UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23059

CLOUGH FUNDS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

303.623.5277

(Registrant’s telephone number, including area code)

Abigail J. Murray, Secretary

Clough Funds Trust

1290 Broadway, Suite 1100

Denver, CO 80203

(Name and address of agent for service)

Date of fiscal year end: October 31, 2015

Date of reporting period: September 30, 2015 – October 31, 2015

Item 1. Report to Stockholders.

| | |

Clough Global Long/Short Fund | | Table of Contents |

| | |

Clough Global Long/Short Fund | | Shareholder Letter |

| | October 31, 2015 (Unaudited) |

Dear Shareholders:

In this inaugural letter to you, the investors in the Clough Global Long/Short Fund (the “Fund”), we share our thoughts on the Fund’s investments over the course of its first fiscal year, which ended on October 31, 2015 and an outlook for the coming year. Our discussion of the Fund’s investment program covers the full period since the launch on January 2, 2015 of the Fund’s predecessor vehicle, a privately offered fund (the “Predecessor Fund”), which merged into the Fund at the Fund’s inception, and therefore, references to the Fund also include the Predecessor Fund in this context.

As you know, the objective of the Fund is to provide investors with long-term capital appreciation. The Fund invests primarily in equities and has a global mandate. Short positions are utilized to reduce the net exposure of the Fund and we expect this will help reduce volatility in the Fund’s returns. The Fund is invested primarily along a handful of global investment themes. Themes are generated on both the long and short side.

Performance

The Fund’s Institutional share class returned 1.74% net of fees for its fiscal year ended October 31, 2015. The Fund trailed the 2.71% return posted by the S&P 500 Index and outperformed the HFRI Long/Short Index (“HFRI”), which returned -0.27% for the same period. The Fund’s returns was less volatile than the benchmark S&P 500 as measured by standard deviation of returns, which was 8.74% for the Fund, as compared to the same measure for the S&P 500 (15.49%).

The Fund posted positive returns on both the long and short side for the period. Gains on the long side were primarily driven by strong performance of holdings in the consumer discretionary sector with investments in U.S. homebuilders, entertainment and consumer durables positions performing well. The Fund experienced losses on long positions in the financial sector, with U.S. money center banks such as Morgan Stanley and U.S. mortgage insurance providers including Radian Group amongst those trading lower. Losses in Financials were more than offset by gains on short positions in Brazilian banks and U.S. private equity fund managers. In the Materials sectors, short positions in mining companies exposed to weak industrial activity in China also produced gains.

From a regional perspective, holdings in both North America and Japan posted gains on both the long and short side, whereas the Fund generated losses on both long positions in India and short positions in Europe. Chinese positions were slightly positive despite the unusually high volatility in Chinese stocks during the year.

Market Review

After one of the longest and strongest market rallies in history, global equity markets have petered out this year. The global economy continues to expand yet growth remains lackluster in most of the world and this has begun to weigh on financial markets.

Manufacturing PMIs (Purchasing Managers Index) are hovering near to even below the 50 level in many parts of the world and Industrial Production in the U.S. is barely in positive territory1. A reading below 50 on the PMI is often associated with economic contractions. The CEO of Fastenal Co, a large distributor of industrial and construction supplies, said on a recent call with analysts that the U.S. was in the midst of an “industrial recession”. In this environment corporate profits have been listless. Indeed, it appears as if the third quarter of 2015 will see the first negative period for earnings growth for S&P 500 companies since 2009. Of course, the energy sector is a major drag on corporate earnings, but even excluding oil & gas stocks, profits have softened. Despite a solid housing market and decent household spending, weaker global activity and a strong dollar have been a headwind for U.S. stocks, which have struggled to remain in positive territory for much of the second half of 2015.

In Europe, deflationary pressures continue to weigh on growth and the European Central Bank (“ECB”) is expected to remain ultra-accommodative. The weak Euro has helped revive export growth, but weaker Chinese demand for imported industrial and consumer goods lingers. Europe won’t be able to export itself out of structural difficulties. The European Union (“EU”) remains plagued by a moribund banking sector that has struggled to recapitalize post the Global Financial Crisis (“GFC”) and subsequent Greek debt crisis. Weak bank balance sheets are a drag on growth which is likely to persist, though there are signs that regulators are beginning to push banks to raise capital levels as firms like Barclays PLC and Deutsche Bank are poised for further restructuring. Even so, European stock markets have outperformed U.S. stocks, though trailed in U.S. dollar terms1.

Chinese stocks have seen extreme volatility, surging earlier in the year and then dramatically falling. More recently they have recovered and the Shanghai Composite has re-entered “bull market” territory. This volatility reflects shifting investor sentiment on China’s economic outlook as gross domestic product (“GDP”) growth dipped below 7% for the first time in 15 years. It’s not all bad in China, as economic and social reforms help support a much needed rebalancing of its economy which had grown too dependent on fixed asset investment and government spending. This transition is much further ahead than most believe, as evidenced by strong consumer spending and services activity. Retail sales grew 14% for the year through September 2015, helped by E-commerce sales which have gained more than 36%. Restaurant sales surged more than 15% and the box office is booming with spending on movies gaining more than 50% year-to-date2. This contrasts with the industrial economy which has seen steel production decline for the second year in a row as inventories pile up globally. Steel prices have declined by nearly two thirds in China in the last five years. Similarly, cement consumption in China has shrunk 5% this year and electricity demand, heavily dependent on industrial activity, is flat on the year3. China has become a two speed economy (i.e., “New China vs. Old China”) and this push and pull continued to create opportunities on both the long and short side.

| | |

Clough Global Long/Short Fund | | Shareholder Letter |

| | October 31, 2015 (Unaudited) |

A strong dollar and weaker industrial activity in China has weighed the most on emerging markets, most notably Brazil in Latin America and some of the smaller ASEAN economies such as Indonesia and Thailand. There are some signs of credit stresses in the commodity-sensitive countries and weak currencies are exacerbating those issues. Emerging market stocks were down over 10% for the first ten months of the year, led by a 34% decline in Brazil’s Bovespa Index (in U.S. dollars).

Portfolio Overview – Investment Themes

We have structured the portfolio alongside the following key insights and themes:

Globally, we believe that interest rates are likely to remain at rock bottom levels and the capital markets, both equity and fixed income will struggle to generate the strong returns we have seen in the post-GFC period. The major global economies, U.S., EU, Japan and China, have decoupled as have their monetary policies. While the ECB and Bank of Japan (“BoJ”) are both continuing (and even possibly expanding) massive Quantitative Easing (“QE”) programs to reflate growth, the U.S. Federal Reserve has exited QE and has signaled a desire to raise interest rates. These divergences have helped to strengthen the dollar and led to increased volatility in the capital markets.

In a low return world, the acute shortage is “yield” and we think investors will need to think creatively and look for yield in the equity markets. Yield can take many forms, including dividends, but we are focusing our efforts in finding undervalued companies generating high levels of free cash flow (FCF) per share relative to their stock prices. We believe that the key to this strategy will be identifying high quality – meaning durable and visible – free cash streams that are being deployed to benefit shareholders. Corporations can allocate cash flow in various ways, but principally as follows: 1) invest in a high return business, 2) pay dividends to shareholders, 3) pay down high cost debt, 4) repurchase shares or 5) pursue value-enhancing acquisitions. Businesses with management teams able to make the right choices on capital allocation amongst these options should be able to create significant value for shareholders. We call these companies “Compounders.”

Compounders in our current portfolio include Allison Transmission, which has a dominant market position providing fully-automatic transmissions for medium and heavy-duty trucks. Allison has only modest revenue growth prospects, yet the company generates high quality, recurring FCF equal to more than 10% of its share price by our calculation. Allison’s borrowing costs are substantially less than that and its business does not require significant reinvestment so share repurchases are very accretive to shareholder value. The shares have not performed well, but we think value is accreting to us as owners and are willing to be patient.

We also find Compounders in the cable sector. The cable business is a digital age utility offering critical broadband infrastructure. Customers are paying up for broadband access and profits there

more than offset profit erosion that may emerge from so-called “cord cutting”. Companies like Charter and Comcast have durable, recurring cash flow and generate high returns on investment (ROI) by upgrading their plant and equipment to improve service levels. The broadening of high speed data networks is also powering the greater digital economy and the Fund has exposure to several of the leading internet companies focused on social media and cloud applications in both the U.S. and China.

The U.S. financial sector is the strongest in the world with healthy and we think excessively capitalized balance sheets. After years of legal and regulatory headwinds, which included massive fines and penalties, the large U.S. money center banks with strong investment banking franchises are poised to see earnings gains and sustained higher returns on equity (ROE). Competitive advantages vis-a-vis Europe’s large global banks are strengthening as the European banks struggle with weak capital positions, deflationary pressures and poor credit quality. Market share gains in the attractive capital markets businesses are structural for the likes of Morgan Stanley, Bank of America and Citigroup. According to Moody’s, from 2008 – 2014 the five largest U.S. banks booked $139 billion in legal provisions, with Bank of America alone incurring $70 billion, and we think that drain on shareholder funds is in the rear view mirror. Strong capital generation will finally be returned to owners of the banks in the form of dividends and stock buybacks and we think the U.S. financial sector offers significant upside in the coming years. We believe these financial companies have Compounder attributes as well.

Economic and social reforms across Asia are changing the outlook for growth and wealth creation. This region, led by China, India and Japan, offers attractive long-term tailwinds for investors. Each of these large economies has their own flavor of reform. Japanese policy has gone all out on reflation policies under Prime Minister Shinzo Abe who was elected in December 2012 with a clear mandate to end a two decade long deflationary economy in Japan. His so-called “Abenomics” agenda has successfully pulled the country out of its decade’s long deflationary stupor. The first phase of Abenomics saw massive QE and a sharp depreciation of the Yen which led to a surge in corporate earnings led by Japan’s large exporters whose foreign profits benefited from translation gains. Profit gains drove stock prices significantly higher.

You can’t devalue your way to greatness however, and Abe’s plan has shifted into Phase 2, which in our mind is driven by true economic reforms; none more important than the policies designed to improve corporate governance. Japanese companies have long ago paid down debts from the late 80s bubble economy and have more recently hoarded cash in a deflationary economy. Government policy and pressure from investors, including some activists, has changed the mindset of management teams. For the first time we are witnessing a Western-style focus on shareholder returns and that is bullish. Japan’s lazy, cash heavy balance sheets are being put to work and capital allocation is improving. Companies such as Nippon Telegraph and Telephone, Japan’s largest telecom provider are buying back stock in droves and this is improving ROEs and valuations are expanding. The large Japanese banks, such as Mizuho

| | |

Annual Report | October 31, 2015 | | 3 |

| | |

Clough Global Long/Short Fund | | Shareholder Letter |

| | October 31, 2015 (Unaudited) |

Financial and Mitsubishi UFJ are also becoming more shareholder friendly. The banks have maintained large equity holdings of their corporate clients which is an inefficient use of capital from a regulatory perspective. Recently the banks have committed to unwinding these cross shareholdings and are likely to accelerate the pace and size of share buybacks with the sales proceeds. This should be very accretive to shareholders given how cheap the bank stocks are, as they trade well below book value.

India is a modest exposure for us today but we expect it to grow in the coming years. India has been plagued by bad, populist governments who have squandered budget deficits with handouts for votes. A lack of infrastructure investment has contributed to persistent inflation pressures and growth disappointments. Narendra Modi was elected Prime Minister eighteen months ago with a clear mandate to build and grow the country and he has an aggressive reform agenda to foster an investment-led growth model for the country. We are optimistic that India’s vast potential may begin to be realized. In India, our investment focus is on infrastructure operators, as well as construction and industrial companies. Importantly, Modi’s arrival coincided with the appointment of the highly respected economist Raghuram Rajan to lead India’s central bank (RBI). The RBI has succeeded in bringing inflation levels down which means interest rates are also lower. This is critical to help fund the investment boom we foresee. Of course, the banking sector will benefit if a credit cycle develops as we expect. The Fund has modest exposure to Indian financials today, which could grow as our confidence increases.

China’s economic rebalancing is a structural, not cyclical event, and will pressure steel producers and suppliers of bulk materials like coal and iron ore across the World for years to come. The Fund has broad short exposure to mining and industrial companies leveraged to the deteriorating fundamentals of “Old China”. Change in China is also presenting many investment opportunities on the long side. We liken this development to the Rust Belt in the U.S. that emerged in the 1970s. Ironically, the suffering in the Rust Belt and the peak of U.S. industrialization did not spell the end of the road for investors in U.S. stocks. Indeed, from 1980 – 2000 U.S. stocks produced annualized returns of around 17.5% over two decades as the large, flexible U.S. economy rebalanced4 and a “New Economy” emerged, powered by a booming middle class. As China deals with its own Rust Belt, the development of its capital markets is critical, as growth led by the private sector, as opposed to government spending will be funded by the capital markets – not the state-owned banks. Evidence suggests that economic reform is proceeding, as the International Monetary Fund has now added the Chinese Yuan to the Special Drawing Rights basket, marking the Yuan as one of a handful of global reserve currencies.

We also believe the Chinese consumer is very investible given the income and wealth gain China has enjoyed. The middle class has emerged and that can be seen in the new brands emerging in China, booming online sales and spending on travel and entertainment. Importantly, many of the growth companies addressing Chinese consumption are privately owned and managed (i.e., they are not

directly affiliated with the government). We have investments in China’s leading mass market sneaker and apparel brand and the country’s largest mid-to-high end branded furniture manufacturer and retailer. Both are exposed to increase discretionary spending. E-commerce also remains a high growth sector where companies like Alibaba Group and JD.com Inc. have emerged as leaders. Innovation is underestimated in China and Chinese manufacturers are moving up the value chain, making more complex products. While companies like Tesla get all the attention, in our opinion China is likely to lead the world in bringing the Electric Vehicle (“EV”) industry to scale. Public bus and taxi fleet rollouts have begun domestically and are paired with a widespread rollout of the necessary charging infrastructure. Yutong Bus, China’s leading bus manufacturer, recently announced it is exporting EV buses to Paris as well.

On the short side, in addition to sectors and companies on the wrong side of China’s rebalancing, we see many large U.S. multi-nationals who are losing competiveness, domestically but even more acutely in overseas businesses which have driven much of their growth in the last couple of decades. The strong U.S. dollar has been an issue, though the value proposition for consumer staples and old line financial and technology providers is waning as well.

Technology cycles are shortening and commoditization is a broad problem even in the recently booming smartphone industry. Technology cycles have always had winners and losers and creative destruction is the rule, not the exception. Component suppliers to smartphones and PCs are seeing slowing growth and margin pressure. Consolidation via M&A is an offset for some, but broadly speaking we are seeking to hedge the portfolio with some short positions in these areas.

In addition, many smaller Emerging Markets are under pressure as the U.S. Federal Reserve exits QE and the strong U.S. dollar pressures capital flows away from countries and companies with structural trade and budget deficits. Smaller ASEAN markets are stressed with large debt burdens in a strong U.S. dollar environment and we see credit quality deteriorating. We are finding short opportunities in the industrial and financial sectors of select Emerging Market countries.

Outlook

While we are optimistic that our investment themes can produce positive returns in the coming years, it does appear that the broad capital markets are poised to generate lackluster upside, especially compared to the last five years. First, interest rates are low and are likely to remain that way for a long time. The global economy has only added to its leverage in the post-GFC recovery. That debt burden is deflationary as its buildup has effectively pulled forward growth from the future. The burden is so large that servicing debt at higher interest rates is very difficult. As evidence, simply observe that the original taper tantrum in the spring of 2013 caused mortgage rates to spike, which sharply curtailed what was then a robust U.S. housing recovery. Simply put, the economy can’t handle

| | |

Clough Global Long/Short Fund | | Shareholder Letter |

| | October 31, 2015 (Unaudited) |

higher interest rates and while interest rates are likely to remain low, we believe returns from bonds are going to be modest at best.

We also have to recognize that with rates so low and many of the large economies well into implementing unconventional monetary policies which had the explicit intent to raise asset values, stocks, real estate and other asset classes like art are fully inflated. Indeed, U.S. household net worth (“HNW”) is at an all-time high. More importantly, the ratio of HNW-to-GDP is also at an all-time high, eclipsing levels from both 2000 and 2007, periods that proceeded significant stresses in both global economic activity and stock prices. Why is this ratio important? It’s simple. All asset values, whether they are real estate investments, loans such as mortgages or corporate borrowings, or stocks must be supported by some form of cash flow or income. Since economic growth is sluggish and likely to remain so, and the HNW-to-GDP ratio is already beyond recent historical peaks, future returns on assets are likely to be much lower than in recent years.

Financial engineering has also worked to elevate profits and stock prices and slowing growth is revealing balance sheet stress in many corners of the world. Stock buybacks and M&A activity are at extreme levels relative to history. In most instances, buying back shares is a less attractive investment given stock prices are much higher than they were five years ago, but many firms are doing so more than ever despite the higher valuations. Some are even borrowing money for buybacks, which introduces financial risks. We have recently seen companies like Wal-Mart Stores, Caterpillar Inc. and even Oracle Corp. buy back shares at high prices which in retrospect look value-destroying for shareholders.

Lastly, we believe that passive investing has reached an extreme level and will likely contribute to both volatility and dispersion in coming years. Large stocks have had a persistent bid from waves of reallocation out of individual stocks and actively managed funds into indexed exchange-traded funds with the most popular being the S&P 500 ETF (“SPY”). Passive has worked and the SPY has been one of the best performing asset classes since the GFC reached its nadir in 2009. We have compared this period to the Nifty-Fifty era of the 1990s and 1970s and the go-go 1990s when investment flows were concentrated in a narrow group of large cap stocks and indexation first became a craze. Passive investing allocates capital based on company size and market capitalization, not necessarily by business fundamentals and valuations implying there is little value in fundamental research. When growth slows and price momentum wanes, fundamentals become the most important driver of stock prices and valuations are determined by factors such as ROI. In this environment, active management and long / short strategies could thrive.

We started our firm in March 2000 and have seen our share of cycles. Through it all we have placed a great deal of emphasis on investing our investors’ capital prudently, always paying great attention to our downside. Indeed, over the course of time, we believe that seeking to reduce the impact of drawdowns may be the most important driver of long-term returns. We will work diligently

to try to protect and grow your capital in the coming years and we thank you for the trust you have placed in us.

If you have any questions about your investment, please call 1-877-256-8445.

Sincerely,

Charles I. Clough, Jr.

Eric A. Brock

Vincent Lorusso

| 1 | Bloomberg data, October 2015 |

| 2 | UBS, China Equity Strategy, November 2015 |

| 3 | Credit Suisse, Basic Materials Monetary November 2015 |

| 4 | Bloomberg data, Clough Capital calculations |

| | |

Annual Report | October 31, 2015 | | 5 |

| | |

Clough Global Long/Short Fund | | Portfolio Allocation |

| | October 31, 2015 (Unaudited) |

Performance (as of October 31, 2015)

| | | | | | | | | | | | | | | | |

| | | 1 Month | | | | | | Quarter | | | | | | YTD | | Since Inception† |

Class A - NAV* | | 3.00% | | | | | | -3.62% | | | | | | 1.47% | | 1.47% |

Class A - MOP* | | -2.65% | | | | | | -8.92% | | | | | | -4.11% | | -4.11% |

Class C - NAV* | | 3.00% | | | | | | -3.72% | | | | | | 0.98% | | 0.98% |

Class C - CDSC* | | 2.00% | | | | | | -4.69% | | | | | | -0.02% | | -0.02% |

Class I - NAV^ | | 3.00% | | | | | | -3.56% | | | | | | 1.74% | | 1.74% |

S&P 500 Total Return Index(a) | | 8.44% | | | | | | -0.63% | | | | | | 2.70% | | 2.70% |

HFRI Equity Hedge (Total) Index(b) | | 2.96% | | | | | | -2.20% | | | | | | 0.40% | | 0.40% |

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling (855) 425-6844 or by visiting www.cloughglobal.com.

| † | Fund’s commencement date is September 30, 2015. | |

| * | Returns shown prior to 9/30/2015 are based on the returns of Clough Global Long/Short Fund LP Predecessor adjusted for fees and expenses. | |

| ^ | Returns shown prior to 9/30/2015 are based on the returns of Clough Global Long/Short Fund LP Predecessor. | |

| (a) | The Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. Index performance does not reflect fund performance. An investor cannot invest directly in an index. | |

| (b) | An index designed by Hedge Fund Research, Inc. to represent the performance of investment managers who maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed by such managers to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. An investor cannot invest directly in an index. | |

Returns of less than 1 year are cumulative.

An investor cannot invest directly in an index.

The Fund is new and has a limited operating history.

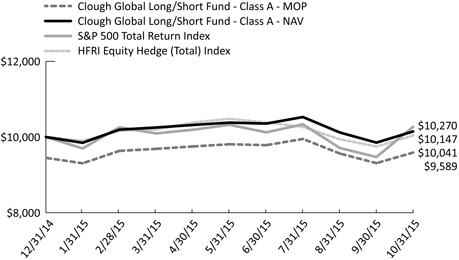

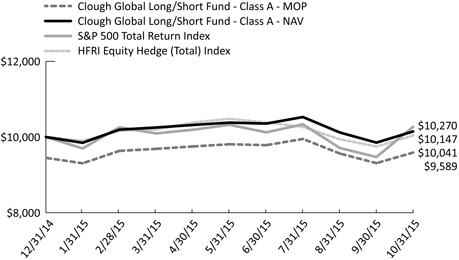

Performance of $10,000 Initial Investment (as of October 31, 2015)

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception, including the Predecessor. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | |

Clough Global Long/Short Fund | | Portfolio Allocation |

| | October 31, 2015 (Unaudited) |

| | | | | | |

| Top Ten Long Holdings (as a % of Net Assets)* | | | | | |

|

Citigroup, Inc. | | | 2.72 | % | | |

Liberty Ventures - Series A | | | 2.42 | % | | |

Bank of America Corp. | | | 2.19 | % | | |

Calpine Corp. | | | 1.86 | % | | |

iShares® MSCI India ETF | | | 1.73 | % | | |

IMAX Corp. | | | 1.71 | % | | |

DR Horton, Inc. | | | 1.65 | % | | |

Mizuho Financial Group, Inc. | | | 1.50 | % | | |

Signet Jewelers, Ltd. | | | 1.45 | % | | |

Lennar Corp. - Class A | | | 1.37 | % | | |

|

Top Ten Holdings | | | 18.60 | % | | |

|

| * | Holdings are subject to change |

| | | | | | | | |

| Sector Allocation ** | | Long Exposure % TNA | | Short Exposure % TNA | | Net Exposure % TNA | | |

|

Consumer Discretionary | | 26.05% | | -1.77% | | 24.28% | | |

Consumer Staples | | 1.99% | | -0.53% | | 1.46% | | |

Energy | | 1.76% | | -3.84% | | -2.08% | | |

Exchange Traded Funds | | 3.63% | | -4.06% | | -0.43% | | |

Financials | | 18.61% | | -5.35% | | 13.26% | | |

Health Care | | 7.73% | | -3.72% | | 4.01% | | |

Industrials | | 6.46% | | -7.65% | | -1.19% | | |

Information Technology | | 7.81% | | -2.57% | | 5.24% | | |

Materials | | 1.00% | | -0.40% | | 0.60% | | |

Real Estate | | 1.70% | | -0.19% | | 1.51% | | |

Telecommunication Services | | 3.43% | | 0.00% | | 3.43% | | |

Utilities | | 2.21% | | -0.30% | | 1.91% | | |

|

Total Investments | | 82.38% | | -30.38% | | 52.00% | | |

|

| | | | |

| Country Allocation ** | | Long Exposure % TNA | | Short Exposure % TNA | | Net Exposure % TNA | | |

|

China | | 14.11% | | -0.49% | | 13.62% | | |

Europe | | 2.55% | | -3.99% | | -1.44% | | |

India | | 3.03% | | 0.00% | | 3.03% | | |

Japan | | 7.12% | | -1.86% | | 5.26% | | |

Other Developed Markets | | 1.71% | | -0.67% | | 1.04% | | |

Other Emerging Markets | | 0.00% | | -5.72% | | -5.72% | | |

United States | | 53.86% | | -17.65% | | 36.21% | | |

|

Total Investments | | 82.38% | | -30.38% | | 52.00% | | |

|

| ** | Allocation summaries calculated as percent of total net assets using market value of cash traded securities, notional value of derivative contracts and excluding short-term investments and futures. |

| | |

Annual Report | October 31, 2015 | | 7 |

| | |

Clough Global Long/Short Fund | | Disclosure of Fund Expenses |

| | October 31, 2015 (Unaudited) |

Examples. As a shareholder of the Clough Global Long/Short Fund (the “Fund”), you incur two types of costs: (1) transaction costs, including applicable redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on May 1, 2015 and held through October 31, 2015.

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period October 1, 2015 –October 31, 2015” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing Fund costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table below is useful in comparing ongoing costs only and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning Account Value 5/1/2015 | | Ending Account Value 10/31/15 | | Expense Ratio(a)(b) | | Expenses Paid During period 5/1/2015 - 10/31/15(c) |

Clough Global Long/Short Fund(d) | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,030.00 | | | | | 2.67 | % | | | $ | 2.30 | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,011.75 | | | | | 2.67 | % | | | $ | 2.28 | |

Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,030.00 | | | | | 3.32 | % | | | $ | 2.86 | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,008.47 | | | | | 3.32 | % | | | $ | 2.83 | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,030.00 | | | | | 2.32 | % | | | $ | 2.00 | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,013.51 | | | | | 2.32 | % | | | $ | 1.98 | |

| (a) | Expense ratio excluding interest expense and dividends paid on borrowed securities for the Clough Global Long/Short Fund is 1.95%, 2.60% and 1.60% for Class A, Class C and Class I respectively. |

| (b) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (c) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184)/365 (to reflect the half-year period). |

| (d) | Clough Global Long/Short Fund commenced operations on September 30, 2015. For the purposes of calculating the “Actual” figures, actual number of days from commencement of operations through October 31, 2015 were used (31 days). |

| | |

Clough Global Long/Short Fund | | Statement of Investments |

| | October 31, 2015 |

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS 76.86% | | | | | | | | |

Consumer Discretionary 25.55% | | | | | | | | |

AMC Entertainment Holdings, Inc. - Class A | | | 6,190 | | | | $169,420 | |

Anta Sports Products, Ltd. | | | 127,000 | | | | 356,392 | |

Best Buy Co., Inc. | | | 3,500 | | | | 122,605 | |

Blue Nile, Inc.(a) | | | 13,461 | | | | 459,020 | |

Carter’s, Inc. | | | 4,994 | | | | 453,855 | |

China ZhengTong Auto Services Holdings, Ltd. | | | 270,500 | | | | 121,105 | |

Comcast Corp. - Class A | | | 5,495 | | | | 344,097 | |

DR Horton, Inc.(b) | | | 20,108 | | | | 591,980 | |

Great Wall Motor Co., Ltd. - Class H | | | 139,500 | | | | 170,627 | |

IMAX Corp.(a) | | | 15,960 | | | | 612,704 | |

JD.com, Inc. - ADR(a) | | | 13,600 | | | | 375,632 | |

Lennar Corp. - Class A(b) | | | 9,801 | | | | 490,736 | |

Liberty Broadband Corp. - Class C(a)(b) | | | 7,359 | | | | 395,693 | |

Liberty Media Corp. - Class C(a)(b) | | | 12,271 | | | | 480,410 | |

Liberty Ventures - Series A(a)(b) | | | 19,852 | | | | 864,951 | |

Lions Gate Entertainment Corp. | | | 7,450 | | | | 290,327 | |

Man Wah Holdings, Ltd. | | | 184,000 | | | | 210,812 | |

Manchester United PLC - Class A | | | 4,900 | | | | 89,180 | |

Moncler SpA | | | 7,907 | | | | 127,381 | |

Monro Muffler Brake, Inc. | | | 1,000 | | | | 74,170 | |

NetFlix, Inc.(a) | | | 1,350 | | | | 146,313 | |

Pacific Textiles Holdings, Ltd. | | | 91,000 | | | | 130,090 | |

Priceline Group, Inc.(a) | | | 161 | | | | 234,133 | |

Rakuten, Inc. | | | 13,600 | | | | 190,188 | |

Restoration Hardware Holdings, Inc.(a) | | | 3,754 | | | | 387,000 | |

Service Corp. International(b) | | | 4,900 | | | | 138,474 | |

Signet Jewelers, Ltd. | | | 3,435 | | | | 518,479 | |

Starbucks Corp.(b) | | | 6,225 | | | | 389,498 | |

William Lyon Homes - Class A(a) | | | 10,077 | | | | 215,043 | |

| | | | | | | | |

| | | | | | | 9,150,315 | |

| | | | | | | | |

| | |

Consumer Staples 1.44% | | | | | | | | |

CVS Health Corp. | | | 700 | | | | 69,146 | |

Prestige Brands Holdings, Inc.(a) | | | 3,100 | | | | 151,931 | |

Suntory Beverage & Food, Ltd. | | | 4,200 | | | | 170,896 | |

WH Group, Ltd.(a) | | | 222,000 | | | | 122,878 | |

| | | | | | | | |

| | | | | | | 514,851 | |

| | | | | | | | |

| | |

Energy 1.76% | | | | | | | | |

Anadarko Petroleum Corp. | | | 2,000 | | | | 133,760 | |

Concho Resources, Inc.(a) | | | 1,250 | | | | 144,887 | |

Devon Energy Corp. | | | 2,800 | | | | 117,404 | |

EOG Resources, Inc. | | | 1,300 | | | | 111,605 | |

Pioneer Natural Resources Co. | | | 900 | | | | 123,426 | |

| | | | | | | | |

| | | | | | | 631,082 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Financials 18.61% | | | | | | | | |

American International Group, Inc. | | | 7,238 | | | | $456,428 | |

Bank of America Corp.(b) | | | 46,750 | | | | 784,465 | |

Bank of China, Ltd. - Class H | | | 462,000 | | | | 218,763 | |

BOC Hong Kong Holdings, Ltd. | | | 78,500 | | | | 252,193 | |

China Construction Bank Corp. - Class H | | | 345,000 | | | | 250,606 | |

Citigroup, Inc.(b) | | | 18,349 | | | | 975,616 | |

Essent Group, Ltd.(a) | | | 9,600 | | | | 231,360 | |

Goldman Sachs Group, Inc. | | | 935 | | | | 175,313 | |

HDFC Bank, Ltd. - ADR | | | 2,100 | | | | 128,394 | |

ICICI Bank, Ltd. - Sponsored ADR | | | 39,002 | | | | 336,197 | |

JPMorgan Chase & Co. | | | 2,100 | | | | 134,925 | |

MGIC Investment Corp.(a) | | | 44,577 | | | | 419,024 | |

Mitsubishi UFJ Financial Group, Inc. | | | 59,600 | | | | 390,485 | |

Mizuho Financial Group, Inc. | | | 259,100 | | | | 537,439 | |

Monex Group, Inc. | | | 70,000 | | | | 198,392 | |

Morgan Stanley | | | 9,910 | | | | 326,733 | |

Radian Group, Inc. | | | 17,100 | | | | 247,437 | |

Solar Capital, Ltd. | | | 12,400 | | | | 214,644 | |

Sumitomo Mitsui Financial Group, Ltd. | | | 9,600 | | | | 386,641 | |

| | | | | | | | |

| | | | | | | 6,665,055 | |

| | | | | | | | |

| | |

Health Care 7.73% | | | | | | | | |

Akorn, Inc.(a) | | | 6,000 | | | | 160,440 | |

Allergan PLC(a) | | | 400 | | | | 123,388 | |

AstraZeneca PLC - Sponsored ADR | | | 1,517 | | | | 48,377 | |

Bristol - Meyers Squibb Co. | | | 1,526 | | | | 100,640 | |

Cerner Corp.(a) | | | 585 | | | | 38,780 | |

Cigna Corp. | | | 786 | | | | 105,355 | |

Community Health Systems, Inc.(a) | | | 1,300 | | | | 36,452 | |

Corindus Vascular Robotics, Inc.(a) | | | 27,700 | | | | 88,640 | |

Dynavax Technologies Corp.(a) | | | 1,975 | | | | 44,852 | |

Gilead Sciences, Inc. | | | 1,100 | | | | 118,943 | |

GW Pharmaceuticals PLC - ADR(a) | | | 1,651 | | | | 130,577 | |

HCA Holdings, Inc.(a) | | | 1,640 | | | | 112,816 | |

Healthways, Inc.(a) | | | 20,440 | | | | 240,579 | |

Hologic, Inc.(a) | | | 2,095 | | | | 81,412 | |

Humana, Inc. | | | 1,013 | | | | 180,952 | |

Intra - Cellular Therapies, Inc.(a) | | | 2,100 | | | | 100,485 | |

Intrexon Corp.(a) | | | 1,286 | | | | 43,210 | |

Intuitive Surgical, Inc.(a) | | | 85 | | | | 42,211 | |

Jazz Pharmaceuticals PLC(a) | | | 832 | | | | 114,217 | |

Perrigo Co. PLC | | | 740 | | | | 116,728 | |

Sinopharm Group Co., Ltd. - Class H | | | 76,400 | | | | 316,419 | |

Team Health Holdings, Inc.(a) | | | 1,200 | | | | 71,604 | |

Universal American Corp. | | | 7,000 | | | | 52,220 | |

Veracyte, Inc.(a) | | | 9,100 | | | | 59,241 | |

Vertex Pharmaceuticals, Inc.(a) | | | 1,925 | | | | 240,124 | |

| | | | | | | | |

| | | | | | | 2,768,662 | |

| | | | | | | | |

| | |

Annual Report | October 31, 2015 | | 9 |

| | |

Clough Global Long/Short Fund | | Statement of Investments |

| | October 31, 2015 |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Industrials 5.62% | | | | | | | | |

Air China, Ltd. - Class H | | | 194,000 | | | | $187,477 | |

Allison Transmission Holdings, Inc.(b) | | | 16,200 | | | | 464,940 | |

Armstrong World Industries, Inc.(a) | | | 4,794 | | | | 237,878 | |

Beijing Enterprises Holdings, Ltd. | | | 14,000 | | | | 88,780 | |

Kansas City Southern | | | 4,370 | | | | 361,661 | |

Keisei Electric Railway Co., Ltd. | | | 7,000 | | | | 86,956 | |

Roper Technologies, Inc. | | | 1,880 | | | | 350,338 | |

Seibu Holdings, Inc. | | | 9,600 | | | | 195,787 | |

TransDigm Group, Inc.(a) | | | 175 | | | | 38,474 | |

| | | | | | | | |

| | | | | | | 2,012,291 | |

| | | | | | | | |

| | |

Information Technology 7.81% | | | | | | | | |

Alibaba Group Holding, Ltd. - Sponsored ADR(a) | | | 3,870 | | | | 324,422 | |

Alphabet, Inc. - Class C(a) | | | 601 | | | | 427,197 | |

Baidu, Inc. - Sponsored ADR(a) | | | 600 | | | | 112,482 | |

Electronics For Imaging, Inc.(a) | | | 4,200 | | | | 195,048 | |

Facebook, Inc. - Class A(a)(b) | | | 3,449 | | | | 351,694 | |

Lam Research Corp. | | | 4,064 | | | | 311,262 | |

Microsoft Corp. | | | 3,300 | | | | 173,712 | |

Nintendo Co., Ltd. | | | 829 | | | | 133,827 | |

Pandora Media, Inc.(a) | | | 14,700 | | | | 169,197 | |

Salesforce.com, Inc.(a) | | | 3,172 | | | | 246,496 | |

ServiceNow, Inc.(a) | | | 1,904 | | | | 155,462 | |

Western Digital Corp. | | | 2,928 | | | | 195,649 | |

| | | | | | | | |

| | | | | | | 2,796,448 | |

| | | | | | | | |

| | |

Materials 1.00% | | | | | | | | |

Axalta Coating Systems, Ltd.(a) | | | 9,600 | | | | 265,248 | |

W.R. Grace & Co.(a)(b) | | | 940 | | | | 94,282 | |

| | | | | | | | |

| | | | | | | 359,530 | |

| | | | | | | | |

| | |

Real Estate 1.70% | | | | | | | | |

Healthcare Trust of America, Inc. -

Class A(b) | | | 4,900 | | | | 128,919 | |

PennyMac Mortgage Investment Trust | | | 9,100 | | | | 133,042 | |

Starwood Property Trust, Inc. | | | 17,300 | | | | 347,557 | |

| | | | | | | | |

| | | | | | | 609,518 | |

| | | | | | | | |

| | |

Telecommunication Services 3.43% | | | | | | | | |

AT&T, Inc. | | | 7,900 | | | | 264,729 | |

China Mobile, Ltd. | | | 39,500 | | | | 472,944 | |

China Unicom Hong Kong, Ltd. | | | 186,000 | | | | 229,662 | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Telecommunication Services (continued) | | | | | |

Nippon Telegraph & Telephone Corp. | | | 7,000 | | | | $260,231 | |

| | | | | | | | |

| | | | | | | 1,227,566 | |

| | | | | | | | |

| | |

Utilities 2.21% | | | | | | | | |

Beijing Enterprises Water Group, Ltd. | | | 154,000 | | | | 122,992 | |

Calpine Corp.(a)(b) | | | 43,000 | | | | 666,930 | |

| | | | | | | | |

| | | | | | | 789,922 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (Cost $26,476,551) | | | | | | | 27,525,240 | |

| | | | | | | | |

| | |

EXCHANGE TRADED FUNDS 3.62% | | | | | | | | |

iShares® China Large Cap ETF(b) | | | 8,100 | | | | 309,987 | |

iShares® MSCI India ETF(b) | | | 21,800 | | | | 620,864 | |

Utilities Select Sector SPDR® ETF | | | 8,400 | | | | 367,500 | |

| | | | | | | | |

| | | | | | | 1,298,351 | |

| | | | | | | | |

| | |

TOTAL EXCHANGE TRADED FUNDS (Cost $1,281,356) | | | | | | | 1,298,351 | |

| | | | | | | | |

| | |

PARTICIPATION NOTES 1.90% | | | | | | | | |

Consumer Discretionary 0.51% | | | | | | | | |

Chongqing Changan Automobile Co., Ltd. - Class A (Loan Participation Notes issued by Morgan Stanley Asia Products), expiring 02/04/2016(a) | | | 75,200 | | | | 183,194 | |

| | | | | | | | |

| | |

Consumer Staples 0.55% | | | | | | | | |

Kweichow Moutai Co., Ltd. - Class A (Loan Participation Notes issued by Morgan Stanley Asia Products), expiring 12/09/2015(a) | | | 5,200 | | | | 176,031 | |

Shanghai Jahwa United Co., Ltd. - Class A (Loan Participation Notes issued by Morgan Stanley Asia Products), expiring 01/29/2016(a)(c) | | | 3,700 | | | | 20,182 | |

| | | | | | | | |

| | | | | | | 196,213 | |

| | | | | | | | |

| | |

Clough Global Long/Short Fund | | Statement of Investments |

| | October 31, 2015 |

| | | | | | | | |

| | |

Shares | | | Value | |

| |

Utilities (continued) | | | | | | | | |

Industrials 0.84% | | | | | | | | |

Zhengzhou Yutong Bus Co., Ltd. - Class A (Loan Participation Notes issued by Morgan Stanley Asia Products), expiring 11/18/2015(a) | | | 86,650 | | | | $300,652 | |

| | | | | | | | |

| | |

TOTAL PARTICIPATION NOTES (Cost $688,882) | | | | | | | 680,059 | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| |

SHORT-TERM INVESTMENTS 17.87% | | | | | |

Money Market Fund 17.87% | | | | | | | | |

BlackRock Liquidity Funds, T-Fund Portfolio - Institutional Class (0.010% 7-day yield) | | | 6,398,013 | | | | 6,398,013 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM INVESTMENTS (Cost $6,398,013) | | | | 6,398,013 | |

| | | | | | | | |

| | |

Total Investments - 100.25% (Cost $34,844,802) | | | | | | | 35,901,663 | |

Liabilities in Excess of Other Assets - (0.25%)(d) | | | | (89,531) | |

| | | | | | | | |

NET ASSETS - 100.00% | | | | | | | $35,812,132 | |

| | | | | | | | |

| | |

| SCHEDULE OF SECURITIES SOLD SHORT(a) | | Shares | | | Value | |

| |

COMMON STOCKS (25.55%) | | | | | | | | |

Consumer Discretionary (1.77%) | | | | | | | | |

Expedia, Inc. | | | (2,920) | | | | (397,996) | |

Fuji Heavy Industries, Ltd. | | | (3,500) | | | | (137,134) | |

MGM Resorts International | | | (2,100) | | | | (48,699) | |

Wynn Resorts, Ltd. | | | (700) | | | | (48,965) | |

| | | | | | | | |

| | | | | | | (632,794) | |

| | | | | | | | |

| | |

Consumer Staples (0.53%) | | | | | | | | |

Carlsberg A/S - Class B | | | (897) | | | | (73,534) | |

General Mills, Inc. | | | (1,992) | | | | (115,755) | |

| | | | | | | | |

| | | | | | | (189,289) | |

| | | | | | | | |

| | |

Energy (3.83%) | | | | | | | | |

Core Laboratories NV | | | (700) | | | | (81,431) | |

Ensco PLC - Class A | | | (10,000) | | | | (166,300) | |

Helmerich & Payne, Inc. | | | (1,700) | | | | (95,659) | |

National Oilwell Varco, Inc. | | | (4,600) | | | | (173,144) | |

Oil States International, Inc. | | | (2,900) | | | | (87,029) | |

| | | | | | | | |

SCHEDULE OF SECURITIES SOLD

SHORT(a) (continued) | | Shares | | | Value | |

| |

Energy (continued) | | | | | | | | |

Petroleo Brasileiro S.A. - Sponsored ADR | | | (59,100) | | | | $(288,408) | |

Rowan Cos., PLC - A Shares | | | (6,300) | | | | (123,984) | |

Seadrill, Ltd. | | | (9,500) | | | | (61,465) | |

Transocean, Ltd. | | | (18,700) | | | | (296,021) | |

| | | | | | | | |

| | | | | | | (1,373,441) | |

| | | | | | | | |

| | |

Financials (4.84%) | | | | | | | | |

Ally Financial, Inc. | | | (3,900) | | | | (77,688) | |

American Express Co. | | | (4,665) | | | | (341,758) | |

Apollo Global Management LLC - A Shares | | | (14,145) | | | | (258,429) | |

Banco Bilbao Vizcaya Argentaria S.A. - Sponsored ADR | | | (3,500) | | | | (30,170) | |

Banco Santander S.A. - Sponsored ADR | | | (6,300) | | | | (34,902) | |

The Blackstone Group LP | | | (2,800) | | | | (92,568) | |

Cullen/Frost Bankers, Inc. | | | (2,100) | | | | (143,724) | |

Greenhill & Co., Inc. | | | (5,958) | | | | (153,836) | |

Itau Unibanco Holding S.A. - Class H, Sponsored Preferred ADR | | | (42,830) | | | | (293,385) | |

PJT Partners, Inc. - Class A | | | (10) | | | | (215) | |

Seven Bank, Ltd. | | | (36,700) | | | | (168,491) | |

United Overseas Bank, Ltd. | | | (9,400) | | | | (136,414) | |

| | | | | | | | |

| | | | | | | (1,731,580) | |

| | | | | | | | |

| | |

Health Care (3.72%) | | | | | | | | |

AbbVie, Inc. | | | (2,200) | | | | (131,010) | |

Aetna, Inc. | | | (945) | | | | (108,467) | |

AmerisourceBergen Corp. | | | (875) | | | | (84,446) | |

Anacor Pharmaceuticals, Inc. | | | (620) | | | | (69,694) | |

ANI Pharmaceuticals, Inc. | | | (4,000) | | | | (167,360) | |

Bruker Corp. | | | (5,100) | | | | (93,687) | |

DaVita HealthCare Partners, Inc. | | | (1,290) | | | | (99,988) | |

Eagle Pharmaceuticals, Inc. | | | (2,279) | | | | (145,195) | |

Express Scripts Holding Co. | | | (1,200) | | | | (103,656) | |

UnitedHealth Group, Inc. | | | (1,864) | | | | (219,542) | |

Varian Medical Systems, Inc. | | | (1,410) | | | | (110,728) | |

| | | | | | | | |

| | | | | | | (1,333,773) | |

| | | | | | | | |

| | |

Industrials (7.65%) | | | | | | | | |

Air France-KLM | | | (20,959) | | | | (153,750) | |

Alfa Laval AB | | | (5,847) | | | | (102,862) | |

American Airlines Group, Inc. | | | (2,660) | | | | (122,945) | |

Caterpillar, Inc. | | | (5,020) | | | | (366,410) | |

Chicago Bridge & Iron Co. NV | | | (4,500) | | | | (201,915) | |

Cummins, Inc. | | | (700) | | | | (72,457) | |

Deutsche Lufthansa AG | | | (13,982) | | | | (206,490) | |

Emerson Electric Co., Inc. | | | (3,800) | | | | (179,474) | |

Flowserve Corp. | | | (4,200) | | | | (194,712) | |

International Consolidated Airlines Group S.A. | | | (19,559) | | | | (175,637) | |

| | |

Annual Report | October 31, 2015 | | 11 |

| | |

Clough Global Long/Short Fund | | Statement of Investments |

| | October 31, 2015 |

| | | | | | | | |

SCHEDULE OF SECURITIES SOLD

SHORT(a) (continued) | | Shares | | | Value | |

| |

Industrials (continued) | | | | | | | | |

Keppel Corp., Ltd. | | | (20,100) | | | | $(101,583) | |

Kone OYJ, B Shares | | | (1,806) | | | | (77,175) | |

Kuehne + Nagel International AG | | | (693) | | | | (96,121) | |

Metso OYJ | | | (6,900) | | | | (168,975) | |

Pentair PLC | | | (3,100) | | | | (173,352) | |

Sandvik AB | | | (7,968) | | | | (74,517) | |

Triumph Group, Inc. | | | (2,100) | | | | (97,818) | |

WW Grainger, Inc. | | | (818) | | | | (171,780) | |

| | | | | | | | |

| | | | | | | (2,737,973) | |

| | | | | | | | |

| | |

Information Technology (2.32%) | | | | | | | | |

Corning, Inc. | | | (3,700) | | | | (68,820) | |

International Business Machines Corp. | | | (850) | | | | (119,068) | |

Knowles Corp. | | | (4,700) | | | | (78,302) | |

Nippon Electric Glass Co., Ltd. | | | (35,000) | | | | (173,158) | |

Taiwan Semiconductor Manufacturing Co., Ltd. - Sponsored ADR | | | (13,200) | | | | (289,872) | |

Tech Data Corp. | | | (1,400) | | | | (101,906) | |

| | | | | | | | |

| | | | | | | (831,126) | |

| | | | | | | | |

| | |

Materials (0.40%) | | | | | | | | |

Cliffs Natural Resources, Inc. | | | (8,400) | | | | (23,184) | |

Vale S.A. - Sponsored ADR | | | (27,795) | | | | (121,186) | |

| | | | | | | | |

| | | | | | | (144,370) | |

| | | | | | | | |

| | |

Real Estate (0.19%) | | | | | | | | |

China Resources Land, Ltd. | | | (26,000) | | | | (67,930) | |

| | | | | | | | |

| | |

Utilities (0.30%) | | | | | | | | |

Hong Kong & China Gas Co., Ltd. | | | (52,700) | | | | (107,024) | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (Proceeds $8,776,334) | | | | | | | (9,149,300) | |

| | | | | | | | |

| | |

EXCHANGE TRADED FUNDS (4.06%) | | | | | | | | |

iShares® MSCI Brazil Capped ETF | | | (2,100) | | | | (48,027) | |

iShares® MSCI Emerging Markets ETF | | | (3,500) | | | | (122,045) | |

iShares® MSCI Indonesia ETF | | | (9,200) | | | | (185,380) | |

iShares® MSCI Japan Index ETF | | | (15,100) | | | | (186,032) | |

iShares® MSCI Malaysia ETF | | | (9,900) | | | | (101,871) | |

iShares® MSCI South Korea Capped ETF | | | (3,900) | | | | (212,082) | |

iShares® MSCI Thailand Capped ETF | | | (3,614) | | | | (235,524) | |

Market Vectors® Oil Service ETF | | | (6,000) | | | | (183,420) | |

Market Vectors® Semiconductor ETF | | | (3,300) | | | | (178,893) | |

| | | | | | | | |

| | |

TOTAL EXCHANGE TRADED FUNDS (Proceeds $1,456,334) | | | | | | | (1,453,274) | |

| | | | | | | | |

| | | | | | | | |

SCHEDULE OF SECURITIES SOLD

SHORT(a) (continued) | | Shares | | | Value | |

| |

EXCHANGE TRADED FUNDS (continued) | | | | | |

PREFERRED STOCKS (0.51%) | | | | | | | | |

Financials (0.51%) | | | | | | | | |

Banco Bradesco S.A. - ADR | | | (33,820) | | | | (183,981) | |

| | | | | | | | |

| | |

TOTAL PREFERRED STOCKS (Proceeds $198,760) | | | | | | | $(183,981) | |

| | | | | | | | |

| | |

TOTAL SECURITIES SOLD SHORT (Proceeds $10,431,428) | | | | | | | $(10,786,555) | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Pledged security; a portion or all of the security is pledged as collateral for total return swap contracts and securities sold short. As of October 31, 2015, the aggregate market value of those securities was $6,016,900 representing 16.80% of net assets. (See Note 1) |

| (c) | Fair valued security; valued by management in accordance with procedures approved by the Fund’s Board of Trustees. As of October 31, 2015, these securities had an aggregate market value of $20,182 or 0.06% of total net assets. |

| (d) | Includes cash which is being held as collateral for futures contracts. |

| | |

Clough Global Long/Short Fund | | Statement of Investments |

| | October 31, 2015 |

FUTURES CONTRACTS

| | | | | | | | | | | | | | | | | | | | |

| Description | | Position | | | | Contracts | | | | Expiration

Date | | | Underlying Face

Amount at Value | | | Unrealized

Appreciation | |

| |

Foreign Currency Contracts | | | | | | | | | | | | | | | | | | | | |

Japenese Yen Currency Future | | Short | | | | 28 | | | | | 12/15/2015 | | | $ | (1,450,400 | ) | | $ | 8,524 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | (1,450,400 | ) | | $ | 8,524 | |

| | | | | | | | | | | | | | | | |

TOTAL RETURN SWAP CONTRACTS

| | | | | | | | | | | | | | | | | | | | | | |

| Counter Party | | Reference

Entity/Obligation | | Notional

Amount | | | Floating Rate

Paid by the Fund | | | Floating

Rate Index | | | Termination

Date | | | Net Unrealized

Appreciation | |

| |

Morgan Stanley | | Catcher Technology Co., Ltd. | | $ | (91,172 | ) | | | 150 bps - 1D FEDEF | | | | 1D FEDEF | | | | 03/09/2017 | | | $ | 2,457 | |

| |

| | | | $ | (91,172 | ) | | | | | | | | | | | | | | $ | 2,457 | |

| |

Abbreviations:

1D FEDEF - Federal Funds Effective Rate (Daily)

AB - Aktiebolag is the Swedish equivalent of the term corporation

ADR - American Depositary Receipt

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders

A/S - Aktieselskab, Joint Stock Company in Denmark

bps - Basis Points

ETF - Exchange Traded Fund

LLC - Limited Liability Corporation

LP - Limited Partnership

Ltd. - Limited

MSCI - Morgan Stanley Capital International

NV - Naamloze Vennootschap (Dutch: Limited Liability Company)

OYJ - Osakeyhtio is the Finnish equivalent of a public limited company.

PLC - Public Limited Company

S.A. - Generally designates corporations in various countries, mostly those employing the civil law.

SpA - Societa` Per Azioni is an Italian shared company

For Fund compliance purposes, each Fund’s sector classifications refer to any one of the sector sub-classifications used by one or more widely recognized market indexes, and/or as defined by each Fund’s management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Sectors are shown as a percent of net assets. These sector classifications are unaudited.

See Notes to the Financial Statements.

| | |

Annual Report | October 31, 2015 | | 13 |

| | |

Clough Global Long/Short Fund | | Statement of Assets and Liabilities |

| | October 31, 2015 |

| | | | |

ASSETS: | | | | |

| |

Investments, at value (Cost - see below) | | $ | 35,901,663 | |

Foreign Currency, at value (Cost $2,677) | | | 2,685 | |

Deposit with broker for futures contracts | | | 46,113 | |

Deposit with broker for securities sold short | | | 10,072,012 | |

Unrealized appreciation on total return swap contracts | | | 2,457 | |

Dividends receivable | | | 6,689 | |

Interest receivable | | | 41 | |

Receivable for investments sold | | | 1,487,881 | |

Receivable for shares sold | | | 9 | |

Prepaid expenses and other assets | | | 97,970 | |

Total Assets | | | 47,617,520 | |

| |

LIABILITIES: | | | | |

| |

Variation margin payable | | | 4,900 | |

Securities sold short (Proceeds $10,431,428) | | | 10,786,555 | |

Payable for investments purchased | | | 916,774 | |

Dividends payable - short sales | | | 9,828 | |

Interest payable - margin account | | | 8,112 | |

Distribution and service fees | | | 30 | |

Accrued legal expense | | | 10,192 | |

Accrued administration fee | | | 4,336 | |

Accrued trustees fee | | | 5,333 | |

Other payables and accrued expenses | | | 59,328 | |

Total Liabilities | | | 11,805,388 | |

Net Assets | | $ | 35,812,132 | |

| | | | | |

Cost of Investments | | $ | 34,844,802 | |

| | | | | |

| |

| COMPOSITION OF NET ASSETS: | | | | |

| |

Paid-in capital | | $ | 35,139,162 | |

Accumulated net investment loss | | | (2,644) | |

Accumulated net realized loss on investment securities, futures contracts, securities sold short, total return swap contracts and foreign currency transactions | | | (37,079) | |

Net unrealized appreciation in value of investment securities, futures contracts, securities sold short, total return swap contracts and translation of assets and liabilities denominated in foreign currency | | | 712,693 | |

Net Assets | | $ | 35,812,132 | |

| | | | | |

PRICING OF CLASS A SHARES: | | | | |

Net Assets | | $ | 26,774 | |

Shares outstanding of no par value, unlimited shares authorized | | | 2,600 | |

Net Asset Value, offering and redemption price per share | | $ | 10.30 | |

| | | | | |

Maximum offering price per share (NAV/0.9425), based on maximum sales charge of 5.75% of the offering price | | $ | 10.93 | |

| | | | | |

PRICING OF CLASS C SHARES: | | | | |

Net Assets | | $ | 25,739 | |

Shares outstanding of no par value, unlimited shares authorized | | | 2,500 | |

Net Asset Value, offering and redemption price per share | | $ | 10.30 | |

| | | | | |

PRICING OF CLASS I SHARES: | | | | |

Net Assets | | $ | 35,759,619 | |

Shares outstanding of no par value, unlimited shares authorized | | | 3,472,903 | |

| | | | | |

Net Asset Value, offering and redemption price per share | | $ | 10.30 | |

See Notes to the Financial Statements.

| | |

Clough Global Long/Short Fund | | Statement of Operations |

| | For the period ended October 31, 2015 (a) |

| | | | |

INVESTMENT INCOME: | | | | |

| |

Dividends (net of foreign withholding taxes of $3) | | $ | 16,739 | |

Total Income | | | 16,739 | |

| |

EXPENSES: | | | | |

| |

Investment advisory fee | | | 34,010 | |

Distribution and shareholder service fees: | | | | |

Class A | | | 8 | |

Class C | | | 22 | |

Administration fee | | | 4,336 | |

Interest expense - margin account | | | 8,109 | |

Trustees fee | | | 5,333 | |

Dividend expense - short sales | | | 10,040 | |

Custody | | | 2,917 | |

Audit & Tax Services | | | 43,000 | |

Legal | | | 10,192 | |

Offering costs | | | 10,316 | |

Printing | | | 5,500 | |

Insurance | | | 2,202 | |

Transfer agent | | | 1,750 | |

Other expenses | | | 3,958 | |

Total Expenses Before Waivers and/or Reimbursements | | | 141,693 | |

Less fees waived and/or reimbursed by Adviser: | | | | |

Class A | | | (85) | |

Class C | | | (82) | |

Class I | | | (83,042) | |

Net Expenses | | | 58,484 | |

Net Investment Loss | | | (41,745) | |

| |

NET REALIZED GAIN/(LOSS) ON: | | | | |

Investment securities | | | 174,140 | |

Securities sold short | | | (153,665) | |

Total return swap contracts | | | (3) | |

Foreign currency transactions | | | (169) | |

NET CHANGE IN UNREALIZED APPRECIATION/(DEPRECIATION) ON: | | | | |

Investment securities | | | 1,056,861 | |

Futures contracts | | | 8,524 | |

Securities sold short | | | (355,127) | |

Total return swap contracts | | | 2,457 | |

Translation of assets and liabilities denominated in foreign currencies | | | (22) | |

Net realized and unrealized gain | | | 732,996 | |

Net Increase in Net Assets from Operations | | $ | 691,251 | |

| | | | | |

| (a) | Commencement of Operations September 30, 2015. |

See Notes to the Financial Statements.

| | |

Annual Report | October 31, 2015 | | 15 |

| | |

Clough Global Long/Short Fund | | Statement of Changes in Net Assets |

| | |

| | | | |

| | | For the Period Ended October 31, 2015 (a) | |

OPERATIONS: | | | | |

| |

Net investment loss | | $ | (41,745) | |

Net realized gain/(loss) from: | | | | |

Investment securities | | | 174,140 | |

Securities sold short | | | (153,665) | |

Total return swap contracts | | | (3) | |

Foreign currency transactions | | | (169) | |

Net change in urealized appreciation/(depreciation) on: | | | | |

Investment securities | | | 1,056,861 | |

Futures contracts | | | 8,524 | |

Securities sold short | | | (355,127) | |

Total return swap contracts | | | 2,457 | |

Translation of assets and liabilities denominated in foreign currencies | | | (22) | |

Net Increase in Net Assets From Operations | | | 691,251 | |

| |

CAPITAL SHARE TRANSACTIONS: | | | | |

Class A | | | | |

Proceeds from shares sold/proceeds from subscription in-kind | | | 25,994 | |

Net Increase in Net Assets From Class A Capital Share Transactions | | | 25,994 | |

| |

Class C | | | | |

Proceeds from shares sold | | | 25,000 | |

Net Increase in Net Assets From Class C Capital Share Transactions | | | 25,000 | |

| |

Class I | | | | |

Proceeds from shares sold/proceeds from subscription in-kind | | | 35,069,887 | |

Net Increase in Net Assets From Class I Capital Share Transactions | | | 35,069,887 | |

| |

Total Increase in Net Assets | | $ | 35,812,132 | |

| |

NET ASSETS: | | | | |

Beginning of period | | | – | |

End of period* | | $ | 35,812,132 | |

| | | | | |

*Includes accumulated net investment loss of: | | $ | (2,644) | |

| | | | | |

| (a) | Commencement of Operations September 30, 2015. |

See Notes to the Financial Statements.

| | |

Clough Global Long/Short Fund – Class A | | Financial Highlights |

| | For a share outstanding throughout the period indicated |

| | | | | |

| | | For the Period

September 30, 2015

(commencement) to

October 31, 2015 |

PER SHARE OPERATING PERFORMANCE: | | | | | |

NET ASSET VALUE, BEGINNING OF PERIOD | | | $ | 10.00 | |

INCOME/(LOSS) FROM OPERATIONS: | | | | | |

Net investment loss(a) | | | | (0.02) | |

Net realized and unrealized gain on investments | | | | 0.32 | |

Total from Investment Operations | | | | 0.30 | |

| |

Net asset value - end of period | | | $ | 10.30 | |

| | | | | | |

| |

Total Investment Return - Net Asset Value(b) | | | | 3.00 | % |

| |

RATIOS AND SUPPLEMENTAL DATA: | | | | | |

Net assets attributable to common shares, end of period (in 000s) | | | $ | 27 | |

| |

RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | | 6.44 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | | 2.67 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | | (2.00) | %(d) |

RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | | 5.72 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | | 1.95 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | | (1.28) | %(d) |

| |

PORTFOLIO TURNOVER RATE(e) | | | | 22 | % |

| (a) | Per share amounts are based upon average shares outstanding. |

| (b) | Total return is for the period indicated and has not been annualized. The total return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (c) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the fund level. |

See Notes to the Financial Statements.

| | |

Annual Report | October 31, 2015 | | 17 |

| | |

Clough Global Long/Short Fund – Class C | | Financial Highlights |

| | For a share outstanding throughout the period indicated |

| | | | | |

| | | For the Period

September 30, 2015

(commencement) to

October 31, 2015 |

PER SHARE OPERATING PERFORMANCE: | | | | | |

NET ASSET VALUE, BEGINNING OF PERIOD | | | $ | 10.00 | |

INCOME/(LOSS) FROM OPERATIONS: | | | | | |

Net investment loss(a) | | | | (0.02) | |

Net realized and unrealized gain on investments | | | | 0.32 | |

Total from Investment Operations | | | | 0.30 | |

| |

Net asset value - end of period | | | $ | 10.30 | |

| | | | | | |

| |

Total Investment Return - Net Asset Value(b) | | | | 3.00 | % |

| |

RATIOS AND SUPPLEMENTAL DATA: | | | | | |

Net assets attributable to common shares, end of period (in 000s) | | | $ | 26 | |

| |

RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | | 7.09 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | | 3.32 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | | (2.66) | %(d) |

RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | | 6.37 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | | 2.60 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | | (1.94) | %(d) |

| |

PORTFOLIO TURNOVER RATE(e) | | | | 22 | % |

| (a) | Per share amounts are based upon average shares outstanding. |

| (b) | Total return is for the period indicated and has not been annualized. The total return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (c) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the fund level. |

See Notes to the Financial Statements.

| | |

Clough Global Long/Short Fund – Class I | | Financial Highlights |

| | For a share outstanding throughout the period indicated |

| | | | | |

| | | For the Period September 30, 2015

(commencement) to

October 31, 2015 |

PER SHARE OPERATING PERFORMANCE: | | | | | |

NET ASSET VALUE, BEGINNING OF PERIOD | | | $ | 10.00 | |

INCOME/(LOSS) FROM OPERATIONS: | | | | | |

Net investment loss(a) | | | | (0.01) | |

Net realized and unrealized gain on investments | | | | 0.31 | |

Total from Investment Operations | | | | 0.30 | |

| |

Net asset value - end of period | | | $ | 10.30 | |

| | | | | | |

| |

Total Investment Return - Net Asset Value(b) | | | | 3.00 | % |

| |

RATIOS AND SUPPLEMENTAL DATA: | | | | | |

Net assets attributable to common shares, end of period (in 000s) | | | $ | 35,760 | |

| |

RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | | 5.62 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | | 2.32 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | | (1.66) | %(d) |

RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | | 4.90 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | | 1.60 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | | (0.94) | %(d) |

| |

PORTFOLIO TURNOVER RATE(e) | | | | 22 | % |

| (a) | Per share amounts are based upon average shares outstanding. |

| (b) | Total return is for the period indicated and has not been annualized. The total return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (c) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the fund level. |

See Notes to the Financial Statements.

| | |

Annual Report | October 31, 2015 | | 19 |

| | |

Clough Global Long/Short Fund | | Notes to Financial Statements |

| | October 31, 2015 |

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING AND OPERATING POLICIES

The Clough Funds Trust (the “Trust”) is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust was organized under the laws of the state of Delaware on March 17, 2015. The Trust currently offers shares of beneficial interest (“shares”) of the Fund. The Fund’s commencement date is September 30, 2015. The Fund is a diversified investment company with an investment objective to seek to provide long-term capital appreciation. The Fund currently offers three Classes of shares: Classes A, C and I. Each share class of the Fund represents an investment in the same portfolio of securities, but each share class has its own expense structure. As of October 31, 2015, over 99% of the Fund is owned by two shareholders, one of whom is an affiliated party that owns 28% of the Fund. The Board of Trustees (the “Board”) may establish additional funds and classes of shares at any time in the future without shareholder approval.

The following is a summary of significant accounting policies followed by the Fund. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements during the reporting period. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon sale of the securities. The Fund is considered an investment company for financial reporting purposes under GAAP.

The net asset value per share of the Fund is determined no less frequently than daily, on each day that the New York Stock Exchange (“NYSE” or the “Exchange”) is open for trading, as of the close of regular trading on the Exchange (normally 4:00 p.m. New York time). Trading may take place in foreign issues held by the Fund at times when a Fund is not open for business. As a result, each Fund’s net asset value may change at times when it is not possible to purchase or sell shares of the Fund.

Investment Valuation: Securities held by the Fund for which exchange quotations are readily available are valued at the last sale price, or if no sale price or if traded on the over-the-counter market, at the mean of the bid and asked prices on such day. Most securities listed on a foreign exchange are valued at the last sale price at the close of the exchange on which the security is primarily traded. In certain countries market maker prices are used since they are the most representative of the daily trading activity. Market maker prices are usually the mean between the bid and ask prices. Certain markets are not closed at the time that the Fund prices its portfolio securities. In these situations, snapshot prices are provided by the individual pricing services or other alternate sources at the close of the NYSE as appropriate. Securities not traded on a particular day are valued at the mean between the last reported bid and the asked quotes, or the last sale price when appropriate; otherwise fair value will be determined by the board-appointed fair valuation committee. Debt securities for which the over-the-counter market is the primary market are normally valued on the basis of prices furnished by one or more pricing services or dealers at the mean between the latest available bid and asked prices. As authorized by the Board of Trustees, debt securities (including short-term obligations that will mature in 60 days or less) may be valued on the basis of valuations furnished by a pricing service which determines valuations based upon market transactions for normal, institutional-size trading units of securities or a matrix method which considers yield or price of comparable bonds provided by a pricing service. Total return swaps are priced based on valuations provided by a Board approved independent third party pricing agent. If a total return swap price cannot be obtained from an independent third party pricing agent the Fund shall seek to obtain a bid price from at least one independent and/or executing broker.

If the price of a security is unavailable in accordance with the aforementioned pricing procedures, or the price of a security is unreliable, e.g., due to the occurrence of a significant event, the security may be valued at its fair value determined by management pursuant to procedures adopted by the Board of Trustees. For this purpose, fair value is the price that the Fund reasonably expects to receive on a current sale of the security. Due to the number of variables affecting the price of a security, however; it is possible that the fair value of a security may not accurately reflect the price that the Fund could actually receive on a sale of the security.

A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

| | |

Clough Global Long/Short Fund | | Notes to Financial Statements |

| | October 31, 2015 |

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| | | | |

Level 1 | | – | | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

Level 2 | | – | | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |