Our Adviser can resign on 60 days’ notice. We may not be able to find a suitable replacement within that time, resulting in a disruption in our operations that could adversely affect our financial condition, business and results of operations.

Our Adviser has the right, under the Advisory Agreement, to resign at any time upon 60 days’ written notice, regardless of whether we have found a replacement. If our Adviser resigns, we may not be able to find a new external investment adviser or hire internal management with similar expertise and ability to provide the same or equivalent services on acceptable terms within 60 days, or at all. If we are unable to do so quickly, our operations are likely to experience a disruption, our financial condition, business and results of operations as well as our ability to pay distributions are likely to be adversely affected, and the net asset value of our common shares may decline.

Any new investment advisory agreement would be subject to approval by our Shareholders. Even if we are able to enter into comparable management or administrative arrangements, the integration of a new adviser or administrator and their lack of familiarity with our investment objective may result in additional costs and time delays that may adversely affect our business, financial condition and results of operations. In addition, if our Adviser resigns or is terminated, we would lose the benefits of our relationship with Silver Point, including Silver Point’s broad and longstanding sourcing relationships, rigorous underwriting process, structuring expertise, and portfolio monitoring and asset management capabilities to originate and manage attractive middle market loans throughout credit cycles on terms that are better than those available to the broader market.

Our Adviser’s responsibilities and its liability to us are limited under the Advisory Agreement, which may lead our Adviser to act in a riskier manner on our behalf than it would when acting for its own account.

Our Adviser has not assumed any responsibility to us other than to render the services described in the Advisory Agreement, and it will not be responsible for any action of our Board of Trustees in declining to follow our Adviser’s advice or recommendations. Pursuant to the Advisory Agreement, our Adviser, its affiliates, and their respective trustees, partners, officers, members, shareholders, controlling persons, employees, agents, consultants and representatives will not be liable to us for their acts under the Advisory Agreement, absent fraud, willful misfeasance or gross negligence, the knowing or material breach of the Advisory Agreement or a violation of the antifraud provisions of any U.S. federal securities law, in each case, as finally determined by a court of competent jurisdiction. These protections may lead our Adviser to act in a riskier manner when acting on our behalf than it would when acting for its own account. See “Item 1A. Risk Factors—Risks Relating to Our Investments—Our Adviser will be paid a management fee even if the value of your investment declines and our Adviser’s incentive fees may create incentives for them to make certain kinds of investments.”

Our ability to enter into transactions with our affiliates is restricted.

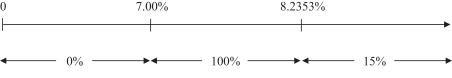

As a BDC, we are prohibited under the Investment Company Act from knowingly participating in certain transactions with our affiliates without, among other things, the prior approval of a majority of our Independent Trustees who have no financial interest in the transaction, or in some cases, the prior approval of the SEC. For example, any person that owns, directly or indirectly, 5% or more of our outstanding voting securities is deemed our affiliate for purposes of the Investment Company Act and, if this is the only reason such person is our affiliate, we are generally prohibited from buying any asset from or selling any asset (other than our capital shares) to such affiliate, absent the prior approval of a majority of our Independent Trustees. The Investment Company Act also prohibits “joint” transactions with an affiliate, which could include joint investments in the same portfolio company, without approval of our Independent Trustees or in some cases the prior approval of the SEC. Moreover, except in certain limited circumstances, we are prohibited from buying any asset from or selling any asset to a holder of more than 25% of our voting securities, absent prior approval of the SEC. The analysis of whether a particular transaction constitutes a joint transaction requires a review of the relevant facts and circumstances then existing.

We have received an exemptive order from the SEC that permits us to, among other things, co-invest with certain other affiliated funds, including certain funds managed by Silver Point. This order is subject to certain

56