UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| Investment Company Act file number 811‑23161 |

Nushares ETF Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Diana R. Gonzalez

Vice President and Secretary

8500 Andrew Carnegie Boulevard

Charlotte, North Carolina 28262

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917‑7700

Date of fiscal year end: July 31

Date of reporting period: July 31, 2024

| Item 1. | Reports to Stockholders. |

| | |

| |

Annual Shareholder Report

July 31, 2024 |

Nuveen Core Plus Bond ETF

NCPB/NASDAQ Stock Market LLC

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen Core Plus Bond ETF for the period of March 5, 2024 (inception) to July 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period since inception? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Core Plus Bond ETF | | $30 | | 0.30% |

| | * | Annualized for period less than one year. |

How did the Fund perform since inception? What affected the Fund’s performance?

| | |

| |

Performance Highlights • The Nuveen Core Plus Bond ETF returned 2.99% for Common Shares at net asset value (NAV) for the abbreviated reporting period from the Fund’s inception on March 5, 2024, through July 31, 2024. The Fund outperformed the Bloomberg U.S. Aggregate Bond Index, which returned 2.6%. • Top contributors to relative performance » The Fund’s exposure to higher-yielding spread sectors, particularly an out-of-benchmark allocation to high yield corporate bonds and overweight to emerging markets debt. » Underweight to U.S. Treasury bonds and an overweight to mortgage-backed securities (MBS). » Security selection within commercial mortgage-backed securities (CMBS), asset-backed securities (ABS) and corporate bonds. • Top detractors from relative performance » Yield curve positioning, including an underweight to the two- and five-year segments of the curve, as short-term rates decreased during the reporting period. » Security selection within U.S. Treasury bonds. | | Performance Attribution  Corporate bonds and emerging markets debt  Underweight to U.S. Treasury bonds and MBS  CMBS and ABS  Yield curve positioning  Security selection within U.S. Treasury bonds |

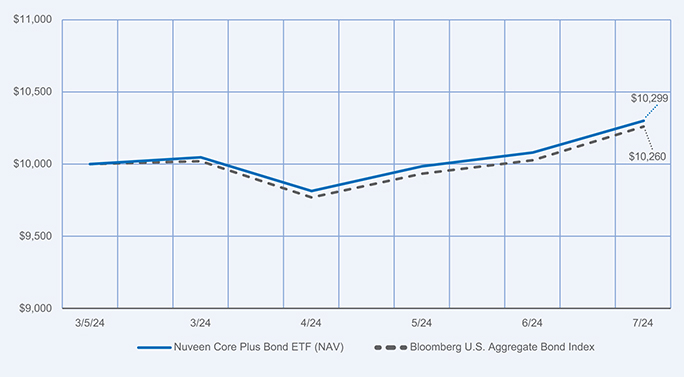

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (March 5, 2024 through July 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | |

| |

| | | Since

Inception

(3/5/24) | |

| | |

| Nuveen Core Plus Bond ETF (NAV) | | | 2.99 | % |

| | |

| Bloomberg U.S. Aggregate Bond Index | | | 2.60 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or call (800) 257-8787.

Fund Statistics (as of July 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 40,558,405 | |

| |

| Total number of portfolio holdings | | | 352 | |

| |

| Portfolio turnover (%) | | | 34% | |

| |

| Total management fees paid for the year | | $ | 39,070 | |

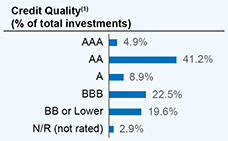

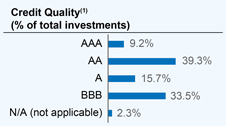

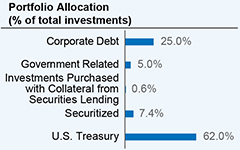

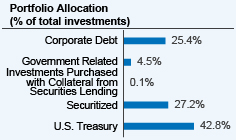

What did the Fund invest in? (as of July 31, 2024)

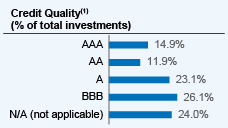

(1) The Fund uses credit quality ratings for its portfolio securities provided by Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) and Fitch, Inc.(“Fitch”). If all three provide a rating for a security, the middle is used; if two of the three agencies rate a security, the lower rating is used; and if only one rating agency rates a security, that rating is used. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below-investment grade ratings. Credit ratings are subject to change. Holdings designated N/R are not rated by Moody’s, S&P or Fitch.

How has the Fund changed?

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by November 29, 2024 at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or upon request at (800) 257-8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P763_AR_0724 3824552-INV-Y-09/25 | |  |

| | |

| |

Annual Shareholder Report

July 31, 2024 |

Nuveen Enhanced Yield U.S. Aggregate Bond ETF

NUAG/NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen Enhanced Yield U.S. Aggregate Bond ETF for the period of August 1, 2023 to July 31, 2024. You can find additional information at

https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Enhanced Yield U.S. Aggregate Bond ETF | | $21 | | 0.21% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Enhanced Yield U.S. Aggregate Bond ETF (NUAG)’s total return at net asset value (NAV) was 6.44% for the 12 months ended July 31, 2024. The Fund’s custom index, the ICE BofA Enhanced Yield U.S. Broad Bond Index, returned 6.83%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index, along with the representative sampling process, which utilizes a subset of index securities in an effort to provide exposure similar to that of the custom index. • During the reporting period, the Fund’s custom index outperformed the Fund’s base index, the ICE BofA U.S. Broad Market Index, which returned 5.18% • Performance drivers between the Fund’s custom index and base index during the reporting period: » Top contributors to the custom index’s relative performance § Overweight to corporate bonds and commercial mortgage-backed securities (CMBS). § Underweight to US treasury bonds, which generally underperformed spread sectors over the reporting period. » There were no material detractors from the custom index’s relative performance during the reporting period. |

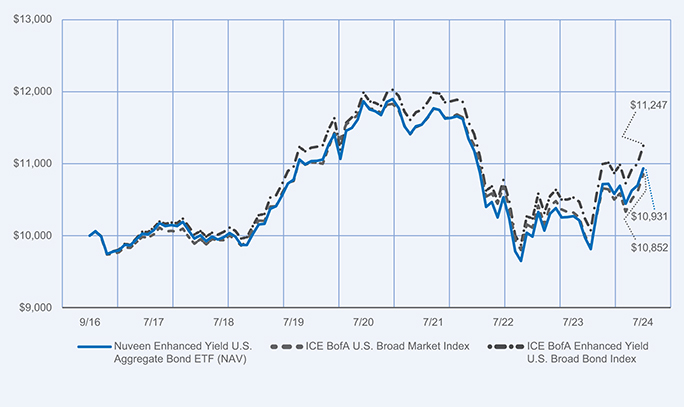

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (September 14, 2016 through July 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | |

| | | 1-Year | | | 5-Year | | | Since

Inception

(9/14/16) | |

| | | | |

| Nuveen Enhanced Yield U.S. Aggregate Bond ETF (NAV) | | | 6.44 | % | | | 0.29 | % | | | 1.14 | % |

| | | | |

| ICE BofA U.S. Broad Market Index | | | 5.18 | % | | | 0.17 | % | | | 1.04 | % |

| | | | |

| ICE BofA Enhanced Yield U.S. Broad Bond Index | | | 6.83 | % | | | 0.53 | % | | | 1.50 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or call (800) 257-8787.

Fund Statistics (as of July 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 35,816,801 | |

| |

| Total number of portfolio holdings | | | 692 | |

| |

| Portfolio turnover (%) | | | 48% | |

| |

| Total management fees paid for the year | | $ | 66,045 | |

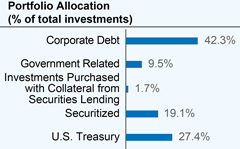

What did the Fund invest in? (as of July 31, 2024)

(1) The Fund uses credit quality ratings for its portfolio securities provided by Moody’s, S&P and Fitch. If all three of Moody’s, S&P, and Fitch provide a rating for a security, an average of the ratings is used; if two of the three agencies rate a security, an average of the two is used; and if only one rating agency rates a security, that rating is used. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below-investment grade ratings. Credit ratings are subject to change. Holdings designated N/R are not rated by Moody’s, S&P or Fitch.

How has the Fund changed?

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by November 29, 2024 at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or upon request at (800) 257-8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257-8787.

| | |

67092P102_AR_0724 3824569-INV-Y-09/25 | |  |

| | |

| |

Annual Shareholder Report

July 31, 2024 |

Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF

NUSA/NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF for the period of August 1, 2023 to July 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF | | $16 | | 0.16% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

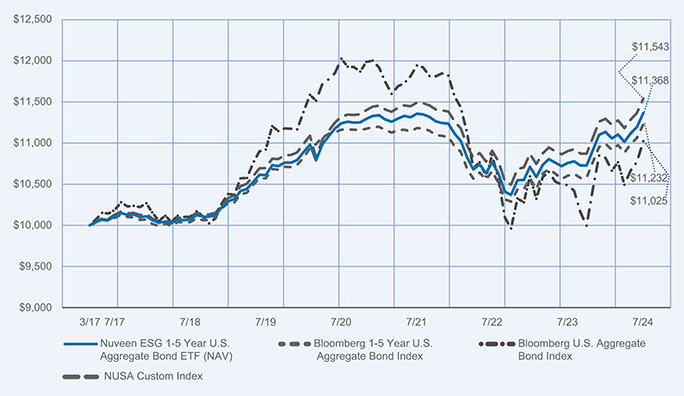

Performance Highlights • The Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF (NUSA)’s total return at net asset value (NAV) was 5.65% for the 12 months ended July 31, 2024. The Fund’s custom index, the Bloomberg MSCI 1-5 Year U.S. Aggregate ESG Select Index, returned 5.85%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index, along with the representative sampling process, which utilizes a subset of index securities in an effort to provide exposure similar to that of the custom index. • During the reporting period, the Fund’s custom index performed in line with the Fund’s base index, the Bloomberg 1-5 Year U.S. Aggregate Bond Index, which returned 5.91% • Sector allocations and performance were consistent in both the custom index and base index, and there were no material contributors or detractors between the custom index and base index over the reporting period. |

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (March 31, 2017 through July 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1‑Year | | | 5‑Year | | | Since

Inception

(3/31/17) | |

| Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF (NAV) | | | 5.65 | % | | | 1.38 | % | | | 1.76 | % |

| Bloomberg 1‑5 Year U.S. Aggregate Bond Index | | | 5.91 | % | | | 1.22 | % | | | 1.60 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 5.10 | % | | | 0.19 | % | | | 1.34 | % |

| NUSA Custom Index * | | | 5.85 | % | | | 1.53 | % | | | 1.98 | % |

* The NUSA Custom Index is defined as the linked returns between the Bloomberg MSCI 1-5 Year U.S. Aggregate ESG Select Index (effective July 1, 2023) and the ICE BofA Enhanced Yield 1-5 Year U.S. Broad Bond Index (through market close on June 30, 2023).

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to

https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of July 31, 2024)

| | | | |

| Fund net assets | | $ | 32,433,010 | |

| Total number of portfolio holdings | | | 294 | |

| Portfolio turnover (%) | | | 37% | |

| Total management fees paid for the year | | $ | 47,258 | |

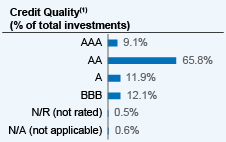

What did the Fund invest in? (as of July 31, 2024)

(1) The Fund uses credit quality ratings for its portfolio securities provided by Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) and Fitch, Inc.(“Fitch”). If all three provide a rating for a security, the middle is used; if two of the three agencies rate a security, the lower rating is used; and if only one rating agency rates a security, that rating is used. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below-investment grade ratings. Credit ratings are subject to change. Holdings designated N/R are not rated by Moody’s, S&P or Fitch.

How has the Fund changed?

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by November 29, 2024 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P110_AR_0724 3824576-INV-Y-09/25 | |  |

| | |

| |

Annual Shareholder Report

July 31, 2024 |

Nuveen ESG High Yield Corporate Bond ETF

NUHY/NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG High Yield Corporate Bond ETF for the period of August 1, 2023 to July 31, 2024. You can find additional information at

https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| Nuveen ESG High Yield Corporate Bond ETF | | $33 | | 0.31% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

Performance Highlights • The Nuveen ESG High Yield Corporate Bond ETF (NUHY)’s total return at net asset value (NAV) was 10.43% for the 12 months ended July 31, 2024. The Fund’s custom index, the Bloomberg MSCI U.S. High Yield Very Liquid ESG Select Index, returned 10.91%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index, along with the representative sampling process, which utilizes a subset of index securities in an effort to provide exposure similar to that of the custom index. • During the reporting period, the Fund’s custom index performed in line with the Fund’s base index, the Bloomberg U.S. High Yield Very Liquid Index, which returned 11.06%. • Performance drivers between the Fund’s custom index and base index during the reporting period: » Top contributors to the custom index’s relative performance § Security selection in the communications sector, led by overweights to Frontier Communications and CSC Holdings LLC. » Top detractors from the custom index’s relative performance § An overweight to lumber production and distribution company Enviva Inc., which filed for bankruptcy during the reporting period. |

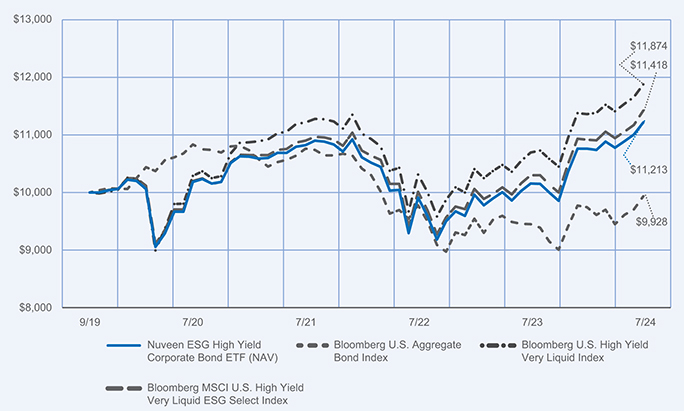

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (September 25, 2019 through July 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | |

| | |

| | | 1‑Year | | | Since

Inception

(9/25/19) | |

| | | |

| Nuveen ESG High Yield Corporate Bond ETF (NAV) | | | 10.43 | % | | | 2.39 | % |

| | | |

| Bloomberg U.S. Aggregate Bond Index | | | 5.10 | % | | | (0.15 | )% |

| | | |

| Bloomberg U.S. High Yield Very Liquid Index | | | 11.06 | % | | | 3.60 | % |

| | | |

| Bloomberg MSCI U.S. High Yield Very Liquid ESG Select Index | | | 10.91 | % | | | 2.77 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of July 31, 2024)

| | | | |

| Fund net assets | | $ | 89,221,581 | |

| Total number of portfolio holdings | | | 394 | |

| Portfolio turnover (%) | | | 43% | |

| Total management fees paid for the year | | $ | 284,454 | |

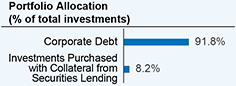

What did the Fund invest in? (as of July 31, 2024)

(1) The Fund uses credit quality ratings for its portfolio securities provided by Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) and Fitch, Inc. (“Fitch”). If all three provide a rating for a security, the middle is used; if two of the three agencies rate a security, the lower rating is used; and if only one rating agency rates a security, that rating is used. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below-investment grade ratings. Credit ratings are subject to change. Holdings designated N/R are not rated by Moody’s, S&P or Fitch.

How has the Fund changed?

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by November 29, 2024 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P854_AR_0724 3824581-INV-Y-09/25 | |  |

| | |

| |

Annual Shareholder Report

July 31, 2024 |

Nuveen ESG U.S. Aggregate Bond ETF

NUBD/NYSE Arca

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen ESG U.S. Aggregate Bond ETF for the period of August 1, 2023 to July 31, 2024. You can find additional information at

https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| Nuveen ESG U.S. Aggregate Bond ETF | | $16 | | 0.16% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

|

Performance Highlights • The Nuveen ESG U.S. Aggregate Bond ETF (NUBD)’s total return at net asset value (NAV) was 5.03% for the 12 months ended July 31, 2024. The Fund’s custom index, the Bloomberg MSCI U.S. Aggregate ESG Select Index, returned 5.09%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index, along with the representative sampling process, which utilizes a subset of index securities in an effort to provide exposure similar to that of the custom index. • During the reporting period, the Fund’s custom index performed in line with the Fund’s base index, the Bloomberg U.S. Aggregate Bond Index, which returned 5.10%. • Sector allocations and performance were consistent in both the custom index and base index, and there were no material contributors or detractors between the custom index and base index over the reporting period. |

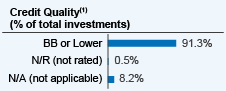

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (September 29, 2017 through July 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1‑Year | | | 5‑Year | | | Since

Inception

(9/29/17) | |

| Nuveen ESG U.S. Aggregate Bond ETF (NAV) | | | 5.03 | % | | | (0.04 | )% | | | 0.89 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 5.10 | % | | | 0.19 | % | | | 1.10 | % |

| Bloomberg MSCI U.S. Aggregate ESG Select Index | | | 5.09 | % | | | 0.19 | % | | | 1.10 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to

https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of July 31, 2024)

| | | | |

| Fund net assets | | $ | 368,721,828 | |

| Total number of portfolio holdings | | | 1,714 | |

| Portfolio turnover (%) | | | 13% | |

| Total management fees paid for the year | | $ | 473,283 | |

What did the Fund invest in? (as of July 31, 2024)

(1) The Fund uses credit quality ratings for its portfolio securities provided by Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) and Fitch, Inc.(“Fitch”). If all three provide a rating for a security, the middle is used; if two of the three agencies rate a security, the lower rating is used; and if only one rating agency rates a security, that rating is used. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below-investment grade ratings. Credit ratings are subject to change. Holdings designated N/R are not rated by Moody’s, S&P or Fitch.

How has the Fund changed?

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by November 29, 2024 at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or upon request at (800) 257-8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P870_AR_0724 3824595‑INV‑Y‑09/25 | |  |

| | |

| |

Annual Shareholder Report

July 31, 2024 |

Nuveen Global Net Zero Transition ETF

NTZG/NASDAQ Stock Market LLC

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen Global Net Zero Transition ETF for the period of August 1, 2023 to July 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| Nuveen Global Net Zero Transition ETF | | $59 | | 0.56% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

| | |

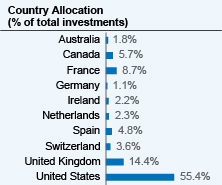

Performance Highlights • The Nuveen Global Net Zero Transition returned 10.99% for Common Shares at net asset value (NAV) for the 12 months ended July 31, 2024. The Fund significantly underperformed the MSCI ACWI Index (Net), which returned 17.02%. • Top contributors to relative performance » Security selection in the industrials sector, including an overweight to U.S. HVAC company Trane Technologies PLC. » Security selection in the consumer staples sector, including overweights to U.S.-based retailers Costco Wholesale Corporation and Walmart Inc. » An overweight to Danish pharmaceutical company Novo Nordisk A/S. • Top detractors from relative performance » Security selection in the information technology sector, including a lack of exposure to U.S.-based NVIDIA Corporation and an overweight to South Korean battery manufacturer Samsung SDI Co Ltd. » Security selection in the consumer discretionary sector, including an overweight to French luxury goods firm Kering SA. » Security selection in the financials sector, including an overweight to Dutch payment company Adyen NV. | | Performance Attribution  Industrials  Consumer staples  Novo Nordisk A/S  Information technology  Consumer discretionary  Financials |

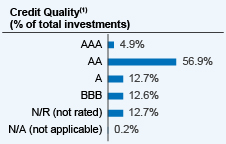

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 23, 2022 through July 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | |

| | |

| | | 1‑Year | | | Since

Inception

(6/23/22) | |

| Nuveen Global Net Zero Transition ETF (NAV) | | | 10.99 | % | | | 13.85 | % |

| MSCI ACWI Index (Net) | | | 17.02 | % | | | 17.89 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of July 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 6,440,931 | |

| |

| Total number of portfolio holdings | | | 70 | |

| |

| Portfolio turnover (%) | | | 22% | |

| |

| Total management fees paid for the year | | $ | 32,928 | |

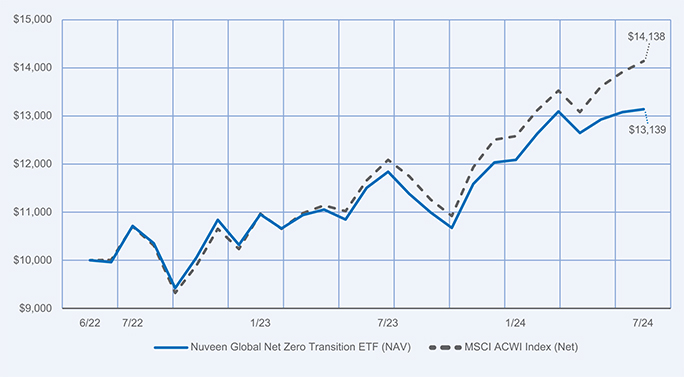

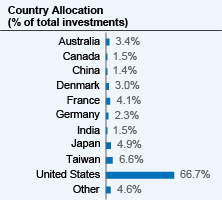

What did the Fund invest in? (as of July 31, 2024)

How has the Fund changed?

| | • | | On August 21, 2024, the Fund’s Board of Trustees approved the liquidation of the Fund, effective October 22, 2024. | |

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P789_AR_0724 3824602‑INV‑Y‑09/25 | |  |

| | |

| |

Annual Shareholder Report

July 31, 2024 |

Nuveen Preferred and Income ETF

NPFI/NASDAQ Stock Market LLC

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen Preferred and Income ETF for the period of March 5, 2024 (inception) to July 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period since inception? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| Nuveen Preferred and Income ETF | | $56 | | 0.55% |

| | * | Annualized for period less than one year. |

How did the Fund perform since inception? What affected the Fund’s performance?

| | |

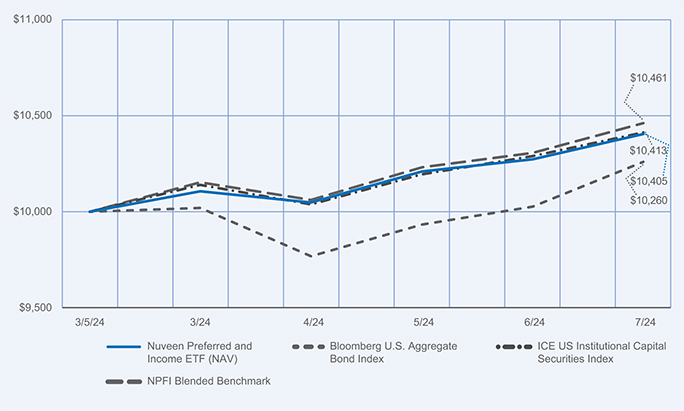

Performance Highlights • The Nuveen Preferred and Income ETF returned 4.05% for Common Shares at net asset value (NAV) for the abbreviated reporting period since the Fund’s inception on March 5, 2024, through July 31, 2024. The Fund underperformed the NPFI Blended Benchmark, which returned 4.61%. The NPFI Blended Benchmark consists of: 60% ICE US Institutional Capital Securities Index (IIPS), and 40% ICE USD Contingent Capital Index (CDLR). • Top contributors to relative performance » Security selection within fixed-to-fixed rate coupon securities, particularly recently issued, higher coupon securities, which outperformed the broader preferred securities market. • Top detractors from relative performance » Shorter-duration positioning, resulting from an overweight to floating-rate coupon securities, which detracted as short-term rates decreased during the reporting period. » Underweight to contingent capital securities (CoCos), which was partially offset by favorable security selection within that segment. | | Performance Attribution  Fixed-to-fixed rate coupon securities  Shorter-duration positioning  Underweight CoCos |

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (March 5, 2024 through July 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | |

| |

| | | Since

Inception

(3/5/24) | |

| | |

| Nuveen Preferred and Income ETF (NAV) | | | 4.05 | % |

| | |

| Bloomberg U.S. Aggregate Bond Index | | | 2.60 | % |

| ICE US Institutional Capital Securities Index | | | 4.13 | % |

| NPFI Blended Benchmark | | | 4.61 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or call (800) 257-8787.

Return of Capital: During the current reporting period, $0.17 per share of the Fund’s distribution was re-characterized as a return of capital resulting from subsequent re-characterizations of cash flows received from the Fund’s investments.

Fund Statistics (as of July 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 17,240,876 | |

| |

| Total number of portfolio holdings | | | 123 | |

| |

| Portfolio turnover (%) | | | 6% | |

| |

| Total management fees paid for the year | | $ | 35,238 | |

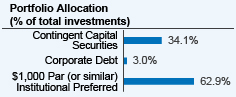

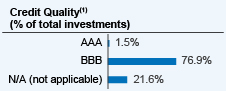

What did the Fund invest in? (as of July 31, 2024)

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

How has the Fund changed?

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by November 29, 2024 at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses or upon request at (800) 257-8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en-us/exchange-traded-funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P771_AR_0724 3824613-INV-Y-09/25 | |  |

| | |

| |

Annual Shareholder Report

July 31, 2024 |

Nuveen Sustainable Core ETF

NSCR/NASDAQ Stock Market LLC

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen Sustainable Core ETF for the period of March 5, 2024 (inception) to July 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period since inception? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| Nuveen Sustainable Core ETF | | $47 | | 0.46% |

| | * | Annualized for period less than one year. |

How did the Fund perform since inception? What affected the Fund’s performance?

| | |

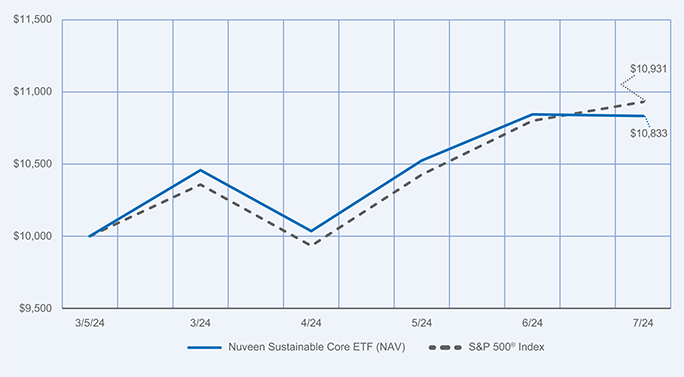

Performance Highlights • The Nuveen Sustainable Core ETF returned 8.33% for Common Shares at net asset value (NAV) for the abbreviated reporting period from the Fund’s inception on March 5, 2024, through July 31, 2024. The Fund underperformed the S&P 500 Index, which returned 9.31%. • Top contributors to relative performance » Security selection in the information technology sector, including a lack of exposure to U.S. chipmakers Advanced Micro Devices, Inc. and Intel Corporation. » Security selection in the utilities sector, including overweights to NextEra Energy, Inc. and American Electric Power Company, Inc. » An overweight to Bank of New York Mellon Corp. • Top detractors from relative performance » Security selection in the health care sector, including overweights to pharmaceutical firms Merck & Co., Inc. and Bristol-Myers Squibb Company. » An underweight to Apple, Inc. | | Performance Attribution  Information technology  Utilities  Bank of New York Mellon Corp.  Health care  Apple, Inc. |

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (March 5, 2024 through July 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | |

| | | Since

Inception

(3/5/24) | |

| Nuveen Sustainable Core ETF (NAV) | | | 8.33 | % |

S&P 500® Index | | | 9.31 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of July 31, 2024)

| | | | |

| Fund net assets | | $ | 5,689,198 | |

| Total number of portfolio holdings | | | 51 | |

| Portfolio turnover (%) | | | 4% | |

| Total management fees paid for the year | | $ | 10,076 | |

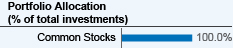

What did the Fund invest in? (as of July 31, 2024)

How has the Fund changed?

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by November 29, 2024 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P748_AR_0724 3824623-INV-Y-09/25 | |  |

| | |

| |

Annual Shareholder Report

July 31, 2024 |

Nuveen Ultra Short Income ETF

NUSB/NASDAQ Stock Market LLC

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen Ultra Short Income ETF for the period of March 5, 2024 (inception) to July 31, 2024. You can find additional information at https://www.nuveen.com/enus/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257-8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period since inception? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| Nuveen Ultra Short Income ETF | | $17 | | 0.17% |

| | * | Annualized for period less than one year. |

How did the Fund perform last year? What affected the Fund’s performance?

| | |

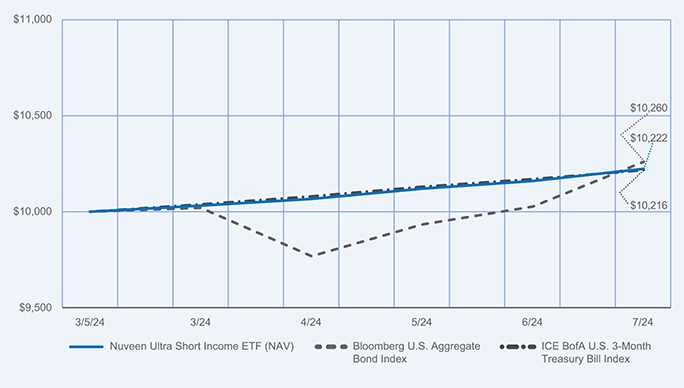

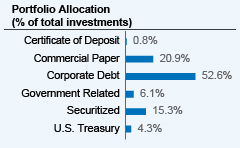

Performance Highlights • The Nuveen Ultra Short Income ETF returned 2.22% for Common Shares at net asset value (NAV) for the abbreviated reporting period since the Fund’s inception on March 5, 2024, through July 31, 2024. The Fund performed in line with the ICE BofA U.S. 3-Month Treasury Bill Index, which returned 2.16%. • Top contributors to relative performance » Out-of-benchmark allocations to spread sectors, notably to investment grade corporate bonds, which was driven by strong performance in the banking and insurance industries. » Out-of-benchmark allocation to asset-backed securities (ABS), led by automotive related securities. » Out-of-benchmark allocation to commercial mortgage-backed securities (CMBS), which rallied and outperformed during the reporting period. • There were no material detractors from relative performance. | | Performance Attribution  Investment grade corporate bonds  ABS  CMBS |

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (March 5, 2024 through July 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | |

| | | Since

Inception

(3/5/24) | |

| Nuveen Ultra Short Income ETF (NAV) | | | 2.22 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 2.60 | % |

| ICE BofA U.S. 3‑Month Treasury Bill Index | | | 2.16 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of July 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 25,792,704 | |

| |

| Total number of portfolio holdings | | | 134 | |

| |

| Portfolio turnover (%) | | | 7% | |

| |

| Total management fees paid for the year | | $ | 11,077 | |

What did the Fund invest in? (as of July 31, 2024)

(1) The Fund uses credit quality ratings for its portfolio securities provided by Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) and Fitch, Inc.(“Fitch”). If all three provide a rating for a security, the middle is used; if two of the three agencies rate a security, the lower rating is used; and if only one rating agency rates a security, that rating is used. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below-investment grade ratings. Credit ratings are subject to change. Holdings designated N/R are not rated by Moody’s, S&P or Fitch.

How has the Fund changed?

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by November 29, 2024 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P755_AR_0724 3824631-INV-Y-09/25 | |  |

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. There were no amendments to or waivers from the code during the period covered by this report. Upon request, a copy of the registrant’s code of ethics is available without charge by calling 800-257-8787.

| Item 3. | Audit Committee Financial Expert. |

As of the end of the period covered by this report, the registrant’s Board of Directors or Trustees (“Board”) had determined that the registrant has at least one “audit committee financial expert” (as defined in Item 3 of Form N-CSR) serving on its Audit Committee. The members of the registrant’s audit committee that have been designated as audit committee financial experts are Joseph A. Boateng, Albin F. Moschner, John K. Nelson, Loren M. Starr and Robert L. Young, who are “independent” for purposes of Item 3 of Form N-CSR.

Mr. Boateng has served as the Chief Investment Officer for Casey Family Programs since 2007. He was previously Director of U.S. Pension Plans for Johnson & Johnson from 2002-2006. Mr. Boateng is a board member of the Lumina Foundation and Waterside School, an emeritus board member of Year Up Puget Sound, member of the Investment Advisory Committee and former Chair for the Seattle City Employees’ Retirement System, and an Investment Committee Member for The Seattle Foundation. Mr. Boateng previously served on the Board of Trustees for the College Retirement Equities Fund (2018-2023) and on the Management Committee for TIAA Separate Account VA-1 (2019-2023).

Mr. Moschner is a consultant in the wireless industry and, in July 2012, founded Northcroft Partners, LLC, a management consulting firm that provides operational, management and governance solutions. Prior to founding Northcroft Partners, LLC, Mr. Moschner held various positions at Leap Wireless International, Inc., a provider of wireless services, where he was as a consultant from February 2011 to July 2012, Chief Operating Officer from July 2008 to February 2011, and Chief Marketing Officer from August 2004 to June 2008. Before he joined Leap Wireless International, Inc., Mr. Moschner was President of the Verizon Card Services division of Verizon Communications, Inc. from 2000 to 2003, and President of One Point Services at One Point Communications from 1999 to 2000. Mr. Moschner also served at Zenith Electronics Corporation as Director, President and Chief Executive Officer from 1995 to 1996, and as Director, President and Chief Operating Officer from 1994 to 1995.

Mr. Nelson formerly served on the Board of Directors of Core12, LLC from 2008 to 2023, a private firm which develops branding, marketing, and communications strategies for clients. Mr. Nelson has extensive experience in global banking and markets, having served in several senior executive positions with ABN AMRO Holdings N.V. and its affiliated entities and predecessors, including LaSalle Bank Corporation from 1996 to 2008, ultimately serving as Chief Executive Officer of ABN AMRO N.V. North America. During his tenure at the bank, he also served as Global Head of its Financial Markets Division, which encompassed the bank’s Currency, Commodity, Fixed Income, Emerging Markets, and Derivatives businesses. He was a member of the Foreign Exchange Committee of the Federal Reserve Bank of the United States and during his tenure with ABN AMRO served as the bank’s representative on various committees of The Bank of Canada, European Central Bank, and The Bank of England. Mr. Nelson previously served as a senior, external advisor to the financial services practice of Deloitte Consulting LLP. (2012-2014).

Mr. Starr was Vice Chair, Senior Managing Director from 2020 to 2021, and Chief Financial Officer, Senior Managing Director from 2005 to 2020, for Invesco Ltd. Mr. Starr is also a Director and member of the Audit Committee for AMG. He is former Chair and member of the Board of Directors, Georgia Leadership Institute for School Improvement (GLISI); former Chair and member of the Board of Trustees, Georgia Council on Economic Education (GCEE). Mr. Starr previously served on the Board of Trustees for the College Retirement Equities Fund and on the Management Committee for TIAA Separate Account VA-1 (2022-2023).

Mr. Young has more than 30 years of experience in the investment management industry. From 1997 to 2017, he held various positions with J.P. Morgan Investment Management Inc. (“J.P. Morgan Investment”) and its affiliates (collectively, “J.P. Morgan”). Most recently, he served as Chief Operating Officer and Director of J.P. Morgan Investment (from 2010 to 2016) and as President and Principal Executive Officer of the J.P. Morgan Funds (from 2013 to 2016). As Chief Operating Officer of J.P. Morgan Investment, Mr. Young led service, administration and business platform support activities for J.P. Morgan’s domestic retail mutual fund and institutional commingled and separate account businesses and co-led these activities for J.P. Morgan’s global retail and institutional

investment management businesses. As President of the J.P. Morgan Funds, Mr. Young interacted with various service providers to these funds, facilitated the relationship between such funds and their boards, and was directly involved in establishing board agendas, addressing regulatory matters, and establishing policies and procedures. Before joining J.P. Morgan, Mr. Young, a former Certified Public Accountant (CPA), was a Senior Manager (Audit) with Deloitte & Touche LLP (formerly, Touche Ross LLP), where he was employed from 1985 to 1996. During his tenure there, he actively participated in creating, and ultimately led, the firm’s midwestern mutual fund practice.

| Item 4. | Principal Accountant Fees and Services. |

The following tables show the amount of fees that KPMG LLP, the Funds’ auditor, billed to the Funds during the Funds’ last two full fiscal years. The Audit Committee approved in advance all audit services and non-audit services that KPMG LLP provided to the Funds, except for those non-audit services that were subject to the pre-approval exception under Rule 2-01 of Regulation S-X (the “pre-approval exception”). The pre-approval exception for services provided directly to the Funds waives the pre-approval requirement for services other than audit, review or attest services if: (A) the aggregate amount of all such services provided constitutes no more than 5% of the total amount of revenues paid by the Funds during the fiscal year in which the services are provided; (B) the Funds did not recognize the services as non-audit services at the time of the engagement; and (C) the services are promptly brought to the Audit Committee’s attention, and the Committee (or its delegate) approves the services before the audit is completed.

The Audit Committee has delegated certain pre-approval responsibilities to its Chair (or, in his absence, any other member of the Audit Committee).

| | | | | | | | | | | | | | | | |

| Fiscal Year Ended July 31, 2024 | | Audit Fees

Billed to Funds1 | | | Audit-Related Fees

Billed to Funds2 | | | Tax Fees

Billed to Funds3 | | | All Other Fees

Billed to Funds4 | |

| Nuveen Enhanced Yield U.S. Aggregate Bond ETF | | | $20,000 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen ESG U.S. Aggregate Bond ETF | | | $20,000 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen ESG High Yield Corporate Bond ETF | | | $22,800 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF | | | $20,000 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Global Net Zero Transition ETF | | | $22,800 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Core Plus Bond ETF5 | | | $20,000 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Preferred and Income ETF5 | | | $22,800 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Sustainable Core ETF5 | | | $17,100 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Ultra Short Income ETF5 | | | $20,000 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Total | | | $185,500 | | | | $0 | | | | $0 | | | | $0 | |

| 1 | “Audit Fees” are the aggregate fees billed for professional services for the audit of the Fund’s annual financial statements and services provided in connection with statutory and regulatory filings or engagements. |

| 2 | “Audit-Related Fees” are the aggregate fees billed for assurance and related services reasonably related to the performance of the audit or review of financial statements that are not reported under “Audit Fees”. These fees include offerings related to the Fund’s common shares and leverage. |

| 3 | “Tax Fees” are the aggregate fees billed for professional services for tax advice, tax compliance, and tax planning. These fees include: all global withholding tax services; excise and state tax reviews; capital gain, tax equalization and taxable basis calculations performed by the principal accountant. |

| 4 | “All Other Fees” are the aggregate fees billed for products and services other than “Audit Fees”, “Audit-Related Fees” and “Tax Fees”. These fees represent all “Agreed-Upon Procedures” engagements pertaining to the Fund’s use of leverage. |

| 5 | Funds commenced operations on 3/5/2024. |

| | | | | | | | | | | | | | | | |

| Fiscal Year Ended July 31, 2024 | | Percentage Approved Pursuant to Pre-approval Exception | |

| | Audit Fees

Billed to Funds | | | Audit-Related Fees

Billed to Funds | | | Tax Fees

Billed to Funds | | | All Other Fees

Billed to Funds | |

| Nuveen Enhanced Yield U.S. Aggregate Bond ETF | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

| | | Percentage Approved Pursuant to Pre-approval Exception | |

| Fiscal Year Ended July 31, 2024 | | Audit Fees Billed to Funds | | | Audit-Related Fees Billed to Funds | | | Tax Fees Billed to Funds | | | All Other Fees Billed to Funds | |

Nuveen ESG U.S. Aggregate Bond ETF | | | 0% | | | | 0% | | | | 0% | | | | 0% | |

| | | | | | | | | | | | | | | | |

Nuveen ESG High Yield Corporate Bond ETF | | | 0% | | | | 0% | | | | 0% | | | | 0% | |

| | | | | | | | | | | | | | | | |

Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF | | | 0% | | | | 0% | | | | 0% | | | | 0% | |

| | | | | | | | | | | | | | | | |

Nuveen Global Net Zero Transition ETF | | | 0% | | | | 0% | | | | 0% | | | | 0% | |

| | | | | | | | | | | | | | | | |

Nuveen Core Plus Bond ETF | | | 0% | | | | 0% | | | | 0% | | | | 0% | |

| | | | | | | | | | | | | | | | |

Nuveen Preferred and Income ETF | | | 0% | | | | 0% | | | | 0% | | | | 0% | |

| | | | | | | | | | | | | | | | |

Nuveen Sustainable Core ETF | | | 0% | | | | 0% | | | | 0% | | | | 0% | |

| | | | | | | | | | | | | | | | |

Nuveen Ultra Short Income ETF | | | 0% | | | | 0% | | | | 0% | | | | 0% | |

| | | | |

| Fiscal Year Ended July 31, 2023 | | Audit Fees Billed to Funds1 | | | Audit-Related Fees Billed to Funds2 | | | Tax Fees Billed to Funds3 | | | All Other Fees Billed to Funds4 | |

Nuveen Enhanced Yield U.S. Aggregate Bond ETF | | | $21,000 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Nuveen ESG U.S. Aggregate Bond ETF | | | $21,000 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Nuveen ESG High Yield Corporate Bond ETF | | | $24,000 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF | | | $21,000 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Nuveen Global Net Zero Transition ETF | | | $24,000 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Total | | | $111,000 | | | | $0 | | | | $0 | | | | $0 | |

| 1 | “Audit Fees” are the aggregate fees billed for professional services for the audit of the Fund’s annual financial statements and services provided in connection with statutory and regulatory filings or engagements. |

| 2 | “Audit-Related Fees” are the aggregate fees billed for assurance and related services reasonably related to the performance of the audit or review of financial statements that are not reported under “Audit Fees”. These fees include offerings related to the Fund’s common shares and leverage. |

| 3 | “Tax Fees” are the aggregate fees billed for professional services for tax advice, tax compliance, and tax planning. These fees include: all global withholding tax services; excise and state tax reviews; capital gain, tax equalization and taxable basis calculations performed by the principal accountant. |

| 4 | “All Other Fees” are the aggregate fees billed for products and services other than “Audit Fees”, “Audit-Related Fees” and “Tax Fees”. These fees represent all “Agreed-Upon Procedures” engagements pertaining to the Fund’s use of leverage. |

| | | | | | | | | | | | | | | | |

| | | Percentage Approved Pursuant to Pre-approval Exception | |

| Fiscal Year Ended July 31, 2023 | | Audit Fees Billed to Funds | | | Audit-Related Fees Billed to Funds | | | Tax Fees Billed to Funds | | | All Other Fees Billed to Funds | |

Nuveen Enhanced Yield U.S. Aggregate Bond ETF | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

Nuveen ESG U.S. Aggregate Bond ETF | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

Nuveen ESG High Yield Corporate Bond ETF | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

| | | Percentage Approved Pursuant to Pre-approval Exception | |

| Fiscal Year Ended July 31, 2023 | | Audit Fees Billed to Funds | | | Audit-Related Fees Billed to Funds | | | Tax Fees Billed to Funds | | | All Other Fees Billed to Funds | |

| Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

| Nuveen Global Net Zero Transition ETF | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | |

| Fiscal Year Ended July 31, 2024 | | Audit-Related Fees

Billed to Adviser

and Affiliated Fund

Service Providers | | | Tax Fees

Billed to Adviser

and Affiliated Fund

Service Providers | | | All Other Fees

Billed to Adviser

and Affiliated Fund

Service Providers | |

Nushares ETF Trust | | | $0 | | | | $0 | | | | $0 | |

| |

| | | Percentage Approved Pursuant to Pre-approval Exception | |

| | Audit-Related Fees

Billed to Adviser

and Affiliated Fund

Service Providers | | | Tax Fees

Billed to Adviser

and Affiliated Fund

Service Providers | | | All Other Fees

Billed to Adviser

and Affiliated Fund

Service Providers | |

| | | 0 | % | | | 0 | % | | | 0 | % |

| | | |

| Fiscal Year Ended July 31, 2023 | | Audit-Related Fees

Billed to Adviser

and Affiliated Fund

Service Providers | | | Tax Fees

Billed to Adviser

and Affiliated Fund

Service Providers | | | All Other Fees

Billed to Adviser

and Affiliated Fund

Service Providers | |

Nushares ETF Trust | | | $0 | | | | $0 | | | | $0 | |

| |

| | | Percentage Approved Pursuant to Pre-approval Exception | |

| | Audit-Related Fees

Billed to Adviser

and Affiliated Fund

Service Providers | | | Tax Fees Billed to Adviser

and Affiliated Fund

Service Providers | | | All Other Fees

Billed to Adviser

and Affiliated Fund

Service Providers | |

| | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

| Fiscal Year Ended July 31, 2024 | | Total Non-Audit Fees

Billed to Fund | | | Total Non-Audit Fees

Billed to Adviser and

Affiliated Fund Service

Providers (engagements

related directly to the

operations and financial

reporting of the Trust) | | | Total Non-Audit Fees

Billed to Adviser and

Affiliated Fund Service

Providers (all other

engagements) | | | Total | |

| Nuveen Enhanced Yield U.S. Aggregate Bond ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen ESG U.S. Aggregate Bond ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen ESG High Yield Corporate Bond ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Global Net Zero Transition ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Core Plus Bond ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Preferred and Income ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Sustainable Core ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Fiscal Year Ended July 31, 2024 | | Total Non-Audit Fees

Billed to Fund | | | Total Non-Audit Fees

Billed to Adviser and

Affiliated Fund Service

Providers (engagements

related directly to the

operations and financial

reporting of the Trust) | | | Total Non-Audit Fees

Billed to Adviser and

Affiliated Fund Service

Providers (all other

engagements) | | | Total | |

| | | | | | | | | | | | | | | | |

| Nuveen Ultra Short Income ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Total | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

“Non-Audit Fees billed to Fund” for both fiscal year ends represent “Tax Fees” and “All Other Fees” billed to Fund in their respective amounts from the previous table.

Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

| | | | | | | | | | | | | | | | |

| Fiscal Year Ended July 31, 2023 | | Total Non-Audit Fees

Billed to Fund | | | Total Non-Audit Fees Billed to Adviser and

Affiliated Fund Service

Providers (engagements

related directly to the

operations and financial

reporting of the Trust) | | | Total Non-Audit Fees

Billed to Adviser and

Affiliated Fund Service

Providers (all other

engagements) | | | Total | |

| Nuveen Enhanced Yield U.S. Aggregate Bond ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen ESG U.S. Aggregate Bond ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen ESG High Yield Corporate Bond ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Global Net Zero Transition ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Total | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

“Non-Audit Fees billed to Fund” for both fiscal year ends represent “Tax Fees” and “All Other Fees” billed to Fund in their respective amounts from the previous table.

Audit Committee Pre-Approval Policies and Procedures. Generally, the Audit Committee must approve (i) all non-audit services to be performed for the Funds by the Funds’ independent accountant and (ii) all audit and non-audit services to be performed by the Funds’ independent accountant for the Affiliated Fund Service Providers with respect to the operations and financial reporting of the Funds. Regarding tax and research projects conducted by the independent accountant for the Funds and Affiliated Fund Service Providers (with respect to operations and financial reports of the Trust), such engagements will be (i) pre-approved by the Audit Committee if they are expected to be for amounts greater than $10,000; (ii) reported to the Audit Committee Chair for his verbal approval prior to engagement if they are expected to be for amounts under $10,000 but greater than $5,000; and (iii) reported to the Audit Committee at the next Audit Committee meeting if they are expected to be for an amount under $5,000.

Item 4(i) and Item 4(j) are not applicable to the registrant.

| Item 5. | Audit Committee of Listed Registrants. |

The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934 (the “Exchange Act”). The registrant’s Board has a separately designated Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (15 U.S.C. 78c(a)(58)(A)). The members of the audit committee are Joseph A. Boateng, Albin F. Moschner, John K. Nelson, Chair, Loren M. Starr, Margaret L. Wolff and Robert L. Young.

| (a) | Schedule of Investments is included as part of the financial statements filed under Item 7 of this Form N-CSR. |

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Report

of

Independent

Registered

Public

Accounting

Firm

To

the

Shareholders

and

Board

of

Trustees

Nushares

ETF

Trust:

Opinion

on

the

Financial

Statements

We

have

audited

the

accompanying

statements

of

assets

and

liabilities

of

the

funds

listed

in

Appendix

A

(nine

of

the

funds

comprising

Nushares

ETF

Trust)

(the

Funds),

including

the

portfolios

of

investments,

as

of

July 31, 2024,

the

related

statements

of

operations

and

changes

in

net

assets

for

the

Funds

and

periods

listed

in

Appendix

A,

and

the

related

notes

(collectively,

the

financial

statements)

and

the

financial

highlights

for

the

Funds

and

periods

listed

in

Appendix

A.

In

our

opinion,

the

financial

statements

and

financial

highlights

present

fairly,

in

all

material

respects,

the

financial

position

of

the

Funds

as

of

July 31, 2024,

the

results

of

their

operations

and

changes

in

their

net

assets

for

the

Funds

and

periods

listed

in

Appendix

A,

and

the

financial

highlights

for

the

Funds

and

periods

listed

in

Appendix

A,

in

conformity

with

U.S. generally

accepted

accounting

principles.

Basis

for

Opinion

These

financial

statements

and

financial

highlights

are

the

responsibility

of

the

Funds'

management.

Our

responsibility

is

to

express

an

opinion

on

these

financial

statements

and

financial

highlights

based

on

our

audits.

We

are

a

public

accounting

firm

registered

with

the

Public

Company

Accounting

Oversight

Board

(United

States)

(PCAOB)

and

are

required

to

be

independent

with

respect

to

the

Funds

in

accordance

with

the

U.S.

federal

securities

laws

and

the

applicable

rules

and

regulations

of

the

Securities

and

Exchange

Commission

and

the

PCAOB.

We

conducted

our

audits

in

accordance

with

the

standards

of

the

PCAOB.

Those

standards

require

that

we

plan

and

perform

the

audit

to

obtain

reasonable

assurance

about

whether

the

financial

statements

and

financial

highlights

are

free

of

material

misstatement,

whether

due

to

error

or

fraud.

Our

audits

included

performing

procedures

to

assess

the

risks

of

material

misstatement

of

the

financial

statements

and

financial

highlights,

whether

due

to

error

or

fraud,

and

performing

procedures

that

respond

to

those

risks.

Such

procedures

included

examining,

on

a

test

basis,

evidence

regarding

the

amounts

and

disclosures

in

the

financial

statements

and

financial

highlights.

Such

procedures

also

included

confirmation

of

securities

owned

as

of

July 31, 2024,

by

correspondence

with

custodians

and

brokers;

when

replies

were

not

received

from

brokers,

we

performed

other

auditing

procedures.

Our

audits

also

included

evaluating

the

accounting

principles

used

and

significant

estimates

made

by

management,

as

well

as

evaluating

the

overall

presentation

of

the

financial

statements

and

financial

highlights.

We

believe

that

our

audits

provide

a

reasonable

basis

for

our

opinion.

Emphasis

of

Matter

As

discussed

in

note

9

to

the

financial

statements,

the

Board

of

Trustees

approved

the

liquidation

of

Nuveen

Global

Net

Zero

Transition

ETF,

effective

October

22,

2024.

Our

opinion

is

not

modified

with

respect

to

this

matter.

/s/

KPMG

LLP

We

have

served

as

the

auditor

of

one

or

more

Nuveen

investment

companies

since

2014.

Chicago,

Illinois

September

27,

2024

Report

of

Independent

Registered

Public

Accounting

Firm

(continued)

Appendix

A

Funds

and

Periods:

For

the

year

ended

July

31,

2024

(statements

of

operations);

each

of

the

years

in

the

two-year

period

ended

July

31,

2024

(statements

of

changes

in

net

assets);

each

of

the

years

in

the

five-year

period

ended

July

31,

2024

(financial

highlights):

Nuveen

Enhanced

Yield

U.S.

Aggregate

Bond

ETF

(NUAG)

Nuveen

ESG

1-5

Year

U.S.

Aggregate

Bond

ETF

(NUSA)

Nuveen

ESG

U.S.

Aggregate

Bond

ETF

(NUBD)

For

the

year

ended

July

31,

2024

(statements

of

operations);

each

of

the

years

in

the

two-year

period

ended

July

31,

2024

(statements

of

changes

in

net

assets);

each

of

the

years

in

the

four-year

period

ended

July

31,

2024

and

the

period

September

25,

2019

(commencement

of

operations)

through

July

31,

2020

(financial

highlights):

Nuveen

ESG

High

Yield

Corporate

Bond

ETF

(NUHY)

For

the

year

ended

July

31,

2024

(statements

of

operations);

each

of

the

years

in

the

two-

year

period

ended

July

31,

2024

(statements

of

changes

in

net

assets);

each

of

the

years

in

the

two-year

period

ended

July

31,

2024

and

the

period

June

23,

2022

(commencement

of

operations)

through

July

31,

2022

(financial

highlights):

Nuveen

Global

Net

Zero

Transition

ETF

(NTZG)

For

the

period

March

5,

2024

(commencement

of

operations)

through

July

31,

2024

(statements

of

operations,

change

in

net

assets

and

the

financial

highlights):

Nuveen

Core

Plus

Bond

ETF

(NCPB)

Nuveen

Preferred

and

Income

ETF

(NPFI)

Nuveen

Sustainable

Core

ETF

(NSCR)

Nuveen

Ultra

Short

Income

ETF

(NUSB)

Nuveen

Core

Plus

Bond

ETF

(NCPB)

Portfolio

of

Investments

July

31,

2024

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

LONG-TERM

INVESTMENTS

-

98.5%

X

–

SECURITIZED

-

37.6%

$

250

(b)

Avis

Budget

Rental

Car

Funding

AESOP

LLC

2023

2A

6.180%

10/20/27

$

250,227

250

BANK5

2024-5YR7

2024

5YR7

5.769%

6/15/57

257,906

250

(b)

BBCMS

Trust

2015-SRCH

2015

SRCH

4.957%

8/10/35

214,555

150

(b)

BBCMS

Trust

2018-CBM

2018

CBM

6.626%

7/15/37

148,309

200

Benchmark

2018-B2

Mortgage

Trust

2018

B2

4.284%

2/15/51

169,534

120

(b)

BX

TRUST

2022

PSB

7.780%

8/15/39

119,922

150

(b)

BX

Trust

2023-DELC

2023

DELC

8.668%

5/15/38

150,863

250

COMM

2015-CCRE26

Mortgage

Trust

2015

CR26

3.630%

10/10/48

243,831

25

(b)

Connecticut

Avenue

Securities

Trust

2022-R03

2022

R03

8.847%

3/25/42

26,355

300

(b)

Connecticut

Avenue

Securities

Trust

2023-R04

2023

R04

8.898%

5/25/43

321,982

185

(b)

Connecticut

Avenue

Securities

Trust

2023-R05

2023

R05

10.098%

6/25/43

200,877

150

(b)

DBSG

2024-ALTA

Mortgage

Trust

2024

ALTA

6.595%

6/10/37

152,009

387

Fannie

Mae

Pool

FN

FS1533

3.000%

4/01/52

340,947

90

Fannie

Mae

Pool

FN

FS7299

3.000%

5/01/52

79,409

229

Fannie

Mae

Pool

FN

MA4624

3.000%

6/01/52

200,203

59

Fannie

Mae

Pool

FN

MA4653

3.000%

7/01/52

51,456

55

Fannie

Mae

Pool

FN

MA4699

2022

1

3.500%

7/01/52

49,710

754

Fannie

Mae

Pool

FN

MA4700

2022

1

4.000%

7/01/52

706,939

775

Fannie

Mae

Pool

FN

MA4731

2022

1

3.500%

9/01/52

702,819

576

Fannie

Mae

Pool

FN

MA4733

4.500%

9/01/52

555,401

639

Fannie

Mae

Pool

FN

MA4784

4.500%

10/01/52

615,674

297

Fannie

Mae

Pool

FN

MA4785

5.000%

10/01/52

292,992

574

Fannie

Mae

Pool

FN

MA4805

2022

1

4.500%

11/01/52

553,575

914

Fannie

Mae

Pool

FN

MA4962

4.000%

3/01/53

856,755

872

Fannie

Mae

Pool

FN

MA4978