NEXPOINT RESIDENTIAL TRUST, INC. [NYSE:NXRT]

The year ended December 31, 2018 as compared to the year ended December 31, 2017

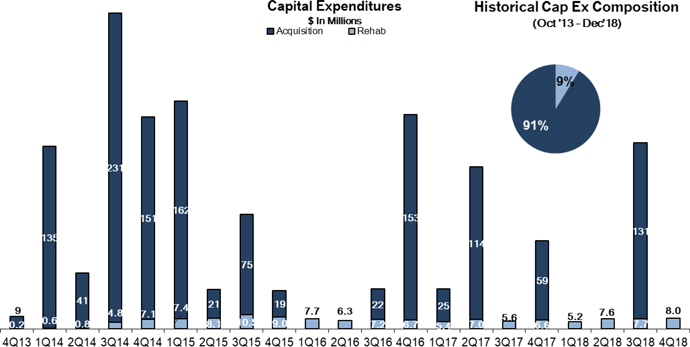

The change in our net loss of $1.6 million for the year ended December 31, 2018 as compared to our net income of $56.4 million for the year ended December 31, 2017 primarily relates to a decrease in gain on sales of real estate of $64.7 million, and was partially offset by an increase in total revenues of $2.4 million and decreases in total property operating expenses of $1.4 million, depreciation and amortization expense of $1.3 million and loss on extinguishment of debt and modification costs of $2.1 million. The change in our net income (loss) between the periods was also due to our acquisition and disposition activity in 2017 and 2018 and the timing of the transactions (we acquired one property in the first quarter of 2017, one property in the second quarter of 2017, one property in the fourth quarter of 2017 and three properties in the third quarter of 2018; we sold four properties in the second quarter of 2017, five properties in the third quarter of 2017 and one property in the first quarter of 2018).

FFO was $32.0 million for the year ended December 31, 2018 compared to $25.1 million for the year ended December 31, 2017, which was an increase of approximately $6.9 million. The change in our FFO between the periods primarily relates to increases in total revenues of $2.4 million and decreases in total property operating expenses of $1.4 million, interest expense of $1.0 million and loss on extinguishment of debt and modification costs of $2.1 million, partially offset by an increase in corporate general and administrative expenses of $1.5 million and adjustments for amounts attributable to noncontrolling interests.

Core FFO was $35.1 million for the year ended December 31, 2018 compared to $30.1 million for the year ended December 31, 2017, which was an increase of approximately $5.0 million. The change in our Core FFO between the periods primarily relates to an increase in FFO, partially offset by a decrease in loss on extinguishment of debt and modification costs of $2.1 million and adjustments for amounts attributable to noncontrolling interests.

AFFO was $40.8 million for the year ended December 31, 2018 compared to $34.8 million for the year ended December 31, 2017, which was an increase of approximately $6.0 million. The change in our AFFO between the periods primarily relates to increases in Core FFO and equity-based compensation expense of $1.1 million.

The year ended December 31, 2017 as compared to the year ended December 31, 2016

The change in our net income of $56.4 for the year ended December 31, 2017 as compared to our net income of $25.9 for the year ended December 31, 2016 primarily relates to increases in total revenues of $11.4 million and gain on sales of real estate of $52.5 million, and was partially offset by increases in total property operating expenses of $4.0 million, depreciation and amortization expense of $13.2 million, interest expense of $9.4 million and loss on extinguishment of debt and modification costs of $4.0 million. The change in our net income between the periods was also due to our acquisition and disposition activity in 2016 and 2017 and the timing of the transactions (we acquired one property in the third quarter of 2016, three properties in the fourth quarter of 2016, one property in the first quarter of 2017, one property in the second quarter of 2017 and one property in the fourth quarter of 2017; we sold three properties in the second quarter of 2016, four properties in the third quarter of 2016, four properties in the second quarter of 2017 and five properties in the third quarter of 2017).

FFO was $25.1 million for the year ended December 31, 2017 compared to $31.0 million for the year ended December 31, 2016, which was a decrease of approximately $5.9 million. The change in our FFO between the periods primarily relates to increases in total property operating expenses of $4.0 million, interest expense of $9.4 million, loss on extinguishment of debt and modification costs of $4.0 million and corporate general and administrative expenses of $2.3 million, partially offset by an increase in total revenues of $11.4 million and adjustments for amounts attributable to noncontrolling interests.

Core FFO was $30.1 million for the year ended December 31, 2017 compared to $31.5 million for the year ended December 31, 2016, which was a decrease of approximately $1.4 million. The change in our Core FFO between the periods primarily relates to a decrease in FFO and a decrease in gain recognized related to the ineffective portion of changes in fair value of our interest rate swap derivatives designated as cash flow hedges of $1.4 million, partially offset by an increase in loss on extinguishment of debt and modification costs of $4.0 million and adjustments for amounts attributable to noncontrolling interests.

AFFO was $34.8 million for the year ended December 31, 2017 compared to $33.6 million for the year ended December 31, 2016, which was an increase of approximately $1.2 million. The change in our AFFO between the periods primarily relates to an increase in equity-based compensation expense of $2.3 million, partially offset by a decrease in Core FFO.

| | | | | | |

www.NexPointLiving.com | | Page 20 | | AN AFFILIATE OF | |  |