UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-23032

Triloma EIG Energy Income Fund - Term I

(Exact name of registrant as specified in charter)

201 North New York Avenue, Suite 200

Winter Park, Florida 32789

(Address of principal executive offices) (Zip code)

NATIONAL REGISTERED AGENTS, INC.

160 Greentree Drive, Suite 101

Dover, DE 19904

(Name and address of agent for service)

Registrant’s telephone number, including area code: (407) 636-7115

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

| Item 1. | Reports to Stockholders. |

The audited financial statements of Triloma EIG Energy Income Fund—Term I (the “Fund” or the “Registrant”) are attached.

TRILOMA EIG ENERGY INCOME FUND – TERM I

Dear Fellow Shareholders,

We formed the Triloma EIG Energy Income Funds (Funds) to provide our shareholders with current income. We believe an effective way to generate this income is through asset-based energy lending – or investing in a global portfolio of privately originated company and project debt – wherein the interest received from these loans supports the payment of monthly cash distributions to our shareholders. Through the collaboration of Triloma Financial Group (Triloma), a private investment management firm providing individuals with a unique approach to alternative investment opportunities, and EIG Global Energy Partners (EIG), a leading institutional investor to the global energy sector with more than $14.4 billion in assets under management1, we have access to substantial market insight and unique energy-related investment opportunities.

In 2016, we achieved several milestones that set the foundation for continued success for our shareholders. From the beginning, EIG agreed to pay operating expenses to ensure that the expenses we bear are at a reasonable level in relation to the Funds’ income. In the first quarter of 2016, we made our first investment, which was closely followed by an order from the SEC giving us the flexibility to co-invest alongside EIG-managed private funds. Later in the year, we completed our first co-investment transaction and approved four others. In the fourth quarter of 2016, we closed on our initial credit facility, which will provide additional liquidity and capital available for investments.

For 35 years, EIG has had a singular focus on providing capital to energy companies and energy-related infrastructure and resource projects. In specialized industries such as energy, we believe it is important to have experience investing across many business and commodity cycles, and to maintain extensive technical capabilities due to the complexities in the underlying businesses. We believe our shareholders benefit from Triloma’s relationship with EIG and its global sourcing and origination platform to directly source investment opportunities. EIG maintains one of the longest continuous track records of any institutional investor in the industry.

We believe that global energy, resource and related infrastructure markets are in a period of dynamic change and that fundamental shifts in global supply and demand have, and will

continue to, put pressure on the entire energy and resource delivery system, from the wellhead to infrastructure, midstream, transportation, power and alternative energy assets. Given these market conditions, it is our view that providing financing to such companies and projects represents a highly attractive risk-reward investment opportunity.

Core to our investment approach is our focus on investing in companies and projects that are secured by hard assets combined with EIG’s in-house technical expertise. Characteristics of energy lending such as asset-level financing via highly structured secured debt instruments foster low defaults and high recovery rates relative to lending in other sectors, among other factors. Often this type of investing is referred to as “project finance,” which can be an efficient way to fund capital intensive and strategically important industries typically characterized by robust or inelastic demand, which underpin predictable and resilient long-term revenues.

Recently Moody’s issued a report2 analyzing default and recovery data on nearly 6,000 distinct projects across North America, Europe, Asia, Latin America, Middle East, Africa and Oceania originated between 1983 – 2014. The report identified that ultimate recovery rates for project finance loans appear to be substantially independent of the economic cycle at both default and emergence, which makes project finance an attractive asset class for some investors seeking to diversify their portfolios. Further, average historical recovery rates for corporate issuers averaged 28% for subordinated bonds, 49% for senior unsecured bonds and 63% for senior secured bonds, whereas project finance loans averaged 80%. In fact, the most likely ultimate recovery rate for project finance was 100%, i.e., no economic loss, in almost two-thirds of cases. Additionally, of the various industries represented within project finance, energy- and infrastructure-related industries have the lowest average default rates.

Thank you for your investment in the Triloma EIG Energy Income Funds. We look forward to earning your continued confidence in the years to come.

Sincerely,

Deryck Harmer

President & CEO

Triloma EIG Energy Income Funds

2 Moody’s Report March 2016: Default and Recovery Rates for Project Finance Bank Loans, 1983-2014. Moody’s is a registered trademark of Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”), and there is no association between Moody’s and Triloma or the Funds.

TABLE OF CONTENTS

Triloma EIG Energy Income Fund – Term I files its complete schedule of fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Adviser uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, will be available on Form N-PX: (i) without charge, upon request, by calling 1-844-224-4714 and (ii) on the SEC’s website at http://www.sec.gov.

(This page intentionally left blank.)

Triloma EIG Energy Income Fund – Term I

(formerly, Triloma EIG Global Energy Term Fund I)

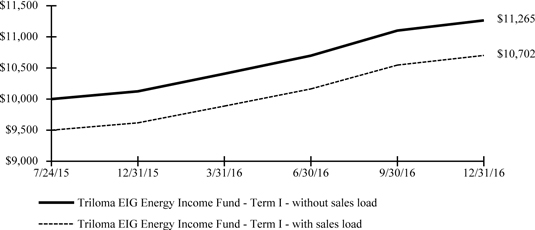

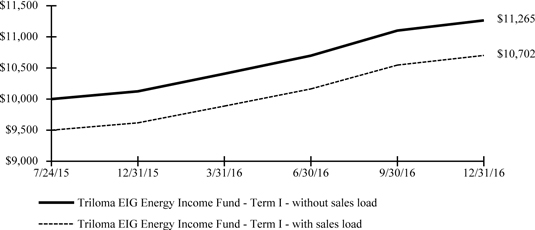

Growth of a $10,000 Investment (unaudited)

Inception of 07/24/2015 through 12/31/2016

Average Annual Total Return for Periods Ended December 31, 2016

| | | | | | | | | | | | |

| | | 1 Year | | | Since Inception | | | Inception Date | |

Triloma EIG Energy Income Fund - Term I - without sales load | | | 11.28 | % | | | 12.65 | % | | | July 24, 2015 | |

Triloma EIG Energy Income Fund - Term I - with sales load | | | 5.71 | % | | | 7.02 | % | | | | |

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Triloma EIG Energy Income Fund – Term I – with sales load return reflects the maximum sales load of 5.00% at the initial investment; the reinvestment does not reflect any sales charges as described in our Distribution Reinvestment Plan. Triloma EIG Energy Income Fund – Term I – without sales load return represents no sales load at the initial investment; the reinvestment does not reflect any sales loads as described in our Distribution Reinvestment Plan.

Performance figures reflect any fee waivers and/or expense reimbursements. Without such waivers and/or reimbursements, the performance would be lower.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the Financial Highlights.

1

Triloma EIG Energy Income Fund – Term I

Understanding Your Fund’s Expenses (Unaudited)

As a shareholder of a fund, you incur ongoing costs, which include costs for fund management, administrative services, and shareholder reports, among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in your Fund and to compare these costs with those of other funds. The examples are based on an investment of $1,000 invested at July 1, 2016, and held for the entire period until December 31, 2016.

The table illustrates your Fund’s costs in two ways.

| • | | Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s return calculated by using the beginning and ending net asset value of the Fund, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period.” |

| • | | Hypothetical Example for Comparison Purposes. This section is intended to help you compare your Fund’s costs with those of other funds. It assumes that the Fund had an annual return of 5% before expenses during the period, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other mutual funds. Because the return is set at 5% for comparison purposes — NOT your Funds’ actual return — the account values shown do not apply to your specific investment. |

Please note that the expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs, such as sales loads. If these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | | Actual Expenses | | | Hypothetical Expenses | | | |

| | | | | | | Expenses Paid | | | | | | Expenses Paid | | | |

| | | | Ending | | | During Year | | | Ending | | | During Period | | | |

| | | | Account Value | | | July 1, 2016 - | | | Account Value | | | July 1, 2016 - | | | |

Beginning Account

Value | | | December 31, 2016 | | | December 31,

2016(a) | | | December 31, 2016 | | | December 31,

2016 (a) | | | Annualized Expense

Ratio (b) |

| | $ 1,000.00 | | | $ | 1,058.40 | | | $ | - | | | $ | 1,025.14 | | | $ | - | | | 0.00% |

(a) Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the above table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (366 days).

(b) Expense ratio includes waived and reimbursed expenses; had the Fund not had such waivers and reimbursements in place, the expense ratio would have been higher.

2

Triloma EIG Energy Income Fund – Term I

Investment Portfolio Overview (unaudited)

The information contained in this section should be read in conjunction with the following attached Schedule of Investments.

The following table summarizes the composition of the Fund’s investment portfolio by investment type at fair value and enumerates the percentage, by fair value as of December 31, 2016:

| | | | |

Asset Types | | Fair Value | | Percentage of Portfolio |

Senior Secured Debt | | $ 579,583 | | 22.7% |

Senior Unsecured Debt | | 1,978,931 | | 77.3% |

The table below describes investments by industry sub-sectors and enumerates the percentage, by fair value, of the total portfolio assets in such industry sub-sectors as of December 31, 2016:

| | | | |

Sub-Sectors | | Fair Value | | Percentage of Portfolio |

Upstream | | $ 954,358 | | 37.3% |

Power | | 553,545 | | 21.6% |

Midstream | | 471,830 | | 18.4% |

Renewables | | 415,893 | | 16.3% |

Downstream | | 162,888 | | 6.4% |

3

Triloma EIG Energy Income Fund – Term I

Schedule of Investments

December 31, 2016

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Company | | Sub-Sector | | Asset Type | | | Interest Rate | | Base Rate

Floor | | Maturity Date | | | Principal (a) | | | Amortized

Cost | | | Fair Value | | | % of Net

Assets | |

United States — 53.6% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

AES Corp. | | Power | | | Senior Unsecured Debt | | | 6.00% | | - | | | 05/15/2026 | | | | $197,000 | | | | $197,735 | | | | $199,955 | | | | 4.2% | |

AmeriGas Partners LP | | Downstream | | | Senior Unsecured Debt | | | 5.63% | | - | | | 05/20/2024 | | | | 103,000 | | | | 103,000 | | | | 105,318 | | | | 2.2% | |

| | | | | | | | 5.50% | | - | | | 05/20/2025 | | | | 57,000 | | | | 57,427 | | | | 57,570 | | | | 1.2% | |

Archrock Partners | | Midstream | | | Senior Unsecured Debt | | | 6.00% | | - | | | 04/01/2021 | | | | 158,000 | | | | 155,250 | | | | 153,260 | | | | 3.2% | |

Calpine Corp. | | Power | | | Senior Unsecured Debt | | | 5.75% | | - | | | 01/15/2025 | | | | 183,000 | | | | 176,611 | | | | 176,595 | | | | 3.7% | |

Concho Resources Inc. | | Upstream | | | Senior Unsecured Debt | | | 5.50% | | - | | | 04/01/2023 | | | | 103,000 | | | | 103,000 | | | | 106,739 | | | | 2.2% | |

Covanta Holding Corp. | | Renewables | | | Senior Unsecured Debt | | | 5.88% | | - | | | 03/01/2024 | | | | 217,000 | | | | 210,830 | | | | 208,863 | | | | 4.4% | |

Crown Oil Partners V, LP(b)(c)(d)(e) | | Upstream | | | Senior Secured Debt | | | L + 7.50 | | 1.00% | | | 09/09/2019 | | | | 353,760 | | | | 347,389 | | | | 357,298 | | | | 7.5% | |

Genesis Energy L.P. | | Midstream | | | Senior Unsecured Debt | | | 5.63% | | - | | | 06/15/2024 | | | | 98,000 | | | | 96,098 | | | | 96,285 | | | | 2.0% | |

Matador Resources | | Upstream | | | Senior Unsecured Debt | | | 6.88% | | - | | | 04/15/2023 | | | | 158,000 | | | | 167,839 | | | | 165,899 | | | | 3.5% | |

NRG Energy Inc. | | Power | | | Senior Unsecured Debt | | | 6.25% | | - | | | 05/01/2024 | | | | 182,000 | | | | 175,131 | | | | 176,995 | | | | 3.7% | |

NRG Yield Operating LLC | | Renewables | | | Senior Unsecured Debt | | | 5.38% | | - | | | 08/15/2024 | | | | 206,000 | | | | 204,980 | | | | 207,030 | | | | 4.3% | |

QEP Resources Inc. | | Upstream | | | Senior Unsecured Debt | | | 5.25% | | - | | | 05/01/2023 | | | | 158,000 | | | | 158,392 | | | | 158,395 | | | | 3.3% | |

RSP Permian Inc. | | Upstream | | | Senior Unsecured Debt | | | 6.63% | | - | | | 10/01/2022 | | | | 157,000 | | | | 155,912 | | | | 166,027 | | | | 3.5% | |

Sabine Pass Liquefaction | | Midstream | | | Senior Secured Debt | | | 6.25% | | - | | | 03/15/2022 | | | | 203,000 | | | | 200,277 | | | | 222,285 | | | | 4.7% | |

| | | | | | | | | | | | | | | | | | | | | | |

Total United States | | | | | | | | | | | | | | | | | | | | | $2,509,871(f) | | | | $2,558,514 | | | | 53.6% | |

| | | | | | | | | | | | | | | | | | | | | | |

Total Investments | | | | | | | | | | | | | | | | | | | | | | | | | $2,558,514 | | | | 53.6% | |

Other Assets and Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | $2,217,940 | | | | 46.4% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Net Assets | | | | | | | | | | | | | | | | | | | | | | | | | $4,776,454 | | | | 100.0% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares Outstanding | | | | | | | | | | | | | | | | | | | | | | | | | 184,243 | | | | | |

Net Asset Value Per Common Share | | | | | | | | | | | | | | | | | | | | | | | | | $25.92 | | | | | |

As of December 31, 2016, the Fund’s investments were categorized as follows in the fair valuation hierarchy:

| | | | | | | | | | | | | | | | |

Investments in Securities | | Level 1 -

Quoted

Prices | | | Level 2 -Other

Significant

Observable

Inputs | | | Level 3 -

Significant

Unobservable

Inputs | | | Total | |

United States | | $ | — | | | $ | 2,201,216 | | | $ | 357,298 | | | $ | 2,558,514 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | — | | | $ | 2,201,216 | | | $ | 357,298 | | | $ | 2,558,514 | |

| | | | | | | | | | | | | | | | |

Portfolio Composition

| | | | |

ASSET TYPE | | | | |

Senior Secured Debt | | | 12.2% | |

Senior Unsecured Debt | | | 41.4% | |

Other Assets and Liabilities | | | 46.4% | |

| | | | |

| | | 100.0% | |

The accompanying notes are an integral part of these financial statements.

4

Triloma EIG Energy Income Fund – Term I

Schedule of Investments

December 31, 2016

The following is a reconciliation of the investments in which significant unobservable inputs were used in determining value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment in Securities | | Beginning Balance

at December 31,

2015 | | | Purchases | | | Sales (g) | | | Accrued

Discounts

(Premiums) | | | Total Realized

Gain (Loss) | | | Net Change in

Unrealized

Appreciation (Depreciation)(h) | | | Net Transfers

into (out of)

Level 3 | | | Ending Balance

at December 31,

2016 | | | Net Change in Unrealized

Appreciation (Depreciation)

on Investments Held at

December 31, 2016 (h) | |

United States | | $ | - | | | $ | 346,500 | | | $ | - | | | $ | 889 | | | $ | - | | | $ | 9,909 | | | $ | - | | | $ | 357,298 | | | $ | 9,909 | |

The following table summarizes the quantitative inputs and assumptions used for items categorized as recurring Level 3 assets as of December 31, 2016. The following disclosures also include qualitative information on the sensitivity of the fair value measurements to changes in the significant unobservable inputs.

| | | | | | | | | | | | |

| Asset Type | | Fair Value at

December 31,

2016 | | | Valuation Techniques | | Unobservable Inputs | | Ranges (Average) | | Impact to valuation from

an increase in input |

Senior | | | $357,298 | | | Discounted Cash Flow | | Discount Rate | | 9.00% - 10.00% (9.3%) | | Decrease |

Secured Debt | | | | | | Contractual Terms | | Redemption Transaction | | 100% - 102% (101%) | | Increase |

The unobservable inputs used to determine fair value of recurring Level 3 assets may have similar or diverging impacts on valuation. Significant increases and decreases in these inputs in isolation and interrelationships between those inputs could result in significantly higher or lower fair value measurement.

| (a) | Denominated in U.S. Dollars, unless otherwise noted. |

(b) Securities are categorized as Level 3 securities under the fair valuation hierarchy. The total value of Level 3 securities is 7.5% of the Fund’s Net Assets.

(c) Fair valued as determined in good faith in accordance with procedures established by the Board. At December 31, 2016, total aggregate fair value of investments is $357,298, representing 7.5% of the Fund’s net assets.

| (d) | Restricted securities held by the Fund as of December 31, 2016 are as follows: |

| | | | | | | | | | | | | | | | | | |

| Investments | | Company | | Acquisition Date | | | Acquisition Cost | | | Value | | | Value as

Percentage of

Net Assets | |

United States | | Crown Oil Partners V, LP | | | 9/9/2016 | | | | $346,500 | | | | $357,298 | | | | 7.5 | % |

| | | | | | | | | $346,500 | | | | $357,298 | | | | 7.5 | % |

| | | | | | | | | | | | | | | | | | |

| (e) | Payment-In-Kind. Income may be received in additional securities and/or cash. |

(f) Aggregate cost for federal income tax purposes is $2,509,871. Aggregate gross unrealized appreciation and depreciation for all securities is $54,556 and ($5,913), respectively. Net unrealized appreciation for tax purposes is $48,643.

| (g) | Sales include all sales of securities, maturities, paydowns and securities tendered in corporate actions. |

(h) Any difference between net change in unrealized appreciation/(depreciation) on investments held at December 31, 2016 may be due to an investment no longer held as Level 3 or transferred into/out of Level 3.

The accompanying notes are an integral part of these financial statements.

5

Triloma EIG Energy Income Fund – Term I

Statement of Assets and Liabilities

| | | | |

| | | December 31, 2016 | |

Assets | | | | |

Investments, at Fair Value (Cost $2,509,871) | | $ | 2,558,514 | |

Cash and Cash Equivalents | | | 2,785,667 | |

Prepaid Expenses | | | 32,590 | |

Interest Receivable | | | 31,043 | |

| | | | |

Total Assets | | | 5,407,814 | |

| | | | |

Liabilities | | | | |

Legal Fees Payable | | | 214,981 | |

Due Diligence Fees Payable | | | 107,910 | |

Audit and Tax Fees Payable | | | 63,450 | |

Payable Due to Sub-Advisor | | | 53,500 | |

Printing Fee Payable | | | 52,013 | |

Payable Due to Administrator | | | 41,667 | |

Marketing Fees Payable | | | 23,437 | |

Trustees’ Fees Payable | | | 10,607 | |

Management Fee Payable | | | 8,647 | |

Other Accrued Expenses | | | 55,148 | |

| | | | |

Total Liabilities | | | 631,360 | |

| | | | |

Total Net Assets | | $ | 4,776,454 | |

| | | | |

Components of Net Assets | | | | |

Paid-in Capital | | $ | 4,727,811 | |

Net Unrealized Appreciation on Investments | | | 48,643 | |

| | | | |

Total Net Assets | | $ | 4,776,454 | |

| | | | |

| |

Shares Outstanding (Unlimited Shares Authorized) | | | 184,243 | |

Net Asset Value (NAV) Per Share | | $ | 25.92 | |

Public Offering Price (POP) | | $ | 26.25 | |

The accompanying notes are an integral part of these financial statements.

6

Triloma EIG Energy Income Fund – Term I

Statement of Operations

| | | | |

| | | For the Year Ended

December 31, 2016 | |

Investment Income | | | | |

Interest Income | | $ | 59,503 | |

| | | | |

Total Investment Income | | | 59,503 | |

| |

Expenses | | | | |

Management Fee | | | 58,474 | |

Administration Fees | | | 500,004 | |

Legal Fees | | | 457,388 | |

Due Diligence Fees | | | 271,231 | |

Audit and Tax Fees | | | 110,300 | |

Printing Fees | | | 117,160 | |

Marketing Fees | | | 106,170 | |

Trustees’ Fees | | | 64,379 | |

Transfer Agent Fees | | | 52,769 | |

Custody Fees | | | 33,074 | |

Offering Costs | | | 30,747 | |

Compliance Fees | | | 28,884 | |

Registration Fees | | | 10,866 | |

Pricing Fees | | | 1,203 | |

Miscellaneous Expenses | | | 143,987 | |

| | | | |

Total Expenses | | | 1,986,636 | |

| |

Expense Support Payments by Sub-Advisor | | | (1,984,121) | |

Management Fee Waiver | | | (2,515) | |

| | | | |

Total Net Operating Expenses | | | — | |

| | | | |

Net Investment Income | | | 59,503 | |

| | | | |

Net Change in Unrealized Appreciation/(Depreciation) on Investments | | | 48,643 | |

| | | | |

Net Unrealized Gain on Investments | | | 48,643 | |

| | | | |

Expense Support Payments by Sub-Advisor | | | 102,310 | |

| | | | |

Increase in Net Assets Resulting from Operations | | $ | 210,456 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

7

Triloma EIG Energy Income Fund – Term I

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the Year Ended

December 31, 2016 | | | For the Period

July 24, 2015 to

December 31, 2015* | |

| | | | |

Operations: | | | | | | | | |

Net Investment Income | | $ | 59,503 | | | $ | 1,293 | |

Net Change in Unrealized Appreciation/(Depreciation) on Investments | | | 48,643 | | | | – | |

Net Increase from Expense Support Payments from Sub-Advisor | | | 102,310 | | | | – | |

| | | | |

Increase in Net Assets Resulting from Operations | | | 210,456 | | | | 1,293 | |

| | | | |

| | |

Dividends and Distributions: | | | | | | | | |

Net Investment Income | | | (161,813 | ) | | | (1,293) | |

| | | | |

Total Dividends and Distributions to Shareholders | | | (161,813 | ) | | | (1,293) | |

| | | | |

| | |

Capital Share Transactions: | | | | | | | | |

Proceeds from Shares Issued | | | 4,576,869 | | | | 105,000 | |

Reinvestments of Cash Distributions | | | 47,137 | | | | – | |

Cost of Shares Repurchased | | | (1,195 | ) | | | – | |

| | | | |

Net Increase in Net Assets from Capital Share Transactions | | | 4,622,811 | | | | 105,000 | |

| | | | |

Total Increase in Net Assets | | | 4,671,454 | | | | 105,000 | |

| | | | |

| | |

Net Assets: | | | | | | | | |

Beginning of Year | | | 105,000 | | | | – | |

| | | | |

End of Year | | $ | 4,776,454 | | | $ | 105,000 | |

| | | | |

Undistributed Net Investment Income | | $ | – | | | $ | – | |

| | | | |

| | |

Share Transactions: | | | | | | | | |

Shares Issued | | | 178,273 | | | | 4,200 | |

Shares Issued from Reinvestments of Cash Distributions | | | 1,816 | | | | – | |

Shares Repurchased | | | (46 | ) | | | – | |

| | | | |

Net Increase in Shares Outstanding from Share Transactions | | | 180,043 | | | | 4,200 | |

| | | | |

| * | Fund commenced operations on July 24, 2015. |

The accompanying notes are an integral part of these financial statements.

8

Triloma EIG Energy Income Fund – Term I

Financial Highlights

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Period

| | | | | | | | |

| | | For the Year Ended

December 31, 2016 | | | For the Period

July 24, 2015 to

December 31, 2015 (a) | |

Net Asset Value, Beginning of Period | | $ | 25.00 | | | $ | 25.00 | |

| | | | | | | | |

Income (Loss) from Investment Operations: | | | | | | | | |

Net Investment Income(b) | | | 0.67 | | | | 0.31 | |

Net Realized and Unrealized Gain | | | 0.50 | | | | — | |

Expense Support Payments(b) | | | 1.15 | | | | — | |

| | | | | | | | |

Total from Operations | | | 2.32 | | | | 0.31 | |

| | | | | | | | |

Dividends and Distributions: | | | | | | | | |

Net Investment Income(c) | | | (1.82) | | | | (0.31) | |

| | | | | | | | |

Total Dividends and Distributions | | | (1.82) | | | | (0.31) | |

| | | | | | | | |

Issuance of Common Stock above Net Asset Value(d) | | | 0.42 | | | | — | |

| | | | | | | | |

Net increase resulting from capital share transactions | | | 0.42 | | | | — | |

| | | | | | | | |

| | |

Net Asset Value, End of Period | | $ | 25.92 | | | $ | 25.00 | |

| | | | | | | | |

| | |

Public Offering Price, End of Period | | $ | 26.25 | | | $ | 26.32 | |

| | | | | | | | |

| | |

Total Return - NAV(e) | | | 11.28%(f) | | | | 1.23%(f) | |

| | | | | | | | |

| | |

Total Return - Price(g) | | | 11.28%(h) | | | | 1.23%(h) | |

| | | | | | | | |

| | |

Ratios and Supplemental Data | | | | | | | | |

Net Assets, End of Period (in thousands) | | $ | 4,776 | | | $ | 105 | |

Ratios to Average Net Assets:(i) | | | | | | | | |

Net Investment Income | | | 2.61%(k) | | | | 2.82% | |

Net Operating Expenses | | | 0.00% | | | | 0.00% | |

Total Operating Expenses | | | 87.05% | | | | 2,022.58%(j) | |

Portfolio Turnover Rate | | | 0% | | | | 0% | |

| | Amounts designated as “—” are either not applicable, $0 or have been rounded to $0. |

| (a) | Fund commenced operations on July 24, 2015. |

| (b) | Per share calculations were performed using average shares. |

| (c) | The per share data for distributions reflects the actual amount of distributions paid per share during the period. |

| (d) | The continuous issuance of common stock may cause an increase in net asset value per share due to sales of shares at the prevailing public offering price and the net proceeds received that are in the excess of net asset value per share for each subscription. The per share data is the sum of the number of shares issued times the difference between the net proceeds per share and the net asset value per share on each transaction date divided by the average shares for the period. |

| (e) | Total Return - NAV is based on the change in current net asset value on the first day of each period reported and a sale at the current net asset value on the last day of each period reported, and assuming reinvestment of distributions in accordance with the Fund’s distribution reinvestment plan. |

| | Total return based on net asset value is hypothetical as investors cannot purchase Fund shares at the net asset value. |

| (f) | Had the Expense Support Agreement (see Note 5) not been provided support beyond Operating Expenses, the Total Return – NAV would have been 10.27% for the year ended 2016 and (0.02)% for the period ended 2015. |

| (g) | Total Return - Price is based on the change in the public offering price, net of sales loads, on the first day of each period reported and a sale at the current net asset value on the last day of each period reported, and assuming reinvestment of distributions, in accordance with the Fund’s distribution reinvestment plan. |

| (h) | Had the Expense Support Agreement (see Note 5) not been provided support beyond Operating Expenses, the Total Return – Price would have been 8.91% for the year ended 2016 and (0.02)% for the period ended 2015. |

| (j) | Non-recurring organizational and operating expenses of $255,000 have not been annualized, but are included in the ratio. |

| (k) | Percentage does not include Expense Support Payments. |

The accompanying notes are an integral part of these financial statements.

9

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements

December 31, 2016

Note 1. Organization

Triloma EIG Energy Income Fund – Term I (the “Fund”) was formed as a Delaware statutory trust on February 18, 2015, and commenced upon the effectiveness of its registration statement on July 24, 2015. The Fund is an externally managed, non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”), and has elected to be treated as a regulated investment company (a “RIC”) for federal income tax purposes under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). The Fund’s investment advisor and administrator, Triloma Energy Advisors, LLC, (the “Advisor”, “TEA” or the “Administrator”) is responsible for the overall management of the Fund’s activities. EIG Credit Management Company, LLC (“EIG” or the “Sub-Advisor”), the Fund’s investment sub-advisor, is responsible for the day-to-day management of the Fund’s investment portfolio. The Advisor and the Sub-Advisor are each a private investment firm that is registered as an investment advisor with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The investment process is a collaborative effort between the Advisor and the Sub-Advisor and the investment committee of each must approve all Fund portfolio investments.

The Fund’s investment objective is primarily to provide shareholders with current income; as secondary investment objectives, the Fund will seek to provide capital preservation and, to a lesser extent, long-term capital appreciation. The Fund seeks to achieve its investment objectives by investing primarily in a global portfolio of privately originated energy company and project debt. Under normal circumstances, the Fund will invest at least 80% of its total assets in debt and equity investments of energy companies and projects. There can be no assurance that the Fund will achieve its investment objectives.

Note 2. Summary of Significant Accounting Policies

The Fund is an investment company and follows accounting and reporting guidance under Accounting Standards Codification Topic 946, Financial Services – Investment Companies. The accompanying financial statements were prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). Net Asset Value per share (“NAV”) for financial reporting purposes may differ from the NAV for processing transactions.

Cash and Cash Equivalents: The Fund considers all highly liquid investments with original maturities of 90 days or less to be cash equivalents. The Fund’s cash and cash equivalents are maintained with a major United States financial institution, which is a member of the Federal Deposit Insurance Corporation. At any time, cash in bank may exceed insured limits.

Securities Valuation: Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available, including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded, or, if there is no such reported sale, at the most recent quoted bid price. Values of debt securities are generally reported at the last sales price if the security is actively traded. If a debt security is not actively traded it is valued at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Debt obligations with remaining maturities of sixty days or less may be valued at their amortized cost, provided such amount approximates market value.

Securities for which market prices are not “readily available” are valued in accordance with fair value procedures established by the Fund’s Board of Trustees (“Board”). The Fund’s fair value procedures are implemented by the Advisor as designed by the Board. Factors considered in valuation may include information obtained by contacting issuer or analysts, analysis of the issuer’s financial statements and, if necessary, information concerning other securities in similar circumstances. When a security is valued in accordance with the fair value procedures, the Advisor will determine the value after taking into consideration relevant information reasonably available to the Advisor.

10

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2016

Hierarchy of Fair Value Inputs

In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| | • | | Level 1 — Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | • | | Level 2 — Other significant observable inputs, which may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, referenced indices, quoted prices in inactive markets, adjusted quoted prices in inactive markets, etc.; and |

| | • | | Level 3 — Unobservable inputs, which may include management’s own assumptions in determining the fair value of investments. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the sub-adviser, issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances. |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

All transfers, if any, are recognized by the Fund at the end of each period. For details of the investment classifications, refer to the Schedule of Investments for the Fund.

During the year ended December 31, 2016, there have been no significant changes to the Fund’s fair value methodologies.

Fair Value Measurements: Descriptions of the valuation techniques applied to the Fund’s significant categories of assets and liabilities measured at fair value on a recurring basis are as follows:

Corporate bonds: The fair value of corporate bonds is estimated using various techniques, which consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, fundamental data relating to the issuer, and credit default swap spreads adjusted for any basis difference between cash and derivative instruments. While most corporate bonds are categorized in Level 2 of the fair value hierarchy, in instances where lower relative weight is placed on transaction prices, quotations, or similar observable inputs, they are categorized in Level 3.

Security transactions and investment income: Security transactions are recorded on the trade date. Realized gains and losses are reported on the identified cost basis. Dividend income, if any, is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is informed of the ex-dividend dates, net of foreign taxes. Interest income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis commencing on the settlement date.

Offering Costs: Offering costs are amortized over a 12-month period upon commencement of fund operations and consist of registration fees, underwriting fees, and certain printing and other costs incurred in connection with the continuous offering of the Fund’s common stock. As of December 31, 2016, offering costs have been fully amortized.

Trustee compensation: The Fund pays the members of the Board of Trustees (“Trustees”), a majority of whom are independent, certain remuneration for their services, plus travel and other expenses. The Fund does not pay compensation to Trustees who also serve in an executive officer capacity for the Fund, the Advisor or the Sub-Advisor. Amounts payable to Trustees for compensation and reimbursable expenses are included in the accompanying Statement of Assets and Liabilities. Trustees’ fees earned during the period are reported in the Statement of Operations.

11

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2016

Distributions to shareholders: Distributions are recorded at the time the dividend or distribution is made and are determined in accordance with federal income tax regulations, which may differ from GAAP.

Use of Estimates: The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material.

Contingencies: In the normal business, the Fund may enter into contracts that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects the risk to be remote.

Risks: The Fund’s principal risk are generally attributable to the underlying investments. The Fund’s holdings are subject to the following risks:

| | • | | Market risk – risk due to the factors affecting the securities market |

| | • | | Sector risk – risk due to investments concentrated in the energy sector |

| | • | | Issuer risk – risk due to a specific issuer |

| | • | | Counterparty risk - risk due to counterparty non-performance |

| | • | | Interest Rate risk – risk due to fluctuations in interest rates |

Note 3. Securities and Other Investments

Loan participations and assignments: The Fund may invest in direct debt instruments which are interests in amounts owed to lenders or lending syndicates by corporate or other borrowers, either in the form of participations at the time the loan is originated (“Participations”) or buying an interest in the loan in the secondary market from a financial institution or institutional investor (“Assignments”). Participations and Assignments in commercial and project financing loans may be secured or unsecured. These investments may include standby financing commitments, including revolving credit facilities that obligate the Funds to supply additional cash to the borrowers on demand, also referred to as unfunded commitments. Loan Participations and Assignments involve risks of insolvency of the lending banks or other financial intermediaries. As such, the Funds assume the credit risks associated with the corporate borrowers and may assume the credit risks associated with the interposed banks or other financial intermediaries.

Based on the ability to invest in Loan Participations and Assignments, the Fund may be contractually obligated to receive approval from the agent banks and/or borrowers prior to the sale of these investments. A fund that participates in such syndications, or that can buy a portion of the loans, become part lenders. Loans are often administered by agent banks acting as agents for all holders.

The agent banks administer the terms of the loans, as specified in the loan agreements. In addition, the agent banks are normally responsible for the collection of principal and interest payments from the borrowers and the apportionment of these payments to the credit of all institutions that are parties to the loan agreements. Unless the Fund has direct recourse against the borrowers under the terms of the loans or other indebtedness, the Fund may have to rely on the agent banks or other financial intermediaries to apply appropriate credit remedies against corporate borrowers.

12

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2016

The fund had commitments that were entered during 2016 that remain unfunded at December 31, 2016. Below are the pending unfunded commitments entered into by the Fund:

| | |

Borrower | | Unfunded Commitment Amount |

Crown Oil Partners V, LP | | $150,000 |

Bioenergy Infrastructure Holdings | | $700,000 |

At December 31, 2016, the Fund had sufficient cash, credit line capacity and/or securities to cover these commitments.

The Fund held no unsecured loan participations at December 31, 2016. Open secured loan participations and assignments are included within the Schedule of Investments.

Payment in-kind securities (“PIK”): PIKs give the issuer the option of making interest payments in either cash or additional debt securities at each interest payment date. Those additional debt securities usually have the same terms, including maturity dates and interest rates, and associated risks as the original bonds.

PIK Securities held at December 31, 2016 are identified in the Schedule of Investments.

Restricted and illiquid securities: The Fund may invest in unregulated restricted securities. Restricted and illiquid securities are subject to legal or contractual restrictions on resale or are illiquid. Restricted securities generally may be resold in transactions exempt from registration under the Securities Act of 1933. A security may be considered illiquid if it lacks a readily available market or if its valuation has not changed for a certain period of time. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at the current valuation may be difficult.

Restricted and illiquid securities held at December 31, 2016 are identified in the Schedule of Investments.

Note 4. Related Party Transactions

In the initial year of operations, the Advisor invested in the Fund. As of December 31, 2016, TEA owned 17,047 shares or 9.25% of the outstanding shares.

Investment Advisory Agreement

Pursuant to an investment advisory agreement (the “Investment Advisory Agreement”) between the Fund and the Advisor, the Advisor is entitled to a fee consisting of two components—a base management fee (the “Management Fee”) and an incentive fee (the “Incentive Fee”).

The Management Fee is calculated and payable monthly in arrears at the annual rate of 2% of the Fund’s average gross assets during the relevant month. The Management Fee may or may not be taken by the Advisor in whole or in part at the discretion of the Advisor. All or any part of the Management Fee not taken as to any month will be deferred without interest and may be taken in any such other month as the Advisor may determine. The Management Fee for any partial month will be appropriately prorated. No part of the Management Fee was deferred during the period.

The Management Fee for the year ended December 31, 2016 was $58,474 of which $2,515 has not been taken as determined by the Advisor. The Advisor does not intend to recapture any previously waived fees.

The Incentive Fee is earned on “pre-incentive fee net investment income” and shall be calculated and payable in arrears as of the end of each calendar quarter during which the Investment Advisory Agreement or Sub-Advisory Agreement is in effect. In the case of a liquidation or if the Investment Advisory Agreement or Investment Sub-Advisory Agreement is terminated, the fee will also become payable as of the effective date of the event. The Incentive Fee is subject to a hurdle rate, expressed as a rate of return on the Fund’s average “adjusted capital,” equal to 1.875% per quarter (or an annualized hurdle rate of 7.5%), and is subject to a “catch-up” feature. For this purpose, “pre-incentive fee net investment income” is the sum of interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter. Also, pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as OID, debt instruments with PIK interest and zero coupon securities), accrued income only when the cash is received by the Fund.

13

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2016

For purposes of computing the Incentive Fee, net interest, if any, associated with a derivative or swap (which represents the difference between (i) the interest income and fees received in respect of the reference assets of the derivative or swap and (ii) the interest expense paid by the Fund to the derivative or swap counterparty) will be included in the calculation of quarterly pre-incentive fee net investment income.

“Adjusted capital” means the (a) cumulative proceeds received by the Fund from the sale of Shares, including proceeds from the Fund’s distribution reinvestment plan, net of sales load reduced by the sum of (b) (i) distributions paid to our Shareholders that represent return of capital and (ii) amounts paid for share repurchases pursuant to the Fund’s share repurchase program.

No Incentive Fee was charged to or paid by the Fund for the year ended December 31, 2016.

Administration Agreement

Pursuant to an administration agreement between the Fund and the Administrator (the “Administration Agreement”), the Administrator performs and oversees all aspects of the general day-to-day business activities and operations of the Fund, including custodial, distribution disbursing, accounting, auditing, compliance and related services. The Administrator manages the Fund’s corporate affairs subject to the supervision of the Board and furnishes the Fund with office facilities and executive personnel together with clerical and certain recordkeeping and administrative services necessary to administer the Fund. These services include maintaining and preserving certain records, preparing and filing various materials with state and U.S. federal regulators, providing general ledger accounting, fund accounting, legal and other administrative services. In addition, the Administrator assists the Fund in calculating its NAV, overseeing the preparation and filing of tax returns and the preparation, printing and dissemination of annual and other reports to shareholders and to the SEC, and generally overseeing the payment of the Fund’s expenses and the performance of administrative and professional services rendered to the Fund by others.

The Fund pays the Administrator an Administration Fee for its services under the Administration Agreement, calculated weekly and payable monthly in arrears. The fee consists of two components: (i) a fixed administrative fee of $31,250 per month and (ii) a variable administrative fee ranging between the annual rates of 0.05% and 0.10% of the Fund’s average net assets during the relevant month, subject to a monthly minimum fee of $10,417. The variable administrative fee is calculated at the following annual rates based on the average net assets: 0.10% on the first $300,000,000 of average net assets; 0.07% on the next $300,000,000 of average net assets; 0.06% on the next $900,000,000 of average net assets; and 0.05% on average net assets over $1.5 billion. The Administration Fee may be taken in whole or in part at the discretion of the Administrator. All or any part of the Administration Fee not taken as to any month will be deferred without interest and may be taken in any such other month as the Administrator may determine. The Administration Fee for any partial month will be appropriately prorated. No part of the Administration Fee was deferred during the year.

Administration Fees totaled $500,004 for the year ended December 31, 2016.

Note 5. Expense Support and Reimbursement Agreement

Pursuant to an expense support and reimbursement agreement between the Fund and the Sub-Advisor, the Sub-Advisor has agreed to pay operating expenses (including organizational and offering expenses) (an “Expense Payment”) to ensure that the Fund bears a reasonable level of expenses in relation to its income. The purpose of this arrangement is to ensure that no portion of any distributions (at a rate set by the Fund) will be paid from offering proceeds or borrowings and no portion of a distribution will constitute a return of capital. Under this arrangement, the Sub-Advisor will make payments to the Fund monthly in an amount equal to the positive difference, if any, between the Fund’s cumulative distributions paid to the Fund’s shareholders during the relevant portion of the fiscal year (the “Relevant Period”) less cumulative Available Operating Funds (defined below) received by the Fund on account of its investment portfolio during such Relevant Period, reduced by cumulative Expense Payments (defined below) received by the Fund or increased by cumulative Payments (defined below) paid by the Fund during such Relevant Period. “Available Operating Funds” means, in respect of the relevant month, the sum of (i) the Fund’s

14

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2016

estimated net investment taxable income (including net short-term capital gains reduced by net long-term capital losses), (ii) the Fund’s net capital gains (including the excess of net long-term capital gains over net short-term capital losses) and (iii) dividends and other distributions paid to the Fund on account of preferred and common equity investments (to the extent such amounts listed in clause (iii) are not included under clauses (i) and (ii) above).

The Sub-Advisor is entitled to be conditionally reimbursed by the Fund (a “Reimbursement Payment”) for Expense Payments funded by Sub-Adviser under this arrangement if (and only to the extent that), during any calendar month occurring within three years of the date on which the Sub-Advisor funded such amount, the Fund’s Available Operating Funds exceed the cumulative distributions paid to Fund Shareholders in such month; provided, however, that (i) the Fund will only reimburse the Sub-Advisor for expense support payments made by the Sub-Advisor to the extent that the payment of such reimbursement (together with any other reimbursement paid during such fiscal year) does not cause Other Operating Expenses (as defined below) (on an annualized basis and net of any expense reimbursement payments received by the Fund during such fiscal year) to exceed the lesser of (i) 2% of the Fund’s average net assets attributable to the Fund’s common shares of beneficial interest for the fiscal year-to-date period after taking such Expense Payments into account and (ii) the percentage of the Fund’s average net assets attributable to the Fund’s common shares of beneficial interest represented by Other Operating Expenses during the fiscal year in which such Expense Payment was made (provided, however, that this clause (ii) shall not apply to any Reimbursement Payment which relates to an Expense Payment made during the same fiscal year). “Other Operating Expenses” means the Fund’s total Operating Expenses, excluding management fees, incentive fees, organization and offering expenses, distribution fees, dealer manager fees, financing fees and costs, interest expense, brokerage commissions and extraordinary expenses.

The Fund or the Sub-Advisor may terminate the expense support and reimbursement agreement at any time. The Sub-Advisor has indicated it expects to continue such reimbursements until it deems that the Fund has achieved economies of scale sufficient to ensure that it bears a reasonable level of expenses in relation to its income. The conditional obligation of the Fund to reimburse the Sub-Advisor shall survive the termination of such agreement by either party. The table below summarizes the expense support received and terms for recapturing previously reimbursed expenses.

| | | | | | | | |

For the Month Ended | | Amount of Expense Payment from Sub- Advisor | | Other Operating Expense Ratio Limitation (1) | | Annualized Distribution Rate Per Share (2) | | Reimbursement Eligilibity Experiation |

July 2015 | | 936,586 | | 2.00% | | - | | July 2018 |

August 2015 | | 27,540 | | 2.00% | | - | | August 2018 |

September 2015 | | 73,920 | | 2.00% | | - | | September 2018 |

October 2015 | | 141,232 | | 2.00% | | - | | October 2018 |

November 2015 | | 113,668 | | 2.00% | | 1.78 | | November 2018 |

December 2015 | | 390,825 | | 2.00% | | 1.78 | | December 2018 |

January 2016 | | 68,375 | | 2.00% | | 1.78 | | January 2019 |

February 2016 | | 75,394 | | 2.00% | | 1.78 | | February 2019 |

March 2016 | | 161,479 | | 2.00% | | 1.78 | | March 2019 |

April 2016 | | 249,052 | | 2.00% | | 1.79 | | April 2019 |

May 2016 | | 251,916 | | 2.00% | | 1.81 | | May 2019 |

June 2016 | | 237,257 | | 2.00% | | 1.81 | | June 2019 |

July 2016 | | 209,003 | | 2.00% | | 1.82 | | July 2019 |

August 2016 | | 215,471 | | 2.00% | | 1.85 | | August 2019 |

September 2016 | | 229,898 | | 2.00% | | 1.85 | | September 2019 |

October 2016 | | 225,906 | | 2.00% | | 1.85 | | October 2019 |

November 2016 | | 93,665 | | 2.00% | | 1.87 | | November 2019 |

December 2016 | | 69,015 | | 2.00% | | 1.87 | | December 2019 |

(1) The Other Operating Expense Ratio Limiation equals the lesser of 2.0% of the Fund’s average net assets or the percentage of the Fund’s average net assets represented by Other Operating Expenses during the fiscal year in which such Expense Payment was made. “Other Operating Expenses” means all operating costs and expenses incurred by the Fund, excluding management fees, incentive fees, organization and offering expenses, distribution fees, dealer manager fees, financing fees and costs, interest expense, brokerage commissions and extraordinary expenses.

(2) The Annualized Distribution Rate Per Share equals the projected annualized distribution amount which is calculated based on the average weekly regular cash distributions per share that were declared with record dates in the applicable Expense Payment month.

15

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2016

EIG, the Sub-Advisor, is an affiliate of EIG Separate Investments, LP. EIG Separate Investments, LP within the first year of operations, has invested in the Fund. As of December 31, 2016, the affiliate of the Sub-Advisor owned 22,597 shares or 12.26% of the outstanding shares.

Note 6. Capital and Distributions

During the year ended December 31, 2016, the Fund issued 178,273 common shares at Public Offering Price on issue date. During the year ended December 31, 2016, the Fund repurchased 46 common shares. In connection with the Fund’s Distribution Reinvestment Plan, the Fund issued 1,816 common shares at Public Offering Price without sales load on issue date. At December 31, 2016, the Fund had 184,243 outstanding common shares.

The following table reflects the sources of the cash distributions that the Fund declared on its common shares during the periods noted below:

| | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

2016 | | | July 24, 2015-

December 31,

2015 | |

| | | Distribution | | | | | | Distribution | | | | |

Source of Distribution | | Amount | | | Percentage | | | Amount | | | Percentage | |

Net investment income (prior to expense reimbursment from sponsor) | | $ | 59,503 | | | | 36.8 | % | | $ | - | | | | - | |

Short-term capital gains proceeds from sale of assets | | | - | | | | - | | | | - | | | | - | |

Long-term capital gains proceeds from sale of assets | | | - | | | | - | | | | - | | | | - | |

Expense reimbursement from Sub-Advisor | | | 102,310 | | | | 63.2 | % | | | 1,293 | | | | 100.0 | % |

| | | | | | | | |

Total | | $ | 161,813 | | | | 100.0 | % | | $ | 1,293 | | | | 100.0 | % |

| | | | | | | | |

Note 7. Credit Facility

The Fund entered into a credit agreement with the Bank of Nova Scotia in December 2016, in the amount of $10 Million. This credit facility provides a source of funds for general business purposes, including the purchase of investment securities. Under the terms of the credit facility, in addition to interest charged on drawn balances, the Fund shall pay an annual commitment fee of 0.25% on the unused commitment unless the Fund has drawn 75% or greater of the total line. These fees of $109 are reflected in Miscellaneous Expenses in the Statement of Operations.

For the year Ended December 31, 2016, the Fund did not draw any amount from the credit facility.

Note 8. Investment Transactions

For the year ended December 31, 2016, the Fund made purchases of $2,511,453 of investment securities other than long-term U.S. Government and short-term securities. The Fund made no sales of investment securities during the year. The Fund had no purchases or sales of long-term U.S. Government securities.

Note 9. Federal Tax Information

The Fund has not made any provision for federal income or excise taxes due to its policy to distribute all of its taxable income and capital gains to its shareholders and otherwise qualify as a regulated investment company under Subchapter M of the Internal Revenue Code. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Fund’s federal and state tax returns remain subject to examination by the Internal Revenue Service and state tax authorities for the prior three years, as applicable. Management has evaluated the Fund’s tax provisions taken for all open tax years, as well as tax positions expected to be taken in 2017, and has concluded that no provision for income tax is required in the Fund’s financial statements. If applicable, the Fund recognizes interest accrued related to unrecognized tax benefits in interest and penalties expense in Miscellaneous Expenses on the Statement of Operations. The Fund identifies its major tax jurisdictions as U.S. Federal, the state of Florida, and foreign jurisdictions where the Fund makes significant investments; however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

16

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Concluded)

December 31, 2016

The tax character of dividends and distributions declared during the years ended December 31, were as follows:

| | | | | | | | | | | | |

| | | Ordinary

Income | | | Long-Term Capital

Gain | | | Total | |

2016 | | $ | 161,813 | | | $ | - | | | $ | 161,813 | |

2015 | | | 1,293 | | | | - | | | | 1,293 | |

As of December 31, 2016, the components of Distributable Earnings on a tax basis were as follows:

| | |

Undistributed Ordinary Income | | $ - |

Undistributed Long-Term Capital Gains | | - |

Capital Loss Carryforwards | | - |

Other Temporary Differences | | - |

Unrealized Appreciation/(Depreciation) | | 48,643 |

Note 10. Subsequent Events

On February 22, 2017, the Board of Trustees approved an amended Administration Agreement (“Agreement”). The amendment to the Agreement results in a change of the fixed component of the fee. The fixed administrative fee component of the Agreement changed from $31,250 to $34,250.

17

(This page intentionally left blank.)

Triloma EIG Energy Income Fund – Term I

Report of Independent Registered Certified Public Accounting Firm

To the Board of Trustees and Shareholders of the Triloma EIG Energy Income Fund - Term I

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Triloma EIG Energy Income Fund — Term I (the “Fund”) as of December 31, 2016, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities as of December 31, 2016 by correspondence with the custodian, provide a reasonable basis for our opinion.

February 27, 2017

Tampa, Florida

19

Triloma EIG Energy Income Fund – Term I

Trustees and Officers of the Fund (Unaudited)

The following chart lists Trustees and Officers as of December 31, 2016.

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the Trustees and Officers. The SAI may be obtained without charge by calling 1-844-224-4714.

| | | | | | |

| Name | | Birthdate | | Trustee Since | | NUMBER OF

REGISTERED

INVESTMENT

COMPANIES IN FUND COMPLEX OVERSEEN BY TRUSTEE |

| Interested Trustee | | | | | | |

| | | | |

| Barry L. Goff | | 1961 | | 2015 | | 2 |

| | | | |

| Brian T. Gilmore | | 1969 | | 2015 | | 2 |

| Independent Trustees | | | | | | |

| | | | |

| Jack A Cuneo | | 1947 | | 2015 | | 2 |

| | | | |

| David W. Rothschild | | 1948 | | 2015 | | 2 |

| | | | |

| Bruce E. Waits | | 1955 | | 2015 | | 2 |

The address for each Trustee is 201 North New York Avenue, Suite 250, Winter Park, FL 32789, unless otherwise indicated.

Interested Trustees

Barry L. Goff. Mr. Goff serves as the Fund’s Trustee. Mr. Goff also currently serves as an investment committee member of Triloma. Mr. Goff co-founded and has served as a principal and officer of various affiliates of Triloma Financial Group since 2012. Mr. Goff is responsible for the overall management of private equity and real estate investment opportunities at Triloma Financial Group. From 2003 to 2011, Mr. Goff served as a managing director of Tavistock Group, the private investment vehicle of Forbes Billionaire Joe Lewis. During that time Mr. Goff also served as the chief executive officer of Tavistock Restaurants, where he and his team assembled and operated a portfolio of almost 100 restaurants for Tavistock Group. While with Tavistock Group, from 2009 to 2011, Mr. Goff also organized and led Tavistock Capital Group, a team focused exclusively on originating and investing in various U.S.-based distressed asset opportunities, including the purchase of the senior secured debt of a restaurant operating company, the acquisition of a $491 million face value residential loan pool in a joint venture with the FDIC, and the acquisition of the St. Regis Hotel & Residences, a recently-developed world class property located in the heart of Buckhead in Atlanta, Georgia. Prior to joining Tavistock, Mr. Goff spent five years at CNL Financial Group serving as the Chief Investment Officer and President of CNL Restaurant Properties, Inc., where he was responsible for more than $1.4 billion of real estate investments and over $100 million of legacy equity and mezzanine funds. Previously, Mr. Goff practiced law for ten years in Atlanta, Georgia, Los Angeles, California and Orlando, Florida. Mr. Goff received a B.S. degree from the University of Central Florida, a J.D. from the University of Florida Levin College of Law, and an L.L.M. from New York University School of Law.

Brian T. Gilmore. Mr. Gilmore serves as the Fund’s Trustee. Mr. Gilmore also currently serves as a Senior Vice President of EIG and is one of EIG’s investment professionals responsible for the origination, evaluation, negotiation and acquisition of energy and infrastructure investments on a global basis. He is also a portfolio manager for EIG’s Global Project Funds. Mr. Gilmore joined EIG in 2002 from Banc of America Securities where he was a Vice President focusing on mergers and acquisitions in the Energy and Power Group. Previously, he was an

Associate in the Project and Structured Finance group at Deutsche Banc Securities and also worked for National Economic Research Associates and Cambridge Energy Research Associates. Mr. Gilmore received an AB from Vassar College and an MBA from the University of Chicago.

20

Triloma EIG Energy Income Fund – Term I

Trustees and Officers of the Fund (Unaudited)

Independent Trustees

Jack A. Cuneo. Mr. Cuneo serves as the Fund’s Trustee. Mr. Cuneo has over 40 years of experience in the real estate industry and had been involved in a wide range of real estate investment activity including acquisitions, development, joint venture structuring, property sales, work outs and private equity financing for REITs and real estate operating companies. Mr. Cuneo was the founder, President and Chief Executive Officer of Chambers Street Properties (NYSE: CSG) until his retirement in March 2015. Prior to Chambers Street, he was the Chairman, President and CEO of CB Richards Ellis Realty Trust from March 2004 to June 2012, and an Executive Managing Director of CBRE Global Investors from July 2008 until June 2012. Mr. Cuneo also spent 26 years at Merrill Lynch where he served from 1997 to 2000 as Chairman and CEO of Merrill Lynch Hubbard, a real estate investment subsidiary which provided real estate investment programs for individual investors. Mr. Cuneo was a Managing Director of the Global Real Estate and Hospitality Group at Merrill Lynch from 2000 to 2002 where he led private equity, and advisory activities. Mr. Cuneo is a member of The Urban Land Institute, and the Policy Advisory Board at the Haas School of Business, at the University of California, Berkeley. Mr. Cuneo received a B.A. from City College of New York.

David W. Rothschild. Mr. Rothschild serves as the Fund’s Trustee. Mr. Rothschild has been engaged in the private practice of law in Canada primarily focusing on national and international business transactions involving Japanese corporations; complex commercial litigation; aboriginal transactions involving business, energy start- ups and infrastructure projects. Since 2012, Mr. Rothschild has served as a consultant supporting various energy and infrastructure projects with the Mohawk Council of Kahnawake and the Kahnawake Economic Development Corporation. From 2000 until 2012, Mr. Rothschild served as an independent Investment Committee member to three energy and infrastructure funds managed by EIG Global Energy Partners. From 1996 to 2012, Mr. Rothschild was a partner with Davis, LLP and co-managing partner of its Montreal Office. Prior to joining Davis, Mr. Rothschild was the co-founding partner of Hara Rothschild, Eastern Canada’s only boutique firm focused exclusively on Japan, and served as a partner of various other law firms including Fasken’s, Gottlieb & Associates, and Fraser & Beatty. Mr. Rothschild received a B.A. from Bishop’s University and a License en Droit from the Université de Sherbrooke.

Bruce E. Waits. Mr. Waits serves as the Fund’s Trustee. Since 2006, Mr. Waits has been engaged in the private practice of law in Texas serving large energy companies where he focuses on structuring tax efficient domestic and international commercial transactions, project review, documentation and tax planning, representation before the IRS and non-U.S. tax authorities, plus a wide range of other tax-related legal services. From 2000 to 2006, Mr. Waits was the General Tax Counsel for Chevron Phillips Chemical Company where he established and managed the tax department and was responsible for the company’s worldwide tax functions including project structuring, tax planning, controversies, legislation, compliance and tax accounting. Prior to joining Chevron Phillips, Mr. Waits spent 12 years with Phillips Petroleum Company where he began as a Senior Tax Attorney and was eventually promoted to General Tax Counsel with management responsibilities for worldwide tax planning and structuring, litigation and legislation. Previously, Mr. Waits worked seven years for the IRS, spent three years in public accounting and for two years was tax director of the First National Bank of Oklahoma City, at that time the largest bank in the state of Oklahoma. Mr. Waits earned a B.S. degree in business administration from Northeastern State University, a J.D. from the Tulsa University College of Law, and an LL.M. in tax from the New York University School of Law. Mr. Waits is licensed to practice law in the state of Oklahoma and Texas and is a member of the Oklahoma, Texas and American Bar Associations. Mr. Waits is also licensed as a certified public accountant in Oklahoma and Arkansas and has served in various committee leadership positions for the Tax Executives Institute, American Petroleum Institute and American Chemistry Council.

21

Triloma EIG Energy Income Fund – Term I

Trustees and Officers of the Fund (Unaudited)

| | | | |

Name | | Birthdate | | Positions Held |

Executive Officers | | | | |

| | | |

Deryck A. Harmer | | 1980 | | President and Chief Executive Officer |

| | | |

Elizabeth Strouse | | 1974 | | Chief Financial Officer |

| | | |

Hope L. Newsome | | 1977 | | Secretary and Chief Compliance Officer |

The address for each executive officer is 201 North New York Avenue, Suite 250, Winter Park, FL 32789.

Deryck A. Harmer. Mr. Harmer serves as the Fund’s President and Chief Executive Officer. Mr. Harmer also currently serves as president, chief executive officer and investment committee member of Triloma, positions that he has held since 2015. Prior to joining Triloma, Mr. Harmer spent over eleven years at CNL Financial Group, most recently as chief strategy officer, member of the operating committee and member of the board of directors for CNL Securities Corp., a FINRA registered broker-dealer. His responsibilities at CNL Financial Group included a variety of roles across the investment management and capital markets divisions, with experience creating, managing and raising capital for alternative investment vehicles. While at CNL Financial Group, Mr. Harmer also served as senior vice president and launched Corporate Capital Trust, a public non-traded business development company advised by CNL Fund Advisors Company and KKR Asset Management. Mr. Harmer served as senior vice president and investment committee member of CNL Fund Advisors Company, leading its investment and operating activities. Prior to joining CNL Financial Group, Mr. Harmer performed tax services for a broad range of companies at PricewaterhouseCoopers between 2002 and 2003. Mr. Harmer has a B.S., summa cum laude, in Accounting from Florida State University and an M.B.A. with a concentration in Finance from Rollins College.

Elizabeth Strouse. Ms. Strouse serves as our Chief Financial Officer. Ms. Strouse also currently serves as chief financial officer of Triloma, positions that she has held since 2016. Ms. Strouse has extensive accounting, administration and financial reporting experience in the investment management industry. Prior to joining Triloma, Ms. Strouse served as managing director with State Street Corp, primarily responsible for assisting their key asset management clients navigate the complex regulatory environment. From 2009 to 2014, Ms. Strouse served as chief accounting officer of Transamerica Asset Management, providing oversight for approximately $70 billion of assets under management within approximately 190 registered funds, including serving as the principal financial officer, chairman of the valuation committee, and member of various risk committees. Prior to joining Transamerica, Ms. Strouse led the fund administration team at TIAA-CREF and provided assurance services for investment management clients at PricewaterhouseCoopers. Ms. Strouse is a certified public accountant and received her B.B.A. in Accounting from the University of Michigan, and her M.Acc. from the University of South Florida.