United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

Attention: Coy Garrison

| | Re: | Lightstone Real Estate Income Trust Inc. |

| | Post-Effective Amendment to Form S-11 |

| | Filed April 20, 2016 |

Dear Mr. Garrison:

On behalf of our client, Lightstone Real Estate Income Trust Inc. (the “Company”), we are submitting this letter in response to the written comments of the staff (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) contained in your letter, dated April 28, 2016 (the “Comment Letter”) with respect to the Post-Effective Amendment to Form S-11filed by the Company with the Commission on April 20, 2016 (File No. 333-200464) (the “POSAM”).

The responses are set forth below, with the headings and numbered items of this letter corresponding to the headings and numbered items contained in the Comment Letter. For the convenience of the Staff, each of the comments from the Comment Letter is restated in bold italics prior to the response.

Estimation of NAV and Sponsor Subordinated Loan Agreement, page 64

| 1. | Please address the following as it relates to your calculation of net asset value: |

| · | As your calculation of net asset value is not inclusive of all assets and liabilities of the company, explain to us how you determined your characterization of the measure as “net asset value” would not be confusing to investors. |

The Company’s believes its calculation of net asset value (“NAV”) is inclusive of all appropriate asset and liabilities. The Company has excluded the subordinated loan from its calculation of NAV because pursuant to its terms, as described on page 64 of the POSAM, no repayment is due or payable to the sponsor until holders of the Company’s common shares have received liquidation distributions equal to their net investment plus a cumulative, pre-tax, non-compounded annual return of 8% on their net investment. Because the NAV of $10.00 per common share does exceed the net investment (i.e., the offering price) plus the requisite rate of return, the sponsor currently is not be expected to receive any repayment under the subordinated loan and therefore, it has been assigned no value for purposes of the NAV.

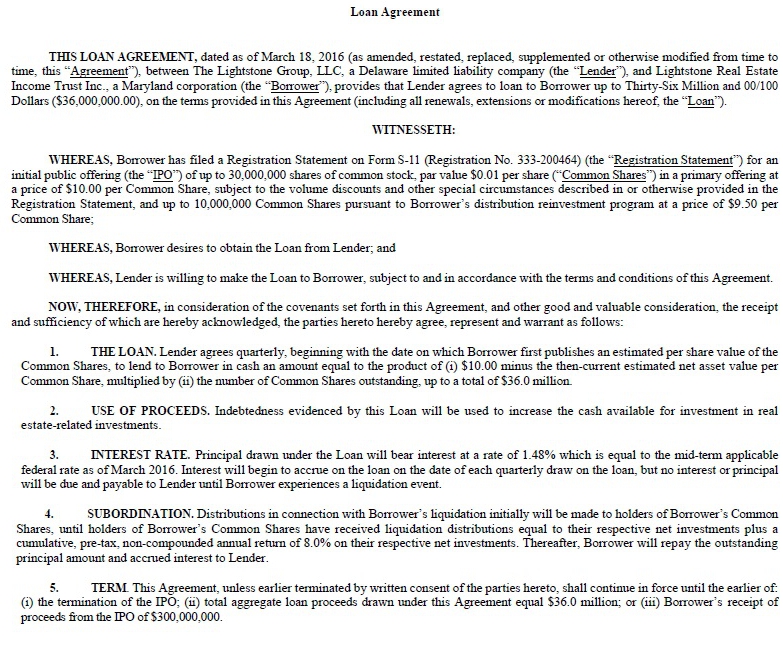

The loan agreement (attached hereto as Exhibit A) states as follows:

“SUBORDINATION. Distributions in connection with Borrower’s liquidation initially will be made to holders of Borrower’s Common Shares, until holders of Borrower’s Common Shares have received liquidation distributions equal to their respective net investments plus a cumulative, pre-tax, non-compounded annual return of 8.0% on their respective net investments. Thereafter, Borrower will repay the outstanding principal amount and accrued interest to Lender.”

Coy Garrison

Division of Corporation Finance

U.S. Securities and Exchange Commission

April 29, 2016

Page 2

| · | Explain to us how you determined it would be appropriate to base your calculation of net asset value on a hypothetical liquidation value. |

The Company determined that disclosure in the POSAM of net asset value should be based on a hypothetical liquidation value as the result of discussions between Lightstone Value Plus Real Estate Trust III, Inc. (“Lightstone III”), another real estate investment trust sponsored by The Lightstone Group, LLC, the Company’s sponsor, and the Commission with respect to a Post-Effective Amendment to Form S-11filed by Lightstone III with the Commission on September 11, 2015, and the subsequent Pre-Effective Amendment filed by Lightstone III with the Commission on December 29, 2015 (collectively, the “December POSAM”). At that time, Lightstone III had in-depth discussions with Jennifer Gowetski and the Commission made the following request of Lightstone III concerning the estimation of NAV and the subordinated participation interests as disclosed in the correspondence filed by Lightstone III with the Commission on February 2, 2016 (attached hereto as Exhibit B, the “Correspondence Letter”):

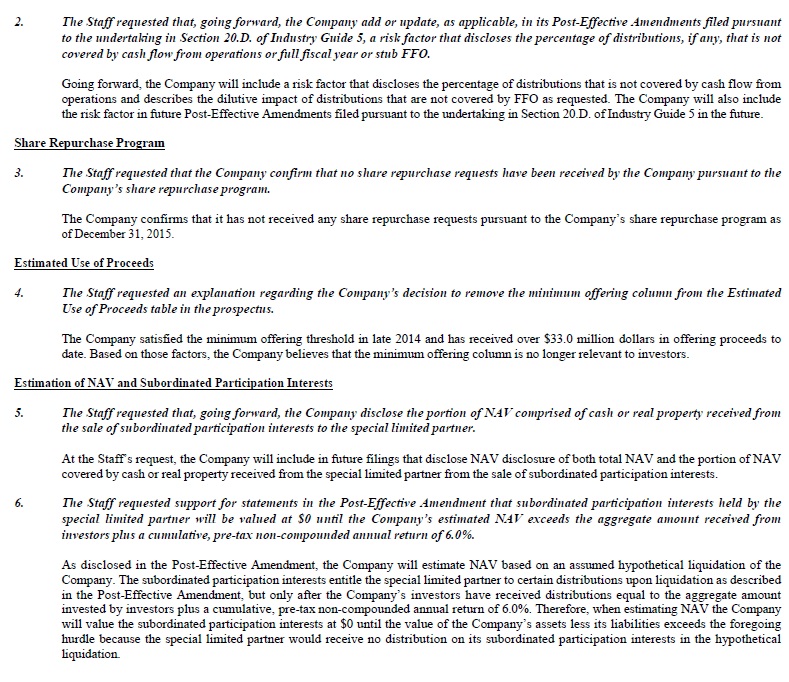

“The Staff requested support for statements in the Post-Effective Amendment that subordinated participation interests held by the special limited partner will be valued at $0 until the Company’s estimated NAV exceeds the aggregate amount received from investors plus a cumulative, pre-tax non-compounded annual return of 6.0%.”

Lightstone III provided the following response in the Correspondence Letter:

“As disclosed in the Post-Effective Amendment, the Company will estimate NAV based on an assumed hypothetical liquidation of the Company. The subordinated participation interests entitle the special limited partner to certain distributions upon liquidation as described in the Post-Effective Amendment, but only after the Company’s investors have received distributions equal to the aggregate amount invested by investors plus a cumulative, pre-tax non-compounded annual return of 6.0%. Therefore, when estimating NAV the Company will value the subordinated participation interests at $0 until the value of the Company’s assets less its liabilities exceeds the foregoing hurdle because the special limited partner would receive no distribution on its subordinated participation interests in the hypothetical liquidation.”

Following this exchange, the Commission declared the December POSAM effective on March 1, 2016.

Furthermore, the Company’s process for estimating the value of its assets and liabilities was performed in accordance with the Appraised Value Methodology specified in Regulatory Notice 15-02 (modifying FINRA Rule 2340), which requires that “the per share estimated value disclosed in an issuer’s most recent periodic or current report be based on valuations of the assets and liabilities of the DPP or REIT, and that those valuations be (i) performed at least annually; (ii) conducted by, or with the material assistance or confirmation of, a third-party valuation expert or service; and (iii) derived from a methodology that conforms to standard industry practice.

The Company’s valuation was conducted by a third-party valuation expert in accordance with the provisions of the Investment Program Association Practice Guideline 2013-01, “Valuations of Publicly Registered Non-Listed REITs,” issued April 29, 2013 which specifies to:

“Calculate and deduct: (i) any net asset value allocable to preferred securities; and (ii) any estimated incentive fees, participations, or special interests held by or allocable to the sponsor, advisor, management or general partners based on aggregate NAV of the company and payable in a hypothetical liquidation of the company as of the valuation date in accordance with provisions of the partnership or advisory agreements and the terms of the preferred securities.”

Coy Garrison

Division of Corporation Finance

U.S. Securities and Exchange Commission

April 29, 2016

Page 3

This process is in compliance with CF Disclosure Guidance: Topic No. 6 for determining Net Asset Value, footnote #4 of which directs the reader to FINRA Rule 2340.

| · | Tell us the probability of a liquidity event in the near term, and explain to us how that probability analysis factored into your calculation of the net asset value. |

The Company does not expect to undertake a liquidity event in the near term and no probability analysis was considered in the calculation of its NAV. Rather, the Company calculated its NAV based on a hypothetical liquidation in accordance with the Company’s knowledge of Lightstone III’s previous discussions with the Staff and provisions of the Investment Program Association Practice Guideline 2013-1, “Valuations of Publicly Registered Non-Listed REITs,” issued April 29, 2013.

| · | Clarify whether the estimate included in the NAV Report prepared by M&S is consistent with the tabular disclosure of your estimated net asset value on page 66. |

The Company confirms that the estimated NAV Report prepared by M&S is consistent with the tabular disclosure of its estimated NAV on page 66 of the POSAM. Furthermore, the disclosure on page 66 is consistent with the disclosure Lightstone III included in the December POSAM specifically requested by the Staff as discussed in the Correspondence Letter:

“The Staff requested that, going forward, the Company disclose the portion of NAV comprised of cash or real property received from the sale of subordinated participation interests to the special limited partner.

At the Staff’s request, the Company will include in future filings that disclose NAV disclosure of both total NAV and the portion of NAV covered by cash or real property received from the special limited partner from the sale of subordinated participation interests.”

In order to clarify the existing tabular disclosure on page 66, the Company agrees to undertake to add a footnote to the disclosure explaining the role of the subordinated loan in calculating NAV.

| · | We note you have opted to implement the appraised value method. Please confirm for us that should you determine the liability to your sponsor should be included in your determination of net asset value, you will not revert to the net investment methodology. |

The Company has opted to implement the appraised value method and confirms that should it determine the liability to its sponsor should be included in its determination of net asset value, it will not revert to the net investment methodology.

The Company acknowledges that:

| · | should the Commission or the staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing; |

| · | the action of the Commission or the staff, acting pursuant to delegated authority, in declaring he filing effective, does not relieve the company from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and |

| · | the company may not assert staff comments and declaration of effectiveness as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Coy Garrison

Division of Corporation Finance

U.S. Securities and Exchange Commission

April 29, 2016

Page 4

We hope the foregoing answers are responsive to your comments and look forward to resolving any outstanding issues as quickly as possible. If you have any questions in connection with our responses to your comments, please feel free to contact me by phone at (212) 969-3445 or by email at PFass@proskauer.com.

| | | |

| | | Yours truly, | |

| | | | |

| | | /s/ Peter M. Fass | |

| | | Peter M. Fass | |

| | | | |

EXHIBIT A

EXHIBIT B