UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23096

Legg Mason ETF Investment Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| | |

| Annual Report | | October 31, 2018 |

LEGG MASON

DEVELOPED EX-US DIVERSIFIED CORE ETF

DDBI

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks to track the investment results of an index composed of publicly traded equity securities of developed markets outside the United States.

Letter from the president

Dear Shareholder,

We are pleased to provide the annual report of Legg Mason Developed ex-US Diversified Core ETF for the twelve-month reporting period ended October 31, 2018. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund net asset value and market price, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

November 30, 2018

| | |

| II | | Legg Mason Developed ex-US Diversified Core ETF |

Investment commentary

Economic review

Economic activity in the U.S. was mixed during the twelve months ended October 31, 2018 (the “reporting period”). Looking back, the U.S. Department of Commerce reported that fourth quarter 2017 and first quarter 2018 U.S. gross domestic product (“GDP”)i growth was 2.3% and 2.2%, respectively. GDP growth then accelerated to 4.2% during the second quarter of 2018 — the strongest reading since the third quarter of 2014. Finally, the U.S. Department of Commerce’s second reading for third quarter 2018 GDP growth — released after the reporting period ended — was 3.5%. The deceleration in GDP growth in the third quarter of 2018 reflected a downturn in exports and decelerations in nonresidential fixed investment and personal consumption expenditures. Imports increased in the third quarter after decreasing in the second. These movements were partly offset by an upturn in private inventory investment.

Job growth in the U.S. was solid overall and supported the economy during the reporting period. As reported by the U.S. Department of Labor, when the reporting period ended on October 31, 2018, the unemployment rate was 3.7%, versus 4.1% when the period began. October 2018’s reading equaled the lowest unemployment rate since 1969. The percentage of longer-term unemployed also declined during the reporting period. In October 2018, 22.5% of Americans looking for a job had been out of work for more than six months, versus 23.8% when the period began.

Turning to the global economy, in its October 2018 World Economic Outlook, the International Monetary Fund (“IMF”)ii said, “Global growth for 2018–19 is projected to remain steady at its 2017 level, but its pace is less vigorous than projected in April [2018] and it has become less balanced. Downside risks to global growth have risen in the past six months and the potential for upside surprises has receded.” From a regional perspective, the IMF projects 2018 growth in the Eurozone will be 2.0%, versus 2.4% in 2017. Japan’s economy is expected to expand 1.1% in 2018, compared to 1.7% in 2017. Elsewhere, the IMF projects that overall growth in emerging market countries will be 4.7% in 2018, the same as in 2017.

Looking back, at its meeting that concluded on September 20, 2017, the Federal Reserve Board (the “Fed”)iii kept the federal funds rateiv on hold, but reiterated its intention to begin reducing its balance sheet, saying, “In October, the Committee will initiate the balance sheet normalization program….” At its meeting that ended on December 13, 2017, the Fed raised rates to a range between 1.25% and 1.50%. As expected, the Fed kept rates on hold at its meeting that concluded on January 31, 2018. However, at its meeting that ended on March 21, 2018, the Fed again raised the federal funds rate, moving it to a range between 1.50% and 1.75%. At its meeting that concluded on June 13, 2018, the Fed raised the federal funds rate to a range between 1.75% and 2.00%. Finally, at its meeting that ended on September 26, 2018, the Fed raised the federal funds rate to a range between 2.00% and 2.25%.

Central banks outside the U.S. took different approaches to monetary policy during the reporting period. Looking back, in December 2016, the European Central Bank (“ECB”)v extended its bond buying program until December 2017. From April 2017 through

| | |

| Legg Mason Developed ex-US Diversified Core ETF | | III |

Investment commentary (cont’d)

December 2017, the ECB purchased €60 billion-per-month of bonds. In October 2017, the ECB announced that it would continue to buy bonds through September 2018, but after December 2017 it would pare its purchases to €30 billion-per-month. In June 2018, the ECB announced it would end its bond buying program by the end of the year, but it did not anticipate raising interest rates “at least through the summer of 2019”. In other developed countries, on November 2, 2017, the Bank of Englandvi raised rates from 0.25% to 0.50% — the first increase since July 2007. It then raised rates to 0.75% at its meeting on August 2, 2018. After holding rates steady at 0.10% for more than five years, in January 2016, the Bank of Japanvii announced that it cut the rate on current accounts that commercial banks hold with it to -0.10% and kept rates on hold during the reporting period. Elsewhere, the People’s Bank of Chinaviii kept rates steady at 4.35% during the reporting period.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

November 30, 2018

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. Forecasts and predictions are inherently limited and should not be relied upon as an indication of actual or future performance.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The International Monetary Fund (“IMF”) is an organization of 189 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. |

| iii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iv | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| v | The European Central Bank (“ECB”) is responsible for the monetary system of the European Union and the euro currency. |

| vi | The Bank of England (“BoE”), formally the Governor and Company of the BoE, is the central bank of the United Kingdom. The BoE’s purpose is to maintain monetary and financial stability. |

| vii | The Bank of Japan is the central bank of Japan. The bank is responsible for issuing and handling currency and treasury securities, implementing monetary policy, maintaining the stability of the Japanese financial system and the yen currency. |

| viii | The People’s Bank of China is the central bank of the People’s Republic of China with the power to carry out monetary policy and regulate financial institutions in mainland China. |

| | |

| IV | | Legg Mason Developed ex-US Diversified Core ETF |

Fund overview

Q. What is the Fund’s investment strategy?

A. Legg Mason Developed ex-US Diversified Core ETF (the “Fund”) seeks to track the investment results of the QS DBI Developed ex-US Diversified Index (the “Underlying Index”). The Underlying Index seeks to provide exposure to equity markets in developed countries outside the United States and is based on a proprietary methodology created and sponsored by QS Investors, LLC (“QS Investors”), the Fund’s subadviser. The Underlying Index is composed of equity securities in developed markets outside the United States that are included in the MSCI World ex-US Indexi.

The proprietary rules-based process initially groups this universe of securities into multiple investment categories based on geography and sector. Within each of these investment categories, securities are weighted by market capitalization. The process then combines those investment categories with more highly correlated historical performance into a smaller number of “clusters.” A cluster is a group of investment categories based on geography and sector that have demonstrated a tendency to behave similarly (high correlation). Thereafter, each of these clusters is equally weighted in the Underlying Index to produce a highly diversified portfolio. QS Investors anticipates that the number of component securities in the Underlying Index will range from 900 to 1,000. The Underlying Index may include large, medium and small capitalization companies. The components of the Underlying Index, and the degree to which these components represent certain countries and sectors, may change over time. The Underlying Index’s components are reconstituted annually and rebalanced quarterly. The Underlying Index is reconstituted on a different date from the MSCI World ex-US Index. Securities that are removed from, or added to, the MSCI World ex-US Index are removed from, or considered for inclusion in, the Underlying Index at the next annual reconstitution or quarterly rebalancing of the Underlying Index. The Fund’s portfolio is rebalanced when the Underlying Index is rebalanced or reconstituted. The Fund may trade at times other than when the Underlying Index is rebalanced or reconstituted for a variety of reasons, including when adjustments may be made to its representative sampling process from time to time or when investing cash.

The term “diversified” highlights the purpose of QS Investors’ Diversification Based Investing methodology, which seeks to avoid concentration risks often identified with market cap-weighted funds. The term “core” highlights the segment of the investment universe where the Fund invests — as opposed to introducing value or size biases or investing in niche segments of the market.

The Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, if any, in securities that compose the Underlying Index. Securities that compose the Underlying Index include depositary receipts representing securities in the Underlying Index. The equity securities that the Fund will hold are principally common stocks.

The Fund may invest up to 20% of its net assets in certain index futures, options, options on index futures, swap contracts or other derivatives related to its Underlying Index and its component securities; cash and cash equivalents; other investment companies, including exchange-traded

| | |

| Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report | | 1 |

Fund overview (cont’d)

funds; exchange-traded notes; depository receipts; and in securities and other instruments not included in its Underlying Index but which QS Investors believes will help the Fund track its Underlying Index. The Fund may invest in exchange-traded equity index futures and currency derivatives to gain exposure to local markets and may also use currency derivatives for cash management purposes.

Q. What were the overall market conditions during the Fund’s reporting period?

A. After a prolonged period of steady upward momentum in global equity markets during 2017, volatility returned in 2018, marked by two key episodes during the twelve-month reporting period ended October 31, 2018, the first in February 2018 and the second in October 2018.

For much of the reporting period, global equity returns were positive across most regions and sectors, although non-U.S. developed markets underperformed the U.S., which hit all-time highs in September 2018. In non-U.S. markets, growth slowed over the reporting period; a strong first quarter tapered off to more mixed results across regions and sectors for the remainder of the period, even prior to the significant decline in October 2018.

International equities ended 2017 with double-digit gains. Most major equity markets posted positive returns in each quarter of 2017, in spite of geopolitical tensions in the Middle East and the Korean peninsula as well as rate hikes in the U.S. and the United Kingdom. This persistent trend of global equity growth ended early in the first quarter of 2018. Despite a backdrop of solid global economic gains, the market in early February 2018 dipped into correction territory. The sell-off was believed to be sparked by a report that inflation in the U.S. was rising higher than expected, leading to fear that the U.S. Federal Reserve Board (the “Fed”)ii would accelerate their rate tightening schedule. Aside from inflation, global manufacturing indicators weakened slightly off a nearly three-and-a-half year high in January 2018. Equities remained volatile through the end of the quarter amid talks of new tariffs and trade friction between the U.S. and China. For the first quarter of 2018, only emerging markets stayed positive among the major regions.

Many developed markets outside the U.S. and all emerging markets declined in U.S. dollar terms in the second quarter of 2018, as the U.S. dollar continued to strengthen and global trade tensions increased amid tariff implementation. Equity market performance continued to be driven by a narrow segment of stocks, as the rally in momentum/growth stocks continued.

In the third quarter of 2018, equity markets outside the U.S. were modestly positive overall, but mixed among major regions. In keeping with the general trend of 2018, developed markets outperformed emerging markets, which declined slightly. Large cap indices outperformed small caps and growth stocks continued to outperform value. While business optimism in the U.S. reached new highs in September 2018, it deteriorated in other regions on weakening economic expansion, higher costs for oil and other commodities, and trade tensions.

The final month of the reporting period proved to be a challenging month for investors, as volatility returned in earnest. Throughout the month, practically every

| | |

| 2 | | Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report |

asset class sold off to some extent, both in the U.S. and abroad. The narrow, growth-based names that had driven most of the gains for most of 2018 became expensive on most fundamental metrics. Investors reacted to this rising risk by pivoting towards value; value indices solidly outperformed growth indices for the month of October. Most equity market regions and sectors had negative returns in U.S. dollar terms. In many markets, inflationary pressures, including commodity prices and interest rate hikes, were cited as causes for less optimistic views of business growth. Economic expansion weakened across a number of major markets as growth was impacted by tense trade negotiations. Growth and solvency in emerging markets and concerns about the outcome of the U.S. mid-term elections were also deemed to be catalysts.

From a regional perspective, Japan was the best performing developed region outside the U.S. for the reporting period, and prior to October 2018 had positive returns in most sectors, a number in double digits. October 2018 brought the twelve months return into negative territory, with wide performance dispersion across sectors. While business sentiment declined in the final months of the reporting period on the high cost of the materials, the economy is experiencing moderate growth with a rising gross domestic product (“GDP”)iii. The Bank of Japan (“BoJ”)iv reported that inflation is on trend, and the BoJ will continue an accommodative stance.

The U.K. also had a positive return for the early part of the reporting period despite periods of difficulty around Brexit negotiations. However, the third calendar quarter of 2018 as well as the final month of the reporting period saw negative returns across most sectors despite an uptick in manufacturing and the rate of job creation, likely as a result of fears around rising inflation and Brexit. The Bank of Englandv left interest rates unchanged in September 2018 and noted that news about difficult Brexit negotiations was making private companies take cost-cutting measures and hold back on investments.

Continental Europe was the laggard among the major regions throughout much of the period. Widely mixed returns among European markets persisted. By the end of the period, most markets experienced somewhat reduced trade activity, growth slowdowns, and rising input costs as well as reduced output prices, sending business sentiment down on these and other worries, including trade protectionism and higher tariffs. In October 2018, exports declined for the first time in over five years.

Across the smaller regions, the resource-based Australia, New Zealand & Canada region and Asia Developed ex-Japan posted negative returns and underperformed the MSCI World ex-US Index overall. Both were in positive territory until October 2018. Emerging Markets declined as well, underperforming developed markets throughout much of the reporting period.

The Fund uses a passive investment approach to achieve its investment objective, and therefore made no change in investment approach in response to market conditions.

Performance review

For the twelve months ended October 31, 2018, Legg Mason Developed ex-US Diversified Core ETF generated a -4.83% return on a net asset value (“NAV”)vi basis and -5.64% based on its market pricevii per share.

| | |

| Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report | | 3 |

Fund overview (cont’d)

The performance table shows the Fund’s total return for the twelve months ended October 31, 2018 based on its NAV and market price as of October 31, 2018. The Fund’s seeks to track the investment results of the QS DBI Developed ex-US Diversified Index, which returned -4.62% for the same period. The Fund’s broad-based market index, the MSCI World ex-US Index returned -6.76% over the same time frame. The Lipper International Multi-Cap Core Funds Category Average1 returned -8.49% for the same period. Please note that Lipper performance returns are based on each fund’s NAV.

| | | | | | | | |

Performance Snapshot as of October 31, 2018

(unaudited) | |

| | | 6 months | | | 12 months | |

| Legg Mason Developed ex-US Diversified Core ETF: | | | | | | | | |

$27.29 (NAV) | | | -8.09 | % | | | -4.83 | %*† |

$27.34 (Market Price) | | | -8.32 | % | | | -5.64 | %*‡ |

| QS DBI Developed ex-US Diversified Index | | | -8.03 | % | | | -4.62 | % |

| MSCI World ex-US Index | | | -9.52 | % | | | -6.76 | % |

| Lipper International Multi-Cap Core Funds Category Average1 | | | -10.71 | % | | | -8.49 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Principal value and investment returns will fluctuate so shares, when sold, may be worth more or less than their original cost. Performance data current to the most recent month-end is available at www.leggmason.com/etf.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the ETF. Market price returns shown are typically based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV is determined, which is typically 4:00 p.m. Eastern time (US). These returns do not represent investors’ returns had they traded shares at other times. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Information showing the number of days the market price of the Fund’s shares was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV (i.e., premium or discount) for various time periods is available by visiting the Fund’s website at www.leggmason.com/etf.

As of the Fund’s current prospectus dated March 1, 2018, the gross total annual fund operating expense ratio for the Fund was 0.40%.

* Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions at NAV.

‡ Total return assumes the reinvestment of all distributions at market price.

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended October 31, 2018, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 423 funds for the six-month period and among the 406 funds for the twelve-month period in the Fund’s Lipper category. |

| | |

| 4 | | Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report |

What were the leading contributors to performance?

A. Looking at the Underlying Index by country during the reporting period, Israel, Norway and Finland were the leading contributors to performance and were the only countries with positive returns for the reporting period. From a sector perspective, the Health Care and Energy sectors led the way, with double digit positive returns. Those sectors, along with the Consumer Staples sector, were the only ones in positive territory for the period.

What were the leading detractors from performance?

A. As represented in the Underlying Index, from a country perspective, Germany, France and Spain were the leading detractors from performance for the reporting period. From a sector perspective the Financials, Communication Services1 and Industrials sectors were the leading detractors for the period.

Looking for additional information?

The Fund’s daily NAV is available on-line at www.leggmason.com/etf. The Fund is traded under the symbol “DDBI” and its closing market price is available on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-877-721-1926 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in Legg Mason Developed ex-US Diversified Core ETF. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

QS Investors, LLC

November 20, 2018

RISKS: Equity securities are subject to market and price fluctuations. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. In rising markets, the value of large-cap stocks may not rise as much as smaller-cap stocks. Small-and mid-cap stocks involve greater risks and volatility than large-cap stocks. Diversification does not guarantee a profit or protect against a loss. The Fund may focus its investments in certain industries, increasing its vulnerability to market volatility. There is no guarantee that the Fund will achieve a high degree of correlation to the index it seeks to track. The Fund does not seek to outperform the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the

| 1 | As of September 28, 2018, the Telecommunication Services sector was broadened to include some companies previously classified in the Consumer Discretionary and Information Technology sectors and renamed the Communication Services sector. |

| | |

| Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report | | 5 |

Fund overview (cont’d)

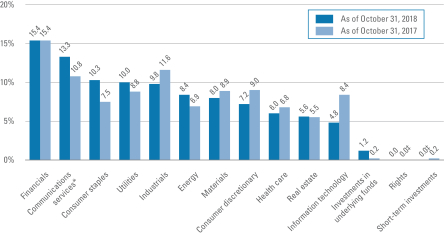

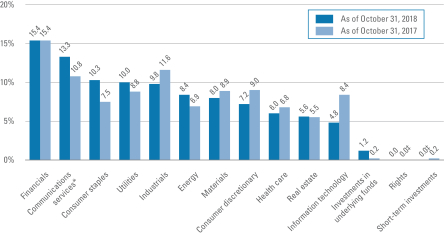

appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of October 31, 2018 were: Financials (15.3%), Communication Services (13.3%), Consumer Staples (10.2%), Utilities (10.0%) and Industrials (9.7%). The Fund’s composition may differ over time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. An index is a statistical composite that tracks a specified financial market, sector or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | MSCI World ex-US Index captures large and mid-cap companies across 22 of 23 developed markets countries, excluding the United States. |

| ii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iii | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| iv | The Bank of Japan (“BoJ”) is the central bank of Japan. The bank is responsible for issuing and handling currency and treasury securities, implementing monetary policy, maintaining the stability of the Japanese financial system and the yen currency. |

| v | The Bank of England (“BoE”), formally the Governor and Company of the BoE, is the central bank of the United Kingdom. The BoE’s purpose is to maintain monetary and financial stability. |

| vi | Net Asset Value (NAV) is calculated by subtracting total liabilities from total assets and dividing the results by the number of shares outstanding. |

| vii | Market Price is determined by supply and demand. It is the price at which an investor purchases or sells shares of the Fund. The Market Price may differ from the Fund’s NAV. |

| | |

| 6 | | Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report |

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of October 31, 2018 and October 31, 2017. The composition of the Fund’s investments is subject to change at any time. |

| ‡ | Represents less than 0.1% |

| * | As of September 28, 2018, the Telecommunication Services sector was broadened to include some companies previously classified in the Consumer Discretionary and Information Technology sectors and renamed the Communication Services sector. |

| | |

| Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report | | 7 |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, such as brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

This example is based on an investment of $1,000 invested on May 1, 2018 and held for the six months ended October 31, 2018.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on actual total return1 | | | | Based on hypothetical total return1 |

Actual

Total

Return2 | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period3 | | | | Hypothetical

Annualized

Total Return | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period3 |

| | | -8.09% | | | | $ | 1,000.00 | | | | $ | 919.10 | | | | | 0.40 | % | | | $ | 1.93 | | | | | | | 5.00 | % | | | | $1,000.00 | | | | $ | 1,023.19 | | | | | 0.40 | % | | | $ | 2.04 | |

| 1 | For the six months ended October 31, 2018. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of fee waivers and/or reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| | |

| 8 | | Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report |

Fund performance (unaudited)

| | | | |

| Net Asset Value | | | |

| Average annual total returns1 | | | |

| Twelve Months Ended 10/31/18 | | | -4.83 | % |

| Inception* through 10/31/18 | | | 4.90 | |

| |

| Cumulative total returns1 | | | |

| Inception date of 12/28/15 through 10/31/18 | | | 14.58 | % |

| | | | |

| Market Price | | | |

| Average annual total returns2 | | | |

| Twelve Months Ended 10/31/18 | | | -5.64 | % |

| Inception* through 10/31/18 | | | 4.96 | |

| |

| Cumulative total returns2 | | | |

| Inception date of 12/28/15 through 10/31/18 | | | 14.75 | % |

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

Investors buy and sell shares of the Fund at market price, not NAV, in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the Fund. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is typically based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV is determined, which is typically 4:00 p.m. Eastern time (US). These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other exchange-traded funds, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at market price. |

| * | Inception date of the Fund is December 28, 2015. |

| | |

| Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report | | 9 |

Fund performance (unaudited) (cont’d)

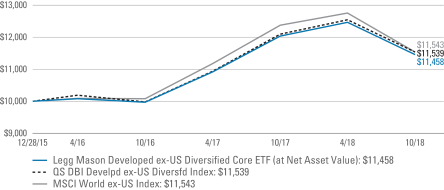

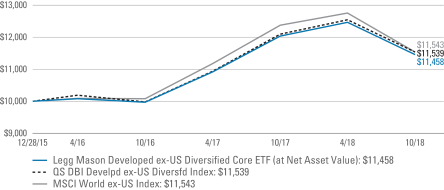

Historical performance

Value of $10,000 invested in

Legg Mason Developed ex-US Diversified Core ETF vs QS DBI Developed ex-US Diversified Index and MSCI World ex-US Index† — December 28, 2015 - October 2018

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in Legg Mason Developed ex-US Diversified Core ETF on December 28, 2015, assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through October 31, 2018. The hypothetical illustration also assumes a $10,000 investment in the QS DBI Developed ex-US Diversified Index and the MSCI World ex-US Index. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund. The QS DBI Developed ex-US Diversified Index (the “Underlying Index”) is an index composed of publicly traded equity securities of developed markets outside the United States that are included in the MSCI World ex-US Index. The Underlying Index is based on a proprietary methodology created and sponsored by QS Investors, LLC, the Fund’s subadvisor. The MSCI World ex-US Index captures large and mid-cap companies across 22 of 23 developed markets countries, excluding the United States. The indices are not subject to the same management and trading expenses as a fund. An index is a statistical composite that tracks a specified financial market, sector, or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. Theses expenses negatively impact fund performance. All index performance reflects no deductions for fees, expenses or taxes. Please note that an investor cannot invest directly in an index. |

| | |

| 10 | | Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report |

Schedule of investments

October 31, 2018

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Common Stocks — 98.2% | | | | | | | | | | | | | | | | |

| Communication Services — 13.2% | | | | | | | | | | | | | | | | |

Diversified Telecommunication Services — 8.5% | | | | | | | | | | | | | | | | |

BCE Inc. | | | | | | | | | | | 818 | | | $ | 31,736 | |

BT Group PLC | | | | | | | | | | | 4,611 | | | | 14,172 | |

Deutsche Telekom AG, Registered Shares | | | | | | | | | | | 3,752 | | | | 61,621 | |

Iliad SA | | | | | | | | | | | 69 | | | | 7,994 | |

Nippon Telegraph & Telephone Corp. | | | | | | | | | | | 900 | | | | 37,880 | |

Orange SA | | | | | | | | | | | 4,862 | | | | 76,133 | |

Singapore Telecommunications Ltd. | | | | | | | | | | | 50,052 | | | | 114,214 | |

Swisscom AG, Registered Shares | | | | | | | | | | | 243 | | | | 111,463 | |

Telecom Italia SpA | | | | | | | | | | | 87,241 | | | | 51,322 | * |

Telecom Italia SpA, Savings Shares | | | | | | | | | | | 43,397 | | | | 21,970 | |

Telefonica SA | | | | | | | | | | | 10,412 | | | | 85,389 | |

Telenor ASA | | | | | | | | | | | 5,591 | | | | 102,874 | |

Telia Co., AB | | | | | | | | | | | 14,024 | | | | 63,309 | |

Telstra Corp. Ltd. | | | | | | | | | | | 39,689 | | | | 86,639 | |

TELUS Corp. | | | | | | | | | | | 1,075 | | | | 36,902 | |

TPG Telecom Ltd. | | | | | | | | | | | 3,291 | | | | 16,724 | |

United Internet AG, Registered Shares | | | | | | | | | | | 132 | | | | 5,471 | |

Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 925,813 | |

Entertainment — 0.3% | | | | | | | | | | | | | | | | |

Nintendo Co., Ltd. | | | | | | | | | | | 100 | | | | 31,155 | |

Vivendi SA | | | | | | | | | | | 304 | | | | 7,350 | |

Total Entertainment | | | | | | | | | | | | | | | 38,505 | |

Interactive Media & Services — 0.1% | | | | | | | | | | | | | | | | |

Auto Trader Group PLC | | | | | | | | | | | 2,023 | | | | 10,588 | |

Media — 0.9% | | | | | | | | | | | | | | | | |

Altice USA, Inc., Class A Shares | | | | | | | | | | | 1,854 | | | | 30,239 | |

Shaw Communications Inc., Class B Shares | | | | | | | | | | | 1,131 | | | | 21,108 | |

Singapore Press Holdings Ltd. | | | | | | | | | | | 19,859 | | | | 38,003 | |

WPP PLC | | | | | | | | | | | 674 | | | | 7,653 | |

Total Media | | | | | | | | | | | | | | | 97,003 | |

Wireless Telecommunication Services — 3.4% | | | | | | | | | | | | | | | | |

1&1 Drillisch AG | | | | | | | | | | | 129 | | | | 5,765 | |

KDDI Corp. | | | | | | | | | | | 2,400 | | | | 59,854 | |

Millicom International Cellular SA, SDR | | | | | | | | | | | 391 | | | | 22,117 | |

NTT DOCOMO Inc. | | | | | | | | | | | 1,800 | | | | 45,369 | |

Rogers Communications Inc., Class B Shares | | | | | | | | | | | 1,924 | | | | 99,317 | |

SoftBank Group Corp. | | | | | | | | | | | 1,087 | | | | 87,149 | |

See Notes to Financial Statements.

| | |

| Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report | | 11 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Wireless Telecommunication Services — continued | | | | | | | | | | | | | | | | |

Tele2 AB, Class B Shares | | | | | | | | | | | 1,992 | | | $ | 22,667 | |

Vodafone Group PLC | | | | | | | | | | | 17,042 | | | | 32,188 | |

Total Wireless Telecommunication Services | | | | | | | | | | | | | | | 374,426 | |

Total Communication Services | | | | | | | | | | | | | | | 1,446,335 | |

| Consumer Discretionary — 7.1% | | | | | | | | | | | | | | | | |

Auto Components — 0.7% | | | | | | | | | | | | | | | | |

Bridgestone Corp. | | | | | | | | | | | 200 | | | | 7,732 | |

Cie Generale des Etablissements Michelin SCA | | | | | | | | | | | 52 | | | | 5,346 | |

Continental AG | | | | | | | | | | | 42 | | | | 6,946 | |

Denso Corp. | | | | | | | | | | | 200 | | | | 8,950 | |

Magna International Inc. | | | | | | | | | | | 807 | | | | 39,826 | |

Minth Group Ltd. | | | | | | | | | | | 2,000 | | | | 6,480 | |

Total Auto Components | | | | | | | | | | | | | | | 75,280 | |

Automobiles — 1.2% | | | | | | | | | | | | | | | | |

Bayerische Motoren Werke AG | | | | | | | | | | | 76 | | | | 6,564 | |

Daimler AG, Registered Shares | | | | | | | | | | | 136 | | | | 8,068 | |

Ferrari NV | | | | | | | | | | | 175 | | | | 20,522 | |

Fiat Chrysler Automobiles NV | | | | | | | | | | | 1,544 | | | | 23,530 | * |

Honda Motor Co., Ltd. | | | | | | | | | | | 400 | | | | 11,487 | |

Nissan Motor Co., Ltd. | | | | | | | | | | | 800 | | | | 7,284 | |

Subaru Corp. | | | | | | | | | | | 200 | | | | 5,411 | |

Suzuki Motor Corp. | | | | | | | | | | | 100 | | | | 5,007 | |

Toyota Motor Corp. | | | | | | | | | | | 694 | | | | 40,679 | |

Total Automobiles | | | | | | | | | | | | | | | 128,552 | |

Distributors — 0.2% | | | | | | | | | | | | | | | | |

Jardine Cycle & Carriage Ltd. | | | | | | | | | | | 1,200 | | | | 26,230 | |

Hotels, Restaurants & Leisure — 2.2% | | | | | | | | | | | | | | | | |

Aristocrat Leisure Ltd. | | | | | | | | | | | 2,018 | | | | 37,902 | |

Compass Group PLC | | | | | | | | | | | 374 | | | | 7,359 | |

Crown Resorts Ltd. | | | | | | | | | | | 1,144 | | | | 10,143 | |

Domino’s Pizza Enterprises Ltd | | | | | | | | | | | 259 | | | | 9,914 | |

Flight Centre Travel Group Ltd. | | | | | | | | | | | 292 | | | | 9,603 | |

Galaxy Entertainment Group Ltd. | | | | | | | | | | | 4,000 | | | | 21,634 | |

Genting Singapore Ltd. | | | | | | | | | | | 64,000 | | | | 40,670 | |

Melco Resorts & Entertainment Ltd., ADR | | | | | | | | | | | 501 | | | | 8,332 | |

MGM China Holdings Ltd. | | | | | | | | | | | 6,000 | | | | 8,480 | |

Restaurant Brands International Inc. | | | | | | | | | | | 555 | | | | 30,479 | |

Sands China Ltd. | | | | | | | | | | | 5,130 | | | | 20,221 | |

SJM Holdings Ltd. | | | | | | | | | | | 6,000 | | | | 4,845 | |

See Notes to Financial Statements.

| | |

| 12 | | Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report |

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Hotels, Restaurants & Leisure — continued | | | | | | | | | | | | | | | | |

Tabcorp Holdings Ltd. | | | | | | | | | | | 6,704 | | | $ | 21,952 | |

Wynn Macau Ltd. | | | | | | | | | | | 3,600 | | | | 7,430 | |

Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 238,964 | |

Household Durables — 0.6% | | | | | | | | | | | | | | | | |

Electrolux AB, Class B Shares | | | | | | | | | | | 346 | | | | 7,200 | |

Husqvarna AB, Class B Shares | | | | | | | | | | | 813 | | | | 6,148 | |

Panasonic Corp. | | | | | | | | | | | 800 | | | | 8,857 | |

Sekisui House Ltd. | | | | | | | | | | | 397 | | | | 5,847 | |

Sony Corp. | | | | | | | | | | | 397 | | | | 21,599 | |

Techtronic Industries Co., Ltd. | | | | | | | | | | | 2,460 | | | | 11,517 | |

Total Household Durables | | | | | | | | | | | | | | | 61,168 | |

Multiline Retail — 0.5% | | | | | | | | | | | | | | | | |

Canadian Tire Corp. Ltd., Class A Shares | | | | | | | | | | | 180 | | | | 20,305 | |

Dollarama Inc. | | | | | | | | | | | 765 | | | | 21,209 | |

Marks & Spencer Group PLC | | | | | | | | | | | 2,296 | | | | 8,684 | |

Total Multiline Retail | | | | | | | | | | | | | | | 50,198 | |

Specialty Retail — 0.8% | | | | | | | | | | | | | | | | |

Dufry AG, Registered Shares | | | | | | | | | | | 85 | | | | 9,595 | |

Hennes & Mauritz AB | | | | | | | | | | | 1,632 | | | | 28,881 | |

Industria de Diseno Textil SA | | | | | | | | | | | 1,851 | | | | 52,285 | |

Total Specialty Retail | | | | | | | | | | | | | | | 90,761 | |

Textiles, Apparel & Luxury Goods — 0.9% | | | | | | | | | | | | | | | | |

adidas AG | | | | | | | | | | | 32 | | | | 7,541 | |

Cie Financiere Richemont SA, Registered Shares | | | | | | | | | | | 380 | | | | 27,842 | |

Gildan Activewear Inc. | | | | | | | | | | | 625 | | | | 18,727 | |

Luxottica Group SpA | | | | | | | | | | | 251 | | | | 15,790 | |

LVMH Moet Hennessy Louis Vuitton SE | | | | | | | | | | | 35 | | | | 10,660 | |

Moncler SpA | | | | | | | | | | | 255 | | | | 8,870 | |

Swatch Group AG | | | | | | | | | | | 30 | | | | 10,164 | |

Total Textiles, Apparel & Luxury Goods | | | | | | | | | | | | | | | 99,594 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 770,747 | |

| Consumer Staples — 10.1% | | | | | | | | | | | | | | | | |

Beverages — 1.7% | | | | | | | | | | | | | | | | |

Anheuser-Busch InBev SA/NV | | | | | | | | | | | 583 | | | | 43,029 | |

Asahi Group Holdings Ltd. | | | | | | | | | | | 400 | | | | 17,609 | |

Carlsberg A/S, Class B Shares | | | | | | | | | | | 384 | | | | 42,373 | |

Coca-Cola Amatil Ltd. | | | | | | | | | | | 880 | | | | 6,181 | |

Diageo PLC | | | | | | | | | | | 344 | | | | 11,905 | |

See Notes to Financial Statements.

| | |

| Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report | | 13 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Beverages — continued | | | | | | | | | | | | | | | | |

Heineken Holding NV | | | | | | | | | | | 90 | | | $ | 7,801 | |

Heineken NV | | | | | | | | | | | 120 | | | | 10,823 | |

Kirin Holdings Co., Ltd. | | | | | | | | | | | 600 | | | | 14,347 | |

Pernod Ricard SA | | | | | | | | | | | 86 | | | | 13,135 | |

Suntory Beverage & Food Ltd. | | | | | | | | | | | 200 | | | | 8,161 | |

Treasury Wine Estates Ltd. | | | | | | | | | | | 948 | | | | 10,159 | |

Total Beverages | | | | | | | | | | | | | | | 185,523 | |

Food & Staples Retailing — 2.8% | | | | | | | | | | | | | | | | |

Aeon Co., Ltd. | | | | | | | | | | | 400 | | | | 9,180 | |

Alimentation Couche-Tard Inc., Class B Shares | | | | | | | | | | | 1,427 | | | | 68,316 | |

Empire Co., Ltd., Class A Shares | | | | | | | | | | | 881 | | | | 16,067 | |

FamilyMart UNY Holdings Co., Ltd. | | | | | | | | | | | 100 | | | | 11,626 | |

George Weston Ltd. | | | | | | | | | | | 196 | | | | 14,291 | |

ICA Gruppen AB | | | | | | | | | | | 306 | | | | 10,844 | |

Koninklijke Ahold Delhaize NV | | | | | | | | | | | 428 | | | | 9,810 | |

Loblaw Cos. Ltd. | | | | | | | | | | | 668 | | | | 33,490 | |

Metro Inc. | | | | | | | | | | | 873 | | | | 27,461 | |

Seven & i Holdings Co., Ltd. | | | | | | | | | | | 792 | | | | 34,338 | |

Wesfarmers Ltd. | | | | | | | | | | | 1,381 | | | | 45,631 | |

Woolworths Group Ltd. | | | | | | | | | | | 1,416 | | | | 28,532 | |

Total Food & Staples Retailing | | | | | | | | | | | | | | | 309,586 | |

Food Products — 3.5% | | | | | | | | | | | | | | | | |

Ajinomoto Co., Inc. | | | | | | | | | | | 400 | | | | 6,474 | |

Danone SA | | | | | | | | | | | 226 | | | | 16,025 | |

Kerry Group PLC, Class A Shares | | | | | | | | | | | 577 | | | | 59,166 | |

Marine Harvest ASA | | | | | | | | | | | 4,569 | | | | 110,896 | |

MEIJI Holdings Co., Ltd | | | | | | | | | | | 200 | | | | 13,291 | |

Nestle SA, Registered Shares | | | | | | | | | | | 494 | | | | 41,803 | |

Nisshin Seifun Group Inc. | | | | | | | | | | | 400 | | | | 7,978 | |

Nissin Foods Holdings Co., Ltd. | | | | | | | | | | | 100 | | | | 6,460 | |

Orkla ASA | | | | | | | | | | | 8,902 | | | | 77,042 | |

Saputo Inc. | | | | | | | | | | | 798 | | | | 24,373 | |

Toyo Suisan Kaisha Ltd. | | | | | | | | | | | 198 | | | | 6,825 | |

Yakult Honsha Co., Ltd. | | | | | | | | | | | 100 | | | | 7,097 | |

Total Food Products | | | | | | | | | | | | | | | 377,430 | |

Household Products — 0.5% | | | | | | | | | | | | | | | | |

Essity AB, Class B Shares | | | | | | | | | | | 1,132 | | | | 25,873 | |

Henkel AG & Co. KGaA | | | | | | | | | | | 70 | | | | 6,869 | |

See Notes to Financial Statements.

| | |

| 14 | | Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report |

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Household Products — continued | | | | | | | | | | | | | | | | |

Lion Corp. | | | | | | | | | | | 300 | | | $ | 5,636 | |

Reckitt Benckiser Group PLC | | | | | | | | | | | 90 | | | | 7,283 | |

Unicharm Corp. | | | | | | | | | | | 395 | | | | 10,752 | |

Total Household Products | | | | | | | | | | | | | | | 56,413 | |

Personal Products — 1.0% | | | | | | | | | | | | | | | | |

Beiersdorf AG | | | | | | | | | | | 66 | | | | 6,835 | |

Kao Corp. | | | | | | | | | | | 400 | | | | 26,693 | |

L’Oreal SA | | | | | | | | | | | 96 | | | | 21,635 | |

Shiseido Co., Ltd. | | | | | | | | | | | 297 | | | | 18,782 | |

Unilever NV, CVA | | | | | | | | | | | 442 | | | | 23,801 | |

Unilever PLC | | | | | | | | | | | 190 | | | | 10,066 | |

Total Personal Products | | | | | | | | | | | | | | | 107,812 | |

Tobacco — 0.6% | | | | | | | | | | | | | | | | |

British American Tobacco PLC | | | | | | | | | | | 246 | | | | 10,667 | |

Imperial Brands PLC | | | | | | | | | | | 238 | | | | 8,068 | |

Japan Tobacco Inc. | | | | | | | | | | | 1,000 | | | | 25,754 | |

Swedish Match AB | | | | | | | | | | | 415 | | | | 21,173 | |

Total Tobacco | | | | | | | | | | | | | | | 65,662 | |

Total Consumer Staples | | | | | | | | | | | | | | | 1,102,426 | |

| Energy — 8.4% | | | | | | | | | | | | | | | | |

Energy Equipment & Services — 0.1% | | | | | | | | | | | | | | | | |

Tenaris SA | | | | | | | | | | | 605 | | | | 9,004 | |

Oil, Gas & Consumable Fuels — 8.3% | | | | | | | | | | | | | | | | |

Aker BP ASA | | | | | | | | | | | 372 | | | | 12,304 | |

BP PLC | | | | | | | | | | | 5,489 | | | | 39,788 | |

Caltex Australia Ltd. | | | | | | | | | | | 500 | | | | 10,015 | |

Canadian Natural Resources Ltd. | | | | | | | | | | | 394 | | | | 10,837 | |

Enagas SA | | | | | | | | | | | 916 | | | | 24,328 | |

Enbridge Inc. | | | | | | | | | | | 595 | | | | 18,585 | |

Eni SpA | | | | | | | | | | | 3,930 | | | | 69,937 | |

Equinor ASA | | | | | | | | | | | 3,868 | | | | 100,923 | |

Idemitsu Kosan Co., Ltd. | | | | | | | | | | | 397 | | | | 18,117 | |

Inpex Corp. | | | | | | | | | | | 3,175 | | | | 36,559 | |

JXTG Holdings Inc. | | | | | | | | | | | 8,691 | | | | 59,236 | |

Neste Oyj | | | | | | | | | | | 1,253 | | | | 103,298 | |

Oil Search Ltd. | | | | | | | | | | | 2,586 | | | | 14,241 | |

Origin Energy Ltd. | | | | | | | | | | | 3,611 | | | | 18,657 | * |

Pembina Pipeline Corp. | | | | | | | | | | | 196 | | | | 6,355 | |

See Notes to Financial Statements.

| | |

| Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report | | 15 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Oil, Gas & Consumable Fuels — continued | | | | | | | | | | | | | | | | |

Repsol SA | | | | | | | | | | | 4,368 | | | $ | 78,321 | |

Royal Dutch Shell PLC, Class A Shares | | | | | | | | | | | 1,247 | | | | 39,842 | |

Royal Dutch Shell PLC, Class B Shares | | | | | | | | | | | 1,089 | | | | 35,691 | |

Santos Ltd. | | | | | | | | | | | 3,498 | | | | 16,462 | |

Showa Shell Sekiyu KK | | | | | | | | | | | 594 | | | | 11,453 | |

Snam SpA | | | | | | | | | | | 3,475 | | | | 14,387 | |

Suncor Energy Inc. | | | | | | | | | | | 591 | | | | 19,873 | |

Total SA | | | | | | | | | | | 1,818 | | | | 107,032 | |

TransCanada Corp. | | | | | | | | | | | 194 | | | | 7,333 | |

Woodside Petroleum Ltd. | | | | | | | | | | | 1,447 | | | | 35,741 | |

Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 909,315 | |

Total Energy | | | | | | | | | | | | | | | 918,319 | |

| Financials — 15.3% | | | | | | | | | | | | | | | | |

Banks — 10.2% | | | | | | | | | | | | | | | | |

ABN AMRO Group NV, CVA | | | | | | | | | | | 492 | | | | 12,097 | |

Australia & New Zealand Banking Group Ltd. | | | | | | | | | | | 1,025 | | | | 18,837 | |

Banco Bilbao Vizcaya Argentaria SA | | | | | | | | | | | 3,203 | | | | 17,728 | |

Banco de Sabadell SA | | | | | | | | | | | 4,848 | | | | 6,399 | |

Banco Santander SA | | | | | | | | | | | 6,750 | | | | 32,084 | |

Bank Hapoalim BM | | | | | | | | | | | 8,805 | | | | 59,611 | |

Bank Leumi Le-Israel BM | | | | | | | | | | | 13,514 | | | | 84,304 | |

Bank of Montreal | | | | | | | | | | | 120 | | | | 8,994 | |

Bank of Nova Scotia | | | | | | | | | | | 418 | | | | 22,487 | |

Barclays PLC | | | | | | | | | | | 2,963 | | | | 6,531 | |

BNP Paribas SA | | | | | | | | | | | 464 | | | | 24,252 | |

BOC Hong Kong Holdings Ltd. | | | | | | | | | | | 2,000 | | | | 7,475 | |

CaixaBank SA | | | | | | | | | | | 2,064 | | | | 8,375 | |

Canadian Imperial Bank of Commerce | | | | | | | | | | | 200 | | | | 17,313 | |

Commonwealth Bank of Australia | | | | | | | | | | | 581 | | | | 28,508 | |

Credit Agricole SA | | | | | | | | | | | 595 | | | | 7,637 | |

Danske Bank A/S | | | | | | | | | | | 2,381 | | | | 45,688 | |

DBS Group Holdings Ltd. | | | | | | | | | | | 2,300 | | | | 38,964 | |

DNB ASA | | | | | | | | | | | 3,671 | | | | 66,629 | |

Erste Group Bank AG | | | | | | | | | | | 1,455 | | | | 59,349 | |

Hang Seng Bank Ltd. | | | | | | | | | | | 400 | | | | 9,368 | |

HSBC Holdings PLC | | | | | | | | | | | 3,267 | | | | 26,921 | |

ING Groep NV | | | | | | | | | | | 2,867 | | | | 34,044 | |

Intesa Sanpaolo SpA | | | | | | | | | | | 11,294 | | | | 24,992 | |

See Notes to Financial Statements.

| | |

| 16 | | Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report |

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Banks — continued | | | | | | | | | | | | | | | | |

KBC Group NV | | | | | | | | | | | 565 | | | $ | 38,986 | |

Lloyds Banking Group PLC | | | | | | | | | | | 13,825 | | | | 10,108 | |

Mediobanca Banca di Credito Finaziario SPA | | | | | | | | | | | 1,064 | | | | 9,345 | |

Mitsubishi UFJ Financial Group Inc. | | | | | | | | | | | 6,400 | | | | 38,835 | |

Mizrahi Tefahot Bank Ltd. | | | | | | | | | | | 1,311 | | | | 22,077 | |

Mizuho Financial Group Inc. | | | | | | | | | | | 23,400 | | | | 40,225 | |

National Australia Bank Ltd. | | | | | | | | | | | 931 | | | | 16,635 | |

National Bank of Canada | | | | | | | | | | | 282 | | | | 12,832 | |

Nordea Bank Abp | | | | | | | | | | | 1,415 | | | | 12,322 | |

Oversea-Chinese Banking Corp. Ltd. | | | | | | | | | | | 3,367 | | | | 26,113 | |

Raiffeisen Bank International AG | | | | | | | | | | | 697 | | | | 19,033 | |

Royal Bank of Canada | | | | | | | | | | | 466 | | | | 34,037 | |

Skandinaviska Enskilda Banken AB, Class A Shares | | | | | | | | | | | 779 | | | | 8,077 | |

Societe Generale SA | | | | | | | | | | | 200 | | | | 7,360 | |

Standard Chartered PLC | | | | | | | | | | | 889 | | | | 6,242 | |

Sumitomo Mitsui Financial Group Inc. | | | | | | | | | | | 900 | | | | 35,201 | |

Svenska Handelsbanken AB, Class A Shares | | | | | | | | | | | 719 | | | | 7,831 | |

Swedbank AB, Class A Shares | | | | | | | | | | | 422 | | | | 9,516 | |

Toronto-Dominion Bank | | | | | | | | | | | 576 | | | | 32,031 | |

UniCredit SpA | | | | | | | | | | | 1,302 | | | | 16,694 | |

United Overseas Bank Ltd. | | | | | | | | | | | 1,386 | | | | 24,401 | |

Westpac Banking Corp. | | | | | | | | | | | 1,145 | | | | 21,789 | |

Total Banks | | | | | | | | | | | | | | | 1,118,277 | |

Capital Markets — 1.0% | | | | | | | | | | | | | | | | |

Brookfield Asset Management Inc., Class A Shares | | | | | | | | | | | 196 | | | | 8,018 | |

Credit Suisse Group AG, Registered Shares | | | | | | | | | | | 1,227 | | | | 16,126 | |

Deutsche Bank AG, Registered Shares | | | | | | | | | | | 789 | | | | 7,734 | |

Deutsche Boerse AG | | | | | | | | | | | 128 | | | | 16,222 | |

Hong Kong Exchanges & Clearing Ltd. | | | | | | | | | | | 600 | | | | 15,919 | |

Julius Baer Group Ltd. | | | | | | | | | | | 154 | | | | 7,048 | |

Macquarie Group Ltd. | | | | | | | | | | | 122 | | | | 10,134 | |

Nomura Holdings Inc. | | | | | | | | | | | 1,200 | | | | 5,822 | |

Singapore Exchange Ltd. | | | | | | | | | | | 1,200 | | | | 5,927 | |

UBS Group AG, Registered Shares | | | | | | | | | | | 1,313 | | | | 18,392 | |

Total Capital Markets | | | | | | | | | | | | | | | 111,342 | |

Diversified Financial Services — 0.3% | | | | | | | | | | | | | | | | |

Groupe Bruxelles Lambert SA | | | | | | | | | | | 154 | | | | 14,339 | |

Investor AB, Class B Shares | | | | | | | | | | | 148 | | | | 6,424 | |

See Notes to Financial Statements.

| | |

| Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report | | 17 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Diversified Financial Services — continued | | | | | | | | | | | | | | | | |

Kinnevik AB, Class B Shares | | | | | | | | | | | 238 | | | $ | 6,612 | |

Total Diversified Financial Services | | | | | | | | | | | | | | | 27,375 | |

Insurance — 3.8% | | | | | | | | | | | | | | | | |

Aegon NV | | | | | | | | | | | 1,571 | | | | 9,662 | |

Ageas | | | | | | | | | | | 390 | | | | 19,536 | |

AIA Group Ltd. | | | | | | | | | | | 7,949 | | | | 60,180 | |

Allianz SE, Registered Shares | | | | | | | | | | | 204 | | | | 42,632 | |

Assicurazioni Generali SpA | | | | | | | | | | | 927 | | | | 14,999 | |

Aviva PLC | | | | | | | | | | | 1,433 | | | | 7,846 | |

AXA SA | | | | | | | | | | | 931 | | | | 23,355 | |

Dai-ichi Life Holdings Inc. | | | | | | | | | | | 400 | | | | 7,571 | |

Gjensidige Forsikring ASA | | | | | | | | | | | 725 | | | | 11,265 | |

Insurance Australia Group Ltd. | | | | | | | | | | | 1,250 | | | | 6,052 * | |

Intact Financial Corp. | | | | | | | | | | | 146 | | | | 11,563 | |

Japan Post Holdings Co., Ltd. | | | | | | | | | | | 1,200 | | | | 14,248 | |

Manulife Financial Corp. | | | | | | | | | | | 394 | | | | 6,219 | |

MS&AD Insurance Group Holdings Inc. | | | | | | | | | | | 198 | | | | 5,976 | |

Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen, Registered Shares | | | | | | | | | | | 48 | | | | 10,331 | |

NN Group NV | | | | | | | | | | | 208 | | | | 8,955 | |

Prudential PLC | | | | | | | | | | | 326 | | | | 6,542 | |

Sampo Oyj, Class A Shares | | | | | | | | | | | 1,361 | | | | 62,701 | |

Sompo Holdings Inc. | | | | | | | | | | | 198 | | | | 8,211 | |

Sun Life Financial Inc. | | | | | | | | | | | 196 | | | | 7,195 | |

Suncorp Group Ltd. | | | | | | | | | | | 757 | | | | 7,517 | |

Swiss Re AG | | | | | | | | | | | 108 | | | | 9,766 | |

Tokio Marine Holdings Inc. | | | | | | | | | | | 600 | | | | 28,422 | |

Tryg A/S | | | | | | | | | | | 456 | | | | 11,025 | |

Zurich Insurance Group AG | | | | | | | | | | | 46 | | | | 14,323 | |

Total Insurance | | | | | | | | | | | | | | | 416,092 | |

Total Financials | | | | | | | | | | | | | | | 1,673,086 | |

| Health Care — 6.0% | | | | | | | | | | | | | | | | |

Biotechnology — 0.8% | | | | | | | | | | | | | | | | |

CSL Ltd. | | | | | | | | | | | 500 | | | | 66,622 | |

Genmab A/S | | | | | | | | | | | 38 | | | | 5,208 * | |

Shire PLC | | | | | | | | | | | 257 | | | | 15,370 | |

Total Biotechnology | | | | | | | | | | | | | | | 87,200 | |

Health Care Equipment & Supplies — 0.6% | | | | | | | | | | | | | | | | |

Cochlear Ltd. | | | | | | | | | | | 44 | | | | 5,538 | |

See Notes to Financial Statements.

| | |

| 18 | | Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report |

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Health Care Equipment & Supplies — continued | | | | | | | | | | | | | | | | |

EssilorLuxottica SA | | | | | | | | | | | 60 | | | $ | 8,209 | |

Hoya Corp. | | | | | | | | | | | 400 | | | | 22,733 | |

Olympus Corp. | | | | | | | | | | | 197 | | | | 6,581 | |

Sysmex Corp. | | | | | | | | | | | 198 | | | | 13,902 | |

Terumo Corp. | | | | | | | | | | | 197 | | | | 10,631 | |

Total Health Care Equipment & Supplies | | | | | | | | | | | | | | | 67,594 | |

Health Care Providers & Services — 0.3% | | | | | | | | | | | | | | | | |

Fresenius SE & Co. KGaA | | | | | | | | | | | 102 | | | | 6,504 | |

Ramsay Health Care Ltd. | | | | | | | | | | | 209 | | | | 8,328 | |

Sonic Healthcare Ltd. | | | | | | | | | | | 979 | | | | 15,647 | |

Total Health Care Providers & Services | | | | | | | | | | | | | | | 30,479 | |

Health Care Technology — 0.1% | | | | | | | | | | | | | | | | |

M3 Inc. | | | | | | | | | | | 600 | | | | 9,666 | |

Pharmaceuticals — 4.2% | | | | | | | | | | | | | | | | |

Astellas Pharma Inc. | | | | | | | | | | | 2,081 | | | | 32,214 | |

AstraZeneca PLC | | | | | | | | | | | 264 | | | | 20,206 | |

Bayer AG, Registered Shares | | | | | | | | | | | 331 | | | | 25,420 | |

Chugai Pharmaceutical Co., Ltd. | | | | | | | | | | | 200 | | | | 11,749 | |

Daiichi Sankyo Co., Ltd. | | | | | | | | | | | 494 | | | | 18,884 | |

Eisai Co., Ltd. | | | | | | | | | | | 200 | | | | 16,678 | |

GlaxoSmithKline PLC | | | | | | | | | | | 1,083 | | | | 20,912 | |

Kyowa Hakko Kirin Co., Ltd. | | | | | | | | | | | 500 | | | | 9,725 | |

Merck KGaA | | | | | | | | | | | 76 | | | | 8,148 | |

Novartis AG, Registered Shares | | | | | | | | | | | 268 | | | | 23,510 | |

Novo Nordisk A/S, Class B Shares | | | | | | | | | | | 829 | | | | 35,868 | |

Ono Pharmaceutical Co., Ltd. | | | | | | | | | | | 400 | | | | 9,116 | |

Otsuka Holdings Co., Ltd. | | | | | | | | | | | 397 | | | | 19,024 | |

Roche Holding AG | | | | | | | | | | | 80 | | | | 19,493 | |

Sanofi | | | | | | | | | | | 408 | | | | 36,446 | |

Santen Pharmaceutical Co., Ltd | | | | | | | | | | | 500 | | | | 7,421 | |

Shionogi & Co., Ltd. | | | | | | | | | | | 397 | | | | 25,441 | |

Takeda Pharmaceutical Co., Ltd. | | | | | | | | | | | 692 | | | | 28,022 | |

Teva Pharmaceutical Industries Ltd., ADR | | | | | | | | | | | 4,510 | | | | 90,110 | |

Total Pharmaceuticals | | | | | | | | | | | | | | | 458,387 | |

Total Health Care | | | | | | | | | | | | | | | 653,326 | |

| Industrials — 9.7% | | | | | | | | | | | | | | | | |

Aerospace & Defense — 0.6% | | | | | | | | | | | | | | | | |

Airbus SE | | | | | | | | | | | 94 | | | | 10,407 | |

See Notes to Financial Statements.

| | |

| Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report | | 19 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Aerospace & Defense — continued | | | | | | | | | | | | | | | | |

BAE Systems PLC | | | | | | | | | | | 1,203 | | | $ | 8,082 | |

Bombardier Inc., Class B Shares | | | | | | | | | | | 2,027 | | | | 4,924 * | |

CAE Inc. | | | | | | | | | | | 595 | | | | 10,520 | |

Leonardo SpA | | | | | | | | | | | 569 | | | | 6,183 | |

Safran SA | | | | | | | | | | | 82 | | | | 10,596 | |

Singapore Technologies Engineering Ltd. | | | | | | | | | | | 5,400 | | | | 13,843 | |

Total Aerospace & Defense | | | | | | | | | | | | | | | 64,555 | |

Air Freight & Logistics — 0.1% | | | | | | | | | | | | | | | | |

Deutsche Post AG, Registered Shares | | | | | | | | | | | 246 | | | | 7,791 | |

Airlines — 0.3% | | | | | | | | | | | | | | | | |

International Consolidated Airlines Group SA | | | | | | | | | | | 1,421 | | | | 10,981 | |

Singapore Airlines Ltd. | | | | | | | | | | | 2,881 | | | | 19,722 | |

Total Airlines | | | | | | | | | | | | | | | 30,703 | |

Building Products — 0.2% | | | | | | | | | | | | | | | | |

Assa Abloy AB, Class B Shares | | | | | | | | | | | 502 | | | | 10,024 | |

Cie de Saint-Gobain | | | | | | | | | | | 158 | | | | 5,950 | |

Geberit AG, Registered Shares | | | | | | | | | | | 18 | | | | 7,056 | |

Total Building Products | | | | | | | | | | | | | | | 23,030 | |

Commercial Services & Supplies — 0.3% | | | | | | | | | | | | | | | | |

Brambles Ltd. | | | | | | | | | | | 2,859 | | | | 21,519 | |

Secom Co., Ltd. | | | | | | | | | | | 198 | | | | 16,231 | |

Total Commercial Services & Supplies | | | | | | | | | | | | | | | 37,750 | |

Construction & Engineering — 0.6% | | | | | | | | | | | | | | | | |

ACS Actividades de Construccion y Servicios SA | | | | | | | | | | | 174 | | | | 6,528 | |

CIMIC Group Ltd. | | | | | | | | | | | 308 | | | | 10,323 | |

Ferrovial SA | | | | | | | | | | | 998 | | | | 20,015 | |

SNC-Lavalin Group Inc. | | | | | | | | | | | 196 | | | | 7,015 | |

Vinci SA | | | | | | | | | | | 116 | | | | 10,367 | |

WSP Global Inc. | | | | | | | | | | | 199 | | | | 9,959 | |

Total Construction & Engineering | | | | | | | | | | | | | | | 64,207 | |

Electrical Equipment — 0.8% | | | | | | | | | | | | | | | | |

ABB Ltd., Registered Shares | | | | | | | | | | | 867 | | | | 17,497 | |

Legrand SA | | | | | | | | | | | 122 | | | | 7,982 | |

Mitsubishi Electric Corp. | | | | | | | | | | | 1,000 | | | | 12,702 | |

Nidec Corp. | | | | | | | | | | | 100 | | | | 12,840 | |

Prysmian SpA | | | | | | | | | | | 258 | | | | 5,016 | |

Schneider Electric SE | | | | | | | | | | | 154 | | | | 11,160 | |

Siemens Gamesa Renewable Energy SA | | | | | | | | | | | 553 | | | | 6,135 * | |

See Notes to Financial Statements.

| | |

| 20 | | Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report |

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Electrical Equipment — continued | | | | | | | | | | | | | | | | |

Vestas Wind Systems A/S | | | | | | | | | | | 206 | | | $ | 12,924 | |

Total Electrical Equipment | | | | | | | | | | | | | | | 86,256 | |

Industrial Conglomerates — 1.5% | | | | | | | | | | | | | | | | |

CK Hutchison Holdings Ltd. | | | | | | | | | | | 5,500 | | | | 55,390 | |

Jardine Matheson Holdings Ltd. | | | | | | | | | | | 500 | | | | 28,855 | |

Jardine Strategic Holdings Ltd. | | | | | | | | | | | 500 | | | | 16,750 | |

Keppel Corp., Ltd. | | | | | | | | | | | 5,546 | | | | 24,831 | |

NWS Holdings Ltd. | | | | | | | | | | | 4,000 | | | | 7,919 | |

Sembcorp Industries Ltd. | | | | | | | | | | | 4,563 | | | | 9,292 | |

Siemens AG, Registered Shares | | | | | | | | | | | 198 | | | | 22,820 | |

Total Industrial Conglomerates | | | | | | | | | | | | | | | 165,857 | |

Machinery — 1.2% | | | | | | | | | | | | | | | | |

Atlas Copco AB, Class A Shares | | | | | | | | | | | 332 | | | | 8,231 | |

CNH Industrial NV | | | | | | | | | | | 1,565 | | | | 16,289 | |

FANUC Corp. | | | | | | | | | | | 100 | | | | 17,487 | |

Komatsu Ltd. | | | | | | | | | | | 400 | | | | 10,436 | |

Kone OYJ, Class B Shares | | | | | | | | | | | 495 | | | | 24,128 | |

Metso OYJ | | | | | | | | | | | 237 | | | | 7,495 | |

Sandvik AB | | | | | | | | | | | 589 | | | | 9,338 | |

Schindler Holding AG | | | | | | | | | | | 38 | | | | 8,024 | |

Volvo AB, Class B Shares | | | | | | | | | | | 464 | | | | 6,945 | |

Wartsila OYJ Abp | | | | | | | | | | | 793 | | | | 13,527 | |

Yangzijiang Shipbuilding Holdings Ltd. | | | | | | | | | | | 14,300 | | | | 12,805 | |

Total Machinery | | | | | | | | | | | | | | | 134,705 | |

Marine — 0.1% | | | | | | | | | | | | | | | | |

A.P. Moller — Maersk A/S, Class B Shares | | | | | | | | | | | 6 | | | | 7,621 | |

Kuehne + Nagel International AG, Registered Shares | | | | | | | | | | | 48 | | | | 6,686 | |

Total Marine | | | | | | | | | | | | | | | 14,307 | |

Professional Services — 0.8% | | | | | | | | | | | | | | | | |

Adecco Group AG, Registered Shares | | | | | | | | | | | 186 | | | | 9,123 | |

Experian PLC | | | | | | | | | | | 360 | | | | 8,291 | |

Randstad NV | | | | | | | | | | | 156 | | | | 7,875 | |

Recruit Holdings Co., Ltd | | | | | | | | | | | 300 | | | | 8,073 | |

RELX PLC | | | | | | | | | | | 380 | | | | 7,526 | |

RELX PLC | | | | | | | | | | | 478 | | | | 9,462 | |

SEEK Ltd. | | | | | | | | | | | 970 | | | | 12,279 | |

SGS SA, Registered Shares | | | | | | | | | | | 4 | | | | 9,512 | |

Wolters Kluwer NV | | | | | | | | | | | 220 | | | | 12,503 | |

Total Professional Services | | | | | | | | | | | | | | | 84,644 | |

See Notes to Financial Statements.

| | |

| Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report | | 21 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Road & Rail — 1.9% | | | | | | | | | | | | | | | | |

Aurizon Holdings Ltd. | | | | | | | | | | | 5,387 | | | $ | 16,036 | |

Canadian National Railway Co. | | | | | | | | | | | 1,045 | | | | 89,552 | |

Canadian Pacific Railway Ltd. | | | | | | | | | | | 196 | | | | 40,293 | |

ComfortDelGro Corp. Ltd. | | | | | | | | | | | 7,600 | | | | 12,348 | |

DSV A/S | | | | | | | | | | | 234 | | | | 18,820 | |

East Japan Railway Co. | | | | | | | | | | | 200 | | | | 17,500 | |

MTR Corp., Ltd. | | | | | | | | | | | 3,000 | | | | 14,542 | |

Total Road & Rail | | | | | | | | | | | | | | | 209,091 | |

Trading Companies & Distributors — 0.5% | | | | | | | | | | | | | | | | |

Finning International Inc. | | | | | | | | | | | 422 | | | | 8,786 | |

ITOCHU Corp. | | | | | | | | | | | 600 | | | | 11,138 | |

Mitsubishi Corp. | | | | | | | | | | | 400 | | | | 11,271 | |

Mitsui & Co., Ltd. | | | | | | | | | | | 600 | | | | 10,024 | |

Sumitomo Corp. | | | | | | | | | | | 595 | | | | 9,034 | |

Total Trading Companies & Distributors | | | | | | | | | | | | | | | 50,253 | |

Transportation Infrastructure — 0.8% | | | | | | | | | | | | | | | | |

Aena SME SA | | | | | | | | | | | 108 | | | | 17,273 | |

Atlantia SpA | | | | | | | | | | | 645 | | | | 12,979 | |

SATS Ltd. | | | | | | | | | | | 2,800 | | | | 10,069 | |

Sydney Airport | | | | | | | | | | | 2,977 | | | | 13,588 | |

Transurban Group | | | | | | | | | | | 4,254 | | | | 34,190 | |

Total Transportation Infrastructure | | | | | | | | | | | | | | | 88,099 | |

Total Industrials | | | | | | | | | | | | | | | 1,061,248 | |

| Information Technology — 4.8% | | | | | | | | | | | | | | | | |

Communications Equipment — 1.2% | | | | | | | | | | | | | | | | |

Nokia OYJ | | | | | | | | | | | 18,115 | | | | 102,626 | |

Telefonaktiebolaget LM Ericsson, Class B Shares | | | | | | | | | | | 3,509 | | | | 30,630 | |

Total Communications Equipment | | | | | | | | | | | | | | | 133,256 | |

Electronic Equipment, Instruments & Components — 0.6% | | | | | | | | | | | | | | | | |

Hexagon AB, Class B Shares | | | | | | | | | | | 384 | | | | 18,848 | |

Hitachi Ltd. | | | | | | | | | | | 400 | | | | 12,270 | |

Kyocera Corp. | | | | | | | | | | | 200 | | | | 10,878 | |

Murata Manufacturing Co., Ltd. | | | | | | | | | | | 100 | | | | 15,210 | |

Omron Corp. | | | | | | | | | | | 198 | | | | 8,035 | |

Total Electronic Equipment, Instruments & Components | | | | | | | | | | | | | | | 65,241 | |

IT Services — 1.0% | | | | | | | | | | | | | | | | |

Amadeus IT Group SA | | | | | | | | | | | 698 | | | | 56,294 | |

Atos SE | | | | | | | | | | | 68 | | | | 5,839 | |

See Notes to Financial Statements.

| | |

| 22 | | Legg Mason Developed ex-US Diversified Core ETF 2018 Annual Report |

Legg Mason Developed ex-US Diversified Core ETF

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

IT Services — continued | | | | | | | | | | | | | | | | |

Capgemini SE | | | | | | | | | | | 87 | | | $ | 10,646 | |

CGI Group Inc., Class A Shares | | | | | | | | | | | 272 | | | | 16,839 * | |

Fujitsu Ltd. | | | | | | | | | | | 100 | | | | 6,080 | |

Shopify Inc., Class A Shares | | | | | | | | | | | 69 | | | | 9,556 * | |

Total IT Services | | | | | | | | | | | | | | | 105,254 | |

Semiconductors & Semiconductor Equipment — 0.6% | | | | | | | | | | | | | | | | |

ASML Holding NV | | | | | | | | | | | 133 | | | | 22,743 | |

Infineon Technologies AG | | | | | | | | | | | 300 | | | | 6,020 | |

NXP Semiconductors NV | | | | | | | | | | | 190 | | | | 14,248 | |

STMicroelectronics NV | | | | | | | | | | | 454 | | | | 6,903 | |

Tokyo Electron Ltd. | | | | | | | | | | | 100 | | | | 13,899 | |

Total Semiconductors & Semiconductor Equipment | | | | | | | | | | | | | | | 63,813 | |

Software — 1.2% | | | | | | | | | | | | | | | | |

Check Point Software Technologies Ltd. | | | | | | | | | | | 300 | | | | 33,300 * | |

Constellation Software Inc. | | | | | | | | | | | 19 | | | | 13,108 | |

Dassault Systemes SE | | | | | | | | | | | 64 | | | | 8,038 | |

Micro Focus International PLC | | | | | | | | | | | 853 | | | | 13,281 | |

NICE Ltd. | | | | | | | | | | | 80 | | | | 8,477 * | |

Open Text Corp. | | | | | | | | | | | 247 | | | | 8,358 | |

Sage Group PLC | | | | | | | | | | | 2,390 | | | | 16,625 | |

SAP SE | | | | | | | | | | | 254 | | | | 27,243 | |

Total Software | | | | | | | | | | | | | | | 128,430 | |

Technology Hardware, Storage & Peripherals — 0.2% | | | | | | | | | | | | | | | | |

Canon Inc. | | | | | | | | | | | 600 | | | | 17,130 | |

FUJIFILM Holdings Corp. | | | | | | | | | | | 200 | | | | 8,671 | |

Total Technology Hardware, Storage & Peripherals | | | | | | | | | | | | | | | 25,801 | |