UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| | | | | |

| (Mark One) | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2019 | |

| OR | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ___ to ___ | |

| |

Commission File Number: 001-37552 | |

WILLSCOT CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 82-3430194 |

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) |

901 S. Bond Street, #600

Baltimore, Maryland 21231

(Address of principal executive offices)

(410) 931-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Class A common stock, par value $0.0001 per share | WSC | The Nasdaq Capital Market |

| Warrants to purchase Class A common stock(1) | WSCWW | OTC Markets Group Inc. |

| Warrants to purchase Class A common stock(2) | WSCTW | OTC Markets Group Inc. |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer ☒ | Accelerated filer ☐ |

Non-accelerated filer ☐ | Smaller reporting company ☐ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common shares held by non-affiliates of the registrant, computed as of June 30, 2019 (the last business day of the registrant’s most recently completed second quarter), was approximately $848,851,148.

Shares of Class A common stock, par value $0.0001 per share, outstanding: 110,316,368 shares at February 27, 2020.

Shares of Class B common stock, par value $0.0001 per share, outstanding: 8,024,419 shares at February 27, 2020.

Documents Incorporated by Reference

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the registrant's definitive proxy statement relating to the Annual Meeting of Shareholders to be held in 2020, which definitive proxy statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

WILLSCOT CORPORATION

Annual Report on Form 10-K

Table of Contents

PART I

ITEM 1. Business

Unless the context otherwise requires, “we,” “us,” “our” and the “Company” refers to WillScot Corporation ("WillScot") and its subsidiaries.

Our Company

Headquartered in Baltimore, Maryland, we are a market leader in the North America specialty rental services industry. We provide innovative modular space and portable storage solutions to diverse end markets utilizing a branch network of approximately 120 locations throughout the United States (“US”), Canada and Mexico.

With roots dating back more than 60 years, we lease modular space and portable storage units (our “lease fleet”) to customers in the commercial and industrial, construction, education, energy and natural resources, government and other end markets. We deliver “Ready to Work” solutions through our growing offering of value-added products and services (“VAPS”), such as the rental of steps, ramps, and furniture packages, damage waivers and other amenities. These turnkey solutions offer customers flexible, low-cost and timely solutions to meet their space needs on an outsourced basis. We complement our core leasing business by selling both new and used units, allowing us to leverage our scale, achieve purchasing benefits and redeploy capital employed in our lease fleet.

WillScot is the holding company for the Williams Scotsman family of companies. All of our assets and operations are owned through Williams Scotsman Holdings Corp. (“WS Holdings”). We operate and own 91.0% of WS Holdings, and Sapphire Holding S.a r.l (“Sapphire”), an affiliate of TDR Capital LLP ("TDR Capital"), owns the remaining 9.0%.

Products and Services

Our modular space and portable storage units are used to meet a broad range of customer needs. Our units are made of wood, steel, or aluminum frames mounted on a steel chassis, and typically range in size from 8 to 14 feet in width and 16 to 70 feet in length. Most units are equipped with air conditioning and heating, electrical and Ethernet cable outlets and, if necessary, plumbing facilities. Our units are transported by truck, either towed (if fitted with axles and hitches) or mounted on flat-bed trailers. Additionally, we offer VAPS along with our lease fleet (collectively, “rental equipment”) in order to deliver “Ready to Work” solutions to our customers.

Modular Space Solutions

Panelized and Stackable Offices. Our FlexTM panelized and stackable offices are the next generation of modular space technology and offer maximum flexibility and design configurations. These units provide a modern, innovative design, smaller footprint, ground level access and interchangeable panels, including all glass panels that allow customers to configure the space to their precise requirements. These units have the ability to expand upwards (up to three stories) and outwards.

Single-Wide Modular Space Units. Single-wide modular space units include mobile offices and sales offices. These units offer maximum ease of installation and removal and are deployed across the broadest range of applications in our fleet. These units typically have “open interiors” which can be modified using movable partitions, and include tile floors, air conditioning and heating units, partitions and, if requested, toilet facilities.

Section Modulars and Redi-Plex. Section modulars are two or more units combined into one structure. Redi-Plex complexes offer advanced versatility for large, open floor plans or custom layouts with private offices. Redi-Plex is built with clearspan construction, which eliminates interference from support columns and allows for up to sixty feet of open building width and building lengths that increase in twelve foot increments, based on the number of units coupled together. Our proprietary design meets a wide range of national and state building, electrical, mechanical and plumbing codes, which creates versatility in fleet management.

Classrooms. Classroom units are generally double-wide units adapted specifically for use by school systems or universities. Classroom units usually feature teaching aids, air conditioning/heating units, windows and, if requested, toilet facilities.

Container Offices. Container offices are International Organization for Standardization (“ISO”) certified shipping containers that we convert for office use. They provide safe, secure, ground-level access with fully welded weather-resistant steel corrugated exteriors and exterior window guards made of welded steel and tamper-proof screws. Container offices are available in 20 and 40 foot lengths and in a combination of office and storage floor plans, or all-office floor plans.

Other Modular Space. We offer a range of other specialty products that vary across regions and provide flexibility to serve demands for local markets. Examples include toilet facilities to complement office and classroom units, guard houses, dormitories, and dining facilities.

Portable Storage Solutions

Storage units are typically ISO shipping containers with swing doors that are repurposed for commercial storage applications. These units are primarily ground-level entry, windowless storage containers made of heavy exterior metals for secure storage and water tightness.

VAPS

We offer a thoughtfully curated portfolio of VAPS that make modular space and portable storage units more productive, comfortable, secure and “Ready to Work” for our customers. We lease furniture, steps, ramps, basic appliances, internet connectivity devices and other items to our customers for use in connection with our products. We also offer our lease customers a damage waiver program that protects them in case the leased unit is damaged. For customers who do not select the damage waiver program, we bill them for the cost of repairs above and beyond normal wear and tear.

Delivery, Installation and Removal

We provide delivery, site-work, installation, disassembly, unhooking and removal, and other services to our customers for an additional fee as part of our leasing and sales operations. Typically, units are placed on temporary foundations constructed by our in-house service technicians or subcontractors. These in-house service technicians or subcontractors also generally install any ancillary products and VAPS.

Product Leases

Rental equipment leasing is our core business. Over 90% of new lease orders are on our standard lease agreement, pre-negotiated master lease or national account agreements. The initial lease periods vary, and our leases are customarily renewable on a month-to-month basis after their initial term. While the initial lease term is often relatively short, the average actual lease duration of our lease portfolio (including month-to-month renewals) is significantly longer. Our average minimum lease terms at delivery for modular space units and portable storage units are 14 months and 7 months, respectively, while the average duration of our lease portfolio is 34 months.

Customers are responsible for the costs of delivery and set-up, dismantling and pick-up, customer-specified modifications, costs to return custom modifications back to standard configuration at end of lease and any loss or damage beyond normal wear and tear. Our leases generally require customers to maintain liability and property insurance covering the units during the lease term and to indemnify us from losses caused by the negligence of the customer.

As of December 31, 2019, we had over 125,000 modular space units, of which 88,495, or 69%, were on rent, as well as over 25,000 portable storage units, of which 16,892, or 66%, were on rent.

Product Sales

We complement our core leasing business with product sales of new units that we purchase from a broad network of third-party manufacturers. We typically do not purchase new units for resale until we have obtained firm purchase orders (which normally are non-cancelable and include up-front deposits) for such units. Buying units directly for resale adds scale to our purchasing, which is beneficial to our overall supplier relationships and purchasing terms. New unit sales are a natural extension of our leasing operations in situations where customers have long-lived or permanent projects, making it more cost-effective to purchase rather than to lease a standard unit.

In the normal course of managing our business, we also sell idle used rental units at fair market value and units that are already on rent if the customer expresses interest in owning rather than continuing to rent the unit. The sale of units from our rental equipment has historically been both a profitable and cost-effective method to finance the replenishment and upgrade of the lease fleet as well as to generate free cash flow during periods of lower rental demand and utilization. Our sales business may include modifying or customizing units to meet customer requirements. We also offer delivery, installation and removal-related services for an additional fee as part of our sales operations.

Customers

In 2019, we served over 50,000 customers. We believe that our customers prefer our modular space products over fixed, on-site built space because modular space products are a quick, flexible, and cost-effective solution for temporary or permanent expansion.

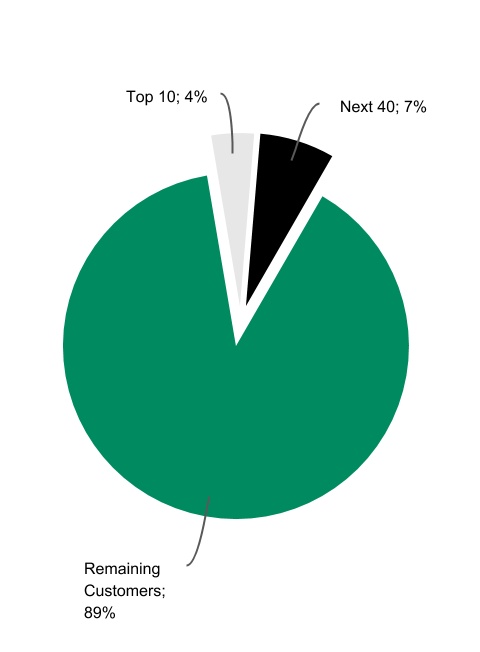

For the years ended December 31, 2019, 2018 and 2017, no one customer accounted for more than 3% of our total consolidated revenues. For the year ended December 31, 2019, no one customer accounted for more than 1% of revenue, our top 10 customers accounted for 4% of revenue, and our top 50 customers accounted for less than 11% of revenue, reflecting the low customer concentration and project diversification within our portfolio. Our strategy involves operating standardized rental equipment and "Ready to Work" solutions that can be redeployed across our diversified customer base and branch network in 15 discrete end markets. Key customer end markets include:

Construction and Infrastructure

We provide office and storage space to a broad array of contractors associated with non-residential buildings and non-building infrastructure. Our client portfolio includes many of the largest general contractors and engineering, architecture, procurement, and construction companies in North America, as well as home builders, developers, and subcontractors. Examples include highway, street, bridge and tunnel contractors; water, sewer, communication and power line contractors; and special construction trades, including glass, glazing and demolition. Our construction and infrastructure customer base is characterized by a wide variety of contractors that are associated with original construction as well as capital improvements in the private, institutional and municipal arenas.

Commercial and Industrial

Our customers use our products as their primary office or retail space, to expand their existing commercial workspace, to increase their storage capabilities, and as temporary space for festivals, sporting, and other events. Customers in this category span a variety of industries ranging from agriculture, forestry & fishing; arts, media, hotels & entertainment; chemicals and other manufacturing; professional services; and retail & wholesale trade, including fast food and retail, as well as commercial offices, warehousing and other industrial end markets.

Energy and Natural Resources

Our products are leased to companies involved in electricity generation and transmission, utilities, up-mid-and down-stream oil and gas, mining exploration and extraction, and other related sectors.

Education

Rapid shifts in populations within regions often necessitate quick and cost effective expansion of education facilities, particularly in elementary and secondary schools and universities and colleges. Regional and local governmental budgetary pressures, classroom size reduction legislation, refurbishment of existing facilities and the expansion of charter schools have made modular classrooms a convenient and economically advantageous alternative to expand capacity in education settings. In addition, our products are used as classrooms when schools are undergoing large scale modernization, which allows continuous operation of a school while modernization progresses.

Government

Government customers consist of national, state, provincial and local public sector organizations. Modular space and portable storage solutions are particularly attractive to focused niches such as small municipal buildings, prisons and jails, courthouses, military installations, national security buildings and offices during building modernization, as well as disaster relief.

Competitive Strengths

We believe that the following competitive strengths have been instrumental to our success and position us for future growth:

North American Market Leader with Significant Scale Advantages

We have developed our market position by leveraging our extensive branch network, diverse fleet, technical expertise, operational capabilities and strong brand awareness among our customers. Our extensive scale allows us to attract and retain talent and implement industry leading technology tools and process. This results in significant operational benefits, such as optimization of fleet yield and utilization, efficient capital allocation, superior service capabilities and the ability to offer consistent "Ready to Work" solutions across all of our branch locations.

Customer, End Market and Geographic Diversity

We have established strong relationships with a diverse customer base, ranging from large national accounts to small local businesses. Our customers operate in multiple end markets, including commercial and industrial, construction, education, energy and natural resources and government, among others. We believe that the diversity of our customer end markets reduces our exposure to changes related to a given customer, shifts within an industry or geographic region, and end market industry seasonality, while also providing significant opportunities to grow the business. When combined with our 34 month average lease duration, the diversification and flexibility in our portfolio results in predictable lease revenue streams.

Since geographic proximity to customers is a competitive advantage in the industry, we maintain a network of approximately 120 branches and additional drop lots to better service our customers. Our branches typically have a sales staff dedicated to the local market, with transportation personnel responsible for delivery and pick-up of our units and yard personnel responsible for loading and unloading units and performing repairs and maintenance. Customers benefit from improved service and response times, reduced time to occupancy, better access to sales representatives with local market knowledge, as well as lower freight costs, which are typically paid by the customer. We benefit because we are able to leverage investments in shared services, technology, and marketing costs over a larger lease base, redeploy units within our branch network to optimize utilization, enhance our competitive position by providing ample local supply and offer profitable short-term leases which either would not be profitable or would be cost prohibitive to the customer without a local market presence. We believe that the geographic diversity of our branch network reduces our exposure to changes related to a given

region, while presenting us with significant growth opportunities.

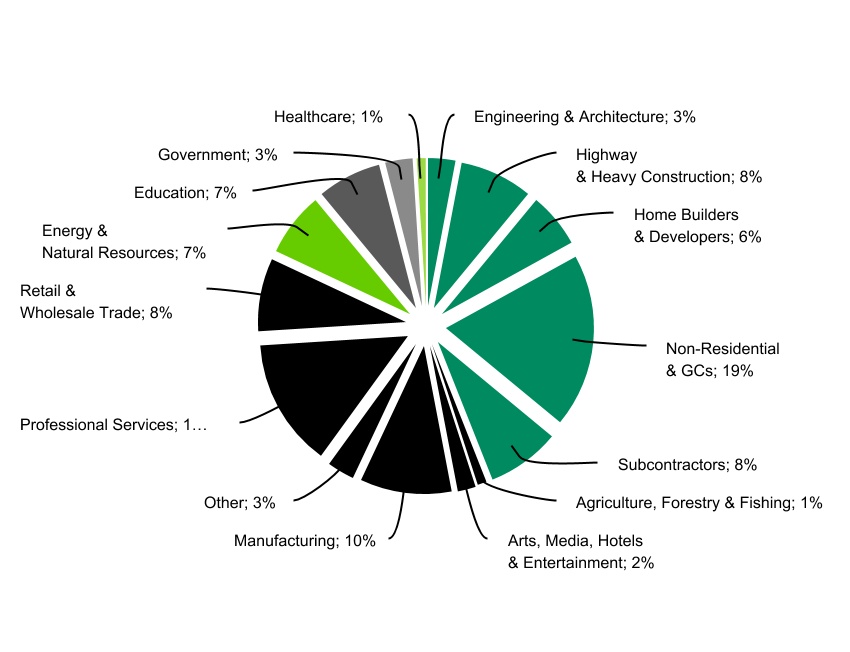

The following chart illustrates the breakdown of our customers and revenue by end markets as of December 31, 2019. In order to optimize the use of fleet asset across our branch network, we centrally manage fleet rebalancing across our end markets. This allows us to serve 15 distinct end markets in which no customer accounted for more than 1% of consolidated revenue for the year ended December 31, 2019.

| | | | | |

| REVENUE MIX BY END MARKET | CUSTOMER CONCENTRATION |

Long-Life Fleet and Effective Fleet Management

As of December 31, 2019, our modular space and portable storage lease fleet consists of 76.8 million square feet of relocatable space, comprising approximately 153,000 units with a gross book value of approximately $2.6 billion. Modular space units have attractive economic characteristics and our ability to lease and maintain our assets profitability over economic lives that often exceed 20 years, is a unique capability and competitive advantage for WillScot. We utilize standard fleet maintenance procedures across the branch network, monitor fleet condition and allocate capital expenditures centrally, and ensure all units meet consistent quality and condition requirements, regardless of unit age, prior to delivery to a customer.

Our standardized lease fleet meets multi-state industrial building codes, which allows us to leverage our branch network and rapidly redeploy units to areas of higher customer demand in the surrounding geographic markets, as well as easily modify our structures to meet specific customer needs. Additionally, we have the flexibility to refurbish existing units in order to re-lease them when we have sufficient customer demand or we can choose to sell used units to customers.

The relative simplicity and favorable condition and quality of the lease fleet, as well as our sourcing strategy where we source our units with no significant dependence on any one particular supplier and have no long-term purchase contracts with manufacturers, provides purchasing flexibility and allows us to adjust such expenditures based on our business needs and prevailing economic conditions.

The nature of our modular space product line and diverse customer end uses support our growing offering of VAPS, which typically have useful lives between 2 and 8 years and offer an incremental return on investment.

We supplement our fleet and VAPS investments with acquisitions, and adjust our investments in fleet and acquisitions opportunistically.

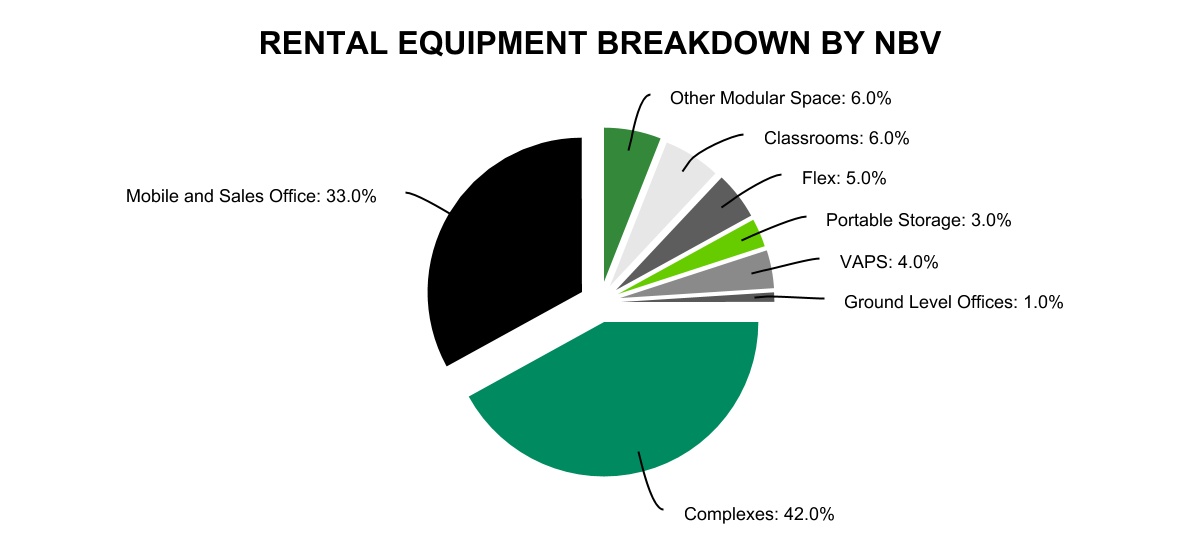

The following chart illustrates the breakdown of the net book value of our rental equipment between the various modular space product types, portable storage and VAPS as of December 31, 2019.

Our Industry

Our business primarily operates within the modular space and portable storage markets however, our services span across a variety of related sectors, including furniture rental, transportation and logistics, facilities management and rental services, and commercial real estate.

Modular Space Market

The modular space market is fragmented. Modular space units are non-residential structures designed to meet federal, provincial, state and local building codes and, in most cases, are designed to be relocatable. Modular space units are constructed offsite, utilizing manufacturing techniques to prefabricate single or multi-story whole building solutions in deliverable modular sections. Units are typically constructed of steel, wood and conventional building materials.

The modular space market has evolved in recent years as businesses and other potential customers increasingly recognize the value of modular space. The key growth drivers in this market are:

•Growing need and demand for space - driven by general economic activity, including gross domestic product growth, industrial production, mining and natural resources activity, non-residential construction, urbanization, public and education spending, and the scale and frequency of special events.

•Increasing shift from traditional fixed, on-site built space to modular space solutions - driven by several advantages as compared with fixed, on-site built space, including:

◦Quick to install - the pre-fabrication of modular space units allows them to be put in place rapidly, providing potential long-term solutions to needs that may have materialized quickly.

◦Flexibility - flexible assembly design allows modular space units to be built to suit a customer’s needs while offering customers the ability to adjust their space as their needs change.

◦Cost effectiveness - modular space units provide a cost effective solution for temporary and permanent space requirements and allow customers to improve returns on capital in their core business.

◦Quality - the pre-fabrication of modular space units is based on a repeatable process in a controlled environment, resulting in more consistent quality.

◦Mobility - modular space units can easily be disassembled, transported to a new location and re-assembled.

◦Environmentally friendly - relocatable buildings promote the reuse of facilities, on an as-needed basis by the occupants.

Portable Storage Market

The portable storage market is highly fragmented and remains primarily local in nature. Portable storage provides customers with a flexible and low-cost storage alternative to permanent warehouse space and fixed-site self-storage. In addition, portable storage addresses the need for security while providing for convenience and immediate accessibility to customers.

Other Related Markets

In the normal course of providing our “Ready to Work” solutions, we perform services that are characteristic of activities in other industries. For example, we coordinate a broad network of third-party and in-house transportation and service resources to support the timely movement of our products, as well as maintenance on, customer sites. Additionally, we design, source, lease and maintain a broad offering of ancillary products, including furniture, that render our modular structures immediately functional in support of our customers’ needs. We also provide technical expertise and oversight for customers regarding building design and permitting, site preparation and expansion or contraction of installed space based on changes in project requirements. Further, we have the capability to compete in adjacent markets, such as commercial and institutional housing, that have received less focus historically in the modular space market. We believe that this broad service capability differentiates us from other rental and business services providers and clearly differentiates us in the marketplace.

Competition

Although our competition varies significantly by local market, the modular space and portable storage industry is highly competitive and fragmented as a whole. Based on customer feedback, we believe that participants in our industry compete on the basis of customer relationships, product quality and availability, delivery speed, VAPS and service capabilities, pricing, and overall ease of doing business. We typically compete with one or more local providers in all of our markets, as well as with a limited number of national and regional companies. Some of our competitors may have greater market share in certain geographic regions. Significant modular space and portable storage competitors include Mobile Mini, Mobile Modular, Pac-Van, ATCO Structures & Logistics and BOXX Modular. Numerous other regional and local companies compete in individual markets.

Strategic Acquisitions

We believe the scalability of our branch network, corporate and shared services infrastructure, technology, and processes allows us to integrate acquisitions efficiently, realize cost savings, cross-sell VAPS, and improve the yield on acquired assets. As such, we manage an active acquisition pipeline and consider acquisitions to be an important component of our growth strategy.

Employees

As of December 31, 2019, we had over 2,500 employees. We have collective bargaining agreements in portions of our Mexico-based operations representing approximately 1% of our employees. Approximately 89% of our employees are in the field, while 11% serve in corporate functions. We have not experienced a strike or significant work stoppage, and we consider our relations with employees to be good.

Intellectual Property

We own a number of trademarks, none of which are individually material to our business. Our trademarks are registered or pending applications for registrations in the US Patent and Trademark Office and various non-US jurisdictions. We operate primarily under the WillScot brand.

Regulatory and Environmental Compliance

We are subject to certain environmental, transportation, anti-corruption, import controls, health and safety and other laws and regulations in countries, states or provinces, and localities in which we operate. We incur significant costs in our business to comply with these laws and regulations. However, from time to time we may be subject to additional costs and penalties as a result of non-compliance. The discovery of currently unknown matters or conditions, new laws and regulations or different enforcement or interpretation of existing laws and regulations could materially harm our business or operations in the future.

We are subject to laws and regulations that govern and impose liability for activities that may have adverse environmental effects, including discharges into air and water, and handling and disposal of hazardous substances and waste. As of the date of this filing, no environmental matter has been material to our operations. Based on our management’s assessment, we believe that any environmental matters relating to us of which we are currently aware will not be material to our overall business or financial condition.

The jurisdictions in which we operate are also subject to anti-bribery laws and regulations, such as the US Foreign Corrupt Practices Act of 1977, as amended (the “FCPA”). These regulations prevent companies and their officers, employees and agents from making payments to officials and public entities of foreign countries to facilitate obtaining new contracts. Violations of these laws and regulations may result in criminal sanctions and significant monetary penalties.

A portion of our units are subject to regulation in certain states under motor vehicle and similar registrations and certificate of title statutes. Management believes that we have complied, in all material respects, with all motor vehicle

registration and similar certificate of title statutes in states where such statutes clearly apply to modular space units. We have not taken actions under such statutes in states where we have determined that such statutes do not apply to modular space units. However, in certain states, the applicability of such statutes to modular space units is not clear beyond doubt. If additional registration and related requirements are deemed to be necessary in such states or if the laws in such states or other states were to change to require us to comply with such requirements, we could be subject to additional costs, fees and taxes as well as administrative burdens in order to comply with such statutes and requirements. Management does not believe that the effect of such compliance will be material to our business and financial condition.

Recent Developments

Warrant Redemption

On January 24, 2020, the Company delivered a notice (the “Redemption Notice”) for the redemption of all of its outstanding Public Warrants (as defined in Item 5, 2015 Warrants, of this Annual Report on Form 10-K) to purchase shares of the Company’s Class A common stock, par value $0.0001 per share, that were issued under the Warrant Agreement, dated September 10, 2015, by and between the Company’s legal predecessor company Double Eagle Acquisition Corp. (“Double Eagle”) and Continental Stock Transfer & Trust Company, as warrant agent (the “Warrant Agreement”), as part of the units sold in Double Eagle's initial public offering (the “IPO”) that remain unexercised at 5:00 p.m. New York City time on February 24, 2020. As further described in the Redemption Notice and permitted under the Warrant Agreement, holders of the Public Warrants who exercised such Public Warrants following the date of the Redemption Notice were required to do so on a “cashless basis.”

From January 1, 2020 through January 24, 2020, 796,610 Public Warrants were exercised for cash, resulting in the Company receiving cash proceeds of $4.6 million in the aggregate. An aggregate of 398,305 shares of the Company's Class A common stock were issued in connection with these exercises.

After January 24, 2020 through February 24, 2020, 5,836,040 Public Warrants were exercised on a cashless basis. An aggregate of 1,097,162 shares of the Company's Class A common stock were issued in connection with these exercises. Thereafter, the Company completed the redemption of 38,509 remaining Public Warrants for $0.01 per warrant.

Following the redemption of the Public Warrants, (i) 17,561,700 Private Warrants (as defined in Item 5, 2015 Warrants, of this Annual Report on Form 10-K), each exercisable for one-half of one share of Common Stock at an exercise price of $5.75 per half-share, issued under the Warrant Agreement in a private placement simultaneously with the IPO and still held by the initial holders thereof or their permitted transferees remain outstanding and (ii) 9,966,070, each exercisable for one share of the Company's Class A common stock at an exercise price of $15.50 per share, issued in connection with the Company’s acquisition of Modular Space Holdings, Inc. ("ModSpace") under a warrant agreement dated August 15, 2018, between Continental Stock Transfer & Trust Company, as warrant agent. As of February 28, 2020, 110,316,368 shares of the Company's Class A common stock were issued and outstanding.

Merger

On March 1, 2020, the Company, along with its newly formed subsidiary, Picasso Merger Sub, Inc. (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Mobile Mini, Inc. (“Mobile Mini”). The Merger Agreement provides for the merger of Mobile Mini with and into Merger Sub (the “Merger”), with Mobile Mini surviving as a wholly-owned subsidiary of the Company. At the effective time of the Merger, and subject to the terms and subject to the conditions set forth in the Merger Agreement, each outstanding share of the common stock of Mobile Mini shall be converted into the right to receive 2.4050 shares of WillScot Class A common stock. Under the terms of the Merger Agreement, we expect our and Mobile Mini’s stockholders would own 54% and 46% of the combined company, respectively.

The Merger has been unanimously approved by the Company and Mobile Mini’s boards of directors. The Merger is subject to customary closing conditions, including receipt of regulatory and stockholder approvals by the Company and Mobile Mini’s stockholders, and is expected to close in third quarter of 2020. Additionally, the transaction also has the support of TDR Capital, the Company's largest shareholder, which has entered into a customary voting agreement in support of the Merger.

In connection with the Merger, the Company entered into a commitment letter (the “Commitment Letter”), dated March 1, 2020, with the lenders party thereto (the “Lenders”). Pursuant to the Commitment Letter, the Lenders have agreed to provide debt financing to refinance the Company’s existing ABL Facility (as defined below), Mobile Mini’s existing ABL credit facility and Mobile Mini’s outstanding senior notes due 2024 on the terms and conditions set forth in the Commitment Letter.

Available Information

Our website address is www.willscot.com. We make available, free of charge through our website, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the United States Securities and Exchange Commission (the “SEC”). The SEC maintains an internet website at www.sec.gov that contains reports, proxy and information statements and other information regarding WillScot.

ITEM 1A. Risk Factors

Risks Relating to Our Business

We face significant competition in the modular space and portable storage unit industry. If we are unable to compete successfully, we could lose customers and our revenue and profitability could decline.

Although our competition varies significantly by market, the modular space and portable storage unit industry is highly competitive in general. We compete on the basis of a number of factors, including customer relationships, product quality and availability, delivery speed, VAPS and service capabilities, pricing, and overall ease of doing business. We may experience pricing pressures in our operations as some of our competitors seek to obtain market share by reducing prices, and we may face reduced demand for our products and services if our competitors are able to provide new or innovative products or services that better appeal to customers. In most of our end markets, we face competition from national, regional and local companies who have an established market position in the specific service area, and we expect to encounter similar competition in any new markets that we may enter. In certain markets, some of our competitors may have greater market share, less debt, greater pricing flexibility, more attractive product or service offerings, or superior marketing and financial resources. Increased competition could result in lower profit margins, substantial pricing pressure and reduced market share. Price competition, together with other forms of competition, may materially adversely affect our business, results of operations and financial condition.

Our operations are exposed to operational, economic, political and regulatory risks.

We operate in the US, Canada and Mexico. For the year ended December 31, 2019, approximately 90.9%, 7.6%, and 1.5% of our revenue was generated in the US, Canada and Mexico, respectively. Our operations in these countries could be affected by foreign and domestic economic, political and regulatory risks, including the following:

• regulatory requirements that are subject to change and that could restrict our ability to assemble, lease or sell

products;

• inflation, recession, and fluctuations in foreign currency exchange and interest rates;

• trade protection measures, including increased duties and taxes and import or export licensing requirements;

• compliance with applicable antitrust and other regulatory rules and regulations relating to potential acquisitions;

• different local product preferences and product requirements;

• pressures on management time and attention due to the complexities of overseeing multi-national operations;

• challenges in maintaining staffing;

• different labor regulations and the potential impact of collective bargaining;

• potentially adverse consequences from changes in, or interpretations of, tax laws;

• political and economic instability;

• enforcement of remedies in various jurisdictions;

• the risk that the business partners upon whom we depend for technical assistance will not perform as expected;

• compliance with applicable export control laws and economic sanctions laws and regulations;

• price controls and ownership regulations;

• obstacles to the repatriation of earnings and cash;

• differences in business practices that may result in violation of company policies, including, but not limited to, bribery

and collusive practices; and

• reduced protection for intellectual property in some countries.

These and other risks may materially adversely affect our business, results of operations and financial condition.

Global or local economic movements could have a material adverse effect on our business.

We operate our business in the US, Canada and Mexico. Our business may be negatively impacted by economic movements or downturns in the local markets in which we operate or global markets generally. These adverse economic conditions may reduce commercial activity, cause disruption and extreme volatility in global financial markets and increase rates of default and bankruptcy. Reduced commercial activity has historically resulted in reduced demand for our products and services. For example, reduced commercial activity in the construction, energy and natural resources sectors in certain markets in which we operate, particularly the US and Canada, has negatively impacted our business in the past. Disruptions in financial markets could negatively impact the ability of our customers to pay their obligations to us in a timely manner and increase our counterparty risk. If economic conditions worsen, we may face reduced demand and an increase, relative to historical levels, in the time it takes to receive customer payments. If we are not able to adjust our business in a timely and

effective manner to changing economic conditions, our business, results of operations and financial condition may be materially adversely affected.

Moreover, the level of demand for our products and services is sensitive to the level of demand within various sectors, particularly the commercial and industrial, construction, education, energy and natural resources, and government end markets. Each of these sectors is influenced not only by the state of the general global economy, but also by a number of more specific factors as well. For example, a decline in global or local energy prices may materially adversely affect demand for modular buildings within the energy and resources sector. The levels of activity in these sectors and geographic regions may also be cyclical, and we may not be able to predict the timing, extent or duration of the activity cycles in the markets in which we or our key customers operate. A decline or slowed growth in any of these sectors or geographic regions could result in reduced demand for our products and services, which may materially adversely affect our business, results of operations and financial condition.

Effective management of our fleet is vital to our business, and our failure to properly safeguard, design, manufacture, repair and maintain our fleet could harm our business and reduce our operating results and cash flows.

Our modular space and portable storage units have long economic lives and managing our fleet is a critical element to our leasing business. Rental equipment asset management requires designing and building long-lived products that anticipate customer needs and changes in legislation, regulations, building codes and local permitting in the various markets in which we operate. In addition, we must cost-effectively maintain and repair our fleet to maximize the economic life of the products and the proceeds we receive from product sales. As the needs of our customers change, we may incur costs to relocate or retrofit our assets to better meet shifts in demand. If the distribution of our assets is not aligned with regional demand, we may be unable to take advantage of sales and leasing opportunities in certain regions, despite excess inventory in other regions. If we are not able to successfully manage our lease assets, our business, results of operations and financial condition may be materially adversely affected.

If we do not appropriately manage the design, manufacture, repair and maintenance of our product fleet, or if we delay or defer such repair or maintenance or suffer unexpected losses of rental equipment due to theft or obsolescence, we may be required to incur impairment charges for equipment that is beyond economic repair or incur significant capital expenditures to acquire new rental equipment to serve demand. These failures may also result in personal injury or property damage claims, including claims based on poor indoor air quality and termination of leases or contracts by customers. Costs of contract performance, potential litigation and profits lost from termination could materially adversely affect our future operating results and cash flows.

Trade policies and changes in trade policies, including the imposition of tariffs, their enforcement and downstream consequences, may materially adversely affect our business, results of operations, and outlook.

Tariffs and/or other developments with respect to trade policies, trade agreements and government regulations may materially, adversely affect our business, financial condition and results of operations. For example, the US government has imposed tariffs on steel, aluminum and lumber imports from certain countries, which could result in increased costs to us for these materials. Without limitation, (i) tariffs currently in place and (ii) the imposition by the federal government of new tariffs on imports to the US could materially increase (a) the cost of our products that we are offering for sale or lease, (b) the cost of certain products that we source from foreign manufacturers, and (c) the cost of certain raw materials or products that we utilize. We may not be able to pass such increased costs on to our customers, and we may not be able to secure sources of certain products and materials that are not subject to tariffs on a timely basis. Although we actively monitor our procurement policies and practices to avoid undue reliance on foreign-sourced goods subject to tariffs, when practicable, such developments may materially adversely affect our business, financial condition and results of operations.

We may be unable to acquire and integrate new operations, which could cause our business to suffer.

We may be unable to complete strategic acquisitions or integrate acquired businesses or assets into our operations for various reasons. We completed the Modular Space Holdings, Inc., or ModSpace, and Acton Mobile Holdings LLC, or Acton, acquisitions in 2018 and 2017. While the ModSpace and Acton integrations are substantially complete, we may explore acquisitions in the future that meet our strategic growth plans. We cannot predict if or when acquisitions will be completed, and we may face significant competition for acquisition targets. Acquisitions involve numerous risks, including the following:

•difficulties in integrating the operations, technologies, products and personnel of the acquired companies;

•diversion of management’s attention from normal daily operations of the business;

•loss of key employees;

•difficulties in entering markets in which we have no or limited prior experience and where our competitors in such markets have stronger market positions;

•difficulties in complying with regulations, such as environmental regulations, and managing risks related to an acquired business;

•an inability to timely obtain financing, including any amendments required to existing financing agreements;

•an inability to implement uniform standards, controls, procedures and policies;

•undiscovered and unknown problems, defects, liabilities or other issues related to any acquisition that become known to us only after the acquisition, particularly relating to rental equipment on lease that are unavailable for inspection during the diligence process; and

•loss of key customers, suppliers or employees.

In connection with acquisitions, we may assume liabilities or acquire damaged assets, some of which may be unknown to us at the time of such acquisitions.

We assess the condition and regulatory certification of an acquired fleet as part of our acquisition due diligence. In some cases, fleet condition or regulatory certification may be difficult to determine due to the fleet being on lease at the time of acquisition and/or inadequate certification records. Fleet acquisitions may therefore result in a rectification cost that we may not have factored into the acquisition price, impacting deployability and ultimate profitability of the fleet we acquired.

In particular, we have made two major acquisitions (Acton and ModSpace) since November 29, 2017. Although we have substantially integrated the acquired businesses and assets into our organization and platforms, we must continue to take actions in 2020 to realize the combined cost synergies that we forecast for those acquisitions. We may incur more costs than we anticipated to achieve the forecast synergies (thus reducing the net benefit of the cost synergies), realize synergies later than we expected or fail altogether to achieve a portion of the cost savings we anticipated. Any of these events could cause reductions in our earnings per share, impact our ability to borrow funds under our credit facility, decrease or delay the accretive effect of the acquisitions that we anticipated and negatively impact our stock price.

Acquisitions are inherently risky, and we cannot provide assurance that any future acquisitions will be successful or will not materially adversely affect our business, results of operations and financial condition. If we do not manage new markets effectively, some of our new branches and acquisitions may lose money or fail, and we may have to close unprofitable branches. Closing a branch in such circumstances would likely result in additional expenses that would cause our operating results to suffer. To manage growth successfully, we will need to continue to identify additional qualified managers and employees to integrate acquisitions within our established operating, financial and other internal procedures and controls. We will also need to effectively motivate, train and manage our employees. Failure to successfully integrate recent and future acquisitions and new branches into existing operations could materially adversely affect our results of operations and financial condition.

If we do not manage our credit risk effectively, collect on our accounts receivable, or recover our rental equipment from our customers, it could materially adversely affect our business, financial condition and results of operations.

We perform credit evaluation procedures on our customers on each transaction and require security deposits or other forms of security from our customers when we identify a significant credit risk. Failure to manage our credit risk and receive timely payments on our customer accounts receivable may result in the write-off of customer receivables and loss of units if we are unable to recover our rental equipment from our customers’ sites. If we are not able to manage credit risk, or if a large number of customers should have financial difficulties at the same time, our credit and rental equipment losses would increase above historical levels. If this should occur, our business, financial condition, results of operations and cash flows may be materially adversely affected.

Our ability to use our net operating loss carryforwards and other tax attributes may be limited.

As of December 31, 2019, we had US net operating loss (“NOL”) carryforwards of approximately $899.5 million and $619.9 million for US federal income tax and state tax purposes, respectively, available to offset future taxable income, prior to consideration of annual limitations that Section 382 of the Internal Revenue Code of 1986 may impose. The US NOL carryforwards begin to expire in 2019 for state and 2022 for federal if not utilized. In addition, we had foreign NOLs of $20.7 million as a result of our operations in Canada and Mexico. Our Mexico and Canadian NOL carryforwards begin to expire in 2021 and 2038, respectively, if not utilized.

Our US NOL and tax credit carryforwards could expire unused and be unavailable to offset future income tax liabilities. Under Section 382 of the Internal Revenue Code and corresponding provisions of US state law, if a corporation undergoes an “ownership change,” generally defined as a greater than 50% change, by value, in its equity ownership over a three-year period, the corporation’s ability to use its US NOLs and other applicable tax attributes before the ownership change, such as research and development tax credits, to offset its income after the ownership change may be limited. We have completed Section 382 analyses for applicable transactions, and performed utilization analysis under US GAAP. As a result, if we earn net taxable income, our ability to use our pre-ModSpace US NOL carryforwards to offset US federal taxable income may be subject to limitations, which could potentially result in increased future tax liability to us. In addition, at the state level, there may be periods during which the use of US NOLs is suspended or otherwise limited, which could accelerate or permanently increase state taxes owed.

Lastly, we may experience ownership changes in the future as a result of subsequent shifts in our stock ownership, some of which may be outside of our control. If we determine that an ownership change has occurred and our ability to use our

historical NOL and tax credit carryforwards is materially limited, it may result in increased future tax obligations and income tax expense.

We may be unable to recognize deferred tax assets such as those related to our tax loss carryforwards and, as a result, lose future tax savings, which could have a negative impact on our liquidity and financial position.

We recognize deferred tax assets primarily related to deductible temporary differences based on our assessment that the item will be utilized against future taxable income and the benefit will be sustained upon ultimate settlement with the applicable taxing authority. Such deductible temporary differences primarily relate to tax loss carryforwards and business interest expense limitations. Tax loss carryforwards arising in a given tax jurisdiction may be carried forward to offset taxable income in future years from such tax jurisdiction and reduce or eliminate income taxes otherwise payable on such taxable income, subject to certain limitations. Deferred interest expense exists primarily within our US operating companies, where interest expense was not previously deductible as incurred but may become deductible in the future subject to certain limitations. We may have to write down, through income tax expense, the carrying amount of certain deferred tax assets to the extent we determine it is not probable we will realize such deferred tax assets.

Some of the tax loss carryforwards expire and if we do not have sufficient taxable income in future years to use the tax benefits before they expire, the benefit may be permanently lost. In addition, the taxing authorities could challenge our calculation of the amount of our tax attributes, which could reduce certain of our recognized tax benefits. Further, tax laws in certain jurisdictions may limit the ability to use carryforwards upon a change in control.

Unanticipated changes in our tax obligations, the adoption of a new tax legislation, or exposure to additional income tax liabilities could affect profitability.

We are subject to income taxes in the US, Canada and Mexico. Our tax liabilities are affected by the amounts we charged for inventory, services, funding and other transactions on an intercompany basis. We are subject to potential tax examinations in these jurisdictions. Tax authorities may disagree with our intercompany charges, cross-jurisdictional transfer pricing or other tax positions and assess additional taxes. We regularly assess the likely outcomes of these examinations to determine the appropriateness of our tax provision. However, there can be no assurance that we will accurately predict the outcomes of these potential examinations, and the amounts that we ultimately pay upon resolution of examinations could be materially different from the amounts we previously included in our income tax provision and, therefore, could have a material impact on our results of operations and cash flows. In addition, our future effective tax rate could be adversely affected by changes to our operating structure, changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation allowance of deferred tax assets, changes in tax laws and the discovery of new information in the course of our tax return preparation process. Changes in tax laws or regulations may increase tax uncertainty and adversely affect our results of operations.

Changes in state building codes could adversely impact our ability to remarket our buildings, which could have a material adverse impact on our business, financial condition and results of operations.

Building codes are generally reviewed, debated and, in certain cases, modified on a national level every three years as an ongoing effort to keep the regulations current and improve the life, safety and welfare of the building’s occupants. All aspects of a given code are subject to change, including, but not limited to, such items as structural specifications for earthquake safety, energy efficiency and environmental standards, fire and life safety, transportation, lighting and noise limits. On occasion, state agencies have undertaken studies of indoor air quality and noise levels with a focus on permanent and modular classrooms. This process leads to a systematic change that requires engagement in the process and recognition that past methods will not always be accepted. New modular construction is very similar to conventional construction where newer codes and regulations generally increase cost. New governmental regulations may increase our costs to acquire new rental equipment, as well as increase our costs to refurbish existing equipment.

Compliance with building codes and regulations entails risk as state and local government authorities do not necessarily interpret building codes and regulations in a consistent manner, particularly where applicable regulations may be unclear and subject to interpretation. These regulations often provide broad discretion to governmental authorities that oversee these matters, which can result in unanticipated delays or increases in the cost of compliance in particular markets. The construction and modular industries have developed many “best practices” which are constantly evolving. Some of our peers and competitors may adopt practices that are more or less stringent than ours. When, and if, regulators clarify regulatory standards, the effect of the clarification may be to impose rules on our business and practices retroactively, at which time we may not be in compliance with such regulations and we may be required to incur costly remediation. If we are unable to pass these increased costs on to our customers, our business, financial condition, operating cash flows and results of operations could be negatively impacted.

Our operations face foreign currency exchange rate exposure, which may materially adversely affect our business, results of operations and financial condition.

We hold assets, incur liabilities, earn revenue and pay expenses in certain currencies other than the US dollar, primarily the Canadian dollar and the Mexican peso. Our consolidated financial results are denominated in US dollars, and

therefore, during times of a strengthening US dollar, our reported revenue in non-US dollar jurisdictions will be reduced because the local currency will translate into fewer US dollars. Revenue and expenses are translated into US dollars at the average exchange rate for the period. In addition, the assets and liabilities of our non-US dollar subsidiaries are translated into US dollars at the exchange rates in effect on the balance sheet date. Foreign currency exchange adjustments arising from certain intercompany obligations with and between our domestic companies and our foreign subsidiaries are marked-to-market and recorded as a non-cash loss or gain in each of our financial periods in our consolidated statements of operations. Accordingly, changes in currency exchange rates will cause our foreign currency translation adjustment in the consolidated statements of comprehensive loss to fluctuate. In addition, fluctuations in foreign currency exchange rates will impact the amount of US dollars we receive when we repatriate funds from our non-US dollar operations.

Fluctuations in interest rates and commodity prices may also materially adversely affect our revenues, results of operations and cash flows.

Although we have converted a portion of our senior secured revolving credit facility borrowings into fixed-rate debt through interest rate swaps, a significant portion of our borrowings under the facility remain variable rate debt. Fluctuations in interest rates may negatively impact the amount of interest payments, as well as our ability to refinance portions of our existing debt in the future at attractive interest rates. In addition, certain of our end markets, as well as portions of our cost structure, such as transportation costs, are sensitive to changes in commodity prices, which can impact both demand for and profitability of our services. These changes could impact our future earnings and cash flows, assuming other factors are held constant.

Significant increases in raw material and labor costs could increase our operating costs significantly and harm our profitability.

We incur labor costs and purchase raw materials, including steel, lumber, siding and roofing, fuel and other products to perform periodic repairs, modifications and refurbishments to maintain physical conditions of our units and in connection with get-ready, delivery and installation of our units. The volume, timing and mix of such work may vary quarter-to-quarter and year-to-year. Generally, increases in labor and raw material costs will increase the acquisition costs of new units and also increase the repair and maintenance costs of our fleet. We also maintain a truck fleet to deliver units to and return units from our customers, the cost of which is sensitive to maintenance and fuel costs and rental rates on leased equipment. During periods of rising prices for labor or raw materials, and in particular, when the prices increase rapidly or to levels significantly higher than normal, we may incur significant increases in our acquisition costs for new units and higher operating costs that we may not be able to recoup from customers through changes in pricing, which could materially adversely affect our business, results of operations and financial condition.

Third parties may fail to manufacture or provide necessary components for our products properly or in a timely manner.

We are often dependent on third parties to manufacture or supply components for our products. We typically do not enter into long-term contracts with third-party suppliers. We may experience supply problems as a result of financial or operating difficulties or the failure or consolidation of our suppliers. We may also experience supply problems as a result of shortages and discontinuations resulting from product obsolescence or other shortages or allocations by suppliers. Unfavorable economic conditions may also adversely affect our suppliers or the terms on which we purchase products. In the future, we may not be able to negotiate arrangements with third parties to secure products that we require in sufficient quantities or on reasonable terms. If we cannot negotiate arrangements with third parties to produce our products or if the third parties fail to produce our products to our specifications or in a timely manner, our business, results of operations and financial condition may be materially adversely affected.

We are subject to risks associated with labor relations, labor costs and labor disruptions.

We are subject to the costs and risks generally associated with labor disputes and organizing activities related to unionized labor. From time to time, strikes, public demonstrations or other coordinated actions and publicity may disrupt our operations. We may incur increased legal costs and indirect labor costs as a result of contractual disputes, negotiations or other labor-related disruptions. We have collective bargaining agreements with employees in portions of our Mexico-based operations, which accounted for approximately 1.0% of our total employees as of December 31, 2019. These operations may be more highly affected by labor force activities than others, and all collective bargaining agreements must be renegotiated annually. Other locations may also face organizing activities or effects. Labor organizing activities could result in additional employees becoming unionized. Furthermore, collective bargaining agreements may limit our ability to reduce the size of work forces during an economic downturn, which could put us at a competitive disadvantage.

Failure to retain key personnel could impede our ability to execute our business plan and growth strategy.

Our ability to profitably execute our business plan depends on our ability to attract, develop and retain qualified personnel. Certain of our key executives, managers and employees have knowledge and an understanding of our business and our industry, and/or have developed meaningful customer relationships, that cannot be duplicated readily. Our ability to attract and retain qualified personnel is dependent on, among other things, the availability of qualified personnel and our ability to provide a competitive compensation package. Failure to retain qualified key personnel may materially adversely affect our business, results of operations and financial condition.

Moreover, labor shortages, the inability to hire or retain qualified employees and increased labor costs could have a material adverse effect on our ability to control expenses and efficiently conduct our operations. We may not be able to continue to hire and retain the sufficiently skilled labor force necessary to operate efficiently and to support our operating strategies. Labor expenses could also increase as a result of continuing shortages in the supply of personnel.

If we determine that our goodwill, intangible assets, and indefinite-life intangible assets have become impaired, we may incur impairment charges, which may adversely impact our operating results.

We have a substantial amount of goodwill and indefinite-life intangible assets (trade names), which represents the excess of the total purchase price of our acquisitions over the fair value of the assets acquired, and other intangible assets. As of December 31, 2019, we had approximately $235.2 million and $126.6 million of goodwill and intangible assets, net, respectively, in our consolidated balance sheets, which would represent approximately 8.1% and 4.5% of total assets, respectively.

We test goodwill and indefinite-lived intangible assets for impairment on an annual basis and when events occur or circumstances change that indicate that the fair value of the reporting unit or intangible asset may be below its carrying amount. Fair value determinations require considerable judgment and are sensitive to inherent uncertainties and changes in estimates and assumptions regarding revenue growth rates, EBIT margins, capital expenditures, working capital requirements, tax rates, terminal growth rates, discount rates, exchange rates, royalty rates, benefits associated with a taxable transaction and synergistic benefits available to market participants. Declines in market conditions, a trend of weaker than anticipated financial performance for our reporting units or declines in projected revenue, a decline in our share price for a sustained period of time, an increase in the market-based weighted average cost of capital or a decrease in royalty rates, among other factors, are indicators that the carrying value of our goodwill or indefinite-life intangible assets may not be recoverable. In the event impairment is identified, a charge to earnings would be recorded which may materially adversely affect our financial condition and results of operations.

We are subject to various laws and regulations, including those governing government contracts, corruption and the environment. Obligations and liabilities under these laws and regulations may materially harm our business.

Government Contract Laws and Regulations

We lease and sell our products to government entities, and this subjects us to statutes and regulations applicable to companies doing business with the government. The laws governing government contracts can differ from the laws governing private contracts. For example, many government contracts contain favorable pricing terms and conditions that are not typically included in private contracts, such as clauses that make certain obligations of government entities subject to budget appropriations. Many government contracts can be terminated or modified, in whole or in part, at any time, without penalty, by the government. In addition, our failure to comply with these laws and regulations might result in administrative penalties or the suspension of our government contracts or debarment and, as a result, the loss of the related revenue which would harm our business, results of operations and financial condition. We are not aware of any action contemplated by any regulatory authority related to any possible non-compliance by or in connection with our operations.

Our operations are subject to an array of governmental regulations in each of the jurisdictions in which we operate. For example, our activities in the US are subject to regulation by several federal and state government agencies, including the Occupational Safety and Health Administration, and by federal and state laws. Our operations and activities in other jurisdictions are subject to similar governmental regulations. Similar to conventionally constructed buildings, the modular business industry is also subject to regulations by multiple governmental agencies in each jurisdiction relating to, among others, environmental, zoning and building standards, and health, safety and transportation matters. Noncompliance with applicable regulations, implementation of new regulations or modifications to existing regulations may increase costs of compliance, require a termination of certain activities or otherwise materially adversely affect our business, results of operations and financial condition.

US Government Contract Laws and Regulations

Our government customers include the US government, which means we are subject to various statutes and regulations applicable to doing business with the US government. These types of contracts customarily contain provisions that give the US government substantial rights and remedies, many of which are not typically found in commercial contracts and which are unfavorable to contractors, including provisions that allow the government to unilaterally terminate or modify our federal government contracts, in whole or in part, at the government’s convenience. Under general principles of US government contracting law, if the government terminates a contract for convenience, the terminated company may generally recover only its incurred or committed costs and settlement expenses and profit on work completed prior to the termination. If the government terminates a contract for default, the defaulting company may be liable for any extra costs incurred by the government in procuring undelivered items from another source.

In addition, US government contracts and grants normally contain additional requirements that may increase our costs of doing business, reduce our profits, and expose us to liability for failure to comply with these terms and conditions. These requirements include, for example:

• specialized disclosure and accounting requirements unique to US government contracts;

• financial and compliance audits that may result in potential liability for price adjustments, recoupment of government funds after such funds have been spent, civil and criminal penalties, or administrative sanctions such as suspension or debarment from doing business with the US government;

• public disclosures of certain contract and company information; and

• mandatory socioeconomic compliance requirements, including labor requirements, non-discrimination and affirmative action programs and environmental compliance requirements.

If we fail to comply with these requirements, our contracts may be subject to termination, and we may be subject to financial and/or other liability under our contracts or under the Federal Civil False Claims Act. The False Claims Act’s “whistleblower” provisions allow private individuals, including present and former employees, to sue on behalf of the US government. The False Claims Act statute provides for treble damages and other penalties, and if our operations are found to be in violation of the False Claims Act, we could face other adverse action, including suspension or prohibition from doing business with the US government. Any penalties, damages, fines, suspension or damages could adversely affect our ability to operate our business and our financial results.

Anti-Corruption Laws and Regulations

We are subject to various anti-corruption laws that prohibit improper payments or offers of payments to foreign governments and their officials by a US person for the purpose of obtaining or retaining business. We operate in countries that may present a more corruptible business environment than the US. Such activities create the risk of unauthorized payments or offers of payments by one of our employees or agents that could be in violation of various laws, including the FCPA. We have implemented safeguards and policies to discourage these practices by our employees and agents. However, existing safeguards and any future improvements may prove to be ineffective and employees or agents may engage in conduct for which we might be held responsible.

If employees violate our policies or we fail to maintain adequate record-keeping and internal accounting practices to accurately record our transactions, we may be subject to regulatory sanctions. Violations of the FCPA or other anti-corruption laws may result in severe criminal or civil sanctions and penalties, including suspension or debarment from US government contracting, and we may be subject to other liabilities which could materially adversely affect our business, results of operations and financial condition. We are also subject to similar anti-corruption laws in other jurisdictions.

Environmental Laws and Regulations

We are subject to a variety of national, state, regional and local environmental laws and regulations. Among other things, these laws and regulations impose limitations and prohibitions on the discharge and emission of, and establish standards for the use, disposal and management of, regulated materials and waste and impose liabilities for the costs of investigating and cleaning up, and damages resulting from, present and past spills, disposals or other releases of hazardous substances or materials. In the ordinary course of business, we use and generate substances that are regulated or may be hazardous under environmental laws. We have an inherent risk of liability under environmental laws and regulations, both with respect to ongoing operations and with respect to contamination that may have occurred in the past on our properties or as a result of our operations. From time to time, our operations or conditions on properties that we have acquired have resulted in liabilities under these environmental laws. We may in the future incur material costs to comply with environmental laws or sustain material liabilities from claims concerning noncompliance or contamination. We have no reserves for any such liabilities.

We cannot predict what environmental legislation or regulations will be enacted in the future, how existing or future laws or regulations will be administered or interpreted, or what environmental conditions may be found to exist at our facilities or at third party sites for which we may be liable. Enactment of stricter laws or regulations, stricter interpretations of existing laws and regulations or the requirement to undertake the investigation or remediation of currently unknown environmental contamination at sites we own or third party sites may require us to make additional expenditures, some of which could be material.

Any failure of our management information systems could disrupt our business operations both in the field and back office, which could result in decreased lease or sale revenue and increase overhead costs.

The failure of our management information systems to perform as anticipated could damage our reputation with our customers, disrupt our business or result in, among other things, decreased lease and sales revenue and increased overhead costs. Any such failure could harm our business, results of operations and financial condition. In addition, the delay or failure to implement information system upgrades and new systems effectively could disrupt our business, distract management’s focus and attention from business operations and growth initiatives and increase our implementation and operating costs, any of which could materially adversely affect our operations and operating results.

We have previously been the target of an attempted cyber-attack and may be subject to breaches of the information systems that we use. We have not experienced a material cybersecurity breach. We have programs in place that are intended to detect, contain and respond to data security incidents and that provide employee awareness training regarding phishing, malware, and other cyber risks to protect against cyber risks and security breaches. However, because the techniques used to

obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and may be difficult to detect for long periods of time, we may be unable to anticipate these techniques or implement adequate preventative measures. In addition, because our systems contain information about individuals and other businesses, the failure to maintain the security of the data we hold, whether the result of our own error or the malfeasance or errors of others, could harm our reputation or give rise to legal liabilities leading to lower revenue, increased costs, regulatory sanctions and other potential material adverse effects on our business, results of operations and financial condition.

Our operations could be subject to natural disasters and other business disruptions, which could materially adversely affect our future revenue, financial condition, cash flows and increase our costs and expenses.