August 4, 2022 Dear Shareholders: Before we dive into Zillow’s results, we’d like to address the state of the housing market as it rebalances after a COVID-fueled couple of years characterized by low interest rates, strong demand, and historically low inventory. Today, homes are even harder to afford. Rapidly rising mortgage rates have compounded the existing affordability challenges created by unprecedented home price appreciation. This has driven buyer sentiment to a 20-year low, and reduced buyer demand, which has cooled the previously red-hot seller’s market. Across the industry, we are seeing price growth meaningfully soften on pending sales and new mortgage applications, with for-sale inventory levels rising as homes spend more time on the market. Ultimately, with all these factors combined, the housing industry saw flat year-over-year total transaction dollar volume in Q21 while various leading indicators deteriorated. Although demand indicators stabilized in July compared to June, we expect second-half 2022 total industry transaction dollar volume to meaningfully contract year over year. Despite the challenges of the macroeconomic environment, we are reporting in-line Q2 consolidated results that demonstrate Zillow is on firm ground and well-positioned to invest in our long-term vision and growth strategy. For Q2, our core IMT segment met the low end of our revenue expectations and exceeded the midpoint of our IMT segment Adjusted EBITDA outlook range, as we effectively managed costs while investing in future growth. Our solid footing is underpinned by a healthy balance sheet, and a business that generates operating cash flow. Our cash and investments balance of $3.5 billion as of the end of Q2 increased from $3.1 billion at the end of 2021, after nearly $600 million in stock repurchases over the first half of this year. The strength of our business comes in large part from our formidable brand2. We have a huge, passionate and engaged audience of 234 million average monthly unique users on our apps and sites, which remains more than three times3 the size of our closest competitor. And our rentals traffic grew once again this quarter, with 27 million average monthly unique users, per Comscore4. This is a powerful differentiator that comes from years of building great products and services for our customers. Apartment and house hunting is aspirational and entertaining as well as practical. Dreaming and 4 Comscore data, which includes average monthly unique users on rental listings on Zillow, Trulia and HotPads mobile apps and sites for Q2 2022 versus Q2 2021. 3 App Annie data as of July 2022. 2 https://wp-tid.zillowstatic.com/bedrock/app/uploads/sites/21/2022/08/2Q22_Zillow-Group-Media-Clips_080322.pdf 1 National Association of REALTORS® existing homes sold during Q2 2022 multiplied by the average selling price per home for Q2 2022 compared to the same periods in 2021. 2 | Q2 2022

shopping on Zillow, Trulia and StreetEasy doesn’t stop because of a poor housing macro outlook. Our business model is ultimately driven by transactions, but it is our relationship with our customers between transactions that is, and always has been, our advantage. The people who create those products and services have made Zillow into the successful brand it is today, and they are key to the vision we're building toward. In an effort to retain talent in this competitive job market, especially tech and product employees, we are rolling out an equity initiative to shore up total compensation for the many employees who are experiencing a significant gap between planned and actual compensation. The Board and our executive team agreed this is a practical decision for Zillow, that we expect to minimize the challenges and costs associated with attrition down the line, all while recognizing the importance of retaining key talent and realigning their compensation with the interests of shareholders. We expect this action will result in approximately 2% dilution, spread largely over the next two years. We will repurchase shares under our existing share buyback program in the near term to cover the potential future dilution, while continuing to be opportunistic about future potential share repurchases. While the near-term macro picture is not in our control, we are in control of executing on our strategy and product roadmap that is oriented around increasing engagement, increasing transactions, and increasing revenue per transaction. And, we continue to make strides toward building a single platform of connected, digitized solutions that will serve more customers in our funnel. We’re focused on product initiatives within five growth pillars — financing, touring, seller solutions, integrating our services, and enhancing our partner network — and we’re proud of our progress: ● Seller solutions — We’ve struck an exclusive multi-year partnership with Opendoor to provide Zillow customers the ability to get a cash offer on their home, combining two category leaders to transform how people start their move. Potential sellers on Zillow apps and sites may request and view an offer directly from Opendoor, and a licensed Zillow advisor will help them compare it easily to an open-market sale using a real estate agent. Zillow will receive a referral fee when a customer sells to Opendoor, and customers who opt to sell traditionally will be connected with a Zillow Premier Agent partner. We’ll also offer a bundle that allows sellers to buy their next home with a Premier Agent partner, finance with Zillow Home Loans, and close with Zillow Closing Services, while selling their existing home to Opendoor. Building out a suite of complementary seller offerings over time opens up meaningful opportunities for us across agent transactions and adjacent services like mortgage and title & escrow. When it’s fully rolled out, this will create another way for Zillow to serve potential sellers across more than 50 U.S. markets, while growing our business in the capital-light manner we described when we exited iBuying. 3 | Q2 2022

● Touring — We’ve rolled out real-time availability of tours through ShowingTime for agent-facing interfaces, and adoption signs are positive: more than 250 markets have enabled this feature, and 74% of listings in markets where it's enabled are participating. The ease that real-time availability has brought to tour scheduling to date is a win for all involved because it enables agents to quickly help high-intent customers find and win their next home. Separately, initial changes we’ve made to Zillow’s apps and sites to make touring more prominent have contributed to improving the touring mix to nearly 50% of our connections today, versus less than one-third of our connections this time last year. Our goal continues to be to integrate the ShowingTime functionality on our customer-facing apps and sites, making it as easy to book a home tour as it is to book a restaurant reservation online. ● Financing — Many millions of customers have inquired about financing on Zillow in the past 12 months, and we’ve begun to make changes to our apps and sites designed to convert a portion of that huge customer signal into originating purchase mortgages through Zillow Home Loans. As a result, pre-approvals for purchase mortgages doubled from January to June 2022, and our purchase origination volume grew 58% sequentially in Q2. We are early in our journey and still have work to do, but we believe we have an opportunity to be a substantial purchase mortgage originator and help more customers with their financing needs. Additionally, a vast majority of customers who initially come to us for a mortgage do not yet have a real estate agent. This gives us confidence that we can introduce Zillow Home Loan customers to trusted Premier Agent partners, who are happy to meet buyers who already have financing lined up and are ready to find and win their next home. We are investing to build technology that supports customers across our platform, and build efficient digital tools for loan officers and agents. While the early indicators are promising, we want to ensure the key foundational components are in place so we can scale profitably. We’re investing in financing not only as a significant growth pillar but as a critical enabler of Zillow’s integrated transaction experience. The past few years in housing have been unpredictable, uncertain, and unlike anything we’ve seen before. But when we look at the strength of our brand, our audience, our profitability and operating cash flow, and our strategy for growth, we are confident we can seize the opportunity to improve the way people transact in real estate across the U.S. — which we expect will deliver outstanding long-term returns for our company, our employees and our shareholders. Sincerely, Rich Barton, Co-founder & CEO Allen Parker, CFO 4 | Q2 2022

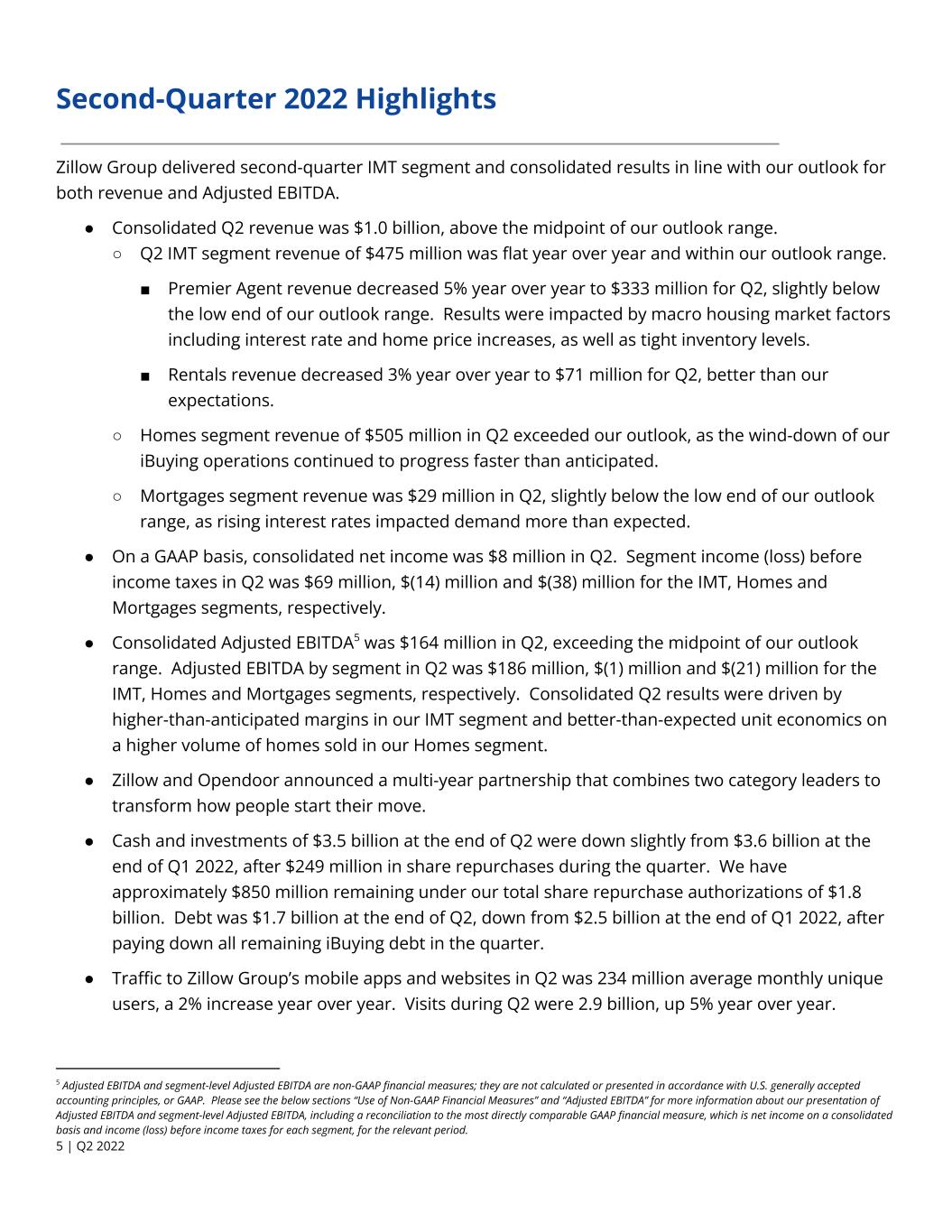

Second-Quarter 2022 Highlights Zillow Group delivered second-quarter IMT segment and consolidated results in line with our outlook for both revenue and Adjusted EBITDA. ● Consolidated Q2 revenue was $1.0 billion, above the midpoint of our outlook range. ○ Q2 IMT segment revenue of $475 million was flat year over year and within our outlook range. ■ Premier Agent revenue decreased 5% year over year to $333 million for Q2, slightly below the low end of our outlook range. Results were impacted by macro housing market factors including interest rate and home price increases, as well as tight inventory levels. ■ Rentals revenue decreased 3% year over year to $71 million for Q2, better than our expectations. ○ Homes segment revenue of $505 million in Q2 exceeded our outlook, as the wind-down of our iBuying operations continued to progress faster than anticipated. ○ Mortgages segment revenue was $29 million in Q2, slightly below the low end of our outlook range, as rising interest rates impacted demand more than expected. ● On a GAAP basis, consolidated net income was $8 million in Q2. Segment income (loss) before income taxes in Q2 was $69 million, $(14) million and $(38) million for the IMT, Homes and Mortgages segments, respectively. ● Consolidated Adjusted EBITDA5 was $164 million in Q2, exceeding the midpoint of our outlook range. Adjusted EBITDA by segment in Q2 was $186 million, $(1) million and $(21) million for the IMT, Homes and Mortgages segments, respectively. Consolidated Q2 results were driven by higher-than-anticipated margins in our IMT segment and better-than-expected unit economics on a higher volume of homes sold in our Homes segment. ● Zillow and Opendoor announced a multi-year partnership that combines two category leaders to transform how people start their move. ● Cash and investments of $3.5 billion at the end of Q2 were down slightly from $3.6 billion at the end of Q1 2022, after $249 million in share repurchases during the quarter. We have approximately $850 million remaining under our total share repurchase authorizations of $1.8 billion. Debt was $1.7 billion at the end of Q2, down from $2.5 billion at the end of Q1 2022, after paying down all remaining iBuying debt in the quarter. ● Traffic to Zillow Group’s mobile apps and websites in Q2 was 234 million average monthly unique users, a 2% increase year over year. Visits during Q2 were 2.9 billion, up 5% year over year. 5 Adjusted EBITDA and segment-level Adjusted EBITDA are non-GAAP financial measures; they are not calculated or presented in accordance with U.S. generally accepted accounting principles, or GAAP. Please see the below sections “Use of Non-GAAP Financial Measures” and “Adjusted EBITDA” for more information about our presentation of Adjusted EBITDA and segment-level Adjusted EBITDA, including a reconciliation to the most directly comparable GAAP financial measure, which is net income on a consolidated basis and income (loss) before income taxes for each segment, for the relevant period. 5 | Q2 2022

Select Second-Quarter 2022 Results INTERNET, MEDIA & TECHNOLOGY SEGMENT Revenue for the Internet, Media & Technology (“IMT”) segment of $475 million was flat year over year in Q2, and within our outlook range of $472 million to $492 million. IMT segment GAAP income before income taxes in Q2 was $69 million, or 15% of IMT segment revenue. IMT segment Adjusted EBITDA was $186 million, or 39% of IMT segment revenue in Q2, exceeding the midpoint of our outlook range for $182 million Adjusted EBITDA and 38% Adjusted EBITDA margin. The outperformance in Q2 was driven by a combination of active cost management to drive operating efficiencies, as well as lower advertising and marketing costs. Premier Agent Premier Agent revenue for Q2 decreased 5% year over year to $333 million, slightly below the low end of our outlook range and below total industry transaction dollar volume, which was flat6 year over year for the quarter. The year-over-year revenue decline was impacted by macro housing market factors including interest rate and home price increases, as well as tight inventory levels. Rentals Rentals revenue of $71 million in Q2 was down 3% year over year and up 16% sequentially from Q1, better than our expectations. High occupancy rates, which dampen overall demand for rental advertising, continued to weigh on growth, although they showed signs of easing. We also continue to see healthy demand from prospective renters on Zillow, as a higher number of potential renters are sending inquiries to properties in their search for a new home. Rentals traffic grew 31% year over year to 27 million average monthly unique users in Q27. 7 Comscore data, which includes average monthly unique users on rental listings on Zillow, Trulia and HotPads mobile apps and sites for Q2 2022 versus Q2 2021. 6 National Association of REALTORS® existing homes sold during Q2 2022 multiplied by the average selling price per home for Q2 2022 compared to the same periods in 2021. 6 | Q2 2022

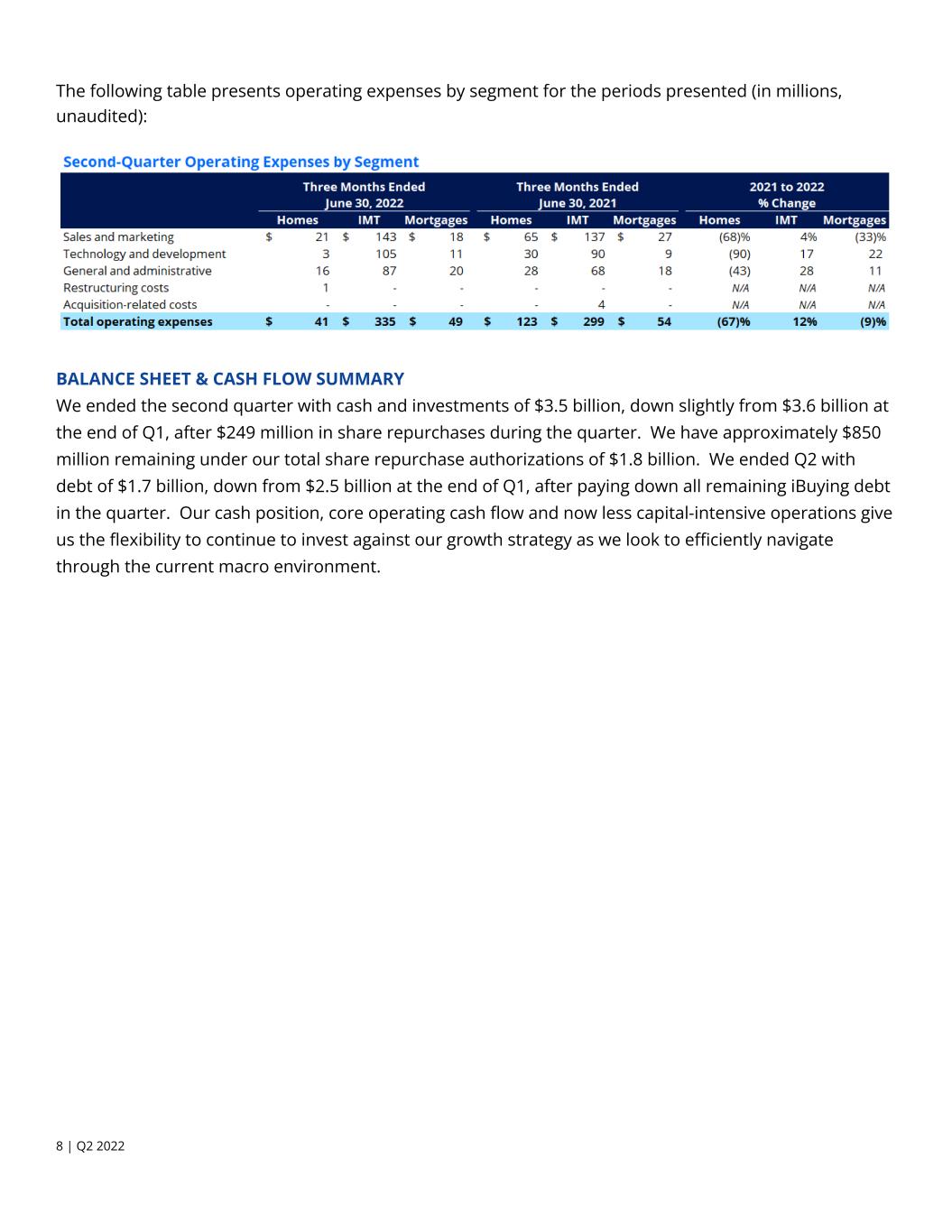

HOMES SEGMENT Q2 revenue of $505 million exceeded our outlook range, driven by a higher-than-expected number of homes sold during the quarter — a total of 1,211 homes sold. We are no longer acquiring homes and ended the quarter with 71 homes in inventory. Homes segment loss before income taxes was $14 million in Q2. Homes segment Adjusted EBITDA was a loss of $1 million, $4 million better than the high end of our outlook range. Adjusted EBITDA outperformance was due to better-than-expected unit economics on a higher volume of homes sold in Q2. MORTGAGES SEGMENT Mortgages segment revenue of $29 million for Q2 was slightly below the low end of our outlook range of $31 million, as rapid increases in interest rates negatively impacted refinancing loan originations and demand in our mortgage marketplace more than expected. Our purchase loan origination volume grew 58% sequentially in Q2 as we continued to transition from a business originally built to service our iBuying customers to serving millions of customers across our apps and sites. Mortgages segment loss before income taxes in Q2 was $38 million. Mortgages segment Adjusted EBITDA in Q2 was a loss of $21 million, below the low end of our outlook, as we continued to invest in building a consumer-facing origination experience, internal tools, and integration. Second-Quarter 2022 Financial Details OPERATING EXPENSE SUMMARY Total operating expenses were $425 million in Q2, down 11% from $476 million a year ago. The decrease was primarily driven by lower holding and selling costs in the Homes segment due to lower sales volume as we continued to wind down our iBuying operations. The IMT segment experienced an increase in headcount-related costs, partially offset by lower year-over-year marketing- and advertising-related expenses. Since the announcement of the iBuying wind-down, we have incurred $173 million in total wind-down-related costs through the end of Q2 and expect the total to be approximately $175 million. 7 | Q2 2022

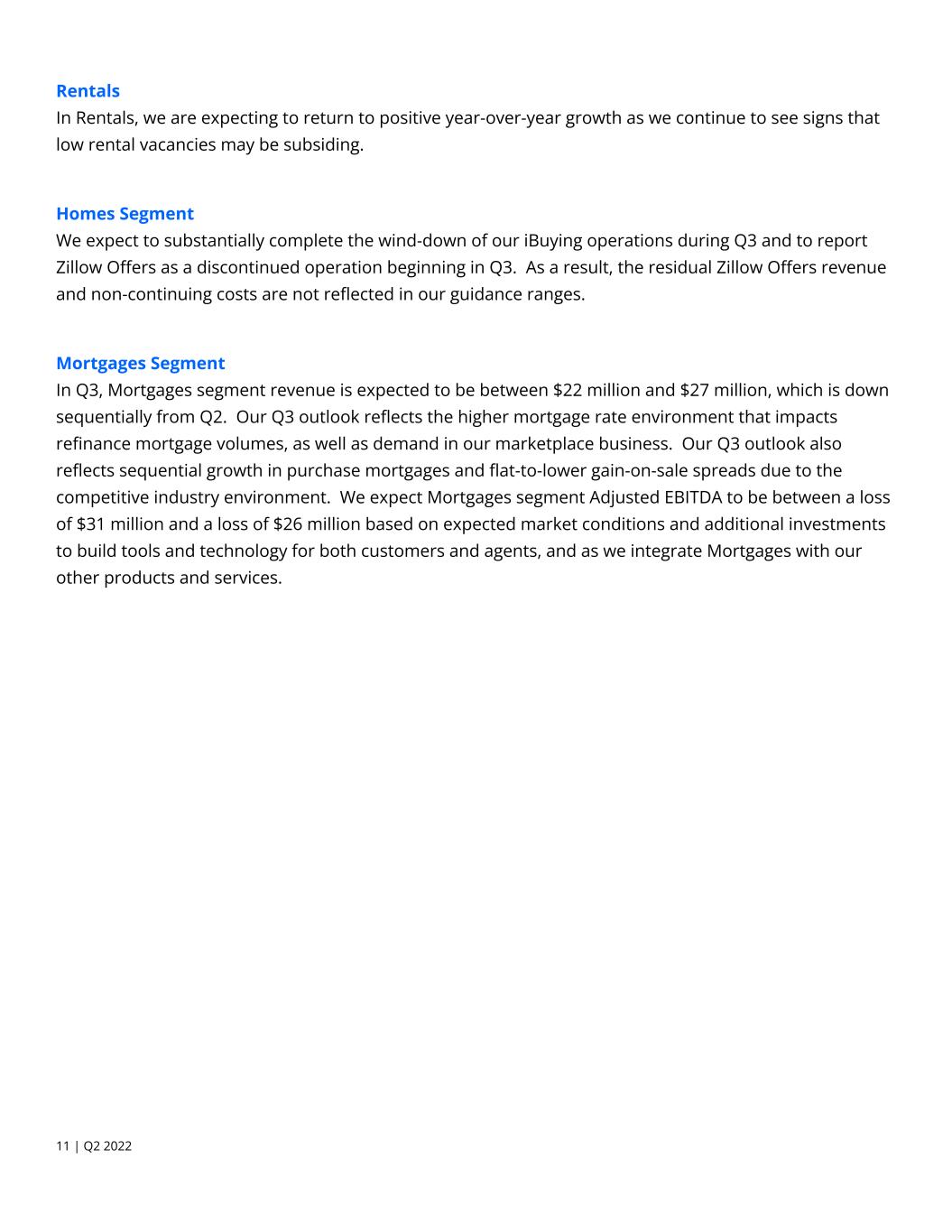

The following table presents operating expenses by segment for the periods presented (in millions, unaudited): BALANCE SHEET & CASH FLOW SUMMARY We ended the second quarter with cash and investments of $3.5 billion, down slightly from $3.6 billion at the end of Q1, after $249 million in share repurchases during the quarter. We have approximately $850 million remaining under our total share repurchase authorizations of $1.8 billion. We ended Q2 with debt of $1.7 billion, down from $2.5 billion at the end of Q1, after paying down all remaining iBuying debt in the quarter. Our cash position, core operating cash flow and now less capital-intensive operations give us the flexibility to continue to invest against our growth strategy as we look to efficiently navigate through the current macro environment. 8 | Q2 2022

Outlook The following table presents our outlook for the three months ending Sept. 30, 2022 (in millions): * Zillow Group has not provided a quantitative reconciliation of forecasted GAAP net income (loss) to forecasted total Adjusted EBITDA or of forecasted GAAP income (loss) before income taxes to forecasted segment Adjusted EBITDA within this communication because the company is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to: income taxes which are directly impacted by unpredictable fluctuations in the market price of the company’s capital stock; depreciation and amortization expense from new acquisitions; impairments of assets; gains or losses on extinguishment of debt and acquisition-related costs. These items, which could materially affect the computation of forward-looking GAAP net income (loss) and income (loss) before income taxes, are inherently uncertain and depend on various factors, many of which are outside of Zillow Group’s control. For more information regarding the non-GAAP financial measures discussed in this communication, please see “Use of Non-GAAP Financial Measures” below. ** We have excluded from our outlook for Weighted-average shares outstanding - diluted any potentially dilutive impact of the conversion of our convertible senior notes due in 2024, 2025 and 2026 and any potentially anti-dilutive impact of future share repurchases. The maximum number of shares underlying the convertible senior notes is 33.9 million shares of Class C capital stock. Consolidated Outlook We expect Q3 consolidated revenue to be $446 million at the midpoint of our outlook. We remain focused on delivering innovative services to grow customer transaction share and revenue per transaction toward our long-term financial targets. Internet, Media & Technology Segment In Q3, we expect IMT segment revenue to be between $409 million and $434 million, declining 12% year over year at the midpoint of our outlook range. We expect Q3 IMT segment Adjusted EBITDA to be between $111 million and $121 million and Adjusted EBITDA margin of 28% at the midpoint of our Adjusted EBITDA outlook range. We believe our Q3 investment level is appropriate despite the headwinds in the market, given the significant growth opportunities ahead, the positive signals we see in testing, and the seller solutions opportunity with the announcement of our partnership with Opendoor. 9 | Q2 2022

Premier Agent In Q3, Premier Agent revenue is expected to be between $275 million and $295 million, down 21% year over year at the midpoint of our outlook range. While we continue to focus on connecting high-intent customers to all our partners, our Q3 Premier Agent revenue outlook is largely informed by the following macro housing trends that are making it harder for customers to transact and are affecting our partner network: ● Lower home purchase demand driven by recent increases in interest rates, which has made home purchases less affordable and is impacting our overall Premier Agent connection lead volume. The recent double-digit percentage annual decline in the Mortgage Bankers Association (MBA)’s purchase mortgage applications index also indicates further headwinds for the housing sector. ● Lower home price appreciation driven by softening demand and inventory levels that are growing, but still lower than before the pandemic. The chart below, showing data from the MBA and the National Association of Realtors, illustrates the sharp potential deceleration in year-over-year transaction volume growth exiting Q2. Since 2001, the MBA data has been a directionally accurate leading indicator for year-over-year industry transaction volume growth. 10 | Q2 2022

Rentals In Rentals, we are expecting to return to positive year-over-year growth as we continue to see signs that low rental vacancies may be subsiding. Homes Segment We expect to substantially complete the wind-down of our iBuying operations during Q3 and to report Zillow Offers as a discontinued operation beginning in Q3. As a result, the residual Zillow Offers revenue and non-continuing costs are not reflected in our guidance ranges. Mortgages Segment In Q3, Mortgages segment revenue is expected to be between $22 million and $27 million, which is down sequentially from Q2. Our Q3 outlook reflects the higher mortgage rate environment that impacts refinance mortgage volumes, as well as demand in our marketplace business. Our Q3 outlook also reflects sequential growth in purchase mortgages and flat-to-lower gain-on-sale spreads due to the competitive industry environment. We expect Mortgages segment Adjusted EBITDA to be between a loss of $31 million and a loss of $26 million based on expected market conditions and additional investments to build tools and technology for both customers and agents, and as we integrate Mortgages with our other products and services. 11 | Q2 2022

Forward-Looking Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks and uncertainties, including, without limitation, statements regarding the future performance and operation of our business, the expected amount and timing of charges, write-downs and cash expenditures and expected wind down plans of iBuying operations, the current and future health and stability of the residential housing market and economy, volatility of mortgage interest rates and our expectations regarding future shifts in behavior by consumers and employees. Statements containing words such as “may,” “believe,” “anticipate,” “expect,” “intend,” “plan,” “project,” “predict,” “will,” “projections,” “continue,” “estimate,” “outlook,” “guidance,” “would,” “could,” or similar expressions constitute forward-looking statements. Forward-looking statements are made based on assumptions as of August 4, 2022, and although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee these results. Differences in Zillow Group’s actual results from those described in these forward-looking statements may result from actions taken by Zillow Group as well as from risks and uncertainties beyond Zillow Group’s control. Factors that may contribute to such differences include, but are not limited to, the current and future health and stability of the economy, financial conditions and residential housing market, including any extended downturn or slowdown; changes in general economic and financial conditions (including federal monetary policy, interest rate changes, inflation, home price appreciation, and housing inventory) that may reduce demand for our products and services, lower our profitability or reduce our access to financing; actual or anticipated changes in our rates of growth and innovation relative to that of our competitors; investment of resources to pursue strategies and develop new products and services that may not prove effective or that are not attractive to customers and real estate partners; the duration and impact of the COVID-19 pandemic (including variants) or other public health crises on our ability to operate, demand for our products or services, or general economic conditions; actual or anticipated fluctuations in our financial condition and results of operations; changes in projected operational and financial results; addition or loss of a significant number of customers; acquisitions, strategic partnerships, joint ventures, capital-raising activities or other corporate transactions or commitments by us or our competitors; actual or anticipated changes in technology, products, markets or services by us or our competitors; ability to protect the information and privacy of our customers and other third parties; ability to protect our brand and intellectual property; ability to obtain or maintain licenses and permits to support our current and future businesses; ability to comply with MLS rules and requirements to access and use listing data, and to maintain or establish relationships with listings and data providers; ability to operate and grow our mortgage origination business, including the ability to obtain sufficient financing; the impact of natural disasters and other catastrophic events; changes in laws or government regulation affecting our business; and the impact of pending or future litigation or regulatory actions. The foregoing list of risks and uncertainties is illustrative but not exhaustive. For more information about potential factors that could affect Zillow Group’s business and financial results, please review the “Risk Factors” described in Zillow Group’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and in future quarterly and annual reports. Except as may be required by law, Zillow Group does not intend and undertakes no duty to update this information to reflect future events or circumstances. 12 | Q2 2022

No Incorporation by Reference This communication includes website addresses and references to additional materials found on those websites, including Zillow Group’s websites. These websites and materials are not incorporated by reference herein or our other filings with the Securities and Exchange Commission. Use of Estimates and Statistical Data This communication includes estimates and other statistical data made by independent third parties and by Zillow Group relating to the housing market, connection, engagement, growth, and other data about Zillow Group’s performance and the residential real estate industry. These data involve a number of assumptions and limitations, which may significantly impair their accuracy, and you are cautioned not to give undue weight to such estimates. Projections, assumptions and estimates of future performance are necessarily subject to a high degree of uncertainty and risk. Use of Non-GAAP Financial Measures This communication includes references to Adjusted EBITDA (in total and for each segment, and including forecasted Adjusted EBITDA and EBITDA margin), which are non-GAAP financial measures not prepared in conformity with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures are not prepared under a comprehensive set of accounting rules and, therefore, should only be reviewed alongside results reported under GAAP. Adjusted EBITDA To provide investors with additional information regarding our financial results, this communication includes references to Adjusted EBITDA in total and for each segment, each a non-GAAP financial measure. We have provided a reconciliation below of Adjusted EBITDA in total to net income and Adjusted EBITDA by segment to income (loss) before income taxes for each segment, the most directly comparable U.S. generally accepted accounting principles (“GAAP”) financial measures. Adjusted EBITDA is a key metric used by our management and board of directors to measure operating performance and trends and to prepare and approve our annual budget. In particular, the exclusion of certain expenses in calculating Adjusted EBITDA facilitates operating performance comparisons on a period-to-period basis. Our use of Adjusted EBITDA in total and for each segment has limitations as an analytical tool, and you should not consider these measures in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; • Adjusted EBITDA does not consider the potentially dilutive impact of share-based compensation; • Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditures or contractual commitments; • Adjusted EBITDA does not reflect restructuring costs; • Adjusted EBITDA does not reflect acquisition-related costs; • Adjusted EBITDA does not reflect the loss on extinguishment of debt • Adjusted EBITDA does not reflect interest expense or other income; • Adjusted EBITDA does not reflect income taxes; and • Other companies, including companies in our own industry, may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. 13 | Q2 2022

Because of these limitations, you should consider Adjusted EBITDA in total and for each segment alongside other financial performance measures, including various cash flow metrics, net income, income (loss) before income taxes for each segment, and our other GAAP results. The following tables present a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure, which is net income on a consolidated basis and income (loss) before income taxes for each segment along with the calculation of Adjusted EBITDA margin and associated year over year growth rates and the most directly comparable GAAP financial measure and related year over year growth rates, which is net income on a consolidated basis and income (loss) before income taxes margin for each segment, for each of the periods presented (in millions, unaudited): Three Months Ended June 30, 2021 to 2022 % Change Six Months Ended June 30, 2021 to 2022 % Change2022 2021 2022 2021 Revenue: Homes segment: Zillow Offers $ 504 $ 772 (35) % $ 4,222 $ 1,473 187 % Other (1) 1 5 (80) % 4 8 (50) % Total Homes segment revenue 505 777 (35) % 4,226 1,481 185 % IMT segment: Premier Agent 333 349 (5) % 696 683 2 % Rentals 71 73 (3) % 132 137 (4) % Other (2) 71 54 31 % 137 102 34 % Total IMT segment revenue 475 476 — % 965 922 5 % Mortgages segment 29 57 (49) % 75 125 (40) % Total revenue $ 1,009 $ 1,310 (23) % $ 5,266 $ 2,528 108 % Other Financial Data: Gross profit $ 443 $ 538 (18) % $ 1,078 $ 1,045 3 % Income (loss) before income taxes: Homes segment $ (14) $ (59) 76 % $ (82) $ (117) 30 % IMT segment 69 134 (49) % 177 277 (36) % Mortgages segment (38) (18) (111) % (65) (20) (225) % Corporate items (3) (3) (34) 91 % (9) (68) 87 % Total income before income taxes $ 14 $ 23 (39) % $ 21 $ 72 (71) % Net income $ 8 $ 10 (20) % $ 24 $ 62 (61) % Adjusted EBITDA: Homes segment $ (1) $ (29) 97 % $ 22 $ (62) 135 % IMT segment 186 218 (15) % 395 427 (7) % Mortgages segment (21) (6) (250) % (33) — — % Total Adjusted EBITDA $ 164 $ 183 (10) % $ 384 $ 365 5 % (1) Other Homes segment revenue relates to revenue associated with the title and escrow services provided through Zillow Closing Services. (2) Other IMT segment revenue includes revenue generated by new construction and display advertising, as well as revenue from the sale of various other advertising and business technology solutions for real estate professionals, including dotloop. In the fourth quarter of 2021, we began to include the financial results of ShowingTime.com, Inc. in the IMT segment. (3) Certain corporate items are not directly attributable to any of our segments, including the loss on extinguishment of debt, interest income earned on our short-term investments included in other income and interest costs on our convertible senior notes included in interest expense. (4) Adjusted EBITDA is a non-GAAP financial measure; it is not calculated or presented in accordance with U.S. generally accepted accounting principles, or GAAP. See below for more information regarding our presentation of Adjusted EBITDA, including a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure, which is net income on a consolidated basis and income (loss) before income taxes for each segment, for each of the periods presented. 14 | Q2 2022

Three Months Ended June 30, 2021 to 2022 % Change 2021 to 2022 Margin Change Basis Points Six Months Ended June 30, 2021 to 2022 % Change 2021 to 2022 Margin Change Basis PointsPercentage of Revenue: 2022 2021 2022 2021 Gross profit 44 % 41 % 7 % 300 20 % 41 % (51) % (2,100) Income (loss) before income taxes: Homes segment (3) % (8) % 63 % 500 (2) % (8) % 75 % 600 IMT segment 15 % 28 % (46) % (1,300) 18 % 30 % (40) % (1,200) Mortgages segment (131) % (32) % (309) % (9,900) (87) % (16) % (444) % (7,100) Corporate items N/A N/A N/A N/A N/A N/A N/A N/A Total income before income taxes 1 % 2 % (50) % (100) — % 3 % (100) % (300) Net income 1 % 1 % — % — — % 2 % (100) % (200) Adjusted EBITDA: Homes segment — % (4) % 100 % 400 1 % (4) % 125 % 500 IMT segment 39 % 46 % (15) % (700) 41 % 46 % (11) % (500) Mortgages segment (72) % (11) % (555) % (6,100) (44) % — % — % (4,400) Total Adjusted EBITDA 16 % 14 % 14 % 200 7 % 14 % (50) % (700) The following tables present a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure, which is net income on a consolidated basis and income (loss) before income taxes for each segment, for each of the periods presented (in millions, unaudited): Three Months Ended June 30, 2022 Homes IMT Mortgages Corporate Items (2) Consolidated Reconciliation of Adjusted EBITDA to Net Income and Income (Loss) Before Income Taxes: Net income (1) N/A N/A N/A N/A $ 8 Income taxes N/A N/A N/A N/A 6 Income (loss) before income taxes $ (14) $ 69 $ (38) $ (3) $ 14 Other income (7) — — (5) (12) Depreciation and amortization 4 37 3 — 44 Share-based compensation 8 80 13 — 101 Restructuring costs 1 — — — 1 Loss on extinguishment of debt 7 — — — 7 Interest expense — — 1 8 9 Adjusted EBITDA $ (1) $ 186 $ (21) $ — $ 164 15 | Q2 2022

Three Months Ended June 30, 2021 Homes IMT Mortgages Corporate Items (2) Consolidated Reconciliation of Adjusted EBITDA to Net Income and Income (Loss) Before Income Taxes: Net income (1) N/A N/A N/A N/A $ 10 Income taxes N/A N/A N/A N/A 13 Income (loss) before income taxes $ (59) $ 134 $ (18) $ (34) $ 23 Other income — — (1) — (1) Depreciation and amortization 5 22 2 — 29 Share-based compensation 20 58 10 — 88 Acquisition-related costs — 4 — — 4 Loss on extinguishment of debt — — — 1 1 Interest expense 5 — 1 33 39 Adjusted EBITDA $ (29) $ 218 $ (6) $ — $ 183 Six Months Ended June 30, 2022 Homes IMT Mortgages Corporate Items (2) Consolidated Reconciliation of Adjusted EBITDA to Net Income and Income (Loss) Before Income Taxes: Net income (1) N/A N/A N/A N/A $ 24 Income taxes N/A N/A N/A N/A (3) Income (loss) before income taxes $ (82) $ 177 $ (65) $ (9) $ 21 Other income (13) — (1) (6) (20) Depreciation and amortization 9 72 6 — 87 Share-based compensation 20 140 23 — 183 Restructuring costs 31 6 2 — 39 Loss on extinguishment of debt 21 — — — 21 Interest expense 36 — 2 15 53 Adjusted EBITDA $ 22 $ 395 $ (33) $ — $ 384 16 | Q2 2022

Six Months Ended June 30, 2021 Homes IMT Mortgages Corporate Items (2) Consolidated Reconciliation of Adjusted EBITDA to Net Income and Income (Loss) Before Income Taxes: Net income (1) N/A N/A N/A N/A $ 62 Income taxes N/A N/A N/A N/A 10 Income (loss) before income taxes $ (117) $ 277 $ (20) $ (68) $ 72 Other income — — (2) (1) (3) Depreciation and amortization 10 45 3 — 58 Share-based compensation 36 100 16 — 152 Acquisition-related costs — 5 — — 5 Loss on extinguishment of debt — — — 2 2 Interest expense 9 — 3 67 79 Adjusted EBITDA $ (62) $ 427 $ — $ — $ 365 (1) We use income (loss) before income taxes as our profitability measure in making operating decisions and assessing the performance of our segments, therefore, net income and income taxes are calculated and presented only on a consolidated basis within our financial statements. (2) Certain corporate items are not directly attributable to any of our segments, including the loss on extinguishment of debt, interest income earned on our short-term investments included in other income and interest costs on our convertible senior notes included in interest expense. 17 | Q2 2022