` Exhibit 99.2

1

2

To Our Shareholders Q2’22 was another exceptionally strong quarter for ZipRecruiter. We generated a record $239.9 million in revenue, up 31% y/y and above our guidance range. We posted net income of $13.1 million and Adjusted EBITDA of $45.4 million. This equates to a net income margin of 5% and an Adjusted EBITDA margin of 19%. We’re proud to exceed guidance again for both revenue and Adjusted EBITDA, maintaining strong profitability even as we continue to make significant investments in our marketplace. In Q2’22 the U.S. labor market continued its record-setting pace, with over 350 thousand1 jobs added each month. This is more than twice2 the pre-pandemic pace. Job growth was broad-based, with the vast majority of industries contributing gains. The labor market also remained tight - with approximately one unemployed person for every two job openings3 for each month in Q2’22. However, despite the strength of the quarter as a whole, and the shortage of talent for currently-open job postings, we began to see employers pulling back on job postings during the final weeks of June. We see our marketplace as a leading indicator for job activity and, as has been widely reported, U.S. job openings fell by over 5% to 10.7 million4 in June 2022. We see signs of a cooling hiring environment, as companies respond to supply chain disruptions, inflation, rising interest rates and macroeconomic uncertainty. In response to this, we are revising our full year 2022 revenue guidance to $890 million, at the midpoint. We were prepared for this moment and, despite the downward revision in revenue guidance, are raising full year Adjusted EBITDA guidance to $170 million, at the midpoint. This represents an adjusted EBITDA margin of 19%, a 3 percentage point increase versus the annual guidance we provided in May, demonstrating the resiliency of our business and our commitment to profitable growth. Our philosophy on investment is unchanged; we constantly measure the ROI of specific initiatives and adjust spend levels up or down accordingly. This investment discipline has been a key aspect of our strong financial performance through a wide range of macroeconomic conditions. Despite signs of macro-economic headwinds, we are confident in our strategic priorities and are focused on capitalizing on the long-term opportunity. Below, we’re thrilled to highlight our progress against the three pillars of our strategy. With over 4 million5 workers quitting their jobs every month for the past 13 months, job seekers are looking for better matches, higher wages, and more flexible schedules. Job seekers need the right tools to help them find the right job. Employers need the best technology to surface the right 5 Per Federal Reserve Economic Data, total non-farm quits, seasonally adjusted, from June 2021 to June 2022. 4 Per U.S. Bureau of Labor Statistics, Total U.S. job openings, as of June 2022. 3 Per U.S. Bureau of Labor Statistics, Number of unemployed persons per job opening, seasonally adjusted, as of June 2022, for the periods April, May and June 2022. 2 Per U.S. Bureau of Labor Statistics, Current Employment Statistics, calculated as the average net change in total non-farm employment per calendar month for January - December 2019 vs April - June 2022. 1 Per U.S. Bureau of Labor Statistics, Current Employment Statistics, as of June 2022, calculated as net change in total non-farm employment per calendar month. 3

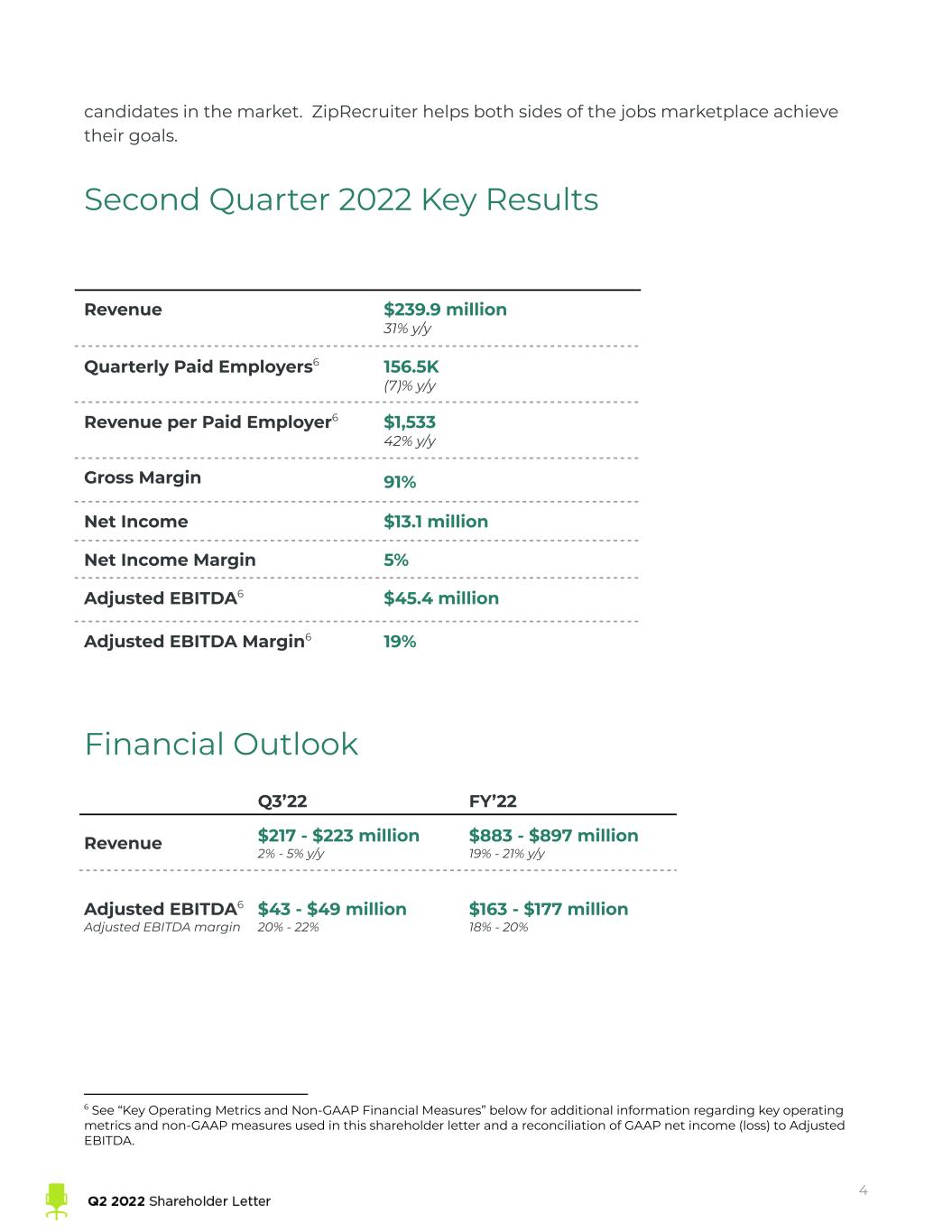

candidates in the market. ZipRecruiter helps both sides of the jobs marketplace achieve their goals. Second Quarter 2022 Key Results Revenue $239.9 million 31% y/y Quarterly Paid Employers6 156.5K (7)% y/y Revenue per Paid Employer6 $1,533 42% y/y Gross Margin 91% Net Income $13.1 million Net Income Margin 5% Adjusted EBITDA6 $45.4 million Adjusted EBITDA Margin6 19% Financial Outlook Q3’22 FY’22 Revenue $217 - $223 million 2% - 5% y/y $883 - $897 million 19% - 21% y/y Adjusted EBITDA6 Adjusted EBITDA margin $43 - $49 million 20% - 22% $163 - $177 million 18% - 20% 6 See “Key Operating Metrics and Non-GAAP Financial Measures” below for additional information regarding key operating metrics and non-GAAP measures used in this shareholder letter and a reconciliation of GAAP net income (loss) to Adjusted EBITDA. 4

Growth Strategies and Recent Progress In Q2’22 we continued to make progress against the three key pillars of our strategy: 1) increase the number of employers in our marketplace, 2) increase the number of job seekers in our marketplace, and 3) make our matching technology smarter over time. Growth Strategy #1: Increase the number of employers in our marketplace Total paid employers increased to 157 thousand in Q2’22 from 150 thousand in Q1’22, consistent with sequential growth we saw during Q2 in the years prior to the pandemic. On a year-over-year basis, paid employers decreased by 7%, reflecting the surge in hiring demand last year as employers rushed to keep pace with the reopening of the American economy. ZipRecruiter works for employers of all sizes and across all industries. Building on our roots of successfully helping small and medium businesses hire the talent they need, we’ve continued to win and grow business among larger, enterprise employers. These employers traditionally use a separate applicant tracking system (ATS) and prefer to pay for candidates on a performance basis. In Q2’22 performance-based revenue grew 66% y/y, increasing to 22% of total revenue, compared to 17% in Q2’21. This demonstrates our ability to win with the most sophisticated of employers. In Q2’22 we made a number of improvements to one of our employers’ favorite features: Invite to Apply, which allows employers to identify strong fit potential candidates and invite them to apply to their job. Employers love the ability to communicate directly with job seekers and job seekers love the personal touch of Invite to Apply. In Q2’22, we introduced a number of onboarding and engagement improvements. Thanks to these improvements employers sent over 10% more invitations and received over 10% more responses, on average. In Q2’22, employers sent more than 1 million invitations to apply. We believe this novel experience of employers going first is at the core of how ZipRecruiter is disrupting the traditional labor market. Growth Strategy #2: Increase the number of job seekers in our marketplace We made significant progress against our second growth strategy of increasing the number of job seekers in our marketplace. Over the last several quarters, we have been weaving our helpful, AI-enabled personal recruiter named Phil through specific parts of our job seekers’ journeys. In Q2’22 we introduced the world to our first end-to-end job search experience featuring Phil. Phil now walks job seekers through their entire job search journey, greeting the job seeker at the start, getting to know their job search goals and providing a curated list of Great Match jobs based on the job 5

seeker’s inputs, resume, interaction with jobs, and even data from other job seekers with similar goals and backgrounds. Job seekers love Phil because he’s an expert guide and partner in an otherwise opaque process. Armed with the billions of interactions across millions of jobs and job seekers in our marketplace, Phil now also gives job seekers useful data to encourage them on their journey and set them up for success. For example, Phil shows job seekers the number of job opportunities in their area, the number of companies hiring and even average pay ranges. Job seekers are better equipped for the job search, thanks to Phil. Since ZipRecruiter’s inception, our marketing efforts have focused on attracting employers into our marketplace. With hundreds of millions of dollars invested to-date, we enjoy over 80%7 aided brand recognition among U.S. employers. In 2021 we began applying this disciplined marketing approach towards job seekers, endeavoring to build the kind of brand recognition that we have with employers. In Q2’22, for example, we partnered with Illumination’s Minions: The Rise of Gru to create a suite of video assets which aired across multiple channels. 7 Based on our ZipRecruiter Brand Awareness Survey, 2022, an internal company-designed survey of 573 participants, which included (1) certain persons who had been involved in hiring processes and had used, or intended to use, online job posting websites within the preceding two years in connection with such hiring processes, (2) decision makers at hiring sites or systems, or influencers in the process of hiring candidates and (3) business owners, human resource managers, and non-human resource managers for various small, medium and large U.S.-based companies. The survey responses were used to measure brand health dimensions for us within the U.S. employer market and to explore how we benchmark against our competition. We designed the Brand Awareness Survey in accordance with what we believe are best practices for conducting a survey. Nevertheless, while we believe this survey is reliable, it involves a number of assumptions and limitations, and no independent sources have verified such a survey. 6

We're excited by what we're seeing from these investments. Initiatives like these and many others have driven 70%+8 aided brand awareness among U.S. job seekers, an all-time high for ZipRecruiter. Growth Strategy #3: Make our matching technology smarter over time Superior, algorithmic matching remains a core focus, bringing job seekers and employers together faster. Our matching algorithms learn and improve from employers’ and job seekers’ actions over time. For example, our technology takes into account the attributes of a job seeker receiving a Thumbs Up from an employer, scans the profiles of the millions of job seekers in our marketplace and suggests other Great Match candidates for the job. This means that the longer an employer uses ZipRecruiter, the better our matching algorithms work. In fact, during Q2'22, the average Paid Employer who joined over a year ago received 4 times more Great Matches than those joining within the past year. We surface the right jobs to the right job seekers in many ways, including email and in-app notifications. In Q2 we introduced an algorithmic improvement which can better predict a job seeker’s interest in a given job. With this algorithm powering our email alerts, our job seekers enjoy a more individually-curated set of results. This resulted in a 6% increase in engagement while significantly streamlining the presentation of job ads to the job seeker. Better matching is a journey. Improvements like these have an immediate, positive effect for our job seekers and employers. This benefit grows over time as our algorithms learn and apply the wisdom of the crowds to drive even better matches faster. Investing in our people and community We recently made a key promotion on our executive team. Elliot Wilson was promoted from SVP of Sales and Support to EVP of Sales and Support. Elliot joined ZipRecruiter in February 2017 and has been instrumental in scaling our sales, customer success, and operations organizations. We are delighted to welcome Elliot to the executive team, leading the charge for continued growth. 8 Based on our ZipRecruiter Brand Awareness Survey, 2022, an internal company-designed survey of 2,133 job seekers who either (1) are actively seeking a new job, (2) have engaged in a job search in the past year but are no longer active or (3) are open to a new job opportunity but not actively seeking. The survey responses were used to measure brand health dimensions for us within the U.S. job seeker market and to explore how we benchmark against our competition. We designed the Brand Awareness Survey in accordance with what we believe are best practices for conducting a survey. Nevertheless, while we believe this survey is reliable, it involves a number of assumptions and limitations, and no independent sources have verified such a survey. 7

ZipRecruiter has once again received awards recognizing us among the best places to work. In Q2’22, ZipRecruiter made the Inc. Best Workplaces list, which showcases companies that do the most to support their employees and keep them engaged. ZipRecruiter was also selected to be on Newsweek’s Most Loved Workplaces list, ranking among the top companies recognized for employee happiness, satisfaction and emotional connection. Lastly, ZipRecruiter was recognized by Comparably as one of the best companies for career growth, based on employees’ anonymous ratings of their professional development opportunities. ZipRecuiter’s commitment to our employees starts with our leadership team and we are proud that ZipRecruiter also won Comparably awards for “Best CEOs for Diversity” and “Best CEOs for Women.” We are honored to win these awards and they represent our commitment to our mission, our employees and our communities. Inc. is a registered trademark of Mansueto Ventures LLC. 8

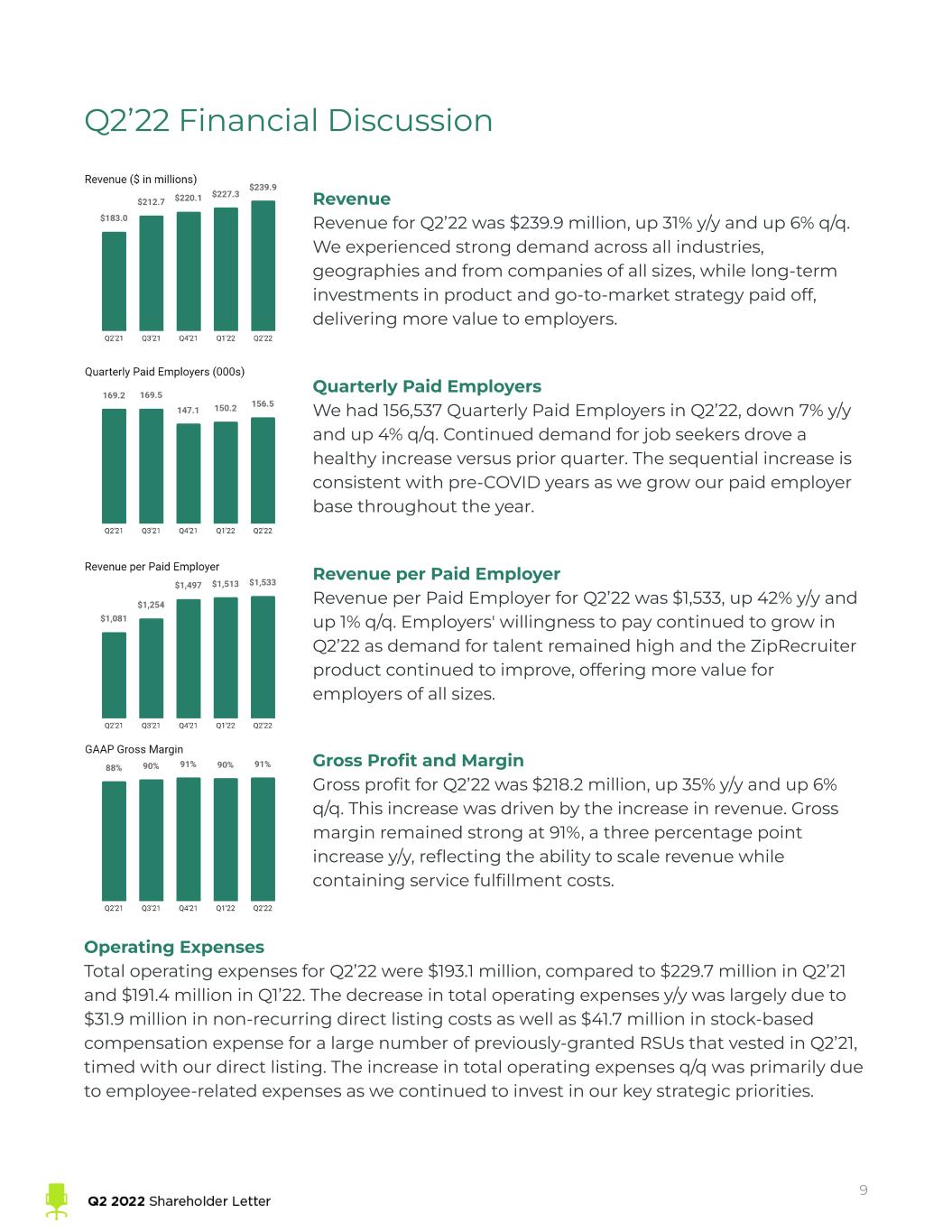

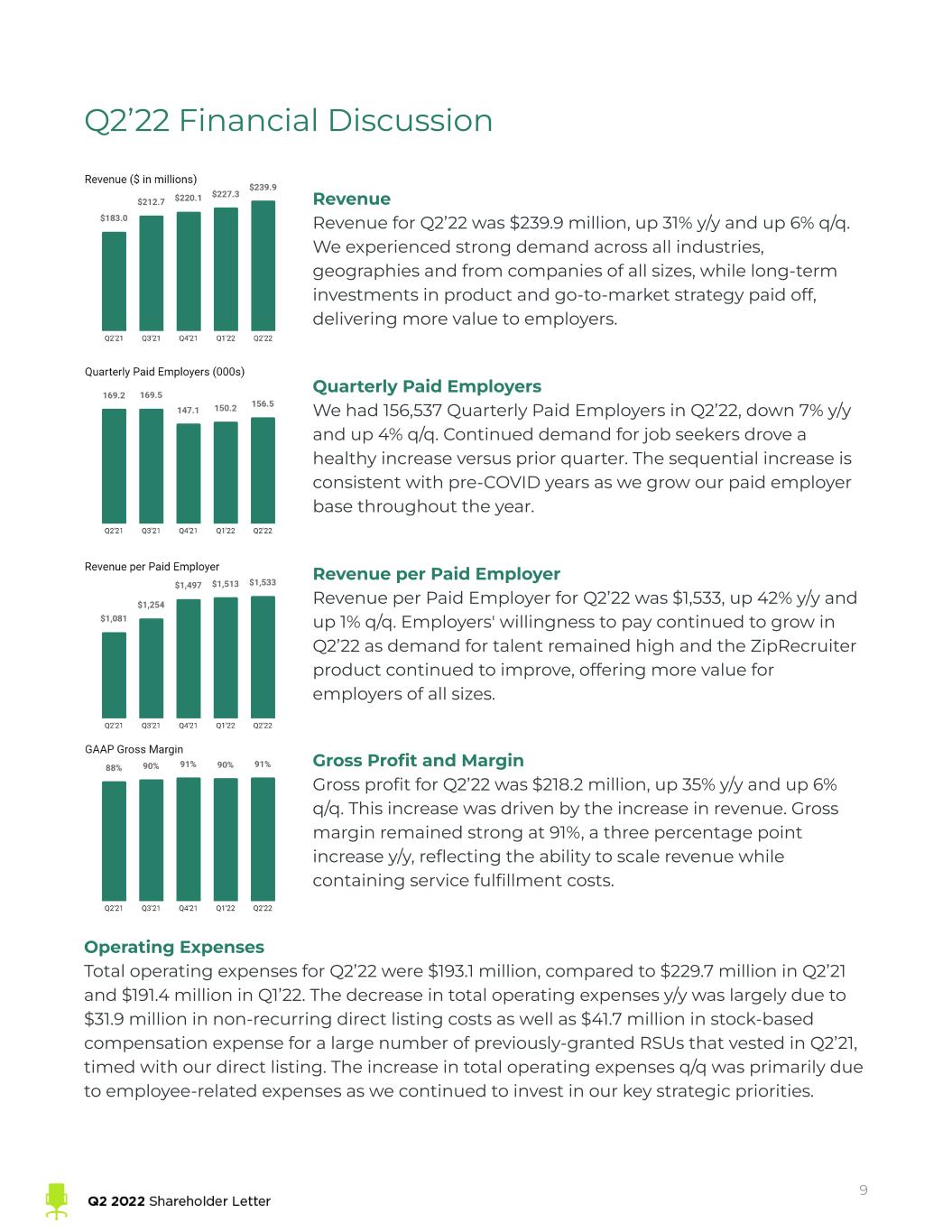

Q2’22 Financial Discussion Revenue Revenue for Q2’22 was $239.9 million, up 31% y/y and up 6% q/q. We experienced strong demand across all industries, geographies and from companies of all sizes, while long-term investments in product and go-to-market strategy paid off, delivering more value to employers. Quarterly Paid Employers We had 156,537 Quarterly Paid Employers in Q2’22, down 7% y/y and up 4% q/q. Continued demand for job seekers drove a healthy increase versus prior quarter. The sequential increase is consistent with pre-COVID years as we grow our paid employer base throughout the year. Revenue per Paid Employer Revenue per Paid Employer for Q2’22 was $1,533, up 42% y/y and up 1% q/q. Employers' willingness to pay continued to grow in Q2’22 as demand for talent remained high and the ZipRecruiter product continued to improve, offering more value for employers of all sizes. Gross Profit and Margin Gross profit for Q2’22 was $218.2 million, up 35% y/y and up 6% q/q. This increase was driven by the increase in revenue. Gross margin remained strong at 91%, a three percentage point increase y/y, reflecting the ability to scale revenue while containing service fulfillment costs. Operating Expenses Total operating expenses for Q2’22 were $193.1 million, compared to $229.7 million in Q2’21 and $191.4 million in Q1’22. The decrease in total operating expenses y/y was largely due to $31.9 million in non-recurring direct listing costs as well as $41.7 million in stock-based compensation expense for a large number of previously-granted RSUs that vested in Q2’21, timed with our direct listing. The increase in total operating expenses q/q was primarily due to employee-related expenses as we continued to invest in our key strategic priorities. 9

Sales and Marketing (S&M) expenses were $136.6 million in Q2’22, or 57% of revenue, compared to $114.2 million, or 62% of revenue, in Q2’21, and $137.6 million, or 61% of revenue, in Q1’22. The decrease in sales and marketing expense q/q was primarily driven by a lower investment in media marketing in the current quarter. Research and Development (R&D) expenses were $30.9 million in Q2’22, or 13% of revenue, compared to $37.9 million, or 21% of revenue, in Q2’21, and $29.6 million, or 13% of revenue, in Q1’22. The increase in research and development expenses q/q was primarily driven by an increase in product and engineering headcount-related expenses in the current quarter. General and Administrative (G&A) expenses were $25.5 million in Q2’22, or 11% of revenue, compared to $77.6 million, or 42% of revenue, in Q2’21, and $24.2 million, or 11% of revenue, in Q1’22. The increase in general and administrative expenses q/q was primarily driven by an increase in professional services and other headcount-related expenses in the current quarter. Net Income (Loss) and Adjusted EBITDA Net income in Q2’22 was $13.1 million, compared to a net loss of $(52.8) million in Q2’21 and net income of $8.4 million in Q1’22. Adjusted EBITDA was $45.4 million, equating to a margin of 19%, in Q2’22, compared to $(1.7) million, with a margin of -1%, in Q2’21 and $37.2 million, with a margin of 16%, in Q1’22. The increase in net income and Adjusted EBITDA y/y was primarily driven by higher revenue and larger non-recurring costs timed with our direct listing in Q2’21. The increase in net income and Adjusted EBITDA q/q was primarily due to higher revenue. Fully Diluted Shares As of June 30, 2022, ZipRecruiter had a fully diluted capitalization of 130.0 million shares of Class A common stock and Class B common stock. This fully diluted capitalization share count includes (a) the shares of Class A common stock and Class B common stock outstanding and (b) all shares of Class A common stock and Class B common stock reserved for issuance to settle outstanding stock options and restricted stock units, but 10

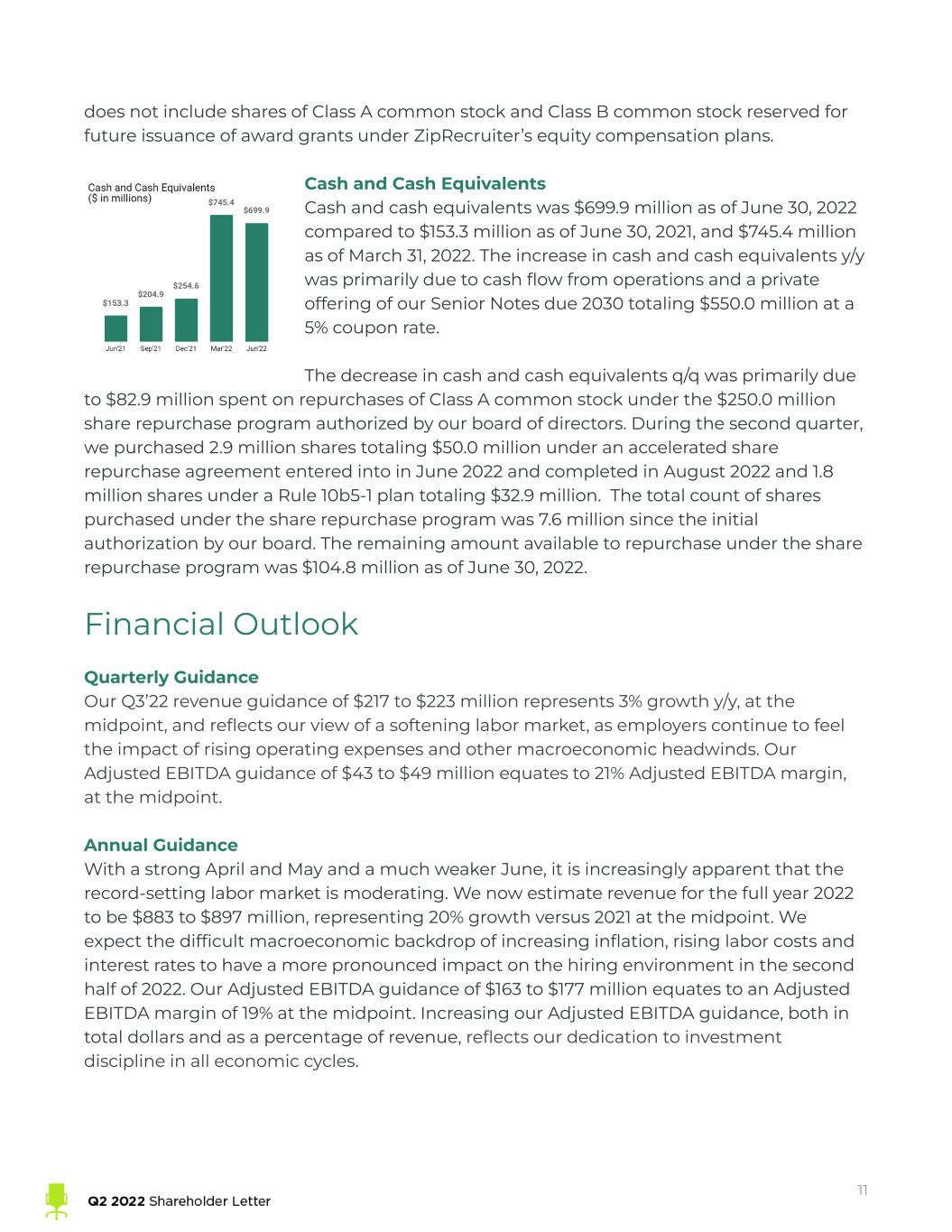

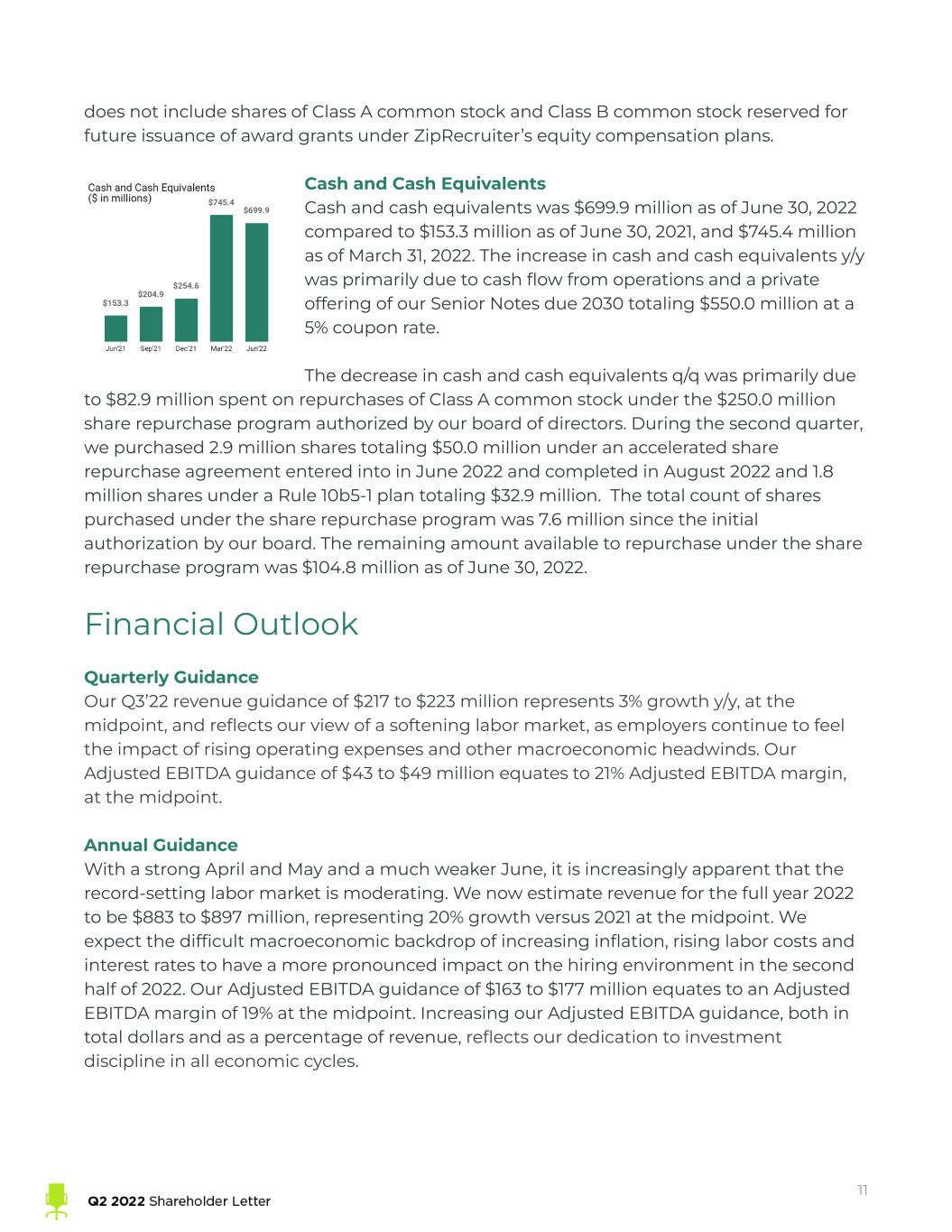

does not include shares of Class A common stock and Class B common stock reserved for future issuance of award grants under ZipRecruiter’s equity compensation plans. Cash and Cash Equivalents Cash and cash equivalents was $699.9 million as of June 30, 2022 compared to $153.3 million as of June 30, 2021, and $745.4 million as of March 31, 2022. The increase in cash and cash equivalents y/y was primarily due to cash flow from operations and a private offering of our Senior Notes due 2030 totaling $550.0 million at a 5% coupon rate. The decrease in cash and cash equivalents q/q was primarily due to $82.9 million spent on repurchases of Class A common stock under the $250.0 million share repurchase program authorized by our board of directors. During the second quarter, we purchased 2.9 million shares totaling $50.0 million under an accelerated share repurchase agreement entered into in June 2022 and completed in August 2022 and 1.8 million shares under a Rule 10b5-1 plan totaling $32.9 million. The total count of shares purchased under the share repurchase program was 7.6 million since the initial authorization by our board. The remaining amount available to repurchase under the share repurchase program was $104.8 million as of June 30, 2022. Financial Outlook Quarterly Guidance Our Q3’22 revenue guidance of $217 to $223 million represents 3% growth y/y, at the midpoint, and reflects our view of a softening labor market, as employers continue to feel the impact of rising operating expenses and other macroeconomic headwinds. Our Adjusted EBITDA guidance of $43 to $49 million equates to 21% Adjusted EBITDA margin, at the midpoint. Annual Guidance With a strong April and May and a much weaker June, it is increasingly apparent that the record-setting labor market is moderating. We now estimate revenue for the full year 2022 to be $883 to $897 million, representing 20% growth versus 2021 at the midpoint. We expect the difficult macroeconomic backdrop of increasing inflation, rising labor costs and interest rates to have a more pronounced impact on the hiring environment in the second half of 2022. Our Adjusted EBITDA guidance of $163 to $177 million equates to an Adjusted EBITDA margin of 19% at the midpoint. Increasing our Adjusted EBITDA guidance, both in total dollars and as a percentage of revenue, reflects our dedication to investment discipline in all economic cycles. 11

We believe ZipRecruiter is the right solution at all stages of the economic cycle Q2’22 marked yet another record for ZipRecruiter, with all-time highs in revenue and Revenue per Paid Employer. ZipRecruiter was ready to help U.S. employers respond to the accelerated demand for talent, investing along our three strategic pillars to drive better outcomes for both employers and job seekers. After several quarters of outsized hiring activity, we enter a cooling macroeconomic environment, and remain similarly ready to respond. Even as we see pockets of soft demand among employers, we believe our disciplined approach to capital allocation will result in even more profitable growth in 2022, even as we continue making significant investments for long-term success. At all stages of the macroeconomic cycle, our mission remains our guiding star. As hiring demand moderates, the need to help job seekers will only become more pronounced. ZipRecruiter helps job seekers find great jobs, respond quickly and stand out. We do all of this with best-in-class advanced AI-enabled matching. Thanks again to all of our shareholders for partnering with us. You make it possible for us to continue executing on our mission to actively connect people to their next great opportunity. _______________________________ Ian Siegel Chief Executive Officer _______________________________ David Travers President _______________________________ Tim Yarbrough Chief Financial Officer 12

Forward-Looking Statements This shareholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this shareholder letter that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, our market opportunity and expected hiring activity for the remainder of 2022; statements under the section titled "Financial Outlook"; statements regarding our expected financial performance and operational performance for the third quarter of 2022 and the fiscal year ending December 31, 2022; our expected future revenue growth, Adjusted EBITDA profitability and Revenue per Paid Employer, as well as statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature. These forward-looking statements are based on management's current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: our ability to attract and retain employers and job seekers; our ability to compete with well-established competitors and new entrants; our ability to achieve and/or maintain profitability; our ability to maintain, protect and enhance our brand and intellectual property; our dependence on macroeconomic factors; our ability to maintain and improve the quality of our platform; our dependence on the interoperability of our platform with mobile operating systems that we do not control; our ability to successfully implement our business plan during a global economic downturn caused by the COVID-19 pandemic that may impact the demand for our services or have a material adverse impact on our and our business partners’ financial condition and results of operations; our ability and the ability of third parties to protect our users’ personal or other data from a security breach and to comply with laws and regulations relating to consumer data privacy and data protection; our ability to detect errors, defects or disruptions in our platform; our ability to comply with the terms of underlying licenses of open source software components on our platform; our ability to expand into markets outside the United States; our ability to achieve desired operating margins; our compliance with a wide variety of U.S. and international laws and regulations; our reliance on Amazon Web Services; our ability to mitigate payment and fraud risks; our dependence on our senior management and our ability to attract and retain new talent; and the other important risk factors more fully discussed and described in documents we have filed with the Securities and Exchange Commission (“SEC”), including our Quarterly Report on Form 10-Q for the three months ended March 31, 2022 that we filed with the SEC and our Quarterly Report on Form 10-Q for the three months ended June 30, 2022 that we will file with the SEC. In addition, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements that we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this release are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. In addition, the forward-looking statements made in this shareholder letter relate only to events or information as of the date on which the statements are made in this letter. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. 13

Conference Call Details We will host a conference call to discuss our financial results on Monday, August 15, 2022, at 2:00 p.m. Pacific Time. A live webcast of the call can be accessed from ZipRecruiter’s Investor Relations website. An archived version will be available on the website two hours after the call. Investors and analysts can participate in the conference call by dialing +1 (888) 440-4199, or +1 (646) 960-0818 for callers outside the United States, and mentioning the passcode, “ZipRecruiter”, or by referencing conference ID “9351892”. A telephonic replay of the conference call will be available until Monday, August 22, 2022. To listen to the replay please dial +1 (800) 770-2030 or +1 (647) 362-9199 for callers outside the United States and enter replay code “9351892”. 14

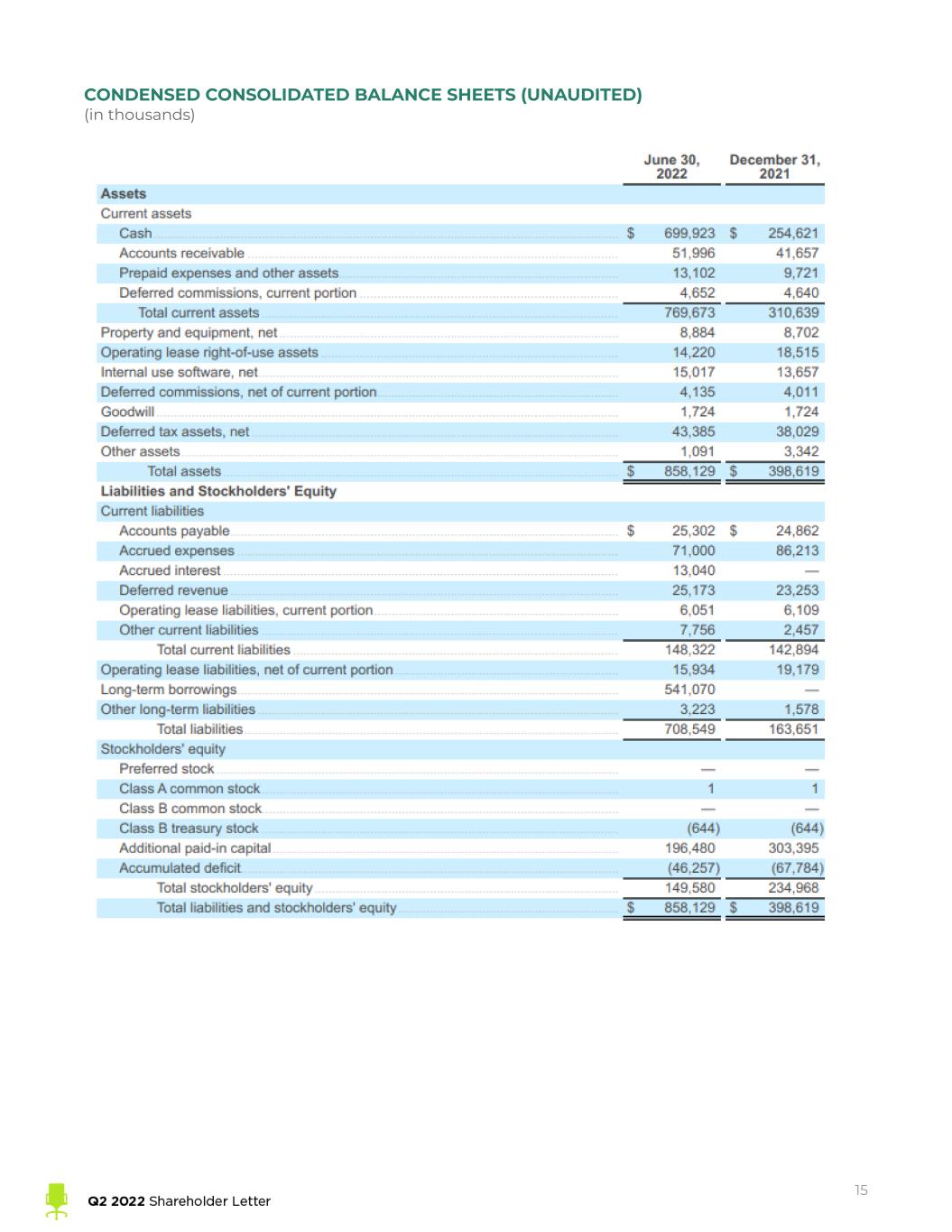

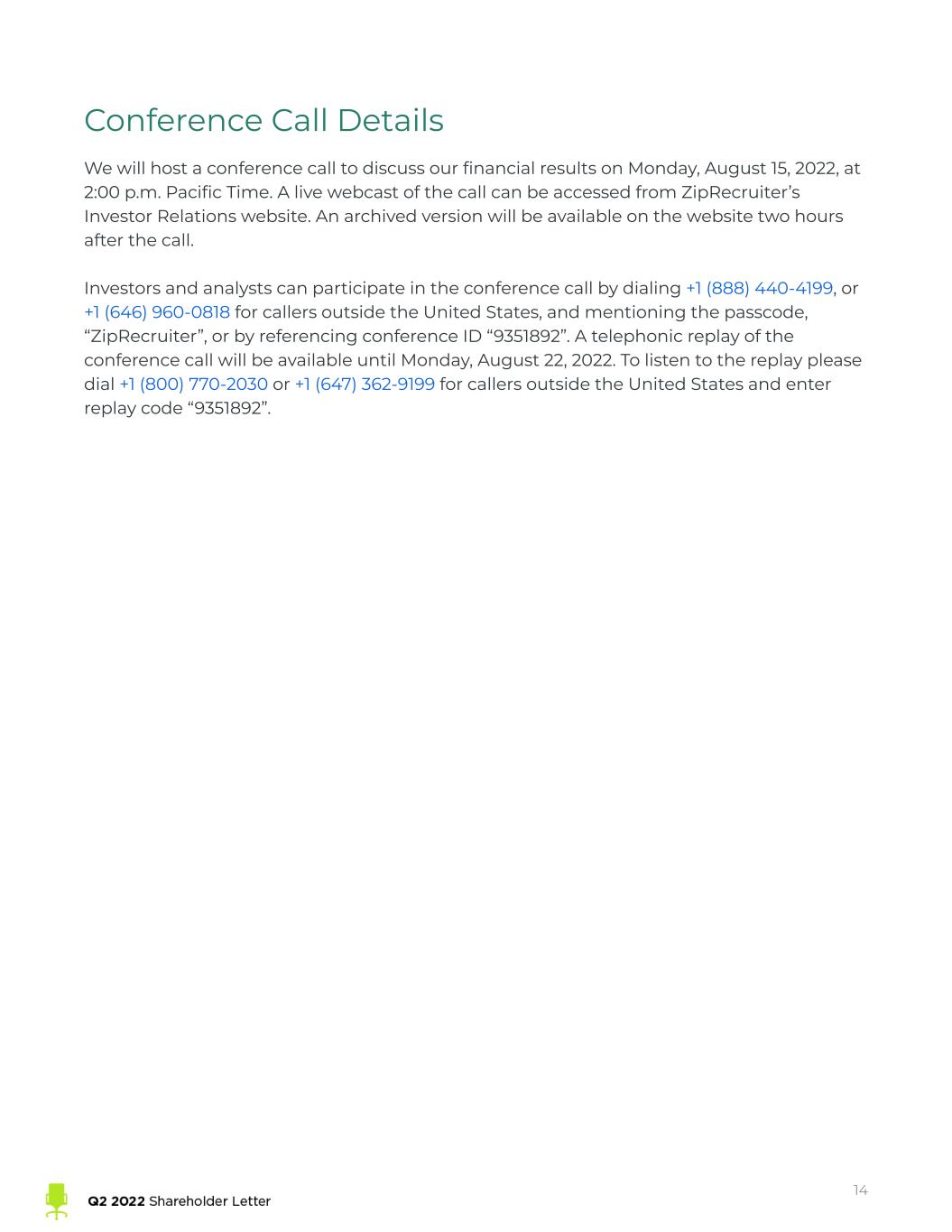

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (in thousands) 15

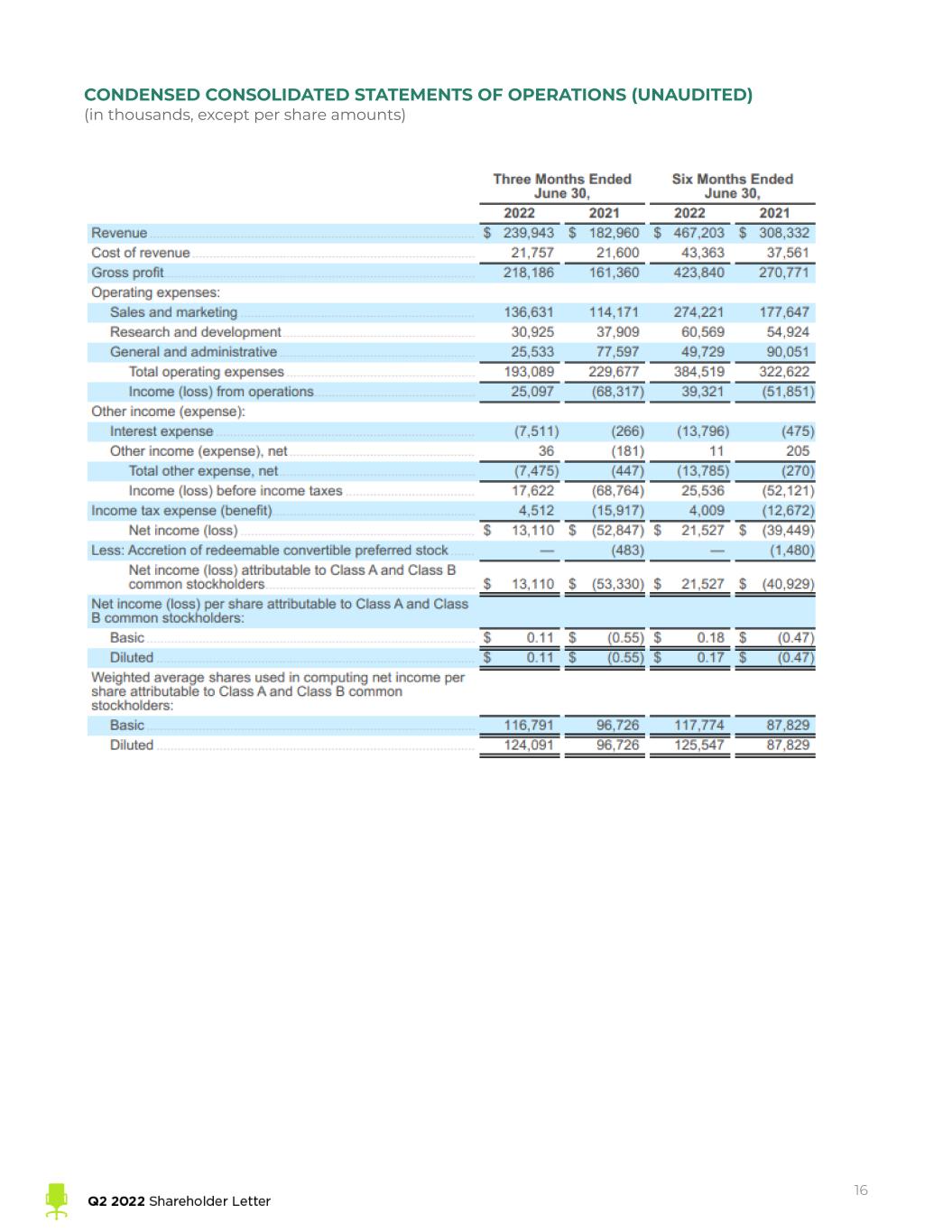

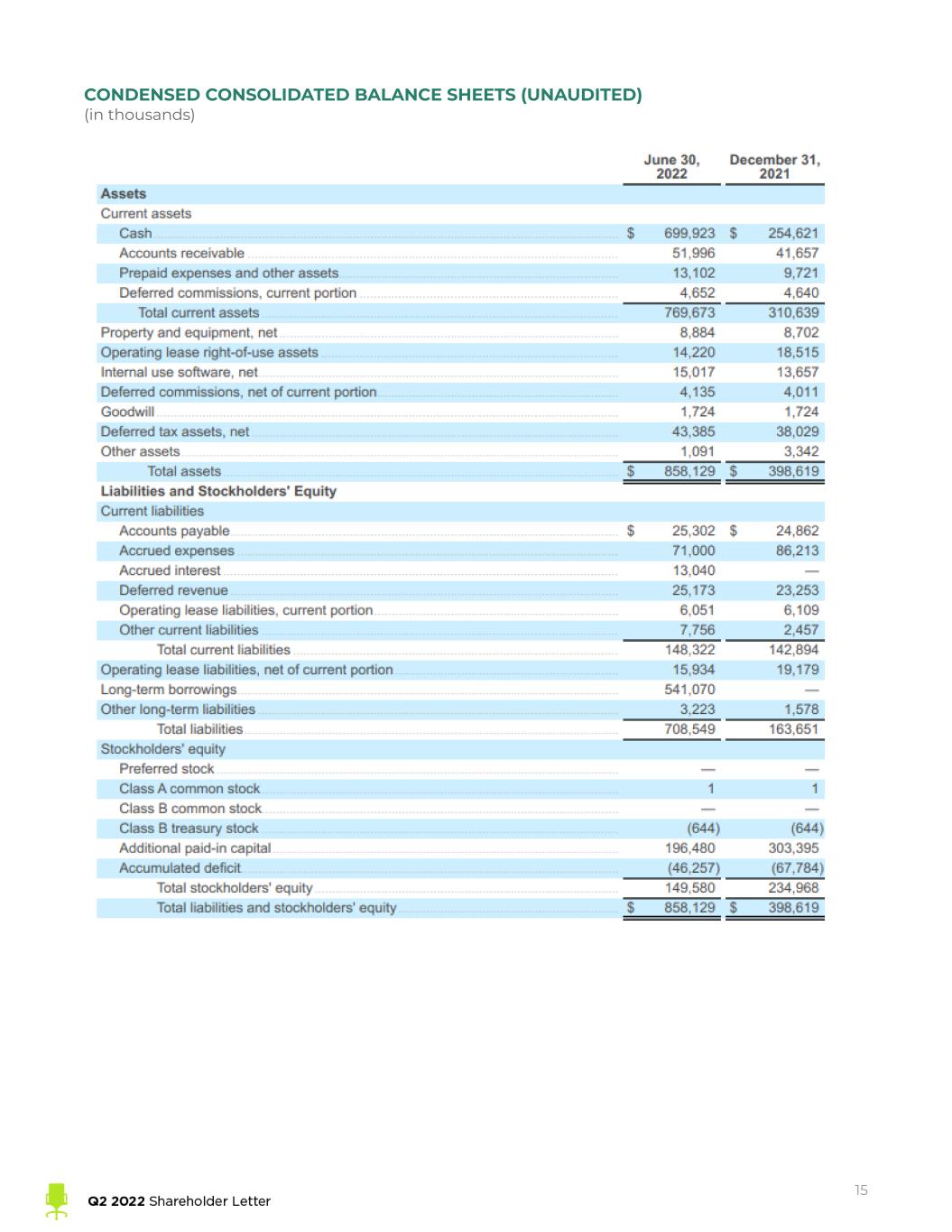

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (in thousands, except per share amounts) 16

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) (in thousands) 17

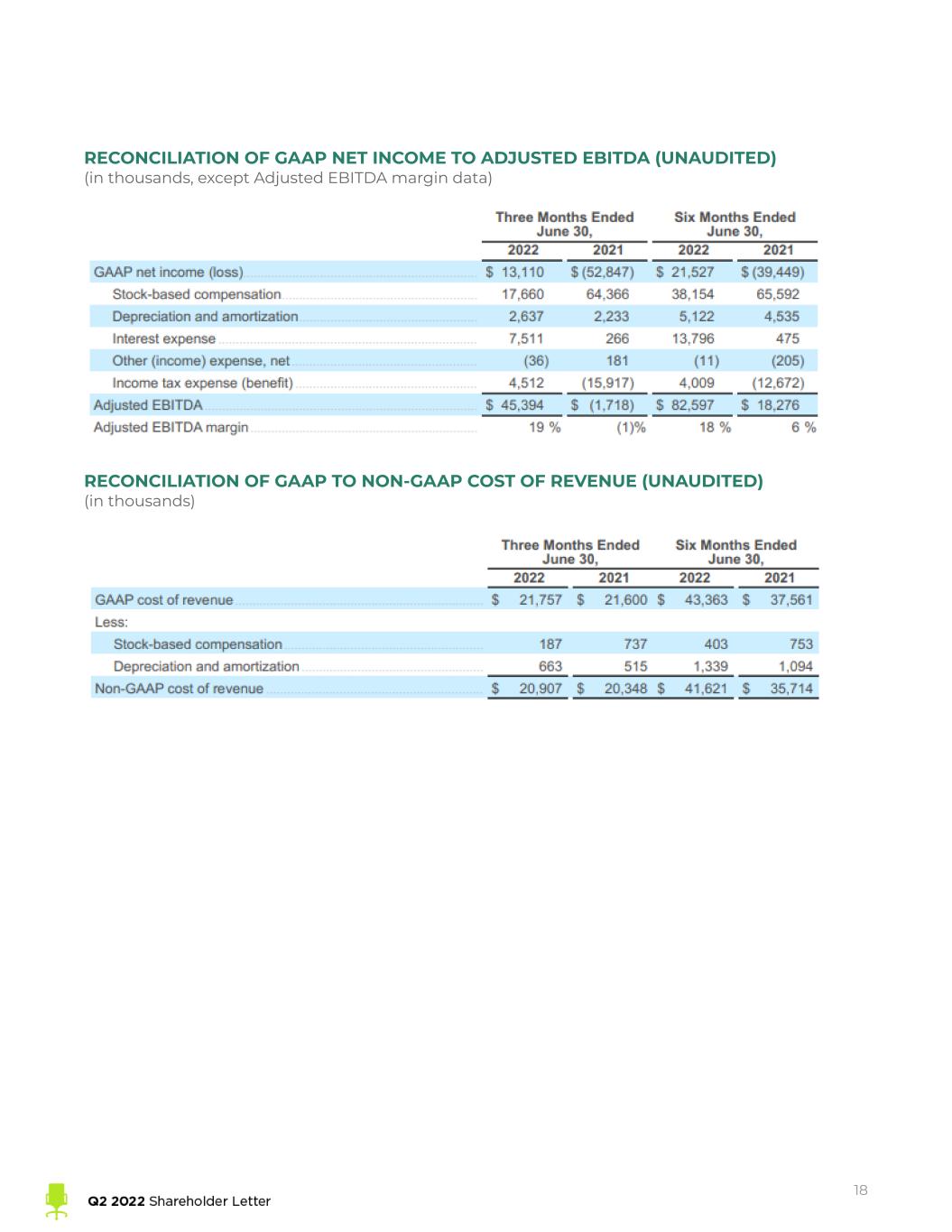

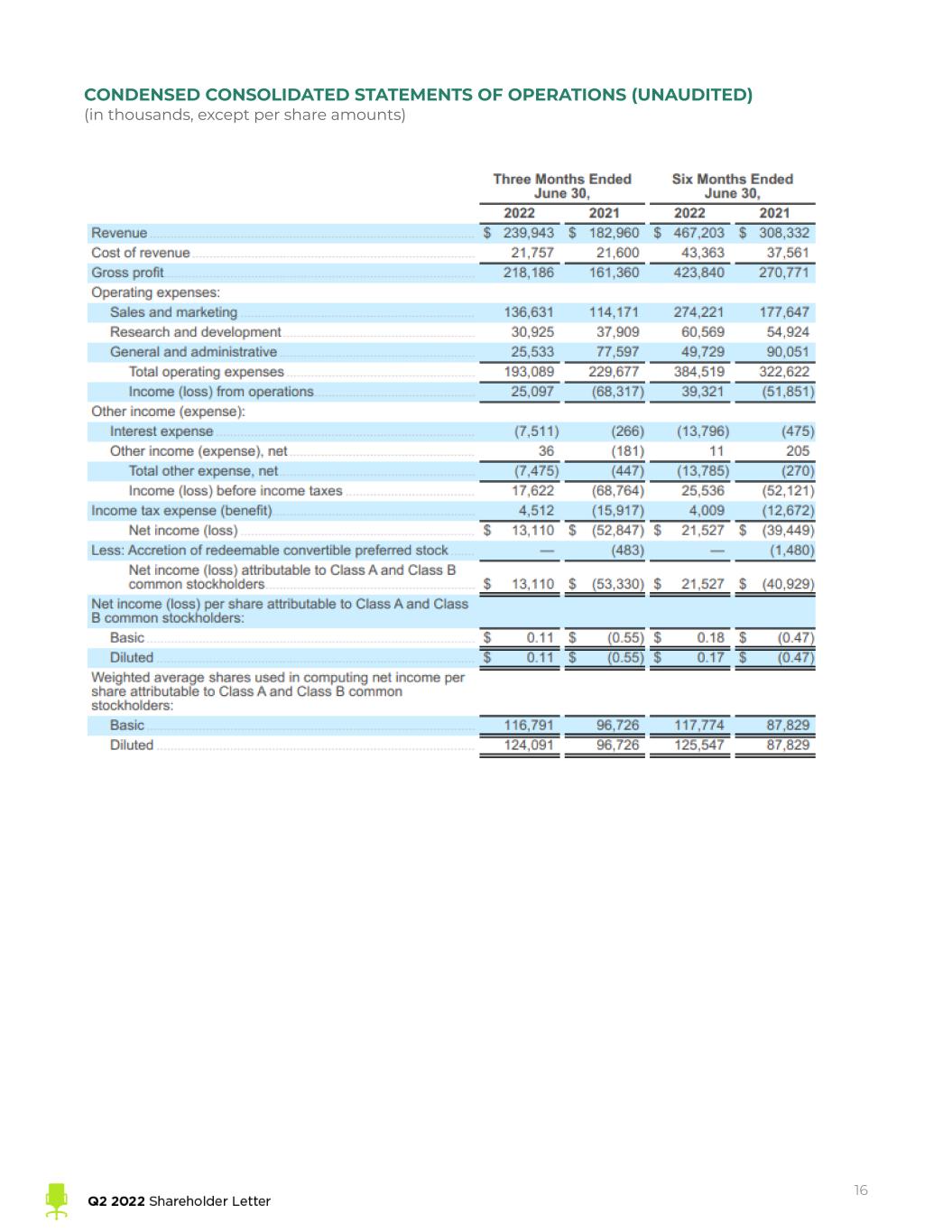

RECONCILIATION OF GAAP NET INCOME TO ADJUSTED EBITDA (UNAUDITED) (in thousands, except Adjusted EBITDA margin data) RECONCILIATION OF GAAP TO NON-GAAP COST OF REVENUE (UNAUDITED) (in thousands) 18

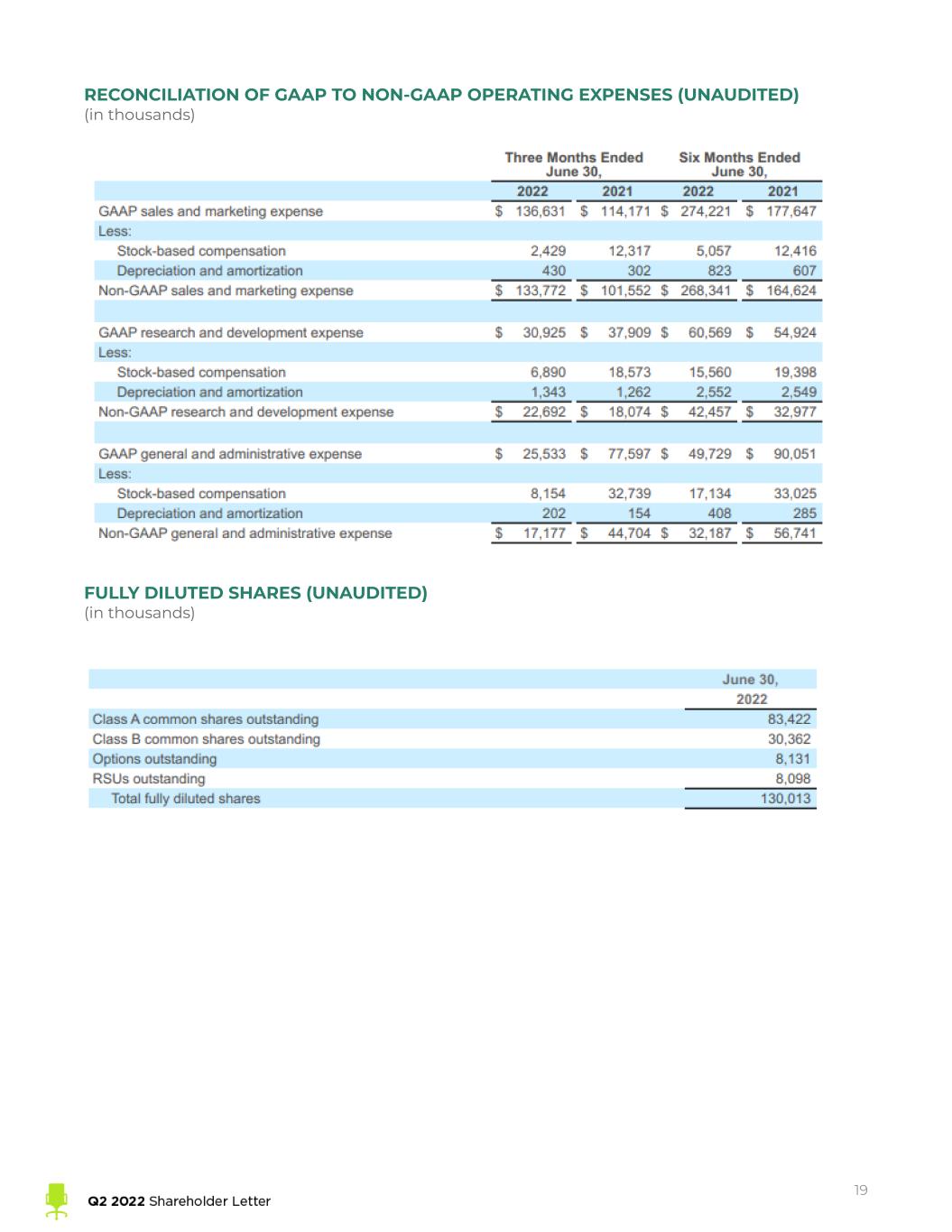

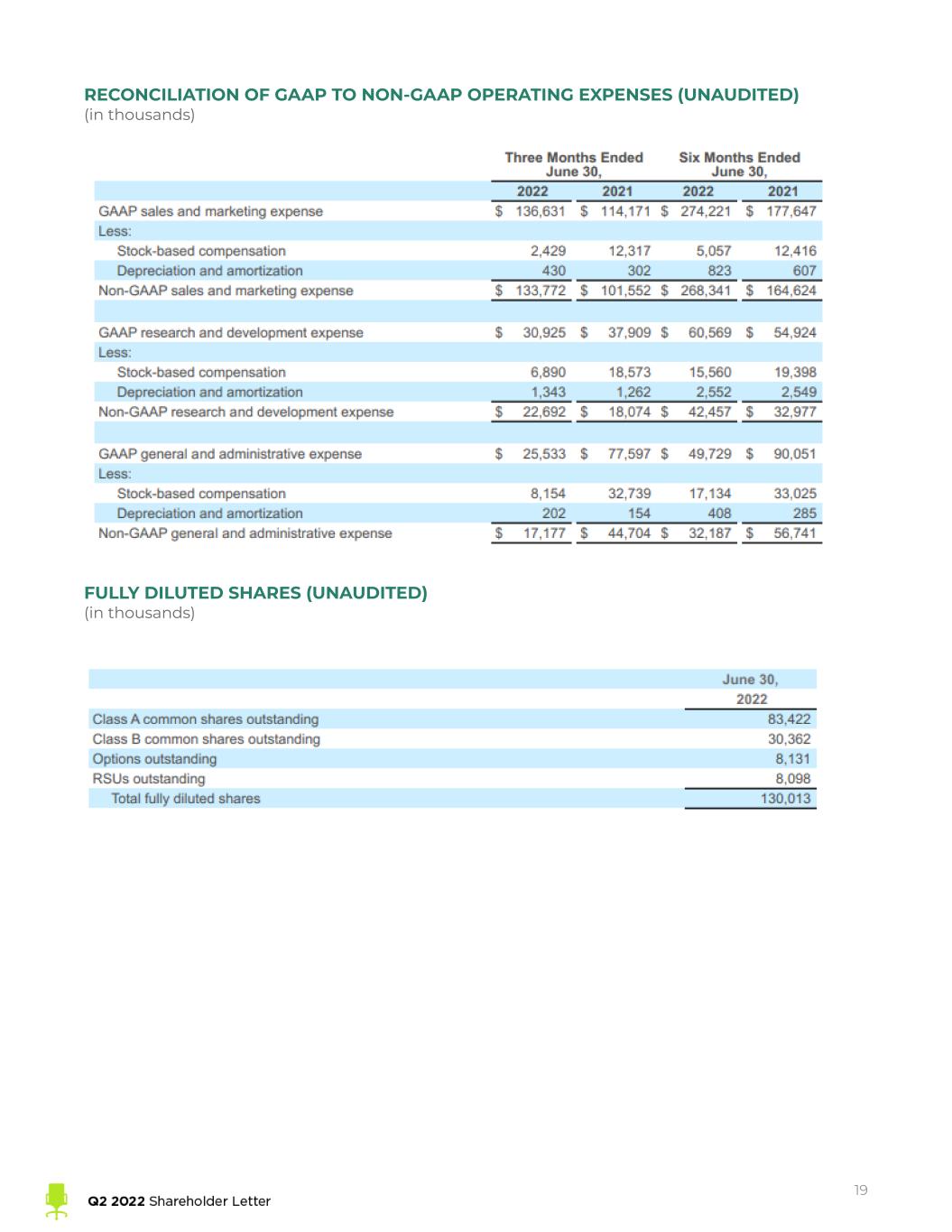

RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSES (UNAUDITED) (in thousands) FULLY DILUTED SHARES (UNAUDITED) (in thousands) 19

Key Operating Metrics and Non-GAAP Financial Measures This shareholder letter includes certain key operating metrics, including Quarterly Paid Employers and Revenue per Paid Employer, and non-GAAP financial measures, including Non-GAAP cost of revenue, Non-GAAP operating expenses, Adjusted EBITDA and Adjusted EBITDA margin. We define Paid Employers as any employer(s) (or entities acting on behalf of an employer) on a paying subscription plan or performance marketing campaign for at least one day. Paid Employer(s) excludes employers from our Job Distribution Partners or other indirect channels, employers who are not actively searching for candidates, but otherwise have access to previously posted jobs, and employers on free trial. Job Distribution Partners are defined as third-party sites who have a relationship with us and advertise jobs from our marketplace. Quarterly Paid Employers means, with respect to any fiscal quarter, the count of Paid Employers during such fiscal quarter. Revenue per Paid Employer is the total company revenue in a particular period divided by the count of Quarterly Paid Employers in the same period. We define Non-GAAP cost of revenue as our cost of revenue before stock-based compensation expense, and depreciation and amortization. We define Non-GAAP operating expenses as our operating expenses before stock-based compensation expense, and depreciation and amortization. We define Adjusted EBITDA as our net income (loss) before interest expense, other income (expense), net, income tax expense (benefit) and depreciation and amortization, adjusted to eliminate stock-based compensation expense. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of revenue for the same period. Management and our board of directors use these key operating metrics and non-GAAP financial measures as supplemental measures of our performance because they assist us in comparing our operating performance on a consistent basis, as they remove the impact of some items not directly resulting from our core operations. We also use these key operating metrics and non-GAAP financial measures for planning purposes, including the preparation of our internal annual operating budget and financial projections, to evaluate the performance and effectiveness of our strategic initiatives and to evaluate our capacity for capital expenditures to expand our business. Non-GAAP cost of revenue, Non-GAAP operating expenses, Adjusted EBITDA and Adjusted EBITDA margin should not be considered in isolation, as an alternative to, or superior to net income (loss), revenue, cash flows or other measures derived in accordance with GAAP. These non-GAAP measures are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Management believes that the presentation of non-GAAP financial measures is an appropriate measure of operating performance because they eliminate the impact of some expenses that do not relate directly to the performance of our underlying business. These non-GAAP financial measures should not be construed as an inference that our future results will be unaffected by unusual or other items. Additionally, Adjusted EBITDA and Adjusted EBITDA margin are not intended to be a measure of free cash flow for management’s discretionary use, as they do not reflect our tax payments and certain other cash costs that may recur in the future, including, among other things, cash requirements for costs to replace assets being depreciated and amortized. Management compensates for these limitations by relying on our GAAP results in addition to using Adjusted EBITDA and Adjusted EBITDA margin as supplemental measures of our performance. Our measures of Adjusted EBITDA and Adjusted EBITDA margin used herein are not necessarily comparable to similarly titled captions of other companies due to different methods of calculation. We are not able to provide a reconciliation of Adjusted EBITDA and Adjusted EBITDA margin for Q3’22 or the full fiscal year 2022 to net income and net income margin, the comparable GAAP measures, respectively, because certain items that are excluded from non-GAAP financial measures cannot be reasonably predicted or are not in our control. In particular, we are unable to forecast the timing or magnitude of stock-based compensation or amortization of intangible assets, as applicable, without unreasonable efforts, and these items could significantly impact, either individually or in the aggregate, GAAP measures in the future. See the tables above regarding reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures. 20