united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

[Amended N-CSR filing to correct audit opinion contained in previous filing]

Investment Company Act file number 811-23066

Northern Lights Fund Trust IV

(Exact name of registrant as specified in charter)

17605 Wright Street, Omaha, Nebraska 68130

(Address of principal executive offices) (Zip code)

Richard Malinowski, Gemini Fund Services, LLC.

80 Arkay Drive, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 11/30

Date of reporting period:11/30/18

Item 1. Reports to Stockholders.

| |||

| IQ-Striquer Fund | |||

| Class | A | Shares | IQSAX |

| Class | I | Shares | IQSIX |

| Annual Report | |||

| November 30, 2018 | |||

| Advised by: | |||

| IQ Capital Strategy, LLC | |||

| 10239 Clemson Blvd., Suite 150 | |||

| Seneca, South Carolina 29678 | |||

| 1-848-227-4825 | |||

| www.iqcapitalstrategy.com | |||

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of the IQ-Striquer Fund. Such offering is made only by prospectus, which includes details as to offering price and other material information.

Distributed by Northern Lights Distributors, LLC.

| |||

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website www.iqcapitalstrategy.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you.

1

| 4164-NLD-1/23/2019 |

December 31, 2018

RE: IQ Striquer Fund Recap of 2018

Dear IQ Striquer Fund Shareholders:

2018 was a big year for IQ Capital Strategy. The launch of the IQ Striquer Funds (IQSIX and IQSAX) was not without its challenges and victories. The IQ Striquer Fund is comprised of our Large Cap Equity Allocation, which grew 4.6%, and our Alternative Strategy Allocation, which dropped 15.2%. This resulted in a net drop of approximately 10.6% since the inception date of 1/31/18 (as of November 30, 2018). Our Large Cap Equity Allocation outperformed the S&P 500, which grew only 2.4% during the same period. Therefore, our Large Cap Equity Allocation provided almost twice the return of the market. Our Alternative Strategy Allocation had a drop, but it also delivered the negative correlation that this fund is designed to provide to its shareholders (see the notes below to learn more about the Alternative Strategy Allocation.) Overall, the fund accomplished its objective of obtaining the positive returns from the stock market while at the same time having a low correlation of returns when compared to the market.

The year-end has the fund effectively neutral and flat its equity positions, earning interest on its cash balances, and a significant allocation to the global commodity and currency markets (the Alternative Strategy allocation). The Alternative Strategy Allocation is comprised of a number of Commodity Trading Advisors (CTAs) who trade various trend-following strategies across the global markets. Normally, CTA returns are negatively correlated to stock prices. The following commentary has been provided by CTA Robert Marcellus, Chairman of Richmond Optimus, LLC (4.7 Exempt CTA/CPO). Mr. Marcellus manages the Alternative Strategy Allocation of the IQSIX fund.

“2018 has been a very volatile year for most markets (stocks, bonds, currencies, commodities) and various manager strategies around the world. We are entering a period of higher interest rates on a global basis, which is marked change from the past 30+ years of lower interest rates. We also find ourselves in a period of monetary policy uncertainty. One can argue that the various ’stimuli’ deployed by global central banks, the US Federal Reserve, and the US Treasury have failed to increase global Gross Domestic Product (GDP) and have resulted in higher debt burdens by many governments. The end results appear to be that the boost to global GDP has been marginal whilst debt loads of governments have increased. We consider the past ten years a ‘growth recession’ and not one that has shown anywhere near the growth rates prior to 2008. The massive increase in assets at the Federal Reserve is unrivaled in its 105 year history. Investors are left having to navigate global markets that are very similar to the volatile 1970s, uncertain political environments, and increasing vague economic data produced by governments. We have also seen unprecedented manipulation of stocks and bonds by central banks and governments. For instance, the Swiss National Bank is one of the more transparent of the global central banks, and shows outright ownership of over 100 billion dollars of the top ten NASDAQ listed stocks. We are left to wonder what happens when the selling starts. Most central banks are much more opaque in their market operations. The Bank of Japan, for instance owns a reportable interest (10% or greater) in 90% of the stocks that comprise the Nikkei Index. Even the US leader of global futures exchanges, the Chicago Mercantile Exchange, has at one point offered a ‘fee rebate’ program to ‘qualified’ central banks when trading stock index and interest rate products on the Chicago Exchanges. These are indeed truly amazing times.

The recent environment has seen CTA returns, in general, languish due to the rapidly changing trends. They haven’t really helped yet, but notably are only a few percentage points away from positive territory. The

10239 Clemson Blvd., Suite 150, Seneca, SC 29678 ● iqcapitalstrategy.com ● (848) CAPITAL

2

| 4164-NLD-1/23/2019 |

Fund’s allocation to CTAs is showing a loss that is well within expectations and its targeted volatility based on historical CTA manager returns.

We are very excited for the future of our investments, in that CTA’s returns tend to snap back with a vengeance after a market dislocation event. While CTAs significantly outperformed during the 2008 crisis, many would fail to recall that CTA returns in 2006 and 2007 were choppy and flat. We also recall the Asian crisis of 1997/98 when CTAs initially experienced losses in the early portions of the change in trends, causing much distress to investors who really didn’t understand the product. As they are known to do, CTA trend-following strategies tend to be quick to shed losses and subsequently transition to the short side of markets and capture the resulting trend of a crisis. The CTA returns post the 1997 dislocation for 1998 provided outsized gains to investors.”

Overall, we feel that market volatility is a positive for our fund due to its alternative strategies. Our equity models, from a long-only perspective have even further outperformed the market and have us currently with negligible exposure to further stock market corrections. There may be a time in the near future when our equity model will return to invested on the long side, but that could easily be after a further massive decline in stocks. We remain optimistic, nimble, and resolute with our trading strategies.

Thank you for your support during 2018, we feel we are well positioned for what comes ahead.

Sincerely,

R. Brian Massey, CEO

IQ Capital Strategy

10239 Clemson Blvd., Suite 150, Seneca, SC 29678 ● iqcapitalstrategy.com ● (848) CAPITAL

3

| Fund Performance - (Unaudited) |

| November 30, 2018 |

| IQ-STRIQUER FUND |

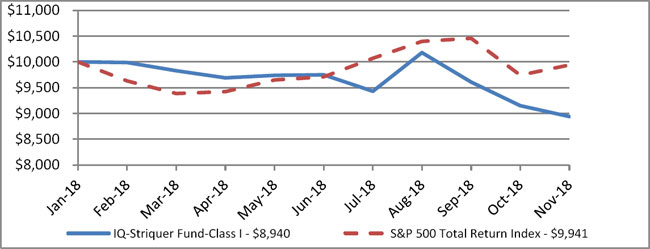

The Fund’s performance figures* for the period ended November 30, 2018, compared to its benchmark:

| Since Inception** - | |

| Fund/Index | November 30, 2018 |

| IQ-Striquer Fund - Class A | (10.80)% |

| IQ-Striquer Fund - Class A with Load | (13.90)% |

| IQ-Striquer Fund - Class I | (10.60)% |

| S&P 500 Total Return Index *** | (0.59)% |

Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total operating expense ratio, as stated in the fee table in the Fund’s Prospectus dated October 10, 2017, is 2.30% for Class A shares and 2.05% for Class I shares. Class C shares are not currently offered for sale. Class A shares are subject to a maximum sales load of 3.50% and a maximum deferred sales load of 1.00%. Redemptions of any class share within 60 days of purchase may be assessed a redemption fee of 1.00% of the purchase price. See the financial highlights for the current expense ratios. The Fund’s adviser, has contractually agreed to reduce its fees and/or absorb expenses of the Fund, until at least March 31, 2020, to ensure that total annual fund operating expenses after fee waiver and/or reimbursement (exclusive of any front-end or contingent deferred loads, taxes, brokerage fees and commissions, borrowing costs (such as interest and dividend expense on securities sold short), acquired fund fees and expenses, fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses), or extraordinary expenses such as litigation (which may include indemnification of Fund officers and Trustees, contractual indemnification of Fund service providers (other than the adviser) will not exceed 2.19%, 2.94% or 1.94% of the Fund’s average daily net assets attributable to Class A, Class C and Class I shares, respectively. These fee waivers and expense reimbursements are subject to possible recoupment from the Fund in future years (within the three years from the time the fees were waived or reimbursed), if such recoupment can be achieved within the lesser of the foregoing expense limits or those in place at the time of recapture. This agreement may be terminated only by the Trust’s Board of Trustees on 60 days’ written notice to the adviser. Absent this agreement, the performance would have been lower. For performance information current to the most recent month-end table, please call 1-848-227-4825. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

| * | Performance data quoted is historical. |

| ** | Inception date is January 31, 2018. |

| *** | The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark. |

IQ-Striquer Fund vs. S&P 500 Total Return Index

| Holdings By Asset Type | % of Net Assets | |||

| Common Stock | 24.4 | % | ||

| Money Market Fund | 49.6 | % | ||

| Other Assets Less Liabilities - Net | 26.0 | % | ||

| 100.0 | % | |||

Please refer to the Portfolio of Investments in this annual report for a detailed listing of the Fund’s holdings.

4

| IQ-STRIQUER FUND |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS |

| November 30, 2018 |

| Shares | Fair Value | |||||||

| COMMON STOCK - 24.4% | ||||||||

| DIVERSIFIED FINANCIAL SERVICES - 4.3% | ||||||||

| 4,100 | Visa, Inc. | $ | 581,011 | |||||

| HEALTHCARE-SERVICES - 5.0% | ||||||||

| 2,400 | UnitedHealth Group, Inc. | 675,264 | ||||||

| PHARMACEUTICALS - 6.3% | ||||||||

| 18,400 | Pfizer, Inc. | 850,632 | ||||||

| SOFTWARE - 4.2% | ||||||||

| 5,100 | Microsoft Corp. | 565,539 | ||||||

| TELECOMMUNICATIONS - 4.6% | ||||||||

| 12,900 | Cisco Systems, Inc. | 617,523 | ||||||

| TOTAL COMMON STOCK (Cost - $3,177,992) | 3,289,969 | |||||||

| SHORT-TERM INVESTMENT - 49.6% | ||||||||

| MONEY MARKET FUND - 49.6% | ||||||||

| 6,677,741 | Federated Government Obligations Fund - Institutional Shares, 2.08% *+ | 6,677,741 | ||||||

| TOTAL SHORT-TERM INVESTMENT (Cost - $6,677,741) | ||||||||

| TOTAL INVESTMENT - 74.0% (Cost - $9,855,733) | $ | 9,967,710 | ||||||

| OTHER ASSETS LESS LIABILITIES - NET - 26.0% | 3,500,193 | |||||||

| NET ASSETS - 100.0% | $ | 13,467,903 | ||||||

| * | Money Market Fund; rate reflects seven-day effective yield on November 30, 2018. |

| + | A portion of this investment is a holding of IQSF Fund Limited. |

LONG FUTURES CONTRACTS

| Notional Value | ||||||||||||||||

| Number of | Open Long Futures | at November | Unrealized | |||||||||||||

| Contracts | Contracts | Counterparty | Expiration Date | 30, 2018 | Appreciation | |||||||||||

| 69 | Johnson & Johnson | ADM Investor Services, Inc. | Dec-18 | 1,014,921 | $ | 20,512 | ||||||||||

| Total Net Unrealized Appreciation on Long Futures Contacts | $ | 20,512 | ||||||||||||||

SHORT FUTURES CONTRACTS

| Notional Value | ||||||||||||||||

| Number of | Open Short Futures | at November | Unrealized | |||||||||||||

| Contracts | Contracts | Counterparty | Expiration Date | 30, 2018 | Depreciation | |||||||||||

| 74 | Invesco QQQ Trust Series 1 | ADM Investor Services, Inc. | Dec-18 | 1,254,744 | $ | (6,934 | ) | |||||||||

| Total Net Unrealized Depreciation on Short Futures Contacts | $ | (6,934 | ) | |||||||||||||

TOTAL RETURN SWAP

| Notional Value | ||||||||||||||||

| at November 30, | Variable Rate | Unrealized | ||||||||||||||

| 2018 | Description | Counterparty | Fixed Rate Paid | Received | Maturity Date | Depreciation | ||||||||||

| 19,217,660 | Richmond Global Basket Total Return Swap+ | Deutsche Bank | 0.35% of the notional value | Total returns from the Richmond Global Basket | 3/3/2023 | $ | (747,605 | ) | ||||||||

| Total Net Unrealized Depreciation on Swap Contract | $ | (747,605 | ) | |||||||||||||

| + | This investment is a holding of IQSF Fund Limited. |

See accompanying notes to financial statements.

5

| IQ-STRIQUER FUND |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| November 30, 2018 |

| Total Return Swap Holdings ^ |

| FUTURES CONTRACTS Short Positions |

| Notional Value at | Unrealized | |||||||||||||||||

| Number of | November 30, | Appreciation/ | % of Fund | |||||||||||||||

| Contracts | Description | Counterparty | Expiration Date | 2018 | (Depreciation) | Net Assets | ||||||||||||

| 2 | 2 year Euro-Schatz Future | Deutsche Bank | Dec-18 | 203,256 | 1,145 | 0.00 | ||||||||||||

| 2 | 2 year US Treasury Notes Future | Deutsche Bank | Mar-19 | 333,196 | (37 | ) | (0.00 | ) | ||||||||||

| 1 | 3 month Euro (EURIBOR) | Deutsche Bank | Sep-19 | 274,626 | (82 | ) | (0.00 | ) | ||||||||||

| 3 | 3 month Sterling | Deutsche Bank | Mar-20 | 418,541 | 89 | 0.00 | ||||||||||||

| 2 | 3 month Sterling | Deutsche Bank | Mar-19 | 275,307 | — | 0.00 | ||||||||||||

| 6 | 5 year US Treasury Notes Future | Deutsche Bank | Mar-19 | 623,224 | (529 | ) | (0.00 | ) | ||||||||||

| 14 | CAD/USD | Deutsche Bank | Dec-18 | 1,037,406 | 7,500 | 0.00 | ||||||||||||

| 6 | CHF/USD | Deutsche Bank | Dec-18 | 715,661 | 17,046 | 0.00 | ||||||||||||

| 7 | CME E-Mini Russell 2000 Index | Deutsche Bank | Dec-18 | 537,556 | (2,144 | ) | (0.00 | ) | ||||||||||

| 21 | Corn Future | Deutsche Bank | Mar-19 | 388,484 | (4,048 | ) | (0.00 | ) | ||||||||||

| 11 | EUR/USD | Deutsche Bank | Dec-18 | 1,509,302 | 19,406 | 0.00 | ||||||||||||

| 19 | Eurodollar | Deutsche Bank | Dec-20 | 4,532,629 | (290 | ) | (0.00 | ) | ||||||||||

| 4 | Eurodollar | Deutsche Bank | Sep-19 | 898,933 | (1,029 | ) | (0.00 | ) | ||||||||||

| 1 | Eurodollar | Deutsche Bank | Mar-20 | 214,571 | (485 | ) | (0.00 | ) | ||||||||||

| 6 | Gold | Deutsche Bank | Feb-19 | 791,122 | 484 | 0.00 | ||||||||||||

| 1 | Hang Seng Index | Deutsche Bank | Dec-18 | 199,886 | (1,658 | ) | (0.00 | ) | ||||||||||

| 16 | JPY/USD | Deutsche Bank | Dec-18 | 1,713,289 | 15,618 | 0.00 | ||||||||||||

| 17 | Light Sweet Crude Oil (WTI) Future | Deutsche Bank | Apr-19 | 868,893 | 207,500 | 0.02 | ||||||||||||

| 11 | Light Sweet Crude Oil (WTI) Future | Deutsche Bank | Nov-19 | 592,236 | 90,863 | 0.01 | ||||||||||||

| 7 | Nikkei 225 Future | Deutsche Bank | Dec-18 | 806,038 | (27,862 | ) | (0.00 | ) | ||||||||||

| 7 | Silver | Deutsche Bank | Mar-19 | 508,656 | 6,085 | 0.00 | ||||||||||||

| 26 | Soybeans Future | Deutsche Bank | Jul-19 | 1,197,610 | (22,132 | ) | (0.00 | ) | ||||||||||

| 14 | Soybeans Future | Deutsche Bank | Mar-19 | 652,246 | (15,243 | ) | (0.00 | ) | ||||||||||

| Long Positions | ||||||||||||||||||

| Description | ||||||||||||||||||

| 7 | 10 year Australian Treasury Bond Future | Deutsche Bank | Dec-18 | 5,042,283 | 2,311 | 0.00 | ||||||||||||

| 4 | 10 year Canadian Govt Bond Future | Deutsche Bank | Mar-19 | 446,672 | 2,715 | 0.00 | ||||||||||||

| 5 | 10 year Italian Bond Future | Deutsche Bank | Mar-19 | 676,682 | 5,283 | 0.00 | ||||||||||||

| 5 | 10 year Italian Bond Future | Deutsche Bank | Dec-18 | 659,191 | 24,159 | 0.00 | ||||||||||||

| 3 | 10 year Japanese Government Bond Future | Deutsche Bank | Dec-18 | 3,659,759 | 15,281 | 0.00 | ||||||||||||

| 8 | 10 year US Treasury Notes Future | Deutsche Bank | Mar-19 | 987,790 | 1,827 | 0.00 | ||||||||||||

| 4 | 2 year Euro-Schatz Future | Deutsche Bank | Mar-19 | 467,832 | (244 | ) | (0.00 | ) | ||||||||||

| 11 | 3 month Euro (EURIBOR) | Deutsche Bank | Jun-19 | 3,245,556 | 778 | 0.00 | ||||||||||||

| 9 | 3 month Euro (EURIBOR) | Deutsche Bank | Dec-19 | 2,569,343 | 1,909 | 0.00 | ||||||||||||

| 3 | 3 month Euro (EURIBOR) | Deutsche Bank | Sep-20 | 735,618 | 845 | 0.00 | ||||||||||||

| 1 | 3 month Euro (EURIBOR) | Deutsche Bank | Jun-20 | 328,943 | 401 | 0.00 | ||||||||||||

| 1 | 3 month Euro (EURIBOR) | Deutsche Bank | Mar-20 | 313,498 | 333 | 0.00 | ||||||||||||

| 12 | 3 month Sterling | Deutsche Bank | Dec-19 | 1,818,441 | (334 | ) | (0.00 | ) | ||||||||||

| 8 | 3 month Sterling | Deutsche Bank | Sep-19 | 1,335,330 | (373 | ) | (0.00 | ) | ||||||||||

| 3 | 3 month Sterling | Deutsche Bank | Jun-19 | 489,089 | 1 | 0.00 | ||||||||||||

| 2 | 3 year Australian Treasury Bond Future | Deutsche Bank | Dec-18 | 435,409 | 8 | 0.00 | ||||||||||||

| 11 | 90 Day Bank Accepted Bill Future | Deutsche Bank | Sep-19 | 1,990,637 | 872 | 0.00 | ||||||||||||

| 7 | 90 Day Bank Accepted Bill Future | Deutsche Bank | Mar-19 | 1,273,134 | 93 | 0.00 | ||||||||||||

| 1 | 90 Day Bank Accepted Bill Future | Deutsche Bank | Jun-19 | 256,476 | 88 | 0.00 | ||||||||||||

| 1 | DAX Index Future | Deutsche Bank | Dec-18 | 198,652 | (2,762 | ) | (0.00 | ) | ||||||||||

| 79 | DJ EURO STOXX Banks Future | Deutsche Bank | Dec-18 | 432,045 | (20,000 | ) | (0.00 | ) | ||||||||||

| 5 | Euro-BOBL Future | Deutsche Bank | Mar-19 | 705,242 | 202 | 0.00 | ||||||||||||

| 2 | Euro-BOBL Future | Deutsche Bank | Dec-18 | 262,880 | 1,781 | 0.00 | ||||||||||||

| 7 | Euro-BUND Future | Deutsche Bank | Mar-19 | 1,376,820 | 1,150 | 0.00 | ||||||||||||

| 4 | Euro-BUND Future | Deutsche Bank | Dec-18 | 817,944 | 13,107 | 0.00 | ||||||||||||

| 1 | Euro-BUXL Future | Deutsche Bank | Mar-19 | 279,433 | 777 | 0.00 | ||||||||||||

| 16 | Eurodollar | Deutsche Bank | Dec-19 | 3,831,815 | 2,716 | 0.00 | ||||||||||||

| 8 | Eurodollar | Deutsche Bank | Dec-18 | 2,033,399 | (563 | ) | (0.00 | ) | ||||||||||

| 5 | Eurodollar | Deutsche Bank | Jun-19 | 1,106,445 | (103 | ) | (0.00 | ) | ||||||||||

| 3 | Euro-OAT Futures | Deutsche Bank | Mar-19 | 552,978 | 416 | 0.00 | ||||||||||||

| 9 | Lean Hog Future | Deutsche Bank | Apr-19 | 256,205 | 1,454 | 0.00 | ||||||||||||

| 11 | Light Sweet Crude Oil (WTI) Future | Deutsche Bank | Mar-19 | 557,682 | (154,862 | ) | (0.01 | ) | ||||||||||

See accompanying notes to financial statements.

6

| IQ-STRIQUER FUND |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| November 30, 2018 |

| Long Positions (Continued) | ||||||||||||||||||

| Description | ||||||||||||||||||

| 10 | Light Sweet Crude Oil (WTI) Future | Deutsche Bank | Dec-18 | 492,692 | (88,521 | ) | (0.01 | ) | ||||||||||

| 7 | Long Gilt Future | Deutsche Bank | Mar-19 | 1,121,866 | 2,748 | 0.00 | ||||||||||||

| 2 | Mini Japanese Government Bond Future | Deutsche Bank | Dec-18 | 218,505 | 865 | 0.00 | ||||||||||||

| 8 | Nikkei 225 (JPY) Future | Deutsche Bank | Dec-18 | 803,642 | 29,408 | 0.00 | ||||||||||||

| 3 | NY Harbour ULSD Future | Deutsche Bank | Dec-18 | 195,699 | (11,272 | ) | (0.00 | ) | ||||||||||

| 26 | Soybeans Future | Deutsche Bank | Jan-19 | 1,149,633 | 21,945 | 0.00 | ||||||||||||

| 14 | Soybeans Future | Deutsche Bank | May-19 | 634,960 | 11,773 | 0.00 | ||||||||||||

| 4 | Three Month Canadian Bankers Acceptance Future | Deutsche Bank | Jun-19 | 797,788 | 1,438 | 0.00 | ||||||||||||

| Subtotal | 157,847 | |||||||||||||||||

| ^ | This investment is not a direct holding of IQSF Fund Limited. The holdings were determined based on the absolute notional values of the positions within the underlying swap basket. |

| FORWARD FOREIGN CURRENCY CONTRACTS | ||||||||||||||||||||||||||

| Unrealized | ||||||||||||||||||||||||||

| Settlement | Currency to | Foreign | Appreciation/ | % of Fund | ||||||||||||||||||||||

| Date | Counterparty | Deliver/Receive | Value | In Exchange For | Currency Value | U.S. Dollar Value | (Depreciation) | Net Assets | ||||||||||||||||||

| 12/21/2018 | Deutsche Bank | CAD | 363,708 | USD | 275,845 | 278,092 | 2,247 | 0.00 | ||||||||||||||||||

| 12/21/2018 | Deutsche Bank | CHF | 345,996 | USD | 343,096 | 339,567 | (3,529 | ) | (0.00 | ) | ||||||||||||||||

| 12/20/2018 | Deutsche Bank | HKD | 2,507,363 | USD | 320,886 | 321,140 | 254 | 0.00 | ||||||||||||||||||

| 4/2/2019 | Deutsche Bank | HKD | 3,260,503 | USD | 410,126 | 410,328 | 202 | 0.00 | ||||||||||||||||||

| 4/2/2019 | Deutsche Bank | HKD | 1,609,745 | USD | 205,063 | 204,879 | (185 | ) | (0.00 | ) | ||||||||||||||||

| 9/18/2019 | Deutsche Bank | HKD | 3,178,991 | USD | 399,873 | 400,275 | 402 | 0.00 | ||||||||||||||||||

| 9/18/2019 | Deutsche Bank | HKD | 1,569,502 | USD | 199,937 | 199,627 | (309 | ) | (0.00 | ) | ||||||||||||||||

| 12/5/2018 | Deutsche Bank | HUF | 96,936,480 | USD | 336,585 | 335,511 | (1,074 | ) | (0.00 | ) | ||||||||||||||||

| 12/3/2018 | Deutsche Bank | JPY | 24,151,455 | EUR | 186,830 | 164,491 | * | (642 | ) | (0.00 | ) | |||||||||||||||

| 12/4/2018 | Deutsche Bank | JPY | 28,658,640 | EUR | 222,806 | 197,683 | * | 952 | 0.00 | |||||||||||||||||

| 1/28/2019 | Deutsche Bank | JPY | 22,588,982 | EUR | 192,247 | 169,721 | * | (139 | ) | (0.00 | ) | |||||||||||||||

| 1/31/2019 | Deutsche Bank | JPY | 29,862,314 | USD | 256,329 | 256,678 | 349 | 0.00 | ||||||||||||||||||

| 6/19/2019 | Deutsche Bank | MXN | 5,117,065 | USD | 232,313 | 243,521 | 11,208 | 0.00 | ||||||||||||||||||

| 12/5/2018 | Deutsche Bank | NZD | 741,385 | EUR | 448,780 | 396,761 | * | 314 | 0.00 | |||||||||||||||||

| 12/21/2018 | Deutsche Bank | RUB | 16,494,763 | USD | 230,696 | 230,199 | (497 | ) | (0.00 | ) | ||||||||||||||||

| 12/21/2018 | Deutsche Bank | TRY | 2,014,927 | USD | 365,218 | 381,028 | 15,810 | 0.00 | ||||||||||||||||||

| 12/4/2018 | Deutsche Bank | USD | 262,163 | EUR | 225,612 | 220,659 | (4,953 | ) | (0.00 | ) | ||||||||||||||||

| 12/5/2018 | Deutsche Bank | USD | 422,192 | GBP | 332,880 | 332,768 | (112 | ) | (0.00 | ) | ||||||||||||||||

| 12/21/2018 | Deutsche Bank | USD | 345,357 | AUD | 476,829 | 473,736 | (3,093 | ) | (0.00 | ) | ||||||||||||||||

| 12/21/2018 | Deutsche Bank | USD | 302,221 | NZD | 447,296 | 442,348 | (4,948 | ) | (0.00 | ) | ||||||||||||||||

| 12/21/2018 | Deutsche Bank | USD | 230,829 | EUR | 204,170 | 203,169 | (1,001 | ) | (0.00 | ) | ||||||||||||||||

| 12/21/2018 | Deutsche Bank | USD | 196,750 | GBP | 151,402 | 147,992 | (3,410 | ) | (0.00 | ) | ||||||||||||||||

| 12/27/2018 | Deutsche Bank | USD | 238,899 | EUR | 205,063 | 198,694 | (6,369 | ) | (0.00 | ) | ||||||||||||||||

| 12/27/2018 | Deutsche Bank | USD | 238,899 | EUR | 205,063 | 211,433 | 6,370 | 0.00 | ||||||||||||||||||

| 12/28/2018 | Deutsche Bank | USD | 4,358,293 | EUR | 3,819,714 | 3,818,222 | (1,492 | ) | (0.00 | ) | ||||||||||||||||

| 12/28/2018 | Deutsche Bank | USD | 890,645 | AUD | 1,212,966 | 1,212,924 | (43 | ) | (0.00 | ) | ||||||||||||||||

| 4/17/2019 | Deutsche Bank | USD | 392,183 | EUR | 307,595 | 307,669 | 74 | 0.00 | ||||||||||||||||||

| 12/20/2018 | Deutsche Bank | ZAR | 2,499,207 | USD | 199,937 | 199,934 | (3 | ) | (0.00 | ) | ||||||||||||||||

| 12/21/2018 | Deutsche Bank | ZAR | 3,460,440 | USD | 256,329 | 257,412 | 1,083 | 0.00 | ||||||||||||||||||

| 12/21/2018 | Deutsche Bank | ZAR | 3,082,047 | USD | 214,144 | 206,459 | (7,685 | ) | (0.00 | ) | ||||||||||||||||

| Subtotal | (219 | ) | ||||||||||||||||||||||||

| All Other Investments | (905,233 | ) | ||||||||||||||||||||||||

| Total Unrealized Depreciation of Swap | (747,605 | ) | ||||||||||||||||||||||||

| ^ | This investment is not a direct holding of IQSF Fund Limited. The holdings were determined based on the absolute notional values of the positions within the underlying swap basket. |

| * | U.S. Dollar Value translation at November 30, 2018. |

| AUD - Austrailian Dollar | JPY - Japanese Yen |

| CAD - Canadian Dollar | MXN - Mexican Peso |

| CHF - Swiss Franc | NZD - New Zealand Dollar |

| EUR - Euro | RUB - Russian Ruble |

| GBP - Pound Sterling | TRY - Turkish Lira |

| HKD - Hong Kong Dollar | USD - U.S. Dollar |

| HUF - Hungarian Forint | ZAR - South African Rand |

See accompanying notes to financial statements.

7

| IQ-STRIQUER FUND |

| CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES |

| November 30, 2018 |

| ASSETS | ||||

| Investment securities: | ||||

| Securities at Cost | $ | 9,855,733 | ||

| Securities at Value | 9,967,710 | |||

| Cash on deposit with Broker - swap margin balance (a) | 3,592,954 | |||

| Deposit at Broker for futures contracts | 1,207,349 | |||

| Net unrealized appreciation from open futures contracts | 13,578 | |||

| Dividends and interest receivable | 16,366 | |||

| Due from Advisor | 2,451 | |||

| Prepaid expenses and other assets | 36,200 | |||

| TOTAL ASSETS | 14,836,608 | |||

| LIABILITIES | ||||

| Fund shares repurchased | 1,026 | |||

| Payable for securities purchased | 577,594 | |||

| Unrealized depreciation - swap contract | 747,605 | |||

| Payable to related parties | 8,441 | |||

| Distribution (12b-1) fees payable | 1,105 | |||

| Accrued expenses and other liabilities | 32,934 | |||

| TOTAL LIABILITIES | 1,368,705 | |||

| NET ASSETS | $ | 13,467,903 | ||

| Net Assets Consist Of: | ||||

| Paid in capital | $ | 14,918,661 | ||

| Accumulated loss | (1,450,758 | ) | ||

| NET ASSETS | $ | 13,467,903 | ||

| Net Asset Value Per Share: | ||||

| Class A Shares: | ||||

| Net Assets | $ | 5,410,824 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 606,739 | |||

| Net asset value and redemption price per share (Net assets/Shares of Beneficial Interest) (b) | $ | 8.92 | ||

| Maximum offering price per share (net asset value plus maximum sales charge of 3.50%) (c) | $ | 9.24 | ||

| Class I Shares: | ||||

| Net Assets | $ | 8,057,079 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 901,722 | |||

| Net asset value, offering price and redemption price per share (Net assets/Shares of Beneficial Interest) (b) | $ | 8.94 | ||

| (a) | This cash is a holding of IQSF Fund Limited. |

| (b) | Redemptions made within 60 days of purchase may be assessed a redemption fee of 1.00%. |

| (c) | On investments of $50,000 or more, the offering price is reduced. |

See accompanying notes to financial statements.

8

| IQ-STRIQUER FUND |

| CONSOLIDATED STATEMENT OF OPERATIONS |

| For the Period Ended November 30, 2018(1) |

| INVESTMENT INCOME | ||||

| Dividends | $ | 11,235 | ||

| Interest | 101,525 | |||

| TOTAL INVESTMENT INCOME | 112,760 | |||

| EXPENSES | ||||

| Investment advisory fees | 110,341 | |||

| Distribution (12b-1) fees: | ||||

| Class A | 7,231 | |||

| Registration fees | 43,091 | |||

| Administrative services fees | 32,419 | |||

| Transfer agent fees | 30,763 | |||

| Audit fees | 25,008 | |||

| Accounting services fees | 24,740 | |||

| Legal fees | 23,629 | |||

| Compliance officer fees | 21,384 | |||

| Shareholder reporting expenses | 13,678 | |||

| Trustees’ fees and expenses | 9,770 | |||

| Custodian fees | 9,479 | |||

| Other expenses | 5,756 | |||

| TOTAL EXPENSES | 357,289 | |||

| Fees waived and expenses reimbursed by Advisor | (206,603 | ) | ||

| NET EXPENSES | 150,686 | |||

| NET INVESTMENT LOSS | (37,926 | ) | ||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| Net realized gain (loss) from: | ||||

| Investments | (78,266 | ) | ||

| Futures contracts | (712,516 | ) | ||

| Net change in unrealized appreciation (depreciation) on: | ||||

| Investments | 111,977 | |||

| Futures contracts | 13,578 | |||

| Swap contract | (747,605 | ) | ||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | (1,412,832 | ) | ||

| NET DECREASE IN NET ASSETS FROM OPERATIONS | $ | (1,450,758 | ) | |

| (1) | The IQ-Striquer Fund commenced operations on January 31, 2018. |

See accompanying notes to financial statements.

9

| IQ-STRIQUER FUND |

| CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS |

| For the | ||||

| Period Ended | ||||

| November 30, 2018 | (1) | |||

| FROM OPERATIONS | ||||

| Net investment loss | $ | (37,926 | ) | |

| Net realized loss from investment transactions and futures contracts | (790,782 | ) | ||

| Net change in unrealized depreciation of investments, swap contract and futures contracts | (622,050 | ) | ||

| Net decrease in net assets resulting from operations | (1,450,758 | ) | ||

| FROM SHARES OF BENEFICIAL INTEREST | ||||

| Proceeds from shares sold: | ||||

| Class A | 6,190,619 | |||

| Class I | 9,566,473 | |||

| Redemption fee proceeds: | ||||

| Class A | 385 | |||

| Class I | 582 | |||

| Payments for shares redeemed: | ||||

| Class A | (188,604 | ) | ||

| Class I | (650,794 | ) | ||

| Net increase in net assets from shares of beneficial interest | 14,918,661 | |||

| TOTAL INCREASE IN NET ASSETS | 13,467,903 | |||

| NET ASSETS | ||||

| Beginning of Period | — | |||

| End of Period | $ | 13,467,903 | ||

| SHARE ACTIVITY | ||||

| Class A: | ||||

| Shares Sold | 626,647 | |||

| Shares Redeemed | (19,908 | ) | ||

| Net increase in shares of beneficial interest outstanding | 606,739 | |||

| Institutional Class: | ||||

| Shares Sold | 969,835 | |||

| Shares Redeemed | (68,113 | ) | ||

| Net increase in shares of beneficial interest outstanding | 901,722 | |||

| (1) | The IQ-Striquer Fund commenced operations on January 31, 2018. |

See accompanying notes to financial statements.

10

| IQ-STRIQUER FUND |

| CONSOLIDATED FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period Presented |

| Class A | ||||

| For the | ||||

| Period Ended | ||||

| November 30, | ||||

| 2018* | ||||

| Net asset value, beginning of period | $ | 10.00 | ||

| Activity from investment operations: | ||||

| Net investment loss (1) | (0.06 | ) | ||

| Net realized and unrealized loss on investments | (1.02 | ) | ||

| Total from investment operations | (1.08 | ) | ||

| Paid-in-capital from redemption fees | 0.00 | (2) | ||

| Net asset value, end of period | $ | 8.92 | ||

| Total return (3,4) | (10.80 | )% | ||

| Net assets, end of period (000s) | $ | 5,411 | ||

| Ratio of gross expenses to average net assets (5,6,8) | 5.03 | % | ||

| Ratio of net expenses to average net assets (6,9) | 2.20 | % | ||

| Ratio of gross expenses to average net assets, excluding dividends from securities sold short (5,6) | 4.78 | % | ||

| Ratio of net expenses to average net assets, excluding dividends from securities sold short (6) | 1.93 | % | ||

| Ratio of net investment loss to average net assets (6,10) | (0.70 | )% | ||

| Portfolio Turnover Rate (4,7) | 1160 | % | ||

| * | IQ-Striquer Fund commenced operations on January 31, 2018. |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Less than $0.005 per share. |

| (3) | Total returns shown exclude the effect of applicable sales loads/redemption fees. Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gain distributionss, if any. Had the advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (4) | Not annualized. |

| (5) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the advisor. |

| (6) | Annualized. |

| (7) | The portfolio turnover rate excludes investments whose maturities or expiration dates at the time of acquisition were one year or less. For this reason all money market funds that were traded throughout the period are excluded from the calculation. The timing of the Fund’s limited amount of purchases and sales of long term securities produced the resulting portfolio turnover percentage, which appears inflated due to the nature of the calculation. |

| (8) | Ratio of gross expenses to average net assets excluding the expenses and income of IQSF Fund Limited | 5.03 | % | ||

| (9) | Ratio of net expenses to average net assets excluding the expenses and income of IQSF Fund Limited | 2.20 | % | ||

| (10) | Ratio of net investment income/(loss) to average net assets excluding the expenses and income of IQSF Fund Limited | (0.88 | )% | ||

See accompanying notes to financial statements.

11

| IQ-STRIQUER FUND |

| CONSOLIDATED FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period Presented |

| Class I | ||||

| For the | ||||

| Period Ended | ||||

| November 30, | ||||

| 2018* | ||||

| Net asset value, beginning of period | $ | 10.00 | ||

| Activity from investment operations: | ||||

| Net investment loss (1) | (0.03 | ) | ||

| Net realized and unrealized loss on investments | (1.03 | ) | ||

| Total from investment operations | (1.06 | ) | ||

| Paid-in-capital from redemption fees | 0.00 | (2) | ||

| Net asset value, end of period | $ | 8.94 | ||

| Total return (3,4) | (10.60 | )% | ||

| Net assets, end of period (000s) | $ | 8,057 | ||

| Ratio of gross expenses to average net assets (5,6,8) | 4.71 | % | ||

| Ratio of net expenses to average net assets (6,9) | 1.95 | % | ||

| Ratio of gross expenses to average net assets, excluding dividends from securities sold short (5,6) | 4.45 | % | ||

| Ratio of net expenses to average net assets, excluding dividends from securities sold short (6) | 1.68 | % | ||

| Ratio of net investment loss to average net assets (6,10) | (0.39 | )% | ||

| Portfolio Turnover Rate (4,7) | 1160 | % | ||

| * | IQ-Striquer Fund commenced operations on January 31, 2018. |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Less than $0.005 per share. |

| (3) | Total returns shown exclude the effect of applicable sales loads/redemption fees. Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gain distributions, if any. Had the advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (4) | Not annualized. |

| (5) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the advisor. |

| (6) | Annualized. |

| (7) | The portfolio turnover rate excludes investments whose maturities or expiration dates at the time of acquisition were one year or less. For this reason all money market funds that were traded throughout the period are excluded from the calculation. The timing of the Fund’s limited amount of purchases and sales of long term securities produced the resulting portfolio turnover percentage, which appears inflated due to the nature of the calculation. |

| (8) | Ratio of gross expenses to average net assets excluding the expenses and income of IQSF Fund Limited | 4.71 | % | ||

| (9) | Ratio of net expenses to average net assets excluding the expenses and income of IQSF Fund Limited | 1.95 | % | ||

| (10) | Ratio of net investment income/(loss) to average net assets excluding the expenses and income of IQSF Fund Limited | (0.57 | )% | ||

See accompanying notes to financial statements.

12

| IQ STRIQUER FUND |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

| 1. | ORGANIZATION |

The IQ-Striquer Fund (the “Fund”) is a diversified series of Northern Lights Fund Trust IV (the “Trust”), a trust organized under the laws of the State of Delaware on June 2, 2015, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund’s investment objective is to seek to provide capital appreciation with lower volatility than equity markets. The Fund commenced operations on January 31, 2018.

The Fund currently offers Class A and Class I shares. Class A shares are offered at net asset value plus a maximum front-end sales charge of 3.50% and a maximum deferred sales charge of 1.00%. Class I shares are offered at net asset value. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services Investment Companies” including Accounting Standards Update (“ASU”) 2013-08. Fund level income and expenses, and realized and unrealized capital gains and losses are allocated to each class of shares based on their relative net assets within the Fund. Class specific expenses are allocated to that share class.

Security Valuation –Securities and dividends listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price. In the absence of a sale, such securities shall be valued at the mean between the current bid and ask prices on the day of valuation. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase may be valued at amortized cost. Debt securities (other than short-term obligations) are valued each day by an independent pricing service approved by the Board of Trustees (the “Board”) based on methods which include consideration of: yields or prices of securities of comparable quality, coupon, maturity and type, indications as to values from dealers, and general market conditions or market quotations from a major market maker in the securities. Investments in open-end investment companies are valued at net asset value.

Futures contracts and options on futures contracts that are actively traded on commodity exchanges are fair valued based on quoted prices from the applicable exchange, and to the extent valuation adjustments are not applied to futures contracts, they are categorized as Level 1. To the extent that valuation adjustments are observable and timely, the fair values of futures contracts would be categorized as Level 2; otherwise the fair values would be categorized as Level 3.

Forward foreign currency contracts are fair valued using the mean between broker-dealer bid and ask quotations, and forward foreign currency exchange rates gathered from leading market makers. To the extent that these inputs are observable and timely, the fair values of forward foreign currency contracts would be categorized as Level 2; otherwise the fair values would be categorized as Level 3.

The value of total return basket swaps are derived from a combination of (i) the net value of the underlying positions, which are valued daily using the last sale or closing price on the principal exchange on which the securities are traded; (ii) financing costs; (iii) the value of dividends or accrued interest; (iv) cash balances within the swap; and (v) other factors, as applicable.

13

| IQ STRIQUER FUND |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

To the extent that these inputs are observable and timely, the fair values of total return basket swaps would be categorized as Level 2; otherwise the fair values would be categorized as Level 3.

Valuation of Underlying Funds –The Fund may invest in portfolios of open-end or closed-end investment companies (the “Underlying Funds”). Investment companies are valued at their respective net asset values as reported by such investment companies. Exchange-traded funds (“ETFs”) are valued at the last reported sale price or the official closing price.

Open-end investment companies value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value to the methods established by the board of directors of the open-end funds. The shares of many closed-end investment companies and ETFs, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company or ETF purchased by the Fund will not change.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to a fair value team composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) adviser. The team may also enlist third party consultants such as a valuation specialist from a public accounting firm, valuation consultant, or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value.

Fair Valuation Process –As noted above, the fair value team is composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) adviser. The applicable investments are valued collectively via inputs from each of these groups. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source), (ii) securities for which, in the judgment of the adviser, the prices or values available do not represent the fair value of the instrument. Factors which may cause the adviser to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to the Fund’s calculation of its net asset value. Restricted or illiquid securities, such as private investments or non-traded securities are valued via inputs from the adviser based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If the adviser is unable to obtain a current bid from such independent dealers or other independent parties, the fair value team shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 –Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

14

| IQ STRIQUER FUND |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

Level 2 –Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 –Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of November 30, 2018 for the Fund’s investments measured at fair value:

| Assets * | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock | $ | 3,289,969 | $ | — | $ | — | $ | 3,289,969 | ||||||||

| Money Market Fund | 6,677,741 | — | — | 6,677,741 | ||||||||||||

| Long Futures Contracts | 20,512 | — | — | 20,512 | ||||||||||||

| Total | $ | 9,988,222 | $ | — | $ | — | $ | 9,988,222 | ||||||||

| Liabilities* | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Short Futures Contracts | $ | 6,934 | $ | — | $ | — | $ | 6,934 | ||||||||

| Swap Contract | — | 747,605 | — | 747,605 | ||||||||||||

| Total | $ | 6,934 | $ | 747,605 | $ | — | $ | 754,539 | ||||||||

There were no transfers between any level during the period ended November 30, 2018.

It is the Fund’s policy to record transfers into or out of any Level at the end of the reporting period.

The Fund did not hold any Level 3 securities during the period.

| * | Please refer to the Consolidated Portfolio of Investments for industry classifications. |

15

| IQ STRIQUER FUND |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

Offsetting of Financial Assets and Derivative Assets

The Fund’s policy is to recognize a net asset or liability equal to the unrealized appreciation (depreciation) for swap contracts and futures contracts. The following table presents financial instruments that are subject to enforceable netting arrangements or other similar agreements as of November 30, 2018:

| Liabilities: | ||||||||||||||||||||

| Net Amounts of | ||||||||||||||||||||

| Gross Amounts of Assets | Liabilities Presented in | Cash or | ||||||||||||||||||

| Offset in the | the Consolidated | Financial | ||||||||||||||||||

| Gross Amounts of | Consolidated Statement | Statement of Assets & | Instruments | |||||||||||||||||

| Description | Recognized Liabilities | of Assets & Liabilities | Liabilities | Pledged (1) | Net Amount | |||||||||||||||

| Swap Contract | $ | 747,605 | $ | — | $ | 747,605 | $ | 747,605 | $ | — | ||||||||||

| Total | $ | 747,605 | $ | — | $ | 747,605 | $ | 747,605 | $ | — | ||||||||||

| (1) | The amount is limited to the derivative balance and accordingly, does not include excess collateral pledged. Total collateral held for the swap contract as of November 30, 2018 was $3,592,954. |

Impact of Derivatives on the Consolidated Statement of Assets and Liabilities

The following is a summary of the location of derivative investments on the Fund’s Consolidated Statement of Assets and Liabilities as of November 30, 2018:

| Derivative Investment Type | Asset/Liability Derivatives |

| Equity/Currency/Commodity/Interest Rate Contracts | Net unrealized appreciation from open futures contracts Due to Broker – Swap Contract |

The following table sets forth the fair value of the Fund’s derivative contracts by primary risk exposure as of November 30, 2018:

| Derivative Investment Value | ||||||||||||||||||||

| Equity | Currency | Commodity | Interest Rate | Total as of | ||||||||||||||||

| Derivative Investment Type | Contracts * | Contracts | Contracts | Contracts | November 30, 2018 | |||||||||||||||

| Futures Contracts | $ | 13,578 | $ | — | $ | — | $ | — | $ | 13,578 | ||||||||||

| Total Return Swap | (747,605 | ) | (747,605 | ) | ||||||||||||||||

| * | The Fund’s risk exposure includes equity contracts, currency contracts, commodity contracts, and interest rate contracts as disclosed in the Consolidated Portfolio of Investments. |

Impact of Derivatives on the Consolidated Statement of Operations

The following is a summary of the location of derivative investments on the Fund’s Consolidated Statement of Operations as of November 30, 2018:

| Derivative Investment Type | Location of Loss on Derivatives |

| Net realized loss from futures contracts | |

| Equity/Currency/Commodity/Interest Rate Contracts | Net change in unrealized appreciation on futures contracts |

| Net change in unrealized depreciation on swap contract | |

For the period ended November 30, 2018, the notional value and net change in unrealized appreciation/depreciation from the swap were as follows:

| Fund | Net Change in Unrealized Depreciation | Notional | ||

| IQSF | $(747,605) | 19,217,660 | ||

The following is a summary of the Fund’s realized gain (loss) on derivative investments recognized in the Consolidated

16

| IQ STRIQUER FUND |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

Statements of Operations categorized by primary risk exposure as of November 30, 2018:

| Realized loss on derivatives recognized in the Consolidated Statement of Operations | ||||||||||||||||||||

| Equity | Currency | Commodity | Interest Rate | Total as of | ||||||||||||||||

| Derivative Investment Type | Contracts | Contracts | Contracts | Contracts | November 30, 2018 | |||||||||||||||

| Futures Contracts | $ | 712,516 | $ | — | $ | — | $ | — | $ | 712,516 | ||||||||||

| Net change in unrealized gain (loss) on derivatives recognized in the Consolidated Statement of Operations | ||||||||||||||||||||

| Equity | Currency | Commodity | Interest Rate | Total as of | ||||||||||||||||

| Derivative Investment Type | Contracts | Contracts | Contracts | Contracts | November 30, 2018 | |||||||||||||||

| Futures Contracts | $ | 13,578 | $ | — | $ | — | $ | — | $ | 13,578 | ||||||||||

| Total Return Swap | (747,605 | ) | — | — | — | (747,605 | ) | |||||||||||||

The derivative instruments outstanding as of November 30, 2018 as disclosed in the Consolidated Portfolio of Investments and the amounts of changes in unrealized gains and losses on derivative instruments during the period as disclosed in the Consolidated Statement of Operations serve as indicators of the volume of derivative activity for the Fund.

Consolidation of Subsidiaries: The consolidated financial statements of the IQ-Striquer Fund include IQSF Fund Limited (“IQSF”), a wholly-owned and controlled subsidiary of the Fund. All inter-company accounts and transactions have been eliminated in consolidation.

The Fund may invest up to 25% of its total assets in a controlled foreign corporation, which acts as an investment vehicle in order to effect certain investments consistent with the Fund’s investment objectives and policies. IQSF commenced operations on March 5, 2018.

A summary of the IQ-Striquer Fund’s investments in IQSF is as follows:

| IQSF Fund Limited (IQSF) | ||||||||

| November 30, 2018 | ||||||||

| Fair Value of IQSF | $ | 2,850,510 | ||||||

| Other Assets | $ | — | ||||||

| Total Net Assets | $ | 2,850,510 | ||||||

| Percentage of the Fund’s Total Net Assets | 21.2 | % | ||||||

For tax purposes, IQSF is an exempted Cayman investment company. IQSF received an undertaking from the Government of the Cayman Islands exempting it from all local income, profits and capital gains taxes. No such taxes are levied in the Cayman Islands at the present time. For U.S. income tax purposes, IQSF is a controlled foreign corporation, which generates, and is allocated, no income that is considered effectively connected with U.S. trade of business and as such is not subject to U.S. income tax. However, as a wholly-owned controlled foreign corporation, IQSF’s net income and capital gain, to the extent of its earnings and profits, will be included each year in each of the Fund’s investment company taxable income.

Foreign Currency –Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions.

The Company does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included

17

| IQ STRIQUER FUND |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Company’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period-end, resulting from changes in exchange rates.

Counterparty Risk –Counterparty risk is the risk that the counterparty to a financial instrument will cause a financial loss for the Fund by failing to discharge an obligation. A concentration of counterparty risk exists in that the part of a Fund’s cash is held at the broker. The Fund could be unable to recover assets held at the prime broker, including assets directly traceable to the Fund, in the event of the broker’s bankruptcy. The Fund does not anticipate any material losses as a result of this concentration.

Foreign Currency Risk –Currency investing and trading risks include market risk, credit risk and currency risk. Market risk results from adverse changes in exchanges in exchange rates. Credit risk results because a currency-trade counterparty may default. Country risk arises because a government may interfere with transactions in its currency.

Foreign Investment Risk –Foreign investing involves adverse fluctuations in foreign currency values, adverse political, social and economic developments, less liquidity, greater volatility, less developed or less efficient trading markets, political instability and differing auditing and legal standards.

Concentration of Risk –Investing in securities of foreign issuers and currency transactions may involve certain considerations and risks not typically associated with investments in the United States. These risks include revaluation of currencies, adverse fluctuations in foreign currency values and possible adverse political, social and economic developments, including those particular to a specific industry, country or region. These conditions could cause the securities and their markets to be less liquid and prices more volatile than those of comparable U.S. companies and U.S. government securities.

Swap Agreements –The Fund may enter into various swap transactions for investment purposes or to manage interest rate, equity, foreign exchange (currency), or credit risk. Swap agreements are two-party contracts entered into primarily to exchange the returns (or differentials in rates of returns) earned or realized on particular pre-determined investments or instruments.

The gross returns to be exchanged or “swapped” between parties are calculated with respect to a notional amount, i.e., the return on or increase in value of a particular dollar amount invested at a particular interest rate, in a particular foreign currency, or in a “basket” of securities representing a particular index or market segment. Changes in the value of swap agreements are recognized as unrealized gains or losses in the Consolidated Statement of Operations by “marking to market” on a daily basis to reflect the value of the swap agreement at the end of each day as reported by the swap counterparty. Realized gains and losses from the decrease in notional value of the swap are recognized on trade date. A liquidation payment received or made at the termination of the swap agreement will first be offset against the due to broker-swap contract balance outstanding at the time the position is liquidated, with the remainder being recorded as a realized gain or loss on the Consolidated Statement of Operations.

IQSF maintains cash and securities, of $3,592,954, as collateral to secure its obligations under the swap. Entering into these agreements involves, to varying degrees, lack of liquidity and elements of credit, market, and counterparty risk in excess of amounts recognized on the Consolidated Statement of Assets and Liabilities. The Fund’s maximum risk of loss from counterparty credit risk is the discounted net value of the cash flows to be received from the counterparty over the contract’s remaining life, to the extent that that amount is positive. In order to maintain prudent risk exposure to the counterparty, the adviser will reduce exposure to the counterparty whenever that exposure exceeds 5% of the net assets of the Fund for a period of one week or such lesser time as the adviser may determine. If the adviser determines that the counterparty presents an imprudent risk, the swap may be terminated in its entirety.

18

| IQ STRIQUER FUND |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

Futures Contracts –The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund may purchase or sell futures contracts to hedge against market risk and to reduce return volatility. Initial margin deposits required upon entering into futures contracts as presented in deposit at broker for futures contracts in the Consolidated Statements of Assets and Liabilities are satisfied by the segregation of specific securities or cash as collateral for the account of the broker (the Fund’s agent in acquiring the futures position). During the period the futures contracts are open, changes in the value of the contracts are recognized as unrealized gains or losses by “marking to market” on a daily basis to reflect the market value of the contracts at the end of each day’s trading. Variation margin payments are received or made depending upon whether unrealized gains or losses are incurred. When the contracts are closed, the Fund recognizes a realized gain or loss equal to the difference between the proceeds from, or cost of, the closing transaction and the Fund’s basis in the contract. If the Fund were unable to liquidate a futures contract and/or enter into an offsetting closing transaction, the Fund would continue to be subject to market risk with respect to the value of the contracts and continue to be required to maintain the margin deposits on the futures contracts. The Fund segregates liquid securities having a value at least equal to the amount of the current obligation under any open futures contract. Risks may exceed amounts recognized in the Consolidated Statements of Assets and Liabilities. With futures, there is minimal counterparty credit risk to a Fund because futures are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default.

Forward Foreign Currency Contracts –As foreign securities are purchased, the Fund may enter into forward currency exchange contracts in order to hedge against foreign currency exchange rate risks. A forward involves an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. The market value of the contract fluctuates with changes in currency exchange rates. The contract is marked-to-market daily and the change in market value is recorded by the Fund as an unrealized gain or loss. As foreign securities are sold, a portion of the contract is generally closed and the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

Short Sales –A “short sale” is a transaction in which the Fund sells a security it does not own but has borrowed in anticipation that the market price of the security will decline. The Fund is obligated to replace the security borrowed by purchasing it on the open market at a later date. If the price of the security sold short increases between the time of the short sale and the time the Fund replaces the borrowed security, the Fund will incur a loss, unlimited in size. Conversely, if the price declines, the Fund will realize a gain, limited to the price at which the Fund sold the security short. Certain cash and securities are held as collateral.

Security Transactions and Related Income –Security transactions are accounted for on trade date. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities using the effective yield method. Dividend income and expense are recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds. Withholding taxes on foreign dividends and foreign capital gain taxes have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions to Shareholders –Dividends from net investment income, if any, are declared and paid quarterly. Distributable net realized capital gains, if any, are declared and distributed annually. Dividends from net investment income and distributions from net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP and are recorded on the ex-dividend date. These “book/tax” differences are considered either temporary (e.g., deferred losses, capital loss carryforwards, etc.) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. Any such reclassifications will have no effect on net assets, results of operations, or net asset values per share of the Fund.

Federal Income Tax –The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to shareholders. Therefore, no provision for federal income tax is required.

19

| IQ STRIQUER FUND |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions expected to be taken in the Fund’s November 30, 2018 tax return and has concluded to date that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. The Fund identified its major tax jurisdictions as U.S. federal, Nebraska and foreign jurisdictions where the Fund makes significant investments. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Expenses –Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses, which are not readily identifiable to a specific fund, are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the funds in the Trust.

Indemnification –The Trust indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the risk of loss due to these warranties and indemnities appears to be remote.

| 3. | INVESTMENT TRANSACTIONS |

For the period ended November 30, 2018, cost of purchases and proceeds from sales of portfolio securities, other than short-term investments and U.S. Government securities, amounted to $7,810,692 and $4,550,337, respectively.

| 4. | AGGREGATE TAX UNREALIZED APPRECIATION AND DEPRECIATION |

At November 30, 2018 the aggregate cost for federal tax purposes, which differs from fair value by net unrealized appreciation(depreciation) of securities, are as follows:

| Net Unrealized | ||||||||||||||||

| Gross Unrealized | Gross Unrealized | Appreciation/ | ||||||||||||||

| Fund | Tax Cost | Appreciation | Depreciation | (Depreciation) | ||||||||||||

| IQ-Striquer Fund | $ | 9,868,980 | $ | 18,602,544 | $ | (19,237,841 | ) | $ | (635,297 | ) | ||||||

| 5. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

IQ Capital Strategy LLC serves as the Fund’s investment adviser (the “Adviser”). Pursuant to an investment advisory agreement with the Trust, on behalf of the Fund, the Adviser, under the oversight of the Board, oversees the daily operations of the Fund and supervises the performance of administrative and professional services provided by others. As compensation for its services and the related expenses borne by the Adviser, the Fund pays the Adviser a management fee, computed and accrued daily and paid monthly, at an annual rate of 1.50% of the Fund’s average daily net assets. For the period ended November 30, 2018, the Fund incurred $110,341 in advisory fees.

The Adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, until at least March 31, 2020, to ensure that total annual fund operating expenses after fee waiver and/or reimbursement (exclusive of any front-end or contingent deferred loads, taxes, brokerage fees and commissions, borrowing costs (such as interest and dividend expense on securities sold short), acquired fund fees and expenses, fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses), or extraordinary expenses such as litigation) will not exceed 2.19%, 2.94% or 1.94% of the Fund’s average daily net assets attributable to Class A shares, Class C shares and Class I shares, respectively. During the period ended November 30, 2018, the Adviser waived fees and reimbursed expenses in the amount of $206,603, pursuant to its contractual agreement.

20

| IQ STRIQUER FUND |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

If the Adviser waives any fees or reimburses any expenses and any operating expenses are subsequently lower than their respective expense limitation, the Adviser shall be entitled to reimbursement by the Fund provided that such reimbursement does not cause the Fund’s operating expenses to exceed the respective expense limitation. The Adviser may seek reimbursement only for expenses waived or paid by it during the three years prior to such reimbursement; provided, however, that such expenses may only be reimbursed to the extent they were waived or paid after the date of the waiver agreement (or any similar agreement).

| November 30, 2021 | ||||

| IQ-Striquer Fund | $ | 206,603 | ||

Distributor – The distributor of the Fund is Northern Lights Distributors, LLC (the “Distributor”), an affiliate of GFS (defined below). The Board has adopted, on behalf of the Fund, a Distribution Plan pursuant to Rule 12b-1, (the “Plan”) under the Investment Company Act of 1940, as amended, to pay for certain distribution activities and shareholder services. Under the Plan, the Fund is permitted to pay 0.25% per year of its average daily net assets of Class A shares for such distribution and shareholder service activities. For the period ended November 30, 2018, the Class A shares incurred $7,231 in distribution fees.

The Distributor acts as the Fund’s principal underwriter in a continuous offering of the Fund’s shares. For the period ended November 30, 2018, the Distributor received $2,621 in underwriting commissions for sales of the Fund’s Class A shares, of which $446 was retained by the principal underwriter or other affiliated broker-dealers.

Gemini Fund Services, LLC (“GFS”) – an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to separate servicing agreements with GFS, the Fund pays GFS customary fees for providing administration, fund accounting and transfer agency services to the Fund as shown in the Statement of Operations. Certain officers of the Trust are also officers of GFS, and are not paid any fees directly by the Fund for serving in such capacities.

Northern Lights Compliance Services, LLC (“NLCS”) – NLCS, an affiliate of GFS and the Distributor, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives customary fees from the Fund which are included in the compliance officer fees in the Statement of Operations.

Blu Giant, LLC (“Blu Giant”) – Blu Giant, an affiliate of GFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund which are included in the shareholder reporting expenses in the Statement of Operations.

| 6. | CONTROL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of November 30, 2018, Charles Schwab & Co., Inc. held approximately 70% of the voting securities of the IQ-Striquer Fund, and therefore, may be presumed to control the Fund.

| 7. | REDEMPTION FEES |

The Fund may assess a short-term redemption fee of 1.00% of the total redemption amount if a shareholder sells their shares after holding them for less than 60 days. The redemption fee is paid directly to the Fund in which the short-term

21

| IQ STRIQUER FUND |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

redemption fee occurs. For the period ended November 30, 2018, Class A assessed $385 and Class I assessed $582 in redemption fees.

| 8. | UNDERLYING INVESTMENT IN OTHER INVESTMENT COMPANIES |

The Fund currently seeks to achieve its investment objectives by investing a portion of its assets in Federated Government Obligations Fund – Institutional Shares, a registered open-end investment company (the “Security”). The Fund may redeem its investment from the Security at any time if the Adviser determines that it is in the best interest of the Fund and its shareholders to do so.