Filed Pursuant to Rule 253(g)(2)

File No. 024-10659

RISE COMPANIES CORP.

SUPPLEMENT NO. 4 DATED JANUARY 21, 2020

TO THE OFFERING CIRCULAR DATED JULY 24, 2019

This document supplements, and should be read in conjunction with, the offering circular of Rise Companies Corp. (the "Company", “we”, “our” or “us”), dated July 24, 2019 and filed by us with the Securities and Exchange Commission (the “Commission”) on July 25, 2019 (the “Offering Circular”). Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the Offering Circular.

The purpose of this supplement is to:

| · | Disclose the time-weighted, weighted average annualized return across all of our sponsored investment programs for 2019; |

| · | Update the offering price for our common shares throughout the Offering Circular; |

| · | Update the “Our Solution” section of the Offering Circular; and |

| · | Describe amendments approved, and update language throughout the Offering Circular, with respect to: |

| o | our Certificate of Incorporation to reflect (i) the increase in authorized shares and (ii) the increase in shares designated as Class B Common Stock; |

| o | our 2014 Stock Option and Grant Plan to reflect the increase in shares of Class A Common Stock available for grant. |

Certain 2019 Performance Metrics

We have historically offered our Program investors attractive risk-adjusted returns; the time-weighted, weighted average annualized return across all of our sponsored investment programs was approximately 9.47% in 2019. However, no assurance can be given that the Programs sponsored by us will achieve such results in the future, as past performance is not indicative of future results.

Offering Price for Our Common Shares

The following information supersedes and replaces the first paragraph on the cover page of the Offering Circular:

We are offering up to 10,000,000 shares of our Class B Common Stock to the public. Effective January 21, 2020, the offering price per share of our Class B Common Stock will be $8.87. Investors will pay the most recent publicly announced offering price as of the date of their subscription.

.

The following information supersedes and replaces the table on the cover page of the Offering Circular:

| | | Per Share | | | Total

Minimum | | | Total

Maximum (1) | |

| Public Offering Price (2) | | $ | 8.87 | | | | 1,000,000 | (3)(6) | | $ | 66,462,170 | (7) |

| Underwriting Discounts and Commissions (4) | | $ | — | | | $ | — | | | $ | — | |

| Proceeds to Us from this Offering to the Public (Before Expenses (5)) | | $ | 8.87 | | | | 1,000,000 | (3)(6) | | $ | 66,462,170 | (7) |

| Proceeds to Other Persons | | $ | — | | | $ | — | | | $ | — | |

| (1) | This is a “best efforts” offering, which means we are only required to use our best efforts to sell the Class B Common Stock offered in this offering. |

| (2) | The price per share shown was arbitrarily determined by our board of directors and will apply for the duration of this offering. |

| (3) | We previously exceeded the minimum level of sales. |

| (4) | Investors will not pay upfront selling commissions in connection with the purchase of our Class B Common Stock. |

| (5) | All expenses incurred as a result of this offering, which we estimate to be approximately $63,000, will be borne by us. Purchasers of our Class B Common Stock are not directly responsible for costs incurred as a result of this offering. |

| (6) | Total minimum calculations reflect the previous share price under this offering of $5.00. Total minimums under this offering have already been met. |

| (7) | Total maximum calculations take into account 2,884,129 of Class B common shares previously sold under this offering at the offering price of $5.00 per share, 699,880 of Class B common shares previously sold under this offering at the offering price of $5.50 per share, 649,781 of Class B common shares previously sold under this offering at the offering price of $6.00 per share, 240,589 of Class B common shares previously sold under this offering at the offering price of $6.30 per share, 522,878 of Class B common shares previously sold under this offering at the offering price of $6.60 per share, 814,870 of Class B common shares previously sold under this offering at the offering price of $6.90 per share, 1,073,480 of Class B common shares previously sold under this offering at the offering price of $7.30 per share, 457,898 of Class B common shares previously sold under this offering at the offering price of $7.67 per share, 1,029,649 of Class B common shares previously sold under this offering at the offering price of $8.05 per share, and 864,499 of Class B common shares previously sold under this offering at the offering price of $8.45 per share. We are currently continuing to offer up to approximately $6.8 million in our Class B common shares, which, when taken together with the approximately $26.9 million in Class B common shares sold in the previous 12-months, is less than the rolling 12-month maximum offering amount of $50 million allowable under Regulation A. |

The following information supersedes and replaces the following risk factors on pages 16 and 17 of the Offering Circular:

This offering and the offerings of our eDirectTM Programs are focused on attracting a large number of investors that plan on making relatively small investments. An inability to attract such investors may have an adverse effect on the success of our and our eDirectTM Programs’ offerings, and we may not raise adequate capital to implement our business strategy.

Our Class B Common Stock and the common shares of our eDirectTM Programs are being offered and sold only to “qualified purchasers” (as defined in Regulation A). “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D (which, in the case of natural persons, (A) have an individual net worth, or joint net worth with the person’s spouse, that exceeds $1,000,000 at the time of the purchase, excluding the value of the primary residence of such person, or (B) earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year) and (ii) all other investors so long as their investment in the particular issuer does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). However, our Class B Common Stock and the common shares of our eDirectTM Programs are currently being offered and sold only to those investors that are within the latter category (i.e., investors whose investment in our Class B Common Stock or in the common shares of an eDirectTMProgram, as applicable, does not represent more than 10% of the applicable amount), regardless of an investor’s status as an “accredited investor.” Therefore, our target investor base inherently consists of persons that may not have the high net worth or income that investors in traditional initial public offerings have, where the investor base is typically composed of “accredited investors.”

Our reliance on attracting investors that may not meet the net worth or income requirements of “accredited investors” carries certain risks that may not be present in traditional initial public offerings. For example, certain economic, geopolitical and social conditions may influence the investing habits and risk tolerance of these smaller investors to a greater extent than “accredited investors,” which may have an adverse effect on our ability to raise adequate capital to implement our business strategy. Additionally, our focus on investors that plan on making, or are able to make, relatively small investments requires a larger investor base in order to meet our goal of raising approximately $7.0 million in this offering and each eDirectTM Program’s goal of raising $50,000,000 on a rolling 12-month basis in its offering. We may have difficulties in attracting a large investor base, which may have an adverse effect on the success of this offering, the eDirectTM Programs’ offerings, and a larger investor base involves increased transaction costs, which will increase our, our eDirectTM Programs’ expenses. Further, if our eDirectTM Programs are unable to successfully raise capital for their respective business strategies, we will experience a decrease in the fees that we collect from our eDirectTM Programs or from real estate operators that may be borrowers or joint venture partners with our eDirectTM Programs, which would have a negative effect on our growth prospects.

We will continue to be controlled by our executive officers who hold shares of our capital stock, and their interests may conflict with those of our other stockholders.

Upon the completion of this offering (that is, assuming that we are able to raise the balance of the aggregate $7.0 million of Class B Common Stock being offered in this offering), our executive officers who hold shares of our capital stock, one of whom is Benjamin Miller, our Chief Executive Officer, will collectively hold more than fifty percent (50%) of the combined voting power of our capital stock (after giving effect to the voting rights of the holders of preferred stock, voting on an as-converted basis). So long as our executive officers continue to collectively hold, directly or indirectly, shares of capital stock representing more than 50% of the voting power of our capital stock, they will be able to exercise control over all matters requiring stockholder approval, including the election of directors (and therefore our management and policies), amendment of our amended and restated certificate of incorporation and approval of significant corporate transactions. The control exercised by our executive officers may have the effect of delaying or preventing a change in control of our Company or discouraging others from making tender offers for our shares, which could prevent stockholders from receiving a premium for their shares. These actions may be taken even if other stockholders oppose them. The interests of our executive officers may not always coincide with the interests of other stockholders, and our executive officers may act in a manner that advances their best interests and not necessarily those of our other stockholders.

The following information supersedes and replaces the first paragraph under “Use of Proceeds” on page 32 of the Offering Circular:

We estimate that the net proceeds to us from the sale of Class B Common Stock in this offering will be approximately $66.5 million, based upon (i) prior raises of approximately $59.5 million based on an average offer price of $6.46, (ii) the sale of an additional 786,579 shares of Class B Common Stock being offered under this offering circular at an offering price of $8.87 per share and after deducting estimated offering expenses payable by us.

The following information supersedes and replaces “Dilution” on page 34 of the Offering Circular:

If you invest in our Class B Common Stock, your interest will be diluted to the extent of the difference between the offering price per share of our Class B Common Stock and the pro forma net tangible book value per share of our Class B Common Stock immediately after this offering. Dilution results from the fact that the per share offering price of our Class B Common Stock is substantially in excess of the pro forma net tangible book value per share attributable to the existing equity holders. Net tangible book value represents net book equity attributable to equity holders of the Company excluding intangible assets. Note, the net tangible book value does not include any assets or liabilities attributable to consolidated but non-controlling interests (i.e., eDirectTM Programs and Fundrise LP).

Our pro forma net tangible book value per share as of June 30, 2019 was approximately $21.1 million, or approximately $0.85 per share of our Common Stock on a fully diluted basis. Pro forma net tangible book value represents the amount of total tangible assets less total liabilities. Pro forma net tangible book value per share represents pro forma net tangible book value divided by the number of shares of Common Stock outstanding on a fully diluted basis.

The following table illustrates the substantial and immediate dilution per share of Class B Common Stock to a purchaser in this offering, assuming issuance of 9,213,421 and 10,000,000 shares of Class B Common Stock in this offering:

| On Basis of Full Conversion of Issued Instruments | | $59.7 Million

Raise (1) | | | $66.5 Million

Raise | |

| Price per Share | | $ | 6.46 | | | $ | 8.87 | |

| Shares issued | | | 9,237,653 | | | | 10,000,000 | |

| Capital Raised | | $ | 59,700,152 | | | $ | 66,462,170 | |

| Less: Estimated Offering Costs | | $ | (500,000 | ) | | $ | (500,000 | ) |

| Net Offering Proceeds from raise(s) | | $ | 15,093,691 | | | $ | 21,855,709 | |

| Net Tangible Book Value Pre-Offering | | $ | 21,067,020 | (2) | | $ | 21,067,020 | (2) |

| Net Tangible Book Value Post-Offering | | $ | 36,160,711 | (2) | | $ | 42,922,729 | (2) |

| | | | | | | | | |

| Shares issued and outstanding Pre-Offering assuming full conversion | | | 24,752,405 | (3) | | | 24,752,405 | (3) |

| Post-Offering Shares Issued and Outstanding | | | 33,990,058 | (3) | | | 34,752,405 | (3) |

| | | | | | | | | |

| Net tangible book value per share prior to offering | | $ | 0.85 | | | $ | 0.85 | |

| Increase/(Decrease) per share attributable to new investors | | $ | 0.21 | | | $ | 0.38 | |

| Net tangible book value per share after offering | | $ | 1.06 | | | $ | 1.24 | |

| Dilution per share to new investors ($) | | $ | 5.40 | | | $ | 7.63 | |

| Dilution per share to new investors (%) | | | 83.54 | % | | | 86.08 | % |

| (1) | As of the date of this supplement, 2,884,129 shares were previously issued at $5.00 per share, 699,880 shares were previously issued at $5.50, 649,781 shares were previously issued at $6.00, 240,589 shares were previously issued at $6.30, 522,878 shares were previously issued at $6.60, 814,870 shares were previously issued at $6.90, 1,073,480 shares were previously issued at $7.30, 457,898 shares were previously issued at $7.67, 1,029,649 shares were previously issued at $8.05 per share and 864,499 shares were previously issued at $8.45 per share. The weighted average price per share of previously issued shares is approximately $6.46. The total amount raised in these offerings was $59.7 million. The information that follows has taken this into effect. |

| (2) | Net tangible book value is based on the net tangible equity attributable to equity holders of the Company as of June 30, 2019. In the instance upon dissolution/sale of the Company, the value of assets and liabilities attributable to non-controlling interests would be excluded from the value of the Company. Thus, assets and liabilities attributable to non-controlling interests (i.e., eDirectTM Programs and Fundrise LP) are excluded from the Company's net tangible book value. |

| (3) | Assumes conversion of all issued shares of Series A Preferred Stock to Class A Common Stock, and vesting of all issued restricted Class A Common Stock grants. |

The following table sets forth, as of January 21, 2020, on the same pro forma basis as above, the number of shares of Class B Common Stock purchased from us, the total consideration paid, or to be paid, and the average price per share paid, or to be paid, by existing stockholders and by the new investors, calculated at an assumed offering price of $5.00 per share for 2,884,129 shares, an offering price of $5.50 per share for 699,880 shares, an offering price of $6.00 per share for 649,781 shares, an offering price of $6.30 per share for 240,589 shares, an offering price of $6.60 per share for 522,878 shares, an offering price of $6.90 per share for 814,870 shares, an offering price of $7.30 per share for 1,073,480 shares, an offering price of $7.67 per share for 457,898 shares, an offering price of $8.05 per share for 1,029,649 shares, an offering price of $8.45 per share for 864,499 shares, and assuming the remaining 762,347 shares are issued at $8.87 per share, before deducting estimated offering expenses payable by us:

| | | Dates Issued | | | Issued Shares | | | Effective Cash

Price

per Share at

Issuance

or Potential

Conversion | |

| Class A Common Stock | | | 2014-2017 | | | | 2,887,359 | | | $ | 0.17 | (2) |

| Class F Common Stock | | | 2014 | | | | 10,000,000 | | | | N/A | (3) |

| Series A Preferred Shares | | | 2014 | | | | 10,647,531 | (1) | | $ | 2.19 | |

| Series A Preferred Shares (Conversion of convertible notes payable) | | | 2014 | | | | 1,217,515 | (1) | | $ | 1.20 | |

| | | | | | | | | | | | | |

| Total Common Stock Equivalents | | | | | | | 24,752,405 | | | $ | 1.02 | |

| Class B Investors, assuming $66.5 Million raise in this offering | | | | | | | 10,000,000 | | | $ | 6.65 | (4) |

| | | | | | | | | | | | | |

| Total After Inclusion of this Offering | | | | | | | 34,752,405 | | | $ | 2.64 | |

| (1) | Assumes conversion of all issued shares of Series A Preferred Stock to Class A Common Stock. |

| (2) | As of December 31, 2019, 2,886,900 shares have been authorized, of which 2,301,250 shares have vested, 164,497 remain unvested, and 420,123 have been forfeited and are available for reissuance under our Stock Plan. 1,912,900 shares were issued for an effective cash price of $0.1105 per share. 174,000 shares were issued for an effective cash price of $0.19 per share. 797,500 were issued at $0.29 per share. 2,500 shares were issued at $5.50 per share. In addition, as of December 31, 2019, 459 options were exercised for $5.50 per share. |

| (3) | Common shares issued without cash payment includes 10,000,000 Class F shares to the co-founders for the contribution of Fundrise LLC, Popularise LLC, Fundrise Servicing LLC, and other assets of the Company. |

| (4) | As of the date of this offering, 2,884,129 shares were previously issued at $5.00 per share, 699,880 shares were previously issued at $5.50, 649,781 shares were previously issued at $6.00, 240,589 shares were previously issued at $6.30, 522,878 shares were previously issued at $6.60, 814,870 shares were previously issued at $6.90, 1,073,630 shares were previously issued at $7.30, 457,898 shares were previously issued at $7.67, 1,029,649 shares were previously issued at $8.05 per share, and 864,499 shares were previously issued at $8.45 per share. Assuming the remaining 762,347 shares are issued at $8.87 per share, the Class B weighted average per share will be $6.65. |

The table above does not give effect to shares of our Class A Common Stock that may be issued upon the exercise of options that we expect to grant under our stock-based compensation plans after the time of this offering. To the extent shares of our Class A Common Stock are issued pursuant to the Company’s 2014 Stock Option and Grant Plan, there will be further dilution to new investors.

Our Solution

The following information supersedes and replaces the “Our Solution” section of the Offering Circular:

Our Solution

We own and operate the Fundrise Platform, a leading online, direct investment technology platform located atwww.fundrise.com. We believe technology-powered investment is a more efficient mechanism than the conventional financial system to invest in real estate and other assets. Enabled by our proprietary technology, we aggregate thousands of individuals from across the country to create the scale of an institutional investor without the high fees and overhead typical of the old-fashioned investment business. Individuals can invest through the Fundrise Platform at ultra-low costs for what we believe is a more transparent, web-based experience. Investors use the Fundrise Platform to potentially earn attractive risk-adjusted returns from asset classes that have generally been closed to many investors and only available to high net worth investors and institutions.

Since inception through December 31, 2019, we have originated approximately $1.1 billion in both equity and debt investments deployed across more than approximately $4.9 billion of real estate property, while collecting and processing more than 5 million investor dividend distributions and principal repayment transactions since we sponsored our first online investment in 2012. As our business has grown and changed, from offering a platform to facilitate the sponsor of investment, to an active sponsor of specific real estate projects, to the creation and offering of the eREITTM programs, the eFundTM programs, and the Opportunity Fund program (eREITTM programs, eFundTM and Opportunity Fund programs collectively the “Sponsored Programs”) our real estate debt and equity originations over the same period have changed as well. Our originations have increased over the period starting January 1, 2014 and ending December 31, 2019 from approximately $0.9 million to $1.1 billion, an impressive 228% compounded annual growth rate (CAGR).

We have fully redeemed out of approximately 101 investments across all Sponsored Programs as of December 31, 2019.

As of December 31, 2019, we have yet to generate any profits from our operations and are incurring net losses, and do not expect to generate any profits, if ever, until our assets under management, or AUM, through our Programs is substantially larger.

Excluding whole loan co-investors and real estate debt and equity originated but not fully drawn down, the average amount invested across both the Sponsored Programs and Project Dependent Notes program is approximately $8,064 per unique investor and the average amount invested in the Sponsored Programs was approximately $8,012 per unique investor as of December 31, 2019.In April 2014, at the time of our Series A financing round, the Company priced its stock in an arms-length transaction at a $2.18 a share, and has since experienced the following comparative growth metrics:

| | | April 14,

2014 | | | December 31,

2016 | | | December 31,

2017 | | | December 31,

2018 | | | December 31,

2019 | | | YTD

Growth | | | ITD

Growth | |

| Assets Under Management | | $ | 665,100 | | | $ | 146,971,876 | | | $ | 250,390,722 | | | $ | 485,517,662 | | | $ | 988,201,522 | | | | 104 | % | | | 148,479 | % |

| Real Estate Transactions | | | 9 | | | | 93 | | | | 143 | | | | 245 | | | | 316 | | | | 29 | % | | | 3,411 | % |

| Active Investors* | | | 478 | | | | 12,195 | | | | 25,026 | | | | 63,271 | | | | 122,544 | | | | 94 | % | | | 25,537 | % |

| iPO Investors* | | | 0 | | | | 0 | | | | 3,676 | | | | 8,229 | | | | 16,353 | | | | 99 | % | | | | ** |

| Employees | | | 12 | | | | 43 | | | | 49 | | | | 76 | | | | 110 | | | | 45 | % | | | 817 | % |

*Active Investors represents the approximate total number of unique investors less the approximate number of investors who were no longer invested in any of the programs as of such date.

**We began offering shares through our internet Public Offering (iPO) in February 2017.

As of April 14, 2014, the Company's programs had received subscriptions from 556 unique investors compared to December 31, 2019 when the Company's programs had received subscriptions from 134,505 unique investors, which is an absolute change of approximately 24,092% and from year-end 2013 to year-end 2019 and a compounded annual growth rate over the same period of approximately 150%.

By combining sound investment principles with our proprietary web-based technology, we believe we have built a solution that will transform how the real estate capital markets operate, increasing their efficiency and transparency. Our model is built specifically to leverage the economies of scale created by the Internet to cut out excessive fees, while also lowering execution costs and reducing both time and manual resources.

We believe we are participating in and driving the third wave of a paradigm shift in the financial industry similar to the invention of and move to online brokerages and online payment systems that occurred in the late 1990s and 2000s, and the “marketplace lending” and automated registered investment advisor movements in the 2000s and 2010s.

We believe that the first wave of this paradigm was from physical brokerages to online brokerages, such as E*TRADE Financial Corp., TD Ameritrade Corp., and Charles Schwab Corp. According to each of their Quarterly Reports on Form 10-Q for fiscal period ended March 31, 2019, E*TRADE Financial Corp., TD Ameritrade Corp., and Charles Schwab Corp. have grown their customer bases to 7,057,000, 11,763,000, and 11,787,000 accounts, respectively, with $593.0 billion, $1,297.1 billion, $3,5856.40 billion in client assets, respectively.

We believe the second wave of this paradigm shift is represented by technology-driven asset management companies such automated registered investment advisors, such as Wealthfront Inc. and Betterment, LLC. In addition, according to their Forms ADV, dated January 18, 2019 and May 23, 2019, respectively, Wealthfront Inc. and Betterment, LLC have grown their assets under management to approximately $11.5 billion (with approximately 281,000 accounts) and $16.4 billion (with approximately 542,000 accounts), respectively.

However, unlike online brokerage platforms, online payment processors, marketplace lending platforms, or automated registered investment advisors, we are focused on sponsoring and directly offering to investors (without the costs associated with such intermediaries), alternative investments, in particular real estate, which, according to a Prequin report as of the end of 2017, as an asset class (defined as real estate, private equity and hedge funds) hit a record high of $8.8 trillion in 2017 and was forecast to grow to $14 trillion by 2023.

Our end-to-end integrated technology platform transforms the real estate origination, underwriting, funding, and servicing processes; replacing expensive sales and management teams with online and mobile applications, implementing data driven decision-making, and automating transactions through payment processing APIs (application programming interfaces). Through our direct-to-the-investor investment platform, we allow an individual investor to invest in the value (price per square foot) and yields available in the private real estate market.

Simultaneously, the technology platform allows for the seamless purchase of interests in private real estate investments, performance tracking and reporting through a personalized dashboard, and automated account management and maintenance, including financial updates and tax reporting. This allows us to service thousands of investors at a fraction of the cost of conventional, offline management typical in real estate.

Because the entire system is built on an API-based, technology platform and utilizes data driven analysis and decision-making, the model is continuously improving and increasing in efficiency as the volume of data points increase exponentially and our automated processes undergo constant optimization.

We believe that investors in general, and younger investors in particular, prefer to invest through a web and mobile platform rather than a conventional platform or in person process. As of December 31, 2018, the average age of investors in our Programs was approximately 37 years old. According to 2011, 2017, and 2018 Aite Group reports, New Realities in Wealth Management, at the end of each year discount and online brokerages managed 19% in 2011, 20.5% in 2016, and 21.5% in 2017 of the wealth management industry’s total client investment assets versus 38% in 2011, 33% in 2016, and 31.4% in 2017 managed by the wirehouses. Self-clearing retail brokerages (outside wirehouses) managed 15.6% in 2011, 17.6% in 2016, and 18.18% in 2017 of total client assets. At the end of 2017, total client assets hit a record of $24.2 trillion and the four largest wirehouses were Bank of America Merrill Lynch, UBS, Morgan Stanley, and Wells Fargo Advisors.

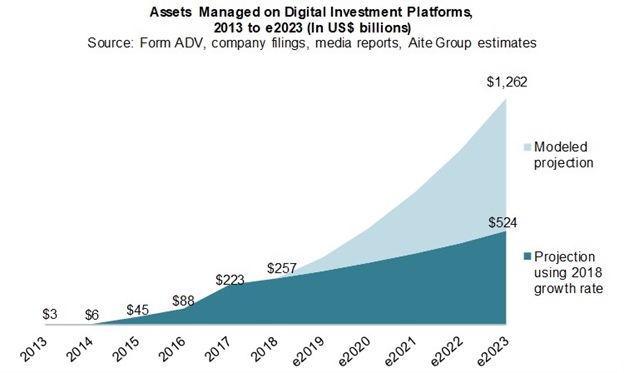

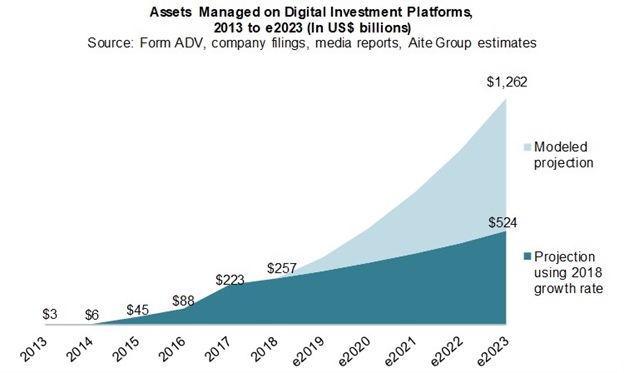

The above data illustrate the changing preferences and demographic trends underway in the industry. Moreover, according to Aite Group’s U.S. Digital Investment Management Market Monitor, Q2 2019, client assets under management on robo-advice platforms is forecast to continue to grow.

Amendment to Certificate of Incorporation; Increase in Authorized Shares

As recommended and approved by our board of directors (the “Board”), including all of our independent directors, on January 21, 2020, we received the requisite consent of our stockholders to the amendment of our Amended and Restated Certificate of Incorporation (“Certificate of Incorporation”) pursuant to an amendment and restatement of the Certification of Incorporation, to increase the authorized number of its shares of common stock by 10,000,0000 shares, all of which are designated as Class B Common Stock. The total number of shares of common stock authorized to be issued is now 91,000,000, par value $0.0001 per share (the “Common Stock”), of which 43,000,000 are designated as “Class A Common Stock”, 20,000,000 are designated as “Class B Common Stock”, 10,000,000 are designated as “Class F Common Stock” and 18,000,000 are designated as “Class M Common Stock”.

The information set forth in the Offering Circular under the headings“RISK FACTORS- Your interest in us will be diluted if we issue additional shares, which could reduce the overall value of your investment”and“-Your interest in us will be diluted if we issue additional shares, which could reduce the overall value of your investment”and “SECURITIES BEING OFFERED –General”should be read to reflect the changes noted above.

In addition, the foregoing description of the amendment to our Certificate of Incorporation is qualified in its entirety by reference to the copy of the Second Amended and Restated Certificate of Incorporation included as an exhibit to our Offering Statement filed with the Securities and Exchange Commission (“SEC”).

Amendment to 2014 Stock Option and Grant Plan

As recommended and approved by our Board, including all of our independent directors, on January 21, 2020, we received the requisite consent of our stockholders to the amendment of our 2014 Stock Option and Grant Plan (the “Plan”) pursuant to an amendment and restatement of the Plan, to increase the number of shares of Class A Common Stock eligible for grant under the Plan by 5,500,000 shares of Class A Common Stock, from 4,600,000 shares to 10,100,000 shares.

The information set forth in the Offering Circular under the heading “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS -Components of Results of Operations -Stock-Based Compensation”should be read to reflect the changes noted above.

In addition, the foregoing description of the amendment to the Plan is qualified in its entirety by reference to the copy of the Second Amended and Restated 2014 Stock Option and Grant Plan included as an exhibit to our Offering Statement filed with the SEC.