Exhibit 3.5.13

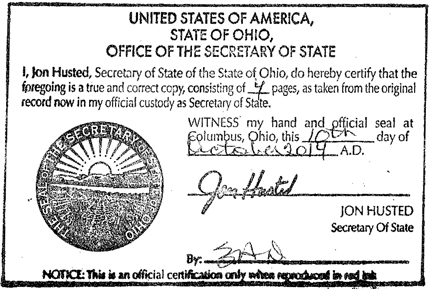

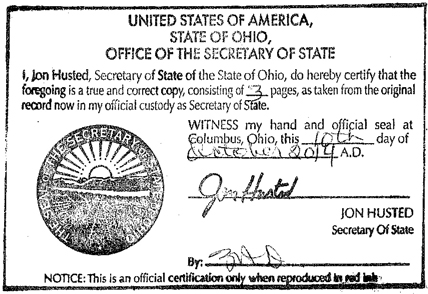

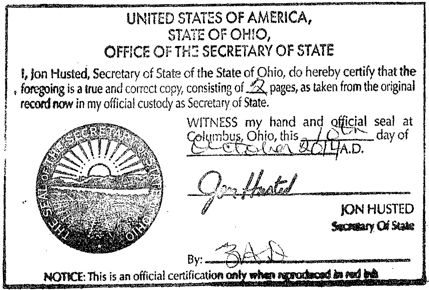

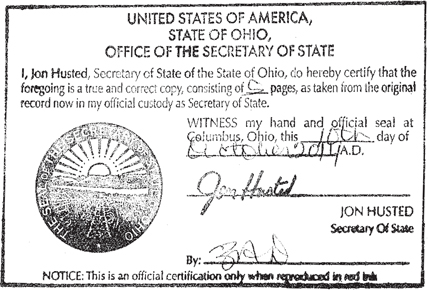

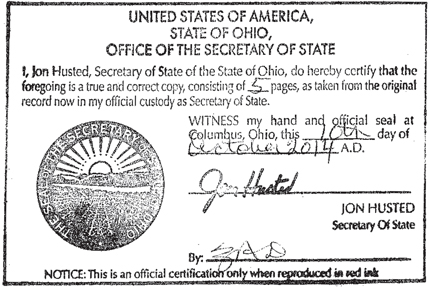

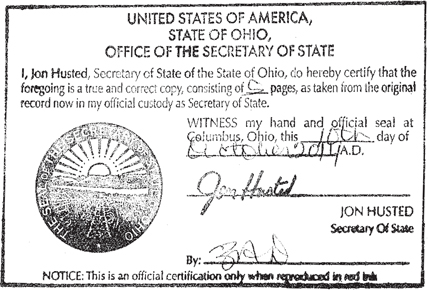

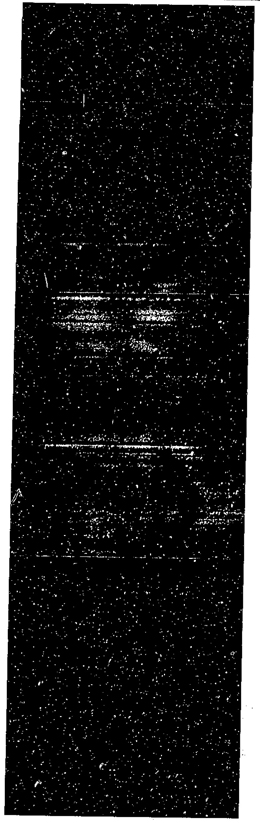

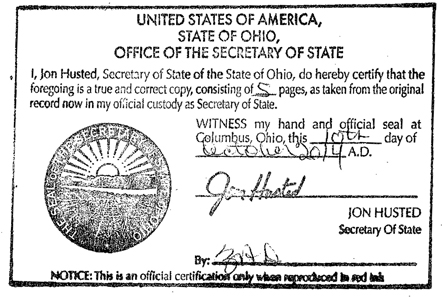

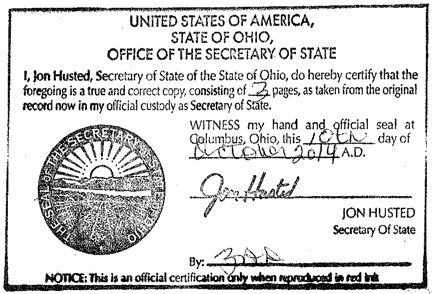

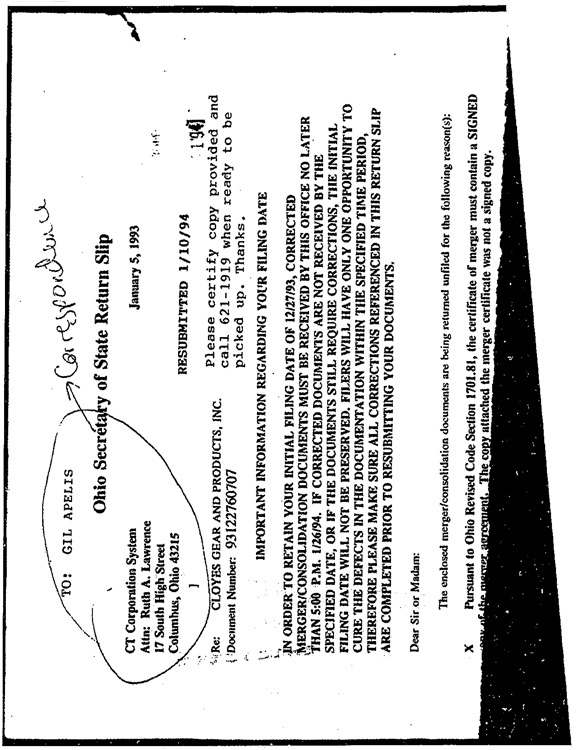

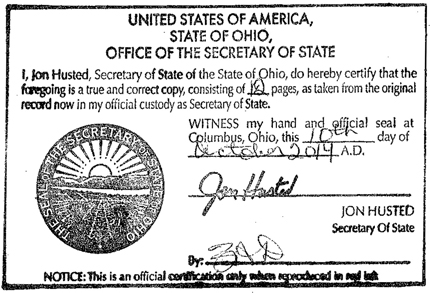

UNITED STATES OF AMERICA

STATE OF OHIO

OFFICE OF THE SECRETARY OF STATE

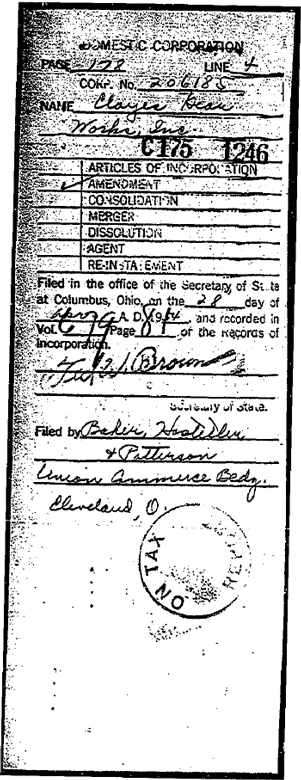

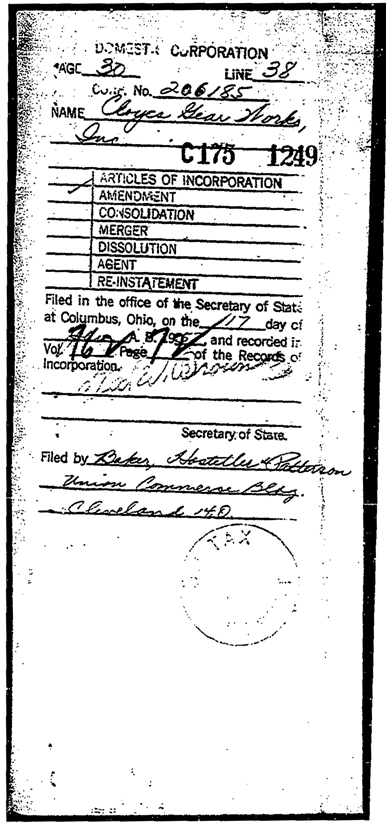

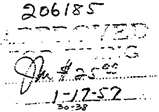

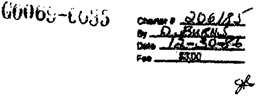

I, Jon Husted, do hereby certify that I am the duly elected, qualified and present acting Secretary of State for the State of Ohio, and as such have custody of the records of Ohio and Foreign business entities; that said records show ARTICLES OF INCORPORATION for CLOYES GEAR WORKS, INC., an Ohio Corporation, Charter No. 206185, filed in this office on January 22, 1948; CERTIFICATE OF AMENDMENT was filed April 28, 1954; CERTIFICATE OF AMENDMENT changing its corporate title to: CLOYES GEAR AND PRODUCTS, INC., was filed on January 17, 1957; CERTIFICATE OF AMENDMENT filed in this office on June 11, 1959; CERTIFICATE OF AMENDMENT filed in this office on December 28, 1964; CERTIFICATE OF AMENDED ARTICLES OF INCORPORATION were filed in this office on September 27, 1977; CERTIFICATE OF MERGER OF NAPA QUALITY AUTO PARTS, INC., an Ohio Corporation, Charter number 364049, having its principal location in Cleveland, County of Cuyahoga, incorporated on August 30, 1967, was filed on December 19, 1986, into CLOYES GEAR AND PRODUCTS, INC., survivor of said MERGER; CERTIFICATE OF MERGER of RUSH METALS COMPANY, a Nevada Corporation, into CLOYES GEAR AND PRODUCTS, INC. the survivor of said MERGER, was filed on December 19, 1986; Certificate of MERGER of CLOVES GEAR COMPANY, an Arkansas Corporation, into CLOYES GEAR AND PRODUCTS, INC., survivor of said MERGER, was filed on December 19, 1986; CERTIFICATE OF AMENDMENT filed in this office on January 09, 1987; Certificate of MERGER of CLOYES- IWIS, a Delaware corporation, into CLOYES GEAR AND PRODUCTS, INC., survivor of said MERGER, was filed on December 27, 1993; CERTIFICATE OF AMENDED ARTICLES OF

1 / 2

INCORPORATION were filed in this office on April 30, 1998; CERTIFICATE OF AMENDED ARTICLES OF INCORPORATION was filed in this office on June 14, 2002; CERTIFICATE OF AMENDED ARTICLES OF INCORPORATION was filed in this office on May 16, 2006.

THE FOREGOING STATEMENT CONSTITUTES A COMPLETE LIST OF ALL CHARTER DOCUMENTS ON FILE WITH THIS OFFICE. Said business entity, CLOYES GEAR AND PRODUCTS, INC., an Ohio Corporation, Charter No. 206185, having its principal location in Mentor, County of Lake, was filed on January 22, 1948, and is currently in GOOD STANDING upon the records of this office.

| ||

Witness my hand and the seal of the Secretary of State at Columbus, Ohio this 10th day of October, A.D. 2014.

| ||

| Ohio Secretary of State | ||

Validation Number: 201428300806 | ||

2 / 2

| Doc ID --> | C175_1243 |

Page 1

| Doc ID --> | C175_1243 |

| C175 1243 |

| ||

206185

| ||||

ARTICLES OF INCORPORATION

OF CLOYES GEARS WORKS, INC.

|

| The undersigned, all of whom are citizens of the United States, desiring to form a corporation for profit under the General Corporation Act of the State or Ohio, do hereby certify:

| |

FIRST: The name of said corporation shall be Cloyes Gear Works, Inc.

SECOND: The principal office of said corporation is to be located at Cleveland, Ohio, in Cuyahoga County, Ohio.

THIRD: Said corporation is formed for the purpose of manufacturing, purchasing, selling and otherwise dealing in goods, wares, merchandise and personal property of every kind and description, including, but not limited to, parts and gears for automobiles, trucks, tractors, machines and machinery; to purchase or otherwise acquire, own, hold, lease, improve, sell or otherwise dispose of, trade and deal in and with real estate, leasehold estates and other interests in real estate; to buy, sell, own, hold, lease, trade and deal in and with, maintain and operate machinery and equipment, materials and supplies and all other articles necessary, useful or convenient for use in connection with and in carrying on the business of the corporation, or any part thereof, with the right to acquire the good will, rights and property, and to undertake the whole or any part of the assets and liabilities of any person, firm, estate, partnership or corporation, and to pay for the same in cash, stock of this corporation, bonds or otherwise, and to hold or in any manner dispose of the whole or any part of the property so acquired, and to conduct in any lawful manner the whole or any part of the business so acquired, and to exercise all of the powers necessary, convenient or expedient in and about the conduct and management of such business.

FOURTH: The maximum number of shares which the corporation is authorized to have outstanding is 250 shares of the par value of $100.00 each. |

- 1 -

Page 2

| Doc ID --> | C175_1243 |

C175 1244

VOL 548 PAGE 269

FIFTH: The amount of capital with which the corporation will begin business is Twenty Five Thousand Dollars ($25,000.00).

IN WITNESS WHEREOF, we have hereunto set our hands this 16th day of January, 1948.

|

|

|

|

|

|

| Incorporators |

| STATE OF OHIO | ) | |||

| ) | SS: | |||

| COUNTY OF CUYAHOGA | ) |

Before me, a Notary Public in and for said County and State, personally appeared the above named Robert W. Wheeler, I. W. Stillinger and Brooks W. Maccracken, each of whom acknowledged the signing of the foregoing Articles of Incorporation to be his free act and deed.

IN TESTIMONY WHEREOF, I have hereunto subscribed my name and affixed my official seal at Cleveland, Ohio, this 16th day of January, 1948.

|  | |

| ||

| Notary Public | ||

Page 3

| Doc ID --> | C175_1243 |

ORIGINAL APPOINTMENT OF AGENT OF

CLOYES GEAR WORKS, INC.

C175 1245

KNOW ALL MEN BY THESE PRESENTS, that Herbert C. Stebbins, Jr., of 17214 Roseland Avenue, N. E., Cleveland 12, Cuyahoga County, Ohio, a natural person and resident of said County, being the County in which the principal office of Cloyes Gear Works, Inc. is located, is hereby appointed the person on whom process, tax notices and demands against Cloyes Gear Works, Inc., may be served.

| CLOYES GEAR WORKS, INC. | ||

|  | |

| ||

| ||

| ||

| ||

| ||

| Incorporators. | ||

Cloyes Gear Works, Inc.,

17214 Roseland Avenue, N. E.,

Cleveland 12, Ohio.

Gentlemen:

I hereby accept the appointment as the representative of your Company upon whom process, tax notices or demands may be served.

| ||

|

| State of Ohio. | ) | |||

| ) | SS. | |||

| Cuyahoga County | ) |

Personally appeared before me, the undersigned, a notary publics in and for said County, on this 16th day of January, 1948, the above named Herbert C. Stebbins, Jr., who acknowledged the signing of the foregoing to be his free act and dead for the uses and purposes herein mentioned.

WITNESS my hand and official seal on the day and year last aforesaid.

| ||

| ||

| Notary Public |

Page 4

| Doc ID --> | C175_1247 |

Page 1

| Doc ID --> | C175_1247 |

|

CERTIFICATE OF AMENDMENT

TO THE ARTICLES OF

CLOYES GEAR WORKS, INC. |

C175 1247 |  |

Herbert C. Stebbins, Jr., President, and Robert W. Wheeler, Secretary of Cloyes Gear Works, Inc., an Ohio corporation with its principal office located at Cleveland, Ohio, do hereby certify that all of the Shareholders who would be entitled to a notice of shareholders’ meeting for the purpose of amending the Articles of Incorporation thereof as contained in the following Resolution and to vote thereon did on the 27th day of April, 1954, by unanimous written consent without meeting adopt the following Resolution to amend the Articles:

RESOLVED that the following Amended Articles of Incorporation of Cloyes Gear Works, Inc. be and the same are hereby adopted to supersede and take the place of the existing Articles of Incorporation and all amendments thereto:

AMENDED ARTICLES OF INCORPORATION

OF

CLOYES GEAR WORKS, INC.

FIRST: The name of said corporation shall be Cloyes Gear Works, Inc.

SECOND: The principal office of said corporation is to be located at Cleveland, Ohio, in Cuyahoga County, Ohio.

THIRD: Said corporation is formed for the purpose of manufacturing, purchasing, selling and otherwise dealing in goods, wares, merchandise and personal property of every kind and description, including, but not limited to, parts and gears for automobiles, trucks, tractors, machines and machinery; to purchase or otherwise acquire, own, hold, lease, improve, sell or otherwise dispose of, trade and deal in and with real estate, leasehold estates and other interests in real estate; to buy, sell, own, held, lease, trade and deal in and with, maintain, and operate machinery and equipment, materials and supplier and all other articles necessary, useful or convenient for use in connection with and in carrying on the business of the corporation, or any part thereof, with the right to acquire the good |

Page 2

| Doc ID --> | C175_1247 |

C175 1248

| will, rights and property, and to undertake the whole or any part of the assets and liabilities of any person, firm, estate, partnership or corporation, and to pay for the same in cash, stock of this corporation, bonds or otherwise, and to hold or in any manner dispose of the whole or any part of the property so acquired, and to conduct in any lawful manner the whole or any part of the business so acquired, and to exercise all of the powers necessary, convenient or expedient in and about the conduct and management of such business.

FOURTH:Section 1. The maximum number of shares which the corporation is authorised to have outstanding shall be six hundred (600) which shall be classified and bear designations as follows: three hundred (300) shares shall be Class A Common stock of the par value of Twenty Five Dollars ($25.00) per share and three hundred shares shall be Class B Common stock of the par value of Twenty Five Dollars ($25.00) per share.

Section 2. The one hundred shares issued and outstanding at the time of the adoption of these Amended Articles of Incorporation, all of the par value of One Hundred Dollars ($100.00) per share, are hereby reclassified and changed into an aggregate number of one hundred (100) shares of Class A Common stock of the par value of Twenty Five Dollars ($25.00) per share and two hundred (200) shares of Class B Common stock of the par value of Twenty Five Dollars ($25.00) per share, each such outstanding share being hereby reclassified and changed into one (1) share of Class A Common stock and two (2) shares of Class B Common stock.

Section 3. The exclusive voting power of the corporation shall be vested in the holders of Class A Common stock and the holders of Class B Common stock shall have no voting rights other than as required by law.

FIFTH: At the time of filing these Amended Articles of Incorporation, the stated capital of the corporation is Ten Thousand Dollars ($10,000).

SIXTH: These Amended Articles of Incorporation shall supersede and take the place of the heretofore existing Articles of Incorporation and all amendments thereto.

IN WITNESS WHEREOF Herbert C. Stebbins, Jr., President, and Robert W. Wheeler Secretary of Cloyes Gear Works, Inc., acting for and on behalf of said Corporation, have hereunto subscribed their names and affixed the official seal of the Corporation this 27th day of April, 1954. |

|  | |

| ||

| President | ||

| ||

| ||

| Secretary |

Page 3

| Doc ID --> | C175_1250 |

Page 1

| Doc ID --> | C175_1250 |

VOL 762 PAGE 72 |

CERTIFICATE OF AMENDMENT OF ARTICLES OF INCORPORATION OF CLOYES GEAR WORKS, INC. |  |

C175 1250

Raymond T. Lewis, President, and John D. Drinko, Secretary, of Cloyes Gear Works, Inc., an Ohio corporation, with its principal office located at Cleveland, Cuyahoga County, Ohio, do hereby certify that the holders of all the shares of said Corporation entitled to vote on a proposal to amend the Articles of Incorporation thereof, as contained in the following Resolution, by unanimous consent, in writing, on January 9, 1957, pursuant to the authority of $1701.54 of the Ohio Revised Code, duly consented and agreed to the adoption of the following Resolution to amend said Articles of Incorporation:

RESOLVED, that the Articles of Incorporation of Cloyes Gear Works, Inc. be, and they are hereby, amended by striking out in its entirety Article FIRST thereof and inserting, in lieu thereof, a new Article FIRST, reading as follows:

FIRST: The name of said Corporation shall be CLOYES GEAR AND PRODUCTS, INC.

IN WITNESS WHEREOF, said Raymond T. Lewis, President, and John D. Drinko, Secretary, of Cloyes Gear Works, Inc., acting for and on behalf of said Corporation have hereunto subscribed their names and affixed the seal of said Corporation this 15 day of January, 1957.

| CLOYES GEAR WORKS, INC. | ||||

| By |  | ||

| ||||

| Raymond T. Lewis, President | ||||

| By |

| |||

| ||||

| John D. Drinko, Secretary | ||||

Page 2

| Doc ID --> | B105_0312 |

B105 311

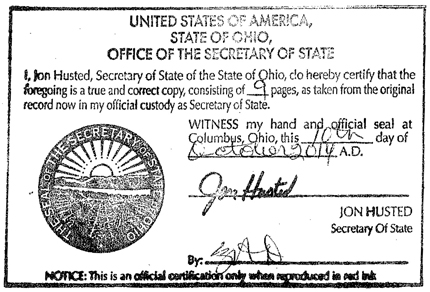

RECEIPT AND CERTIFICATE No. 12585

CLOYES GEAR AND PRODUCTS, INC.

NAME

206185

NUMBER

DOMESTIC CORPORATIONS

ARTICLES OF INCORPORATION

AMENDMENT

MERGER CONSOLIDATION

DISSOLUTION

AGENT

RE-INSTATEMENT

CERTIFICATE OF CONTINUED EXISTENCE

MISCELLANEOUS

FOREIGN CORPORATIONS

LICENSE

AMENDMENT

SURRENDER OF LICENSE

APPOINTMENT OF AGENT

CHANGE OF PRINCIPAL OFFICE

RE-INSTATEMENT

FORM 7

PENALTY

MISCELLANEOUS FILINGS

ANNEXATION/INCORPORATION—CITY OR VILLAGE

RESERVATION OF CORPORATE NAMES

REGISTRATION OF NAME

REGISTRATION OF NAME RENEWALS

REGISTRATION OF NAME—CHANGE OF REGISTRANTS ADDRESS

TRADE MARK

TRADE MARK RENEWAL

SERVICE MARK

SERVICE MARK RENEWAL

MARK OF OWNERSHIP

MARK OF OWNERSHIP RENEWAL

EQUIPMENT CONTRACT CHATTEL MORTGAGE

POWER OF ATTORNEY

SERVICE OF PROCESS

MISCELLANEOUS

ASSIGNMENT—TRADE MARK, MARK OF OWNERSHIP, SERVICE MARK

I certify that the attached document was received and filed in the office of TED W. BROWN, Secretary of State, at Columbus, Ohio, on the 11th day of June A.D. 19[ILLEGIBLE], and recorded on Roll B105 at Frame 311 of the RECORDS of INCOPORATION and MISCELLANEOUS FILINGS.

|

|

| TED W. BROWN |

| Secretary of State |

| Filed by and Returned To. | [ILLEGIBLE] |

Page 1

| Doc ID --> | B105_0312 |

B105 312

CERTIFICATE OF AMENDMENT OF ARTICLES OF INCORPORATION OF CLOYES GEAR AND PRODUCTS, INC. |  |

HARRY D. MYERS, President, and JOHN D. DRINKO, Secretary, of CLOYES GEAR AND PRODUCTS, INC., an Ohio Corporation, do hereby certify that the holders of all the issued and outstanding shares of said Corporation entitled to vote on a proposal to amend the Articles of Incorporation thereof, as contained in the following resolution, on the 1st day of June, 1959, duly consented to the adoption of the following resolution to amend said Articles of Incorporation, pursuant to the authority of Section 1701.54 of the Ohio Revised Code:

RESOLVED, that Article FOURTH of the Articles of Incorporation, as amended, be, and it is hereby, amended to henceforth be and read as follows:

FOURTH:Section 1. The maximum number of shares which the Corporation is authorized to have outstanding is Two Thousand Six Hundred (2,600), of which Two Thousand (2,000) shall be Preferred Shares of the par value of One Hundred Dollars ($100) per share, Three Hundred (300) shall be Class A Common Shares of the par value of Twenty Five Dollars ($25) per share and Three Hundred (300) shall be Class B Common Shares of the par value of Twenty Five-Dollars ($25) per share.

Section 2. The express terms and provisions of the shares of each class are as follows:

Preferred Shares.

(a)Dividends. Holders of Preferred Shares shall be entitled to receive, when and as declared by the Board of Directors of the Corporation, cumulative dividends at the rate of, but not to exceed, Five Dollars ($5.00) a share per annum, payable quarterly on the 1st day of January, April, July and October in each year, in preference to dividends on the Common Shares. Dividends on the Preferred Shares shall be

Page 2

| Doc ID --> | B105_0312 |

B015 313

cumulative from and after July 1, 1959, or from and after the first payment date subsequent to issuance, if issued subsequent to July 1, 1959.

(b)Dissolution and Liquidation. Preferred Shares shall be preferred as to assets as well as dividends. Upon any dissolution, liquidation or winding up of the Corporation, whether voluntary or involuntary, holders of Preferred Shares shall be entitled to receive and be paid for each share thereof, out of the assets of the Corporation (whether capital or surplus); One Hundred Dollars ($100) plus an amount equal to the accrued and unpaid dividends thereon to the date of payment. The consolidation or merger of the Corporation at any time, or from time to time, or a sale of all or substantially all of the assets of the Corporation shall not be construed as a dissolution, liquidation or winding up of the Corporation within the meaning hereof.

After payment of the full preferential amounts aforesaid, holders of Preferred Shares shall not be entitled to any further participation in any distribution of assets or funds of the Corporation, and the remaining assets and funds of the Corporation shall be divided and distributed among the holders of the Common Shares then outstanding according to their respective interests.

(c)Redemption. The Corporation, at its option to be exercised by the Board of Directors, may redeem the whole or any part of the Preferred Shares at any time, or from time to time, by the payment in cash of One Hundred Dollars ($100) a share, plus an amount equal to dividends accrued and unpaid thereon to the date of redemption, and plus a premium of Three Dollars ($3.00) a share if redeemed on or before July 1, 1964, and a premium of Five Dollars ($5.00) a share if redeemed thereafter.

If at any time less than all the outstanding Preferred Shares are to be called for redemption, the shares to be redeemed shall be selected by lot; or pro-rata, or by such other equitable method as the Board of Directors, in its discretion, may determine. Notice of every such redemption, stating the redemption date, the redemption price, and the place of payment thereof, shall be given by mailing a copy of each notice at least thirty (30) days prior to the date fixed for redemption to the holders of record of the Preferred Shares to be redeemed at their respective addresses as the name appear on the books of the Corporation.

[ILLEGIBLE]

Page 3

| Doc ID --> | B105_0312 |

B105 314

After such notice of redemption shall have been duly given, the Corporation shall pay the redemption price herein before set forth for each share called for redemption, or in lieu of such payments shall deposit the redemption price in cash on or prior to the redemption date with such bank or trust company in the City of Cleveland, Ohio, as may be designated by the Board of Directors of the Corporation , in trust, for payment on the redemption date to the holders of Preferred Shares to be redeemed.

On and after the date fixed in such notice as the date of redemption of the Preferred Shares (unless default shall be made by the Corporation in the payment and/or deposit of the redemption price pursuant to such notice and the provisions hereof) all dividends on the Preferred Shares so called for redemption shall cease to accrue and on such date, or on the deposit in trust as aforesaid of all funds sufficient for such redemption, the rights of the holders of Preferred Shares as shareholders of the Corporation shall cease and terminate, except the right to receive the redemption price, and no more, from the Corporation or from a depositary as above described, Upon surrender of their certificates properly endorsed.

(d)Purchase. The Corporation shall have the right at any time or from time to time to acquire Preferred Shares by purchase at a price not in excess of the redemption price hereinbefore set forth which would be applicable at the date of such purchase and to hold and/or dispose of such Preferred Shares.

(e)Voting. The holders of Preferred Shares shall have no voting rights or powers or be entitled to notice of meetings of shareholders except as may otherwise be provided by statute; provided, however, that if the Corporation shall have made default in the payment of eight (8) quarterly cumulative dividends then, during the continuance of such default, but no longer, the holders of the Preferred Shares shall be entitled to notice of all shareholders’ meetings and shall have the right to cast one vote for each Preferred Share held.

(f) The holders of the Preferred Shares shall have no pre-emptive rights to acquire additional shares of any class of the Corporation.

Page 4

| Doc ID --> | B105_0312 |

B105 315

Common Shares

Except as hereinbefore provided with respect to the Preferred Shares, the exclusive voting power of the Corporation shall be vested in the holders of Class A Common Shares and holders of Class A Common Shares shall have the right to cast one vote for each Common Share held. Holders of Class B Common Shares shall have no voting rights other than as required by law.

IN WITNESS WHEREOF, said Harry D. Myers, President, and John D. Drinko, Secretary, of Cloyes Gear and Products, Inc., acting for and on behalf of said Corporation, have hereunto subscribed their names this 10th day of June, 1959.

|

|

| Harry D. Myers, President |

|

|

| John D. Drinko, Secretary |

[ILLEGIBLE]

Page 5

| Doc ID --> | B387_0863 |

B387 862 RECEIPT AND CERTIFICATE No. 15227 CLOYES GEAR AND PRODUCTS, INC. |

NAME

206185

NUMBER

| DOMESTIC CORPORATIONS | MISCELLANEOUS FILINGS | |

ARTICLES OF INCORPORATION | ANNEXATIONS/INCORPORATION—CITY | |

AMENDMENT | OR VILLAGE | |

MERGER/CONSOLIDATION | RESERVATION OF CORPORATE NAMES | |

DISSOLUTION | REGISTRATION OF NAME | |

AGENT | REGISTRATION OF NAME RENEWALS | |

RE-INSTATEMENT | REGISTRATION OF NAME—CHANGE | |

CERTIFICATES OF CONTINUED | OF REGISTRANTS ADDRESS | |

EXISTENCE | TRADE MARK | |

MISCELLANEOUS | TRADE MARK RENEWAL | |

SERVICE MARK | ||

| FOREIGN CORPORATIONS | SERVICE MARK RENEWAL | |

MARK OF OWNERSHIP | ||

LICENSE | MARK OF OWNERSHIP RENEWAL | |

AMENDMENT | EQUIPMENT CONTRACT/CHATTEL | |

SURRENDER OF LICENSE | MORTGAGE | |

APPOINTMENT OF AGENT | POWER OF ATTORNEY | |

CHANGE OF ADDRESS OF AGENT | SERVICE OF PROCESS | |

CHANGE OF PRINCIPAL OFFICE | MISCELLANEOUS | |

RE-INSTATEMENT | ASSIGNMENT—TRADE MARK, MARK | |

FORM 7 | OF OWNERSHIP, SERVICE MARK, | |

PENALTY | REGISTRATION OF NAME | |

I certify that the attached document was received and filed in the office of TED W. BROWN, Secretary of State, at Columbus, Ohio, on the 28th day of Dec. A. D. 1964, and recorded on Roll B387 at Frame 862 of the RECORDS OF INCORPORATION and MISCELLANEOUS FILINGS.

|

|

| TED W. BROWN |

| Secretary of State |

| Filed by and Returned To: | Baker, Hostetler & Patterson | |||||

Union Commerce Bldg. | ||||||

Cleveland, Ohio | ||||||

| FEE RECEIVED: | $385.00 | |||||

| NAME: | CLOYES GEAR AND PRODUCTS, INC. | |||||

[ILLEGIBLE]

Page 1

| Doc ID --> | B387_0863 |

| B387 863 |  | |||

| CERTIFICATE OF AMENDMENT | ||||

| OF | ||||

| ARTICLES OF INCORPORATION | ||||

| OF | ||||

| CLOYES GEAR AND PRODUCTS, INC. |

HARRY D. MYERS, President, and JOHN D. DRINKO, Secretary, of CLOYES GEAR AND PRODUCTS, INC., an Ohio corporation, do hereby certify that the holders of all the issued and outstanding shares of said Corporation entitled to vote on a proposal to amend the Articles of Incorporation thereof, as contained in the following resolution, on the 24th day of December, 1964, duly consented to the adoption of the following resolution to amend said Articles of Incorporation, in a writing signed pursuant to the authority of Section 1701.54 of the Ohio Revised Code:

RESOLVED, that Article FOURTH of the Articles of Incorporation, as amended, be, and it is hereby, amend to henceforth be and read as follows:

FOURTH:Section 1. The maximum number of shares which the Corporation is authorized to have outstanding is Nine Thousand Eight Hundred (9,800), of which Two Thousand (2,000) shall be preferred shares of the par value of One Hundred Dollars ($100) per share; Three Hundred (300) shall be Class A Common Shares of the par value of Twenty-five Dollars ($25) per share and Seven Thousand Five Hundred (7,500) shall be Class B Common Shares of the par value of Twenty-five Dollars ($25) per share.

Section 2. The express terms and provisions of the shares of each class are as follows:

Preferred Shares.

(a)Dividends. Holders of Preferred Shares shall be entitled to receive, when and as declared by the Board of Directors of the Corporation, cumulative dividends at the rate of, but not to exceed, Five Dollars ($5.00) a share per annum, payable quarterly on the 1st day of January, April, July and October

Page 2

| Doc ID --> | B387_0863 |

B387 864

in each year, in preference to dividends on the Common Shares. Dividends on the Preferred Shares shall be cumulative from and after July 1, 1959, or from and after the first payment date subsequent to issuance, if issued subsequent to July 1, 1959.

(b)Dissolution and Liquidation. Preferred Shares shall be preferred as to assets as well as dividends. Upon any dissolution, liquidation or winding up of the Corporation, whether voluntary or involuntary, holders of Preferred Shares shall be entitled to receive and be paid for each share thereof, out of the assets of the Corporation (whether capital or surplus), One Hundred Dollars ($100) plus an amount equal to the accrued and unpaid dividends thereon to the date of payment. The consolidation or merger of the Corporation at any time, or from time to time, or a sale of all or substantially all of the assets of the Corporation shall not be construed as a dissolution, liquidation or winding up of the Corporation within the meaning hereof.

After payment of the full preferential amounts aforesaid, holders of Preferred Shares shall not be entitled to any further participation in any distribution of assets or funds of the Corporation, and the remaining assets and funds of the Corporation shall be divided and distributed among the holders of the Common Shares then outstanding according to their respective interests.

(c)Redemption. The Corporation, at its option to be exercised by the Board of Directors, may redeem the whole or any part of the Preferred Shares at any time, or from time to time, by the payment in cash of One Hundred Dollars ($100) a share, plus an amount equal to dividends accrued and unpaid thereon to the date of redemption, and plus a premium of Three Dollars ($3.00) a share if redeemed on or before July 1, 1964, and a premium of Five Dollars ($5.00) a share if redeemed thereafter.

If at any time less than all the outstanding Preferred Shares are to be called for redemption, the shares to be redeemed shall be selected by lot, or pro-rata, or by such other equitable method as the Board of Directors, in its discretion, may determine. Notice of every such redemption, stating the redemption date, the redemption price, and the place of payment thereof, shall be given by mailing a copy of such notice at least thirty (30) days prior to the date fixed for

-2-

Page 3

| Doc ID --> | B387_0863 |

B387 865

redemption to the holders of record of the Preferred Shares to be redeemed, at their respective addresses as the same appear on the books of the Corporation. After such notice of redemption shall have been duly given, the Corporation shall pay the redemption price hereinbefore set forth for each share called for redemption, or in lieu of such payments shall deposit the redemption price in cash on or prior to the redemption date with such bank or trust company in the City of Cleveland, Ohio, as may be designated by the Board of Directors of the Corporation, in trust, for payment on the redemption date to the holders of Preferred Shares so to be redeemed.

On and after the date fixed in such notice as the date of redemption of the Preferred Shares (unless default shall be made by the Corporation in the payment and/or deposit of the redemption price pursuant to such notice and the provisions hereof) all dividends on the Preferred Shares so called for redemption shall cease to accrue and on such date, or on the deposit in trust as aforesaid of all funds sufficient for such redemption, the rights of the holders of Preferred Shares as shareholders of the Corporation shall cease and terminate, except the right to receive the redemption price, and no more, from the Corporation or from a depositary as above described, upon surrender of their certificates properly endorsed.

(d)Purchase. The Corporation shall have the right at any time or from time to time to acquire Preferred Shares by purchase at a price not in excess of the redemption price hereinbefore set forth which would be applicable at the date of such purchase and to hold and/or dispose of such Preferred Shares.

(e)Voting. The holders of Preferred Share shall have no voting rights or powers or be entitled to notice of meetings of shareholders except as may otherwise be provided by statute; provided, however, that if the Corporation shall have made default in the payment of eight (8) quarterly cumulative dividends then, during the continuance of such default, but no longer, the holders of the Preferred Shares shall be entitled to notice of all shareholders’ meetings and shall have the right to cast one vote for each Preferred Share held.

(f) The holders of the Preferred Shares shall have no pre-emptive rights to acquire additional shares of any class of the Corporation.

-3-

Page 4

| Doc ID --> | B387_0863 |

B387 866

Common Shares

Except as hereinbefore provided with respect to the Preferred Shares, the exclusive voting power of the Corporation shall be vested in the holders of Class A Common Shares and holders of Class A Common Shares shall have the right to cast one vote for each Common Share held. Holders of Class B Common Shares shall have no voting rights other than as required by law.

IN WITNESS WHEREOF, said Harry D. Myers, President, and John D. Drinko, Secretary, of Cloyes Gear and Products, Inc., acting for and on behalf of said Corporation, have hereunto subscribed their names this 26th day of December, 1964.

|

|

| Harry D. Myers, President |

|

|

| John D. Drinko, Secretary |

- 4 -

Page 5

| Doc ID --> | E322_1305 |

Page 1

| Doc ID --> | E322_1305 |

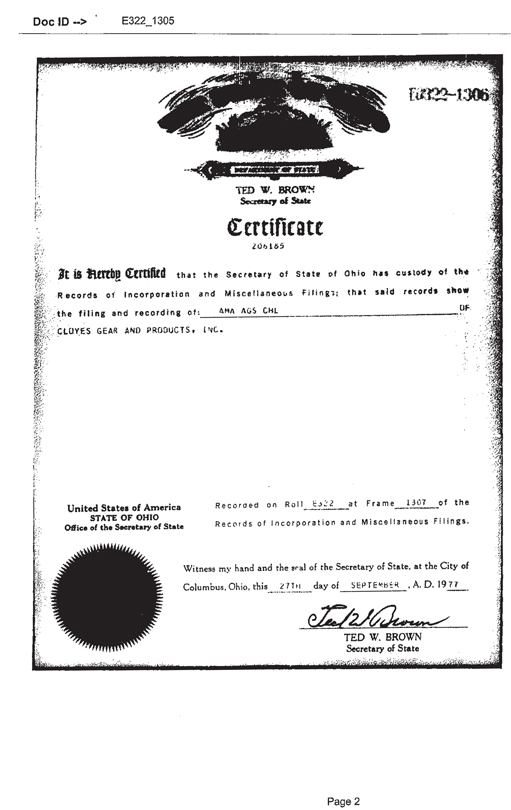

E0322-1306

DEPARTMENT OF STATE

TED W. BROWN

Secretary of State

Certificate

206185

It is hereby certified that the Secretary of State of Ohio has custody of the Records of Incorporation and Miscellaneous Filings; that said records show the filing and recording of: AMA AGS CHL OF CLOYES GEAR AND PRODUCTS, INC.

United State of America

STATE OF OHIO

Office of the Secretary of State

Recorded on Roll E322 at Frame 1307 of the Records of Incorporation and Miscellaneous Filings.

Witness my hand and the seal of the Secretary of State, at the City of Columbus, Ohio, this 27TH day of SEPTEMBER, A.D. 1977

TED W. BROWN

Secretary of State

Page 2

Page 2

| Doc ID --> | E322_1305 |

ILLEGIBLE

CERTIFICATE

OF

AMENDED ARTICLES OF

INCORPORATION

OF

CLOYES GEAR AND PRODUCTS, INC.

Malcola R. Myers, President and J. Richard Hamilton, Secretary of Cloyes Gear & Products, Inc., a corporation having its principal office located at Willoughby, Cuyahoga County, Ohio, do hereby certify that a meeting of the holders of the shares of said Corporation entitling them to vote on the proposal to adopt the Amended Articles of Incorporation referred to in the following resolution was duly called and held on the 5th day of August, 1977, that at such meeting a quorum of such shareholders was present in person or by proxy, and that by the affirmative vote of the holders of shares entitled to exercise more than two-thirds (2/3) of the voting power of the Corporation on such proposal the following resolution was adopted:

“RESOLVED, that he Amended Articles of Incorporation presented to this meeting and attached hereto as Exhibit A be, and they hereby are, adopted by this Corporation as its Amended Articles of Incorporation;….”

Page 3

| Doc ID --> | E322_1305 |

[ILLEGIBLE]

The undersigned [ILLEGIBLE] that the Amended Articles of Incorporation attached to [ILLEGIBLE] Certificate [ILLEGIBLE] Exhibit [ILLEGIBLE] and by this reference [ILLEGIBLE] hereof are the Amended Articles of Incorporation adopted by the Corporation as aforesaid.

IN WITNESS WHEREOF, said Malcolm R. Myers, President and J. Richard Hamilton, Secretary of Cloyes Gear & Products, Inc., acting for and on behalf of said Corporation, have hereunto subscribed their names this [ILLEGIBLE] day of August, 1977.

|

|

| Malcolm R. Myers, President |

|

|

| J. Richard Hamilton, Secretary |

-2-

Page 4

| Doc ID --> | E322_1305 |

E0322-1309

[ILLEGIBLE]

AMENDED ARTICLES OF INCORPORATION

OF

CLOYES GEAR AND PRODUCTS, INC.

FIRST: The name of the Corporation in Cloyes Gear and Products, Inc.

SECOND: The place in the State of Ohio where the principal office of the Corporation is located in the City of Willoughby, Lake County.

THIRD: The purpose of the Corporation in to engage in any lawful act or activity for which corporations may be formed under Sections 1701.01 to 1701.98, inclusive, of the Ohio Revised Code.

FOURTH:Section 1. The maximum number of shares which the Corporation is authorized to have outstanding is Nine Thousand Eight Hundred (9,800), of which Two Thousand (2,000) shall be preferred shares of the par value of One Hundred Dollars ($100) per share, Three Hundred (300) shall be Class A Common Shares of the par value of Twenty-five Dollars ($25) per share and Seven Thousand Five Hundred (7,500) shall be Class B Common Shares of the par value of Twenty-five Dollars ($25) per share.

Page 5

| Doc ID --> | E322_1305 |

E0322-1310

Section 2. The express terms and provisions of the shares of each class are as follows:

Preferred Shares.

(a)Dividends. Holders of Preferred Shares shall be entitled to receive, when and as declared by the Board of Directors of the Corporation, cumulative dividends at such annual rate as shall be fixed by the Board of Directors upon issuance of the shares, payable quarterly on the 1st day of January, April, July and October in each year, in preference to dividends on the Common Shares. Dividends on the Preferred Shares shall be cumulative from and after the first payment date subsequent to issuance.

(b)Dissolutions and Liquidation. Preferred Shares shall be preferred as to assets as well as dividends. Upon any dissolution, liquidation or winding up of the Corporation, whether voluntary or involuntary, holders of Preferred Shares shall be entitled to receive and be paid for each share thereof, out of the assets of the Corporation (whether capital of surplus), One Hundred Dollars ($100) plus an amount equal to the accrued and unpaid dividends thereon to the date of payment. The consolidation or merger of the Corporation at any time, or from time to time, or a sale of all or substantially all of the assets of the Corporation shall not be construed as a dissolution, liquidation or winding up of the Corporation within the meaning hereof.

-2-

Page 6

| Doc ID --> | E322_1305 |

E0322-1311

After payment of the full preferential amounts aforesaid, holders of Preferred Shares shall not be entitled to any further participation in any distribution of assets or funds of the Corporation, and the remaining assets and funds of the Corporation shall be divided and distributed among the holders of the Common Shares then outstanding according to their respective interests.

(c)Redemption. The Corporation, at its option to be exercised by the Board of Directors, may redeem the whole or any part of the Preferred Shares at any time, or from time to time, by the payment in cash of One Hundred Dollars ($100) a share, plus an amount equal to dividends accrued and unpaid thereon to the date of redemption, and plus a premium of Five Dollars ($5.00) a share.

If at any time less than all the outstanding Preferred Shares are to be called for redemption, the shares to be redeemed shall be selected by lot, or pro-rata, or by such other equitable method as the Board of Directors, in its discretion, may determine. Notice of every such redemption, stating the redemption date, the redemption price, and the place of payment thereof, shall be given by mailing a copy of such notice at least thirty (30) days prior to the

-3-

Page 7

| Doc ID --> | E322_1305 |

E0322-1312

date fixed for redemption to the holders of record of the Preferred Shares to be redeemed, at their respective addresses as the same appear on the books of the Corporation. After such notice of redemption shall have been duly given, the Corporation shall pay the redemption price hereinbefore set forth for each share called for redemption, or in lieu of such payments shall deposit the redemption price in cash on or prior to the redemption date with such bank or trust company in the City of Cleveland, Ohio, as may be designated by the Board of Directors of the Corporation, in trust, for payment on the redemption date to the holders of Preferred Shares so to be redeemed.

On and after the date fixed in such notice as the date of redemption of the Preferred Shares (unless default shall be made by the Corporation in the payment and/or deposit of the redemption price pursuant to such notice and the provisions hereof) all dividends on the Preferred Shares so called for redemption shall cease to accrue and on such date, or on the deposit in trust as aforesaid of all funds sufficient for such redemption, the rights of the holders of Preferred Shares as shareholders of the Corporation shall cease and terminate, except the right to receive the redemption price, and no more, from the Corporation or from a depositary as above described, upon surrender of their certificates properly endorsed.

-4-

Page 8

| Doc ID --> | E322_1305 |

E0322-1313

(d)Purchase. The Corporation shall have the right at any time or from time to time to acquire Preferred Shares by purchase at a price not in excess of the redemption price hereinbefore set forth which would be applicable at the date of such purchase and to hold and/or dispose of such Preferred Shares.

(e)Voting. The holders of Preferred Share shall have no voting rights or powers or be entitled to notice of meetings of shareholders except as may otherwise be provided by statute; provided, however, that if the Corporation shall have made default in the payment of eight (8) quarterly cumulative dividends then, during the continuance of such default, but no longer, the holders of the Preferred Shares shall be entitled to notice of all shareholders’ meetings and shall have the right to cast one vote for each Preferred Share held.

(f) The holders of the Preferred Shares shall have no pre-emptive rights to acquire additional shares of any class of the Corporation.

Common Shares

Except as hereinbefore provided with respect to the Preferred Shares, the exclusive voting power of the Corporation shall be vested in the holders of Class A Common Shares and holders of Class A Common Shares shall have the

-5-

Page 9

| Doc ID --> | E322_1305 |

E0322-1314

right to cast one vote for each Common Share held. Holders of Class B Common Shares shall have no voting rights other than as required by law.

FIFTH: No holder of shares of the Corporation of any class shall be entitled as such, as a matter of right, to subscribe for or purchase shares of any class, now or hereafter authorized, or to subscribe for or purchase securities convertible into or exchangeable for shares of the corporation or to which shall be attached or appertain any warrants or rights entitling the holder thereof to subscribe for or purchase, if any, for such considerations and upon such terms and conditions as its Board of Directors from tim to time may determine.

SIXTH: To the extent permitted by law, the Corporation, by action of its Board of Directors, may purchase or otherwise acquire shares of any class issued by it at such times, for such considerations and upon such terms and conditions as its Board of Directors may determine.

SEVENTH: These Amended Articles of Incorporation take the place and supersede the existing Articles of Incorporation as heretofore amended.

-6-

Page 10

| Doc ID --> | E322_1305 |

[ILLEGIBLE]

Subsequent Appointment of Agent Sections 1701.01 [ILLEGIBLE] Revised Code |  |

KNOW ALL MEN BY THESE PRESENTS,[ILLEGIBLE]

(Name of Agent)

of7610 Eagle Hills Road, R.D. 3, Waite Hill

[ILLEGIBLE]

in Willoughby 44094,LakeCounty, Ohio, a natural person residing in [ILLEGIBLE]

(City or Village)

county, [ILLEGIBLE]

the county in which the principal office ofCloyes Gear and Products, Inc.

(Name of Corporation)

is located, is hereby appointed as the agent on whom ([ILLEGIBLE]) process, tax notices and demands against

said Cloyes Gear and Products, Inc.

(Name of Corporation)

may be served, to succeed A.G.C. Co.

(Name of Former Agent)

heretofore appointed as agent, which appointment is hereby made pursuant to a resolution of the board of directors (trustees) passed on the 5thdayof August,1977.

All previous appointments are hereby revoked.

| Cloyes Gear and Products, Inc. | ||||

| (Name of Corporation) | ||||

| By |  | |||

| ([ILLEGIBLE] Secretary) | ||||

| Cleveland, Cuyahoga County | , Ohio | |||

| September 23, | , 1977 | |||

Cloyes Gear and Products, Inc. |

| (Name of Corporation) |

Gentlement: I [ILLEGIBLE](XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX) hereby accept(X) appointment as the agent of your corporation upon whom (which) process, tax notices or demands may be served.

| ||

| (Signature of Agent or Name of Corporation) | ||

| By | ||

| (Signature of Officer Signing and Title) | ||

Page 11

| Doc ID --> | E322_1305 |

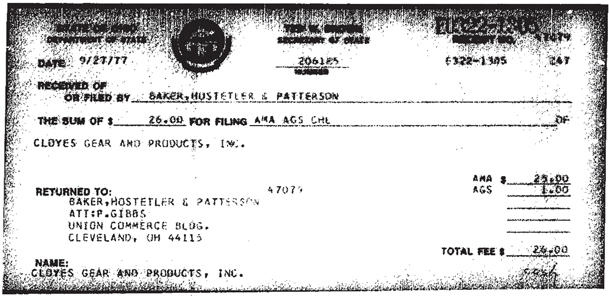

BAKER, HOSTETLER & PATTERSON UNION COMMERCE BUILDING CLEVELAND, OHIO 44115 [ILLEGIBLE] [ILLEGIBLE] [ILLEGIBLE] [ILLEGIBLE] [ILLEGIBLE] [ILLEGIBLE] [ILLEGIBLE] [ILLEGIBLE] | E0322-1316 |

September 26, 1977

Secretary of State |  | |

| State of Ohio | ||

| Corporation Division | ||

| 30 East Broad Street | ||

| Columbus, Ohio 43216 |

RE: Cloyes Gear and Products, Inc.

Gentlemen:

I enclose for filing on behalf of Cloyes Gear and Products, Inc., a Subsequent Appointment of Agent form and a Certificate of Amended Articles of Incorporation, together with a check in the amount of $26.00 to cover the statutory fee.

Please return the enclosed documents directly to me after they are filed.

| Yours sincerely, |

| Pamela Gibbs |

| Legal Assistant |

787:14J

Enclosures

3996-FF-3

[ILLEGIBLE]

Page 12

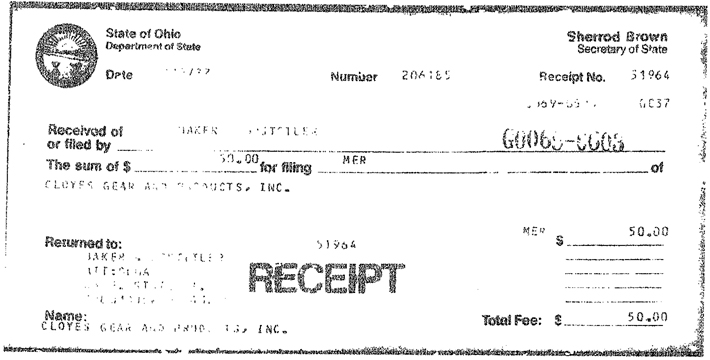

| Doc ID --> | G069_0603 |

Page 1

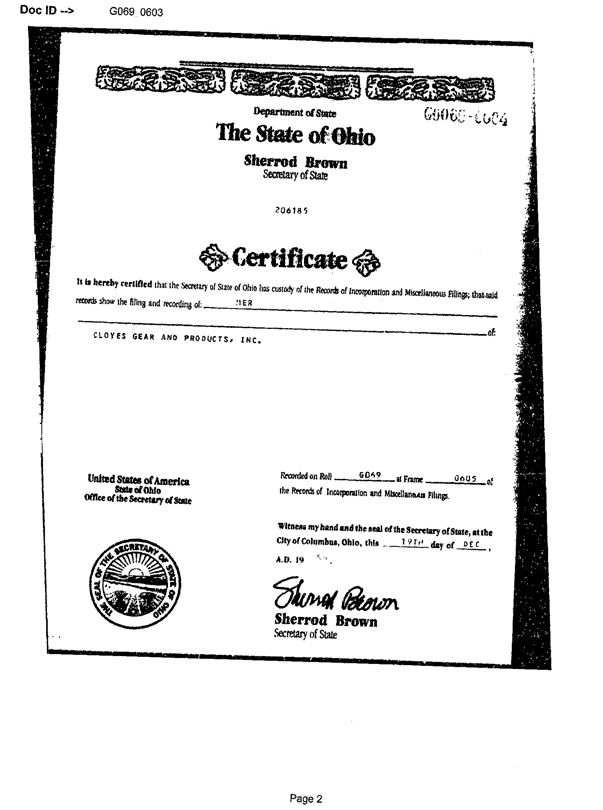

G0069-0004

Department of State

The State of Ohio

Sherrod Brown

Secretary of State

206185

Certificate

It is hereby certified that the Secretary of State of Ohio has custody of the Records of Incorporation and Miscellaneous Filings; that said records show the filing and recording of: HER of:

CLOYES GEAR AND PRODUCTS, INC.

United States of America State of Ohio

Office of Secretary of State

Recorded on Roll G069 at Frame 0605 of the Records of Incorporation and Miscellaneous Filings.

Witness my hand and the seal of the Secretary of State, at the City of Columbus, Ohio, this 19TH day of DEC A.D. 19

Sherrod Brown

Secretary of State

THE SEAL OF THE SECRETARY OF STATE OF OHIO

| Doc ID --> | G069_0603 |

CERTIFICATE AS TO THE MANNER

OF ADOPTION OF AGREEMENT AND PLAN OF MERGER

OF

CLOYES GEAR AND PRODUCTS, INC,

AND

NAPA QUALITY AUTO PARTS, INC.

Malcolm R. Myers, President, and J. Richard Hamilton, Secretary, of Cloyes Gear and Products, Inc., an Ohio corporation with its principal office located at 4520 Beidler Road, Willoughby, Ohio, and Malcolm R. Myers, President, and J. Richard Hamilton, Secretary, of NAPA Quality Auto Parts, Inc., an Ohio corporation with its principal office located in Cleveland, Ohio, do hereby certify that the signed counterpart of the Agreement and Plan of Merger attached hereto was approved and adopted by their respective Boards of Directors of Cloyes Gear and Products, Inc. and NAPA Quality Auto Parts, Inc. at [ILLEGIBLE] of all the directors of each of said corporations [ILLEGIBLE] called and held on the 10th day of December, 1986, and at which a quorum for the transaction of business was present throughout each meeting, and that said Agreement and Plan of Merger was not adopted nor required to be adopted by the shareholders of either of said corporations in accordance with Ohio Revised Code Section 1701180.

The Agreement and Plan of Merger does not conflict with the articles or regulations of either corporation, and it does not change the articles or regulations of Cloyes Gear and Products, Inc. nor authorise any action which apart from the merger would require adoption by the shareholders or by the holders of a particular class of shares of Cloyes Gear and Products, Inc. The merger does not involve issuance or transfer by the said surviving corporation to the shareholders of NAPA Quality Auto Parts, Inc. of such number of shares of the surviving corporation which will entitle the holders thereof after the consummation of the merger to exercise one-sixth or more of the voting power of the Cloyes Gear and Products, Inc. in the election of the directors. There is no change in the directors of Cloyes Gear and Products, Inc. that would require action by the shareholders or by the holders of a particular class of said surviving corporation. Cloyes Gear and Products, Inc. owns one hundred per-cent of the outstanding shares of NAPA Quality Auto Parts, Inc. The Agreement and Plan of Merger thereby was adopted by the action of the board of directors of Cloyes Gear and Products, Inc., and is the duly adopted agreement and act of the said corporation.

Page 3

| Doc ID --> | G069_0603 |

IN WITNESS WHEREOF, said Malcolm R. Myers and J. Richard Hamilton, President and Secretary, respectively, of Cloyes Gear and Products, Inc. and Malcolm R. Myers and J. Richard Hamilton, President and Secretary, respectively of NAPA Quality Auto Parts, Inc., have hereunto subscribed their names on the 17th day of December, 1986.

|

Malcolm R. Myers, President Cloyes Gear and Products, Inc. |

|

J. Richard Hamilton, Secretary Cloyes Gear and Products, Inc. |

|

Malcolm R. Myers, President NAPA Quality Auto Parts, Inc. |

|

J. Richard Hamilton, Secretary NAPA Quality Auto Parts, Inc. |

GKKl (O)

cas 12/16/86

-2-

Page 4

| Doc ID --> | G069_0603 |

AGREEMENT AND PLAN OF MERGER

OF

CLOYES GEAR AND PRODUCTS, INC.

AND

NAPA QUALITY AUTO PARTS, INC.

THIS AGREEMENT is made this 17th day of December, 1986, by and between CLOYES GEAR AND PRODUCTS, INC., an Ohio corporation (“Cloyes Ohio”), and NAPA QUALITY AUTO PARTS, INC., an Ohio corporation (“NAPA”), said corporations being sometimes collectively referred to herein as the “constituent corporations.”

PREMISES:

WHEREAS, Cloyes Ohio was incorporated under the laws of the state of Ohio by Articles of Incorporation filed in the office of the Secretary of State of Ohio on the 22nd day of January, 1948, and recorded in Volume 548, Page 268 of the Records of Incorporation and Miscellaneous Filings in said office; and

WHEREAS NAPA was incorporated under the laws of the State of Ohio, its Articles of Incorporation having been filed in the Office of the Secretary of State of Arkansas on the 30th day of August, 1967; and recorded on Roll B519, Frame 510 of the Records of Incorporation and Miscellaneous [Illegible]

Page 5

| Doc ID --> | G069_0603 |

WHEREAS, NAPA is authorised to issue 500 Common Shares, without par value, all of which are issued and outstanding at the date hereof and owned by Cloyes Ohio;

NOW, THEREFORE, in consideration of the premises and of the covenants herein contained, the constituent corporations, having complied with all the conditions of Ohio Revised Code Section 1701.80 and no approval by the shareholders of Cloyes Ohio or NAPA being required, have agreed and do hereby agree that NAPA shall be and it is hereby merged with and into Cloyes Ohio (hereinafter sometimes called the “Surviving Corporation”), pursuant to and upon the authority of Ohio Revised Code Section 1701.80, and that the terms of the merger the mode of carrying them into effect and the manner and basis of making distributions to the shareholders of the constituent corporations are and shall be as follows:

1. The Amended Articles of incorporation and the Code of Regulations of Cloyes Ohio as in effect immediately prior to the merger shall continue to be the Amended Articles of Incorporation and the Code of Regulations, respectively, of the Surviving Corporation.

2. Each outstanding share of Class A Common Stock, $25 par value, and each outstanding share of Class B common stock, $25 par value, of Cloyes Ohio shall continue

-2-

Page 6

| Doc ID --> | G069_0603 |

as one outstanding share of Class A Common Stock, $25 par value, and one outstanding share of Class B Common Stock, $25 par value, respectively, of the Surviving Corporation and the certificates representing such shares of Cloyes Ohio prior to the effective date hereof shall continue without change as the certificates representing an equal number of shares of Class A Common Stock, $25 par value, and an equal number of Class B Common Stock, $25 par value, respectively, of the Surviving Corporation.

3. Each outstanding Common Share, without par value, of NAPA shall be and is hereby canceled, and the rights of the holder thereof extinguished.

4. The said merger shall be and become effective as provided in Ohio Revised Code Section 1701.81 upon the filing of the Certificate As To The Manner Of Adoption Of Agreement and Plan of Merger and this Agreement and Plan of Merger in the Office of the Secretary of State of Ohio.

5. This Agreement may be executed in any number of counterparts, each of which when so executed shall be an original, but such counterparts shall together constitute one and the same instrument.

IN WITNESS WHEREOF, the constituent corporations have caused this Agreement and Plan of Merger to be signed

-3-

Page 7

| Doc ID --> | G069_0603 |

in their respective corporate names by their respective officers, thereunto duly authorised, on the date first above written.

| CLOYES GEAR AND PRODUCTS, INC. | ||

| By |  | |

| Malcolm R. Myers, President | ||

| By |  | |

| J. Richard Hamilton, Secretary | ||

| NAPA QUALITY AUTO PARTS, INC. | ||

| By |  | |

| Malcolm R. Myers, President | ||

| By |  | |

| J. Richard Hamilton, Secretary | ||

GKK2/H

cas 12/16/86

-4-

Page 8

| Doc ID --> | G069_0603 |

[ILLEGIBLE]

Page 9

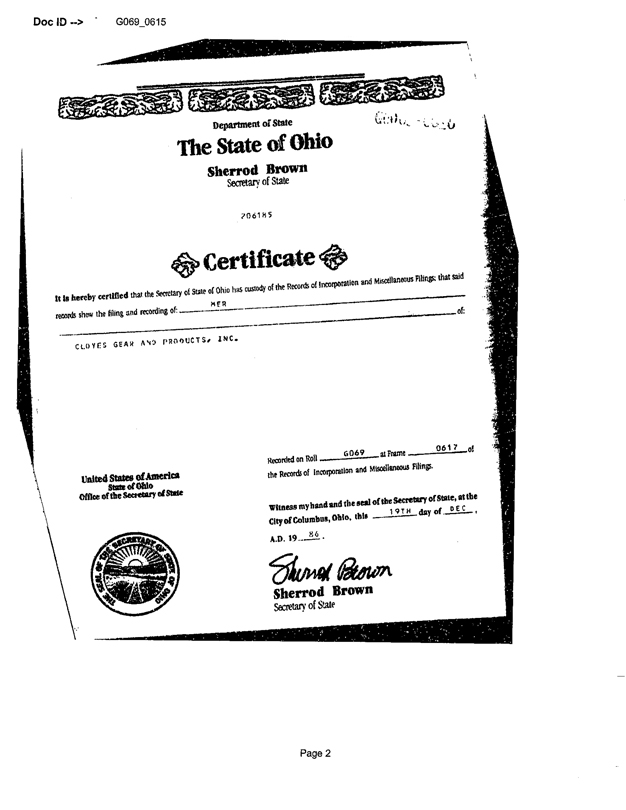

| Doc ID --> | G069_0615 |

Page 1

Doc ID -- > G069_0615

G069 0616

Department of State

The State of Ohio

Sherrod Brown

Secretary of State

206185

Certificate

It is hereby certified that the Secretary of State of Ohio has custody of the Records of incorporation and Miscellaneous Filings: that said

records show the filing and recording of: MER

of:

CLOYES GEAR AND PRODUCTS, INC.

United States of America

State of Ohio

Office of the Secretary of State

THE SEAL OF THE SECRETARY OF STATE OF OHIO

Recorded on Roll G069 at Frame 0617 of the Records of Incorporation and Miscellaneous Filings.

Witness my hand and the seal of this Secretary of State, at the City of Columbus, Ohio, this 19th day of DEC,

A.D. 1986.

Sherrod Brown

Secretary of State

Page 2

| Doc ID --> | G069_0615 |

CERTIFICATE AS TO THE MANNER

OF ADOPTION OF AGREEMENT AND PLAN OF MERGER

OF

CLOYES GEAR AND PRODUCTS, INC.

AND

RUSH METALS COMPANY

Malcolm R. Myers, President, and J. Richard Hamilton, Secretary, of Cloyes Gear and Products, Inc., an Ohio corporation with its principal office located at 4520 Beidler Road, Willoughby, Ohio, and Malcolm R. Myers, Executive Vice President, and J. Richard Hamilton, Secretary, of Rush Metals Company, an Oklahoma corporation with its principal office located at P.O. Box 218, Billings, Oklahoma, do hereby certify that the signed counterpart of the Agreement and Plan of Merger attached hereto was approved and adopted by their respective Boards of Directors of Cloyes Gear and Products, Inc. and Rush Metals Company at meetings of all of the directors of each of said corporation duly called and held on the 10th day of December, [ILLEGIBLE], and at which a quorum for the transaction of business was present throughout each meeting; and that said agreement and Plan of Merger was not adopted nor required to be adopted by the shareholders of either of said corporations in accordance with Ohio Revised Code Section 1701.80 and the Oklahoma Business Corporation Act Section 1083.

The Agreement and Plan of Merger does not conflict with the articles or regulations of either corporation, and it does not change the articles or regulations of Cloyes Gear and Products, Inc. nor authorize any action which apart from the merger would require adoption by the shareholders or by the holders of a particular class of shares of Cloyes Gear and Products, Inc. The merger does not involve issuance or transfer by the said surviving corporation to the shareholders or Rush Metals Company of such number of shares of the surviving corporation which will entitle the holders thereof after the consummation of the merger to exercise one-sixth or more of the voting power of the Cloyes Gear and Products, Inc. in the election of the directors. There is no change in the directors of Cloyes Gear and Products, Inc. that would require action by the shareholders or by the holders of a particular class of said surviving corporation, Cloyes Gear and Products, Inc. owns one hundred per-cent of the outstanding shares of Rush Metals Company. The Agreement and Plan of Merger thereby was adopted by the action of the board of directors of Cloyes Gear and Products, Inc., and is the duly adopted agreement and act of the said corporation.

Page 3

| Doc ID --> | G069_0615 |

IN WITNESS WHEREOF, said Malcolm R. Myers and J. Richard Hamilton, President and Secretary, respectively, of Cloyes Gear and Products, Inc. and Malcolm R. Myers and J. Richard Hamilton, Executive Vice President and Secretary, respectively, of Rush Metals Company, have hereunto subscribed their names on the 17th day of December, 1986.

|

| Malcolm R. Myers, President |

| Cloyes Gear and Products, Inc. |

|

| J. Richard Hamilton, Secretary |

| Cloyes Gear and Products, Inc. |

|

| Malcolm R. Myers, Executive Vice President |

| Rush Metals Products |

|

| J. Richard Hamilton, Secretary |

| Rush Metals Company |

GKK1 (N)

cas 12/16/86

-2-

Page 4

| Doc ID --> | G069_0615 |

AGREEMENT AND PLAN OF MERGER

OF

CLOYES GEAR AND PRODUCTS, INC.

AND

RUSH METALS COMPANY

THIS AGREEMENT is made this 17th day of December, 1986, by and between CLOYES GEAR AND PRODUCTS, INC., an Ohio corporation (“Cloyes Ohio”), and RUSH METALS COMPANY, an Oklahoma corporation (“Cloyes Oklahoma”) said corporations being sometimes collectively referred to herein at the “constituent corporations.”

PREMISES:

WHEREAS, Cloyes Ohio was incorporated under the laws of the State of Ohio by Articles of Incorporation filed in the office of the Secretary of State of Ohio on the 22nd day of January, 1948, and recorded in Volume 548, Page 268 of the Records of Incorporation and Miscellaneous Filings in said office; and

WHEREAS Cloyes Oklahoma was incorporated under the laws of the State of Oklahoma, its Articles of Incorporation having been filed in the Office of the Secretary of State of Oklahoma on the 11th day of August, 1980; and

WHEREAS, Cloyes Oklahoma is authorized to issue [ILLEGIBLE] Common Shares, without par value, 100 of which are issued and outstanding at the date hereof and owned by Cloyes Ohio;

Page 5

| Doc ID --> | G069_0615 |

NOW, THEREFORE, in consideration of the premises and of the covenants herein contained, the constituent corporations, having complied with all the conditions of Ohio Revised Code Section 1701.90 and the Oklahoma Business Corporation Act Section 1003 and no approval by the shareholders of Cloyes Ohio or Cloyes Oklahoma being required, have agreed and do hereby agree that Cloyes Oklahoma shall be and it is hereby merged with and into Cloyes Ohio (hereinafter sometimes called the “Surviving Corporation”), pursuant to and upon the authority of Ohio Revised Code Section 1701.60 and the Oklahoma Business Corporation Act Section 1983, and that the terms of the merger, the mode of carrying then into effect and the manner and basis of making distributions to the shareholders of the constituent corporations are and shall be as follows:

1. The Amended Articles of Incorporation and the Code of Regulations of Cloyes Ohio as in effect immediately prior to the merger shall continue to be the Amended Articles of Incorporation and the Code of Regulations, respectively, of the Surviving Corporation.

2. Each outstanding share of Class A Common Stock, $25 par value, and each outstanding share of Class H common Stock, $25 par value, of Cloyes Ohio shall continue

-2-

Page 6

| Doc ID --> | G069_0615 |

as one outstanding share of Class A Common Stock, $25 par value, and one outstanding share of Class B Common Stock, $25 par value, respectively, of the Surviving Corporation and the certificates representing such shares of Cloyes Ohio prior to the effective date hereof shall continue without change as the certificates representing an equal number of shares of Class A Common Stock, $25 par value, and an equal number of Class B Common Stock, $25 par value, respectively, of the Surviving Corporation.

3. Each outstanding Common Share, without par value, of Cloyes Oklahoma shall be and is hereby canceled, and the rights of the holder thereof extinguished.

4. The said merger shall be and become effective as provided in Ohio Revised Code Section 1701.81 and in the Oklahoma Business Corporation Act Section 64-707 upon the later to occur of the filing of the Certificate As To The Manner Of Adoption of Agreement and Plan of Merger and this Agreement and Plan of Merger in the Office of the Secretary of State of Ohio or the filing of the Certificate of Merger in the Office of the Secretary of State of Oklahoma.

5. This Agreement may be executed in any number of counterparts, each of which when so executed shall be an original, but such counterparts shall together constitute one and the same instrument.

-3-

Page 7

| Doc ID --> | G069_0615 |

IN WITNESS WHEREOF, the constituent corporations have caused this Agreement and Plan of Merger to be signed in their respective corporate names by their respective officers, thereunto duly authorized, on the date first above written.

| CLOYES GEAR AND PRODUCTS, INC. | ||

| By |  | |

| Malcolm R. Myers, President | ||

| By |  | |

| J. Richard Hamilton, Secretary | ||

| RUSH METALS COMPANY | ||

| By |  | |

| Malcolm R. Myers, Executive Vice President | ||

| By |  | |

| J. Richard Hamilton, Secretary | ||

GKK2/G

bjw 12/16/86

-4-

Page 8

| Doc ID --> | G069_0623 |

Page 1

Doc ID -- > G069_0623

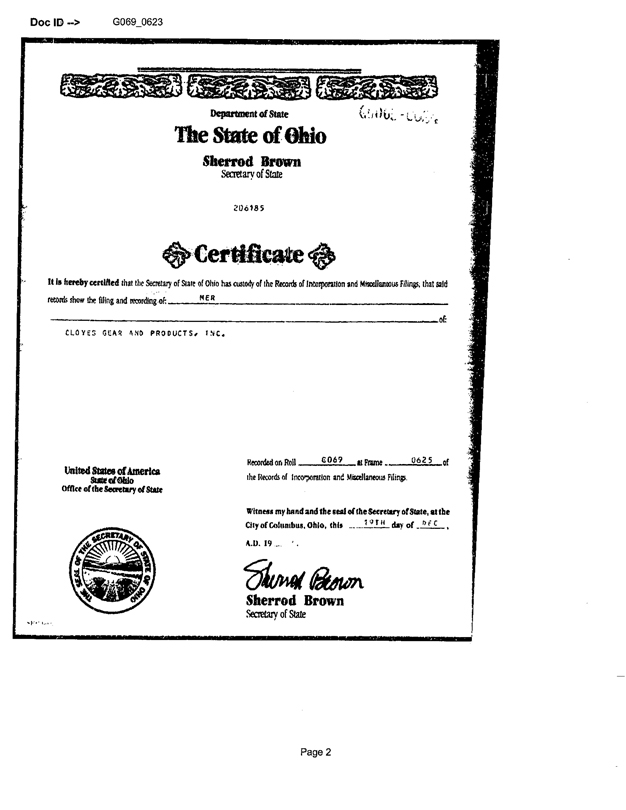

Department of State

The State of Ohio

Sherrod Brown

Secretary of State

206185

Certificate

It is hereby certified that the Secretary of State of Ohio has custody of the Records of Incorporation and Miscellaneous Filings, that said

records show the filing and recording of: MER

CLOYES GEAR AND PRODUCTS, INC.

United States of America State of Ohio

Office of the Secretary of State

THE SEAL OF THE SECRETARY OF STATE OF OHIO

Recorded on Roll G069 at Frame 0625 of the Records of Incorporation and Miscellaneous Filings.

Witness my hand and the seal of the Secretary of State, at the City of Columbus, Ohio, this 19TH day of DEC, A.D. 19_.

Sherrod Brown

Secretary of State

Page 2

| Doc ID --> | G069_0623 |

CERTIFICATE AS TO THE MANNER

OF ADOPTION OF AGREEMENT AND PLAN OF MERGER

OF

CLOYES GEAR AND, INC.

AND

CLOYES GEAR COMPANY

Malcolm R. Myers, President, and J. Richard Hamilton, Secretary, of Cloyes Gear and Products, Inc., an Ohio corporation with its principal office located at 4520 Beidler Road, Willoughby, Ohio, and Malcolm R. Myers, President, and J. Richard Hamilton, Secretary, of Cloyes Gear Company, an Arkansas corporation with its principal office located at 515 West Walworth, P.O. Box 528, Arkansas, do hereby certify that the signed counterpart of the Agreement and Plan of Merger attached hereto was approved and adopted by their respective Boards of Directors of Cloyes Gear and Products, Inc. and Cloyes Gear Company at meetings of all of the directors of each of said corporations duly called and held on the 10th day of December, 1986 and at which a quorum for the transaction of business was present throughout each meeting; and that said Agreement and Plan of Merger was not adopted nor required to be adopted by the shareholders of either of said corporations in accordance with Ohio Revised Code Section 1701.80 and the Arkansas Business Corporation Act Section 64-709.

The Agreement and Plan of Merger does not conflict with the articles or regulations of either corporation, and it does not change the articles or regulations of Cloyes Gear and Products, Inc. nor authorize any action which apart from the merger would require adoption by the shareholders or by the holders of a particular class of shares of Cloyes Gear and Products, Inc. The merger does not involve issuance or transfer by the said surviving corporation to the shareholders of Cloyes Gear Company of such number of shares of the surviving corporation which will entitle the holders thereof after the consummation of the merger to exercise one-sixth or more of the voting power of the Cloyes Gear and Products, Inc. in the election of the directors. There is no change in the directors of Cloyes Gear and Products, Inc. that would require action by the shareholders or by the holders of a particular class of said surviving corporation. Cloyes Gear and Products, Inc. owns one hundred per-cent the outstanding shares of Cloyes Gear Company. The Agreement and Plan of Merger thereby was adopted by the action of the board of directors of Cloyes Gear and Products, Inc., and is the duly adopted agreement and act of the said corporation.

Page 3

| Doc ID --> | G069_0623 |

IN WITNESS WHEREOF, said Malcolm R. Myers and J. Richard Hamilton, President and Secretary, respectively, of Cloyes Gear and Products, Inc. and Malcolm R. Myers and J. Richard Hamilton, President and Secretary, respectively, of Cloyes Gear Company, have hereunto subscribed their names on the 17th day of December, 1986.

|

| Malcolm R. Myers, President |

| Cloyes Gear and Products, Inc. |

|

| J. Richard Hamilton, Secretary |

| Cloyes Gear and Products, Inc. |

|

| Malcolm R. Myers, President |

| Cloyes Gear Products |

|

| J. Richard Hamilton, Secretary |

| Cloyes Gear Company |

GKK1 (K)

cas 12/16/86

-2-

Page 4

| Doc ID --> | G069_0623 |

AGREEMENT AND PLAN OF MERGER

OF

CLOVES GEAR AND PRODUCTS, INC.

AND

CLOYES GEAR COMPANY

THIS AGREEMENT is made this 17th day of December, 1986, by and between CLOYES GEAR AND PRODUCTS, INC., an Ohio corporation (“Cloyes Ohio”), and CLOYES GEAR COMPANY, an Arkansas corporation (“Cloyes Arkansas”), said corporations being sometimes collectively referred to herein as the “constituent corporations.”

PREMISES:

WHEREAS, Cloyes Ohio was incorporated under the laws of the State of Ohio by Articles of Incorporation filed in the office of the Secretary of State of Ohio on the 22nd day of January, 1948, and recorded in Volume 548, Page 268 of the Records of Incorporation and Miscellaneous Filings in said office; and

WHEREAS Cloyes Arkansas was incorporated under the laws of the State of Arkansas, its Articles of Incorporation having been filed in the Office of the Secretary of State of Arkansas on the 7th day of November, 1962; and

WHEREAS, Cloyes Arkansas is authorized to issue 2,000 Common Shares, without par value, all of which are issued and outstanding at the date hereof and owned by Cloyes Ohio;

Page 5

| Doc ID --> | G069_0623 |

NOW, THEREFORE, in consideration of the premises and of the covenants herein contained, the constituent corporations, having complied with all the conditions of Ohio Revised Code Section 1701,80 and the Arkansas Business Corporation Act Section 64-709 and no approval by the shareholders of Cloyes Ohio or Cloyes Arkansas being required, have agreed and do hereby agree that Cloyes Arkansas shall be and it is hereby merged with and into Cloyes Ohio (hereinafter sometimes called the “Surviving Corporation”), pursuant to and upon the authority of Ohio Revised Code Section 1701.80 and the Arkansas Business Corporation Act Section 64-709, and that the terms of the merger, the made of carrying them into effect and the manner and basis of making distributions to the shareholders of the constituent corporations are and shall be as follows:

1. The Amended Articles of Incorporation and the Code of Regulations of Cloyes Ohio as in effect immediately prior to the merger shall continue to be the Amended Articles of Incorporation and the Code of Regulations, respectively, of the Surviving Corporation.

2. Each outstanding share of Class A Common Stock, $25 par value, and each outstanding share of Class B Common Stock, $25 par value of Cloyes Ohio shall continue

-2-

Page 6

| Doc ID --> | G069_0623 |

as one outstanding share of Class A Common Stock, $25 par value, and one outstanding share of Class B Common Stock, $25 par value, respectively, of the Surviving Corporation and the certificates representing such shares of Cloyes Ohio prior to the effective date hereof shall continue without change as the certificates representing an equal number of shares of Class A Common Stock, $25 par value, and an equal number of Class B Common Stock, $25 par value, respectively, of the Surviving Corporation.

3. Each outstanding Common Share, without par value, of Cloyes Arkansas shall be and is hereby canceled, and the rights of the holder thereof extinguished.

4. The said merger shall be and become effective as provided in Ohio Revised Code Section 1701.81 and in the Arkansas Business Corporation Act Suction 64-707 upon the later to occur of the filing of the Certificate As To The Manner Of Adoption Of Agreement and Plan of Merger and this Agreement and Plan of Merger in the Office of the Secretary of State of Ohio or the filing of Articles of Merger in the Office of the Secretary of State of Arkansas.

5. This Agreement may be executed in any number of counterparts, each of which when so executed shall be an original, but such counterparts shall together constitute one and the same instrument.

-3-

Page 7

| Doc ID --> | G069_0623 |

IN WITNESS WHEREOF, the constituent corporations have caused this Agreement and Plan of Merger to be signed in their respective corporate names by their respective officers, thereunto duly authorized, on the date first above written.

| CLOYES GEAR AND PRODUCTS, INC. | ||

| By |  | |

| Malcolm R. Myers, President | ||

| By |  | |

| J. Richard Hamilton, Secretary | ||

| COYES GEAR COMPANY | ||

| By |  | |

| Malcolm R. Myers, President | ||

| By |  | |

| J. Richard Hamilton, Secretary | ||

GKK2/D

cas 12/16/86

-4-

Page 8

| Doc ID --> | G069_0631 |

Page 1

Doc ID --> G069_0631

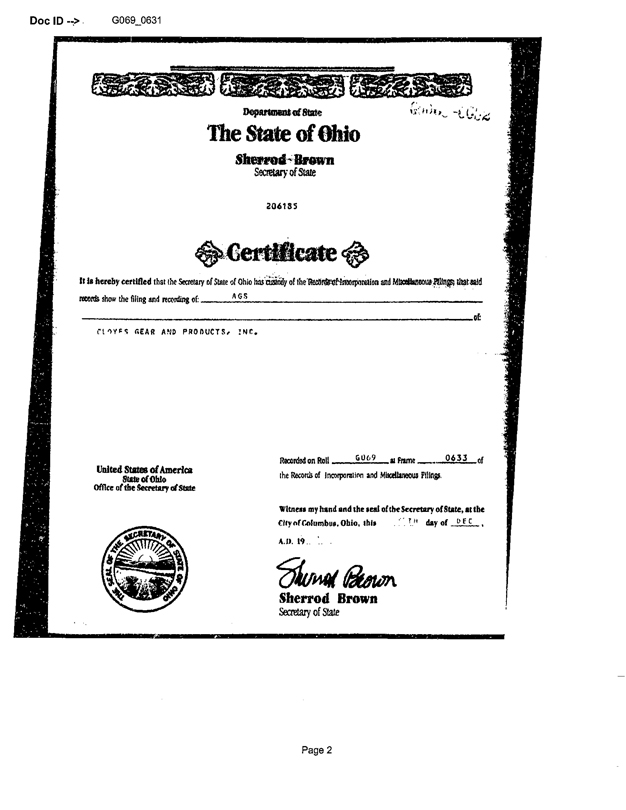

Department of State

The State of Ohio

Sherrod Brown

Secretary of State

206185

Certificate

It is hereby certified that the Secretary of State of Ohio has custody of the Records of Incorporation and Miscellaneous Filings that said records show the filing and recording of: AGS

CLOYES GEAR AND PRODUCTS, INC.

United States of America

State of Ohio

Office of the Secretary of State

THE SEAL OF THE SECRETARY OF STATE OF OHIO

Recorded on Roll G069 at Frame 0633 of the Records of Incorporation and Miscellaneous Filings.

Witness my hand and the seal of the Secretary of State, at the

City of Columbus, Ohio, this [ILLEGIBLE] day of DEC,

A.D. 19

Sherrod Brown

Secretary of State

Page 2

| Doc ID --> | G069_0631 |

Form AGS, August 1983 Presented by Sherrod Brown Secretary of State |  |

Subsequent Appointment of Agent

Cloyes Gear and Products, Inc. | hereby appoints | A.G.C Co. | of | |||

| (Name of Corporation) | (Name of New Agent) |

3200 National City Center | , | Cleveland | , | Cuyahoga | County, | |||||

| (Street) | (City, Village or Township) |

| Ohio, | 44114 | , to succeed | Alan G. Rorick | as agent upon whom | ||||

| (Zip Code) | (Name of Former Agent) |

any process, notice or demand required or permitted by states to be served upon the corporation may be served.

| Date: | December 23, 1986 |

| By |  | |

|

| Name and Title of Person Signing: | J. Richard Hamilton | |||

| [Illegible] | ||||

| (Strike out inappropriate title) |

Instructions

| 1) | The statutory agent for a corporation may be (a) a natural person who is a resident of Ohio, or (b) an Ohio corporation or a foreign profit corporation licensed in Ohio which has a business address in this state and is explicitly authorized by its articles of incorporation to act as a statutory agent R.C. 1701.07(A), 1702.06(A). |

| 2) | A subsequent appointment of agent must be signed by the chairman of the board, the president, a vice-president, the secretary or an assistant secretary, R.C. 1701.07(L) |

| 3) | The agent’s complete street address must be given, a post office box is not acceptable. R.C. 1701.07(C), 1702.08(C). |

| 4) | The filing fee for a subsequent appointment of agent is $3.00. R.C. 1701.07(M), 1702.08(L). |

[ILLEGIBLE]

Page 3

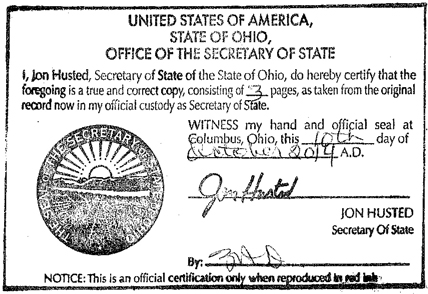

| Doc ID --> | G093_1020 |

Page 1

| Doc ID --> | G093_1020 |

Doc ID --> G093_1020

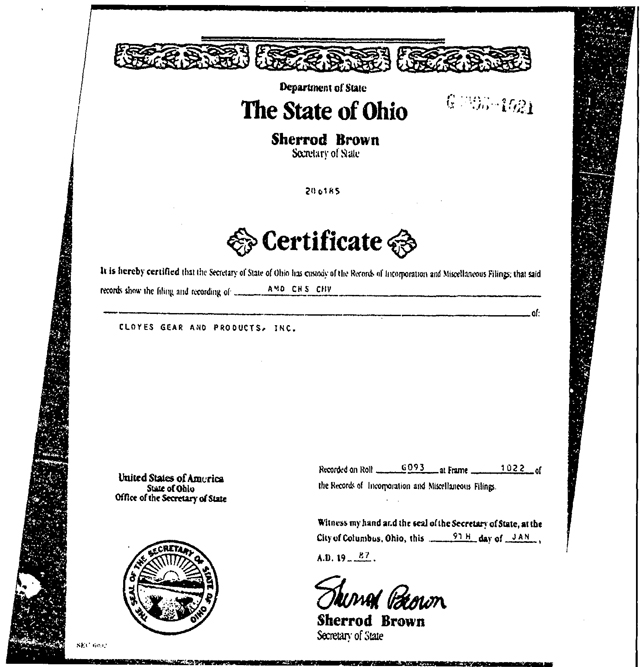

Department of State

The State of Ohio

Sherrod Brown

Secretary of State

206185

Certificate

It is hereby certified that the Secretary of State of Ohio has custody of the Records of Incorporation and Miscellaneous Filings: that said records show the filing and recording of AMD CHS CHV

of:

CLOYES GEAR AND PRODUCTS, INC.

| United States of America | Recorded on Roll G093 at Frame 1022 of | |

| State of Ohio | the Records of Incorporation and Miscellaneous Filings. | |

| Office of the Secretary of State | ||

| Witness my hand and the seal of the Secretary of State, at the City of Columbus, Ohio, this 9th day of JAN, | ||

| A.D. 19 87. |

THE SEAL OF THE SECRETARY OF STATE OF OHIO

Sherrod Brown

Sherrod Brown

Secretary of State

Page 2

Page 2

| Doc ID --> | G093_1020 |

CERTIFICATE OF ADOPTION

OF

AMENDMENT TO THE AMENDED ARTICLES OF INCORPORATION

OF

CLOYES GEAR AND PRODUCTS, INC.

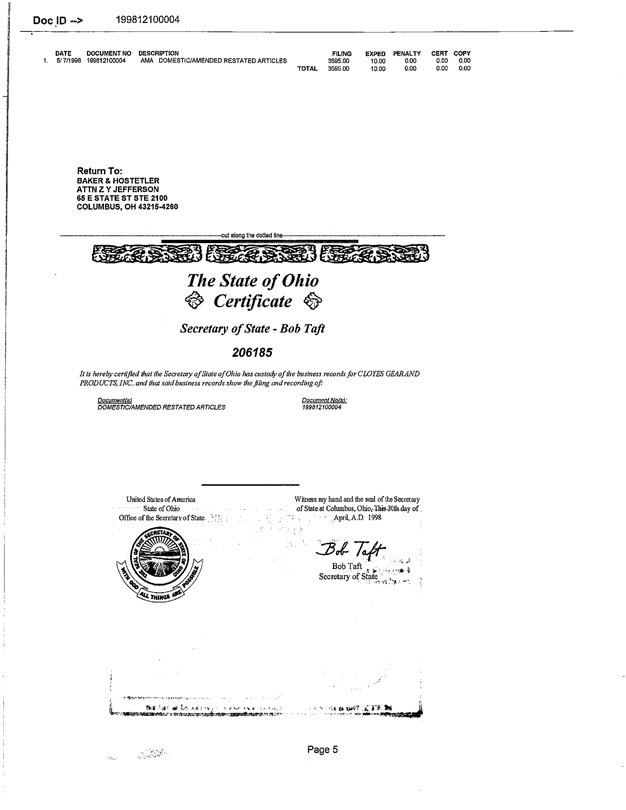

JOHN M. McNAMARA, Vice President-Operations, and J. RICHARD HAMILTON, Secretary of Cloyes Gear and Products, Inc., an Ohio corporation with its principal office at Willoughby, Ohio, do hereby certify that by the unanimous action of the holders of all the outstanding Class A and Class B shares of said Corporation, the following resolutions were duly adopted by the affirmative vote of the holders of all said outstanding Class A and Class B Common shares on December 17, 1986, pursuant to Section 1701.54 of the Ohio Revised Code:

RESOLVED, that the Corporation’s Amended Articles of Incorporation be amended to eliminate the authorized number of the Corporation’s preferred shares, $100 par value; and

FURTHER RESOLVED, that to effect the preceding resolution, Article Four of the Amended Articles of Incorporation of the Corporation be, and the same hereby is, amended by deleting Article Four in its entirety and substituting therefor the following new Article Four, as follows;

FOURTH:Section 1. The maximum number of shares which the Corporation is authorized to have outstanding is Nine Thousand Eight Hundred (9,800), of which Three Hundred (300) shall be Class A Common shares of the par value of Twenty-five Dollars ($25) per share and Nine Thousand Five Hundred (9,500) shall be Class B Common shares of the par value of Twenty-five Dollars ($25) per share.

Page 3

| Doc ID --> | G093_1020 |

Section 2. The express terms and provisions of the shares of each class are as follows:

The exclusive voting power of the Corporation shall be vested in the holders of Class A Common shares and holders of Class A Common shares shall have the right to cast one vote for each Common share held. Holders of Class B Common shares shall have no voting rights other than as required by law.

IN WITNESS WHEKEOF, said John H. McNamara, Vice President-Operations and J. Richard Hamilton, Secretary of Cloyes Gear and Products, Inc., acting for and on behalf of said Corporation, have hereunto subscribed their names as of the 17th day of December, 1986.

|

| John M. McNamara |

| Vice President - Operation |

|

| J. Richard Hamilton |

| (Secretary |

- 2 -

Page 4

| Doc ID --> | G093_1020 |

Page 5

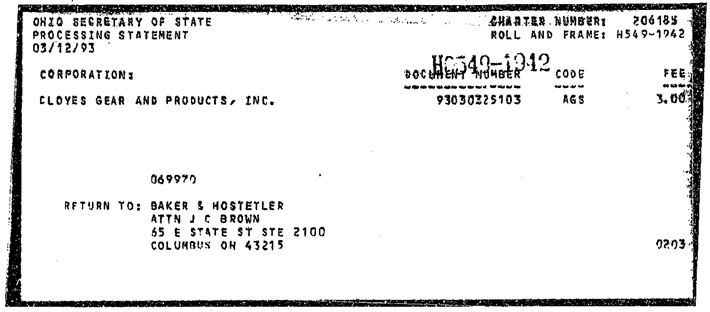

| Doc ID --> | H549_1942 |

Page 1

| Doc ID --> | H549_1942 |

Doc ID --> H549_1942

H0543-1943

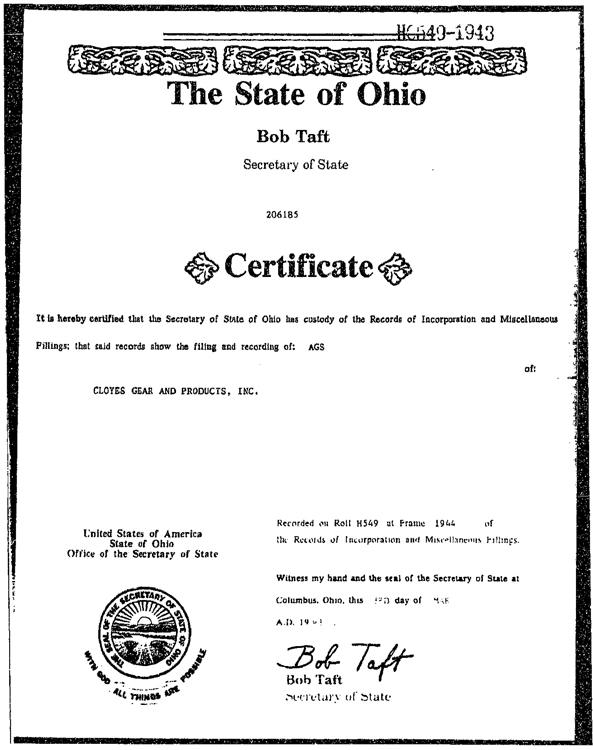

The State of Ohio

Bob Taft

Secretary of State

206185

Certificate

It is hereby certified that the Secretary of State of Ohio has custody of the Records of Incorporation and Miscellaneous

Fillings; that said records show the filing and recording of: AGS

of:

CLOYES GEAR AND PRODUCTS, INC.

| United States of America State of Ohio Office of the Secretary of State | Recorded on Roll H549 at Frame 1944 of the Records of Incorporation and Miscellaneous Fillings. | |

| Witness my hand and the seal of the Secretary of State at Columbus. Ohio, this [ILLEGIBLE] day of MAR | ||

| THE SEAL OF THE SECRETARY OF STATE OF OHIO | A.D. 19 [ILLEGIBLE] | |

| WITH GOD ALL THINGS ARE POSSIBLE | Bob Taft | |

| Bob Taft | ||

| Secretary of State |

Page 2

| Doc ID --> | H549_1942 |

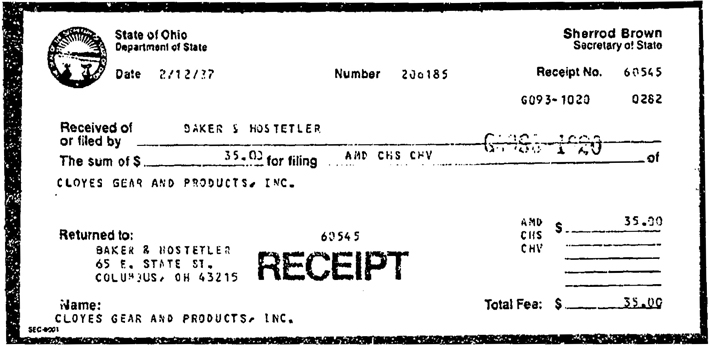

| Prescribed by Bob Taft, Secretary of State 30 East Broad Street, 14th Floor Columbus, Ohio 43266-0418 Form AGS (September 1992) |  | Charter No. 206185 Approved [ILLEGIBLE] Date 3-3-93 Fee $3.00 03030325103 |

SUBSEQUENT APPOINTMENT OF AGENT

CLOYES GEAR AND PRODUCTS, INC. | hereby appoints | |

| (name of corporation) |

| 3200 National City Center, | ||

JOHN D. DRINKO | 1900 East Ninth Street | |

| (name of new agent) | (street address) |

Cleveland | , Ohio | 44114 | . | |||

| (city) | (zip code) | |||||

NOTE: P.O. Box addressee are not acceptable.

| to succeed | A.G.C. CO. | as agent upon whom any process, | ||

| (Name of Former Agent) |

notice or demand required or permitted by statute to be served upon the corporation may be served.

| This line is to be signed by a corporate officer. | ||

| ||

| Title: |  | |

| ||

Acceptance of Appointment

| The undersigned, | JOHN D. DRINKO | , named herein as the statutory agent for |

CLOYES GEAR AND PRODUCTS, INC. | , hereby acknowledges and accepts | |

| (name of corporation) |

the appointment of statutory agent for said corporation.

|

JOHN D. DRINKO Statutory Agent |

INSTRUCTIONS

| [ILLEGIBLE] | The statutory agent for a corporation may be (a) a natural person who is a resident of Ohio, or (b) an Ohio corporation or a foreign profit corporation licensed in Ohio which has a business address in this state and is explicitly authorized [ILLEGIBLE] its articles of incorporation to act as a statutory agent. R.C 1701 07(A), 1702.06(A) |

| [ILLEGIBLE] | A subsequent appointment of agent must be signed by the chairman of the board, the president, a vice-president, the secretary or an assistant secretary R.C. 1701.07(L) |

[ILLEGIBLE]

[ILLEGIBLE] As of October [ILLEGIBLE] 1992 [ILLEGIBLE] 07(8) will be amended to require acknowledgment and acceptance [ILLEGIBLE]

Page 3

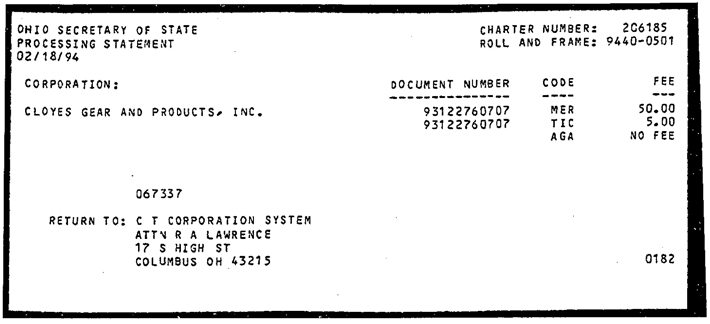

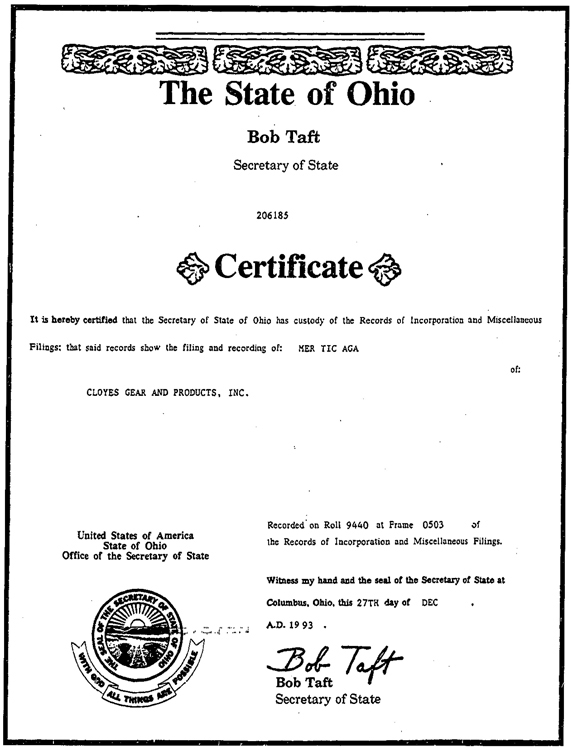

| Doc ID --> | 9440_0501 |

Page 1

| Doc ID --> | 9440_0501 |

Doc ID --> 9440_0501

The State of Ohio

Bob Taft

Secretary of State 206185

Certificate