UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-23032

Triloma EIG Energy Income Fund - Term I

(Exact name of registrant as specified in charter)

201 North New York Avenue, Suite 200

Winter Park, Florida 32789

(Address of principal executive offices) (Zip code)

NATIONAL REGISTERED AGENTS, INC.

160 Greentree Drive, Suite 101

Dover, DE 19904

(Name and address of agent for service)

Registrant’s telephone number, including area code: (407) 636-7115

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

| Item 1. | Reports to Stockholders. |

The audited financial statements of Triloma EIG Energy Income Fund - Term I (the “Fund” or the “Registrant”) are attached.

Triloma EIG Energy Income Fund - Term I

| | | | | | | | |

Officers Deryck A. Harmer President and Chief Executive Officer Elizabeth Strouse Chief Financial Officer Hope L. Newsome Secretary and Chief Compliance Officer Board of Trustees Barry L. Goff Interested Trustee Brian T. Gilmore Interested Trustee Jack A. Cuneo Independent Trustee David W. Rothschild Independent Trustee Bruce E. Waits Independent Trustee Profile The Triloma EIG Energy Income Funds are unlisted investment companies that invest primarily in a global portfolio of privately originated energy company and project debt. The Funds’ investment objectives are primarily to provide shareholders with current income; as secondary investment objectives, the Funds will seek to provide capital preservation and, to a lesser extent, long-term capital appreciation.1 They are managed by Triloma Energy Advisors and EIG Credit Management Company, and offer individuals an opportunity to invest in U.S. and non-U.S. energy companies and projects, in many instances alongside institutional investors. | | | | | |

ENERGY ASSETS Focusing on hard assets and long useful lives1

INCOME FOCUS Seeks to mitigate inflation risk1

GLOBAL DIVERSIFICATION Through privately originated debt1 OFFERING HIGHLIGHTS1 Monthly Income Potentially Mitigates Inflation Risk 1099 Reporting Finite Offering Liquidity Event |

1There can be no assurance that the Funds will achieve their investment objectives. Triloma EIG Energy Income Fund and Triloma EIG Energy Income Fund - Term I (together, the Triloma EIG Energy Income Funds) are advised by Triloma Energy Advisors, LLC and EIG Credit Management Company, LLC, affiliates of Triloma Financial Group (Triloma) and EIG Global Energy Partners (EIG), respectively. Triloma and EIG are not affiliated. | | | | |

TRILOMA EIG ENERGY INCOME FUND – TERM I

Dear Fellow Shareholders,

As an investment manager, our primary goal is to identify and mitigate risk for our investors. To achieve that goal, we look to invest in undervalued assets, and in 2017, that proved challenging. A look at the stock market reveals nearly every industry average at all-time highs with significant gains realized since the financial crisis in 2008. The economy is truly enjoying one of the longest bull markets on record. In light of this record-breaking market and bond uncertainty with the risk of rising interest rates, we often hear investors ask, “Where can you find appropriate risk-adjusted returns today without potential stock market volatility?”

We are happy to report that not all asset classes are at all-time highs and in fact we have observed diverging cycles between the energy industry and the rest of the market over the last few years. Often, investing in an industry when it has stabilized after a recovery can mitigate risk and provide outsized returns. Compounded by global population growth, the demand for energy and the infrastructure to provide it is only expected to rise. We believe that investment opportunities focused on financing hard energy assets provides an effective strategy that mitigates the potential volatility and uncertainty in the financial markets.

Investment Opportunities

In 2017, oil prices stabilized as cutbacks in production from the Organization of the Petroleum Exporting Countries (“OPEC”) helped lower overall inventories while natural gas prices remained low but stable domestically. Liquefied natural gas (“LNG”) exports continued to ramp up as the spreads between domestic natural gas prices and global LNG prices remain wide. We continue to see investment opportunities related to natural gas, which benefits from the globalization of LNG and demand for cleaner power generation. In the upstream sector, we continue to pursue opportunities to invest in high quality assets with low cost production and proven reserves diversified across multiple basins.

It was once commonly accepted that midstream energy infrastructure assets were immune to commodity price changes due to their longer-term contracts and volume based pricing, but the last few years have revealed the importance of understanding the impact of the changing marketplace across the value chain. With the shale revolution, the location of the growing oil and gas supply has changed in the United States. Continued investments in infrastructure connecting these new supplies to end markets is required. We seek to identify these midstream investment opportunities that not only are secured by hard assets, but are also in markets with positive long-term supply demand dynamics and supported with long-term contracts.

The power and renewable markets experienced a number of industry changing events during the year including continued cost efficiency and consolidation. Historically renewable projects such as solar and wind power generation depended on subsidies to be economically viable. Today with continued technological improvement and cost declines, renewables are becoming more and more competitive in comparison to fossil fuels in countries such as Chile, South Africa and Australia.

Supported by an asset that has a long-term useful life and predicable cash flows, we continue to focus on opportunities to invest in an evolving generation of new power projects globally.

At the core of our investment approach is a focus on investing in energy companies and projects that are secured by hard assets. Asset-based lending is a method of funding in which the lender looks primarily to the revenues and assets of a single project, both as a source of repayment and as collateral for their exposure. This type of financing is generally used for large, complex and expensive assets or projects that might include power plants, processing facilities, pipelines, and transportation infrastructure. By investing primarily in debt, our investors typically have a priority claim on the assets and cash flows of a company.

Triloma EIG Energy Income Fund – Term I

In light of the opportunities and challenges identified above, we are excited to share that the Triloma EIG Energy Income Fund – Term I (“Fund”) has continued to successfully execute the strategy of investing in a global portfolio of privately originated energy companies and project debt, reaching important milestones in 2017 by growing and diversifying the portfolio, participating in numerous originated investments both domestically and internationally alongside EIG Global Energy Partners (“EIG”) managed investment vehicles, as well as increasing the Fund’s net asset values and distributions to shareholders throughout the year.

Through our partnership with EIG, we participated in eight energy and infrastructure projects with total commitments in excess of $2.0 billion during the year. Due to our partnership with EIG, we were able to diversify the portfolio across the energy value chain, investing in assets that generally would be too large to access on a stand-alone basis. In 2017, we capitalized on opportunities to generate gains in order to reinvest in directly originated projects. We will continue to seek those opportunities as we believe direct investments can offer stronger risk-adjusted returns than those offered in the broadly syndicated market.

Global energy, resource and related infrastructure markets are in a period of dynamic change. Fundamental shifts in global supply and demand have, and will continue to, put pressure on the entire energy and resource delivery system, from the wellhead to infrastructure, midstream, transportation, power and alternative energy assets. For investors seeking income-oriented strategies during 2017, the Fund provided access to proprietary investments focused on taking advantage of these trends in the global energy and infrastructure marketplace. Thank you for your trust and investment in the Triloma EIG Energy Income Fund – Term I, and we look forward to the year ahead.

Sincerely,

Deryck Harmer

President & CEO

Triloma EIG Energy Income Fund – Term I

TABLE OF CONTENTS

Triloma EIG Energy Income Fund – Term I files its complete schedule of fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Adviser uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, will be available on Form N-PX: (i) without charge, upon request, by calling 1-844-224-4714 and (ii) on the SEC’s website at http://www.sec.gov.

Triloma EIG Energy Income Fund – Term I

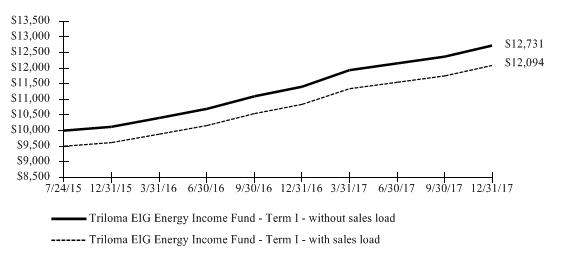

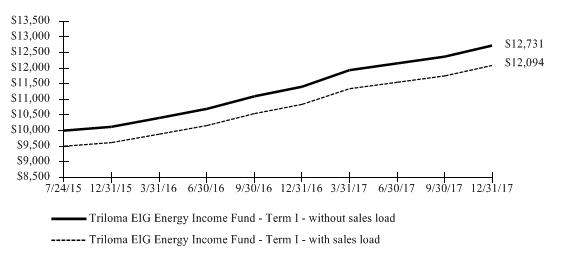

Growth of a $10,000 Investment (Unaudited)

Inception of 07/24/2015 through 12/31/2017

| | | | | | |

| Performance as of December 31, 2017 | | | | | | |

| | | | | Total Return | | Cumulative Average

Total Return |

| | | Inception Date | | 1 Year | | Since Inception |

Triloma EIG Energy Income Fund - Term I - without sales load | | 07/24/15 | | 11.59% | | 27.31% |

Triloma EIG Energy Income Fund - Term I - with sales load | | 07/24/15 | | 6.01% | | 20.94% |

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Triloma EIG Energy Income Fund – Term I – with sales load return reflects the maximum sales load of 5.00% at the initial investment; the reinvestment does not reflect any sales charges as described in our Distribution Reinvestment Plan. Triloma EIG Energy Income Fund – Term I – without sales load return represents no sales load at the initial investment; the reinvestment does not reflect any sales loads as described in our Distribution Reinvestment Plan.

Performance figures reflect any fee waivers and/or expense reimbursements. Without such waivers and/or reimbursements, the performance would be lower.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the Financial Highlights.

1

Triloma EIG Energy Income Fund – Term I

Understanding Your Fund’s Expenses (Unaudited)

As a shareholder of a fund, you incur ongoing costs, which include costs for fund management, administrative services, and shareholder reports, among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in your fund and to compare these costs with those of other funds. The examples are based on an investment of $1,000 invested at July 1, 2017, and held for the entire period until December 31, 2017.

The table illustrates your fund’s costs in two ways.

| · | | Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the fund’s return calculated by using the beginning and ending net asset value of the fund, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.” |

| · | | Hypothetical Example for Comparison Purposes. This section is intended to help you compare your fund’s costs with those of other funds. It assumes that the fund had an annual return of 5% before expenses during the period, but that the expense ratio is unchanged. In this case, because the return used is not the fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other mutual funds. Because the return is set at 5% for comparison purposes — NOT your fund’s actual return — the account values shown do not apply to your specific investment. |

Please note that the expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs, such as sales loads. If these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | Actual Expenses | | | Hypothetical Expenses | | | |

Beginning

Account Value | | Ending

Account Value

December 31, 2017 | | | Expenses Paid

During July 1, 2017 -

December 31, 2017 (a) | | | Ending

Account Value

December 31, 2017 | | | Expenses Paid During

July 1, 2017 -

December 31, 2017 (a) | | | Annualized

Expense

Ratio (b) |

| $ 1,000.00 | | $ | 1,060.90 | | | $ | 14.03 | | | $ | 1,011.59 | | | $ | 13.69 | | | 2.70% |

(a) Expenses are calculated using the fund’s annualized expense ratio (as disclosed in the above table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (365 days).

(b) Expense ratio includes waived and reimbursed expenses; had the fund not had such waivers and reimbursements in place, the expense ratio would have been higher.

2

Triloma EIG Energy Income Fund – Term I

Investment Portfolio Overview (Unaudited)

The information contained in this section should be read in conjunction with the following attached Schedule of Investments.

The following table summarizes the composition of the Fund’s investment portfolio, excluding Short Term Investments, by investment type at fair value and enumerates the percentage, by fair value as of December 31, 2017:

| | | | | | | | | | | | |

Asset Types | | | | Fair Value | | | | | Percentage

of Portfolio |

Senior Secured Debt | | | | | $ 9,080,625 | | | | | | 53.8% | |

| | | | |

Senior Unsecured Debt | | | | | 6,846,636 | | | | | | 40.6% | |

| | | | |

Equity/Other | | | | | 938,150 | | | | | | 5.6% | |

|

| The table below describes investments by industry sub-sectors and enumerates the percentage, by fair value, of the total portfolio assets in such industry sub-sectors, excluding Short Term Investments, as of December 31, 2017: | |

| | | | |

Sub-Sectors | | | | Fair Value | | | | | Percentage

of Portfolio |

Upstream | | | | | $ 7,590,273 | | | | | | 45.0% | |

| | | | |

Midstream | | | | | 3,491,250 | | | | | | 20.7% | |

| | | | |

Power | | | | | 3,054,283 | | | | | | 18.1% | |

| | | | |

Renewables | | | | | 2,123,325 | | | | | | 12.6% | |

| | | | |

Downstream | | | | | 606,280 | | | | | | 3.6% | |

|

| The table below describes investments by country and enumerates the percentage, by fair value, of the total portfolio assets in such countries, excluding Short Term Investments, as of December 31, 2017: | |

| | | | |

Country | | | | Fair Value | | | | | Percentage

of Portfolio |

United States | | | | | $ 15,263,799 | | | | | | 90.5% | |

| | | | |

Congo-Brazzaville | | | | | 911,557 | | | | | | 5.4% | |

| | | | |

Kazakhstan | | | | | 419,045 | | | | | | 2.5% | |

| | | | |

United Kingdom | | | | | 271,010 | | | | | | 1.6% | |

3

Triloma EIG Energy Income Fund – Term I

Schedule of Investments

December 31, 2017

| | | | | | | | | | | | | | | | | | | | | | | | |

| Company | | Sub-Sector | | | Asset Type | | Interest Rate | | Base Rate Floor | | Maturity/ Expiration Date | | | Principal (a)/Shares | | | Cost (b)(c) | | Fair Value | | % of Net Assets |

| | | |

Congo-Brazzaville — 5.8% | | | | | | | |

New Age, Ltd. (d)(e)(f) | | | Upstream | | | Senior Secured Debt (g) | | 15.00% | | - | | | 06/28/2020 | | | $ | 754,641 | | | $740,667 | | $873,407 | | 5.5% |

| | | | | | Warrants (h)(i) | | N/A | | - | | | 06/28/2026 | | | | 15,131 | | | 18,228 | | 38,150 | | 0.3% |

| | | | |

Total Congo-Brazzaville | | | | | | | 758,895 | | 911,557 | | 5.8% |

| | | |

Kazakhstan — 2.7% | | | | | | | |

Tengizchevroil Finance Company International LTD (j) | | | Upstream | | | Senior Secured Debt | | 4.00% | | - | | | 08/15/2026 | | | | 418,000 | | | 407,033 | | 419,045 | | 2.7% |

| | | | |

Total Kazakhstan | | | | | | | 407,033 | | 419,045 | | 2.7% |

| | | |

United Kingdom — 1.7% | | | | | | | |

Bioenergy Infrastructure Holdings, Ltd. (d)(e)(f)(k) | | | Renewables | | | Senior Secured Debt | | L + 7.25% | | 1.00% | | | 12/22/2022 | | | | 271,010 | | | 269,743 | | 271,010 | | 1.7% |

| | | | |

Total United Kingdom | | | | | | | 269,743 | | 271,010 | | 1.7% |

| | | |

United States — 96.7% | | | | | | | |

AES Corp. | | | Power | | | Senior Unsecured Debt | | 6.00% | | - | | | 05/15/2026 | | | | 289,000 | | | 292,535 | | 312,120 | | 2.0% |

| | | | | | Senior Unsecured Debt | | 5.50% | | - | | | 03/15/2024 | | | | 305,000 | | | 310,982 | | 317,200 | | 2.0% |

Aethon United LP (d)(e)(f)(k) | | | Upstream | | | Senior Secured Debt | | L + 6.75% | | 1.00% | | | 09/08/2023 | | | | 687,500 | | | 667,691 | | 682,344 | | 4.3% |

AmeriGas Partners LP Fin Corp. | | | Downstream | | | Senior Unsecured Debt | | 5.63% | | - | | | 05/20/2024 | | | | 346,000 | | | 349,288 | | 359,840 | | 2.3% |

| | | | | | Senior Unsecured Debt | | 5.50% | | - | | | 05/20/2025 | | | | 244,000 | | | 249,493 | | 246,440 | | 1.5% |

ARB Midstream LLC (d)(e)(f)(k) | | | Midstream | | | Senior Secured Debt | | L + 7.25% | | 1.00% | | | 11/06/2021 | | | | 1,145,455 | | | 1,112,009 | | 1,134,000 | | 7.2% |

Archrock Partners LP/Fin | | | Midstream | | | Senior Unsecured Debt | | 6.00% | | - | | | 04/01/2021 | | | | 221,000 | | | 218,137 | | 221,000 | | 1.4% |

| | | | | | Senior Unsecured Debt | | 6.00% | | - | | | 10/01/2022 | | | | 360,000 | | | 361,240 | | 360,000 | | 2.3% |

Calpine Corp. | | | Power | | | Senior Unsecured Debt | | 5.75% | | - | | | 01/15/2025 | | | | 684,000 | | | 667,473 | | 650,655 | | 4.1% |

Covanta Holding Corp. | | | Renewables | | | Senior Unsecured Debt | | 5.88% | | - | | | 03/01/2024 | | | | 412,000 | | | 406,530 | | 418,180 | | 2.6% |

| | | | | | Senior Unsecured Debt | | 5.88% | | - | | | 07/01/2025 | | | | 123,000 | | | 122,827 | | 123,615 | | 0.8% |

Enviva Partners, LP | | | Renewables | | | Senior Unsecured Debt | | 8.50% | | - | | | 11/01/2021 | | | | 628,000 | | | 667,578 | | 668,820 | | 4.2% |

Felix Investments Holdings (d)(e)(f)(k) | | | Upstream | | | Senior Secured Debt | | L +6.50% | | 1.00% | | | 08/09/2022 | | | | 666,667 | | | 655,724 | | 666,667 | | 4.2% |

Genesis Energy L.P. | | | Midstream | | | Senior Unsecured Debt | | 5.63% | | - | | | 06/15/2024 | | | | 607,000 | | | 601,028 | | 591,825 | | 3.7% |

Holly Energy Partners LP (j) | | | Midstream | | | Senior Unsecured Debt | | 6.00% | | - | | | 08/01/2024 | | | | 477,000 | | | 498,755 | | 497,273 | | 3.2% |

Matador Resources, Co | | | Upstream | | | Senior Unsecured Debt | | 6.88% | | - | | | 04/15/2023 | | | | 274,000 | | | 288,574 | | 288,385 | | 1.8% |

Northeast Natural Energy, LLC (d)(e)(f)(k) | | | Upstream | | | Senior Secured Debt | | L +8.00% | | - | | | 03/02/2022 | | | | 1,025,000 | | | 1,012,343 | | 1,025,000 | | 6.5% |

NRG Energy Inc. | | | Power | | | Senior Unsecured Debt | | 6.25% | | - | | | 05/01/2024 | | | | 617,000 | | | 615,067 | | 646,308 | | 4.1% |

NRG Yield Operating LLC | | | Renewables | | | Senior Unsecured Debt | | 5.38% | | - | | | 08/15/2024 | | | | 620,000 | | | 628,225 | | 641,700 | | 4.1% |

Panda Hummel (k) | | | Power | | | Senior Secured Debt | | L + 6.00% | | 1.00% | | | 10/27/2022 | | | | 1,200,000 | | | 1,127,375 | | 1,128,000 | | 7.2% |

Rosehill Operating Company, LLC (d)(e)(f) | | | Upstream | | | Senior Secured Debt | | 10.00% | | - | | | 01/31/2023 | | | | 600,000 | | | 582,577 | | 594,000 | | 3.8% |

| | | | | | Preferred Stock (g)(l) | | 10.00% | | - | | | | | | | 900,000 | | | 900,000 | | 900,000 | | 5.7% |

RSP Permian (j) | | | Upstream | | | Senior Unsecured Debt | | 5.25% | | - | | | 01/15/2025 | | | | 491,000 | | | 499,655 | | 503,275 | | 3.2% |

Sabine Pass Liquefaction | | | Midstream | | | Senior Secured Debt | | 5.63% | | - | | | 04/15/2023 | | | | 626,000 | | | 691,155 | | 687,152 | | 4.4% |

The accompanying notes are an integral part of these financial statements.

4

Triloma EIG Energy Income Fund – Term I

Schedule of Investments

December 31, 2017

| | | | | | | | | | | | | | | | | | | | | | | | |

| Company | | Sub-Sector | | Asset Type | | Interest Rate | | Base Rate Floor | | | Maturity/ Expiration Date | | | Principal (a)/Shares | | | Cost (b)(c) | | Fair Value | | % of Net Assets |

| | | |

United States (continued) | | | | | | | |

SilverBow Resources (d)(e)(f)(k) | | Upstream | | Senior Secured Debt | | L +7.50% | | | 1.00% | | | | 12/15/2024 | | | $ | 1,600,000 | | | $1,568,089 | | $1,600,000 | | 10.1% |

| | | | |

Total United States | | | | | | | 15,094,350 | | 15,263,799 | | 96.7% |

| | | |

Short Term Investments (US) — 8.2% | | | | | | | |

Fidelity Institutional Government Portfolio, 1.165% (m) | | Short-Term | | Money Market | | N/A | | | - | | | | | | | | 648,046 | | | 648,046 | | 648,046 | | 4.1% |

Invesco Short Term Investments Trust Government & Agency Portfolio, 1.217% (m) | | Short-Term | | Money Market | | N/A | | | - | | | | | | | | 648,047 | | | 648,047 | | 648,047 | | 4.1% |

| | | | |

Total Short Term Investments | | | | | | | 1,296,093 | | 1,296,093 | | 8.2% |

Total Investments | | | | | | | | | | | | | | | | | | | | $17,826,114 | | $18,161,504 | | 115.1% |

Other Assets and Liabilities | | | | | | | | | | | | | | | | | | | | | | (2,386,319) | | (15.1)% |

Total Net Assets | | | | | | | | | | | | | | | | | | | | | | $15,775,185 | | 100.0% |

| | | | | | | | | | | | | | | | | | | | | | | | |

Shares Outstanding | | | | | | | | | | | | | | | | | | | | | | 578,087 | | |

Net Asset Value Per Common Share | | | | | | | | | | | | | | | | | | | | $27.29 | | |

Portfolio Composition

| | |

| ASSET TYPE | | % of Net Assets |

Senior Secured Debt | | 57.6% |

| |

Senior Unsecured Debt | | 43.4% |

| |

Money Market | | 8.2% |

| |

Equity/Warrants | | 5.9% |

| |

Other Assets and Liabilities | | (15.1)% |

| | 100.0% |

As of December 31, 2017, the Fund’s investments were categorized as follows in the fair valuation hierarchy:

| | | | | | | | | | | | | | | | |

Investments in Securities | | Level 1 -

Quoted

Prices | | | Level 2 - Other

Significant

Observable

Inputs | | | Level 3 -

Significant

Unobservable

Inputs | | | Total | |

United States | | $ | 1,296,093 | | | $ | 8,661,788 | | | $ | 6,602,011 | | | $ | 16,559,892 | |

Congo-Brazzaville | | | — | | | | — | | | | 911,557 | | | | 911,557 | |

Kazakhstan | | | — | | | | 419,045 | | | | — | | | | 419,045 | |

United Kingdom | | | — | | | | — | | | | 271,010 | | | | 271,010 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 1,296,093 | | | $ | 9,080,833 | | | $ | 7,784,578 | | | $ | 18,161,504 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

5

Triloma EIG Energy Income Fund – Term I

Schedule of Investments

December 31, 2017

The following is a reconciliation of the investments in which significant unobservable inputs were used in determining value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment in Securities | | Beginning Balance

at December 31, 2016 | | | Purchases | | | Sales (n) | | | Accrued

Discounts

(Premiums) | | | Total Realized

Gain (Loss) | | | Net Change in Unrealized Appreciation (Depreciation) (o) | | | Net Transfers

into (out of)

Level 3 | | | Ending Balance at December 31, 2017 | | | Net Change in Unrealized

Appreciation (Depreciation) on Investments Held at December 31, 2017 (o) | |

Congo-Brazzaville | | $ | - | | | $ | 754,641 | | | $ | - | | | $ | 4,253 | | | $ | - | | | $ | 152,663 | | | $ | - | | | $ | 911,557 | | | $ | 152,663 | |

United Kingdom | | | - | | | | 269,578 | | | | - | | | | 165 | | | | - | | | | 1,267 | | | | - | | | | 271,010 | | | | 1,267 | |

United States | | | 357,298 | | | | 6,493,710 | | | | (359,511 | ) | | | 4,093 | | | | 12,751 | | | | 93,670 | | | | - | | | | 6,602,011 | | | | 103,578 | |

The following table summarizes the quantitative inputs and assumptions used for items categorized as recurring Level 3 assets as of December 31, 2017. The following disclosures also include qualitative information on the sensitivity of the fair value measurements to changes in the significant unobservable inputs.

| | | | | | | | | | | | |

Investments in Securities | | Fair Value at

December 31, 2017 | | | Valuation Techniques | | Significant Unobservable Inputs | | Ranges (Average) | | Impact to valuation from an increase in input |

Congo-Brazzaville | | | $911,557 | | | Discounted cash flow

Black-Scholes | | Discount Rate Risk Free Rate Volatility Rate | | 10.00% 2.09% 65.0% - 85.0% (80.5%) | | Decrease

Increase

Increase |

United Kingdom | | | 271,010 | | | Discounted cash flow | | Discount Rate | | 9.30% | | Decrease |

United States | | | 6,602,011 | | | Discounted cash flow | | Discount Rate | | 8.9% - 16.5% (11.1%) | | Decrease |

The unobservable inputs used to determine fair value of recurring Level 3 assets may have similar or diverging impacts on valuation. Significant increases and decreases in these inputs in isolation and interrelationships between those inputs could result in significantly higher or lower fair value measurement.

(a) Denominated in U.S. Dollars, unless otherwise noted.

(b) Cost represents amortized cost for debt securities, cost plus capitalized payment-in-kind distributions on the debt securities and cost for all other types of investments.

(c) Aggregate cost for federal income tax purposes is $17,826,114. Aggregate gross unrealized appreciation and depreciation for all securities is $371,378 and $(35,988), respectively. Net unrealized appreciation for tax purposes is $335,390.

(d) Securities are categorized as Level 3 securities under the fair valuation hierarchy. The total value of Level 3 securities is 49.3% of the Fund’s Net Assets.

(e) Fair valued as determined in good faith in accordance with procedures established by the Board. At December 31, 2017, total aggregate fair valued investments are $7,784,578, representing 49.3% of the Fund’s net assets.

(f) Restricted securities held by the Fund as of December 31, 2017 are as follows:

| | | | | | | | | | | | | | | | |

| Country | | Company | | Acquisition Date | | Acquisition Cost | | | Value | | | Value as

Percentage of

Net Assets | |

Congo-Brazzaville | | New Age, Ltd. | | 1/20/2017 | | | $717,792 | | | | $868,909 | | | | 5.5% | |

| | | | 6/28/2017 | | | 18,144 | | | | 20,999 | | | | 0.1% | |

| | | | 12/28/2017 | | | 18,705 | | | | 21,649 | | | | 0.2% | |

United Kingdom | | Bioenergy Infrastructure Holdings, Ltd. | | 2/16/2017 | | | 141,750 | | | | 143,181 | | | | 0.9% | |

| | | | 5/16/2017 | | | 15,683 | | | | 15,683 | | | | 0.1% | |

| | | | 8/15/2017 | | | 92,940 | | | | 92,941 | | | | 0.6% | |

| | | | 11/15/2017 | | | 19,205 | | | | 19,205 | | | | 0.1% | |

United States | | Aethon United LP | | 9/8/2017 | | | 666,875 | | | | 682,344 | | | | 4.3% | |

United States | | ARB Midstream LLC | | 11/6/2017 | | | 1,111,091 | | | | 1,134,000 | | | | 7.2% | |

The accompanying notes are an integral part of these financial statements.

6

Triloma EIG Energy Income Fund – Term I

Schedule of Investments

December 31, 2017

(f) Restricted securities (continued)

| | | | | | | | | | | | | | | | |

| Country | | Company | | Acquisition Date | | | Acquisition Cost | | | Value | | | Value as

Percentage of

Net Assets |

United States | | Felix Investments Holdings | | | 8/9/2017 | | | | $655,000 | | | | $666,667 | | | 4.2% |

United States | | Northeast Natural Energy, LLC | | | 3/2/2017 | | | | 614,744 | | | | 625,000 | | | 4.0% |

| | | | | 5/26/2017 | | | | 148,500 | | | | 150,000 | | | 0.9% |

| | | | | 8/15/2017 | | | | 123,750 | | | | 125,000 | | | 0.8% |

| | | | | 11/22/2017 | | | | 123,750 | | | | 125,000 | | | 0.8% |

United States | | Rosehill Operating Company, LLC | | | 12/8/2017 | | | | 1,482,000 | | | | 1,494,000 | | | 9.5% |

United States | | SilverBow Resources | | | 12/15/2017 | | | | 1,568,000 | | | | 1,600,000 | | | 10.1% |

| | | | | | | | | |

| | | | | | | | | $7,517,929 | | | | $7,784,578 | | | 49.3% |

| | | | | | | | | |

(g) Payment-In-Kind. Income may be received in additional securities and/or cash. Rates are the minimum interest rate to be received in cash and the maximum possible payment-in-kind rate, as of December 31, 2017.

| | | | | | |

| Country | | Company | | Cash Rate | | Payment In-Kind Rate |

Congo-Brazzaville | | New Age, Ltd. | | 10.00% | | 5.00% |

United States | | Rosehill Operating Company, LLC | | 6.00% | | 4.00% |

(h) Non income producing.

(i) Warrants have exercise price of $4.00.

(j) Security exempt from registration under Regulation S of the Securities Act of 1933, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933. At December 31, 2017, the value of the Regulation S securities are $1,419,593, representing 9.0% of the Fund’s net assets.

(k) The interest rate on these senior secured debt holdings are subject to a base lending rate plus a spread. As of December 31, 2017, the rates are as follows:

| | | | | | | | |

| Country | | Company | | Reference Rate | | Current Rate | |

United Kingdom | | Bioenergy Infrastructure Holdings, Ltd. | | 3 month Libor + 7.25% | | | 8.69 | % |

United States | | Aethon United LP | | 3 month Libor + 6.75% | | | 8.27 | % |

United States | | ARB Midstream LLC | | 3 month Libor + 7.25% | | | 8.64 | % |

United States | | Felix Investments Holdings | | 3 month Libor + 6.50% | | | 7.90 | % |

United States | | Northeast Natural Energy, LLC | | 3 month Libor + 8.00% | | | 9.49 | % |

United States | | Panda Hummel | | 1 month Libor + 6.00% | | | 7.57 | % |

United States | | SilverBow Resources | | 3 month Libor + 7.50% | | | 9.09 | % |

(l) Series B, redeemable after January 31, 2023.

(m) Rates disclosed reflect the 1-day yield at December 31, 2017.

(n) Sales include all sales of securities, maturities, paydowns and securities tendered in corporate actions.

(o) Any difference between net change in unrealized appreciation (depreciation) and net change in unrealized appreciation (depreciation) on investments still held at December 31, 2017, is generally due to investments no longer held or categorized as Level 3 at year end.

The accompanying notes are an integral part of these financial statements.

7

Triloma EIG Energy Income Fund – Term I

Statement of Assets and Liabilities

| | | | |

| | | December 31, 2017 |

Assets | | | | |

Investments, at Fair Value (Cost $17,826,114) | | $ | 18,161,504 | |

Cash | | | 14,347 | |

Receivable Due from Sub-Advisor | | | 605,245 | |

Interest Receivable | | | 227,025 | |

Other Income Receivable | | | 2,454 | |

Prepaid Expenses and Other Assets | | | 50,696 | |

| | | | |

Total Assets | | | 19,061,271 | |

| | | | |

| |

Liabilities | | | | |

Payable for Investment Securities Purchased | | | 20,998 | |

Management Fee Payable | | | 27,502 | |

Administrative Fees Payable | | | 44,667 | |

Distribution Fees Payable | | | 241,175 | |

Payable for Line of Credit | | | 2,500,000 | |

Due Diligence Fees Payable | | | 86,484 | |

Pricing Fees Payable | | | 73,928 | |

Audit and Tax Fees Payable | | | 65,950 | |

Marketing Fees Payable | | | 48,178 | |

Printing Fee Payable | | | 34,501 | |

Legal Fees Payable | | | 30,008 | |

Trustee’s Fees Payable | | | 8,567 | |

Interest Expense Payable | | | 1,450 | |

Other Accrued Expenses | | | 102,678 | |

| | | | |

Total Liabilities | | | 3,286,086 | |

| | | | |

Commitments and Contingencies (See Note 4) | | | | |

Total Net Assets | | $ | 15,775,185 | |

| | | | |

| |

Components of Net Assets | | | | |

Paid-in Capital | | $ | 15,428,963 | |

Accumulated Net Realized Gain on Investments | | | 10,832 | |

Net Unrealized Appreciation on Investments | | | 335,390 | |

| | | | |

Total Net Assets | | $ | 15,775,185 | |

| | | | |

| |

Shares Outstanding, Par Value $0.001 Per Share (Unlimited Shares Authorized) | | | 578,087 | |

Net Asset Value (NAV) Per Share | | $ | 27.29 | |

Maximum Public Offering Price (POP) | | $ | 29.00 | |

The accompanying notes are an integral part of these financial statements.

8

Triloma EIG Energy Income Fund – Term I

Statement of Operations

| | | | |

| | | For the Year Ended

December 31, 2017 |

Investment Income | | | | |

Interest Income | | $ | 690,620 | |

Payment-In-Kind Income | | | 39,667 | |

Other Income | | | 49,786 | |

| | | | |

Total Investment Income | | | 780,073 | |

| |

Expenses | | | | |

Management Fee | | | 223,441 | |

Administration Fees | | | 530,004 | |

Legal Fees | | | 304,147 | |

Due Diligence Fees | | | 302,440 | |

Marketing Fees | | | 243,992 | |

Distribution Fees | | | 186,755 | |

Transfer Agent Fees | | | 154,106 | |

Audit and Tax Fees | | | 149,930 | |

Pricing Fees | | | 136,590 | |

Trustees’ Fees | | | 81,251 | |

Printing Fees | | | 74,707 | |

Interest Expense | | | 59,541 | |

Custody Fees | | | 25,430 | |

Registration Fees | | | 20,232 | |

Miscellaneous Expenses | | | 163,503 | |

| | | | |

Total Expenses | | | 2,656,069 | |

| |

Expense Support Payments by Sub-Advisor | | | (2,504,706 | ) |

| | | | |

Total Net Operating Expenses | | | 151,363 | |

| | | | |

Net Investment Income | | | 628,710 | |

| | | | |

Net Realized Gain on Investments | | | 69,539 | |

Net Change in Unrealized Appreciation/(Depreciation) on Investments | | | 286,747 | |

| | | | |

Net Realized and Unrealized Gain on Investments | | | 356,286 | |

| | | | |

Additional Expense Support Payments by Sub-Advisor | | | – | |

| | | | |

Increase in Net Assets Resulting from Operations | | $ | 984,996 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

9

Triloma EIG Energy Income Fund – Term I

Statements of Changes in Net Assets

| | | | | | |

| | | For the Year Ended | | | For the Year Ended |

| | | December 31, 2017 | | | December 31, 2016 |

| | | |

Operations: | | | | | | |

Net Investment Income | | $ | 628,710 | | | $ 59,503 |

Net Realized Gain on Investments | | | 69,539 | | | – |

Net Change in Unrealized Appreciation/(Depreciation) on Investments | | | 286,747 | | | 48,643 |

Net Increase from Additional Expense Support Payments from Sub-Advisor | | | – | | | 102,310 |

| | | |

Increase in Net Assets Resulting from Operations | | | 984,996 | | | 210,456 |

| | | |

| | |

Dividends and Distributions: | | | | | | |

Net Investment Income | | | (628,710) | | | (161,813) |

Capital Gains | | | (58,707) | | | – |

| | | |

Total Dividends and Distributions to Shareholders | | | (687,417) | | | (161,813) |

| | | |

| | |

Capital Share Transactions: | | | | | | |

Proceeds from Shares Issued | | | 10,417,611 | | | 4,576,869 |

Reinvestments of Distributions | | | 283,541 | | | 47,137 |

Cost of Shares Repurchased | | | – | | | (1,195) |

| | | |

Net Increase in Net Assets from Capital Share Transactions | | | 10,701,152 | | | 4,622,811 |

| | | |

Total Increase in Net Assets | | | 10,998,731 | | | 4,671,454 |

| | | |

| | |

Net Assets: | | | | | | |

| | |

Beginning of Year | | | 4,776,454 | | | 105,000 |

| | | |

End of Year | | $ | 15,775,185 | | | $ 4,776,454 |

| | | |

Undistributed Net Investment Income | | $ | – | | | $ – |

| | | |

The accompanying notes are an integral part of these financial statements.

10

Triloma EIG Energy Income Fund – Term I

Statement of Cash Flows

| | | | |

| | | For the Year Ended | |

| | | December 31, 2017 | |

Cash Flows from Operating Activities: | | | | |

Net Increase in Net Asset Resulting from Operations | | $ | 984,996 | |

| |

Adjustments to Reconcile Net Increase in Net Assets Resulting from Operations to Net Cash used in Operating Activities: | | | | |

Purchases of Long Term Investments | | | (17,068,369 | ) |

Proceeds from Disposition of Investment Securities | | | 3,155,606 | |

Net Purchases of Short Term Investments | | | (1,296,093 | ) |

Payment-In-Kind Income Received | | | (36,791 | ) |

Net Realized (Gain)/Loss from Investments | | | (69,539 | ) |

Net Change in Unrealized (Appreciation)/Depreciation on Investments | | | (286,747 | ) |

Amortization of Premium/Accretion of Discount on Investments, Net | | | (1,057 | ) |

Increase in Receivable Due from Sub-Advisor | | | (550,815 | ) |

Increase in Interest Receivable | | | (195,982 | ) |

Increase in Other Income Receivable | | | (2,454 | ) |

Increase in Prepaid Expenses and Other Assets | | | (18,106 | ) |

Increase in Payable for Investment Securities Purchased | | | 20,998 | |

Increase in Management Fee Payable | | | 18,855 | |

Increase in Administrative Fees Payable | | | 3,000 | |

Increase in Distribution Fees Payable | | | 186,745 | |

Decrease in Due Diligence Fees Payable | | | (21,426 | ) |

Increase in Pricing Fees Payable | | | 73,928 | |

Increase in Audit and Tax Fees Payable | | | 2,500 | |

Increase in Marketing Fees Payable | | | 24,741 | |

Decrease in Printing Fee Payable | | | (17,512 | ) |

Decrease in Legal Fees Payable | | | (184,973 | ) |

Decrease in Trustee’s Fees Payable | | | (2,040 | ) |

Increase in Interest Expense Payable | | | 1,450 | |

Decrease in Payable Due to Sub-Advisor | | | (53,500 | ) |

Increase in Other Accrued Expenses | | | 47,530 | |

| | | | |

Net Cash (Used in) Operating Activities | | | (15,285,055 | ) |

| | | | |

| |

Cash Flows From Financing Activities | | | | |

Cash Distributions Paid | | $ | (403,876 | ) |

Proceeds from Capital Shares Sold | | | 10,417,611 | |

Line of Credit Borrowings | | | 2,500,000 | |

| | | | |

Net Cash Provided by Financing Activities | | | 12,513,735 | |

| | | | |

Net Change in Cash | | | (2,771,320 | ) |

Cash and Cash Equivalents at beginning of year | | | 2,785,667 | |

| | | | |

Cash at end of year | | $ | 14,347 | |

| | | | |

| |

Supplemental Disclosure of Cash Flow Information | | | | |

| |

Non-cash Financing Activities not included herein consist of Reinvestments of Distributions | | $ | 283,541 | |

Interest paid during the year | | $ | 36,294 | |

The accompanying notes are an integral part of these financial statements.

11

Triloma EIG Energy Income Fund – Term I

Financial Highlights

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Period

| | | | | | | | | | | | |

| | | For the Year | | | For the Year | | | For the Period | |

| | | Ended | | | Ended | | | July 24, 2015 | |

| | | December 31, | | | December 31, | | | to December | |

| | | 2017 | | | 2016 | | | 31, 2015(a) | |

Net Asset Value, Beginning of Period | | $ | 25.92 | | | $ | 25.00 | | | $ | 25.00 | |

| | | | | | | | | | | | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | |

Net Investment Income(b) | | | 1.75 | | | | 0.67 | | | | 0.31 | |

Net Realized and Unrealized Gain | | | 1.25 | | | | 0.50 | | | | — | |

Additional Expense Support Payments(b) | | | — | | | | 1.15 | | | | — | |

| | | | | | | | | | | | |

| | | |

Total from Investment Operations | | | 3.00 | | | | 2.32 | | | | 0.31 | |

| | | | | | | | | | | | |

| | | |

Dividends and Distributions: | | | | | | | | | | | | |

Net Investment Income(c) | | | (1.80) | | | | (1.82) | | | | (0.31) | |

Net Realized Gain(c) | | | (0.12) | | | | — | | | | — | |

| | | | | | | | | | | | |

| | | |

Total Dividends and Distributions | | | (1.92) | | | | (1.82) | | | | (0.31) | |

| | | | | | | | | | | | |

| | | |

Issuance of Common Stock above Net Asset Value(b) | | | 0.29 | | | | 0.42 | | | | — | |

| | | | | | | | | | | | |

| | | |

Net increase resulting from capital share transactions(d) | | | 0.29 | | | | 0.42 | | | | — | |

| | | | | | | | | | | | |

| | | |

Net Asset Value, End of Period | | $ | 27.29 | | | $ | 25.92 | | | $ | 25.00 | |

| | | | | | | | | | | | |

| | | |

Maximum Public Offering Price, End of Period | | $ | 29.00 | | | $ | 27.63 | | | $ | 26.32 | |

| | | | | | | | | | | | |

| | | |

Total Return – NAV(e) | | | 13.01% | | | | 11.28%(f) | | | | 1.23%(f) | |

| | | | | | | | | | | | |

| | | |

Total Return – Price(g) | | | 11.59% | | | | 11.28%(h) | | | | 1.23%(h) | |

| | | | | | | | | | | | |

| | | |

Ratios and Supplemental Data | | | | | | | | | | | | |

Net Assets, End of Period (in thousands) | | $ | 15,775 | | | $ | 4,776 | | | $ | 105 | |

Ratios to Average Net Assets: | | | | | | | | | | | | |

Net Investment Income(i) | | | 6.49%(k) | | | | 2.61%(k) | | | | 2.82% | |

Net Operating Expenses(i) | | | 1.56% | | | | 0.00% | | | | 0.00% | |

Total Operating Expenses(i) | | | 27.40% | | | | 89.43% | | | | 2,022.58%(j) | |

Portfolio Turnover Rate | | | 30% | | | | 0% | | | | 0% | |

Amounts designated as “—” are either not applicable, $0 or have been rounded to $0.

| (a) | Fund commenced operations on July 24, 2015. |

| (b) | Per share calculations were performed using average shares. |

| (c) | The per share data for distributions reflects the actual amount of distributions paid per share during the period. |

| (d) | The continuous issuance of common stock may cause an increase in net asset value per share due to sales of shares at the prevailing public offering price and the net proceeds received that are in the excess of net asset value per share for each subscription. The per share data is the sum of the number of shares issued times the difference between the net proceeds per share and the net asset value per share on each transaction date divided by the average shares for the period. |

| (e) | Total Return - NAV is based on the change in current net asset value on the first day of each period reported and a sale at the current net asset value on the last day of each period reported, and assuming reinvestment of distributions in accordance with the Fund’s distribution reinvestment plan. Total return based on net asset value is hypothetical as investors cannot purchase or sell Fund shares at the net asset value. |

| (f) | Had the Expense Support Agreement (see Note 5) not been provided support beyond Operating Expenses, the Total Return – NAV would have been 10.27% for the year ended 2016 and (0.02)% for the period ended 2015. |

| (g) | Total Return - Price is based on the change in the public offering price, net of sales loads, on the first day of each period reported and a sale at the current net asset value on the last day of each period reported, and assuming reinvestment of distributions, in accordance with the Fund’s distribution reinvestment plan. |

| (h) | Had the Expense Support Agreement (see Note 5) not been provided support beyond Operating Expenses, the Total Return – Price would have been 8.91% for the year ended 2016 and (0.02)% for the period ended 2015. |

| (j) | Non-recurring organizational and operating expenses of $255,000 have not been annualized, but are included in the ratio. |

| (k) | Percentage does not include Expense Support Payments. |

The accompanying notes are an integral part of these financial statements.

12

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements

December 31, 2017

Note 1. Organization

Triloma EIG Energy Income Fund – Term I (the “Fund”) was formed as a Delaware statutory trust, and commenced upon the effectiveness of its registration statement on July 24, 2015. The Fund is an externally managed, non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment advisor and administrator, Triloma Energy Advisors, LLC, (the “Advisor”, “Triloma” or the “Administrator”) is responsible for the overall management of the Fund’s activities. EIG Credit Management Company, LLC (“EIG” or the “Sub-Advisor”), the Fund’s investment sub-advisor, is responsible for the day-to-day management of the Fund’s investment portfolio. The Advisor and the Sub-Advisor are each a private investment firm that is registered as an investment advisor with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The investment process is a collaborative effort between the Advisor and the Sub-Advisor and the investment committee of each must approve all Fund portfolio investments.

The Fund’s investment objective is primarily to provide shareholders with current income; as secondary investment objectives, the Fund will seek to provide capital preservation and, to a lesser extent, long-term capital appreciation. The Fund seeks to achieve its investment objectives by investing primarily in a global portfolio of privately originated energy company and project debt. Under normal circumstances, the Fund will invest at least 80% of its total assets in debt and equity investments of energy companies and projects. There can be no assurance that the Fund will achieve its investment objectives.

Note 2. Summary of Significant Accounting Policies

The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and those differences could be material. Net Asset Value per share (“NAV”) for financial reporting purposes may differ from the NAV for processing transactions. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. Below is a summary of significant accounting policies:

Cash and Cash Equivalents: The Fund considers all highly liquid investments with original maturities of 90 days or less to be cash equivalents. The Fund’s cash and cash equivalents are maintained with a major United States financial institution, which is a member of the Federal Deposit Insurance Corporation. At any time, cash in bank may exceed insured limits.

Security transactions and investment income: Security transactions are recorded on the trade date. Loan originations are recorded on the funding date. Realized gains and losses are reported on the specific identified cost basis. Net change in unrealized appreciation or depreciation reflects the change in portfolio investment values during the reporting period, including any reversal of previously recorded unrealized gains or losses, when gains or losses are realized, and the respective unrealized gain or loss on foreign currency for any foreign denominated investments, if applicable. Dividend income, if any, is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is informed of the ex-dividend dates, net of foreign taxes. Interest income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis commencing on the settlement date.

Payment-in-kind interest income (“PIK”) is accrued as interest income and is reclassified as payment-in-kind interest income if there is a contracted set rate or when the additional securities are received.

Fee Income: The Fund may earn fees associated with the creation of EIG-originated debt instruments. These fees are generally non-recurring and are recognized as fee income to the extent that the fee is allocable to future funding commitments upon the earlier of the investment commitment date or investment closing date. This portion of the fee income is included in the Statement of Operations in Other Income. The portion of the fee that is allocable to the

13

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2017

funding required at the investment closing date, will accrue in correspondence with the originated debt instrument. This portion of the fee is included in the Statement of Operations in Interest Income.

Trustee compensation: The Fund pays the members of the Board of Trustees (“Board” or “Trustees”), a majority of whom are independent, certain remuneration for their services, plus travel and other expenses. The Fund does not pay compensation to Trustees who also serve in an executive officer capacity for the Fund, the Advisor or the Sub-Advisor. Amounts payable to Trustees for compensation and reimbursable expenses are included in the accompanying Statement of Assets and Liabilities. Trustees’ fees earned during the period are reported in the Statement of Operations.

Distributions to shareholders: Distributions from net investment income and/or additional expense support received from the Sub-Advisor are recorded at the time the dividend or distribution is made. Distributions of capital gains are recorded upon payment and made at least annually. The character and timing of distributions are determined in accordance with U.S. federal income tax regulations, which may differ from U.S. GAAP.

Contingencies: In the normal business, the Fund may enter into contracts that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects the risk to be remote.

Principal Risks: In the normal course of business, the Fund invests in securities or other instruments and may enter into certain transactions, and such activities are subject to various risks. The Fund’s prospectus provides details of the risks to which the Fund is subject to. Key principal risks driven by the investments in which the Fund holds are summarized below:

| | · | | Market/Valuation Risks - The market values of equities, such as common stocks and preferred securities or equity related investments may decline due to general market conditions which are not specifically related to a particular company. They may also decline due to factors which affect a particular industry or industries. The Fund may invest in illiquid investments and may experience difficulty in selling those investments in a timely manner at the price that they believe the investments are worth. Prices may fluctuate widely over short or extended periods in response to company, market or economic news. Markets also tend to move in cycles, with periods of rising and falling prices. This volatility may cause the Fund’s NAV to experience significant increases or decreases over short periods of time. If there is a general decline in the securities and other markets, the NAV of the Fund may lose value, regardless of the individual results of the securities and other instruments in which the Fund invests. |

The price the Fund could receive upon the sale of any particular portfolio investment may differ from the Fund’s valuation of the investment, particularly for securities that trade in thin or volatile markets or that are valued using a fair valuation technique or a price provided by an independent pricing service. Changes to significant unobservable inputs and assumptions (i.e., publicly traded company multiples, growth rate, time to exit) due to the lack of observable inputs may significantly impact the resulting fair value and therefore the Fund’s results of operations. As a result, the price received upon the sale of an investment may be less than the value ascribed by the Fund, and could realize a greater than expected loss or lesser than expected gain upon the sale of the investment.

| | · | | Liquidity Risk - Illiquid and restricted investments may be difficult to dispose of at a fair price at the times when the Fund believes it is desirable to do so. The market price of illiquid and restricted securities generally is more volatile than that of more liquid investments, which may adversely affect the price that the Fund recovers upon the sale of such investments. Illiquid and restricted investments may also be more difficult to value, especially in challenging markets. The Advisor’s and/or Sub-Advisor’s judgment, through the means of a committee, may play a greater role in the valuation process. Investment of the Fund’s assets in illiquid and restricted investments may restrict the Fund’s ability to take advantage of market opportunities. Contractual restrictions on the resale of investments vary in length and scope and are generally the result of a negotiation between the issuer and acquirer of the investments. In either case, the Fund could bear market risks during that period. |

14

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2017

| | · | | Concentration Risk – The Fund primarily invests its assets in fixed-income securities. Changes in market interest rates or economic conditions may affect the value and/or liquidity of such investments. Interest rate risk is the risk that prices of bonds and other fixed-income securities will increase as interest rates fall and decrease as interest rates rise. The Fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates. |

Additionally, the Fund has a significant level of holdings in privately originated debt. Changes in economic conditions, including delinquencies and/or defaults on assets underlying these securities, can affect the value, income and/or liquidity of such positions.

| | · | | Energy Sector Risk – The Fund’s investments in energy companies expose the Fund to risks associated with adverse economic, environmental or regulatory occurrences affecting the energy sector, and a downturn in the energy sector could have a significant impact on the Fund. |

Note 3. Investment Valuation and Fair Value Measurements

Investment Valuation Policies: The Fund’s investments are valued at fair value (also referred to as “market value” within the financial statements) as of the close of trading on the NYSE (generally 4:00 p.m., Eastern time) (or if the reporting date falls on a day the NYSE is closed, investments are valued at fair value as of the period end). U.S. GAAP defines fair value as the price the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Fund determines the fair values of the financial instruments using various pricing services or independent broker-dealers under policies approved by the Board. Under the delegation of the Board, the Advisor has formed a committee to develop pricing policies and procedures and to oversee the pricing function for all financial instruments.

The Board has delegated the day-to-day responsibility for applying and administering the Fund’s valuation policy (“Valuation Policy”) to a valuation committee (“Valuation Committee”), comprised of certain officers of the Funds and other employees of the Advisor with the assistance and support of the Sub-Advisor. The composition of this Valuation Committee may change from time to time. The Valuation Committee follows fair valuation guidelines as set forth in the Valuation Policy to make fair value determinations on all securities and assets for which market quotations are unavailable or unreliable. The Board retains the responsibility for periodic review and consideration of the appropriateness of any fair value pricing methodology established or implemented for the Fund. Fair value pricing methods, the Valuation Policy and independent pricing services can change from time to time as approved by the Board, as deemed necessary or changes in industry best practices.

Fair Value Inputs and Methodologies: The following methods and inputs are used to establish the fair value of the Fund’s assets and liabilities:

| | · | | Fixed-income securities for which market quotations are readily available are generally valued using the last available bid prices or current market quotations provided by independent dealers or third-party pricing services. The pricing services may use matrix pricing or valuation models that utilize certain inputs and assumptions to derive values, including transaction data (e.g., recent representative bids and offers), credit quality information, perceived market movements, news, and other relevant information. The amortized cost method of valuation may be used with respect to debt obligations with sixty days or less remaining to maturity unless the Advisor determines such method does not represent fair value. |

| | · | | Money market funds are permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, to value securities at amortized cost which approximates fair value. Government money market funds value all security positions using amortized cost, which approximates fair value. The Fund holds all money market securities at their respective NAVs. |

| | · | | Warrants and rights which are listed on major security exchanges are valued at their last reported sales price as of the valuation date or, if there is no reported sale price, at the midpoint of the most recent quoted bid and ask prices at the close of business. |

| | · | | The Payable for the Line of Credit carrying balance held by the Fund, located on the Statement of Assets and Liabilities approximates its fair value. |

15

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2017

If events (e.g., a company announcement, market volatility or a natural disaster) occur that are expected to materially affect the value of such investments, or in the event that the application of these methods of valuation results in a price for an investment that is deemed not to be representative of the market value of such investment, or if a price is not available, the investment will be valued by the Advisor with the assistance of the Fund’s Sub-Advisor, or its delegates, in accordance with a policy approved by the Board as reflecting fair value (“Fair Valued Investments”). Valuation techniques such as discounted cash flow, use of market comparables and matrix pricing are types of valuation approaches and are typically used in determining fair value. When determining the price for Fair Valued Investments, the Advisor, or its delegate, seeks to determine the price that the Fund might reasonably expect to receive or pay from the current sale or purchase of that asset or liability in an arm’s-length transaction. Fair value determinations shall be based upon all available factors that the Advisor and Sub-Advisor, or its delegates, deem relevant and consistent with the principles of fair value measurement.

Various methods for calibrating valuation approaches for investments where an active market does not exist are used, including regular due diligence of the Fund’s pricing vendors, regular reviews of key inputs and assumptions, transactional back testing, reviews of missing or stale prices and large movements in market values and reviews of any market related activity. The pricing of all Fair Valued Investments is subsequently reported to the Board or a committee thereof on a quarterly basis. As a result of the inherent uncertainty in valuation of these investments, the fair values may differ from the values that would have been used had an active market existed.

For investments in equity (including warrants and rights) or debt that are not considered marketable securities, the Advisor and Sub-Advisor generally fair values each investment using a discounted cash flow method by calculating the net present value of the projected cash flows from the investment over the period the investment is expected to be held. The discount rate applied is based on a risk-adjusted premium which reasonably reflects the risk of not achieving a return of capital on the investment within the stated term of the investment. Inherent also in this analysis is the assessment of the probability of a payment default. In determining the appropriate discount rate for each investment, the company’s current and future financial prospects as well as inherent uncertainties in the timing of underlying cash flows and other information deemed pertinent including external engineering reports, comparable transactions and commodity prices are considered. The Sub-Advisor also develops commodity price decks, which are reviewed by the Advisor, which reflect the market’s view on commodity prices over the term of an investment, by using actual historic and forecast forward price data. Average, rather than spot price, commodity inputs are considered more relevant valuation inputs as they are more closely aligned to the Fund’s long-term investment strategy. Commodity price inputs are expected to have a greater impact on the valuation of equity holdings and non-performing or under-performing loans. Commodity price inputs have only limited impact on the valuation of performing loans.

Where the Fund has access to price data for other securities or other investments or interest from multiple sources, a relative weighting is given to all such data (based on management’s assessment of the relevance and reliability of such data) as well as to the results of the discounted cash flow method described above in order to arrive at a valuation for the investment.

Where the date of acquisition of an investment is in the close proximity to the fair market value measurement date, the price at which such investment is closed or the par value of such investment is used as the primary determinant of fair market value.

The information received from private companies in the valuation of non-marketable investments is often not subject to the public company disclosure, timing and reporting standards held by the Fund. Typically, the most recently available information is as of a date that varies from the date the Fund calculates its NAV. This factor may result in a difference between the value of the investment and the price the Fund could receive upon the sale of the investment.

Hierarchy of Fair Value Inputs: In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to

16

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2017

unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| | |

· Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

|

· Level 2 – Other significant observable inputs, which may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, referenced indices, quoted prices in inactive markets, adjusted quoted prices in inactive markets, etc.; and |

|

· Level 3 – Unobservable inputs, which may include management’s own assumptions in determining the fair value of investments. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the sub-adviser, issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances. |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. Investments classified within Level 3 have significant unobservable inputs used by the Advisor in determining the price for Fair Valued Investments. Level 3 investments include non-marketable equity (including, warrants and rights) or debt. There may not be a secondary market, and/or there are a limited number of investors. Level 3 investments may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the Sub-Advisor and reviewed by the Advisor in the absence of market information.

Changes in valuation techniques may result in transfers into or out of an assigned level within the hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value hierarchy are deemed to have occurred as of the end of the reporting period. The categorization of a value determined for investments is based on the pricing transparency of the investments and is not necessarily an indication of the risks associated with investing in those securities. During the year ended December 31, 2017, the Fund did not have any transfers between any of the levels of the fair value hierarchy.

Note 4. Securities and Other Investments

Loan participations and assignments: The Fund may invest in direct debt instruments which are interests in amounts owed to lenders or lending syndicates by corporate or other borrowers, either in the form of participations at the time the loan is originated (“Participations”) or buying an interest in the loan in the secondary market from a financial institution or institutional investor (“Assignments”). Participations and Assignments in commercial and project financing loans may be secured or unsecured. These investments may include standby financing commitments, including revolving credit facilities that obligate the Fund to supply additional cash to the borrowers on demand, also referred to as unfunded commitments. Loan Participations and Assignments involve risks of insolvency of the lending banks or other financial intermediaries. As such, the Fund assumes the credit risks associated with the corporate borrowers and may assume the credit risks associated with the interposed banks or other financial intermediaries.

Based on the ability to invest in Loan Participations and Assignments, the Fund may be contractually obligated to receive approval from the agent banks and/or borrowers prior to the sale of these investments. A fund that participates in such syndications, or that can buy a portion of the loans, become part lenders. Loans are often administered by agent banks acting as agents for all holders.

The agent banks administer the terms of the loans, as specified in the loan agreements. In addition, the agent banks are normally responsible for the collection of principal and interest payments from the borrowers and the apportionment of these payments to the credit of all institutions that are parties to the loan agreements. Unless the Fund has direct recourse against the borrowers under the terms of the loans or other indebtedness, the Fund may have to rely on the agent banks or other financial intermediaries to apply appropriate credit remedies against corporate borrowers.

17

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2017

The Fund had commitments that were entered into that remain unfunded at December 31, 2017. Since these commitments and the associated amounts may expire without being drawn upon, the total commitment does not necessarily represent a future cash requirement. Below are the pending unfunded commitments entered into by the Fund:

| | |

| Borrower | | Unfunded Commitment Amount |

Aethon United BR, LP | | $312,500 |

ARB Midstream Operating Company, LLC | | $654,660 |

Bioenergy Infrastructure Holdings LTD | | $429,005 |

Felix Investments Holdings II, LLC | | $333,333 |

Northeast Natural Energy, LLC | | $477,300 |

Rosehill Operating Company, LLC | | $300,000 |

At December 31, 2017, the Fund had sufficient cash, credit line capacity and/or securities to cover these commitments should the funding requirements occur.

The Fund held no unsecured loan participations at December 31, 2017. Open secured loan participations and assignments are included within the Schedule of Investments.

Preferred Stocks: Preferred stock has a preference over common stock in liquidation (and generally in receiving dividends as well), but is subordinated to the liabilities of the issuer in all respects. As a general rule, the market value of preferred stock with a fixed dividend rate and no conversion element varies inversely with interest rates and perceived credit risk while the market price of convertible preferred stock generally also reflects some element of conversion value. Because preferred stock is junior to debt securities and other obligations of the issuer, deterioration in the credit quality of the issuer will cause greater changes in the value of a preferred stock than in a more senior debt security with similar stated yield characteristics. The preferred stock can be structured with either a fixed or adjustable coupon that can have either a perpetual or stated maturity date. Unlike interest payments on debt securities, preferred stock dividends are payable only if declared by the issuer’s board of directors or dictated within the purchase agreement for non-marketable preferred stock. Preferred stock also may be subject to optional or mandatory redemption provisions.

Payment-in-kind securities (“PIK”): PIKs give the issuer the option of making interest payments in either cash or additional securities at each interest payment date. Those additional securities usually have the same terms, including maturity dates and interest rates, and associated risks as the original instruments held.

PIK Securities held at December 31, 2017 are identified in the Schedule of Investments.

Restricted and illiquid securities: The Fund may invest in unregulated restricted securities. Restricted and illiquid securities are subject to legal or contractual restrictions on resale or are illiquid. Restricted securities generally may be resold in transactions exempt from registration under the Securities Act of 1933. A security may be considered illiquid if it lacks a readily available market or if its valuation has not changed for a certain period of time. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at the current valuation may be difficult.

Restricted and illiquid securities held at December 31, 2017 are identified in the Schedule of Investments.

Note 5. Related Party Transactions

In the initial year of operations, the Advisor invested in the Fund. As of December 31, 2017, the Advisor owned 17,047 shares or 2.95% of the outstanding shares.

EIG, the Sub-Advisor, is an affiliate of EIG Separate Investments, LP. EIG Separate Investments, LP has invested in the Fund. As of December 31, 2017, the affiliate of the Sub-Advisor owned 22,597 shares or 3.91% of the outstanding shares.

18

Triloma EIG Energy Income Fund – Term I

Notes to Financial Statements (Continued)

December 31, 2017

Investment Advisory Agreement

Pursuant to an investment advisory agreement (the “Investment Advisory Agreement”) between the Fund and the Advisor, the Advisor is entitled to a fee consisting of two components—a base management fee (the “Management Fee”) and an incentive fee (the “Incentive Fee”).

The Management Fee is calculated and payable monthly in arrears at the annual rate of 2% of the Fund’s average gross assets. The Management Fee may or may not be taken by the Advisor in whole or in part at the discretion of the Advisor. All or any part of the Management Fee not taken as to any month will be deferred without interest and may be taken in any such other month as the Advisor may determine. The Management Fee for any partial month will be appropriately prorated. No part of the Management Fee was deferred during the period.

The Management Fee for the year ended December 31, 2017 was $223,441.

The Incentive Fee is earned on “pre-incentive fee net investment income” and shall be calculated and payable in arrears as of the end of each calendar quarter during which the Investment Advisory Agreement or Sub-Advisory Agreement is in effect. In the case of a liquidation or if the Investment Advisory Agreement or Investment Sub-Advisory Agreement is terminated, the fee will also become payable as of the effective date of the event. The Incentive Fee is subject to a hurdle rate, expressed as a rate of return on the Fund’s average “adjusted capital,” equal to 1.875% per quarter (or an annualized hurdle rate of 7.5%), and is subject to a “catch-up” feature. For this purpose, “pre-incentive fee net investment income” is the sum of interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter. Also, pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as OID, debt instruments with PIK interest and zero coupon securities), accrued income only when the cash is received by the Fund.

For purposes of computing the Incentive Fee, net interest, if any, associated with a derivative or swap (which represents the difference between (i) the interest income and fees received in respect of the reference assets of the derivative or swap and (ii) the interest expense paid by the Fund to the derivative or swap counterparty) will be included in the calculation of quarterly pre-incentive fee net investment income.