UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-23161 |

Nushares ETF Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Diana R. Gonzalez

Vice President and Secretary

8500 Andrew Carnegie Boulevard

Charlotte, North Carolina 28262

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917‑7700

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen ESG Dividend ETF

NUDV/Cboe BZX Exchange, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG Dividend ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen ESG Dividend ETF | | $30 | | 0.26% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen ESG Dividend ETF (NUDV)’s total return at net asset value (NAV) was 34.14% for the 12 months ended October 31, 2024. The Fund’s custom index, the Nuveen ESG USA High Dividend Index, returned 34.59%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index. • During the reporting period, the Fund’s custom index underperformed the Fund’s base index, the MSCI USA Index, which returned 38.40%. • Performance drivers between the Fund’s custom index and base index during the reporting period: • Top contributors to the custom index’s relative performance » An overweight to and stock selection in the financials sector, led by overweights to Goldman Sachs Group, Inc. and Morgan Stanley. » An underweight to and stock selection in the energy sector, led by a lack of exposure to Exxon Mobil Corporation and Chevron Corporation. » Stock selection in the real estate sector, led by overweights to Iron Mountain, Inc. and Welltower Inc. • Top detractors from the custom index’s relative performance » An underweight to and stock selection in the information technology sector, including a lack of exposure to NVIDIA Corporation and Broadcom Inc. » Stock selection in the consumer staples sector, including overweights to Archer-Daniels-Midland Companies and PepsiCo, Inc. » An underweight to and stock selection in the communications services sector, including a lack of exposure to Meta Platforms and Netflix, Inc. |

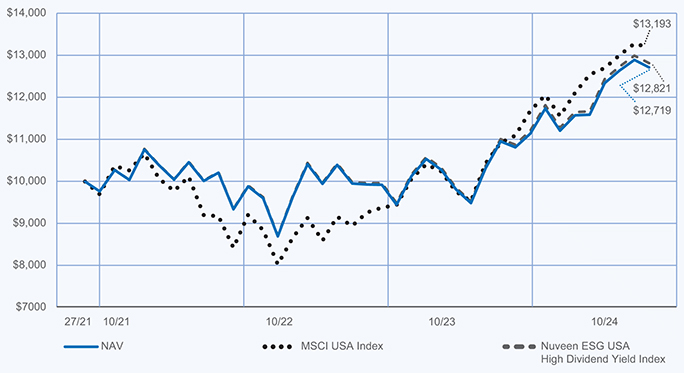

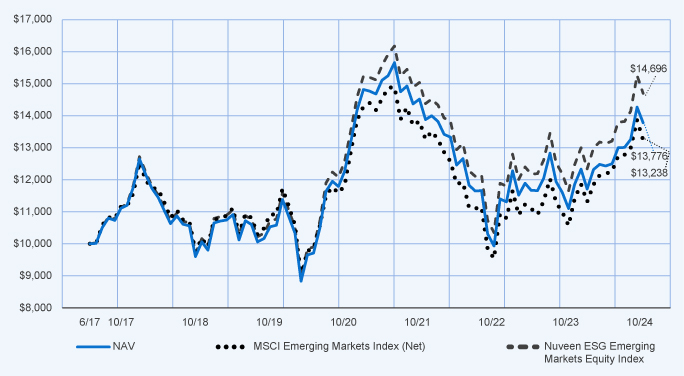

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (September 27, 2021 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | |

| | |

| | | 1‑Year | | Since

Inception

(9/27/21) |

| | | |

| NAV | | 34.14% | | 8.09% |

| | | |

| MSCI USA Index | | 38.40% | | 9.37% |

| | | |

| Nuveen ESG USA High Dividend Yield Index | | 34.59% | | 8.37% |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 11,701,928 | |

| |

| Total number of portfolio holdings | | | 121 | |

| |

| Portfolio turnover (%) | | | 68% | |

| |

| Total management fees paid for the year | | $ | 24,934 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Portfolio manager update: Effective June 18, 2024, Lei Lao retired and is no longer a portfolio manager of the Fund. Additionally, effective June 18, 2024, Nazar Romanyak, CFA and Darren Tran, CFA were added as portfolio managers of the Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P813_AR_1024 4015310-INV-Y-12/25 | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

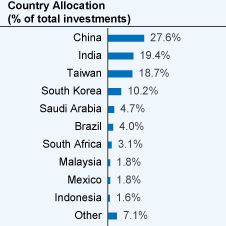

Nuveen ESG Emerging Markets Equity ETF

NUEM/Cboe BZX Exchange, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG Emerging Markets Equity ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment* |

| | | |

| Nuveen ESG Emerging Markets Equity ETF | | $40 | | 0.36% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen ESG Emerging Markets Equity ETF (NUEM)’s total return at net asset value (NAV) was 24.12% for the 12 months ended October 31, 2024. The Fund’s custom index, the Nuveen ESG Emerging Markets Equity Index, returned 26.15%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses, along with fair value pricing of the Fund’s international securities. • A non‑U.S. Equity Fund’s return may sometimes diverge from the return of its benchmark index more than would be expected. This may be the result of a fair-value pricing adjustment. Many foreign exchanges close before the Fund’s daily net asset value (NAV) is calculated (generally 4 p.m. ET). In the intervening hours, the value of foreign securities can change, and these changes are not reflected immediately in the Fund’s benchmark index. They may, however, be reflected in the calculation of the Fund’s NAV for that day. • During the reporting period, the Fund’s custom index outperformed the Fund’s base index, the MSCI Emerging Markets Index (Net), which returned 25.32%. • Performance drivers between the Fund’s custom index and base index during the reporting period: • Top contributors to the custom index’s relative performance » Security selection in the information technology sector, led by an overweight to Taiwan Semiconductor Manufacturing Co., Ltd. and a lack of exposure to Samsung Electronics Co., Ltd. » Security selection in the consumer discretionary sector, led by overweights to Meituan and Trent Limited. » An overweight to Yuhan Corporation. • Top detractors from the custom index’s relative performance » Security selection in the communication services sector, including a lack of exposure to Tencent Holdings Ltd. And an overweight to Netease Inc. » Security selection in the consumer staples sector, including overweights to Wal‑Mart de Mexico SAB de CV and Nongfu Spring Co., Ltd. |

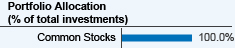

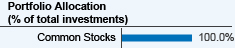

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 6, 2017 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | | | | |

| | | |

| | | 1‑Year | | 5‑Year | | Since

Inception

(6/6/17) |

| | | | |

| NAV | | | | 24.12% | | | | | 5.52% | | | | | 4.42% | |

| | | | |

| MSCI Emerging Markets Index (Net) | | | | 25.32% | | | | | 3.93% | | | | | 3.86% | |

| | | | |

| Nuveen ESG Emerging Markets Equity Index | | | | 26.15% | | | | | 6.54% | | | | | 5.34% | |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 290,624,535 | |

| |

| Total number of portfolio holdings | | | 210 | |

| |

| Portfolio turnover (%) | | | 58% | |

| |

| Total management fees paid for the year | | $ | 890,640 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Portfolio manager update: Effective June 18, 2024, Lei Lao retired and is no longer a portfolio manager of the Fund. Additionally, effective June 18, 2024, Nazar Romanyak, CFA and Darren Tran, CFA were added as portfolio managers of the Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787

| | |

67092P888_AR_1024 4015308‑INV‑Y‑12/25 | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

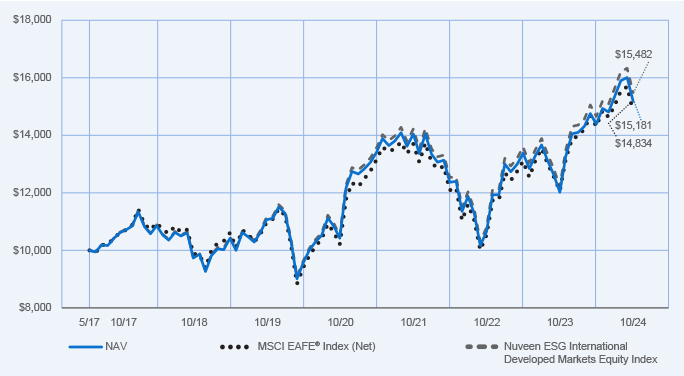

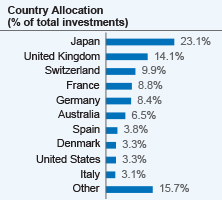

Nuveen ESG International Developed Markets Equity ETF

NUDM/Cboe BZX Exchange, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG International Developed Markets Equity ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen ESG International Developed Markets Equity ETF | | $35 | | 0.31% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen ESG International Developed Markets Equity ETF (NUDM)’s total return at net asset value (NAV) was 26.37% for the 12 months ended October 31, 2024. The Fund’s custom index, the Nuveen ESG International Developed Markets Equity Index, returned 26.77%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses, along with fair value pricing of the Fund’s international securities. • A non‑U.S. Equity Fund’s return may sometimes diverge from the return of its benchmark index more than would be expected. This may be the result of a fair-value pricing adjustment. Many foreign exchanges close before the Fund’s daily net asset value (NAV) is calculated (generally 4 p.m. ET). In the intervening hours, the value of foreign securities can change, and these changes are not reflected immediately in the Fund’s benchmark index. They may, however, be reflected in the calculation of the Fund’s NAV for that day. • During the reporting period, the Fund’s custom index outperformed the Fund’s base index, the MSCI EAFE Index (Net), which returned 22.97%. • Performance drivers between the Fund’s custom index and base index during the reporting period: • Top contributors to the custom index’s relative performance » Security selection in the financials sector, led by overweights to NatWest Group Plc and Intesa Sanpaolo S.p.A. » Security selection in the consumer staples sector, led by an overweight to Nestle S.A. and a lack of exposure to Diageo plc. » An underweight allocation to the energy sector. • Top detractors from the custom index’s relative performance » Security selection in the consumer discretionary sector, including overweights to Oriental Land Co., Ltd. and Panasonic HOldins Corporation. » Security selection in the materials sector, including overweights to Umicore SA and Pilbara Minerals Limited. |

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 6, 2017 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | | | | |

| | | |

| | | 1‑Year | | 5‑Year | | Since

Inception (6/6/17) |

| | | | |

| NAV | | | | 26.37% | | | | | 6.53% | | | | | 5.80% | |

| | | | |

MSCI EAFE® Index (Net) | | | | 22.97% | | | | | 6.24% | | | | | 5.47% | |

| | | | |

| Nuveen ESG International Developed Markets Equity Index | | | | 26.77% | | | | | 6.81% | | | | | 6.08% | |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 464,730,362 | |

| |

| Total number of portfolio holdings | | | 151 | |

| |

| Portfolio turnover (%) | | | 58% | |

| |

| Total management fees paid for the year | | $ | 1,259,958 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Portfolio manager update: Effective June 18, 2024, Lei Lao retired and is no longer a portfolio manager of the Fund. Additionally, effective June 18, 2024, Nazar Romanyak, CFA and Darren Tran, CFA were added as portfolio managers of the Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P805_AR_1024 4015307‑INV‑Y‑12/25 | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

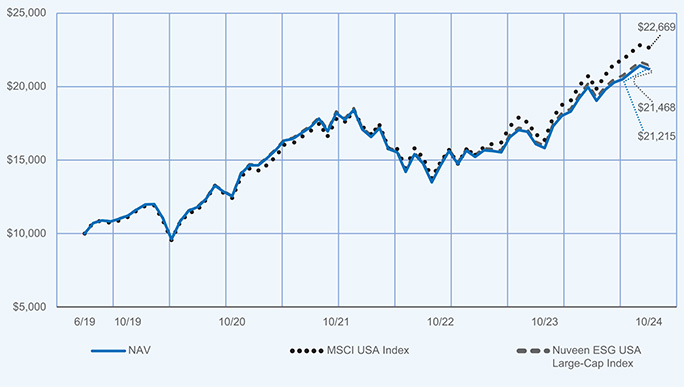

Nuveen ESG Large‑Cap ETF

NULC/Cboe BZX Exchange, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG Large‑Cap ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen ESG Large‑Cap ETF | | $25 | | 0.21% |

* Annualized for a period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen ESG Large‑Cap ETF (NULC)’s total return at net asset value (NAV) was 34.04% for the 12 months ended October 31, 2024. The Fund’s custom index, the Nuveen ESG USA Large‑Cap Index, returned 34.36%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index. • During the reporting period, the Fund’s custom index significantly underperformed the Fund’s base index, the MSCI USA Index, which returned 38.4%. • Performance drivers between the Fund’s custom index and base index during the reporting period: • Top contributors to the custom index’s relative performance » An overweight to NVIDIA Corporation. » An underweight to and stock selection within the energy sector, led by a lack of exposure to Exxon Mobil Corporation and Chevron Corporation. » An overweight to Fiserv, Inc. • Top detractors from the custom index’s relative performance » An overweight to Intel Corporation. » Stock selection in the communication services sector, led by a lack of exposure to Meta Platforms Inc. » Stock selection in the consumer staples sector, led by overweights to Archer Daniels Midland Corporation and Procter & Gamble Company. |

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 3, 2019 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | |

| | | |

| | | 1‑Year | | 5‑Year | | Since

Inception

(6/3/19) |

| | | | |

| NAV | | 34.04% | | 13.58% | | 14.91% |

| | | | |

| MSCI USA Index | | 38.40% | | 15.27% | | 16.33% |

| | | | |

| Nuveen ESG USA Large‑Cap Index | | 34.36% | | 13.83% | | 15.16% |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 34,344,806 | |

| |

| Total number of portfolio holdings | | | 123 | |

| |

| Portfolio turnover (%) | | | 50% | |

| |

| Total management fees paid for the year | | $ | 59,110 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Portfolio manager update: Effective June 18, 2024, Lei Lao retired and is no longer a portfolio manager of the Fund. Additionally, effective June 18, 2024, Nazar Romanyak, CFA and Darren Tran, CFA were added as portfolio managers of the Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P862_AR_1024 4015306‑INV‑Y‑12/25 | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen ESG Large‑Cap Growth ETF

NULG/Cboe BZX Exchange, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG Large‑Cap Growth ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen ESG Large‑Cap Growth ETF | | $31 | | 0.26% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen ESG Large‑Cap Growth ETF (NULG)’s total return at net asset value (NAV) was 41.51% for the 12 months ended October 31, 2024. The Fund’s custom index, the Nuveen ESG USA Large‑Cap Growth Index, returned 41.86%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index. • During the reporting period, the Fund’s custom index underperformed the Fund’s base index, the MSCI USA Growth Index, which returned 44.69%. • Performance drivers between the Fund’s custom index and base index during the reporting period: • Top contributors to the custom index’s relative performance » Stock selection within information technology, led by a lack of exposure to Apple Inc., and an overweight to NVIDIA Corporation. » An underweight to the energy sector. » An overweight position in Axon Enterprise Inc. • Top detractors from the custom index’s relative performance » Stock selection within communication services, including a lack of exposure to Meta Platforms and an overweight to Warner Bros. Discovery, Inc. » An overweight to and stock selection within healthcare, including overweights to IDEXX Laboratories, Inc. and West Pharmaceutical Services, Inc. » An overweight to and stock selection within consumer discretionary, including overweights to lululemon athletica inc. and Tesla, Inc. |

How did the Fund perform over the period since inception?

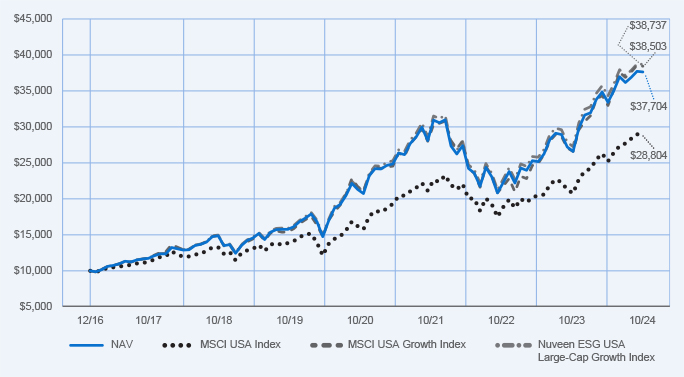

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

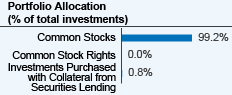

Fund Performance (December 13, 2016 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | |

| | | |

| | | 1‑Year | | 5‑Year | | Since

Inception

(12/13/16) |

| | | | |

| NAV | | 41.51% | | 18.49% | | 18.34% |

| | | | |

| MSCI USA Index | | 38.40% | | 15.27% | | 14.36% |

| | | | |

| MSCI USA Growth Index | | 44.69% | | 19.40% | | 18.65% |

| | | | |

| Nuveen ESG USA Large‑Cap Growth Index | | 41.86% | | 18.87% | | 18.74% |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 1,499,008,938 | |

| |

| Total number of portfolio holdings | | | 59 | |

| |

| Portfolio turnover (%) | | | 60% | |

| |

| Total management fees paid for the year | | $ | 3,374,590 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Portfolio manager update: Effective June 18, 2024, Lei Lao retired and is no longer a portfolio manager of the Fund. Additionally, effective June 18, 2024, Nazar Romanyak, CFA and Darren Tran, CFA were added as portfolio managers of the Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P201_AR_1024 4015305‑INV‑Y‑12/25 | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen ESG Large-Cap Value ETF

NULV/Cboe BZX Exchange, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG Large-Cap Value ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen ESG Large-Cap Value ETF | | $30 | | 0.26% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen ESG Large-Cap Value ETF (NULV)’s total return at net asset value (NAV) was 28.04% for the 12 months ended October 31, 2024. The Fund’s custom index, the Nuveen ESG USA Large-Cap Value Index, returned 28.49%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index. • During the reporting period, the Fund’s custom index underperformed the Fund’s base index, the MSCI USA Value Index, which returned 31.80%. • Performance drivers between the Fund’s custom index and base index during the reporting period: • Top contributors to the custom index’s relative performance » An underweight to and stock selection within energy, led by a lack of exposure to Chevron Corporation and Exxon Mobil Corporation. » An overweight to and stock selection within financials, led by overweights to Fiserv, Inc. and Bank of New York Mellon Corp. » An overweight to Welltower Inc. • Top detractors from the custom index’s relative performance » Stock selection within information technology, led by a lack of exposure to Broadcom Inc. and an overweight to Intel Corporation. » An overweight to and stock selection within consumer staples, led by an overweight to Archer-Daniels Midland Companies. » Stock selection in utilities, led by an overweight to Exelon Corporation and a lack of exposure to Constellation Energy Corporation. |

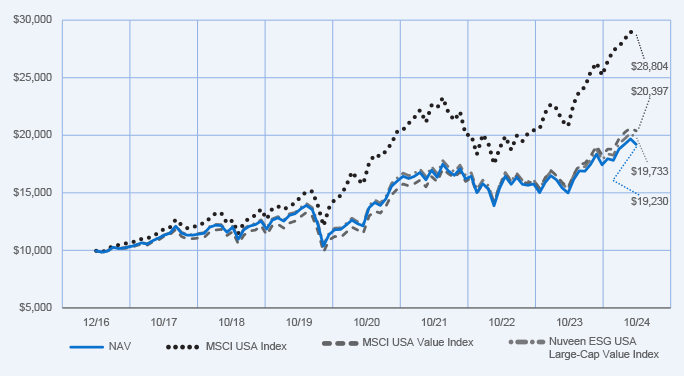

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (December 13, 2016 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | |

| | | |

| | | 1‑Year | | 5‑Year | | Since

Inception

(12/13/16) |

| | | | |

| NAV | | 28.04% | | 7.82% | | 8.65% |

| | | | |

| MSCI USA Index | | 38.40% | | 15.27% | | 14.36% |

| | | | |

| MSCI USA Value Index | | 31.80% | | 10.16% | | 9.46% |

| | | | |

| Nuveen ESG USA Large-Cap Value Index | | 28.49% | | 8.16% | | 9.01% |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or call (800) 257-8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 1,694,495,505 | |

| |

| Total number of portfolio holdings | | | 105 | |

| |

| Portfolio turnover (%) | | | 47% | |

| |

| Total management fees paid for the year | | $ | 3,962,191 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Portfolio manager update: Effective June 18, 2024, Lei Lao retired and is no longer a portfolio manager of the Fund. Additionally, effective June 18, 2024, Nazar Romanyak, CFA and Darren Tran, CFA were added as portfolio managers of the Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or upon request at (800) 257-8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257-8787.

| | |

67092P300_AR_1024 4015304-INV-Y-12/25 | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen ESG Mid‑Cap Growth ETF

NUMG/Cboe BZX Exchange, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG Mid‑Cap Growth ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment* |

| | | |

| Nuveen ESG Mid‑Cap Growth ETF | | $36 | | 0.31% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen ESG Mid‑Cap Growth ETF (NUMG)’s total return at net asset value (NAV) was 30.07% for the 12 months ended October 31, 2024. The Fund’s custom index, the Nuveen ESG USA Mid‑Cap Growth Index, returned 30.46%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index, along with the representative sampling process, which utilizes a subset of index securities in an effort to provide exposure similar to that of the custom index. • During the reporting period, the Fund’s custom index significantly underperformed the Fund’s base index, the MSCI USA Mid‑Growth Index, which returned 38.71%. • Performance drivers between the Fund’s custom index and base index during the reporting period: • Top contributors to the custom index’s relative performance » An overweight to Axon Enterprise Inc. » A lack of exposure to BioMarin Pharmaceuticals Inc. » An overweight to DaVita Inc. • Top detractors from the custom index’s relative performance » Stock selection in the information technology sector, including a lack of exposure to Palantir Technologies Inc. and AppLovin Corp. » Stock selection in the financials sector, including a lack of exposure to Coinbase Global, Inc. and an overweight to MarketAxess Holdings Inc. » A lack of exposure to Vertiv Holdings Co. |

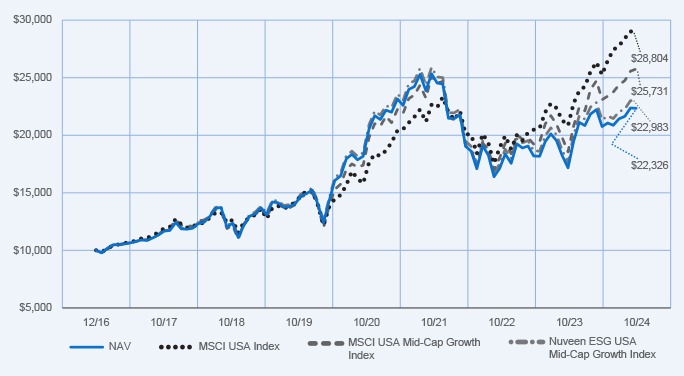

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (December 13, 2016 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | |

| | | |

| | | 1‑Year | | | 5‑Year | | | Since

Inception

(12/13/16) |

| | | | |

| NAV | | | 30.07 | % | | | 9.75 | % | | 10.73% |

| | | | |

| MSCI USA Index | | | 38.40 | % | | | 15.27 | % | | 14.36% |

| | | | |

| MSCI USA Mid‑Cap Growth Index | | | 38.71 | % | | | 13.04 | % | | 12.74% |

| | | | |

| Nuveen ESG USA Mid‑Cap Growth Index | | | 30.46 | % | | | 10.12 | % | | 11.13% |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 400,608,219 | |

| |

| Total number of portfolio holdings | | | 45 | |

| |

| Portfolio turnover (%) | | | 78% | |

| |

| Total management fees paid for the year | | $ | 1,157,986 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Portfolio manager update: Effective June 18, 2024, Lei Lao retired and is no longer a portfolio manager of the Fund. Additionally, effective June 18, 2024, Nazar Romanyak, CFA and Darren Tran, CFA were added as portfolio managers of the Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P409_AR_1024 4015303‑INV‑Y‑12/25 | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen ESG Mid-Cap Value ETF

NUMV/Cboe BZX Exchange, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG Mid-Cap Value ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen ESG Mid-Cap Value ETF | | $37 | | 0.31% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen ESG Mid-Cap Value ETF (NUMV)’s total return at net asset value (NAV) was 36.20% for the 12 months ended October 31, 2024. The Fund’s custom index, the Nuveen ESG USA Mid-Cap Value Index, returned 36.71%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index. • During the reporting period, the Fund’s custom index outperformed the Fund’s base index, the MSCI USA Mid-Value Index, which returned 35.09%. • Performance drivers between the Fund’s custom index and base index during the reporting period: • Top contributors to the custom index’s relative performance » An underweight to and stock selection within energy, led by a lack of exposure to Coterra Energy Inc. and APA Corporation. » Stock selection within real estate, led by overweights to Iron Mountain, Inc. and BXP Inc. » Stock selection in financials, led by overweights to Robinhood Markets, Inc and Regions Financial Corporation. • Top detractors from the custom index’s relative performance » Stock selection in the consumer discretionary sector, including overweights to LKQ Corporation and Vail Resorts, Inc. » An underweight to and stock selection in utilities, including a lack of exposure to Vistra Corp. and Constellation Energy Corporation. » Stock selection in health care, including overweights to Steris plc and Jazz Pharmaceuticals. |

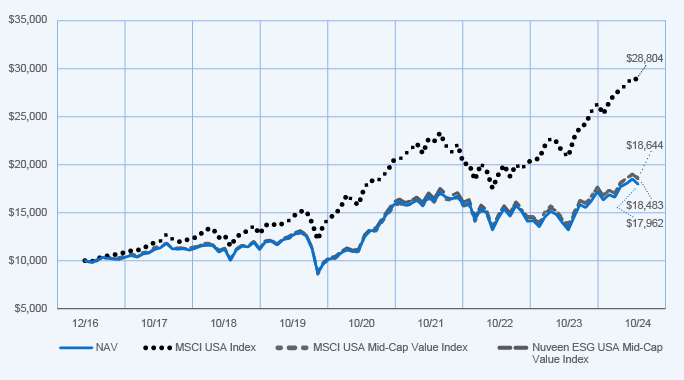

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (December 13, 2016 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | |

| | | |

| | | 1‑Year | | 5‑Year | | Since

Inception

(12/13/16) |

| | | | |

| NAV | | 36.20% | | 7.77% | | 7.71% |

| | | | |

| MSCI USA Index | | 38.40% | | 15.27% | | 14.36% |

| | | | |

| MSCI USA Mid-Cap Value Index | | 35.09% | | 8.67% | | 8.22% |

| | | | |

| Nuveen ESG USA Mid-Cap Value Index | | 36.71% | | 8.13% | | 8.10% |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or call (800) 257-8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 365,080,533 | |

| |

| Total number of portfolio holdings | | | 92 | |

| |

| Portfolio turnover (%) | | | 51% | |

| |

| Total management fees paid for the year | | $ | 1,023,282 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Portfolio manager update: Effective June 18, 2024, Lei Lao retired and is no longer a portfolio manager of the Fund. Additionally, effective June 18, 2024, Nazar Romanyak, CFA and Darren Tran, CFA were added as portfolio managers of the Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or upon request at (800) 257-8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257-8787.

| | |

67092P508_AR_1024 4015302-INV-Y-12/25 | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen ESG Small‑Cap ETF

NUSC/Cboe BZX Exchange, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG Small‑Cap ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen ESG Small‑Cap ETF | | $36 | | 0.31% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen ESG Small‑Cap ETF (NUSC)’s total return at net asset value (NAV) was 31.69% for the 12 months ended October 31, 2024. The Fund’s custom index, the Nuveen ESG USA Small‑Cap Index, returned 32.13%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index. • During the reporting period, the Fund’s custom index underperformed the Fund’s base index, the MSCI USA Small‑Cap Index, which returned 33.89%. • Performance drivers between the Fund’s custom index and base index during the reporting period: • Top contributors to the custom index’s relative performance » An underweight to and stock selection within energy, led by a lack of exposure to Range Resources Corporation and Murphy Oil Corporation. » Stock selection in financials, led by overweights to Jackson Financial Incorporation and East West Bancorp, Inc. » Stock selection in consumer staples, led by overweight positions in Freshpet Inc and US Foods Holding Corp. • Top detractors from the custom index’s relative performance » Stock selection in the industrials sector, led by overweights to Core & Main, Inc. and Plug Power Inc. » Stock selection in consumer discretionary, led by a lack of exposure to Carvana Co. and an overweight to Mattel, Inc. » Stock selection in information technology, led by a lack of exposure to MicroStrategy Incorporated and an overweight to Rambus inc. |

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

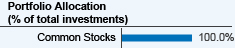

Fund Performance (December 13, 2016 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | | | | |

| | | |

| | | 1‑Year | | 5‑Year | | Since

Inception

(12/13/16) |

| | | | |

| NAV | | | | 31.69 | % | | | | 9.66 | % | | | | 9.01 | % |

| | | | |

| MSCI USA Index | | | | 38.40 | % | | | | 15.27 | % | | | | 14.36 | % |

| | | | |

| MSCI USA Small‑Cap Index | | | | 33.89 | % | | | | 10.41 | % | | | | 9.48 | % |

| | | | |

| Nuveen ESG USA Small‑Cap Index | | | | 32.13 | % | | | | 9.98 | % | | | | 9.38 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 1,209,134,336 | |

| |

| Total number of portfolio holdings | | | 511 | |

| |

| Portfolio turnover (%) | | | 45% | |

| |

| Total management fees paid for the year | | $ | 3,343,361 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Portfolio manager update: Effective June 18, 2024, Lei Lao retired and is no longer a portfolio manager of the Fund. Additionally, effective June 18, 2024, Nazar Romanyak, CFA and Darren Tran, CFA were added as portfolio managers of the Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P607_AR_1024 4015301‑INV‑Y‑12/25 | |  |

| | |

| | Annual Shareholder Report October 31, 2024 |

Nuveen Dividend Growth ETF

NDVG/NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen Dividend Growth ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Dividend Growth ETF | | $75 | | 0.65% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Dividend Growth ETF returned 31.80% for Common Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund significantly underperformed the S&P 500 Index, which returned 38.02%. • Top contributors to relative performance » An overweight to Broadcom Inc. » An overweight to American Express Company. • Top detractors from relative performance » Security selection in the information technology sector, including a lack of exposure to NVIDIA Corporation. » Security selection and an underweight to the communication services sector, including a lack of exposure to Meta Platforms Inc. and an overweight to Comcast Corporation. » An overweight to Elevance Health Inc. |

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

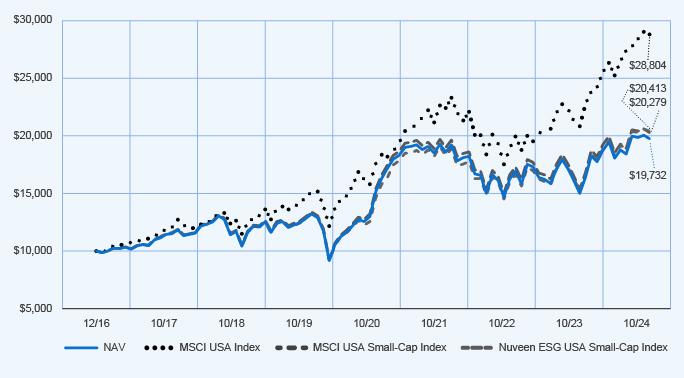

Fund Performance (August 4, 2021 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | |

| | |

| | | 1‑Year | | Since

Inception

(8/4/21) |

| | | |

| NAV | | 31.80% | | 9.76% |

| | | |

S&P 500® Index | | 38.02% | | 10.01% |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 11,341,709 | |

| |

| Total number of portfolio holdings | | | 42 | |

| |

| Portfolio turnover (%) | | | 10% | |

| |

| Total management fees paid for the year | | $ | 73,500 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P821_AR_1024 4015300‑INV‑Y‑12/25 | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Growth Opportunities ETF

NUGO/NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen Growth Opportunities ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment* |

| | | |

| Nuveen Growth Opportunities ETF | | $69 | | 0.56% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Growth Opportunities ETF returned 47.47% for Common Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund outperformed the Russell 1000 Growth Index, which returned 43.77%. • Top contributors to relative performance » Security selection and an overweight in the information technology sector, led by overweights to NVIDIA Corporation and Broadcom Inc. » Security selection in the communication services sector, led by an overweight to Meta Platforms Inc. » Security selection in the consumer staples sector, led by an overweight to Costco Wholesale Corporation. • Top detractors from relative performance » An overweight to DexCom Inc. » Security selection in the energy sector, including an out‑of‑benchmark position in EOG Resources, Inc. |

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

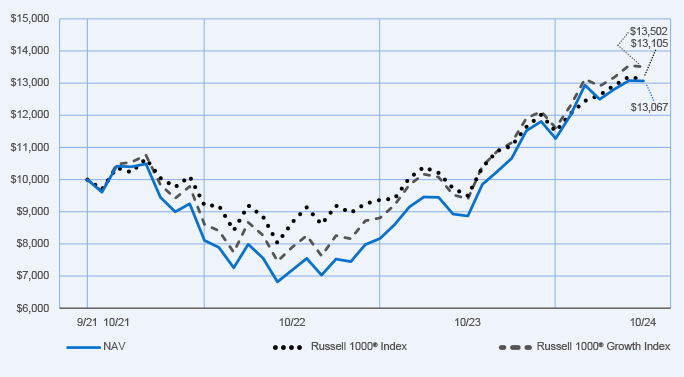

Fund Performance (September 27, 2021 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | |

| | |

| | | 1‑Year | | | Since

Inception

(9/27/21) | |

| | | |

| NAV | | | 47.47 | % | | | 9.03 | % |

| | | |

Russell 1000® Index | | | 38.07 | % | | | 9.14 | % |

| | | |

Russell 1000® Growth Index | | | 43.77 | % | | | 10.19 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 2,750,826,793 | |

| |

| Total number of portfolio holdings | | | 41 | |

| |

| Portfolio turnover (%) | | | 22% | |

| |

| Total management fees paid for the year | | $ | 15,676,478 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P797_AR_1024 4015299‑INV‑Y‑12/25 | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Small Cap Select ETF

NSCS/NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen Small Cap Select ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Small Cap Select ETF | | $100 | | 0.86% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Small Cap Select ETF returned 33.38% for Common Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund underperformed the Russell 2000 Index, which returned 34.07%. • Top contributors to relative performance » Security selection in the information technology sector, led by overweights to Q2 Holdings, Inc., Semtech Corporation and Commvault Systems, Inc. » Security selection in the financials sector, led by an out‑of‑benchmark position in Evercore Inc. and an overweight to Piper Sandler Companies. » Security selection in the industrials sector, led by overweights to Atmus Filtration Technologies, Inc. and SPX Technologies, Inc. • Top detractors from relative performance » Security selection in the consumer discretionary sector, including overweights to Dana Incorporated, Arhaus, Inc. and Topgolf Callaway Brands Corp. » An overweight to Array Technologies Inc. in the industrials sector. » Security selection in the health care sector, including overweights to AtriCure, Inc., Option Care Health Inc. and SI‑BONE, Inc. |

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

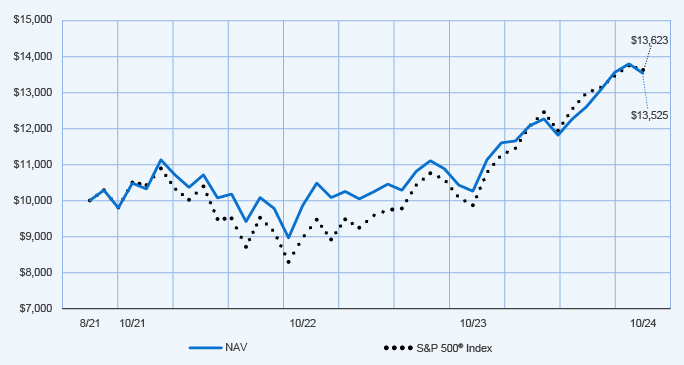

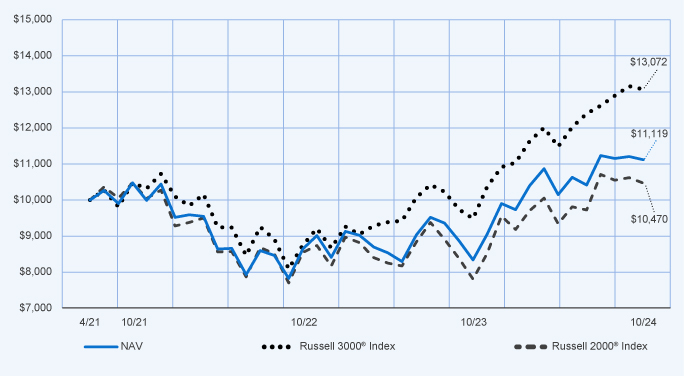

Fund Performance (August 4, 2021 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | |

| | |

| | | 1‑Year | | | Since

Inception

(8/4/21) |

| | | |

| NAV | | | 33.38 | % | | 3.33% |

| | | |

Russell 3000® Index | | | 37.86 | % | | 8.62% |

| | | |

Russell 2000® Index | | | 34.07 | % | | 1.43% |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 7,460,445 | |

| |

| Total number of portfolio holdings | | | 87 | |

| |

| Portfolio turnover (%) | | | 49% | |

| |

| Total management fees paid for the year | | $ | 57,305 | |

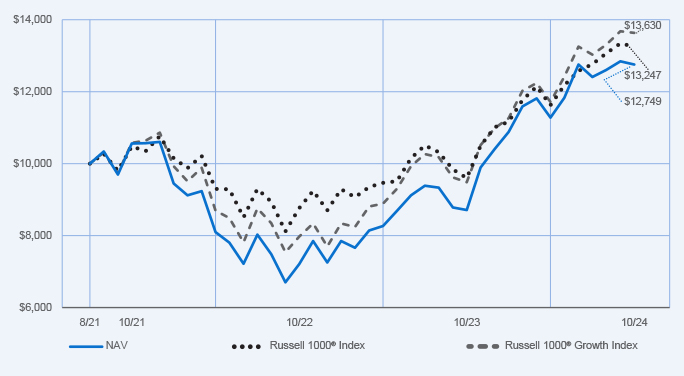

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P839_AR_1024 4015298‑INV‑Y‑12/25 | |  |

| | |

| |

Annual Shareholder Report

October 31, 2024 |

Nuveen Winslow Large-Cap Growth ESG ETF

NWLG/NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen Winslow Large-Cap Growth ESG ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Winslow Large-Cap Growth ESG ETF | | $80 | | 0.65% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Winslow Large-Cap Growth ESG ETF returned 46.37% for Common Shares at net asset value (NAV) for the 12 months ended October 31, 2024. The Fund outperformed the Russell 1000 Growth Index, which returned 43.77%. • Top contributors to relative performance » Security selection in the consumer discretionary sector, led by an overweight to MercadoLibre, Inc. and a lack of exposure to Tesla, Inc. » Security selection in the health care sector, led by an overweight to Intuitive Surgical, Inc. » Security selection in the industrials sector, led by an overweight to Trane Technologies plc. • Top detractors from relative performance » Underweight and stock selection in the communication services sector, including a lack of exposure to Meta Platforms Inc and an underweight to Netflix, Inc. » Stock selection in the information technology sector, including an out-of-benchmark position in ASML Holding NV and an overweight to Workday, Inc. |

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

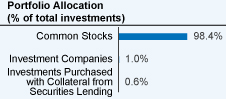

Fund Performance (August 4, 2021 through October 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | |

| | |

| | | 1‑Year | | Since

Inception

(8/04/21) |

| | | |

| NAV | | 46.37% | | 7.78% |

| | | |

Russell 1000® Index | | 38.07% | | 9.06% |

| | | |

Russell 1000® Growth Index | | 43.77% | | 10.03% |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or call (800) 257-8787.

Fund Statistics (as of October 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 9,241,915 | |

| |

| Total number of portfolio holdings | | | 41 | |

| |

| Portfolio turnover (%) | | | 57% | |

| |

| Total management fees paid for the year | | $ | 49,004 | |

What did the Fund invest in? (as of October 31, 2024)

How has the Fund changed?

| | • | | Portfolio Manager Updates: Effective June 18, 2024, Calvin Bohman was added as a portfolio manager of the Fund. Effective September 30, 2024, Stephan Petersen retired from Winslow Capital Management and is no longer a portfolio manager of the Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by February 28, 2025 at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or upon request at (800) 257-8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the October 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended October 31, 2024 and October 31, 2023, and for the subsequent interim period through December 26, 2024, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257-8787.

| | |

67092P847_AR_1024 4015284-INV-Y-12/25 | |  |

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. There were no amendments to or waivers from the code during the period covered by this report. Upon request, a copy of the registrant’s code of ethics is available without charge by calling 800-257-8787.

| Item 3. | Audit Committee Financial Expert. |

As of the end of the period covered by this report, the registrant’s Board of Directors or Trustees (“Board”) had determined that the registrant has at least one “audit committee financial expert” (as defined in Item 3 of Form N-CSR) serving on its Audit Committee. The members of the registrant’s audit committee that have been designated as audit committee financial experts are Joseph A. Boateng, Albin F. Moschner, John K. Nelson, Loren M. Starr and Robert L. Young, who are “independent” for purposes of Item 3 of Form N-CSR.

Mr. Boateng has served as the Chief Investment Officer for Casey Family Programs since 2007. He was previously Director of U.S. Pension Plans for Johnson & Johnson from 2002-2006. Mr. Boateng is a board member of the Lumina Foundation and Waterside School, an emeritus board member of Year Up Puget Sound, member of the Investment Advisory Committee and former Chair for the Seattle City Employees’ Retirement System, and an Investment Committee Member for The Seattle Foundation. Mr. Boateng previously served on the Board of Trustees for the College Retirement Equities Fund (2018-2023) and on the Management Committee for TIAA Separate Account VA-1 (2019-2023).

Mr. Moschner is a consultant in the wireless industry and, in July 2012, founded Northcroft Partners, LLC, a management consulting firm that provides operational, management and governance solutions. Prior to founding Northcroft Partners, LLC, Mr. Moschner held various positions at Leap Wireless International, Inc., a provider of wireless services, where he was as a consultant from February 2011 to July 2012, Chief Operating Officer from July 2008 to February 2011, and Chief Marketing Officer from August 2004 to June 2008. Before he joined Leap Wireless International, Inc., Mr. Moschner was President of the Verizon Card Services division of Verizon Communications, Inc. from 2000 to 2003, and President of One Point Services at One Point Communications from 1999 to 2000. Mr. Moschner also served at Zenith Electronics Corporation as Director, President and Chief Executive Officer from 1995 to 1996, and as Director, President and Chief Operating Officer from 1994 to 1995.

Mr. Nelson formerly served on the Board of Directors of Core12, LLC from 2008 to 2023, a private firm which develops branding, marketing, and communications strategies for clients. Mr. Nelson has extensive experience in global banking and markets, having served in several senior executive positions with ABN AMRO Holdings N.V. and its affiliated entities and predecessors, including LaSalle Bank Corporation from 1996 to 2008, ultimately serving as Chief Executive Officer of ABN AMRO N.V. North America. During his tenure at the bank, he also served as Global Head of its Financial Markets Division, which encompassed the bank’s Currency, Commodity, Fixed Income, Emerging Markets, and Derivatives businesses. He was a member of the Foreign Exchange Committee of the Federal Reserve Bank of the United States and during his tenure with ABN AMRO served as the bank’s representative on various committees of The Bank of Canada, European Central Bank, and The Bank of England. Mr. Nelson previously served as a senior, external advisor to the financial services practice of Deloitte Consulting LLP. (2012-2014).

Mr. Starr was Vice Chair, Senior Managing Director from 2020 to 2021, and Chief Financial Officer, Senior Managing Director from 2005 to 2020, for Invesco Ltd. Mr. Starr is also a Director and member of the Audit Committee for AMG. He is former Chair and member of the Board of Directors, Georgia Leadership Institute for School Improvement (GLISI); former Chair and member of the Board of Trustees, Georgia Council on Economic Education (GCEE). Mr. Starr previously served on the Board of Trustees for the College Retirement Equities Fund and on the Management Committee for TIAA Separate Account VA-1 (2022-2023).

Mr. Young has more than 30 years of experience in the investment management industry. From 1997 to 2017, he held various positions with J.P. Morgan Investment Management Inc. (“J.P. Morgan Investment”) and its affiliates (collectively, “J.P. Morgan”). Most recently, he served as Chief Operating Officer and Director of J.P. Morgan Investment (from 2010 to 2016) and as President and Principal Executive Officer of the J.P. Morgan Funds (from 2013 to 2016). As Chief Operating Officer of J.P. Morgan Investment, Mr. Young led service, administration and business platform support activities for J.P. Morgan’s domestic retail mutual fund and institutional commingled and separate account businesses and co-led these activities for J.P. Morgan’s global retail and institutional

investment management businesses. As President of the J.P. Morgan Funds, Mr. Young interacted with various service providers to these funds, facilitated the relationship between such funds and their boards, and was directly involved in establishing board agendas, addressing regulatory matters, and establishing policies and procedures. Before joining J.P. Morgan, Mr. Young, a former Certified Public Accountant (CPA), was a Senior Manager (Audit) with Deloitte & Touche LLP (formerly, Touche Ross LLP), where he was employed from 1985 to 1996. During his tenure there, he actively participated in creating, and ultimately led, the firm’s midwestern mutual fund practice.

| Item 4. | Principal Accountant Fees and Services. |