| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This information should be read in conjunction with the financial statements and notes included in Item 1 of Part I of this Quarterly Report. This Quarterly Report, including the exhibits hereto and the information incorporated by reference herein, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such forward-looking statements involve risks and uncertainties. Except for historical information, statements about future gold prices, gold bullion sales, foreign currencies (including the Reference Currencies), foreign currency exchange rates, costs, plans, or objectives are forward-looking statements based on our estimates, beliefs, assumptions and projections. Words such as “could,” “would,” “may,” “expect,” “anticipate,” “target,” “goals,” “project,” “intend,” “plan,” “believe,” “seek,” “outlook,” “estimate,” “predict,” and variations on such words, and similar expressions that reflect our current views with respect to future events and fund performance, are intended to identify such forward-looking statements. These forward-looking statements are only predictions, subject to risks and uncertainties that are difficult to predict and many of which are outside of our control, and actual results could differ materially from those discussed. Important factors that could affect performance and cause results to differ materially from our expectations are described in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Annual Report on Form10-K for the fiscal year ended September 30, 2017, as updated from time to time in the Trust’s Securities and Exchange Commission filings.

Organization and Trust Overview

World Gold Trust (the “Trust”), formerly known as World Currency Gold Trust, was organized as a Delaware statutory trust on August 27, 2014 and is governed by the Fourth Amended and Restated Agreement and Declaration of Trust (“Declaration of Trust”) dated as of April 16, 2018, between WGC USA Asset Management Company, LLC (the “Sponsor”) and the Delaware Trust Company (the “Trustee”). The Trust is authorized to issue an unlimited number of shares of beneficial interest (“Shares”). The beneficial interest in the Trust may be divided into one or more series. The Trust has established six separate series. The accompanying unaudited financial statements relate to the Trust, SPDR® Long Dollar Gold Trust (“GLDW”) and SPDR®GoldMiniSharesSM Trust (“GLDM”). GLDW and GLDM are currently the only operational series of the Trust. GLDW commenced operations in the first calendar quarter of 2017. GLDM commenced operations during the second calendar quarter of 2018. The fiscal year end of the Trust and both GLDW and GLDM (referred to jointly as the “Funds”) is September 30. GLDW and GLDM issue shares of beneficial interest (“Shares”), which represent units of fractional undivided beneficial interest in and ownership of either GLDW or GLDM, respectively. The Trust has had no operations prior to January 27, 2017, other than matters relating to its organization, the registration of the Shares under the Securities Act of 1933, as amended, and the sale and issuance by GLDW on December 19, 2016 to WGC (US) Holdings, Inc., an affiliate of the Sponsor, of 10 GLDW Shares at an aggregate purchase price of $1,000. GLDW’s Shares and GLDM’s Shares began trading on the NYSE Arca on January 30, 2017 and June 26, 2018, respectively. As of August 6, 2018, GLDW and GLDM had 210,000 Shares and 8,700,000 Shares, respectively, outstanding.

As of the date of this quarterly report, Goldman, Sachs & Co., J.P. Morgan Securities LLC, Merrill Lynch Professional Clearing Corp., Morgan Stanley & Co., LLC, UBS Securities LLC and Virtu Financial BD LLC are the Authorized Participants. An updated list of Authorized Participants can be obtained from the Administrator or the Sponsor.

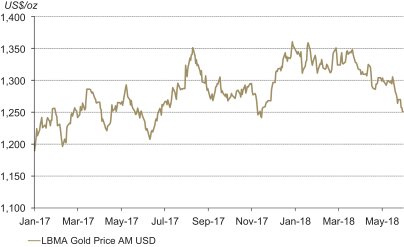

The investment objective of GLDM is for the Shares to reflect the performance of the price of gold bullion, less GLDM’s expenses.

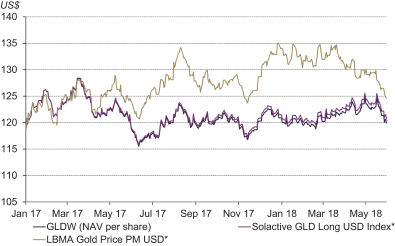

The investment objective of GLDW is to track the performance of the Solactive GLD® Long USD Gold Index (the “Index”), less GLDW’s expenses. The Index seeks to track the daily performance of a long position in physical gold, as represented by the LBMA Gold Price AM, and a short position in a basket ofnon-U.S. currencies (i.e., a long U.S. dollar (“USD”) exposure versus the basket (“FX Basket”)). Thosenon-U.S. currencies, which are weighted according to the Index, consist of the following: Euro, Japanese Yen, British Pound Sterling, Canadian Dollar, Swedish Krona and Swiss Franc (each, a “Reference Currency”).

40