| | |

| | Free Writing Prospectus Filed Pursuant to Rule 433 Registration Statement No. 333-206640 January 27, 2017 |

Key Information

SPDR® Long Dollar Gold Trust

Gold for a Strong Dollar Environment™

Objective

The SPDR® Long Dollar Gold Trust (the “Fund”) seeks to track the performance of the Solactive GLD® Long USD Gold Index, less fund expenses. The Index combines a long position in physical gold and a long dollar exposure against a basket of non-U.S. currencies comprising the euro (EUR), the Japanese yen (JPY), the British pound (GBP), the Canadian dollar (CAD), the Swedish krona (SEK) and the Swiss franc (CHF).1

Investment Case

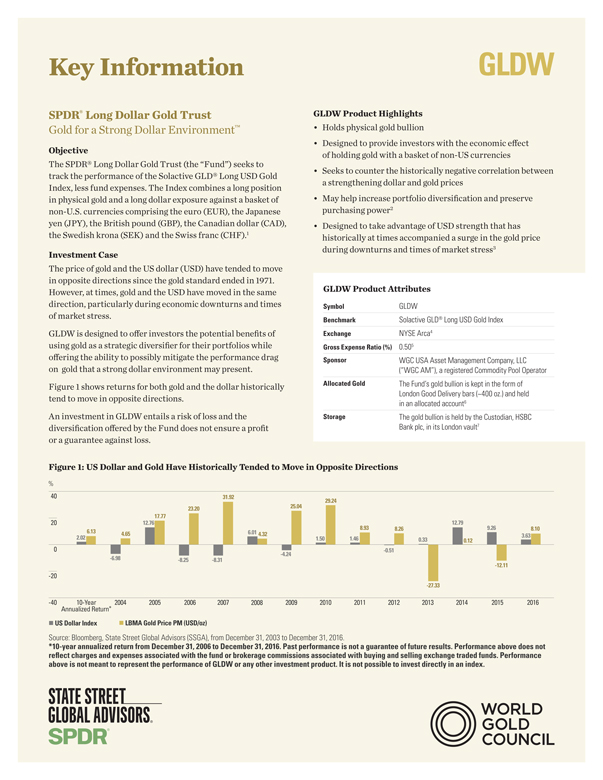

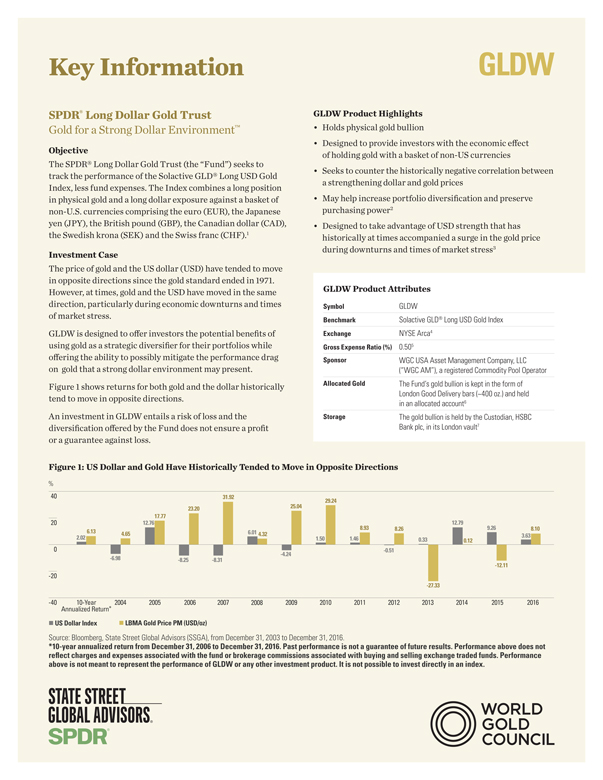

The price of gold and the US dollar (USD) have tended to move in opposite directions since the gold standard ended in 1971. However, at times, gold and the USD have moved in the same direction, particularly during economic downturns and times of market stress. GLDW is designed to offer investors the potential benefits of using gold as a strategic diversifier for their portfolios while offering the ability to possibly mitigate the performance drag on gold that a strong dollar environment may present.

Figure 1 shows returns for both gold and the dollar historically tend to move in opposite directions.

An investment in GLDW entails a risk of loss and the diversification offered by the Fund does not ensure a profit or a guarantee against loss.

GLDW Product Highlights

• Holds physical gold bullion

• Designed to provide investors with the economic effect of holding gold with a basket of non-US currencies

• Seeks to counter the historically negative correlation between a strengthening dollar and gold prices

• May help increase portfolio diversification and preserve purchasing power2

• Designed to take advantage of USD strength that has historically at times accompanied a surge in the gold price during downturns and times of market stress 3

Figure 1: US Dollar and Gold Have Historically Tended to Move in Opposite Directions

%

40

20

0

-20

2.02

6.13

-6.98

4.65

12.76

17.77

23.20

-8.25 -8.31

31.92

6.01 4.32

25.04

-4.24

29.24

1.50 1.46

8.93

-0.51

8.26

0.33

-27.33

12.79

0.12

9.26

-12.11

3.63

8.10

-40

10-Year

Annualized Return*

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

n US Dollar Index n LBMA Gold Price PM (USD/oz)

GLDW Product Attributes

Symbol GLDW

Benchmark Solactive GLD® Long USD Gold Index

Exchange NYSE Arca4

Gross Expense Ratio (%) 0.505

Sponsor WGC USA Asset Management Company, LLC

(“WGC AM”), a registered Commodity Pool Operator

Allocated Gold The Fund’s gold bullion is kept in the form of London Good Delivery bars (~400 oz.) and held in an allocated account6

Storage The gold bullion is held by the Custodian, HSBC

Bank plc, in its London vault7

Source: Bloomberg, State Street Global Advisors (SSGA), from December 31, 2003 to December 31, 2016.

*10-year annualized return from December 31, 2006 to December 31, 2016. Past performance is not a guarantee of future results. Performance above does not reflect charges and expenses associated with the fund or brokerage commissions associated with buying and selling exchange traded funds. Performance above is not meant to represent the performance of GLDW or any other investment product. It is not possible to invest directly in an index.

STATE STREET

GLOBAL ADVISORS SPDR

WORLD

GOLD

COUNCIL

Key Information

1 The US Dollar Index is a currency benchmark that measures the performance of the US dollar against a basket of currencies comprised of: 57.6% EUR, 13.6% JPY,

11.9% GBP, 9.1% CAD, 4.2% SEK and 3.6% CHF. The currencies and weights were determined by the US Federal Reserve as a measure of the foreign exchange value of the dollar and are static. An index is unmanaged, is not subject to fees and is not available for direct investment.

2 Over the past 25 years, the correlation of gold to stocks, bonds and other commodities was -0.01, 0.21, and 0.41, respectively. Source: SSGA, Bloomberg, as of 12/31/2016. Computed using monthly return data from December 1991

to December 2016. Correlation measures the degree to which the deviations of one variable from its mean are related to those of a different variable from its respective mean. Stocks represented by S&P 500 Index; Bonds represented by the Bloomberg Barclays US Aggregate Index; Commodities represented by Bloomberg Commodity Index. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. An index is unmanaged, is not subject to fees and is not available for direct investment.

3 During the Great Recession from January 1, 2008 to March 31, 2009, spot gold rose 9.9% and the US Dollar Index rose 11.4%. During the first volatile phase of the Sovereign Debt Crisis from November 30, 2009 to May 28, 2010, spot gold rose 2.7% and the US Dollar Index rose 15.5%. During the second volatile phase of the Sovereign Debt Crisis from Apr 29, 2011 to Jun 29, 2012, spot gold rose

4.1% and the US Dollar Index rose 11.6%. Spot gold measured by the LBMA Gold

Price. Sources: Bloomberg, World Gold Council, SSGA. Past performance is not a guarantee of future results. Performance above does not reflect charges and expenses associated with the fund or brokerage commissions associated with buying and selling exchange traded funds. Performance above is not meant to represent the performance of any investment product. It is not possible to invest directly in an index.

4 Minimum order is one share, and individual shareholders cannot interact directly with the trust under any circumstances.

5 The gross expense ratio is the fund’s total annual operating expense ratio. It is gross of any fee waivers or expense reimbursements. It can be found in the fund’s most recent prospectus.

6 An allocated account is an account with a bullion dealer, which may also be a bank, to which individually identified units of gold (such as bars) owned by the account holder are credited. The gold held in an allocated gold account is specific to that account and is identified by a list that shows, for each unit of gold, the refiner, assay or fineness, serial number and gross and fine weight.

7 The Custodian may, from time to time, hold with sub-custodians a relatively small percentage of the Trust’s gold for a relatively short amount of time before having that gold moved to the Custodian’s London vault.

Glossary

Bloomberg Barclays US Aggregate Bond Index A benchmark of the performance of the U.S. dollar-denominated investment grade bond market. This includes government bonds, investment-grade corporate bonds, mortgage pass through securities, commercial mortgage backed securities and asset-backed securities that are publicly for sale in the US.

Bloomberg Commodity Index A broadly diversified commodity price index distributed by Bloomberg Indexes that tracks 22 commodity futures and seven sectors. No one commodity can compose less than 2 percent or more than 15 percent of the index and no sector can represent more than 33 percent of the index.

Gold Standard A monetary standard under which the basic unit of currency

is defined by a stated quantity of gold. In 1971 US President Richard Nixon ended the ability to convert US dollars into gold at the fixed price of $35 per ounce.

Great Recession The economic recession of January 1, 2008 to March 31, 2009

that is generally considered the most significant downturn since the Great Depression of the 1930s. The Great Recession was triggered largely by the sub-prime mortgage crisis that led to the collapse of systemically vital US investment banks such as Bear Stearns and Lehman Brothers.

LBMA Gold Price The LBMA Gold Price is determined twice each business day (10:30 a.m. and 3:00 p.m. London time) by the participants in a physically settled, electronic and tradable auction.

Long or Long Position A long or a long position is the purchase of a security such as a stock, commodity or currency in the hope that the asset’s price will rise. A long position is the opposite of a “short” position or short selling.

Short or Short Position A strategy that seeks to profit from a decline in price of a stock or security. The short seller borrows the security and sells it to another investor, hoping the price falls and that he or she can buy it back at a lower price and lock in a profit. A short position is the opposite of a long position.

S&P 500 Index A popular benchmark for U.S. large-cap equities that includes

500 companies from leading industries and captures approximately 80% coverage of available market capitalization.

Sovereign Debt Crisis A period of time that began to unfold in late 2009 when several European countries on the periphery of the Eurozone became unable to repay or refinance government debt or bail out banks without the assistance of the European Central Bank and the International Monetary Fund. It was brought to heel in July 2012 with the ECB’s pledge to save the euro and the Eurozone at all costs. While the crisis began with the collapse of Icelandic and Irish banks, it became largely focused on southern European countries — mainly Greece, and also Spain, Portugal and even Italy.

Solactive GLD® Long USD Gold Index A benchmark that combines a long exposure to spot gold and a a long dollar exposure against a basket (“FX Basket”)

of non-US currencies comprising the euro, the Japanese yen, the British pound, the

Canadian dollar, the Swiss franc and the Swedish krona.

US Dollar Index A currency benchmark that measures the performance of the US dollar against a basket of currencies: the euro, the Japanese yen, the British pound, the Canadian dollar, the Swiss franc and the Swedish krona.

Volatility The tendency of a market index or security to jump around in price. Volatility is typically expressed as the annualized standard deviation of returns. In modern portfolio theory, securities with higher volatility are generally seen

as riskier due to higher potential losses.

World Gold Council (WGC) The market-development organization for the gold industry. In 2004, an affiliate of the World Gold Council, with State Street Global Markets as its marketing agent, launched SPDR® Gold Shares (GLD®), the first

US-listed physical gold ETF.

State Street Global Advisors

Key Information

ssga.com| spdrgoldshares.com

State Street Global Advisors On e Lincoln Street, Boston, MA 0 2 111- 2 90 0.

T: +1 61 7 66 4 77 27. T: 86 6 320 4 0 53 .

Important Risk Information

Investing involves risk, and you could lose money on an investment in SPDR® Lo ng

Dollar Gold Trust (“ GL DW”) .

Commodities and commodity-index linked securities may be affected by changes in overall market movement s, change s in interest rates, and other factors such a s weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities.

G L D W is subject to regulation under the Commodity Exchange Act of 1936 (the “CEA”). U.S. regulation of swap agreements is rapidly changing and is subject to further regulatory developments which could be adverse to G L D W. GL DW’s swap agreements will be subject to counterparty risk and liquidity risk.

Currency exchange rates between the U.S. dollar and non - U.S. currencies ma y

fluctuate significantly over short periods of time and may cause the value o f GLDW’s investments to decline.

G L D W is a passive investment vehicle that is designed to track the Index. GL DW’s performance may deviate from changes in the levels of its Index (i.e ., create “tracking error” between GL D W and the Index) for a number of reasons, such a s the fees and

expenses of GLDW , which are not accounted for by the Index.

Frequent trading of E TF s could significantly increase commissions and other costs

such that they may offset any saving s from low fees or costs.

Diversification does not ensure a profit or guarantee against loss.

Investing in commodities entails significant risk and is not appropriate for all investors.

Important Information Relating to SPDR ® Long Dollar Gold Trust (“GLDW”): The SPDR ® Long Dollar Gold Trust (“GLDW”) has filed a registration

statement (including a prospectus ) with the Securities and Exchange

Com m i ssi on (“SEC”), and has also filed the prospectus with t he National Futures Association, for the offering to which this communication relates . Before you invest , you should re ad the prospectus in that registration

statement and other documents GLDW has filed with the SEC for m ore

complete information about GLD W and this offering . You m ay get the s e documents for free by visiting E D GA R on t he SEC website at sec.gov or

by visiting spdrgoldshares.com . Alternatively, the Trust or any authorize d

participant will arrange to send you the prospectus if you request it by

calling 866 .320.4053 .

G L D W is not an investment com p any registered under the Investment Company Act of 1940 (the “1 9 40 A ct”). As a result, shareholders of the Trust do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act.

GLDW shares trade like stocks, are subject to investment risk and will fluctuate in

market value. The value of GLDW shares relates directly to the value of the gold

held by GLDW (less its expenses) and the value of a basket (“FX Basket”) comprising the euro, Japanese yen, British pound sterling, Canadian dollar, Swedish krona and Swiss franc (“Reference Currencies”) against the U.S. dollar. A decline in the price of gold and/or an increase in the value of the Reference Currencies comprising the FX basket against the U.S. dollar could materially and adversely affect an investment

in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold and the price of each Reference Currency against the U.S. dollar represented by them. GLDW does not generate any income, and as GLDW regularly sells gold to pay for its ongoing expenses, the amount of gold represented by each Share will decline over time to that extent. Investing involves risk, and you could lose money on an investment in GLDW.

Please see the GLDW prospectus for a detailed discussion of the risks of investing

in GLDW shares. The GLDW prospectus is available by clicking here.

The World Gold Council name and logo are a registered trademark and used with the permission of the World Gold Council pursuant to a license agreement. The World Gold Council in not responsible for the content of, and is not liable for the use of or reliance on, this material. World Gold Council is an affiliate of GLDW’s Sponsor.

SPDR® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”) and has been sublicensed by S&P Dow Jones Indices LLC (“SPDJI” and together with its affiliates and SPFS, “S&P”) for use by State Street Global Advisors. No financial product offered by State Street Global Advisors, a division of State Street Bank and Trust Company, or its affiliates is sponsored, endorsed, sold or promoted by S&P. S&P makes no representation regarding the advisability of investing in such product(s) nor does S&P have any liability in relation thereto.

Important Information Relating to Solactive GLD® Long USD Gold Index: GLDW is not sponsored, promoted, sold or supported in any other manner by

Solactive AG nor does Solactive AG offer any express or implicit guarantee or

assurance either with regard to the results of using the Index and/or Index trademark or the Index value at any time or in any other respect. The Index is calculated and published by Solactive AG. Solactive AG uses its best efforts to ensure that the

Index is calculated correctly. Irrespective of its obligations towards GLDW, Solactive AG has no obligation to point out errors in the Index to third parties including but not limited to investors in and/or financial intermediaries transacting in or with GLDW. Neither publication of the Index by Solactive AG nor the licensing of the Index or Index trademark for the purpose of use in connection with GLDW constitutes a recommendation by Solactive AG to invest capital in GLDW nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment

in GLDW.

For more information, please contact the Marketing Agent for GLDW: State Street Global Markets, LLC, One Lincoln Street, Boston, MA, 02111; T: +1 866 320 4053 spdrgoldshares.com

Not FDIC Insured • No Bank Guarantee • May Lose Value

State Street Global Advisors

© 2016 State Street Corporation. All Rights Reserved.

ID7698-IBG-21225 0916 Exp. Date: 09/30/2017