UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23096

Legg Mason ETF Investment Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| | |

| Annual Report | | October 31, 2018 |

LEGG MASON

EMERGING MARKETS DIVERSIFIED CORE ETF

EDBI

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks to track the investment results of an index composed of publicly traded equity securities in emerging markets.

Letter from the president

Dear Shareholder,

We are pleased to provide the annual report of Legg Mason Emerging Markets Diversified Core ETF for the twelve-month reporting period ended October 31, 2018. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund net asset value and market price, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

November 30, 2018

| | |

| II | | Legg Mason Emerging Markets Diversified Core ETF |

Investment commentary

Economic review

Economic activity in the U.S. was mixed during the twelve months ended October 31, 2018 (the “reporting period”). Looking back, the U.S. Department of Commerce reported that fourth quarter 2017 and first quarter 2018 U.S. gross domestic product (“GDP”)i growth was 2.3% and 2.2%, respectively. GDP growth then accelerated to 4.2% during the second quarter of 2018 — the strongest reading since the third quarter of 2014. Finally, the U.S. Department of Commerce’s second reading for third quarter 2018 GDP growth — released after the reporting period ended — was 3.5%. The deceleration in GDP growth in the third quarter of 2018 reflected a downturn in exports and decelerations in nonresidential fixed investment and personal consumption expenditures. Imports increased in the third quarter after decreasing in the second. These movements were partly offset by an upturn in private inventory investment.

Job growth in the U.S. was solid overall and supported the economy during the reporting period. As reported by the U.S. Department of Labor, when the reporting period ended on October 31, 2018, the unemployment rate was 3.7%, versus 4.1% when the period began. October 2018’s reading equaled the lowest unemployment rate since 1969. The percentage of longer-term unemployed also declined during the reporting period. In October 2018, 22.5% of Americans looking for a job had been out of work for more than six months, versus 23.8% when the period began.

Turning to the global economy, in its October 2018 World Economic Outlook, the International Monetary Fund (“IMF”)ii said, “Global growth for 2018-19 is projected to remain steady at its 2017 level, but its pace is less vigorous than projected in April [2018] and it has become less balanced. Downside risks to global growth have risen in the past six months and the potential for upside surprises has receded.” From a regional perspective, the IMF projects 2018 growth in the Eurozone will be 2.0%, versus 2.4% in 2017. Japan’s economy is expected to expand 1.1% in 2018, compared to 1.7% in 2017. Elsewhere, the IMF projects that overall growth in emerging market countries will be 4.7% in 2018, the same as in 2017.

Looking back, at its meeting that concluded on September 20, 2017, the Federal Reserve Board (the “Fed”)iii kept the federal funds rateiv on hold, but reiterated its intention to begin reducing its balance sheet, saying, “In October, the Committee will initiate the balance sheet normalization program….” At its meeting that ended on December 13, 2017, the Fed raised rates to a range between 1.25% and 1.50%. As expected, the Fed kept rates on hold at its meeting that concluded on January 31, 2018. However, at its meeting that ended on March 21, 2018, the Fed again raised the federal funds rate, moving it to a range between 1.50% and 1.75%. At its meeting that concluded on June 13, 2018, the Fed raised the federal funds rate to a range between 1.75% and 2.00%. Finally, at its meeting that ended on September 26, 2018, the Fed raised the federal funds rate to a range between 2.00% and 2.25%.

Central banks outside the U.S. took different approaches to monetary policy during the reporting period. Looking back, in December 2016, the European Central Bank (“ECB”)v extended its bond buying program until December 2017. From April 2017 through December 2017, the ECB purchased €60

| | |

| Legg Mason Emerging Markets Diversified Core ETF | | III |

Investment commentary (cont’d)

billion-per-month of bonds. In October 2017, the ECB announced that it would continue to buy bonds through September 2018, but after December 2017 it would pare its purchases to €30 billion-per-month. In June 2018, the ECB announced it would end its bond buying program by the end of the year, but it did not anticipate raising interest rates “at least through the summer of 2019”. In other developed countries, on November 2, 2017, the Bank of Englandvi raised rates from 0.25% to 0.50% — the first increase since July 2007. It then raised rates to 0.75% at its meeting on August 2, 2018. After holding rates steady at 0.10% for more than five years, in January 2016, the Bank of Japanvii announced that it cut the rate on current accounts that commercial banks hold with it to -0.10% and kept rates on hold during the reporting period. Elsewhere, the People’s Bank of Chinaviii kept rates steady at 4.35% during the reporting period.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

November 30, 2018

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. Forecasts and predictions are inherently limited and should not be relied upon as an indication of actual or future performance.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The International Monetary Fund (“IMF”) is an organization of 189 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. |

| iii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iv | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| v | The European Central Bank (“ECB”) is responsible for the monetary system of the European Union and the euro currency. |

| vi | The Bank of England (“BoE”), formally the Governor and Company of the BoE, is the central bank of the United Kingdom. The BoE’s purpose is to maintain monetary and financial stability. |

| vii | The Bank of Japan is the central bank of Japan. The bank is responsible for issuing and handling currency and treasury securities, implementing monetary policy, maintaining the stability of the Japanese financial system and the yen currency. |

| viii | The People’s Bank of China is the central bank of the People’s Republic of China with the power to carry out monetary policy and regulate financial institutions in mainland China. |

| | |

| IV | | Legg Mason Emerging Markets Diversified Core ETF |

Fund overview

Q. What is the Fund’s investment strategy?

A. Legg Mason Emerging Markets Diversified Core ETF (the “Fund”) seeks to track the investment results of the QS DBI Emerging Markets Diversified Index (the “Underlying Index”). The Underlying Index seeks to provide exposure to equity securities in emerging markets and is based on a proprietary methodology created and sponsored by QS Investors, LLC (“QS Investors”), the Fund’s subadviser. The Underlying Index is composed of emerging markets equity securities that are included in the MSCI Emerging Markets Indexi.

The proprietary rules-based process initially groups this universe of securities into multiple investment categories based on geography and sector. Within each of these investment categories, securities are weighted by market capitalization. The process then combines those investment categories with more highly correlated historical performance into a smaller number of “clusters.” A cluster is a group of investment categories based on geography and sector that have demonstrated a tendency to behave similarly (high correlation). Thereafter, each of these clusters is weighted in the Underlying Index to produce a highly diversified portfolio. QS Investors anticipates that the number of component securities in the Underlying Index will range from 700 to 800. The Underlying Index may include large, medium and small capitalization companies. The components of the Underlying Index, and the degree to which these components represent certain countries and sectors, may change over time.

The Underlying Index’s components are reconstituted annually and rebalanced quarterly. The Underlying Index is reconstituted on a different date from the MSCI Emerging Markets Index. Securities that are removed from, or added to, the MSCI Emerging Markets Index are removed from, or considered for inclusion in, the Underlying Index at the next annual reconstitution or quarterly rebalancing of the Underlying Index. The Fund’s portfolio is rebalanced when the Underlying Index is rebalanced or reconstituted. The Fund may trade at times other than when the Underlying Index is rebalanced or reconstituted for a variety of reasons, including when adjustments may be made to its representative sampling process from time to time or when investing cash.

The term “diversified” highlights the purpose of QS Investors’ Diversification Based Investing methodology, which seeks to avoid concentration risks often identified with market cap-weighted funds. The term “core” high- lights the segment of the investment universe where the Fund invests — as opposed to introducing value or size biases or investing in niche segments of the market.

The Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, if any, in securities that compose the Underlying Index. Securities that compose the Underlying Index include depository receipts representing securities in the Underlying Index. The equity securities that the Fund will hold are principally common stocks. The Fund may invest up to 20% of its net assets in certain index futures, options, options on index futures, swap contracts or other derivatives related to its Underlying Index and its component securities; cash and cash equivalents; other investment companies, including exchange-traded funds; exchange-traded notes; depository receipts; and in

| | |

| Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report | | 1 |

Fund overview (cont’d)

securities and other instruments not included in its Underlying Index but which QS Investors believes will help the Fund track its Underlying Index. The Fund may invest in exchange-traded equity index futures and currency derivatives to gain exposure to local markets and may also use currency derivatives for cash management purposes.

Q. What were the overall market conditions during the Fund’s reporting period?

A. Emerging markets, as measured by the MSCI Emerging Markets Index, outperformed its developed markets counterparts, as measured by the MSCI World Indexii, at the start of the twelve-month reporting period ended October 31, 2018. In fact, emerging markets outperformed global markets overall for all four quarters of 2017, benefiting from a weak U.S. dollar, increasing global trade and synchronized global economic expansion. Like the developed world, corporate earnings in these markets continued to grow through calendar year 2017. South Africa was the chief outperformer in the MSCI Emerging Markets Index in the final quarter of 2017, largely due to an appreciation of its currency, and its stock market hit a new high in November 2017. China also ended 2017 on a high note, with stronger growth despite the government’s tightening monetary policy and attempts to slow down the real estate market.

Emerging markets outperformance continued into 2018 until a correctional sell-off from late January through February 2018, falling over 10% sparked by investor fears that the U.S. Federal Reserve Board (the “Fed”)iii would accelerate their rate tightening schedule amid positive economic data. The MSCI Emerging Markets Index rebounded strongly from the correction through mid-March, rallying over 7% driven by the concentrated, growth/momentum technology rally which characterized 2017. Beginning in mid-March 2018, emerging markets broadly began to realize headwinds including a significant strengthening of the U.S. dollar against several major emerging market currencies, heightening treasury yields and implementation of several major tariffs. China, Brazil and Taiwan continued to generate positive returns during this volatile time period, while markets most sensitive to tightening global liquidity and rising oil prices had their largest sell-off.

Emerging markets had a negative return for the third calendar quarter of 2018. Turkish equities were down over 20%, driven by a significant drop in the Turkish lira; the equity market, as measured in local currency actually rose in September 2018. Turkey has been facing multiple political and economic headwinds, including its large current account deficit, growing tensions with the U.S., inflation, and investor exits. Fears of contagion abated during September 2018, however, as several other vulnerable emerging markets took various steps to shore up their financial weaknesses. Russia and Indonesia were among those to raise interest rates; South Africa decided to keep rates steady on tempering inflation. Most markets saw commodity inflation hit businesses, and the strong U.S. dollar has exacerbated the situation. Among the larger markets, China equities declined for the quarter. Manufacturing growth softened, but there were gains in non-manufacturing industries. Local consumer purchasing power increased in 2018 with rising wages, and property investment is on the rise. Business and consumer sentiment weakened as the trade

| | |

| 2 | | Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report |

disputes with the U.S. threatened a variety of industries. Taiwan had a solid gain, though growth has also weakened; most sectors had gains, led by the Energy sector. After six months in contraction, South Korean manufacturing moved to growth, on an increase in local orders, as export orders declined. The equity market had a small positive return for the quarter, but remained in negative territory for the year to date. India, the world’s fastest-growing large economy, also declined. Brazil equities had positive returns, but volatility is expected to return as a divisive election is forthcoming that has repercussions for its equity market and economy.

October 2018, the final month of the reporting period, proved to be a challenging month for investors, as volatility returned in earnest. Throughout the month, practically every asset class sold off to some extent, both in the U.S. and abroad. All countries in the MSCI All Country World Indexiv with the exception of Brazil and Qatar registered losses, many with double digit declines. Even the U.S., which had been a rare comfort zone for investors until September 2018, fell in October, curtailing year-to-date gains. Oil prices plunged following an agreement between Russia and Saudi Arabia to address supply concerns in conjunction with lower forecasts for demand next year. An appreciating U.S. dollar, coupled with a decline in investor sentiment, caused emerging markets equities to underperform developed markets equities.

The Fund uses a passive investment approach to achieve its investment objective, and therefore made no change in investment approach in response to market conditions.

Performance review

For the twelve months ended October 31, 2018, Legg Mason Emerging Markets Diversified Core ETF generated a -11.64% return on a net asset value (“NAV”)v basis and -12.66% based on its market pricevi per share.

The performance table shows the Fund’s total return for the twelve months ended October 31, 2018 based on its NAV and market price as of October 31, 2018. The Fund seeks to track the investment results of the QS DBI Emerging Markets Diversified Index, which returned -11.52%. for the same period. The Fund’s broad-based market index, the MSCI Emerging Markets Index, returned -12.52% over the same time frame. The Lipper Emerging Markets Funds Category Average1 returned -13.58% for the same period. Please note that Lipper performance returns are based on each fund’s NAV.

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended October 31, 2018, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 847 funds for the twelve-month period in the Fund’s Lipper category. |

| | |

| Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report | | 3 |

Fund overview (cont’d)

| | | | | | | | |

Performance Snapshot as of October 31, 2018

(unaudited) | |

| | | 6 months | | | 12 months | |

| Legg Mason Emerging Markets Diversified Core ETF: | | | | | | | | |

$27.53 (NAV) | | | -15.00 | % | | | -11.64 | %*† |

$27.51 (Market Price) | | | -14.41 | % | | | -12.66 | %*‡ |

| QS DBI Emerging Markets Diversified Index | | | -14.89 | % | | | -11.52 | % |

| MSCI Emerging Markets Index | | | -16.53 | % | | | -12.52 | % |

| Lipper Emerging Markets Funds Category Average1 | | | -16.80 | % | | | -13.58 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Principal value and investment returns will fluctuate so shares, when redeemed or sold in the market, may be worth more or less than their original cost. Performance data current to the most recent month-end is available at www.leggmason.com/etf.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the ETF. Market price returns shown are typically based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV is determined, which is typically 4:00 p.m. Eastern time (US). These returns do not represent investors’ returns had they traded shares at other times. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Information showing the number of days the market price of the Fund’s shares was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV (i.e., premium or discount) for various time periods is available by visiting the Fund’s website at www.leggmason.com/etf.

As of the Fund’s current prospectus dated March 1, 2018, the gross total annual fund operating expense ratio for the Fund was 0.50%.

* Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions, at NAV.

‡ Total return assumes the reinvestment of all distributions, at market price.

Q. What were the leading contributors to performance?

A. Looking at the Underlying Index by country, Brazil was the leading contributor to performance for the reporting period. Taiwan was also a moderate contributor. From a sector perspective, the leading contributors were the Energy and Health Care sectors, the only sectors with positive returns for the reporting period.

Q. What were the leading detractors from performance?

A. At the country level, within the Underlying Index, the leading detractor from performance was China. Turkey, Indonesia and India also detracted from performance for

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended October 31, 2018, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 876 funds for the six-month period and 847 funds for the twelve-month period in the Fund’s Lipper category. |

| | |

| 4 | | Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report |

the reporting period. Most sectors detracted from results, with the Communication Services1, Consumer Discretionary and Materials sectors being the most negative. Cyclical sectors and the consumer facing Information Technology sector, which were responsible for driving heightened 2017 returns, tend to be more exposed to global trade dynamics.

Looking for additional information?

The Fund’s daily NAV is available on-line at www.leggmason.com/etf. The Fund is traded under the symbol “EDBI” and its closing market price is available on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-877-721-1926 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in Legg Mason Emerging Markets Diversified Core ETF. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

QS Investors, LLC

November 20, 2018

RISKS: Equity securities are subject to market and price fluctuations. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. In rising markets, the value of large cap stocks may not rise as much as smaller-cap stocks. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. Diversification does not guarantee a profit or protect against a loss. The Fund may focus its investments in certain industries, increasing its vulnerability to market volatility. There is no guarantee that the Fund will achieve a high degree of correlation to the index it seeks to track. The Fund does not seek to outperform the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses and have a potentially large

impact on Fund performance. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

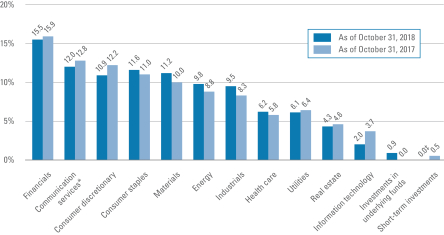

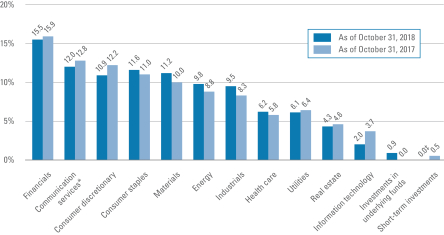

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of October 31, 2018 were: Financials (15.5%), Communication Services (12.1%), Consumer Staples (11.5%), Materials (11.2%) and Consumer Discretionary (10.8%). The Fund’s composition may differ over time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. An index is a statistical composite that tracks a specified

| 1 | As of September 28, 2018, the Telecommunication Services sector was broadened to include some companies previously classified in the Consumer Discretionary and Information Technology sectors and renamed the Communication Services sector. |

| | |

| Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report | | 5 |

Fund overview (cont’d)

financial market, sector or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The MSCI Emerging Markets Index is a free float adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The Index is calculated assuming the minimum possible dividend reinvestment. |

| ii | The MSCI World Index is an unmanaged index considered representative of growth stocks of developed countries. Index performance is calculated with net dividends. |

| iii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iv | The MSCI All Country World Index (“MSCI ACWI”) is a market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 45 country indices comprising 24 developed and 21 emerging market country indices. |

| v | Net Asset Value (NAV) is calculated by subtracting total liabilities from total assets and dividing the results by the number of shares outstanding. |

| vi | Market Price is determined by supply and demand. It is the price at which an investor purchases or sells shares of the Fund. The Market Price may differ from the Fund’s NAV. |

| | |

| 6 | | Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report |

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of October 31, 2018 and October 31, 2017 and does not include derivatives such as futures contracts. The composition of the Fund’s investments is subject to change at anytime. |

| ‡ | Represents less than 0.1%. |

| * | As of September 28, 2018, the Telecommunication Services sector was broadened to include some companies previously classified in the Consumer Discretionary and Information Technology sectors and renamed the Communication Services sector. |

| | |

| Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report | | 7 |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, such as brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to com-pare these costs with the ongoing costs of investing in other funds.

This example is based on an investment of $1,000 invested on May 1, 2018 and held for the six months ended October 31, 2018.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on actual total return1 | | | | Based on hypothetical total return1 |

Actual

Total

Return2 | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period3 | | | | Hypothetical

Annualized

Total Return | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period3 |

| | | -15.00% | | | | $ | 1,000.00 | | | | $ | 850.00 | | | | | 0.50 | % | | | $ | 2.33 | | | | | | | 5.00 | % | | | | $1,000.00 | | | | $ | 1,022.68 | | | | | 0.50 | % | | | $ | 2.55 | |

| 1 | For the six months ended October 31, 2018. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| | |

| 8 | | Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report |

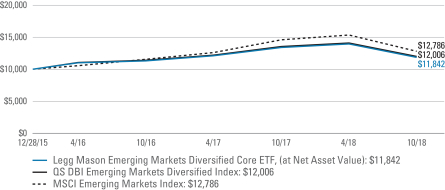

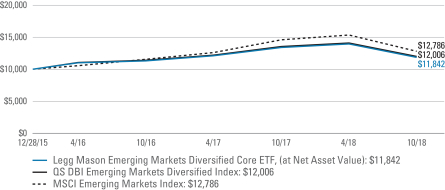

Fund performance (unaudited)

| | | | |

| Net Asset Value | | | |

| Average annual total returns1 | | | |

| Twelve Months Ended 10/31/18 | | | -11.64 | % |

| Inception* through 10/31/18 | | | 6.13 | |

| |

| Cumulative total returns1 | | | |

| Inception date of 12/28/15 through 10/31/18 | | | 18.42 | % |

| | | | |

| Market Price | | | |

| Average annual total returns2 | | | |

| Twelve Months Ended 10/31/18 | | | -12.66 | % |

| Inception* through 10/31/18 | | | 6.07 | % |

| |

| Cumulative total returns2 | | | |

| Inception date of 12/28/15 through 10/31/18 | | | 18.25 | % |

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

Investors buy and sell shares of the Fund at market price, not NAV, in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the Fund. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is typically based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV is determined, which is typically 4:00 p.m. Eastern time (US). These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other exchange-traded funds, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at market price. |

| * | Inception date of the Fund is December 28, 2015. |

| | |

| Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report | | 9 |

Fund performance (unaudited) (cont’d)

Historical performance

Value of $10,000 invested in

Legg Mason Emerging Markets Diversified Core ETF vs QS DBI Emerging Markets Diversified Index and MSCI Emerging Markets Index† — December 28, 2015 - October 31, 2018

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. The returns shown do not reflect the deduction of taxes that investors would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in Legg Mason Emerging Markets Diversified Core ETF on December 28, 2015, assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through October 31, 2018. The hypothetical illustration also assumes a $10,000 investment in the QS DBI Emerging Markets Diversified Index and the MSCI Emerging Markets Index. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund. The QS DBI Emerging Markets Diversified Core Index (the “Underlying Index”) is an index composed of emerging markets equity securities that are included in the MSCI Emerging Market Index. The Underlying Index is based on a proprietary methodology created and sponsored by QS Investors, LLC, the Fund’s subadviser. The MSCI Emerging Markets Index (the “Index”) is a free float adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The Index is calculated assuming the minimum possible dividend reinvestment. The indices are not subject to the same management and trading expenses as a fund. An index is a statistical composite that tracks a specified financial market, sector, or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index. |

| | |

| 10 | | Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report |

Schedule of investments

October 31, 2018

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Common Stocks — 96.4% | | | | | | | | | | | | | | | | |

| Communication Services — 11.7% | | | | | | | | | | | | | | | | |

Diversified Telecommunication Services — 3.3% | | | | | | | | | | | | | | | | |

Bharti Infratel Ltd. | | | | | | | | | | | 4,427 | | | $ | 16,120 | |

China Telecom Corp. Ltd., Class H Shares | | | | | | | | | | | 56,000 | | | | 26,431 | |

China Unicom Hong Kong Ltd. | | | | | | | | | | | 26,000 | | | | 26,997 | |

Chunghwa Telecom Ltd. | | | | | | | | | | | 15,000 | | | | 53,081 | |

KT Corp. | | | | | | | | | | | 402 | | | | 10,089 | |

KT Corp., ADR | | | | | | | | | | | 1,028 | | | | 14,228 | |

Telekom Malaysia Berhad | | | | | | | | | | | 11,200 | | | | 6,370 | |

Telekomunikasi Indonesia Persero Tbk PT | | | | | | | | | | | 1,000,800 | | | | 253,450 | |

Tower Bersama Infrastructure Tbk PT | | | | | | | | | | | 43,100 | | | | 13,268 | |

True Corp. PCL | | | | | | | | | | | 191,148 | | | | 34,020 | (a) |

Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 454,054 | |

Interactive Media & Services — 0.8% | | | | | | | | | | | | | | | | |

Baidu Inc., ADR | | | | | | | | | | | 100 | | | | 19,006 | * |

Tencent Holdings Ltd. | | | | | | | | | | | 2,600 | | | | 88,553 | |

Total Interactive Media & Services | | | | | | | | | | | | | | | 107,559 | |

Media — 0.6% | | | | | | | | | | | | | | | | |

Naspers Ltd., Class N Shares | | | | | | | | | | | 497 | | | | 87,264 | |

Wireless Telecommunication Services — 7.0% | | | | | | | | | | | | | | | | |

Advanced Info Service PCL, Registered Shares | | | | | | | | | | | 19,000 | | | | 112,338 | (a) |

America Movil SAB de CV, Series L Shares | | | | | | | | | | | 120,878 | | | | 87,684 | |

Axiata Group Bhd | | | | | | | | | | | 24,000 | | | | 19,558 | |

Bharti Airtel Ltd. | | | | | | | | | | | 17,791 | | | | 70,339 | |

China Mobile Ltd. | | | | | | | | | | | 20,000 | | | | 187,004 | |

DiGi.Com Berhad | | | | | | | | | | | 28,700 | | | | 29,561 | |

Far EasTone Telecommunications Co., Ltd. | | | | | | | | | | | 8,000 | | | | 19,054 | |

Idea Cellular Ltd. | | | | | | | | | | | 24,852 | | | | 12,990 | * |

Maxis Berhad | | | | | | | | | | | 20,400 | | | | 25,497 | |

Mobile TeleSystems PJSC, ADR | | | | | | | | | | | 9,700 | | | | 77,697 | |

MTN Group Ltd. | | | | | | | | | | | 9,562 | | | | 55,366 | |

SK Telecom Co., Ltd. | | | | | | | | | | | 400 | | | | 94,072 | |

Taiwan Mobile Co., Ltd. | | | | | | | | | | | 7,000 | | | | 24,997 | |

TIM Participacoes SA | | | | | | | | | | | 8,359 | | | | 25,947 | |

Turkcell Iletisim Hizmetleri AS | | | | | | | | | | | 43,949 | | | | 89,023 | |

Vodacom Group Ltd. | | | | | | | | | | | 2,896 | | | | 24,398 | |

Total Wireless Telecommunication Services | | | | | | | | | | | | | | | 955,525 | |

Total Communication Services | | | | | | | | | | | | | | | 1,604,402 | |

See Notes to Financial Statements.

| | |

| Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report | | 11 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Consumer Discretionary — 10.7% | | | | | | | | | | | | | | | | |

Auto Components — 0.4% | | | | | | | | | | | | | | | | |

Bosch Ltd. | | | | | | | | | | | 39 | | | $ | 10,415 | |

Cheng Shin Rubber Industry Co., Ltd. | | | | | | | | | | | 8,000 | | | | 11,260 | |

Hyundai Mobis Co., Ltd. | | | | | | | | | | | 92 | | | | 15,339 | |

Motherson Sumi Systems Ltd. | | | | | | | | | | | 5,320 | | | | 11,746 | |

Total Auto Components | | | | | | | | | | | | | | | 48,760 | |

Automobiles — 2.9% | | | | | | | | | | | | | | | | |

Astra International Tbk PT | | | | | | | | | | | 437,700 | | | | 227,451 | |

Bajaj Auto Ltd. | | | | | | | | | | | 229 | | | | 8,032 | |

Brilliance China Automotive Holdings Ltd. | | | | | | | | | | | 8,000 | | | | 6,980 | |

BYD Co., Ltd., Class H Shares | | | | | | | | | | | 1,500 | | | | 9,720 | |

Dongfeng Motor Group Co., Ltd., Class H Shares | | | | | | | | | | | 8,000 | | | | 7,878 | |

Eicher Motors Ltd. | | | | | | | | | | | 61 | | | | 18,037 | |

Geely Automobile Holdings Ltd. | | | | | | | | | | | 10,000 | | | | 19,134 | |

Guangzhou Automobile Group Co., Ltd., Class H Shares | | | | | | | | | | | 8,400 | | | | 8,497 | |

Hero MotoCorp Ltd. | | | | | | | | | | | 319 | | | | 11,917 | |

Hyundai Motor Co. | | | | | | | | | | | 209 | | | | 19,533 | |

Kia Motors Corp. | | | | | | | | | | | 437 | | | | 10,891 | |

Mahindra & Mahindra Ltd. | | | | | | | | | | | 2,039 | | | | 21,121 | |

Maruti Suzuki India Ltd. | | | | | | | | | | | 267 | | | | 23,890 | |

Tata Motors Ltd. | | | | | | | | | | | 4,446 | | | | 10,769 | * |

Total Automobiles | | | | | | | | | | | | | | | 403,850 | |

Diversified Consumer Services — 0.4% | | | | | | | | | | | | | | | | |

Kroton Educacional SA | | | | | | | | | | | 7,486 | | | | 22,975 | |

New Oriental Education & Technology Group Inc., ADR | | | | | | | | | | | 300 | | | | 17,553 | * |

TAL Education Group, ADR | | | | | | | | | | | 606 | | | | 17,562 | * |

Total Diversified Consumer Services | | | | | | | | | | | | | | | 58,090 | |

Hotels, Restaurants & Leisure — 1.7% | | | | | | | | | | | | | | | | |

Genting Bhd | | | | | | | | | | | 21,700 | | | | 38,064 | |

Genting Malaysia Bhd | | | | | | | | | | | 30,600 | | | | 32,834 | |

Huazhu Group Ltd., ADR | | | | | | | | | | | 309 | | | | 8,083 | |

Minor International PCL | | | | | | | | | | | 69,800 | | | | 76,854 | (a) |

OPAP SA | | | | | | | | | | | 4,778 | | | | 44,934 | |

Yum China Holdings Inc. | | | | | | | | | | | 804 | | | | 29,008 | |

Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 229,777 | |

Household Durables — 0.1% | | | | | | | | | | | | | | | | |

Haier Electronics Group Co., Ltd. | | | | | | | | | | | 4,000 | | | | 8,358 | * |

LG Electronics Inc. | | | | | | | | | | | 207 | | | | 11,498 | |

Total Household Durables | | | | | | | | | | | | | | | 19,856 | |

See Notes to Financial Statements.

| | |

| 12 | | Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report |

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Internet & Direct Marketing Retail — 1.0% | | | | | | | | | | | | | | | | |

Alibaba Group Holding Ltd., ADR | | | | | | | | | | | 500 | | | $ | 71,140 | * |

Ctrip.com International Ltd., ADR | | | | | | | | | | | 800 | | | | 26,624 | * |

JD.com Inc., ADR | | | | | | | | | | | 1,400 | | | | 32,928 | * |

Vipshop Holdings Ltd., ADR | | | | | | | | | | | 1,700 | | | | 8,262 | * |

Total Internet & Direct Marketing Retail | | | | | | | | | | | | | | | 138,954 | |

Leisure Products — 0.1% | | | | | | | | | | | | | | | | |

Giant Manufacturing Co., Ltd. | | | | | | | | | | | 2,000 | | | | 7,627 | |

Media — 0.7% | | | | | | | | | | | | | | | | |

Cyfrowy Polsat SA | | | | | | | | | | | 3,193 | | | | 18,422 | * |

Grupo Televisa SAB | | | | | | | | | | | 18,663 | | | | 53,922 | |

Surya Citra Media Tbk PT | | | | | | | | | | | 134,400 | | | | 13,880 | |

Zee Entertainment Enterprises Ltd. | | | | | | | | | | | 2,205 | | | | 13,451 | |

Total Media | | | | | | | | | | | | | | | 99,675 | |

Multiline Retail — 1.6% | | | | | | | | | | | | | | | | |

El Puerto de Liverpool SAB de CV, Class C1 Shares | | | | | | | | | | | 2,086 | | | | 13,288 | |

Lojas Renner SA | | | | | | | | | | | 3,655 | | | | 37,077 | |

Magazine Luiza SA | | | | | | | | | | | 400 | | | | 18,135 | |

Matahari Department Store Tbk PT | | | | | | | | | | | 57,700 | | | | 18,408 | |

Robinson PCL | | | | | | | | | | | 15,200 | | | | 29,919 | (a) |

SACI Falabella | | | | | | | | | | | 13,332 | | | | 100,512 | |

Total Multiline Retail | | | | | | | | | | | | | | | 217,339 | |

Specialty Retail — 0.8% | | | | | | | | | | | | | | | | |

FF Group | | | | | | | | | | | 894 | | | | 4,862 | *(a)(b) |

Home Product Center PCL | | | | | | | | | | | 123,400 | | | | 55,465 | (a) |

Hotai Motor Co., Ltd. | | | | | | | | | | | 1,000 | | | | 6,900 | |

JUMBO SA | | | | | | | | | | | 2,229 | | | | 32,529 | |

Petrobras Distribuidora SA | | | | | | | | | | | 2,200 | | | | 14,161 | |

Total Specialty Retail | | | | | | | | | | | | | | | 113,917 | |

Textiles, Apparel & Luxury Goods — 1.0% | | | | | | | | | | | | | | | | |

ANTA Sports Products Ltd. | | | | | | | | | | | 3,000 | | | | 12,322 | |

CCC SA | | | | | | | | | | | 400 | | | | 17,439 | |

Eclat Textile Co., Ltd | | | | | | | | | | | 1,020 | | | | 12,114 | |

Feng TAY Enterprise Co., Ltd. | | | | | | | | | | | 2,120 | | | | 12,743 | |

LPP SA | | | | | | | | | | | 17 | | | | 34,838 | |

Pou Chen Corp. | | | | | | | | | | | 10,000 | | | | 10,132 | |

Shenzhou International Group Holdings Ltd. | | | | | | | | | | | 2,000 | | | | 22,094 | |

Titan Co., Ltd. | | | | | | | | | | | 1,248 | | | | 14,255 | |

Total Textiles, Apparel & Luxury Goods | | | | | | | | | | | | | | | 135,937 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 1,473,782 | |

See Notes to Financial Statements.

| | |

| Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report | | 13 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Consumer Staples — 11.4% | | | | | | | | | | | | | | | | |

Beverages — 1.5% | | | | | | | | | | | | | | | | |

Ambev SA | | | | | | | | | | | 8,811 | | | $ | 38,522 | |

Anadolu Efes Biracilik Ve Malt Sanayii AS | | | | | | | | | | | 4,253 | | | | 14,262 | |

China Resource Beer Holdings Co., Ltd. | | | | | | | | | | | 12,000 | | | | 41,712 | |

Cia Cervecerias Unidas SA | | | | | | | | | | | 2,722 | | | | 33,820 | |

Coca-Cola Icecek AS | | | | | | | | | | | 1,523 | | | | 7,491 | |

Fomento Economico Mexicano SAB de CV | | | | | | | | | | | 3,960 | | | | 33,835 | |

Tsingtao Brewery Co., Ltd., Class H Shares | | | | | | | | | | | 4,000 | | | | 15,792 | |

United Spirits Ltd. | | | | | | | | | | | 1,808 | | | | 14,103 | * |

Total Beverages | | | | | | | | | | | | | | | 199,537 | |

Food & Staples Retailing — 3.5% | | | | | | | | | | | | | | | | |

Berli Jucker PCL | | | | | | | | | | | 9,200 | | | | 15,472 | (a) |

Bid Corp. Ltd. | | | | | | | | | | | 1,490 | | | | 27,920 | |

BIM Birlesik Magazalar AS | | | | | | | | | | | 4,486 | | | | 63,568 | |

Cencosud SA | | | | | | | | | | | 24,412 | | | | 50,785 | |

Clicks Group Ltd. | | | | | | | | | | | 1,220 | | | | 15,533 | |

CP ALL PCL | | | | | | | | | | | 37,500 | | | | 76,075 | (a) |

E-MART Inc. | | | | | | | | | | | 61 | | | | 10,947 | |

Magnit PJSC, Registered Shares, GDR | | | | | | | | | | | 3,103 | | | | 41,409 | |

Pick n Pay Stores Ltd. | | | | | | | | | | | 2,505 | | | | 11,558 | |

President Chain Store Corp. | | | | | | | | | | | 4,000 | | | | 45,115 | |

Raia Drogasil SA | | | | | | | | | | | 500 | | | | 8,471 | |

Shoprite Holdings Ltd. | | | | | | | | | | | 2,128 | | | | 25,983 | |

SPAR Group Ltd. | | | | | | | | | | | 945 | | | | 11,253 | |

Sun Art Retail Group Ltd. | | | | | | | | | | | 20,000 | | | | 21,864 | |

Wal-Mart de Mexico SAB de CV | | | | | | | | | | | 9,780 | | | | 25,084 | |

X5 Retail Group NV, Registered Shares, GDR | | | | | | | | | | | 1,073 | | | | 25,215 | |

Total Food & Staples Retailing | | | | | | | | | | | | | | | 476,252 | |

Food Products — 3.7% | | | | | | | | | | | | | | | | |

BRF SA | | | | | | | | | | | 1,400 | | | | 8,224 | * |

Charoen Pokphand Foods PCL | | | | | | | | | | | 28,100 | | | | 21,404 | (a) |

Charoen Pokphand Indonesia Tbk PT | | | | | | | | | | | 133,000 | | | | 48,117 | |

China Huishan Dairy Holdings Co., Ltd. | | | | | | | | | | | 25,000 | | | | 0 | *(a)(b)(c) |

China Mengniu Dairy Co., Ltd. | | | | | | | | | | | 22,000 | | | | 64,827 | |

CJ CheilJedang Corp. | | | | | | | | | | | 32 | | | | 9,098 | |

Dali Foods Group Co., Ltd. | | | | | | | | | | | 20,000 | | | | 14,287 | |

Gruma SAB de CV, Class B Shares | | | | | | | | | | | 713 | | | | 7,482 | |

Grupo Bimbo SAB de CV, Class A Shares | | | | | | | | | | | 4,822 | | | | 9,044 | |

See Notes to Financial Statements.

| | |

| 14 | | Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report |

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Food Products — continued | | | | | | | | | | | | | | | | |

Indofood CBP Sukses Makmur Tbk PT | | | | | | | | | | | 42,700 | | | $ | 25,068 | |

Indofood Sukses Makmur Tbk PT | | | | | | | | | | | 74,600 | | | | 29,320 | |

Ioi Corp. Bhd | | | | | | | | | | | 12,600 | | | | 13,550 | |

Kuala Lumpur Kepong Berhad | | | | | | | | | | | 2,500 | | | | 14,888 | |

Nestle India Ltd. | | | | | | | | | | | 78 | | | | 10,704 | |

Nestle Malaysia Bhd | | | | | | | | | | | 300 | | | | 10,310 | |

PPB Group Bhd | | | | | | | | | | | 3,240 | | | | 12,977 | |

Sime Darby Plantation Bhd | | | | | | | | | | | 15,000 | | | | 18,855 | |

Standard Foods Corp. | | | | | | | | | | | 6,388 | | | | 9,589 | |

Thai Union Group PCL, Class F Shares | | | | | | | | | | | 20,400 | | | | 10,215 | (a) |

Tiger Brands Ltd. | | | | | | | | | | | 755 | | | | 13,477 | |

Tingyi Cayman Islands Holding Corp. | | | | | | | | | | | 16,000 | | | | 23,675 | |

Ulker Biskuvi Sanayi AS | | | | | | | | | | | 3,074 | | | | 8,108 | * |

Uni-President China Holdings Ltd. | | | | | | | | | | | 14,000 | | | | 13,590 | |

Uni-President Enterprises Corp. | | | | | | | | | | | 36,000 | | | | 87,141 | |

Want Want China Holdings Ltd. | | | | | | | | | | | 44,000 | | | | 31,431 | |

Total Food Products | | | | | | | | | | | | | | | 515,381 | |

Household Products — 0.9% | | | | | | | | | | | | | | | | |

Hindustan Unilever Ltd. | | | | | | | | | | | 1,954 | | | | 42,853 | |

Kimberly-Clark de Mexico SAB de CV, Class A Shares | | | | | | | | | | | 5,023 | | | | 7,260 | |

Unilever Indonesia Tbk PT | | | | | | | | | | | 27,000 | | | | 76,769 | |

Total Household Products | | | | | | | | | | | | | | | 126,882 | |

Personal Products — 0.7% | | | | | | | | | | | | | | | | |

Amorepacific Corp. | | | | | | | | | | | 64 | | | | 8,593 | |

Dabur India Ltd. | | | | | | | | | | | 1,738 | | | | 9,043 | |

Godrej Consumer Products Ltd. | | | | | | | | | | | 1,308 | | | | 12,822 | |

Hengan International Group Co., Ltd. | | | | | | | | | | | 6,000 | | | | 47,529 | |

LG Household & Health Care Ltd. | | | | | | | | | | | 18 | | | | 16,491 | |

Marico Ltd. | | | | | | | | | | | 1,923 | | | | 8,355 | |

Total Personal Products | | | | | | | | | | | | | | | 102,833 | |

Tobacco — 1.1% | | | | | | | | | | | | | | | | |

British American Tabacco Malaysia Bhd | | | | | | | | | | | 1,200 | | | | 8,918 | |

Gudang Garam Tbk PT | | | | | | | | | | | 8,400 | | | | 39,949 | |

Hanjaya Mandala Sampoerna Tbk PT | | | | | | | | | | | 160,400 | | | | 39,355 | |

ITC Ltd. | | | | | | | | | | | 10,017 | | | | 37,944 | |

KT&G Corp. | | | | | | | | | | | 238 | | | | 21,199 | |

Total Tobacco | | | | | | | | | | | | | | | 147,365 | |

Total Consumer Staples | | | | | | | | | | | | | | | 1,568,250 | |

See Notes to Financial Statements.

| | |

| Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report | | 15 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Energy — 9.3% | | | | | | | | | | | | | | | | |

Energy Equipment & Services — 0.5% | | | | | | | | | | | | | | | | |

China Oilfield Services Ltd., Class H Shares | | | | | | | | | | | 8,000 | | | $ | 7,501 | |

Dialog Group Bhd | | | | | | | | | | | 79,400 | | | | 64,324 | |

Total Energy Equipment & Services | | | | | | | | | | | | | | | 71,825 | |

Oil, Gas & Consumable Fuels — 8.8% | | | | | | | | | | | | | | | | |

Adaro Energy Tbk PT | | | | | | | | | | | 351,100 | | | | 38,107 | |

Bharat Petroleum Corp. Ltd. | | | | | | | | | | | 1,636 | | | | 6,087 | |

China Petroleum & Chemical Corp., Class H Shares | | | | | | | | | | | 64,000 | | | | 51,922 | |

China Shenhua Energy Co., Ltd., Class H Shares | | | | | | | | | | | 14,000 | | | | 31,717 | |

CNOOC Ltd. | | | | | | | | | | | 50,000 | | | | 85,848 | |

Coal India Ltd. | | | | | | | | | | | 2,841 | | | | 10,226 | |

Ecopetrol SA | | | | | | | | | | | 87,487 | | | | 102,247 | |

Empresas COPEC SA | | | | | | | | | | | 7,595 | | | | 106,401 | |

Formosa Petrochemical Corp. | | | | | | | | | | | 22,000 | | | | 86,740 | |

Gazprom PJSC | | | | | | | | | | | 9,719 | | | | 22,985 | |

Grupa Lotos SA | | | | | | | | | | | 821 | | | | 14,849 | |

GS Holdings Corp. | | | | | | | | | | | 252 | | | | 10,725 | |

Hindustan Petroleum Corp. Ltd. | | | | | | | | | | | 3,900 | | | | 11,822 | |

Kunlun Energy Co., Ltd. | | | | | | | | | | | 12,000 | | | | 13,624 | |

LUKOIL PJSC | | | | | | | | | | | 404 | | | | 30,389 | |

Novatek PJSC, Registered Shares, GDR | | | | | | | | | | | 86 | | | | 14,577 | |

Oil & Natural Gas Corp. Ltd. | | | | | | | | | | | 3,964 | | | | 8,215 | |

PetroChina Co., Ltd., Class H Shares | | | | | | | | | | | 74,000 | | | | 54,183 | |

Petroleo Brasileiro SA | | | | | | | | | | | 5,873 | | | | 47,781 | |

Petronas Dagangan Bhd | | | | | | | | | | | 4,200 | | | | 26,096 | |

Polski Koncern Naftowy ORLEN SA | | | | | | | | | | | 2,534 | | | | 61,019 | |

Polskie Gornictwo Naftowe i Gazownictwo SA | | | | | | | | | | | 15,554 | | | | 25,419 | * |

PTT Exploration & Production PCL | | | | | | | | | | | 4,100 | | | | 17,253 | (a) |

PTT PCL | | | | | | | | | | | 30,000 | | | | 46,154 | (a) |

Reliance Industries Ltd. | | | | | | | | | | | 5,241 | | | | 75,218 | |

Rosneft Oil Co. PJSC | | | | | | | | | | | 1,580 | | | | 11,067 | |

SK Innovation Co., Ltd. | | | | | | | | | | | 241 | | | | 45,153 | |

S-Oil Corp. | | | | | | | | | | | 167 | | | | 18,172 | |

Tatneft PJSC | | | | | | | | | | | 1,505 | | | | 17,957 | |

Thai Oil PCL | | | | | | | | | | | 4,600 | | | | 11,760 | (a) |

Ultrapar Participacoes SA | | | | | | | | | | | 884 | | | | 10,471 | |

United Tractor Tbk PT | | | | | | | | | | | 40,700 | | | | 89,686 | |

Yanzhou Coal Mining Co., Ltd., Class H Shares | | | | | | | | | | | 10,000 | | | | 9,452 | |

Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 1,213,322 | |

Total Energy | | | | | | | | | | | | | | | 1,285,147 | |

See Notes to Financial Statements.

| | |

| 16 | | Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report |

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Financials — 14.8% | | | | | | | | | | | | | | | | |

Banks — 12.2% | | | | | | | | | | | | | | | | |

Absa Group Ltd. | | | | | | | | | | | 1,300 | | | $ | 13,127 | |

Agricultural Bank of China Ltd., Class H Shares | | | | | | | | | | | 22,000 | | | | 9,654 | |

Akbank TAS | | | | | | | | | | | 16,315 | | | | 19,246 | |

Axis Bank Ltd. | | | | | | | | | | | 1,752 | | | | 13,799 | |

Banco de Chile | | | | | | | | | | | 214,320 | | | | 29,672 | |

Banco de Credito e Inversiones SA | | | | | | | | | | | 412 | | | | 25,890 | |

Banco do Brasil SA | | | | | | | | | | | 1,200 | | | | 13,778 | |

Banco Santander Chile | | | | | | | | | | | 587,888 | | | | 43,122 | |

Banco Santander Mexico SA Institucion de Banca Multiple Grupo | | | | | | | | | | | | | | | | |

Financiero Santand, Class B Shares | | | | | | | | | | | 10,184 | | | | 12,789 | |

Bancolombia SA | | | | | | | | | | | 1,498 | | | | 13,811 | |

Bangkok Bank PCL, Registered Shares | | | | | | | | | | | 2,190 | | | | 14,005 | |

Bank Central Asia Tbk PT | | | | | | | | | | | 61,400 | | | | 95,518 | |

Bank Danamon Indonesia Tbk PT | | | | | | | | | | | 20,600 | | | | 10,061 | |

Bank Mandiri Persero Tbk PT | | | | | | | | | | | 122,200 | | | | 55,061 | |

Bank Negara Indonesia Persero Tbk PT | | | | | | | | | | | 48,600 | | | | 23,417 | |

Bank of China Ltd., Class H Shares | | | | | | | | | | | 83,000 | | | | 35,362 | |

Bank of the Philippine Islands | | | | | | | | | | | 9,590 | | | | 14,724 | |

Bank Polska Kasa Opieki SA | | | | | | | | | | | 587 | | | | 16,044 | |

Bank Rakyat Indonesia Persero Tbk PT | | | | | | | | | | | 353,100 | | | | 73,163 | |

BDO Unibank Inc. | | | | | | | | | | | 18,580 | | | | 42,504 | |

China Construction Bank Corp., Class H Shares | | | | | | | | | | | 91,000 | | | | 72,202 | |

China Merchants Bank Co., Ltd., Class H Shares | | | | | | | | | | | 4,000 | | | | 15,409 | |

CIMB Group Holdings Bhd | | | | | | | | | | | 10,600 | | | | 14,490 | |

Commercial International Bank Egypt, SAE | | | | | | | | | | | 19,977 | | | | 89,432 | |

Creditcorp Ltd. | | | | | | | | | | | 384 | | | | 86,673 | |

CTBC Financial Holding Co., Ltd. | | | | | | | | | | | 23,880 | | | | 15,937 | |

Grupo Financiero Banorte SAB de CV, Class O Shares | | | | | | | | | | | 12,179 | | | | 67,351 | |

Grupo Financiero Inbursa SAB de CV, Class O Shares | | | | | | | | | | | 11,088 | | | | 14,493 | |

Hana Financial Group Inc. | | | | | | | | | | | 311 | | | | 10,453 | |

ICICI Bank Ltd. | | | | | | | | | | | 2,849 | | | | 13,678 | |

Industrial and Commercial Bank of China Ltd., Class H Shares | | | | | | | | | | | 52,000 | | | | 35,156 | |

Itau CorpBanca | | | | | | | | | | | 954,277 | | | | 8,839 | |

Kasikornbank PCL | | | | | | | | | | | 5,200 | | | | 31,294 | |

Kasikornbank PCL | | | | | | | | | | | 8,300 | | | | 49,950 | |

KB Financial Group Inc. | | | | | | | | | | | 329 | | | | 13,685 | |

Komercni banka AS | | | | | | | | | | | 1,240 | | | | 47,113 | |

See Notes to Financial Statements.

| | |

| Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report | | 17 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Banks — continued | | | | | | | | | | | | | | | | |

Krung Thai Bank PCL | | | | | | | | | | | 22,600 | | | $ | 13,703 | (a) |

Malayan Banking Berhad | | | | | | | | | | | 10,100 | | | | 22,906 | |

Mega Financial Holding Co., Ltd. | | | | | | | | | | | 18,000 | | | | 15,212 | |

Metropolitan Bank & Trust Co. | | | | | | | | | | | 8,170 | | | | 10,009 | |

Moneta Money Bank AS | | | | | | | | | | | 10,778 | | | | 35,772 | |

Nedbank Group Ltd. | | | | | | | | | | | 741 | | | | 12,491 | |

OTP Bank Nyrt | | | | | | | | | | | 2,541 | | | | 91,241 | |

Powszechna Kasa Oszczednosci Bank Polski SA | | | | | | | | | | | 2,736 | | | | 28,520 | |

Public Bank Berhad | | | | | | | | | | | 6,800 | | | | 39,976 | |

Santander Bank Polska SA | | | | | | | | | | | 153 | | | | 13,596 | |

Sberbank of Russia PJSC | | | | | | | | | | | 24,588 | | | | 70,989 | |

Shinhan Financial Group Co., Ltd. | | | | | | | | | | | 350 | | | | 13,069 | |

Siam Commercial Bank PCL | | | | | | | | | | | 13,700 | | | | 56,825 | (a) |

Standard Bank Group Ltd. | | | | | | | | | | | 1,517 | | | | 16,780 | |

State Bank of India | | | | | | | | | | | 2,565 | | | | 9,761 | * |

Turkiye Garanti Bankasi AS | | | | | | | | | | | 17,477 | | | | 21,802 | |

Turkiye Halk Bankasi AS | | | | | | | | | | | 9,343 | | | | 10,288 | |

Turkiye Is Bankasi AS, Class C Shares | | | | | | | | | | | 16,073 | | | | 11,445 | |

VTB Bank PJSC | | | | | | | | | | | 18,285,567 | | | | 10,240 | |

Yes Bank Ltd. | | | | | | | | | | | 2,100 | | | | 5,342 | |

Total Banks | | | | | | | | | | | | | | | 1,670,869 | |

Capital Markets — 0.2% | | | | | | | | | | | | | | | | |

B3 SA — Brasil Bolsa Balcao | | | | | | | | | | | 1,762 | | | | 12,660 | |

Moscow Exchange MICEX-RTS PJSC | | | | | | | | | | | 7,383 | | | | 9,872 | * |

Total Capital Markets | | | | | | | | | | | | | | | 22,532 | |

Diversified Financial Services — 1.0% | | | | | | | | | | | | | | | | |

Ayala Corp. | | | | | | | | | | | 2,210 | | | | 38,000 | |

FirstRand Ltd. | | | | | | | | | | | 5,620 | | | | 24,476 | |

Fubon Financial Holdings Co., Ltd. | | | | | | | | | | | 8,000 | | | | 12,526 | |

Grupo de Inversiones Suramericana SA | | | | | | | | | | | 1,483 | | | | 14,363 | |

GT Capital Holdings Inc. | | | | | | | | | | | 1,107 | | | | 15,724 | |

Haci Omer Sabanci Holding AS | | | | | | | | | | | 6,532 | | | | 8,300 | |

Metro Pacific Investments Corp. | | | | | | | | | | | 166,600 | | | | 14,946 | |

Remgro Ltd. | | | | | | | | | | | 988 | | | | 12,725 | |

Total Diversified Financial Services | | | | | | | | | | | | | | | 141,060 | |

Insurance — 1.1% | | | | | | | | | | | | | | | | |

Cathay Financial Holding Co., Ltd. | | | | | | | | | | | 6,000 | | | | 9,501 | |

China Life Insurance Co., Ltd., Class H Shares | | | | | | | | | | | 6,000 | | | | 11,955 | |

See Notes to Financial Statements.

| | |

| 18 | | Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report |

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Insurance — continued | | | | | | | | | | | | | | | | |

China Pacific Insurance Group Co., Ltd., Class H Shares | | | | | | | | | | | 2,800 | | | $ | 10,429 | |

Discovery Ltd. | | | | | | | | | | | 814 | | | | 8,706 | |

PICC Property & Casualty Co., Ltd., Class H Shares | | | | | | | | | | | 9,000 | | | | 8,725 | |

Ping An Insurance Group Co. of China Ltd., Class H Shares | | | | | | | | | | | 4,500 | | | | 42,392 | |

Powszechny Zaklad Ubezpieczen SA | | | | | | | | | | | 2,262 | | | | 23,137 | |

Samsung Fire & Marine Insurance Co., Ltd. | | | | | | | | | | | 50 | | | | 12,220 | |

Samsung Life Insurance Co., Ltd. | | | | | | | | | | | 121 | | | | 9,769 | |

Sanlam Ltd. | | | | | | | | | | | 3,176 | | | | 15,972 | |

Total Insurance | | | | | | | | | | | | | | | 152,806 | |

Thrifts & Mortgage Finance — 0.3% | | | | | | | | | | | | | | | | |

Housing Development Finance Corp., Ltd. | | | | | | | | | | | 1,944 | | | | 46,513 | |

Total Financials | | | | | | | | | | | | | | | 2,033,780 | |

| Health Care — 6.2% | | | | | | | | | | | | | | | | |

Biotechnology — 0.4% | | | | | | | | | | | | | | | | |

3SBio Inc. | | | | | | | | | | | 7,500 | | | | 10,887 | |

Celltrion Inc. | | | | | | | | | | | 168 | | | | 32,065 | * |

SillaJen Inc. | | | | | | | | | | | 148 | | | | 8,949 | * |

Total Biotechnology | | | | | | | | | | | | | | | 51,901 | |

Health Care Equipment & Supplies — 0.4% | | | | | | | | | | | | | | | | |

Hartalega Holdings Bhd | | | | | | | | | | | 16,400 | | | | 24,534 | |

Shandong Weigao Group Medical Polymer Co., Ltd., Class H Shares | | | | | | | | | | | 12,000 | | | | 10,730 | |

Top Glove Corp. Bhd | | | | | | | | | | | 17,400 | | | | 24,700 | |

Total Health Care Equipment & Supplies | | | | | | | | | | | | | | | 59,964 | |

Health Care Providers & Services — 2.1% | | | | | | | | | | | | | | | | |

Bangkok Dusit Medical Services PCL, Class F Shares | | | | | | | | | | | 110,300 | | | | 81,519 | (a) |

Bumrungrad Hospital PCL | | | | | | | | | | | 10,200 | | | | 59,384 | (a) |

Celltrion Healthcare Co., Ltd. | | | | | | | | | | | 90 | | | | 5,031 | * |

IHH Healthcare Bhd | | | | | | | | | | | 28,200 | | | | 33,696 | |

Life Healthcare Group Holdings Ltd. | | | | | | | | | | | 11,171 | | | | 18,535 | |

Netcare Ltd. | | | | | | | | | | | 11,508 | | | | 19,351 | |

Odontoprev SA | | | | | | | | | | | 6,800 | | | | 24,165 | |

Shanghai Pharmaceuticals Holding Co., Ltd., Class H Shares | | | | | | | | | | | 6,500 | | | | 14,361 | |

Sinopharm Group Co., Ltd., Class H Shares | | | | | | | | | | | 6,800 | | | | 32,788 | |

Total Health Care Providers & Services | | | | | | | | | | | | | | | 288,830 | |

Health Care Technology — 0.1% | | | | | | | | | | | | | | | | |

Alibaba Health Information Technology Ltd. | | | | | | | | | | | 20,000 | | | | 16,175 | * |

Life Sciences Tools & Services — 0.3% | | | | | | | | | | | | | | | | |

Genscript Biotech Corp. | | | | | | | | | | | 4,000 | | | | 6,102 | * |

See Notes to Financial Statements.

| | |

| Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report | | 19 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Life Sciences Tools & Services — continued | | | | | | | | | | | | | | | | |

Samsung Biologics Co., Ltd. | | | | | | | | | | | 35 | | | $ | 11,902 | * |

Wuxi Biologics Cayman Inc. | | | | | | | | | | | 2,500 | | | | 17,811 | * |

Total Life Sciences Tools & Services | | | | | | | | | | | | | | | 35,815 | |

Pharmaceuticals — 2.9% | | | | | | | | | | | | | | | | |

Aspen Pharmacare Holdings Ltd. | | | | | | | | | | | 4,011 | | | | 42,375 | |

Aurobindo Pharma Ltd. | | | | | | | | | | | 2,161 | | | | 23,133 | |

Cadila Healthcare Ltd. | | | | | | | | | | | 1,424 | | | | 6,934 | |

China Medical System Holdings Ltd. | | | | | | | | | | | 8,000 | | | | 9,521 | |

China Resources Pharmaceutical Group Ltd. | | | | | | | | | | | 7,500 | | | | 11,002 | |

China Traditional Chinese Medicine Holdings Co., Ltd. | | | | | | | | | | | 16,000 | | | | 10,184 | |

Cipla Ltd. | | | | | | | | | | | 1,908 | | | | 16,237 | |

CSPC Pharmaceutical Group Ltd. | | | | | | | | | | | 24,000 | | | | 50,637 | |

Dr. Reddy’s Laboratories Ltd. | | | | | | | | | | | 949 | | | | 32,629 | |

Glenmark Pharmaceuticals Ltd. | | | | | | | | | | | 1,438 | | | | 12,086 | |

Hypera SA | | | | | | | | | | | 7,700 | | | | 61,297 | |

Lupin Ltd. | | | | | | | | | | | 1,571 | | | | 18,812 | |

Piramal Enterprises Ltd. | | | | | | | | | | | 458 | | | | 13,458 | |

Shanghai Fosun Pharmaceutical Group Co., Ltd., Class H Shares | | | | | | | | | | | 2,500 | | | | 7,494 | |

Sihuan Pharmaceutical Holdings Group Ltd. | | | | | | | | | | | 54,000 | | | | 10,952 | |

Sino Biopharmaceutical Ltd. | | | | | | | | | | | 35,000 | | | | 31,386 | |

SSY Group Ltd. | | | | | | | | | | | 10,000 | | | | 8,406 | |

Sun Pharmaceutical Industies Ltd. | | | | | | | | | | | 4,161 | | | | 32,652 | |

Yuhan Corp. | | | | | | | | | | | 41 | | | | 6,027 | |

Total Pharmaceuticals | | | | | | | | | | | | | | | 405,222 | |

Total Health Care | | | | | | | | | | | | | | | 857,907 | |

| Industrials — 9.5% | | | | | | | | | | | | | | | | |

Aerospace & Defense — 0.3% | | | | | | | | | | | | | | | | |

Aselsan Elektronik Sanayi Ve Ticaret AS | | | | | | | | | | | 3,556 | | | | 16,031 | |

Embraer SA | | | | | | | | | | | 3,552 | | | | 19,871 | |

Total Aerospace & Defense | | | | | | | | | | | | | | | 35,902 | |

Airlines — 1.1% | | | | | | | | | | | | | | | | |

Air China Ltd., Class H Shares | | | | | | | | | | | 10,000 | | | | 8,049 | |

AirAsia Group Bhd | | | | | | | | | | | 15,300 | | | | 9,616 | |

Eva Airways Corp. | | | | | | | | | | | 27,686 | | | | 12,661 | |

Latam Airlines Group SA | | | | | | | | | | | 10,534 | | | | 95,750 | |

Turk Hava Yollari AO | | | | | | | | | | | 9,399 | | | | 23,568 | * |

Total Airlines | | | | | | | | | | | | | | | 149,644 | |

See Notes to Financial Statements.

| | |

| 20 | | Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report |

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Commercial Services & Supplies — 0.1% | | | | | | | | | | | | | | | | |

China Everbright International Ltd. | | | | | | | | | | | 13,000 | | | $ | 10,364 | |

Construction & Engineering — 0.8% | | | | | | | | | | | | | | | | |

China Communications Construction Co., Ltd., Class H Shares | | | | | | | | | | | 20,000 | | | | 18,292 | |

China Railway Construction Corp. Ltd., Class H Shares | | | | | | | | | | | 9,000 | | | | 11,389 | |

China Railway Group Ltd., Class H Shares | | | | | | | | | | | 20,000 | | | | 17,859 | |

China State Construction International Holdings Ltd. | | | | | | | | | | | 8,000 | | | | 5,705 | |

Gamuda Berhad | | | | | | | | | | | 14,700 | | | | 8,396 | |

Ijm Corp. Berhad | | | | | | | | | | | 26,900 | | | | 10,478 | |

Larsen & Toubro Ltd. | | | | | | | | | | | 2,391 | | | | 41,954 | |

Total Construction & Engineering | | | | | | | | | | | | | | | 114,073 | |

Electrical Equipment — 0.4% | | | | | | | | | | | | | | | | |

Bharat Heavy Electricals Ltd. | | | | | | | | | | | 8,775 | | | | 8,158 | |

Havells India Ltd. | | | | | | | | | | | 1,671 | | | | 14,594 | |

Shanghai Electric Group Co., Ltd., Class H Shares | | | | | | | | | | | 22,000 | | | | 7,156 | |

Teco Electric and Machinery Co., Ltd. | | | | | | | | | | | 12,000 | | | | 6,884 | |

Zhuzhou CRRC Times Electric Co., Ltd., Class H Shares | | | | | | | | | | | 2,800 | | | | 14,965 | |

Total Electrical Equipment | | | | | | | | | | | | | | | 51,757 | |

Industrial Conglomerates — 3.3% | | | | | | | | | | | | | | | | |

Aboitiz Equity Ventures Inc. | | | | | | | | | | | 25,070 | | | | 22,022 | |

Alfa SAB de CV, Class A Shares | | | | | | | | | | | 23,990 | | | | 25,446 | |

Alliance Global Group Inc. | | | | | | | | | | | 56,700 | | | | 12,038 | * |

Bidvest Group Ltd. | | | | | | | | | | | 8,479 | | | | 105,524 | |

CITIC Ltd. | | | | | | | | | | | 22,000 | | | | 33,003 | |

DMCI Holdings Inc. | | | | | | | | | | | 45,200 | | | | 10,847 | |

Far Eastern New Century Corp. | | | | | | | | | | | 18,000 | | | | 18,062 | |

Fosun International Ltd. | | | | | | | | | | | 12,000 | | | | 17,512 | |

Grupo Carso SAB de CV, Series A1 Shares | | | | | | | | | | | 2,558 | | | | 7,514 | |

HAP Seng Consolidated Berhad | | | | | | | | | | | 5,200 | | | | 12,240 | |

JG Summit Holdings Inc. | | | | | | | | | | | 37,750 | | | | 33,372 | |

KOC Holding AS | | | | | | | | | | | 11,909 | | | | 33,113 | |

LG Corp. | | | | | | | | | | | 189 | | | | 10,996 | |

Samsung C&T Corp. | | | | | | | | | | | 155 | | | | 14,758 | |

Siemens Ltd. | | | | | | | | | | | 567 | | | | 7,144 | |

Sime Darby Berhad | | | | | | | | | | | 22,900 | | | | 12,040 | |

SK Holdings Co., Ltd. | | | | | | | | | | | 58 | | | | 13,310 | |

SM Investments Corp. | | | | | | | | | | | 3,345 | | | | 56,266 | |

Turkiye Sise ve Cam Fabrikalari AS | | | | | | | | | | | 8,750 | | | | 7,386 | |

Total Industrial Conglomerates | | | | | | | | | | | | | | | 452,593 | |

See Notes to Financial Statements.

| | |

| Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report | | 21 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Machinery — 0.7% | | | | | | | | | | | | | | | | |

Airtac International Group | | | | | | | | | | | 1,000 | | | $ | 8,613 | |

Ashok Leyland Ltd. | | | | | | | | | | | 6,394 | | | | 9,918 | |

China Conch Venture Holdings Ltd. | | | | | | | | | | | 6,500 | | | | 18,241 | |

CRRC Corp. Ltd., Class H Shares | | | | | | | | | | | 17,000 | | | | 14,919 | |

Haitian International Holdings Ltd. | | | | | | | | | | | 5,000 | | | | 9,758 | |

Hiwin Technologies Corp. | | | | | | | | | | | 1,091 | | | | 7,052 | |

WEG SA | | | | | | | | | | | 4,651 | | | | 22,551 | |

Weichai Power Co., Ltd., Class H Shares | | | | | | | | | | | 8,000 | | | | 7,909 | |

Total Machinery | | | | | | | | | | | | | | | 98,961 | |

Marine — 0.1% | | | | | | | | | | | | | | | | |

MISC Berhad | | | | | | | | | | | 10,200 | | | | 14,869 | |

Professional Services — 0.0% | | | | | | | | | | | | | | | | |

51Job Inc., ADR | | | | | | | | | | | 133 | | | | 8,167 | * |

Road & Rail — 0.5% | | | | | | | | | | | | | | | | |

BTS Group Holdings PCL | | | | | | | | | | | 69,400 | | | | 19,156 | (a) |

Localiza Rent a Car SA | | | | | | | | | | | 2,600 | | | | 20,019 | |

Rumo SA | | | | | | | | | | | 5,500 | | | | 24,579 | * |

Total Road & Rail | | | | | | | | | | | | | | | 63,754 | |

Transportation Infrastructure — 2.2% | | | | | | | | | | | | | | | | |

Adani Ports & Special Economic Zone Ltd. | | | | | | | | | | | 3,433 | | | | 14,803 | |

Airports of Thailand PCL | | | | | | | | | | | 48,800 | | | | 94,214 | (a) |

Bangkok Expressway & Metro PCL | | | | | | | | | | | 96,800 | | | | 24,821 | (a) |

Beijing Capital International Airport Co., Ltd., Class H Shares | | | | | | | | | | | 8,000 | | | | 8,664 | |

CCR SA | | | | | | | | | | | 6,734 | | | | 19,706 | |

China Merchants Port Holdings Co., Ltd. | | | | | | | | | | | 6,000 | | | | 10,210 | |

COSCO SHIPPING Ports Ltd. | | | | | | | | | | | 10,000 | | | | 10,205 | |

Grupo Aeroportuario del Pacifico SAB de CV, Class B Shares | | | | | | | | | | | 3,176 | | | | 26,495 | |

Grupo Aeroportuario del Sureste SAB de CV, Class B Shares | | | | | | | | | | | 1,674 | | | | 27,701 | |

International Container Terminal Services Inc. | | | | | | | | | | | 6,270 | | | | 10,605 | |

Malaysia Airports Holdings Bhd | | | | | | | | | | | 8,000 | | | | 15,868 | |

Promotora y Operadora de Infraestructura SAB de CV | | | | | | | | | | | 1,616 | | | | 14,719 | |

TAV Havalimanlari Holding AS | | | | | | | | | | | 2,983 | | | | 12,383 | |

Westports Holdings Berhad | | | | | | | | | | | 9,800 | | | | 7,986 | |

Zhejiang Expressway Co., Ltd., Class H Shares | | | | | | | | | | | 10,000 | | | | 8,381 | |

Total Transportation Infrastructure | | | | | | | | | | | | | | | 306,761 | |

Total Industrials | | | | | | | | | | | | | | | 1,306,845 | |

See Notes to Financial Statements.

| | |

| 22 | | Legg Mason Emerging Markets Diversified Core ETF 2018 Annual Report |

Legg Mason Emerging Markets Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Information Technology — 2.0% | | | | | | | | | | | | | | | | |

Electronic Equipment, Instruments & Components — 0.2% | | | | | | | | | | | | | | | | |