UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-23032

Triloma EIG Global Energy Term Fund I

(Exact name of registrant as specified in charter)

201 North New York Avenue, Suite 250

Winter Park, Florida 32789

(Address of principal executive offices) (Zip code)

NATIONAL REGISTERED AGENTS, INC.

160 Greentree Drive, Suite 101

Dover, DE 19904

(Name and address of agent for service)

Registrant’s telephone number, including area code: (407) 636-7115

Date of fiscal year end: December 31, 2016

Date of reporting period: June 30, 2016

| Item 1. | Reports to Stockholders. |

The semi-annual report is attached.

Triloma EIG Global Energy Term Fund I

Semi-Annual Report to Shareholders

June 30, 2016 (Unaudited)

TABLE OF CONTENTS

Triloma EIG Global Energy Term Fund I files its complete schedule of fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Adviser uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, will be available on Form N-PX: (i) without charge, upon request, by calling 1-844-224-4714 and (ii) on the SEC’s website at http://www.sec.gov.

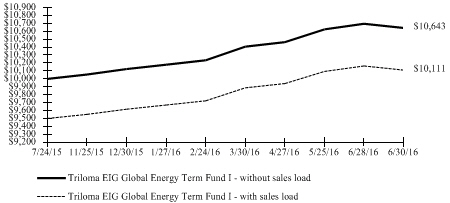

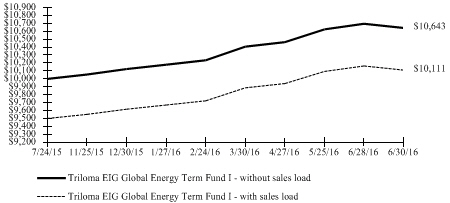

Triloma EIG Global Energy Term Fund I

Growth of a $10,000 Investment

Inception of 07/24/2015 through 06/30/2016

Average Annual Total Return for Periods Ended June 30, 2016:

| | | | | | | | | | | | |

| | | 6 Months | | | Since Inception | | | Inception Date | |

Triloma EIG Globla Energy Term Fund I - without sales load | | | 5.14% | | | | 6.43% | | | | July 24, 2015 | |

Triloma EIG Globla Energy Term Fund I - with sales load | | | -0.12% | | | | 1.11% | | | | | |

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Triloma EIG Global Energy Term Fund I – with sales load return reflects the maximum sales load of 5.00% at the initial investment; the reinvestment of dividends and capital gains do not reflect any sales charges as described in our Distribution Reinvestment Plan. Triloma EIG Global Energy Term Fund I – without sales load return represents no sales load at the initial investment; the reinvestment of dividends and capital gains but does not reflect any sales loads as described in our Distribution Reinvestment Plan.

Performance figures reflect any fee waivers and/or expense reimbursements. Without such waivers and/or reimbursements, the performance would be lower.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the Financial Highlights.

1

Triloma EIG Global Energy Term Fund I

Understanding Your Fund’s Expenses (Unaudited)

As a shareholder of a fund, you incur ongoing costs, which include costs for fund management, administrative services, and shareholder reports, among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in your Fund and to compare these costs with those of other funds. The examples are based on an investment of $1,000 invested at January 1, 2016, and held for the entire period until June 30, 2016.

The table illustrates your Fund’s costs in two ways.

| | • | | Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period.” |

| | • | | Hypothetical Example for Comparison Purposes. This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had a return of 5% before expenses during the period, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other mutual funds. Because the return is set at 5% for comparison purposes — NOT your Funds’ actual return — the account values shown do not apply to your specific investment. |

Please note that the expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs, such as sales loads. If these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| Term Fund I | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | Actual Expenses | | | | Hypothetical Expenses | | | | | |

Beginning Account Value | | Ending Account Value

June 30, 2016 | | | Expenses Paid During Period (a)

January 1, 2016 -

June 30, 2016 | | | Ending Account Value June 30, 2016 | | | Expenses Paid During Period (a)

January 1, 2016 - June 30, 2016 | | | Annualized Expense

Ratio (b) | |

| |

| $ 1,000.00 | | $ | 1,051.20 | | | $ | — | | | $ | 1,024.86 | | | $ | — | | | | 0.00% | |

(a) Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (182 days), and divided by the number of days in the year (366 days).

(b) Expense ratio includes waived expenses; had the Fund not had such waivers in place, the expense ratio would have been higher.

2

Triloma EIG Global Energy Term Fund I

Investment Portfolio Overview

The information contained in this section should be read in conjunction with the following attached Schedule of Investments.

The following table summarizes the composition of the Fund’s investment portfolio by investment type at fair value and enumerates the percentage, by fair value as of June 30, 2016:

| | | | | | | | |

Asset Types | | Fair Value | | | Percentage

of Portfolio | |

Senior Secured Debt | | | $208,583 | | | | 19.1% | |

| | |

Senior Unsecured Debt | | | 885,593 | | | | 80.9% | |

The table below describes investments by industry sub-sectors and enumerates the percentage, by fair value, of the total portfolio assets in such industry sub-sectors as of March 31, 2016:

| | | | | | | | |

Sub-Sectors | | Fair Value | | | Percentage

of Portfolio | |

Power | | | $516,853 | | | | 47.2% | |

| | |

Upstream | | | 264,967 | | | | 24.2% | |

| | |

Midstream | | | 208,583 | | | | 19.1% | |

| | |

Downstream | | | 103,773 | | | | 9.5% | |

3

Triloma EIG Global Energy Term Fund I

Schedule of Investments

June 30, 2016 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Company | | Sub-Sector | | | Asset Type | | | Interest Rate | | | Maturity Date | | | Principal (a) | | | Cost | | | Fair Value | | | % of Net

Assets | |

| |

United States — 47.1% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

AES Corp. | | | Power | | | | Senior Unsecured Debt | | | | 6.00% | | | | 05/15/2026 | | | | $138,000 | | | | $138,000 | | | | $140,932 | | | | 6.1% | |

AmeriGas Partners LLC | | | Downstream | | | | Senior Unsecured Debt | | | | 5.63% | | | | 05/20/2024 | | | | 103,000 | | | | 103,000 | | | | 103,773 | | | | 4.5% | |

Calpine Corp. | | | Power | | | | Senior Unsecured Debt | | | | 5.75% | | | | 01/15/2025 | | | | 183,000 | | | | 176,309 | | | | 177,967 | | | | 7.7% | |

Concho Resources Inc. | | | Upstream | | | | Senior Unsecured Debt | | | | 5.50% | | | | 04/01/2023 | | | | 103,000 | | | | 103,000 | | | | 103,258 | | | | 4.4% | |

Covanta Holding Corp. | | | Power | | | | Senior Unsecured Debt | | | | 5.88% | | | | 03/01/2024 | | | | 103,000 | | | | 100,940 | | | | 99,910 | | | | 4.3% | |

NRG Energy Inc. | | | Power | | | | Senior Unsecured Debt | | | | 6.25% | | | | 05/01/2024 | | | | 103,000 | | | | 97,850 | | | | 98,044 | | | | 4.2% | |

RSP Permian Inc. | | | Upstream | | | | Senior Unsecured Debt | | | | 6.63% | | | | 10/01/2022 | | | | 157,000 | | | | 155,837 | | | | 161,709 | | | | 7.0% | |

Sabine Pass Liquefaction | | | Midstream | | | | Senior Secured Debt | | | | 6.25% | | | | 03/15/2022 | | | | 203,000 | | | | 200,063 | | | | 208,583 | | | | 8.9% | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total United States | | | | | | | | | | | | | | | | | | | | | | | $1,074,999 | | | | $1,094,176 | | | | 47.1% | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Investments (b) | | | | | | | | | | | | | | | | | | | | | | | | | | | $1,094,176 | | | | 47.1% | |

Other Assets and Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | $1,230,001 | | | | 52.9% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Net Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | $2,324,177 | | | | 100.0% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares Outstanding | | | | | | | | | | | | | | | | | | | | | | | | | | | 91,606 | | | | | |

Net Asset Value Per Common Share | | | | | | | | | | | | | | | | | | | | | | | | | | | $25.37 | | | | | |

As of June 30, 2016, the Fund’s investments were categorized as follows in the fair valuation hierarchy:

| | | | | | | | | | | | | | | | |

Investments in Securities | | Quoted

Prices | | | Other

Significant

Observable

Inputs | | | Significant

Unobservable

Inputs | | | Total | |

United States | | $ | — | | | $ | 1,094,176 | | | $ | — | | | $ | 1,094,176 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | — | | | $ | 1,094,176 | | | $ | — | | | $ | 1,094,176 | |

| | | | | | | | | | | | | | | | |

For the period ended June 30, 2016, there were no transfers between levels.

(a) Denominated in U.S. Dollars, unless otherwise noted.

(b) Aggregate cost for federal income tax purposes is $1,074,999. Aggregate gross unrealized appreciation and depreciation for all securities is $20,207 and $1,030, respectively. Net unrealized appreciation for tax purposes is $19,177.

| | | | |

ASSET TYPE | |

| |

Senior Secured Debt | | | 8.9% | |

| |

Senior Unsecured Debt | | | 38.2% | |

| |

Other Assets and Liabilities | | | 52.9% | |

| | | | |

| | | 100.0% | |

The accompanying notes are an integral part of these financial statements

4

Triloma EIG Global Energy Term Fund I

Statement of Assets and Liabilities

(Unaudited)

| | | | |

| | | June 30, 2016 | |

Assets | | | | |

Investments, at Fair Value (Cost $1,074,999) | | $ | 1,094,176 | |

Cash and Cash Equivalents | | | 1,485,072 | |

Receivable Due from Sub-Advisor | | | 729,457 | |

Deferred Offering Costs | | | 34,162 | |

Prepaid Expenses | | | 10,254 | |

Dividends and Interest Receivable | | | 9,351 | |

| | | | |

Total Assets | | | 3,362,472 | |

| |

Liabilities | | | | |

Payable for Investment Securities Purchased | | | 404,790 | |

Legal Expense Payable | | | 392,232 | |

Transfer Agent Fees Payable | | | 58,164 | |

Audit and Tax Expenses Payable | | | 57,581 | |

Payable Due to Administrator | | | 41,667 | |

Compliance Expense Payable | | | 12,452 | |

Trustee Fees Payable | | | 9,235 | |

Management Fee Payable | | | 4,602 | |

Other Accrued Expenses and Liabilities | | | 57,572 | |

| | | | |

Total Liabilities | | | 1,038,295 | |

| | | | |

Total Net Assets | | $ | 2,324,177 | |

| | | | |

| |

Components of Net Assets | | | | |

Paid-in Capital | | $ | 2,305,000 | |

Net Unrealized Appreciation on Investments | | | 19,177 | |

| | | | |

Total Net Assets | | $ | 2,324,177 | |

| | | | |

| |

Shares Issued and Outstanding | | | | |

Shares Outstanding (40,000,000 Shares Authorized) | | | 91,606 | |

Net Asset Value (NAV) Per Share | | $ | 25.37 | |

Public Offering Price (POP) | | $ | 26.89 | |

The accompanying notes are an integral part of these financial statements

5

Triloma EIG Global Energy Term Fund I

Statement of Operations

(Unaudited)

| | | | |

| | | For the Six Months

Ended June 30, 2016 | |

Investment Income | | | | |

Interest Income | | $ | 9,596 | |

Other Income | | | 39,030 | |

| | | | |

Total Investment Income | | | 48,626 | |

| |

Expenses | | | | |

Management Fee | | | 16,345 | |

Administration Fees | | | 250,002 | |

Trustees’ Fees | | | 27,822 | |

Compliance Fees | | | 26,455 | |

Legal Fees | | | 408,931 | |

Transfer Agent Fees | | | 58,768 | |

Audit Fees | | | 43,481 | |

Pricing Fees | | | 15,555 | |

Offering Costs | | | 11,561 | |

Custody Fees | | | 9,727 | |

Registration Fees | | | 3,620 | |

Printing Fees | | | 1,822 | |

Miscellaneous Expenses | | | 130,126 | |

| | | | |

Total Expenses | | | 1,004,215 | |

| |

Expense Support Payments by Sub-Advisor | | | (1,004,215) | |

| | | | |

Total Net Expenses | | | – | |

| | | | |

Net Investment Income | | | 48,626 | |

| | | | |

Net Change in Unrealized Appreciation/(Depreciation) on Investments | | | 19,177 | |

| | | | |

Net Unrealized Gain on Investments | | | 19,177 | |

| | | | |

Increase in Net Assets Resulting from Operations | | $ | 67,803 | |

| | | | |

The accompanying notes are an integral part of these financial statements

6

Triloma EIG Global Energy Term Fund I

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the Six Months

Ended June 30, 2016

(Unaudited) | | | For the Period

July 24, 2015 to

December 31, 2015* | |

| | | | |

Operations: | | | | | | | | |

Net Investment Income | | $ | 48,626 | | | $ | 1,349 | |

Net Change in Unrealized Appreciation/(Depreciation) on Investments | | | 19,177 | | | | – | |

| | | | |

Increase in Net Assets Resulting from Operations | | | 67,803 | | | | 1,349 | |

| | | | |

| | |

Dividends and Distributions: | | | | | | | | |

Net Investment Income | | | (48,626 | ) | | | (1,349) | |

| | | | |

Total Dividends and Distributions to Shareholders | | | (48,626 | ) | | | (1,349) | |

| | | | |

| | |

Capital Share Transactions: | | | | | | | | |

Proceeds from Shares Issued | | | 2,188,064 | | | | 105,000 | |

Reinvestments of Cash Distributions | | | 11,936 | | | | – | |

| | | | |

Total Capital Share Transactions | | | 2,200,000 | | | | 105,000 | |

| | | | |

Net Increase in Net Assets from Capital Share Transactions | | | 2,200,000 | | | | 105,000 | |

| | | | |

Total Increase in Net Assets | | | 2,219,177 | | | | 105,000 | |

| | | | |

| | |

Net Assets: | | | | | | | | |

Beginning of Period | | | 105,000 | | | | – | |

| | | | |

End of Period | | $ | 2,324,177 | | | $ | 105,000 | |

| | | | |

Undistributed Net Investment Income | | $ | – | | | $ | – | |

| | | | |

| | |

Share Transactions: | | | | | | | | |

Shares Issued | | | 86,936 | | | | 4,200 | |

Shares Issued from Reinvestments of Cash Distributions | | | 470 | | | | – | |

| | | | |

Total Transactions | | | 87,406 | | | | – | |

| | | | |

Net Increase in Shares Outstanding from Share Transactions | | | 87,406 | | | | 4,200 | |

| | | | |

*Fund commenced operations on July 24, 2015.

The accompanying notes are an integral part of these financial statements

7

Triloma EIG Global Energy Term Fund I

Financial Highlights

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Period

| | | | | | | | |

| | | For the Six Months | | | For the Period | |

| | | Ended June 30, 2016 | | | July 24, 2015, to | |

| | | (Unaudited) | | | December 31, 2015(a) | |

Net Asset Value, Beginning of Period | | $ | 25.00 | | | $ | 25.00 | |

| | | | | | | | |

Income from Investment Operations: | | | | | | | | |

Net Investment Income(b) | | | 0.90 | | | | 0.31 | |

Net Realized and Unrealized Gain | | | 0.37 | | | | — | |

| | | | | | | | |

| | |

Total from Investment Operations | | | 1.27 | | | | 0.31 | |

| | | | | | | | |

Dividends and Distributions: | | | | | | | | |

Net Investment Income(b) | | | (0.90) | | | | (0.31) | |

| | | | | | | | |

Total Dividends and Distributions | | | (0.90) | | | | (0.31) | |

| | | | | | | | |

| | |

Net Asset Value, End of Period | | $ | 25.37 | | | $ | 25.00 | |

| | | | | | | | |

| | |

Public Offering Price, End of Period | | $ | 26.89 | | | $ | 26.32 | |

| | | | | | | | |

| | |

Total Return - NAV(c) | | | 5.14% | | | | 1.23% | |

| | | | | | | | |

| | |

Total Return - Price(d) | | | 5.14% | | | | 1.23% | |

| | | | | | | | |

Ratios and Supplemental Data | | | | | | | | |

Net Assets, End of Period (in thousands) | | $ | 2,324 | | | $ | 105 | |

Ratios to Average Net Assets: | | | | | | | | |

Expenses(f) | | | 0.00% | | | | 0.00% | |

Expenses (Excluding Expense Support Payments by Sub-Advisor) (f) | | | 153.26% | | | | 2022.58%(e) | |

Net Investment Income (f) | | | 7.14% | | | | 2.82% | |

Portfolio Turnover Rate | | | 0% | | | | 0% | |

Amounts designated as “—” are either not applicable, $0 or have been rounded to $0.

| (a) | Fund commenced operations on July 24, 2015. |

| (b) | Per share calculations were performed using average shares. |

| (c) | Total Return - NAV is based on the change in current net asset value on the first day of each period reported and a sale at the current net asset value on the last day of each period reported, and assuming reinvestment of distributions in accordance with the Fund’s distribution reinvestment plan. Total return based on net asset value is hypothetical as investors cannot purchase or sell Fund shares at the net asset value. |

| (d) | Total Return - Price is based on the change in the public offering price, net of sales loads, on the first day of each period reported and a sale at the current net asset value on the last day of each period reported, and assuming reinvestment of distributions, in accordance with the Fund’s distribution reinvestment plan. |

| (e) | Non-recurring organizational and operating expenses of $255,000 have not been annualized, but are included in the ratio. |

The accompanying notes are an integral part of these financial statements

8

Triloma EIG Global Energy Term Fund I

Notes to Financial Statements

June 30, 2016 (Unaudited)

Note 1. Organization

Triloma EIG Global Energy Term Fund I (the “Fund”) was formed as a Delaware statutory trust on February 18, 2015, and commenced operations upon the effectiveness of its registration statement on July 24, 2015. The Fund is an externally managed, non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”), and has elected to be treated as a regulated investment company (a “RIC”) for federal income tax purposes under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). The Fund’s investment advisor and administrator, Triloma Energy Advisors, LLC, (the “Advisor”, “TEA” or the “Administrator”) is responsible for the overall management of the Fund’s activities. EIG Credit Management Company, LLC (“EIG” or the “Sub-Advisor”), the Fund’s investment sub-advisor, is responsible for the day-to-day management of the Fund’s investment portfolio including sourcing, diligence and negotiation of investments. The Advisor and the Sub-Advisor are each a private investment firm that is registered as an investment advisor with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The investment process is a collaborative effort between the Advisor and the Sub-Advisor and the investment committee of each must approve all Fund portfolio investments sourced by EIG.

The Fund’s investment objectives are to provide shareholders with current income, capital preservation and, to a lesser extent, long-term capital appreciation. The Fund seeks to achieve its investment objectives by investing primarily in a global portfolio of privately originated energy company and project debt. Under normal circumstances, the Fund will invest at least 80% of its total assets in debt and equity investments of energy companies and projects.

Note 2. Summary of Significant Accounting Policies

The Fund is an investment company and follows accounting and reporting guidance under Accounting Standards Codification Topic 946, Financial Services – Investment Companies. The accompanying financial statements were prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). Net Asset Value per share (“NAV”) for financial reporting purposes may differ from the NAV for processing transactions.

Cash and Cash Equivalents: The Fund considers all highly liquid investments with original maturities of 90 days or less to be cash equivalents. The Fund’s cash and cash equivalents are maintained with a major United States financial institution, which is a member of the Federal Deposit Insurance Corporation.

Securities Valuation: Securities listed on securities exchange, market or automated quotation system for which quotations are readily available, including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded, or, if there is no such reported sale, at the most recent quoted bid price. Values of debt securities are generally reported at the last sales price if the security is actively traded. If a debt security is not actively traded it is valued at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Debt obligations with remaining maturities of sixty days or less may be valued at their amortized cost, provided such amount approximates market value.

Securities for which market prices are not “readily available” are valued in accordance with fair value procedures established by the Fund’s Board of Trustees (“Board”). The Fund’s fair value procedures are implemented by the Advisor as designed by the Board. Factors considered in valuation may include information obtained by contacting issuer or analysts, analysis of the issuer’s financial statements and, if necessary, information concerning other securities in similar circumstances. When a security is valued in accordance with the fair value procedures, the Advisor will determine the value after taking into consideration relevant information reasonably available to the Advisor.

9

Triloma EIG Global Energy Term Fund I

Notes to Financial Statements (Continued)

June 30, 2016 (Unaudited)

Hierarchy of Fair Value Inputs

In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| | • | | Level 1 — Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | • | | Level 2 — Other significant observable inputs, which may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, referenced indices, quoted prices in inactive markets, adjusted quoted prices in inactive markets, etc.; and |

| | • | | Level 3 — Unobservable inputs, which may include management’s own assumptions in determining the fair value of investments. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the sub-adviser, issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances. |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

All transfers, if any, are recognized by the Fund at the end of each period. For details of the investment classifications, refer to the Schedule of Investments for the Fund.

During the six month period ended June 30, 2016, there have been no significant changes to the Fund’s fair value methodologies.

Fair Value Measurements: Descriptions of the valuation techniques applied to the Fund’s significant categories of assets and liabilities measured at fair value on a recurring basis are as follows:

Corporate bonds: The fair value of corporate bonds is estimated using various techniques, which consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, fundamental data relating to the issuer, and credit default swap spreads adjusted for any basis difference between cash and derivative instruments. While most corporate bonds are categorized in Level 2 of the fair value hierarchy, in instances where lower relative weight is placed on transaction prices, quotations, or similar observable inputs, they are categorized in Level 3.

Offering Costs: Offering costs are amortized over a 12-month period upon commencement of fund operations and consist of registration fees, underwriting fees, and certain printing and other costs incurred in connection with the continuous offering of the Fund’s common stock. As of June 30, 2016, the remaining amount of unamortized offering costs of the Fund was $34,162. Amortization of offering costs was $11,561 for the six month period ended June 30, 2016

Trustee compensation: The Fund pays the members of the Board of Trustees (“Trustees”), a majority of whom are independent, certain remuneration for their services, plus travel and other expenses. The Fund does not pay compensation to Trustees who also serve in an executive officer capacity for the Fund, the Advisor or the Sub-Advisor. Amounts payable to trustees for compensation and reimbursable expenses are included in the accompanying Statement of Assets and Liabilities. Trustees’ fees earned during the period are reported in the Statement of Operations.

Distributions to shareholders: Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the record date.

10

Triloma EIG Global Energy Term Fund I

Notes to Financial Statements (Continued)

June 30, 2016 (Unaudited)

Use of Estimates: The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material.

Contingencies: In the normal business, the Fund may enter into contracts that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects the risk to be remote.

Risks: The Fund’s principal risk are generally attributable to the underlying investments. The Fund’s holdings are subject to the following risks:

| | • | | Market risk – risk due to the factors affecting the securities market |

| | • | | Sector risk – risk due to investments concentrated in the energy sector |

| | • | | Issuer risk – risk due to a specific issuer |

| | • | | Counterparty risk - risk due to counterparty non-performance |

| | • | | Interest Rate risk – risk due to fluctuations in interest rates |

Note 3. Related Party Transactions

In the initial year of operations, TEA invested in the Fund. As of June 30, 2016, TEA owned 17,047 shares or 18.61% of the outstanding shares.

Investment Advisory Agreement

Pursuant to an investment advisory agreement (the “Investment Advisory Agreement”) between the Fund and the Advisor, the Advisor is entitled to a fee consisting of two components—a base management fee (the “Management Fee”) and an incentive fee (the “Incentive Fee”).

The Management Fee is calculated and payable monthly in arrears at the annual rate of 2% of the Fund’s average gross assets during the relevant month. The Management Fee may or may not be taken by the Advisor in whole or in part at the discretion of the Advisor. All or any part of the Management Fee not taken as to any month will be deferred without interest and may be taken in any such other month as the Advisor may determine. The Management Fee for any partial month will be appropriately prorated. No part of the Management Fee was deferred during the period.

The Management Fee for the six month period ended June 30, 2016 was $16,345.

The Incentive Fee is earned on “pre-incentive fee net investment income” and shall be calculated and payable in arrears as of the end of each calendar quarter during which the Investment Advisory Agreement or Sub-Advisory Agreement is in effect. In the case of a liquidation or if the Investment Advisory Agreement or Investment Sub-Advisory Agreement is terminated, the fee will also become payable as of the effective date of the event. The Incentive Fee is subject to a hurdle rate, expressed as a rate of return on the Fund’s average “adjusted capital,” equal to 1.875% per quarter (or an annualized hurdle rate of 7.5%), and is subject to a “catch-up” feature. For this purpose, “pre-incentive fee net investment income” is the sum of interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter. Also, pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as OID, debt instruments with PIK interest and zero coupon securities), accrued income only when the cash is received by the Fund.

For purposes of computing the Incentive Fee, net interest, if any, associated with a derivative or swap (which represents the difference between (i) the interest income and fees received in respect of the reference assets of the derivative or swap and (ii) the interest expense paid by the Fund to the derivative or swap counterparty) will be included in the calculation of quarterly pre-incentive fee net investment income.

11

Triloma EIG Global Energy Term Fund I

Notes to Financial Statements (Continued)

June 30, 2016 (Unaudited)

“Adjusted capital” means the (a) cumulative proceeds received by the Fund from the sale of Shares, including proceeds from the Fund’s distribution reinvestment plan, net of sales load reduced by the sum of (b) (i) distributions paid to our Shareholders that represent return of capital and (ii) amounts paid for share repurchases pursuant to the Fund’s share repurchase program.

No Incentive Fee was charged to or paid by the Fund for the six month period ended June 30, 2016.

Administration Agreement

Pursuant to an administration agreement between the Fund and the Administrator (the “Administration Agreement”), the Administrator performs and oversees all aspects of the general day-to-day business activities and operations of the Fund, including custodial, distribution disbursing, accounting, auditing, compliance and related services. The Administrator manages the Fund’s corporate affairs subject to the supervision of the Board and furnishes the Fund with office facilities and executive personnel together with clerical and certain recordkeeping and administrative services necessary to administer the Fund. These services include maintaining and preserving certain records, preparing and filing various materials with state and U.S. federal regulators, providing general ledger accounting, fund accounting, legal and other administrative services. In addition, the Administrator assists the Fund in calculating its NAV, overseeing the preparation and filing of tax returns and the preparation, printing and dissemination of annual and other reports to shareholders and to the SEC, and generally overseeing the payment of the Fund’s expenses and the performance of administrative and professional services rendered to the Fund by others.

The Fund pays the Administrator an Administration Fee for its services under the Administration Agreement, calculated weekly and payable monthly in arrears. The fee consists of two components: (i) a fixed administrative fee of $31,250 per month and (ii) a variable administrative fee ranging between the annual rates of 0.05% and 0.10% of the Fund’s average net assets during the relevant month, subject to a monthly minimum fee of $10,417. The variable administrative fee is calculated at the following annual rates based on the average net assets: 0.10% on the first $300,000 of average net assets; 0.07% on the next $300,000 of average net assets; and 0.06% on the next $900,000 of average net assets; and 0.05% on average net assets over $1.5 billion. The Administration Fee may be taken in whole or in part at the discretion of the Administrator. All or any part of the Administration Fee not taken as to any month will be deferred without interest and may be taken in any such other month as the Administrator may determine. The Administration Fee for any partial month will be appropriately prorated. No part of the Administration Fee was deferred during the period.

Administration Fees totaled $250,002 for the six month period ended June 30, 2016.

Note 4. Expense Support and Reimbursement Agreement

Pursuant to an expense support and reimbursement agreement between the Fund and the Sub-Advisor, the Sub-Advisor has agreed to pay operating expenses (including organizational and offering expenses) (an “Expense Payment”) to ensure that the Fund bears a reasonable level of expenses in relation to its income. The purpose of this arrangement is to ensure that no portion of any distributions (at a rate set by the Fund) will be paid from offering proceeds or borrowings and no portion of a distribution will constitute a return of capital. Under this arrangement, the Sub-Advisor will make payments to the Fund monthly in an amount equal to the positive difference, if any, between the Fund’s cumulative distributions paid to the Fund’s shareholders during the relevant portion of the fiscal year (the “Relevant Period”) less cumulative Available Operating Funds (defined below) received by the Fund on account of its investment portfolio during such Relevant Period, reduced by cumulative Expense Payments (defined below) received by the Fund or increased by cumulative Payments (defined below) paid by the Fund during such Relevant Period. “Available Operating Funds” means, in respect of the relevant month, the sum of (i) the Fund’s estimated net investment taxable income (including net short-term capital gains reduced by net long-term capital losses), (ii) the Fund’s net capital gains (including the excess of net long-term capital gains over net short-term capital losses) and (iii) dividends and other distributions paid to the Fund on account of preferred and common equity investments (to the extent such amounts listed in clause (iii) are not included under clauses (i) and (ii) above).

12

Triloma EIG Global Energy Term Fund I

Notes to Financial Statements (Continued)

June 30, 2016 (Unaudited)

The Sub-Advisor is entitled to be conditionally reimbursed by the Fund (a “Reimbursement Payment”) for Expense Payments funded by Sub-Adviser under this arrangement if (and only to the extent that), during any calendar month occurring within three years of the date on which the Sub-Advisor funded such amount, the Fund’s Available Operating Funds exceed the cumulative distributions paid to Fund Shareholders in such month; provided, however, that (i) the Fund will only reimburse the Sub-Advisor for expense support payments made by the Sub-Advisor to the extent that the payment of such reimbursement (together with any other reimbursement paid during such fiscal year) does not cause Other Operating Expenses (as defined below) (on an annualized basis and net of any expense reimbursement payments received by the Fund during such fiscal year) to exceed the lesser of (i) 2% of the Fund’s average net assets attributable to the Fund’s common shares of beneficial interest for the fiscal year-to-date period after taking such Expense Payments into account and (ii) the percentage of the Fund’s average net assets attributable to the Fund’s common shares of beneficial interest represented by Other Operating Expenses during the fiscal year in which such Expense Payment was made (provided, however, that this clause (ii) shall not apply to any Reimbursement Payment which relates to an Expense Payment made during the same fiscal year). “Other Operating Expenses” means the Fund’s total Operating Expenses, excluding management fees, incentive fees, organization and offering expenses, distribution fees, dealer manager fees, financing fees and costs, interest expense, brokerage commissions and extraordinary expenses.

The Fund or the Sub-Advisor may terminate the Expense Support and Reimbursement Agreement at any time. The Sub-Advisor has indicated it expects to continue such reimbursements until it deems that the Fund has achieved economies of scale sufficient to ensure that it bears a reasonable level of expenses in relation to its income. The conditional obligation of the Fund to reimburse the Sub-Advisor shall survive the termination of such agreement by either party.

The Fund or the Sub-Advisor may terminate the expense support and reimbursement agreement at any time. The Sub-Advisor has indicated it expects to continue such reimbursements until it deems that the Fund has achieved economies of scale sufficient to ensure that it bears a reasonable level of expenses in relation to its income. The conditional obligation of the Fund to reimburse the Sub-Advisor shall survive the termination of such agreement by either party.

| | | | | | | | |

| | | Amount of | | | Reimbursement | |

For Periods Ended | | Expense Support | | | Expiration Dates | |

| | |

2015 | | $ | 1,525,633 | | | | 2018 | |

2016 | | | 1,043,245 | | | | 2019 | |

| | | | | | | | |

| | $ | 2,568,878 | | | | | |

| | | | | | | | |

EIG, the Sub-Advisor, is an affiliate of EIG Separate Investments, LP. EIG Separate Investments, LP within the first year of operations, has invested in the Fund. As of June 30, 2016, the affiliate of the Sub-Advisor owned 22,597 shares or 24.67% of the outstanding shares.

13

Triloma EIG Global Energy Term Fund I

Notes to Financial Statements (Concluded)

June 30, 2016 (Unaudited)

Note 5. Capital and Distributions

During the six-month period ended June 30, 2016, the Fund issued 86,936 common shares at Public Offering Price on issue date. In connection with the Fund’s DRP plan, the Fund issued 470 common shares at Public Offering Price without sales load on issue date. At June 30, 2016, the Fund had 91,606 outstanding common shares.

The following table reflects the sources of the cash distributions that the Fund declared on its common shares during the period ended June 30, 2016:

| | | | | | | | | | | | | | | | |

| | | Period Ended June 30 | | | Year Ended December 31 | |

| | | 2016 | | | 2015 | |

| | | Distribution | | | | | | Distribution | | | | |

Source of Distribution | | Amount | | | Percentage | | | Amount | | | Percentage | |

Net investment income (prior to expense reimbursment from sponsor) | | $ | 9,596 | | | | 19.7% | | | $ | - | | | | 0.00% | |

Short-term capital gains proceeds from sale of assets | | | - | | | | - | | | | - | | | | - | |

Long-term capital gains proceeds from sale of assets | | | - | | | | - | | | | - | | | | - | |

Expense reimbursement from Sub-Advisor | | | 39,030 | | | | 80.3% | | | | 1,293 | | | | 100% | |

| | | | | | | | |

Total | | $ | 48,626 | | | | 100.0% | | | $ | 1,293 | | | | 100.00% | |

| | | | | | | | |

Note 6. Investment Transactions

For the six month period ended June 30, 2016, the Fund made purchases of $1,074,763 of investment securities other than long-term U.S. Government and short-term securities. The Fund made no sales of investment securities during the six month period. The Fund had no purchases or sales of long-term U.S. Government securities.

Note 7. Federal Tax Information

The Fund has not made any provision for federal income or excise taxes due to its policy to distribute all of its taxable income and capital gains to its shareholders and otherwise qualify as a regulated investment company under Subchapter M of the Internal Revenue Code. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Fund’s federal and state tax returns remain subject to examination by the Internal Revenue Service and state tax authorities for the prior three years, as applicable. Management has evaluated the Fund’s tax provisions taken for all open tax years, and has concluded that no provision for income tax is required in the Fund’s financial statements. If applicable, the Fund recognizes interest accrued related to unrecognized tax benefits in interest and penalties expense in Miscellaneous Expenses on the Statement of Operations. The Fund identifies its major tax jurisdictions as U.S. Federal, the state of Florida, and foreign jurisdictions where the Fund makes significant investments; however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Note 8. Subsequent Events

The Fund’s Advisor evaluated subsequent events through August 29, 2016, the date the financial statements were available to be issued, and has determined that there have been no subsequent events that occurred during such period which would require disclosure in, or be required to be recognized in, the Statement of Assets and Liabilities as of June 30, 2016.

14

Advisor:

Triloma Energy Advisors, LLC

201 North New York Avenue

Suite 250

Winter Park, FL 32789

Sub-Advisor:

EIG Global Energy Partners, LLC

1700 Pennsylvania Ave NW

Suite 800

Washington DC 20006

Administrator:

Triloma Energy Advisors, LLC

201 North New York Avenue

Suite 250

Winter Park, FL 32789

Legal Counsel:

Dechert LLP

1095 Avenue of the Americas

New York, NY, 10036

Independent Registered Public Accounting Firm:

PricewaterhouseCoopers LLP

4040 West Boy Scout Boulevard

10th Floor

Tampa, FL 33607

This information must be preceded or accompanied by a current

prospectus for the Fund.

Not applicable for semi-annual report.

| Item 3. | Audit Committee Financial Expert. |

Not applicable for semi-annual report.

| Item 4. | Principal Accountant Fees and Services. |

Not applicable for semi-annual report.

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable for semi-annual report.

| Item 6. | Schedule of Investments. |

(a) See Item 1.

(b) Not applicable.

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

Not applicable for semi-annual report.

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. |

(a) Not applicable for semi-annual report.

(b) Not applicable.

| Item 9. | Purchases of Equity Securities by Closed-End Management Company and Affiliated Purchasers. |

Not applicable.

| Item 10. | Submission of Matters to a Vote of Security Holders. |

None.

| Item 11. | Controls and Procedures. |

(a) The certifying officers, whose certifications are included herewith, have evaluated the Registrant’s disclosure controls and procedures within 90 days of the filing date of this report. In their opinion, based on their evaluation, the Registrant’s disclosure controls and procedures are adequately designed, and are operating effectively to ensure, that information required to be disclosed by the Registrant in the reports it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms.

(b) There were no significant changes in the Registrant’s internal control over financial reporting that occurred during the Registrant’s last fiscal half-year that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

(a)(1) Not applicable.

(a)(2) A separate certification for the principal executive officer and the principal financial officer of the Registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940, as amended (17 CFR 270.30a-2(a)), are filed herewith as Exhibit A(2).

(b) Officer certifications as required by Rule 30a-2(b) under the Investment Company Act of 1940, as amended (17 CFR 270.30a-2(b)) also accompany this filing as Exhibit B.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| (Registrant) | | | | | | Triloma EIG Global Energy Term Fund I |

| | | |

| By (Signature and Title) | | | | | | /s/ Deryck A. Harmer |

| | | | | | Deryck A. Harmer |

| | | | | | Chief Executive Officer |

Date: August 26, 2016

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | | | | | |

| By (Signature and Title) | | | | | | /s/ Deryck A. Harmer |

| | | | | | Deryck A. Harmer |

| | | | | | Chief Executive Officer |

| | | |

| Date: August 26, 2016 | | | | | | |

| | | |

| By (Signature and Title) | | | | | | /s/ Elizabeth Strouse |

| | | | | | Elizabeth Strouse |

| | | | | | Chief Financial Officer |

Date: August 26, 2016