UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement. |

| [ ] | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| [X] | Definitive Proxy Statement. |

| [ ] | Definitive Additional Materials. |

| [ ] | Soliciting Material Pursuant to § 240.14a-12. |

The RBB Fund Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

[ ] Fee paid previously with preliminary materials:

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Proxy Materials

PLEASE CAST YOUR VOTE NOW!

Evermore Global Value Fund

A Series of The RBB Fund Trust

c/o U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, WI 53202

March 10, 2023

Dear Shareholder:

I am writing to inform you about an upcoming special shareholder meeting (the “Meeting”) of the Evermore Global Value Fund (the “Fund”), a series of The RBB Fund Trust (the “Trust”), which will be held at the offices of U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, WI, 53202 and virtually via conference call on March 31, 2023, at 10:00 AM Central Time. We intend to hold the Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Meeting attendees or may decide to hold the Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our website www.evermoreglobal.com, and we encourage you to check this website prior to the Meeting if you plan to attend in person. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed in the enclosed proxy card, in advance of the Meeting in the event that, as of March 31, 2023, in-person attendance at the Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

At the Meeting, shareholders will be asked to approve the new investment advisory agreement between F/m Investments, LLC d/b/a North Slope Capital, LLC (“F/m” or the “Adviser”) and the Trust, on behalf of its series, the Fund (the “New Investment Advisory Agreement”). Additionally, shareholders will be asked to approve a new sub-advisory agreement (the “Sub-Advisory Agreement”) between F/m and MFP Investors LLC (“MFP” or the Sub-Adviser”). MFP is an investment management firm founded by the late Michael F. Price, a value investor who was portfolio manager to the Mutual Series funds from the mid-1970s through the mid-1990s. MFP will pay for the costs of this proxy solicitation, including the printing and mailing of the Proxy Statement and related materials.

Pursuant to a Purchase and Assignment and Assumption Agreement between Evermore Global Advisors, LLC (“Evermore”) and MFP, Evermore will sell substantially all of its business and advisory assets to MFP (the “Purchase Agreement”). Contemporaneously, it is proposed that F/m will be appointed as investment adviser to the Fund and MFP will be appointed as sub-adviser to the Fund (the Purchase Agreement and proposals collectively referred to as, the “Transaction”). Evermore, MFP, and F/m believe the Transaction will provide more opportunities for the Fund’s growth over the long term.

The first proposal relates to the approval of the New Investment Advisory Agreement between F/m and the Trust, on behalf of the Fund. The New Investment Advisory Agreement will not result in any change in the Fund’s investment strategies, advisory fees or, as further described below in connection with the second proposal, portfolio management. The arrangement will be largely identical to the current investment advisory agreement between Evermore Global Advisors, LLC (“Evermore”) and the Trust (the “Current Investment Advisory Agreement”). Evermore has served as the investment adviser to the Fund since its inception and served as investment adviser to the predecessor fund since 2010. As a result of the Transaction, and pending shareholder approval of the New Investment Advisory Agreement, F/m will replace Evermore as the adviser to the Fund. Under the Investment Company Act of 1940, shareholder approval of the New Investment Advisory Agreement is necessary in order for F/m to serve as the Fund’s investment adviser following the closing of the Transaction. The material terms of the proposed New Investment Advisory Agreement are identical to the material terms of the Current Investment Advisory Agreement.

The second proposal relates to the approval of the Sub-Advisory Agreement between F/m and MFP. Pursuant to the proposed Sub-Advisory Agreement, MFP will be responsible for day-to-day investment management of the Fund. In connection with the Transaction, MFP will be acquiring certain advisory and other business assets of Evermore and will be hiring Evermore’s key investment professionals. As a result, the Fund and their shareholders will continue to have the benefit of Evermore’s investment strategies and portfolio management expertise by virtue of the Fund’s engagement of MFP as sub-adviser.

The Board of Trustees recommends that you vote in favor of these Proposals.

The attached Proxy Statement describes the Proposals and the voting process for shareholders. The Board asks that you read it carefully and vote in favor of the Proposals. Please return your proxy card in the postage-paid envelope as soon as possible. You also may vote over the Internet or by telephone. Please follow the instructions on the enclosed proxy card to use these methods of voting.

Thank you for your continued support.

Sincerely,

Steven Plump

President

The RBB Fund Trust

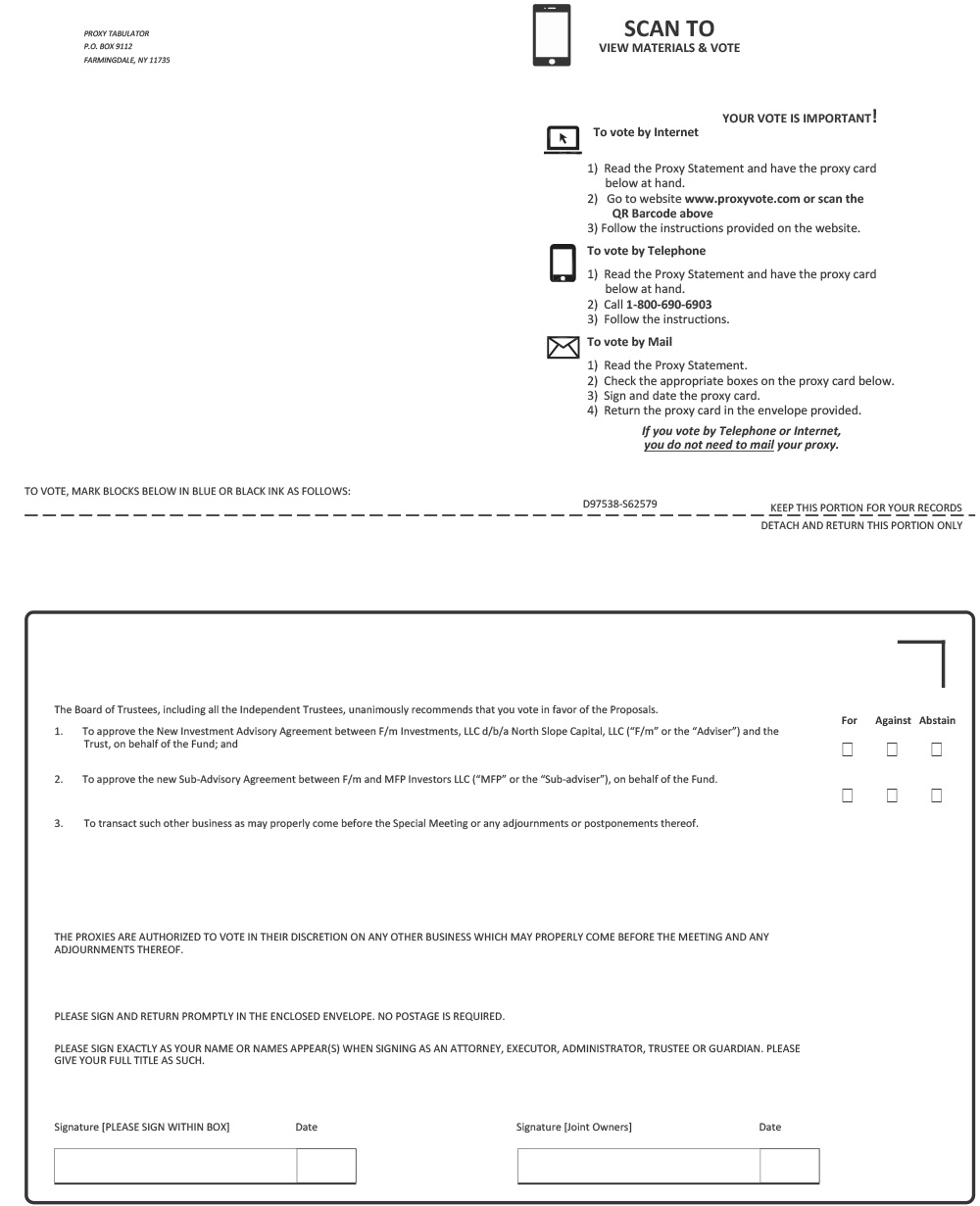

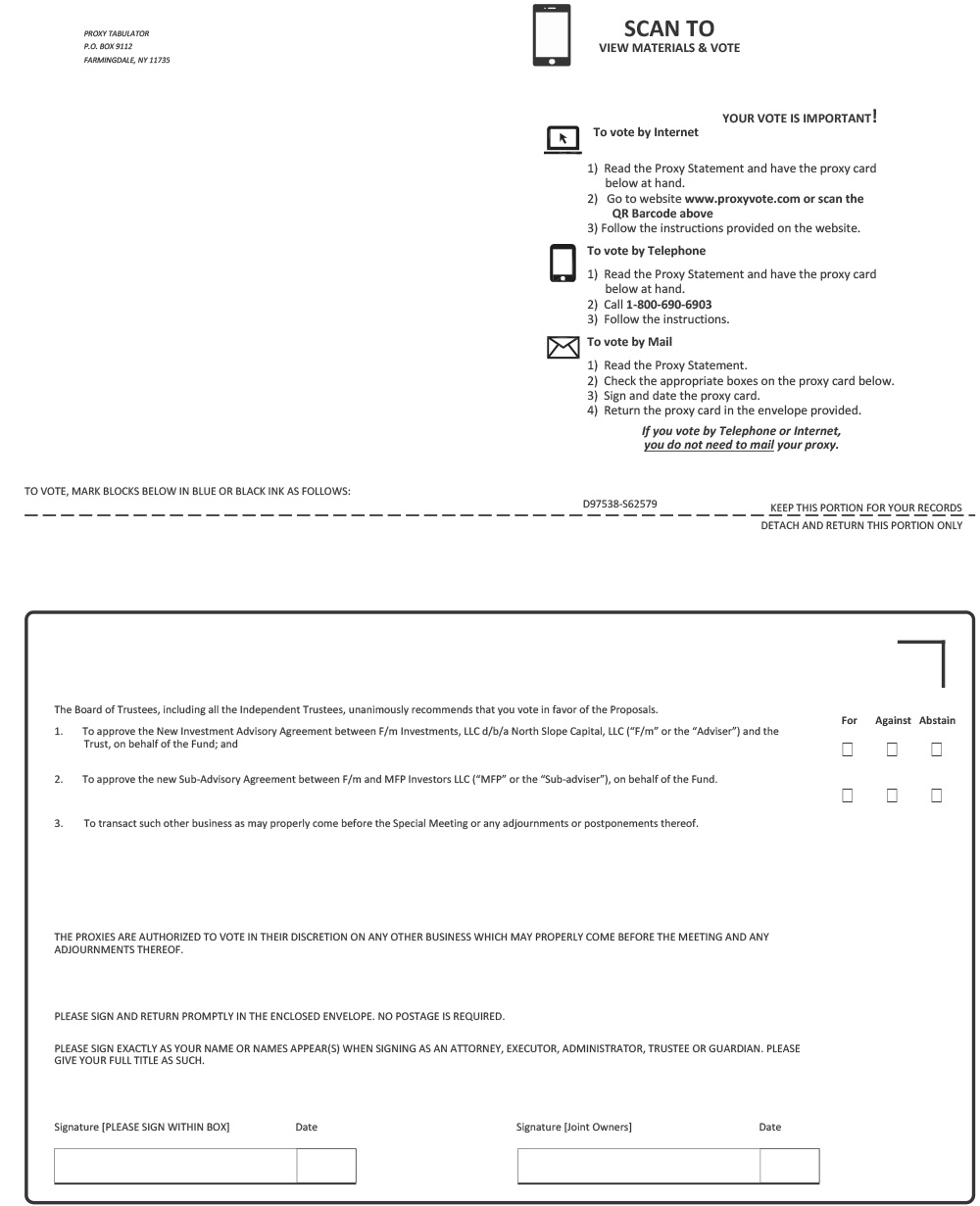

Voting is quick and easy. Everything you need is enclosed. To cast your vote:

| ● | PHONE: Call the toll-free number on your proxy card. Enter the control number on your proxy card and follow the instructions. |

| ● | INTERNET: Visit the website indicated on your proxy card. Enter the control number on your proxy card and follow the instructions. |

| ● | MAIL: Complete the proxy card(s) enclosed in this package. BE SURE TO SIGN EACH CARD before mailing it in the postage-paid envelope. |

Important information to help you understand and vote on the Proposals:

Please read the full text of the proxy statement. Below is a brief overview of the Proposals to be voted upon. Your vote is important.

What is this document and why did you send it to me?

We are sending this document to you for your use in connection with the Trust’s solicitation of your vote to approve a proposal to approve a new investment advisory agreement with F/m Investments, LLC d/b/a North Slope Capital, LLC (“Proposal 1”), a Delaware corporation (“F/m” or the “Adviser”) to enable F/m to become the investment adviser for the Evermore Global Value Fund (the “Fund”), a series of The RBB Fund Trust (the “Trust”). A new investment advisory agreement will be required following the acquisition by MFP Investors LLC of substantially all the business and advisory assets of the Fund’s current adviser, Evermore Global Advisors, LLC (“Evermore”) (such transaction herein referred to as, the “Transaction”). As the closing of the Transaction will result in an assignment, it will automatically terminate the Current Investment Advisory Agreement.

Shareholders are additionally being asked to approve a new sub-advisory agreement engaging MFP Investors LLC (“MFP” or the “Sub-Adviser”) as a sub-adviser to the Fund (“Proposal 2” and together with Proposal 1, the “Proposals”). This document includes a Notice of Meeting of Shareholders, a Proxy Statement, and Proxy Card.

At a meeting of the Trust’s Board of Trustees (the “Board”) held on February 8-9, 2023 and reconvened on February 16, 2023, the Board approved both of the Proposals, which are now subject to shareholder approval. The Board recommends that shareholders also approve the Proposals.

What is Proposal 1 about?

You are being asked to vote to approve a new investment advisory agreement (the “New Investment Advisory Agreement”), between F/m and the Trust on behalf of the Fund.

Under the Investment Company Act of 1940 (the “1940 Act”), shareholder approval of the New Investment Advisory Agreement is necessary to in order for F/m to serve as the Fund’s investment adviser. The material terms of the New Investment Advisory Agreement are identical to the material terms of the Current Investment Advisory Agreement, and the approval of the New Investment Advisory Agreement will not result in any change in the Fund’s investment strategies or advisory fee. No increase in shareholder fees or expenses is being proposed.

What is Proposal 2 about?

F/m has proposed that MFP serve as sub-adviser to the Fund. In connection with the Transaction, MFP will be acquiring substantially all the business and advisory assets of Evermore and will be hiring Evermore’s key investment professionals. So that the Fund and their shareholders will continue to have the benefit of Evermore’s investment strategies and portfolio management expertise, shareholders are being asked to approve a new sub-advisory agreement (the “Sub-Advisory Agreement”) between F/m and MFP. If the Sub-Advisory Agreement is approved, MFP will serve as sub-adviser to the Fund, and the Fund’s current portfolio management team will continue to provide portfolio management services.

What if either Proposal 1 or Proposal 2 are not approved by shareholders?

The Transaction will not consummate until after shareholders have approved both the New Investment Advisory Agreement and the Sub-Advisory Agreement. If shareholders do not approve either the New Investment Advisory Agreement or the Sub-Advisory Agreement, Evermore will continue to manage the Fund pursuant to the Current Investment Advisory Agreement and Evermore and the Board will consider alternative options.

How will my approval of the Proposals affect the management and operation of the Fund?

The Fund’s investment strategies, advisory fees and other terms will not change as a result of the New Investment Advisory Agreement or the Sub-Advisory Agreement. The same portfolio management team will continue to manage the Fund but as employees of MFP.

Is anything changing for the Fund related to the Transaction?

Other than the Transaction resulting in F/m replacing Evermore as the Fund’s investment adviser and MFP becoming a sub-adviser to the Fund, no changes are expected to occur with respect to the day-to-day management of the Fund.

How will my approval of the Proposals affect the expenses of the Fund?

The proposed approvals of the New Investment Advisory Agreement and Sub-Advisory Agreement with F/m and MFP, respectively, will not result in an increase of the investment advisory fee paid by the Fund to the investment adviser or in the Fund’s total expenses.

What are the primary reasons for the selection of F/m as the investment adviser of the Fund and MFP as sub-adviser to the Fund?

The benefits of approving the New Investment Advisory Agreement and the Sub-Advisory Agreement include continuity in the portfolio management of the Fund and retention of the current investment personnel. The Board weighed a number of factors in reaching its decision to allow F/m to serve as the investment adviser for the Fund and MFP to serve as sub-adviser to the Fund, including the history, reputation, qualifications and resources of F/m and MFP, respectively and the fact that Evermore’s current portfolio managers would continue to provide the day-to-day management of the Fund through their anticipated employment at MFP. With respect to the latter point, the Board considered the Fund’s performance in the absolute, as well as against its benchmark and peer group. The Board also considered that, as a result of the proposal, the Fund’s advisory fee would not increase and that all costs incurred by the Fund as a result of the Transaction would be borne by MFP, not the Fund’s shareholders. Lastly, the Board considered the extent to which economies of scale are relevant to the Fund and the potential of realizing such through the combined efforts of F/m and MFP. Please see “Board Recommendation of Approval” in the Proxy Statement for a full discussion of the Board’s considerations.

Are there any material differences between the Current Investment Advisory Agreement and the proposed New Investment Advisory Agreement?

No. There are no material differences between the Current Investment Advisory Agreement and the proposed New Investment Advisory Agreement.

Has the Board approved the Proposals?

Yes. The Board approved each proposal set forth herein, subject to shareholder approval.

Who is Broadridge Financial Solutions, Inc. (“Broadridge”)?

Broadridge is a third-party proxy vendor that MFP has engaged to contact shareholders and record proxy votes. In order to hold a shareholder meeting, a quorum must be reached. If a quorum is not attained, the meeting must adjourn to a future date. Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to call you to solicit your vote.

Who is paying for this proxy mailing and for the other expenses and solicitation costs associated with this shareholder meeting?

MFP will pay for the costs of this proxy solicitation, including the printing and mailing of the Proxy Statement and related materials.

What will happen if the Proposals are not approved by shareholders?

If sufficient votes are not obtained to approve the Proposals with respect to the Fund, the Board will consider what further action to take, including adjourning the special meeting for the Fund and making a reasonable effort to solicit support with respect to the proposal in order to receive sufficient votes. If, following such adjournment, it remains unlikely that the Proposals will be approved by shareholders, the Board will consider alternative actions, taking into account the best interests of shareholders, including (without limitation) the retention of Evermore as the investment adviser of the Fund, the recommendation of one or more other investment advisors, subject to approval by Fund shareholders, or the liquidation of the Fund.

Who is eligible to vote?

Shareholders of record of the Fund as of the close of business on February 28, 2023 (the “Record Date”) are entitled to be present and to vote at the special meeting of shareholders (the “Meeting”) or any adjournment thereof. Shareholders of record of the Fund at the close of business on the Record Date will be entitled to cast one vote for each full share and a fractional vote for each fractional share they hold on the Proposals presented at the Meeting.

How is a quorum for the Meeting established?

The presence of one-third (33-1/3%) of the outstanding shares of the Fund entitled to vote, present in person or represented by proxy, constitutes a quorum for the Proposals for the Fund. Proxies returned for shares whose proxies reflect an abstention on any item are all counted as shares present and entitled to vote for purposes of determining whether the required quorum of shares exists. However, such proxies will not be treated as votes cast at the Meeting. Proxies returned for shares that represent broker non-votes will not be counted as shares present and entitled to vote for purposes of determining whether the required quorum of shares exists. If a quorum is not present for the Fund at the Meeting, or if a quorum is present at the Meeting but sufficient votes to approve the Proposals is not received on behalf of the Fund, or if other matters arise requiring shareholder attention, persons named as proxy agents may propose one or more adjournments of the Meeting to permit further solicitation of proxies with respect to the Fund.

What vote is required to approve the Proposals?

Approval of the New Investment Advisory Agreement between F/m and the Trust (on behalf of the Fund) and the Sub-Advisory Agreement between F/m and MFP, requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon.

How do I vote my shares?

Although you may attend the Meeting and vote in person, you do not have to. You can vote your shares by completing and signing the enclosed proxy card and mailing it in the enclosed postage-paid envelope. You may also vote by touch-tone telephone by calling the toll-free number printed on your proxy card and following the recorded instructions.

In addition, you may vote through the Internet by visiting the Internet address printed on your proxy card and following the on-line instructions. If you need any assistance or have any questions regarding the proposal or how to vote your shares, please call Broadridge Solutions, Inc. at 833-757-0709. Representatives are available to assist you Monday through Friday, 9 a.m. to 10 p.m. Eastern Time.

If you simply sign and date the proxy card but do not indicate a specific vote, your shares will be voted “FOR” the Proposals and to grant discretionary authority to the persons named in the card as to any other matters that properly come before each Meeting. Abstentions will be treated as votes AGAINST a Proposal.

Shareholders who execute proxies may revoke them at any time before they are voted by (1) filing with the Fund a written notice of revocation, (2) timely voting a proxy bearing a later date, or (3) by attending the Meeting and voting in person.

Please complete, sign and return the enclosed proxy card in the enclosed envelope. You may vote your proxies by Internet or telephone in accordance with the instructions set forth on the enclosed proxy card. No postage is required if mailed in the United States.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD MARCH 31, 2023

EVERMORE GLOBAL VALUE FUND

(a Series of The RBB Fund Trust)

c/o U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, WI 53202

Notice is hereby given that a Special Meetings of Shareholders (the “Meeting”) of the Evermore Global Value Fund (the “Fund”), a series of The RBB Fund Trust (the “Trust”), will be at the offices of U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, WI, 53202 and virtually via conference call on March 31, 2023, at 10:00 AM Central Time.

If you are a shareholder of record as of the close of business on February 28, 2023, you are entitled to vote at the Meeting and at any adjournment thereof. Your vote is extremely important. While you are welcome to join us at the Meeting, most shareholders will cast their votes by filling out, signing, and returning the enclosed proxy card, voting by telephone, or voting using the internet.

We intend to hold the Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Meeting attendees or may decide to hold the Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our website www.evermoreglobal.com, and we encourage you to check this website prior to the Meeting if you plan to attend in person. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed in the enclosed proxy card, in advance of the Meeting in the event that, as of March 31, 2023, in-person attendance at the Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

At the Meeting, shareholders of the Fund will be asked to act upon the following Proposals, all of which are more fully described in the accompanying Proxy Statement dated February 22, 2023:

Proposal 1

To approve the New Investment Advisory Agreement between F/m Investments, LLC d/b/a North Slope Capital, LLC (“F/m” or the “Adviser”) and the Trust, on behalf of the Fund; and

Proposal 2

To approve the new Sub-Advisory Agreement between F/m and MFP Investors LLC (“MFP” or the “Sub-adviser”), on behalf of the Fund.

MFP will pay for the costs of this proxy solicitation, including the printing and mailing of the Proxy Statement and related materials.

In addition, shareholders may be asked to act on such other business as may properly come before the Meeting or any adjournments or postponements thereof,

THE BOARD OF TRUSTEES, INCLUDING ALL OF THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS.

The Trust’s Board of Trustees has fixed the close of business on February 28, 2023, as the record date for the determination of the shareholders entitled to notice of, and to vote at, the Meetings and any adjournments thereof. Please read the accompanying Proxy Statement for a full discussion of the Proposals.

| | By Order of the Board of Trustees of the Trust |

| | |

| | /s/ Steven Plump

Steven Plump

President

The RBB Fund Trust |

March 10, 2023

Your vote is very important – please vote your shares promptly.

Shareholders are invited to attend the Meeting. Please note, no representatives from F/m, MFP or the Board will be attending the Meeting. Shareholders are urged to vote using the touch-tone telephone or Internet voting instructions found on the enclosed proxy card or indicate voting instructions on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be.

EVERMORE GLOBAL VALUE FUND

(a Series of The RBB Fund Trust)

c/o U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, WI 53202

PROXY STATEMENT

March 10, 2023

FOR THE SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 31, 2023

Introduction

This Proxy Statement is furnished in connection with the solicitation by the Board of Trustees (the “Board”) of The RBB Fund Trust (the “Trust”) of proxies to be voted at the Special Meeting of Shareholders of the Evermore Global Value Fund (the “Fund”) and any adjournment or postponement thereof (the “Meeting”). We intend to hold the Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Meeting attendees or may decide to hold the Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our website www.evermoreglobal.com, and we encourage you to check this website prior to the Meeting if you plan to attend in person. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed in the enclosed proxy card, in advance of the Meeting in the event that, as of March 31, 2023, in-person attendance at the Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

Proposal 1

To approve the New Investment Advisory Agreement between F/m Investments, LLC d/b/a North Slope Capital, LLC (“F/m” or the “Adviser”) and the Trust, on behalf of the Fund; and

Proposal 2

To approve the new Sub-Advisory Agreement between F/m and MFP Investors LLC (“MFP” or the “Sub-adviser”), on behalf of the Fund.

Shareholders of record at the close of business on the record date, February 28, 2023 (the “Record Date”), are entitled to notice of, and to vote at, the Meeting. The Notice of Special Meeting of Shareholders (the “Notice”), this Proxy Statement and the enclosed Proxy Card are being mailed to Shareholders on or after March 16, 2023.

Financial statements for the Fund are included in annual reports, which are mailed to shareholders. Shareholders may obtain copies of the annual report or semi-annual report free of charge by calling 866-EVERMORE (866-383-7667) or visit the Fund’s website at https://evermoreglobal.com/our-products/global-value-fund-overview/ or writing the Fund, c/o U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, WI 53202.

PROPOSAL 1: APPROVAL OF INVESTMENT ADVISORY AGREEMENT

Background

Evermore has served as the investment adviser to the Fund since its inception and served as investment adviser to the Fund’s predecessor fund since 2010.

Pursuant to a Purchase and Assignment and Assumption Agreement between Evermore Global Advisors, LLC (“Evermore”) and MFP, Evermore will sell substantially all of its business and advisory assets to MFP (the “Purchase Agreement”). Contemporaneously, it is proposed that F/m will be appointed as investment adviser to the Fund and MFP will be appointed as sub-adviser to the Fund (the Purchase Agreement and proposals collectively referred to as, the “Transaction”). Evermore, MFP, and F/m believe the Transaction will provide more opportunities for the Fund’s growth over the long term. F/m, nor MFP, manage any assets with a similar investment objective as the Fund.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), an investment advisory agreement automatically terminates in the event of its “assignment.” MFP’s acquisition of substantially all Evermore’s business and advisory assets will operate as an “assignment” (as defined in the 1940 Act) of the Current Investment Advisory Agreement, effectively terminating the Current Investment Advisory Agreement. Shareholder approval of the New Investment Advisory Agreement is necessary in order for F/m to serve as the Fund’s investment adviser.

The Adviser does not anticipate that the Transaction will have a material impact on the Fund or any third-party vendors that provide services to the Fund, including with respect to the following: operations, personnel, organizational structure; capitalization, or the financial and other resources. Evermore’s key investment personnel are expected to be hired by the newly proposed Sub-Adviser as detailed further below in this document, and no change in senior portfolio management’s strategy for the Fund is anticipated as a result of the implementation of the Transaction.

At a meeting of the Board held on February 8-9, 2023 and reconvened on February 16, 2023, the Board, including a majority of Trustees who are not “interested persons,” (the “Independent Trustees”) as the term defined under the 1940 Act, voted unanimously to approve the proposed New Investment Advisory Agreement between F/m and the Trust on behalf of the Fund (the “New Investment Advisory Agreement”). The Board also voted unanimously to recommend that shareholders approve the New Investment Advisory Agreement. The terms of the New Investment Advisory Agreement are substantially identical to the terms of the Current Investment Advisory Agreement.

The Fund needs shareholder approval of its New Investment Advisory Agreement to allow F/m to act as its investment adviser following consummation of the Transaction. However, if the Fund’s shareholders do not approve F/m as the investment adviser for the Fund, then the Board will have to consider other alternatives for the Fund upon the consummation of the Transaction and resulting expiration of the Current Investment Advisory Agreement.

F/m does not manage any assets with a similar investment objective as the Fund.

Legal Requirements in Approving the New Investment Advisory Agreement

The form of the New Investment Advisory Agreement is attached hereto as Exhibit A. The terms of the New Investment Advisory Agreement are substantially identical to the terms of the Current Investment Advisory Agreement. The Current Investment Advisory Agreement was last submitted to the shareholders of the Fund for approval on the date shown below and was effective with respect to the Fund upon commencement of the Fund’s operations as a portfolio of the Trust:

| Fund | Effective Date

of Current

Advisory Agreement | Date Last Submitted to Fund Shareholders for Approval |

| Evermore Global Value Fund | December 28, 2022 | December 16, 2022 |

The New Investment Advisory Agreement and the Current Investment Advisory Agreement have identical fee structures. There are no material differences between the two agreements, other than their effective dates and that F/m will serve as the Fund’s investment adviser. The material terms of the New Investment Advisory Agreement and the Current Investment Advisory Agreement are compared below in the section entitled “Summary of the New Investment Advisory Agreement and Current Investment Advisory Agreement.”

The New Investment Advisory Agreement will take effect upon shareholder approval and immediately following MFP’s acquisition of Evermore’s business and advisory assets. If shareholders do not approve the New Investment Advisory Agreement with respect to the Fund, then F/m will not be permitted to serve as the Fund’s investment adviser after the consummation of the Transaction, and the Board will have to consider other alternatives for the Fund.

Compensation Paid to Evermore

Under the Current Investment Advisory Agreement, Evermore is entitled to receive a monthly advisory fee computed at an annual rate of:

| Fund | Advisory Fee |

| Evermore Global Value Fund | 0.99% of average daily net assets |

The fee structure under the New Investment Advisory Agreement with F/m will be identical to the fee structure under the Current Investment Advisory Agreement. For the fiscal year ended December 31, 2022, the Fund paid Evermore investment advisory fees in the amounts shown below:

Advisory Fees Paid to Evermore for the Fiscal Year Ended December 31, 2022

| Fund | Advisory Fees

Accrued | Fee Waiver and

Expense

Reimbursement | Net Advisory Fees

Paid |

| Evermore Global Value Fund | $1,546,689 | $190,356 | $1,356,333 |

In the event the Fund’s operating expenses, as accrued each month, exceeded the Fund’s annual expense limitation, Evermore agreed to pay the Fund, on a monthly basis, the excess expenses within 30 calendar days of notification that such payment was due. Evermore has contractually agreed to limit the amount of the Fund’s total annual operating expenses (excluding taxes, interest on borrowings, acquired fund fees and expenses, dividends on securities sold short, brokerage commissions, and other expenditures, which are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of business) to 1.60% of the Fund’s average daily net assets attributable to Investor Shares and to 1.35% of the Fund’s average daily net assets attributable to Institutional Shares through December 31, 2023. Evermore is permitted to recoup, on a class by class basis, any fees it has waived or deferred or expenses it has borne pursuant to an expense limitation agreement to the extent that the Fund’s expenses (after any repayment is taken into account) do not exceed both of (i) the expense limitations that were in effect at the time of the waiver or reimbursement, and (ii) the current expense limitations. The Board of Trustees must approve any recoupment payment made to the Evermore. The Fund will not be obligated to pay any such deferred fees and expenses more than three years after date on which the fees and expenses were waived or deferred.

If shareholders approve the New Investment Advisory Agreement, F/m has agreed to continue the current expense limitation until at least December 31, 2025, but there will be no recoupment of fees waive or expense reimbursement paid to Evermore under the new agreement.

Information about F/m Investments, LLC d/b/a North Slope Capital, LLC

F/m is registered with the Securities and Exchange Commission (“SEC”) as an investment adviser under the Investment Advisers Act of 1940, as amended. F/m’s principal office is located at 3050 K Street NW, Suite W-201, Washington, DC 20007. As of September 30, 2022, the Adviser together with its affiliates had approximately $1.71 billion in assets under management.

F/m Acceleration, LLC (“F/m Acceleration”) and EQSF Holdings, LLC (“EQSF”), each a parent company of F/m, own and control 50% of the Adviser. EQSF is organized as a Delaware limited liability company and is owned by three officers of the Trust. EQSF’s principal business address is 1209 Orange Street, Wilmington DE, 19801.

F/m Acceleration, which is located at 3050 K Street NW, Suite W-201, Washington, DC 20007, is a wholly-owned subsidiary of Diffractive Managers Group, LLC (“Diffractive”). Diffractive is a multi-affiliate asset management company and centralized distribution platform. Founded in 2018, Diffractive owns equity stakes in a number of asset managers and seeks to deliver differentiated active strategies to investment professionals and their clients. As of January 31, 2023, Diffractive and its affiliates had approximately $23 billion in assets under management. Diffractive is organized as a Delaware limited liability company and its principal business address is 111 Huntington Avenue, Boston, Massachusetts 02199.

Diffractive is an indirect, wholly-owned subsidiary of 1251 Capital Group, Inc. (“1251”). 1251 is a Delaware corporation that operates in the investment management, specialty insurance and insurance carriers industries. 1251’s business address is 9 Newbury Street, Floor 5, Boston, Massachusetts 02116.

EQSF, which owns and controls 50% of the Adviser, is owned by three officers of the Trust as set forth in the table:

| Name | Percentage of Ownership if EQSF | Officer Position(s) Held with the

Trust |

| Steven Plump | 33.34% | President |

| James G. Shaw | 33.33% | Chief Financial Officer, Chief Operating Officer and Secretary |

| Craig A. Urciuoli | 33.33% | Director of Marketing and Business Development |

During the fiscal year ended August 31, 2022, Messrs. Plump, Shaw, and Urciuoli received compensation from the Trust in the amount of $20,000, $315,500, and $262,032, respectively. Following the approval of the New Investment Advisory Agreement, the above listed officers of the Trust will continue to serve and be compensated as officers of the Trust.

The following table sets forth the name, position and principal occupation of each current member and principal officer of F/m, each of whom is located at F/m’s principal office location.

| Name | Position/Principal Occupation |

| Mathew A. Swendiman | Chief Compliance Officer |

| Alexander R. Morris | Chief Investment Officer |

No Trustee of the Trust currently holds any position with F/m, F/m Acceleration, EQSF, Diffractive, 1251 or their respective affiliates.

Summary of the New Investment Advisory Agreement and the Current Investment Advisory Agreement

A copy of the proposed New Investment Advisory Agreement is attached hereto as Exhibit A. The following description is only a summary. You should refer to Exhibit A for the New Investment Advisory Agreement for a complete description of the terms of the new agreement. The investment advisory services to be provided by F/m under the New Investment Advisory Agreement and the fee structure are identical to the services currently provided by Evermore and the fee structure under the Current Investment Advisory Agreement.

Advisory Services. Both the New Investment Advisory Agreement and the Current Investment Advisory Agreement state that, subject to the supervision and direction of the Board, the respective investment adviser will provide for the overall management of the Fund including: (i) furnish the Fund with advice and recommendations with respect to the investment of the Fund’s assets and the purchase and sale of portfolio securities for the Fund, including the taking of such steps as may be necessary to implement such advice and recommendations (i.e., placing the orders); (ii) manage and oversee the investments of the Fund, subject to the ultimate supervision and direction of the Board; (iii) vote proxies for the Fund, file ownership reports under Section 13 of the Securities Exchange Act of 1934 for the Fund, and take other actions on behalf of the Fund; (iv) maintain the books and records required to be maintained by the Fund except to the extent arrangements have been made for such books and records to be maintained by the administrator or another agent of the Fund; (v) furnish reports, statements and other data on securities, economic conditions and other matters related to the investment of the Fund’s assets which the Fund’s administrator or distributor or the officers of the Trust may reasonably request; and (vi) render to the Board such periodic and special reports with respect to the Fund’s investment activities as the Board may reasonably request, including at least one in-person appearance annually before the Board.

Brokerage. Both the New Investment Advisory Agreement and the Current Investment Advisory Agreement provide that the respective investment adviser shall be responsible for decisions to buy and sell securities for the Fund, for broker-dealer selection and for negotiation of brokerage commission rates. In selecting a broker-dealer to execute each particular transaction, the respective investment adviser may take the following into consideration: the best net price available; the reliability, integrity and financial condition of the broker-dealer; the size of and difficulty in executing the order; and the value of the expected contribution of the broker-dealer to the investment performance of the Fund on a continuing basis. The price to the Fund in any transaction may be less favorable than that available from another broker-dealer if the difference is reasonably justified by other aspects of the portfolio execution services offered.

Payment of Expenses. Under both the New Investment Advisory Agreement and the Current Investment Advisory Agreement, the respective investment adviser is responsible for providing the personnel, office space and equipment reasonably necessary for the operation of the Fund, the expenses of printing and distributing copies of the Fund’s prospectus, SAI, and sales and advertising materials to prospective investors, the costs of any special Board meetings or shareholder meetings convened for the primary benefit of the respective investment adviser, and any costs of liquidating or reorganizing the Fund.

The Fund is responsible for all of its own expenses, except for those specifically assigned to the respective investment adviser under the investment advisory agreement, including but not limited to: fees and expenses incurred in connection with the issuance, registration and transfer of its shares; brokerage and commission expenses; all fees and expenses related to Fund custody, shareholder services and Fund accounting; interest charges on any borrowings; costs and expenses of pricing and calculating its daily net asset value and of maintaining its books; insurance premiums on property or personnel of the Fund which inure to its benefit; the cost of preparing and printing regulatory documents and other communications for distribution to existing shareholders; legal, auditing and accounting fees; fees and expenses (including legal fees) of registering and maintaining registration of its shares for sale; all expenses of maintaining and servicing shareholder accounts, and all other charges and costs of its operation plus any extraordinary and non-recurring expenses.

Management Fees. Both the New Investment Advisory Agreement and Current Investment Advisory Agreement contain an identical fee structure based on the Fund’s average daily net assets.

Duration and Termination. Both the New Investment Advisory Agreement and the Current Investment Advisory Agreement provide that if not terminated, the agreement shall continue with respect to the Fund for successive annual periods ending on August 16, 2024, provided such continuance is specifically approved at least annually (a) by the vote of a majority of those members of the Board of Trustees of the Trust who are not parties to this Agreement or interested persons of any such party, cast in person at a meeting called for the purpose of voting on such approval, and (b) by the Board of Trustees of the Trust or by vote of a majority of the outstanding voting securities of the Fund. In addition, both the New Investment Advisory Agreement and the Current Investment Advisory Agreement may be terminated at any time, without the payment of any penalty, by the Board of the Trustees of the Trust or by vote of a majority of the outstanding voting securities of the Fund, on 60 days’ prior written notice to the respective investment adviser, or by the respective investment adviser at any time, without payment of any penalty, on 60 days’ prior written notice to the Trust. Both the New Investment Advisory Agreement and the Current Investment Advisory Agreement will immediately terminate in the event of its assignment. As used in the New Investment Advisory Agreement and the Current Investment Advisory Agreement, the terms “majority of the outstanding voting securities,” “interested person” and “assignment” shall have the same meaning as such terms have in the 1940 Act.

Limitation on Liability and Indemnification. Both the New Investment Advisory Agreement and the Current Investment Advisory Agreement provide that, except a loss resulting from a breach of fiduciary duty with respect to the receipt of compensation for services or a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the investment adviser in the performance of its duties or from reckless disregard by it of its obligations and duties under the respective agreement (“disabling conduct”), such investment adviser will not be subject to liability to the Trust or the Fund for any act or omission in the course of, or connected with, rendering services under the agreement or for any losses sustained in the purchase, holding or sale of any security of the Fund. Further, both the New Investment Advisory Agreement and the Current Investment Advisory Agreement provide that the Fund will indemnify the investment adviser against and hold it harmless from any and all losses, claims, damages, liabilities or expenses (including reasonable counsel fees and expenses) resulting from any claim, demand, action or suit not resulting from disabling conduct by the investment adviser. The New Investment Advisory Agreement additionally provides that the Fund will indemnify the Adviser against indemnification payments made by the Adviser to the Sub-Adviser resulting from any claim, demand, action or suit not resulting from disabling conduct by the Adviser.

Board Recommendation of Approval

The Trustees recommend that shareholders of the Fund vote FOR the approval of the New Investment Advisory Agreement. Information about the Board’s considerations and approval is included below in the section entitled “Board Considerations and Approval”.

Vote Required

Approval of the Proposal to approve the New Investment Advisory Agreement in order to engage F/m as the investment adviser for the Fund requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon.

PROPOSAL 2: APPROVAL OF SUB-ADVISORY AGREEMENT

Background

F/m, the Fund’s proposed new investment adviser, is an investment adviser registered with the SEC. Under the New Investment Advisory Agreement, F/m will serve as the Fund’s investment adviser and maintain overall responsibility for the general management and administration of the Fund. However, the New Investment Advisory Agreement provides F/m with the ability to select and retain sub-advisers on behalf of the Fund and F/m has proposed adding MFP Investors LLC (“MFP” or the “Sub-Adviser”) as investment sub-adviser for the Fund. If both the New Investment Advisory Agreement and a new sub-advisory agreement between F/m and MFP (the “Sub-Advisory Agreement”) are approved, MFP will assume responsibility for the day-to-day portfolio management of the Fund. In that capacity, MFP will assume responsibility for daily monitoring of Fund positions, monitoring portfolio holdings for adherence to investment restrictions, all subject to the supervision of F/m and the Board. If the Sub-Advisory Agreement is approved by shareholders, the Fund will continue to be managed with the same investment objective as it was under Evermore. MFP does not manage any assets with a similar investment objective as the Fund.

Upon the consummation of the Transaction and upon shareholder approval of the Proposals, MFP will hire the portfolio management team and key investment professionals from Evermore, including the Fund’s current portfolio managers – David Marcus and Thomas O. If the Proposals are approved, Messrs. Marcus and O. will continue in their capacity as portfolio managers of the Fund and will be jointly and primarily responsible for the day-to-day management of the Fund. Thus, in approving the Sub-Advisory Agreement, the Fund will continue to be managed by the same portfolio management team, there will be no material changes to the Fund’s investment policies, strategies, and risks.

At a meeting of the Board, held on February 8-9, 2023 and reconvened on February 16, 2023, F/m requested, and the Board, including a majority of the Trustees who are not interested persons of the Trust, as defined by the 1940 Act (the “Independent Trustees”), approved the Sub-Advisory Agreement. The Board also voted unanimously to recommend that shareholders approve the Sub-Advisory Agreement.

Under the 1940 Act, in addition to the approval of the Board, the approval of a new investment sub-advisory agreement requires the affirmative vote of a “majority of the outstanding voting securities” of the Fund. Accordingly, you are being asked to approve the Sub-Advisory Agreement for the Fund.

MFP does not manage any assets with a similar investment objective to the Fund.

Information about MFP Investors LLC

MFP is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940, as amended. MFP is an investment management firm founded by the late Michael F. Price, a value investor who was portfolio manager to the Mutual Series funds from the mid-1970s through the mid-1990s. MFP’s principal office is located at 909 Third Avenue, New York, NY 10022. As of December 31, 2022, MFP together with its affiliates had approximately $925 million in assets under management.

The following table sets forth the name, position and principal occupation of each current member and principal officer of MFP, each of whom is located at MFP’s principal office location.

| Name | Position/Principal Occupation |

| Jennifer Cook Price | Managing Director |

| Timothy E. Ladin | General Counsel and Vice President; Chief Compliance Officer |

| Ellen F. Lynch | Chief Financial Officer |

The Estate of Michael Price owns 99% of the Member Interests of MFP and the Price Family Office, LLC owns 1% of the Member Interests of MFP. Jennifer Cook Price is co-executor of the Estate of Michael Price and is the Managing Member of MFP.

Summary of the Sub-Advisory Agreement

A copy of the proposed Sub-Advisory Agreement is attached hereto as Exhibit B. The following description is only a summary. You should refer to Exhibit B for a complete description of the terms of the Sub-Advisory Agreement. The description set forth in this Proxy Statement of the Sub-Advisory Agreement is qualified in its entirety by reference to Exhibit B.

Sub-Advisory Services. The Sub-Advisory Agreement provides that, in conjunction with the Adviser, the Sub-Adviser will make investment decisions for and place all orders for the purchase and sale of securities for the Fund’s investment portfolio, all on behalf of the Fund and subject to the oversight of the Fund’s Board and the Adviser. In performing its duties under the Sub-Advisory Agreement, the Sub-Adviser will monitor the Fund’s investments and will comply with the provisions of the Fund’s organizational documents and the stated investment objectives, policies and restrictions of the Fund. Upon closing of the Transaction, Mr. Marcus and Mr. O will become employees of MFP and continue to be the Lead Portfolio Manager and Co-Portfolio Manager, respectively, of the Fund.

Brokerage. The Sub-Advisory Agreement authorizes MFP to select the brokers or dealers that will execute the purchases and sales of Fund securities and directs MFP to seek for the Fund the most favorable execution and net price available under the circumstances. MFP may cause the Fund to pay a broker a commission more than that which another broker might have charged for effecting the same transaction, in recognition of the value of the brokerage and research and other services provided by the broker to MFP.

Payment of Expenses. Under the Sub-Advisory Agreement, MFP agrees to bear all of its expenses in connection with the performance of its services under the Sub-Advisory Agreement, including provision of personnel, office space, and equipment reasonably necessary to provide sub-advisory services to the Fund.

Management Fees. Under the Sub-Advisory Agreement, the Adviser pays the Sub-Adviser a sub-advisory fee out of the management fee it receives from the Fund. The Adviser will pay the Sub-Adviser an annual sub-advisory fee of 0.89% of the average daily net assets of the Fund. The fee shall be based on the average daily net assets for the month involved. Every month, the Adviser will deduct from the advisory fee paid to the Sub-Adviser the following expenses as agreed by the Sub-Adviser in writing from time to time: (i) expenses paid by such Fund attributable to compensating the Fund’s statutory distributor and/or placement agent and any additional distribution fees, (ii) amounts paid to the Fund by the Adviser related to applicable voluntary fee waivers, expense reimbursements or other payments related to any voluntary expense cap applicable to such Fund, and (iii) expenses paid by such Fund or Adviser with respect to fees charged to such Fund by any financial intermediary related to placement or distribution of such Fund at such intermediary and any applicable sub-transfer agency or shareholder services fees (the “Fee Reimbursements”). In the event any Fee Reimbursement is paid by a Fund other than monthly, such as a financial intermediary placement fee paid annually, Adviser will deduct a pro-rata portion of such fee each month. Except as may otherwise be prohibited by law or regulation (including, without limitation, any then current SEC staff interpretation), the Sub-Adviser may, in its discretion and from time to time, waive all or any portion of its advisory fee.

As MFP did not serve as sub-adviser to the Fund during the fiscal year ended December 31, 2022, MFP did not receive any sub-advisory fees during that period from the Fund. If MFP had served as sub-adviser during the fiscal period ended December 31, 2022, MFP would have accrued $1,392,020 in sub-advisory fees, payable by the investment adviser, under the proposed Sub-Advisory Agreement.

Duration and Termination. If approved by shareholders of the Fund, the Sub-Advisory Agreement will remain in effect until April 16, 2024, unless sooner terminated. Thereafter, if not terminated, this Agreement shall continue with respect to each Fund for successive annual periods ending on August 16 subject to annual approval by the Board, including at least a majority of the Independent Trustees.

Limitation on Liability and Indemnification. The Sub-Advisory Agreement provides that, in the absence of willful misconduct, bad faith, reckless disregard or gross negligence by MFP, MFP will not be subject to liability to the Trust, the Fund or the Adviser for any act or omission in the course of, or connected with, rendering services under the agreement or for any losses sustained in the purchase, holding or sale of any security of the Fund. Further, the Sub-Advisory Agreement provides that the Adviser shall indemnify and hold harmless the Sub-Adviser against any and all losses, claims, damages, liabilities or litigation arising out of or based on (i) any willful misconduct, bad faith, reckless disregard or gross negligence of the Adviser, the Trust or any Trustees of the Trust in the performance of any of their duties or obligations hereunder or under the Investment Advisory Agreement, (ii) any untrue statement of a material fact contained in materials pertaining to the Fund or the omission to state therein a material fact that was required to be stated therein or necessary to make the statements therein not misleading, unless such statement or omission was made solely in reliance upon information furnished to the Adviser or the Trust in writing by the Sub-Adviser for inclusion in such documents or (iii) any action or inaction by the Sub-Adviser that the Sub-Adviser has made or refrained from making, as applicable, in good faith pursuant to and consistent with the Adviser’s, the Trust’s or the Fund’s written instructions to the Sub-Adviser.

Board Recommendation of Approval

The Trustees recommend that shareholders of the Fund vote FOR the approval of the Sub-Advisory Agreement. Information about the Board’s considerations and approval is included below in the section entitled “Board Considerations and Approval”.

Vote Required

Approval of the Proposal to approve the new Sub-Advisory Agreement requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon.

BOARD CONSIDERATIONS AND APPROVAL

At a meeting held on February 8-9, 2023 and reconvened on February 16, 2023 (the “Board Meeting”), the Board, including a majority of the Independent Trustees, unanimously voted to approve the New Investment Advisory Agreement and Sub-Advisory Agreement and to recommend that the shareholders of the Fund vote FOR the Proposals to approve the New Investment Advisory Agreement and Sub-Advisory Agreement.

In considering the approval of the New Investment Advisory Agreement and Sub-Advisory Agreement, the Board, with the assistance of independent counsel, considered its legal responsibilities with regard to all factors deemed to be relevant to the Fund. The Board evaluated the New Investment Advisory Agreement and Sub-Advisory Agreement in light of all the materials provided prior to and during the Board Meeting and at other meetings that preceded the Board Meeting, the presentations made during the Board Meeting, and the discussions held during the Board Meeting. The Trustees reviewed these materials with management of F/m, Evermore and MFP and discussed the New Investment Advisory Agreement and Sub-Advisory Agreement with counsel in executive sessions, at which no representatives of F/m, Evermore or MFP were present. The Trustees considered whether approval of the New Investment Advisory Agreement and Sub-Advisory Agreement would be in the best interests of the Fund and its shareholders and the overall fairness of the New Investment Advisory Agreement. Among other things, the Trustees considered information concerning: (i) the nature, extent and quality of the services to be provided by F/m and MFP to the Fund; (ii) descriptions of the experience and qualifications of F/m’s and MFP’s personnel who would provide those services; (iii) F/m’s and MFP’s investment philosophies and processes; (iv) F/m’s and MFP’s assets under management and client descriptions; (v) F/m’s and MFP’s management fee arrangements with the Trust and other similarly managed clients, as applicable; (vi) F/m’s and MFP’s compliance policies and procedures; (vii) F/m’s and MFP’s financial information, insurance coverage and profitability analysis related to its provision of advisory services to the Fund; (viii) the extent to which economies of scale are relevant to the Fund; (ix) a report prepared by Lipper comparing the Fund’s management fees and total expense ratio to those of its Lipper Group and comparing the performance of the Fund to the performance of its Lipper Group; and (x) information regarding the performance of the Fund relative to its benchmark index.

As of December 31, 2022, the Independent Trustees and their respective immediate family members (spouse or dependent children) did not own beneficially or of record any securities of the Trust’s investment advisers or distributor, or of any person directly or indirectly controlling, controlled by, or under common control with the investment advisers or distributor.

Nature, Extent and Quality of Services Provided to the Funds. The Trustees evaluated the nature, extent and quality of the services that F/m and MFP would provide under the New Investment Advisory Agreement and Sub-Advisory Agreement, respectively. Based on the information provided and the Trustees’ prior experience with F/m and the portfolio management team of MFP, the Trustees concluded that the nature and extent of the services that F/m and MFP would provide under the New Investment Advisory Agreement and Sub-Advisory Agreement, as well as the quality of those services, was satisfactory.

Section 15(f) of the 1940 Act. The Trustees also considered whether the arrangements comply with the conditions of Section 15(f) of the 1940 Act. Section 15(f) provides a non-exclusive safe harbor for an investment adviser to an investment company or any of its affiliated persons to receive any amount or benefit in connection with a change in control of the investment adviser so long as two conditions are met. First, for a period of three years after closing of the applicable transaction, at least 75% of the board members of the investment company cannot be “interested persons” (as defined in the 1940 Act) of the investment adviser or predecessor adviser. Second, an “unfair burden” must not be imposed upon a Fund as a result of the transaction or any express or implied terms, conditions or understandings applicable thereto. The term “unfair burden” is defined in Section 15(f) to include any arrangement during the two-year period after the closing of the transaction whereby the investment adviser (or predecessor or successor adviser) or any interested person of any such investment adviser, receives or is entitled to receive any compensation, directly or indirectly, from a Fund or its shareholders (other than fees for bona fide investment advisory or other services) or from any person in connection with the purchase or sale of securities or other property to, from or on behalf of a Fund (other than bona fide ordinary compensation as principal underwriter for the Fund).

Consistent with the first condition of Section 15(f), F/m and MFP represented that they are not aware of any current plans to reconstitute the Board following the Transaction. Thus, at least 75% of the Trustees of the Company would not be “interested persons” (as defined in the 1940 Act) of F/m or MFP for a period of three years after closing of the Transaction and would be in compliance with this provision of Section 15(f). With respect to the second condition of Section 15(f), F/m and MFP represented that the Transaction will not have an economic impact on their ability to provide services to the Fund and no fee increases are contemplated. Thus, the Trustees found that the Transaction would not result in an "unfair burden" (as defined in Section 15(f)) during the two-year period following the closing of the Transaction. Each of F/m and MFP represented that neither it nor any interested person of it would receive any compensation from the Fund or its shareholders, except as permitted pursuant to Section 15(f).

Costs of Services Provided and Profits Realized by F/m and MFP. The Trustees examined fee information for the Fund, including a comparison of such information to other similarly situated funds, and the total expense ratio of the Fund. In this regard, the Trustees noted that the management fees and total expenses of the Fund were not expected to change as a result of the Transaction or approval of the New Investment Advisory Agreement or Sub-Advisory Agreement. In this regard, the Trustees noted that the fees for MFP under the Sub-Advisory Agreement were paid directly by F/m and not by the Fund. The Trustees also noted that F/m has agreed to continue the current expense limitation until at least December 31, 2025.

The Trustees also reviewed analyses of the estimated profitability of each of F/m and MFP related to its provision of advisory services to the Fund. Based on the information provided, the Trustees concluded that the amount of fees that the Fund currently pays, and would pay under the New Investment Advisory Agreement and Sub-Advisory Agreement, to F/m and MFP are reasonable in light of the nature and quality of the services provided.

Investment Performance of the Fund. The Trustees reviewed information concerning the Fund’s investment performance, both absolutely as well as compared to its benchmark index and Lipper peer group. The Trustees considered the Fund’s investment performance in light of its investment objective and strategies. After considering all of the information, the Trustees concluded that the Fund and its shareholders were likely to benefit from the portfolio managers’ continued provision of investment management services to the Fund.

Economies of Scale and Fee Levels Reflecting Those Economies. In considering the overall fairness of the New Investment Advisory Agreement and Sub-Advisory Agreement, the Trustees assessed the degree to which economies of scale that would be expected to be realized if the Fund’s assets increase, whether the Fund was large enough to generate economies of scale, and the extent to which fee levels would reflect those economies of scale for the benefit of the Fund’s shareholders. The Trustees noted that the Fund’s management fee structure did not contain any breakpoint reductions as the Fund’s assets grew in size, but that the feasibility of incorporating breakpoints would continue to be reviewed on a regular basis. The Trustees determined that the fee schedules in the New Investment Advisory Agreement and Sub-Advisory Agreement are reasonable and appropriate.

Other Benefits to the Adviser. In addition to the above factors, the Trustees also considered other benefits received or to be received by F/m and MFP from their management of the Fund, including, without limitation, the ability to market their advisory services for similar products in the future.

Based on all of the information presented to and considered by the Trustees and the conclusions that it reached, the Board approved the New Investment Advisory Agreement and Sub-Advisory Agreement on the basis that their terms and conditions are fair to, and in the best interests of, the Fund and its shareholders.

General Information

Solicitation of Proxies

In addition to solicitation of proxies by mail, certain officers of the Trust, officers and employees of F/m, Evermore, MFP, or other representatives of the Trust, who will not be paid for their services, may also solicit proxies by telephone or in person. MFP has engaged the proxy solicitation firm of Broadridge Financial Solutions, Inc. will be paid approximately $3,670 and will be reimbursed for its related expenses. The Trust estimates that the total expenditures relating to the solicitation of proxies will be approximately $10,000. MFP will pay for the expenses incident to the solicitation of proxies in connection with the Meeting, which expenses include the fees and expenses of tabulating the results of the proxy solicitation and the fees and expenses of Broadridge Financial Solutions, Inc. MFP also will reimburse upon request persons holding shares as nominees for their reasonable expenses in sending soliciting materials to their principals. The expenses incurred in connection with preparing the proxy statement and its enclosures and all related legal and solicitation expenses will also be paid by MFP.

Householding

If possible, depending on shareholder registration and address information, and unless you have otherwise opted out, only one copy of this Proxy Statement will be sent to shareholders at the same address. However, each shareholder will receive separate proxy cards. If you would like to receive a separate copy of the Proxy Statement, please call 833-757-0709 or write to U.S. Bank Global Fund Services at 615 East Michigan Street, Milwaukee, Wisconsin 53202. If you currently receive multiple copies of Proxy Statements or Shareholder Reports and would like to request to receive a single copy of documents in the future, please call 833-757-0709 or write to U.S. Bank Global Fund Services at 615 East Michigan Street, Milwaukee, Wisconsin 53202.

Voting Procedures

You can vote by mail, on the Internet or by phone by following the instructions on your proxy card, or in person at the Meeting. To vote by mail, sign and send us the enclosed proxy voting card in the envelope provided.

Shares represented by timely and properly executed proxies will be voted as specified. If you do not specify your vote with respect to a particular matter, the proxy holder will vote your shares in accordance with the recommendation of the Trustees. You may revoke your proxy at any time before it is exercised by sending a written revocation addressed to Steven Plump, President, The RBB Fund Trust, c/o U.S. Bank Global Fund Services 615 East Michigan Street, Milwaukee, Wisconsin 53202, by properly executing and delivering a later-dated proxy, or by attending the Meeting and voting in person. Attendance at the Meeting alone, however, will not revoke the proxy.

Each whole share will be entitled to one vote as to any matter on which it is entitled to vote, and each fractional share will be entitled to a proportionate fractional vote.

Quorum and Methods of Tabulation

The presence of one-third (33-1/3%) of the outstanding shares of the Fund entitled to vote, present in person or represented by proxy, constitutes a quorum for the Proposals for the Fund. Votes cast by proxy or in person at the Meeting will be counted by persons appointed by the Board as inspectors for the Meeting.

For purposes of determining the presence of a quorum for the Meetings, the inspectors will count as present the total number of shares voted “for” or “against” approval of any proposal, as well as shares represented by proxies that reflect abstentions. Proxies returned for shares that represent broker non-votes will not be counted as shares present and entitled to vote for purposes of determining whether the required quorum of shares exists. With regard to the Proposals, assuming the presence of a quorum, abstentions will not be treated as votes cast at the Meeting.

Adjournment

If a quorum is not present or sufficient votes in favor of the Proposals is not received by the time scheduled for the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting to a date within a reasonable time after the Record Date to permit further solicitation of proxies with respect to the Proposals. In addition, if the persons named as proxies determine it is advisable to defer action on the Proposals the persons named as proxies may propose one or more adjournments of either Meeting to a date within a reasonable time after the Record Date in order to defer action on the Proposals as they deem advisable. Any such adjournments will require the affirmative vote of a majority of the votes cast on the question in person or by proxy at the session of the Meetings to be adjourned. The persons named as proxies will vote in favor of such adjournment those proxies that they are entitled to vote in favor of the Proposals. They will vote against any such adjournment those proxies required to be voted against any of the Proposals. They will vote in their discretion shares represented by proxies that reflect abstentions and “broker non-votes”. A Proposal for which sufficient affirmative votes have been received by the time of the Meeting will be acted upon and such action will be final regardless of whether a Meeting is adjourned to permit additional solicitation with respect to any other Proposal.

Investment Advisor

The Fund’s investment adviser is Evermore Global Advisors, LLC, located at 55 Union Place, Suite 277, Summit, NJ 07901.

Other Service Providers

The principal executive office of the Trust is located at 615 East Michigan Street, Milwaukee, Wisconsin 53202. The Trust’s administrator, transfer and dividend disbursing agent is U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202. The Trust’s principal underwriter/distributor is Quasar Distributors, LLC, 111 East Kilbourn Avenue, Suite 1250, Milwaukee, WI 53202.

Independent Registered Public Accounting Firm

Ernst & Young (“E&Y”) has acted as the independent registered public accounting firm to the Fund since December 18, 2009. Upon recommendation of the Trust’s Audit Committee, the Board has selected E&Y as the independent registered public accounting firm to audit and certify the Trust’s financial statements for the Fund’s most recent and current fiscal year ended as of December 31, 2022. Representatives of E&Y will not be present at the Meeting.

Outstanding Shares

The number of shares of the Fund and class issued and outstanding on the Record Date was as follows:

| Fund | Number of Issued and Outstanding Shares |

| Evermore Global Value Fund | 10,374,992.875 |

As of the Record Date, the Trustees and officers of the Trust as a group owned beneficially less than one percent (1%) of the outstanding shares of the Fund and of the Trust as a whole. As of the close of business on the Record Date, the following persons were the only persons who were record owners or, to the knowledge of the Fund, were beneficial owners of 5% or more of the Fund’s outstanding shares.

Evermore Global Value Fund

Name and

Address | %

Ownership | Type of Ownership |

| Investor Class |

Charles Schwab & Co. Inc. Special Custody A/C FBO Customers Attn: Mutual Funds 211 Main Street San Francisco, CA 94105-1901 | 39.04% | Record |

National Financial Services LLC Attn: Mutual Funds FBO Customers 499 Washington Boulevard, FL 4th Jersey City, NJ 07310-1995 | 6.73% | Record |

U.S. Bank NA Custody 3673 253rd Avenue NW Isanti, MN 55040-4313 | 5.77% | Beneficial |

| Institutional Class |

Charles Schwab & Co. Inc. Special Custody A/C FBO Customers Attn: Mutual Funds 211 Main Street San Francisco, CA 94105-1901 | 66.94% | Record |

National Financial Services LLC Attn: Mutual Funds FBO Customers 499 Washington Boulevard, FL 4th Jersey City, NJ 07310-1995 | 12.76% | Record |

Band & Co. c/o U.S. Bank NA 1555 Rivercenter Drive Ste 302 Milwaukee, WI 53212-3958 | 10.18% | Record |

Reports to Shareholders.

Copies of the Fund’s most recent annual and semi-annual reports may be requested without charge by calling 866-EVERMORE (866-383-7667) or visit the Fund’s website at https://evermoreglobal.com/our-products/global-value-fund-overview/ or writing the Fund, c/o U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, WI 53202.

Other Matters

The Board knows of no other matters that may come before the Meeting, other than the proposal as set forth above. If any other matter properly comes before the Meeting, the persons named as proxies will vote on the same in their discretion.

Notice to Banks, Broker-Dealers and Voting Directors

Banks, broker-dealers, and voting directors should advise the Trust, in care of U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202, whether other persons are beneficial owners of shares held in their names for which proxies are being solicited and, if so, the number of copies of the Proxy Statement and Annual Reports they wish to receive in order to supply copies to the beneficial owners of the respective shares.

Exhibit A

INVESTMENT ADVISORY AGREEMENT

Evermore Global Value Fund

AGREEMENT made as of ___________, 2023 between THE RBB FUND TRUST, a Delaware statutory trust (herein called the "Fund"), and F/M INVESTMENTS, LLC, d/b/a NORTH SLOPE CAPITAL LLC, a Delaware limited liability company (herein called the "Investment Adviser").

WHEREAS, the Fund is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”), and currently offers or proposes to offer shares representing interests in separate investment portfolios; and

WHEREAS, the Fund desires to retain the Investment Adviser to render certain investment advisory services to the Fund with respect to the Evermore Global Value Fund, a series of the Fund (the “Portfolio”), and the Investment Adviser is willing to so render such services; and

WHEREAS, the Board of Trustees of the Fund has approved this Agreement, subject to approval by the shareholders of the Portfolio, and the Investment Adviser is willing to furnish such services upon the terms and conditions herein set forth;

NOW, THEREFORE, in consideration of the premises and mutual covenants herein contained, and intending to be legally bound hereby, it is agreed between the parties hereto as follows:

SECTION 1. APPOINTMENT. The Fund hereby appoints the Investment Adviser to act as investment adviser for the Portfolio for the period and on the terms set forth in this Agreement. The Investment Adviser accepts such appointment and agrees to render the services herein set forth for the compensation herein provided.

SECTION 2. DELIVERY OF DOCUMENTS. The Fund has furnished the Investment Adviser with copies properly certified or authenticated of each of the following:

(a) Resolutions of the Board of Trustees of the Fund authorizing the appointment of the Investment Adviser and the execution and delivery of this Agreement; and

(b) A prospectus and statement of additional information relating to each class of shares representing interests in the Portfolio of the Fund in effect under the Securities Act of 1933 (such prospectus and statement of additional information, as presently in effect and as they shall from time to time be amended and supplemented, are herein collectively called the "Prospectus" and “Statement of Additional Information,” respectively).

The Fund will promptly furnish the Investment Adviser from time to time with copies, properly certified or authenticated, of all amendments of or supplements to the foregoing, if any.

In addition to the foregoing, the Fund will also provide the Investment Adviser with copies of the Fund’s Amended and Restated Agreement and Declaration of Trust and By-laws, and any registration statement or service contracts related to the Portfolio, and will promptly furnish the Investment Adviser with any amendments of or supplements to such documents.

SECTION 3. MANAGEMENT.