- AC Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Associated Capital (AC) DEF 14ADefinitive proxy

Filed: 26 Apr 24, 4:23pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

Associated Capital Group, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

ASSOCIATED CAPITAL GROUP, INC.

191 Mason Street

Greenwich, CT 06830

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on June 4, 2024

We are pleased to invite you to attend our Annual Meeting of Shareholders (the “Annual Meeting”) to be held on June 4, 2024, at 4:15 p.m., ET, at our office on 191 Mason Street, Greenwich CT 06830 and virtually by Internet webcast. At the Annual Meeting, we will ask shareholders:

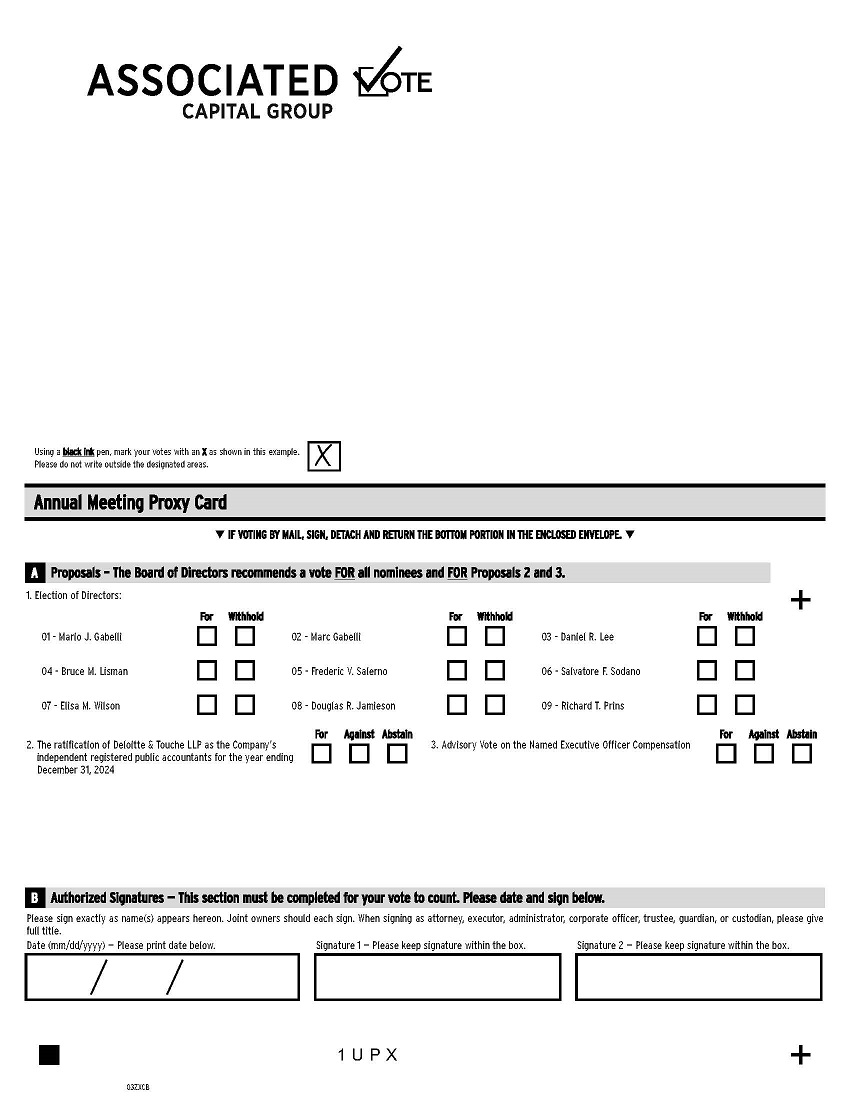

1. | To elect nine directors to the Board of Directors to serve until the 2025 Annual Meeting of Shareholders or until their respective successors have been duly elected and qualified; |

2. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024; |

3. | To hold an advisory vote on the named executive officer compensation; and |

4. | To vote on any other business that properly comes before the meeting. |

At the meeting, we will also review our 2023 financial results and outlook for the future and will answer your questions.

Shareholders of record at the close of business on April 16, 2024 are entitled to vote at the meeting or any adjournments or postponements thereof. Please read the attached proxy statement carefully and vote your shares promptly whether or not you are able to attend the meeting.

We encourage all shareholders to attend the Annual Meeting.

By Order of the Board of Directors | |

PETER D. GOLDSTEIN Secretary |

April 26, 2024

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders

to Be Held on June 4, 2024.

This Notice, the Proxy Statement, and the 2023 Annual Report on Form 10-K are available free of charge on the following website: https://www.associated-capital-group.com/ir/SECfilings.

TABLE OF CONTENTS

INTRODUCTION; PROXY VOTING INFORMATION | |

PROPOSAL 1 ELECTION OF DIRECTORS | |

PROPOSAL 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS | |

PROPOSAL 3 ADVISORY VOTE ON THE NAMED EXECUTIVE OFFICER COMPENSATION | 9 |

CORPORATE GOVERNANCE | |

INFORMATION REGARDING NAMED EXECUTIVE OFFICERS | 15 |

COMPENSATION OF EXECUTIVE OFFICERS | 16 |

| PAY VERSUS PERFORMANCE DISCLOSURES | 18 |

CERTAIN OWNERSHIP OF OUR STOCK | 20 |

DELINQUENT SECTION 16(A) FILINGS | 21 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 21 |

REPORT OF THE AUDIT COMMITTEE | 25 |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 26 |

SHAREHOLDER PROPOSALS FOR THE 2024 ANNUAL MEETING | 26 |

OTHER MATTERS | 27 |

ANNEX A: GUIDELINES FOR DIRECTOR INDEPENDENCE |

ASSOCIATED CAPITAL GROUP, INC.

191 Mason Street

Greenwich, CT 06830

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

June 4, 2024

INTRODUCTION; PROXY VOTING INFORMATION

Unless we have indicated otherwise, or the context otherwise requires, references in this proxy statement to “Associated Capital Group, Inc.,” “Associated Capital Group,” “Associated Capital,” “the Company,” “AC,” “we,” “us” and “our” or similar terms are to Associated Capital Group, Inc., a Delaware corporation, its predecessors and its subsidiaries.

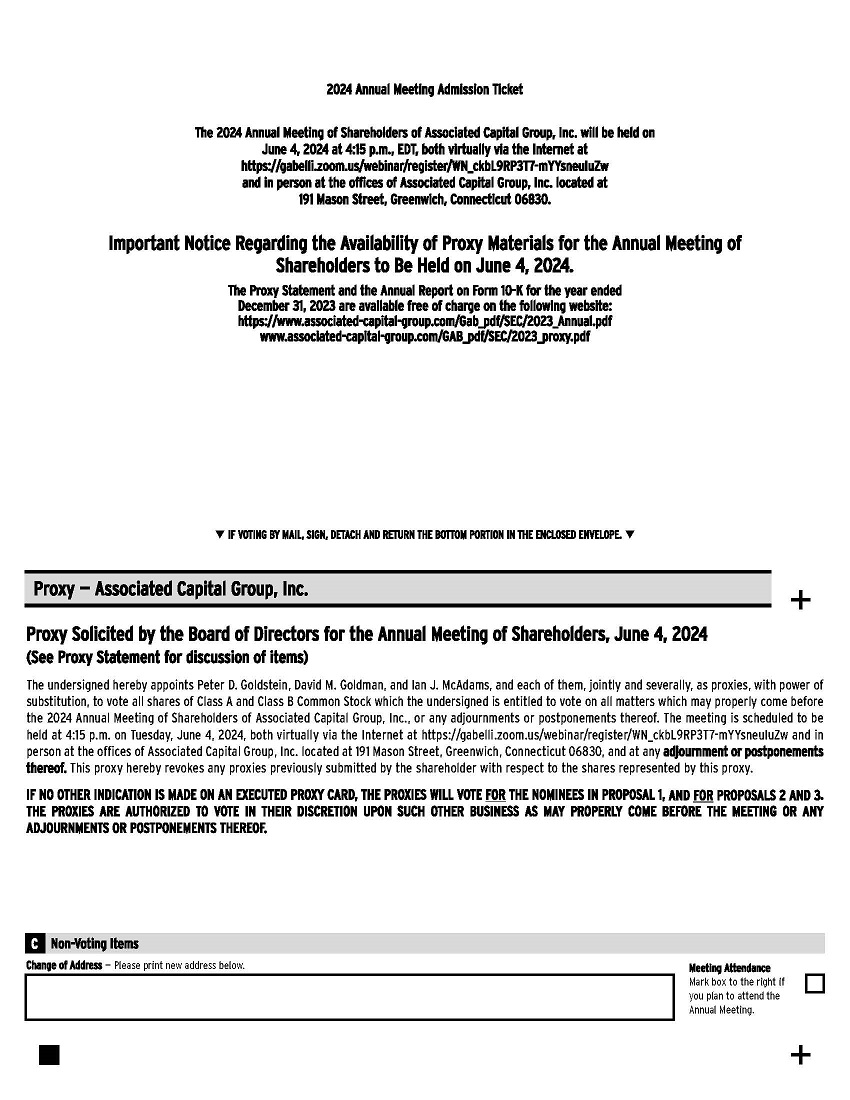

We are sending you this proxy statement and the accompanying proxy card in connection with the solicitation of proxies by the Board of Directors of Associated Capital (the “Board”) for use at our 2024 annual meeting of shareholders (the “2024 Annual Meeting”) to be held at our office at 191 Mason Street, Greenwich, CT 06830 and virtually via internet webcast, on Tuesday, June 4, 2024, at 4:15 p.m., local time, and at any adjournments or postponements thereof.

The purpose of the 2024 Annual Meeting is to (i) elect directors; (ii) ratify the appointment of the Company’s independent registered public accounting firm; (iii) hold an advisory vote on the named executive officer compensation; and (iv) act upon any other matters properly brought to the 2024 Annual Meeting. We are sending you this proxy statement, the proxy card, and our annual report on Form 10-K containing our financial statements and other financial information for the year ended December 31, 2023 (the “2023 Annual Report”) on or about April 29, 2024. The 2023 Annual Report, however, is not part of the proxy solicitation materials.

Shareholders of record at the close of business on April 16, 2024, the record date for the 2024 Annual Meeting, are entitled to notice of and to vote at the 2024 Annual Meeting. On this record date, we had outstanding 2,461,175 shares of Class A Common Stock, par value $0.001 per share (“Class A Stock”), and 18,950,571 shares of Class B Common Stock, par value $0.001 per share (“Class B Stock”).

The presence, in person or by proxy, of a majority of the aggregate voting power of the shares of Class A Stock and Class B Stock outstanding on April 16, 2024 shall constitute a quorum for the transaction of business at the 2024 Annual Meeting. Unless stated otherwise, the Class A Stock and Class B Stock vote together as a single class on all matters. Each share of Class A Stock is entitled to one vote per share, and each share of Class B Stock is entitled to ten votes per share. Directors who receive a plurality of the votes cast at the 2024 Annual Meeting by the holders of Class A Stock and Class B Stock outstanding on April 16, 2024, voting together as a single class, will be elected to serve until the 2025 annual meeting of shareholders (the “2025 Annual Meeting”) or until their successors are duly elected and qualified. Any other matters will be determined by a majority of the votes cast at the 2024 Annual Meeting.

Under the New York Stock Exchange (“NYSE”) rules, the proposal to approve the appointment of independent auditors is considered a “discretionary” item. This means that brokerage firms may vote in their discretion on this matter on behalf of clients who have not furnished voting instructions at least 10 days before the date of the meeting.

In contrast, the election of directors and the advisory vote on the named executive officer compensation are “non-discretionary” items. This means brokerage firms that have not received voting instructions from their clients on these proposals may not vote on them. These so-called “broker non-votes” will be included in the calculation of the number of votes considered to be present at the meeting for purposes of determining a quorum, but will not be considered in determining the number of votes necessary for approval. Accordingly, broker non-votes will have no effect on the outcome of the vote for the election of directors or the advisory vote on the named executive officer compensation. Abstentions will be included in the calculation of the number of votes considered to be present at the meeting for purposes of determining a quorum, but will not be considered in determining the number of votes necessary for approval and therefore will have no effect on the outcome of the vote for the election of directors or the advisory vote on the named executive officer compensation, but will have the same effect as voting against the remaining proposal(s).

We will pay for the costs of soliciting proxies and preparing the 2024 Annual Meeting materials. We ask securities brokers, custodians, nominees and fiduciaries to forward meeting materials to our beneficial shareholders as of the record date, and we will reimburse them for the reasonable out-of-pocket expenses they incur. Our directors, officers and staff members may solicit proxies personally or by telephone, facsimile, e-mail or other means but will not receive additional compensation for doing so.

If you are the beneficial owner, but not the record holder, of shares of our Class A Stock, your broker, custodian or other nominee may only deliver one copy of this proxy statement and our 2023 Annual Report to multiple shareholders who share an address unless we have received contrary instructions from one or more of such shareholders. We will deliver promptly, upon written or oral request, a separate copy of this proxy statement and our 2023 Annual Report to a shareholder at a shared address to which a single copy of the documents was delivered. A shareholder who wishes to receive a separate copy of this proxy statement and 2023 Annual Report, now or in the future, should submit this request by writing to our Secretary at Associated Capital Group, Inc., 191 Mason Street, Greenwich, CT 06830 or by calling our Secretary at (203) 629-9595. Beneficial owners sharing an address who are receiving multiple copies of proxy materials and annual reports and who wish to receive a single copy of such materials in the future will need to contact their broker, custodian or other nominee to request that only a single copy of each document be mailed to all shareholders at the shared address in the future.

All shareholders and properly appointed proxy holders may attend the 2024 Annual Meeting. Shareholders who plan to attend must present valid photo identification. If you hold your shares in a brokerage account, please also bring proof of your share ownership, such as a broker's statement showing that you owned shares of the Company on the record date for the 2024 Annual Meeting or a legal proxy from your broker or nominee. A legal proxy is required if you hold your shares in a brokerage account and you plan to vote in person at the 2024 Annual Meeting. Shareholders of record will be verified against an official list available at the 2024 Annual Meeting. The Company reserves the right to deny admittance to anyone who cannot adequately show proof of share ownership as of the record date for the 2024 Annual Meeting.

The Board has selected each of Peter D. Goldstein, David M. Goldman, and Ian J. McAdams to act as proxies. When you sign and return your proxy card, you appoint each of Messrs. Goldstein, Goldman, and McAdams as your representatives at the 2024 Annual Meeting. Unless otherwise indicated on the proxy, all properly executed proxies received in time to be tabulated for the 2024 Annual Meeting will be voted “FOR” the election of the nominees named below, “FOR” the ratification of the appointment of the Company’s independent registered public accounting firm, “FOR” the approval, on an advisory basis, of the named executive officer compensation, and as the proxyholders may determine in their discretion with regard to any other matter properly brought before the meeting. You may revoke your proxy at any time before the 2024 Annual Meeting by delivering a letter of revocation to our Secretary at Associated Capital Group, Inc., 191 Mason Street, Greenwich, CT 06830 or by properly submitting another proxy bearing a later date. The last proxy you properly submit is the one that will be counted.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders

to Be Held on June 4, 2024

This Notice, the Proxy Statement, and the 2023 Annual Report on Form 10-K are available free of charge on the following website: https://www.associated-capital-group.com/ir/SECfilings.

Associated Capital makes available free of charge through its website, at www.associated-capital-group.com, its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, a link to its Current Reports on Form 8-K and amendments to such reports, as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (“SEC”). Copies of certain of these documents may also be accessed electronically by means of the SEC’s home page at www.sec.gov. Associated Capital also makes available on its website at https://www.associated-capital-group.com/ir/CorporateGovernance the charters for the Audit Committee, Compensation Committee, Governance Committee and Nominating Committee, as well as its Code of Business Conduct and Ethics and Corporate Governance Guidelines. Print copies of these documents are available upon written request to our Secretary at Associated Capital Group, Inc., 191 Mason Street, Greenwich, CT 06830.

SMALLER REPORTING COMPANY

We are a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act, and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

ELECTION OF DIRECTORS

The Company’s current directors are as follows (ages are as of March 31, 2024):

Name | Age | Position | |||

Mario J. Gabelli | 81 | Executive Chair | |||

Douglas R. Jamieson | 69 | Director, Chief Executive Officer and President | |||

Marc Gabelli | 55 | Director, Vice Chair | |||

Daniel R. Lee | 67 | Director | |||

Bruce M. Lisman | 77 | Director | |||

Richard T. Prins | 73 | Director | |||

Frederic V. Salerno | 80 | Director | |||

Salvatore F. Sodano | 68 | Director | |||

Elisa M. Wilson | 51 | Director | |||

The Company’s Amended and Restated Bylaws provide that the Board shall consist of not less than three nor more than twelve directors, the exact number thereof to be fixed from time to time by the Board pursuant to a resolution adopted by a majority of the members then in office. The Board has fixed the number of directors to be elected at the 2024 Annual Meeting at nine.

Our Nominating Committee recommended, and the Board approved, the nomination of each of the current directors, to hold office until the 2025 Annual Meeting or until their respective successors are duly elected and qualified. Directors who receive a plurality of the votes cast at the 2024 Annual Meeting shall be elected. Each of the nominees has consented to being named in the proxy statement and to serve if elected.

All properly executed proxies received in time to be tabulated for the 2024 Annual Meeting will be voted “FOR” the election of the nominees named above, unless otherwise indicated on the proxy. If any nominee becomes unable or unwilling to serve between now and the 2024 Annual Meeting, your proxies may be voted “FOR” the election of a replacement designated by the Board.

The following are brief biographical sketches of the nine nominee directors, including their principal occupations at present and for the past five years, as of March 31, 2024. Unless otherwise noted, the nominee directors have been officers of the organizations named below or of affiliated organizations as their principal occupations for more than five years.

The Board believes that each of the nominee directors possesses the necessary attributes, skills, qualifications and experience that are appropriate for them to serve as a director of the Company. Our directors have held senior positions as leaders of various entities, demonstrating their ability to perform at the highest levels. The expertise and experience of our directors enable them to provide broad knowledge and sound judgment concerning the issues facing the Company.

Nominee Director Biographies

The Board has proposed all of the following as nominees:

Mario J. Gabelli has served as the Company’s Executive Chair since the spin-off transaction from GAMCO Investors, Inc. (“GAMCO”) was completed on November 30, 2015. In addition, Mr. Gabelli served as the Chief Executive Officer of the Company until November 2016. Mr. Gabelli is the Chair and Co-Chief Executive Officer of GAMCO and has served as a director since November 1976. In connection with those responsibilities, he serves as director or trustee of registered investment companies managed by GAMCO and its affiliates. Since March 2017, GAMCO serves as a sub-advisor to Teton Advisors, LLC, and Mr. Gabelli serves as a portfolio manager under that sub-advisory agreement. Mr. Gabelli has served as Chair of LICT Corporation (“LICT”), a public company engaged in broadband transport and other communications services, from 2004 to the present and has been the Chief Executive Officer of LICT since December 2010. In addition, Mr. Gabelli is the Chief Executive Officer, a director and the controlling shareholder of GGCP, Inc. (“GGCP”) a private company which owns a majority of the Associated Capital Class B Stock through GGCP Holdings, LLC (“Holdings”) a subsidiary of GGCP.

Mr. Gabelli serves as Overseer of the Columbia University Graduate School of Business and as a Trustee Associate of Boston College and Trustee of Roger Williams University. He also serves as a director of the Foreign Policy Association, The Winston Churchill Foundation, The E. L. Wiegand Foundation, The American-Italian Cancer Foundation and The Foundation for Italian Art & Culture. He is also Chair of the Gabelli Foundation, Inc., a Nevada private charitable trust. Mr. Gabelli served as Co-President of Field Point Park Association, Inc. Mr. Gabelli holds an M.B.A. from Columbia University Graduate School of Business, and is a summa cum laude graduate with a bachelor of science from Fordham University.

The Board believes that Mr. Gabelli’s qualifications to serve on the Board include his over forty years of experience with the Company and its predecessors, his control of the Company through his ownership of the majority shareholder and his position as Executive Chair of the Company.

Douglas R. Jamieson has served as President and Chief Executive Officer of the Company since November 2016 and as a director since May 2017. In August 2022 he was named co-CEO of GAMCO. He served as President and Chief Operating Officer of GAMCO from August 2004 to November 2016, and as a director since February 2022. He has served as a director of GAMCO Asset Management Inc., a wholly-owned subsidiary of GAMCO, since 1991, as its President and Chief Operating Officer since 2004, and as its Executive Vice President and Chief Operating Officer from 1986 to 2004. Mr. Jamieson also serves as President and a director of Gabelli & Company Investment Advisers, Inc. (f/k/a Gabelli Securities, Inc., “GCIA”), a wholly-owned subsidiary of the Company, a director of Gabelli Securities International (Bermuda) Ltd., a wholly owned subsidiary of the Company, and a director of GAMCO Asset Management (UK) Ltd., a wholly-owned subsidiary of GAMCO. Mr. Jamieson served on the Board of Teton Advisors, Inc. from 2005 through 2010. Mr. Jamieson also serves as a director of several investment funds that are managed by GCIA. Mr. Jamieson was a securities analyst with the predecessor of G.research, LLC (“G.research”), a broker-dealer, from 1981 to 1986. He was a director of GGCP from December 2005 through December 2009, and served as an advisor to the GGCP board through 2010.

The Board believes that Mr. Jamieson’s qualifications to serve on our Board include his business experience, his financial expertise, his experience serving as an executive officer of our Company and his investment experience.

Marc Gabelli served as President of the Company from its formation until November 2016 and has served as a director since May 2017. He also served as a director of GAMCO Investors, Inc. from November 2014 until May 2016, the period prior to the Company’s NYSE listing. Mr. Gabelli has served as President of the Company’s control parent company, GGCP, since 1999 and as a director since 1994. Mr. Gabelli has been Chair of Teton Advisors, Inc. (TETAA:OTC) since January 2018 and LGL Group (LGL:NYSE MKT) since 2017, and co-Chair of Gabelli Merger Plus+ Trust PLC (GMP:LSE) since 2023. Mr. Gabelli is also a non-executive director of Gabelli Securities International (UK) Ltd., Managing Partner of Horizon Research of New Delhi India since 2012, and Director and Managing Partner of Swiss based GGCP and GAMA Funds Holdings GmbH since 2010. As a fund manager since 1990, Mr. Gabelli’s focus is global value investments with portfolio assignments including alternative and traditional asset management. He manages alternative investment portfolios and the group’s investment companies trading on the London Stock Exchange. He has managed several Morningstar five star mutual funds and a Lipper #1 ranked global equity mutual fund. In corporate matters, he has assisted on group restructurings, including GAMCO’s initial public offering and the subsequent formation of the Company. He built the hedge fund platform of the Company’s wholly-owned subsidiary, Gabelli & Partners, LLC, and expanded the business internationally, opening the GAMCO London and Tokyo offices. In 2001, he also formed and served as General Partner of OpNet Partners, a Gabelli venture capital fund focused on optical networking technologies. He is also a Director of LICT. Mr. Gabelli is active in a variety of charitable educational efforts in the United States, Europe and the United Kingdom.

Mr. Gabelli began his career in equity research and arbitrage for Lehman Brothers International. He is a member of the New York Society of Security Analysts. He received an M.B.A. from the Massachusetts Institute of Technology and is a graduate of Harvard University, with a Master’s degree in Government, and Boston College, with a Bachelor’s degree in economics. Marc Gabelli is a son of Mario J. Gabelli.

The Board believes that Mr. Gabelli’s qualifications to serve on our Board include his extensive knowledge of our business and industry, and his financial and leadership expertise as an executive of various investment firms.

Daniel R. Lee has been a director of the Company since the spin-off transaction from GAMCO was completed on November 30, 2015. Mr. Lee served as a director of GCIA from August 2012 until August 2016 and as a director of Lynch Interactive Corporation from 2000 to 2005 and again from January 2010 to July 2013. He has also served in a number of senior executive and financial positions over the course of a long and distinguished business career. Mr. Lee is currently the Chief Executive Officer, President and a director of Full House Resorts, Inc., a developer and manager of gaming properties headquartered in Las Vegas, NV. He has held these positions since December 2014. Previously, he served as Chair and Chief Executive Officer of F.P. Holdings, LP, the owner and operator of The Palms Casino Resort in Las Vegas, NV, from September 2013 to July 2014. Prior to that, he was Managing Partner of Creative Casinos, LLC, a casino developer and operator that he sold. He also served as Chair and Chief Executive Officer of Pinnacle Entertainment, Inc., an owner and operator of gaming entertainment properties, from 2002 to 2009, during which time it was a NYSE-listed company. He held the positions of Chief Financial Officer, Treasurer and Senior Vice President—Finance of Mirage Resorts, Inc., from 1992 to 1999. Previously, he was a Managing Director of a major brokerage firm and was a Chartered Financial Analyst. Mr. Lee served as a director of ICTC from June 2015 until December 2016 and as a director of LICT from 2000 to 2005 and again from January 2010 to July 2013. Mr. Lee also served as a director of Myers Industries Inc. (“Myers”, NYSE: MYE), a diversified manufacturing company focusing on polymer products and wholesale distribution, from May 2013 to May 2015 and from May 2016 to May 2018.

The Board believes that Mr. Lee’s substantial financial experience and expertise, his experience in the financial services industry and his executive management experience as CEO of a large public corporation make him well-qualified to serve on the Company’s board.

Bruce M. Lisman has been a director of the Company since the spin-off transaction from GAMCO was completed on November 30, 2015. Mr. Lisman has served as a director of National Life Group, a mutual life insurance company, since 2004. He has been a director of Myers Industries, a leading material handling company and distributor of tire related products, since April 2015. He has been a board member of Bank of Burlington since 2023. He joined the board of Strattec Security Corporation, a manufacturer and distributor of automotive access control products, in 2023. He is a former board member of Circor International (NYSE: CIR), a flow and motion control manufacturer. He previously served on the boards of PC Construction, an engineering and construction company, as Chair from 2013 to 2021, Merchants Bancshares from 2005 to 2016, and The Pep Boys – Manny, Moe & Jack (NYSE: PBY) from 2015 until 2016 when it was sold. He has also served on the boards of American Forests (Chair) and the University of Vermont (Chair), among other organizations. Before his retirement in 2009, Mr. Lisman was the Director of Research from 1984 to 1987 at Bear Stearns Companies and Co-Head of the Institutional Equities Division from 1987-2008. After Bear Stearns was acquired by JP Morgan Chase & Co (NYSE: JPM) in 2008, he became Chair of JP Morgan’s Global Equity Division, retiring in 2009.

The Board believes that Mr. Lisman’s qualifications to serve on our Board include his extensive board experience as a chair, vice chair and committee chair/member in a broad range of businesses and civic organizations, in addition to his experience serving as an executive officer and his investment experience.

Richard T. Prins has been a director of the Company since June 2021. Mr. Prins was a partner in the law firm Skadden, Arps, Slate, Meagher & Flom LLP (“Skadden”) for 35 years before retiring at the end of 2020. At Skadden, Mr. Prins founded the firm’s investment management practice. Within that industry and related businesses, he was active in many areas, including structuring new kinds of investment funds and securities products, solving complex regulatory issues, handling initial public offerings and follow-on financings and mergers and acquisitions transactions. Mr. Prins also served on Skadden’s management committee and various other committees. Mr. Prins has been a director of Gracie Point Holdings, LLC, a rapidly growing provider of insurance premium finance solutions, since 2018. Mr. Prins serves as a director and is active in committee work at the Chamber Music Society of Lincoln Center and Skowhegan School of Painting & Sculpture. Mr. Prins received his JD with honors from the University of Michigan Law School in 1977 and graduated from Calvin University in 1972.

The Board believes that Mr. Prins’s qualifications to serve on our Board include his extensive legal experience, including his work on investment management related matters.

Frederic V. Salerno has been a director of the Company since February 2017. Mr. Salerno served as the Vice Chair of Verizon Communications, Inc. (“Verizon”). Before the merger of Bell Atlantic and GTE Corporation, Mr. Salerno was Senior Executive Vice President, Chief Financial Officer of Bell Atlantic and served in the Office of the Chair from 1997 to 2001. Prior to joining Bell Atlantic, he served as Executive Vice President and Chief Operating Officer of New England Telephone from 1985 to 1987, President and Chief Executive Officer of New York Telephone from 1987 to 1991 and Vice Chair, Finance and Business Development at NYNEX from 1991 to 1997. Mr. Salerno is also the Chair of the Board of Directors of GGCP. Mr. Salerno currently serves on the Boards of multiple NYSE US regulated subsidiaries and as a director of the Madison Square Garden Entertainment Corp., previously known as the Madison Square Garden Company (NYSE:MSG) prior to a spin-off transaction. He also previously served as a board member of National Fuel Gas Company, Popular, Inc., Viacom, CBS, Florida Community Bank, Akamai Technologies, Inc. and Intercontinental Exchange, Inc.

The Board believes that Mr. Salerno’s qualifications to serve on the Board include his former position as Vice Chair of Verizon and his past and current positions as a director of other public and private companies and charitable organizations.

Salvatore F. Sodano has been a director of the Company since the spin-off transaction from GAMCO was completed on November 30, 2015. Mr. Sodano served as Vice Chair at Broadridge Financial Solutions from June 2016 until June 2020, where he led Broadridge Advisor Solutions (“BAS”). Mr. Sodano served as Chair and chief executive officer of Worldwide Capital Advisory Partners, LLC (“Worldwide Capital”) from April 2013 to 2020. Worldwide Capital provided research and advisory services on corporate finance and investment activities, management, operations and technology matters. From 2012 to 2019, Mr. Sodano served as a senior advisor to the chief executive officer of Burke & Quick Partners, where he previously served as Chair of strategy and business development from October 2012 to August 2013. Mr. Sodano served as Vice Chair and a member of the board of directors of GCIA from September 2014 through August 2016 and served as Chair of the Audit Committee of the board of directors of GCIA from January 2015 through August 2016. In January 2015, Mr. Sodano also became Chair of the Board of Directors and Chair of the Executive Committee and the Executive Compensation Committee of Catholic Health, a 17,000-employee healthcare system. From June 2006 to June 2010, Mr. Sodano served as the Dean of the Frank G. Zarb School of Business at Hofstra University. Mr. Sodano also served as Chair of Hofstra University’s Board of Trustees for the maximum three one-year terms from October 2002 through October 2005. From 1997 to 2004, Mr. Sodano held increasingly senior roles at the National Association of Securities Dealers, Inc. (the “NASD”) and its affiliated companies. Mr. Sodano was serving as Deputy Chief Operating Officer and Chief Financial Officer of the NASD in 1998 when it acquired the American Stock Exchange (the “AMEX”). From 1999 to 2000, Mr. Sodano simultaneously served as Chair and Chief Executive Officer of the AMEX and Chief Operating Officer and Chief Financial Officer of the NASD. He served as a member of the Board of Governors of the NASD from 1999 to 2004. Mr. Sodano was appointed Vice Chair of the NASD Board of Governors in 2000, at which point he relinquished his role as Chief Operating Officer and Chief Financial Officer of the NASD. Mr. Sodano served as Vice Chair of the NASD Board of Governors and Chair and Chief Executive Officer of the AMEX until it was sold in 2004. He remained Chair of the AMEX until he retired in 2005. Mr. Sodano has been the Sorin Distinguished Teaching Fellow at the Frank G. Zarb School of Business at Hofstra University and is currently an adjunct Full Professor.

The Board believes that Mr. Sodano’s qualifications to serve on our Board include his business and academic experience, his financial expertise, including his audit committee experience, his experience as a member of the GCIA board of directors and as Chair of the GCIA Audit Committee.

Elisa M. Wilson has served as a director of GAMCO since February 2009, a director of GGCP since January 2019, and a director of the Company since February 2019. Ms. Wilson is the President and a trustee of the Gabelli Foundation, Inc., a Nevada private charitable trust. She also serves as a director and Vice President of the Breast Cancer Alliance, a member of the Brunswick School BPA board and a member of the Board of Trustees of Boston College. Ms. Wilson earned a B.A. from Boston College and an M.A., Ed.M. from Columbia University. Ms. Wilson is the daughter of Mario J. Gabelli.

The Board believes that Ms. Wilson’s qualifications to serve on our Board include her extensive knowledge of our business and industry, and her broad experience on the boards of both financial and charitable institutions.

Recommendation

The Board recommends that shareholders vote “FOR” all of the nominees to our Board.

Vote Required

Nominees who receive a plurality of the votes cast will be elected to serve as directors of the Company until the 2025 Annual Meeting or until their successors are duly elected and qualified. Withheld votes and broker non-votes, if any, will have no effect on the outcome of this proposal. Shareholders who return a signed proxy card but do not indicate how they wish to vote on Proposal 1 will be deemed to have voted “FOR” all nominees. Abstentions, if any, will not be considered in determining the number of votes necessary for approval and therefore will have no effect on the outcome of the vote for the election of directors.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

We are asking our shareholders to ratify the selection of Deloitte & Touche LLP (“D&T”) as the Company’s independent registered public accountants. In accordance with our governance documents, the Board believes that this proposal is consistent with best practices in corporate governance and is an opportunity for shareholders to provide direct feedback to the Board on an important issue of corporate governance. In the event that the shareholders do not approve the selection of D&T, the Audit Committee will reconsider the selection of D&T. Ultimately, however, the Audit Committee retains full discretion and will make all determinations with respect to the appointment of the independent auditors, whether or not the Company’s shareholders ratify the appointment.

For additional information regarding the selection of D&T as the Company’s independent registered public accountants, please see the section captioned Independent Registered Public Accounting Firm on page 26.

Recommendation

The Board recommends that shareholders vote “FOR” ratification of D&T as the Company’s independent registered public accountants for the year ended December 31, 2024.

Vote Required

Approval of Proposal 2 requires the affirmative vote of a majority of the votes cast on the proposal. Shareholders who return a signed proxy card but do not indicate how they wish to vote on Proposal 2 will be deemed to have voted “FOR” Proposal 2. Broker non-votes, if any, will have no effect on the outcome of this proposal. Abstentions, if any, will have the same effect as a vote against this proposal.

ADVISORY VOTE ON THE NAMED

EXECUTIVE OFFICER COMPENSATION

We are asking our shareholders to approve, on an advisory basis, the compensation of our named executive officers. The Company’s goal for its executive officer compensation program is to attract, motivate and retain talented persons. The Company seeks to accomplish this goal in a way that rewards performance and is aligned with its shareholders’ long-term interests. The Company believes that its executive compensation program satisfies this goal and is strongly aligned with the long-term interests of its shareholders.

The Company requests shareholders’ approval of the compensation of the Company’s named executive officers as disclosed elsewhere in this proxy statement, pursuant to SEC compensation disclosure rules.

As an advisory vote, this proposal is not binding upon the Company. However, the Compensation Committee, which is responsible for designing and administering the Company’s executive compensation program, values the opinion expressed by shareholders on this proposal and will consider the outcome of the vote when making future compensation decisions for the named executive officers.

Recommendation

The Board of Directors recommends that shareholders vote “FOR” the compensation of the Company’s named executive officers’ compensation.

Vote Required

Approval of Proposal 3 requires the affirmative vote of a majority of the votes cast on the proposal. Shareholders who return a signed proxy card but do not indicate how they wish to vote on Proposal 3 will be deemed to have voted “FOR” Proposal 3. Broker non-votes, if any, will have no effect on the outcome of this proposal. Abstentions, if any, will not be considered in determining the number of votes necessary for approval and therefore will have no effect on the outcome of the named executive officer compensation.

Associated Capital continually strives to maintain the highest standards of ethical conduct: reporting results with accuracy and transparency and maintaining full compliance with the laws, rules and regulations that govern the Company’s businesses. The Company is active in ensuring that its governance practices continue to serve the interests of its shareholders and remain at the leading edge of best practices.

Determination of Director Independence

The Board has established guidelines which it uses in determining director independence and that are based on the director independence standards of the NYSE. A copy of these guidelines can be found as Annex A. These guidelines are also attached to the Board’s Corporate Governance Guidelines, which are available at the following website: https://www.associated-capital-group.com/ir/CorporateGovernance. A copy of these guidelines may also be obtained upon request from our Secretary.

In making its determination of independence with respect to Messrs. Lee and Lisman, the Board considered that from time to time, investment advisory affiliates of GAMCO have nominated and may continue to nominate them to the boards of directors of public companies. In making its determination of independence with respect to Messrs. Sodano, Salerno and Lee, the Board considered Mr. Salerno’s service on the board of directors of GGCP and Mr. Sodano’s and Mr. Lee’s former service on the board of directors of GCIA. In making its determination with respect to Mr. Prins, the Board considered Mr. Prins representation of GAMCO and its affiliated entities while a partner at Skadden.

With respect to these relationships, the Board considered Messrs. Lee’s, Lisman’s, Prins’, Salerno’s and Sodano’s lack of economic dependence on the Company and other personal attributes that need to be possessed by independent-minded directors. Based on these guidelines and considerations, the Board concluded that the foregoing directors were independent and determined that none of them had a material relationship with us which would impair his ability to act as an independent director.

The table below sets forth certain information regarding the current directors that serve on our Committees.

Audit | Governance | Compensation | Nominating | |||||

Name | Committee | Committee | Committee | Committee | ||||

Mario J. Gabelli | X | |||||||

Frederic V. Salerno | X | X | X | X | ||||

Daniel R. Lee | X | X | ||||||

Bruce M. Lisman | X | X | ||||||

Salvatore F. Sodano | X | |||||||

Elisa M. Wilson | X |

Committee assignments for 2024 will be made after the annual election of directors.

The Board’s Role in the Oversight of Risk

The Board’s oversight of risk is administered directly through the Board, as a whole, or through its Committees. Various reports and presentations regarding risk management, including the Company’s cybersecurity risk management program, are presented to the Board including the procedures that the Company has adopted to identify and manage risk. Each of the Board’s Committees addresses risks that fall within the Committee’s area of responsibility. For example, the Audit Committee is responsible for “overseeing the quality and objectivity of Associated Capital’s financial statements and the independent audit thereof.” The Audit Committee reserves time at each of its quarterly meetings to meet with the Company’s independent registered public accounting firm outside of the presence of the Company’s management. The Director of Internal Audit also is significantly involved in risk management evaluation and designs the Company’s internal audit programs to take account of risk evaluation and works in conjunction with the Company’s principal financial officers. The Director of Internal Audit reports directly to the Company’s Audit Committee.

Relationship of Compensation and Risk

The Compensation Committee of the Board works with the Executive Chair and Chief Executive Officer and President in reviewing the significant elements of the Company’s compensation policies and programs for all staff. They evaluate the intended behaviors each program is designed to incentivize to ensure that such policies and programs are appropriate for the Company.

The Board and Committees

During 2023, there were four meetings of the Board. Our Board has an Audit Committee, a Compensation Committee, a Governance Committee and a Nominating Committee. We are deemed to be a “controlled company” as defined by the corporate governance standards of the NYSE because GGCP holds more than 50% of the voting power of the Company. As a result, we are exempt from the corporate governance standards of the NYSE requiring that a majority of the Board be independent and that all members of the Governance, Nominating and Compensation Committees be independent. While the Company is a controlled company, the Board nevertheless is currently comprised of a majority of independent directors.

At least once each year, our independent directors meet in a separate executive session. Mr. Salerno serves as lead independent director and chairs the meetings of our non-management and independent directors.

The Audit Committee regularly meets with our independent registered public accounting firm to ensure that satisfactory accounting procedures are being followed and that internal accounting controls are adequate, reviews fees charged by the independent registered public accounting firm and selects our independent registered public accounting firm. Messrs. Lisman, Salerno and Sodano, each of whom is an independent director as defined by the corporate governance standards of the NYSE and the Company’s guidelines as set forth in Annex A, are members of the Audit Committee. The Board has determined that Mr. Sodano meets the standards of an “audit committee financial expert,” as defined by the applicable securities regulations. The Audit Committee met five times during 2023. A copy of the Audit Committee’s charter is posted on our website at https://www.associated-capital-group.com/ir/CorporateGovernance. A shareholder may also obtain a copy of the charter upon written request from our Secretary delivered to our principal executive office.

The Compensation Committee reviews the amounts paid to the Executive Chair for compliance with the terms of his employment agreement and generally reviews benefits and compensation for the other executive officers, including the Chief Executive Officer. It also administers our Stock Award and Incentive Plan. Messrs. Lee and Salerno, each of whom is an independent director, are the members of the Compensation Committee. The Compensation Committee does not have a formal policy regarding delegation of its authority. The Compensation Committee had one meeting during 2023. A copy of the Compensation Committee’s charter is posted on our website at https://www.associated-capital-group.com/ir/CorporateGovernance. A shareholder may also obtain a copy of the charter upon written request from our Secretary delivered to our principal executive office.

The Governance Committee advises the Board on governance policies and procedures. Messrs. Lee, Lisman and Salerno, each of whom is an independent director, are the members of the Governance Committee. The Governance Committee had one meeting during 2023. A copy of the Governance Committee’s charter is posted on our website at https://www.associated-capital-group.com/ir/CorporateGovernance. A shareholder may also obtain a copy of the charter upon written request from our Secretary delivered to our principal executive office.

The Nominating Committee advises the Board on the selection and nomination of individuals to serve as directors of the Company. Nominations for director, including nominations for director submitted to the committee by shareholders, are evaluated according to our needs and the nominee’s knowledge, experience and background. Mr. Mario Gabelli, Mr. Salerno and Ms. Wilson are the members of the Nominating Committee. Mr. Mario Gabelli and Ms. Wilson are not independent directors as defined by the corporate governance standards of the Company. The Nominating Committee had no meetings during 2023. A copy of the Nominating Committee’s charter is posted on our website at https://www.associated-capital-group.com/ir/CorporateGovernance. A shareholder may also obtain a copy of the charter upon written request from our Secretary delivered to our principal executive office.

The Nominating Committee has adopted the following policy regarding diversity: When identifying nominees as directors, the Committee will have a bias to have diverse representation of candidates who serve or have served as chief executive officers or presidents of public or private corporations or entities that are either for-profit or not-for-profit. In accordance with its charter, the Nominating Committee will review the suitability for continued service as a director of each Board member when his or her term expires and when he or she has a change in status, including but not limited to an employment change, and recommend whether or not the director should be re-nominated. The Nominating Committee will review annually with the Board the composition of the Board as a whole and recommend, if necessary, measures to be taken.

Consideration of Director Candidates Recommended by Shareholders

Except as set forth in the Company’s Amended and Restated Bylaws, the Nominating Committee does not have a formal policy regarding the recommendation of director candidates by shareholders. The Board believes it is appropriate not to have such a policy because GGCP holds the majority of the voting power. Nevertheless, the Nominating Committee will consider appropriate candidates recommended by shareholders. Under the process described below, a shareholder wishing to submit such a recommendation should send a letter to our Secretary at 191 Mason Street, Greenwich, CT 06830. The mailing envelope must contain a clear notation that the enclosed letter is a “Director Nominee Recommendation.” The letter must identify the author as a shareholder and provide a brief summary of the candidate’s qualifications and otherwise comply with the requirements of our Amended and Restated Bylaws. At a minimum, candidates recommended for election to the Board must meet the independence standards of the NYSE as well as any criteria used by the Nominating Committee. The Nominating Committee will consider and evaluate candidates recommended by shareholders in the same manner as it considers candidates from other sources. Acceptance of a recommendation does not imply that the committee will ultimately nominate the recommended candidate.

Process for the Consideration of Director Candidates Nominated by Shareholders and of Business Proposed by Shareholders

Associated Capital’s Amended and Restated Bylaws set forth the processes and advance notice procedures that shareholders of Associated Capital must follow, and specifies additional information that shareholders of Associated Capital must provide, when proposing director nominations at any annual or special meeting of Associated Capital’s shareholders or other business to be considered at an annual meeting of shareholders. Generally, the Company’s Amended and Restated Bylaws provide that advance notice of shareholder nominations or proposals of business be provided to Associated Capital not less than ninety (90) days nor more than one hundred twenty (120) days prior to the anniversary date of the preceding annual meeting of shareholders. For the 2025 Annual Meeting therefore, such notice of nomination or other business must be received at Associated Capital’s principal executive offices between February 3, 2025 and March 4, 2025.

Article III, Paragraph 8 of Associated Capital’s Amended and Restated Bylaws sets out the procedures a shareholder must follow in order to nominate a candidate for Board membership. For these requirements, please refer to the Amended and Restated Bylaws as of November 19, 2015, filed with the SEC on November 25, 2015, as Exhibit 3.2 to a Current Report on Form 8-K.

In addition to satisfying the foregoing requirements under our Bylaws, to comply with the universal proxy rules (once they become effective), shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than April 4, 2025 (the 60th day prior to the first anniversary of the annual meeting for the preceding year’s annual meeting).

Director Attendance

During 2023, all of the directors attended at least 75% of the meetings of the Board and the Board committees of which he or she was a member. We do not have a policy regarding directors’ attendance at our annual meetings.

Compensation of Directors

Neither Mr. Mario Gabelli nor Mr. Jamieson received compensation for serving as a director of the Company in 2023. All directors, other than Mr. Mario Gabelli and Mr. Jamieson, receive annual cash retainers and meeting fees as follows:

Board Member | $ | 60,000 | ||

Audit Committee Chair | 20,000 | |||

Compensation Committee Chair | 12,000 | |||

Governance Committee Chair | 12,000 | |||

Attendance per Board Meeting | 5,000 | |||

Attendance per Audit Committee Meeting | 4,000 | |||

Attendance per Compensation and Governance Committees Meeting | 3,000 |

Director Compensation Table for 2022

The following table sets forth fees, awards, and other compensation paid to or earned by our directors in 2022.

Fees Earned or | Stock | Option | ||||||||||||||

Paid in Cash | Awards | Awards | ||||||||||||||

Name | ($) | ($)(a)(b) | ($)(a)(b) | Total ($) | ||||||||||||

Non-executive directors: | ||||||||||||||||

Daniel R. Lee | 80,000 | -0- | -0- | 80,000 | ||||||||||||

Bruce M. Lisman | 112,000 | -0- | -0- | 112,000 | ||||||||||||

Richard T. Prins | 80,000 | -0- | -0- | 80,000 | ||||||||||||

Frederic V. Salerno | 112,000 | -0- | -0- | 112,000 | ||||||||||||

Salvatore F. Sodano | 120,000 | -0- | -0- | 120,000 | ||||||||||||

Elisa M. Wilson | 80,000 | -0- | -0- | 80,000 | ||||||||||||

Executive directors: | ||||||||||||||||

Marc Gabelli | 80,000 | -0- | -0- | 80,000 | ||||||||||||

(a) | There were no AC phantom or other restricted stock awards or option awards granted to any non-executive directors or Mr. Marc Gabelli during 2023. See the Summary Compensation Table for 2023 and footnotes on page 16 for information on Mr. Mario Gabelli’s and Mr. Jamieson’s compensation and Certain Relationships and Related Transactions – Employment on page 24 for information on Mr. Marc Gabelli’s compensation. Also see Outstanding Equity Awards at Fiscal Year-End 2023 on page 19 for information on Mr. Jamieson’s phantom restricted stock awards. |

(b) | There were no AC phantom or other restricted stock awards or option awards outstanding to any non-executive directors or Mr. Marc Gabelli at December 31, 2023. |

Communications with the Board

Our Board has established a process for shareholders and other interested parties to send communications to the Board. Shareholders or other interested parties who wish to communicate with the Board, the non-management or independent directors, or a particular director, may send a letter to our Secretary at Associated Capital Group, Inc., 191 Mason Street, Greenwich, CT 06830. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Board Communication” or “Director Communication.” All such letters must identify the author and clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The Secretary will make copies of all such letters and circulate them to the appropriate director or directors.

Code of Business Conduct

We have adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) that applies to all of our officers, directors and staff members with additional requirements for our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Code of Conduct is posted on our website at https://www.associated-capital-group.com/ir/CorporateGovernance. Any shareholder may also obtain a copy of the Code of Conduct upon request. Shareholders may address a written request for a printed copy of the Code of Conduct to our Secretary at Associated Capital Group, Inc., 191 Mason Street, Greenwich, CT 06830. We intend to satisfy the disclosure requirement regarding any amendment to, or a waiver of, a provision of the Code of Conduct by posting such information on our website.

Employee, Officer and Director Hedging

Pursuant to our policies and procedures for transacting in Company securities, all employees, including our named executive officers, are prohibited from engaging in any transaction intended to hedge or minimize losses in the Company’s securities, including engaging in transactions in puts, calls, or other derivatives of the Company’s securities or short-selling the Company’s securities or “selling against the box” (i.e., failing to deliver sold securities).

Transactions with Related Persons

Our Board has adopted written procedures governing the review, approval or ratification of any transactions with related persons required to be reported in this proxy statement. The procedures require that all related party transactions, other than certain pre-approved categories of transactions, be reviewed and approved by our Governance Committee or the Board. Under the procedures, directors may not participate in any discussion or approval by the Board of related party transactions in which they or a member of their immediate family is an interested person, except that they shall provide information to the Board concerning the transaction. Only transactions that are found to be in the best interests of the Company will be approved.

Currently, we have a number of policies and procedures addressing conflicts of interest. Our Code of Conduct addresses the responsibilities of our officers, directors and staff to disclose conflicts of interest to our Legal/Compliance Department, which determines whether the matter constitutes a related party transaction that should be reviewed by our Governance Committee or Board. Generally, matters involving employer-employee relationships including compensation and benefits, ongoing arrangements that existed prior to our spin-off from GAMCO on November 30, 2015 and financial service relationships, including investments in our investment partnerships, are not presented for review, approval or ratification by our Governance Committee or Board.

Furthermore, our Amended and Restated Certificate of Incorporation provides that no contract, agreement, arrangement or transaction, or any amendment, modification or termination thereof, or any waiver of any right thereunder, (each, a “Transaction”) between Associated Capital and:

(i) | Mario J. Gabelli, any member of his immediate family who is at the time an officer or director of Associated Capital and any entity in which one or more of the foregoing beneficially owns a controlling interest of the outstanding voting securities or comparable interests (each, a “Gabelli”); |

(ii) | any customer or supplier; |

(iii) | any entity in which a director of Associated Capital has a financial interest (a “Related Entity”); or |

(iv) | one or more of the directors or officers of Associated Capital or any Related Entity; |

will be voidable solely because any of the persons or entities listed in (i) through (iv) above are parties thereto, if the standard specified below is satisfied.

Further, no Transaction will be voidable solely because any such directors or officers are present at or participate in the meeting of the Board or committee thereof that authorizes the Transaction or because their votes are counted for such purpose, if the standard specified below is satisfied. That standard will be satisfied, and such Gabelli, the Related Entity, the directors and officers of Associated Capital or the Related Entity (as applicable) will be deemed to have acted reasonably and in good faith (to the extent such standard is applicable to such person’s conduct) and fully to have satisfied any duties of loyalty and fiduciary duties they may have to Associated Capital and its shareholders with respect to such Transaction, if any of the following four requirements are met:

(i) | the material facts as to the relationship or interest and as to the Transaction are disclosed or known to the Board or the committee thereof that authorizes the Transaction, and the Board or such committee in good faith approves the Transaction by the affirmative vote of a majority of the disinterested directors of the Board or such committee, even if the disinterested directors represent less than a quorum; |

(ii) | the material facts as to the relationship or interest and as to the Transaction are disclosed or known to the holders of voting stock entitled to vote thereon, and the Transaction is specifically approved by vote of the holders of a majority of the voting power of the then outstanding voting stock not owned by such Gabelli or such Related Entity, voting together as a single class; |

(iii) | the Transaction is effected pursuant to guidelines that are in good faith approved by a majority of the disinterested directors of the Board or the applicable committee thereof or by vote of the holders of a majority of the then outstanding voting stock not owned by such Gabelli or such Related Entity, voting together as a single class; or |

(iv) | the Transaction is fair to Associated Capital as of the time it is approved by the Board, a committee thereof or the shareholders of Associated Capital. |

For purposes of these provisions, interests in an entity that are not equity or ownership interests or that constitute less than 10% of the equity or ownership interests of such entity will not be considered to confer a financial interest on any person who beneficially owns such interests.

Our Amended and Restated Certificate of Incorporation also provides that any such Transaction authorized, approved, or effected, and each of such guidelines so authorized or approved, as described in (i), (ii) or (iii) above, will be deemed to be entirely fair to Associated Capital and its shareholders, except that, if such authorization or approval is not obtained, or such Transaction is not so effected, no presumption will arise that such Transaction or guideline is not fair to Associated Capital and its shareholders. In addition, our Amended and Restated Certificate of Incorporation provides that a Gabelli will not be liable to Associated Capital or its shareholders for breach of any fiduciary duty that a Gabelli may have as a director of Associated Capital by reason of the fact that a Gabelli takes any action in connection with any transaction between such Gabelli and Associated Capital.

A description of certain related party transactions appears under the heading Certain Relationships and Related Transactions on pages 21 to 24 of this proxy statement.

INFORMATION REGARDING NAMED EXECUTIVE OFFICERS

Introduction

We are a “smaller reporting company” under applicable federal securities laws. As a smaller reporting company, we are providing compensation information pursuant to the reduced disclosure obligations applicable to smaller reporting companies.

Named Executive Officers

As a smaller reporting company, our “named executive officers” for the 2024 fiscal year are (i) our principal executive officer, (ii) our two other most highly compensated executive officers other than our principal executive officer at the end of the 2023 fiscal year, and (iii) up to two additional individuals for whom disclosure would have been provided pursuant to (ii) above but for the fact that the individual was not serving as an executive officer at the end of the 2023 fiscal year. The named executive officers of the Company as of March 31, 2024 are as follows (ages are as of that date):

Name | Age | Position | |||

Douglas R. Jamieson | 69 | Chief Executive Officer and President | |||

Peter D. Goldstein | 70 | Senior Vice President, Chief Legal Officer and Secretary | |||

Ian J. McAdams | 31 | Chief Financial Officer | |||

Patrick B. Huvane, age 56, served as Interim Co-Chief Financial Officer from July 2022 until his being named Vice President – Corporate Strategy in November 2023.

Biographical information for Mr. Jamieson appears under Proposal 1- Election of Directors above. Brief biographical information for Messrs. Goldstein and McAdams are set forth below:

Peter D. Goldstein has served as Chief Legal Officer and Secretary since April 16, 2021. Mr. Goldstein initially started with Gabelli in 1997, and currently serves as the Chief Legal Officer of Associated Capital Group, Inc. and GAMCO Investors, Inc. From 2004 until 2011, Mr. Goldstein served as the director of regulatory affairs and associate general counsel at GAMCO Investors Inc. and, prior to that, as chief compliance officer for the firm’s mutual funds complex. Mr. Goldstein previously served as the general counsel and chief compliance officer at Buckingham Capital Management, Inc. Earlier in his career, Mr. Goldstein was a litigation partner with the law firm Dorsey & Whitney in New York, and a branch chief in the enforcement division of the Securities & Exchange Commission. He was also previously a senior compliance officer at Goldman Sachs Asset Management. Mr. Goldstein holds a B.A., cum laude, from Brandeis University, an M.S. from Harvard University, and a J.D., magna cum laude, from Boston College Law School.

Ian J. McAdams has been Chief Financial Officer of the Company since November 2023. In this position, Mr. McAdams also serves as our Principal Financial Officer. Mr. McAdams joined the Company's finance team in 2021 and previously served as our Manager – External Reporting and Technical Accounting and, from July 2022, as our Interim Co-Chief Financial Officer and Co-Principal Financial Officer. Prior to joining the Company, Mr. McAdams began his career at Ernst & Young LLP where he was a Manager in the Banking and Capital Markets practice primarily focusing on providing client services to both publicly traded and private companies within the banking and asset management industries. Mr. McAdams holds a B.S. degree in Accounting from Binghamton University and is a Certified Public Accountant.

COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation Table for 2023

The following table sets forth the cash and non-cash compensation for fiscal years ended 2023 and 2022 paid to or earned by our Executive Chair and named executive officers for services rendered to the Company. The compensation paid to our named executive officers for the fiscal years set forth below is not necessarily indicative of how we will compensate our named executive officers in future years.

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||

Mario J. Gabelli | 2023 | -0- | -0- | -0- | -0- | 5,036,155 | 5,036,155 | |||||||||||||||||||

Executive Chair(a) | 2022 | -0- | -0- | -0- | -0- | 310,453 | 310,453 | |||||||||||||||||||

Douglas R. Jamieson | 2023 | 475,000 | 450,000 | 475,320 | -0- | 39,818 | 1,440,138 | |||||||||||||||||||

Chief Executive Officer and President(b) | 2022 | 400,000 | 800,000 | -0- | -0- | 34,829 | 1,234,829 | |||||||||||||||||||

Peter D. Goldstein | 2023 | 250,000 | 25,000 | 99,025 | -0- | 2,083 | 376,108 | |||||||||||||||||||

Senior Vice President, Chief Legal Officer and Secretary(c) | 2022 | 250,000 | 50,000 | -0- | -0- | 2,083 | 302,083 | |||||||||||||||||||

Ian J. McAdams | 2023 | 261,250 | 100,000 | 158,440 | -0- | 5,000 | 524,690 | |||||||||||||||||||

Chief Financial Officer | 2022 | 171,346 | 100,000 | 187,650 | -0- | 5,000 | 463,996 | |||||||||||||||||||

| (a) | Mr. Mario Gabelli received no fixed salary or bonus in 2023 or 2022. All other compensation consisted of the following: |

Incentive Management | Portfolio Manager | |||||||||||||||

Fee of Associated | and Other Variable | Total | ||||||||||||||

Capital* ($) | Remuneration* ($) | Perquisites ($) | Remuneration ($) | |||||||||||||

2023 | 4,845,642 | 190,513 | -0- | 5,036,155 | ||||||||||||

2022 | -0- | 310,453 | -0- | 310,453 | ||||||||||||

* | As described in the Employment Agreements section below. |

| Incentive Management Fee of Associated Capital in the table above is net of reallocation to other employees. Portfolio Manager and Other Variable Remuneration relates to fees earned for acting as portfolio and relationship manager of investment partnerships. |

(b) | All other compensation represents compensation as the relationship manager for certain client accounts. Mr. Jamieson earned $4,612,028 and $3,202,536 for 2023 and 2022, respectively, in connection with services provided to GAMCO that is not reflected in the table above. |

| (c) | Mr. Goldstein earned $572,220 and $494,583 for 2023 and 2022, respectively, in connection with services provided to GAMCO that is not reflected in the table above. |

Employment Agreements

Mr. Mario J. Gabelli is currently the only named executive who has an employment agreement with the Company.

On November 30, 2015, Mr. Gabelli entered into the Employment Agreement with the Company, which was approved by the Company’s shareholders on November 12, 2015 and which limits his activities outside of the Company. The Employment Agreement had a three-year initial term with an automatic extension for an additional year on each anniversary of its effective date unless either party gives written notice of termination at least 90 days in advance of the expiration date. The Employment Agreement provides that Mr. Gabelli may not provide investment management services for compensation other than in his capacity as an officer or employee of AC, GAMCO, GGCP, LICT, CIBL, ICTC or Teton or their respective subsidiaries or affiliates except as to certain funds which were in existence at the time of the GAMCO initial public offering and which are subject to performance fee arrangements (collectively “Permissible Accounts”). Since the spin-off transaction, Mr. Gabelli served as a portfolio manager for various mutual funds and separately managed accounts managed by subsidiaries of GAMCO or Teton. The Employment Agreement permits Mr. Gabelli to serve as a director or officer of other entities, with or without compensation.

Mr. Gabelli (or, at his option, his designee) receives an Incentive Management Fee in the amount of 10% of our aggregate annual pre-tax profits, if any, as computed for financial reporting purposes in accordance with U.S. generally accepted accounting principles (before consideration of this fee) so long as he is providing services to the Company. Mr. Gabelli will be deemed to be “providing services” to the Company if he is providing any services to the Company, including, without limitation, services as a director, employee, portfolio manager, advisor or consultant. This Incentive Management Fee is subject to the Compensation Committee’s review at least annually for compliance with the terms of the Employment Agreement. The Employment Agreement may not be amended without the approval of the Compensation Committee and Mr. Gabelli.

Consistent with the practice of GAMCO since its inception in 1976, Mr. Gabelli also receives a percentage of revenues or net operating contribution, which are substantially derived from managing or overseeing the management of investment companies or partnerships, attracting investors for collective investment funds or partnership investments, attracting and/or managing separate accounts, providing investment banking services or otherwise generating revenues for the Company or its subsidiaries. Mr. Gabelli will be paid a percentage of the revenues or net operating contribution related to or generated by such business activities, in a manner and at payment rates as agreed to from time to time by Mr. Gabelli and the Company or the affected subsidiaries, which rates have been and generally will be the same as those received by other professionals in the Company or the affected subsidiaries performing similar services.

Dual Employees

In connection with our spin-off from GAMCO on November 30, 2015, we entered into a Transitional Administrative and Management Services Agreement with GAMCO. Pursuant to this agreement, certain employees perform services for both the Company and GAMCO. See Transitional Administrative and Management Services Agreement on page 22 for more information. The compensation paid to a dual employee is allocated between the companies based on the relative time spent working for each entity. Messrs. Mario J. Gabelli, Jamieson and Goldstein are dual employees; the footnotes to the Summary Compensation Table above provide information regarding their compensation paid by GAMCO.

The following Pay Versus Performance table sets forth information for the Company's Principal Executive Officer ("PEO"), Douglas R. Jamieson for the years ended December 31, 2023 and 2022 as required by Item 402 of SEC Regulation S-K.

Pay Versus Performance Table | ||||||||||||||||||

Year | Summary Compensation table total for PEO ($) | Compensation actually paid to PEO ($)(1) | Average summary compensation table total for non-PEO NEOs ($) | Average compensation actually paid to non-PEO NEOs ($)(1) | Value of initial fixed $100 investment based on Total Shareholder Return ($) | Net income ($ in thousands) | ||||||||||||

2023 | 1,440,138 | 1,064,446 | 450,399 | 401,614 | 83.95 | 37,451 | ||||||||||||

2022 | 1,234,829 | 1,178,471 | 274,316 | 181,500 | 98.16 | (48,907 | ) | |||||||||||

In 2023 and 2022, Douglas R. Jamieson was our Principal Executive Officer. In 2023, our Non-PEO Named Executive Officers ("NEOs") consisted of Peter D. Goldstein, Senior Vice President, Chief Legal Officer, and Secretary, and Ian J. McAdams, Chief Financial Officer. In 2022, our Non-PEO Named Executive Officers ("NEOs") consisted of Peter D. Goldstein, Senior Vice President, Chief Legal Officer, and Secretary, Patrick B. Huvane, Interim Co-Chief Financial Officer, Ian J. McAdams, Interim Co-Chief Financial Officer, and Timothy H. Schott, Executive Vice President - Finance and Chief Financial Officer until his resignation on July 8, 2022.

The Compensation Committee believes the PEO's base salary reflects the value of the executive position and attributes the PEO brings to the Company, including tenure, experience, skill level and performance. No specific weights have been assigned to those factors. The Compensation Committee periodically reviews the salaries of the NEOs and adjusts them as needed to maintain market positioning and consistency with other similarly-situated executive officers and their evolving responsibilities.

Bonus payments are not tied to any financial performance measure and are discretionary based on the evaluation of each individual's performance, change in responsibilities and their potential to contribute to the success of the Company.

(1) Compensation Actually Paid was calculated beginning with each individual's total compensation reported in the Summary Compensation Table, and the following amounts were deducted from and added to such amounts:

PEO | Non-PEO Named Executive Officer Average | |||||||||||||||

2023 | 2022 | 2023 | 2022 | |||||||||||||

Summary Compensation Table | 1,440,138 | 1,234,829 | 450,399 | 274,316 | ||||||||||||

Deduction for amounts reported under the "Stock Awards" column in the Summary Compensation Table for applicable year | (475,320 | ) | - | (128,733 | ) | (46,913 | ) | |||||||||

Increase based on ASC 718 fair value of awards granted during applicable fiscal year that remain unvested as of applicable fiscal year end, determined as of applicable year end | 428,520 | - | 116,058 | 47,239 | ||||||||||||

Deduction for awards granted during prior fiscal year that were outstanding and unvested as of applicable fiscal year end, determined based on change in ASC 718 fair value from prior fiscal year end to applicable fiscal year end | (262,504 | ) | (56,358 | ) | (36,110 | ) | (1,768 | ) | ||||||||

Deduction for awards granted during the prior fiscal year that vested during applicable fiscal year, determined based on change in ASC 718 fair value from prior fiscal year end to vesting date | (66,388 | ) | - | - | - | |||||||||||

Deduction for awards granted during a prior fiscal year that were forfeited during the applicable fiscal year, determined based on the ASC 718 fair value from prior fiscal year end | - | - | - | (91,375 | ) | |||||||||||

Compensation Actually Paid | 1,064,446 | 1,178,471 | 401,614 | 181,500 | ||||||||||||

All information provided above under the "Pay Versus Performance" heading will not be deemed to be incorporated by reference in any filing by the Company under the Securities Act of 1933, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Outstanding Equity Awards at December 31, 2023

The table below contains certain information concerning outstanding phantom stock awards (“PRSAs”) at December 31, 2023 for our Executive Chair and our named executive officers.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022

Number of | Market Value | |||||||

Unvested | of Unvested | |||||||

Name | PRSAs | PRSAs ($) | ||||||

Mario J. Gabelli | -0- | -0- | ||||||

Douglas R. Jamieson | 53,800 | 1,921,198 | ||||||

Peter D. Goldstein | 9,500 | 339,245 | ||||||

Ian J. McAdams | 8,500 | 303,535 | ||||||

(a) | The market value of the outstanding unvested AC PRSAs on the above table is determined with reference to the $35.71 per share closing price of AC’s Class A Stock on December 31, 2023. |

(b) | Mr. Jamieson’s PRSAs will vest on December 18, 2025 as to 9,800 shares, on May 20, 2024 and 2026 as to 30% and 70%, respectively, of 32,000 shares, on May 30, 2026 and 2028 as to 30% and 70%, respectively, of 12,000 shares, in accordance with the terms of his PRSA agreements. |

(c) | Mr. Goldstein’s PRSAs will vest on May 20, 2024 and 2026 as to 30% and 70%, respectively, of 7,000 shares, and on May 30, 2026 and 2028 as to 30% and 70%, respectively, of 2,500 shares, in accordance with the terms of his PRSA agreement. |

(d) | Mr. McAdams’s PRSAs will vest on August 3, 2025 and 2027 as to 30% and 70%, respectively, of 4,500 shares, and on May 30, 2026 and 2028 as to 30% and 70%, respectively, of 4,000 shares, in accordance with the terms of his PRSA agreement. |

Thirty percent of the PRSAs granted vest on the third anniversary of their grant. The remaining seventy percent vest on the fifth anniversary of their grant. Upon vesting, a participant is entitled to a payment in cash of the fair market value of one share of Class A Stock of the Company multiplied by the aggregate number of PRSAs vesting on that date. In addition, an amount equivalent to the cumulative dividends declared on shares of the Company’s Class A Stock during the vesting period will be paid to participants on vesting.

Certain dual employees may hold GAMCO restricted stock awards (e.g., due to services performed for GAMCO). Mr. Jamieson holds 60,000 unvested GAMCO restricted stock awards at December 31, 2023 with a market value of $1,146,600. Mr. Goldstein holds 9,500 unvested GAMCO restricted stock awards at December 31, 2023 with a market value of $238,875.

Potential Payments Upon Termination of Employment or Change of Control

Other than full vesting of outstanding phantom restricted stock awards, there were no potential payments upon termination of employment or change of control for any of the named executive officers as of December 31, 2023.

CEO Pay Ratio

Smaller reporting companies are not required to provide the information required by this item.

CERTAIN OWNERSHIP OF OUR STOCK

The following table sets forth, as of April 16, 2024, certain information with respect to all persons known to us who beneficially own more than 5% of the Class A Stock or Class B Stock. The table also sets forth information with respect to stock ownership of the directors, each of the named executive officers and all directors and executive officers as a group. The number of shares beneficially owned is determined under rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares over which a person has the sole or shared voting or investment power and any shares which the person can acquire within 60 days (e.g., through the exercise of stock options). Except as otherwise indicated, the shareholders listed in the table have sole voting and investment power with respect to the shares set forth in the table.

Title of | Number of | Percent of | |||||||

Name of Beneficial Owner | Class | Shares | Class (%) | ||||||

5% or More Shareholders | |||||||||

The Vanguard Group* | Class A | 162,902(1) | 6.6 | ||||||

Horizon Kinetics Asset Management LLC* | Class A | 1,142,514(2) | 46.4 | ||||||

Directors and Executive Officers | |||||||||

Mario J. Gabelli | Class A | 82,165(3) | 3.3 | ||||||