIn, and Monster. 13 Android is a trademark of Google LLC. 12 Based on internal data measuring the difference in conversion rate for job seekers in January 2022 versus September 2021 before the product enhancements were implemented. 11 ZipRecruiter monthly Job Seeker Confidence Survey based on an online sample administered by Qualtrics on behalf of ZipRecruiter to 1,500 job seekers between the 10th and 16th of each month of 2022 and weighted to the U.S. Census Bureau's American Community Survey. Respondents may be employed, unemployed, or not currently in the labor force, but must reside in the United States and have indicated a desire to find a new job "in the next six months" in order to be included in the sample. 10 National Opinion Research Center, General Social Survey (1991), Ann Arbor, MI. 9 Black, Ines and Hasan, Sharique and Koning, Rembrand, Hunting for talent: Firm-driven labor market search in the United States (April 15, 2020). 8 Survey of 2,064 U.S. residents who are currently employed and started their current jobs within the last 6 months, conducted for ZipRecruiter by Qualtrics using a nationally representative online panel (Feb 9–Feb 28, 2022). 6

Finally, we recently deployed a user interface improvement enabling job seekers to more rapidly apply to jobs on our site. This increased engagement with those jobs, resulting in a 13% increase in job seekers who completed applications. Growth Strategy #3: Make our matching technology smarter over time Core to our mission of actively connecting people to their next great opportunity is bringing job seekers and employers together through smart, AI-driven matching. In Q1’22 we rolled out the newest version of our Great Match algorithm and saw immediate results: candidates scored as a Great Match were 10% more likely to receive a thumbs up under this latest version of the model. The software is learning, and this latest iteration introduced fundamental changes to our matching methodology enabling deeper insight into exactly which of a job seeker’s qualifications or behaviors drive a better match rate. Thanks to a combination of our personal recruiter Phil, and our advancements with matching, we delivered over 7 million Great Match candidates in Q1’22 to employers. The progress we made in Q1 gives us greater confidence in our ability to execute going forward. We look forward to reporting future successes over the course of 2022 and beyond. Investing in our people and community As we help employers find the best talent for their companies, we continue to grow the ZipRecruiter team as well. Despite the ongoing tightness in the labor market, we grew headcount in Q1’22 by over 100, an increase of almost 9%. As of March 31, 2022, we had over 1,275 ZipRecruiter employees. These hires include key additions on many of our teams, including technology, product management and sales. We have been successful in growing our team and our investment in company culture continues to pay off. In March 2022, we completed our internal Employee Engagement survey, the results of which showed that over 85% of employees had a favorable view of their management, felt a deep sense of ownership over their work and have had positive, collaborative experiences across teams. We are thrilled with these results and will continue to build upon our culture, maintaining ZipRecruiter as a place where employees feel valued every day. In celebration of Black History Month, our Black Professionals Forum (BPF) Employee Resource Group partnered with Tolleson Elementary School District in Arizona—a district responsible for educating a growing number of young Black and Brown students. When we heard Tolleson had more than 100 students who were in need of shoes for their school 7

uniforms, BPF launched the ZipRecruiter “Step into Success” fundraiser where our employees’ efforts were able to provide hundreds of pairs of shoes. Additionally, ZipRecruiter has once again been recognized with awards highlighting exceptional places to work. ZipRecruiter won Comparably awards for the “Best Company Outlook,” “Best Company in Los Angeles,” “Best Sales Teams,” and “Best Engineering Teams.” These Comparably awards are an honor to receive and truly represent our commitment to the ZipRecruiter mission. 8

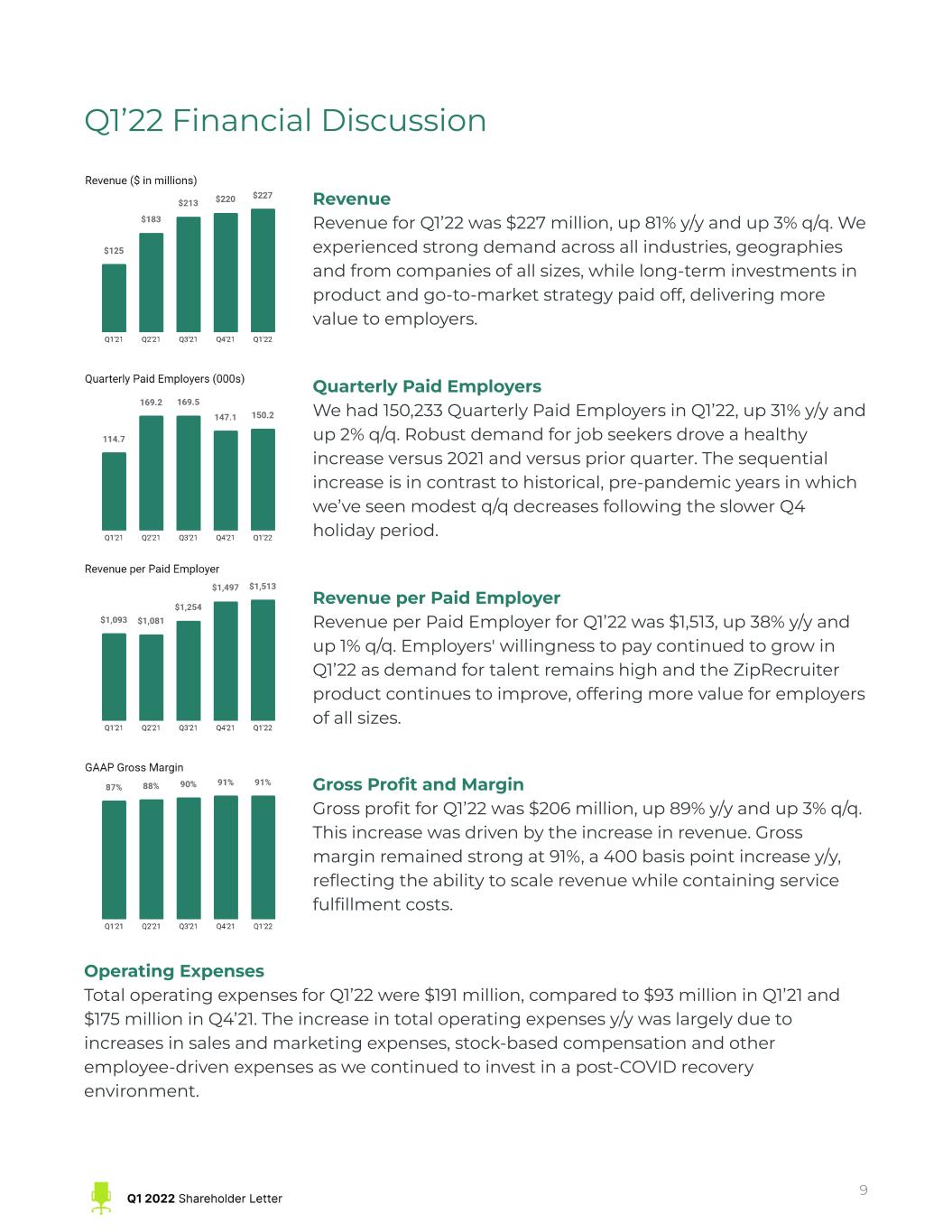

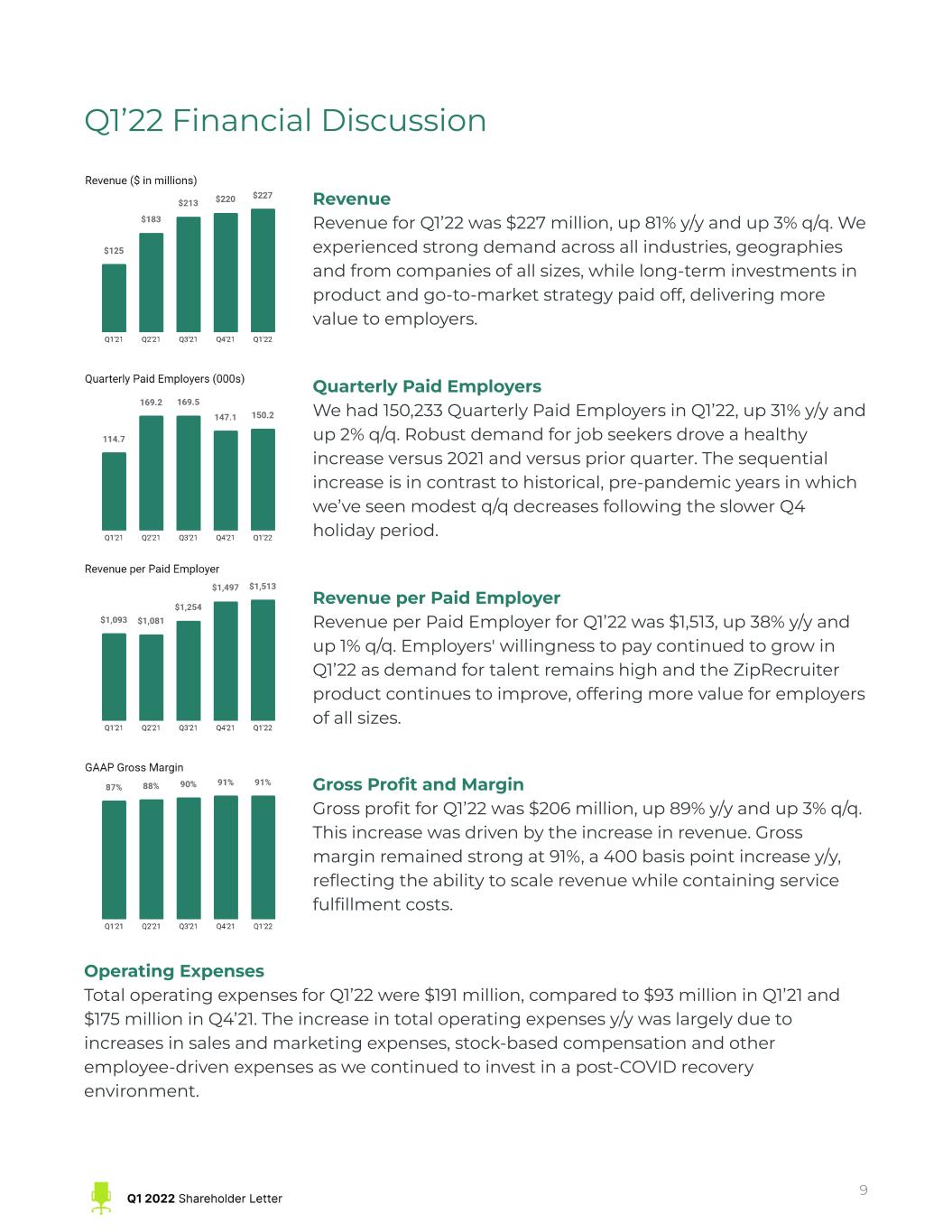

Q1’22 Financial Discussion Revenue Revenue for Q1’22 was $227 million, up 81% y/y and up 3% q/q. We experienced strong demand across all industries, geographies and from companies of all sizes, while long-term investments in product and go-to-market strategy paid off, delivering more value to employers. Quarterly Paid Employers We had 150,233 Quarterly Paid Employers in Q1’22, up 31% y/y and up 2% q/q. Robust demand for job seekers drove a healthy increase versus 2021 and versus prior quarter. The sequential increase is in contrast to historical, pre-pandemic years in which we’ve seen modest q/q decreases following the slower Q4 holiday period. Revenue per Paid Employer Revenue per Paid Employer for Q1’22 was $1,513, up 38% y/y and up 1% q/q. Employers' willingness to pay continued to grow in Q1’22 as demand for talent remains high and the ZipRecruiter product continues to improve, offering more value for employers of all sizes. Gross Profit and Margin Gross profit for Q1’22 was $206 million, up 89% y/y and up 3% q/q. This increase was driven by the increase in revenue. Gross margin remained strong at 91%, a 400 basis point increase y/y, reflecting the ability to scale revenue while containing service fulfillment costs. Operating Expenses Total operating expenses for Q1’22 were $191 million, compared to $93 million in Q1’21 and $175 million in Q4’21. The increase in total operating expenses y/y was largely due to increases in sales and marketing expenses, stock-based compensation and other employee-driven expenses as we continued to invest in a post-COVID recovery environment. 9

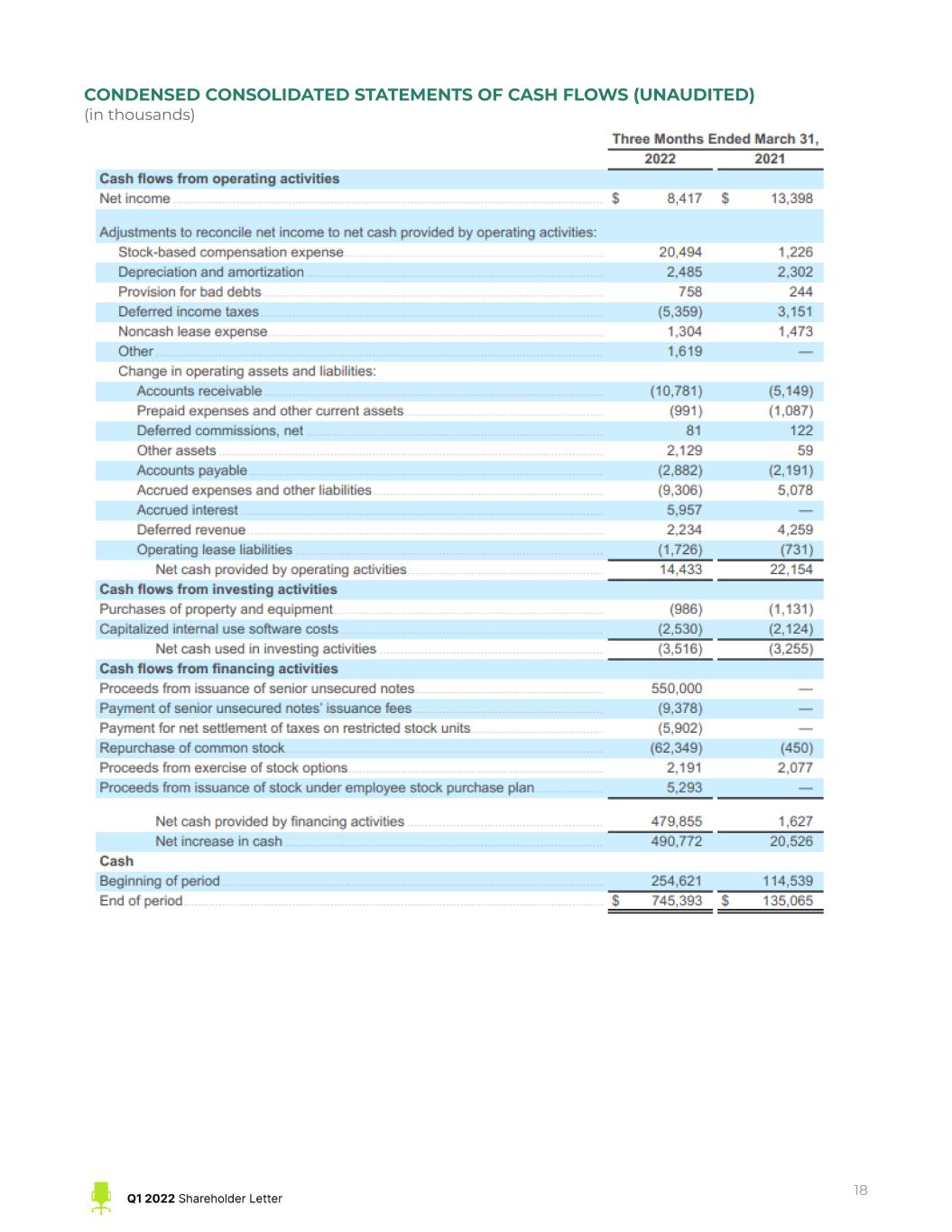

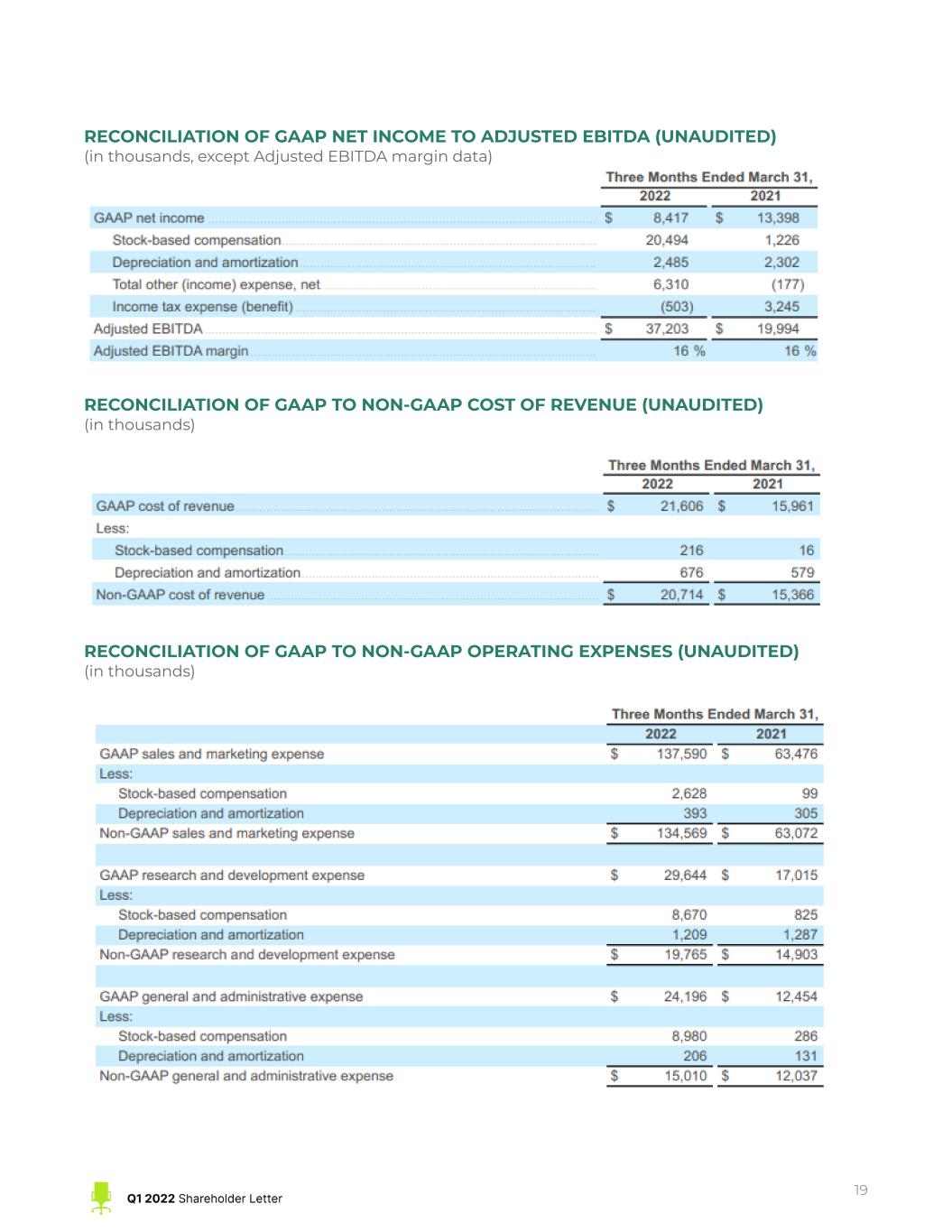

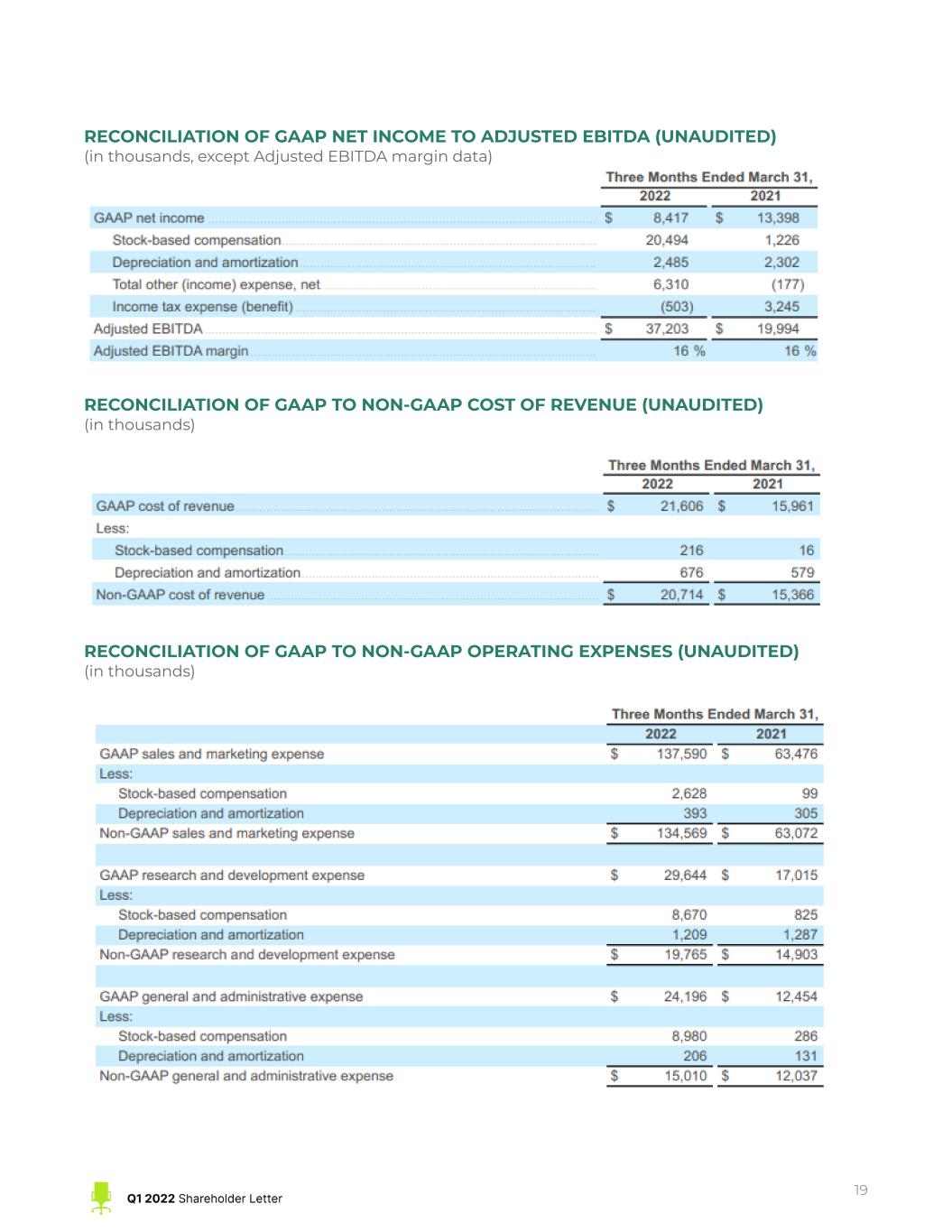

Note that in Q2'21, we incurred $32 million in non-recurring direct listing costs as well as $42 million in stock-based compensation expense for a large number of historical RSUs that vested in the quarter, timed with our direct listing, which contributed towards net loss in Q2’21. Sales and Marketing (S&M) expenses were $138 million in Q1’22, or 61% of revenue, compared to $63 million, or 50% of revenue, in Q1’21, and $121 million, or 55% of revenue, in Q4’21. The increase in sales and marketing expense y/y was primarily driven by a larger investment in media marketing and $3 million in stock-based compensation expense in the current quarter. Research and Development (R&D) expenses were $30 million in Q1’22, or 13% of revenue, compared to $17 million, or 14% of revenue, in Q1’21, and $28 million, or 13% of revenue, in Q4’21. The increase in research and development expenses y/y was primarily driven by an increase in product and engineering headcount and $9 million in stock-based compensation expense in the current quarter. General and Administrative (G&A) expenses were $24 million in Q1’22, or 11% of revenue, compared to $12 million, or 10% of revenue, in Q1’21, and $26 million, or 12% of revenue, in Q4’21. The increase in general and administrative expenses y/y was primarily driven by $9 million in stock-based compensation expense, as well as an increase in other headcount related expenses in the current quarter. Net Income (Loss) and Adjusted EBITDA Net income in Q1’22 was $8 million, compared to $13 million in Q1’21 and $21 million in Q4’21. Adjusted EBITDA was $37 million, equating to a margin of 16%, in Q1’22, compared to $20 million, with a margin of 16%, in Q1’21 and $48 million, with a margin of 22%, in Q4’21. The decrease in net income y/y was primarily driven by $21 million in stock-based compensation expense in the current period. The increase in Adjusted EBITDA y/y was primarily driven by higher revenue partially offset by higher sales and marketing expenses. The decrease in Adjusted EBITDA q/q was primarily due to higher sales and marketing expenses. 10

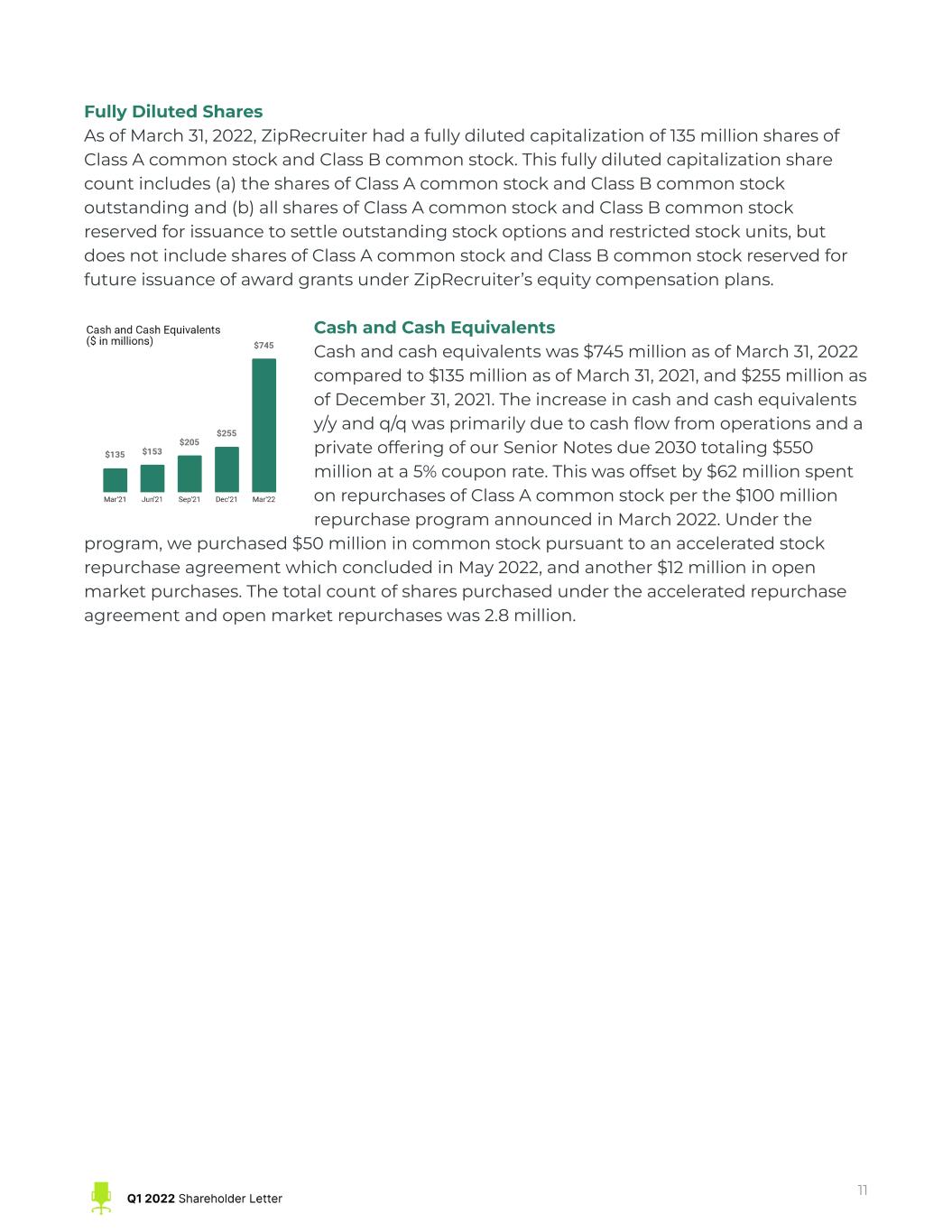

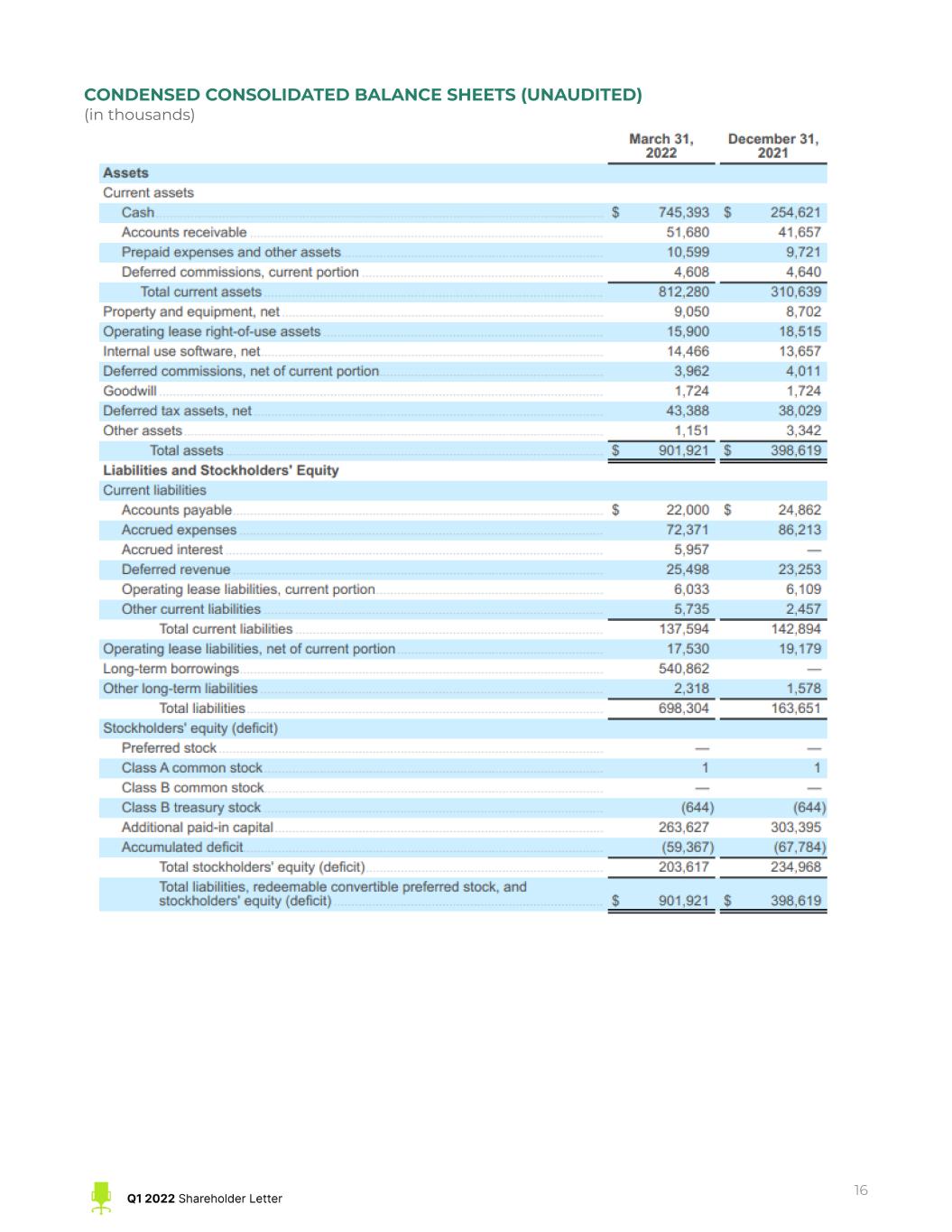

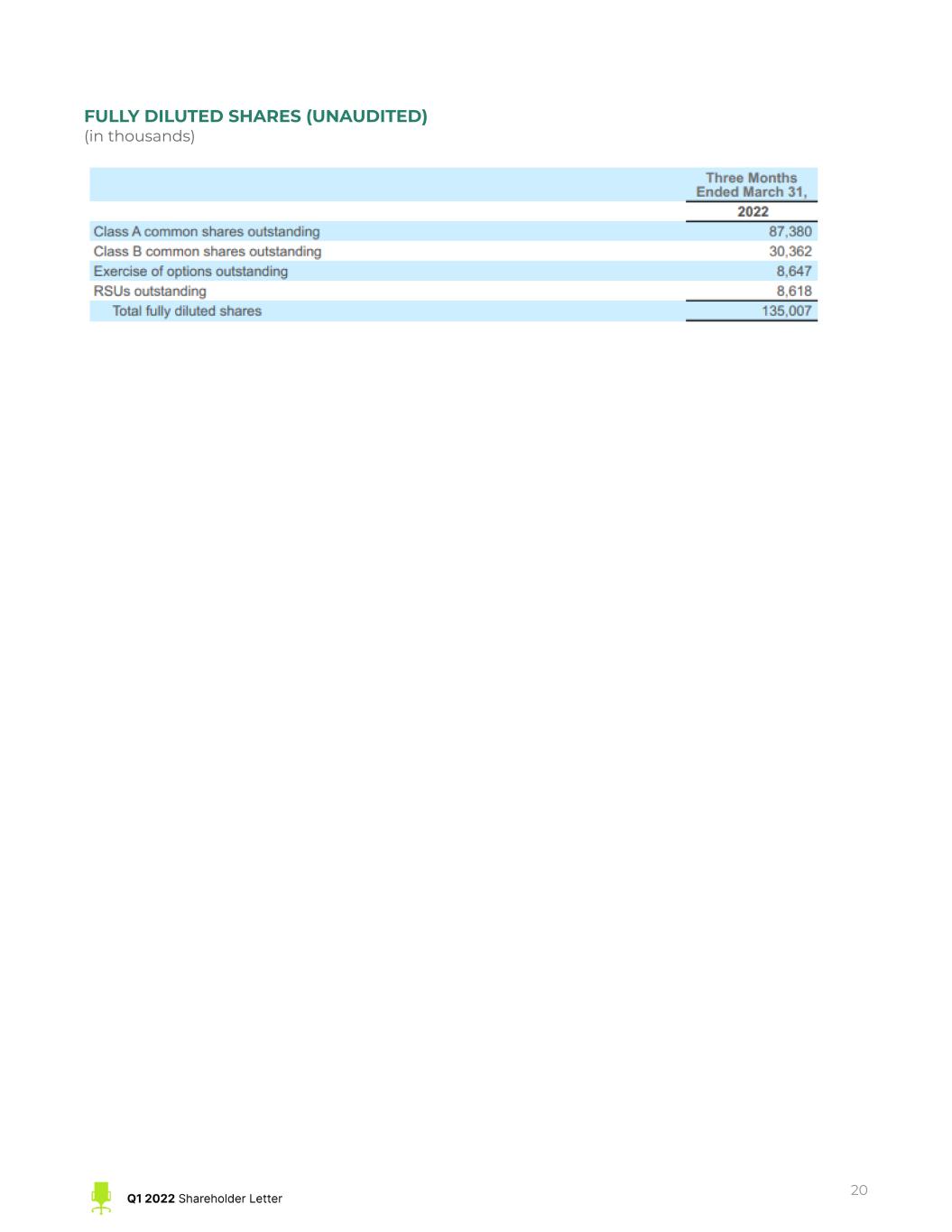

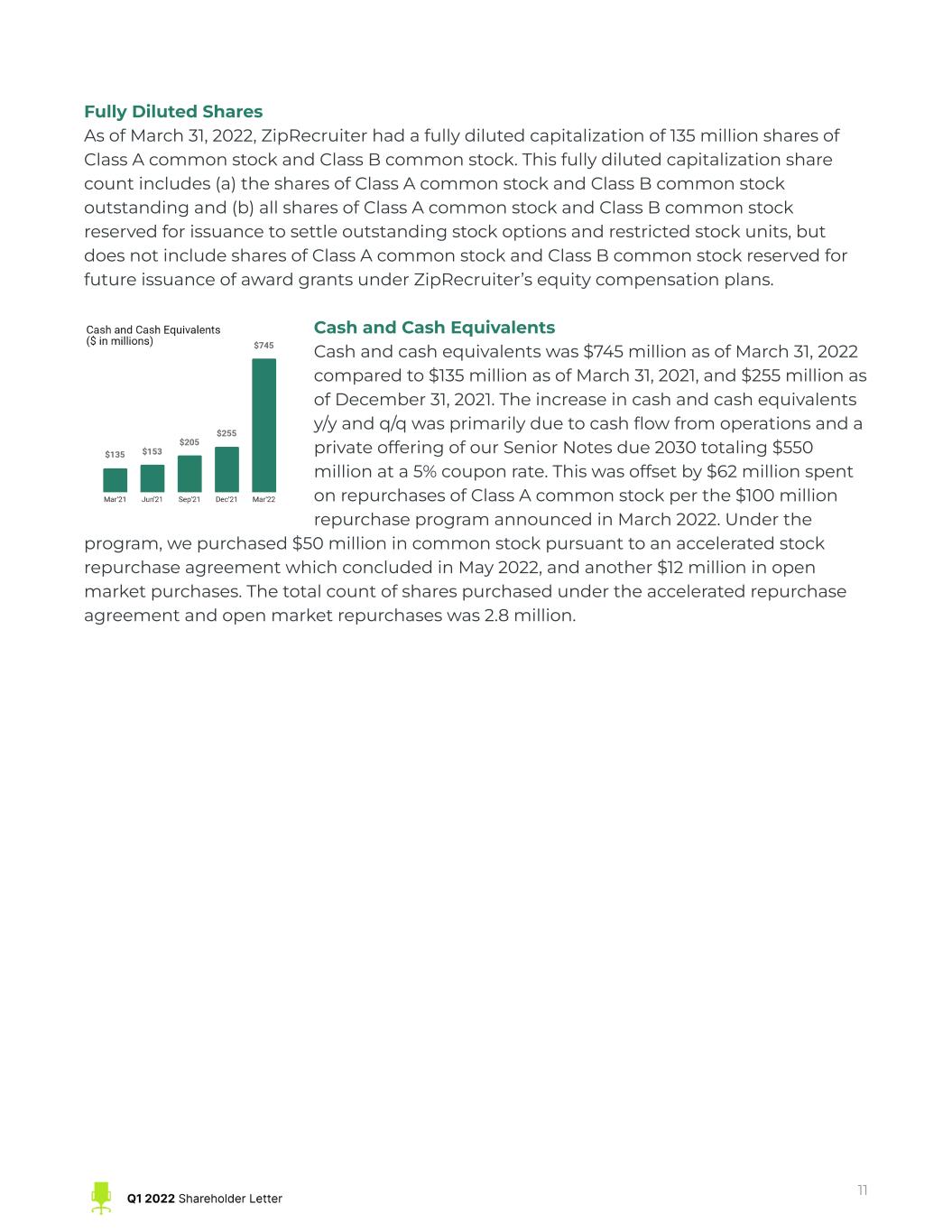

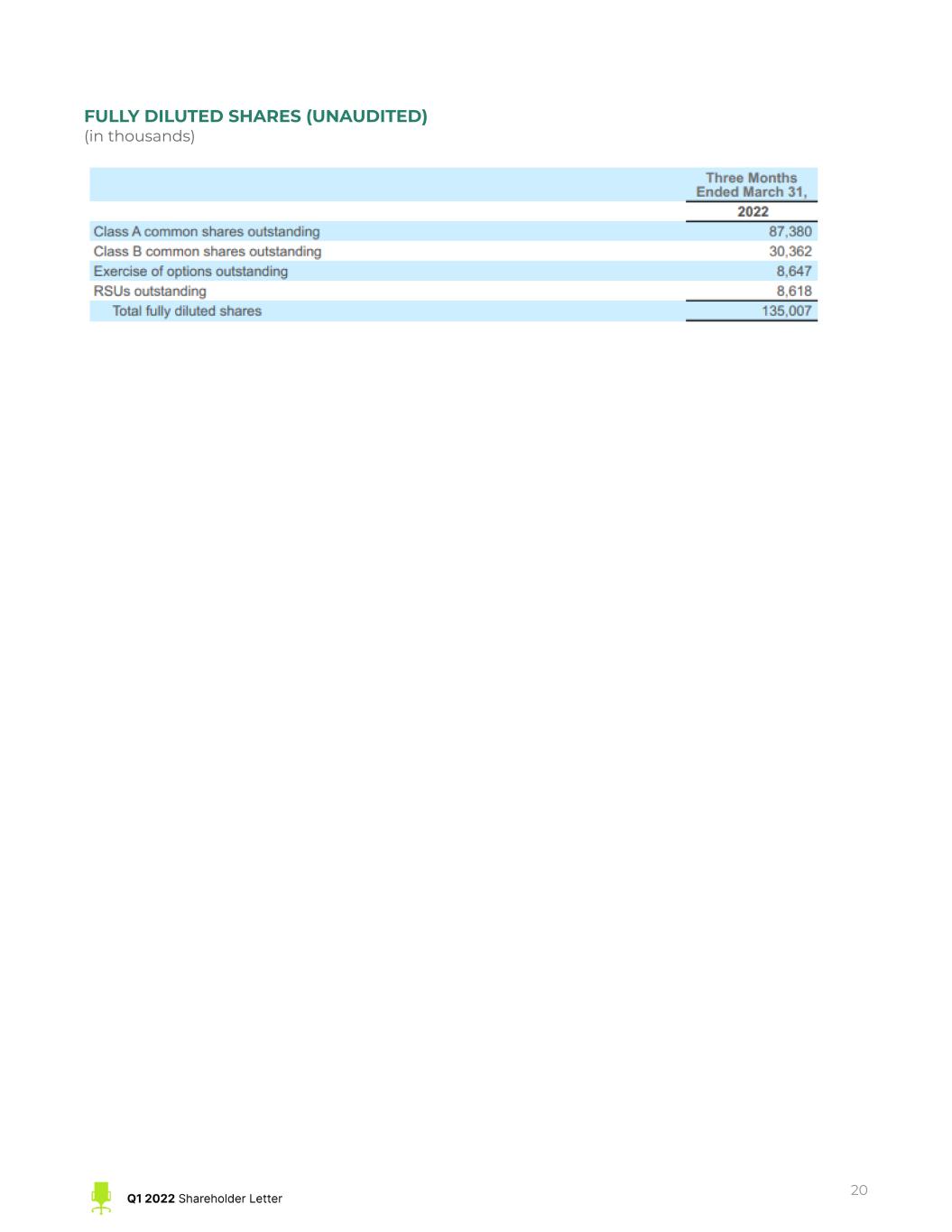

Fully Diluted Shares As of March 31, 2022, ZipRecruiter had a fully diluted capitalization of 135 million shares of Class A common stock and Class B common stock. This fully diluted capitalization share count includes (a) the shares of Class A common stock and Class B common stock outstanding and (b) all shares of Class A common stock and Class B common stock reserved for issuance to settle outstanding stock options and restricted stock units, but does not include shares of Class A common stock and Class B common stock reserved for future issuance of award grants under ZipRecruiter’s equity compensation plans. Cash and Cash Equivalents Cash and cash equivalents was $745 million as of March 31, 2022 compared to $135 million as of March 31, 2021, and $255 million as of December 31, 2021. The increase in cash and cash equivalents y/y and q/q was primarily due to cash flow from operations and a private offering of our Senior Notes due 2030 totaling $550 million at a 5% coupon rate. This was offset by $62 million spent on repurchases of Class A common stock per the $100 million repurchase program announced in March 2022. Under the program, we purchased $50 million in common stock pursuant to an accelerated stock repurchase agreement which concluded in May 2022, and another $12 million in open market purchases. The total count of shares purchased under the accelerated repurchase agreement and open market repurchases was 2.8 million. 11

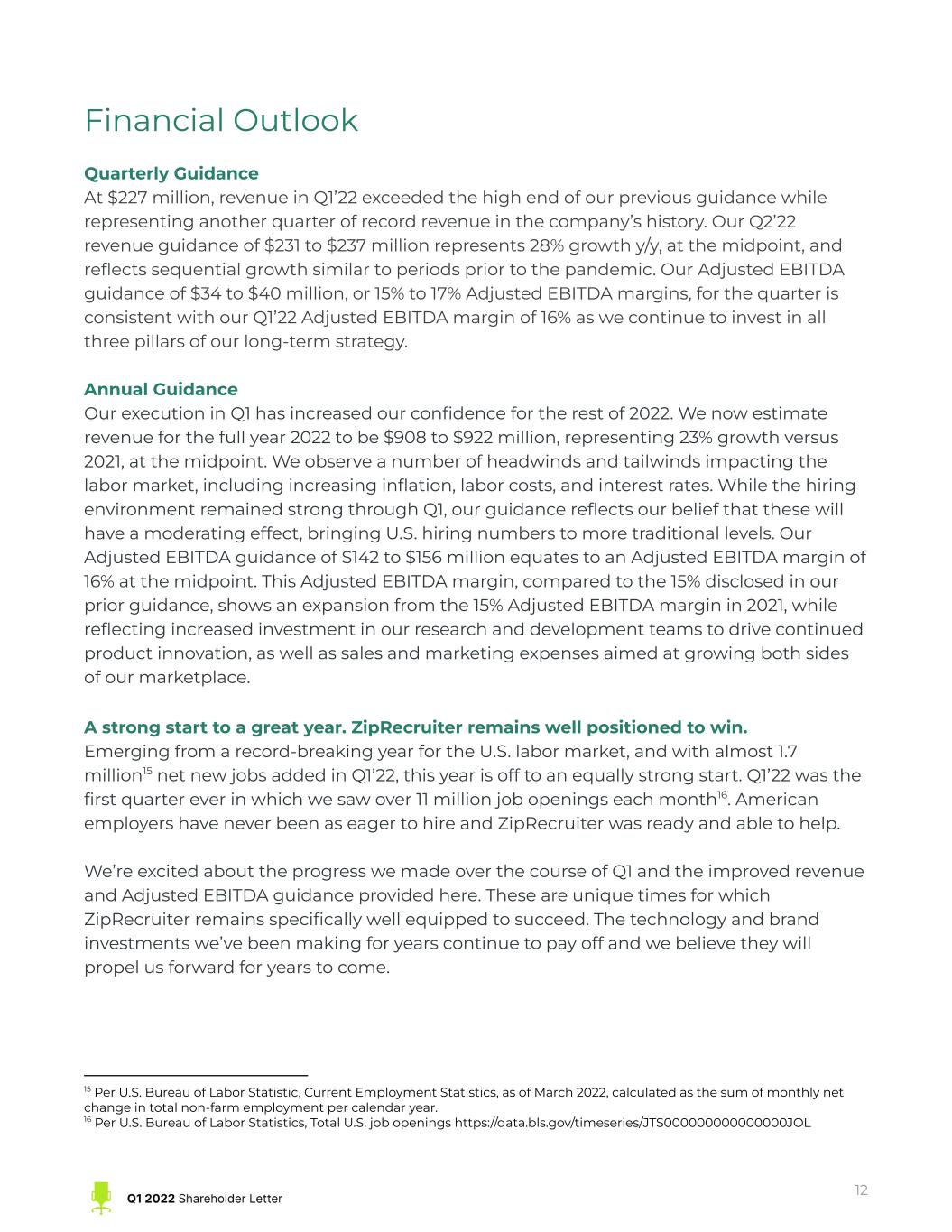

Financial Outlook Quarterly Guidance At $227 million, revenue in Q1’22 exceeded the high end of our previous guidance while representing another quarter of record revenue in the company’s history. Our Q2’22 revenue guidance of $231 to $237 million represents 28% growth y/y, at the midpoint, and reflects sequential growth similar to periods prior to the pandemic. Our Adjusted EBITDA guidance of $34 to $40 million, or 15% to 17% Adjusted EBITDA margins, for the quarter is consistent with our Q1’22 Adjusted EBITDA margin of 16% as we continue to invest in all three pillars of our long-term strategy. Annual Guidance Our execution in Q1 has increased our confidence for the rest of 2022. We now estimate revenue for the full year 2022 to be $908 to $922 million, representing 23% growth versus 2021, at the midpoint. We observe a number of headwinds and tailwinds impacting the labor market, including increasing inflation, labor costs, and interest rates. While the hiring environment remained strong through Q1, our guidance reflects our belief that these will have a moderating effect, bringing U.S. hiring numbers to more traditional levels. Our Adjusted EBITDA guidance of $142 to $156 million equates to an Adjusted EBITDA margin of 16% at the midpoint. This Adjusted EBITDA margin, compared to the 15% disclosed in our prior guidance, shows an expansion from the 15% Adjusted EBITDA margin in 2021, while reflecting increased investment in our research and development teams to drive continued product innovation, as well as sales and marketing expenses aimed at growing both sides of our marketplace. A strong start to a great year. ZipRecruiter remains well positioned to win. Emerging from a record-breaking year for the U.S. labor market, and with almost 1.7 million15 net new jobs added in Q1’22, this year is off to an equally strong start. Q1’22 was the first quarter ever in which we saw over 11 million job openings each month16. American employers have never been as eager to hire and ZipRecruiter was ready and able to help. We’re excited about the progress we made over the course of Q1 and the improved revenue and Adjusted EBITDA guidance provided here. These are unique times for which ZipRecruiter remains specifically well equipped to succeed. The technology and brand investments we’ve been making for years continue to pay off and we believe they will propel us forward for years to come. 16 Per U.S. Bureau of Labor Statistics, Total U.S. job openings https://data.bls.gov/timeseries/JTS000000000000000JOL 15 Per U.S. Bureau of Labor Statistic, Current Employment Statistics, as of March 2022, calculated as the sum of monthly net change in total non-farm employment per calendar year. 12

Thanks again to all of our shareholders for partnering with us. You make it possible for us to continue executing on our mission to actively connect people to their next great opportunity. _______________________________ Ian Siegel Chief Executive Officer _______________________________ David Travers President _______________________________ Tim Yarbrough Chief Financial Officer 13

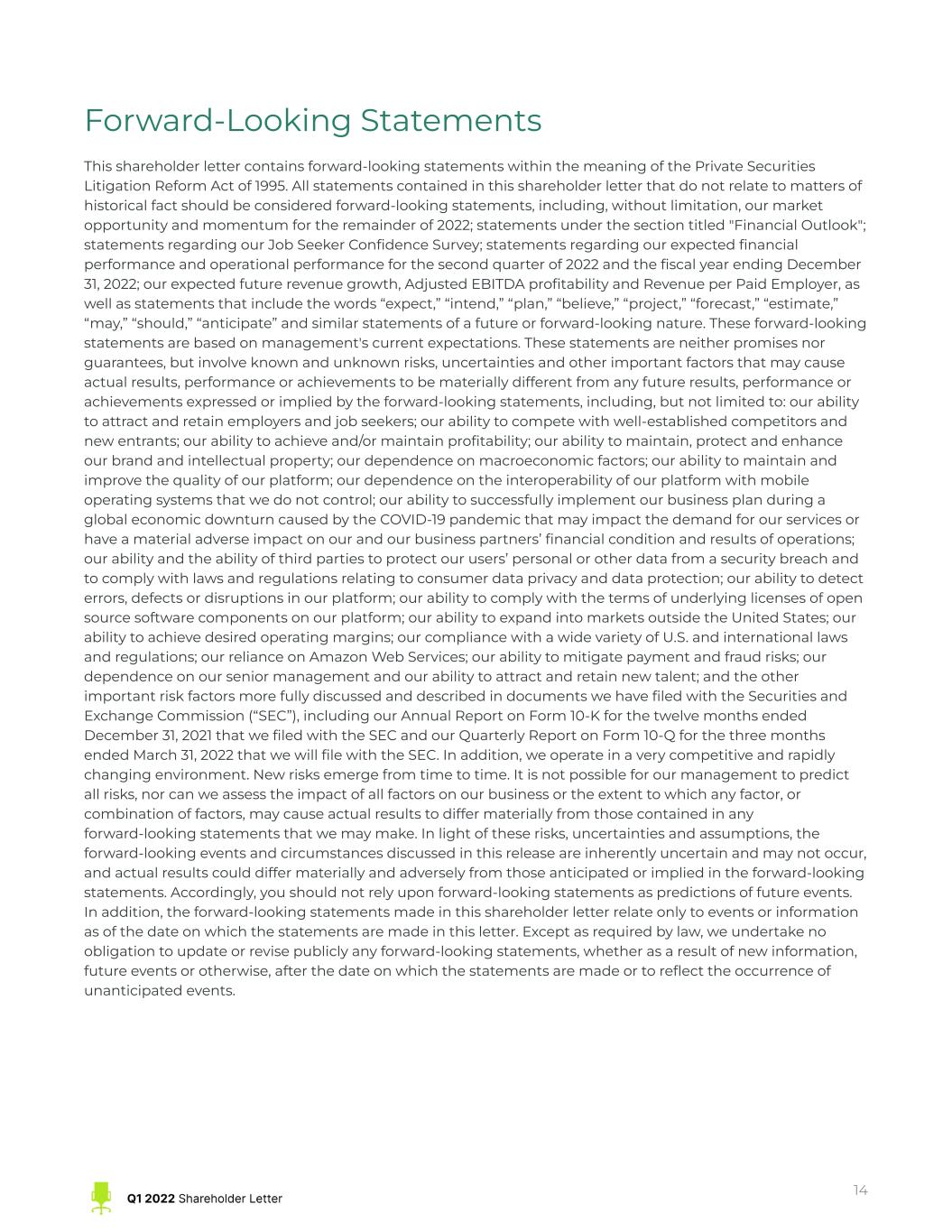

Forward-Looking Statements This shareholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this shareholder letter that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, our market opportunity and momentum for the remainder of 2022; statements under the section titled "Financial Outlook"; statements regarding our Job Seeker Confidence Survey; statements regarding our expected financial performance and operational performance for the second quarter of 2022 and the fiscal year ending December 31, 2022; our expected future revenue growth, Adjusted EBITDA profitability and Revenue per Paid Employer, as well as statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature. These forward-looking statements are based on management's current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: our ability to attract and retain employers and job seekers; our ability to compete with well-established competitors and new entrants; our ability to achieve and/or maintain profitability; our ability to maintain, protect and enhance our brand and intellectual property; our dependence on macroeconomic factors; our ability to maintain and improve the quality of our platform; our dependence on the interoperability of our platform with mobile operating systems that we do not control; our ability to successfully implement our business plan during a global economic downturn caused by the COVID-19 pandemic that may impact the demand for our services or have a material adverse impact on our and our business partners’ financial condition and results of operations; our ability and the ability of third parties to protect our users’ personal or other data from a security breach and to comply with laws and regulations relating to consumer data privacy and data protection; our ability to detect errors, defects or disruptions in our platform; our ability to comply with the terms of underlying licenses of open source software components on our platform; our ability to expand into markets outside the United States; our ability to achieve desired operating margins; our compliance with a wide variety of U.S. and international laws and regulations; our reliance on Amazon Web Services; our ability to mitigate payment and fraud risks; our dependence on our senior management and our ability to attract and retain new talent; and the other important risk factors more fully discussed and described in documents we have filed with the Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K for the twelve months ended December 31, 2021 that we filed with the SEC and our Quarterly Report on Form 10-Q for the three months ended March 31, 2022 that we will file with the SEC. In addition, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements that we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this release are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. In addition, the forward-looking statements made in this shareholder letter relate only to events or information as of the date on which the statements are made in this letter. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. 14

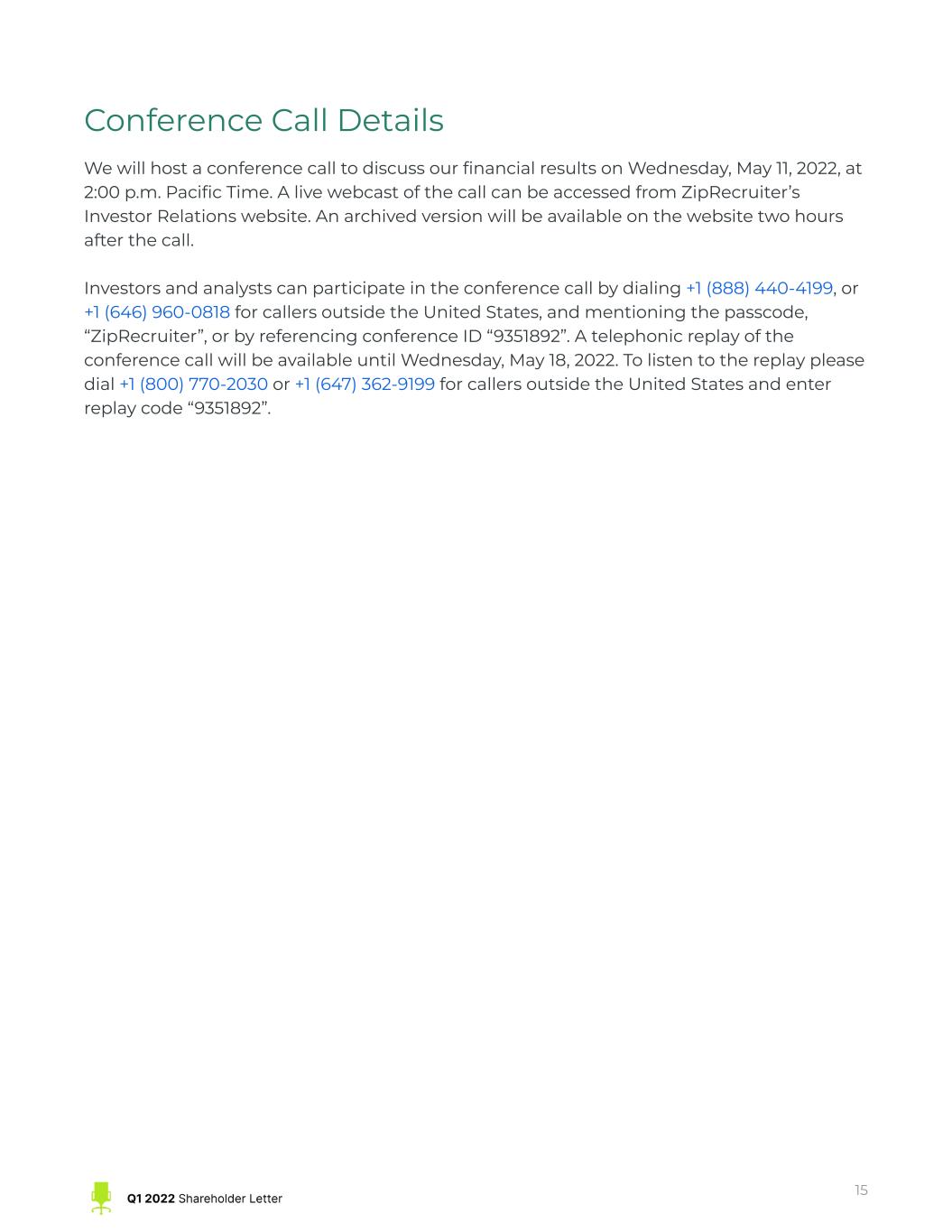

Conference Call Details We will host a conference call to discuss our financial results on Wednesday, May 11, 2022, at 2:00 p.m. Pacific Time. A live webcast of the call can be accessed from ZipRecruiter’s Investor Relations website. An archived version will be available on the website two hours after the call. Investors and analysts can participate in the conference call by dialing +1 (888) 440-4199, or +1 (646) 960-0818 for callers outside the United States, and mentioning the passcode, “ZipRecruiter”, or by referencing conference ID “9351892”. A telephonic replay of the conference call will be available until Wednesday, May 18, 2022. To listen to the replay please dial +1 (800) 770-2030 or +1 (647) 362-9199 for callers outside the United States and enter replay code “9351892”. 15

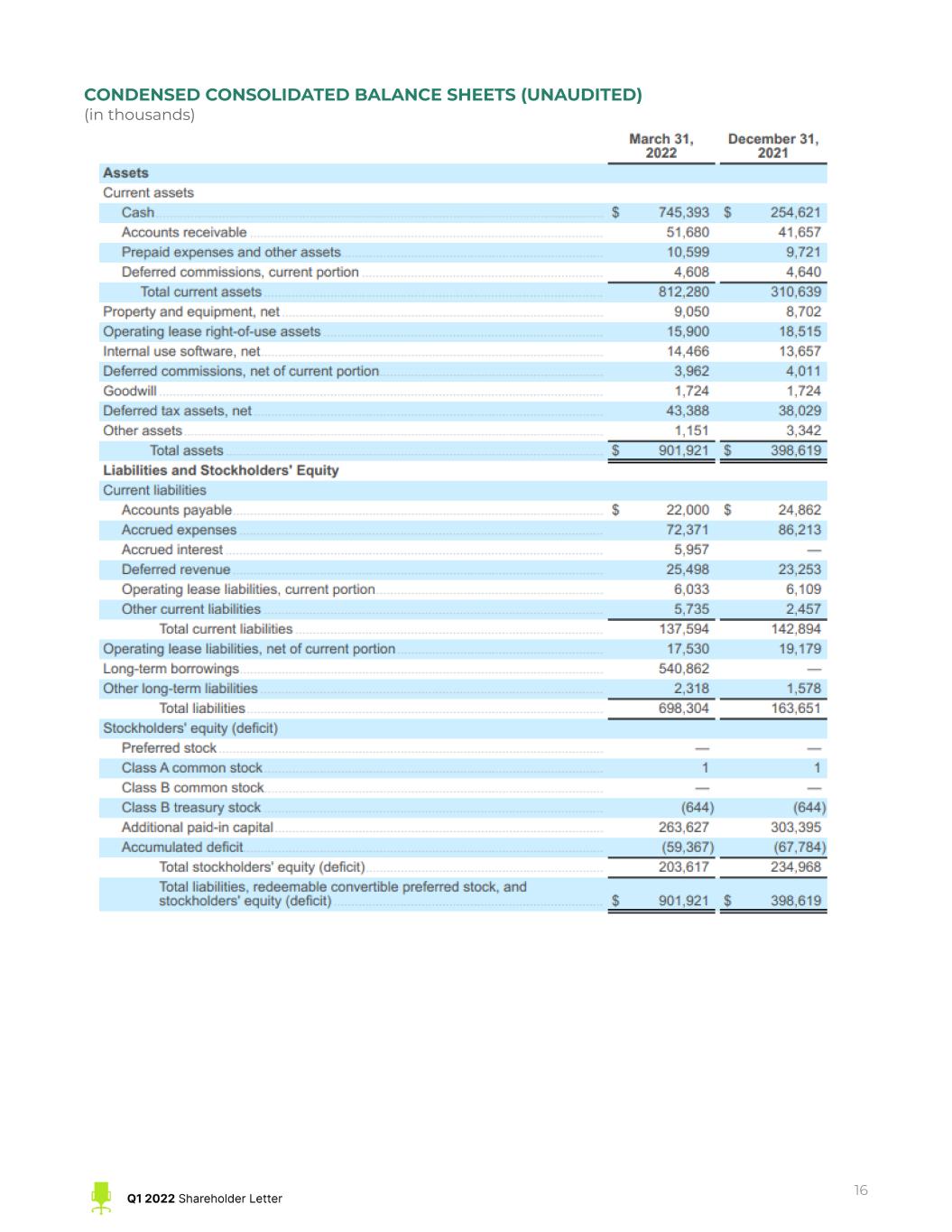

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (in thousands) 16

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (in thousands, except per share amounts) 17

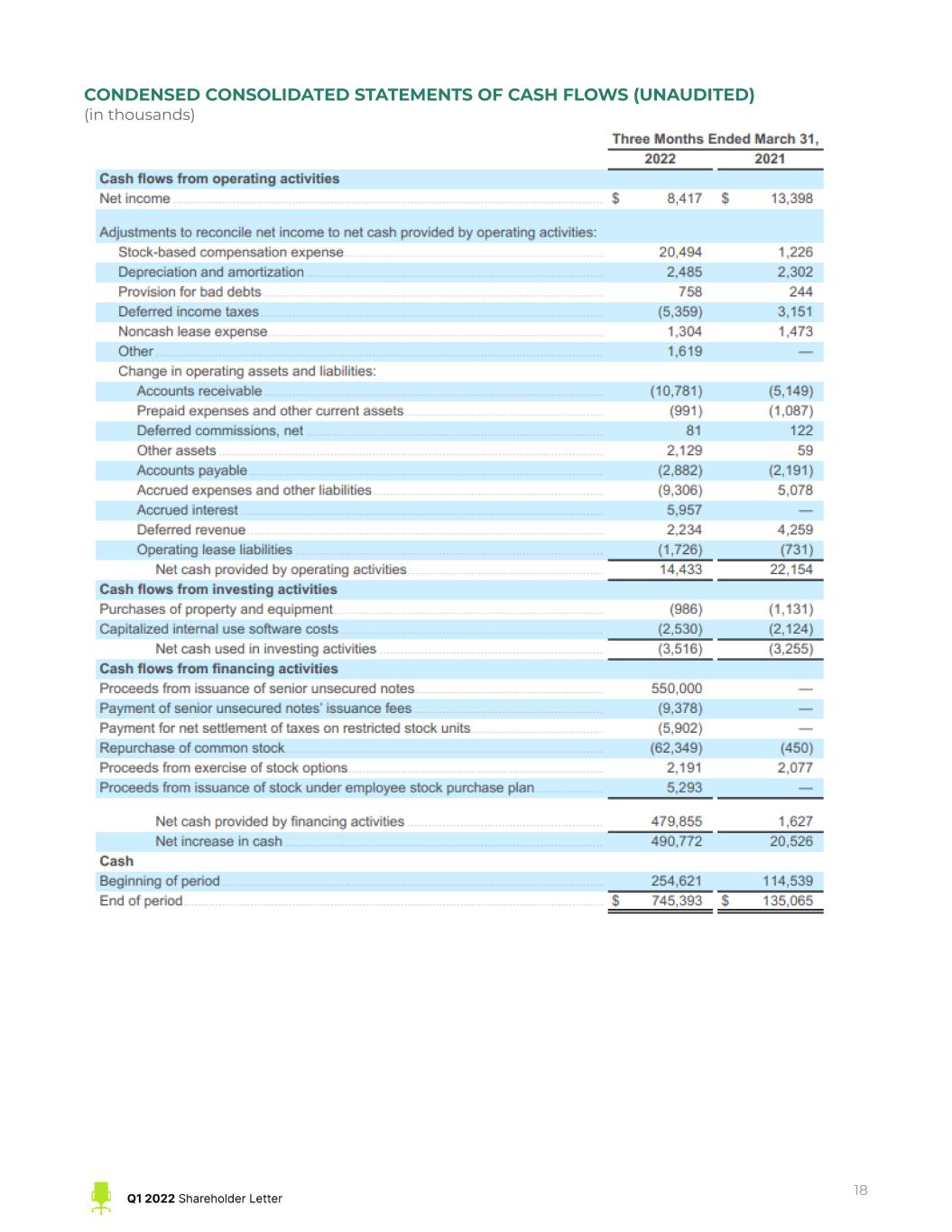

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) (in thousands) 18

RECONCILIATION OF GAAP NET INCOME TO ADJUSTED EBITDA (UNAUDITED) (in thousands, except Adjusted EBITDA margin data) RECONCILIATION OF GAAP TO NON-GAAP COST OF REVENUE (UNAUDITED) (in thousands) RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSES (UNAUDITED) (in thousands) 19

FULLY DILUTED SHARES (UNAUDITED) (in thousands) 20

Key Operating Metrics and Non-GAAP Financial Measures This shareholder letter includes certain key operating metrics, including Quarterly Paid Employers and Revenue per Paid Employer, and non-GAAP financial measures, including Non-GAAP cost of revenue, Non-GAAP operating expenses, Adjusted EBITDA and Adjusted EBITDA margin. We define Paid Employers as any employer(s) (or entities acting on behalf of an employer) on a paying subscription plan or performance marketing campaign for at least one day. Paid Employer(s) excludes employers from our Job Distribution Partners or other indirect channels, employers who are not actively searching for candidates, but otherwise have access to previously posted jobs, and employers on free trial. Job Distribution Partners are defined as third-party sites who have a relationship with us and advertise jobs from our marketplace. Quarterly Paid Employers means, with respect to any fiscal quarter, the count of Paid Employers during such fiscal quarter. Revenue per Paid Employer is the total company revenue in a particular period divided by the count of Quarterly Paid Employers in the same period. We define Non-GAAP cost of revenue as our cost of revenue before stock-based compensation expense, and depreciation and amortization. We define Non-GAAP operating expenses as our operating expenses before stock-based compensation expense, and depreciation and amortization. We define Adjusted EBITDA as our net income (loss) before total other income (expense), net, income tax expense (benefit) and depreciation and amortization, adjusted to eliminate stock-based compensation expense. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of revenue for the same period. Management and our board of directors use these key operating metrics and non-GAAP financial measures as supplemental measures of our performance because they assist us in comparing our operating performance on a consistent basis, as they remove the impact of some items not directly resulting from our core operations. We also use these key operating metrics and non-GAAP financial measures for planning purposes, including the preparation of our internal annual operating budget and financial projections, to evaluate the performance and effectiveness of our strategic initiatives and to evaluate our capacity for capital expenditures to expand our business. Non-GAAP cost of revenue, Non-GAAP operating expenses, Adjusted EBITDA and Adjusted EBITDA margin should not be considered in isolation, as an alternative to, or superior to net income (loss), revenue, cash flows or other measures derived in accordance with GAAP. These non-GAAP measures are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Management believes that the presentation of non-GAAP financial measures is an appropriate measure of operating performance because they eliminate the impact of some expenses that do not relate directly to the performance of our underlying business. These non-GAAP financial measures should not be construed as an inference that our future results will be unaffected by unusual or other items. Additionally, Adjusted EBITDA and Adjusted EBITDA margin are not intended to be a measure of free cash flow for management’s discretionary use, as they do not reflect our tax payments and certain other cash costs that may recur in the future, including, among other things, cash requirements for costs to replace assets being depreciated and amortized. Management compensates for these limitations by relying on our GAAP results in addition to using Adjusted EBITDA and Adjusted EBITDA margin as supplemental measures of our performance. Our measures of Adjusted EBITDA and Adjusted EBITDA margin used herein are not necessarily comparable to similarly titled captions of other companies due to different methods of calculation. We are not able to provide a reconciliation of Adjusted EBITDA and Adjusted EBITDA margin for Q2’22 or the full fiscal year 2022 to net income and net income margin, the comparable GAAP measures, respectively, because certain items that are excluded from non-GAAP financial measures cannot be reasonably predicted or are not in our control. In particular, we are unable to forecast the timing or magnitude of stock-based compensation or amortization of intangible assets, as applicable, without unreasonable efforts, and these items could significantly impact, either individually or in the aggregate, GAAP measures in the future. See the tables above regarding reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures. 21