UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

811-23067

RiverNorth Specialty Finance Corporation

(Exact name of registrant as specified in charter)

325 North LaSalle Street, Suite 645, Chicago, Illinois 60654

(Address of principal executive offices) (Zip code)

Marcus L. Collins, Esq.

RiverNorth Capital Management, LLC

325 North LaSalle Street, Suite 645

Chicago, Illinois 60654

(Name and address of agent for service)

(312) 832-1440

Registrant’s telephone number, including area code

Date of fiscal year end: June 30, 2020

Date of reporting period: June 30, 2020

Item 1. Reports to Stockholders.

OPPORTUNISTIC INVESTMENT STRATEGIES

Annual Report

RIVERNORTH SPECIALTY FINANCE CORPORATION

RSF

| | | | | | |

| | Investment Adviser: RiverNorth Capital Management, LLC 325 N. LaSalle Street, Suite 645 Chicago, IL 60654 www.rivernorth.com | | |  | |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website at https://www.rivernorth.com/closed-end-funds/opp/rsf, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank).

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account.

| | |

RiverNorth Specialty Finance Corporation | | Table of Contents |

| | |

| | |

| RiverNorth Specialty Finance Corporation | | Shareholder Letter |

| | |

Dear Fellow Shareholders,

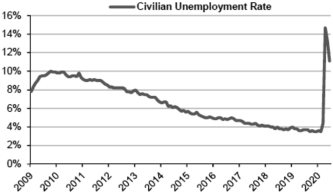

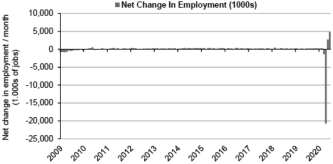

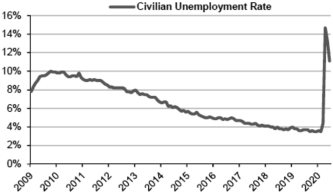

The economy remains on fragile ground as a result of the damage inflected due to the coronavirus pandemic. The U.S. unemployment rate, which was near the lowest level since the 1960s in February 2020, soared to 14.7% just two months later, the highest level since the Great Depression. While a portion of the net job losses in April have reversed in the prior two months, the U.S. consumer remains stressed in the current environment.

While the economic outlook remains uncertain, we believe there are attractive opportunities to deploy capital across certain assets which may offer a compelling risk-adjusted return profile in the current environment. We recently announced a change to the Fund’s investment strategy, and have been reducing the portfolio’s allocation to unsecured consumer whole loans, which has continued post fiscal year-end. As a result, the Fund now has flexibility to invest in a broader range of credit-oriented assets, and we have been repositioning the strategy into a higher mix of tradeable securities which we believe offer a more favorable risk/reward profile. Notes issued by registered investment companies, for example, now comprise the largest allocation within the portfolio and have significant equity subordination for bondholders as required under the Investment Company Act of 1940, as amended (the “1940 Act”).

While we have been deploying capital in a measured fashion, when evaluating opportunities we are being selective and cautious given the continued level of uncertainty and weak economic backdrop. According to Bloomberg’s Contributor Composite, U.S. real gross domestic product (GDP) is expected to decline by 5.6% year over year during 2020, which would be the largest contraction since an 11.6% decline in 1946 (for reference, GDP declined 2.8% in 2009). Thus, we are largely focusing on downside mitigation and capital preservation while sourcing unique opportunities that we believe offer an attractive return profile.

In addition to notes issued by registered investment companies, we are also deploying capital across credit-oriented closed-end funds, including business development companies, which we believe offer compelling value at current levels. We are focusing on funds managed by what we view to be top-tier managers trading at a meaningful discount to book value and/or funds which we believe offer a potential near-term catalyst to drive the discount narrower, such as a corporate action event. We view the shift in the Fund’s investment strategy as a meaningful positive for shareholders, and look forward to providing further updates as we continue to deploy capital and rotate the portfolio.

We are pleased to provide you with the 2020 Annual Report for RiverNorth Specialty Finance Corporation.

Please visit www.rivernorth.com for additional information.

We thank you for your investment and trust in managing your assets.

Respectfully,

RiverNorth Capital Management, LLC

| | |

| 2 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | Shareholder Letter |

| | |

Definitions

Business Development Company – A business development company (BDC) is an organization that invests in small- and medium-sized companies as well as distressed companies. Set up similarly to closed-end investment funds, many BDCs are typically public companies whose shares trade on major stock exchanges, such as the American Stock Exchange (AMEX), Nasdaq, and others.

Closed-End Fund – A closed-end fund is a portfolio of pooled assets that raises a fixed amount of capital through an initial public offering (IPO) and then lists shares for trade on a stock exchange.

Corporate Action – A corporate action is any activity that brings material change to an organization and impacts its stakeholders, including shareholders, both common and preferred, as well as bondholders.

Great Depression – The Great Depression was a severe worldwide economic depression that took place mostly during the 1930s, beginning in the United States.

Investment Company Notes – Investment notes are non-equity securities. Notes typically obligate issuers to repay the creditor the principal loan, in addition to any interest payments, at a

predetermined date.

Risk-Adjusted Return – A risk-adjusted return is a calculation of the profit or potential profit from an investment that takes into account the degree of risk that must be accepted in order to

achieve it.

| | | | |

Annual Report | June 30, 2020 | | | 3 | |

| | |

RiverNorth Specialty Finance Corporation | | Portfolio Update |

| | June 30, 2020 (Unaudited) |

What is the Fund’s investment strategy?

The investment objective of the RiverNorth Specialty Finance Corporation (“the Fund”) is to seek a high level of current income. The Fund seeks to achieve its investment objective by investing in credit instruments, including a portfolio of securities of specialty finance and other financial companies that the Fund’s adviser, RiverNorth Capital Management, LLC, believes offer attractive opportunities for income. The Fund may invest in income-producing securities of any maturity and credit quality, including below investment grade, and equity securities, including exchange traded funds and registered closed-end funds.

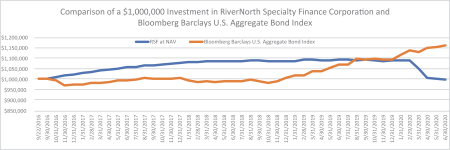

How did RiverNorth Specialty Finance Corporation perform relative to its benchmark during the reporting period?

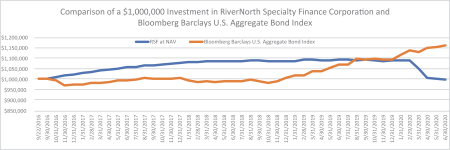

From July 1, 2019 through June 30, 2020, the Fund delivered a net of fees return (based on net asset value) to investors of -8.43%. The Bloomberg Barclays Capital U.S. Aggregate Bond Index (Agg) posted a return of 8.74%.

Performance for the Period Ended June 30, 2020

| | | | | | | | | | | | |

| | | Calendar

Year-to-Date | | | 1 Year | | | Since

Inception* | |

| | | |

RiverNorth Specialty Finance Corporation - NAV | | | -8.32 | % | | | -8.43% | | | | -0.02 | % |

| | | |

RiverNorth Specialty Finance Corporation - Market Price | | | -12.91 | % | | | -16.84% | | | | -3.81 | %^ |

| | | |

Bloomberg Barclays Capital U.S. Aggregate Bond Index | | | 6.14 | % | | | 8.74% | | | | 4.04 | % |

| * | Annualized. RSF inception date: September 22, 2016. |

| ^ | The Fund began trading on the New York Stock Exchange on June 12, 2019 under the ticker symbol RSF. Formerly the Fund was known as RMPLX and was purchased directly. Market price returns are a blend of the NAV return until June 11th, 2019 combined with the market price return thereafter. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling 844.569.4750. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions. Other fees and expenses are applicable to an investment in this fund.

| | |

| 4 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | Portfolio Update |

| | June 30, 2020 (Unaudited) |

What contributing factors were responsible for the Fund’s relative performance during that period?

Over the previous year, investment grade bond prices have generally rallied while credit-oriented assets have experienced spread widening given the economic fallout and uncertainty as a result of the coronavirus pandemic and related lockdowns. Given that the Agg consists solely of domestic investment grade fixed income securities, which have benefited from both Treasury yields falling (i.e. 10 year Treasury note yield was 0.66% as of June 30, 2020 compared to 2.01% a year ago) and Federal Reserve (the “Fed”) support in the secondary market, the Agg generated a significantly more favorable return profile over the past year versus the Fund, which predominately holds higher yielding assets with higher credit risk. While we meaningfully reduced the Fund’s exposure to unsecured consumer loans during the year (which we believe present the highest level of risk in our portfolio), a combination of spread widening and higher expected losses across certain segments within the portfolio resulted in a negative return for the Fund’s investors during the year.

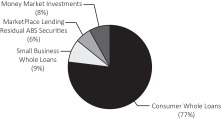

How was RiverNorth Specialty Finance Corporation positioned at the end of June 2020?

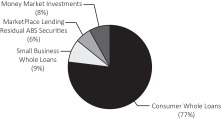

In March, we announced a change to the Fund’s investment strategy, effective as of May 22, 2020, to provide more flexibility to invest in a broad range of credit-oriented products outside of marketplace lending assets. Over the previous year, we had also elected to reduce the Fund’s exposure to unsecured consumer loans. As a result, the Fund’s portfolio mix at June 30, 2020 is significantly different compared to a year ago. As of June 30, 2020, the Fund was comprised of 21% business development company notes (notes issued by business development companies, 0% a year ago), 17% small business whole loans (9% a year ago), 17% consumer whole loans (77% a year ago), 12% marketplace lending senior asset-backed securities (ABS) notes (0% a year ago), 6% marketplace lending residual ABS securities (6% a year ago), 5% publicly-traded business development company common stock (0% a year ago), and 22% money market investments (8% a year ago).

RSF Portfolio Allocation (%)

| | |

6/30/2020

| | 6/30/2019

|

Allocations are subject to change.

Source: RiverNorth

As highlighted above, our largest allocation is currently BDC notes. We find the risk-adjusted return profile of these securities to be compelling given the significant amount of required subordination (equity beneath the bonds) mandated by the Investment Company Act of 1940. For these

| | | | |

Annual Report | June 30, 2020 | | | 5 | |

| | |

RiverNorth Specialty Finance Corporation | | Portfolio Update |

| | June 30, 2020 (Unaudited) |

securities, the underlying issuers must maintain an asset coverage ratio of at least 150%, or at least $1 of equity for every $2 of debt, providing a significant amount of cushion for bondholders. As noted above, the Fund’s unsecured consumer whole loan portfolio shrank meaningfully during the year as a result of both asset sales and natural amortization (all loans are fully amortizing). The credit profile of this portfolio has also increased meaningfully – the weighted average FICO score of the Fund’s underlying consumer borrower was 742 as of June 30, 2020 compared to 716 a year ago. The year over year increase regarding the Fund’s cash position is largely the result of the decision to shrink the consumer portfolio and have capital to redeploy into other assets following the announced change to the Fund’s investment strategy.

Looking back, from our perspective we were fortunate to have entered the March/April timeframe with a meaningfully lower exposure to unsecured consumer loans with a higher than average cash balance. In the latter part of the year, we re-deployed some cash into assets we believe offer a more favorable risk/return profile with more downside mitigation, such as investment company notes as described above, and that has continued post fiscal year-end.

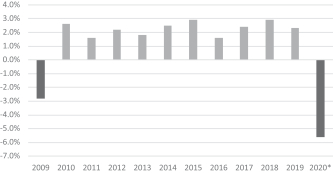

Fund Overview and Outlook:

The economy remains on fragile ground as a result of the disruption inflicted as a result of the coronavirus pandemic. The U.S. unemployment rate, which was near the lowest level since the 1960s in February 2020, soared to 14.7% just two months later, the highest level since the Great Depression. While a portion of the net job losses in April have reversed in the following two months, the U.S. consumer remains stressed in the current environment.

Civilian Unemployment Rate: 1/2009 – 6/2020

| | |

| 6 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | Portfolio Update |

| | June 30, 2020 (Unaudited) |

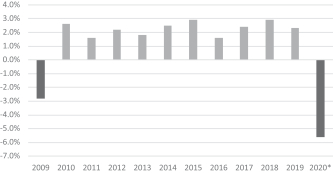

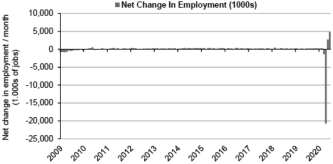

Change in Employment: 1/2009 – 6/2020

Source: Bloomberg, Bureau of Economic Analysis, Federal Reserve Bank of Atlanta

Despite uncertainty regarding the economic outlook going forward, we believe there are attractive opportunities across certain assets which we believe offer an attractive risk/return profile. For example, we have continued to increase the Fund’s allocation to bonds issued by registered investment companies. As of June 30, 2020, the weighted average yield across these securities held within the Fund was 7.3% with a weighted average duration of 3 years across 20 securities.

We are also evaluating credit-oriented closed-end funds, including business development companies, which we believe offer compelling value at current levels. We are focusing on funds managed by what we view to be top-tier managers trading at a meaningful discount to book value and/or funds which we believe offer a potential near-term catalyst to drive the discount narrower, such as a corporate action event.

When evaluating potential near-term opportunities to deploy capital, we are being very selective given the continued level of uncertainly and weak economic environment, as noted above. According to Bloomberg’s Contributor Composite, U.S. real Gross Domestic Product (GDP) is expected to decline by 5.6% year over year during 2020, which would be the largest contraction since an 11.6% decline in 1946 (for reference, GDP declined 2.8% in 2009). Thus, we are largely focusing on downside mitigation and capital preservation while sourcing unique opportunities that we believe offer an attractive return profile.

| | | | |

Annual Report | June 30, 2020 | | | 7 | |

| | |

RiverNorth Specialty Finance Corporation | | Portfolio Update |

| | June 30, 2020 (Unaudited) |

Real GDP Growth Year/Year: 1/2010 – 6/2020

* 2020 GDP Estimate from Bloomberg

Source: Bloomberg, Bureau of Economic Analysis, Federal Reserve Bank of Atlanta

Definitions

Asset-Backed Securities (ABS) – are investment securities—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables.

Bloomberg Barclays U.S. Aggregate Bond Index – an unmanaged index of investment-grade fixed rate debt issues with maturities of at least one year. The index cannot be invested in directly and does not reflect fees and expenses.

Business Development Company – A business development company (BDC) is an organization that invests in small- and medium-sized companies as well as distressed companies. Set up similarly to closed-end investment funds, many BDCs are typically public companies whose shares trade on major stock exchanges, such as the American Stock Exchange (AMEX), NASDAQ, and others.

Duration – a measure of the sensitivity of the price of a fixed income investment to a change in interest rates. Duration is expressed as a number of years.

FICO – a type of credit score created by the Fair Isaac Corporation. Lenders use borrowers’ FICO scores along with other details on borrowers’ credit reports to assess and determine whether to extend credit. Small business loans do not have FICO scores. Weighted average FICO is calculated by weighting the FICO score of each loan by its outstanding balance. The measure gives investors an idea of how creditworthy the Fund’s underlying loans are overall. The lower the weighted average FICO score, the less creditworthy, and riskier the portfolio.

Investment Company Notes – Investment notes are non-equity securities. Notes typically obligate issuers to repay the creditor the principal loan, in addition to any interest payments, at a predetermined date.

Marketplace Lending Asset-Backed Debt Securities – A debt tranche within an asset-backed security offering with marketplace lending assets as the underlying collateral in the loan pool.

Marketplace Lending Asset-Backed Residual Securities – The most junior (equity) tranche within an asset-backed security offering with marketplace lending assets as the underlying collateral in the pool.

| | |

| 8 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | Portfolio Update |

| | June 30, 2020 (Unaudited) |

Risk-Adjusted Return – A risk-adjusted return is a calculation of the profit or potential profit from an investment that takes into account the degree of risk that must be accepted in order to achieve it.

Weighted Average Duration – Duration is a time measure of a bond’s interest-rate sensitivity, based on the weighted average of the time periods over which a bond’s cash flows accrue to the bondholder. Time periods are weighted by multiplying by the present value of its cash flow divided by the bond’s price.

Weighted Average Yield – The total yield on a bond portfolio divided by the number of bonds contained in it, weighted for the size of each bond so that the yield of large holdings does not drown out the calculation of yields on small holdings.

Yield – the income return on an investment. This refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value.

See the prospectus for a more detailed description of Fund risks. Investing involves risk. Principal loss is possible. The Fund is classified as non-diversified, which means the Fund may invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. Investment in securities of a limited number of issuers exposes the Fund to greater market risk and potential losses than if its assets were diversified among the securities of a greater number of issuers. If a borrower is unable to make its payments on a loan, the Fund may be greatly limited in its ability to recover any outstanding principal and interest under such loan, as (among other reasons) the Fund may not have direct recourse against the borrower or may otherwise be limited in its ability to directly enforce its rights under the loan, whether through the borrower or the platform through which such loan was originated, the loan may be unsecured or under-collateralized, and/ or it may be impracticable to commence a legal proceeding against the defaulting borrower. The Alternative Credit Instruments in which the Fund may invest will not typically be guaranteed or insured by any third-party and will not typically be backed by any governmental authority. Prospective borrowers supply a variety of information regarding the purpose of the loan, income, occupation and employment status (as applicable) to the lending platforms. As a general matter, platforms do not verify the majority of this information, which may be incomplete, inaccurate, false or misleading. Prospective borrowers may misrepresent any of the information they provide to the platforms, including their intentions for the use of the loan proceeds. Alternative Credit Instruments are generally not rated by the nationally recognized statistical rating organizations (“NRSROs”). Such unrated instruments may be comparable in quality to securities falling into any of the ratings categories used by such NRSROs. Accordingly, certain of the Fund’s unrated investments could constitute a highly risky and speculative investment, similar to an investment in “junk” bonds. The Alternative Credit Instruments in which the Fund may invest may have varying degrees of credit risk and the Fund will not be restricted by any borrower credit criteria or credit risk limitation. There can be no assurance that payments due on underlying loans, including Alternative Credit, will be made. At any given time, the Fund’s portfolio may be substantially illiquid and subject to increased credit and default risk. The Shares therefore should be purchased only by investors who could afford the loss of the entire amount of their investment. The Fund’s fees and expenses may be considered high and, as a result, such fees and expenses may offset the Fund’s profits. A portion of the investments executed for the Fund may take place in foreign markets. As a result of the foregoing and other risks described in the Prospectus, an investment in the Fund is considered to be highly speculative. The default history for certain Alternative Credit Instruments is limited and future defaults may be higher than historical defaults.

This material is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. These materials are not advice, a recommendation or an offer to enter into any transaction with the Fund or any of its affiliates. There is no guarantee that any of the goals, targets or objectives described in these materials will be achieved.

| | | | |

Annual Report | June 30, 2020 | | | 9 | |

| | |

RiverNorth Specialty Finance Corporation | | |

Summary Schedule of Investments | | June 30, 2020 |

| | | | | | | | | | | | | | | | |

| | | Original

Acquisition

Date | | | Principal/

Shares

Amount | | | Cost | | | Market

Value | |

WHOLE LOANS - 47.13%(a) | | | | | | | | | | | | | | | | |

| | | | |

Consumer Loans - 23.50% | | | | | | | | | | | | | | | | |

| | | | |

SoFi - 23.50% | | | | | | | | | | | | | | | | |

36-Month, 8.82%,

2/1/2019 - 6/5/2021(b) | | | | | | $ | 452,942 | | | $ | 452,424 | | | $ | 386,064 | |

48-Month, 9.23%,

2/9/2022 - 10/1/2022(b) | | | | | | | 616,375 | | | | 614,776 | | | | 620,979 | |

60-Month, 9.71%,

12/1/2020 - 7/15/2024(b) | | | | | | | 8,558,941 | | | | 8,553,567 | | | | 8,341,414 | |

72-Month, 10.34%,

2/8/2024 - 7/20/2024(b) | | | | | | | 589,059 | | | | 587,529 | | | | 588,983 | |

84-Month | | | | | | | | | | | | | | | | |

625973, 11.62%, 07/17/2025 | | | 6/28/2018 | | | | 79,263 | | | | 79,057 | | | | 80,905 | |

560557, 9.99%, 05/18/2025 | | | 6/28/2018 | | | | 77,009 | | | | 76,809 | | | | 78,504 | |

590790, 9.99%, 04/05/2025 | | | 6/28/2018 | | | | 76,091 | | | | 75,893 | | | | 77,388 | |

589847, 7.7%, 04/05/2025 | | | 6/28/2018 | | | | 74,526 | | | | 74,332 | | | | 75,568 | |

578506, 8.2%, 03/13/2025 | | | 6/28/2018 | | | | 73,695 | | | | 73,503 | | | | 74,855 | |

607560, 8.07%, 04/24/2025 | | | 6/28/2018 | | | | 72,671 | | | | 72,482 | | | | 74,137 | |

410452, 9.99%, 11/01/2024 | | | 9/15/2017 | | | | 70,772 | | | | 70,772 | | | | 72,158 | |

Remaining 84-Month, 10.99%, 11/1/2022 - 9/21/2025(b) | | | | | | | 13,404,745 | | | | 13,398,821 | | | | 13,205,617 | |

| | | | | | | | | | | | |

Total 84-Month | | | | | | | | | | | 13,921,669 | | | | 13,739,132 | |

| | | | | | | | | | | | |

Total Consumer Loans | | | | | | | | | | | 24,129,965 | | | | 23,676,572 | |

| | | | | | | | | | | | |

| | | | |

Small Business Loans - 23.63% | | | | | | | | | | | | | | | | |

| | | | |

Square - 23.63%(c) | | | | | | | | | | | | | | | | |

18-Month, 6.99%,

4/4/2018 - 9/25/2021(b)(c) | | | | | | | 30,746,557 | | | | 30,144,543 | | | | 23,809,861 | |

| | | | | | | | | | | | |

Total Small Business Loans | | | | | | | | | | | 30,144,543 | | | | 23,809,861 | |

| | | | | | | | | | | | |

| | | | |

TOTAL WHOLE LOANS | | | | | | | | | | | 54,274,508 | | | | 47,486,433 | |

| | | | | | | | | | | | |

| | | |

ASSET-BACKED SECURITIES - 26.31%(a) | | | | | | | | | | | | | |

|

MarketPlace Lending Residual Securities - 8.95%(d) | |

PMIT 2017-2A CERT 09/15/2023, 0.00% | | | | | | | 5,500,098 | | | | 3,609,826 | | | | 1,211,287 | |

PMIT 2017-3A CERT 11/15/2023, 0.00% | | | | | | | 5,500,000 | | | | 2,864,419 | | | | 1,260,820 | |

PMIT 2018-2A CERT 10/15/2024, 5.00% | | | | | | | 7,700,000 | | | | 3,439,710 | | | | 1,630,552 | |

PMIT 2019-1A CERT 04/15/2025, 13.00% | | | | | | | 22,190 | | | | 1,773,200 | | | | 1,744,924 | |

PMIT 2019-4A CERT 04/15/2025, 12.00% | | | | | | | 25,220 | | | | 3,548,853 | | | | 3,166,603 | |

| | | | | | | | | | | | |

Total MarketPlace Lending Residual Securities | | | | | | | | 15,236,008 | | | | 9,014,186 | |

| | | | | | | | | | | | |

| | |

| 10 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | |

Summary Schedule of Investments | | June 30, 2020 |

| | | | | | | | | | | | |

| | | Principal/

Shares

Amount | | | Cost | | | Market

Value | |

MarketPlace Lending Senior Notes - 17.36% | |

FREEDOM FINANCIAL SERIES 2020-FP1, 2.52%, 03/18/2027 | | $ | 1,934,309 | | | $ | 1,934,198 | | | $ | 1,931,603 | |

LENDINGPOINT ASSET SECURITIZATION 2019-1, 3.154%, 08/15/2025 | | | 598,287 | | | | 599,823 | | | | 597,122 | |

MARLETTE FUNDING TRUST 2018-3A, 3.20%, 09/15/2028 | | | 6,992 | | | | 7,005 | | | | 6,988 | |

MARLETTE FUNDING TRUST 2018-4A, 3.71%, 12/15/2028 | | | 2,132,975 | | | | 2,150,247 | | | | 2,153,848 | |

MARLETTE FUNDING TRUST 2020-1A, 2.24%, 03/15/2030 | | | 1,113,243 | | | | 1,113,189 | | | | 1,117,954 | |

MARLETTE FUNDING TRUST 2019-3A, 2.69%, 09/17/2029 | | | 108,843 | | | | 109,183 | | | | 109,552 | |

MARLETTE FUNDING TRUST 2019-1A, 3.44%, 04/16/2029 | | | 111,784 | | | | 112,599 | | | | 112,869 | |

MARLETTE FUNDING TRUST 2019-4A, 2.39%, 12/15/2029 | | | 68,018 | | | | 68,055 | | | | 68,319 | |

PROSPER MARKETPLACE ISSUANCE TRUST

2019-3A, 3.19%, 09/15/2025 | | | 1,839,173 | | | | 1,852,872 | | | | 1,846,744 | |

PROSPER MARKETPLACE ISSUANCE TRUST

2019-4A, 2.48%, 02/16/2026 | | | 95,624 | | | | 95,891 | | | | 95,723 | |

SOFI CONSUMER LOAN PROGRAM 2016-1 A, 3.26%, 08/25/2025 | | | 459,905 | | | | 462,807 | | | | 463,190 | |

SOFI CONSUMER LOAN PROGRAM 2018-2 A2, 3.35%, 04/26/2027 | | | 326,363 | | | | 328,026 | | | | 329,049 | |

SOFI CONSUMER LOAN PROGRAM 2019-4 A, 2.45%, 08/25/2028 | | | 1,627,522 | | | | 1,640,068 | | | | 1,646,141 | |

SOFI CONSUMER LOAN PROGRAM 2018-4 A, 3.54%, 11/26/2027 | | | 122,461 | | | | 123,409 | | | | 123,853 | |

SOFI CONSUMER LOAN PROGRAM 2020-1 A, 2.02%, 01/25/2029 | | | 1,187,492 | | | | 1,187,456 | | | | 1,200,620 | |

UPSTART SECURITIZATION TRUST 2020-1 A, 2.32%, 04/22/2030 | | | 5,680,623 | | | | 5,680,617 | | | | 5,691,980 | |

| | | | | | | | |

Total MarketPlace Lending Senior Notes | | | | | | | 17,465,445 | | | | 17,495,555 | |

| | | | | | | | |

| | | |

TOTAL ASSET-BACKED SECURITIES | | | | | | | 32,701,453 | | | | 26,509,741 | |

| | | | | | | | |

|

BUSINESS DEVELOPMENT COMPANIES NOTES - 29.66% | |

APOLLO INVT CORP, 5.25%, 03/03/2025 | | | 4,311,929 | | | | 4,273,748 | | | | 3,995,690 | |

BAIN CAPITAL SPECIALTY FIN INC, 8.50%, 06/10/2023 | | | 2,000,000 | | | | 1,980,952 | | | | 1,991,000 | |

BLACKROCK CAP INVT CORP, 5.00%, 06/15/2022 | | | 1,498,000 | | | | 1,361,860 | | | | 1,321,461 | |

BLACKROCK TCP CAPITAL CORP, 4.625%, 03/01/2022 | | | 2,954,000 | | | | 2,870,501 | | | | 2,894,989 | |

BUSINESS DEVELOPMENT CORP, 4.85%, 12/15/2024 | | | 2,200,000 | | | | 2,215,199 | | | | 1,950,069 | |

FS KKR CAPITAL CORP, 4.750%, 05/15/2022 | | | 2,500,000 | | | | 2,398,503 | | | | 2,480,581 | |

| | | | |

Annual Report | June 30, 2020 | | | 11 | |

| | |

RiverNorth Specialty Finance Corporation | | |

Summary Schedule of Investments | | June 30, 2020 |

| | | | | | | | | | | | |

| | | Principal/

Shares

Amount | | | Cost | | | Market

Value | |

FS KKR CAPITAL CORP, 4.125%, 02/01/2025 | | $ | 2,800,000 | | | $ | 2,777,964 | | | $ | 2,705,868 | |

FS KKR CAPITAL CORP II SR GLBL, 4.250%, 02/14/2025 | | | 1,406,000 | | | | 1,251,485 | | | | 1,257,280 | |

HERCULES CAPITAL INC, 4.375%, 02/01/2022 | | | 1,000,000 | | | | 977,193 | | | | 976,759 | |

HERCULES CAPITAL INC, 5.25%, 04/30/2025 | | | 18,313 | | | | 473,432 | | | | 456,909 | |

KCAP FINL INC, 6.125%, 09/30/2022 | | | 112,451 | | | | 2,660,571 | | | | 2,710,069 | |

MONROE CAP CORP, 5.75%, 10/31/2023 | | | 9,936 | | | | 253,677 | | | | 226,143 | |

NEW MTN FIN CORP, 5.750%, 08/15/2023 | | | 4,370,661 | | | | 4,120,225 | | | | 4,113,885 | |

NEW MTN FIN CORP, 5.750%, 10/01/2023 | | | 5,598 | | | | 131,005 | | | | 134,352 | |

OXFORD SQUARE CAP CORP, 6.5%, 03/30/2024 | | | 69,961 | | | | 1,593,568 | | | | 1,659,475 | |

OXFORD SQUARE CAP CORP, 6.25%, 04/30/2026 | | | 601 | | | | 15,536 | | | | 13,910 | |

PENNANTPARK INVT CORP, 5.50%, 10/15/2024 | | | 4,599 | | | | 117,905 | | | | 103,478 | |

THL CREDIT INC, 6.750%, 12/30/2022 | | | 24,272 | | | | 581,517 | | | | 593,208 | |

THL CREDIT INC, 6.125%, 10/30/2023 | | | 6,394 | | | | 161,324 | | | | 151,282 | |

WHITEHORSE FIN INC, 6.50%, 11/30/2025 | | | 5,802 | | | | 151,852 | | | | 140,118 | |

| | | | | | | | |

| | |

TOTAL BUSINESS DEVELOPMENT COMPANIES NOTES | | | | 30,368,017 | | | | 29,876,526 | |

| | | | | | | | |

|

BUSINESS DEVELOPMENT COMPANIES COMMON STOCK - 6.71% | |

GOLUB CAPITAL BDC, INC. | | | 108,640 | | | | 1,252,631 | | | | 1,265,656 | |

BAIN CAPITAL SPECIALTY FINANCE, INC. | | | 124,146 | | | | 1,359,051 | | | | 1,375,538 | |

OAKTREE SPECIALTY LENDING CORPORATION | | | 922,324 | | | | 4,183,625 | | | | 4,122,788 | |

| | | | | | | | |

| | | |

TOTAL BUSINESS DEVELOPMENT COMPANIES | | | | | | | 6,795,307 | | | | 6,763,982 | |

| | | | | | | | |

| | | |

SHORT-TERM INVESTMENTS - 31.52% | | | | | | | | | | | | |

|

Money Market Fund | |

| | | |

Fidelity Institutional Government Portfolio | | | 31,751,238 | | | | 31,751,238 | | | | 31,751,238 | |

| | | | | | | | |

(7 Day Yield 0.06%) | | | | | | | | | | | | |

| | | |

TOTAL SHORT-TERM INVESTMENTS | | | | | | | 31,751,238 | | | | 31,751,238 | |

| | | | | | | | |

| | | | | | | | | | | | |

TOTAL INVESTMENTS - 141.33% | | | | | | | 155,890,523 | | | | 142,387,920 | |

| | | | | | | | |

LIABILITIES IN EXCESS OF OTHER ASSETS - (41.33%) | | | | | | | | 41,638,835 | |

| | | | | | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | | | | | $ | 100,749,085 | |

| | | | | | | | | | | | |

The Summary Schedule of Investments provides information regarding the 50 largest investments and summarized information regarding other investments at June 30, 2020. For individual investments disclosed, the description includes the unique loan identification number.

| (a) | Fair valued by a third party pricing service using unobservable inputs and subject to review by the Adviser pursuant to policies approved by the Board of Directors. |

| | |

| 12 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | |

Summary Schedule of Investments | | June 30, 2020 |

| (b) | Contains past-due loan. A loan is deemed past-due at June 30, 2020, if the loan borrower has not made its required payment as of the most recent due date. Refer to the Past-Due Loans Table for a summary of past-due loans as of June 30, 2020. |

| (c) | Loans are issued at discounts and do not have a stated interest rate. Rate indicated based on projected future cash flows and an implied 18-month final maturity. Actual yield and maturity is dependent on timing of future payments. |

| (d) | Security is the unrated subordinated (residual) class of asset-backed securities with an estimated yield based on projected future cash flows. |

| | | | |

| Past-Due Loans Table | |

| | | Fair Value | |

Whole Loans - 6.01%(*) | | | | |

Consumer Loans - 0.26%(*) | | | | |

SoFi - 0.26%(*) | | | | |

36-Month | | $ | 8,497 | |

60-Month | | | 58,160 | |

72-Month | | | 26,199 | |

84-Month | | | 171,853 | |

| | | | |

Total SoFi | | | 264,709 | |

| | | | |

Total Consumer Loans | | | 264,709 | |

| | | | |

Small Business Loans - 5.75%(*) | | | | |

Square - 5.75%(*) | | | | |

18-Month | | | 5,796,314 | |

| | | | |

Total Square | | | 5,796,314 | |

| | | | |

Total Small Business Loans | | | 5,796,314 | |

| | | | |

Total Whole Loans | | $ | 6,061,023 | |

| | | | |

| (*) | Calculated as a percentage of net assets. |

| | | | |

Annual Report | June 30, 2020 | | | 13 | |

| | |

RiverNorth Specialty Finance Corporation | | |

Statement of Assets and Liabilities | | June 30, 2020 |

| | | | |

ASSETS: | | | | |

Investments: | | | | |

At cost | | $ | 155,890,523 | |

| | | | |

At value | | $ | 142,387,920 | |

Interest income receivable | | | 653,985 | |

Dividend receivable | | | 44,221 | |

Receivable for principal repayments | | | 277,417 | |

Prepaid expenses and other assets | | | 42,113 | |

Total Assets | | | 143,405,656 | |

| |

LIABILITIES: | | | | |

Payable for fund investments purchased | | | 1,300,354 | |

Series A Term Preferred Stock, net of unamortized deferred offering costs (Liquidation Preference $41,400,000) | | | 40,448,072 | |

Dividend payable - redeemable preferred stock | | | 308,210 | |

Payable for professional fees | | | 268,227 | |

Accrued loan service fees | | | 90,005 | |

Payable to Investment Adviser, net of waiver | | | 100,626 | |

Payable for custodian fees | | | 17,281 | |

Payable for administration and fund accounting fees | | | 52,571 | |

Other accrued expenses | | | 71,225 | |

Total Liabilities | | | 42,656,571 | |

Net Assets | | $ | 100,749,085 | |

| |

| |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | | 133,484,901 | |

Distributable earnings (loss) | | | (32,735,816 | ) |

Net Assets | | $ | 100,749,085 | |

| |

| |

PRICING OF SHARES: | | | | |

Shares of beneficial interest outstanding (40,000,000 shares

authorized, $0.0001 par value) | | | 5,774,642 | |

Net Asset Value Per Share | | $ | 17.45 | |

| |

See Notes to Financial Statements.

| | |

| 14 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | |

Statement of Operations | | For the year ended June 30, 2020 |

| | | | |

INVESTMENT INCOME: | | | | |

| |

Interest income | | $ | 18,101,713 | |

| |

Dividend income | | | 192,195 | |

| |

Total Investment Income | | | 18,293,908 | |

| |

OPERATING EXPENSES: | | | | |

| |

Investment Adviser fee | | | 2,125,688 | |

| |

Loan service fees | | | 2,003,668 | |

| |

Valuation expenses | | | 391,679 | |

| |

Professional fees | | | 360,083 | |

| |

Accounting and administration fee | | | 227,590 | |

| |

Printing expenses | | | 127,772 | |

| |

Registration expenses | | | 111,103 | |

| |

Transfer agency expenses | | | 115,987 | |

| |

Director expenses | | | 115,143 | |

| |

Custodian expenses | | | 92,242 | |

| |

Compliance expenses | | | 33,067 | |

| |

Other expenses | | | 65,377 | |

| |

Total operating expenses | | | 5,769,399 | |

| |

LEVERAGE EXPENSES: | | | | |

| |

Dividends to redeemable preferred stock | | | 2,438,998 | |

| |

Interest expense on credit facility | | | 107,044 | |

| |

Amortization of preferred stock and credit facility issuance costs | | | 339,642 | |

| |

Total leverage expenses | | | 2,885,684 | |

| |

Total expenses before expense reimbursement waiver | | | 8,655,083 | |

Expenses reimbursed by Investment Adviser | | | (466,167 | ) |

| |

Net Expenses | | | 8,188,916 | |

| |

Net Investment Income | | | 10,104,992 | |

| |

REALIZED AND UNREALIZED GAIN/(LOSS): | | | | |

| |

Net realized loss on investments | | | (28,260,807 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 7,411,487 | |

Net realized and unrealized loss on investments | | | $ (20,849,320 | ) |

Net Decrease in Net Assets Resulting from Operations | | | $ (10,744,328 | ) |

See Notes to Financial Statements.

| | | | |

Annual Report | June 30, 2020 | | | 15 | |

| | |

RiverNorth Specialty Finance Corporation | | |

Statements of Changes in Net Assets | | |

| | | | | | | | |

| | | For the

Year Ended

June 30, 2020 | | | For the

Year Ended

June 30, 2019 |

NET INCREASE/(DECREASE) IN NET ASSETS FROM OPERATIONS: | |

| | |

Net investment income | | $ | 10,104,992 | | | $ | 25,801,499 | |

| | |

Net realized loss on investments | | | (28,260,807 | ) | | | (21,983,911 | ) |

| | |

Net change in unrealized appreciation (depreciation) on investments | | | 7,411,487 | | | | (2,594,540 | ) |

| | |

Net increase (decrease) in net assets resulting from operations | | | (10,744,328 | ) | | | 1,223,048 | |

|

DISTRIBUTIONS TO SHAREHOLDERS: | |

| | |

Dividends from distributable earnings | | | — | | | | (11,701,341 | ) |

| | |

From tax return of capital | | | (15,579,982 | ) | | | (7,396,057 | ) |

| | |

Net decrease in net assets from distributions to shareholders | | | (15,579,982 | ) | | | (19,097,398 | ) |

|

CAPITAL SHARE TRANSACTIONS: | |

| | |

Proceeds from issuance of common shares | | | — | | | | 45,902,427 | |

| | |

Reinvestment of distributions | | | — | | | | 5,899,471 | |

| | |

Shares redeemed | | | (51,212,572 | ) | | | (115,961,875 | ) |

| | |

Net decrease in net assets from capital stock transactions | | | (51,212,572 | ) | | | (64,159,977 | ) |

| | |

Net Decrease in Net Assets | | | (77,536,882 | ) | | | (82,034,327 | ) |

|

NET ASSETS: | |

| | |

Beginning of year | | | 178,285,967 | | | | 260,320,294 | |

| | |

End of year | | $ | 100,749,085 | | | $ | 178,285,967 | |

See Notes to Financial Statements.

| | |

| 16 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | |

Statement of Cash Flows | | For the year ended June 30, 2020 |

| | | | |

CASH FLOWS PROVIDED BY OPERATING ACTIVITIES: | | | | |

| |

Net decrease in net assets resulting from operations | | $ | (10,744,328 | ) |

| |

Adjustments to reconcile the change in net assets from

operations to net cash provided by operating activities: | | | | |

| |

Purchases of long term investments | | | (137,651,678 | ) |

| |

Sales of long term investments | | | 85,767,653 | |

| |

Proceeds from principal paydowns and return of capital | | | 119,268,146 | |

| |

Net purchases of short-term investments | | | (13,561,216 | ) |

| |

Amortization of preferred share deferred costs | | | 220,186 | |

| |

Net amortization of premiums/discounts | | | 271 | |

| |

Net realized loss on investments | | | 28,260,807 | |

| |

Net change in unrealized appreciation on investments | | | (7,411,487 | ) |

| |

(Increase) decrease in: | | | | |

| |

Interest and other income receivable | | | 1,079,579 | |

| |

Dividend receivable | | | (44,221 | ) |

| |

Prepaid expenses and other assets | | | 119,449 | |

| |

Receivable for principal paydowns | | | 537,875 | |

| |

Increase (decrease) in: | | | | |

| |

Payable for Fund investments purchased | | | 1,300,354 | |

| |

Payable to Investment Adviser | | | (120,343 | ) |

| |

Dividend payable for preferred stock | | | 6,666 | |

| |

Accrued loan services fees | | | (159,950 | ) |

| |

Other accrued expenses | | | 385 | |

| |

Administration, fund accounting and custodian fees payable | | | (60,624 | ) |

| |

Payable for professional fees | | | (14,970 | ) |

Net cash provided by operating activities | | | 66,792,554 | |

| |

CASH FLOWS USED IN FINANCING ACTIVITIES: | | | | |

| |

Advances from credit facility | | | 8,500,000 | |

| |

Repayments on credit facility | | | (8,500,000 | ) |

| |

Shares redeemed | | | (51,212,572 | ) |

| |

Cash dividends paid to common stockholders | | | (15,579,982 | ) |

Net cash used in financing activities | | | (66,792,554 | ) |

| |

NET CHANGE IN CASH: | | | — | |

| |

Cash at beginning of year | | | — | |

Cash at end of year | | $ | — | |

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW AND NON-CASH INFORMATION | |

| |

Cash paid for leverage expense | | $ | 2,552,502 | |

See Notes to Financial Statements.

| | | | |

Annual Report | June 30, 2020 | | | 17 | |

| | |

RiverNorth Specialty Finance Corporation | | |

Financial Highlights | | |

| | | | | | | | | | | | | | | | |

| | | For the

Year Ended

June 30,

2020 | | | For the

Year Ended

June 30,

2019 | | | For the

Year Ended

June 30,

2018 | | | Period from

September 22,

2016(a)

through

June 30, 2017 | |

Net asset value - beginning of period | | $ | 21.45 | | | $ | 23.29 | | | $ | 25.15 | | | $ | 25.00 | |

Income from investment operations: | | | | | | | | | | | | | | | | |

Net investment income(b) | | | 1.56 | | | | 2.69 | | | | 3.12 | | | | 2.32 | |

Net unrealized loss on investments | | | (3.22 | ) | | | (2.54 | ) | | | (2.46 | ) | | | (0.93 | ) |

Total income (loss) from investment operations | | | (1.66 | ) | | | 0.15 | | | | 0.66 | | | | 1.39 | |

Less distributions: | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | (1.22 | ) | | | (2.52 | ) | | | (1.24 | ) |

From tax return of capital | | | (2.34 | ) | | | (0.77 | ) | | | — | | | | — | |

Total distributions | | | (2.34 | ) | | | (1.99 | ) | | | (2.52 | ) | | | (1.24 | ) |

Net increase (decrease) in net asset value | | | (4.00 | ) | | | (1.84 | ) | | | (1.86 | ) | | | 0.15 | |

Net asset value - end of period | | $ | 17.45 | | | $ | 21.45 | | | $ | 23.29 | | | $ | 25.15 | |

| |

Per common share market value - end of period | | $ | 14.85 | | | $ | 20.40 | | | $ | — | | | $ | — | |

Total Return based on net asset value(c) | | | (8.43 | )% | | | 0.66 | % | | | 2.72 | % | | | 5.67 | %(d) |

Total Return based on market value(c) | | | (16.84 | )% | | | (4.26 | )% | | | 2.72 | %(i) | | | 5.67 | %(i) |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 100,749 | | | $ | 178,286 | | | $ | 260,320 | | | $ | 98,111 | |

Ratio of expenses to average net assets excluding fee waivers, reimbursements and recoupments | | | 6.74 | % | | | 5.60 | % | | | 5.06 | % | | | 6.98 | %(e) |

Ratio of expenses to average net assets including fee waivers, reimbursements, and recoupments(f) | | | 6.37 | % | | | 5.65 | % | | | 4.96 | % | | | 2.97 | %(e) |

Ratio of net investment income to average net assets excluding fee waivers and reimbursements | | | 7.50 | % | | | 11.93 | % | | | 12.34 | % | | | 7.86 | %(e) |

Ratio of net investment income to average net assets including fee waivers and reimbursements | | | 7.86 | % | | | 11.99 | % | | | 12.85 | % | | | 11.87 | %(e) |

Portfolio turnover rate | | | 65.8 | % | | | 46.8 | % | | | 61.5 | % | | | 62.8 | %(d) |

Preferred stock, end of period (in thousands) | | $ | 41,400 | | | $ | 41,400 | | | $ | 41,400 | | | $ | — | |

Average daily market price of outstanding preferred stock | | $ | 25.16 | | | $ | 25.21 | | | $ | 25.23 | | | $ | — | |

Facility loan payable (in thousands) | | $ | — | | | $ | — | | | $ | 35,000 | | | $ | — | |

Asset coverage per $1,000 of preferred stock(g) | | $ | 3,411 | | | $ | 5,306 | | | $ | 4,407 | | | $ | — | |

Asset coverage per $1,000 of facility loan(h) | | $ | — | | | $ | — | | | $ | 9,621 | | | $ | — | |

See Notes to Financial Statements.

| | |

| 18 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | |

Financial Highlights | | |

| (a) | Commencement of operations. |

| (b) | Based on average shares outstanding during the period. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Total return is calculated assuming a purchase of shares at the beginning of the period and a sale of shares on the last day of the period at the closing price, excluding brokerage commissions, (market value based total return), or net asset value (net asset value total return). The calculation also assumes reinvestment of distributions at actual prices pursuant to the Fund’s dividend reinvestment plan (market value based total return), or net asset value (net asset value total return). The Fund began trading on the New York Stock Exchange on June 12, 2019 under the ticker symbol RSF. Formerly the Fund was known as RMPLX and was purchased directly. Market price returns are a blend of the NAV return until the June 11th, 2019 combined with the market price return thereafter. The net asset value and market price returns will differ depending upon the level of any discount from or premium to net asset value at which the Fund’s shares traded during the period. |

| (f) | Ratio includes leverage expenses and loan service fees of 3.80%, 3.26%, 2.65% and 1.02%, respectively, that are outside the expense limit. |

| (g) | Represents value of total assets less all liabilities and indebtedness not represented by credit facility borrowings and preferred stock at the end of the period divided by credit facility borrowings and preferred stock outstanding at the end of the period. |

| (h) | Represents value of total assets less all liabilities and indebtedness not represented by credit facility borrowings and preferred stock at the end of the period divided by credit facility borrowings outstanding at the end of the period. |

| (i) | For periods prior to the Fund’s listing on the New York Stock Exchange, NAV returns are disclosed. |

See Notes to Financial Statements.

| | | | |

Annual Report | June 30, 2020 | | | 19 | |

| | |

RiverNorth Specialty Finance Corporation | | |

Notes to Financial Statements | | June 30, 2020 |

1. ORGANIZATION

RiverNorth Specialty Finance Corporation (the “Fund”) (formerly known as RiverNorth Marketplace Lending Corporation) was organized as a Maryland corporation on June 9, 2015, and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified closed-end management investment company. The investment adviser to the Fund is RiverNorth Capital Management, LLC (the “Adviser”).

The Fund is operated as an interval fund under Rule 23c-3 of the 1940 Act. As an interval fund, the Fund has adopted a fundamental policy to conduct quarterly repurchase offers for at least 5% and up to 25% of the outstanding shares at NAV, subject to certain conditions. The Fund will not otherwise be required to repurchase or redeem shares at the option of a shareholder. It is possible that a repurchase offer may be oversubscribed, in which case shareholders may only have a portion of their shares repurchased.

Effective as of June 12, 2019, the Fund listed its common shares on the New York Stock Exchange (the “NYSE”) under the ticker symbol “RSF” and has ceased continuously offering shares of its common stock through Quasar Distributors, LLC or the Fund.

The investment objective of the Fund is to seek a high level of current income. Under normal market conditions, the Fund seeks to achieve its investment objective by investing in credit instruments, including a portfolio of securities of specialty finance and other financial companies that the Adviser believes offer attractive opportunities for income.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946.

Use of Estimates: The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements. The Fund believes that these estimates utilized in preparing the financial statements are reasonable and prudent; however, actual results could differ from these estimates. In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

Federal Income Taxes: The Fund intends to elect to be treated as, and to qualify each year for special tax treatment afforded to, a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (“IRC”). In order to qualify as a RIC, the Fund must, among other things, satisfy income, asset diversification and distribution requirements. As long as it

| | |

| 20 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | |

Notes to Financial Statements | | June 30, 2020 |

so qualifies, the Fund will not be subject to U.S. federal income tax to the extent that it distributes annually its investment company taxable income (which includes ordinary income and the excess of net short-term capital gain over net long-term capital loss) and its “net capital gain” (i.e., the excess of net long-term capital gain over net short-term capital loss). The Fund intends to distribute at least annually substantially all of such income and gain. If the Fund retains any investment company taxable income or net capital gain, it will be subject to U.S. federal income tax on the retained amount at regular corporate tax rates. In addition, if the Fund fails to qualify as a RIC for any taxable year, it will be subject to U.S. federal income tax on all of its income and gains at regular corporate tax rates.

Security Valuation: The Fund’s investments are valued at fair value as further described in Note 3.

Distributions to Shareholders: Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing or character of recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassification has no effect on net assets, results of operations or net asset values per share of the Fund.

Investment Income: Interest income is recognized on an accrual basis to the extent that such amounts are expected to be collected and include amortization/ accretion of premiums or discounts. Interest income from investments in residual asset-backed securities is recognized on the basis of the estimated effective yield to expected redemptions utilizing assumed cash flows in accordance with ASC Sub-Topic 325-40, Beneficial Interests in Securitized Financial Assets. The Adviser monitors the expected cash flows from its residual asset-backed securities and the effective yield is determined and updated periodically.

Investment Transactions: Investment transactions are recorded on the trade date.

3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund might reasonably expect to receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market for the investment. U.S. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including using such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting

| | | | |

Annual Report | June 30, 2020 | | | 21 | |

| | |

RiverNorth Specialty Finance Corporation | | |

Notes to Financial Statements | | June 30, 2020 |

entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| | • | | Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | • | | Level 2 – Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| | • | | Level 3 – Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Marketplace loans, as an asset class, are not presently traded on a developed secondary market. Therefore, market quotations are not available. Accordingly, all marketplace loans are fair valued as determined in good faith by the Adviser pursuant to policies and procedures approved by the Board of Directors (the “Board”) and subject to the Board’s oversight. The Fund utilizes a third party valuation specialist to provide marketplace loan valuations. The third party valuation specialist provides daily valuations on all marketplace loans. A discounted cash flow model is used by the third party valuation specialist to arrive at a value for each marketplace loan held in the Fund’s portfolio. Discounted cash flow is a valuation technique that provides an estimation of the fair value of an asset based on expectations about cash flows that a marketplace loan would generate over time. In general, the primary inputs of fair value in the marketplace loan valuation model are expected future default rates, prepayment rates, and the discount rate applied. An increase (decrease) to the default rate or discount rate would result in a decrease (increase) of fair values and an increase to prepayment rates would result in an increase of fair values. A discounted cash flow model begins with an estimation of periodic cash flows expected to be generated over a discrete period of time (generally the time remaining until maturity of the loan). The estimated cash flows for each interval period (generally monthly) are then converted to their present value equivalent using a rate of return appropriate for the risk of achieving projected cash flows. Although not exhaustive, discounted cash flow models factor in borrower level data. Loans made to small businesses may incorporate different factors.

The Board will initially and periodically review the methodology used in determining the values of marketplace loans. The Board will further consider how changes in the markets may affect the factors utilized in the models and the frequency of reevaluation.

| | |

| 22 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | |

Notes to Financial Statements | | June 30, 2020 |

The value of asset-backed securities is determined by the forecasted performance of the underlying loans in the pool; this forecasted performance takes into account the realized historical loss and prepayment performance of the pool to date. The priority of the securitization class and the claim on cash flow in the transaction is also taken into account. The classes of asset-backed securities the Fund holds are residual classes, which would be adversely effected by deterioration in credit performance of the loan pool.

Equity securities, including business development companies and business development company notes, are generally valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Adviser believes such prices more accurately reflect the fair market value of such securities. Securities that are traded on any stock exchange are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued by the pricing service at its mean price. Securities traded in the NASDAQ over-the-counter market are generally valued by the pricing service at the NASDAQ Official Closing Price.

The following is a summary of the inputs used at June 30, 2020 to value the Fund’s assets and liabilities:

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Whole Loans | | | | | | | | | | | | | | | | |

Consumer Loans | | $ | — | | | $ | — | | | $ | 23,676,572 | | | $ | 23,676,572 | |

Small Business Loans | | | — | | | | — | | | | 23,809,861 | | | | 23,809,861 | |

Asset-Backed Securities | | | | | | | | | | | | | | | | |

MarketPlace Lending Residual Securities | | | — | | | | — | | | | 9,014,186 | | | | 9,014,186 | |

MarketPlace Lending Senior Notes | | | — | | | | 17,495,555 | | | | — | | | | 17,495,555 | |

Business Development Companies Notes | | | — | | | | 29,876,526 | | | | — | | | | 29,876,526 | |

Business Development Companies Common Stock | | | 6,763,982 | | | | — | | | | — | | | | 6,763,982 | |

Short-Term Investments | | | | | | | | | | | | | | | | |

Money Market Fund | | | 31,751,238 | | | | — | | | | — | | | | 31,751,238 | |

| |

Total | | $ | 38,515,220 | | | $ | 47,372,081 | | | $ | 56,500,619 | | | $ | 142,387,920 | |

| |

| | | | |

Annual Report | June 30, 2020 | | | 23 | |

| | |

RiverNorth Specialty Finance Corporation | | |

Notes to Financial Statements | | June 30, 2020 |

The changes of the fair value of investments for which the Fund has used Level 3 inputs to determine the fair value are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Balance

as of

June 30,

2019 | | | Purchases | | | Sales | | | Principal

Paydowns

and Return

of Capital | | | Net

Realized

Gain

(Loss) | | | Change in

Unrealized

Appreciation/

(Depreciation) | | | Transfer

in/out of

Level 3 | | | Balance

as of

June 30,

2020 | | | Change in

Unrealized

Depreciation

Attributable

to Level 3

Investments

Held at

June 30,

2020 | |

Whole Loans | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Consumer Loans | | $ | 166,395,299 | | | $ | — | | | $ | (84,726,464 | ) | | $ | (50,491,181 | ) | | $ | (22,641,443 | ) | | $ | 15,140,361 | | | $ | — | | | $ | 23,676,572 | | | $ | 202,642 | |

Small Business Loans | | | 18,718,880 | | | | 71,528,809 | | | | (564,819 | ) | | | (58,675,481 | ) | | | (5,644,179 | ) | | | (1,553,349 | ) | | | — | | | $ | 23,809,861 | | | | (6,160,080 | ) |

| |

Total Whole Loans | | | 185,114,179 | | | | 71,528,809 | | | | (85,291,283 | ) | | | (109,166,662 | ) | | | (28,285,622 | ) | | | 13,587,012 | | | | | | | | 47,486,433 | | | | (5,957,438 | ) |

| |

Asset-Backed Securities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

MarketPlace Lending Residual Securities | | $ | 13,756,215 | | | $ | 3,895,797 | | | $ | — | | | $ | (2,955,007 | ) | | $ | — | | | $ | (5,682,819 | ) | | | | | | $ | 9,014,186 | | | $ | (5,682,819 | ) |

| |

Total | | $ | 198,870,394 | | | $ | 75,424,606 | | | $ | (85,291,283 | ) | | $ | (112,121,669 | ) | | $ | (28,285,622 | ) | | $ | 7,904,193 | | | $ | — | | | $ | 56,500,619 | | | $ | (11,640,257 | ) |

| |

The table below provides additional information about the Level 3 Fair Value Measurements as of June 30, 2020.

Quantitative Information about Level 3 Fair Value Measurements

| | | | | | | | | | | | | | | | | | | | | | | | |

Type of

Security | | Industry | | | Fair Value at

June 30, 2020 | | | Valuation

Techniques | | | Unobservable

Inputs | | | Range | | | Weighted

Average | |

Whole Loans | | | | | | | | | | | | | | | | | | | | | | | | |

Consumer Loans | |

| Financial

Services |

| | $ | 23,676,572 | | |

| Discounted

Cash Flow |

| |

| Loss-Adjusted

Discount Rate;

Projected Loss

Rate |

| |

| 0%-

5.13%

0.00%-

95.09% |

| | | 2.92%; 6.34% | |

Small Business Loans | |

| Financial

Services |

| | $ | 23,809,861 | | |

| Discounted

Cash Flow |

| |

| Loss-Adjusted

Discount Rate;

Projected Loss

Rate |

| |

| 3.00%-

21.51%

0.00%-

94.44% |

| | | 10.67%; 11.92% | |

Asset-Backed Securities | | | | | | | | | | | | | | | | | | | | | | | | |

MarketPlace Lending Residual Securities | |

| Financial

Services |

| | $ | 9,014,186 | | |

| Discounted

Cash Flow |

| |

| Net Loss/Balance

Prepay/Balance Default/Balance |

| |

| 9.31%-

13.15%

23.33%-

27.28% 10.70%-

15.11% |

| | | 10.72% 24.94% 12.32% | |

Total | | | | | | $ | 56,500,619 | | | | | | | | | | | | | | | | | |

It is the Fund’s policy to recognize transfers into and out of all levels at the end of the reporting period.

There were no transfers into and out of Levels 1, 2, and 3 during the current period presented.

| | |

| 24 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | |

Notes to Financial Statements | | June 30, 2020 |

4. RECENT ACCOUNTING PRONOUNCEMENTS

In August 2018, the Financial Accounting Standards Board issued Accounting Standards Update 2018-13 “Changes to the Disclosure Requirements for Fair Value Measurement” which modifies disclosure requirements for fair value measurements. The guidance is effective for fiscal years beginning after December 15, 2019 and for interim periods within those fiscal years. Management is currently evaluating the impact of this guidance to the Fund.

5. INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

For its services under the Investment Advisory Agreement, the Fund pays the Adviser a monthly management fee computed at the annual rate of 1.25% of the average monthly Managed Assets “Managed Assets” means the total assets of the Fund, including assets attributable to leverage, minus liabilities (other than debt representing leverage and any preferred stock that may be outstanding). In addition to the monthly advisory fee, the Fund pays all other costs and expenses of its operations, including, but not limited to, compensation of its directors (other than those affiliated with the Adviser), custodial expenses, transfer agency and dividend disbursing expenses, legal fees, expenses of independent auditors, expenses of repurchasing shares, expenses of any leverage, expenses of preparing, printing and distributing prospectuses, shareholder reports, notices, proxy statements and reports to governmental agencies, and taxes, if any. In addition, the Adviser has agreed to waive or reimburse expenses of the Fund (other than brokerage fees and commissions; loan servicing fees; borrowing costs such as (i) interest and (ii) dividends on securities sold short; taxes; indirect expenses incurred by the underlying funds in which the Fund may invest; the cost of leverage; and extraordinary expenses) to the extent necessary to limit the Fund’s total annual operating expenses at 1.95% of the average daily Managed Assets for that period through October 28, 2020. The Adviser may recover from the Fund expenses reimbursed for three years after the date of the payment or waiver if the Fund’s operating expenses, including the recovered expenses, falls below the expense cap. For the year ended June 30, 2020, the Adviser did not recoup of any reimbursed expenses, these amounts represent expenses waived due to the expense cap, and is not inclusive of the advisory fee waiver. In future periods, the Adviser may recoup fees as follows:

| | | | | | |

Remaining Amount

to be Recouped(1)

(Expiring by Fiscal

Year Ending

June 30, 2021) | | Remaining Amount

to be Recouped(1)

(Expiring by Fiscal

Year Ending

June 30, 2022) | | Remaining Amount

to be Recouped(1)

(Expiring by Fiscal

Year Ending

June 30, 2023) | | Total |

$1,020,075 | | $201,416 | | $466,167 | | $1,687,658 |

| (1) | Amounts to be recouped are in accordance with the expense limitation agreement, and will not cause the Fund’s total operating expense ratio (excluding loan service fees and leverage costs set forth in the agreement) to exceed 1.95% during the year. |

U.S. Bancorp Fund Services, LLC (“USBFS”) provides the Fund with fund administration and fund accounting services.

DST Systems, Inc. serves as transfer, dividend paying and shareholder servicing agent for the Fund (“Transfer Agent”).

| | | | |

Annual Report | June 30, 2020 | | | 25 | |

| | |

RiverNorth Specialty Finance Corporation | | |

Notes to Financial Statements | | June 30, 2020 |

Officers of the Fund and Directors who are “interested persons” of the Fund or the Adviser received no salary or fees from the Fund, except for the Chief Compliance Officer. Each Director who is not an “interested person” received a fee of $16,500 per year plus $1,500 per meeting attended. In addition, the lead Independent Director receives $250 annually, the Chair of the Audit Committee receives $500 annually, and the Chair of the Nominating and Corporate Governance Committee receives $250 annually. The Fund reimburses each Director and Officer for his or her travel and other expenses relating to the attendance at such meetings.

The Chief Compliance Officer of the Fund is an affiliate of the Fund. For the fiscal year ended June 30, 2020, the total related amounts paid by the Fund for CCO fees are included in Compliance expenses on the Fund’s Statement of Operations. In addition, the Fund owed the Adviser $2,114 for such expenses as of June 30, 2020.

6. FEDERAL INCOME TAXES

It is the Fund’s policy to meet the requirements of the IRC applicable to regulated investment companies, and to distribute all of their taxable net income to their shareholders. In addition, the Fund intends to pay distributions as required to avoid imposition of excise tax. Therefore, no federal income tax provision is required.

Tax Basis of Distributions to Shareholders

The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain were recorded by a Fund.

The tax character of distributions paid by the Fund during the fiscal year ended June 30, 2020, was as follows:

| | | | | | | | |

| Year Ended | | Ordinary

Income | | Net Long Term

Capital Gains | | Return of

Capital | | Total |

June 30, 2019 | | $11,701,341 | | $— | | $$7,396,057 | | $19,097,398 |

June 30, 2020 | | $— | | $— | | $15,579,982 | | $15,579,982 |

Components of Distributable Earnings on a Tax Basis: The tax components of distributable earnings are determined in accordance with income tax regulations which may differ from the composition of net assets reported under GAAP. For the year ended June 30, 2020, the primary book to tax permanent difference was the treatment of capital losses on defaulted loans as ordinary income for tax purposes which resulted in reclassifications among the Fund’s components of net assets as of June 30, 2020.

At June 30, 2020, there were no undistributed earnings for tax purposes.

Under current tax law, capital and currency losses realized after October 31 of the Fund’s fiscal year may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. The Fund has deferred post-October losses of $2,863,611.

| | |

| 26 | | (888) 848-7569 | www.rivernorth.com |

| | |

RiverNorth Specialty Finance Corporation | | |

Notes to Financial Statements | | June 30, 2020 |

Unrealized Appreciation and Depreciation on Investments:

As of June 30, 2020, net unrealized appreciation (depreciation) of investments based on federal tax costs was as follows:

| | | | | | |

Gross Appreciation

(excess of value over tax) | | Gross Depreciation

(excess of tax cost

over value) | | Net Unrealized

Appreciation/

(Depreciation) | | Cost of Investments for

Income Tax Purposes |

$2,499,493 | | $(16,002,096) | | $(13,502,603) | | $155,890,523 |

As of June 30, 2020, for federal income tax purposes, capital loss carryforwards of $16,369,602 ($1,364,754 short-term and $15,004,848 long-term) were available to offset future realized capital gains, to the extent provided by the Internal Revenue Code, with no expiration date.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on U.S. tax returns and state tax returns filed since inception of the Fund. No income tax returns are currently under examination. All tax years since commencement of operations remain subject to examination by the tax authorities in the United States. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

7. INVESTMENT TRANSACTIONS

Investment transactions for the year ended June 30, 2020, excluding U.S. Government Obligations and short-term investments, were as follows:

| | |

| Purchases | | Proceeds from Sales, Principal Paydowns and Return of Capital |

$137,651,678 | | $205,035,799 |

8. REDEEMABLE PREFERRED STOCK

At June 30, 2020, the Fund had issued and outstanding 1,656,000 shares of Series A Preferred Stock, listed under trading symbol RMPL on the NYSE, with a par value of $0.0001 per share and a liquidation preference of $25.00 per share plus accrued and unpaid dividends (whether or not declared). The Fund issued 1,440,000 and 216,000 shares of Series A Preferred Stock on October 25, 2017 and October 30, 2017, respectively. The Series A Preferred Stock is entitled to a dividend at a rate of 5.875% per year based on the $25.00 liquidation preference before the common stock is entitled to receive any dividends. The Series A Preferred Stock is redeemable at $25.00 per share plus accrued and unpaid dividends (whether or not declared) exclusively at the Fund’s option commencing on October 31, 2020. Issuance costs related to Series A Preferred Stock

| | | | |

Annual Report | June 30, 2020 | | | 27 | |

| | |

RiverNorth Specialty Finance Corporation | | |

Notes to Financial Statements | | June 30, 2020 |

of $1,558,000 are deferred and amortized over the period the Series A Preferred Stock is outstanding.

| | | | | | | | | | | | | | | | | | |

| Series | | Mandatory

Redemption

Date | | Fixed Rate | | | Shares

Outstanding | | | Aggregate

Liquidation

Preference | | | Estimated

Fair Value | |

Series A | | October 31,

2024 | | | 5.875 | % | | | 1,656,000 | | | $ | 41,400,000 | | | $ | 41,250,960 | |

The Series A Preferred Stock ranks senior to the common stock of the Fund.

9. REVOLVING CREDIT FACILITY

On September 5, 2017, the Fund entered into a $20,000,000 revolving credit facility with Huntington National Bank. The credit facility had an initial two-year term. On April 4, 2018, the Fund amended its prior credit agreement and entered into a $70,000,000 revolving credit facility. On September 30, 2019, the Fund amended its existing credit agreement and entered into a $30,000,000 revolving credit facility. On December 6, 2019 the Fund terminated its existing credit agreement with Huntington National Bank.

The average principal balance and interest rate for the period during which the credit facility was utilized for the period covering July 1, 2019 through December 6, 2019 was approximately $360,000 and 4.09 percent, respectively.

10. INDEMNIFICATIONS

Under the Fund’s organizational documents, its officers and Directors are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that may contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

| | |

| 28 | | (888) 848-7569 | www.rivernorth.com |

| | |