- GBT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Global Blood Therapeutics (GBT) DEF 14ADefinitive proxy

Filed: 28 Apr 22, 4:02pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Global Blood Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

GLOBAL BLOOD THERAPEUTICS, INC.

181 Oyster Point Boulevard

South San Francisco, CA 94080

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

TO BE HELD ON JUNE 14, 2022

Dear Stockholder:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Global Blood Therapeutics, Inc., a Delaware corporation (the “Company”), to be held on Tuesday, June 14, 2022, at 8:00 a.m. (Pacific Time). Our Board of Directors has determined, in the interest of public health and safety in light of the ongoing COVID-19 pandemic, that this year’s Annual Meeting will be held virtually via a live interactive audio webcast on the Internet. You will be able to vote and to ask questions of, and engage in dialogue with, members of our Board of Directors and senior management at www.virtualshareholdermeeting.com/GBT2022 during the meeting. Our Board of Directors currently intends to hold future stockholder meetings in person or using a “hybrid” in-person and virtual format as soon as practicable once it is safe to do so.

The Annual Meeting will be held for the following purposes:

| 1. | to elect the three Class I directors, as nominated by our Board of Directors, to hold office until the 2025 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| 2. | to approve, on a non-binding, advisory basis, the compensation of our named executive officers, as disclosed in the proxy statement accompanying this notice; |

| 3. | to ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2022; and |

| 4. | to transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

These items of business are more fully described in the proxy statement accompanying this notice.

Our Board of Directors has fixed the close of business on Friday, April 22, 2022, as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting, or at any adjournments of the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, you are urged to vote as soon as possible as instructed in the Important Notice Regarding the Availability of Proxy Materials that you will receive in the mail. You may vote via the Internet or telephone or via mail, by requesting, at any time on or before Tuesday, May 31, 2022, a printed copy of the proxy card. Voting promptly will help us avoid the additional expense of further solicitation to assure a quorum at the Annual Meeting. If you attend the Annual Meeting and file with the Secretary of the Company an instrument revoking your proxy or a duly executed proxy bearing a later date, your proxy will not be used.

By Order of the Board of Directors

| Global | Blood Therapeutics, Inc. |

Ted W. Love, M.D. |

Ted W. Love, M.D.

President and Chief Executive Officer

South San Francisco, California

April 28, 2022

Global Blood Therapeutics, Inc. ï 2022 Proxy Statement i

GLOBAL BLOOD THERAPEUTICS, INC.

181 Oyster Point Boulevard

South San Francisco, CA 94080

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 14, 2022

INFORMATION CONCERNING SOLICITATION AND VOTING

General

This proxy statement (“Proxy Statement”) is furnished in connection with the solicitation of proxies for use prior to or at the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Global Blood Therapeutics, Inc. (the “Company,” “we,” “us” and “our”), a Delaware corporation, to be held virtually at 8:00 a.m. (Pacific Time) on Tuesday, June 14, 2022, and at any adjournments or postponements thereof for the following purposes:

| 1. | to elect the three Class I directors, as nominated by the Board of Directors, to hold office until the 2025 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| 2. | to approve, on a non-binding, advisory basis, the compensation of our named executive officers; |

| 3. | to ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2022; and |

| 4. | to transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Our Board of Directors has determined, in the interest of public health and safety in light of the ongoing COVID-19 pandemic, that this year’s Annual Meeting will be held virtually via a live interactive audio webcast on the Internet at www.virtualshareholdermeeting.com/GBT2022. You will be able to vote and to ask questions of, and engage in dialogue with, members of our Board of Directors and senior management during the meeting. Our Board of Directors currently intends to hold future stockholder meetings in person or using a “hybrid” in-person and virtual format as soon as practicable once it is safe to do so.

On or about April 28, 2022, we will mail to all stockholders entitled to vote at the Annual Meeting a Notice of Internet Availability of Proxy Materials, or Notice, containing instructions on how to access this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, or Annual Report.

Solicitation

This solicitation is made on behalf of our Board of Directors. We will bear the costs of preparing, mailing, online processing and other costs of the proxy solicitation made by our Board of Directors. Certain of our officers and employees may solicit the submission of proxies authorizing the voting of shares in accordance with our Board of Directors’ recommendations. In addition, we have engaged a proxy solicitor, Alliance Advisors, LLC, to assist us in the solicitation of proxies for aggregate fees of approximately $15,000, plus reasonable out-of-pocket expenses. Such solicitations may be made by email, telephone or personal solicitation. No additional compensation will be paid to our officers, directors or regular employees for such services. We will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in sending proxy materials to stockholders.

Global Blood Therapeutics, Inc. ï 2022 Proxy Statement 1

Important Notice Regarding the Availability of Proxy Materials

In accordance with rules and regulations of the Securities and Exchange Commission, or the SEC, instead of mailing a printed copy of our proxy materials to each stockholder of record, we may furnish proxy materials via the Internet. Accordingly, all of our stockholders will receive a Notice, to be mailed on or about April 28, 2022.

On the date of mailing the Notice, stockholders will be able to access all of the proxy materials on the website at www.proxyvote.com. The proxy materials will be available free of charge. The Notice will instruct you as to how you may access and review all of the important information contained in the proxy materials (including the Annual Report) over the Internet or through other methods specified on the website. The website contains instructions as to how to vote by Internet or over the telephone. The Notice also instructs you as to how you may request a paper or email copy of the proxy card. If you received a Notice and would like to receive printed copies of the proxy materials, you should follow the instructions included in the Notice for requesting such materials.

Voting Rights and Outstanding Shares

Only holders of record of our common stock as of the close of business on April 22, 2022, are entitled to receive notice of, and to vote at, the Annual Meeting. Each holder of common stock will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting. At the close of business on April 22, 2022, there were 65,098,164 shares of common stock issued and outstanding.

A quorum of stockholders is necessary to take action at the Annual Meeting. Stockholders representing a majority of the outstanding shares of our common stock as of the record date (present virtually at the Annual Meeting or represented by proxy) will constitute a quorum. We will appoint an inspector of elections for the meeting to determine whether or not a quorum is present and to tabulate votes cast by proxy or virtually at the Annual Meeting. Abstentions, withheld votes and broker non-votes (which occur when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular matter because such broker, bank or other nominee does not have discretionary authority to vote on that matter and has not received voting instructions from the beneficial owner) are counted as present for purposes of determining the presence of a quorum for the transaction of business at the Annual Meeting.

Vote Required for Each Proposal

The vote required, and the method of calculation, for each proposal at our Annual Meeting is described below.

Proposal | Vote Required | Discretionary Voting Permitted? | ||||||

Election of Directors | Plurality | No | ||||||

Approval, on a Non-Binding, Advisory Basis, of the Compensation of our Named Executive Officers |

| Majority |

|

| No |

| ||

Approval of the Ratification of KPMG LLP | Majority | Yes | ||||||

“Discretionary Voting Permitted” means that brokers will have discretionary voting authority with respect to shares held in street name for their clients, even if the broker does not receive voting instructions from their client.

“Majority” means a majority of the votes properly cast for and against such matter.

“Plurality” means a plurality of the votes properly cast on such matter. For the election of directors, the three nominees receiving the highest number of votes, submitted virtually during the Annual Meeting or by proxy, will be elected as directors.

Proposal One—Election of Directors

The three Class I director nominees receiving the highest number of votes, submitted virtually during the Annual Meeting or by proxy, will be elected. You may vote “FOR” all nominees, “WITHHOLD” for all nominees, or “WITHHOLD” for any individual nominee by specifying the name of the nominee on your proxy card. This proposal is not considered to be a discretionary item, so if you do not instruct your broker how to vote with respect to this proposal, your broker may not vote on this proposal, and those votes will be counted as broker “non-votes.” Withheld votes and broker non-votes will have no effect on the outcome of the election of the directors.

2 2022 Proxy Statement ï Global Blood Therapeutics, Inc.

Proposal Two—Approval, on a Non-Binding, Advisory Basis, of the Compensation of our Named Executive Officers

Approval of this proposal requires the affirmative vote of a majority of the votes properly cast for and against this proposal. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. If you abstain from voting on this proposal, your shares will not be counted as “votes cast” with respect to this proposal, and the abstention will have no effect on this proposal. This proposal is not considered to be a routine item, so if you do not instruct your broker how to vote with respect to this proposal, your broker may not vote on this proposal, and those votes will be counted as broker “non-votes.” Broker non-votes will have no effect on the outcome of this proposal.

Proposal Three—Approval of the Ratification of KPMG LLP as Independent Registered Public Accounting Firm

Approval of this proposal requires the affirmative vote of a majority of the votes properly cast for and against this proposal. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. If you abstain from voting on this proposal, your shares will not be counted as “votes cast” with respect to this proposal, and the abstention will have no effect on the proposal. This proposal is considered to be a discretionary item, and your broker will be able to vote on this proposal even if it does not receive instructions from you. Accordingly, we do not anticipate that there will be any broker non-votes on this proposal; however, any broker non-votes will not be counted as “votes cast” and will, therefore, have no effect on this proposal.

Voting Methods

We request that you vote your shares by proxy as instructed in the Notice by one of the following methods: over the Internet, by telephone or by mail. If you choose to vote by mail, your shares will be voted in accordance with your voting instructions if the proxy card is received prior to or at the Annual Meeting. If you sign and return your proxy card but do not give voting instructions, your shares will be voted FOR (i) the election of each of the three nominees as Class I directors; (ii) the approval, on a non-binding, advisory basis, of the compensation of our named executive officers; (iii) the ratification of the appointment of KPMG LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2022; and (iv) as the proxy holders deem advisable, in their discretion, on other matters that may properly come before the Annual Meeting.

Voting by Proxy Over the Internet or by Telephone

Stockholders whose shares are registered in their own names may vote by proxy by mail, over the Internet or by telephone. Instructions for voting by proxy over the Internet or by telephone are set forth on the Notice. The Internet and telephone voting facilities will close at 11:59 p.m. (Eastern Time) on June 13, 2022. The Notice will also provide instructions on how you can elect to receive future proxy materials electronically or in printed form by mail. If you choose to receive future proxy materials electronically, you will receive an email next year with instructions containing a link to the proxy materials and a link to the proxy voting site. Your election to receive proxy materials electronically or in printed form by mail will remain in effect until you terminate such election.

If your shares are held in street name, the voting instruction form sent to you by your broker, bank or other nominee should indicate whether the institution has a process for beneficial holders to provide voting instructions over the Internet or by telephone. A number of banks and brokerage firms participate in a program that also permits stockholders whose shares are held in street name to direct their vote over the Internet or by telephone. If your bank or brokerage firm gives you this opportunity, the voting instructions from the bank or brokerage firm that accompany this Proxy Statement will tell you how to use the Internet or telephone to direct the vote of shares held in your account. If your voting instruction form does not include Internet or telephone information, please complete and return the voting instruction form in the self-addressed, postage-paid envelope provided by your broker. Stockholders who vote by proxy over the Internet or by telephone need not return a proxy card or voting instruction form by mail, but may incur costs, such as usage charges, from telephone companies or Internet service providers.

Revocability of Proxies

Any proxy may be revoked at any time before it is exercised by filing an instrument revoking it with our Secretary or by submitting a duly executed proxy bearing a later date prior to the time of the Annual Meeting. Stockholders who have voted by proxy over the Internet or by telephone or have executed and returned a proxy and who then virtually attend the Annual Meeting and desire to vote during the meeting are requested to notify our Secretary in writing prior to the time of the Annual Meeting. We request that all such written notices of revocation be addressed to Tricia Suvari, Secretary, c/o Global Blood Therapeutics, Inc., at the address of our principal executive offices at 181 Oyster Point Boulevard, South San Francisco, CA 94080. Our telephone number is 650.741.7700. Stockholders may also revoke their proxy by entering a new vote over the Internet or by telephone before these voting facilities close at 11:59 p.m. (Eastern Time) on June 13, 2022.

Global Blood Therapeutics, Inc. ï 2022 Proxy Statement 3

Stockholder Proposals to be Presented at the Next Annual Meeting

Any stockholder who meets the requirements of the proxy rules under the Securities Exchange Act of 1934, as amended, or the Exchange Act, may submit proposals to the Board of Directors to be presented at the 2023 Annual Meeting of Stockholders. Such proposals must comply with the requirements of Rule 14a-8 under the Exchange Act and be submitted in writing by notice delivered or mailed by first-class United States mail, postage prepaid, to our Secretary at our principal executive offices at the address set forth above no later than December 29, 2022, to be considered for inclusion in the proxy materials to be disseminated by the Board of Directors for such annual meeting. If the date of the 2023 Annual Meeting of Stockholders is moved by more than 30 days from the date contemplated at the time of the previous year’s proxy statement, then notice must be received within a reasonable time before we begin to print and send proxy materials. If that happens, we will publicly announce the deadline for submitting a proposal in a press release or in a document filed with the U.S. Securities and Exchange Commission, or SEC. A proposal submitted outside the requirements of Rule 14a-8 under the Exchange Act will be considered untimely if received after March 14, 2023.

Our Amended and Restated Bylaws, or Bylaws, also provide for separate notice procedures to recommend a person for nomination as a director or to propose business to be considered by stockholders at a meeting. To be considered timely under these provisions, the stockholder’s notice must be received by our Secretary at our principal executive offices at the address set forth above no earlier than February 14, 2023, and no later than March 16, 2023. Our Bylaws also specify requirements as to the form and content of a stockholder’s notice.

The Board of Directors, a designated committee thereof or the chair of the meeting may refuse to acknowledge the introduction of any stockholder proposal if it is not made in compliance with the applicable notice provisions.

4 2022 Proxy Statement ï Global Blood Therapeutics, Inc.

ELECTION OF DIRECTORS

Our certificate of incorporation provides for a Board of Directors that is divided into three classes. The term for each class is three years, staggered over time. In 2022, the term of the directors in Class I expires, and all three of our Class I directors— Drs. Ted W. Love and Glenn F. Pierce and Ms. Dawn A. Svoronos—will stand for re-election at the Annual Meeting.

Our Board of Directors is currently comprised of nine members. If the Class I director nominees who are standing for re-election are elected at the Annual Meeting, our Board of Directors will be as follows:

| • | Class I—Drs. Ted W. Love and Glenn F. Pierce and Ms. Dawn A. Svoronos; |

| • | Class II—Drs. Philip A. Pizzo and Alexis A. Thompson and Ms. Wendy L. Yarno; and |

| • | Class III—Messrs. Scott W. Morrison, Deval L. Patrick and Mark L. Perry. |

In the absence of instructions to the contrary, the persons named as proxy holders in the accompanying proxy intend to vote in favor of the election of the three Class I nominees designated below to serve until the 2025 Annual Meeting of Stockholders and until their successors shall have been duly elected and qualified. Each nominee is currently a director. The Board of Directors expects that each nominee will be available to serve as a director, but if any such nominee should become unavailable or unwilling to stand for election, it is intended that the shares represented by the proxy will be voted for such substitute nominee as may be designated by the Board of Directors.

The biographies of our director nominees and each director whose term will continue after the Annual Meeting and their ages as of March 31, 2022, are set forth below.

Name | Position | Year First Elected or Appointed Director | Age | |||||||

Ted W. Love, M.D. | President, Chief Executive Officer and Director | 2013 | 63 | |||||||

Scott W. Morrison | Director | 2016 | 64 | |||||||

Deval L. Patrick | Director | 2015 | 65 | |||||||

Mark L. Perry | Director | 2015 | 66 | |||||||

Glenn F. Pierce, M.D., Ph.D. | Director | 2016 | 66 | |||||||

Philip A. Pizzo, M.D. | Director | 2015 | 77 | |||||||

Dawn A. Svoronos | Director | 2018 | 68 | |||||||

Alexis A. Thompson, M.D., M.P.H. | Director | 2021 | 63 | |||||||

Wendy L. Yarno | Director | 2017 | 67 | |||||||

Global Blood Therapeutics, Inc. ï 2022 Proxy Statement 5

The persons listed below are nominated for election to Class I of the Board of Directors to serve a three-year term ending at the 2025 Annual Meeting of Stockholders and until their successors are elected and qualified.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

|

Ted W. Love, M.D.

Age 63

Director since September 2013

Committees: • N/A | Dr. Love has served as our Chief Executive Officer and President since June 2014, and as a member of our Board of Directors since September 2013. From February 2010 to August 2012, Dr. Love served as executive vice president, research and development and technical operations of Onyx Pharmaceuticals, Inc. Prior to that, from 2001 to January 2009, he served as president, chief executive officer and chairman of Nuvelo, Inc., and previously served as senior vice president, development of Theravance, Inc., from 1998 to 2001. Previously, he spent six years at Genentech, Inc., where he held a number of senior management positions in medical affairs and product development and served as chairman of Genentech’s Product Development Committee. Dr. Love currently serves on the board of directors of Seagen Inc., a biotechnology company, and Royalty Pharma plc, a biopharmaceutical company. Dr. Love also currently serves on the board of directors of the Biotechnology Innovation Organization (BIO), a non-profit biotechnology trade organization. Within the past five years, Dr. Love previously served on the board of directors of the following biotechnology companies: Portola Pharmaceuticals, Inc., Amicus Therapeutics, Inc., and Cascadian Therapeutics, Inc. Dr. Love holds a B.A. from Haverford College and an M.D. from Yale Medical School. He completed a residency in internal medicine and fellowship in cardiology at the Massachusetts General Hospital.

Qualifications: Dr. Love’s qualifications to serve on our Board of Directors include his role as our principal executive officer and more than 25 years of broad leadership and management experience in the pharmaceutical industry.

| |||||

Glenn F. Pierce, M.D., Ph.D.

Age 66

Director since

Committees: • Nominating and Corporate Governance • Research and Development (Chair) | Dr. Pierce has served as a member of our Board of Directors since February 2016. In February 2016, Dr. Pierce joined Third Rock Ventures, a venture capital firm, as an independent consultant and entrepreneur-in-residence. In 2018, Dr. Pierce co-founded Ambys Medicines, a biopharmaceutical company, and served as interim Chief Medical Officer from January 2018 to March 2022. He also serves on the World Federation of Hemophilia (WFH) Board and the National Hemophilia Foundation (NHF) (US) Medical and Scientific Advisory Council. Dr. Pierce is also a director of Voyager Therapeutics, a biopharmaceutical company, and, since June 2021, has served as interim Chief Scientific Officer of the company. Dr. Pierce retired from Biogen in 2014 as senior vice president of Hematology, Cell and Gene Therapies. He had overall R&D responsibility for hemophilia and hemoglobinopathies and served as Chief Medical Officer since joining the company in 2009. Dr. Pierce was also responsible for global medical affairs for Biogen’s portfolio from 2012 to 2014. Dr. Pierce has 30 years’ experience in biotechnology research and development, beginning at Amgen, is the co-author of more than 150 scientific papers and is a named inventor in over 15 patents. Dr. Pierce also served on the Blood Products Advisory Committee at the United States Food and Drug Administration and the Committee on Blood Safety and Availability at the United States Department of Health and Human Services. He received an M.D. and a Ph.D. in Immunology, both from Case Western Reserve University in Cleveland, Ohio and did his postgraduate training in pathology and hematology research at Washington University in St. Louis, Missouri.

Qualifications: Dr. Pierce’s qualifications to serve on our Board of Directors include more than 30 years of experience in leading biotechnology research and development in small, large, public and private biotechnology and biopharmaceutical firms.

|

6 2022 Proxy Statement ï Global Blood Therapeutics, Inc.

Dawn A. Svoronos

Age 68

Director since December 2018

Committees: • Commercial (Chair) | Ms. Svoronos has served as a member of our Board of Directors since December 2018. Ms. Svoronos has more than 30 years of experience in the biopharmaceutical industry, including extensive commercial work with the multinational pharmaceutical company Merck & Co. Inc., where she held roles of increasing seniority over nearly 25 years of service. Prior to her retirement from Merck in 2011, Ms. Svoronos most recently served as President of Merck in Europe/Canada from 2009 to 2011, President of Merck in Canada from 2006 to 2009 and Vice-President of Merck for Asia Pacific from 2005 to 2006. Ms. Svoronos currently serves on the boards of directors of the following public biotechnology companies: Adverum Biotechnologies, Inc., PTC Therapeutics, Inc., Theratechnologies Inc., and Xenon Pharmaceuticals, Inc. Within the past five years, Ms. Svoronos previously served on the board of directors of Endocyte, Inc., a biopharmaceutical company. Ms. Svoronos holds a B.A. from Carleton University in Ottawa, Canada.

Qualifications: Ms. Svoronos’ qualifications to serve on our Board of Directors include her extensive experience in the global commercialization of pharmaceutical products, including her substantial international commercial experience as well as her leadership experience and her service on the boards of directors of other public companies.

|

Class II: Directors Currently Serving Until the 2023 Annual Meeting of Stockholders

Philip A. Pizzo, M.D.

Age 77

Director since September 2015

Committees: • Nominating and • Research and Development | Dr. Pizzo has served as a member of our Board of Directors since September 2015. Dr. Pizzo currently serves as the David and Susan Heckerman Professor of Pediatrics and of Microbiology and Immunology at Stanford School of Medicine and has served as the founding director of the Stanford Distinguished Careers Institute since 2013. He previously served as Dean of the Stanford School of Medicine from 2001 to 2012, where he was also the Carl and Elizabeth Naumann Professor of Pediatrics and of Microbiology and Immunology. Before joining Stanford, he was the physician-in-chief of Children’s Hospital in Boston and chair of the Department of Pediatrics at Harvard Medical School from 1996 to 2001. Prior to that, Dr. Pizzo was at the National Cancer Institute, eventually serving as chief of pediatrics and acting scientific director in the Division of Clinical Sciences. Dr. Pizzo is the author of more than 630 scientific articles and 16 books and monographs, has received numerous awards and honors, is a member of the National Academy of Medicine, and serves on several international boards. Dr. Pizzo holds a B.A. from Fordham University and an M.D. from the University of Rochester, School of Medicine.

Qualifications: Dr. Pizzo’s qualifications to serve on our Board of Directors include his leadership in academic medicine, and his work in the fields of pediatric medicine, science, education and healthcare.

| |||||

Alexis A. Thompson, M.D., M.P.H.

Age 63

Director since

Committees: • Research and Development | Dr. Thompson has served as a member of our Board of Directors since March 2021. Since January 2022, Dr. Thompson has served as the Chief of the Division of Hematology at the Children’s Hospital of Philadelphia, where she also serves as the Elias Schwartz MD Endowed Chair in Hematology. From April 2001 to December 2021, she served as an attending physician at the Ann and Robert H. Lurie Children’s Hospital of Chicago, where she also served as the head of the Hematology Section and director of the Comprehensive Thalassemia Program and as the A. Watson and Sarah Armour Endowed Chair for Childhood Cancer and Blood Disorders. From 2008 to December 2021, Dr. Thompson served as the associate director for equity and minority health at the Robert H. Lurie Cancer Center and Northwestern University Feinberg School of Medicine. She has served on national advisory committees for governmental agencies as well as non-profit organizations focused on improving healthcare access, increasing workforce diversity and reducing health disparities. In 2018, Dr. Thompson served as president of the American Society of Hematology (ASH) and continues to serve on ASH’s Sickle Cell Disease Task Force. She has been a leader in multicenter collaborations, such as the National Heart, Lung, and Blood Institute’s Sickle Cell Disease Implementation Consortium, and has received numerous awards recognizing her expertise in teaching and clinical care. Dr. Thompson received an M.D. from Tulane University, received her M.P.H. from University of California, Los Angeles, and completed her postgraduate training at Children’s Hospital Los Angeles and the Children’s Hospital of Philadelphia.

Qualifications: Dr. Thompson’s qualifications to serve on our Board of Directors include more than 20 years of experience as a world-renowned hematologist and sickle cell disease expert, her leadership in academic medicine, and expertise in science, education and healthcare.

|

Global Blood Therapeutics, Inc. ï 2022 Proxy Statement 7

Wendy L. Yarno

Age 67

Director since December 2017

Committees: • Compensation • Commercial | Ms. Yarno has served as a member of our Board of Directors since December 2017. Ms. Yarno retired in September 2008 from Merck & Co, Inc., where she served in commercial and human resource positions of increasing seniority, most recently as Chief Marketing Officer, before she retired. Prior to this position, Ms. Yarno served as General Manager for Merck’s Cardiovascular/Metabolic United States Business Unit and as Senior Vice President, Human Resources. From 2010 to 2011, Ms. Yarno was the Chief Marketing Officer of HemoShear LLC, a biotechnology research company. Ms. Yarno currently serves on the boards of directors of the following public biopharmaceutical companies: Ideaya Biosciences, Inc., Inovio Pharmaceuticals, Inc. and Tarsus Pharmaceuticals, Inc. Within the past five years, Ms. Yarno previously served as a member of the board of directors of Alder Biopharmaceuticals, Inc., a biopharmaceutical company, Aratana Therapeutics, Inc., a therapeutics company, and MyoKardia, Inc., a biopharmaceutical company. Ms. Yarno received an M.B.A. from Temple University, Fox School of Business, and a B.S. in business administration from Portland State University.

Qualifications: Ms. Yarno’s qualifications to serve on our Board of Directors include her extensive experience commercializing pharmaceutical products, and her extensive operational and senior management experience, in the biopharmaceutical industry, as well as her experience serving on the board of directors (and certain key standing committees) of other biopharmaceutical companies.

|

Class III: Directors Currently Serving Until the 2024 Annual Meeting of Stockholders

Scott W. Morrison

Age 64

Director since January 2016

Committees: • Audit (Chair) • Compensation • Commercial

| Mr. Morrison has served as a member of our Board of Directors since January 2016. From 1996 to December 2015, Mr. Morrison was a partner at Ernst & Young LLP, a public accounting firm, and served as its U.S. Life Sciences Leader since 2002. He currently serves on the board of directors of the following public biopharmaceutical companies: Corvus Pharmaceuticals, Inc., Ideaya Biosciences, Inc., Vera Therapeutics, Inc., and Zai Labs, Inc. Mr. Morrison has served on numerous life sciences industry boards, including the Biotechnology Innovation Organization (BIO) ECS Board, the Bay Area Bioscience Center Board (now California Life Sciences Association), the California Life Sciences Foundation and the Biotechnology Institute. Within the past five years, Mr. Morrison previously served on the board of directors of Audentes Therapeutics, Inc., a biotechnology company. Mr. Morrison holds a B.S. in Accounting and Finance from the University of California, Berkeley and is a Certified Public Accountant (inactive).

Qualifications: Mr. Morrison’s qualifications to serve on our Board of Directors include significant accounting expertise and knowledge of the life sciences industry through his 35-year career in public accounting serving public and private companies in the life sciences sector, as well as his experience serving on the board of directors (and certain key standing committees) of other biotechnology companies since 2015.

| |||||

Deval L. Patrick

Age 65

Director since 2020;

previously April 2015

Committees: • Audit • Nominating and Corporate Governance | Mr. Patrick has served as a member of our Board of Directors since May 2020 and previously served as a member of our Board of Directors from April 2015 to November 2019. Since February 2022, He has been a Professor of Practice and Co-Director of the Center for Public Leadership at the Harvard Kennedy School. Mr. Patrick has served as a Senior Advisor at Bain Capital, LP, an investment firm, since March 2021, and he previously served as managing director of Bain Capital from April 2015 to December 2019. Since March 2020, Mr. Patrick also has served as co-chair of American Bridge 21st Century Foundation and its BridgeTogether initiative, a nonprofit formed to develop and support permanent local grassroots organizing groups. Mr. Patrick currently serves on the board of directors of American Well Corporation, a telehealth company, Toast, Inc., a cloud-based, restaurant software company, Twilio Inc., a cloud communications platform company, and Cerevel Therapeutics Holdings, Inc., a biotechnology company. Within the past five years, Mr. Patrick served on the board of directors of Environmental Impact Acquisition Corp (“ENVI”), a special purpose acquisition company focused on sustainability. From January 2007 to January 2015, Mr. Patrick served as the governor of Massachusetts. Before his tenure in government, Mr. Patrick served as the executive vice president and general counsel at The Coca-Cola Company, and as vice president and general counsel at Texaco Inc. Mr. Patrick received an A.B. in English and American literature from Harvard College and a J.D. from Harvard Law School.

Qualifications: Mr. Patrick’s qualifications to serve on our Board of Directors include his significant experience as a business and government leader with a record of success in solving complex problems, making strategic investments, managing crises and building teams locally, nationally and internationally.

|

8 2022 Proxy Statement ï Global Blood Therapeutics, Inc.

Mark L. Perry

Age 66

Director since April 2015

Committees: • Audit • Compensation • Commercial | Mr. Perry has served as a member of our Board of Directors since April 2015. From October 2012 to October 2013, Mr. Perry served as an entrepreneur-in-residence at Third Rock Ventures. In October 2004, Mr. Perry joined Aerovance, Inc., a biopharmaceutical company, as a director, and he served as president and chief executive officer of Aerovance from February 2007 to October 2011. Prior to that, Mr. Perry served as the senior business adviser of Gilead Sciences, Inc., a biopharmaceutical company, from April 2004 to February 2007 and as an executive officer from May 1994 to April 2004, during which time he served in a variety of capacities, including general counsel, chief financial officer and executive vice president of operations. Earlier in his career, from 1981 to 1994, Mr. Perry served as an attorney at Cooley LLP, and was a partner of the firm from 1987 to 1994. Since August 2011, Mr. Perry has served on various boards of companies and non-profit organizations. Mr. Perry currently serves on the board of directors of Nvidia Corporation, a visual computing company, and, within the past five years, he previously served on the board of directors of MyoKardia, Inc., a biopharmaceutical company. Mr. Perry received a B.A. in history from the University of California, Berkeley and a J.D. from the University of California, Davis.

Qualifications: Mr. Perry’s qualifications to serve on our Board of Directors include more than 30 years of experience serving in professional and management positions in the biotechnology industry, as well as his experience serving on the board of directors (and certain key standing committees) of other biopharmaceutical companies.

|

2022 Director Changes and Appointment of Director Emeritus

On March 24, 2022, Willie L. Brown, Jr. resigned, effective immediately, from our Board of Directors and its Nominating and Corporate Governance Committee after serving as a director since January 2015. His resignation was not a result of any disagreement with the Company. On the same day, our Board of Directors appointed Mr. Brown as Director Emeritus, effective immediately, in which capacity he is serving as an advisor to the Company.

Mr. Brown served as a member of our Board of Directors from January 2015 to March 2022. Since January 2004, Mr. Brown has served as an attorney at law representing clients before state and local governments. Prior to that, from January 1996 to January 2004, Mr. Brown served as the 41st mayor of San Francisco. Mr. Brown is a practicing attorney, community leader and well-respected public official who served over 31 years in the California State Assembly, spending more than 14 years as its Speaker, from 1980 to 1995. He currently serves as chairman and chief executive officer of The Willie L. Brown, Jr. Institute on Politics and Public Service, an independent, non-profit organization providing a forum for non-partisan education, debate and discussion of public policy issues. Mr. Brown holds a degree in political science from San Francisco State University and a J.D. from University of California, Hastings College of the Law. He has received over 17 honorary degrees from prestigious institutions throughout his life.

On March 24, 2022, solely to provide for an equal apportionment of the members of the Board among the three classes of our classified Board following Mr. Brown’s resignation, Dr. Thompson resigned from the Board as a Class I director, effective immediately, and was immediately reappointed by the remaining members of the Board as a Class II director, to serve in such capacity until the next annual meeting of stockholders at which the term of the Class II directors expires or until her successor is duly elected and qualified, or her earlier death, resignation or removal.

Global Blood Therapeutics, Inc. ï 2022 Proxy Statement 9

Board Skills, Experience and Diversity

The below table provides information regarding our Board of Directors, including certain attributes possessed by our directors, which we and our Board of Directors believe are relevant to our business. The below table does not include all of the attributes of our directors, and the fact that a director may not have a particular attribute does not mean such director is unable to contribute to the decision-making process in that area.

| Knowledge, Skills and Experience | ||||||||||||||||||||||||||||||||||||||||||

| 7 of 9 | 8 of 9 | |||||||||||||||||||||||||||||||||||||||||

| Executive leadership | Healthcare/life sciences | |||||||||||||||||||||||||||||||||||||||||

| 7 of 9 | 7 of 9 | |||||||||||||||||||||||||||||||||||||||||

| Business strategy/operations | Public company/other governance role | |||||||||||||||||||||||||||||||||||||||||

| 6 of 9 | 5 of 9 | |||||||||||||||||||||||||||||||||||||||||

| Commercial experience | Government/regulatory | |||||||||||||||||||||||||||||||||||||||||

| 7 of 9 | 4 of 9 | |||||||||||||||||||||||||||||||||||||||||

| International operating experience | Scientific expertise | |||||||||||||||||||||||||||||||||||||||||

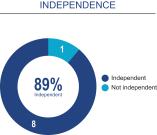

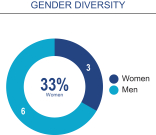

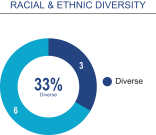

Board composition overview

|  |  |  |

10 2022 Proxy Statement ï Global Blood Therapeutics, Inc.

As required by rules of the NASDAQ Stock Market that were approved by the Securities and Exchange Commission in August 2021, we are providing additional information about the gender and demographic diversity of our directors in the format required by NASDAQ rules. The information in the matrix below is based solely on information provided by our directors about their gender and demographic self-identification.

| Board Diversity Matrix* |

| |||||||||||||||

Total Number of Directors | 9 | |||||||||||||||

| Female | Male | Non-Binary |

Did Not | |||||||||||||

Part I: Gender Identity |

| |||||||||||||||

Directors | 3 | 6 |

|

|

|

|

|

| ||||||||

Part II: Demographic Background |

| |||||||||||||||

African American or Black | 1 | 2 | ||||||||||||||

Alaskan Native or Native American |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Asian |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Hispanic or Latinx |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Native Hawaiian or Pacific Islander |

|

|

|

|

|

|

|

|

|

|

|

| ||||

White | 2 | 4 |

|

|

|

|

|

| ||||||||

Two or More Races or Ethnicities |

|

|

|

|

|

|

|

|

|

|

|

| ||||

LGBTQ+ |

|

|

| |||||||||||||

Did Not Disclose Demographic Background |

|

|

| |||||||||||||

| * | As of April 28, 2022 |

Global Blood Therapeutics, Inc. ï 2022 Proxy Statement 11

Board of Directors’ Role in Risk Management

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face numerous risks, including but not limited to risks relating to our financial condition, commercialization activities, research and development activities, clinical and regulatory matters, operations and intellectual property. Management is responsible for the day-to-day management of risks we face, while our Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The role of our Board of Directors in overseeing the management of our risks is conducted primarily through committees of the Board of Directors, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees. For example, the Compensation Committee assesses risks created by the incentives inherent in our compensation programs, policies and practices. The full Board of Directors (or the appropriate board committee in the case of risks that are under the purview of a particular committee) discusses with management our major risk exposures, their potential impact on the Company, and the steps we take to manage them. When a board committee is responsible for evaluating and overseeing the management of a particular risk or risks, the chair of the relevant committee reports on the discussion to the full Board of Directors during the committee reports portion of the next board meeting. This enables our Board of Directors and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

Board of Directors and Committees of the Board

During 2021, the Board of Directors held a total of four meetings. All directors attended at least 75% of the aggregate of the number of Board meetings and the number of meetings of Board committees on which each such director served during the time each such director served on the Board or such committees.

Our Board of Directors has determined that all of our directors, except for Dr. Love, are independent, as determined in accordance with the rules of The Nasdaq Stock Market LLC, or NASDAQ, and the SEC. In making such independence determination, the Board of Directors considered the relationships that each non-employee director has with us and all other facts and circumstances that the Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director. In considering the independence of the directors listed above, our Board of Directors also considers the association, if any, of our directors with the holders of more than 5% of our common stock. There are no family relationships among any of our directors or executive officers.

The Board of Directors has a standing Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Each of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee is composed entirely of independent directors in accordance with current NASDAQ listing standards. Furthermore, our Audit Committee meets the enhanced independence standards established by the Sarbanes-Oxley Act of 2002 and related rulemaking of the SEC. The authority and responsibilities of each of these committees are summarized below, and more detailed descriptions of their functions are included in their written charters, which are available along with our corporate governance guidelines on our website at www.gbt.com.

Pursuant to their charters, each of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee is authorized to access, at our expense, such internal and external resources as the particular committee deems necessary or appropriate to fulfill its defined responsibilities. Each committee has sole authority to approve fees, costs and other terms of engagement of such outside resources.

The Board of Directors also has a standing Research and Development Committee and Commercial Committee, which are advisory committees.

12 2022 Proxy Statement ï Global Blood Therapeutics, Inc.

The following chart provides membership as of April 28, 2022, for each of the Board of Directors’ standing committees:

|

| Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Research and Development Committee (advisory) | Commercial Committee (advisory) | |||||

Scott W. Morrison | C | ✔ |

|

| ✔ | |||||

Deval L. Patrick | ✔ |

| ✔ |

|

| |||||

Mark L. Perry | ✔ | ✔ |

|

| ✔ | |||||

Glenn F. Pierce, M.D., Ph.D. |

|

| ✔ | C |

| |||||

Philip A. Pizzo, M.D. |

|

| C | ✔ |

| |||||

Dawn A. Svoronos |

|

|

|

| C | |||||

Alexis A. Thompson, M.D., M.P.H. |

|

|

| ✔ |

| |||||

Wendy L. Yarno |

| C |

|

| ✔ | |||||

✔ - Committee member C - Committee chair

Audit Committee | The Audit Committee’s responsibilities include: | |

Chair: Mr. Morrison

Members: Mr. Patrick Mr. Perry

| • appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm;

• pre-approving auditing and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm;

• reviewing the audit plan with our independent registered public accounting firm and members of management responsible for preparing our financial statements;

• reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures as well as critical accounting policies and practices used by us;

• coordinating the oversight and reviewing the adequacy of our internal control over financial reporting and performance of our internal audit function, if any;

• establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns;

• recommending, based on the Audit Committee’s review and discussions with management and our independent registered public accounting firm, whether our audited financial statements shall be included in our Annual Report on Form 10-K;

• monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters;

• preparing the Audit Committee report required by SEC rules to be included in our annual proxy statement;

• reviewing all related person transactions for potential conflict of interest situations and approving all such transactions;

• reviewing quarterly earnings releases;

• overseeing our compliance with legal and regulatory requirements;

• discussing guidelines and policies governing risk assessment matters, and monitoring and overseeing matters related to cybersecurity risks affecting the Company; and

• periodically conducting a performance evaluation of the Audit Committee and reporting to the Board on the results of such evaluation.

| |

Global Blood Therapeutics, Inc. ï 2022 Proxy Statement 13

During 2021, Messrs. Morrison, Patrick and Perry and Ms. Svoronos served on the Audit Committee, and the Committee held four meetings. Our Board of Directors has determined that each of Messrs. Morrison, Patrick and Perry is an “Audit Committee financial expert,” as defined under the applicable rules of the SEC. In April 2021, Ms. Svoronos stepped down as a member of the Audit Committee.

Compensation Committee | The Compensation Committee’s responsibilities include: | |

Chair: Ms. Yarno

Members: Mr. Morrison Mr. Perry | • reviewing and approving corporate goals relevant to the compensation of our Chief Executive Officer;

• evaluating the performance of our Chief Executive Officer in light of such corporate goals and determining the compensation of our Chief Executive Officer;

• reviewing and approving any peer group of companies used to inform the Company’s evaluation of compensation for its employees and directors;

• reviewing and approving the compensation of our other executive officers;

• reviewing and establishing our overall management compensation, philosophy, policy and practices;

• overseeing our strategies and policies relating to culture and human capital management;

• reviewing, overseeing and approving our compensation and similar plans;

• evaluating and assessing potential and current compensation advisors in accordance with the independence standards identified in the applicable NASDAQ Stock Market rules;

• retaining and approving the compensation of any compensation advisors;

• reviewing and recommending to our Board of Directors our policies and procedures for the grant of equity-based awards;

• reviewing and making recommendations to our Board of Directors with respect to non-employee director compensation;

• reviewing and discussing with the Board of Directors the corporate succession plans for the Chief Executive Officer and other executive officers;

• preparing the compensation committee report required by the SEC rules to be included in our annual proxy statement and Annual Report on Form 10-K;

• making recommendations to stockholders on approval of our say-on-pay proposals and on the frequency of say-on-pay votes;

• reviewing and discussing with management the compensation discussion and analysis to be included in our annual proxy statement or Annual Report on Form 10-K; and

• periodically conducting a performance evaluation of the Compensation Committee and reporting to the Board on the results of such evaluation.

| |

Pursuant to its charter, the Compensation Committee has the authority to engage compensation consultants to assist in its evaluation of executive and non-employee director compensation. For 2021, the Compensation Committee engaged Compensia, Inc., or Compensia, a national compensation consulting firm, as a compensation consultant. Our Compensation Committee plans to engage Compensia or one or more other third-party compensation advisors to provide similar information and advice in future years for consideration in establishing overall compensation for our executives and non-employee directors. We do not believe the retention of, and the work performed by, Compensia creates any conflict of interest. See “Executive Compensation-Compensation Discussion and Analysis-Governance of Executive Compensation Program—Role of Compensation Consultant” below for more information.

During 2021, Messrs. Perry and Morrison and Ms. Yarno served on the Compensation Committee, and the Committee held seven meetings.

14 2022 Proxy Statement ï Global Blood Therapeutics, Inc.

Nominating and Corporate Governance Committee | The Nominating and Corporate Governance Committee’s responsibilities include: | |

Chair: Dr. Pizzo

Members: Mr. Patrick Dr. Pierce | • developing and recommending to the Board of Directors criteria for board and committee membership;

• establishing procedures for identifying and evaluating Board of Director candidates, including nominees recommended by stockholders;

• reviewing the size and composition of the Board of Directors to ensure that it is composed of members containing the appropriate skills and expertise to advise us;

• identifying individuals qualified to become members of the Board of Directors;

• recommending to the Board of Directors the persons to be nominated for election as directors and to each of the Board’s committees;

• developing and recommending to the Board of Directors a code of business conduct and ethics and a set of corporate governance guidelines;

• developing a mechanism by which violations of the code of business conduct and ethics can be reported in a confidential manner;

• overseeing the evaluation of the Board of Directors and its committees;

• reviewing and discussing with the Board of Directors the corporate succession plans for directors; and

• periodically conducting a performance evaluation of the Nominating and Corporate Governance Committee and reporting to the Board on the results of such evaluation.

| |

During 2021, Messrs. Brown and Patrick, and Drs. Pierce and Pizzo served on the Nominating and Corporate Governance Committee, and the Committee held three meetings. In March 2022, Mr. Brown resigned as a member and Chair of the Nominating and Corporate Governance Committee in connection with his resignation from the Board of Directors and appointment as Director Emeritus, and Dr. Pizzo was concurrently appointed as Chair of the Nominating and Corporate Governance Committee.

Research and Development Committee (Advisory) | ||

Chair: Dr. Pierce

Members: Dr. Pizzo Dr. Thompson

| Our Board of Directors formed a Research and Development Committee in March 2016. The Research and Development Committee’s responsibilities include providing advice and support related to our research and development programs, strategy and goals. Drs. Pierce, Pizzo and Thompson serve on the Research and Development Committee.

| |

Commercial Committee (Advisory) | ||

Chair: Ms. Svoronos

Members: Mr. Morrison Mr. Perry Ms. Yarno

| Our Board of Directors formed a Commercial Committee in December 2018. The Commercial Committee’s responsibilities include providing advice and support related to our potential and actual commercialization of any products, including our strategy and goals from pre-launch planning through any approval, launch and later phases of the product lifecycle. Messrs. Morrison and Perry and Mses. Svoronos and Yarno serve on the Commercial Committee.

| |

We do not currently have a Chair of the Board, but we have appointed Mr. Perry to serve as our lead independent director. We believe that the appointment of a lead independent director allows our Chief Executive Officer to focus on our day-to-day business, while allowing the lead independent director to lead our Board of Directors in its fundamental role of providing advice to and independent oversight of management. Our Board of Directors recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as

Global Blood Therapeutics, Inc. ï 2022 Proxy Statement 15

the commitment required to serve as our lead independent director, particularly as our Board of Directors’ oversight responsibilities continue to grow.

While our Bylaws and corporate governance guidelines do not require that we appoint a separate Chair of the Board or lead independent director and Chief Executive Officer, our Board of Directors believes that having a Chief Executive Officer and a separate designated lead independent director is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance. Our separated lead independent director and Chief Executive Officer positions are augmented by the independence of eight of our nine directors, and our entirely independent Board committees that provide appropriate oversight in the areas described above. At executive sessions of independent directors, these directors speak candidly on any matter of interest, without the Chief Executive Officer or other executives present. The independent directors met four times in 2021 without management present. We believe this structure provides consistent and effective oversight of our management and the Company.

Annual Performance Evaluations; Assessment of Charters; Director Education

Our Board of Directors, as well as each of its standing committees, conducts an annual self-evaluation, which includes a review of its performance and, in the case of each of the committees, an assessment of the adequacy and appropriateness of its charter. The Nominating and Corporate Governance Committee is responsible for overseeing this evaluation process, which includes an evaluation by the standing committees of their respective performance and charters and the recommendation to our Board of Directors of any changes to the authority, charters, compositions and chairs of such committees. As part of this process, the Nominating and Corporate Governance Committee will also recommend any changes to the composition of our Board of Directors based on the results of such evaluation.

Each director is expected to maintain the necessary level of expertise to perform his or her responsibilities as a director. Our Board of Directors regularly discusses recent developments related to corporate governance, legal and regulatory compliance, disclosure obligations or industry-specific matters. In addition, we encourage our directors to participate in outside continuing education programs to assist them in maintaining such expertise and may, from time to time and depending on the circumstances, pay for all or a portion of such outside continuing education programs.

The director qualifications developed to date focus on what our Board believes to be essential competencies to effectively serve on the Board of Directors. The Nominating and Corporate Governance Committee reassesses such criteria from time to time and submits any proposed changes to the Board of Directors for approval.

In evaluating director candidates, including directors eligible for re-election, the Nominating and Corporate Governance Committee will consider the following:

| • | The current size and composition of the Board and the needs of the Board and its respective committees; |

| • | Such factors as character, integrity, judgment, diversity, independence, skills, education, expertise, business acumen, business experience (such as direct experience in the biotechnology or pharmaceuticals industry or in other fields relevant to the Company’s operations), length of service, understanding of the Company’s business and industry, conflicts of interest, and other commitments, with the Nominating and Corporate Governance Committee not required to assign any particular weight or priority to any one factor; and |

| • | Any other factors the Nominating and Corporate Governance Committee considers appropriate. |

The Nominating and Corporate Governance Committee requires that each nominee it recommends meets the following qualifications: (i) has experience at a strategic or policymaking level in a business, government, non-profit or academic organization of high standing and the ability to exercise sound business judgement, (ii) is highly accomplished in his or her respective field, with superior credentials and recognition, (iii) is well regarded in the community and has a long-term reputation for the highest personal and professional ethics and integrity, (iv) has an understanding of the fiduciary responsibilities of a director and a commitment to devote sufficient time and availability to the affairs of the Company, particularly in light of the number of boards of directors on which such nominee may serve, (v) to the extent such nominee serves or has previously served on other boards, the nominee has a demonstrated history of actively contributing at board meetings, and (vi) has skills and background that are complementary to those of other members of and/or candidates for our Board of Directors and shall be effective, together with such other members or candidates to the Board, in collectively serving the long-term interests of our stockholders.

16 2022 Proxy Statement ï Global Blood Therapeutics, Inc.

In addition to those minimum qualifications, the Nominating and Corporate Governance Committee recommends that our Board of Directors select persons for nomination to help ensure that:

| • | a majority of our Board is “independent” in accordance with NASDAQ standards; |

| • | each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee be comprised entirely of independent directors; and |

| • | at least one member of the Audit Committee shall have the experience, education and other qualifications necessary to qualify as an “Audit Committee financial expert” as defined by the rules of the SEC. |

In addition to other standards the Nominating and Corporate Governance Committee may deem appropriate from time to time for the overall structure and compensation of the Board of Directors, the Nominating and Corporate Governance Committee may consider whether the nominee, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience, including gender diversity and representation of underrepresented groups, including as may be required by applicable law or the NASDAQ Stock Market Rules. Although we have no formal policy regarding board diversity, we and our Board of Directors strongly believe that corporate board diversity, including gender, racial and ethnic diversity, provides a more effective and dynamic Board of Directors that can better mitigate risk and enhance long-term performance for stockholders.

The Nominating and Corporate Governance Committee adheres to the following process for identifying and evaluating nominees for the Board of Directors. First, it solicits recommendations for nominees from non-management directors, our Chief Executive Officer, other executive officers, third-party search firms or any other source it deems appropriate. The Nominating and Corporate Governance Committee then reviews and evaluates the qualifications of proposed nominees and conducts inquiries it deems appropriate; all proposed nominees are evaluated in the same manner, regardless of who initially recommended such nominee. In reviewing and evaluating proposed nominees, the Nominating and Corporate Governance Committee may consider, in addition to the minimum qualifications and other criteria for Board membership approved by our Board from time to time, all facts and circumstances that it deems appropriate or advisable, including, among other things, the skills of the proposed nominee, his or her depth and breadth of business experience or other background characteristics, his or her independence and the needs of the Board.

If the Nominating and Corporate Governance Committee decides to retain a third-party search firm to identify proposed nominees, it has sole authority to retain and terminate such firm and to approve any such firm’s fees and other retention terms.

Each nominee for election as director at the Annual Meeting is recommended by the Nominating and Corporate Governance Committee and is presently a director and stands for re-election by the stockholders. From time to time, we may pay fees to third-party search firms to assist in identifying and evaluating potential nominees, although no such fees have been paid in connection with nominations to be acted upon at the Annual Meeting.

Pursuant to our Bylaws, stockholders who wish to nominate persons for election to the Board of Directors at an annual meeting must be a stockholder of record at the time of giving the notice, entitled to vote at the meeting, present (in person or by proxy) at the meeting and must comply with the notice procedures in our Bylaws. A stockholder’s notice of nomination to be made at an annual meeting must be delivered to our principal executive offices not less than 90 days nor more than 120 days before the anniversary date of the immediately preceding annual meeting. However, if an annual meeting is more than 30 days before or more than 60 days after such anniversary date, the notice must be delivered no later than the later of the 90th day prior to such annual meeting or the 10th day following the day on which the first public announcement of the date of such annual meeting was made. A stockholder’s notice of nomination may not be made at a special meeting unless such special meeting is held in lieu of an annual meeting. The stockholder’s notice must include the following information for the person making the nomination:

| • | name and address; |

| • | the class and number of shares of the Company owned beneficially or of record; |

| • | disclosure regarding any derivative, swap or other transactions which give the nominating person economic risk similar to ownership of shares of the Company or provide the opportunity to profit from an increase in the price of value of shares of the Company; |

| • | any proxy (other than a revocable proxy given in response to a public proxy solicitation made pursuant to, and in accordance with, the Exchange Act), agreement, arrangement, understanding or relationship that confers a right to vote any shares of the Company; |

| • | any agreement, arrangement, understanding or relationship engaged in for the purpose of acquiring, holding, disposing or voting of any shares of any class or series of capital stock of the Company; |

Global Blood Therapeutics, Inc. ï 2022 Proxy Statement 17

| • | any rights to dividends or other distributions on the shares that are separate from the underlying shares; |

| • | any performance-related fees that the nominating person is entitled to based on any increase or decrease in the value of any shares of the Company; |

| • | a description of all agreements, arrangements or understandings by and between the proposing stockholder and another person relating to the proposed business (including an identification of each party to such agreement, arrangement or understanding and the names, addresses and class and number of shares owned beneficially or of record of other stockholders known by the proposing stockholder support such proposed business); |

| • | a statement whether or not the proposing stockholder will deliver a proxy statement and form of proxy to holders of, in the case of a business proposal, at least the percentage of voting power of all shares of capital stock required to approve the proposal or, in the case of director nominations, at least the percentage of voting power of all of the shares of capital stock reasonably believed by the proposing stockholder to be sufficient to elect the nominee; and |

| • | any other information relating to the nominating person that would be required to be disclosed in a proxy statement filed with the SEC. |

With respect to proposed director nominees, the stockholder’s notice must include all information required to be disclosed in a proxy statement in connection with a contested election of directors or otherwise required pursuant to Regulation 14A under the Exchange Act (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected).

For matters other than the election of directors, the stockholder’s notice must also include a brief description of the business desired to be brought before the meeting, the reasons for conducting such business at the meeting and any material interest in such business of the stockholder(s) proposing the business.

The stockholder’s notice must be updated and supplemented, if necessary, so that the information required to be provided in the notice is true and correct as of the record date for the meeting and as of the date that is 10 business days prior to the meeting.

The Board of Directors, a designated committee thereof or the chairman of the meeting will determine if the procedures in our Bylaws have been followed, and if not, declare that the proposal or nomination be disregarded. The nominee must be willing to provide any other information reasonably requested by the Nominating and Corporate Governance Committee in connection with its evaluation of the nominee’s independence. There have been no material changes to the process by which stockholders may recommend nominees to our Board of Directors.

Stockholder Communications with the Board of Directors

Stockholders may send correspondence to the Board of Directors c/o the lead independent director of the Board at our principal executive offices at the address set forth above. We will forward all correspondence addressed to the Board or any individual Board member. Stockholders may also communicate online with our Board of Directors as a group by accessing our website at www.gbt.com and selecting “IR Contact” under the Investors tab.

Director Attendance at Annual Meetings

Directors are encouraged to attend our annual meetings of stockholders, and all of our then 10 directors attended the 2021 Annual Meeting of Stockholders.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is, or has at any time during the past fiscal year been, an officer or employee of the Company or had any relationship requiring disclosure under Item 404 of Regulation S-K. None of the members of the Compensation Committee has formerly been an officer of the Company. None of our executive officers serve, or in the past fiscal year, have served as a member of the Board of Directors or Compensation Committee of any other entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

18 2022 Proxy Statement ï Global Blood Therapeutics, Inc.

In March 2020, we adopted a stock ownership policy for our non-employee directors, which requires each director to acquire and hold a number of shares of our common stock equal in value to at least three times his or her applicable annual cash retainer for regular service on our Board of Directors, excluding any annual cash retainers paid for committee service, until such director’s service on the Board of Directors ceases. We only count directly and beneficially owned shares, including, with respect to non-employee directors, 50% of shares underlying vested and unexercised in-the-money stock options. Each non-employee director has until the later of April 1, 2025, or the Initial Determination Date, or the April 1st in the year that is the fifth anniversary of his or her initial election to our Board of Directors, to attain the required ownership level. Once a director satisfies his or her stock ownership requirement, the director must continue to satisfy such stock ownership requirement as assessed on each April 1st thereafter, or Determination Date. If a director fails to satisfy such stock ownership requirement as of any Determination Date (including the Initial Determination Date), then such director shall be required to come into compliance with his or her applicable stock ownership requirement within two years following the Determination Date on which he or she failed to satisfy such stock ownership requirement. As of April 1, 2022, 6 of our 8 non-employee directors met their stock ownership requirement, and the remaining non-employee directors have until the later of the Initial Determination Date or the April 1st in the year that is the fifth anniversary of his or her initial election to our Board of Directors to attain the required ownership level.

Environmental, Social and Governance Practices

Our mission is to discover, develop and deliver life-changing treatments for people living with grievous blood-based disorders, starting with sickle cell disease. We view our environmental, social and governance, or ESG, practices as important pillars that should be aligned to the Company’s cultural values and guide us to achieve our mission and contribute to sustainable long-term performance, including recruiting and retaining the best talent. Published in April 2022, our inaugural ESG report focuses on four key areas in which we believe we will have impact and deliver long-term sustainable value for our business and society: improving access to affordable healthcare; investing in our employees and communities; increasing our environmental sustainability: and upholding our ethics and values. Responsibility for ESG strategy and management is led by functional experts throughout the Company and championed by our executive leadership team.

Environmental

We recognize that the sustainability of the Company is linked to our ability to understand and engage all our stakeholders in a consistent and meaningful manner. Starting with our Board of Directors and our executive leadership team, we are committed to long-term value driven by the pillars of governance, social responsibility, and integrity across all we do, including employee engagement, research and development, operations, commercialization and access to medicines for patients. Our efforts to help preserve the environment and reduce our impact on climate change include, among other things, our new headquarters that recently achieved LEED Silver certification; utilizing technology to reduce energy and water consumption; reducing, reusing and recycling our resources when practicable; partnering with third-party organizations for the ethical treatment of animals in research; and promoting employee commuting programs.

Social—Diversity, Equity & Inclusion

We have a values-driven culture that starts with our executive leadership team. Since our founding, we have recognized that having a more diverse, equitable and inclusive environment can help us to better deliver for patients through increased performance, better decision making, increased productivity and greater motivation. In addition, we believe that to foster innovation, increase access to care and reduce disparities, our workforce needs to be reflective of the patients and communities we serve and compensated in line with the value brought to patients, caregivers and communities.

We adopted the Workforce Development and Diversity & Inclusion, or WWDI, Principles created by the Biotechnology Innovation Organization, or BIO, to foster D&I among employees, customers and patients. We strive to make the Company a place where exceptionally talented candidates will be eager to work, collaborate and grow their careers—regardless of race, gender or sexual orientation.

Global Blood Therapeutics, Inc. ï 2022 Proxy Statement 19