ASSOCIATED CAPITAL GROUP, INC. Reports Full Year and Fourth Quarter Results

| · | Assets Under Management (AUM) increased to $1.27 billion at December 31, 2016 from $1.08 billion at December 31, 2015 |

| · | Diluted EPS of $0.41 per share for the year ended December 31, 2016, AC's first year as a public company |

| · | GAAP book value per share increased to $36.04 at December 31, 2016 from $29.54 at December 31, 2015 |

| · | Repurchased 1.1 million shares during the fourth quarter at an average price of $31.51 per share |

Rye, New York, February 8, 2017 – Associated Capital Group, Inc. (“AC” or the “Company”) reported financial results for the fourth quarter and year ended December 31, 2016. The quarter represents AC’s fourth full quarter as a stand-alone public company since the spin-off from GAMCO Investors, Inc. (“GAMCO”) on November 30, 2015.

Fourth Quarter Overview

Fourth quarter operating revenues increased to $16.3 million from $9.0 million generated in the fourth quarter of 2015 driven primarily by a $4.9 million increase in incentive fees. Fourth quarter investment and other non-operating income, net declined by $6.7 million versus the 2015 fourth quarter due primarily to a $2.0 million reduction in investment gains and the $5.4 million cost of AC’s initial Shareholder Designated Charitable Contribution Program. Net income was $3.6 million, or $0.15 per diluted share, compared to $4.2 million, or $0.17 per diluted share in the fourth quarter of 2015.

| Financial Highlights | | | Q4 | | | Full Year | |

| ($'s in 000's except AUM and per share data) | | | 2016 | | | | | 2015 | | | | 2016 | | | | 2015 | |

| | | | | | | | | | | | | | | | | | |

AUM - end of period (in millions) | | | | | | | | | | | $ | 1,272 | | | $ | 1,080 | |

| | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 16,295 | | | | $ | 8,995 | | | $ | 31,227 | | | $ | 22,842 | |

| | | | | | | | | | | | | | | | | | |

| Operating income/(loss), before management fee (a) | | | 659 | | | | | (5,314 | ) | | | (10,639 | ) | | | (14,621 | ) |

| | | | | | | | | | | | | | | | | | |

| Investment and other non-operating income, net | | | 4,599 | | | | | 11,252 | | | | 26,577 | | | | 11,736 | |

| | | | | | | | | | | | | | | | | | |

| Income/(loss) before income taxes | | | 4,731 | | | | | 5,369 | | | | 14,345 | | | | (2,576 | ) |

| | | | | | | | | | | | | | | | | | |

| Net income/(loss) | | | 3,647 | | | | | 4,189 | | | | 10,218 | | | | (111 | ) |

| | | | | | | | | | | | | | | | | | |

| Net income/(loss) per share | | $ | 0.15 | | | | $ | 0.17 | | | $ | 0.41 | | | $ | - | |

| | | | | | | | | | | | | | | | | | |

| Shares outstanding at December 31 | | | 24,255 | | (b) | | | 25,440 | | | | 24,255 | | | | 25,440 | |

| (a) See GAAP to non-GAAP reconciliation on page 6. | | | | | | | | | | | | | | |

| (b) Shares outstanding consist of 5,058 and 19,197 Class A and B shares, respectively, of which 23,831 are non-RSA shares | |

| and 424 RSA shares. | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Financial Condition

At December 31, 2016, the Company’s book value on a GAAP basis was $874 million, or $36.04 per share, up from $752 million, or $29.54 per share, at December 31, 2015. The increase in GAAP book value is driven primarily by a $150 million prepayment of the GAMCO Note (defined below) offset by $41.6 million invested in share repurchases. The Company has no long term debt. Our liquid financial resources underpin our flexibility to pursue strategic objectives that may include acquisitions, lift-outs, seeding new investment strategies, and co-investing, as well as shareholder compensation in the form of share repurchases and dividends.

Our investment in GAMCO stock at December 31, 2016 was valued at $136 million on a mark to market basis, similar to its value at December 31, 2015.

A note was issued by GAMCO to AC with an initial face value of $250 million (the “GAMCO Note”) as part of the spin-off transaction. The current principal balance of this note is not treated as an asset for GAAP purposes, but as a reduction in equity. As the GAMCO Note is paid down, GAAP book value will increase. During the third quarter of 2016, GAMCO prepaid $150 million of the GAMCO Note, reducing the principal outstanding to $100 million. In January 2017, GAMCO prepaid an additional $10 million, reducing the principal outstanding to $90 million.

Fourth Quarter Results of Operations

Assets Under Management (AUM)

| | | | | | | | | | |

| | | December 31, | | | September 30, | | | December 31, | |

| | | 2016 | | | 2016 | | | 2015 | |

| (in millions) | | | | | | | | | |

| Event Merger Arbitrage | | $ | 1,076 | | | $ | 1,044 | | | $ | 869 | |

| Event-Driven Value | | | 133 | | | | 144 | | | | 145 | |

| Other | | | 63 | | | | 63 | | | | 66 | |

| Total AUM | | $ | 1,272 | | | $ | 1,251 | | | $ | 1,080 | |

| | | | | | | | | | | | | |

Assets Under Management at December 31, 2016 were $1.27 billion, an increase of $192 million from $1.08 billion at December 31, 2015 due to $124 million of net inflows and $68 million of net appreciation.

Revenues and results of operations

Total operating revenues for the three months ended December 31, 2016 were $16.3 million versus $9.0 million in the comparable prior year period, reflecting increased investment advisory fees, incentive fees and revenue from institutional research services:

| - | Incentive fees increased to $9.3 million in the fourth quarter of 2016 from $4.4 million in the comparable quarter, due primarily to positive performance in our merger arbitrage funds on higher asset levels. |

| - | Investment advisory fees increased to $2.4 million in the fourth quarter of 2016, up from $1.9 million in the comparable 2015 quarter due to increased assets under management. |

| - | Institutional research services revenue was $2.7 million in the fourth quarter 2016 versus $2.3 million in the year ago quarter. The increase is primarily due to fees earned from at-the market offerings of certain GAMCO closed-end funds and increased commissions earned from affiliated advisors. |

For years in which our funds have positive performance, fourth quarter revenue will generally exceed the revenue levels in each of the first three quarters due to the recognition of annual incentive fees.

Fourth quarter operating income of $0.1 million in 2016 was improved from the operating loss of $5.9 million in the comparable quarter of 2015. Operating gain before management fee increased to $0.7 million in the fourth quarter of 2016 versus an operating loss before management fee of $5.3 million in the prior year period. The change was primarily due to increased incentive fees earned, offset in part by increased variable compensation and increased expenses due to our transformation to a stand-alone public company.

Investments and other non-operating income, net

During the fourth quarter of 2016, investment and other non-operating income, net was a $4.6 million gain versus a gain of $11.3 million in the fourth quarter of 2015. Investment gains were $7.1 million in the 2016 quarter versus gains of $9.1 million in the comparable 2015 quarter, primarily due to gains on marking the portfolio to market. The net amounts for the fourth quarter of 2016 also include a $5.4 million cost related to our initial Shareholder Designated Contribution Program. Net dividend and interest income was $2.9 million in the 2016 quarter versus $2.1 million earned in the comparable quarter in 2015.

Business and Investment Highlights

Event Driven Asset Management

Gabelli Associates Fund LP, which invests in merger arbitrage opportunities, was up 9.1% on a gross basis (6.4% net) for the year ended December 31, 2016. Global deal volume totaled $3.7 trillion, the third highest volume of M&A activity on record. Year over year, the total number of deals increased as activity remains vibrant.

Our merger arbitrage team completed the translation of our merger arbitrage book, “Deals, Deals and More Deals” into Italian and Chinese. The book is now produced in four languages:

Institutional Research

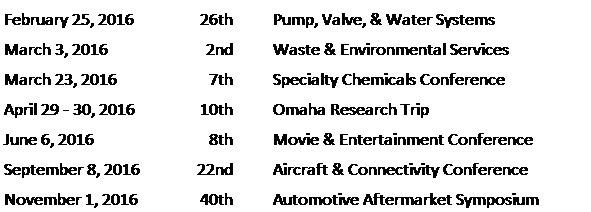

During the past year, G.research, our institutional research services business sponsored seven investment symposiums, (listed in chronological order):

We also hosted thirty-six roadshows with institutional investors and senior executives of companies followed by our research analysts.

Shareholder Compensation

During the quarter ended December 31, 2016, the Company repurchased 1.1 million AC shares at an average price of $31.51 per share, for a total investment of $34.7 million. This includes a purchase of 926,345 shares on December 30, 2016 at a price of $31.05.

In addition, in the current year through February 8, 2017, we have repurchased an additional 3,399 shares at an average price of $33.43 per share, for a total investment of $0.1 million.

On November 4, 2016, the Board of Directors approved a semi-annual dividend of $0.10 per share to all of its Class A and Class B shareholders paid on January 25, 2017 to shareholders of record on January 11, 2017.

About Associated Capital Group, Inc.

The Company was spun-off from GAMCO on November 30, 2015. The Company manages proprietary capital and operates businesses via Gabelli & Company Investment Advisers, Inc. (“GCIA” f/k/a/Gabelli Securities, Inc.), its 100% owned subsidiary.

GCIA and its wholly owned subsidiary, Gabelli & Partners, collectively serve as general partners or investment managers to investment funds including limited partnerships, offshore companies and separate accounts. The Company primarily manages assets in equity event-driven strategies, across a range of risk and event arbitrage portfolios. The business earns fees from its advisory assets, and income (loss) from proprietary trading and investment portfolio activities. The advisory fees include management and incentive fees. Management fees are largely based on a percentage of the portfolios assets under management. Incentive fees are based on the percentage of profits derived from the investment performance delivered to clients' invested assets. GCIA is registered with the Securities and Exchange Commission as an investment advisor under the Investment Advisers Act of 1940, as amended.

The Company operates its institutional research services business through G.research, a wholly owned subsidiary of the Company. G.research is a broker-dealer registered under the Securities Exchange Act of 1934, as amended, that provides institutional research services and acts as an underwriter.

NOTES ON NON-GAAP FINANCIAL MEASURES

| A. | Management believes the analysis of Adjusted Economic book value ("AEBV") and AEBV per share, both non-GAAP financial measures, are useful in analyzing the Company's financial condition during the period in which it builds its core operating business. For GAAP purposes, the amount of the GAMCO Note, which was issued to the Company as part of the spin-off transaction, is treated as a reduction in equity for the period all or a portion of it is outstanding. The GAMCO Note is expected to be paid down ratably over five years or sooner at GAMCO’s option. As the GAMCO Note pays down, the Company's total equity will increase, and once the GAMCO Note is fully paid off by GAMCO, the Company's total equity and AEBV will be the same. AEBV and AEBV per share represent book value and book value per share, respectively, without reducing equity for the period all or any portion of the GAMCO Note is outstanding. The calculations of AEBV and AEBV per share at December 31, 2016 are shown below: |

| Associated Capital Group, Inc. | |

| Reconciliation of Total Equity to Adjusted Economic Book Value | |

| | | | | | | |

| | | Total | | | Per Share | |

| Total equity as reported | | $ | 874,022 | | | $ | 36.04 | |

| Add: GAMCO Note | | | 100,000 | | | | 4.12 | |

| Adjusted Economic book value | | $ | 974,022 | | | $ | 40.16 | |

| | | | | | | | | |

| B. | Operating income/(loss) before management fee expense is used by management to evaluate its business operations. We believe this measure is useful in illustrating the operating results of the Company as management fee expense is based on pre-tax income/(loss) before management fee expense, which includes non-operating items including investment gains and losses from the Company’s proprietary investment portfolio and interest expense. The reconciliation of operating income/(loss) before management fee expense to operating income/(loss) is provided below. |

| Associated Capital Group, Inc. | |

| Reconciliation of non-GAAP financial measures to GAAP | |

| | | | | | | | | | | | | |

| | | | Q4 | | | | Q4 | | | Full Year | | | Full Year | |

| | | | 2016 | | | | 2015 | | | 2016 | | | 2015 | |

| Operating income/(loss) before management fee | | $ | 659 | | | $ | (5,314 | ) | | $ | (10,639 | ) | | $ | (14,621 | ) |

| Deduct: management fee expense | | | 527 | | | | 569 | | | | 1,593 | | | | (309 | ) |

| Operating income/(loss) | | $ | 132 | | | $ | (5,883 | ) | | $ | (12,232 | ) | | $ | (14,312 | ) |

| | | | | | | | | | | | | | | | | |

| Table I | | | | | | |

| ASSOCIATED CAPITAL GROUP, INC. | |

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION | |

| (Dollars in thousands, except per share data) | |

| | | | | | | |

| | | | | | | |

| | | December 31, | | | December 31, | |

| | | 2016 | | | 2015 | |

| | | | | | | |

| ASSETS | | | | | | |

| | | | | | | |

| Cash and cash equivalents | | $ | 314,093 | | | $ | 205,750 | |

| Investments | | | 468,139 | | | | 420,991 | |

| Investment in GAMCO stock | | | 135,701 | | | | 136,360 | |

| Receivable from brokers | | | 12,588 | | | | 56,510 | |

| Other receivables | | | 18,362 | | | | 13,229 | |

| Other assets | | | 3,720 | | | | 3,908 | |

| | | | | | | | | |

| Total assets | | $ | 952,603 | | | $ | 836,748 | |

| | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | |

| | | | | | | | | |

| Payable to brokers | | $ | 2,396 | | | $ | 50,648 | |

| Income taxes payable and deferred tax liabilities | | | 6,978 | | | | 5,669 | |

| Compensation payable | | | 17,676 | | | | 10,926 | |

| Securities sold short, not yet purchased | | | 9,984 | | | | 9,623 | |

| Accrued expenses and other liabilities | | | 37,317 | | | | 2,595 | |

| Sub-total | | | 74,351 | | | | 79,461 | |

| | | | | | | | | |

| Redeemable noncontrolling interests | | | 4,230 | | | | 5,738 | |

| | | | | | | | | |

| Equity | | | 972,705 | | | | 1,003,406 | |

| 4% PIK Note due from GAMCO | | | (100,000 | ) | | | (250,000 | ) |

| Accumulated comprehensive income (loss) | | | 1,317 | | | | (1,857 | ) |

| Total equity | | | 874,022 | | | | 751,549 | |

| | | | | | | | | |

| Total liabilities and equity | | $ | 952,603 | | | $ | 836,748 | |

| | | | | | | | | |

| Table II | | | | | | | | |

| | | | | | | | | |

| ASSOCIATED CAPITAL GROUP, INC. |

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| (Dollars in thousands, except per share data) |

| | | | | | | | | |

| | | For the Quarter Ended December 31, | | |

| | | | | | | | | |

| | | 2016 | | | | 2015 | | |

| | | | | | | | | |

| Investment advisory and incentive fees | | $ | 11,734 | | | | $ | 6,340 | | |

| Institutional research services | | | 2,650 | | | | | 2,267 | | |

| Other revenues | | | 1,911 | | | | | 388 | | |

| Total revenues | | | 16,295 | | | | | 8,995 | | |

| | | | | | | | | | | |

| Compensation costs | | | 12,800 | | | | | 9,788 | | |

| Stock based compensation | | | 449 | | | | | 3,036 | | |

| Other operating expenses | | | 2,387 | | | | | 1,485 | | |

| Total expenses | | | 15,636 | | | | | 14,309 | | |

| | | | | | | | | | | |

| Operating income/(loss) before management fee | | | 659 | | | | | (5,314 | ) | |

| | | | | | | | | | | |

| Investment gain | | | 7,139 | | | | | 9,110 | | |

| Interest and dividend income from GAMCO | | | 1,000 | | | | | 1,141 | | |

| Interest and dividend income, net | | | 1,871 | | | | | 1,001 | | |

| Shareholder-designated contribution | | | (5,411 | ) | | | | - | | |

| Investment and other non-operating income, net | | | 4,599 | | | | | 11,252 | | |

| | | | | | | | | | | |

| Gain before management fee and income taxes | | | 5,258 | | | | | 5,938 | | |

| Management fee | | | 527 | | | | | 569 | | |

| Income before income taxes | | | 4,731 | | | | | 5,369 | | |

| Income tax | | | 1,103 | | | | | 1,469 | | |

| Net income | | | 3,628 | | | | | 3,900 | | |

| Net loss attributable to noncontrolling interests | | | (19 | ) | | | | (289 | ) | |

| Net income attributable to Associated Capital Group, Inc. | | $ | 3,647 | | | | $ | 4,189 | | |

| | | | | | | | | | | |

| Net income per share attributable to Associated Capital Group, Inc.: | | | | | | | |

| Basic | | $ | 0.15 | | | | $ | 0.17 | | |

| | | | | | | | | | | |

| Diluted | | $ | 0.15 | | | | $ | 0.17 | | |

| | | | | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | | | |

| Basic | | | 24,845 | | | | | 24,887 | | |

| | | | | | | | | | | |

| Diluted | | | 25,119 | | | | | 25,170 | | |

| | | | | | | | | | | |

| Actual shares outstanding | | | 24,255 | | (a) | | | 25,440 | | (a) |

| | | | | | | | | | | |

| Notes: | | | | | | | | | | |

| (a) Includes 424,340 and 553,100 of RSAs at December 31, 2016 and 2015, respectively. | | | | | |

| Table III | | | | | | | | |

| | | | | | | | | |

| ASSOCIATED CAPITAL GROUP, INC. |

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| (Dollars in thousands, except per share data) |

| | | | | | | | | |

| | | For the Year Ended December 31, | | |

| | | | | | | | | |

| | | 2016 | | | | 2015 | | |

| | | | | | | | | |

| Investment advisory and incentive fees | | $ | 18,320 | | | | $ | 12,635 | | |

| Institutional research services | | | 9,604 | | | | | 8,397 | | |

| Other revenues | | | 3,303 | | | | | 1,810 | | |

| Total revenues | | | 31,227 | | | | | 22,842 | | |

| | | | | | | | | | | |

| Compensation costs | | | 30,968 | | | | | 26,343 | | |

| Stock based compensation | | | 2,464 | | | | | 4,931 | | |

| Other operating expenses | | | 8,434 | | | | | 6,189 | | |

| Total expenses | | | 41,866 | | | | | 37,463 | | |

| | | | | | | | | | | |

| Operating loss before management fee | | | (10,639 | ) | | | | (14,621 | ) | |

| | | | | | | | | | | |

| Investment gain | | | 19,909 | | | | | 8,276 | | |

| Interest and dividend income from GAMCO | | | 8,012 | | | | | 1,141 | | |

| Interest and dividend income, net | | | 4,067 | | | | | 2,319 | | |

| Shareholder-designated contribution | | | (5,411 | ) | | | | - | | |

| Investment and other non-operating income, net | | | 26,577 | | | | | 11,736 | | |

| | | | | | | | | | | |

| Gain/(loss) before management fee and income taxes | | | 15,938 | | | | | (2,885 | ) | |

| Management fee | | | 1,593 | | | | | (309 | ) | |

| Income/(loss) before income taxes | | | 14,345 | | | | | (2,576 | ) | |

| Income tax | | | 3,876 | | | | | (1,685 | ) | |

| Net income/(loss) | | | 10,469 | | | | | (891 | ) | |

| Net income/(loss) attributable to noncontrolling interests | | | 251 | | | | | (780 | ) | |

| Net income/(loss) attributable to Associated Capital Group, Inc. | | $ | 10,218 | | | | $ | (111 | ) | |

| | | | | | | | | | | |

| Net income/(loss) per share attributable to Associated Capital Group, Inc.: | | | | | | | |

| Basic | | $ | 0.41 | | | | $ | - | | |

| | | | | | | | | | | |

| Diluted | | $ | 0.41 | | | | $ | - | | |

| | | | | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | | | |

| Basic | | | 24,870 | | | | | 24,887 | | |

| | | | | | | | | | | |

| Diluted | | | 25,175 | | | | | 25,170 | | |

| | | | | | | | | | | |

| Actual shares outstanding | | | 24,255 | | (a) | | | 25,440 | | (a) |

| | | | | | | | | | | |

| Notes: | | | | | | | | | | |

| (a) Includes 424,340 and 553,100 of RSAs at December 31, 2016 and 2015, respectively. | | | | | |

| Table IV | | | | | | |

| | | | | | | |

| ASSOCIATED CAPITAL GROUP, INC. | |

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |

| (Dollars in thousands, except per share data) | |

| | | | | | | |

| | | For the Year Ended December 31, | |

| | | | | | | |

| | | 2016 | | | 2015 | |

| Operating activities | | | | | | |

| Net income (loss) | | $ | 10,469 | | | $ | (891 | ) |

| Increase in investments in trading securities | | | (13,769 | ) | | | (71,552 | ) |

| (Increase) decrease in investments in partnerships | | | (13,168 | ) | | | 7,688 | |

| Other adjustments | | | 23,056 | | | | 17,405 | |

| Net cash provided by (used in) operating activities | | | 6,588 | | | | (47,350 | ) |

| | | | | | | | | |

| Investing activities | | | | | | | | |

| Purchases of available for sale securities | | | (5,107 | ) | | | (43,271 | ) |

| Other | | | 992 | | | | 1,537 | |

| Net cash used in investing activities | | | (4,115 | ) | | | (41,734 | ) |

| | | | | | | | | |

| Financing activities | | | | | | | | |

| Proceeds from payment of GAMCO 4% PIK Note | | | 150,000 | | | | - | |

| Purchase of treasury stock | | | (41,630 | ) | | | (44 | ) |

| Dividends paid | | | (2,504 | ) | | | - | |

| Repayment of demand loan with GAMCO | | | - | | | | (16,000 | ) |

| Net transfer from GAMCO | | | - | | | | 25,190 | |

| Other | | | 6 | | | | 135 | |

| Net cash provided by financing activities | | | 105,872 | | | | 9,281 | |

| Net increase (decrease) in cash and cash equivalents | | | 108,345 | | | | (79,803 | ) |

| Cash and cash equivalents at beginning of year | | | 205,750 | | | | 285,530 | |

| Increase in cash from consolidation | | | - | | | | 10 | |

| Increase (decrease) in cash from deconsolidation | | | (2 | ) | | | 13 | |

| Cash and cash equivalents at end of year | | $ | 314,093 | | | $ | 205,750 | |

| | | | | | | | | |

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

The financial results set forth in this press release are preliminary. Our disclosure and analysis in this press release, which do not present historical information, contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements convey our current expectations or forecasts of future events. You can identify these statements because they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning. They also appear in any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance of our products, expenses, the outcome of any legal proceedings, and financial results. Although we believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know about our business and operations, the economy and other conditions, there can be no assurance that our actual results will not differ materially from what we expect or believe. Therefore, you should proceed with caution in relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other important factors, some of which are listed below, that are difficult to predict and could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward-looking statements. Some of the factors that could cause our actual results to differ from our expectations or beliefs include a decline in the securities markets that adversely affect our assets under management, negative performance of our products, the failure to perform as required under our investment management agreements, a general downturn in the economy that negatively impacts our operations. We also direct your attention to the more specific discussions of these and other risks, uncertainties and other important factors contained in our Form 10 and other public filings. Other factors that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We do not undertake to update publicly any forward-looking statements if we subsequently learn that we are unlikely to achieve our expectations whether as a result of new information, future developments or otherwise, except as may be required by law.