Exhibit 3.5.21

DFI/CORP/38 RECORD 2011 | United States of America |  | ||

State of Wisconsin

| ||||

DEPARTMENT OF FINANCIAL INSTITUTIONS

|

To All to Whom These Presents Shall Come, Greeting:

I, GEORGE PETAK, Administrator, Division of Corporate and Consumer Services, Department of Financial Institutions, do hereby certify that the annexed copy has been compared by me with the record on file in the Corporation Section of the Division of Corporate & Consumer Services of this department and that the same is a true copy thereof and the whole of such record; and that I am the legal custodian of said record, and that this certification is in due form.

| IN TESTIMONY WHEREOF, I have hereunto set my hand and affixed the official seal of the Department. | |||||

| ||||||

GEORGE PETAK, Administrator Division of Corporate and Consumer Services Department of Financial Institutions | ||||||

DATE: OCT 10 2014 |

BY: |

| ||||

Effective July 1, 1996, the Department of Financial Institutions assumed the functions previously performed by the Corporations Division of the Secretary of State and is the successor custodian of corporate records formerly held by the Secretary of State.

|

| ||||

Sec. 179.76(3) & (5), 180.1161(3) & (5), 181.1161(3) & (5) and 183.1207(3) & (5), Wis. Stats.

|

State of Wisconsin DEPARTMENT OF FINANCIAL INSTITUTIONS Division of Corporate & Consumer Services

CERTIFICATE OF CONVERSION |

1. Before conversion:

Company Name:

Citation Foundry Corporation

| Indicate (X) | ¨ Limited Partnership (Ch. 179, Wis. Stats.) x Business Corporation (Ch. 180, Wis. Stats.) ¨ Nonstock Corporation (Ch. 181, Wis. Stats.) ¨ Limited Liability Company (Ch. 183, Wis. Stats.) | Organized under the | ||

| Entity Type | laws of | |||

Wisconsin | ||||

| (state or country *) |

2. Does the converting entity have a fee simple ownership interest in any Wisconsin real estate?

x Yes ¨ No

If yes, the entity is required to file a report with the Wisconsin Department of Revenue under section 73.14 of the Wisconsin Statutes. (See instructions.)

| * | If a foreign (out-of-state) business entity is converting to a Wisconsin business entity, attach a certificate of status or document of similar import authenticated by the Secretary of State or other appropriate official in the jurisdiction where the foreign business entity is organized, to include the name of the business entity and itsdate of incorporation or formation. |

| 3. After conversion: |  | |

| Company Name: |

Grede Wisconsin Subsidiaries LLC

| Indicate (X) | ¨ Limited Partnership (Ch. 179, Wis. Stats.) ¨ Business Corporation (Ch. 180, Wis. Stats.) ¨ Nonstock Corporation (Ch. 181, Wis. Stats.) x Limited Liability Company (Ch. 183, Wis. Stats.) | Organized under the | ||

| Entity Type | laws of | |||

Wisconsin | ||||

| (state or country) |

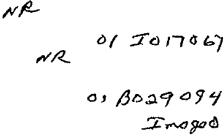

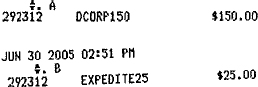

FILING FEE - $150.00 Use of this form is mandatory.

|

| DFI/CORP/1000(R06/06) | 1 | |

W1043 - 06/20/2006 C T System Online |

4. A Plan of Conversion containing all the following parts is attached as Exhibit A. (NOTE: A template forPlan of Conversion is included in this form. Use of the template isoptional.)

| A. | The name, form of business entity, and identity of the jurisdiction governing the business entity that is to be converted. |

| B. | The name, form of business entity, and identity of the jurisdiction that will govern the business entity after conversion. |

| C. | The terms and conditions of the conversion. |

| D. | The manner and basis of converting the shares or other ownership interests of the business entity that is being converted into shares or other ownership interests of the new form of business entity. |

| E. | The effective date and time of conversion, if the conversion is to be effective other than at the time of filing the certificate of conversion as provided under sec. 179.11(2), 180.0123, 181.0123 or 183.0111, whichever governs the business entity prior to conversion. |

| F. | A copy of the articles of incorporation, articles of organization, certificate of limited partnership, or other similar governing document of the business entity after conversion as Exhibit B. (NOTE: Templates for certificate of limited partnership, articles of incorporation, and articles of organization are included in this form. Use of the templates isoptional.) |

| G. | Other provisions relating to the conversion, as determined by the business entity. |

5. The Plan of Conversion was approved in accordance with the applicable law of the jurisdiction that governs the organization of the business entity.

6. Registered Agent (Agent for Service of Process) and Registered Office (Agent’s business office) of the business entityPRIOR TO CONVERSION:

Registered Agent (Agent for Service of Process):

CT Corporation System | Registered Office:

8040 Excelsior Drive, Suite 200 Madison, WI 53717 | |

Additional Entry for aLimited Partnershiponlyà |

Record Office: |

7. Registered Agent (Agent for Service of Process) and Registered Office (Agent’s business office) of the business entityAFTER CONVERSION:

Registered Agent (Agent for Service of Process):

CT Corporation System | Registered Office in WI (Street & Number, City, State (WI) and ZIP code): | |

8040 Excelsior Drive, Suite 200 Madison, WI 53717

| ||

| Additional Entry for aLimited Partnershiponlyà | Record Office: |

| DFI/CORP/1000(R06/06) | 2 | |

W1043 - 06/20/2006 C T System Online |

| 8. Executed onFebruary 1, 2010 (date) by the business entity PRIOR TO ITS CONVERSION. |  | |

| ||

| (Signature) | ||

| Mark (X) below the title of the person executing the document. |

Douglas J. Grimm | |

For alimited partnership | (Printed Name) | |

| Title: ¨ General Partner |

For a corporation | |

| For alimited liability company | Title: x President OR ¨ Secretary | |

| Title: ¨ Member OR ¨ Manager | or other officer title | |

| ||

INSTRUCTIONS (Ref. Sec. 179.76(3) & (5), 180.1161(3) & (5), 181.1161(3) & (5) and 183.1207(3) & (5), Wis. Stats. for document content)

| Submit one original and one exact copy along with the required filing fee of $150.00 to the address listed below. Make checks payable to the “Department of Financial Institutions”. Filing fee is non-refundable. Sign the document manually or otherwise allowed under sec. 179.14 (1g)(c), 180.0103 (16), 181.0103 (23) or 183.0107 (1g)(c), Wis. Stats. | ||||

| Mailing Address: | ||||

| Department of Financial Institutions | Physical Address for Express Mail: | |||

Division of Corporate & Consumer Services P O Box 7846 Madison WI 53707-7846 | Department of Financial Institutions Division of Corporate & Consumer Services 345 W. Washington Ave – 3rd Fl. Madison WI 53703 | Phone: 608-261-7577 FAX: 608-267-6813 TTY: 608-266-8818 | ||

NOTICE: This form may be used to accomplish a filing required or permitted by statute to be made with the department. Information requested may be used for secondary purposes. This document can be made available in alternate formats upon request to qualifying individuals with disabilities.

1. Enter the company name, type of business entity, and state of organization of business entityprior to conversion. Definitions of foreign entity types are set forth in ss. 179.01(4), 180.0103(9), 181.0103(13) and 183.0102(8), Wis. Stats.

If a foreign (out-of-state) business entity is converting to a Wisconsin business entity, attach a certificate of status or document of similar import authenticated by the Secretary of State or other appropriate official in the jurisdiction where the foreign business entity is organized, to include the name of the business entity and itsdate of incorporation or formation.

2. Select yes or no to indicate whether the converting entity has a fee simple ownership interest in any Wisconsin real estate. See sec. 73.14 and 77.25, Wis. Stats., or contact the Wisconsin Department of Revenue at (608)266-1594 for questions regarding fee simple ownership interest and the filing requirements with that department.

3. Enter the company name, type of business entity, and state of organization of business entityafter conversion.

| DFI/CORP/1000(R06/06) | 3 | |

W1043 - 06/20/2006 C T System Online |

| Sec. 179.76(3) & (5), |  | |||

| 180.1161(3) & (5), | ||||

| 181.1161(3) & (5) and | ||||

| 183.1207(3) & (5), | State of Wisconsin | |||

| Wis. Stats. | DEPARTMENT OF FINANCIAL INSTITUTIONS | |||

| Division of Corporate & Consumer Services |

EXHIBIT A

PLAN OF CONVERSION

1. Before conversion:

| Company Name: | ||||

Citation Foundry Corporation | ||||

Indicate (X) Entity Type | ¨ Limited Partnership (Ch. 179, Wis. Stats.) x Business Corporation (Ch. 180, Wis. Stats.) ¨ Nonstock Corporation (Ch. 181, Wis. Stats.) ¨ Limited Liability Company (Ch. 183, Wis. Stats.) | Organized under the laws of

Wisconsin (state or country) | ||

| 2. After conversion: | ||||

| Company Name: | ||||

Grede Wisconsin Subsidiaries LLC | ||||

Indicate (X) Entity Type | ¨ Limited Partnership (Ch. 179, Wis. Stats.) ¨ Business Corporation (Ch. 180, Wis. Stats.) ¨ Nonstock Corporation (Ch. 181, Wis. Stats.) x Limited Liability Company (Ch. 183, Wis. Stats.) | Organized under the laws of

Wisconsin (state or country) | ||

| 3. The terms and conditions of the conversion. | ||||

The effect of conversion shall be as provided by the applicable provisions of the Wisconsin Statutes.

| DFI/CORP/1000(R06/06) | 5 |

W1043 - 06/20/2006 C T System Online

4. The manner and basis of converting the shares or other ownership interests of the business entity that is to be converted into shares or other ownership interests of the new form of business entity.

Effective as of the effective date and time of conversion, all of the issued and outstanding capital stock of Citation Foundry Corporation shall automatically be converted into 100% of the membership interest of Grede Wisconsin Subsidiaries LLC and Citation Corporation, the sole shareholder of Citation Foundry Corporation immediately prior to conversion, shall be the sole member of Grede Wisconsin Subsidiaries LLC immediately after conversion.

5. Other provisions relating to the conversion, as determined by the business entity.

None

6. (OPTIONAL) Effective Date and Time of Conversion

The effective date and time of conversion shall be (date) at (time).

(An effective date declared under this article may not be earlier than the date the document is delivered to the department for filing, nor more than 90 days after its delivery.If no effective date and time is declared, the effective date and time will be determined by sec. 179.11(2), 180.0123,181.0123 or 183.0111, whichever section governs the business entity prior to conversion.)

7. The articles of incorporation, articles of organization, certificate of limited partnership, or other similar governing document of the business entity after conversion is attached as Exhibit B.

(NOTE: Templates for certificate of limited partnership, articles of incorporation, and articles of organization are included in this form. Use of the templates isoptional)

( Attach the appropriate governing document after conversion as Exhibit B )

| DFI/CORP/1000(R06/06) | 6 |

W1043 - 06/20/2006 C T System Online

Articles of Organization

For a Wisconsin Limited Liability Company (Ch. 183)

EXHIBIT B

Article 1. Name of the limited liability company:Grede Wisconsin Subsidiaries LLC (Must end with “LLC” or contain other appropriate words or abbreviations. See sec. 183.0103, Wis. Stats.)

Article 2. The limited liability company is organized under Ch. 183 of the Wisconsin Statutes.

Article 3. The management of the limited liability company shall be vested in:

¨ a manager or managersORx Its members

| Article 4. Name of the registered agent: | Article 5. Street address (in Wisconsin) of the | |

| registered office: | ||

| CT Corporation System | 8040 Excelsior Drive, Suite 200 | |

| Madison, WI 53717 |

(NOTICE: Articles of Organization may containonly the above information.)

| ||

| Fee simple ownership interest x Yes ¨ No (for DFI use only) | ||

| CERTIFICATE OF CONVERSION | ||

|

| |

Gene P. Bowen Bodman LLP 201 W. Big Beaver Rd. Suite 500 Troy, MI 48084

p Enter your return address within the bracket above. |

Phone number during the day: (248 )743 -6000

INSTRUCTIONS (Cont’d)

4. Attach the Plan of Conversion as Exhibit A. If the Plan of Conversion declares a specific effective time or delayed effective time and date, such date may not be prior to the date the document is delivered to the department for filing, nor more than 90 days after delivery. The drafter may use the templatePlan of Conversion provided in this form or may prepare the Plan by other means. Use of the template isoptional.

5. This article states that the Plan of Conversion was approved in accordance with the applicable law of the jurisdiction that governs the organization of the business entity prior to conversion.

6. Provide the name of the business entity’s registered agent and the address of its registered officeprior to conversion. If the business entity is a domestic limited partnership, also provide the address of its record office.

7. Provide the name of the business entity’s registered agent and the address of its registered officeafter conversion. If the business entity after conversion will be a domestic limited partnership, also provide the address of its record office, NOTE: The address of the registered office must describe its physical location, i.e., street name and number, city (in Wisconsin) and ZIP code. P O Box addresses may be included as part of the address (if located in the same community), but are not sufficient alone. Compare the information supplied in Article 6 to see that it agrees with the information set forth in the articles of incorporation or similar governing document attached as Exhibit B.

8. Enter the date of execution and the name and title of the person signing the document. The person executing the document will do so in their capacity as an officer, member, etc., of the business entity prior to its conversion. For example, an officer of the corporation would sign a Certificate of Conversion converting a corporation to a limited liability company.

| DFI/CORP/1000(R06/06) | 4 |

W1043 - 06/20/2006 C T System Online

DFI/CORP/30 DOCUMENT 2011 | United States of America |  | ||

State of Wisconsin | ||||

DEPARTMENT OF FINANCIAL INSTITUTIONS |

To All to Whom These Presents Shall Come, Greeting:

I, GEORGE PETAK, Administrator, Division of Corporate and Consumer Services, Department of Financial Institutions, do hereby certify that the annexed copy has been compared with the document on file in the Corporation Section of the Division of Corporate & Consumer Services of this department, and that the same is a true copy thereof; and that I am the legal custodian of said document, and that this certification is in due form.

| IN TESTIMONY WHEREOF, I have hereunto set my hand and affixed the official seal of the Department. | |||||

| ||||||

GEORGE PETAK, Administrator Division of Corporate and Consumer Services Department of Financial Institutions | ||||||

DATE: OCT 10 2014 |

BY: |

| ||||

Effective July 1, 1996, the Department of Financial Institutions assumed the functions previously performed by the Corporations Division of the Secretary of State and is the successor custodian of corporate records formerly held by the Secretary of State.

ARTICLES OF INCORPORATION

OF

BERLIN FOUNDRY CORPORATION

These Articles of Incorporation are executed by the undersigned for the purpose of forming a Wisconsin corporation under Chapter 180 of the Wisconsin Statutes:

ARTICLE I

The name of the corporation isBerlin Foundry Corporation.

ARTICLE II

The period of existence of the corporation shall beperpetual.

ARTICLE III

The corporation is authorized to engage in any lawful activity for which corporations may be organized under Chapter 180 of the Wisconsin Statutes and any successor provisions.

ARTICLE IV

The aggregate number of shares which the corporation shall have authority to issue is Five Hundred Sixty Thousand (560,000) shares, designated by class and par value as follows:

Class | Number of Shares | Par Value Per Share | ||||

Class A Common Stock | 280,000 | Ten Cents ($.10) | ||||

Class B Common Stock | 280,000 | Ten Cents ($.10) | ||||

ARTICLE V

The respective preferences, limitations, designations and relative rights of the classes of stock which the corporation is authorized to issue are as follows:

5.1.Class A Common Stock.

5.1.1.Voting. Except as otherwise required by the Wisconsin Business Corporation Law, all of the voting power of the corporation shall be vested in the holders of the Class A Common Stock, and each holder of the Class A Common Stock shall have one (1) vote for each share of Class A Common Stock held by him/her of record of all matters voted upon by the stockholders.

5.1.2.Dividends. The Board of Directors may, from time to time, declare a dividend on the Common Stock out of the unreserved, but unrestricted, earned surplus of the corporation, and the holders of the Class A Common Stock and the holders of the Class B Common Stock shall share ratably in any such dividend in proportion to the number of shares held by each, irrespective of the class to which such shares belong.

5.1.3.Liquidation. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the corporation, the assets of the Corporation shall be distributed ratably among the holders of the Class A Common Stock and the Class B Common Stock in proportion to the number of shares held by each, irrespective of the class to which such shares belong.

5.2.Class B Common Stock.

5.2.1.Voting. Except as otherwise required by the Wisconsin Business Corporation Law, the holders of Class B Common Stock shall possess no voting rights with respect to such shares.

5.2.2.Other Rights. Except for the right to vote, the Class B Common Stock shall be subject to and have the identical rights, privileges and restrictions as the Class A Common Stock.

ARTICLE VI

The registered office of the corporation is located at242 South Pearl Street, in the City of Berlin,Green Lake County,Wisconsin 54923 and the name of its registered agent at such address isWalter L. Nocito.

ARTICLE VII

The number of directors constituting the initial Board of Directors of the corporation shall be as provided in the By-Laws of the corporation. The number of directors of the corporation may be changed from time to time by the By-Laws of the corporation, but in no case shall be less than one (1).

ARTICLE VIII

The name and address of the incorporator is Peter M. Sommerhauser, 780 North Water Street, Milwaukee, Wisconsin 53202.

Executed in duplicate this 18th day of November, 1985.

|

|

| Peter M. Sommerhauser |

| STATE OF WISCONSIN | ) | |||

| ) | SS | |||

| COUNTY OF MILWAUKEE | ) |

Personally came before me this 18th day of November, 1985, the above named Peter M. Sommerhauser, to me known to be the person who executed the foregoing instrument and acknowledged the same.

|

|

| Notary Public, State of Wisconsin |

| My Commission: expires July 10, 1988 |

This instrument was drafted by:

Peter M. Sommerhauser

Godfrey & Kahn, S.C.

780 North Water Street

Milwaukee, Wisconsin 53202

# 7000 Articles Green Lake

STATE OF WISCONSIN FILED

NOV 20 1985

DOUGLAS LA FOLLETTE SECRETARY OF STATE |

| PLEASE RETURN TO: |

|

|

| Godfrey & Kahn, S.C. |

| 780 North Water Street |

| Milwaukee, WI 53202 |

DFI/CORP/30 DOCUMENT 2011 | United States of America

State of Wisconsin

DEPARTMENT OF FINANCIAL INSTITUTIONS |  |

To All to Whom These Presents Shall Come, Greeting:

I, GEORGE PETAK, Administrator, Division of Corporate and Consumer Services, Department of Financial Institutions, do hereby certify that the annexed copy has been compared with the document on file in the Corporation Section of the Division of Corporate & Consumer Services of this department, and that the same is a true copy thereof; and that I am the legal custodian of said document, and that this certification is in due form.

| IN TESTIMONY WHEREOF, I have hereunto set my hand and affixed the official seal of the Department.

GEORGE PETAK, Administrator Division of Corporate and Consumer Services Department of Financial Institutions | |||||

DATE: OCT 10 2014 | BY: |  | ||||

Effective July 1, 1996, the Department of Financial Institutions assumed the functions previously performed by the Corporations Division of the Secretary of State and is the successor custodian of corporate records formerly held by the Secretary of State.

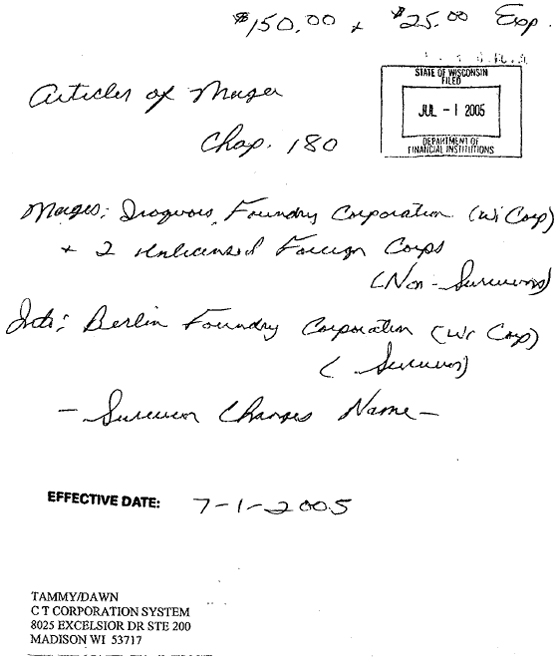

| ARTICLES OF MERGER | |||

OF HI-TECH, INC., AN INDIANA CORPORATION, IROQUOIS FOUNDRY CORPORATION, A WISCONSIN CORPORATION BOHN ALUMINUM, INC., AN INDIANA CORPORATION INTO BERLIN FOUNDRY CORPORATION, A WISCONSIN CORPORATION |  |

Pursuant to the provisions of Section 180.1105 of the Wisconsin Business Corporation Law, the above domestic and foreign corporations have adopted the following Articles of Merger:

FIRST: The names of the non-surviving parties to the merger and the names of the states under the laws of which such corporations are organized are as follows:

Name | Type of Entity | State | ||

| HI-TECH, Inc. | Business Corporation | Indiana | ||

| Iroquois Foundry Corporation | Business Corporation | Wisconsin | ||

| Bohn Aluminum, Inc. | Business Corporation | Indiana | ||

SECOND: The name of the surviving corporation is Berlin Foundry Corporation, and it is a business corporation organized under the laws of the State of Wisconsin.

THIRD: The Plan of Merger attached to these Articles of Merger as Exhibit “A” and incorporated herein by this reference was approved by each business entity that is a party to the merger in the manner required by the laws applicable to each business entity, and in accordance with Section 180.1103 of the Wisconsin Business Corporation Law.

FOURTH:These Articles of Merger, when filed, shall be effective on July 1, 2005 at 8:00am.

FIFTH: As stated in the Plan of Merger attached hereto as Exhibit A, the Articles of Incorporation of the Surviving Corporation (Berlin Foundry Corporation) shall hereby be amended in accordance with the Wisconsin Act, as follows:

The Articles of Incorporation shall be amended to reflect the change of the name of the Surviving Corporation by deleting the heading in its entirety and substituting in lieu thereof the following:

ARTICLES OF INCORPORATION OF CITATION FOUNDRY CORPORATION |  |

1373036

The Articles of Incorporation shall be amended to reflect the change of the name of the Surviving Corporation by deleting Article I in its entirety and substituting in lieu thereof the following:

ARTICLE I

The name of the corporation isCitation Foundry Corporation.

** the remainder of this page is intentionally left blank **

| 1373036 | 2 |

Executed on the 29th day of June, 2005

| SURVIVING BUSINESS ENTITY: | ||

| BERLIN FOUNDRY CORPORATION | ||

| By: |  | |

| ||

| Geoffrey A. Bell | ||

| Its Vice-President | ||

| OTHER PARTIES TO THE MERGER: | ||

| HI-TECH, INC. | ||

| By: |  | |

| ||

| Geoffrey A. Bell | ||

| Its Vice-President | ||

| IROQUOIS FOUNDRY CORPORATION | ||

| By: |  | |

| ||

| Geoffrey A. Bell | ||

| Its Vice-President | ||

| BOHN ALUMINUM, INC. | ||

| By: |  | |

| ||

| Geoffrey A. Bell | ||

| Its Vice-President | ||

This document was executed outside the State of Wisconsin.

| 1373036 | 3 |

PLAN OF MERGER

OF

HI-TECH, INC., AN INDIANA CORPORATION,

IROQUOIS FOUNDRY CORPORATION, A WISCONSIN CORPORATION

BOHN ALUMINUM, INC., AN INDIANA CORPORATION

INTO

BERLIN FOUNDRY CORPORATION, A WISCONSIN CORPORATION

THIS PLAN OF MERGER by and among HI-TECH, INC., an Indiana Corporation (“HI-TECH”), IROQUOIS FOUNDRY CORPORATION, a Wisconsin Corporation (“Iroquois”), BOHN ALUMINUM, INC., an Indiana Corporation (“Bohn”), and BERLIN FOUNDRY CORPORATION, a Wisconsin Corporation (“Corporation”).

W I T N E S S E T H:

WHEREAS, it has been proposed that the HI-TECH, Iroquois, and Bohn shall merge with and into the Corporation, whereby Berlin Foundry Corporation will be the surviving entity of the merger, pursuant to Section 180.1100 to Section 180.1106 of the Wisconsin Business Corporation Law (the “Wisconsin Act”), and Section 23-1-40-1 to Section 23-1-40-8 of the Indiana Business Corporation Law (“Indiana Act”); and

WHEREAS, the board of directors and the shareholders of Iroquois have adopted and approved the merger in accordance with Section 180.1103 of the Wisconsin Act; the board of directors and the shareholders of Bohn have adopted and approved the merger in accordance with Section 23-1-40-3 of the Indiana Act; the board of directors and the shareholders of HI-TECH have adopted and approved the merger in accordance with Section 23-1-40-3 of the Indiana Act; the board of directors and the shareholders of the Corporation have adopted and approved the merger in accordance with Section 180.1103 of the Wisconsin Act;

NOW, THEREFORE, in consideration of the premises and of the mutual agreements of the parties, this Plan of Merger, and the terms and conditions hereof and the mode of carrying the same into effect, together with any provisions required or permitted to be set forth herein, are hereby determined and agreed upon as hereinafter set forth.

1.The Merger. As of the Effective Date (hereinafter defined), HI-TECH, Iroquois, and Bohn shall, pursuant to 180.1100 to Section 180.1107 of the Wisconsin Act and Section 23-1-40-1 to Section 20-1-40-8 of the Indiana Act, be merged with and into the Corporation; the separate organizational existence of HI-TECH, Iroquois, and Bohn shall thereupon cease; and the Corporation (Berlin Foundry Corporation) shall be the entity surviving the merger and shall continue to exist as a Wisconsin corporation under the Wisconsin Act (the “Merger”). The Corporation shall hereinafter sometimes be referred to as the “Surviving Entity.” At the Effective Date, the Surviving Entity shall thereupon and thereafter possess all the rights, privileges, powers and franchises, of a public as well as of a private nature, of HI-TECH, Iroquois, Bohn and the Corporation (collectively referred to as the “Constituent Entities”), and shall be subject to all the restrictions, disabilities and duties of all of the Constituent Entities; and all the property, real, personal and mixed, and franchises of all of the Constituent Entities, and all debts due to any of the Constituent Entities on whatever account, including subscriptions to

1372935 v2

shares and other choses in action belonging to any of the Constituent Entities, and all and every other interest shall be deemed to be transferred to and vested in the Surviving Entity without further act or deed; and all rights of creditors and all liens upon any property of any of the Constituent Entities shall be preserved unimpaired; and all debts, liabilities and duties of any of the Constituent Entities shall thenceforth attach to the Surviving Entity, and may be enforced against the Surviving Entity, to the same extent as if said debts, liabilities and duties had been incurred or contracted by the Surviving Entity, all with the effect set forth in the Indiana Act and the Wisconsin Act.

2.Articles of Incorporation; Amendment. The Articles of Incorporation of the Corporation, as amended, and as in effect immediately prior to the Effective Date, shall be the Articles of Incorporation of the Surviving Entity, except that as of the Effective Time, the Articles of Incorporation of the Surviving Corporation (Berlin Foundry Corporation) shall be amended in accordance with the Wisconsin Act, as follows:

The Articles of Incorporation shall be amended to reflect the change of the name of the Surviving Corporation by deleting the heading in its entirety and substituting in lieu thereof the following:

ARTICLES OF INCORPORATION

OF

CITATION FOUNDRY CORPORATION

The Articles of Incorporation shall be amended to reflect the change of the name of the Surviving Corporation by deleting Article I in its entirety and substituting in lieu thereof the following:

ARTICLE I

The name of the corporation is Citation Foundry Corporation.

3.Terms and Conditions of Merger.

(a) After the execution of this Plan of Merger, the Surviving Entity will submit Articles of Merger to the Indiana Secretary of State in accordance with the Indiana Act (“Indiana Articles”), and submit Articles of Merger with the Wisconsin Department of Financial Institutions, or other appropriate entity, in accordance with the Wisconsin Act (“Wisconsin Articles”). The Indiana Articles shall be filed with the Secretary of State of Indiana and the Wisconsin Articles with the Wisconsin Department of Financial Institutions (or other appropriate entity), at any time after the date hereof and shall be and become effective on July 1, 2005, at 8:00am (the “Effective Date”).

(b) The statutory merger provided for herein shall constitute a tax-free reorganization pursuant to the Internal Revenue Code of 1986, as amended.

| 1372935 v2 | 2 |

(c) The Bylaws of the Corporation, as in effect immediately prior to the Effective Date, shall be the Bylaws of the Surviving Entity and shall continue in full force and effect until amended, changed or repealed as provided in the Articles of Incorporation and Bylaws of the Surviving Entity, and in the manner prescribed by the Wisconsin Act.

(d) Immediately after the Effective Date, the directors of the Corporation immediately prior to the Effective Date will be the directors of the Surviving Corporation, and the officers of the Corporation immediately prior to the Effective Date will be the officers of the Surviving Corporation, in each case until their successors are elected and qualified.

4.Manner and Basis of Converting Interest. The manner and basis of converting the shares in each corporation that is a party to the merger into shares of the Surviving Entity, and the mode of carrying the merger into effect are as follows:

(a) At the Effective Time, all of the shares of stock of HI-TECH issued and outstanding immediately prior to the Effective Time of the Merger, as well as all authorized stock, shall be completely retired and canceled by virtue of the merger and without any action of HI-TECH or the holder of any of its shares.

(b) At the Effective Time, all of the shares of stock of Iroquois issued and outstanding immediately prior to the Effective Time of the Merger, as well as all authorized stock, shall be completely retired and canceled by virtue of the merger and without any action of Iroquois or the holder of any of its shares.

(c) At the Effective Time, all of the shares of stock of Bohn issued and outstanding immediately prior to the Effective Time of the Merger, as well as all authorized stock, shall be completely retired and canceled by virtue of the merger and without any action of Bohn or the holder of any of its shares.

(d) Each issued and outstanding share of stock in the Corporation (of whatever class), as well as each authorized but unissued share of stock of the Corporation (of whatever class), will not be converted, exchanged or altered in any manner as a result of the Merger and will remain as stock of the Surviving Entity exactly as before the Merger, and the certificates which represented outstanding shares of stock of the Surviving Corporation prior to the Effective Date, without further action, shall continue to be and represent outstanding shares of stock of the Surviving Corporation thereafter without the issuance or exchange of new shares or share certificates. Each share of stock of the Surviving Entity outstanding immediately prior to the Effective Date of the Merger is to be an identical outstanding or treasury share of the Surviving Entity after the Effective Date of the Merger.

(e) Citation Corporation, a Delaware corporation (“Citation”) is the sole owner of all of the shares of stock in each of the Constituent Entities, and will be the sole owner of all shares of stock of the Surviving Entity after the Merger; accordingly, it is not necessary for Citation to receive shares of stock (or any other cash or property) in exchange for the cancellation of its shares in HI-TECH, Iroquois, or Bohn.

| 1372935 v2 | 3 |

IN WITNESS WHEREOF, the undersigned has caused this Plan of Merger to be executed on this the 29th day of June, 2005. This document was executed outside the State of Wisconsin.

| BERLIN FOUNDRY CORPORATION | ||||

| By: |  | |||

| ||||

| Geoffrey A. Bell | ||||

| Its Vice-President | ||||

| Date: | June 29, 2005 | |||

| HI-TECH, INC. | ||||

| By: |  | |||

| ||||

| Geoffrey A. Bell | ||||

| Its Vice-President | ||||

| Date: | June 29, 2005 | |||

| IROQUOIS FOUNDRY CORPORATION | ||||

| By: |  | |||

| ||||

| Geoffrey A. Bell | ||||

| Its Vice-President | ||||

| Date: | June 29, 2005 | |||

| BOHN ALUMINUM, INC. | ||||

| By: |  | |||

| ||||

| Geoffrey A. Bell | ||||

| Its Vice-President | ||||

| Date: | June 29, 2005 | |||

| 1372935 | 4 |