Exhibit 99.2

Acquisition of Intellibed August 2022

2 Except for statements of historical fact, information contained in this presentation may constitute "forward - looking statements" within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward - looking statements reflect the cur rent views of Purple Innovation, Inc. (the "Company") about future events and are subject to risks, uncertainties, assumptions and changes in circ ums tances that may cause events or the Company’s actual activities or results to differ significantly from those expressed in any forward - looking stateme nt. In some cases, you can identify forward - looking statements by terminology such as “may,” “will,” “plan,” “expect,” “estimate,” “anticipate,” “intend,” “goal,” “strategy,” “believe” and similar expressions and variations thereof. Forward - looking statements include statements regarding the Company’s future ope rating results, market position, strategy and plans, and expectations for future operations. These forward - looking statements are subject to a number o f risks, uncertainties and assumptions. The known risks, uncertainties and factors are described in detail under the caption “Risk Factors” in the Form 10 - K, 10 - Qs and other documents the Company has filed with the Securities and Exchange Commission (the “SEC”). Many of these risks and uncertaintie s h ave been, and will be, exacerbated by the COVID - 19 pandemic and any worsening of the global business and economic environment as a result. These forwar d - looking statements speak only as of the date of this presentation, and the Company undertakes no obligation to revise or update any forward - looking statements to reflect events or circumstances after the date hereof. Certain information contained in this presentation may be derived from information provided by industry sources. The Company bel ieves such information is accurate and that the sources from which it has been obtained are reliable. However, the Company cannot guarantee the accu rac y of, and has not independently verified, such information. Adjusted EBITDA is a non - GAAP financial measure that removes the impact of certain non - cash and non - recurring costs. Management believes that the use of such non - GAAP financial measure provides investors with additional useful information with respect to the impact of various a djustments, which we view as a better measure of our operating performance. The description of the merger is subject to the terms of the merger agreement, as filed with the SEC. Disclaimer ACQUISITION OF INTELLIBED | AUGUST 2022

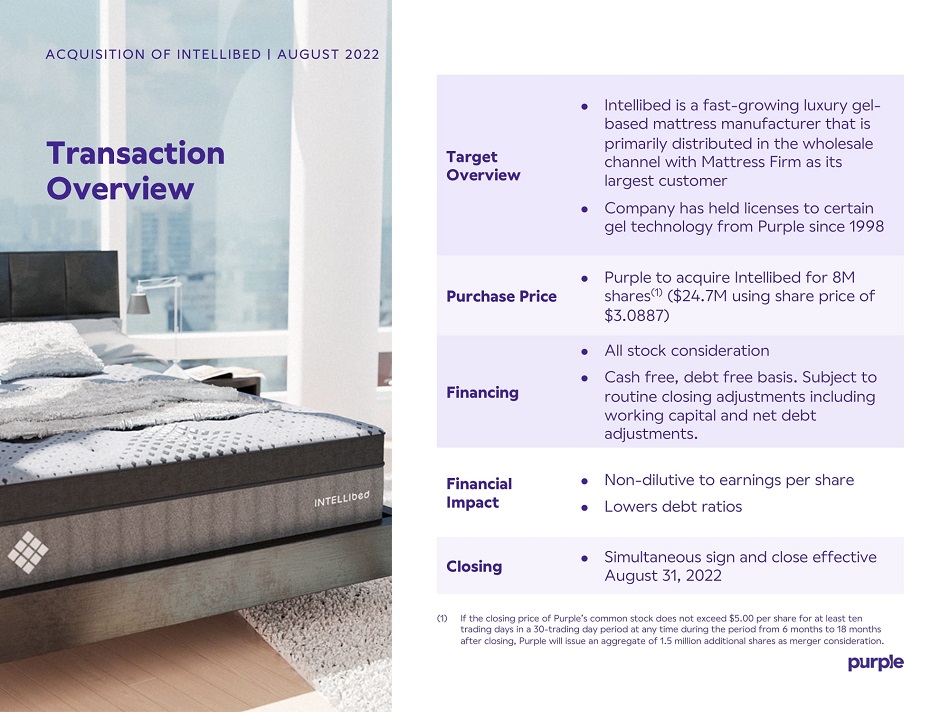

ACQUISITION OF INTELLIBED | AUGUST 2022 Transaction Overview (1) If the closing price of Purple’s common stock does not exceed $5.00 per share for at least ten trading days in a 30 - trading day period at any time during the period from 6 months to 18 months after closing, Purple will issue an aggregate of 1.5 million additional shares as merger consideration. Target Overview Intellibed is a fast - growing luxury gel - based mattress manufacturer that is primarily distributed in the wholesale channel with Mattress Firm as its largest customer Company has held licenses to certain gel technology from Purple since 1998 Purchase Price Purple to acquire Intellibed for 8M shares (1) ($24.7M using share price of $3.0887) Financing All stock consideration Cash free, debt free basis. Subject to routine closing adjustments including working capital and net debt adjustments. Financial Impact Non - dilutive to earnings per share Lowers debt ratios Closing Simultaneous sign and close effective August 31 , 2022

4 Intellibed is a ~$50M Revenue luxury sleep and health wellness company offering therapeutic mattresses scientifically designed for maximum back support, spinal alignment, and pressure point relief Headquarters: Salt Lake City, Utah Premium Product Offering: Mattresses (97% of sales), Bases (2% of sales), and Other (1% of sales) (1) Distribution Channels: Primarily Wholesale with 636 doors (2) , complemented by DTC business Customer Profile: Luxury customers with expected budget of $1,500 – $7,000 Well - Invested Manufacturing Facility: Three operating production lines Team Members: 59 full - time employees Intellibed Overview ACQUISITION OF INTELLIBED | AUGUST 2022 Wholesale 90% DTC 10% Sales by Channel (2021) (1) Other represents Pillows, Sheets, Mattress Protectors, Toppers and various other products. (2) 3/31/22 door count, pro forma for doors planned to be exited after discontinuation of Sleepy’s products later this year. Inte lli bed door count includes doors that are currently overlapping doors with Purple.

5 Elevate & Strengthen Product Offering Purple + Intellibed better positioned to grow gel category by offering more complete, top to bottom product range that can grow the most interesting premium category for wholesale customers Gain market share in premium mattress core Secure control over our differentiated product offering Enhance Purple Capabilities Unifying IP provides unlimited flexibility for future innovation Add to innovation pipeline with Sleep Genius adjustable bases + Expand Distribution Ecosystem Scale wholesale with high - performing partners Enhance luxury product range within Purple showrooms Intellibed benefits from Purple’s strong DTC capabilities 2,500+ Potential new wholesale door expansion opportunity for Intellibed mattress models via future placement with existing Purple retailers, net of overlapping stores (1) Enhance Financial Profile Enhances growth potential and is accretive to earnings, margins, and free cash flow Generates attractive revenue and cost synergies Credit enhancing – lowers debt ratios Strong Strategic Rationale for Combination to Grow the Gel Category ACQUISITION OF INTELLIBED | AUGUST 2022 Purple Premium $1.3K – $3.8K Intellibed Luxury $1.7K – $7.0K+ ➜ Purple Purple + Intellibed (1) Potential door placement opportunity may be higher pending final review of overlap with existing doors.

6 Elevate Product Offering with Highly Complementary Products ACQUISITION OF INTELLIBED | AUGUST 2022 Intellibed mattress models target higher, luxury price points versus Purple’s existing offerings and will be a natural step - up extension of Purple’s product line allowing the Company to compete in the luxury category Entry Level ~15% Market $ Share “Original Purple” $999 – $1,899 Purple entry models Luxury ~30% Market $ Share Luxury top end where Purple currently does not play GelMatrix Hybrids $5,000+ Purple Brand Elevation and Extension Premium ~55% Market $ Share GelFlex Grid Hybrids $1,999 – $4,000 GelMatrix Hybrids $2,199 – $4,100 Note: Product brand positioning and future price points for model lines still under development.

• Acquisition of Intellibed | July 2022 Enhances Purple’s Mattress and Non - Mattress Capabilities to Grow the Gel Category ACQUISITION OF INTELLIBED | AUGUST 2022 Unified IP Provides Future Product Flexibility The combined Company reunites proprietary IP and allows for unlimited flexibility for future gel - based product innovations

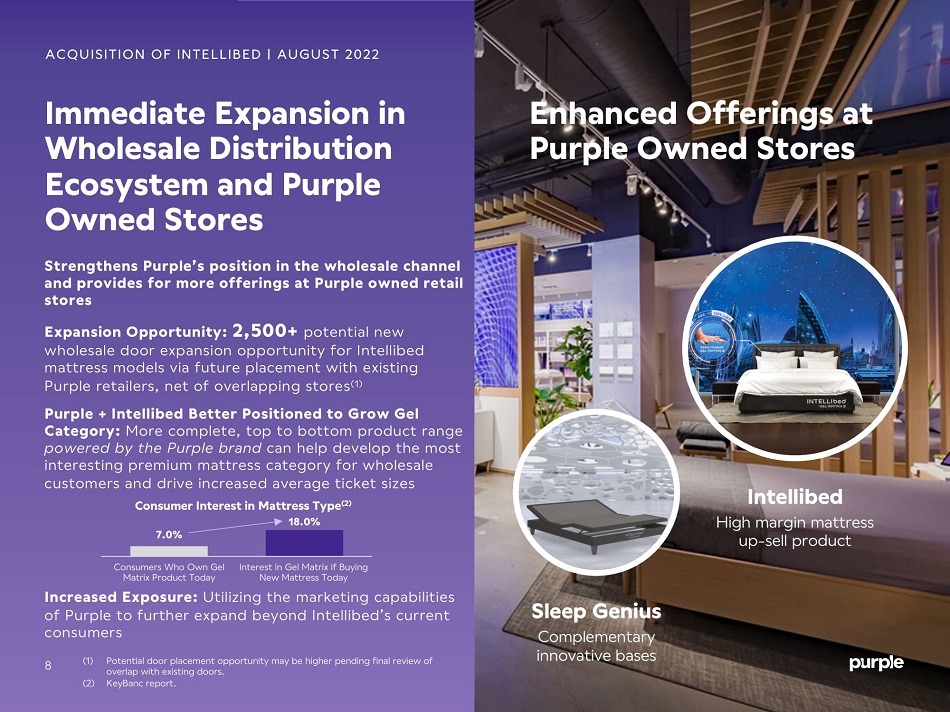

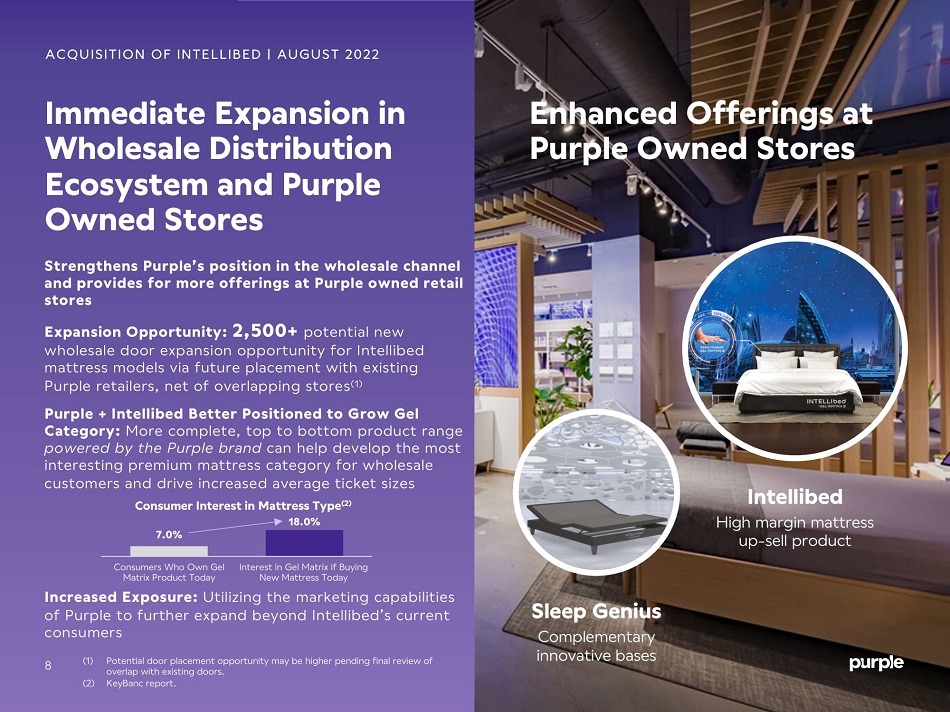

8 Immediate Expansion in Wholesale Distribution Ecosystem and Purple Owned Stores Strengthens Purple’s position in the wholesale channel and provides for more offerings at Purple owned retail stores Expansion Opportunity: 2,500+ potential new wholesale door expansion opportunity for Intellibed mattress models via future placement with existing Purple retailers, net of overlapping stores (1) Purple + Intellibed Better Positioned to Grow Gel Category: More complete, top to bottom product range powered by the Purple brand can help develop the most interesting premium mattress category for wholesale customers and drive increased average ticket sizes Increased Exposure: Utilizing the marketing capabilities of Purple to further expand beyond Intellibed’s current consumers Enhanced Offerings at Purple Owned Stores ACQUISITION OF INTELLIBED | AUGUST 2022 Intellibed High margin mattress up - sell product Sleep Genius Complementary innovative bases (1) Potential door placement opportunity may be higher pending final review of overlap with existing doors. (2) KeyBanc report. 7.0% 18.0% Consumers Who Own Gel Matrix Product Today Interest in Gel Matrix if Buying New Mattress Today Consumer Interest in Mattress Type (2)

9 Highly Attractive Financial Profile ACQUISITION OF INTELLIBED | AUGUST 2022 Enhances Purple’s growth potential and is accretive to earnings, margins and free cash flow with strong cost and revenue synergies Revenue Synergies: – Increased placement at new and existing wholesale doors driving productivity – Increased product range for customers in Purple - owned stores – Intellibed benefits from Purple’s strong DTC capabilities – Increased marketing support to grow Intellibed line and Sleep Genius bases Cost Synergies: – Improved product formulation options with ownership of full IP – Sourcing and procurement benefits – Future efficiencies in manufacturing and distribution and benefits from scale – Operating expenses – Lowers debt ratios + Strengthens revenue base + Non - dilutive to earnings Acquisition Improves Purple’s 2022 Financial Position

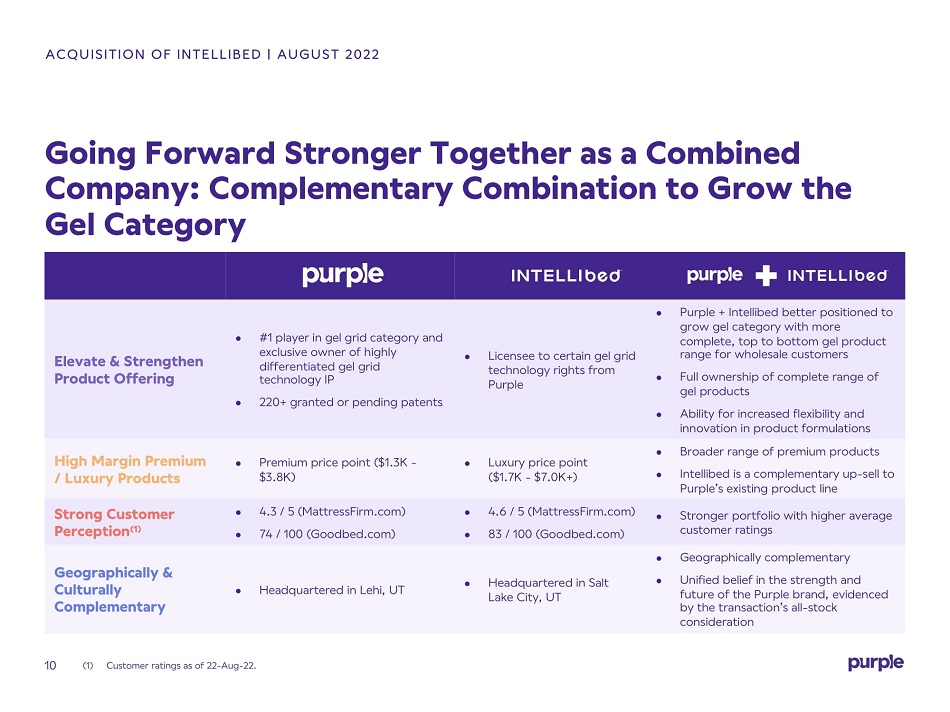

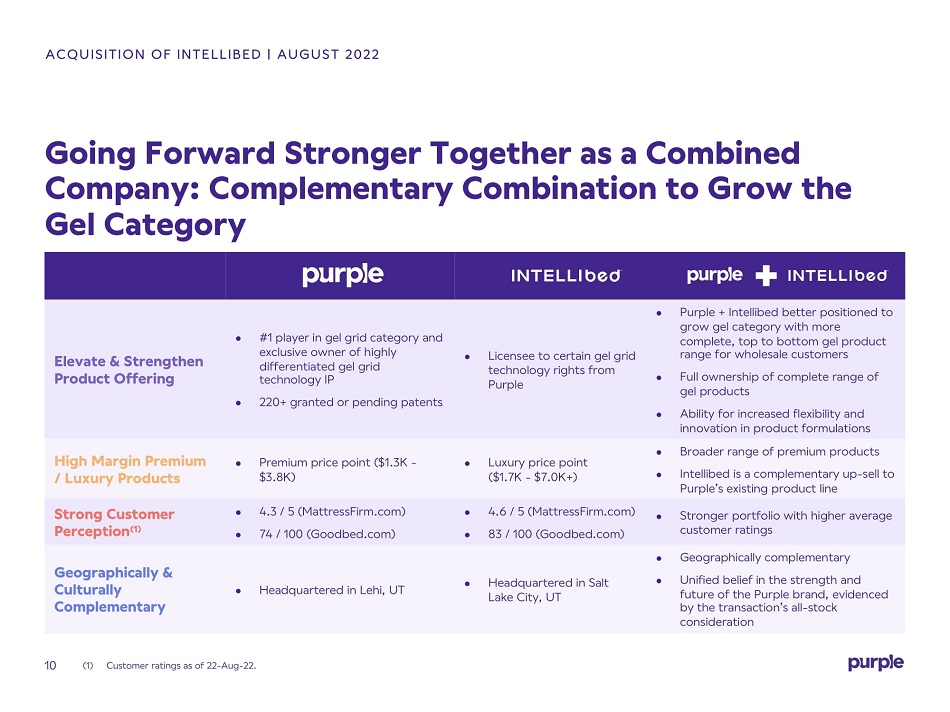

10 Elevate & Strengthen Product Offering #1 player in gel grid category and exclusive owner of highly differentiated gel grid technology IP 220+ granted or pending patents Licensee to certain gel grid technology rights from Purple Purple + Intellibed better positioned to grow gel category with more complete, top to bottom gel product range for wholesale customers Full ownership of complete range of gel products Ability for increased flexibility and innovation in product formulations High Margin Premium / Luxury Products Premium price point ($1.3K - $3.8K) Luxury price point ($1.7K - $7.0K+) Broader range of premium products Intellibed is a complementary up - sell to Purple’s existing product line Strong Customer Perception (1) 4.3 / 5 (MattressFirm.com) 74 / 100 (Goodbed.com) 4.6 / 5 (MattressFirm.com) 83 / 100 (Goodbed.com) Stronger portfolio with higher average customer ratings Geographically & Culturally Complementary Headquartered in Lehi, UT Headquartered in Salt Lake City, UT Geographically complementary Unified belief in the strength and future of the Purple brand, evidenced by the transaction’s all - stock consideration Going Forward Stronger Together as a Combined Company: Complementary Combination to Grow the Gel Category ACQUISITION OF INTELLIBED | AUGUST 2022 (1) Customer ratings as of 22 - Aug - 22.

11 Going Forward Stronger Together as a Combined Company: Enhanced Capabilities to Grow the Gel Category ACQUISITION OF INTELLIBED | AUGUST 2022 Increased Mattress & Non - mattress Offerings 1 Mattress Family 2 Key Mattress Family Lines Sleep Genius base technology Broader range of gel mattress offerings Gains strong base technology for potential use on all mattress families Wholesale Distribution ~3,200 stores as of June 2022 ~636 stores (1) Deeper national wholesale distribution coverage Enhanced trade - up options for retailers Owned Stores 40 owned retail locations as of June 2022 1 owned store Increased product range for customers in Purple owned stores Manufacturing Scale & Technology 3 Facilities Injection molding 1 Facility Screed molding Increased capabilities Broader gel grid technology opportunities Marketing Years of Purple brand development Strong commitment to brand marketing Run with minimal marketing budget Better in Purple family, leverages strong brand and marketing spend Unified marketing campaign “Intellibed – Powered by Purple” (1) 3/31/22 door count, pro forma for doors planned to be exited after discontinuation of Sleepy’s products later this year. Inte lli bed door count includes doors that are currently overlapping doors with Purple.

Thank You