At December 31, 2018, HSBC Bank plc (the “GLDW Custodian”) held 22,729.7 ounces of gold on behalf of GLDW in its vault, 100% of which was allocated gold in the form of London Good Delivery gold bars including 89.4 ounces of gold payable in connection with the settlement of the Gold Delivery Agreement with a market value of $29,131,547 (cost $28,233,429) based on the LBMA Gold Price AM on December 31, 2018. Through the date of this report, (i) 2.2 ounces of gold were receivable by the GLDW Custodian in connection with the settlement of the Gold Delivery Agreement and (ii) GLDW has used no subcustodians.

At September 30, 2018, the GLDW Custodian held 22,004.4 ounces of gold on behalf of GLDW, 100% of which was allocated gold in the form of London Good Delivery gold bars with a market value of $26,042,261 (cost $27,378,794). Subcustodians did not hold any gold in their vaults on behalf of GLDW.

On September 12, 2018, Inspectorate International Limited concluded the annual full count of GLDW’s gold bullion held by the GLDW Custodian. On October 1, 2018, Inspectorate International Limited concluded reconciliation procedures from September 12, 2018 through September 30, 2018. The results can be found on www.spdrgoldshares.com.

GLDM

GLDM commenced operations on June 26, 2018 and in the period from then to December 31, 2018, 31,000,000 GLDM Shares were created (310 Creation Units) in exchange for 309,858.7 ounces of gold and 106.8 ounces of gold were sold to pay sponsor fees.

At December 31, 2018, ICBC Standard Bank Plc (the “GLDM Custodian”) held 290,769.3 ounces of gold on behalf of GLDM in its vault, 100% of which was allocated gold in the form of London Good Delivery gold bars including gold payable, if any, with a market value of $372,664,432 (cost $356,375,416) based on the LBMA Gold Price AM on December 31, 2018. Through the date of this report, (i) 18,982.6 ounces of gold were receivable by the GLDM Custodian in connection with the creation of Shares and (ii) GLDM has used no subcustodians.

At September 30, 2018, the GLDM Custodian held 185,927 ounces of gold in its vault, 100% of which was allocated gold in the form of London Good Delivery gold bars with a market value of $220,741,876 (cost $226,957,150). Subcustodians did not hold any gold in their vaults on behalf of GLDM.

On September 13, 2018, Inspectorate International Limited concluded the annual full count of GLDM’s gold bullion held by the GLDM Custodian. On October 1, 2018, Inspectorate International Limited concluded reconciliation procedures from September 13, 2018 through September 30, 2018. The results can be found on www.spdrgoldshares.com.

Cash Resources and Liquidity

At December 31, 2018, neither GLDW nor GLDM had any cash balances. When selling gold to pay expenses, the Administrator endeavors to sell the smallest amount of gold needed to pay expenses in order to minimize the Funds’ holdings of assets other than gold. As a consequence, we expect that the Funds will not record any net cash flow from their operations and that their cash balance will be zero at the end of each reporting period.

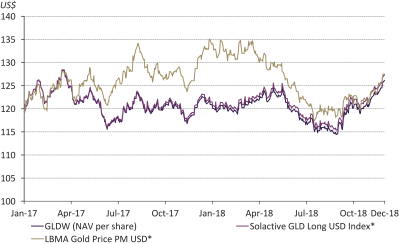

Analysis of Movements in the Price of Gold

As movements in the price of gold are expected to directly affect the price of the Funds’ Shares, it is important to understand and follow movements in the price of gold. Past movements in the gold price are not indicators of future movements.

43