As filed with the U.S. Securities and Exchange Commission on July 7, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23108

Amplify ETF Trust

(Exact name of registrant as specified in charter)

310 South Hale Street

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

Christian Magoon

Amplify ETF Trust

310 South Hale Street

Wheaton, IL 60187

(Name and address of agent for service)

With copies to:

Morrison C. Warren, Esq.

Chapman and Cutler LLP

111 West Monroe Street

Chicago, IL 60603

(855)-267-3837

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: April 30, 2022

Item 1. Reports to Stockholders.

AMPLIFY ETF TRUST

Amplify High Income ETF YYY

Amplify Online Retail ETF IBUY

Amplify CWP Enhanced Dividend Income ETF DIVO

Amplify Transformational Data Sharing ETF BLOK

Amplify Lithium & Battery Technology ETF BATT

Amplify BlackSwan Growth & Treasury Core ETF SWAN

Amplify Emerging Markets FinTech ETF EMFQ

Amplify Seymour Cannabis ETF CNBS

Amplify Pure Junior Gold Miners ETF JGLD

Amplify BlackSwan ISWN ETF ISWN

Amplify Cleaner Living ETF DTOX

Amplify Thematic All-Stars ETF MVPS

Amplify Digital & Online Trading ETF BIDS

Amplify BlackSwan Tech & Treasury ETF SWAN

Amplify Inflation Fighter ETF IWIN

SEMI-ANNUAL REPORT

April 30, 2022

Amplify ETF Trust

Table of Contents

Amplify ETF Trust (the “Trust”) files its complete schedule of fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Part F of Form N-PORT within sixty days after the end of the period. The Trust’s Part F of Form N-PORT is available on the Commission’s website at www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Amplify Investments, LLC (the “Adviser”) uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-855-267-3837 and (ii) on the Commission’s website at www.sec.gov.

1

Amplify ETF Trust

Amplify High Income ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

INVESTMENT COMPANIES — 99.5% | | | | | |

Equity — 9.4% | | | | | |

Aberdeen Total Dynamic Dividend Fund | | 1,178,173 | | $ | 10,426,831 |

Cohen & Steers REIT and Preferred and Income Fund, Inc. | | 214,928 | | | 5,267,885 |

John Hancock Tax-Advantaged Dividend Income Fund | | 259,362 | | | 6,478,863 |

Liberty All-Star Equity Fund | | 1,615,356 | | | 11,355,953 |

| | | | | | 33,529,532 |

Fixed Income — 90.1% | | | | | |

Aberdeen Asia-Pacific Income Fund, Inc. | | 2,986,527 | | | 9,556,886 |

AllianceBernstein Global High Income Fund, Inc. | | 992,147 | | | 10,119,899 |

Allspring Income Opportunities | | 1,423,732 | | | 10,734,939 |

Blackrock Capital Allocation Trust | | 93,387 | | | 1,453,102 |

BlackRock Corporate High Yield Fund, Inc. | | 887,923 | | | 9,154,486 |

BlackRock Credit Allocation Income Trust | | 290,292 | | | 3,338,358 |

Blackstone Strategic Credit Fund | | 642,925 | | | 7,985,129 |

Calamos Global Dynamic Income Fund(a) | | 505,406 | | | 3,967,437 |

Cohen & Steers Tax-Advantaged Preferred Securities & Income Fund | | 401,267 | | | 8,233,999 |

DoubleLine Income Solutions Fund | | 749,247 | | | 10,137,312 |

DoubleLine Yield Opportunities Fund | | 651,884 | | | 10,319,324 |

Eaton Vance Limited Duration Income Fund | | 398,861 | | | 4,375,505 |

First Trust High Income Long/Short Fund | | 222,751 | | | 2,857,895 |

First Trust High Yield Opportunities 2027 Term Fund | | 379,080 | | | 6,269,983 |

First Trust Intermediate Duration Preferred & Income Fund(a) | | 230,812 | | | 4,641,629 |

Flaherty & Crumrine Preferred and Income Securities Fund, Inc. | | 150,700 | | | 2,748,768 |

Highland Income Fund | | 931,937 | | | 11,052,773 |

Invesco Senior Income Trust | | 2,097,551 | | | 8,683,861 |

Description | | Shares | | Value |

MainStay CBRE Global Infrastructure Megatrends Fund | | 651,550 | | $ | 11,597,590 |

Nuveen AMT-Free Quality Municipal Income Fund | | 251,534 | | | 3,134,114 |

Nuveen Core Plus Impact Fund | | 652,543 | | | 8,587,466 |

Nuveen Credit Strategies Income Fund | | 1,874,754 | | | 11,098,544 |

Nuveen Dynamic Municipal Opportunities Fund | | 147,747 | | | 1,694,658 |

Nuveen Floating Rate Income Fund | | 1,103,182 | | | 10,469,197 |

Nuveen Multi-Asset Income Fund | | 659,585 | | | 9,544,195 |

Nuveen Preferred & Income Opportunities Fund | | 927,192 | | | 7,408,264 |

Nuveen Preferred & Income Securities Fund | | 1,276,683 | | | 9,894,293 |

Nuveen Quality Municipal Income Fund | | 168,831 | | | 2,161,037 |

Oxford Lane Capital Corp.(a) | | 1,598,747 | | | 10,935,430 |

PGIM Global High Yield Fund, Inc. | | 795,666 | | | 10,232,265 |

PGIM High Yield Bond Fund, Inc.(a) | | 760,335 | | | 10,591,467 |

PIMCO Corporate & Income Opportunity Fund(a) | | 492,798 | | | 7,155,427 |

Pimco Dynamic Income Fund | | 489,161 | | | 11,206,679 |

PIMCO Dynamic Income Opportunities Fund | | 442,396 | | | 7,065,064 |

PIMCO High Income Fund | | 1,422,102 | | | 8,034,876 |

PIMCO Income Strategy Fund II | | 807,644 | | | 6,719,598 |

Templeton Global Income Fund | | 2,365,019 | | | 11,091,939 |

Thornburg Income Builder Opportunities Trust (a) | | 644,036 | | | 10,182,209 |

Virtus AllianzGI Convertible & Income Fund | | 2,143,916 | | | 9,540,426 |

Western Asset Diversified Income Fund | | 653,208 | | | 10,124,724 |

Western Asset Emerging Markets Debt Fund, Inc. | | 932,615 | | | 9,018,387 |

| | | | | | 323,119,134 |

Total Investment Companies

(Cost $412,522,309) | | | | | 356,648,666 |

| | | | | | |

MONEY MARKET FUNDS — 0.2% | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34%(b) | | 801,129 | | | 801,129 |

Total Money Market Funds

(Cost $801,129) | | | | | 801,129 |

The accompanying notes are an integral part of the financial statements.

2

Amplify ETF Trust

Amplify High Income ETF

Schedule of Investments

April 30, 2022 (Unaudited) (Continued)

Description | | Shares | | Value |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 1.8% | | | | | |

First American Government Obligations Fund - Class X — 0.22%(b) | | 6,529,336 | | $ | 6,529,336 |

Total Investments Purchased with Proceeds from Securities Lending

(Cost $6,529,336) | | | | | 6,529,336 |

| | | | | | |

Total Investments — 101.5%

(Cost $419,852,774) | | | | $ | 363,979,131 |

Percentages are based on Net Assets of $358,770,070.

The accompanying notes are an integral part of the financial statements.

3

Amplify ETF Trust

Amplify Online Retail ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 99.6% | | | | | |

Marketplace — 37.2% | | | | | |

Affirm Holdings, Inc.(a)(b) | | 65,001 | | $ | 1,865,529 |

Alibaba Group Holding Ltd. - ADR(b) | | 27,029 | | | 2,624,246 |

BigCommerce Holdings, Inc.(b) | | 232,135 | | | 4,148,252 |

ContextLogic, Inc. - Class A(a)(b) | | 2,009,301 | | | 3,415,812 |

Copart, Inc.(b) | | 67,224 | | | 7,640,008 |

Coupang, Inc.(b) | | 147,611 | | | 1,899,754 |

Dada Nexus Ltd. - ADR(b) | | 213,762 | | | 1,631,004 |

Delivery Hero SE(b)(c) | | 35,798 | | | 1,277,974 |

DiDi Global, Inc. - ADR(b) | | 536,687 | | | 1,008,971 |

DingDong Cayman Ltd. - ADR(a)(b) | | 145,209 | | | 771,060 |

DoorDash, Inc. - Class A(a)(b) | | 50,841 | | | 4,139,983 |

Etsy, Inc.(b) | | 43,690 | | | 4,071,471 |

Fiverr International Ltd.(b) | | 27,190 | | | 1,447,867 |

Global-e Online Ltd.(b) | | 76,394 | | | 1,721,921 |

Groupon, Inc.(a)(b) | | 445,480 | | | 8,691,315 |

Jumia Technologies AG - ADR(a)(b) | | 234,442 | | | 1,657,505 |

Just Eat Takeaway.com NV(b)(c) | | 62,859 | | | 1,744,039 |

KE Holdings, Inc. - ADR(b) | | 236,791 | | | 3,357,696 |

Liquidity Services, Inc.(b) | | 476,931 | | | 6,877,345 |

Lyft, Inc. - Class A(b) | | 213,525 | | | 6,960,915 |

MercadoLibre, Inc.(b) | | 2,934 | | | 2,856,630 |

Ozon Holdings PLC - ADR(a)(b)(d) | | 106,678 | | | — |

PayPal Holdings, Inc.(b) | | 45,470 | | | 3,998,177 |

Pinduoduo, Inc. - ADR(b) | | 48,584 | | | 2,093,484 |

Poshmark, Inc. - Class A(b) | | 435,295 | | | 4,805,657 |

Rakuten Group, Inc. | | 406,100 | | | 2,872,663 |

Sea Ltd. - ADR(b) | | 12,697 | | | 1,050,804 |

Shopify, Inc. - Class A(b) | | 3,034 | | | 1,294,972 |

The RealReal, Inc.(a)(b) | | 823,676 | | | 4,464,324 |

ThredUp, Inc. - Class A(b) | | 510,673 | | | 3,365,335 |

Uber Technologies, Inc.(b) | | 228,983 | | | 7,208,385 |

Upwork, Inc.(b) | | 214,017 | | | 4,487,936 |

Vivid Seats, Inc. - Class A(a) | | 783,583 | | | 7,733,964 |

| | | | | | 113,184,998 |

Description | | Shares | | Value |

Traditional Retail — 47.5% | | | | | |

1-800-Flowers.com, Inc. - Class A(b) | | 307,568 | | $ | 3,137,194 |

About You Holding SE(a)(b) | | 194,207 | | | 2,106,158 |

Amazon.com, Inc.(b) | | 3,120 | | | 7,755,166 |

ASKUL Corp. | | 334,000 | | | 4,097,307 |

ASOS PLC(b) | | 130,106 | | | 2,287,154 |

BARK, Inc.(a)(b) | | 1,454,001 | | | 4,492,863 |

CarParts.com, Inc.(b) | | 699,798 | | | 4,191,790 |

Carvana Co.(b) | | 34,735 | | | 2,013,241 |

Chegg, Inc.(a)(b) | | 307,198 | | | 7,600,078 |

Chewy, Inc. - Class A(a)(b) | | 143,114 | | | 4,158,893 |

Cimpress PLC(b) | | 48,599 | | | 2,454,735 |

eBay, Inc. | | 138,781 | | | 7,205,509 |

Farfetch Ltd. - Class A(b) | | 114,607 | | | 1,283,598 |

Figs, Inc. - Class A(b) | | 247,669 | | | 3,878,496 |

HelloFresh SE(b) | | 44,063 | | | 1,886,336 |

IAC/InterActiveCorp(b) | | 68,292 | | | 5,660,041 |

iQIYI, Inc. - ADR(a)(b) | | 527,852 | | | 1,879,153 |

JD.com, Inc. - ADR(b) | | 55,159 | | | 3,401,104 |

Lands’ End, Inc.(b) | | 389,891 | | | 5,466,272 |

MYT Netherlands Parent BV - ADR(a)(b) | | 164,642 | | | 1,965,825 |

Netflix, Inc.(b) | | 15,243 | | | 2,901,657 |

Newegg Commerce, Inc.(a)(b) | | 818,537 | | | 5,255,008 |

Ocado Group PLC(b) | | 187,663 | | | 2,180,427 |

Overstock.com, Inc.(b) | | 99,927 | | | 3,353,550 |

Peloton Interactive, Inc. - Class A(b) | | 116,474 | | | 2,045,283 |

PetMed Express, Inc.(a) | | 327,176 | | | 7,165,154 |

Purple Innovation, Inc.(a)(b) | | 528,211 | | | 2,176,229 |

Qurate Retail, Inc. - Class A | | 1,057,653 | | | 4,452,719 |

Rent the Runway, Inc. - Class A(a)(b) | | 659,674 | | | 4,182,333 |

Revolve Group, Inc.(b) | | 137,779 | | | 5,822,541 |

Shutterstock, Inc. | | 87,401 | | | 6,618,004 |

Solo Brands, Inc. - Class A(a)(b) | | 572,078 | | | 3,415,306 |

Spotify Technology SA(b) | | 15,067 | | | 1,531,561 |

Stitch Fix, Inc. - Class A(b) | | 299,962 | | | 2,849,639 |

Temple & Webster Group Ltd.(b) | | 493,313 | | | 2,056,444 |

Vipshop Holdings Ltd. - ADR(b) | | 389,462 | | | 2,983,279 |

Vroom, Inc.(a)(b) | | 526,607 | | | 821,507 |

Wayfair, Inc. - Class A(a)(b) | | 38,955 | | | 2,997,198 |

Zalando SE(b)(c) | | 51,329 | | | 2,048,481 |

ZOZO, Inc. | | 143,200 | | | 3,045,517 |

| | | | | | 144,822,750 |

Travel — 14.9% | | | | | |

Airbnb, Inc. - Class A(b) | | 60,586 | | | 9,282,381 |

Booking Holdings, Inc.(b) | | 4,314 | | | 9,535,278 |

Expedia Group, Inc.(b) | | 64,523 | | | 11,275,394 |

The accompanying notes are an integral part of the financial statements.

4

Amplify ETF Trust

Amplify Online Retail ETF

Schedule of Investments

April 30, 2022 (Unaudited) (Continued)

Description | | Shares | | Value |

MakeMyTrip Ltd.(b) | | 136,998 | | $ | 3,489,339 |

Trip.com Group Ltd. - ADR(b) | | 156,788 | | | 3,708,036 |

TripAdvisor, Inc.(b) | | 318,869 | | | 8,185,367 |

| | | | | | 45,475,795 |

Total Common Stocks

(Cost $641,439,516) | | | | | 303,483,543 |

| | | | | | |

MONEY MARKET FUNDS — 0.4% | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34%(e) | | 1,098,119 | | | 1,098,119 |

Total Money Market Funds

(Cost $1,098,119) | | | | | 1,098,119 |

| | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 17.1% | | | | | |

First American Government Obligations Fund - Class X — 0.22%(e) | | 52,198,176 | | | 52,198,176 |

Total Investments Purchased with Proceeds from Securities Lending

(Cost $52,198,176) | | | | | 52,198,176 |

| | | | | | |

Total Investments — 117.1%

(Cost $694,735,811) | | | | $ | 356,779,838 |

Percentages are based on Net Assets of $304,654,929.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund Management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The Global Industy Classification Standard (GICS®) was developed by and/or is the exclusive of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

5

Amplify ETF Trust

Amplify CWP Enhanced Dividend Income ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 90.6% | | | | | |

Communication Services — 1.4% | | | | | |

Verizon Communications, Inc. | | 399,676 | | $ | 18,504,999 |

Consumer Discretionary — 9.5% | | | | | |

McDonald’s Corp. | | 289,891 | | | 72,229,242 |

The Home Depot, Inc. | | 179,778 | | | 54,005,311 |

| | | | | | 126,234,553 |

Consumer Staples — 7.7% | | | | | |

The Coca-Cola Co. | | 443,845 | | | 28,676,825 |

The Procter & Gamble Co. | | 459,880 | | | 73,833,734 |

| | | | | | 102,510,559 |

Energy — 9.7% | | | | | |

Chevron Corp. | | 445,745 | | | 69,834,869 |

Marathon Petroleum Corp. | | 684,805 | | | 59,756,084 |

| | | | | | 129,590,953 |

Financials — 15.7% | | | | | |

Aflac, Inc. | | 663,331 | | | 37,995,600 |

Intercontinental Exchange, Inc. | | 522,455 | | | 60,505,513 |

JPMorgan Chase & Co. | | 429,514 | | | 51,266,791 |

The Goldman Sachs Group, Inc. | | 196,614 | | | 60,063,611 |

| | | | | | 209,831,515 |

Health Care — 13.4% | | | | | |

Johnson & Johnson | | 382,504 | | | 69,026,672 |

Merck & Co., Inc. | | 349,819 | | | 31,025,447 |

UnitedHealth Group, Inc. | | 154,255 | | | 78,446,380 |

| | | | | | 178,498,499 |

Industrials — 9.4% | | | | | |

CSX Corp. | | 1,210,720 | | | 41,576,125 |

Deere & Co. | | 134,555 | | | 50,801,240 |

United Parcel Service, Inc. - Class B | | 183,764 | | | 33,073,845 |

| | | | | | 125,451,210 |

Description | | Shares | | Value |

Information Technology — 17.6% | | | | | |

Apple, Inc. | | 431,046 | | $ | 67,954,402 |

Cisco Systems, Inc. | | 722,885 | | | 35,406,907 |

Microsoft Corp. | | 227,330 | | | 63,088,622 |

Visa, Inc. - Class A | | 321,984 | | | 68,624,450 |

| | | | | | 235,074,381 |

Materials — 2.8% | | | | | |

Dow, Inc. | | 570,906 | | | 37,965,249 |

Utilities — 3.4% | | | | | |

Duke Energy Corp. | | 416,576 | | | 45,890,012 |

Total Common Stocks

(Cost $1,175,889,358) | | | | | 1,209,551,930 |

| | | | | | |

Total Investments — 90.6%

(Cost $1,175,889,358) | | | | $ | 1,209,551,930 |

Percentages are based on Net Assets of $1,334,958,709.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Fund’s Administrator, U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of the financial statements.

6

Amplify ETF Trust

Amplify CWP Enhanced Dividend Income ETF

Schedule of Options Written

April 30, 2022 (Unaudited)

| | Contracts | | Notional

Amount | | Value |

Call Options Written(a) — (0.06)% | | | | | | | | | | |

CHEVRON CORP NEW, Expires 5/20/2022, Strike Price $177.50 | | 3,500 | | $ | (54,834,500 | ) | | $ | (155,750 | ) |

CSX Corp., Expires 5/20/2022, Strike Price $37.50 | | 9,000 | | | (30,906,000 | ) | | | (135,000 | ) |

DOW, Inc., Expires 5/20/2022, Strike Price $73.00 | | 5,000 | | | (33,250,000 | ) | | | (127,500 | ) |

Duke Energy Corp., Expires 5/20/2022, Strike Price $120.00 | | 3,400 | | | (37,454,400 | ) | | | (42,500 | ) |

PROCTER AND GAMBLE Co., Expires 5/20/2022, Strike Price $170.00 | | 4,000 | | | (64,220,000 | ) | | | (184,000 | ) |

VISA, Inc., Expires 5/20/2022, Strike Price $240.00 | | 2,520 | | | (53,708,760 | ) | | | (104,580 | ) |

| | | | | | | | | | | |

Total Call Options Written

(Premiums Received $1,435,853) | | | | | | | | $ | (749,330 | ) |

The accompanying notes are an integral part of the financial statements.

7

Amplify ETF Trust

Amplify Transformational Data Sharing ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 90.9% | | | | | |

Banks — 8.7% | | | | | |

Customers Bancorp, Inc.(a) | | 232,721 | | $ | 9,790,572 |

New York Community Bancorp, Inc. | | 846,630 | | | 7,822,861 |

Signature Bank/New York NY | | 52,374 | | | 12,687,602 |

Silvergate Capital Corp.(a) | | 341,430 | | | 39,933,653 |

| | | | | | 70,234,688 |

Diversified Financials — 22.0% | | | | | |

CME Group, Inc. | | 176,028 | | | 38,609,982 |

Coinbase Global, Inc. - Class A(a) | | 242,762 | | | 27,361,705 |

Galaxy Digital Holdings Ltd.(a)(b) | | 2,595,654 | | | 28,388,229 |

Mogo, Inc.(a)(b)(c) | | 5,403,017 | | | 10,157,672 |

Nocturne Acquisition Corp.(a)(c)(d) | | 380,000 | | | 4,104,000 |

Robinhood Markets, Inc. - Class A(a)(b) | | 542,538 | | | 5,319,585 |

SBI Holdings, Inc./Japan | | 1,669,227 | | | 37,468,374 |

Vontobel Holding AG | | 139,238 | | | 10,248,719 |

WisdomTree Investments, Inc. | | 2,553,004 | | | 14,884,013 |

| | | | | | 176,542,279 |

Media & Entertainment — 3.4% | | | | | |

ROBLOX Corp. - Class A(a) | | 197,408 | | | 6,050,555 |

Z Holdings Corp. | | 5,303,831 | | | 21,031,412 |

| | | | | | 27,081,967 |

Retailing — 3.0% | | | | | |

Overstock.com, Inc.(a) | | 607,524 | | | 20,388,505 |

Rakuten Group, Inc. | | 555,475 | | | 3,929,309 |

| | | | | | 24,317,814 |

Semiconductors — 1.0% | | | | | |

Intel Corp. | | 179,700 | | | 7,833,123 |

Semiconductors & Semiconductor Equipment — 7.3% | | | | | |

Advanced Micro Devices, Inc.(a) | | 180,410 | | | 15,428,663 |

NVIDIA Corp. | | 177,950 | | | 33,004,387 |

Taiwan Semiconductor Manufacturing Co. Ltd. ADR | | 107,717 | | | 10,010,141 |

| | | | | | 58,443,191 |

Description | | Shares | | Value |

Software & Services — 43.1% | | | | | | |

Accenture PLC - Class A | | | 86,374 | | $ | 25,943,295 |

Argo Blockchain PLC(a)(c) | | | 23,404,917 | | | 19,424,145 |

BIGG Digital Assets, Inc.(a)(b) | | | 6,073,454 | | | 2,505,687 |

Bitfarms Ltd./Canada(a)(b) | | | 7,484,007 | | | 21,555,152 |

Block, Inc.(a) | | | 167,313 | | | 16,654,336 |

Core Scientific, Inc.(a)(b) | | | 1,321,079 | | | 7,807,577 |

Digital Garage, Inc. | | | 890,430 | | | 29,640,976 |

GMO internet, Inc. | | | 1,618,739 | | | 32,742,746 |

Hive Blockchain Technologies Ltd.(a)(b) | | | 16,836,428 | | | 24,770,053 |

Hut 8 Mining Corp.(a)(b) | | | 5,159,550 | | | 18,394,690 |

International Business Machines Corp. | | | 222,150 | | | 29,370,452 |

Marathon Digital Holdings, Inc.(a)(b) | | | 1,373,124 | | | 21,420,734 |

Mastercard, Inc. - Class A | | | 23,654 | | | 8,595,391 |

MicroStrategy, Inc.(a)(b) | | | 84,367 | | | 29,880,260 |

PayPal Holdings, Inc.(a) | | | 143,983 | | | 12,660,425 |

Riot Blockchain, Inc.(a)(b) | | | 2,269,416 | | | 23,011,878 |

Stronghold Digital Mining, Inc. - Class A(a)(b) | | | 1,152,522 | | | 4,494,836 |

Visa, Inc. - Class A | | | 37,742 | | | 8,043,952 |

Voyager Digital Ltd.(a)(b) | | | 2,914,544 | | | 9,664,856 |

| | | | | | | 346,581,441 |

Technology Hardware & Equipment — 2.4% | | | | | | |

Canaan, Inc. - ADR(a)(b) | | | 2,343,573 | | | 8,905,577 |

CompoSecure, Inc.(a)(b) | | | 1,383,802 | | | 10,669,114 |

| | | | | | | 19,574,691 |

Total Common Stocks

(Cost $1,155,011,619) | | | | | | 730,609,194 |

| | | | | | | |

| | | Par Value | | |

CONVERTIBLE BONDS — 3.4% | | | | | | |

Core Scientific, Inc. 4.000% Cash and 6.000% PIK, 04/19/2025(c)(e)(f) | | $ | 27,487,225 | | | 27,487,225 |

Total Convertible Bonds

(Cost $27,477,362) | | | | | | 27,487,225 |

| | | | | | | |

| | | Shares | | |

EXCHANGE TRADED FUNDS — 4.2% | | | | | | |

3iQ CoinShares Bitcoin ETF(a)(b) | | | 2,430,407 | | | 15,481,693 |

Bitcoin ETF(a) | | | 152,560 | | | 2,195,338 |

Purpose Bitcoin ETF(a) | | | 2,178,759 | | | 15,599,914 |

Total Exchange Traded Funds

(Cost $43,364,388) | | | | | | 33,276,945 |

The accompanying notes are an integral part of the financial statements.

8

Amplify ETF Trust

Amplify Transformational Data Sharing ETF

Schedule of Investments

April 30, 2022 (Unaudited) (Continued)

Description | | Shares | | Value |

MONEY MARKET FUNDS — 1.2% | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34%(g) | | 9,908,540 | | $ | 9,908,540 |

Total Money Market Funds

(Cost $9,908,540) | | | | | 9,908,540 |

| | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 19.5% | | | | | |

First American Government Obligations Fund - Class X — 0.22%(g) | | 156,677,719 | | | 156,677,719 |

Total Investments Purchased with Proceeds from Securities Lending

(Cost $156,677,719) | | | | | 156,677,719 |

| | | | | | |

Total Investments — 119.2%

(Cost $1,392,439,628) | | | | $ | 957,959,623 |

Percentages are based on Net Assets of $803,360,342.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund Management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The Global Industy Classification Standard (GICS®) was developed by and/or is the exclusive of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

9

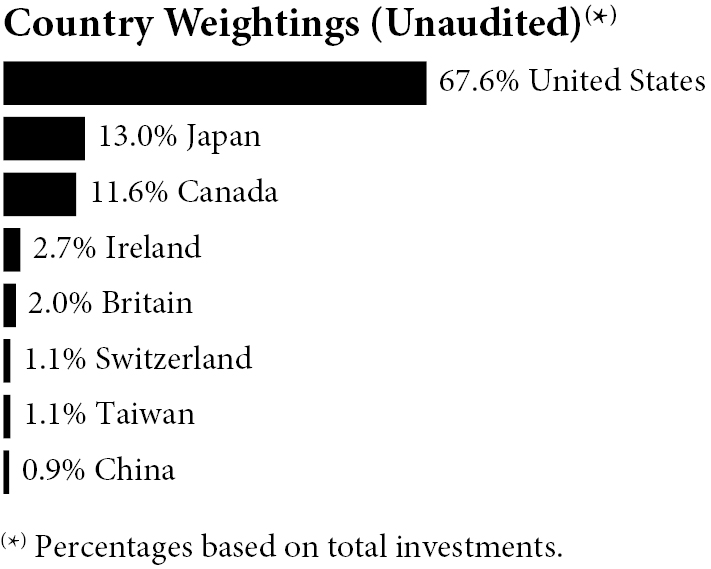

Amplify ETF Trust

Amplify Lithium & Battery Technology ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 99.4% | | | | | |

Consumer Discretionary — 21.1% | | | | | |

BYD Co. Ltd. - Class H | | 320,763 | | $ | 9,638,832 |

EVgo, Inc.(a)(b) | | 156,268 | | | 1,415,788 |

Fisker, Inc.(a)(b) | | 38,363 | | | 385,932 |

Li Auto, Inc. - ADR(b) | | 96,221 | | | 2,158,237 |

Lucid Group, Inc.(a)(b) | | 155,443 | | | 2,810,409 |

NIO, Inc. - ADR(b) | | 152,271 | | | 2,542,926 |

Panasonic Holdings Corp. | | 320,319 | | | 2,864,421 |

QuantumScape Corp.(a)(b) | | 35,123 | | | 524,737 |

Rivian Automotive, Inc. - Class A(a)(b) | | 85,095 | | | 2,573,273 |

Tesla, Inc.(b) | | 16,190 | | | 14,097,604 |

Volta, Inc.(a)(b) | | 236,611 | | | 494,517 |

XPeng, Inc. - ADR(b) | | 80,083 | | | 1,970,843 |

Yadea Group Holdings Ltd.(c) | | 306,707 | | | 467,467 |

| | | | | | 41,944,986 |

Industrials — 18.7% | | | | | |

Blink Charging Co.(a)(b) | | 56,520 | | | 1,079,532 |

ChargePoint Holdings, Inc.(a)(b) | | 112,027 | | | 1,449,629 |

Contemporary Amperex Technology Co. Ltd. | | 166,445 | | | 10,343,747 |

Description | | Shares | | Value |

Ecopro BM Co. Ltd. | | 6,211 | | $ | 2,355,828 |

EnerSys | | 18,347 | | | 1,200,995 |

Eve Energy Co. Ltd. | | 249,016 | | | 2,490,160 |

FREYR Battery SA - ADR(a)(b) | | 131,023 | | | 1,176,586 |

FuelCell Energy, Inc.(a)(b) | | 290,722 | | | 1,186,146 |

GS Yuasa Corp. | | 57,886 | | | 1,011,193 |

Hyliion Holdings Corp.(a)(b) | | 270,369 | | | 867,884 |

Li-Cycle Holdings Corp. - ADR(a)(b) | | 157,365 | | | 1,021,299 |

Lightning eMotors, Inc.(a)(b) | | 251,670 | | | 1,077,148 |

Microvast Holdings, Inc.(a)(b) | | 196,392 | | | 974,104 |

Nikola Corp.(a)(b) | | 175,052 | | | 1,256,873 |

Plug Power, Inc.(a)(b) | | 104,234 | | | 2,190,999 |

Proterra, Inc.(a)(b) | | 158,564 | | | 984,682 |

Romeo Power, Inc.(a)(b) | | 494,180 | | | 543,598 |

The Lion Electric Co. - ADR(a)(b) | | 140,735 | | | 859,891 |

Varta AG(a) | | 13,526 | | | 1,281,097 |

Vitzrocell Co. Ltd. | | 94,832 | | | 985,317 |

Wallbox NV - ADR(a)(b) | | 97,732 | | | 1,161,056 |

Wuxi Lead Intelligent Equipment Co. Ltd. | | 240,575 | | | 1,616,860 |

| | | | | | 37,114,624 |

Information Technology — 9.4% | | | | | |

Dynapack International Technology Corp. | | 351,187 | | | 956,738 |

Iljin Materials Co. Ltd. | | 18,130 | | | 1,270,255 |

L&F Co. Ltd.(b) | | 11,159 | | | 1,948,383 |

NAURA Technology Group Co. Ltd. | | 73,132 | | | 2,653,491 |

NEC Corp. | | 50,877 | | | 1,979,802 |

Samsung SDI Co. Ltd. | | 8,848 | | | 4,304,242 |

Simplo Technology Co. Ltd. | | 109,007 | | | 1,078,032 |

SolarEdge Technologies, Inc.(b) | | 9,524 | | | 2,384,905 |

TDK Corp. | | 63,151 | | | 1,978,107 |

| | | | | | 18,553,955 |

Materials — 49.9% | | | | | |

African Rainbow Minerals Ltd. | | 94,668 | | | 1,569,897 |

Albemarle Corp. | | 16,076 | | | 3,099,935 |

Allkem Ltd.(b) | | 214,638 | | | 1,857,740 |

AMG Advanced Metallurgical Group NV | | 32,159 | | | 1,273,590 |

Aneka Tambang Tbk | | 10,952,557 | | | 1,964,313 |

BHP Group Ltd. - ADR(a) | | 246,163 | | | 16,487,998 |

China Molybdenum Co. Ltd. - Class H | | 5,198,919 | | | 2,643,518 |

Eramet SA(b) | | 12,634 | | | 1,707,351 |

First Quantum Minerals Ltd. | | 107,309 | | | 3,076,473 |

Ganfeng Lithium Co. Ltd. - Class H(c) | | 243,901 | | | 2,977,662 |

Glencore PLC | | 1,493,896 | | | 9,341,781 |

IGO Ltd. | | 199,271 | | | 1,854,267 |

ioneer Ltd.(b) | | 2,313,526 | | | 1,103,368 |

The accompanying notes are an integral part of the financial statements.

10

Amplify ETF Trust

Amplify Lithium & Battery Technology ETF

Schedule of Investments

April 30, 2022 (Unaudited) (Continued)

Description | | Shares | | Value |

Jinchuan Group International Resources Co. Ltd. | | 7,204,900 | | $ | 936,536 |

Johnson Matthey PLC | | 59,941 | | | 1,677,046 |

Largo, Inc.(b) | | 138,983 | | | 1,161,933 |

LG Chem Ltd. | | 9,207 | | | 3,804,485 |

Liontown Resources Ltd.(b) | | 1,215,988 | | | 1,258,662 |

Lithium Americas Corp.(b) | | 53,854 | | | 1,357,407 |

Livent Corp.(b) | | 61,703 | | | 1,317,976 |

Lundin Mining Corp. | | 198,799 | | | 1,815,212 |

Mineral Resources Ltd. | | 43,932 | | | 1,817,088 |

MMC Norilsk Nickel PJSC - ADR(d) | | 182,937 | | | — |

Neometals Ltd.(b) | | 1,097,324 | | | 1,232,748 |

Nouveau Monde Graphite, Inc.(b) | | 150,214 | | | 912,053 |

Piedmont Lithium, Inc.(b) | | 23,867 | | | 1,561,141 |

Pilbara Minerals Ltd.(b) | | 717,192 | | | 1,444,184 |

Shanghai Putailai New Energy Technology Co. Ltd. | | 111,834 | | | 2,015,966 |

Showa Denko KK | | 67,733 | | | 1,318,908 |

SK IE Technology Co. Ltd.(b)(c) | | 18,239 | | | 1,844,230 |

Sociedad Quimica y Minera de Chile SA - ADR | | 48,672 | | | 3,591,994 |

South32 Ltd. | | 856,875 | | | 2,887,873 |

Standard Lithium Ltd.(a)(b) | | 164,669 | | | 1,056,220 |

Sumitomo Metal Mining Co. Ltd. | | 52,595 | | | 2,298,334 |

TMC the metals co., Inc.(a)(b) | | 760,254 | | | 1,170,791 |

Umicore SA | | 51,938 | | | 2,023,473 |

Vale Indonesia Tbk PT | | 4,259,859 | | | 2,145,062 |

Vulcan Energy Resources Ltd.(b) | | 167,910 | | | 1,006,039 |

Western Areas Ltd.(b) | | 466,143 | | | 1,264,715 |

W-Scope Corp.(b) | | 151,807 | | | 1,120,640 |

Yunnan Energy New Material Co. Ltd. | | 110,383 | | | 3,400,976 |

Zhejiang Huayou Cobalt Co. Ltd. | | 195,849 | | | 2,447,295 |

| | | | | | 98,846,880 |

Utilities — 0.3% | | | | | |

Fastned BV(a)(b) | | 22,116 | | | 697,140 |

Total Common Stocks

(Cost $236,814,134) | | | | | 197,157,585 |

| | | | | | |

MONEY MARKET FUNDS — 0.3% | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34%(e) | | 540,637 | | | 540,637 |

Total Money Market Funds

(Cost $540,637) | | | | | 540,637 |

| | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 13.8% | | | | | |

First American Government Obligations Fund, Class X — 0.22%(e) | | 27,407,727 | | | 27,407,727 |

Description | | Shares | | Value |

Total Investments Purchased with Proceeds from Securities Lending

(Cost $27,407,727) | | | | $ | 27,407,727 |

| | | | | | |

Total Investments — 113.5%

(Cost $264,762,498) | | | | $ | 225,105,949 |

Percentages are based on Net Assets of $198,250,140.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund Management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The Global Industy Classification Standard (GICS®) was developed by and/or is the exclusive of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

11

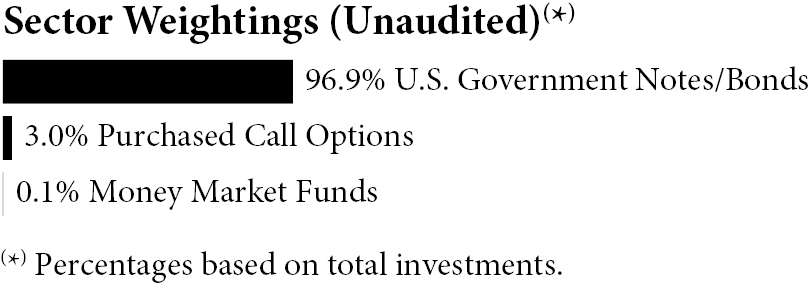

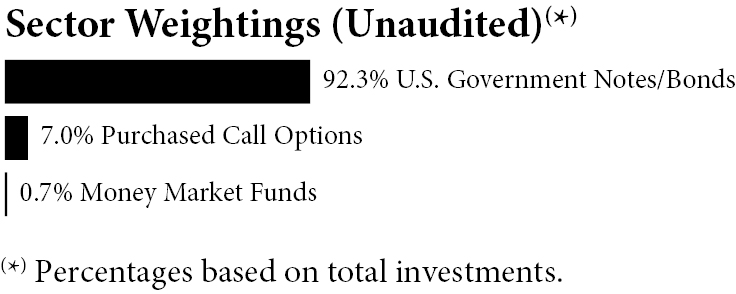

Amplify ETF Trust

Amplify BlackSwan Growth & Treasury Core ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | | | Par Value | | Value |

U.S. GOVERNMENT NOTES/BONDS — 91.9% | | | | | | | | |

0.375%, 10/31/2023 | | | | $ | 3,510,500 | | $ | 3,401,208 |

0.625%, 10/15/2024 | | | | | 101,356,500 | | | 96,122,388 |

1.125%, 10/31/2026 | | | | | 100,697,000 | | | 93,046,388 |

1.375%, 10/31/2028 | | | | | 100,371,000 | | | 91,047,476 |

1.250%, 08/15/2031 | | | | | 102,442,500 | | | 88,852,862 |

2.000%, 08/15/2051 | | | | | 128,908,500 | | | 104,687,802 |

Total U.S. Government Notes/Bonds

(Cost $543,152,529) | | | | | | | | 477,158,124 |

| | Contracts | | Notional

Amount | | |

PURCHASED OPTIONS(a) — 6.9% | | | | | | | |

SPDR S&P 500 ETF Trust, Expires 06/17/2022, Strike Price $375.00 | | 4,597 | | $ | 189,396,400 | | 19,819,965 |

SPDR S&P 500 ETF Trust, Expires 12/16/2022, Strike Price $400.00 | | 3,871 | | | 159,485,200 | | 16,124,651 |

Total Purchased Options

(Cost $58,330,328) | | | | | | | 35,944,616 |

| | Shares | | | | |

MONEY MARKET FUNDS — 0.7% | | | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34%(b) | | 3,759,616 | | | | | 3,759,616 |

Total Money Market Funds

(Cost $3,759,616) | | | | | | | 3,759,616 |

| | | | | | | | |

Total Investments — 99.5%

(Cost $605,242,473) | | | | | | $ | 516,862,356 |

Percentages are based on Net Assets of $519,598,573.

The accompanying notes are an integral part of the financial statements.

12

Amplify ETF Trust

Amplify Emerging Markets FinTech ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 98.3% | | | | | |

Banking — 10.7% | | | | | |

Banco Inter SA | | 35,200 | | $ | 108,752 |

Bank BTPN Syariah Tbk PT | | 644,800 | | | 153,450 |

Bank Jago Tbk PT(a) | | 136,000 | | | 109,291 |

NU Holdings Ltd. - Class A(a)(b) | | 23,192 | | | 139,384 |

TCS Group Holding PLC - GDR(c)(d) | | 2,536 | | | — |

| | | | | | 510,877 |

Digital Assets — 5.5% | | | | | |

Danal Co. Ltd.(a) | | 18,880 | | | 144,907 |

Huobi Technology Holdings Ltd.(a)(d) | | 168,000 | | | 117,765 |

| | | | | | 262,672 |

Insurance — 7.1% | | | | | |

Fanhua, Inc. - ADR | | 18,376 | | | 111,726 |

Ping An Insurance Group Co of China Ltd. - Class H | | 16,000 | | | 104,816 |

Renaissance Insurance Group JSC(a)(c) | | 196,320 | | | — |

ZhongAn Online P&C Insurance Co. Ltd. - Class H(a)(e) | | 35,200 | | | 123,821 |

| | | | | | 340,363 |

Description | | Shares | | Value |

Investment & Trading — 7.6% | | | | | |

Futu Holdings Ltd. - ADR(a)(b) | | 3,800 | | $ | 121,562 |

Up Fintech Holding Ltd. - ADR(a)(b) | | 30,496 | | | 118,325 |

XP, Inc. - Class A(a) | | 4,984 | | | 122,656 |

| | | | | | 362,543 |

Lending & Credit — 12.3% | | | | | |

360 DigiTech, Inc. - ADR | | 6,536 | | | 94,315 |

Cango, Inc. - ADR(a)(b) | | 34,784 | | | 110,265 |

FinVolution Group - ADR | | 30,944 | | | 116,349 |

Kaspi.KZ JSC - GDR(d) | | 1,824 | | | 118,560 |

Lufax Holding Ltd. - ADR | | 26,568 | | | 147,452 |

| | | | | | 586,941 |

Payment — 53.2% | | | | | |

Alibaba Group Holding Ltd.(a) | | 8,000 | | | 104,102 |

Dlocal Ltd.(a) | | 5,536 | | | 125,501 |

EVERTEC, Inc. | | 3,768 | | | 148,459 |

Fawry for Banking & Payment Technology Services SAE(a) | | 237,168 | | | 59,260 |

Forth Smart Service PCL - NVDR | | 481,600 | | | 303,724 |

Grab Holdings Ltd.(a)(b) | | 31,304 | | | 92,347 |

Green World FinTech Service Co. Ltd. | | 3,800 | | | 65,621 |

Jumia Technologies AG - ADR(a)(b) | | 18,744 | | | 132,520 |

Kakaopay Corp.(a) | | 1,520 | | | 136,146 |

Kginicis Co. Ltd. | | 10,832 | | | 150,061 |

MercadoLibre, Inc.(a) | | 160 | | | 155,781 |

Net 1 UEPS Technologies, Inc.(a) | | 32,136 | | | 158,752 |

Network International Holdings PLC(a)(e) | | 46,864 | | | 153,448 |

Pagseguro Digital Ltd. - Class A(a) | | 9,056 | | | 133,214 |

PAX Global Technology Ltd. | | 216,000 | | | 188,026 |

QIWI PLC - ADR(c) | | 22,528 | | | — |

Sea Ltd. - ADR(a) | | 1,080 | | | 89,381 |

StoneCo Ltd. - Class A(a) | | 12,000 | | | 113,040 |

Tencent Holdings Ltd. | | 2,400 | | | 115,440 |

Yeahka Ltd.(a) | | 41,600 | | | 110,281 |

| | | | | | 2,535,104 |

Real Estate Services — 1.9% | | | | | |

KE Holdings, Inc. - ADR(a) | | 6,216 | | | 88,143 |

Total Common Stocks

(Cost $6,744,052) | | | | | 4,686,643 |

| | | | | | |

RIGHTS — 0.9% | | | | | |

Fawry for Banking & Payment Technology Services SAE(a)(c) | | 222,262 | | | 46,160 |

Total Rights

(Cost $62,556) | | | | | 46,160 |

The accompanying notes are an integral part of the financial statements.

13

Amplify ETF Trust

Amplify Emerging Markets FinTech ETF

Schedule of Investments

April 30, 2022 (Unaudited) (Continued)

Description | | Shares | | Value |

MONEY MARKET FUNDS — 0.5% | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34%(f) | | 21,792 | | $ | 21,792 |

Total Money Market Funds

(Cost $21,792) | | | | | 21,792 |

| | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 13.6% | | | | | |

First American Government Obligations Fund - Class X — 0.22%(f) | | 646,018 | | | 646,018 |

Total Investments Purchased with Proceeds from Securities Lending

(Cost $646,018) | | | | | 646,018 |

| | | | | | |

Total Investments — 113.3%

(Cost $7,474,418) | | | | $ | 5,400,613 |

Percentages are based on Net Assets of $4,765,437.

The accompanying notes are an integral part of the financial statements.

14

Amplify ETF Trust

Amplify Seymour Cannabis ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 54.3% | | | | | |

Consumer Discretionary — 3.7% | | | | | |

Greenlane Holdings, Inc. - Class A(a) | | 929,143 | | $ | 320,554 |

GrowGeneration Corp.(a) | | 325,581 | | | 1,924,184 |

| | | | | | 2,244,738 |

Consumer Staples — 4.9% | | | | | |

Neptune Wellness Solutions, Inc.(a) | | 1,628,706 | | | 275,251 |

Village Farms International, Inc.(a) | | 637,493 | | | 2,747,595 |

| | | | | | 3,022,846 |

Financials — 8.4% | | | | | |

AFC Gamma, Inc.(b) | | 168,196 | | | 2,692,818 |

RIV Capital, Inc.(a)(c) | | 1,319,982 | | | 1,304,929 |

Silver Spike Investment Corp.(a)(c) | | 109,028 | | | 1,149,155 |

| | | | | | 5,146,902 |

Health Care — 25.1% | | | | | |

Aleafia Health, Inc.(a) | | 77,872 | | | 6,365 |

Auxly Cannabis Group, Inc.(a) | | 3,017,044 | | | 317,052 |

Canopy Growth Corp.(a)(d) | | 445,349 | | | 2,542,943 |

Cara Therapeutics, Inc.(a) | | 198,686 | | | 1,732,542 |

cbdMD, Inc.(a) | | 528,960 | | | 338,534 |

Charlotte’s Web Holdings, Inc.(a) | | 1,060,407 | | | 924,498 |

Clever Leaves Holdings, Inc.(a) | | 146,875 | | | 201,219 |

Cronos Group, Inc.(a) | | 443,260 | | | 1,338,645 |

IM Cannabis Corp.(a) | | 93,000 | | | 104,246 |

Jazz Pharmaceuticals Plc(a) | | 12,080 | | | 1,935,458 |

MediPharm Labs Corp.(a) | | 2,844,844 | | | 265,739 |

Organigram Holdings, Inc.(a) | | 652,878 | | | 920,558 |

PerkinElmer, Inc. | | 81 | | | 11,875 |

The Valens Co., Inc.(a) | | 629,007 | | | 612,041 |

Tilray Brands, Inc.(a)(d) | | 778,674 | | | 3,877,796 |

Zynerba Pharmaceuticals, Inc.(a) | | 212,298 | | | 299,340 |

| | | | | | 15,428,851 |

Industrials — 2.2% | | | | | |

Hydrofarm Holdings Group, Inc.(a)(d) | | 144,996 | | | 1,384,712 |

| | | | | | |

Information Technology — 8.2% | | | | | |

Akerna Corp.(a) | | 256,091 | | | 174,142 |

WM Technology, Inc.(a) | | 836,424 | | | 4,851,259 |

| | | | | | 5,025,401 |

Description | | Shares | | Value |

Real Estate — 1.8% | | | | | |

Innovative Industrial Properties, Inc.(b) | | 7,569 | | $ | 1,094,402 |

Total Common Stocks

(Cost $99,138,066) | | | | | 33,347,852 |

| | | | | | |

MONEY MARKET FUNDS — 21.2% | | | | | |

Dreyfus Government Cash Management — 0.24%(e) | | 12,988,602 | | | 12,988,602 |

Total Money Market Funds

(Cost $12,988,602) | | | | | 12,988,602 |

| | | | | | |

Total Investments — 75.5%

(Cost $112,126,668) | | | | $ | 46,336,454 |

Percentages are based on Net Assets of $61,391,548.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund Management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The Global Industy Classification Standard (GICS®) was developed by and/or is the exclusive of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

15

Amplify ETF Trust

Amplify Seymour Cannabis ETF

Schedule of Total Return Swaps

April 30, 2022 (Unaudited)

Reference Entity(a) | | Counterparty | | Long/Short | | Expiration

Date | | Financing

Rate(b) | | Payment

Frequency | | Notional

Amount | | Value/Unrealized

Appreciation

(Depreciation) |

Ayr Wellness, Inc. | | Cowen Financial Products, LLC | | Long | | 04/26/2023 | | 1.82% | | Monthly | | $ | 1,910,989 | | $ | — |

Columbia Care, Inc. | | Cowen Financial Products, LLC | | Long | | 04/26/2023 | | 1.82% | | Monthly | | | 752,609 | | | — |

Cresco Labs, Inc. | | Cowen Financial Products, LLC | | Long | | 04/26/2023 | | 1.82% | | Monthly | | | 3,839,542 | | | — |

Curaleaf Holdings, Inc. | | Cowen Financial Products, LLC | | Long | | 04/26/2023 | | 1.82% | | Monthly | | | 4,933,144 | | | — |

Green Thumb Industries, Inc. | | Cowen Financial Products, LLC | | Long | | 04/26/2023 | | 1.82% | | Monthly | | | 5,713,271 | | | — |

TerrAscend Corp. | | Cowen Financial Products, LLC | | Long | | 04/26/2023 | | 1.82% | | Monthly | | | 1,500,370 | | | — |

Trulieve Cannabis Corp. | | Cowen Financial Products, LLC | | Long | | 04/26/2023 | | 1.82% | | Monthly | | | 3,706,200 | | | — |

Verano Holdings Corp. | | Cowen Financial Products, LLC | | Long | | 04/26/2023 | | 1.82% | | Monthly | | | 2,641,800 | | | — |

| | | | | | | | | | | | | | | | $ | — |

The accompanying notes are an integral part of the financial statements.

16

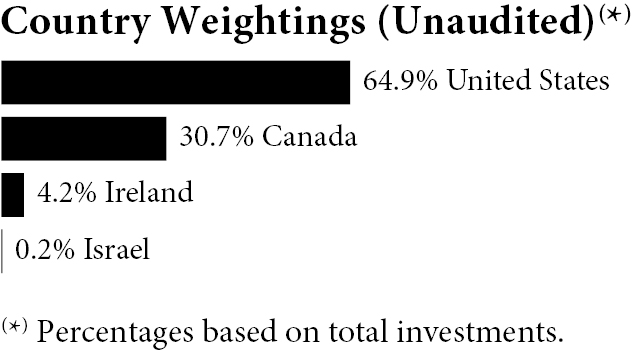

Amplify ETF Trust

Amplify Pure Junior Gold Miners ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 99.8% | | | | | |

Materials — 99.8% | | | | | |

Alamos Gold, Inc. | | 3,918 | | $ | 30,595 |

Alkane Resources Ltd.(a) | | 12,122 | | | 8,787 |

Argonaut Gold, Inc.(a) | | 14,059 | | | 23,651 |

B2Gold Corp. | | 8,322 | | | 35,488 |

Calibre Mining Corp.(a) | | 16,817 | | | 18,685 |

Centamin PLC | | 29,525 | | | 33,947 |

DRDGOLD Ltd. - ADR | | 2,886 | | | 23,088 |

Dundee Precious Metals, Inc. | | 5,273 | | | 30,696 |

Eldorado Gold Corp.(a) | | 2,886 | | | 28,181 |

Equinox Gold Corp.(a) | | 3,982 | | | 28,540 |

Evolution Mining Ltd. | | 13,675 | | | 39,358 |

GCM Mining Corp. | | 3,795 | | | 15,589 |

Gold Road Resources Ltd. | | 28,304 | | | 31,278 |

Great Panther Mining Ltd.(a) | | 57,563 | | | 12,088 |

Greatland Gold PLC(a) | | 137,981 | | | 23,040 |

i-80 Gold Corp.(a) | | 4,135 | | | 10,903 |

IAMGOLD Corp.(a) | | 9,223 | | | 26,196 |

K92 Mining, Inc.(a) | | 4,560 | | | 32,647 |

Karora Resources, Inc.(a) | | 5,974 | | | 30,850 |

Kinross Gold Corp.(b) | | 0 | | | — |

Koza Altin Isletmeleri AS(a) | | 5,943 | | | 68,887 |

Lundin Gold, Inc.(a) | | 2,975 | | | 24,092 |

McEwen Mining, Inc.(a) | | 33,446 | | | 22,415 |

Novagold Resources, Inc.(a) | | 1,815 | | | 11,375 |

OceanaGold Corp.(a) | | 13,058 | | | 32,695 |

Osisko Gold Royalties Ltd. | | 2,455 | | | 30,369 |

Osisko Mining, Inc.(a) | | 7,287 | | | 23,092 |

Pan African Resources PLC | | 52,898 | | | 14,511 |

Perseus Mining Ltd. | | 25,105 | | | 35,414 |

Ramelius Resources Ltd. | | 32,206 | | | 34,560 |

Red 5 Ltd.(a) | | 58,181 | | | 16,952 |

Regis Resources Ltd. | | 22,655 | | | 33,649 |

Resolute Mining Ltd.(a) | | 70,879 | | | 17,630 |

Royal Gold, Inc. | | 447 | | | 58,325 |

Description | | Shares | | Value |

Sabina Gold & Silver Corp.(a) | | 9,768 | | $ | 10,089 |

Seabridge Gold, Inc.(a) | | 1,320 | | | 23,311 |

Silver Lake Resources Ltd.(a) | | 22,148 | | | 29,275 |

SSR Mining, Inc. | | 1,542 | | | 34,096 |

St Barbara Ltd. | | 32,275 | | | 30,620 |

Torex Gold Resources, Inc.(a) | | 2,686 | | | 30,222 |

Wesdome Gold Mines Ltd.(a) | | 2,859 | | | 29,327 |

West African Resources Ltd.(a) | | 34,151 | | | 33,006 |

Westgold Resources Ltd. | | 21,875 | | | 25,417 |

Yamana Gold, Inc. | | 6,548 | | | 36,325 |

| | | | | | 1,189,261 |

Total Common Stocks

(Cost $1,439,165) | | | | | 1,189,261 |

| | | | | | |

CONTINGENT VALUE RIGHTS — 0.0% | | | |

Kinross Gold Corp.(a)(b) | | 2,143 | | | — |

Total Contingent Value Rights

(Cost $0) | | | | | — |

| | | | | | |

MONEY MARKET FUNDS — 0.2% | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34%(c) | | 1,890 | | | 1,890 |

Total Money Market Funds

(Cost $1,890) | | | | | 1,890 |

| | | | | | |

Total Investments — 100.0%

(Cost $1,441,055) | | | | $ | 1,191,151 |

Percentages are based on Net Assets of $1,190,762.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund Management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The Global Industy Classification Standard (GICS®) was developed by and/or is the exclusive of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

17

Amplify ETF Trust

Amplify BlackSwan ISWN ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | | | Par Value | | Value |

U.S. GOVERNMENT NOTES/BONDS — 96.2% | | | | | | | | |

0.375%, 10/31/2023 | | | | $ | 306,000 | | $ | 296,473 |

0.625%, 10/15/2024 | | | | | 9,008,000 | | | 8,542,821 |

1.125%, 10/31/2026 | | | | | 8,982,000 | | | 8,299,579 |

1.375%, 10/31/2028 | | | | | 8,951,000 | | | 8,119,536 |

1.250%, 08/15/2031 | | | | | 9,146,000 | | | 7,932,726 |

2.000%, 08/15/2051 | | | | | 11,823,000 | | | 9,601,569 |

Total U.S. Government Notes/Bonds

(Cost $47,506,389) | | | | | | | | 42,792,704 |

| | Contracts | | Notional

Amount | | |

PURCHASED OPTIONS(a) — 3.0% | | | | | | | |

iShares MSCI EAFE ETF, Expires 06/17/2022, Strike Price $72.00 | | 2,572 | | $ | 17,654,208 | | 158,178 |

iShares MSCI EAFE ETF, Expires 01/20/2023 , Strike Price $66.00 | | 1,897 | | | 13,021,008 | | 1,152,428 |

Total Purchased Options

(Cost $4,694,227) | | | | | | | 1,310,606 |

| | Shares | | | | |

MONEY MARKET FUNDS — 0.1% | | | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34% (b) | | 63,362 | | | | | 63,362 |

Total Money Market Funds

(Cost $63,362) | | | | | | | 63,362 |

| | | | | | | | |

Total Investments — 99.3%

(Cost $52,263,978) | | | | | | $ | 44,166,672 |

Percentages are based on Net Assets of $44,471,472.

The accompanying notes are an integral part of the financial statements.

18

Amplify ETF Trust

Amplify Cleaner Living ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 99.2% | | | | | |

Cleaner Building & Infrastructure — 17.0% | | | | | |

Array Technologies, Inc.(a) | | 782 | | $ | 5,106 |

Ballard Power Systems, Inc.(a) | | 1,024 | | | 8,505 |

Beam Global(a) | | 578 | | | 8,924 |

Blink Charging Co.(a) | | 416 | | | 7,946 |

Bloom Energy Corp. - Class A(a) | | 568 | | | 10,542 |

Daqo New Energy Corp. - ADR(a) | | 308 | | | 12,804 |

Enphase Energy, Inc.(a) | | 64 | | | 10,330 |

FuelCell Energy, Inc.(a) | | 1,948 | | | 7,948 |

Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | 240 | | | 9,598 |

JinkoSolar Holding Co. Ltd. - ADR(a) | | 294 | | | 15,070 |

Schnitzer Steel Industries, Inc. | | 274 | | | 12,503 |

SolarEdge Technologies, Inc.(a) | | 44 | | | 11,018 |

TPI Composites, Inc.(a) | | 842 | | | 9,632 |

Trex Co., Inc.(a) | | 96 | | | 5,586 |

| | | | | | 135,512 |

Cleaner Energy — 16.1% | | | | | |

Azure Power Global Ltd.(a) | | 742 | | | 10,425 |

Brookfield Renewable Corp. - Class A | | 400 | | | 14,363 |

Brookfield Renewable Partners LP | | 404 | | | 14,224 |

Clean Energy Fuels Corp.(a) | | 1,934 | | | 11,333 |

Innergex Renewable Energy, Inc. | | 944 | | | 12,639 |

NextEra Energy Partners LP | | 156 | | | 10,399 |

Ormat Technologies, Inc. | | 176 | | | 13,675 |

Renewable Energy Group, Inc.(a) | | 298 | | | 18,196 |

Sunnova Energy International, Inc.(a) | | 410 | | | 7,081 |

SunPower Corp.(a) | | 580 | | | 9,576 |

Sunrun, Inc.(a) | | 320 | | | 6,394 |

| | | | | | 128,305 |

Cleaner Food & Dining — 34.1% | | | | | |

BellRing Brands, Inc.(a) | | 494 | | | 10,586 |

Beyond Meat, Inc.(a) | | 206 | | | 7,597 |

Calavo Growers, Inc. | | 304 | | | 11,017 |

Chipotle Mexican Grill, Inc.(a) | | 8 | | | 11,645 |

Description | | Shares | | Value |

Dole PLC | | 930 | | $ | 11,076 |

FMC Corp. | | 120 | | | 15,905 |

Fresh Del Monte Produce, Inc. | | 470 | | | 12,244 |

Freshpet, Inc.(a) | | 118 | | | 11,015 |

Kura Sushi USA, Inc. - Class A(a) | | 182 | | | 9,133 |

Laird Superfood, Inc.(a) | | 908 | | | 2,733 |

Landec Corp.(a) | | 1,306 | | | 12,995 |

Mission Produce, Inc.(a) | | 664 | | | 8,446 |

National Beverage Corp. | | 256 | | | 11,285 |

Natural Grocers by Vitamin Cottage, Inc. | | 760 | | | 15,496 |

Oatly Group AB - ADR(a) | | 1,458 | | | 5,191 |

Pilgrim’s Pride Corp.(a) | | 436 | | | 12,361 |

Primo Water Corp. | | 722 | | | 10,560 |

Sanderson Farms, Inc. | | 64 | | | 12,120 |

Sprouts Farmers Market, Inc.(a) | | 462 | | | 13,768 |

SunOpta, Inc.(a) | | 1,904 | | | 10,493 |

Tattooed Chef, Inc.(a) | | 766 | | | 6,120 |

The Alkaline Water Co., Inc.(a) | | 8,862 | | | 6,904 |

The Hain Celestial Group, Inc.(a) | | 316 | | | 10,599 |

The Simply Good Foods Co.(a) | | 328 | | | 13,661 |

The Vita Coco Co., Inc.(a) | | 1,186 | | | 12,880 |

Zevia PBC - Class A(a) | | 1,550 | | | 5,332 |

| | | | | | 271,162 |

Cleaner Health & Beauty — 17.2% | | | | | |

Allbirds, Inc. - Class A(a) | | 968 | | | 4,917 |

F45 Training Holdings, Inc.(a) | | 1,188 | | | 10,443 |

Herbalife Nutrition Ltd.(a) | | 364 | | | 9,675 |

Life Time Group Holdings, Inc.(a) | | 660 | | | 9,438 |

Lululemon Athletica, Inc.(a) | | 32 | | | 11,348 |

Medifast, Inc. | | 68 | | | 12,129 |

Nautilus, Inc.(a) | | 1,990 | | | 5,990 |

Peloton Interactive, Inc. - Class A(a) | | 350 | | | 6,146 |

Planet Fitness, Inc. - Class A(a) | | 154 | | | 12,325 |

The Honest Co., Inc.(a) | | 1,698 | | | 6,724 |

Tivity Health, Inc.(a) | | 534 | | | 17,157 |

USANA Health Sciences, Inc.(a) | | 132 | | | 10,119 |

WW International, Inc.(a) | | 814 | | | 7,969 |

Xponential Fitness, Inc. - Class A(a) | | 612 | | | 12,681 |

| | | | | | 137,061 |

Cleaner Transportation — 14.8% | | | | | |

Arcimoto, Inc.(a) | | 1,446 | | | 4,859 |

Canoo, Inc.(a) | | 1,430 | | | 6,864 |

ElectraMeccanica Vehicles Corp.(a) | | 4,950 | | | 8,662 |

Fisker, Inc.(a) | | 754 | | | 7,585 |

Kandi Technologies Group, Inc.(a) | | 3,650 | | | 9,307 |

Li Auto, Inc. - ADR(a) | | 414 | | | 9,286 |

The accompanying notes are an integral part of the financial statements.

19

Amplify ETF Trust

Amplify Cleaner Living ETF

Schedule of Investments

April 30, 2022 (Unaudited) (Continued)

Description | | Shares | | Value |

Lucid Group, Inc.(a) | | 360 | | $ | 6,509 |

Nikola Corp.(a) | | 1,388 | | | 9,966 |

NIO, Inc. - ADR - ADR(a) | | 392 | | | 6,546 |

Niu Technologies - ADR(a) | | 724 | | | 6,914 |

Plug Power, Inc.(a) | | 406 | | | 8,534 |

Rivian Automotive, Inc. - Class A(a) | | 120 | | | 3,629 |

Tesla, Inc.(a) | | 14 | | | 12,191 |

Volcon, Inc.(a) | | 1,178 | | | 1,814 |

Workhorse Group, Inc.(a) | | 2,702 | | | 8,133 |

XPeng, Inc. - ADR(a) | | 288 | | | 7,088 |

| | | | | | 117,887 |

Total Common Stocks

(Cost $1,228,115) | | | | | 789,927 |

| | | | | | |

MONEY MARKET FUNDS — 0.8% | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34%(b) | | 6,001 | | | 6,001 |

Total Money Market Funds

(Cost $6,001) | | | | | 6,001 |

| | | | | | |

Total Investments — 100.0%

(Cost $1,234,116) | | | | $ | 795,928 |

Percentages are based on Net Assets of $795,667.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund Management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

20

Amplify ETF Trust

Amplify Thematic All-Stars ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 99.3% | | | | | |

Communication Services — 8.2% | | | | | |

Alphabet, Inc. - Class A(a) | | 106 | | $ | 241,912 |

Baidu, Inc. - Class A(a) | | 2,457 | | | 40,897 |

Meta Platforms, Inc. - Class A(a) | | 404 | | | 80,990 |

Netflix, Inc.(a) | | 87 | | | 16,561 |

ROBLOX Corp. - Class A(a) | | 1,702 | | | 52,166 |

Roku, Inc.(a) | | 512 | | | 47,565 |

Sea Ltd. - ADR(a) | | 627 | | | 51,891 |

Snap, Inc. - Class A(a) | | 1,131 | | | 32,188 |

Spotify Technology SA(a) | | 513 | | | 52,147 |

Tencent Holdings Ltd. | | 1,064 | | | 51,178 |

Twitter, Inc.(a) | | 805 | | | 39,461 |

| | | | | | 706,956 |

Consumer Discretionary — 10.0% | | | | | |

Alibaba Group Holding Ltd.(a) | | 4,843 | | | 63,021 |

Amazon.com, Inc.(a) | | 69 | | | 171,509 |

Aptiv PLC - ADR(a) | | 371 | | | 39,474 |

DraftKings, Inc. - Class A(a) | | 2,074 | | | 28,372 |

MercadoLibre, Inc.(a) | | 40 | | | 38,945 |

Panasonic Holdings Corp. | | 2,072 | | | 18,560 |

Tesla, Inc.(a) | | 520 | | | 452,795 |

XPeng, Inc. - Class A(a) | | 3,453 | | | 45,329 |

| | | | | | 858,005 |

Financials — 2.4% | | | | | |

Coinbase Global, Inc. - Class A(a) | | 1,551 | | | 174,813 |

Galaxy Digital Holdings Ltd.(a) | | 1,076 | | | 11,829 |

Robinhood Markets, Inc. - Class A(a)(b) | | 2,093 | | | 20,522 |

| | | | | | 207,164 |

Health Care — 3.4% | | | | | |

Agilent Technologies, Inc. | | 196 | | | 23,377 |

Beam Therapeutics, Inc.(a) | | 383 | | | 14,374 |

Description | | Shares | | Value |

CRISPR Therapeutics AG(a) | | 469 | | $ | 23,272 |

Danaher Corp. | | 215 | | | 53,993 |

Exact Sciences Corp.(a) | | 363 | | | 19,983 |

Illumina, Inc.(a) | | 62 | | | 18,392 |

Intellia Therapeutics, Inc.(a) | | 496 | | | 24,319 |

Intuitive Surgical, Inc.(a) | | 226 | | | 54,082 |

Teladoc Health, Inc.(a) | | 1,816 | | | 61,308 |

| | | | | | 293,100 |

Industrials — 8.7% | | | | | |

ABB Ltd. | | 2,752 | | | 83,922 |

AeroVironment, Inc.(a) | | 310 | | | 24,899 |

Array Technologies, Inc.(a) | | 2,256 | | | 14,732 |

Ballard Power Systems, Inc.(a) | | 5,285 | | | 44,123 |

Bloom Energy Corp. - Class A(a) | | 2,009 | | | 37,287 |

Booz Allen Hamilton Holding Corp. | | 273 | | | 22,285 |

ChargePoint Holdings, Inc.(a) | | 1,276 | | | 16,512 |

Evoqua Water Technologies Corp.(a) | | 679 | | | 28,308 |

FANUC Corp. | | 151 | | | 23,502 |

FuelCell Energy, Inc.(a) | | 3,876 | | | 15,814 |

Pentair PLC | | 514 | | | 26,086 |

Plug Power, Inc.(a) | | 5,519 | | | 116,009 |

Roper Technologies, Inc. | | 54 | | | 25,376 |

Schneider Electric SE | | 140 | | | 20,337 |

Shoals Technologies Group, Inc. - Class A(a) | | 1,815 | | | 18,114 |

Sunrun, Inc.(a) | | 3,729 | | | 74,505 |

Tetra Tech, Inc. | | 158 | | | 22,006 |

Vestas Wind Systems A/S | | 3,004 | | | 77,885 |

Xylem, Inc./NY | | 724 | | | 58,282 |

| | | | | | 749,984 |

Information Technology — 60.0% | | | | | |

Adobe, Inc.(a) | | 90 | | | 35,635 |

Advanced Micro Devices, Inc.(a) | | 1,257 | | | 107,499 |

Adyen NV(a)(c) | | 19 | | | 32,532 |

Akamai Technologies, Inc.(a) | | 1,173 | | | 131,704 |

Ambarella, Inc.(a) | | 238 | | | 19,535 |

Analog Devices, Inc. | | 277 | | | 42,763 |

Apple, Inc. | | 614 | | | 96,797 |

Arista Networks, Inc.(a) | | 188 | | | 21,727 |

Autodesk, Inc.(a) | | 144 | | | 27,256 |

Block, Inc.(a) | | 2,752 | | | 273,934 |

Canadian Solar, Inc.(a) | | 949 | | | 26,116 |

Check Point Software Technologies Ltd.(a) | | 376 | | | 47,485 |

Cisco Systems, Inc. | | 2,617 | | | 128,181 |

Cloudflare, Inc. - Class A(a) | | 1,381 | | | 118,959 |

Crowdstrike Holdings, Inc. - Class A(a) | | 1,084 | | | 215,456 |

CyberArk Software Ltd.(a) | | 223 | | | 35,042 |

The accompanying notes are an integral part of the financial statements.

21

Amplify ETF Trust

Amplify Thematic All-Stars ETF

Schedule of Investments

April 30, 2022 (Unaudited) (Continued)

Description | | Shares | | Value |

Daqo New Energy Corp. - ADR(a) | | 790 | | $ | 32,840 |

Dropbox, Inc. - Class A(a) | | 1,246 | | | 27,100 |

Enphase Energy, Inc.(a)(b) | | 1,956 | | | 315,698 |

F5, Inc.(a) | | 162 | | | 27,120 |

First Solar, Inc.(a) | | 1,897 | | | 138,538 |

Fortinet, Inc.(a) | | 298 | | | 86,125 |

Infineon Technologies AG | | 1,044 | | | 30,233 |

Intel Corp. | | 1,750 | | | 76,282 |

International Business Machines Corp. | | 362 | | | 47,860 |

Intuit, Inc. | | 50 | | | 20,938 |

Itron, Inc.(a) | | 801 | | | 38,272 |

JinkoSolar Holding Co. Ltd. - ADR(a)(b) | | 845 | | | 43,315 |

Juniper Networks, Inc. | | 1,380 | | | 43,498 |

Mandiant, Inc.(a) | | 1,808 | | | 39,740 |

Mastercard, Inc. - Class A | | 59 | | | 21,439 |

Microsoft Corp. | | 706 | | | 195,929 |

MicroStrategy, Inc.(a)(b) | | 65 | | | 23,021 |

Mimecast Ltd.(a) | | 342 | | | 27,251 |

MongoDB, Inc.(a) | | 57 | | | 20,231 |

NortonLifeLock, Inc. | | 1,355 | | | 33,929 |

NVIDIA Corp. | | 1,889 | | | 350,353 |

NXP Semiconductors NV | | 344 | | | 58,790 |

Okta, Inc.(a) | | 843 | | | 100,578 |

ON Semiconductor Corp.(a) | | 1,121 | | | 58,415 |

Oracle Corp. | | 464 | | | 34,058 |

Palo Alto Networks, Inc.(a) | | 318 | | | 178,487 |

PayPal Holdings, Inc.(a) | | 576 | | | 50,648 |

QUALCOMM, Inc. | | 733 | | | 102,393 |

Qualys, Inc.(a) | | 407 | | | 55,466 |

Rapid7, Inc.(a) | | 301 | | | 28,752 |

salesforce.com, Inc.(a) | | 315 | | | 55,421 |

Samsung SDI Co. Ltd. | | 131 | | | 63,727 |

SentinelOne, Inc. - Class A(a) | | 1,025 | | | 34,102 |

ServiceNow, Inc.(a) | | 78 | | | 37,292 |

Shopify, Inc. - Class A(a) | | 172 | | | 73,413 |

Skyworks Solutions, Inc. | | 150 | | | 16,995 |

SolarEdge Technologies, Inc.(a) | | 856 | | | 214,351 |

Splunk, Inc.(a) | | 705 | | | 86,024 |

STMicroelectronics NV | | 696 | | | 26,238 |

SunPower Corp.(a)(b) | | 2,053 | | | 33,895 |

Tenable Holdings, Inc.(a) | | 836 | | | 46,172 |

Trend Micro, Inc./Japan | | 368 | | | 20,621 |

Trimble, Inc.(a) | | 672 | | | 44,822 |

Twilio, Inc. - Class A(a) | | 1,063 | | | 118,865 |

UiPath, Inc. - Class A(a) | | 3,727 | | | 66,452 |

Unity Software, Inc.(a) | | 1,502 | | | 99,748 |

Description | | Shares | | Value |

Varonis Systems, Inc.(a) | | 833 | | $ | 35,986 |

VMware, Inc. | | 632 | | | 68,281 |

Workday, Inc. - Class A(a) | | 131 | | | 27,078 |

Xinyi Solar Holdings Ltd. | | 32,051 | | | 48,366 |

Zoom Video Communications, Inc. - Class A(a) | | 1,015 | | | 101,064 |

Zscaler, Inc.(a) | | 839 | | | 170,099 |

| | | | | | 5,156,932 |

Materials — 2.6% | | | | | |

Albemarle Corp. | | 535 | | | 103,164 |

Ecolab, Inc. | | 250 | | | 42,335 |

Ganfeng Lithium Co. Ltd. - Class H(c) | | 1,957 | | | 23,895 |

Livent Corp.(a) | | 1,770 | | | 37,807 |

MP Materials Corp.(a) | | 405 | | | 15,406 |

| | | | | | 222,607 |

Real Estate — 1.8% | | | | | |

American Tower Corp.(d) | | 121 | | | 29,163 |

Crown Castle International Corp.(d) | | 209 | | | 38,709 |

Digital Realty Trust, Inc.(d) | | 207 | | | 30,247 |

Equinix, Inc.(d) | | 81 | | | 58,246 |

| | | | | | 156,365 |

Utilities — 2.2% | | | | | |

American Water Works Co., Inc. | | 267 | | | 41,139 |

Atlantica Sustainable Infrastructure PLC | | 706 | | | 21,815 |

EDP Renovaveis SA | | 874 | | | 20,875 |

Ormat Technologies, Inc. | | 495 | | | 38,462 |

Orsted AS(c) | | 342 | | | 38,457 |

Sunnova Energy International, Inc.(a) | | 1,764 | | | 30,464 |

| | | | | | 191,212 |

Total Common Stocks

(Cost $12,402,368) | | | | | 8,542,325 |

| | | | | | |

PREFERRED STOCKS — 0.5% | | | | | |

Materials — 0.5% | | | | | |

Sociedad Quimica y Minera de Chile SA - Class B | | 578 | | | 42,890 |

Total Preferred Stocks

(Cost $29,446) | | | | | 42,890 |

| | | | | | |

MONEY MARKET FUNDS — 0.1% | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34%(e) | | 9,898 | | | 9,898 |

Total Money Market Funds

(Cost $9,898) | | | | | 9,898 |

The accompanying notes are an integral part of the financial statements.

22

Amplify ETF Trust

Amplify Thematic All-Stars ETF

Schedule of Investments

April 30, 2022 (Unaudited) (Continued)

Description | | Shares | | Value |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 5.5% | | | | | |

First American Government Obligations Fund - Class X — 0.22%(e) | | 471,517 | | $ | 471,517 |

Total Investments Purchased with Proceeds from Securities Lending

(Cost $471,517) | | | | | 471,517 |

| | | | | | |

Total Investments — 105.4%

(Cost $12,913,229) | | | | $ | 9,066,630 |

Percentages are based on Net Assets of $8,601,873.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund Management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The Global Industy Classification Standard (GICS®) was developed by and/or is the exclusive of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

23

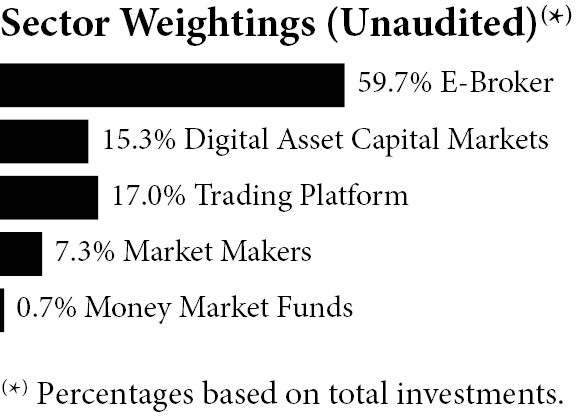

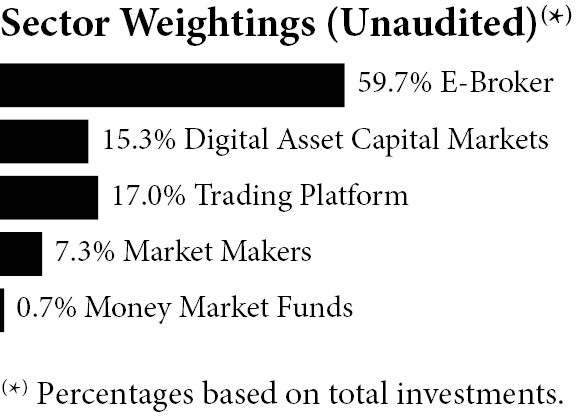

Amplify ETF Trust

Amplify Digital & Online Trading ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 99.0% | | | | | |

Digital Asset Capital Markets — 15.3% | | | | | |

Coinbase Global, Inc. - Class A(a) | | 209 | | $ | 23,557 |

Galaxy Digital Holdings Ltd.(a) | | 1,201 | | | 13,203 |

Silvergate Capital Corp.(a) | | 171 | | | 20,000 |

Voyager Digital Ltd.(a) | | 2,339 | | | 7,796 |

| | | | | | 64,556 |

E-Broker — 59.5% | | | | | |

flatexDEGIRO AG(a) | | 797 | | | 13,810 |

Futu Holdings Ltd. - ADR(a) | | 548 | | | 17,530 |

IG Group Holdings PLC | | 2,401 | | | 24,583 |

Interactive Brokers Group, Inc. | | 354 | | | 21,084 |

KGI Securities Thailand PCL - NVDR | | 28,200 | | | 4,528 |

Matsui Securities Co. Ltd. | | 1,200 | | | 7,456 |

Monex Group, Inc. | | 3,000 | | | 13,847 |

Moneylion, Inc.(a) | | 2,977 | | | 6,192 |

NH Investment & Securities Co. Ltd. | | 1,682 | | | 14,530 |

Robinhood Markets, Inc. - Class A(a) | | 1,968 | | | 19,296 |

SOFI TECHNOLOGIES, Inc.(a) | | 2,838 | | | 17,369 |

Swissquote Group Holding SA | | 105 | | | 17,427 |

The Charles Schwab Corp. | | 494 | | | 32,767 |

Up Fintech Holding Ltd. - ADR(a) | | 3,437 | | | 13,336 |

XP, Inc. - Class A(a) | | 1,136 | | | 27,957 |

| | | | | | 251,712 |

Market Makers — 7.3% | | | | | |

Flow Traders(b) | | 456 | | | 14,865 |

Virtu Financial, Inc. - Class A | | 548 | | | 15,826 |

| | | | | | 30,691 |

Trading Platform — 16.9% | | | | | |

CMC Markets PLC(b) | | 871 | | | 3,171 |

Forge Global Holdings, Inc.(a) | | 343 | | | 6,483 |

MarketAxess Holdings, Inc. | | 110 | | | 28,997 |

Plus500 Ltd. | | 631 | | | 12,351 |

Tradeweb Markets, Inc. - Class A | | 290 | | | 20,645 |

| | | | | | 71,647 |

Total Common Stocks

(Cost $611,133) | | | | | 418,606 |

Description | | Shares | | Value |

MONEY MARKET FUNDS — 0.8% | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34% (c) | | 3,180 | | $ | 3,180 |

Total Money Market Funds

(Cost $3,180) | | | | | 3,180 |

| | | | | | |

Total Investments — 99.8%

(Cost $614,313) | | | | $ | 421,786 |

Percentages are based on Net Assets of $422,697.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund Management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

24

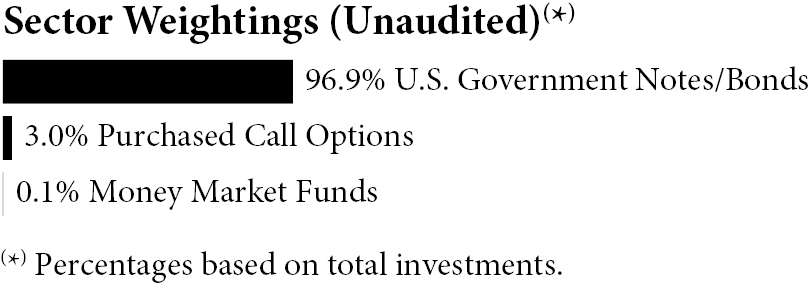

Amplify ETF Trust

Amplify BlackSwan Tech & Treasury ETF

Schedule of Investments

April 30, 2022 (Unaudited)

Description | | | | Par Value | | Value |

U.S. GOVERNMENT NOTES/BONDS — 94.9% | | | | | | | | |

0.375%, 10/31/2023 | | | | $ | 17,000 | | $ | 16,471 |

0.625%, 10/15/2024 | | | | | 499,000 | | | 473,231 |

1.125%, 10/31/2026 | | | | | 497,000 | | | 459,239 |

1.375%, 10/31/2028 | | | | | 494,000 | | | 448,112 |

1.250%, 08/15/2031 | | | | | 503,000 | | | 436,274 |

2.000%, 08/15/2051 | | | | | 628,000 | | | 510,005 |

Total U.S. Government Notes/Bonds

(Cost $2,585,723) | | | | | | | | 2,343,332 |

| | Contracts | | Notional

Amount | | |

PURCHASED OPTIONS(a) — 4.3% | | | | | | | |

Invesco QQQ Trust Series 1, Expires 6/17/2022, Strike Price $300.00 | | 29 | | $ | 908,425 | | 71,268 |

Invesco QQQ Trust Series 1, Expires 12/16/2022, Strike Price $350.00 | | 24 | | | 751,800 | | 34,272 |

Total Purchased Options

(Cost $398,361) | | | | | | | 105,540 |

| | | | | | | | |

| | Shares | | | | |

MONEY MARKET FUNDS — 0.1% | | | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.34%(b) | | 2,895 | | | | | 2,895 |

Total Money Market Funds

(Cost $2,895) | | | | | | | 2,895 |

| | | | | | | | |

Total Investments — 99.3%

(Cost $2,986,979) | | | | | | $ | 2,451,767 |

Percentages are based on Net Assets of $2,468,133.

The accompanying notes are an integral part of the financial statements.

25

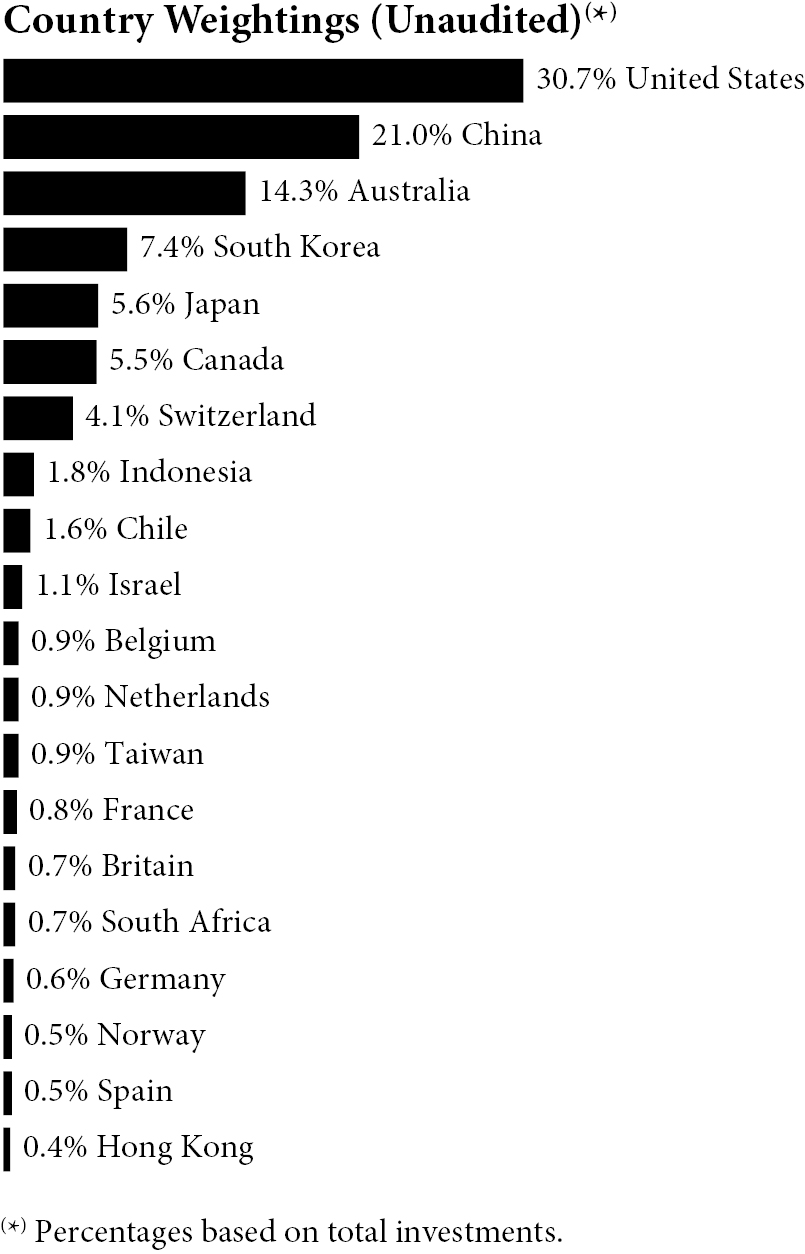

Amplify ETF Trust

Amplify Inflation Fighter ETF

Consolidated Schedule of Investments

April 30, 2022 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 69.4% | | | | | |

Consumer Discretionary — 14.6% | | | | | |

Airbnb, Inc. - Class A(a) | | 1,632 | | $ | 250,039 |

Century Communities, Inc. | | 5,561 | | | 293,176 |

DR Horton, Inc. | | 3,885 | | | 270,357 |

Green Brick Partners, Inc.(a) | | 14,057 | | | 276,923 |

Lennar Corp. - Class A | | 3,605 | | | 275,746 |

LGI Homes, Inc.(a) | | 3,009 | | | 281,973 |

M/I Homes, Inc.(a) | | 6,506 | | | 288,086 |

MDC Holdings, Inc. | | 7,603 | | | 280,627 |

PulteGroup, Inc. | | 6,588 | | | 275,115 |

Toll Brothers, Inc. | | 6,091 | | | 282,440 |

Tri Pointe Homes, Inc.(a) | | 14,057 | | | 290,558 |

| | | | | | 3,065,040 |

Consumer Staples — 1.8% | | | | | |

Alico, Inc. | | 9,422 | | | 373,771 |

Energy — 8.4% | | | | | |

Cameco Corp. | | 10,049 | | | 259,468 |

Denison Mines Corp.(a) | | 164,915 | | | 213,100 |

Energy Fuels, Inc./Canada(a) | | 33,669 | | | 252,854 |

NexGen Energy Ltd.(a) | | 49,281 | | | 242,828 |

Texas Pacific Land Corp. | | 314 | | | 429,112 |

Uranium Energy Corp.(a) | | 86,262 | | | 366,614 |

| | | | | | 1,763,976 |

Financials — 0.6% | | | | | |

LendingTree, Inc.(a) | | 1,656 | | | 131,519 |

Information Technology — 3.4% | | | | | |

Core Scientific, Inc.(a) | | 58,261 | | | 344,323 |

Entegris, Inc. | | 1,700 | | | 189,363 |

QUALCOMM, Inc. | | 1,403 | | | 195,985 |

| | | | | | 729,671 |

Description | | Shares | | Value |

Materials — 11.7% | | | | | |

Franco-Nevada Corp. | | 2,057 | | $ | 310,936 |

Nucor Corp. | | 2,391 | | | 370,079 |

Osisko Gold Royalties Ltd. | | 22,872 | | | 281,326 |

POSCO Holdings, Inc. - ADR | | 4,820 | | | 273,342 |

Rio Tinto PLC - ADR | | 4,457 | | | 316,982 |

Royal Gold, Inc. | | 2,357 | | | 307,541 |

Vale SA - ADR | | 17,133 | | | 289,376 |

Wheaton Precious Metals Corp. | | 6,810 | | | 305,497 |

| | | | | | 2,455,079 |

Real Estate — 28.9% | | | | | |

Farmland Partners, Inc.(b) | | 35,880 | | | 528,154 |

Five Point Holdings, LLC - Class A(a) | | 52,773 | | | 308,722 |

Forestar Group, Inc.(a) | | 18,495 | | | 301,653 |

FRP Holdings, Inc.(a) | | 5,720 | | | 323,237 |

Gladstone Land Corp.(b) | | 13,677 | | | 497,843 |

Kennedy-Wilson Holdings, Inc. | | 14,423 | | | 325,239 |

Morguard Corp. | | 2,580 | | | 253,451 |

PotlatchDeltic Corp.(b) | | 8,927 | | | 494,466 |

Rayonier, Inc.(b) | | 11,490 | | | 496,368 |

Realogy Holdings Corp.(a) | | 10,630 | | | 116,505 |

Redfin Corp.(a) | | 8,858 | | | 98,767 |

Stratus Properties, Inc.(a) | | 8,099 | | | 340,158 |

Tejon Ranch Co.(a) | | 18,614 | | | 340,822 |

The Howard Hughes Corp.(a) | | 3,416 | | | 342,591 |

The St Joe Co. | | 8,151 | | | 433,715 |

WeWork, Inc. - Class C(a) | | 32,248 | | | 226,058 |

Weyerhaeuser Co.(b) | | 12,352 | | | 509,149 |

Zillow Group, Inc.(a) | | 3,380 | | | 134,592 |

| | | | | | 6,071,490 |

Total Common Stocks

(Cost $15,222,190) | | | | | 14,590,546 |

| | | | | | |

EXCHANGE TRADED

FUNDS — 18.7% | | | | | |

abrdn Precious Metals Basket ETF Trust(a) | | 4,274 | | | 396,798 |

FolioBeyond Rising Rates ETF | | 7,610 | | | 244,890 |

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF | | 48,551 | | | 905,476 |

Simplify Interest Rate Hedge ETF | | 4,310 | | | 251,833 |

Teucrium Agricultural Fund(a) | | 23,000 | | | 791,200 |

United States Copper Index Fund(a) | | 23,339 | | | 617,316 |

WisdomTree Enhanced Commodity Strategy Fund | | 23,274 | | | 595,582 |

Total Exchange Traded Funds

(Cost $3,743,022) | | | | | 3,803,095 |

The accompanying notes are an integral part of the financial statements.

26

Amplify ETF Trust

Amplify Inflation Fighter ETF

Consolidated Schedule of Investments

April 30, 2022 (Unaudited) (Continued)

Description | | Shares | | Value |

MONEY MARKET FUNDS — 8.9% | | | | | |

First American Government Obligations Fund, Class X — 0.22%(c) | | 7,188 | | $ | 7,188 |

Invesco Government & Agency Portfolio - Institutional Class — 0.34% (c) | | 1,861,802 | | | 1,861,802 |

Total Money Market Funds

(Cost $1,868,990) | | | | | 1,868,990 |

| | | | | | |

Total Investments — 96.4%

(Cost $20,834,202) | | | | $ | 20,262,631 |

Percentages are based on Net Assets of $21,015,721.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Fund’s Administrator, U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of the financial statements.

27

Amplify ETF Trust

Amplify Inflation Fighter ETF

Consolidated Schedule of Open Futures Contracts

April 30, 2022 (Unaudited)

| | Number of

Contracts | | Description | | Expiration

Month | | Notional

Amount | | Value/Unrealized

Appreciation

(Depreciation) | | |

357 | | Micro Bitcoin | | June 2022 | | $ | 1,370,166 | | $ | — | |

54 | | Micro Gold | | June 2022 | | | 1,032,318 | | | — | |

| | | | | | | | | | $ | — | |

The accompanying notes are an integral part of the financial statements.

28

Amplify ETF Trust

Statements of Assets and Liabilities

April 30, 2022

| | Amplify

High Income

ETF | | Amplify

Online

Retail ETF | | Amplify

CWP Enhanced

Dividend

Income ETF | | Amplify

Transformational

Data Sharing

ETF | | Amplify

Lithium &

Battery

Technology ETF |

Assets: | | | | | | | | | | | | | | | | | | | |

Investments, at Cost | | $ | 419,852,774 | | | $ | 694,735,811 | | | $ | 1,175,889,358 | | $ | 1,392,439,628 | | | $ | 198,250,140 | |

Foreign Currency, at Cost | | | — | | | | 1,406 | | | | — | | | — | | | | — | |

Investments, at Value | | $ | 363,979,130 | | | $ | 356,779,837 | | | $ | 1,209,551,930 | | $ | 957,959,623 | | | $ | 225,105,951 | |

Foreign Currency, at Value | | | — | | | | 1,329 | | | | — | | | — | | | | — | |

Cash | | | — | | | | — | | | | 124,087,349 | | | — | | | | — | |

Receivable for Capital Shares Sold | | | 119,439 | | | | — | | | | 14,477,830 | | | — | | | | — | |

Dividends and Interest Receivable | | | 1,316,727 | | | | 41,170 | | | | 1,165,208 | | | 2,345,381 | | | | 462,990 | |

Securities Lending Income Receivable | | | 37,509 | | | | 221,224 | | | | — | | | 278,197 | | | | 193,760 | |

Total Assets | | | 365,452,805 | | | | 357,043,560 | | | | 1,349,282,317 | | | 960,583,201 | | | | 225,762,701 | |

| | | | | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | |

Options Written, at Value (Premiums Received $0, $0, $21,435,853, $0, $0) | | | — | | | | — | | | | 749,330 | | | — | | | | — | |

Payable for Investments Purchased | | | — | | | | — | | | | 12,987,851 | | | — | | | | — | |

Collateral Received for Securities Loaned (See Note 4) | | | 6,529,336 | | | | 52,198,176 | | | | — | | | 156,677,719 | | | | 27,407,727 | |

Advisory Fees Payable, net of waiver, if any | | | 153,399 | | | | 190,455 | | | | 586,427 | | | 545,140 | | | | 104,834 | |

Total Liabilities | | | 6,682,735 | | | | 52,388,631 | | | | 14,323,608 | | | 157,222,859 | | | | 27,512,561 | |

| | | | | | | | | | | | | | | | | | | | |

Net Assets | | $ | 358,770,070 | | | $ | 304,654,929 | | | $ | 1,334,958,709 | | $ | 803,360,342 | | | $ | 198,250,140 | |

| | | | | | | | | | | | | | | | | | | | |

Net Assets Consist of: | | | | | | | | | | | | | | | | | | | |

Paid-in Capital ($0.01 par value) | | $ | 256,500 | | | $ | 56,000 | | | $ | 372,500 | | $ | 299,000 | | | $ | 134,500 | |

Additional Paid-in Capital | | | 442,440,663 | | | | 737,146,669 | | | | 1,315,261,204 | | | 1,464,432,908 | | | | 243,709,440 | |