As filed with the U.S. Securities and Exchange Commission on June 5, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23108

Amplify ETF Trust

(Exact name of registrant as specified in charter)

3333 Warrenville Road Suite #350

Lisle, IL 60532

(Address of principal executive offices) (Zip code)

Christian Magoon

Amplify ETF Trust

3333 Warrenville Road Suite #350

Lisle, IL 60532

(Name and address of agent for service)

With copies to:

Morrison C. Warren, Esq.

Chapman and Cutler LLP

111 West Monroe Street

Chicago, IL 60603

(855)-267-3837

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: March 31, 2024

Item 1. Reports to Stockholders.

| | 2024 Semi-Annual Report |

AMPLIFY ETF TRUST | MARCH 31, 2024 |

| | YYY | | Amplify High Income ETF |

| | | IBUY | | Amplify Online Retail ETF |

| | | DIVO | | Amplify CWP Enhanced Dividend Income ETF |

| | | BLOK | | Amplify Transformational Data Sharing ETF |

| | | BATT | | Amplify Lithium & Battery Technology ETF |

| | | SWAN | | Amplify BlackSwan Growth & Treasury Core ETF |

| | | EMFQ | | Amplify Emerging Markets FinTech ETF |

| | | CNBS | | Amplify Seymour Cannabis ETF |

| | | ISWN | | Amplify BlackSwan ISWN ETF |

| | | MVPS | | Amplify Thematic All-Stars ETF |

| | | QSWN | | Amplify BlackSwan Tech & Treasury ETF |

| | | IWIN | | Amplify Inflation Fighter ETF |

| | | NDIV | | Amplify Natural Resources Dividend Income ETF |

| | | IDVO | | Amplify International Enhanced Dividend Income ETF |

| | | COWS | | Amplify Cash Flow Dividend Leaders ETF |

| | | HCOW | | Amplify Cash Flow High Income ETF |

| | | SOF | | Amplify Samsung SOFR ETF |

| | | SILJ | | Amplify Junior Silver Miners ETF |

| | | HACK | | Amplify Cybersecurity ETF |

| | | IPAY | | Amplify Mobile Payments ETF |

| | | ITEQ | | Amplify BlueStar Israel Technology ETF |

| | | ETHO | | Amplify Etho Climate Leadership U.S. ETF |

| | | MJ | | Amplify Alternative Harvest ETF |

| | | IVES | | Amplify Global Cloud Technology ETF |

| | | GAMR | | Amplify Video Game Tech ETF |

| | | AIEQ | | Amplify AI Powered Equity ETF |

| | | AWAY | | Amplify Travel Tech ETF |

| | | GERM | | Amplify Treatments, Testing and Advancements ETF |

| | | MJUS | | Amplify U.S. Alternative Harvest ETF |

| | | | | |

Amplify ETF Trust

Table of Contents

Amplify ETF Trust (the “Trust”) files its complete schedule of fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Part F of Form N-PORT within sixty days after the end of the period. The Trust’s Part F of Form N-PORT is available on the Commission’s website at www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Amplify Investments LLC (the “Adviser”) uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-855-267-3837 and (ii) on the Commission’s website at www.sec.gov.

1

Amplify ETF Trust Amplify High Income ETF Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | Shares | | Value |

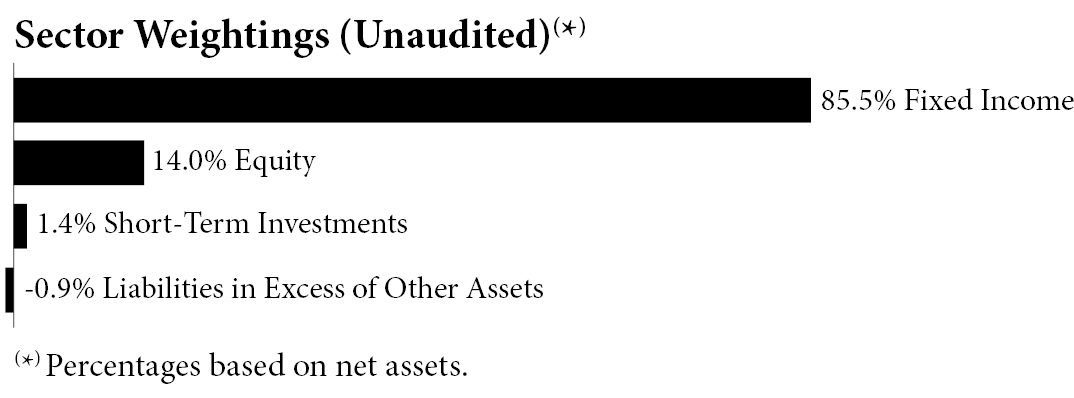

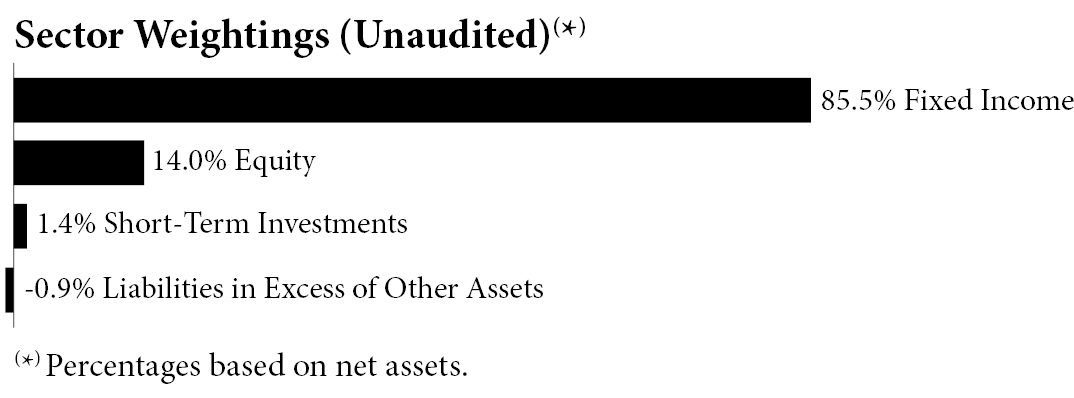

INVESTMENT COMPANIES — 99.5% | | | | | |

Equity — 14.0% | | | | | |

abrdn Total Dynamic Dividend Fund | | 1,505,002 | | $ | 12,476,467 |

Kayne Anderson Energy Infrastructure Fund | | 1,387,998 | | | 13,893,859 |

Liberty All-Star Equity Fund(a) | | 1,836,718 | | | 13,132,534 |

MainStay CBRE Global Infrastructure Megatrends Term Fund | | 927,433 | | | 11,657,833 |

Virtus Dividend Interest & Premium Strategy Fund | | 987,723 | | | 12,623,100 |

| | | | | | 63,783,793 |

Fixed Income — 85.5% | | | | | |

Aberdeen Asia-Pacific Income Fund,

Inc. | | 1,588,040 | | | 4,446,512 |

AllianceBernstein Global High Income Fund, Inc. | | 318,041 | | | 3,377,595 |

BlackRock Corporate High Yield Fund, Inc. | | 1,083,347 | | | 10,605,967 |

BlackRock Credit Allocation Income Trust | | 1,239,796 | | | 13,253,419 |

BlackRock Municipal Income Fund,

Inc. | | 432,048 | | | 5,210,499 |

BlackRock MuniHoldings California Quality Fund, Inc. | | 989,938 | | | 10,899,217 |

BlackRock MuniHoldings Fund, Inc. | | 388,323 | | | 4,690,942 |

BlackRock MuniHoldings New Jersey Quality Fund, Inc. | | 229,068 | | | 2,664,061 |

BlackRock MuniYield Fund, Inc. | | 209,986 | | | 2,322,445 |

BlackRock MuniYield Quality Fund III, Inc. | | 310,489 | | | 3,558,204 |

Blackstone Strategic Credit 2027 Term Fund | | 1,107,769 | | | 13,182,451 |

Brookfield Real Assets Income Fund,

Inc. | | 966,991 | | | 12,493,524 |

ClearBridge MLP & Midstream Fund, Inc. | | 267,804 | | | 12,260,067 |

DoubleLine Income Solutions Fund(a) | | 823,072 | | | 10,453,014 |

Description | | Shares | | Value |

Eagle Point Credit Co., Inc. | | 1,535,006 | | $ | 15,518,911 |

Eaton Vance Ltd. Duration Income

Fund | | 1,241,360 | | | 12,103,260 |

First Trust Intermediate Duration Preferred & Income Fund(a) | | 772,857 | | | 13,849,597 |

Flaherty & Crumrine Preferred and Income Securities Fund, Inc. | | 746,732 | | | 11,088,970 |

FS Credit Opportunities Corp. | | 2,017,301 | | | 11,962,595 |

Highland Opportunities and Income Fund | | 1,126,375 | | | 7,918,416 |

Invesco Senior Income Trust | | 2,670,995 | | | 11,431,859 |

Nuveen AMT-Free Municipal Credit Income Fund | | 556,441 | | | 6,760,758 |

Nuveen AMT-Free Quality Municipal Income Fund | | 702,802 | | | 7,780,018 |

Nuveen California Quality Municipal Income Fund | | 740,902 | | | 8,164,740 |

Nuveen Credit Strategies Income

Fund(a) | | 2,424,875 | | | 13,506,554 |

Nuveen Floating Rate Income Fund/Closed-end Fund | | 1,554,132 | | | 13,567,572 |

Nuveen Municipal Credit Income

Fund | | 623,345 | | | 7,629,743 |

Nuveen New York AMT-Free Quality Municipal Income Fund(a) | | 362,909 | | | 3,944,821 |

Nuveen Preferred & Income Opportunities Fund | | 1,854,872 | | | 13,336,530 |

Nuveen Quality Municipal Income

Fund | | 509,545 | | | 5,839,386 |

Oxford Lane Capital Corp.(a) | | 3,006,840 | | | 15,274,747 |

PIMCO Access Income Fund | | 977,581 | | | 15,377,349 |

PIMCO Corporate & Income Opportunity Fund | | 728,097 | | | 10,826,802 |

PIMCO Corporate & Income Strategy Fund(a) | | 186,295 | | | 2,602,541 |

Pimco Dynamic Income Fund(a) | | 840,641 | | | 16,215,966 |

PIMCO Dynamic Income Opportunities Fund(a) | | 1,167,822 | | | 15,380,216 |

PIMCO High Income Fund | | 1,363,283 | | | 6,734,618 |

PIMCO Income Strategy Fund II(a) | | 1,021,458 | | | 7,620,077 |

Western Asset Diversified Income

Fund | | 925,630 | | | 13,375,354 |

Western Asset Inflation-Linked Opportunities & Income Fund | | 1,394,776 | | | 12,036,917 |

| | | | | | 389,266,234 |

TOTAL INVESTMENT COMPANIES

(Cost $459,884,830) | | | | | 453,050,027 |

The accompanying notes are an integral part of the financial statements.

2

Amplify ETF Trust Amplify High Income ETF Schedule of Investments as of March 31, 2024 (Unaudited) (Continued) |

Description | | Shares | | Value |

SHORT-TERM INVESTMENTS — 1.4% | | | | | | |

Investments Purchased with Proceeds from Securities Lending — 1.3% | | | | | | |

First American Government Obligations Fund - Class X, 5.23%(b) | | 5,840,600 | | $ | 5,840,600 | |

Money Market Funds — 0.1% | | | | | | |

Invesco Government & Agency Portfolio - Institutional

Class, 5.24%(b) | | 428,528 | | | 428,528 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $6,269,128) | | | | | 6,269,128 | |

| | | | | | | |

TOTAL INVESTMENTS — 100.9%

(Cost $466,153,958) | | | | | 459,319,155 | |

Liabilities in Excess of Other Assets — (0.9)% | | | | | (4,141,992 | ) |

TOTAL NET ASSETS — 100.0% | | | | $ | 455,177,163 | |

The accompanying notes are an integral part of the financial statements.

3

Amplify ETF Trust Amplify Online Retail ETF Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | Shares | | Value |

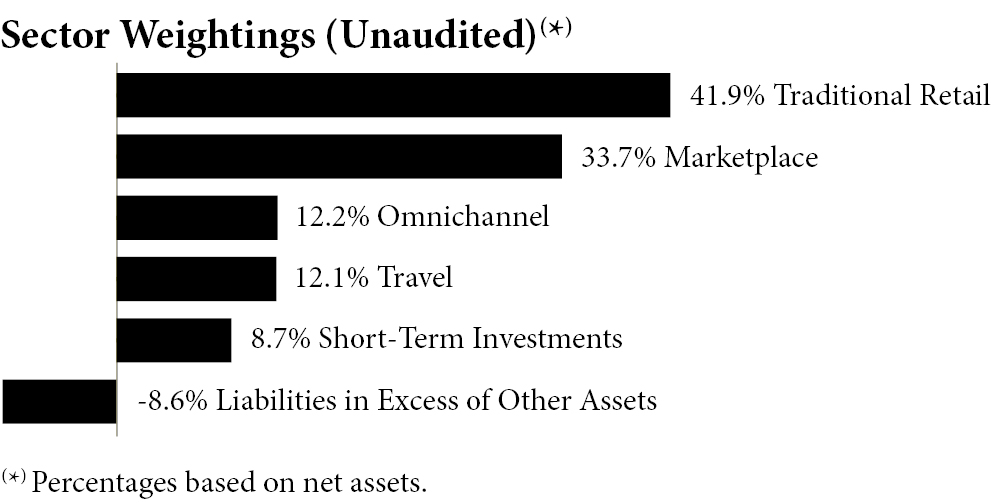

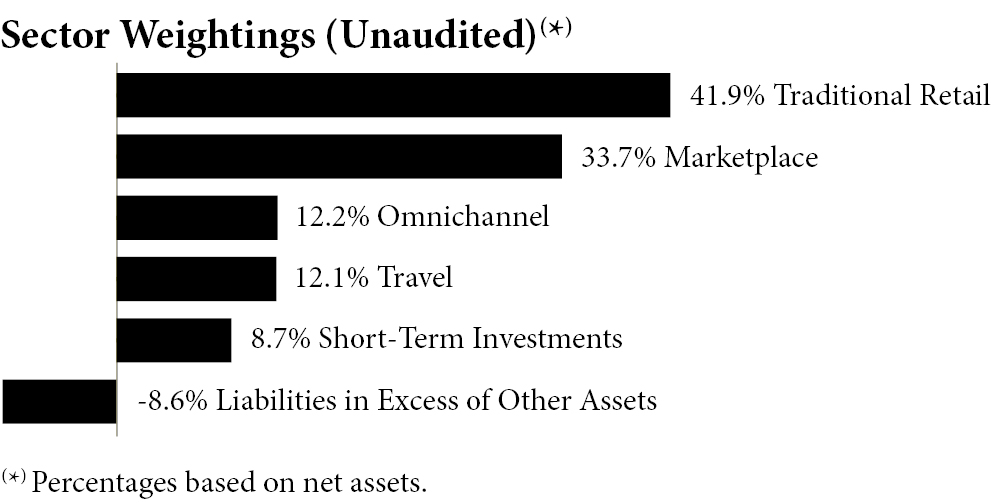

COMMON STOCKS — 99.9% | | | | | |

Marketplace — 33.7% | | | | | |

Affirm Holdings, Inc.(a) | | 168,455 | | $ | 6,276,634 |

Alibaba Group Holding Ltd. | | 123,900 | | | 1,112,123 |

BigCommerce Holdings, Inc.(a) | | 334,432 | | | 2,304,236 |

Copart, Inc.(a) | | 67,699 | | | 3,921,126 |

Coupang, Inc.(a) | | 187,747 | | | 3,340,019 |

Delivery Hero SE(a)(b)(c) | | 48,068 | | | 1,376,479 |

DoorDash, Inc. - Class A(a) | | 39,086 | | | 5,382,924 |

Etsy, Inc.(a) | | 48,903 | | | 3,360,614 |

Fiverr International Ltd.(a)(d) | | 60,429 | | | 1,273,239 |

Global-e Online Ltd.(a) | | 35,737 | | | 1,299,040 |

JD.com, Inc. - Class A | | 98,200 | | | 1,353,842 |

KE Holdings, Inc. - ADR | | 83,649 | | | 1,148,501 |

Maplebear, Inc.(a)(d) | | 118,424 | | | 4,416,031 |

Meituan - Class B(a)(b)(c) | | 89,000 | | | 1,100,780 |

MercadoLibre, Inc.(a) | | 954 | | | 1,442,410 |

Ozon Holdings PLC - ADR(a)(d)(e) | | 106,678 | | | 0 |

PayPal Holdings, Inc.(a) | | 57,425 | | | 3,846,901 |

PDD Holdings, Inc. - ADR(a) | | 12,035 | | | 1,399,069 |

Sea Ltd. - ADR(a) | | 30,634 | | | 1,645,352 |

Shopify, Inc. - Class A(a) | | 25,390 | | | 1,959,345 |

Uber Technologies, Inc.(a) | | 67,681 | | | 5,210,760 |

Upwork, Inc.(a) | | 297,241 | | | 3,644,175 |

Vivid Seats, Inc. - Class A(a) | | 517,697 | | | 3,101,005 |

VTEX - Class A(a) | | 228,560 | | | 1,867,335 |

| | | | | | 61,781,940 |

Omnichannel — 12.2% | | | | | |

Apple, Inc. | | 4,408 | | | 755,884 |

Best Buy Co., Inc. | | 11,740 | | | 963,032 |

Dick’s Sporting Goods, Inc. | | 7,152 | | | 1,608,199 |

Gap, Inc. | | 59,571 | | | 1,641,180 |

H & M Hennes & Mauritz AB - Class B | | 92,352 | | | 1,507,848 |

Home Depot, Inc. | | 2,691 | | | 1,032,268 |

Industria de Diseno Textil SA | | 35,549 | | | 1,791,790 |

Kohl’s Corp. | | 34,868 | | | 1,016,402 |

Description | | Shares | | Value |

Kroger Co. | | 16,959 | | $ | 968,868 |

Lululemon Athletica, Inc.(a) | | 1,940 | | | 757,861 |

Macy’s, Inc. | | 63,947 | | | 1,278,301 |

Next PLC | | 8,898 | | | 1,037,712 |

NIKE, Inc. - Class B | | 7,611 | | | 715,282 |

Nordstrom, Inc. | | 55,004 | | | 1,114,931 |

Tapestry, Inc. | | 29,075 | | | 1,380,481 |

Target Corp. | | 7,061 | | | 1,251,280 |

Ulta Beauty, Inc.(a) | | 2,039 | | | 1,066,152 |

Walmart, Inc. | | 13,989 | | | 841,718 |

Williams-Sonoma, Inc. | | 5,140 | | | 1,632,104 |

| | | | | | 22,361,293 |

Traditional — 41.9% | | | | | |

1-800-Flowers.com, Inc. - Class A(a) | | 383,752 | | | 4,156,034 |

Allegro.eu SA(a)(b)(c) | | 173,493 | | | 1,439,412 |

Amazon.com, Inc.(a) | | 21,658 | | | 3,906,670 |

ASKUL Corp. | | 95,400 | | | 1,386,765 |

Beyond, Inc.(a) | | 194,394 | | | 6,980,689 |

Carvana Co.(a)(d) | | 114,141 | | | 10,034,135 |

Chegg, Inc.(a) | | 395,518 | | | 2,994,071 |

Chewy, Inc. - Class A(a) | | 154,984 | | | 2,465,795 |

eBay, Inc. | | 77,112 | | | 4,069,971 |

Figs, Inc. - Class A(a) | | 560,760 | | | 2,792,585 |

HelloFresh SE(a) | | 55,967 | | | 398,448 |

Hims & Hers Health, Inc.(a) | | 503,632 | | | 7,791,187 |

IAC, Inc.(a) | | 70,512 | | | 3,761,110 |

Netflix, Inc.(a) | | 7,060 | | | 4,287,750 |

Ocado Group PLC(a) | | 214,233 | | | 1,231,635 |

Revolve Group, Inc.(a)(d) | | 219,739 | | | 4,651,875 |

Shutterstock, Inc. | | 79,968 | | | 3,663,334 |

Spotify Technology SA(a) | | 7,392 | | | 1,950,749 |

Vipshop Holdings Ltd. - ADR | | 86,387 | | | 1,429,705 |

Wayfair, Inc. - Class A(a) | | 66,848 | | | 4,537,642 |

Zalando SE(a)(b)(c) | | 52,655 | | | 1,506,411 |

ZOZO, Inc. | | 63,700 | | | 1,577,085 |

| | | | | | 77,013,058 |

Travel — 12.1% | | | | | |

Airbnb, Inc. - Class A(a) | | 24,830 | | | 4,095,957 |

Booking Holdings, Inc. | | 1,072 | | | 3,889,087 |

Expedia Group, Inc.(a) | | 31,811 | | | 4,381,965 |

MakeMyTrip Ltd.(a) | | 32,593 | | | 2,315,733 |

Trip.com Group Ltd.(a) | | 37,250 | | | 1,642,980 |

TripAdvisor, Inc.(a) | | 207,585 | | | 5,768,788 |

| | | | | | 22,094,510 |

TOTAL COMMON STOCKS (Cost $225,312,082) | | | | | 183,250,801 |

The accompanying notes are an integral part of the financial statements.

4

Amplify ETF Trust Amplify Online Retail ETF Schedule of Investments as of March 31, 2024 (Unaudited) (Continued) |

Description | | Shares | | Value |

SHORT-TERM INVESTMENTS — 8.7% | | | | | | |

Investments Purchased with Proceeds from Securities Lending — 8.6% | | | | | | |

First American Government Obligations Fund - Class X, 5.23%(f) | | 15,824,515 | | $ | 15,824,515 | |

Money Market Funds — 0.1% | | | | | | |

Invesco Government & Agency Portfolio - Institutional

Class, 5.24%(f) | | 142,275 | | | 142,275 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $15,966,790) | | | | | 15,966,790 | |

| | | | | | | |

TOTAL INVESTMENTS — 108.6%

(Cost $241,278,872) | | | | | 199,217,591 | |

Liabilities in Excess of Other Assets — (8.6)% | | | | | (15,805,434 | ) |

TOTAL NET ASSETS — 100.0% | | | | $ | 183,412,157 | |

The accompanying notes are an integral part of the financial statements.

5

Amplify ETF Trust Amplify CWP Enhanced Dividend Income ETF Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | Shares | | Value |

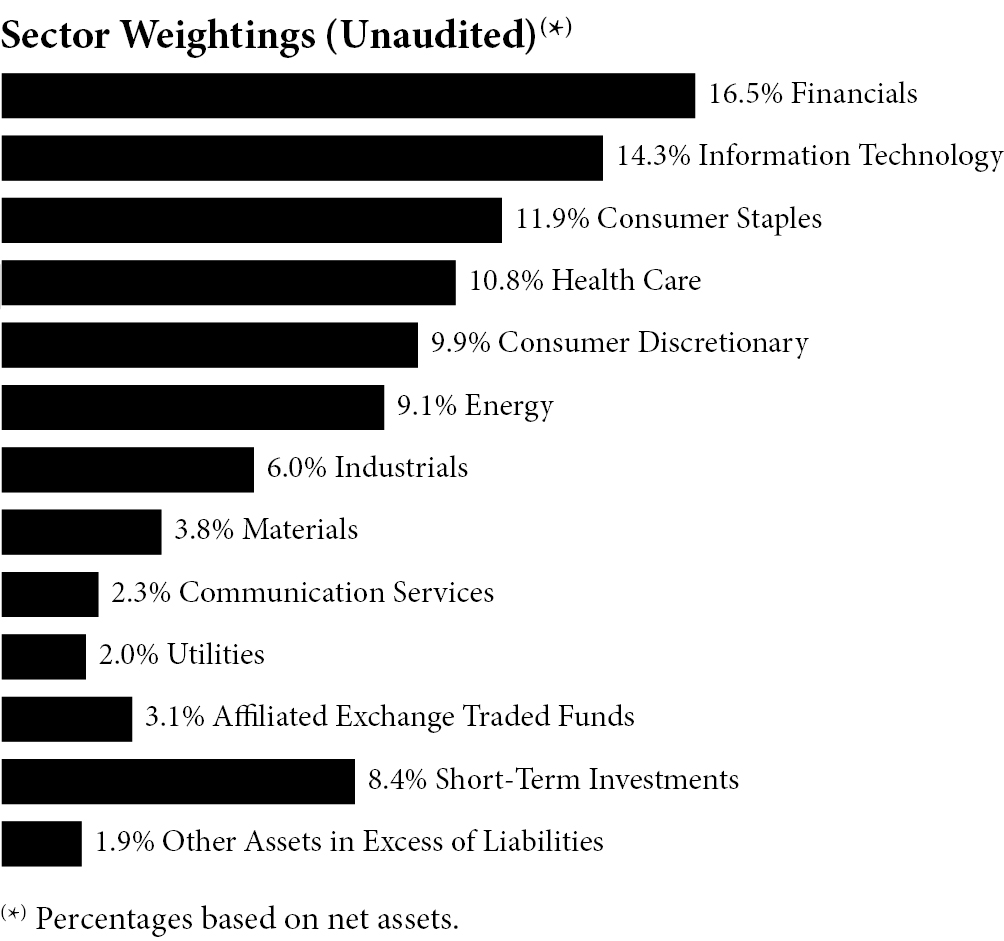

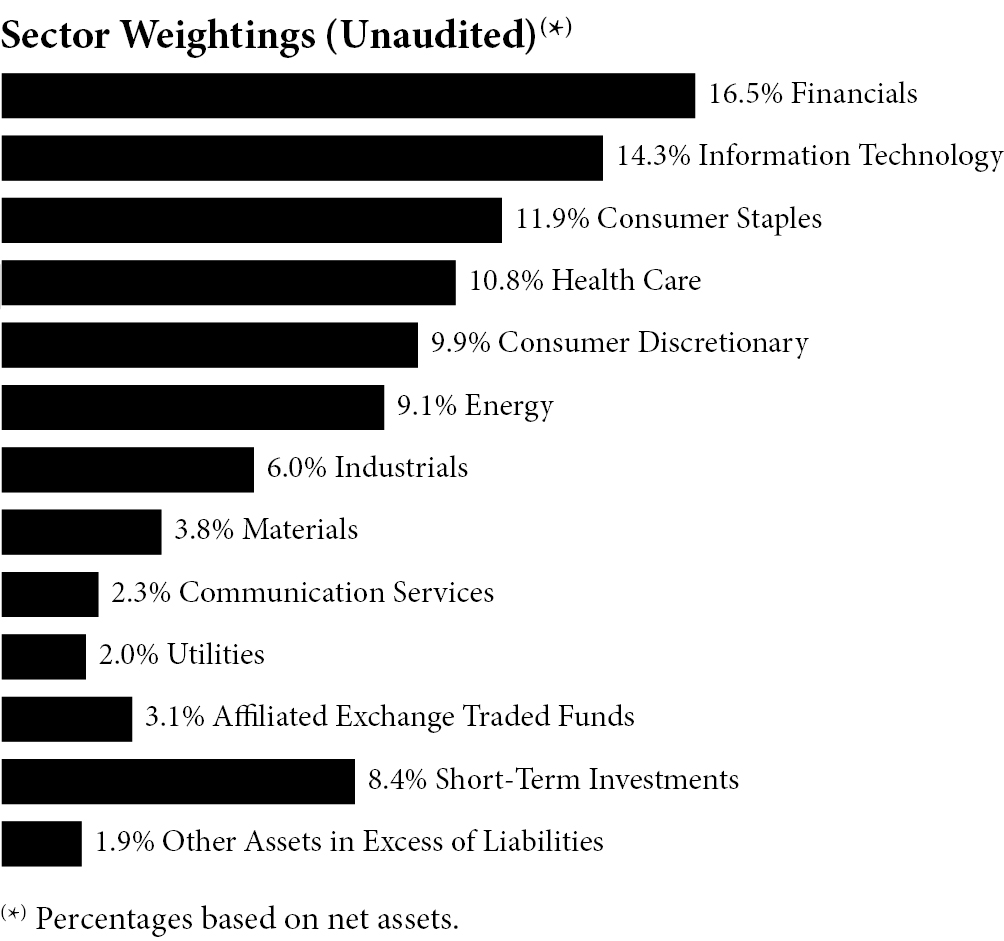

COMMON STOCKS — 86.6% | | | | | |

Communication Services — 2.3% | | | | | |

Verizon Communications, Inc. | | 1,712,386 | | $ | 71,851,717 |

Consumer Discretionary — 9.9% | | | | | |

Home Depot, Inc. | | 440,377 | | | 168,928,617 |

McDonald’s Corp.(a) | | 507,362 | | | 143,050,716 |

| | | | | | 311,979,333 |

Consumer Staples — 11.9% | | | | | |

Coca-Cola Co. | | 1,038,965 | | | 63,563,879 |

Procter & Gamble Co. | | 963,004 | | | 156,247,399 |

Walmart, Inc.(a) | | 2,607,785 | | | 156,910,423 |

| | | | | | 376,721,701 |

Energy — 9.1% | | | | | |

Chevron Corp.(a) | | 974,265 | | | 153,680,561 |

ConocoPhillips | | 482,597 | | | 61,424,946 |

Marathon Petroleum Corp. | | 367,356 | | | 74,022,234 |

| | | | | | 289,127,741 |

Financials — 16.5% | | | | | |

CME Group, Inc. | | 492,918 | | | 106,120,316 |

Goldman Sachs Group, Inc. | | 373,728 | | | 156,102,448 |

JPMorgan Chase & Co. | | 512,382 | | | 102,630,115 |

Visa, Inc. - Class A(a) | | 567,483 | | | 158,373,156 |

| | | | | | 523,226,035 |

Health Care — 10.8% | | | | | |

Amgen, Inc. | | 275,396 | | | 78,300,591 |

Merck & Co., Inc. | | 785,793 | | | 103,685,386 |

UnitedHealth Group, Inc. | | 323,080 | | | 159,827,676 |

| | | | | | 341,813,653 |

Description | | Shares | | Value |

Industrials — 6.0% | | | | | |

Caterpillar, Inc. | | 332,158 | | $ | 121,712,656 |

Deere & Co. | | 166,649 | | | 68,449,410 |

| | | | | | 190,162,066 |

Information Technology — 14.3% | | | | | |

Apple, Inc. | | 531,329 | | | 91,112,297 |

Broadcom, Inc. | | 23,835 | | | 31,591,147 |

Cisco Systems, Inc. | | 1,260,533 | | | 62,913,202 |

International Business Machines Corp. | | 475,784 | | | 90,855,713 |

Microsoft Corp. | | 414,667 | | | 174,458,700 |

| | | | | | 450,931,059 |

Materials — 3.8% | | | | | |

Agnico Eagle Mines Ltd.(a) | | 859,456 | | | 51,266,550 |

Freeport-McMoRan, Inc. | | 1,455,615 | | | 68,443,018 |

| | | | | | 119,709,568 |

Utilities — 2.0% | | | | | |

Duke Energy Corp.(a) | | 643,487 | | | 62,231,628 |

TOTAL COMMON STOCKS (Cost $2,346,549,383) | | | | | 2,737,754,501 |

| | | | | | |

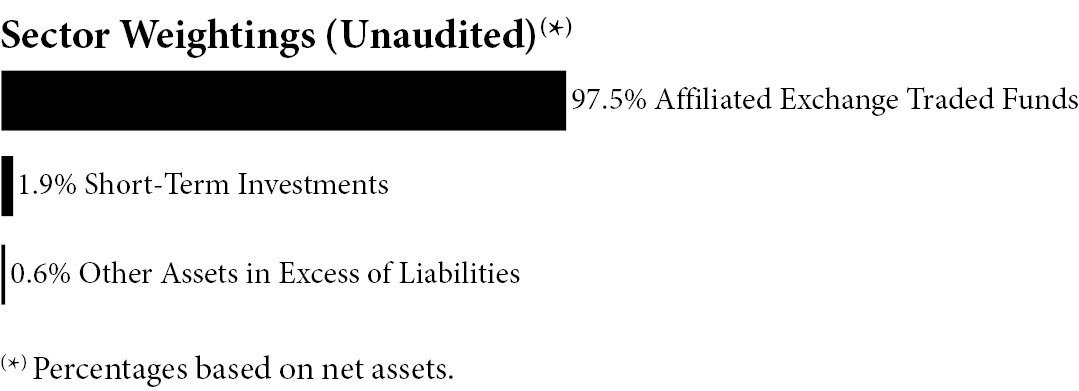

AFFILIATED EXCHANGE TRADED FUNDS — 3.1% | | | | | |

Amplify Samsung SOFR ETF(b)(c) | | 986,646 | | | 98,926,061 |

TOTAL AFFILIATED EXCHANGE TRADED FUNDS

(Cost $99,022,082) | | | | | 98,926,061 |

| | | | | | |

SHORT-TERM INVESTMENTS — 8.4% | | | | | |

Investments Purchased with Proceeds from Securities

Lending — 0.0%(d) | | | | | |

First American Government Obligations Fund - Class X,

5.23%(e) | | 73,831 | | | 73,831 |

Money Market Funds — 8.4% | | | | | |

Invesco Government & Agency Portfolio - Institutional Class,

5.24%(e) | | 264,406,249 | | | 264,406,249 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $264,480,080) | | | | | 264,480,080 |

| | | | | | |

TOTAL INVESTMENTS — 98.1%

(Cost $2,710,051,545) | | | | | 3,101,160,642 |

Other Assets in Excess of

Liabilities — 1.9% | | | | | 59,095,014 |

TOTAL NET ASSETS — 100.0% | | | | $ | 3,160,255,656 |

The accompanying notes are an integral part of the financial statements.

6

Amplify ETF Trust Amplify CWP Enhanced Dividend Income ETF Schedule of Investments as of March 31, 2024 (Unaudited) (Continued) |

The accompanying notes are an integral part of the financial statements.

7

Amplify ETF Trust Amplify CWP Enhanced Dividend Income ETF Schedule of Options Written as of March 31, 2024 (Unaudited) |

| | Notional

Amount | | Contracts | | Value |

CALL OPTIONS WRITTEN — (0.1)%(a)(b) | | | | | | | | | | | |

Agnico Eagle Mines Ltd., Expiration: 04/19/2024; Exercise Price: $60.00 | | $ | (43,437,130 | ) | | (7,282 | ) | | $ | (1,001,275 | ) |

Chevron Corp.,

Expiration: 04/19/2024; Exercise Price: $157.50 | | | (86,757,000 | ) | | (5,500 | ) | | | (1,540,000 | ) |

Duke Energy Corp., Expiration: 04/19/2024; Exercise Price: $100.00 | | | (10,638,100 | ) | | (1,100 | ) | | | (27,500 | ) |

McDonald’s Corp., Expiration: 04/19/2024; Exercise Price: $295.00 | | | (119,828,750 | ) | | (4,250 | ) | | | (140,250 | ) |

Visa, Inc.,

Expiration: 04/19/2024; Exercise Price: $287.50 | | | (118,609,000 | ) | | (4,250 | ) | | | (476,000 | ) |

Walmart, Inc.,

Expiration: 04/12/2024; Exercise Price: $62.00 | | | (84,238,000 | ) | | (14,000 | ) | | | (147,000 | ) |

TOTAL OPTIONS WRITTEN

(Premiums received $3,609,058) | | | | | | | | | $ | (3,332,025 | ) |

The accompanying notes are an integral part of the financial statements.

8

Amplify ETF Trust Amplify Transformational Data Sharing ETF Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | Shares | | Value |

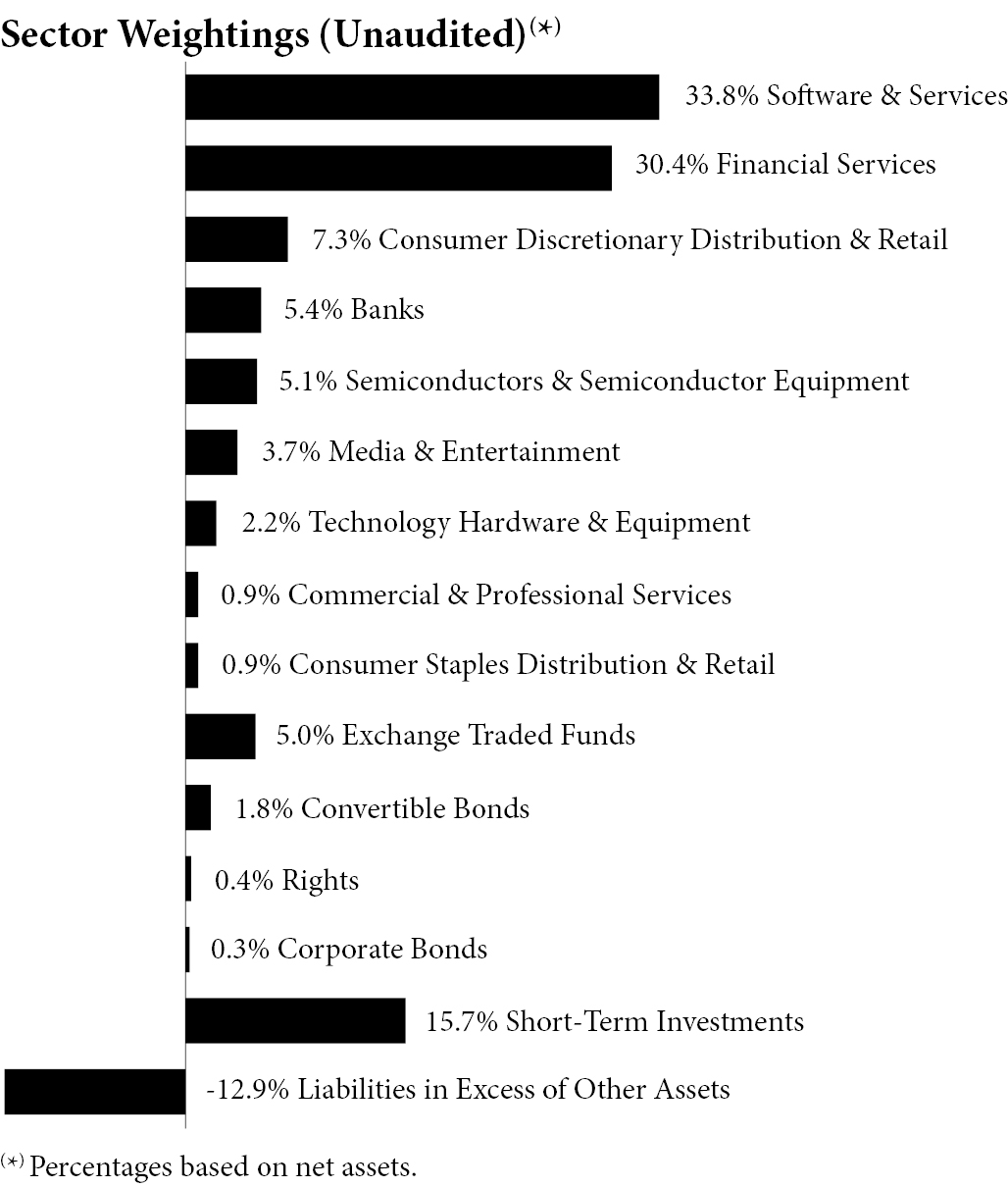

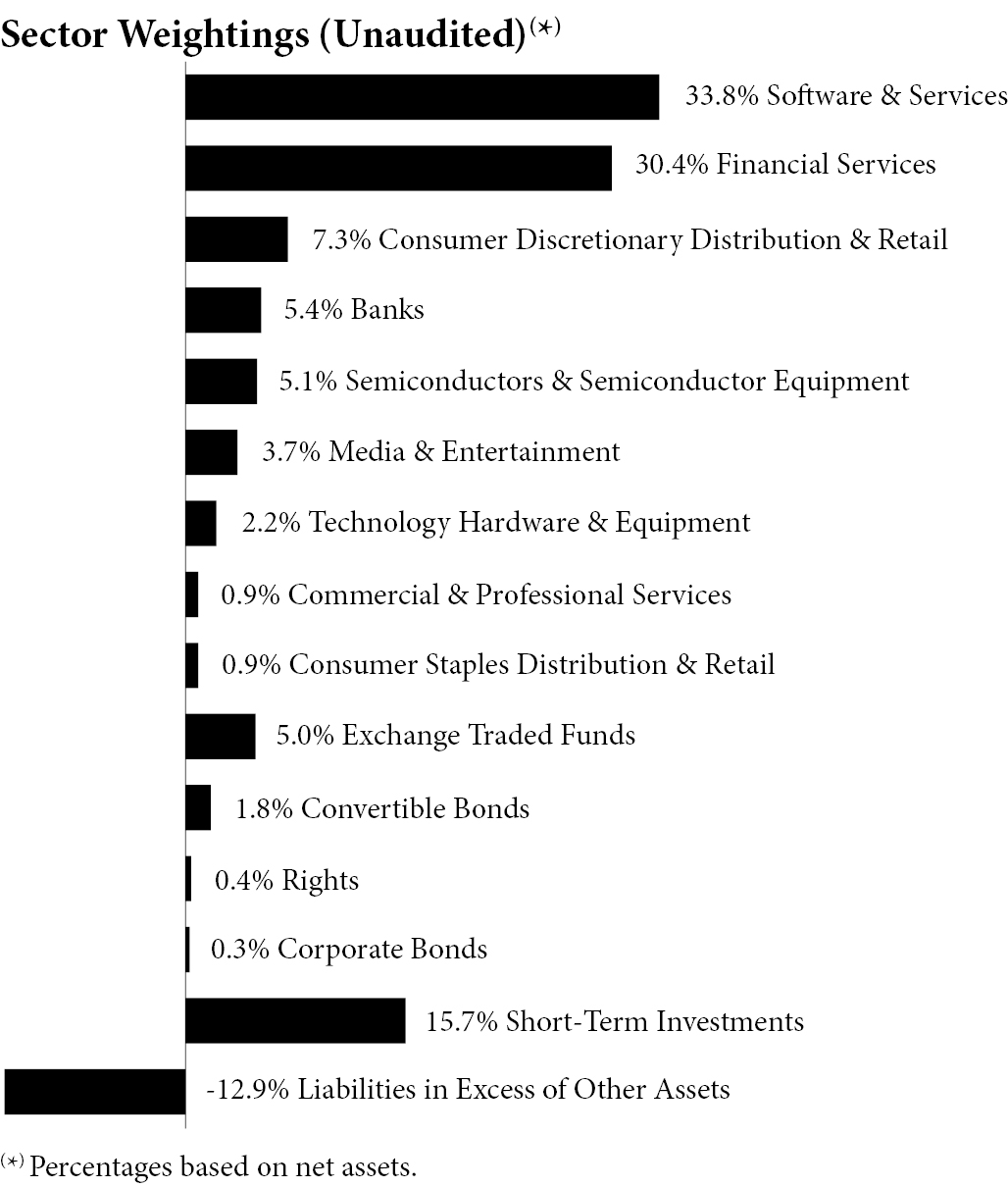

COMMON STOCKS — 89.7% | | | | | |

Banks — 5.4% | | | | | |

Customers Bancorp, Inc.(a) | | 197,290 | | $ | 10,468,207 |

DBS Group Holdings Ltd. | | 323,138 | | | 8,622,597 |

NU Holdings Ltd./Cayman Islands - Class A(a) | | 1,849,825 | | | 22,068,412 |

| | | | | | 41,159,216 |

Commercial & Professional Services — 0.9% | | | | | |

CACI International, Inc.(a) | | 18,720 | | | 7,091,698 |

Consumer Discretionary Distribution & Retail — 7.3% | | | | | |

Alibaba Group Holding Ltd. - ADR | | 97,053 | | | 7,022,755 |

Beyond, Inc.(a) | | 927,611 | | | 33,310,512 |

MercadoLibre, Inc.(a) | | 9,696 | | | 14,659,964 |

| | | | | | 54,993,231 |

Consumer Staples Distribution & Retail — 0.9% | | | | | |

Walmart, Inc. | | 116,355 | | | 7,001,080 |

Financial Services — 30.4% | | | | | |

BlackRock, Inc. | | 13,923 | | | 11,607,605 |

Block, Inc.(a) | | 271,472 | | | 22,961,102 |

CME Group, Inc. | | 73,870 | | | 15,903,472 |

Description | | Shares | | Value |

Coinbase Global, Inc. - Class A(a) | | 130,106 | | $ | 34,493,703 |

Franklin Resources, Inc. | | 261,538 | | | 7,351,833 |

Galaxy Digital Holdings Ltd.(a) | | 3,584,876 | | | 38,295,490 |

Mastercard, Inc. - Class A | | 18,022 | | | 8,678,854 |

Mogo, Inc.(a)(b) | | 1,352,143 | | | 2,704,286 |

PayPal Holdings, Inc.(a) | | 373,220 | | | 25,002,008 |

Robinhood Markets, Inc. - Class A(a) | | 1,302,872 | | | 26,226,813 |

SBI Holdings, Inc. | | 890,574 | | | 23,267,408 |

Visa, Inc. - Class A | | 26,024 | | | 7,262,778 |

WisdomTree, Inc. | | 462,682 | | | 4,252,048 |

| | | | | | 228,007,400 |

Media & Entertainment — 3.7% | | | | | |

LY Corp. | | 2,634,740 | | | 6,657,339 |

ROBLOX Corp. - Class A(a) | | 541,800 | | | 20,685,924 |

| | | | | | 27,343,263 |

Semiconductors & Semiconductor Equipment — 5.1% | | | | | |

Advanced Micro Devices, Inc.(a) | | 78,782 | | | 14,219,363 |

Broadcom, Inc. | | 4,963 | | | 6,578,010 |

QUALCOMM, Inc. | | 41,644 | | | 7,050,329 |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | 79,922 | | | 10,873,388 |

| | | | | | 38,721,090 |

Software & Services — 33.8% | | | | | |

Accenture PLC - Class A | | 44,567 | | | 15,447,368 |

BIGG Digital Assets, Inc.(a)(b) | | 6,353,087 | | | 867,684 |

Bitfarms Ltd./Canada(a)(b) | | 6,942,531 | | | 15,481,844 |

Cipher Mining, Inc.(a)(b) | | 2,233,737 | | | 11,503,744 |

Cleanspark, Inc.(a) | | 1,183,456 | | | 25,101,102 |

Core Scientific, Inc.(a)(b) | | 3,383,550 | | | 11,977,767 |

Digital Garage, Inc. | | 416,452 | | | 9,023,402 |

GMO internet group, Inc. | | 939,412 | | | 16,960,055 |

Hive Digital Technologies Ltd.(a)(b) | | 3,452,957 | | | 11,636,465 |

Hut 8 Corp.(a)(b) | | 1,555,273 | | | 17,170,214 |

International Business Machines Corp. | | 111,166 | | | 21,228,259 |

Marathon Digital Holdings, Inc.(a)(b) | | 1,104,594 | | | 24,941,732 |

MicroStrategy, Inc.(a)(b) | | 19,786 | | | 33,726,424 |

Opera Ltd. - ADR(b) | | 438,049 | | | 6,925,555 |

Oracle Corp. | | 87,051 | | | 10,934,476 |

Riot Platforms, Inc.(a)(b) | | 1,660,683 | | | 20,326,760 |

| | | | | | 253,252,852 |

Technology Hardware &

Equipment — 2.2% | | | |

Canaan, Inc. - ADR(a)(b) | | 2,651,419 | | | 4,030,157 |

CompoSecure, Inc. - Class A(a) | | 1,721,693 | | | 12,447,840 |

| | | | | | 16,477,997 |

TOTAL COMMON STOCKS

(Cost $757,086,432) | | | | | 674,047,827 |

The accompanying notes are an integral part of the financial statements.

9

Amplify ETF Trust Amplify Transformational Data Sharing ETF Schedule of Investments as of March 31, 2024 (Unaudited) (Continued) |

Description | | Shares | | Value |

EXCHANGE TRADED FUNDS — 5.0% | | | | | |

3iQ Bitcoin ETF(a) | | 292,525 | | $ | 3,336,541 |

Bitcoin ETF(a) | | 115,361 | | | 2,961,317 |

CI Galaxy Bitcoin ETF(a) | | 1,254,170 | | | 16,655,377 |

Purpose Bitcoin ETF(a)(b) | | 1,125,675 | | | 14,487,437 |

TOTAL EXCHANGE TRADED FUNDS

(Cost $24,402,112) | | | | | 37,440,672 |

| | Par | | |

CONVERTIBLE BONDS — 1.8% | | | | | | | |

Core Scientific, Inc., 4.00% Cash and 12.00% PIK, 01/23/2029(a) | | $ | 14,836,015 | | | 13,222,598 | |

TOTAL CONVERTIBLE BONDS

(Cost $14,836,015) | | | | | | 13,222,598 | |

| | | | | | | | |

| | | Contracts | | |

RIGHTS — 0.4% | | | | | | | |

Core Scientific, Inc.(a) | | | 3,409,449 | | | 2,727,559 | |

TOTAL RIGHTS

(Cost $0) | | | | | | 2,727,559 | |

| | | | | | | | |

| | | Par | | |

CORPORATE BONDS — 0.3% | | | | | | | |

MicroStrategy, Inc., 6.13%, 06/15/2028(a)(c) | | $ | 2,000,000 | | | 1,934,258 | |

TOTAL CORPORATE BONDS

(Cost $1,591,694) | | | | | | 1,934,258 | |

| | | | | | | | |

| | | | Shares | | | | |

SHORT-TERM INVESTMENTS — 15.7% | | | | | | | |

Investments Purchased with Proceeds from Securities Lending — 14.1% | | | | | | | |

First American Government Obligations Fund - Class X, 5.23%(d) | | | 106,201,451 | | | 106,201,451 | |

Money Market Funds — 1.6% | | | | | | | |

Invesco Government & Agency Portfolio - Institutional Class, 5.24%(d) | | | 11,800,634 | | | 11,800,634 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $118,002,085) | | | | | | 118,002,085 | |

| | | | | | | | |

TOTAL INVESTMENTS — 112.9%

(Cost $915,918,338) | | | | | | 847,374,999 | |

Liabilities in Excess of Other Assets — (12.9)% | | | | | | (96,812,122 | ) |

TOTAL NET ASSETS — 100.0% | | | | | $ | 750,562,877 | |

Percentages are stated as a percent of net assets.

ADR - American Depositary Receipt

PIK - Payment in Kind

PLC - Public Limited Company

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

(a) Non-income producing security.

(b) All or a portion of this security is on loan as of March 31, 2024. The total market value of these securities was $98,438,702 which represented 13.1% of net assets.

(c) Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of March 31, 2024, the value of these securities total $1,934,258 or 0.3% of the Fund’s net assets.

(d) The rate shown represents the 7-day effective yield as of March 31, 2024.

The accompanying notes are an integral part of the financial statements.

10

Amplify ETF Trust Amplify Lithium & Battery Technology ETF Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | Shares | | Value |

COMMON STOCKS — 99.4% | | | | | |

Consumer Discretionary — 20.3% | | | | | |

BAIC Motor Corp. Ltd. -

Class H(a)(b) | | 651,894 | | $ | 178,238 |

BYD Co. Ltd. | | 173,060 | | | 4,457,563 |

EVgo, Inc.(c)(d) | | 222,930 | | | 559,554 |

Li Auto, Inc. - ADR(c) | | 60,756 | | | 1,839,691 |

Lucid Group, Inc.(c)(d) | | 153,251 | | | 436,765 |

NIO, Inc. - ADR(c)(d) | | 126,061 | | | 567,275 |

Description | | Shares | | Value |

Panasonic Holdings Corp. | | 193,782 | | $ | 1,841,428 |

Polestar Automotive Holding UK PLC - ADR(c)(d) | | 170,730 | | | 262,924 |

QuantumScape Corp.(c)(d) | | 40,037 | | | 251,833 |

Rivian Automotive, Inc. - Class A(c) | | 61,109 | | | 669,144 |

Tesla, Inc.(c) | | 30,479 | | | 5,357,904 |

Vinfast Auto Ltd.(c)(d) | | 153,560 | | | 763,193 |

XPeng, Inc. - ADR(c) | | 61,382 | | | 471,414 |

Yadea Group Holdings Ltd.(a)(b) | | 236,766 | | | 383,574 |

Zhejiang Leapmotor Technology Co. Ltd.(a)(b)(c) | | 100,016 | | | 335,435 |

| | | | | | 18,375,935 |

Industrials — 26.9%(e) | | | | | |

Advanced Energy Solution Holding Co. Ltd. | | 28,442 | | | 615,880 |

ChargePoint Holdings, Inc.(c)(d) | | 249,787 | | | 474,595 |

Contemporary Amperex Technology Co. Ltd. | | 263,244 | | | 6,875,897 |

Ecopro BM Co. Ltd.(c) | | 8,858 | | | 1,825,883 |

EnerSys | | 7,078 | | | 668,588 |

Enovix Corp.(c)(d) | | 56,175 | | | 449,962 |

FuelCell Energy, Inc.(c)(d) | | 397,854 | | | 473,446 |

GS Yuasa Corp. | | 35,713 | | | 740,305 |

Kempower Oyj(c)(d) | | 18,495 | | | 410,641 |

L&F Co. Ltd.(c) | | 7,292 | | | 954,392 |

LG Energy Solution Ltd.(c) | | 15,232 | | | 4,542,728 |

Microvast Holdings, Inc.(c)(d) | | 516,358 | | | 432,192 |

Nikola Corp.(c)(d) | | 703,811 | | | 731,963 |

Plug Power, Inc.(c)(d) | | 136,704 | | | 470,262 |

Shin Heung Energy & Electronics Co. Ltd. | | 15,090 | | | 696,074 |

SK IE Technology Co. Ltd.(a)(b)(c) | | 14,162 | | | 768,982 |

Sociedad Quimica y Minera de Chile SA - ADR(d) | | 27,709 | | | 1,362,174 |

Varta AG(c)(d) | | 28,817 | | | 460,277 |

Vitzrocell Co. Ltd. | | 38,909 | | | 538,729 |

Wallbox NV(c)(d) | | 308,275 | | | 437,751 |

W-Scope Corp.(c) | | 90,696 | | | 326,525 |

| | | | | | 24,257,246 |

Information Technology — 12.0% | | | | | |

Dynapack International Technology Corp. | | 179,984 | | | 534,269 |

Lotte Energy Materials Corp. | | 21,792 | | | 808,550 |

NAURA Technology Group Co. Ltd. | | 43,864 | | | 1,861,327 |

NEC Corp. | | 23,460 | | | 1,707,041 |

Phoenix Silicon International Corp. | | 299,199 | | | 481,471 |

Power Logics Co. Ltd.(c) | | 57,951 | | | 390,429 |

Samsung SDI Co. Ltd. | | 5,668 | | | 2,010,377 |

The accompanying notes are an integral part of the financial statements.

11

Amplify ETF Trust Amplify Lithium & Battery Technology ETF Schedule of Investments as of March 31, 2024 (Unaudited) (Continued) |

Description | | Shares | | Value |

Simplo Technology Co. Ltd. | | 49,848 | | $ | 703,247 |

SolarEdge Technologies, Inc.(c) | | 10,034 | | | 712,213 |

TDK Corp. | | 31,886 | | | 1,557,018 |

| | | | | | 10,765,942 |

Materials — 40.2%(e) | | | | | |

African Rainbow Minerals Ltd. | | 61,267 | | | 532,059 |

Albemarle Corp. | | 10,775 | | | 1,419,498 |

Alpha HPA Ltd.(c) | | 952,242 | | | 546,064 |

AMG Critical Materials NV | | 24,275 | | | 551,020 |

Aneka Tambang Tbk | | 6,355,908 | | | 641,404 |

Arcadium Lithium PLC(c) | | 4,372 | | | 19,316 |

BHP Group Ltd. - ADR(d) | | 96,372 | | | 5,559,701 |

CMOC Group Ltd. - Class H | | 2,524,517 | | | 2,144,915 |

Core Lithium Ltd.(c) | | 4,038,626 | | | 407,923 |

Eramet SA | | 8,500 | | | 646,044 |

First Quantum Minerals Ltd. | | 90,078 | | | 968,245 |

Ganfeng Lithium Group Co. Ltd. - Class H(a)(b) | | 361,827 | | | 1,107,176 |

Glencore PLC | | 810,914 | | | 4,455,267 |

IGO Ltd. | | 148,767 | | | 685,392 |

Ivanhoe Electric, Inc./US(c)(d) | | 62,282 | | | 610,364 |

Jinchuan Group International Resources Co. Ltd. | | 7,091,335 | | | 742,937 |

Johnson Matthey PLC | | 33,538 | | | 757,282 |

Leo Lithium Ltd.(c)(f) | | 742,011 | | | 0 |

Liontown Resources Ltd.(c) | | 926,034 | | | 706,035 |

Lithium Americas Argentina Corp.(c) | | 119,143 | | | 642,181 |

Lithium Americas Corp.(c)(d) | | 120,949 | | | 812,777 |

Lundin Mining Corp. | | 101,294 | | | 1,036,458 |

Mineral Resources Ltd. | | 24,219 | | | 1,118,490 |

MMC Norilsk Nickel PJSC - ADR(c)(f) | | 182,937 | | | 0 |

MP Materials Corp.(c) | | 37,670 | | | 538,681 |

Nickel Industries Ltd. | | 1,289,654 | | | 680,725 |

Patriot Battery Metals, Inc.(c) | | 112,005 | | | 697,060 |

Pilbara Minerals Ltd. | | 387,291 | | | 966,606 |

Resonac Holdings Corp. | | 34,055 | | | 788,723 |

Sayona Mining Ltd.(c) | | 18,212,101 | | | 462,848 |

Sigma Lithium Corp.(c)(d) | | 38,698 | | | 501,526 |

South32 Ltd. | | 496,540 | | | 970,708 |

Standard Lithium Ltd.(c) | | 308,016 | | | 363,459 |

Sumitomo Metal Mining Co. Ltd. | | 34,930 | | | 1,034,425 |

Tianqi Lithium Corp. | | 235,914 | | | 1,097,148 |

TMC the metals co., Inc.(c)(d) | | 365,385 | | | 522,501 |

Umicore SA | | 35,146 | | | 758,158 |

Vale Indonesia Tbk PT | | 2,574,504 | | | 660,879 |

| | | | | | 36,153,995 |

TOTAL COMMON STOCKS

(Cost $121,452,439) | | | | | 89,553,118 |

Description | | Shares | | Value |

SHORT-TERM INVESTMENTS — 19.4% | | | | | | |

Investments Purchased with Proceeds from Securities Lending — 19.2% | | | | | | |

First American Government Obligations Fund - Class X, 5.23%(g) | | 17,317,647 | | $ | 17,317,647 | |

Money Market Funds — 0.2% | | | | | | |

Invesco Government & Agency Portfolio - Institutional

Class, 5.24%(g) | | 165,505 | | | 165,505 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $17,483,152) | | | | | 17,483,152 | |

| | | | | | | |

TOTAL INVESTMENTS — 118.8%

(Cost $138,935,591) | | | | | 107,036,270 | |

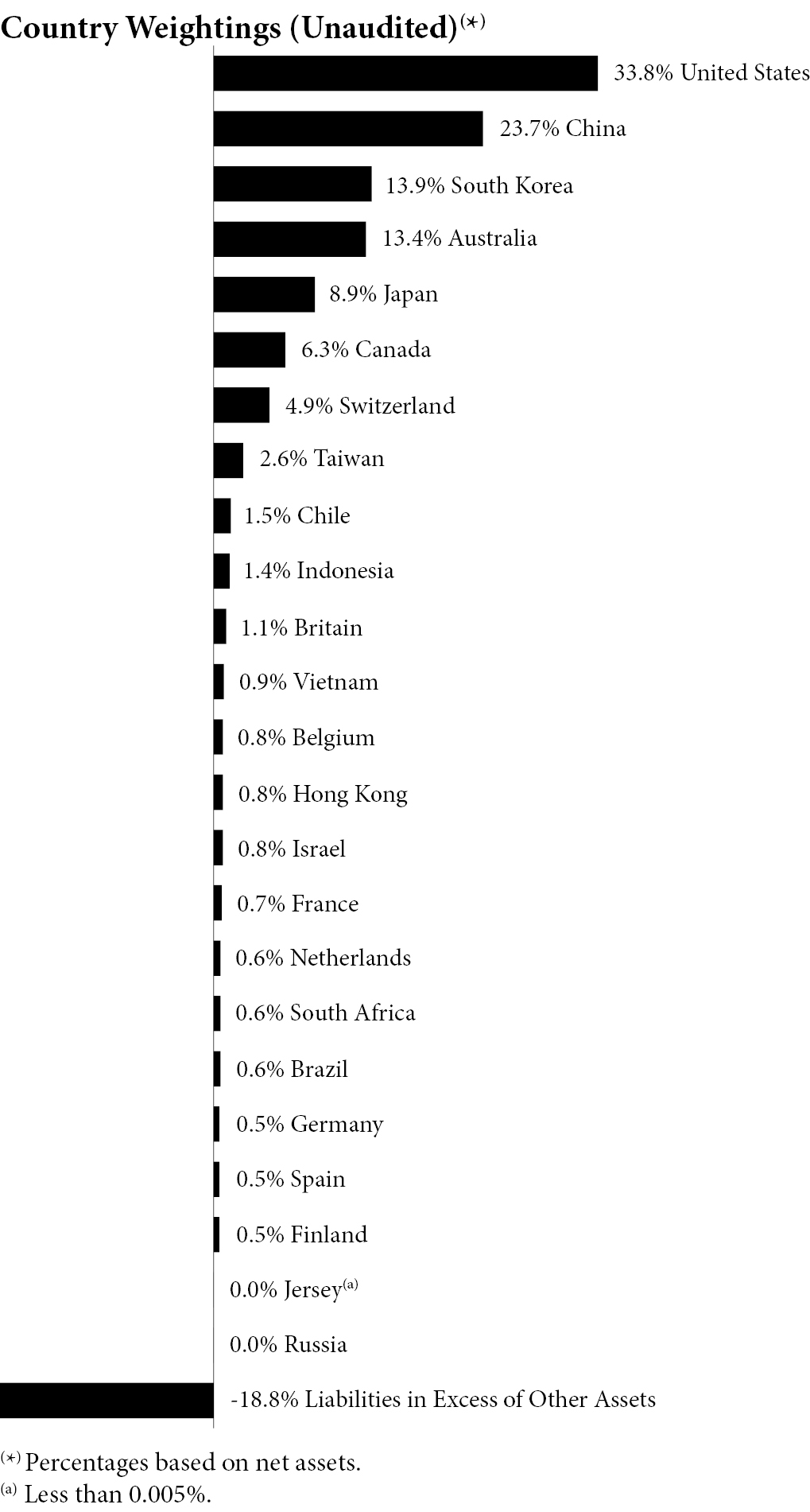

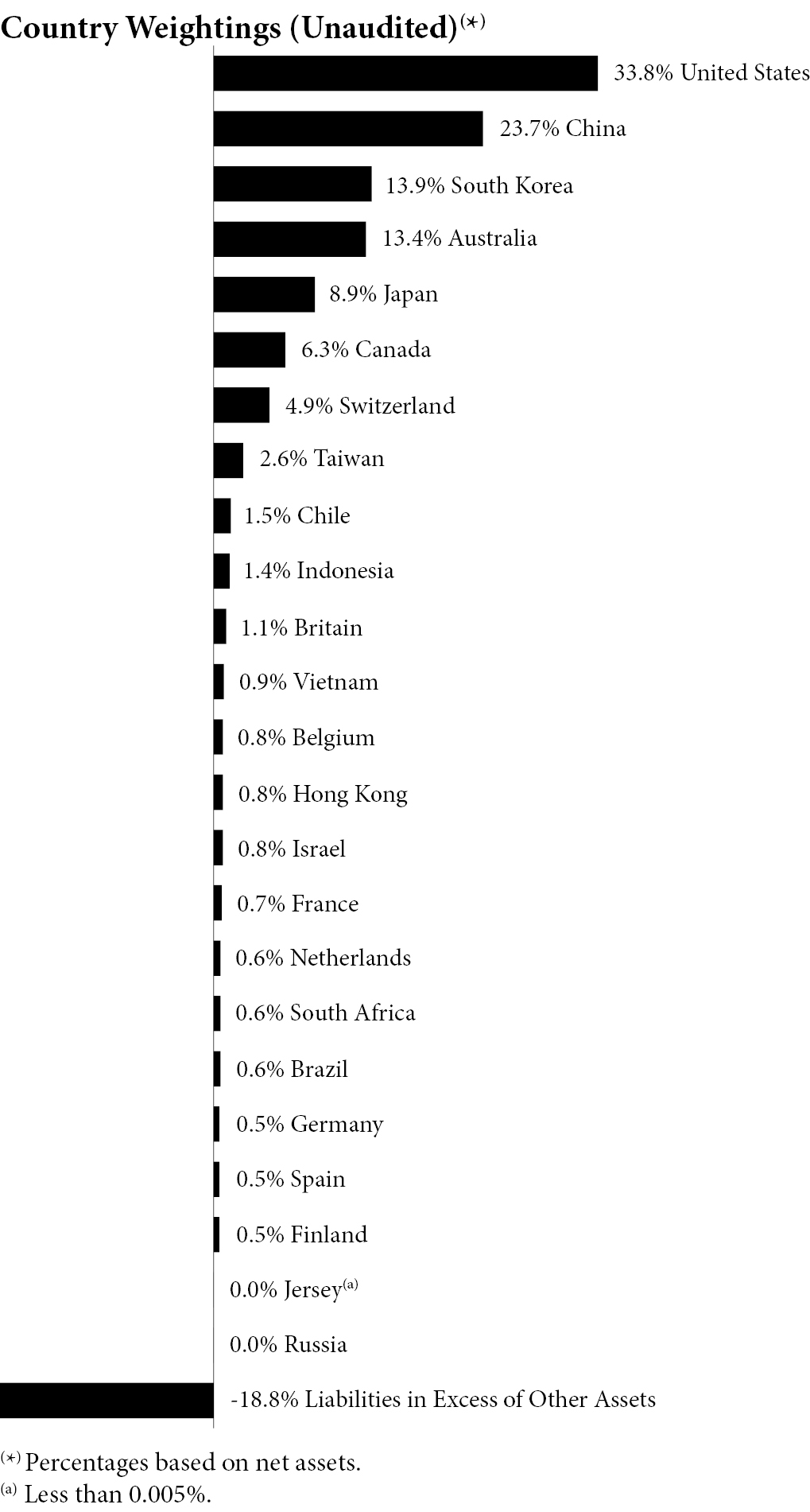

Liabilities in Excess of Other Assets — (18.8)% | | | | | (16,936,455 | ) |

TOTAL NET ASSETS — 100.0% | | | | $ | 90,099,815 | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

NV - Naamloze Vennootschap

PJSC - Public Joint Stock Company

PLC - Public Limited Company

SA - Sociedad Anónima

(a) Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of March 31, 2024, the value of these securities total $2,773,405 or 3.1% of the Fund’s net assets.

(b) Security is exempt from registration pursuant to Regulation S under the Securities Act of 1933, as amended. As of March 31, 2024, the value of these securities total $2,773,405 or 3.1% of the Fund’s net assets.

(c) Non-income producing security.

(d) All or a portion of this security is on loan as of March 31, 2024. The total market value of these securities was $16,332,991 which represented 18.1% of net assets.

(e) To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors.

(f) Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting as Valuation Designee. These securities represented $0 or 0.0% of net assets as of March 31, 2024.

(g) The rate shown represents the 7-day effective yield as of March 31, 2024.

The accompanying notes are an integral part of the financial statements.

12

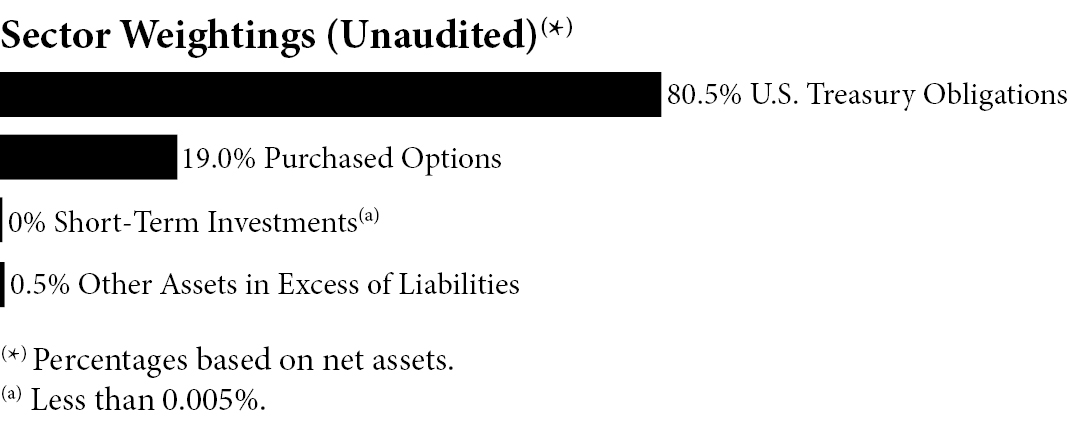

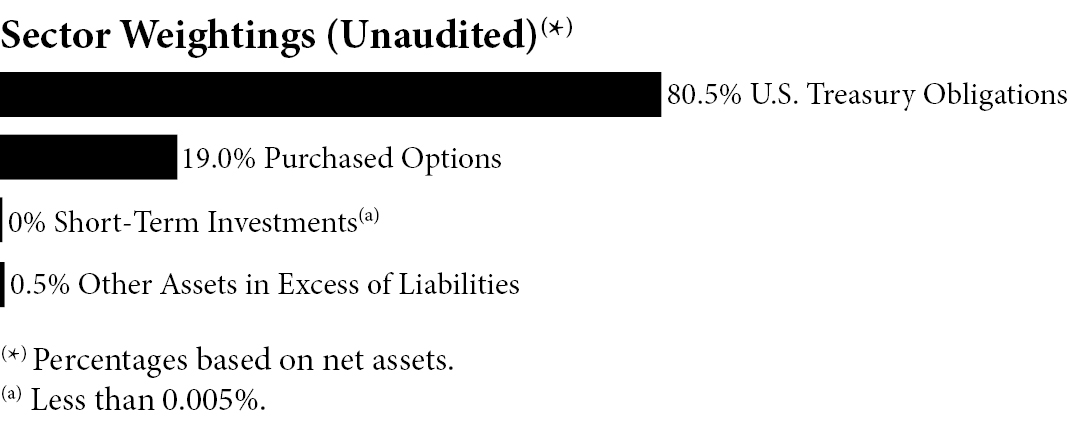

Amplify ETF Trust Amplify BlackSwan Growth & Treasury Core ETF Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | | | Par | | Value |

U.S. TREASURY OBLIGATIONS — 80.5% | | | |

United States Treasury Note/Bond | | | | | | | | | |

2.38%, 05/15/2029 | | | | | $ | 15,662,000 | | $ | 14,340,519 |

1.75%, 11/15/2029 | | | | | | 16,308,000 | | | 14,373,655 |

0.63%, 05/15/2030 | | | | | | 17,873,000 | | | 14,449,552 |

0.88%, 11/15/2030 | | | | | | 17,782,000 | | | 14,408,976 |

1.63%, 05/15/2031 | | | | | | 17,033,000 | | | 14,370,263 |

1.38%, 11/15/2031 | | | | | | 17,600,000 | | | 14,391,781 |

2.88%, 05/15/2032 | | | | | | 15,745,000 | | | 14,311,036 |

4.13%, 11/15/2032 | | | | | | 14,340,000 | | | 14,256,817 |

3.38%, 05/15/2033 | | | | | | 15,229,000 | | | 14,281,947 |

4.50%, 11/15/2033 | | | | | | 13,895,000 | | | 14,219,579 |

TOTAL U.S. TREASURY OBLIGATIONS

(Cost $146,800,017) | | | | | | | | | 143,404,125 |

| | | | | | | | | | |

| | | Notional

Amount | | Contracts | | |

PURCHASED OPTIONS — 19.0%(a)(b) | | | | | | | | | |

Call Options — 19.0% | | | | | | | | | |

SPDR S&P 500 ETF | | | | | | | | | |

Expiration: 06/21/2024; Exercise Price: $400.00 | | $ | 70,719,064 | | | 1,352 | | | 17,423,224 |

Expiration: 12/20/2024; Exercise Price: $440.00 | | | 83,795,814 | | | 1,602 | | | 16,478,172 |

Total Call Options | | | | | | | | | 33,901,396 |

TOTAL PURCHASED OPTIONS

(Cost $15,929,790) | | | | | | | | | 33,901,396 |

| | | | | | | | | | |

| | | | | Shares | | |

SHORT-TERM INVESTMENTS — 0.0%(c) | | | | | | | | | |

Money Market Funds — 0.0%(c) | | | | | | | | | |

Dreyfus Treasury Securities Cash Management, 4.39%(d) | | | | | | 28,819 | | | 28,819 |

Invesco Government & Agency Portfolio - Institutional Class, 5.24%(d) | | | | | | 2,239 | | | 2,239 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $31,058) | | | | | | | | | 31,058 |

| | | | | | | | | | |

TOTAL INVESTMENTS — 99.5%

(Cost $162,760,865) | | | | | | | | | 177,336,579 |

Other Assets in Excess of Liabilities — 0.5% | | | | | | | | | 885,981 |

TOTAL NET ASSETS — 100.0% | | | | | | | | $ | 178,222,560 |

Percentages are stated as a percent of net assets.

(a) Exchange-traded.

(b) 100 shares per contract.

(c) Represents less than 0.05% of net assets.

(d) The rate shown represents the 7-day effective yield as of March 31, 2024.

The accompanying notes are an integral part of the financial statements.

13

Amplify ETF Trust Amplify Emerging Markets FinTech ETF Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | Shares | | Value |

COMMON STOCKS — 99.5% | | | | | |

Banking — 8.7% | | | | | |

Bank BTPN Syariah Tbk PT | | 623,200 | | $ | 53,260 |

Bank Jago Tbk PT(a) | | 296,900 | | | 49,998 |

NU Holdings Ltd. - Class A(a) | | 6,624 | | | 79,024 |

TCS Group Holding PLC - GDR(a)(b)(c) | | 2,536 | | | 0 |

| | | | | | 182,282 |

Digital Assets/Wallets — 9.1% | | | | | |

Danal Co. Ltd.(a) | | 20,160 | | | 61,847 |

Discovery Ltd. | | 8,000 | | | 50,963 |

OSL Group Ltd.(a) | | 73,000 | | | 79,282 |

| | | | | | 192,092 |

Fintech Software — 9.6% | | | | | |

Bairong, Inc.(a)(c)(d) | | 26,000 | | | 36,809 |

GoTo Gojek Tokopedia Tbk PT(a) | | 10,458,000 | | | 45,513 |

Linklogis, Inc. - Class B(c)(d) | | 275,500 | | | 49,281 |

Sapiens International Corp. NV | | 2,164 | | | 69,594 |

| | | | | | 201,197 |

Description | | Shares | | Value |

Insurance — 3.8% | | | | | |

Ping An Insurance Group Co. of China Ltd. - Class H | | 9,500 | | $ | 40,117 |

Renaissance Insurance Group JSC(b) | | 196,320 | | | 0 |

ZhongAn Online P&C Insurance Co. Ltd. - Class H(a)(c)(d) | | 25,500 | | | 40,727 |

| | | | | | 80,844 |

Investment & Trading — 7.9% | | | | | |

Futu Holdings Ltd. - ADR(a) | | 1,272 | | | 68,878 |

Up Fintech Holding Ltd. - ADR(a) | | 10,588 | | | 36,423 |

XP, Inc. - Class A | | 2,368 | | | 60,763 |

| | | | | | 166,064 |

Lending & Credit — 11.6% | | | | | |

FinVolution Group - ADR | | 8,244 | | | 41,550 |

LexinFintech Holdings Ltd. - ADR | | 21,876 | | | 39,377 |

Lufax Holding Ltd. - ADR | | 16,660 | | | 70,305 |

Pagaya Technologies Ltd. - Class A(a) | | 4,218 | | | 42,598 |

Qifu Technology, Inc. - ADR | | 2,771 | | | 51,070 |

| | | | | | 244,900 |

Payment — 47.0% | | | | | |

Alibaba Group Holding Ltd. | | 4,400 | | | 39,494 |

Dlocal Ltd./Uruguay(a) | | 3,632 | | | 53,390 |

EVERTEC, Inc. | | 1,464 | | | 58,414 |

Forth Smart Service PCL - NVDR | | 317,885 | | | 55,322 |

Grab Holdings Ltd. - Class A(a) | | 19,080 | | | 59,911 |

Jumia Technologies AG - ADR(a)(e) | | 19,968 | | | 102,236 |

Kakaopay Corp.(a) | | 1,712 | | | 49,468 |

Kginicis Co. Ltd. | | 6,444 | | | 56,147 |

MercadoLibre, Inc.(a) | | 36 | | | 54,431 |

Network International

Holdings PLC(a)(c)(d) | | 12,208 | | | 60,639 |

Pagseguro Digital Ltd. - Class A(a) | | 4,460 | | | 63,689 |

PAX Global Technology Ltd. | | 85,000 | | | 67,011 |

Sea Ltd. - ADR(a) | | 1,476 | | | 79,276 |

StoneCo Ltd. - Class A(a) | | 3,340 | | | 55,477 |

Tencent Holdings Ltd. | | 1,100 | | | 42,699 |

Valid Solucoes e Servicos de Seguranca em Meios de Pagamento

e Identificacao SA | | 13,600 | | | 50,101 |

Yeahka Ltd.(a) | | 25,200 | | | 39,218 |

| | | | | | 986,923 |

Real Estate Services — 1.8% | | | | | |

KE Holdings, Inc. - ADR | | 2,796 | | | 38,389 |

TOTAL COMMON STOCKS

(Cost $2,681,246) | | | | | 2,092,691 |

The accompanying notes are an integral part of the financial statements.

14

Amplify ETF Trust Amplify Emerging Markets FinTech ETF Schedule of Investments as of March 31, 2024 (Unaudited) (Continued) |

Description | | Shares | | Value |

SHORT-TERM INVESTMENTS — 5.0% | | | | | | |

Investments Purchased with Proceeds from Securities Lending — 4.5% | | | | | | |

First American Government

Obligations Fund - Class X,

5.23%(f) | | 93,948 | | $ | 93,948 | |

Money Market Funds — 0.5% | | | | | | |

Invesco Government & Agency Portfolio - Institutional Class, 5.24%(f) | | 10,064 | | | 10,064 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $104,012) | | | | | 104,012 | |

| | | | | | | |

TOTAL INVESTMENTS — 104.5%

(Cost $2,785,258) | | | | | 2,196,703 | |

Liabilities in Excess of Other

Assets — (4.5)% | | | | | (94,394 | ) |

TOTAL NET ASSETS — 100.0% | | | | $ | 2,102,309 | |

Percentages are stated as a percent of net assets.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

GDR - Global Depositary Receipt

NV - Naamloze Vennootschap

NVDR - Non-Voting Depositary Receipt

PLC - Public Limited Company

SA - Sociedad Anónima

The accompanying notes are an integral part of the financial statements.

15

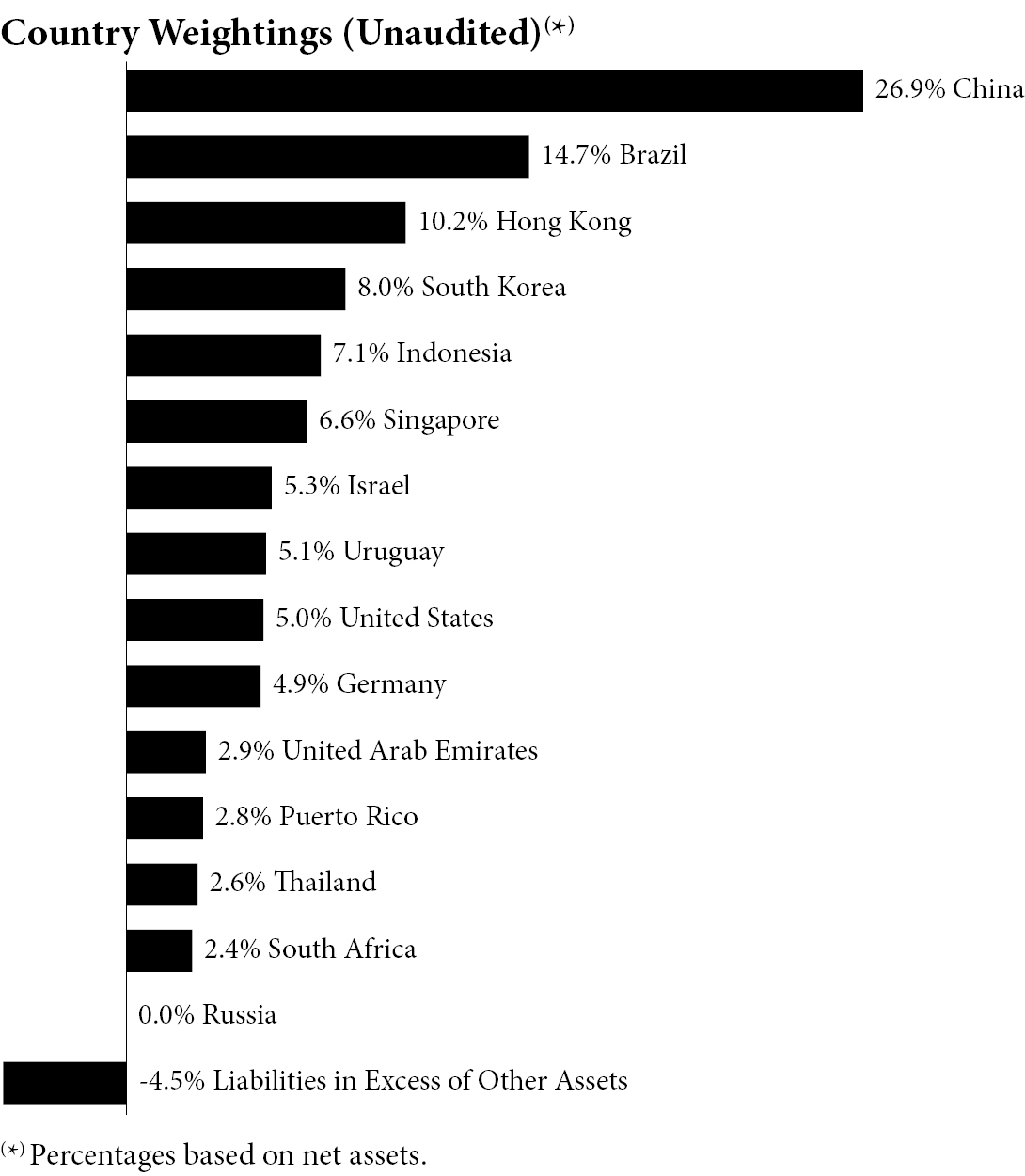

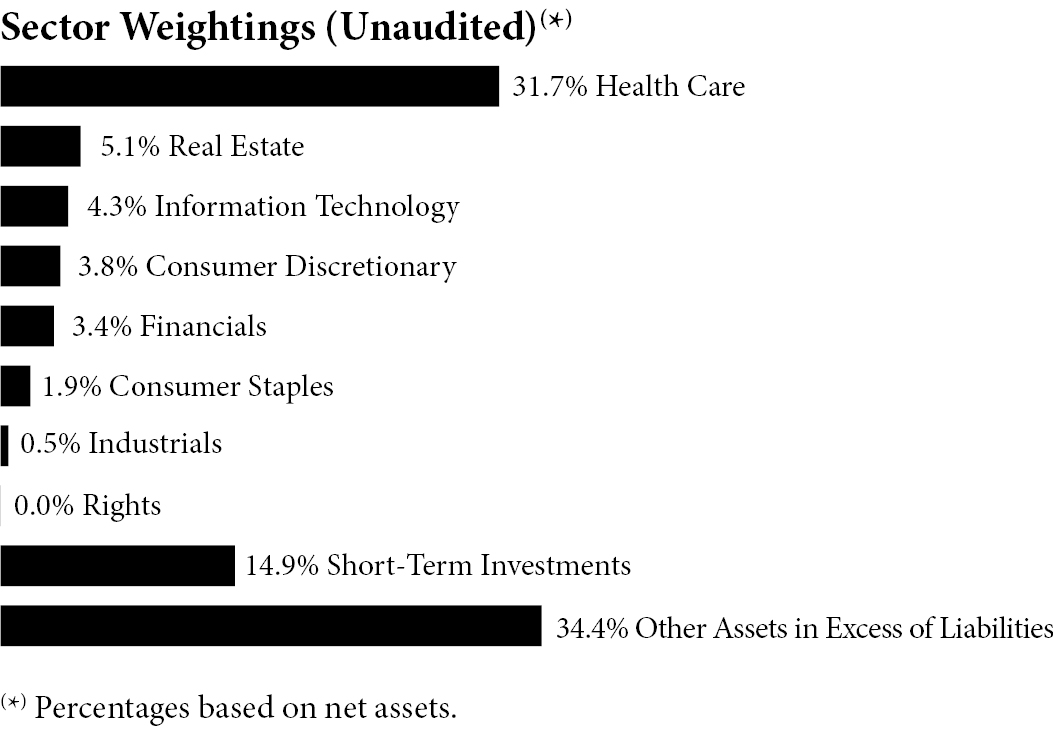

Amplify ETF Trust Amplify Seymour Cannabis ETF Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | Shares | | Value |

COMMON STOCKS — 50.7% | | | | | |

Consumer Discretionary — 3.8% | | | | | |

GrowGeneration Corp.(a)(b) | | 499,894 | | $ | 1,429,697 |

Consumer Staples — 1.9% | | | | | |

Village Farms International, Inc.(a)(b) | | 580,778 | | | 720,165 |

Financials — 3.4% | | | | | |

Chicago Atlantic Real Estate Finance, Inc. | | 30,000 | | | 473,100 |

Silver Spike Investment Corp. | | 82,918 | | | 796,842 |

| | | | | | 1,269,942 |

Health Care — 31.7%(c) | | | | | |

Aleafia Health, Inc.(a)(d) | | 80,872 | | | 0 |

Auxly Cannabis Group, Inc.(a) | | 3,137,044 | | | 115,797 |

Canopy Growth Corp.(a)(b) | | 36,276 | | | 313,062 |

Cara Therapeutics, Inc.(a) | | 65,538 | | | 59,640 |

Charlotte’s Web Holdings, Inc.(a)(b) | | 1,102,907 | | | 223,912 |

Clever Leaves Holdings, Inc.(a) | | 5,093 | | | 24,803 |

Cronos Group, Inc.(a) | | 524,169 | | | 1,368,081 |

Curaleaf Holdings, Inc.(a) | | 704,200 | | | 3,763,912 |

Jazz Pharmaceuticals PLC(a) | | 553 | | | 66,592 |

MediPharm Labs Corp.(a) | | 2,927,844 | | | 172,919 |

Organigram Holdings, Inc.(a)(b) | | 169,800 | | | 365,070 |

SNDL, Inc.(a)(b) | | 298,790 | | | 599,074 |

TerrAscend Corp.(a) | | 980,700 | | | 1,838,971 |

Tilray Brands, Inc.(a)(b) | | 1,168,784 | | | 2,886,895 |

| | | | | | 11,798,728 |

Industrials — 0.5% | | | | | |

Hydrofarm Holdings Group, Inc.(a) | | 171,646 | | | 185,378 |

Information Technology — 4.3% | | | | | |

WM Technology, Inc.(a) | | 1,214,393 | | | 1,615,143 |

Real Estate — 5.1% | | | | | |

Innovative Industrial Properties, Inc. | | 18,424 | | | 1,907,621 |

TOTAL COMMON STOCKS

(Cost $71,533,278) | | | | | 18,926,674 |

Description | | Contracts | | Value |

RIGHTS — 0.0%(e) | | | | | |

Harmony Biosciences Holdings, Inc., Expires 10/12/2024,

Exercise Price $2.54(a)(d) | | 220,858 | | $ | 0 |

TOTAL RIGHTS

(Cost $0) | | | | | 0 |

| | | | | | |

| | | Shares | | |

SHORT-TERM INVESTMENTS — 14.9% | | | | | |

Investments Purchased with Proceeds from Securities Lending — 12.4% | | | | | |

First American Government

Obligations Fund - Class X,

5.23%(f) | | 4,641,018 | | | 4,641,018 |

| | | | | | |

Money Market Funds — 2.5% | | | | | |

Invesco Government & Agency Portfolio - Institutional Class, 5.24%(f) | | 915,716 | | | 915,716 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $5,556,734) | | | | | 5,556,734 |

| | | | | | |

TOTAL INVESTMENTS — 65.6%

(Cost $77,090,012) | | | | | 24,483,408 |

Other Assets in Excess of

Liabilities — 34.4% | | | | | 12,856,297 |

TOTAL NET ASSETS — 100.0% | | | | $ | 37,339,705 |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

PLC - Public Limited Company

The accompanying notes are an integral part of the financial statements.

16

Amplify ETF Trust Amplify Seymour Cannabis ETF Schedule of Total Return Swap Contracts as of March 31, 2024 (Unaudited) |

Reference Entity | | Counterparty | | Long/

Short | | Maturity

Date | | Financing

Rate(a) | | Payment

Frequency | | Notional

Amount | | Upfront

Payments

(Receipts) | | Value/

Unrealized

Appreciation

(Depreciation) |

Ayr Wellness, Inc. | | Nomura Global Financial Products, Inc. | | Long | | 05/28/2024 | | 6.82 | | Month | | $ | 637,394 | | $ | 0 | | $ | 148,351 |

Ayr Wellness, Inc. Warrant Expires 02/07/2026 | | Nomura Global Financial Products, Inc. | | Long | | 05/28/2024 | | 6.82 | | Month | | | 93,344 | | | 0 | | | 34,465 |

Cannabist Company | | Nomura Global Financial Products, Inc. | | Long | | 05/28/2024 | | 6.82 | | Month | | | 104,809 | | | 0 | | | 30,134 |

Cresco Lab, Inc. | | Nomura Global Financial Products, Inc. | | Long | | 05/28/2024 | | 6.82 | | Month | | | 2,425,614 | | | 0 | | | 193,587 |

Curaleaf Holdings, Inc. | | Nomura Global Financial Products, Inc. | | Long | | 05/28/2024 | | 6.82 | | Month | | | 765,441 | | | 0 | | | 54,470 |

Green Thumb Industries, Inc. | | Nomura Global Financial Products, Inc. | | Long | | 05/28/2024 | | 6.82 | | Month | | | 5,115,744 | | | 0 | | | 577,811 |

Truelieve Cannabis Corp. | | Nomura Global Financial Products, Inc.. | | Long | | 05/28/2024 | | 6.82 | | Month | | | 5,252,764 | | | 0 | | | 631,179 |

Verano Holdings Corp. | | Nomura Global Financial Products, Inc. | | Long | | 05/28/2024 | | 6.82 | | Month | | | 3,464,487 | | | 0 | | | 357,315 |

| | | | | | | | | | | | | | | | $ | 0 | | $ | 2,027,312 |

The accompanying notes are an integral part of the financial statements.

17

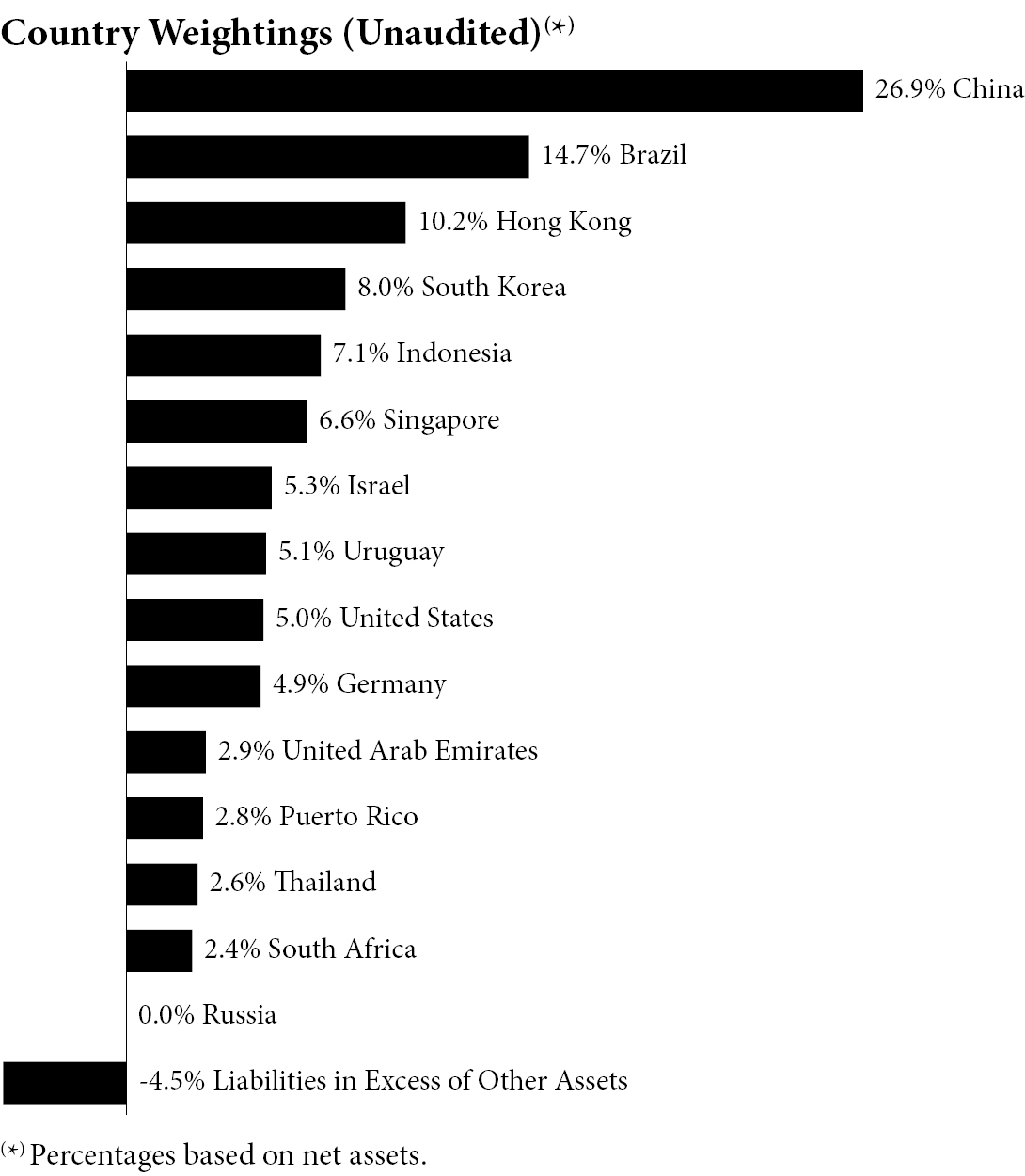

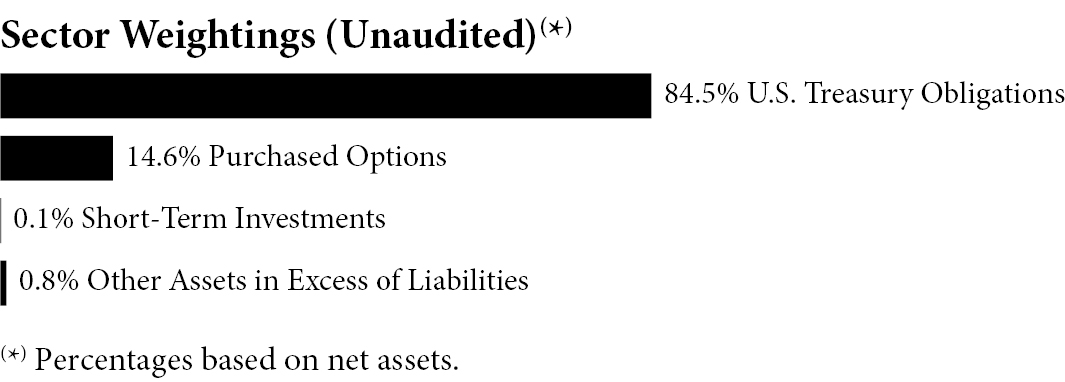

Amplify ETF Trust Amplify BlackSwan ISWN ETF Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | | | Par | | Value |

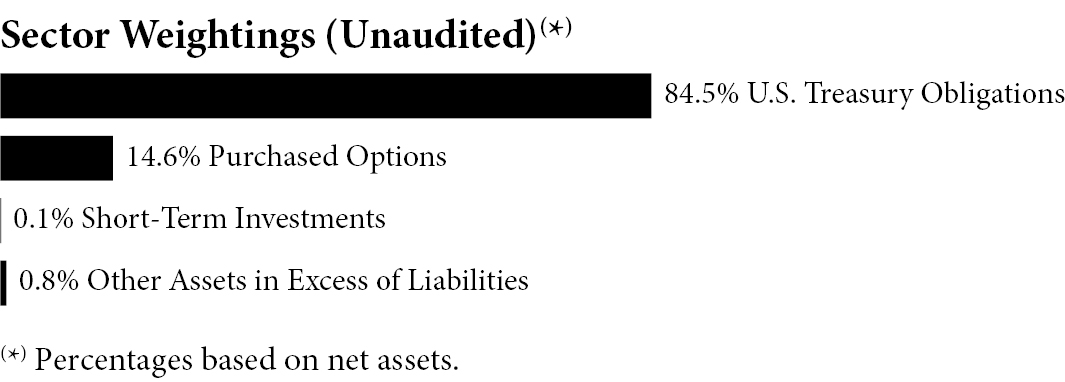

U.S. TREASURY OBLIGATIONS — 84.5% | | | | | | | | |

United States Treasury Note/Bond | | | | | | | | |

2.38%, 05/15/2029 | | | | $ | 3,594,000 | | $ | 3,290,756 |

1.75%, 11/15/2029 | | | | | 3,742,000 | | | 3,298,149 |

0.63%, 05/15/2030 | | | | | 4,101,000 | | | 3,315,483 |

0.88%, 11/15/2030 | | | | | 4,080,000 | | | 3,306,075 |

1.63%, 05/15/2031 | | | | | 3,909,000 | | | 3,297,913 |

1.38%, 11/15/2031 | | | | | 4,039,000 | | | 3,302,750 |

2.88%, 05/15/2032 | | | | | 3,613,000 | | | 3,283,949 |

4.13%, 11/15/2032 | | | | | 3,291,000 | | | 3,271,910 |

3.38%, 05/15/2033 | | | | | 3,495,000 | | | 3,277,655 |

4.50%, 11/15/2033 | | | | | 3,189,000 | | | 3,263,493 |

TOTAL U.S. TREASURY OBLIGATIONS

(Cost $33,675,861) | | | | | | | | 32,908,133 |

| | Notional

Amount | | Contracts | | |

PURCHASED OPTIONS — 14.6%(a)(b) | | | | | | | | |

Call Options — 14.6% | | | | | | | | |

iShares MSCI EAFE ETF | | | | | | | | |

Expiration: 12/20/2024; Exercise Price: $69.00 | | $ | 19,781,322 | | 2,477 | | | 3,182,945 |

Expiration: 12/20/2024; Exercise Price: $68.00 | | | 14,726,184 | | 1,844 | | | 2,517,060 |

Total Call Options | | | | | | | | 5,700,005 |

TOTAL PURCHASED OPTIONS

(Cost $3,881,401) | | | | | | | | 5,700,005 |

| | | | | | | | | |

| | | | | Shares | | |

SHORT-TERM INVESTMENTS — 0.1% | | | | | | | | |

Money Market Funds — 0.1% | | | | | | | | |

Dreyfus Treasury Securities Cash Management, 4.39%(c) | | | | | 2,552 | | | 2,552 |

Invesco Government & Agency Portfolio - Institutional Class, 5.24%(c) | | | | | 20,786 | | | 20,786 |

| | | | | | | | | 23,338 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $23,338) | | | | | | | | 23,338 |

| | | | | | | | | |

TOTAL INVESTMENTS — 99.2%

(Cost $37,580,600) | | | | | | | | 38,631,476 |

Other Assets in Excess of Liabilities — 0.8% | | | | | | | | 299,456 |

TOTAL NET ASSETS — 100.0% | | | | | | | $ | 38,930,932 |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of the financial statements.

18

Amplify ETF Trust Amplify Thematic All-Stars ETF Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | Shares | | Value |

COMMON STOCKS — 99.6% | | | | | |

Communication Services — 8.0% | | | | | |

Alphabet, Inc. - Class A(a) | | 559 | | $ | 84,369 |

Baidu, Inc. - Class A(a) | | 513 | | | 6,732 |

Meta Platforms, Inc. - Class A | | 115 | | | 55,842 |

Netflix, Inc.(a) | | 24 | | | 14,576 |

ROBLOX Corp. - Class A(a) | | 690 | | | 26,344 |

Roku, Inc.(a) | | 204 | | | 13,295 |

Tencent Holdings Ltd. | | 366 | | | 14,207 |

| | | | | | 215,365 |

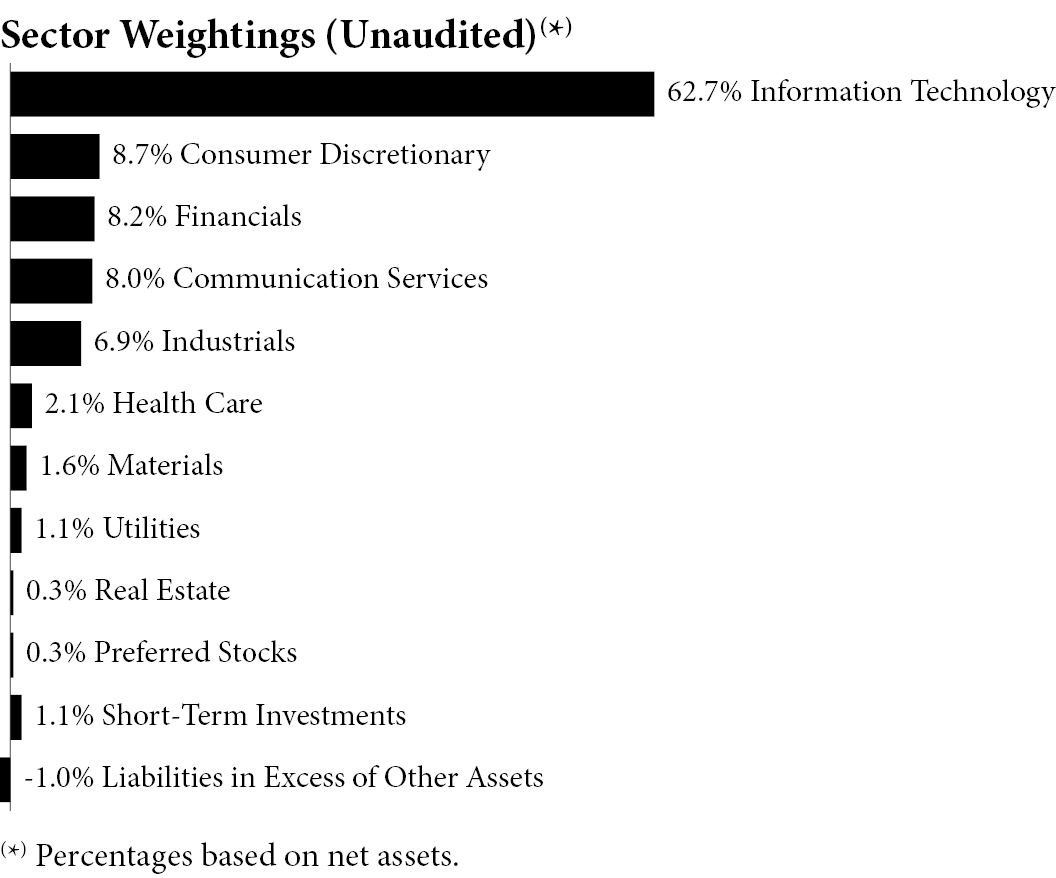

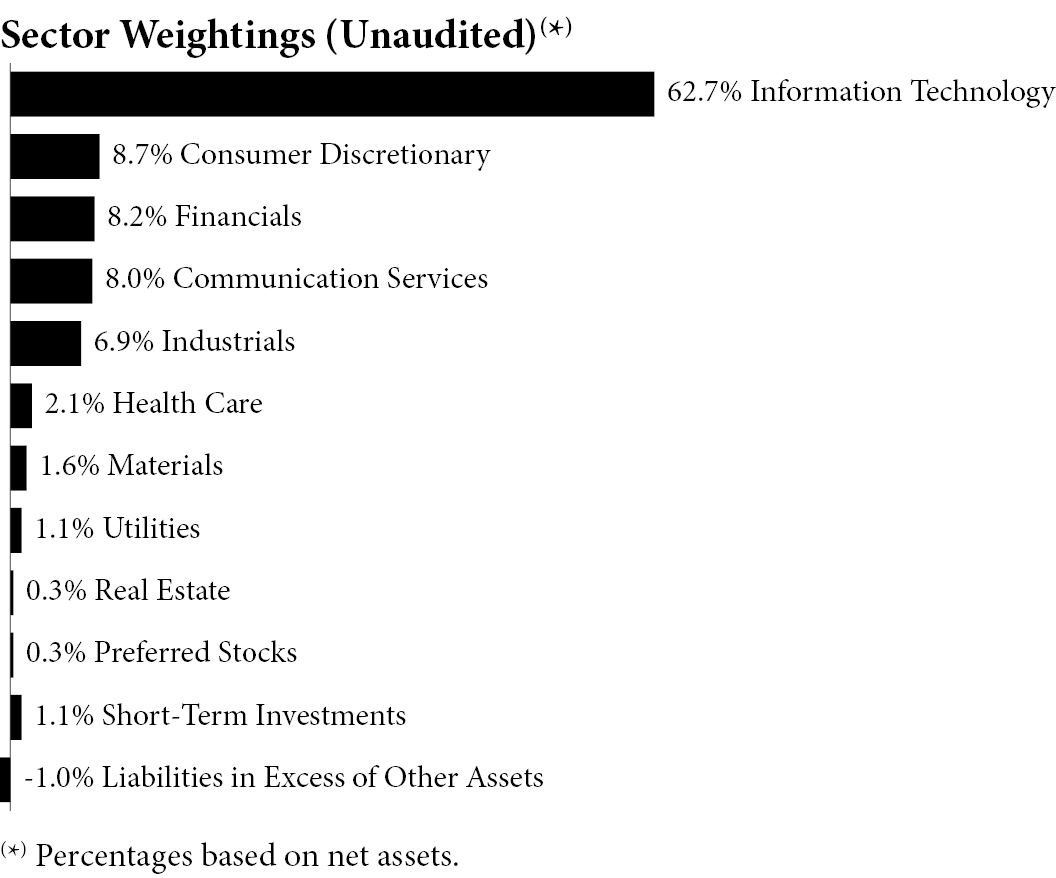

Consumer Discretionary — 8.7% | | | | | |

Alibaba Group Holding Ltd. | | 998 | | | 8,958 |

Amazon.com, Inc.(a) | | 359 | | | 64,756 |

Aptiv PLC(a) | | 89 | | | 7,089 |

DraftKings, Inc. - Class A(a) | | 249 | | | 11,307 |

Lucid Group, Inc.(a)(b) | | 2,876 | | | 8,197 |

MercadoLibre, Inc.(a) | | 5 | | | 7,560 |

Rivian Automotive, Inc. - Class A(a) | | 972 | | | 10,643 |

Tesla, Inc.(a) | | 658 | | | 115,670 |

| | | | | | 234,180 |

Financials — 8.2% | | | | | |

Adyen NV(a)(c)(d) | | 5 | | | 8,467 |

Block, Inc.(a) | | 798 | | | 67,495 |

Coinbase Global, Inc. - Class A(a) | | 376 | | | 99,684 |

PayPal Holdings, Inc.(a) | | 164 | | | 10,986 |

Robinhood Markets, Inc. - Class A(a) | | 1,013 | | | 20,392 |

Toast, Inc. - Class A(a) | | 355 | | | 8,847 |

Visa, Inc. - Class A | | 23 | | | 6,419 |

| | | | | | 222,290 |

Description | | Shares | | Value |

Health Care — 2.1% | | | | | |

CRISPR Therapeutics AG(a) | | 120 | | $ | 8,179 |

Danaher Corp. | | 65 | | | 16,232 |

Intuitive Surgical, Inc.(a) | | 65 | | | 25,940 |

Teladoc Health, Inc.(a) | | 438 | | | 6,614 |

| | | | | | 56,965 |

Industrials — 6.9% | | | | | |

ABB Ltd. | | 487 | | | 22,649 |

Advanced Drainage Systems, Inc. | | 46 | | | 7,923 |

Array Technologies, Inc.(a) | | 801 | | | 11,943 |

Booz Allen Hamilton Holding Corp. | | 61 | | | 9,055 |

NEXTracker, Inc. - Class A(a) | | 145 | | | 8,159 |

Pentair PLC | | 102 | | | 8,715 |

Plug Power, Inc.(a)(b) | | 3,231 | | | 11,115 |

Schneider Electric SE | | 52 | | | 11,774 |

Shoals Technologies Group, Inc. -

Class A(a) | | 1,008 | | | 11,269 |

Siemens AG | | 36 | | | 6,880 |

Sunrun, Inc.(a) | | 1,800 | | | 23,724 |

Tetra Tech, Inc. | | 38 | | | 7,019 |

Uber Technologies, Inc.(a) | | 100 | | | 7,699 |

Veralto Corp. | | 84 | | | 7,447 |

Vestas Wind Systems AS(a) | | 504 | | | 14,084 |

Xylem, Inc./NY | | 149 | | | 19,257 |

| | | | | | 188,712 |

Information Technology — 62.7%(e) | | | | | |

Adobe, Inc.(a) | | 30 | | | 15,138 |

Advanced Micro Devices, Inc.(a) | | 321 | | | 57,937 |

Akamai Technologies, Inc.(a) | | 218 | | | 23,710 |

Ambarella, Inc.(a) | | 135 | | | 6,854 |

Analog Devices, Inc. | | 53 | | | 10,483 |

ANSYS, Inc.(a) | | 20 | | | 6,943 |

Apple, Inc. | | 141 | | | 24,179 |

Arista Networks, Inc.(a) | | 44 | | | 12,759 |

Autodesk, Inc.(a) | | 34 | | | 8,854 |

Broadcom, Inc. | | 49 | | | 64,945 |

Check Point Software Technologies Ltd.(a) | | 108 | | | 17,713 |

Cisco Systems, Inc. | | 1,069 | | | 53,354 |

Cleanspark, Inc.(a) | | 449 | | | 9,523 |

Cloudflare, Inc. - Class A(a) | | 470 | | | 45,510 |

Confluent, Inc. - Class A(a) | | 202 | | | 6,165 |

Crowdstrike Holdings, Inc. - Class A(a) | | 295 | | | 94,575 |

CyberArk Software Ltd.(a) | | 84 | | | 22,313 |

Datadog, Inc. - Class A(a) | | 122 | | | 15,079 |

Dynatrace, Inc.(a) | | 152 | | | 7,059 |

Enphase Energy, Inc.(a) | | 577 | | | 69,805 |

F5, Inc.(a) | | 52 | | | 9,859 |

The accompanying notes are an integral part of the financial statements.

19

Amplify ETF Trust Amplify Thematic All-Stars ETF Schedule of Investments as of March 31, 2024 (Unaudited) (Continued) |

Description | | Shares | | Value |

Fastly, Inc. - Class A(a) | | 490 | | $ | 6,355 |

First Solar, Inc.(a) | | 398 | | | 67,182 |

Fortinet, Inc.(a) | | 502 | | | 34,292 |

Gen Digital, Inc. | | 402 | | | 9,005 |

HubSpot, Inc.(a) | | 16 | | | 10,025 |

Infineon Technologies AG | | 211 | | | 7,182 |

Intel Corp. | | 558 | | | 24,647 |

International Business Machines Corp. | | 114 | | | 21,769 |

Intuit, Inc. | | 10 | | | 6,500 |

Itron, Inc.(a) | | 95 | | | 8,789 |

Juniper Networks, Inc. | | 258 | | | 9,561 |

Marathon Digital Holdings, Inc.(a) | | 374 | | | 8,445 |

Micron Technology, Inc. | | 85 | | | 10,021 |

Microsoft Corp. | | 172 | | | 72,365 |

MicroStrategy, Inc. - Class A(a) | | 8 | | | 13,636 |

MongoDB, Inc.(a) | | 28 | | | 10,042 |

NVIDIA Corp. | | 171 | | | 154,510 |

NXP Semiconductors NV | | 45 | | | 11,150 |

Okta, Inc.(a) | | 309 | | | 32,327 |

ON Semiconductor Corp.(a) | | 164 | | | 12,062 |

Oracle Corp. | | 200 | | | 25,122 |

Palo Alto Networks, Inc.(a) | | 198 | | | 56,258 |

PTC, Inc.(a) | | 36 | | | 6,802 |

Pure Storage, Inc. - Class A(a) | | 179 | | | 9,306 |

QUALCOMM, Inc. | | 261 | | | 44,187 |

Qualys, Inc.(a) | | 148 | | | 24,697 |

Rapid7, Inc.(a) | | 254 | | | 12,456 |

Riot Platforms, Inc.(a) | | 467 | | | 5,716 |

Roper Technologies, Inc. | | 15 | | | 8,413 |

Salesforce, Inc. | | 83 | | | 24,998 |

Samsung SDI Co. Ltd. | | 45 | | | 15,961 |

SentinelOne, Inc. - Class A(a) | | 1,474 | | | 34,359 |

ServiceNow, Inc.(a) | | 27 | | | 20,585 |

Shopify, Inc. - Class A(a) | | 383 | | | 29,556 |

Snowflake, Inc. - Class A(a) | | 38 | | | 6,141 |

SolarEdge Technologies, Inc.(a) | | 497 | | | 35,277 |

STMicroelectronics NV | | 160 | | | 6,898 |

Tenable Holdings, Inc.(a) | | 394 | | | 19,475 |

Teradyne, Inc. | | 107 | | | 12,073 |

Trend Micro, Inc./Japan | | 192 | | | 9,724 |

Trimble, Inc.(a) | | 153 | | | 9,847 |

Twilio, Inc. - Class A(a) | | 309 | | | 18,895 |

UiPath, Inc. - Class A(a) | | 1,727 | | | 39,151 |

Unity Software, Inc.(a) | | 869 | | | 23,202 |

Varonis Systems, Inc.(a) | | 344 | | | 16,226 |

Workday, Inc. - Class A(a) | | 26 | | | 7,092 |

Description | | Shares | | Value |

Zoom Video Communications, Inc. - Class A(a) | | 203 | | $ | 13,270 | |

Zscaler, Inc.(a) | | 230 | | | 44,305 | |

| | | | | | 1,692,614 | |

Materials — 1.6% | | | | | | |

Albemarle Corp. | | 177 | | | 23,318 | |

Ecolab, Inc. | | 83 | | | 19,165 | |

| | | | | | 42,483 | |

Real Estate — 0.3% | | | | | | |

Equinix, Inc. | | 9 | | | 7,428 | |

Utilities — 1.1% | | | | | | |

American Water Works Co., Inc. | | 62 | | | 7,577 | |

Ormat Technologies, Inc. | | 127 | | | 8,406 | |

Orsted AS(a)(c)(d) | | 138 | | | 7,681 | |

Sunnova Energy International, Inc.(a)(b) | | 1,071 | | | 6,565 | |

| | | | | | 30,229 | |

TOTAL COMMON STOCKS

(Cost $3,035,620) | | | | | 2,690,266 | |

| | | | | | | |

PREFERRED STOCKS — 0.3% | | | | | | |

Industrials — 0.3% | | | | | | |

Sociedad Quimica y Minera de Chile SA - Class B, 0.00% | | 160 | | | 7,781 | |

TOTAL PREFERRED STOCKS

(Cost $7,636) | | | | | 7,781 | |

| | | | | | | |

SHORT-TERM INVESTMENTS — 1.1% | | | | | | |

Investments Purchased with Proceeds from Securities Lending — 1.0% | | | | | | |

First American Government Obligations Fund - Class X, 5.23%(f) | | 27,290 | | | 27,290 | |

Money Market Funds — 0.1% | | | | | | |

Invesco Government & Agency Portfolio - Institutional

Class, 5.24%(f) | | 2,326 | | | 2,326 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $29,616) | | | | | 29,616 | |

| | | | | | | |

TOTAL INVESTMENTS — 101.0%

(Cost $3,072,872) | | | | | 2,727,663 | |

Liabilities in Excess of Other Assets — (1.0)% | | | | | (26,298 | ) |

TOTAL NET ASSETS — 100.0% | | | | $ | 2,701,365 | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

20

Amplify ETF Trust Amplify Thematic All-Stars ETF Schedule of Investments as of March 31, 2024 (Unaudited) (Continued) |

(a) Non-income producing security.

(b) All or a portion of this security is on loan as of March 31, 2024. The total market value of these securities was $25,093 which represented 0.9% of net assets.

(c) Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of March 31, 2024, the value of these securities total $16,148 or 0.6% of the Fund’s net assets.

(d) Security is exempt from registration under Regulation S under the Securities Act of 1933, as amended. As of March 31, 2024, the value of these securities total $16,148 or 0.6% of the Fund’s net assets.

(e) To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors.

(f) The rate shown represents the 7-day effective yield as of March 31, 2024.

The accompanying notes are an integral part of the financial statements.

21

Amplify ETF Trust Amplify BlackSwan Tech & Treasury ETF Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | | | Par | | Value |

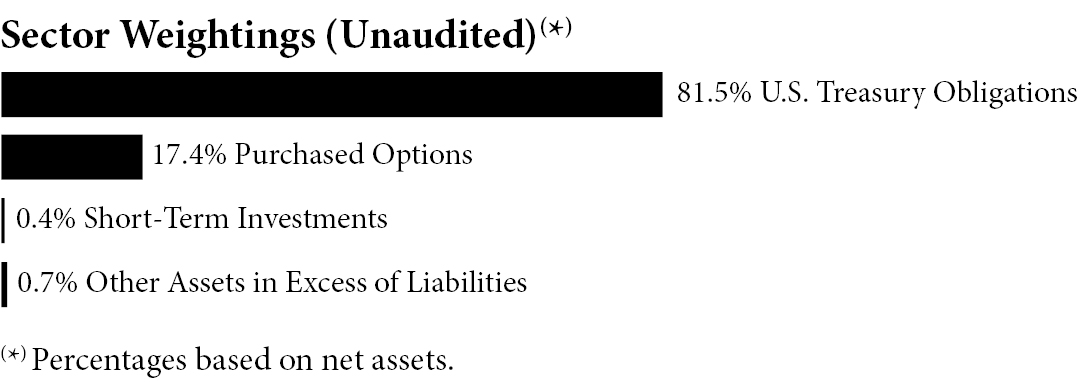

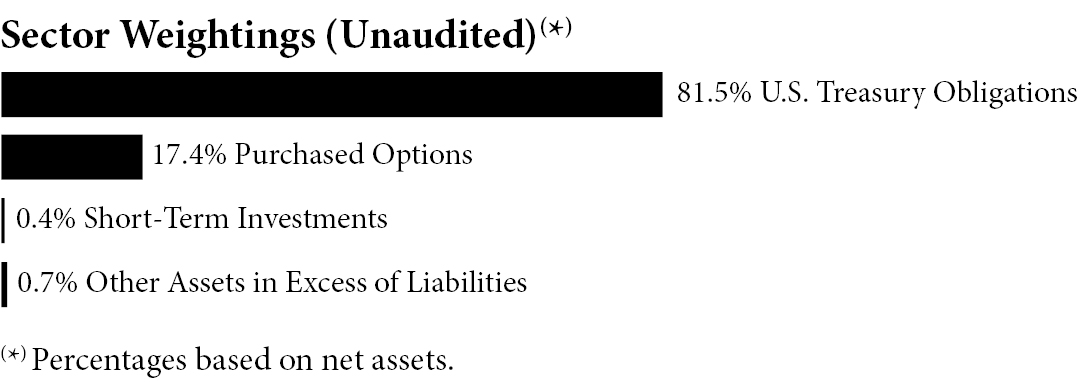

U.S. TREASURY OBLIGATIONS — 81.5% | | | |

United States Treasury Note/Bond | | | | | | | | |

2.38%, 05/15/2029 | | | | $ | 227,600 | | $ | 208,396 |

1.75%, 11/15/2029 | | | | | 237,600 | | | 209,417 |

0.63%, 05/15/2030 | | | | | 260,600 | | | 210,684 |

0.88%, 11/15/2030 | | | | | 258,600 | | | 209,547 |

1.63%, 05/15/2031 | | | | | 247,600 | | | 208,893 |

1.38%, 11/15/2031 | | | | | 256,600 | | | 209,826 |

2.88%, 05/15/2032 | | | | | 229,600 | | | 208,689 |

4.13%, 11/15/2032 | | | | | 208,600 | | | 207,390 |

3.38%, 05/15/2033 | | | | | 221,600 | | | 207,819 |

4.50%, 11/15/2033 | | | | | 202,300 | | | 207,026 |

TOTAL U.S. TREASURY OBLIGATIONS

(Cost $2,142,083) | | | | | | | | 2,087,687 |

| | Notional

Amount | | Contracts | | |

PURCHASED OPTIONS — 17.4%(a)(b) | | | | | | | | |

Call Options — 17.4% | | | | | | | | |

Invesco QQQ Trust Series 1 | | | | | | | | |

Expiration: 06/21/2024; Exercise Price: $329.78 | | $ | 888,020 | | 20 | | | 237,910 |

Expiration: 12/20/2024; Exercise Price: $369.78 | | | 976,822 | | 22 | | | 206,899 |

Total Call Options | | | | | | | | 444,809 |

TOTAL PURCHASED OPTIONS

(Cost $225,984) | | | | | | | | 444,809 |

| | | | | | | | | |

| | | | | Shares | | |

SHORT-TERM INVESTMENTS — 0.4% | | | | | | | | |

Money Market Funds — 0.4% | | | | | | | | |

Dreyfus Treasury Securities Cash Management, 4.39%(c) | | | | | 2,669 | | | 2,669 |

Invesco Government & Agency Portfolio - Institutional Class, 5.24%(c) | | | | | 8,083 | | | 8,083 |

| | | | | | | | | 10,752 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $10,752) | | | | | | | | 10,752 |

| | | | | | | | | |

TOTAL INVESTMENTS — 99.3%

(Cost $2,378,819) | | | | | | | | 2,543,248 |

Other Assets in Excess of Liabilities — 0.7% | | | | | | | | 18,964 |

TOTAL NET ASSETS — 100.0% | | | | | | | $ | 2,562,212 |

Percentages are stated as a percent of net assets.

(a) Exchange-traded.

(b) 100 shares per contract.

(c) The rate shown represents the 7-day effective yield as of March 31, 2024.

The accompanying notes are an integral part of the financial statements.

22

Amplify ETF Trust Amplify Inflation Fighter ETF Consolidated Schedule of Investments as of March 31, 2024 (Unaudited) |

Description | | Shares | | Value |

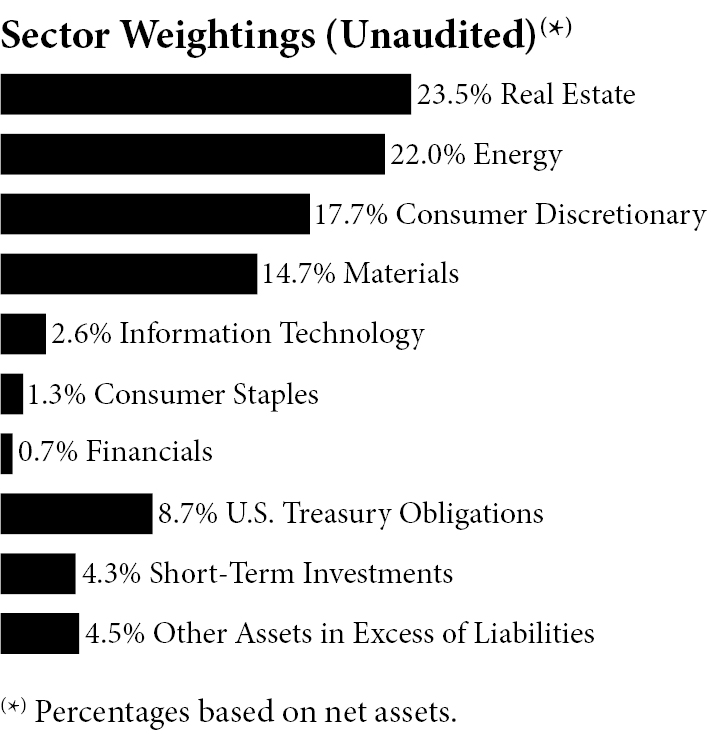

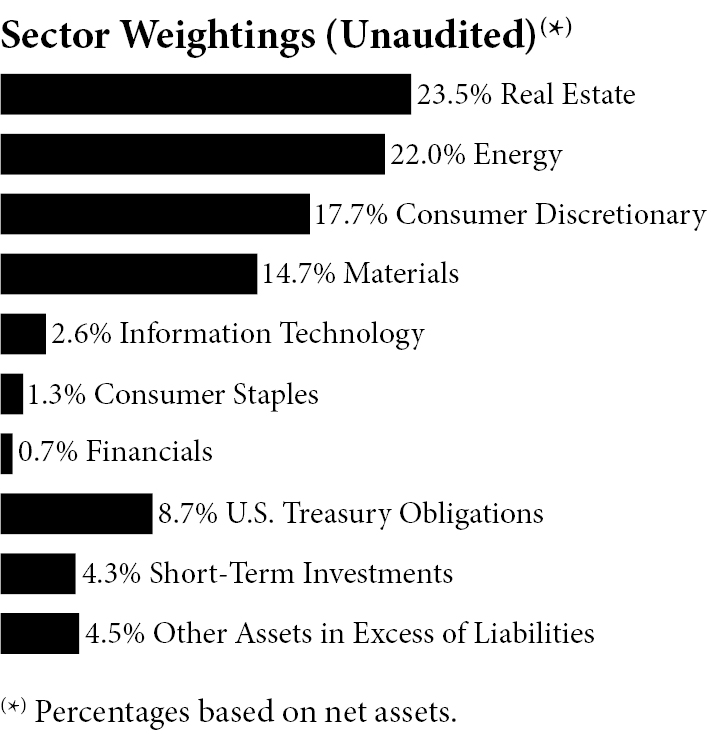

COMMON STOCKS — 82.5% | | | | | |

Consumer Discretionary — 17.7% | | | | | |

Airbnb, Inc. - Class A(a) | | 457 | | $ | 75,387 |

Century Communities, Inc. | | 1,799 | | | 173,604 |

DR Horton, Inc. | | 765 | | | 125,881 |

Green Brick Partners, Inc.(a) | | 4,144 | | | 249,592 |

Lennar Corp. - Class A | | 532 | | | 91,493 |

LGI Homes, Inc.(a) | | 785 | | | 91,350 |

M/I Homes, Inc.(a) | | 1,519 | | | 207,025 |

MDC Holdings, Inc. | | 2,073 | | | 130,412 |

PulteGroup, Inc. | | 1,064 | | | 128,340 |

Tri Pointe Homes, Inc.(a) | | 2,583 | | | 99,859 |

| | | | | | 1,372,943 |

Consumer Staples — 1.3% | | | | | |

Alico, Inc. | | 3,421 | | | 100,167 |

Energy — 22.0% | | | | | |

Antero Resources Corp.(a) | | 3,741 | | | 108,489 |

Cameco Corp. | | 5,694 | | | 246,500 |

Centrus Energy Corp. - Class A(a) | | 1,200 | | | 49,836 |

Denison Mines Corp.(a) | | 53,350 | | | 104,372 |

Energy Fuels, Inc.(a) | | 14,849 | | | 93,400 |

NexGen Energy Ltd.(a) | | 15,947 | | | 123,969 |

Ovintiv, Inc. | | 1,142 | | | 59,270 |

Petroleo Brasileiro SA - ADR | | 4,556 | | | 69,297 |

Phillips 66 | | 570 | | | 93,104 |

Shell PLC - ADR | | 1,064 | | | 71,331 |

Suncor Energy, Inc. | | 5,470 | | | 201,897 |

Texas Pacific Land Corp. | | 231 | | | 133,636 |

Uranium Energy Corp.(a) | | 45,245 | | | 305,403 |

Ur-Energy, Inc.(a) | | 30,000 | | | 48,000 |

| | | | | | 1,708,504 |

Description | | Shares | | Value |

Financials — 0.7% | | | | | |

LendingTree, Inc.(a) | | 1,267 | | $ | 53,645 |

Information Technology — 2.6% | | | | | |

Entegris, Inc. | | 555 | | | 78,000 |

QUALCOMM, Inc. | | 743 | | | 125,790 |

| | | | | | 203,790 |

Materials — 14.7% | | | | | |

Alcoa Corp. | | 3,038 | | | 102,654 |

Franco-Nevada Corp. | | 669 | | | 79,718 |

Nucor Corp. | | 1,064 | | | 210,566 |

Osisko Gold Royalties Ltd. | | 7,370 | | | 121,015 |

POSCO Holdings, Inc. - ADR(b) | | 1,419 | | | 111,278 |

Rio Tinto PLC - ADR | | 1,737 | | | 110,716 |

Royal Gold, Inc. | | 994 | | | 121,079 |

Vale SA - ADR | | 5,522 | | | 67,313 |

Wheaton Precious Metals Corp. | | 4,477 | | | 211,002 |

| | | | | | 1,135,341 |

Real Estate — 23.5% | | | | | |

Farmland Partners, Inc. | | 13,456 | | | 149,362 |

Five Point Holdings LLC - Class A(a) | | 17,001 | | | 53,213 |

Forestar Group, Inc.(a) | | 5,963 | | | 239,653 |

FRP Holdings, Inc.(a) | | 1,848 | | | 113,467 |

Gladstone Land Corp. | | 8,078 | | | 107,761 |

Howard Hughes Holdings, Inc.(a) | | 1,844 | | | 133,911 |

Kennedy-Wilson Holdings, Inc. | | 4,647 | | | 39,871 |

Morguard Corp. | | 705 | | | 61,592 |

PotlatchDeltic Corp. | | 2,882 | | | 135,512 |

Rayonier, Inc. | | 4,656 | | | 154,765 |

Redfin Corp.(a) | | 2,860 | | | 19,019 |

Stratus Properties, Inc.(a) | | 2,273 | | | 51,893 |

Tejon Ranch Co.(a) | | 5,996 | | | 92,398 |

The St Joe Co. | | 3,624 | | | 210,083 |

Weyerhaeuser Co. | | 5,920 | | | 212,587 |

Zillow Group, Inc. - Class C(a) | | 1,096 | | | 53,463 |

| | | | | | 1,828,550 |

TOTAL COMMON STOCKS

(Cost $6,144,666) | | | | | 6,402,940 |

The accompanying notes are an integral part of the financial statements.

23

Amplify ETF Trust Amplify Inflation Fighter ETF Consolidated Schedule of Investments as of March 31, 2024 (Unaudited) (Continued) |

Description | | Par | | Value |

U.S. TREASURY OBLIGATIONS — 8.7% | | | | | | |

United States Treasury Floating Rate Note(c) | | | | | | |

5.23% (3 Month US Treasury Money Market Yield + (0.08%)),

04/30/2024 | | $ | 225,000 | | $ | 224,946 |

5.34% (3 Month US Treasury Money Market Yield + 0.04%),

07/31/2024 | | | 225,000 | | | 224,985 |

5.44% (3 Month US Treasury Money Market Yield + 0.14%),

10/31/2024 | | | 225,000 | | | 225,096 |

TOTAL U.S. TREASURY OBLIGATIONS (Cost $674,591) | | | | | | 675,027 |

| | | Shares | | |

SHORT-TERM INVESTMENTS — 4.3% | | | | | | |

Money Market Funds — 2.8% | | | | | | |

Invesco Government & Agency Portfolio - Institutional Class, 5.24%(d) | | | 217,174 | | | 217,174 |

Investments Purchased with Proceeds from Securities Lending — 1.5% | | | | | | |

First American Government Obligation Fund - Class X, 5.23%(d) | | | 116,104 | | | 116,104 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $333,278) | | | | | | 333,278 |

| | | | | | | |

TOTAL INVESTMENTS — 95.5%

(Cost $7,152,535) | | | | | | 7,411,245 |

Other Assets in Excess of

Liabilities — 4.5% | | | | | | 352,151 |

TOTAL NET ASSETS — 100.0% | | | | | $ | 7,763,396 |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

(a) Non-income producing security.

(b) All or a portion of this security is on loan as of March 31, 2024. The total market value of these securities was $107,906 which represented 1.4% of net assets.

(c) All or a portion of this security is held as collateral for the open futures. At March 31, 2024, the value of these securities amounted to $675,027 or 8.7% of net assets.

(d) The rate shown represents the 7-day effective yield as of March 31, 2024.

The accompanying notes are an integral part of the financial statements.

24

Amplify ETF Trust Amplify Inflation Fighter ETF Consolidated Schedule of Open Futures Contracts as of March 31, 2024 (Unaudited) |

Description | | Contracts

Purchased | | Expiration

Date | | Notional | | Value/Unrealized

Appreciation

(Depreciation) |

Bitcoin | | 93 | | 04/26/2024 | | $ | 665,229 | | $ | 11,875 |

Micro Gold | | 30 | | 06/26/2024 | | | 671,520 | | | 10,897 |

| | | | | | | | | | $ | 22,772 |

| | | | | | | | | | | |

Total Unrealized Appreciation (Depreciation) | | | | | | | | | $ | 22,772 |

The accompanying notes are an integral part of the financial statements.

25

Amplify ETF Trust

Amplify Natural Resources Dividend Income ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 99.4% | | | | | |

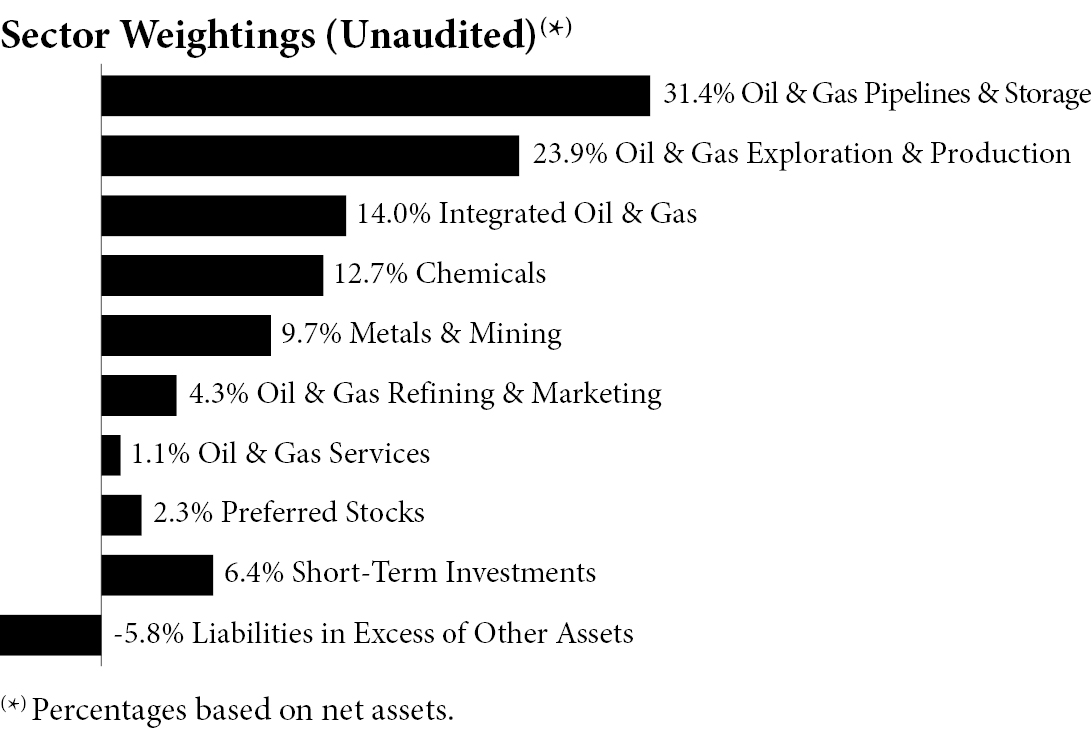

Chemicals — 12.7% | | | | | |

Chemours Co. | | 3,542 | | $ | 93,013 |

Dow, Inc. | | 3,121 | | | 180,800 |

Eastman Chemical Co. | | 1,461 | | | 146,421 |

FMC Corp. | | 2,290 | | | 145,873 |

ICL Group Ltd.(a) | | 32,618 | | | 175,485 |

International Flavors &

Fragrances, Inc. | | 1,676 | | | 144,119 |

LyondellBasell Industries

NV - Class A | | 1,793 | | | 183,388 |

Nutrien Ltd. | | 2,614 | | | 141,966 |

Sasol Ltd. - ADR(a) | | 34,516 | | | 269,570 |

| | | | | | 1,480,635 |

Integrated Oil & Gas — 14.1% | | | | | |

BP PLC - ADR | | 4,658 | | | 175,513 |

Chevron Corp. | | 950 | | | 149,853 |

Ecopetrol SA - ADR(a) | | 18,741 | | | 221,894 |

Eni SpA - ADR | | 4,615 | | | 146,388 |

Equinor ASA - ADR | | 3,648 | | | 98,605 |

Exxon Mobil Corp. | | 1,272 | | | 147,857 |

Petroleo Brasileiro SA - ADR | | 13,224 | | | 201,137 |

Shell PLC - ADR | | 2,278 | | | 152,717 |

Suncor Energy, Inc. | | 5,080 | | | 187,503 |

TotalEnergies SE - ADR | | 2,136 | | | 147,021 |

| | | | | | 1,628,488 |

Metals & Mining — 9.6% | | | | | |

Agnico Eagle Mines Ltd. | | 2,156 | | | 128,605 |

BHP Group Ltd. - ADR(a) | | 2,654 | | | 153,109 |

Glencore PLC - ADR | | 31,227 | | | 341,936 |

Newmont Corp. | | 4,233 | | | 151,711 |

Description | | Shares | | Value |

Rio Tinto PLC - ADR | | 2,357 | | $ | 150,235 |

Southern Copper Corp. | | 1,868 | | | 198,979 |

| | | | | | 1,124,575 |

Metal Fabrication — 2.3% | | | | | |

Gerdau SA - ADR | | 61,679 | | | 272,621 |

Oil & Gas Exploration &

Production — 23.7% | | | | | |

APA Corp. | | 3,431 | | | 117,958 |

Canadian Natural Resources Ltd. | | 2,391 | | | 182,481 |

Chesapeake Energy Corp.(a) | | 1,342 | | | 119,210 |

Chord Energy Corp. | | 1,336 | | | 238,129 |

Civitas Resources, Inc. | | 4,561 | | | 346,226 |

Coterra Energy, Inc. | | 4,310 | | | 120,163 |

Devon Energy Corp. | | 5,552 | | | 278,599 |

Diamondback Energy, Inc. | | 1,788 | | | 354,327 |

EOG Resources, Inc. | | 975 | | | 124,644 |

Permian Resources Corp. | | 8,966 | | | 158,340 |

Pioneer Natural Resources Co. | | 825 | | | 216,563 |

Viper Energy, Inc. | | 7,540 | | | 289,988 |

Woodside Energy Group Ltd. - ADR | | 11,550 | | | 230,654 |

| | | | | | 2,777,282 |

Oil & Gas Pipelines & Storage — 31.5%(b) | | | | | |

Antero Midstream Corp. | | 19,140 | | | 269,108 |

Cheniere Energy Partners LP | | 2,957 | | | 146,046 |

DT Midstream, Inc. | | 3,023 | | | 184,705 |

Enbridge, Inc. | | 6,606 | | | 239,006 |

Energy Transfer LP | | 12,672 | | | 199,331 |

Enterprise Products Partners LP | | 5,125 | | | 149,548 |

Hess Midstream LP - Class A | | 7,014 | | | 253,415 |

Kinder Morgan, Inc. | | 12,203 | | | 223,803 |

Kinetik Holdings, Inc. | | 8,684 | | | 346,231 |

MPLX LP | | 4,850 | | | 201,566 |

ONEOK, Inc. | | 2,628 | | | 210,687 |

Pembina Pipeline Corp. | | 5,372 | | | 189,846 |

Plains All American Pipeline LP | | 9,755 | | | 171,298 |

Plains GP Holdings LP | | 14,475 | | | 264,168 |

TC Energy Corp. | | 5,830 | | | 234,366 |

Western Midstream Partners LP | | 5,178 | | | 184,078 |

Williams Cos., Inc. | | 4,911 | | | 191,382 |

| | | | | | 3,658,584 |

Oil & Gas Refining & Marketing — 4.4% | | | | | |

HF Sinclair Corp. | | 2,127 | | | 128,407 |

Phillips 66 | | 797 | | | 130,182 |

Sunoco LP | | 1,688 | | | 101,770 |

Valero Energy Corp. | | 844 | | | 144,062 |

| | | | | | 504,421 |

The accompanying notes are an integral part of the financial statements.

26

Amplify ETF Trust

Amplify Natural Resources Dividend Income ETF

Schedule of Investments

as of March 31, 2024 (Unaudited) (Continued)

Description | | Shares | | Value |

Oil & Gas Services — 1.1% | | | | | | |

Noble Corp. PLC | | 2,616 | | $ | 126,850 | |

TOTAL COMMON STOCKS

(Cost $10,433,792) | | | | | 11,573,456 | |

| | | | | | | |

SHORT-TERM INVESTMENTS — 6.4% | | | | | | |

Investments Purchased with Proceeds from Securities Lending — 6.2% | | | | | | |

First American Government Obligations Fund - Class X, 5.23%(c) | | 719,859 | | | 719,859 | |

| | | | | | | |

Money Market Funds — 0.2% | | | | | | |

Invesco Government & Agency Portfolio - Institutional Class, 5.24%(c) | | 22,448 | | | 22,448 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $742,307) | | | | | 742,307 | |

| | | | | | | |

TOTAL INVESTMENTS — 105.8%

(Cost $11,176,099) | | | | | 12,315,763 | |

Liabilities in Excess of Other Assets — (5.8)% | | | | | (677,823 | ) |

TOTAL NET ASSETS — 100.0% | | | | $ | 11,637,940 | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

ADR - American Depositary Receipt

ASA - Advanced Subscription Agreement

NV - Naamloze Vennootschap

PLC - Public Limited Company

SA - Sociedad Anónima

(a) All or a portion of this security is on loan as of March 31, 2024. The total market value of these securities was $691,403 which represented 5.9% of net assets.

(b) To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors.

(c) The rate shown represents the 7-day effective yield as of March 31, 2024.

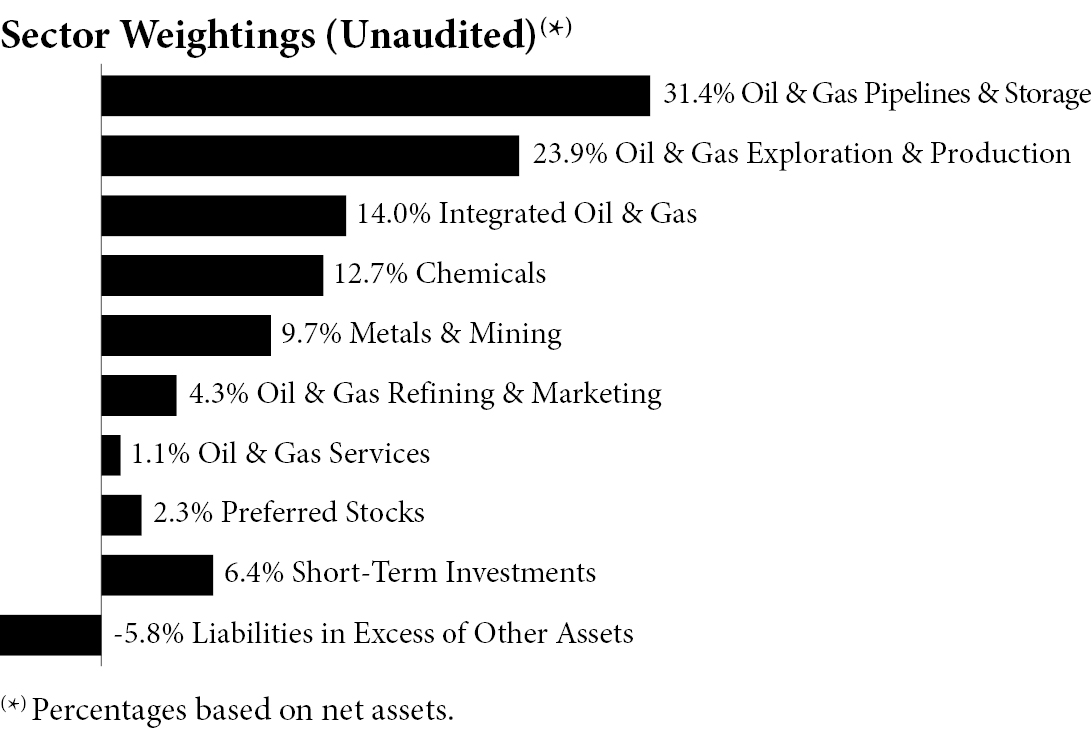

Sector Classification as of March 31, 2024 | | | | |

(% of Net Assets) | | | | | | | |

Energy | | $ | 8,695,625 | | | 74.8 | % |

Materials | | | 2,877,831 | | | 24.6 | |

Investments Purchased with Proceeds from Securities Lending | | | 719,859 | | | 6.2 | |

Money Market Funds | | | 22,448 | | | 0.2 | |

Liabilities in Excess of Other Assets | | | (677,823 | ) | | (5.8 | ) |

| | | | 11,637,940 | | | 100.0 | % |

The accompanying notes are an integral part of the financial statements.

27

Amplify ETF Trust

Amplify International Enhanced Dividend Income ETF

Schedule of Investments

as of March 31, 2024 (Unaudited)

Description | | Shares | | Value |

COMMON STOCKS — 94.5% | | | | | |

Communication Services — 10.5% | | | | | |

NetEase, Inc. - ADR | | 26,189 | | $ | 2,709,776 |

Nintendo Co. Ltd. - ADR(a) | | 179,882 | | | 2,444,596 |

Tencent Music Entertainment Group - ADR(b)(c) | | 231,258 | | | 2,587,777 |

TIM SA - ADR | | 130,472 | | | 2,315,878 |

Turkcell Iletisim Hizmetleri AS - ADR | | 169,477 | | | 879,586 |

| | | | | | 10,937,613 |

Consumer Discretionary — 17.1% | | | | | |

Alibaba Group Holding Ltd. - ADR | | 22,615 | | | 1,636,421 |

Coupang, Inc.(b) | | 102,802 | | | 1,828,848 |

Ferrari NV(c) | | 7,511 | | | 3,274,346 |

Description | | Shares | | Value |

Flutter Entertainment PLC(b) | | 4,341 | | $ | 857,304 |

InterContinental Hotels Group PLC - ADR(a) | | 10,770 | | | 1,137,958 |

Li Auto, Inc. - ADR(b) | | 28,219 | | | 854,471 |

MakeMyTrip Ltd.(b)(c) | | 32,000 | | | 2,273,600 |

PDD Holdings, Inc. - ADR(b)(c) | | 16,993 | | | 1,975,436 |

Sony Group Corp. - ADR | | 11,735 | | | 1,006,159 |

Toyota Motor Corp. - ADR(a)(c) | | 11,671 | | | 2,937,357 |

| | | | | | 17,781,900 |

Consumer Staples — 4.5% | | | | | |

Coca-Cola Femsa SAB de CV - ADR | | 20,123 | | | 1,955,956 |

Fomento Economico Mexicano

SAB de CV - ADR(c) | | 20,625 | | | 2,686,818 |

| | | | | | 4,642,774 |

Energy — 14.9% | | | | | |

Cameco Corp. | | 73,184 | | | 3,170,331 |

Canadian Natural Resources Ltd. | | 27,896 | | | 2,129,023 |

Ecopetrol SA - ADR(a) | | 181,630 | | | 2,150,499 |

Eni SpA - ADR | | 31,326 | | | 993,661 |

Petroleo Brasileiro SA - ADR | | 185,100 | | | 2,815,371 |

TotalEnergies SE - ADR | | 32,516 | | | 2,238,076 |

Ultrapar Participacoes SA - ADR | | 167,304 | | | 956,979 |

YPF SA - ADR(b) | | 55,513 | | | 1,099,157 |

| | | | | | 15,553,097 |

Financials — 21.0% | | | | | |

Banco Bilbao Vizcaya Argentaria SA - ADR(c) | | 432,620 | | | 5,122,222 |

Banco Macro SA - ADR(c) | | 17,704 | | | 852,979 |

Banco Santander SA - ADR | | 294,147 | | | 1,423,671 |

Bancolombia SA - ADR | | 60,770 | | | 2,079,549 |

ICICI Bank Ltd. - ADR | | 154,338 | | | 4,076,067 |

Mitsubishi UFJ Financial Group, Inc. - ADR | | 454,363 | | | 4,648,133 |

Sumitomo Mitsui Financial Group, Inc. - ADR(a) | | 235,566 | | | 2,772,612 |

XP, Inc. - Class A | | 39,629 | | | 1,016,880 |

| | | | | | 21,992,113 |

Health Care — 5.5% | | | | | |

AstraZeneca PLC - ADR | | 8,180 | | | 554,195 |

Novartis AG - ADR(c) | | 20,024 | | | 1,936,922 |

Novo Nordisk A/S - ADR | | 8,075 | | | 1,036,830 |

Teva Pharmaceutical Industries Ltd. - ADR(b)(c) | | 153,730 | | | 2,169,130 |

| | | | | | 5,697,077 |