| Proskauer Rose LLP | Eleven Times Square | New York, NY 10036-8299 |

| June 15, 2016 | Peter M. Fass |

| | Member of the Firm |

| | d 212.969.3445 |

| | f 212.969.2900 |

| | pfass@proskauer.com |

| | www.proskauer.com |

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

Attention: Coy Garrison

| | Re: | Lightstone Real Estate Income Trust Inc. |

| | Post-Effective Amendment to Form S-11 |

| | Filed April 20, 2016 |

Dear Mr. Garrison:

On behalf of our client, Lightstone Real Estate Income Trust Inc. (the “Company”), we are submitting this letter to supplement the conversation we had with your office on June 13, 2016, following up on our response, dated May 31, 2016 (the “Response Letter”), to the written comments of the staff (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) contained in your letter, dated May 27, 2016, with respect to Post-Effective Amendment to Form S-11filed by the Company with the Commission on April 20, 2016 (File No. 333-200464) (the “POSAM”).

Please find attached the following in response to the Staff’s comments:

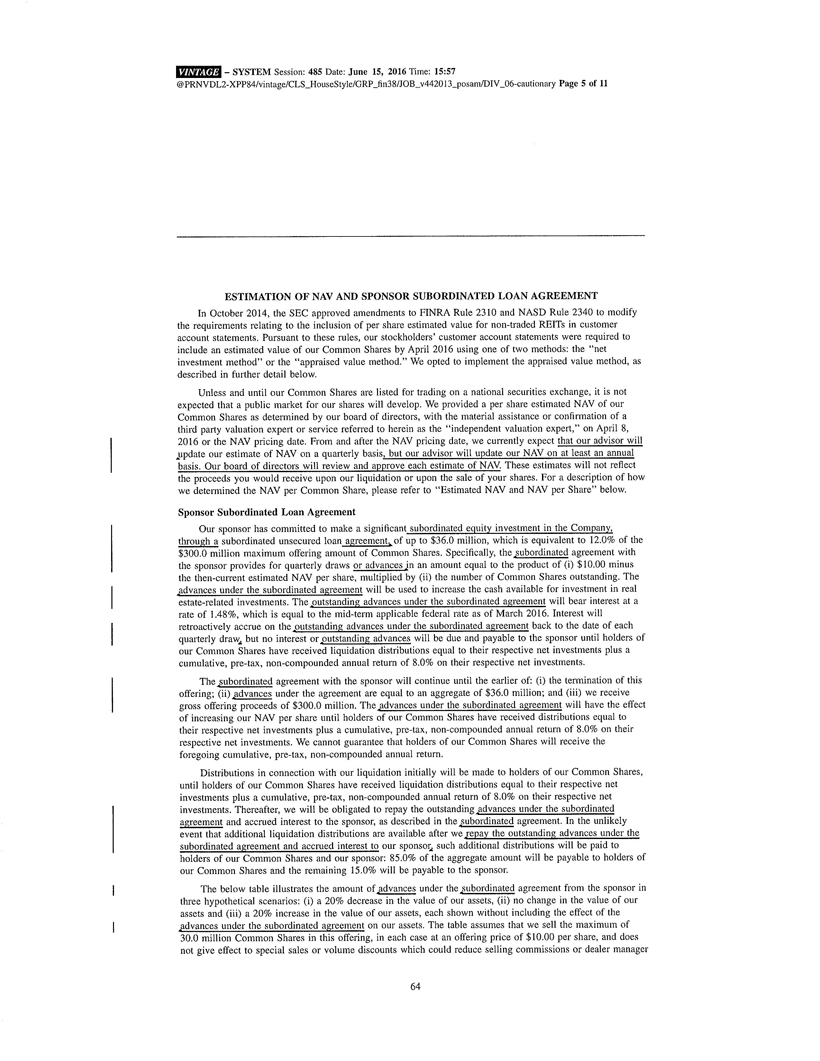

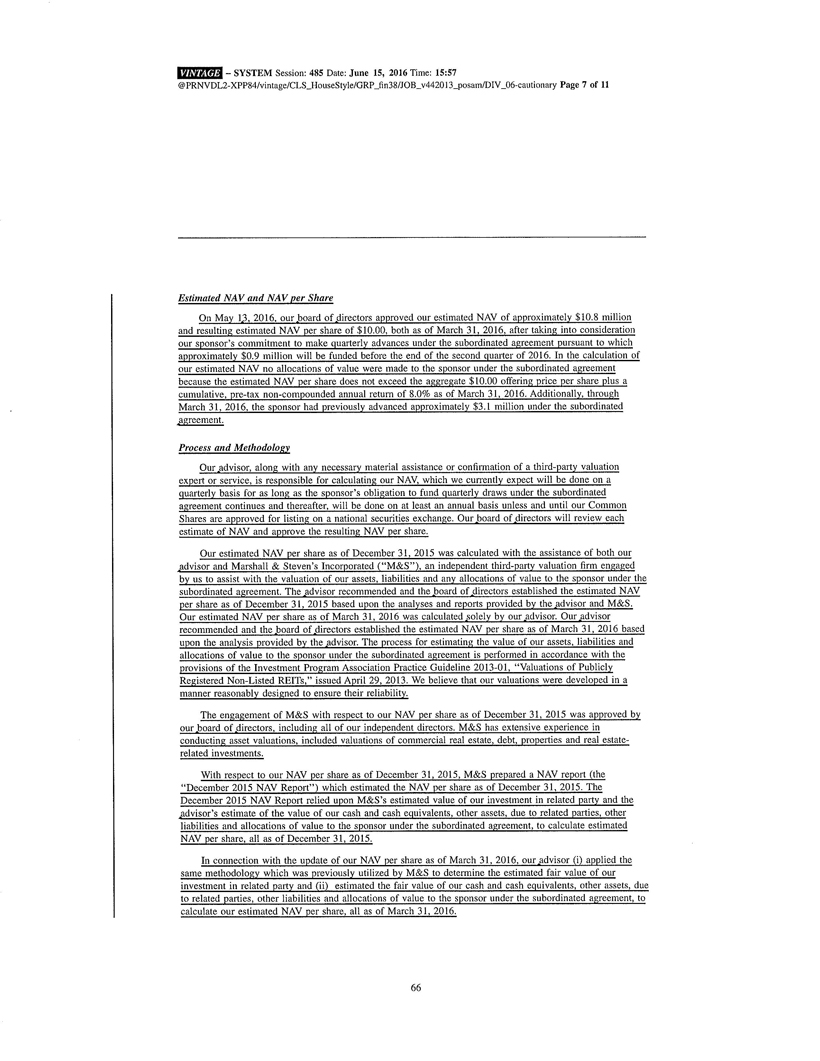

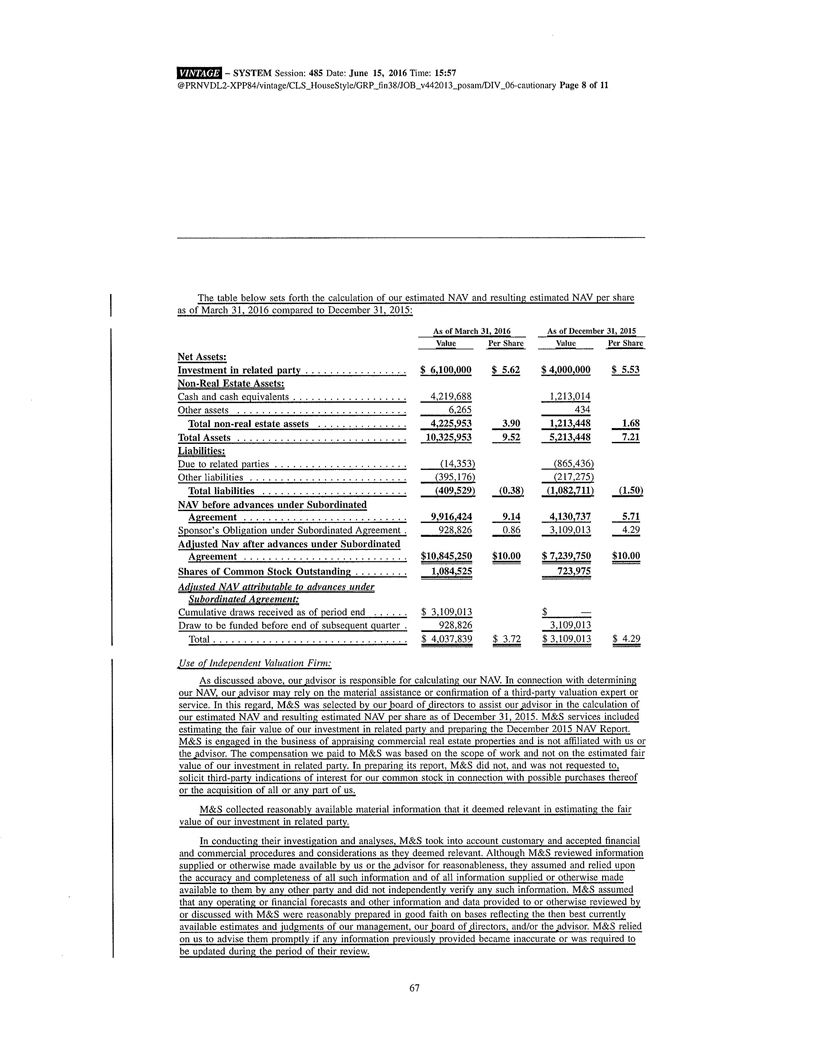

| 1. | Revised disclosure to be included in a Pre-Effective Amendment No. 1 to the POSAM (attached hereto as Exhibit A). The revised disclosure includes: |

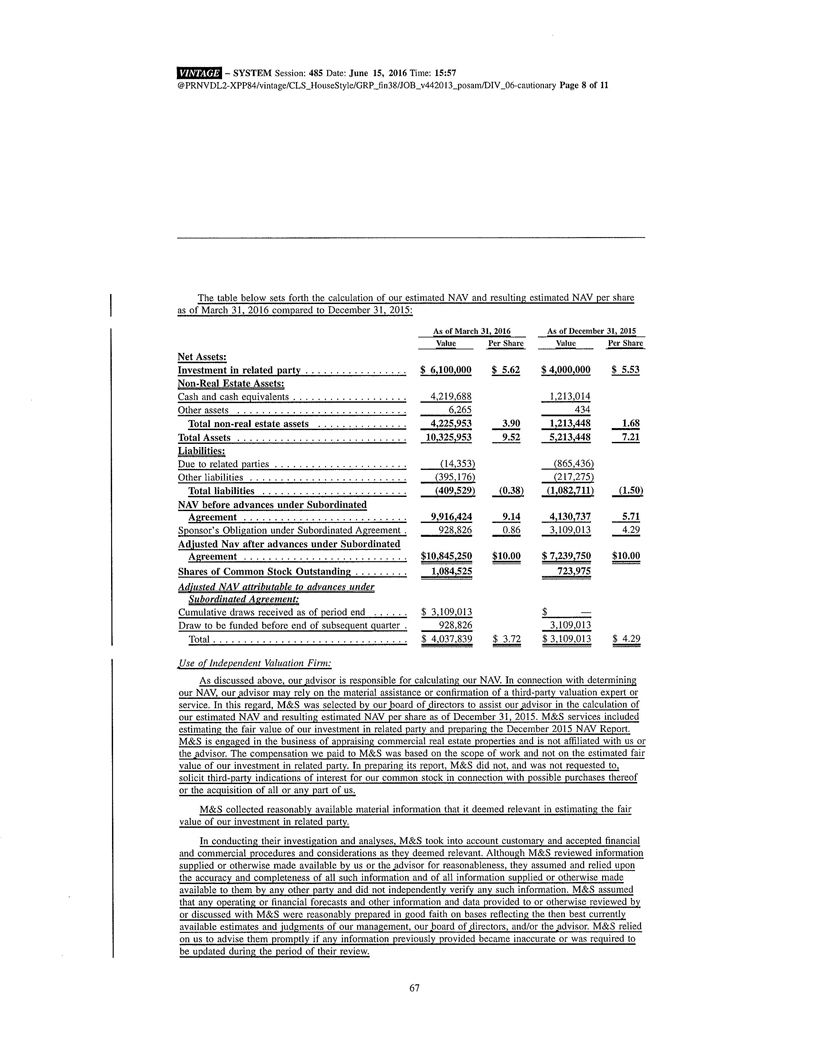

| a. | The addition of the word “Adjusted” in the estimated net asset value table; |

| b. | Changes to the timing of the sponsor’s advances under the loan agreement; |

| c. | The estimated net asset value as of the March 31, 2016; and |

| d. | The list of factors that might cause a stockholder not to ultimately realize distributions per share of common stock equal to the estimated net asset value per share upon liquidation, as previously disclosed to the Commission in the Response Letter. |

| 2. | A proposed Amended and Restated Loan Agreement clarifying the date of the advances under the agreement (attached hereto as Exhibit B). |

We believe the answers provided are responsive to your comments and look forward to resolving any outstanding issues as quickly as possible. When the Staff concludes that the comments are satisfied, the pre-effective amendment to the POSAM, with revisions to all relevant sections, will be filed, and the proposed Amended and Restated Loan Agreement will be executed and filed. If you have any questions in connection with the responses to your comments, please feel free to contact me by phone at (212) 969-3445 or by email at PFass@proskauer.com.

| | | Yours truly, | |

| | | | |

| | | /s/ Peter M. Fass | |

| | | Peter M. Fass | |

| Proskauer Rose LLP | Eleven Times Square | New York, NY 10036-8299 |

EXHIBIT A

| Proskauer Rose LLP | Eleven Times Square | New York, NY 10036-8299 |

EXHIBIT B