UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-23161 |

Nushares ETF Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Diana R. Gonzalez

Vice President and Secretary

8500 Andrew Carnegie Boulevard

Charlotte, North Carolina 28262

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917‑7700

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

| Item 1. | Reports to Stockholders. |

| | |

| |

Annual Shareholder Report

December 31, 2024 |

Nuveen Short-Term REIT ETF

NURE/Cboe BZX Exchange, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about the Nuveen Short-Term REIT ETF for the period of January 1, 2024 to December 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment* |

| | | |

| Nuveen Short-Term REIT ETF | | $36 | | 0.35% |

* Annualized for period less than one year.

How did the Fund perform last year? What affected the Fund’s performance?

|

|

Performance Highlights • The Nuveen Short-Term REIT ETF (NURE)’s total return at net asset value (NAV) was 6.83% for the 12 months ended December 31, 2024. The Fund’s custom index, the Dow Jones U.S. Select Short-Term REIT Index (DJUSSTRT), returned 7.2%. • The difference between the Fund’s total return at NAV and that of the custom index is attributable to management fees and other expenses incurred by the Fund that are not incurred by the custom index. • During the reporting period, the Fund’s custom index underperformed the Fund’s base index, the Dow Jones U.S. Select REIT Index (DWRTF), which returned 8.1%. • Performance drivers between the Fund’s custom index and base index during the reporting period: ○ Top contributors to the custom index’s relative performance ◾ A lack of exposure to the industrials sector. ◾ An overweight allocation to the residential sector, led by an overweight to Independence Realty Trust, Inc. and Camden Property Trust. ○ Top detractors from the custom index’s relative performance ◾ Security selection in the specialty sector, including a lack of exposure to Digital Realty Trust, Inc. and Equinix, Inc. ◾ An overweight allocation to the hotels/lodging sector, including an overweight allocation to Service Properties Trust and Host Hotels & Resorts, Inc. |

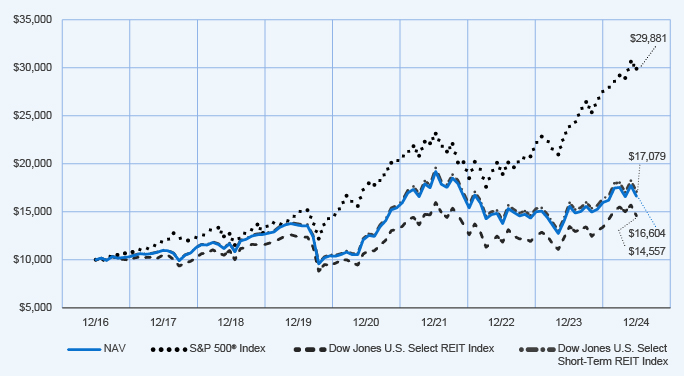

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (December 19, 2016 through December 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | |

| | | |

| | | 1‑Year | | 5‑Year | | Since Inception

(12/19/16) |

| | | | |

| NAV | | 6.83% | | 4.19% | | 6.52% |

| | | | |

S&P 500® Index | | 25.02% | | 14.53% | | 14.60% |

| | | | |

| Dow Jones U.S. Select REIT Index | | 8.10% | | 3.40% | | 4.79% |

| | | | |

| Dow Jones U.S. Select Short-Term REIT Index | | 7.20% | | 4.58% | | 6.89% |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or call (800) 257‑8787.

Return of Capital: During the current reporting period, $0.23 per share of the Fund’s distribution was re‑characterized as a return of capital resulting from subsequent re‑characterizations of cash flows received from the Fund’s investments.

Fund Statistics (as of December 31, 2024)

| | | | |

| |

| Fund net assets | | $ | 50,949,224 | |

| |

| Total number of portfolio holdings | | | 33 | |

| |

| Portfolio turnover (%) | | | 29% | |

| |

| Total management fees paid for the year | | $ | 174,969 | |

What did the Fund invest in? (as of December 31, 2024)

How has the Fund changed?

| | • | | Portfolio manager update: Effective June 18, 2024, Lei Liao retired and is no longer a portfolio manager of the Fund. Additionally, effective June 18, 2024, Nazar Romanyak, CFA and Darren Tran, CFA have been added as portfolio managers of the Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by April 30, 2025 at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses or upon request at (800) 257‑8787.

Changes in independent registered public accounting firm

On October 24, 2024, the Fund’s Board of Trustees appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund and dismissed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the Fund subject to the completion of the December 31, 2024 fiscal year audit. KPMG was informed of their dismissal on October 24, 2024. During the Fund’s fiscal years ended December 31, 2024 and December 31, 2023, and for the subsequent interim period through February 28, 2025, there have been no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/exchange‑traded‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67092P706_AR_1224 4148261-0226 | |  |

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. There were no amendments to or waivers from the code during the period covered by this report. Upon request, a copy of the registrant’s code of ethics is available without charge by calling 800-257-8787.

Item 3. | Audit Committee Financial Expert. |

As of the end of the period covered by this report, the registrant’s Board of Directors or Trustees (“Board”) had determined that the registrant has at least one “audit committee financial expert” (as defined in Item 3 of Form N-CSR) serving on its Audit Committee. The members of the registrant’s audit committee that have been designated as audit committee financial experts are Joseph A. Boateng, John K. Nelson, Loren M. Starr and Robert L. Young, who are “independent” for purposes of Item 3 of Form N-CSR.

Mr. Boateng has served as the Chief Investment Officer for Casey Family Programs since 2007. He was previously Director of U.S. Pension Plans for Johnson & Johnson from 2002-2006. Mr. Boateng is a board member of the Lumina Foundation and Waterside School, an emeritus board member of Year Up Puget Sound, member of the Investment Advisory Committee and former Chair for the Seattle City Employees’ Retirement System, and an Investment Committee Member for The Seattle Foundation. Mr. Boateng previously served on the Board of Trustees for the College Retirement Equities Fund (2018-2023) and on the Management Committee for TIAA Separate Account VA-1 (2019-2023).

Mr. Nelson formerly served on the Board of Directors of Core12, LLC from 2008 to 2023, a private firm which develops branding, marketing, and communications strategies for clients. Mr. Nelson has extensive experience in global banking and markets, having served in several senior executive positions with ABN AMRO Holdings N.V. and its affiliated entities and predecessors, including LaSalle Bank Corporation from 1996 to 2008, ultimately serving as Chief Executive Officer of ABN AMRO N.V. North America. During his tenure at the bank, he also served as Global Head of its Financial Markets Division, which encompassed the bank’s Currency, Commodity, Fixed Income, Emerging Markets, and Derivatives businesses. He was a member of the Foreign Exchange Committee of the Federal Reserve Bank of the United States and during his tenure with ABN AMRO served as the bank’s representative on various committees of The Bank of Canada, European Central Bank, and The Bank of England. Mr. Nelson previously served as a senior, external advisor to the financial services practice of Deloitte Consulting LLP. (2012-2014).

Mr. Starr was Vice Chair, Senior Managing Director from 2020 to 2021, and Chief Financial Officer, Senior Managing Director from 2005 to 2020, for Invesco Ltd. Mr. Starr is also a Director and Chair of the Audit Committee for AMG. He is former Chair and member of the Board of Directors, Georgia Leadership Institute for School Improvement (GLISI); former Chair and member of the Board of Trustees, Georgia Council on Economic Education (GCEE). Mr. Starr previously served on the Board of Trustees for the College Retirement Equities Fund and on the Management Committee for TIAA Separate Account VA-1 (2022-2023).

Mr. Young has more than 30 years of experience in the investment management industry. From 1997 to 2017, he held various positions with J.P. Morgan Investment Management Inc. (“J.P. Morgan Investment”) and its affiliates (collectively, “J.P. Morgan”). Most recently, he served as Chief Operating Officer and Director of J.P. Morgan Investment (from 2010 to 2016) and as President and Principal Executive Officer of the J.P. Morgan Funds (from 2013 to 2016). As Chief Operating Officer of J.P. Morgan Investment, Mr. Young led service, administration and business platform support activities for J.P. Morgan’s domestic retail mutual fund and institutional commingled and separate account businesses and co-led these activities for J.P. Morgan’s global retail and institutional investment management businesses. As President of the J.P. Morgan Funds, Mr. Young interacted with various service providers to these funds, facilitated the relationship between such funds and their boards, and was directly involved in establishing board agendas, addressing regulatory matters, and establishing policies and procedures. Before joining J.P. Morgan, Mr. Young, a former Certified Public Accountant (CPA), was a Senior Manager (Audit) with Deloitte & Touche LLP (formerly, Touche Ross LLP), where he was employed from 1985 to 1996. During his tenure there, he actively participated in creating, and ultimately led, the firm’s midwestern mutual fund practice.

Item 4. | Principal Accountant Fees and Services. |

The following tables show the amount of fees that KPMG LLP, the Funds’ auditor, billed to the Funds during the Funds’ last two full fiscal years. The Audit Committee approved in advance all audit services and non-audit services that KPMG LLP provided to the Funds, except for those non-audit services that were subject to the pre-approval exception under Rule 2-01 of Regulation S-X (the “pre-approval exception”). The pre-approval exception for services provided directly to the Funds waives the pre-approval requirement for services other than audit, review or attest services if: (A) the aggregate amount of all such services provided constitutes no more than 5% of the total amount of revenues paid by the Funds during the fiscal year in which the services are provided; (B) the Funds did not recognize the services as non-audit services at the time of the engagement; and (C) the services are promptly brought to the Audit Committee’s attention, and the Committee (or its delegate) approves the services before the audit is completed.

The Audit Committee has delegated certain pre-approval responsibilities to its Chair (or, in his absence, any other member of the Audit Committee).

| | | | | | | | | | | | | | | | |

Fiscal Year Ended December 31, 2024 | | Audit Fees Billed to Funds1 | | | Audit-Related Fees Billed to Funds2 | | | Tax Fees Billed to Funds3 | | | All Other Fees Billed to Funds4 | |

Nuveen Short-Term REIT ETF | | | $20,000 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total | | | $20,000 | | | | $0 | | | | $0 | | | | $0 | |

1 | “Audit Fees” are the aggregate fees billed for professional services for the audit of the Fund’s annual financial statements and services provided in connection with statutory and regulatory filings or engagements. |

2 | “Audit-Related Fees” are the aggregate fees billed for assurance and related services reasonably related to the performance of the audit or review of financial statements that are not reported under “Audit Fees”. These fees include offerings related to the Fund’s common shares and leverage. |

3 | “Tax Fees” are the aggregate fees billed for professional services for tax advice, tax compliance, and tax planning. These fees include: all global withholding tax services; excise and state tax reviews; capital gain, tax equalization and taxable basis calculations performed by the principal accountant. |

4 | “All Other Fees” are the aggregate fees billed for products and services other than “Audit Fees”, “Audit-Related Fees” and “Tax Fees”. These fees represent all “Agreed-Upon Procedures” engagements pertaining to the Fund’s use of leverage. |

| | | | | | | | | | | | | | | | |

Fiscal Year Ended December 31, 2024 | | Percentage Approved Pursuant to Pre-approval Exception | |

| | Audit Fees Billed to Funds | | | Audit-Related Fees Billed to Funds | | | Tax Fees Billed to Funds | | | All Other Fees Billed to Funds | |

Nuveen Short-Term REIT ETF | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | |

Fiscal Year Ended December 31, 2023 | | Audit Fees Billed to Funds1 | | | Audit-Related Fees Billed to Funds2 | | | Tax Fees Billed to Funds3 | | | All Other Fees Billed to Funds4 | |

Nuveen Short-Term REIT ETF | | | $21,000 | | | | $0 | | | | $0 | | | | $0 | |

Total | | | $21,000 | | | | $0 | | | | $0 | | | | $0 | |

1 | “Audit Fees” are the aggregate fees billed for professional services for the audit of the Fund’s annual financial statements and services provided in connection with statutory and regulatory filings or engagements. |

2 | “Audit-Related Fees” are the aggregate fees billed for assurance and related services reasonably related to the performance of the audit or review of financial statements that are not reported under “Audit Fees”. These fees include offerings related to the Fund’s common shares and leverage. |

3 | “Tax Fees” are the aggregate fees billed for professional services for tax advice, tax compliance, and tax planning. These fees include: all global withholding tax services; excise and state tax reviews; capital gain, tax equalization and taxable basis calculations performed by the principal accountant. |

4 | “All Other Fees” are the aggregate fees billed for products and services other than “Audit Fees”, “Audit-Related Fees” and “Tax Fees”. These fees represent all “Agreed-Upon Procedures” engagements pertaining to the Fund’s use of leverage. |

| | | | | | | | | | | | | | | | |

Fiscal Year Ended December 31, 2023 | | Percentage Approved Pursuant to Pre-approval Exception | |

| | Audit Fees Billed to Funds | | | Audit-Related Fees Billed to Funds | | | Tax Fees Billed to Funds | | | All Other Fees Billed to Funds | |

Nuveen Short-Term REIT ETF | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | |

Fiscal Year Ended December 31, 2024 | | | | | Audit-Related Fees Billed to Adviser and Affiliated Fund

Service Providers | | | Tax Fees Billed to Adviser and Affiliated Fund

Service Providers | | | All Other Fees Billed to Adviser and Affiliated Fund

Service Providers | |

Nushares ETF Trust | | | | | | | $0 | | | | $0 | | | | $0 | |

| | |

| | | | | | Percentage Approved Pursuant to Pre-approval Exception | |

| | Audit-Related Fees Billed to Adviser and Affiliated Fund

Service Providers | | | Tax Fees Billed to Adviser and Affiliated Fund

Service Providers | | | All Other Fees Billed to Adviser and Affiliated Fund

Service Providers | |

| | | | | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | |

Fiscal Year Ended December 31, 2023 | | | | | Audit-Related Fees Billed to Adviser and Affiliated Fund

Service Providers | | | Tax Fees Billed to Adviser and Affiliated Fund

Service Providers | | | All Other Fees Billed to Adviser and Affiliated Fund

Service Providers | |

Nushares ETF Trust | | | | | | | $0 | | | | $0 | | | | $0 | |

| | |

| | | | | | Percentage Approved Pursuant to Pre-approval Exception | |

| | Audit-Related Fees Billed to Adviser and Affiliated Fund

Service Providers | | | Tax Fees Billed to Adviser and Affiliated Fund

Service Providers | | | All Other Fees Billed to Adviser and Affiliated Fund

Service Providers | |

| | | | | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | |

Fiscal Year Ended December 31, 2024 | | Total Non-Audit Fees

Billed to Fund | | | Total Non-Audit Fees

Billed to Adviser and

Affiliated Fund Service

Providers (engagements

related directly to the

operations and

financial reporting of

the Trust) | | | Total Non-Audit Fees

Billed to Adviser and

Affiliated Fund Service

Providers (all other

engagements) | | | Total | |

Nuveen Short-Term REIT ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

Total | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

“Non-Audit Fees billed to Fund” for both fiscal year ends represent “Tax Fees” and “All Other Fees” billed to Fund in their respective amounts from the previous table.

Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

| | | | | | | | | | | | | | | | |

Fiscal Year Ended December 31, 2023 | | Total Non-Audit Fees

Billed to Fund | | | Total Non-Audit Fees

Billed to Adviser and

Affiliated Fund Service

Providers (engagements

related directly to the

operations and financial

reporting of the Trust) | | | Total Non-Audit Fees

Billed to Adviser and

Affiliated Fund Service

Providers (all other

engagements) | | | Total | |

Nuveen Short-Term REIT ETF | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Fiscal Year Ended December 31, 2023 | | Total Non-Audit Fees

Billed to Fund | | | Total Non-Audit Fees

Billed to Adviser and

Affiliated Fund Service

Providers (engagements

related directly to the

operations and financial

reporting of the Trust) | | | Total Non-Audit Fees

Billed to Adviser and

Affiliated Fund Service

Providers (all other

engagements) | | | Total | |

Total | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

“Non-Audit Fees billed to Fund” for both fiscal year ends represent “Tax Fees” and “All Other Fees” billed to Fund in their respective amounts from the previous table.

Audit Committee Pre-Approval Policies and Procedures. Generally, the Audit Committee must approve (i) all non-audit services to be performed for the Funds by the Funds’ independent accountant and (ii) all audit and non-audit services to be performed by the Funds’ independent accountant for the Affiliated Fund Service Providers with respect to the operations and financial reporting of the Funds. Regarding tax and research projects conducted by the independent accountant for the Funds and Affiliated Fund Service Providers (with respect to operations and financial reports of the Trust), such engagements will be (i) pre-approved by the Audit Committee if they are expected to be for amounts greater than $10,000; (ii) reported to the Audit Committee Chair for his verbal approval prior to engagement if they are expected to be for amounts under $10,000 but greater than $5,000; and (iii) reported to the Audit Committee at the next Audit Committee meeting if they are expected to be for an amount under $5,000.

Item 4(i) and Item 4(j) are not applicable to the registrant.

Item 5. | Audit Committee of Listed Registrants. |

The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934 (the “Exchange Act”). The registrant’s Board has a separately designated Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (15 U.S.C. 78c(a)(58)(A)). The members of the audit committee are Joseph A. Boateng, Amy B. R. Lancellotta, John K. Nelson, Chair, Loren M. Starr, Matthew Thornton III, Margaret L. Wolff and Robert L. Young.

(a) | Schedule of Investments is included as part of the financial statements filed under Item 7 of this Form N-CSR. |

Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Item

7.

Financial

Statements

and

Financial

Highlights

for

Open-End

Management

Investment

Companies

Report

of

Independent

Registered

Public

Accounting

Firm

To

the

Shareholders

and

Board

of

Trustees

Nushares

ETF

Trust:

Opinion

on

the

Financial

Statements

We

have

audited

the

accompanying

statement

of

assets

and

liabilities

of

Nuveen

Short-Term

REIT

ETF

(one

of

the

funds

comprising

Nushares

ETF

Trust)

(the

Fund),

including

the

portfolio

of

investments,

as

of

December

31,

2024,

the

related

statement

of

operations

for

the

year

then

ended,

the

statement

of

changes

in

net

assets

for

each

of

the

years

in

the

two-year

period

then

ended,

and

the

related

notes

(collectively,

the

financial

statements)

and

the

financial

highlights

for

each

of

the

years

in

the

five-year

period

then

ended.

In

our

opinion,

the

financial

statements

and

financial

highlights

present

fairly,

in

all

material

respects,

the

financial

position

of

the

Fund

as

of

December

31,

2024,

the

results

of

its

operations

for

the

year

then

ended,

the

changes

in

its

net

assets

for

each

of

the

years

in

the

two-year

period

then

ended,

and

the

financial

highlights

for

each

of

the

years

in

the

five-year

period

then

ended,

in

conformity

with

U.S.

generally

accepted

accounting

principles.

Basis

for

Opinion

These

financial

statements

and

financial

highlights

are

the

responsibility

of

the

Fund's

management.

Our

responsibility

is

to

express

an

opinion

on

these

financial

statements

and

financial

highlights

based

on

our

audits.

We

are

a

public

accounting

firm

registered

with

the

Public

Company

Accounting

Oversight

Board

(United

States)

(PCAOB)

and

are

required

to

be

independent

with

respect

to

the

Fund

in

accordance

with

the

U.S.

federal

securities

laws

and

the

applicable

rules

and

regulations

of

the

Securities

and

Exchange

Commission

and

the

PCAOB.

We

conducted

our

audits

in

accordance

with

the

standards

of

the

PCAOB.

Those

standards

require

that

we

plan

and

perform

the

audit

to

obtain

reasonable

assurance

about

whether

the

financial

statements

and

financial

highlights

are

free

of

material

misstatement,

whether

due

to

error

or

fraud.

Our

audits

included

performing

procedures

to

assess

the

risks

of

material

misstatement

of

the

financial

statements

and

financial

highlights,

whether

due

to

error

or

fraud,

and

performing

procedures

that

respond

to

those

risks.

Such

procedures

included

examining,

on

a

test

basis,

evidence

regarding

the

amounts

and

disclosures

in

the

financial

statements

and

financial

highlights.

Such

procedures

also

included

confirmation

of

securities

owned

as

of

December

31,

2024,

by

correspondence

with

custodians

and

brokers;

when

replies

were

not

received

from

brokers,

we

performed

other

auditing

procedures.

Our

audits

also

included

evaluating

the

accounting

principles

used

and

significant

estimates

made

by

management,

as

well

as

evaluating

the

overall

presentation

of

the

financial

statements

and

financial

highlights.

We

believe

that

our

audits

provide

a

reasonable

basis

for

our

opinion.

/s/

KPMG

LLP

We

have

served

as

the

auditor

of

one

or

more

Nuveen

investment

companies

since

2014.

Chicago,

Illinois

February

28,

2025

Portfolio

of

Investments

December

31,

2024

NURE

See

Notes

to

Financial

Statements

SHARES

DESCRIPTION

VALUE

LONG-TERM

INVESTMENTS

-

99.3%

REAL

ESTATE

INVESTMENT

TRUST

COMMON

STOCKS

-

99.3%

APARTMENTS

-

47.5%

70,304

American

Homes

4

Rent,

Class

A

$

2,630,776

51,681

(a)

Apartment

Investment

and

Management

Co,

Class

A

469,780

11,735

AvalonBay

Communities

Inc

2,581,348

22,032

Camden

Property

Trust

2,556,593

6,590

Centerspace

435,929

36,466

Equity

Residential

2,616,800

8,905

Essex

Property

Trust

Inc

2,541,843

89,502

Independence

Realty

Trust

Inc

1,775,720

79,723

Invitation

Homes

Inc

2,548,744

16,762

Mid-America

Apartment

Communities

Inc

2,590,902

8,789

NexPoint

Residential

Trust

Inc

366,941

59,895

UDR

Inc

2,600,042

32,232

Veris

Residential

Inc

536,018

TOTAL

APARTMENTS

24,251,436

DIVERSIFIED

-

2.1%

35,099

Elme

Communities

535,962

29,259

UMH

Properties

Inc

552,410

TOTAL

DIVERSIFIED

1,088,372

HOTELS

-

22.7%

88,866

Apple

Hospitality

REIT

Inc

1,364,093

19,449

Chatham

Lodging

Trust

174,069

82,549

DiamondRock

Hospitality

Co

745,417

140,199

Host

Hotels

&

Resorts

Inc

2,456,287

82,205

Park

Hotels

&

Resorts

Inc

1,156,624

47,708

Pebblebrook

Hotel

Trust

646,443

60,468

RLJ

Lodging

Trust

617,378

22,676

Ryman

Hospitality

Properties

Inc

2,366,014

66,883

Service

Properties

Trust

169,883

43,112

Summit

Hotel

Properties

Inc

295,317

80,016

Sunstone

Hotel

Investors

Inc

947,389

40,587

Xenia

Hotels

&

Resorts

Inc

603,123

TOTAL

HOTELS

11,542,037

MANUFACTURED

HOMES

-

10.4%

38,829

Equity

LifeStyle

Properties

Inc

2,586,011

21,901

Sun

Communities

Inc

2,693,166

TOTAL

MANUFACTURED

HOMES

5,279,177

SELF-STORAGE

-

16.6%

56,903

CubeSmart

2,438,294

16,637

Extra

Space

Storage

Inc

2,488,895

27,936

National

Storage

Affiliates

Trust

1,059,054

8,208

Public

Storage

2,457,804

TOTAL

SELF-STORAGE

8,444,047

TOTAL

REAL

ESTATE

INVESTMENT

TRUST

COMMON

STOCKS

(Cost

$59,112,860)

50,605,069

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$59,112,860)

50,605,069

OTHER

ASSETS

&

LIABILITIES,

NET

-

0.7%

344,155

NET

ASSETS

-

100%

$

50,949,224

REIT

Real

Estate

Investment

Trust

(a)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

Statement

of

Assets

and

Liabilities

See

Notes

to

Financial

Statements.

December

31,

2024

NURE

ASSETS

Long-term

investments,

at

value

†

$

50,605,069

Cash

134,306

Receivables:

Dividends

307,447

Other

1,087

Total

assets

51,047,909

LIABILITIES

Payables:

Management

fees

15,207

Investments

purchased

-

regular

settlement

81,528

Accrued

expenses:

Professional

fees

395

Trustees

fees

468

Other

1,087

Total

liabilities

98,685

Net

assets

$

50,949,224

Shares

outstanding

1,600,000

Net

asset

value

("NAV")

per

share

$

31

.84

NET

ASSETS

CONSIST

OF:

Paid-in

capital

71,195,015

Total

distributable

earnings

(loss)

(

20,245,791

)

Net

assets

$

50,949,224

Authorized

shares

Unlimited

Par

value

per

share

$

0

.01

†

Long-term

investments,

cost

$

59,112,860

See

Notes

to

Financial

Statements.

Year

Ended

December

31,

2024

NURE

INVESTMENT

INCOME

Dividends

$

1,553,950

Interest

838

Total

investment

income

1,554,788

EXPENSES

Management

fees

174,969

Professional

fees

453

Trustees

fees

1,809

Total

expenses

177,231

Net

investment

income

(loss)

1,377,557

REALIZED

AND

UNREALIZED

GAIN

(LOSS)

Realized

gain

(loss):

Investments

(2,581,869)

In-kind

redemptions

735,017

Net

realized

gain

(loss)

(1,846,852)

Change

in

unrealized

appreciation

(depreciation)

on:

Investments

3,736,499

Net

change

in

unrealized

appreciation

(depreciation)

3,736,499

Net

realized

and

unrealized

gain

(loss)

1,889,647

Net

increase

(decrease)

in

net

assets

from

operations

$

3,267,204

Statement

of

Changes

in

Net

Assets

See

Notes

to

Financial

Statements.

NURE

Year

Ended

12/31/24

Year

Ended

12/31/23

OPERATIONS

Net

investment

income

(loss)

$

1,377,557

$

1,380,808

Net

realized

gain

(loss)

(1,846,852)

(6,682,321)

Net

change

in

unrealized

appreciation

(depreciation)

3,736,499

12,176,565

Net

increase

(decrease)

in

net

assets

from

operations

3,267,204

6,875,052

DISTRIBUTIONS

TO

SHAREHOLDERS

Dividends

(1,377,557)

(1,380,808)

Return

of

capital

(368,008)

(640,997)

Total

distributions

(1,745,565)

(2,021,805)

FUND

SHARE

TRANSACTIONS

Subscriptions

10,904,836

13,206,910

Redemptions

(10,888,402)

(35,458,630)

Net

increase

(decrease)

from

Fund

share

transactions

16,434

(22,251,720)

Net

increase

(decrease)

in

net

assets

1,538,073

(17,398,473)

Net

assets

at

the

beginning

of

period

49,411,151

66,809,624

Net

assets

at

the

end

of

period

$

50,949,224

$

49,411,151

The

following

data

is

for

a

share outstanding

for

each

fiscal year

end

unless

otherwise

noted:

Investment

Operations

Less

Distributions

Net

Asset

Value,

Beginning

of

Period

Net

Investment

Income

(Loss)

(a)

Net

Realized

/Unrealized

Gain

(Loss)

Total

From

Net

Investment

Income

From

Net

Realized

Gains

Return

of

Capital

Total

Net

Asset

Value,

End

of

Period

Market

Price,

End

of

Period

NURE

12/31/24

$

30.88

$

0.87

$

1.21

$

2.08

$

(0.89)

$

—

$

(0.23)

$

(1.12)

$

31.84

$

31.80

12/31/23

28.43

0.75

2.85

3.60

(0.80)

—

(0.35)

(1.15)

30.88

30.88

12/31/22

40.68

0.54

(11.99)

(11.45)

(0.59)

—

(0.21)

(0.80)

28.43

28.42

12/31/21

26.98

0.46

13.79

14.25

(0.39)

—

(0.16)

(0.55)

40.68

40.74

12/31/20

30.24

0.48

(2.82)

(2.34)

(0.59)

(0.04)

(0.29)

(0.92)

26.98

26.98

(a)

Based

on

average

shares

outstanding.

(b)

Percentage

is

not

annualized.

(c)

Does

not

include

in-kind

transactions.

See

Notes

to

Financial

Statements.

Ratios

and

Supplemental

Data

Total

Return

Ratios

to

Average

Net

Assets

Based

on

Net

Asset

Value

(b)

Based

on

Market

Price

(b)

Net

Assets,

End

of

Period

(000)

Expenses

Net

Investment

Income

(Loss)

Portfolio

Turnover

Rate

(c)

6.83

%

6.69

%

$

50,949

0.35

%

2.76

%

29

%

12.99

13.03

49,411

0.36

2.56

17

(28.37)

(28.49)

66,810

0.35

1.56

18

53.19

53.42

117,978

0.35

1.31

11

(7.29)

(7.27)

24,283

0.35

1.95

29

Notes

to

Financial

Statements

1.

General

Information

Trust

and

Fund

Information:

Nushares

ETF

Trust

(the

Trust)

is

an

open-end

management

investment

company

registered

under

the

Investment

Company

Act

of

1940,

as

amended

(the

“1940

Act”).

The

Trust

is

comprised

of

Nuveen

Short-Term

REIT

ETF

(NURE)

(the

“Fund”),

among

others.

The

Trust

was

organized

as

a

Massachusetts

business

trust

on

February

20,

2015.

Shares

of

the

Fund

are

listed

and

traded

on

the

Cboe

BZX

Exchange,

Inc.

(the

“Exchange“).

Current

Fiscal

Period:

The

end

of

the

reporting

period

for

the

Fund

is

December

31,

2024,

and

the

period

covered

by

these

Notes

to

Financial

Statements

is

the

fiscal

year

ended

December

31,

2024

(the

"current

fiscal

period").

Investment

Adviser

and

Sub-Adviser:

The

Fund’s

investment

adviser

is

Nuveen

Fund

Advisors,

LLC

(the

“Adviser”),

a

subsidiary

of

Nuveen,

LLC

(“Nuveen”).

Nuveen

is

the

investment

management

arm

of

Teachers

Insurance

and

Annuity

Association

of

America

(“TIAA”).

The

Adviser

has

overall

responsibility

for

management

of

the

Funds,

oversees

the

management

of

the

Fund’s

portfolios,

manages

the

Fund’s

business

affairs

and

provides

certain

clerical,

bookkeeping

and

other

administrative

services.

The

Adviser

has

entered

into

sub-advisory

agreements

with

Teachers

Advisors,

LLC

(the

“Sub-Adviser”),

an

affiliate

of

the

Adviser,

under

which

the

Sub-Adviser

manages

the

investment

portfolio

of

the

Fund.

2.

Significant

Accounting

Policies

The

accompanying

financial

statements

were

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(“U.S.

GAAP”),

which

may

require

the

use

of

estimates

made

by

management

and

the

evaluation

of

subsequent

events.

Actual

results

may

differ

from

those

estimates. The

Fund

is

an

investment

company

and

follows

accounting

guidance

in

the

Financial

Accounting

Standards

Board

(“FASB”)

Accounting

Standards

Codification

946,

Financial

Services

—

Investment

Companies.

The

Net

Asset

Value

("NAV")

for

financial

reporting

purposes

may

differ

from

the

NAV

for

processing

security

and

creation

unit

transactions.

The

NAV

for

financial

reporting

purposes

includes

security

and

creation

unit

transactions

through

the

date

of

the

report.

Total

return

is

computed

based

on

the

NAV

used

for

processing

security

and creation

unit transactions.

The

following

is

a

summary

of

the

significant

accounting

policies

consistently

followed

by

the

Fund.

Compensation:

The Trust

pays

no compensation

directly

to

those

of

its officers,

all

of

whom

receive

remuneration

for

their

services

to the

Trust

from

the

Adviser

or

its

affiliates.

The

Fund's

Board

of Trustees

(the

"Board")

has

adopted

a

deferred

compensation

plan

for

independent

trustees

that

enables

trustees

to

elect

to

defer

receipt

of

all

or

a

portion

of

the

annual

compensation

they

are

entitled

to

receive

from

certain

Nuveen-advised

funds.

Under

the

plan,

deferred

amounts

are

treated

as

though

equal

dollar

amounts

had

been

invested

in

shares

of

select

Nuveen-advised

funds.

Distributions

to

Shareholders:

Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date.

The

amount,

character

and

timing

of

distributions

are

determined

in

accordance

with

federal

income

tax

regulations,

which

may

differ

from

U.S.

GAAP.

The

tax

character

of

Fund

distributions

for

a

fiscal

year

is

dependent

upon

the

amount

and

tax

character

of

distributions

received

from

securities

held

in

the

Fund’s

portfolio.

Distributions

received

from

certain

securities

in

which

the

Fund

invests,

most

notably

real

estate

investment

trust

(REIT)

securities,

may

be

characterized

for

tax

purposes

as

ordinary

income,

long-term

capital

gain

and/or

a

return

of

capital.

The

issuer

of

a

security

reports

the

tax

character

of

its

distributions

only

once

per

year,

generally

during

the

first

two

months

of

the

calendar

year

for

the

previous

year.

The

distribution

is

included

in

the

Fund’s

ordinary

income

until

such

time

the

Fund

is

notified

by

the

issuer

of

the

actual

tax

character.

Dividend

income,

net

realized

gains,

(loss)

and

unrealized

appreciation

(depreciation)

recognized

on

the

Statement

of

Operations

reflect

the

amounts

of

income,

capital

gain,

and/or

return

of

capital

as

reported

by

the

issuers

of

such

securities

for

distributions

during

the

current

fiscal

period.

Indemnifications:

Under

the

Trust’s

organizational

documents,

its

officers

and

trustees

are

indemnified

against

certain

liabilities

arising

out

of

the

performance

of

their

duties

to

the

Trust.

In

addition,

in

the

normal

course

of

business,

the

Trust

enters

into

contracts

that

provide

general

indemnifications

to

other

parties.

The

Trust’s

maximum

exposure

under

these

arrangements

is

unknown

as

this

would

involve

future

claims

that

may

be

made

against

the

Trust

that

have

not

yet

occurred.

However,

the

Trust

has

not

had

prior

claims

or

losses

pursuant

to

these

contracts

and

expects

the

risk

of

loss

to

be

remote.

Investments

and

Investment

Income:

Securities

transactions

are

accounted

for

as

of

the

end

of

trade

date

for

financial

reporting

purposes.

Realized

gains

and

losses

on

securities

transactions

are

based

upon

the

specific

identification

method.

Dividend

income

is

recorded

on

the

ex-dividend

date.

Non-cash

dividends

received

in

the

form

of

stock,

if

any,

are

recognized

on

the

ex-dividend

date

and

recorded

at

fair

value.

Securities

lending

income

i

s

comprised

of

fees

earned

from

borrowers

and

income

earned

on

cash

collateral

investments.

Segment

Reporting:

In

November

2023,

the

FASB

issued

Accounting

Standard

Update

(“ASU”)

No.

2023-07,

Segment

Reporting

(Topic

280)

Improvements

to

Reportable

Segment

Disclosures

(“ASU

2023-07”).

The

amendments

in

ASU

2023-07

improve

reportable

segment

disclosure

requirements,

primarily

through

enhanced

disclosures

about

significant

segment

expenses.

ASU

2023-07

also

requires

a

public

entity

that

has

a

single

reportable

segment

to

provide

all

the

disclosures

required

by

the

amendments

in

ASU

2023-07

and

all

existing

segment

disclosures

in

Topic

280.

The

amendments

in

ASU

2023-07

are

effective

for

fiscal

years

beginning

after

December

15,

2023,

and

interim

periods

within

fiscal

years

beginning

after

December

15,

2024.

The

Fund

adopted

ASU

2023-07

during

the

current

reporting

period.

Adoption

of

the

new

standard

impacted

financial

statement

disclosures

only

and

did

not

affect

the

Fund's

financial

positions

or

the

results

of

their

operations.

The

officers

of

the

Fund

act

as

the

chief

operating

decision

maker

(“CODM”). The

Fund

represents

a

single

operating

segment.

The

CODM

monitors

the

operating

results

of the

Fund

as

a

whole

and

is

responsible

for

the Fund’s

long-term

strategic

asset

allocation

in

accordance

with

the

terms

of

its

prospectus,

based

on

a

defined

investment

strategy

which

is

executed

by

the

Fund’s

portfolio

managers

as

a

team.

The

financial

information

in

the

form

of

the

Fund’s

portfolio

composition,

total

returns,

expense

ratios

and

changes

in

net

assets

(i.e.,

changes

in

net

assets

resulting

from

operations,

subscriptions

and

redemptions),

which

are

used

by

the

CODM

to

assess

the

segment’s

performance

versus

the

Fund’s

comparative

benchmarks

Notes

to

Financial

Statements

(continued)

Real

Estate

Investment

Trust

Common

Stocks

and

to

make

resource

allocation

decisions

for

the

Fund’s

single

segment,

is

consistent

with

that

presented

within

the

Fund’s

financial

statements.

Segment

assets

are

reflected

on

the

Statement

of

Assets

and

Liabilities

as

“total

assets”

and

significant

segment

revenues

and

expenses

are

listed

on

the

Statement

of

Operations.

3.

Investment

Valuation

and

Fair

Value

Measurements

The

Fund's

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Adviser,

subject

to

oversight

of

the Board.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

A

description

of

the

valuation

techniques

applied

to

the

Fund's

major

classifications

of

assets

and

liabilities

measured

at

fair

value

follows:

Equity

securities

and

exchange-traded

funds

listed

or

traded

on

a

national

market

or

exchange

are

valued

based

on

their

last

reported

sales

price

or

official

closing

price

of

such

market

or

exchange

on

the

valuation

date.

Foreign

equity

securities

and

registered

investment

companies

that

trade

on

a

foreign

exchange

are

valued

at

the

last

reported

sales

price

or

official

closing

price

on

the

principal

exchange

where

traded,

and

converted

to

U.S.

dollars

at

the

prevailing

rates

of

exchange

on

the

valuation

date.

To

the

extent

these

securities

are

actively

traded

and

no

valuation

adjustments

are

applied,

they

are

generally

classified

as

Level

1.

When

valuation

adjustments

are

applied

to

the

most

recent

last

sales

price

or

official

closing

price,

these

securities

are

generally

classified

as

Level

2.

For

any

portfolio

security

or

derivative

for

which

market

quotations

are

not

readily

available

or

for

which

the

Adviser

deems

the

valuations

derived

using

the

valuation

procedures

described

above

not

to

reflect

fair

value,

the

Adviser

will

determine

a

fair

value

in

good

faith

using

alternative

procedures

approved

by

the

Adviser,

subject

to

the

oversight

of

the

Board.

As

a

general

principle,

the

fair

value

of

a

security

is

the

amount

that

the

owner

might

reasonably

expect

to

receive

for

it

in

a

current

sale.

A

variety

of

factors

may

be

considered

in

determining

the

fair

value

of

such

securities,

which

may

include

consideration

of

the

following:

yields

or

prices

of

investments

of

comparable

quality,

type

of

issue,

coupon,

maturity

and

rating,

market

quotes

or

indications

of

value

from

security

dealers,

evaluations

of

anticipated

cash

flows

or

collateral,

general

market

conditions

and

other

information

and

analysis,

including

the

obligor’s

credit

characteristics

considered

relevant.

To

the

extent

the

inputs

are

observable

and

timely,

the

values

would

be

classified

as

Level

2;

otherwise

they

would

be

classified

as

Level

3.

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

4.

Portfolio

Securities

Securities

Lending:

The

Fund

may

lend

securities

representing

up

to

one-third

of

the

value

of

its

total

assets

to

broker-dealers,

banks,

and

other

institutions

in

order

to

generate

additional

income.

When

loaning

securities,

the

Fund

retains

the

benefits

of

owning

the

securities,

including

the

economic

equivalent

of

dividends

or

interest

generated

by

the

security.

The

loans

are

continuous,

can

be

recalled

at

any

time,

and

have

no

set

maturity.

State

Street

Bank

and

Trust

Company,

serves

as

the

securities

lending

agent

(the

“Agent”).

When

a

Fund

loans

its

portfolio

securities,

it

will

receive,

at

the

inception

of

each

loan,

cash

collateral

equal

to

an

amount

not

less

than

100%

of

the

market

value

of

the

loaned

securities.

The

actual

percentage

of

the

cash

collateral

will

vary

depending

upon

the

asset

type

of

the

loaned

securities.

Collateral

for

the

loaned

securities

is

invested

in

a

government

money

market

vehicle

maintained

by

the

Agent,

which

is

subject

to

the

requirements

of

Rule

2a-7

under

the

1940

Act.

The

value

of

the

loaned

securities

and

the

liability

to

return

the

cash

collateral

received

are

recognized

on

the

Statement

of

Assets

and

Liabilities.

If

the

market

value

of

the

loaned

securities

increases,

the

borrower

must

furnish

additional

collateral

to

the

Fund,

which

is

also

recognized

on

the

Statement

of

Assets

and

Liabilities.

Securities

out

on

loan

are

subject

to

termination

at

any

time

at

the

option

of

the

borrower

or

the

Fund.

Upon

termination,

the

borrower

is

required

to

return

to

the

Fund

securities

identical

to

the

securities

loaned.

During

the

term

of

the

loan,

the

Fund

bears

the

market

risk

with

respect

to

the

investment

of

collateral

and

the

risk

that

the

Agent

may

default

on

its

contractual

obligations

to

the

Fund.

The

Agent

bears

the

risk

that

the

borrower

may

default

on

its

obligation

to

return

the

loaned

securities

as

the

Agent

is

contractually

obligated

to

indemnify

the

Fund

if

at

the

time

of

a

default

by

a

borrower

some

or

all

of

the

loan

securities

have

not

been

returned.

Securities

lending

income

recognized

by

a

Fund

consists

of

earnings

on

invested

collateral

and

lending

fees,

net

of

any

rebates

to

the

borrower

and

compensation

to

the

Agent.

Such

income

is

recognized

on

the

Statement

of

Operations.

As

of

the

end

of

the

reporting

period,

the

Fund

did

not

have

any

securities

out

on

loan.

Purchases

and

Sales:

Long-term

purchases

and

sales

(excluding in-kind

transactions)

during

the

current fiscal

period

were

as

follows:

In-kind

transactions during

the

current fiscal

period

were

as

follows:

The

Fund

may

purchase

securities

on

a

when-issued

or

delayed-delivery

basis.

Securities

purchased

on

a

when-issued

or

delayed-delivery

basis

may

have

extended

settlement

periods;

interest

income

is

not

accrued

until

settlement

date.

Any

securities

so

purchased

are

subject

to

market

fluctuation

during

this

period.

If the

Fund

has

outstanding

when-issued/delayed-delivery

purchases

commitments

as

of

the

end

of

the

reporting

period,

such

amounts

are

recognized

on

the

Statement

of

Assets

and

Liabilities.

5.

Derivative

Investments

The Fund

is

authorized

to

invest

in

certain

derivative

instruments.

As

defined

by

U.S.

GAAP,

a

derivative

is

a

financial

instrument

whose

value

is

derived

from

an

underlying

security

price,

foreign

exchange

rate,

interest

rate,

index

of

prices

or

rates,

or

other

variables.

Investments

in

derivatives

as

of

the

end

of

and/or

during

the

current

fiscal

period,

if

any,

are

included

within

the

Statement

of

Assets

and

Liabilities

and

the

Statement

of

Operations,

respectively.

Market

and

Counterparty

Credit

Risk:

In

the

normal

course

of

business

the

Fund

may

invest

in

financial

instruments

and

enter

into

financial

transactions

where

risk

of

potential

loss

exists

due

to

changes

in

the

market

(market

risk)

or

failure

of

the

other

party

to

the

transaction

to

perform

(counterparty

credit

risk).

The

potential

loss

could

exceed

the

value

of

the

financial

assets

recorded

on

the

financial

statements.

Financial

assets,

which

potentially

expose the

Fund

to

counterparty

credit

risk,

consist

principally

of

cash

due

from

counterparties

on

forward,

option

and

swap

transactions,

when

applicable.

The

extent

of

the

Fund’s

exposure

to

counterparty

credit

risk

in

respect

to

these

financial

assets

approximates

their

carrying

value

as

recorded

on

the

Statement

of

Assets

and

Liabilities.

The Fund

helps

manage

counterparty

credit

risk

by

entering

into

agreements

only

with

counterparties

the

Adviser

believes

have

the

financial

resources

to

honor

their

obligations

and

by

having

the

Adviser

monitor

the

financial

stability

of

the

counterparties.

Additionally,

counterparties

may

be

required

to

pledge

collateral

daily

(based

on

the

daily

valuation

of

the

financial

asset)

on

behalf

of the

Fund

with

a

value

approximately

equal

to

the

amount

of

any

unrealized

gain

above

a

pre-determined

threshold.

Reciprocally,

when the

Fund

has

an

unrealized

loss,

the

Fund

has

instructed

the

custodian

to

pledge

assets

of

the

Fund

as

collateral

with

a

value

approximately

equal

to

the

amount

of

the

unrealized

loss

above

a

pre-determined

threshold.

Collateral

pledges

are

monitored

and

subsequently

adjusted

if

and

when

the

valuations

fluctuate,

either

up

or

down,

by

at

least

the

pre-determined

threshold

amount.

6.

Fund

Shares

The

Fund

issues

and

redeems

its

shares

on

a

continuous

basis

at

NAV

only

in

aggregations

of

a

specified

number

of

shares

or

multiples

thereof

(“Creation

Units”).

Only

certain

institutional

investors

(referred

to

as

“Authorized

Participants”)

who

have

entered

into

agreements

with

Nuveen

Securities,

LLC,

the

Fund’s

distributor,

may

purchase

and

redeem

Creation

Units.

Once

created,

shares

of

the

Fund

trade

on

the

Exchange

at

market

prices

and

are

only

available

to

individual

investors

through

their

brokers.

Creation

Units

are

purchased

and

redeemed

in-kind

for

a

designated

portfolio

of

securities

included

in

the

Fund’s

Index

and/or

a

specified

amount

of

cash.

Authorized

Participants

are

charged

fixed

transaction

fees

in

connection

with

purchasing

and

redeeming

Creation

Units.

Authorized

Participants

transacting

in

Creation

Units

for

cash

may

also

pay

an

additional

variable

charge

to

compensate

the

Fund

for

certain

transaction

costs

(i.e.,

taxes

on

currency

or

other

financial

transactions,

and

brokerage

costs)

and

market

impact

expenses

it

incurs

in

purchasing

or

selling

portfolio

securities.

Such

variable

charges,

if

any,

are

included

in

“Proceeds

from

shares

sold”

on

the

Statements

of

Changes

in

Net

Assets.

Purchases

Sales

Fund

Non-U.S.

Government

Purchases

Non-U.S.

Government

Sales

NURE

$

14,459,774

$

26,088,630

Fund

In-Kind

Purchases

In-Kind

Sales

NURE

$

10,882,016

$

10,867,216

Notes

to

Financial

Statements

(continued)

Transactions

in

Fund

shares

during

the

current

and

prior

period

were

as

follows:

7.

Income

Tax

Information

The

Fund

intends

to

distribute

substantially

all

of

its

net

investment

income

and

net

capital

gains

to

shareholders

and

otherwise

comply

with

the

requirements

of

Subchapter

M

of

the

Internal

Revenue

Code

applicable

to

regulated

investment

companies.

Therefore,

no

federal

income

tax

provision

is

required.

The

Fund

files

income

tax

returns

in

U.S.

federal

and

applicable

state

and

local

jurisdictions.

A

Fund's

federal

income

tax

returns

are

generally

subject

to

examination

for

a

period

of

three

fiscal

years

after

being

filed.

State

and

local

tax

returns

may

be

subject

to

examination

for

an

additional

period

of

time

depending

on

the

jurisdiction.

Management

has

analyzed the

Fund's

tax

positions

taken

for

all

open

tax

years

and

has

concluded

that

no

provision

for

income

tax

is

required

in

the

Fund's

financial

statements.

Differences

between

amounts

for

financial

statement

and

federal

income

tax

purposes

are

primarily

due

to

timing

differences

in

recognizing

gains

and

losses

on

investment

transactions.

Temporary

differences

do

not

require

reclassification.

As

of

year

end,

permanent

differences

that

resulted

in

reclassifications

among

the

components

of

net

assets

relate

primarily

to

redemptions

in-kind.

Temporary

and

permanent

differences

have

no

impact

on

a

Fund's

net

assets.

As

of

year

end,

the

aggregate

cost

and

the

net

unrealized

appreciation/(depreciation)

of

all

investments

for

federal

income

tax

purposes

were

as