Market Abuse and Inside Information Policy 1 S A N T A N D E R U K G R O U P H O LD IN G S P LC A N D I T S S U B S ID IA R IE S M A R K E T A B U S E P O LI C Y Market Abuse and Inside Information Policy July 2023 The objective of this policy is to set out the regulatory requirements and expectations relating to prohibiting market abuse, as reflected by the Market Abuse Regulation (MAR) and the insider provisions of the Criminal Justices Act 1993 (as amended), so that Colleagues do not disclose or use Inside Information that they have access to for the benefit of themselves or any other persons and market integrity is protected.

Market Abuse and Inside Information Policy 2 Table of Contents TABLE OF CONTENTS 2 1. OBJECTIVE, DEFINITION, PURPOSE, SCOPE AND CONTACT DETAILS 4 1.1 Objective & Purpose 4 1.2 Definition 4 1.3 Scope 8 1.4 Contact Details 9 2. POLICY REQUIREMENTS 10 2.1 Policy criteria 10 2.1.1 The market abuse regime 10 2.1.2 When you might have Inside Information 10 2.1.3 Confidential Information and Inside Information – What is the difference? 11 2.1.4 Penalties for breach of MAR 11 2.1.5 Data Protection 12 2.2 Specific criteria 12 2.2.1 Insider Dealing Prohibition 12 2.2.1.1 Legitimate Dealing Behaviour 12 2.2.1.2 Personal Account Dealing and PDMR transactions 13 2.2.2 Market Manipulation 13 2.2.2.1 Misleading signals or artificially securing price 13 2.2.2.2 Contrivance 13 2.2.2.3 Dissemination 14 2.2.2.4 Publishing incorrect volume data 14 2.2.2.5 Benchmarks 14 2.2.2.6 Placing, modifying or cancelling orders 14 2.2.3 Unlawful disclosure of Inside Information 15 2.2.3.1 Behaviour that does not indicate unlawful disclosure 15 2.2.3.2 Market Soundings 16 2.2.4 Delaying Disclosure 16 2.2.5 Reporting of suspicious transactions and/or orders (STOR) 16 2.2.6 Investment Recommendations 17 2.2.7 Record Keeping 18 2.3 Policy Principles 18 3. GOVERNANCE & ACCOUNTABILITY 20 3.1 Governance 20 3.2 Roles & Responsibilities 20 4. GOVERNANCE OF THIS POLICY 21

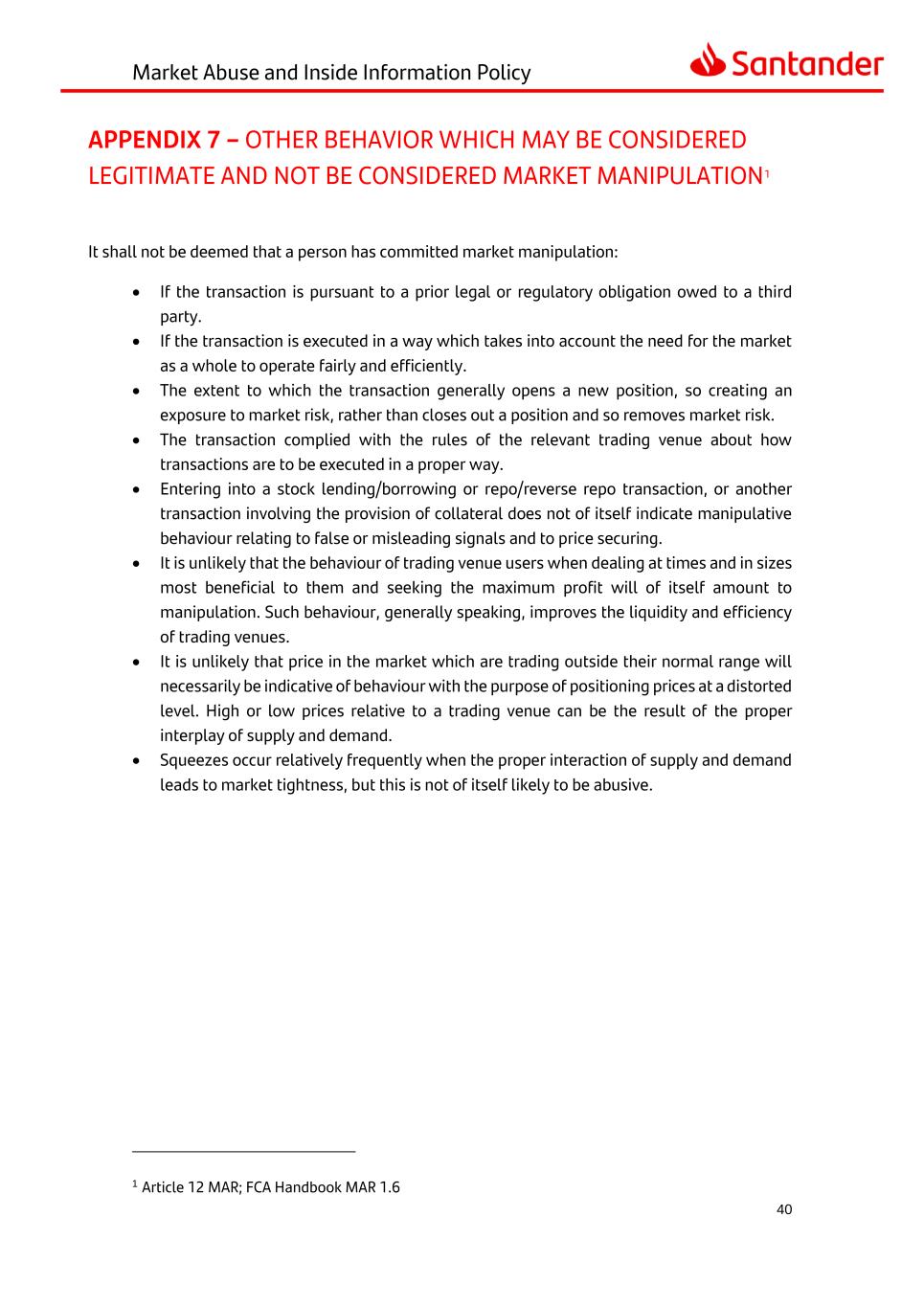

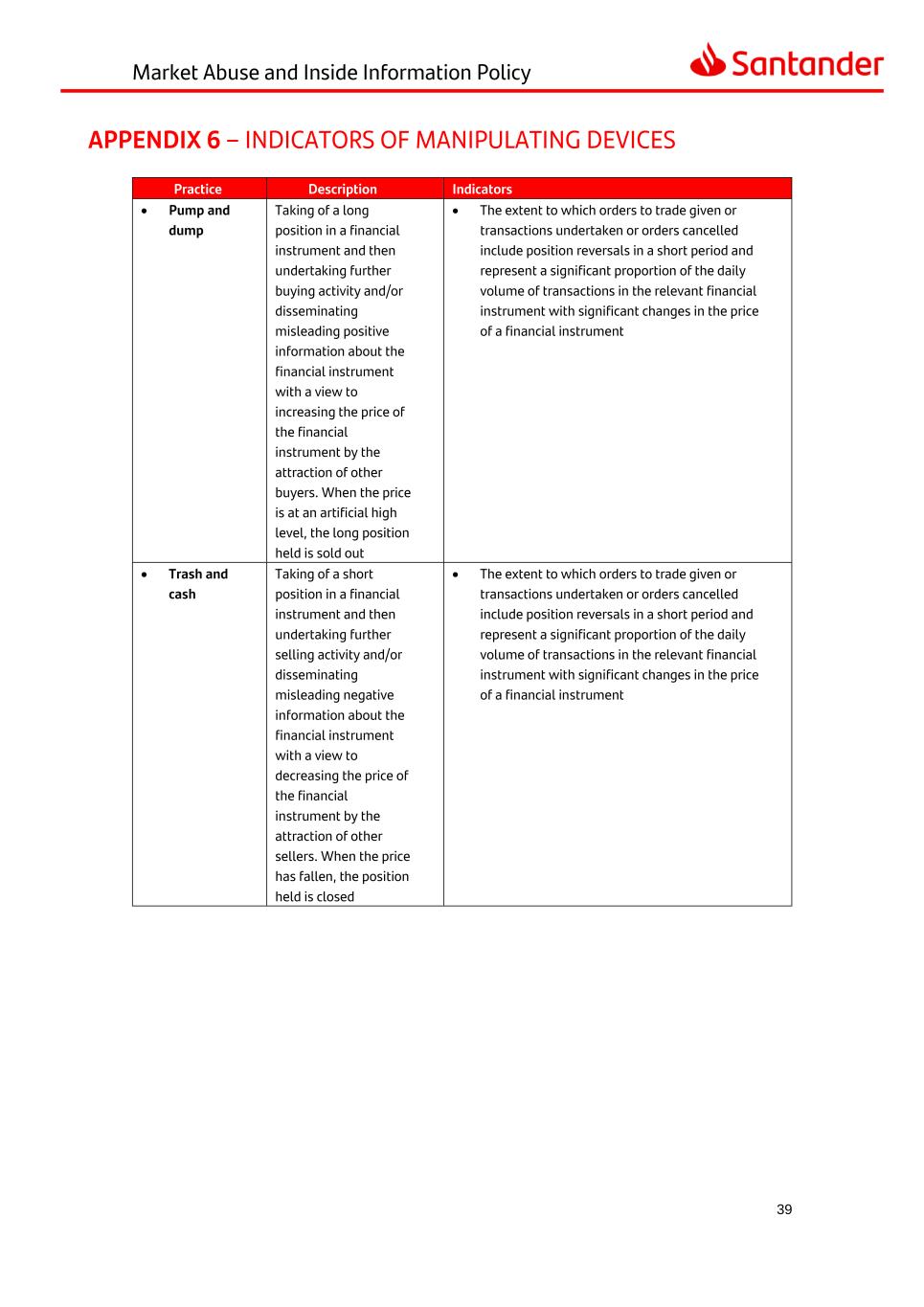

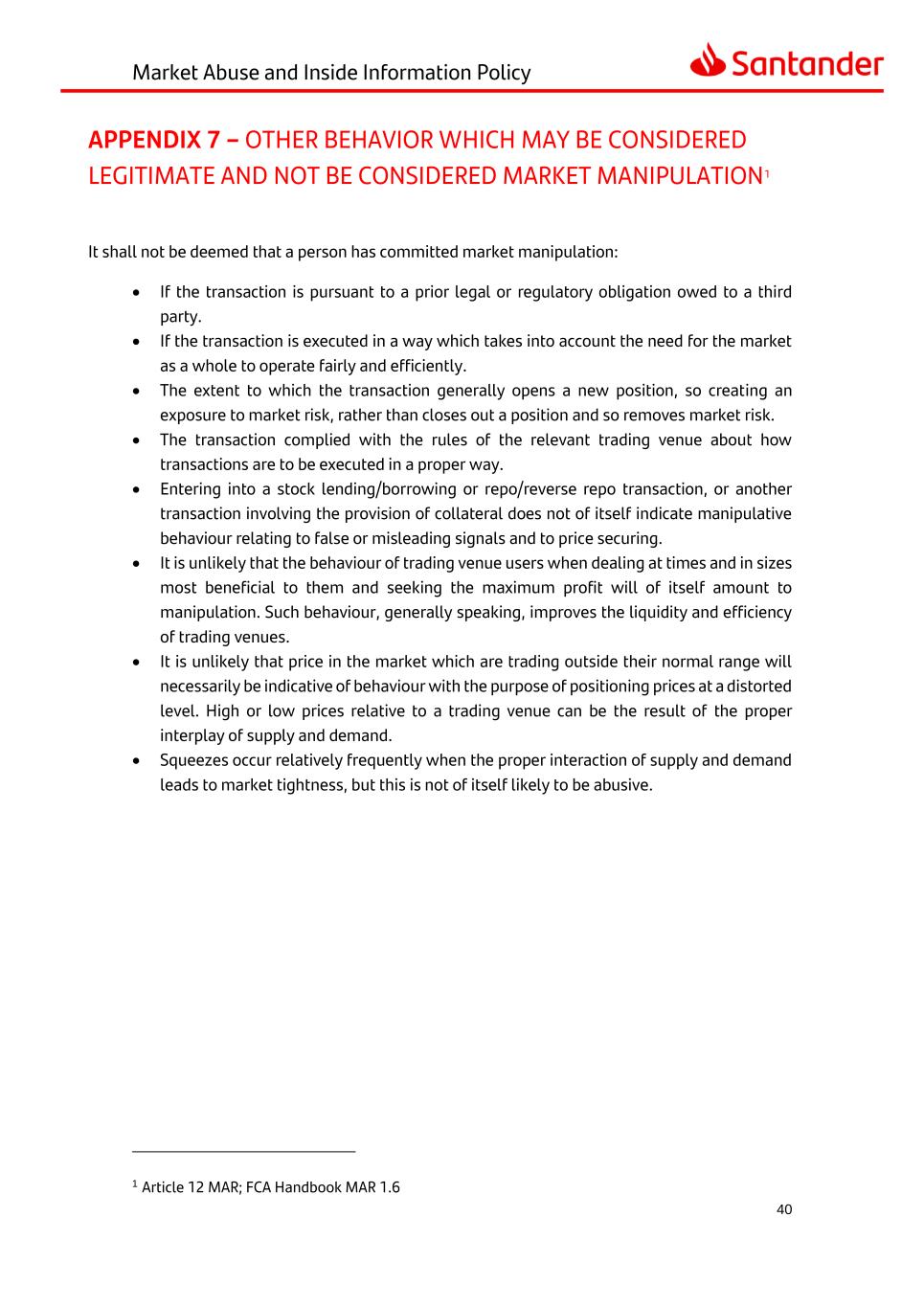

Market Abuse and Inside Information Policy 3 4.1 Ownership of the policy 21 4.2 Interpretation 21 4.3 Date of approval and review of the policy 21 4.4 Dispensation, Waiver and Breaches 21 5. POLICY STANDARDS & PROCEDURES SUPPORTING THIS POLICY 22 6. CHANGE CONTROL 23 6.1 Change Table 23 APPENDIX 1 - INDICATORS OF WHAT IS INSIDE INFORMATION 24 APPENDIX 2 – INDICATORS OF INSIDER DEALING 25 APPENDIX 3 – INSIDER DEALING AND INDICATORS OF LEGITIMATE (DEALING) BEHAVIOUR 26 APPENDIX 4 – INDICATORS OF UNLAWFUL DISCLOSURE 28 APPENDIX 5 – INDICATORS OF MANIPULATING TRANSACTIONS 29 APPENDIX 6 – INDICATORS OF MANIPULATING DEVICES 39 APPENDIX 7 – OTHER BEHAVIOR WHICH MAY BE CONSIDERED LEGITIMATE AND NOT BE CONSIDERED MARKET MANIPULATION 40

Market Abuse and Inside Information Policy 4 1. Objective, Definition, Purpose, Scope and Contact Details 1.1 Objective & Purpose The objective of this policy is to set out the regulatory requirements and expectations relating to prohibiting market abuse, as reflected by the Market Abuse Regulation (MAR) and the insider provisions of the Criminal Justices Act 1993 (as amended), so that Colleagues do not unlawfully disclose or use Inside Information that they have access to for the benefit of themselves or any other persons and market integrity is protected. The sanctions for insider dealing and market abuse are very serious - the civil liabilities imposed by MAR, and the criminal liabilities imposed by applicable insider dealing laws, apply to all Colleagues. If you have any query regarding this policy or doubt as to whether or not you are in possession of Inside Information, you should contact: (i) Corporate Governance Office at insiderlists@santander.co.uk for Inside Information queries relating to HoldCo Group Securities or (ii) the Compliance Control Room (at RFBControlRoom@santander.co.uk) for Inside Information queries relating to Client Deals or Corporate Deals and (iii) RFB Wholesale Compliance for queries relating to market manipulation at RFBWholesaleCompliance@santander.co.uk. MAR aims to increase market integrity and investor protection and contains prohibitions of insider dealing, unlawful disclosure of inside information and market manipulation. This policy focuses on assisting Colleagues with identifying the behaviours associated with market abuse and taking the appropriate steps to prevent and detect these. It is vital that Colleagues who have access to Inside Information and those Colleagues who transact in the financial markets comply with this policy (and other HoldCo Group policies as applicable – please see section 4.5 below), and their legal obligations in relation to market abuse. 1.2 Definition Defined terms used in this policy have the meaning set out in this section, unless otherwise defined. “Banco”: means Banco Santander, S.A. “Banco Securities”: means Banco’s listed securities, including ordinary shares listed on the London Stock Exchange plc (and others) and any other Financial Instruments whose price or value materially depends on Banco’s listed securities (including but not limited to options or spreadbets). References to Banco Securities include those ordinary shares that are obtained or held as a result of, or through, HoldCo Group share schemes including the ShareSave scheme, the Partnership Shares (Share Incentive Plan), any Long Term Incentive Plan or Deferred Bonuses, or the Banco scrip dividend scheme and any similar share schemes or employee reward plans from time to time. “CCB”: means the Santander Corporate and Commercial Bank division.

Market Abuse and Inside Information Policy 5 “Client Deal”: where a member of the HoldCo Group has been instructed to act on behalf of a third party client in relation to a particular deal, project or matter involving that client. This is particularly relevant to employees of Wholesale and CCB. “Colleague”: means any member of Staff. “Confidential Information”: has the meaning given in the Project Confidentiality Policy for Confidential Projects run by the HoldCo Group and the Information Barriers Policy for Client Deals and Corporate Deals with a third party. Please refer to these policies for further guidance as required. “Confidential Project”: has the meaning given in the Project Confidentiality Policy and the Information Barriers Policy as applicable. “Corporate Deals”: means a merger, acquisition, sale/disposal. Partnership, joint venture, investment in a corporate, securitisation, bond offering, consortium proposal, spin-off or provision of loan (for strategic purposes). “Deal Team Captain”: is the most senior person responsible for the overall execution of the transaction relating to Client Deals and Corporate Deals with a third party. “Disclosure Committee”: means the HoldCo Disclosure Committee and the RFB Disclosure Committee, as appropriate, which each operates in accordance with its applicable Disclosure Committee Terms of Reference. “ExCo”: means the Executive Committee of Holdco or the RFB, as applicable. “ExCo Sponsor”: means the ExCo member who is ultimately responsible for the Inside Information project (if applicable). “FCA”: means the Financial Conduct Authority. “Financial Instruments”: MAR and the Criminal Justices Act 1993 (as amended by the Insider Dealing (Securities and Regulated Markets) Order 2023) applies to financial instruments, which are widely- defined in Article (4)(1) of Directive 2014/65/EU (commonly known as MiFID 2), as amended and transposed into the UK, to include shares, debt instruments, debt instruments convertible to shares, other securities, money-market instruments, collective-investments schemes, contracts for differences (“CFDs”) and options, futures, swaps, forward rate agreements and any other derivative contracts relating to securities, currencies, credit risk, interest rates, financial indices or measures amongst others, which are: • Traded or admitted to trading (or a request for admission to trade has been made) on a UK, EU or Gibraltar regulated market, NASDAQ Exchange, SIX Swiss Exchange or the New York Stock Exchange (NYSE) or certain other specified trading facilities such as a UK, EU or Gibraltar MTF or OTF; or • not traded but whose price or value depends on, or has an effect on, the price or value of any traded financial instrument, such as credit default swaps and CFDs “HoldCo”: means Santander UK Group Holdings plc.

Market Abuse and Inside Information Policy 6 “HoldCo Group”: means the consolidated group of HoldCo, including HoldCo and its subsidiaries. “HoldCo Group Securities”: means any Financial Instruments issued, or to be issued, by companies within the HoldCo Group which are listed on relevant exchanges, or by other unconsolidated issuing vehicles in which a company within the HoldCo Group has an interest, and any other Financial Instruments whose price or value materially depends on such Financial Instruments (including options or spreadbets). Some of those issuing entities are: • HoldCo; • the RFB; • Holmes Master Issuer plc; • Fosse Master Issuer plc; and • Santander Consumer (UK) plc sponsored Motor securitisation issuing vehicles. “Inside Information”: is information which: • is of a precise nature; • has not been made public; • relates directly or indirectly to one or more issuers or to one or more Financial Instruments; and • if it were made public, would be likely to have a significant effect on the prices of those Financial Instruments or those related derivative Financial Instruments. Further guidance can be found in Appendix 1 of this policy. There are also different definitions of inside information in relation to commodity derivatives, emission allowances and auctioned products based thereon (which are outside the scope of this policy) and for persons charged with the execution of orders concerning financial instruments. “Insider”: is a person who is in possession of Inside Information as a result of: • being a member of the administrative, management or supervisory bodies of the issuer; • their holding in the capital of the issuer; • having access to the information through the exercise of their employment, profession or duties; • being involved in criminal activities; or • being otherwise in possession of information where that person knows, or ought to know, that it is Inside Information. “Insider List”: a list maintained in accordance with MAR of Insiders.

Market Abuse and Inside Information Policy 7 “MAR”: means the Market Abuse Regulation (Regulation 596/2014), as amended and transposed into the UK with effect from 1 January 2021, including pursuant to the Market Abuse (Amendment) (EU Exit) Regulations 2019 and as may be amended from time to time. “Market Sounding”: comprises the communication of information, prior to the announcement of a transaction, in order to gauge the interest of potential investors in a possible transaction and the conditions relating to it such as its potential size or pricing, to one or more potential investors. “MTF”: means a multilateral trading facility. “MSR”: means market sounding recipient. “OTF”: means an organised trading facility. “PDMR”: means a person within an issuer who is: • a member of the administrative, management or supervisory body of that company; or • a senior executive who is not a member of the bodies referred to above, who has regular access to Inside Information relating, directly or indirectly, to that company and power to take managerial decisions affecting the future developments and business prospects of that company. The PDMRs of each company within the HoldCo Group that is an issuer of HoldCo Group Securities are likely to be the directors (executive and non-executive) of that issuer and certain senior executives who have potential access to Inside Information about, and the authority to make decisions affecting the future development and business prospects of, the issuer. “Permanent Insiders”: are persons who, due to the nature of their function or position, have access at all times to all Inside Information within an issuer. Permanent Insiders in relation to Client Deals and Corporate Deal are individuals who due to the nature of their roles are in receipt of sensitive information relating to our clients’ activities, either through holding senior business management positions or by membership of project approval committees. “Project Manager”: means the person responsible for the Inside Information project, to the extent such person is not the ExCo Sponsor. “Project Sponsor”: means the ExCo Sponsor (if applicable) or the Project Manager. “Regulated Information”: has the meaning given in the Disclosures Policy. “Regulated Markets”: means a multilateral system operated and/or managed by a market operator, which brings together or facilitates the bringing together of multiple third-party buying and selling interests in Financial Instruments – in the system and in accordance with its non-discretionary rules – in a way that results in a contract, in respect of the Financial Instruments admitted to trading under its rules and/or systems, and which is authorised. “Restricted Persons”: includes Staff who are not PDMRs but who are likely to be in possession of sensitive information due to their role and who are listed on the Restricted Persons list. Restricted Persons will be notified by Corporate Governance Office of their status as such.

Market Abuse and Inside Information Policy 8 “RFB”: means Santander UK plc. “Staff”: means all directors, officers, employees, agents and workers, as well as contractors and agency workers or similar of the HoldCo Group. “Third Party Issuer”: means an issuer of Third Party Securities. “Third Party Securities”: means Financial Instruments not falling within the definition of HoldCo Group Securities or Banco Securities. “Wholesale”: means those Colleagues designated as Wholesale. 1.3 Scope This policy applies to the Holdco Group, comprising of: • The RFB and its subsidiaries (this is the ring-fenced bank sub-group); and • HoldCo and all companies owned or part owned by it, directly or through its subsidiaries, including successors or assignees. Staff within Wholesale and CCB are within the scope of this policy and are also subject to the Wholesale Compliance Manual and the CCB Market Conduct Procedures respectively, which establish additional procedures for handling third party Inside Information and conflicts of interest management. This policy does not contain controls for dealing with Inside Information relating to Banco or Banco Securities. Banco procedures and controls should be adhered to in addition to this policy. Please note that you may also need to comply with other HoldCo Group policies or standards where you are in possession of Inside Information: • The Policy for the Management and Dissemination of Insider Information relating to the HoldCo Group which sets out the requirements for confirming the existence of inside information and agreeing the delay of disclosure of such, where appropriate, It also addresses the setting up, maintaining and closing an Insider List when in possession of Inside Information in relation to Holdco Group Securities. • The Project Confidentiality Policy, where the Inside Information relates to a Confidential Project being run by any member of the HoldCo Group and does not include receipt of information relating to Third Party Securities. • For information on dealing in Financial Instruments, please see the Personal Account Dealing Policy. If you are in possession of Inside Information, you will be an Insider and must not buy or sell securities (or deal in any other manner) to which the Inside Information relates or recommend or induce others to deal in them. Any such action would amount to insider dealing and will constitute a criminal offence. • The Disclosures Policy, which sets out further requirements regarding the manner and requirements for disclosure of Regulated Information, which includes Inside Information • All personal data relating to individuals (e.g. customers, staff, contractors, suppliers etc.) must be kept in line with the Record Retention Policy and the Data Protection Policy in line with current data protection legislation.

Market Abuse and Inside Information Policy 9 • The Information Barriers Policy Standard which sets out the responsibilities of a Deal Captain when in receipt of Inside Information in relation to Client Deals and Corporate Deals with a third party and the requirements around how to set up, maintain and close an Insider List. Please refer to those policies or procedures for full guidance. All HoldCo Group policies can be found on the Santander UK intranet. The Wholesale Compliance Manual (which includes the Information Barriers Policy) can be found on the Wholesale SharePoint and the CCB Market Conduct Procedures can be found in the Risk Oversight section of the CCB Vault SharePoint. All Colleagues are also required to comply with the Employee Handbook, and with all other policies and procedures established by the HoldCo Group which apply to them under their contracts of employment. 1.4 Contact Details Queries relating to this policy should be directed to Corporate Governance Office via insiderlists@santander.co.uk, the Compliance Control Room via RFBControlRoom@santander.co.uk, or RFB Wholesale Compliance via RFBWholesaleCompliance@santander.co.uk where indicated in this policy.

Market Abuse and Inside Information Policy 10 2. Policy Requirements 2.1 Policy criteria 2.1.1 The market abuse regime Following the UK’s withdrawal from the European Union, the Market Abuse Regulation (Regulation 596/2014), as it applied to the UK on 31 December 2020, was transposed into UK law pursuant to the European Union (Withdrawal) Act 2018 and the Market Abuse (Amendment) (EU Exit) Regulations 2019. Accordingly, the MAR regime continues to apply, as amended to ensure it can apply effectively within the UK. MAR is the UK’s civil market abuse regime, sitting alongside the criminal regime. The FCA is designated as the UK regulator for the purposes of MAR, which is included within the FCA Handbook. A main objective of MAR is to enhance market integrity. The obligations relating to Inside Information are designed to ensure that there is prompt and fair disclosure of relevant information to the market, to ensure that investors are not misled. The HoldCo Group and all Colleagues are subject to the prohibitions on insider dealing (Article 8, MAR), the unlawful disclosure of inside information (Article 10, MAR) and market manipulation (Article 12, MAR) which will be outlined in the criteria below. 2.1.2 When you might have Inside Information Inside Information may relate to HoldCo Group Securities or Third Party Securities. You may come into possession of Inside Information in a number of ways. For example: • Being asked to get involved in a project involving Inside Information relating to the HoldCo Group. You would be put on an Insider List relating to HoldCo Group Securities. Please see the Policy Standard for the Management and Dissemination of Inside Information relating to the HoldCo Group. • You may be involved in a transaction with a third party with listed securities, the existence of which constitutes Inside Information for that third party – this would constitute third party Inside Information relating to Third Party Securities. Please see the Information Barriers Policy Standard. • A client may share Inside Information with its relationship advisor as part of a Client Deal – this would relate to a client’s Third Party Securities. Please see the Information Barriers Policy Standard. • Certain colleagues and other people, by virtue of their position in the bank as PDMRs or Restricted Persons, are considered to be more likely to be in possession of Inside Information relating to HoldCo Group Securities. All PDMRs and Restricted Persons are notified by Corporate Governance Office that they are considered to be such persons. Please see the Personal Account Dealing Policy for guidance on the restrictions as to when such persons can deal in HoldCo Group Securities and the process for obtaining clearance. • Generally becoming aware of Inside Information – this could be overhearing information in a branch, the office or elsewhere, and could relate to HoldCo Group Securities or Third Party

Market Abuse and Inside Information Policy 11 Securities. Even if you’re not on an Insider List, if you know, or ought to know, it is Inside Information, then restrictions on its use apply. 2.1.3 Confidential Information and Inside Information – What is the difference? There is an important distinction between Confidential Information and Inside Information. Confidential Information will not necessarily constitute Inside Information. However, due to the nature of Inside Information, Inside Information will always be Confidential Information as well. Notwithstanding this, the Holdco Group is still required to treat Confidential Information relating to a transaction, product or service sensitively and ensure access to it, is restricted. Please see the Project Confidentiality Policy and the Project Confidentiality Policy Standard for the requirements to follow once a Confidential Project has been identified for matters in relation to the Holdco Group and the Information Barriers Policy for matters in relation to Client Deals or Corporate Deals with a third party. If you think a project or matter you are working on includes or may include Inside Information relating to HoldCo Group Securities, or you are in any way unsure, refer to the Policy Standard Regarding the Management and Dissemination of Inside Information relating to the HoldCo Group and contact the Corporate Governance Office as soon as possible at insiderlists@santander.co.uk. If you think the project you are working on includes or may include Inside Information relating to a Client Deal or Corporate Deal with a third party, the Deal Team Captain or Project Sponsor must escalate the project as soon as possible to the RFBControlRoom@santander.co.uk using the deal notification form available on the RFB Wholesale SharePoint. If Inside Information is identified, the Compliance Control Room or Corporate Governance Office (depending on whether the information relates to Third Party Securities or Holdco Group securities) draws up and maintains Insider Lists to ensure the appropriate management of information and, where relevant, submits those to regulators on a timely basis when requests are made. Please refer to the Information Barriers Policy Standard for Client Deals and Corporate Deals with a third party and the Policy Standard for the Management and Dissemination of Inside Information relating to for the HoldCo Group for HoldCo Group Securities. Appendix 1 contains further information on identifying Inside Information. Please read this carefully. 2.1.4 Penalties for breach of MAR and the Criminal Justices Act 1993 There are very serious financial and regulatory penalties on both the HoldCo Group and individual Colleagues for breaches of MAR. The FCA may impose unlimited financial penalties, publicly censure a person, suspend trading in the UK of HoldCo Group Securities, and/or make an order to compensate or disgorge profits to affected persons. Injunctions to prevent market abuse (and to freeze assets) may also be ordered. Other statutory offences (such as fraud, dishonest concealment of material facts, and dishonest delay in publishing information relating to securities where an investor suffers a loss as a result) may also be committed depending on the nature of the breach of MAR. If the behaviour falls within the scope of the insider dealing provisions of the Criminal Justice Act 1993, that individual may be liable to a fine and/or imprisonment. The Financial Services Act 2021 increases the

Market Abuse and Inside Information Policy 12 maximum sentence for the insider dealing and market manipulation offences in the Criminal Justice Act 1993 and the Financial Services Act 2012 from seven to ten years. Even careless disclosure of Inside Information could expose both the HoldCo Group and the relevant Colleague to very significant consequences. 2.1.5 Data Protection The information required by MAR to be collected for the purposes of Insider Lists is more detailed than under the previous regime and contains personal data. We will comply with the current data protection legislation in relation to the collection and retention of such data. 2.2 Specific criteria 2.2.1 Insider Dealing Prohibition Under Article 14, MAR all Colleagues are prohibited from: • engaging in or attempting to engage in insider dealing; or • recommending that, or inducing, another person to engage in insider dealing. Insider Dealing occurs where: • a person, while in possession of inside information, uses that information (directly or indirectly for their own account or for the account of a third party) to: a) acquire or dispose of Financial Instruments to which that information relates; b) cancel or amend an order concerning a Financial Instrument (to which that information relates), where the order was placed before they possessed Inside Information; or c) recommend that another person engage in dealing or induce another person to engage in dealing (acquiring or disposing of Financial Instruments or cancelling or amending an order concerning a Financial Instrument, in each case to which that information relates). • a person, on the basis of a recommendation or inducement which s/he knows or ought to know is based on Inside Information, engages in dealing (acquiring or disposing of Financial Instruments or cancelling or amending an order concerning a Financial Instrument, in each case to which that information relates). Indications of insider dealing are contained in Appendix 2. Please read these carefully. 2.2.1.1 Legitimate Dealing Behaviour Certain behaviour is set out in Article 9, MAR (with further guidance in the FCA Handbook) as “legitimate behaviour”. For market makers and persons that may lawfully deal in Financial Instruments on their own account, pursuing their legitimate business of such dealing (including entering into an agreement for the underwriting of an issue of Financial Instruments) may not in itself amount to market abuse.

Market Abuse and Inside Information Policy 13 Indications of legitimate dealing behaviour are outlined in Appendix 3. Please read Appendix 3 carefully and if in doubt speak to RFB Wholesale Compliance. 2.2.1.2 Personal Account Dealing and PDMR transactions All Colleagues must ensure they conduct personal account dealing as set out in the Personal Account Dealing Policy Standard, which ensures compliance with insider dealing rules. Article 19 MAR requires PDMRs, and persons closely associated with them (PCAs), to notify the FCA and the issuer of relevant personal transactions they undertake in Holdco Group Securities and other linked Financial Instruments. PDMRs and PCAs should notify the issuer and the FCA within three working days of the date of the transaction. The issuer should disclose to the public within two working days of receiving the notification from the PDMR and PCA. PDMRs within issuers are also prohibited from conducting certain personal transactions during a closed period. Please see the Personal Account Dealing Policy Standard for further information regarding the requirements for PDMRs and their PCAs when transacting in Financial Instruments of Holdco Group Securities. 2.2.2 Market Manipulation Article 15, MAR prohibits a person from engaging or attempting to engage in market manipulation. Market Manipulation or attempted market manipulation is a type of market abuse where there is a deliberate effort to interfere with the free and fair operation of the market and create artificial, false or misleading appearances with respect to the price of, or market for, a product, security, commodity or currency. Market manipulation comprises the following activities: 2.2.2.1 Misleading signals or artificially securing price Your behaviour could amount to market manipulation or attempted market manipulation if you enter into a transaction, place an order to trade or engage in any other behaviour which: • gives, or is likely to give, false or misleading signals as to the supply of, demand for, or price of, a Financial Instrument; or • secures, or is likely to secure, the price of one or several Financial Instruments at an abnormal or artificial level, unless the person entering into a transaction, placing an order to trade or engaging in any other behaviour establishes that such transaction, order or behaviour has been carried out for legitimate reasons, and conforms with an accepted market practice (i.e. a specific market practice that is accepted by a competent authority in accordance with Article 13 MAR). Appendix 5 lists the indicators of manipulating transactions, behaviour and distortion. Please read Appendix 5 carefully and if in doubt please contact RFB Wholesale Compliance. 2.2.2.2 Contrivance

Market Abuse and Inside Information Policy 14 Your behaviour could amount to market manipulation or attempted market manipulation if you enter into a transaction, place an order to trade or engage in any other behaviour which affects or is likely to affect the price of one or several Financial Instruments, which employs a fictitious device or any other form of deception or contrivance. Appendix 6 lists indicators of manipulating devices. Please read Appendix 6 carefully and if in doubt contact RFB Wholesale Compliance. 2.2.2.3 Dissemination Your behaviour could amount to market manipulation or attempted market manipulation if you disseminate information through the media, including the internet, or by another means, which gives, or is likely to give, false or misleading signals as to the supply of, demand for, or price of, a Financial Instrument, or is likely to secure the price of one or several Financial Instruments at an abnormal or artificial level, including the dissemination of rumours, where the person who made the dissemination knew, or ought to have known, that the information was false or misleading. It is prohibited to spread false or misleading information, including rumours and false or misleading news and hence those active in the financial markets who freely express information contrary to their own opinion or better judgement, which they know or should know to be false or misleading, to the detriment of investors and issuers is not permitted. 2.2.2.4 Publishing incorrect volume data Publishing incorrect volume data presents a risk that trading decisions may be made based on misleading information. 2.2.2.5 Benchmarks Your behaviour could amount to market manipulation or attempted market manipulation if you transmit false or misleading information or provide false or misleading input in relation to a benchmark where you knew or ought to have known that it was false or misleading, or if you engage in any other behaviour which manipulates the calculation of a benchmark. 2.2.2.6 Placing, modifying or cancelling orders The following behaviour shall also be considered as market manipulation, where the effect of such behaviour has one of the effects referred to in section 2.2.2.1 or section 2.2.2.2 above: • the placing of orders to a trading venue, including cancellation or modification thereof by any available means of trading, including electronic means, by: a) disrupting or delaying the functionality of the trading system of the trading venue or being likely to do so; b) making it more difficult for other persons to identify genuine orders on the trading system of the trading venue or being likely to do so, including by entering orders which result in the overloading or destabilisation of the order book; or

Market Abuse and Inside Information Policy 15 c) creating or being likely to create a false or misleading signal about the supply of, or demand for, or price of, a Financial Instrument, in particular by entering orders to initiate or exacerbate a trend. Article 12 MAR sets out further examples of behaviour that shall be considered as market manipulation. 2.2.3 Unlawful disclosure of Inside Information Article 14, MAR prohibits the unlawful disclosure of Inside Information. Once Inside Information has been identified, it should be handled very carefully. Please see the Information Barriers Policy Standard relating to Client Deals and Corporate Deals with a third party and the Policy Standard for the Management and Dissemination of Inside Information relating to the Holdco Group for further guidance on the necessary steps that should be taken. Until Inside Information is made public (in compliance with MAR), you will commit an offence if you disclose that information to any other person, except where the disclosure is made in the normal exercise of your employment, profession or duties. As with Confidential Information of any kind, Inside Information should only be shared with those who strictly need to know it, and who are under duties of confidentiality. This principle applies even to individuals in the same team or department – the information should only be shared with those who have a genuine need to know. If you are in possession of Inside Information and there is a ‘need to know’ reason to share it with another person, for example a Colleague or a third party, you must seek prior approval from Corporate Governance Office at insiderlists@santander.co.uk in respect of Inside Information concerning Holdco Group Securities or from the Compliance Control Room at RFBControlRoom@santander.co.uk for Inside Information queries relating to Client Deals or Corporate Deal with a third party. Any such disclosure may require a stock exchange announcement, as set out in the Disclosures Policy. 2.2.3.1 Behaviour that does not indicate unlawful disclosure The following behaviour indicates that a Colleague makes a disclosure of Inside Information and is considered to be in the proper course of the exercise of employment, profession or duties if it is: • made to a government department, the Bank of England, the Competition Commission, the Takeover Panel, the FCA or any regulatory body or authority for the purposes of fulfilling a legal or regulatory obligation or otherwise to such a body in connection with the performance of functions of that body. The following factors are to be taken into account in determining whether or not the disclosure was made by a Colleague in the proper course of exercise of employment, profession or duties and are indications that it was: • whether the disclosure is permitted by the rules of a trading venue, of the FCA or the Takeover Code • whether disclosure is accompanied by confidentiality requirements upon the person to whom the disclosure is made and is:

Market Abuse and Inside Information Policy 16 a) reasonable and is to enable a person to perform the proper functions of their employment, profession or duties; or b) reasonable and is (for example, to a professional adviser) for the purposes of facilitating or seeking or giving advice about a transaction or takeover bid; or c) reasonable and is for the purpose of facilitating any commercial, financial or investment transaction (including prospective underwriters or places of securities); or d) reasonable and is for the purpose of obtaining a commitment or expression of support in relation to an offer which is subject to the Takeover Code; or e) in fulfilment of a legal obligation, including to employee representatives or trade unions acting on their behalf. Please note that responding to a request under the Freedom of Information Act 2000 (“FOIA”) for Inside Information does not in itself make the disclosure lawful under MAR. Disclosure still needs to satisfy the requirements above, and FOIA has provisions that exempt certain information from disclosure where prohibited by or incompatible with specific legislation, including MAR. 2.2.3.2 Market Soundings MAR sets out a framework to make legitimate disclosures of Inside Information during market soundings. Provided certain requirements are met, disclosing market participants are protected from an allegation of unlawful disclosure of Inside Information. The Holdco Group does not currently engage in market soundings as a disclosing market participant though where staff in CFO Division are a MSR under the rules they must refer to the Market Sounding Procedure. 2.2.4 Delaying Disclosure The Disclosure Committee may decide to delay disclosure in accordance with the rules and make use of an exception under Art 17 of MAR if all the relevant conditions are satisfied (and these should be narrowly interpreted). Please refer to the Policy Standard for the Management and Dissemination of Inside Information relating to the HoldCo Group. 2.2.5 Reporting of suspicious transactions and/or orders (STOR) A suspicious transaction or order is one where there are ‘reasonable grounds’ to suspect it might constitute market abuse, such as insider dealing or market manipulation. Holdco Group is required to maintain effective arrangements, systems, controls and procedures aimed at preventing and detecting market abuse, including any attempt to commit market abuse, and to regularly monitor both the business and its employees’ compliance with the rules set out under MAR. Holdco Group is required to report to the FCA, without delay, the following: • suspicious order(s) (whether or not they have been executed, including any cancellations or modifications thereof) • suspicious transaction(s) (whether or not they have been executed, including any cancellation or modifications thereof)

Market Abuse and Inside Information Policy 17 • attempted market abuse where Holdco Group has reasonable grounds to suspect that the transaction(s) or order(s) could constitute market abuse, considering all information that is available. Holdco Group is required to report not only transactions and orders which are considered at the time to be suspicious, but also any transaction(s) and/or order(s) which become suspicious retrospectively considering subsequent events or information. For the Holdco Group and its staff to meet its obligations to maintain orderly markets and report suspicious orders or transactions (STORs) to the regulator, all Colleagues are under a duty to report any suspicious activity without delay. Therefore: • you must remain alert to situations where individuals/counterparties are committing or are attempting to commit market abuse; • if you identify any suspicions of actual or attempted market abuse you should contact the RFB Wholesale Compliance team or the RFB Compliance Surveillance team in the first instance; • you should not inform the individual/counterparty of your suspicion under any circumstance; and • if you are unsure as to whether a transaction or series of transactions could constitute market abuse, please contact the RFB Wholesale Compliance team who will be able to provide further guidance. Please note, certain transactions/orders by themselves may seem completely devoid of suspicion but might deliver indications of market abuse when seen in conjunction with other transactions/orders, certain behaviours or other information. In situations where Holdco Group is one of several market participants involved in a transaction, regardless of any other STORs that may be submitted by other market participants, Holdco Group has a responsibility to report suspicions, and must submit a separate STOR to the FCA. Where a Colleague has observed unusual or suspicious behaviour in the market – but complete information isn’t available e.g., the business or colleague was either not directly involved in the activity, or has no knowledge of the perpetrator’s identity; the FCA also expects firms to report such events via their Market Observation form, in much the same way a STOR is reported. 2.2.6 Investment Recommendations An Investment Recommendation as defined in MAR is: • “information recommending or suggesting an investment strategy; • explicitly or implicitly, concerning one or several Financial Instruments or issuers • including any opinion as to the present or future value or price of such instruments; and • that is intended for distribution channels or for the public.”

Market Abuse and Inside Information Policy 18 The scope of Investment Recommendation may also include commentaries, trade ideas where buy, sell, hold or relative value recommendations of any issuer or financial instrument are made regardless of the inclusion of a specific time horizon or price target. It is prohibited, by this Policy, for Colleagues to disseminate investment recommendations on Financial Instruments. 2.2.7 Record Keeping In accordance with the Record Retention Policy, all versions of an Insider List (including those prepared by external parties on the issuer’s behalf or account) must be retained for a period of ten years from the date on which it is drawn up or updated (whichever is the latest). Regulators or other appointed bodies may request a copy of an Insider List (whether relating to the HoldCo Group Inside Information or third party Inside Information) at any time. When regulators or appointed bodies undertake an investigation, they frequently require a response within 48 hours and, where an Insider List is requested, the list must be provided as soon as possible (Article 18(1)(c), MAR). It is therefore important that Insider Lists are maintained in a detailed and accurate manner in accordance with the requirements of MAR so that they can be provided at short notice. The UK data protection legislation allows companies to provide personal data to regulators without the express consent of the persons named on an Insider List on the basis that the company is under a legal obligation to respond to such a request. However, different rules may apply to personal data relating to overseas employees and/or overseas advisers, especially those based outside the EU. Please seek the advice of the Data Protection Legal team. 2.3 Policy Principles This policy is aligned with the overall Risk and Policy Frameworks and achieves the five specific minimum standards set out in the Risk Governance Documentation Framework as follows: • Comprehensive: details the definition of Inside Information and unlawful disclosure, insider dealing and market manipulation, the steps for Colleagues to take if market abuse is identified (whether relating to HoldCo Group Securities, Client Deals or Corporate Deals) and the potential consequences of any breaches of MAR. • Communicated: this Policy is available to all Colleagues on the Policy Library intranet. • Understood: if you have any query regarding this policy, you should contact: (i) Corporate Governance Office (at insiderlists@santander.co.uk) if the query relates to Inside Information concerning HoldCo Group Securities; or (ii) the Compliance Control Room (at RFBControlRoom@santander.co.uk) if the query relates to Inside Information concerning Third Party Securities in the context of a Client Deal or a Corporate Deal with a third party; or (iii) to RFB Wholesale Compliance (at RFBWholesaleCompliance@santander.co.uk) for any other queries related to market abuse.

Market Abuse and Inside Information Policy 19 • Complied: on an on-going basis and, when made aware of any Inside Information, Corporate Governance Office and Compliance Control Room will ensure that this policy is being complied with in full. Corporate Governance Office requires Insiders to acknowledge in writing their legal and regulatory obligations and the sanctions applicable to insider dealing and unlawful disclosure of inside information. • Effective: this policy will be reviewed on a bi-annual basis to ensure that it remains fit for purpose and effective.

Market Abuse and Inside Information Policy 20 3. Governance & Accountability 3.1 Governance RFB Wholesale Compliance, Treasury and Structured Finance Legal and Corporate Governance Office will review the Policy on a bi-annual basis, or sooner should there be a change in the Regulations or a change in the Corporate Governance Framework. 3.2 Roles & Responsibilities All Colleagues are responsible for complying with this policy, with the support of Corporate Governance Office, the Disclosure Committee, RFB Wholesale Compliance and the Compliance Control Room where indicated in this policy.

Market Abuse and Inside Information Policy 21 4. Governance of this Policy 4.1 Ownership of the policy This policy is owned by the Chief Compliance Officer. 4.2 Interpretation In the event of a dispute, RFB Wholesale Compliance and the Compliance Control Room, together with the Company Secretary where applicable, is responsible for the interpretation of this policy. 4.3 Date of approval and review of the policy This version of the policy was approved on 31 July 2023 and is effective from 31 July 2023. This policy must be reviewed at least bi-annually. The next annual review is due in April 2025. 4.4 Dispensation, Waiver and Breaches Given the nature of this policy, there are no waivers, and it is very unlikely that there will be any dispensations. Any dispensations (i.e. temporary deviation from the policy for a defined period, subject to an action plan for remediation and compliance) must be requested through the COO Policy Team (sanukpolicyregister@santander.co.uk) using the process and form detailed on the Santander UK Policy Library SharePoint site. Any request will be reviewed by the Company Secretary and the Chief Compliance Officer or their delegate. All requests are recorded on the Policy Register by the COO Policy Team. If you become aware of a breach or potential breach of this policy (or become aware of any activity which may amount to market abuse or insider dealing), it is your duty to immediately report this to: • in relation to HoldCo Group Securities, Corporate Governance Office at insiderlists@santander.co.uk; or • in relation to Third Party Securities in the context of a Client Deal or Corporate Deal, the Compliance Control Room at RFBControlRoom@santander.co.uk; or • In relation to market manipulation, RFB Wholesale Compliance at RFBWholesaleCompliance@santander.co.uk The Compliance Control Room or Corporate Governance Office (as appropriate) will then escalate the matter as necessary or required. It is possible for one staff member to breach the obligations in this Policy.

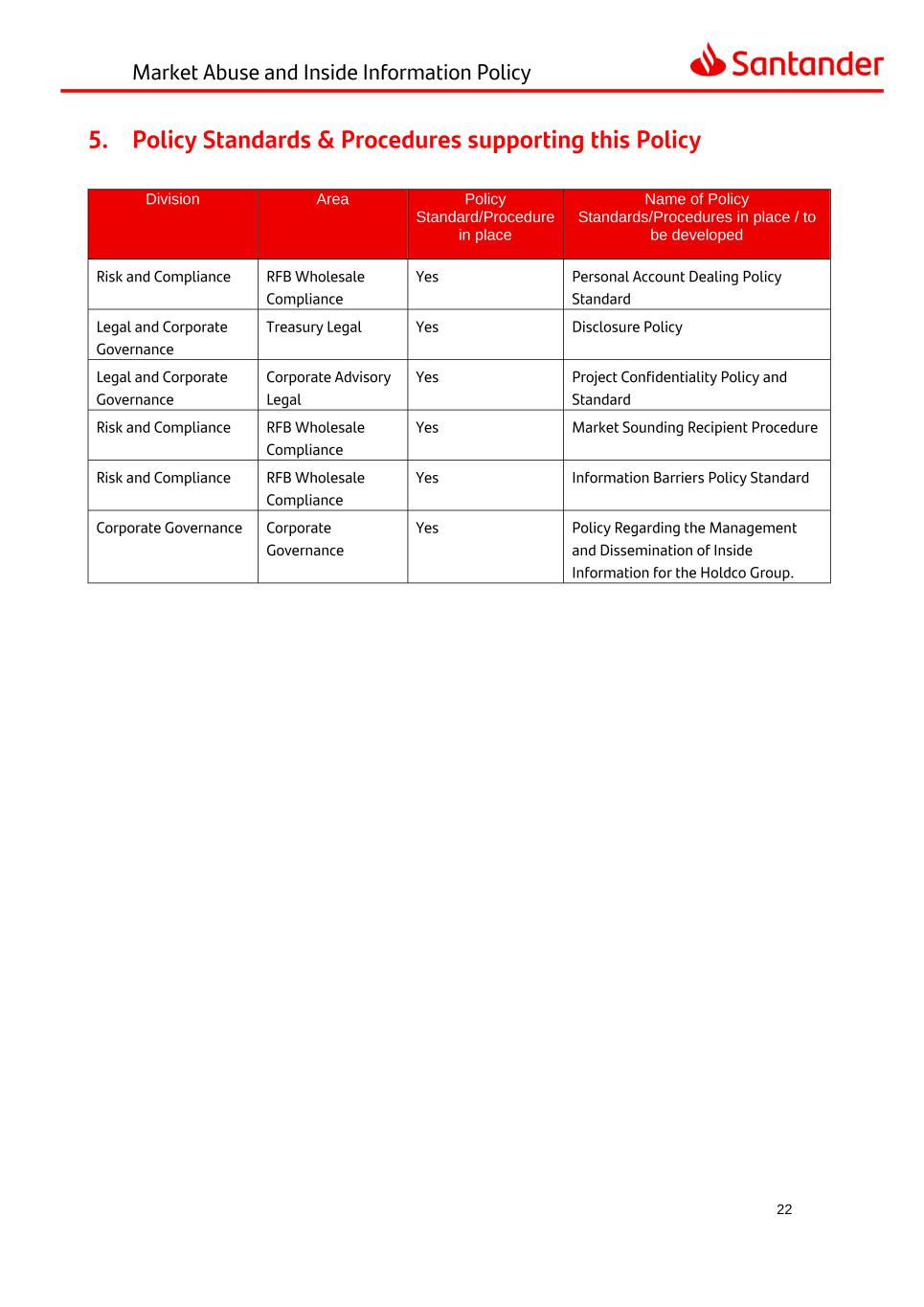

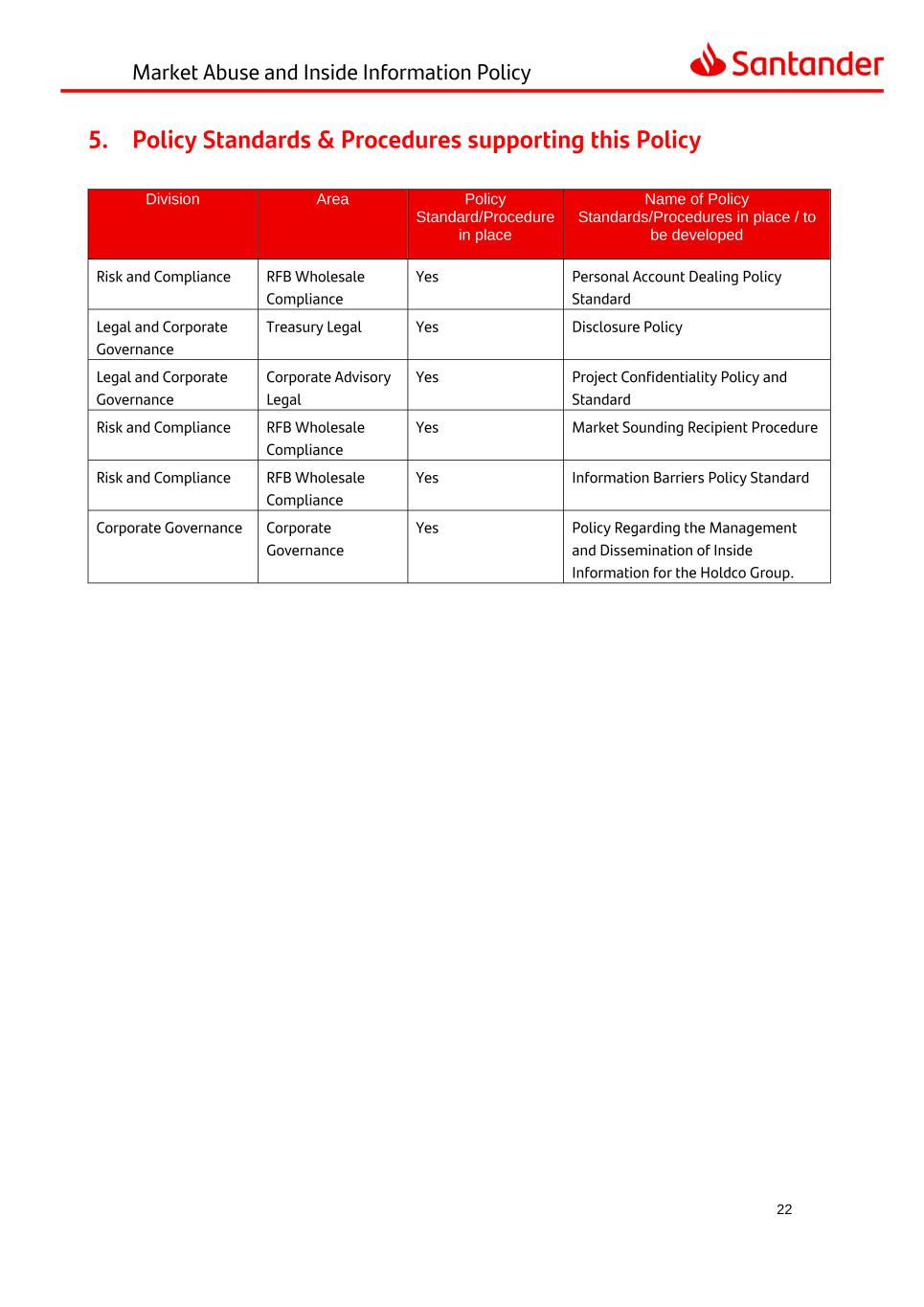

Market Abuse and Inside Information Policy 22 5. Policy Standards & Procedures supporting this Policy Division Area Policy Standard/Procedure in place Name of Policy Standards/Procedures in place / to be developed Risk and Compliance RFB Wholesale Compliance Yes Personal Account Dealing Policy Standard Legal and Corporate Governance Treasury Legal Yes Disclosure Policy Legal and Corporate Governance Corporate Advisory Legal Yes Project Confidentiality Policy and Standard Risk and Compliance RFB Wholesale Compliance Yes Market Sounding Recipient Procedure Risk and Compliance RFB Wholesale Compliance Yes Information Barriers Policy Standard Corporate Governance Corporate Governance Yes Policy Regarding the Management and Dissemination of Inside Information for the Holdco Group.

Market Abuse and Inside Information Policy 23 6. Change Control 6.1 Change Table Policy Version & Approval Date Author DirRED Owner Group Validation Name & Date (if applicable) Description of Change Policy Version Author DirRED Owner & Approval Date Group Validation Name & Date (if applicable) Description of Change Vs 1.0 July 2023 RFB Wholesale Compliance Alison Webdale - First Version amalgamating the existing RFB Wholesale Compliance Market Abuse Policy with the Holdco Group Inside Information Policy previously owned by Legal

Market Abuse and Inside Information Policy 24 APPENDIX 1 - INDICATORS OF WHAT IS INSIDE INFORMATION Inside Information is not always easy to identify and it is not possible to produce an exhaustive list of the types of information that might constitute Inside Information. It needs to be assessed on a case-by-case basis. Broadly, as defined in section 1.2 above, inside information comprises of information which: • is of a precise nature; • has not been made public; • relates directly or indirectly to one or more issuers or to one or more Financial Instruments; and • if it were made public, would be likely to have a significant effect on the prices of those Financial Instruments or those related derivative Financial Instruments. Under MAR, information is “precise” if it indicates an event or set of circumstances which has occurred or exists or which may reasonably be expected to occur or come into existence. This means that there must be a realistic prospect of the event happening. It is also important to emphasise that the information does not have to be specific enough to indicate whether the price of a share or other Financial Instrument will go up or down, for it to be ‘precise’. Information can only be Inside Information if it has not already been made public. For example, if it has not already been disclosed to the market using a regulatory information service or is not already generally available in the press or on the internet. MAR 1.2 of the FCA Handbook provides further helpful guidance on this. Information that has a ‘significant effect’ on price if made public should be considered as information a reasonable investor would be likely to use as part of the basis of their investment decisions. The fact alone that information is commercially sensitive does not necessarily mean that it is Inside Information. On its own, a piece of information may not be Inside Information; but when taken with other information, it could be. A collective assessment should therefore be made. For Staff involved with the execution of orders concerning Financial Instruments, Inside Information also means information conveyed by a client and relating to the client’s pending orders in Financial Instruments which is of a precise nature, relating, directly or indirectly, to one or more issuers or to one or more financial instruments, and which, if it were made public, would be likely to have a significant effect on the prices of those Financial Instruments, or on the price of related derivative financial instruments.

Market Abuse and Inside Information Policy 25 APPENDIX 2 – INDICATORS OF INSIDER DEALING Practice Description Example • Front-running/pre- positioning Front-running is the practice of a trader making trades just before a large non-publicized order to gain an economic advantage. • A dealer on the trading desk of a firm dealing in oil derivatives accepts a very large order from a client to acquire a long position in oil futures deliverable in a month. Before executing the order, the dealer trades for the firm and on his personal account by taking a long position in those oil futures, based on the expectation that he will be able to sell them at profit due to the significant price increase that will result from the execution of his client's order. Both trades constitute insider dealing. • Insider Dealing Dealing based on inside information which is not trading information • X, a director at B PLC has lunch with a friend; Y. X tells Y that his company has received a takeover offer that is at a premium to the current share price at which it is trading. Y enters into a spread bet priced or valued by reference to the share price of B PLC based on his expectation that the price in B PLC will increase once the takeover offer is announced. • Suspicious language that suggests a person is recommending others to engage in insider dealing N/A • A director of a company, while in possession of inside information, instructs an employee of that company to sell a financial instrument in respect of which the information is inside information. • A person recommends or advises a friend to engage in behaviour which, if he himself engaged in it, would amount to market abuse.

Market Abuse and Inside Information Policy 26 APPENDIX 3 – INSIDER DEALING AND INDICATORS OF LEGITIMATE (DEALING) BEHAVIOUR Market Makers 1) For market makers and persons that may lawfully deal in financial instruments on their own account, pursuing their legitimate business of such dealing (including entering into an agreement for the underwriting of an issue of financial instruments) may not in itself amount to Market Abuse. 2) Legitimate market making activities can be considered as follows: a. Providing simultaneous two-way quotes of comparable size and at competitive prices, with the result of providing liquidity on a regular and ongoing basis to the market. ▪ A market maker must hold themselves out as being willing and able to buy and sell, including entering into long and short positions, in a financial position on a regular or continuous basis. ▪ A market making desk can be considered to be regularly purchasing securities from, or selling positions to, clients or counterparties in the secondary market. ▪ Transaction volumes and risk should be proportionate to historical client liquidity and investment needs. b. Fulfilling orders initiated by clients or in response to clients’ requests to trade. ▪ A market maker’s clients generally consist of market participants that make use of its intermediation services. In considering facilitating client trades the Regulator will consider the extent to which the transaction generally opens a new position, so creating an exposure to market risk, rather than closing out a position and so removing market risk. c. Hedging positions arising from the fulfilment of activities under the points above. ▪ A market maker generally manages and limits the extent to which they are exposed to movements in the price of retained principal positions. ▪ Risk should not be retained in excess of the size and type required for market making. They focus on servicing client demands and typically only transact with non-clients (i.e. brokers) to the extent that such transactions directly facilitate or support client transactions such as through hedging, acquiring positions in advance of client demand, or selling positions acquired from clients. 3) The following factors may be taken into account in determining that a person's behaviour in executing an order (including an order relating to a bid) on behalf of another was carried out legitimately: ▪ Whether the person has complied with the applicable provisions of COBS

Market Abuse and Inside Information Policy 27 ▪ Whether the person has agreed with its client it will act in a particular way when carrying out, or arranging the carrying out of, the order. ▪ Whether the person's behaviour was with a view to facilitating or ensuring the effective carrying out of the order. ▪ The extent to which the person's behaviour was reasonable by the proper standards of conduct of the market and (if relevant) proportional to the risk undertaken by them. ▪ Whether, if the relevant trading or bidding (including the withdrawal of a bid) by that person is connected with a transaction entered into or to be entered into with a client (including a potential client), the trading or bidding either has no impact on the price or there has been adequate disclosure to that client that trading or bidding will take place and they have not objected to it 4) Information obtained during a public takeover or merger ▪ It shall not be deemed from the fact that a person is in possession of inside information that they have used that information and thus engaged in insider dealing, where such information was obtained during a public takeover or merger and the person uses that information solely for the purpose of the merger or public takeover, if at the point of approval of the merger or acceptance of the offer by the shareholders, any inside information has been made public or has ceased to constitute inside information. (This shall not apply to stake-building). ▪ Examples of using information solely for the purpose of proceeding with a merger or public takeover may include: ▪ Information that an offer or potential offeror is going to make, or is considering making, an offer for the target; ▪ Information that an offeror or potential offeror may obtain through due diligence

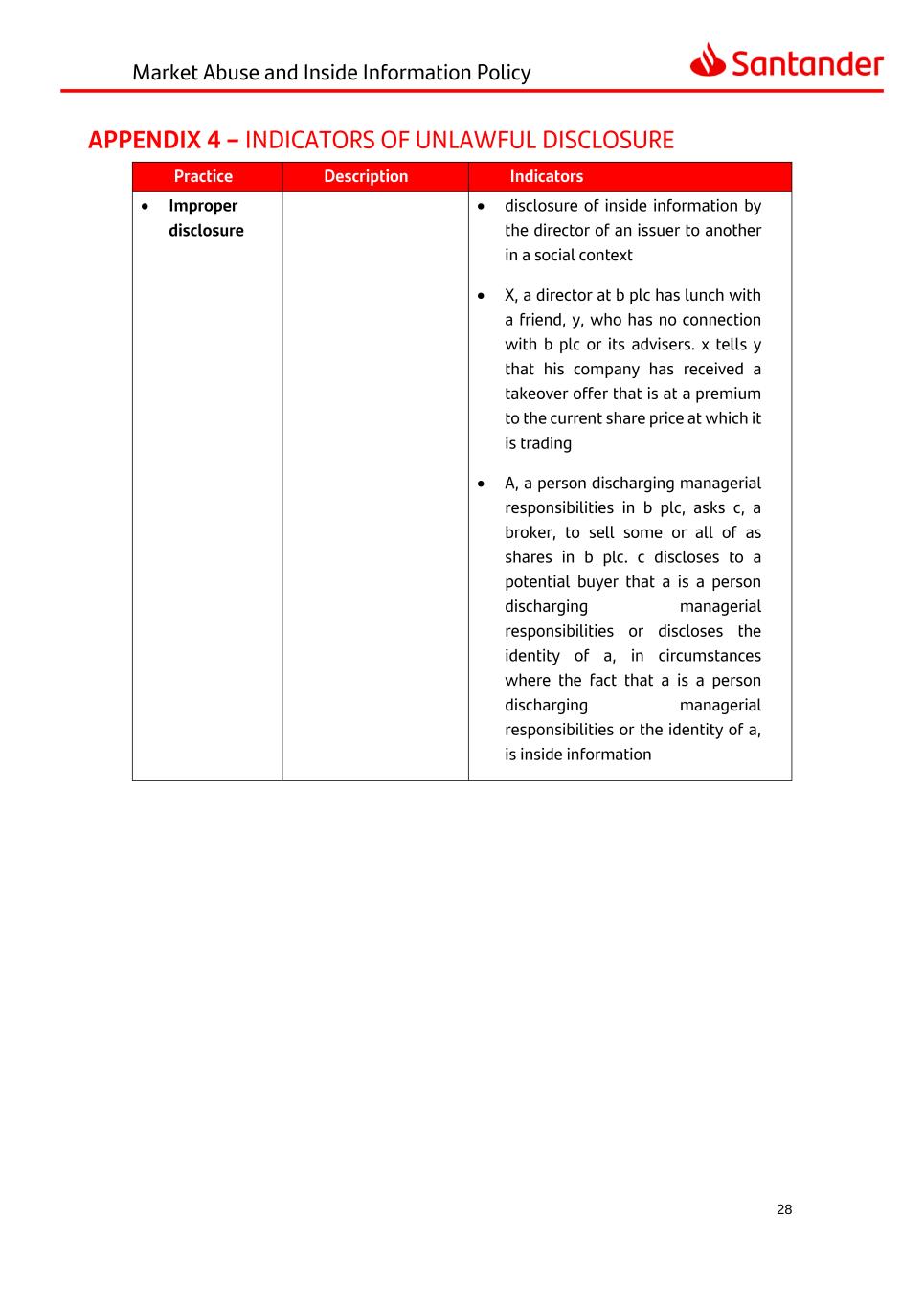

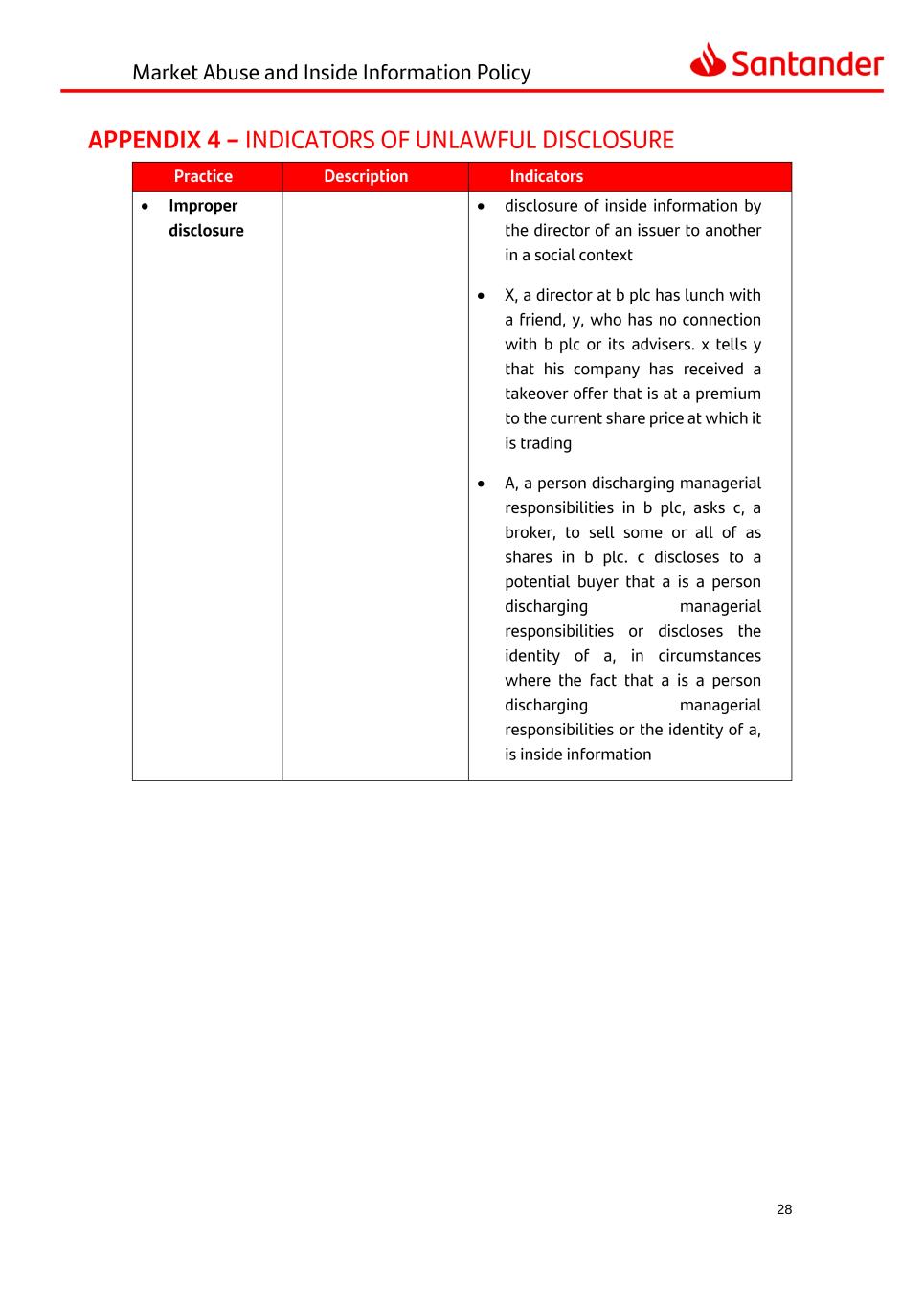

Market Abuse and Inside Information Policy 28 APPENDIX 4 – INDICATORS OF UNLAWFUL DISCLOSURE Practice Description Indicators • Improper disclosure • disclosure of inside information by the director of an issuer to another in a social context • X, a director at b plc has lunch with a friend, y, who has no connection with b plc or its advisers. x tells y that his company has received a takeover offer that is at a premium to the current share price at which it is trading • A, a person discharging managerial responsibilities in b plc, asks c, a broker, to sell some or all of as shares in b plc. c discloses to a potential buyer that a is a person discharging managerial responsibilities or discloses the identity of a, in circumstances where the fact that a is a person discharging managerial responsibilities or the identity of a, is inside information

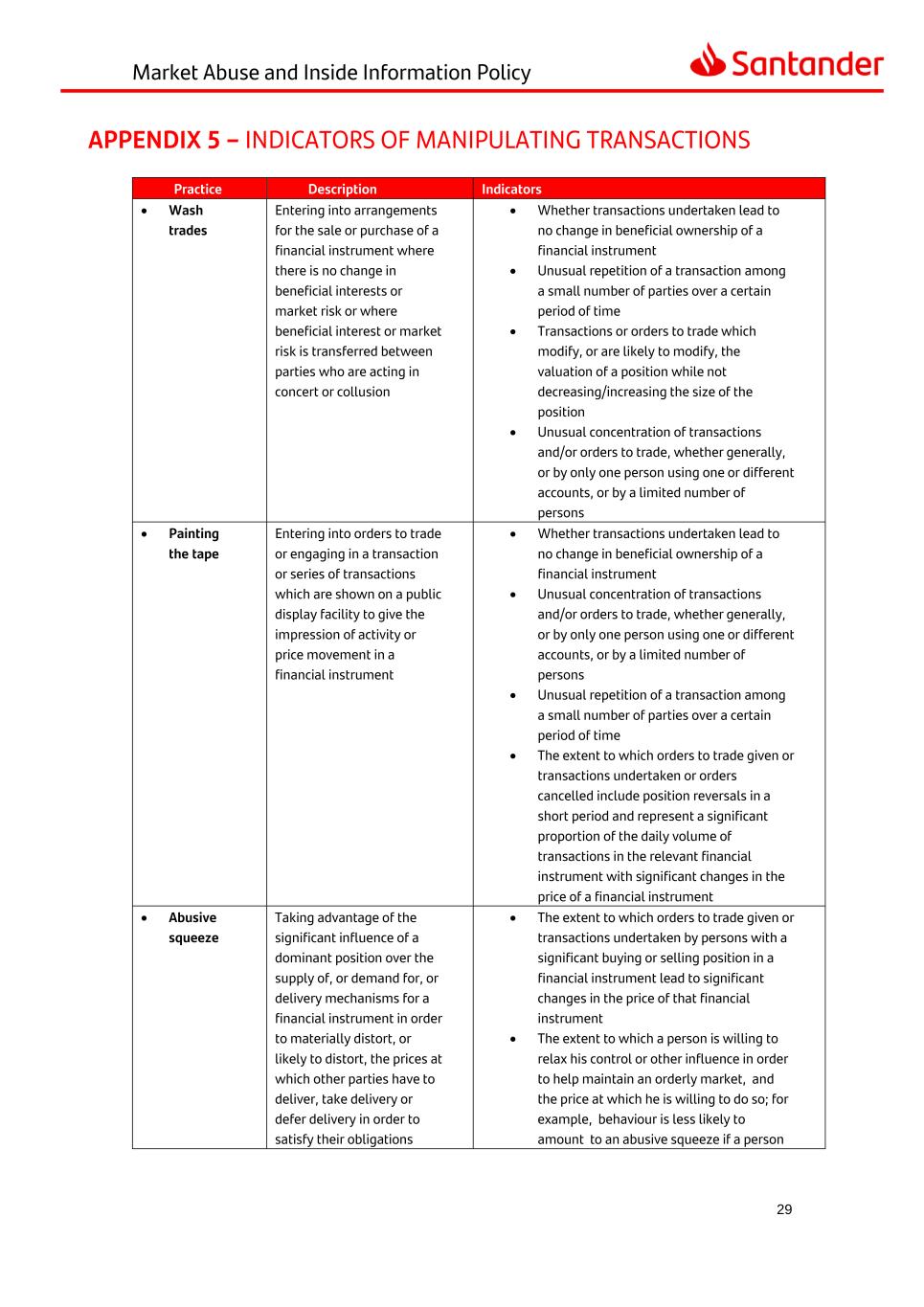

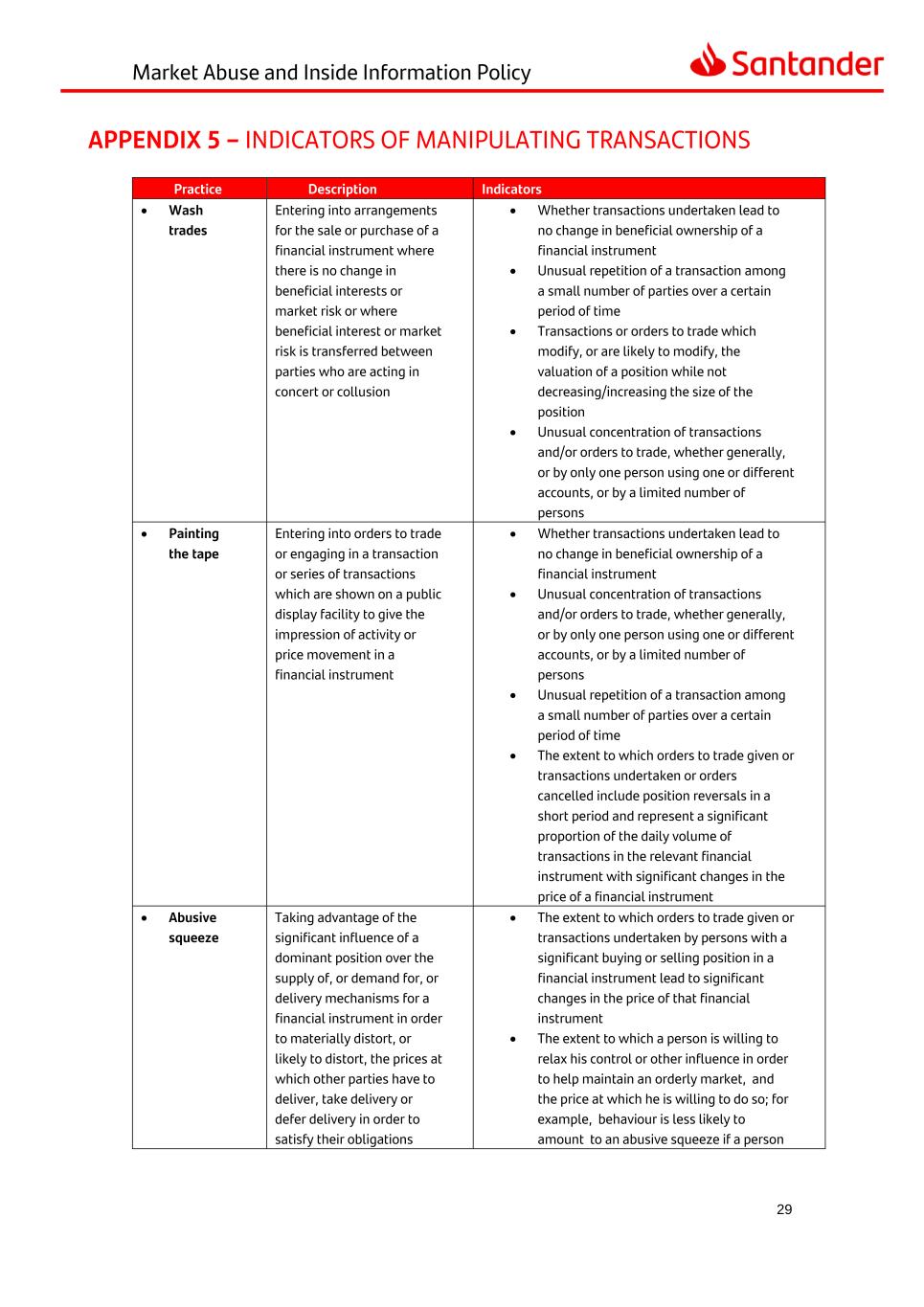

Market Abuse and Inside Information Policy 29 APPENDIX 5 – INDICATORS OF MANIPULATING TRANSACTIONS Practice Description Indicators • Wash trades Entering into arrangements for the sale or purchase of a financial instrument where there is no change in beneficial interests or market risk or where beneficial interest or market risk is transferred between parties who are acting in concert or collusion • Whether transactions undertaken lead to no change in beneficial ownership of a financial instrument • Unusual repetition of a transaction among a small number of parties over a certain period of time • Transactions or orders to trade which modify, or are likely to modify, the valuation of a position while not decreasing/increasing the size of the position • Unusual concentration of transactions and/or orders to trade, whether generally, or by only one person using one or different accounts, or by a limited number of persons • Painting the tape Entering into orders to trade or engaging in a transaction or series of transactions which are shown on a public display facility to give the impression of activity or price movement in a financial instrument • Whether transactions undertaken lead to no change in beneficial ownership of a financial instrument • Unusual concentration of transactions and/or orders to trade, whether generally, or by only one person using one or different accounts, or by a limited number of persons • Unusual repetition of a transaction among a small number of parties over a certain period of time • The extent to which orders to trade given or transactions undertaken or orders cancelled include position reversals in a short period and represent a significant proportion of the daily volume of transactions in the relevant financial instrument with significant changes in the price of a financial instrument • Abusive squeeze Taking advantage of the significant influence of a dominant position over the supply of, or demand for, or delivery mechanisms for a financial instrument in order to materially distort, or likely to distort, the prices at which other parties have to deliver, take delivery or defer delivery in order to satisfy their obligations • The extent to which orders to trade given or transactions undertaken by persons with a significant buying or selling position in a financial instrument lead to significant changes in the price of that financial instrument • The extent to which a person is willing to relax his control or other influence in order to help maintain an orderly market, and the price at which he is willing to do so; for example, behaviour is less likely to amount to an abusive squeeze if a person

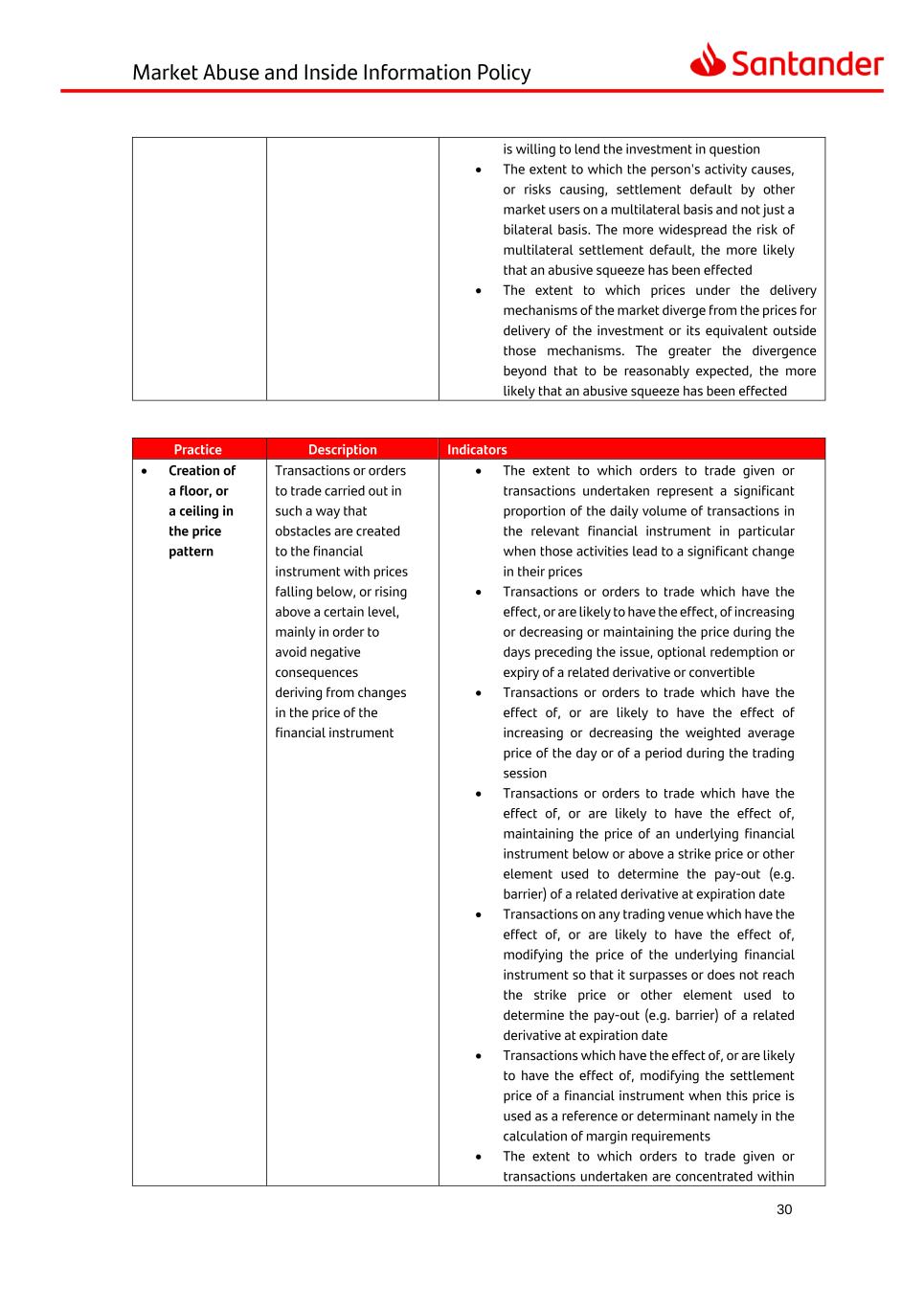

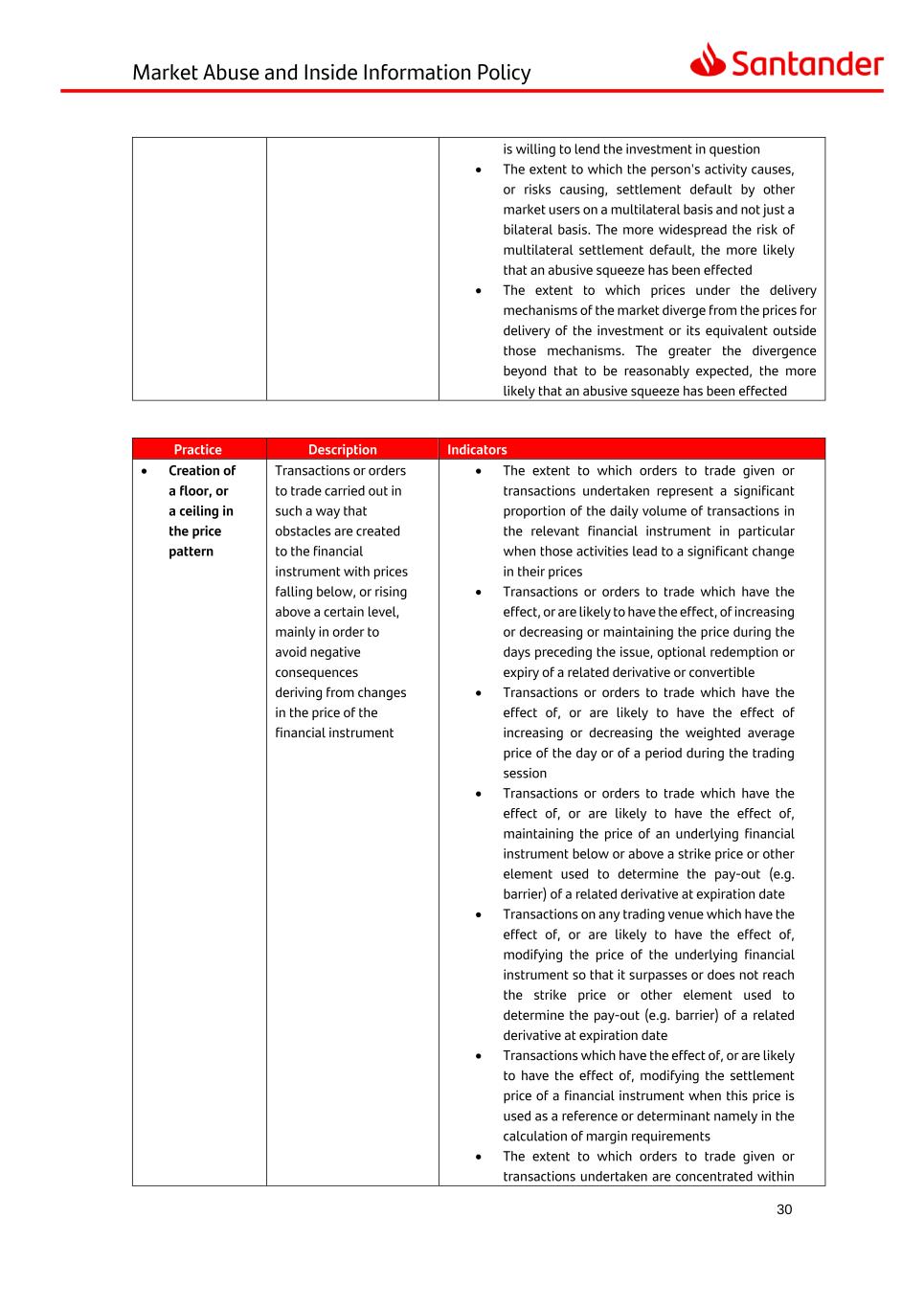

Market Abuse and Inside Information Policy 30 is willing to lend the investment in question • The extent to which the person's activity causes, or risks causing, settlement default by other market users on a multilateral basis and not just a bilateral basis. The more widespread the risk of multilateral settlement default, the more likely that an abusive squeeze has been effected • The extent to which prices under the delivery mechanisms of the market diverge from the prices for delivery of the investment or its equivalent outside those mechanisms. The greater the divergence beyond that to be reasonably expected, the more likely that an abusive squeeze has been effected Practice Description Indicators • Creation of a floor, or a ceiling in the price pattern Transactions or orders to trade carried out in such a way that obstacles are created to the financial instrument with prices falling below, or rising above a certain level, mainly in order to avoid negative consequences deriving from changes in the price of the financial instrument • The extent to which orders to trade given or transactions undertaken represent a significant proportion of the daily volume of transactions in the relevant financial instrument in particular when those activities lead to a significant change in their prices • Transactions or orders to trade which have the effect, or are likely to have the effect, of increasing or decreasing or maintaining the price during the days preceding the issue, optional redemption or expiry of a related derivative or convertible • Transactions or orders to trade which have the effect of, or are likely to have the effect of increasing or decreasing the weighted average price of the day or of a period during the trading session • Transactions or orders to trade which have the effect of, or are likely to have the effect of, maintaining the price of an underlying financial instrument below or above a strike price or other element used to determine the pay-out (e.g. barrier) of a related derivative at expiration date • Transactions on any trading venue which have the effect of, or are likely to have the effect of, modifying the price of the underlying financial instrument so that it surpasses or does not reach the strike price or other element used to determine the pay-out (e.g. barrier) of a related derivative at expiration date • Transactions which have the effect of, or are likely to have the effect of, modifying the settlement price of a financial instrument when this price is used as a reference or determinant namely in the calculation of margin requirements • The extent to which orders to trade given or transactions undertaken are concentrated within

Market Abuse and Inside Information Policy 31 a short time span in the trading session and lead to a price change which is subsequently reversed • The extent to which orders to trade given change the representation of the best bid or offer prices in a financial instrument or more generally the representation of the order book available to market participants, and are removed before they are executed • The extent to which orders to trade are given or transactions are undertaken at or around a specific time when reference prices, settlement prices and valuations are calculated and lead to price changes which have an effect on such prices and valuations Practice Description Indicators • Ping orders Entering small orders to trade in order to ascertain the level of hidden orders and particularly to assess what is resting on a dark platform • The extent to which orders to trade given or transactions undertaken represent a significant proportion of the daily volume of transactions in the relevant financial instrument in particular when those activities lead to a significant change in their prices • Phishing Executing orders to trade, or a series of orders to trade, in order to uncover orders of other participants, and then entering an order to trade to take advantage of the information obtained • The extent to which orders to trade given or transactions undertaken represent a significant proportion of the daily volume of transactions in the relevant financial instrument in particular when those activities lead to a significant change in their prices Practice Description Indicators • Inter-trading venues manipulation Trading on one trading venue or outside a trading venue to improperly position the price of a financial instrument in another trading venue or outside a trading venue • The extent to which orders to trade given or transactions undertaken by persons with a significant buying or selling position in a financial instrument lead to significant changes in the price of that financial instrument • Execution of a transaction, changing the bid- offer prices, when the spread between the bid and offer prices is a factor in the determination of the price of any other transaction whether or not on the same trading venue • Transactions or orders to trade which have the effect, or are likely to have the effect, of increasing or decreasing or maintaining the

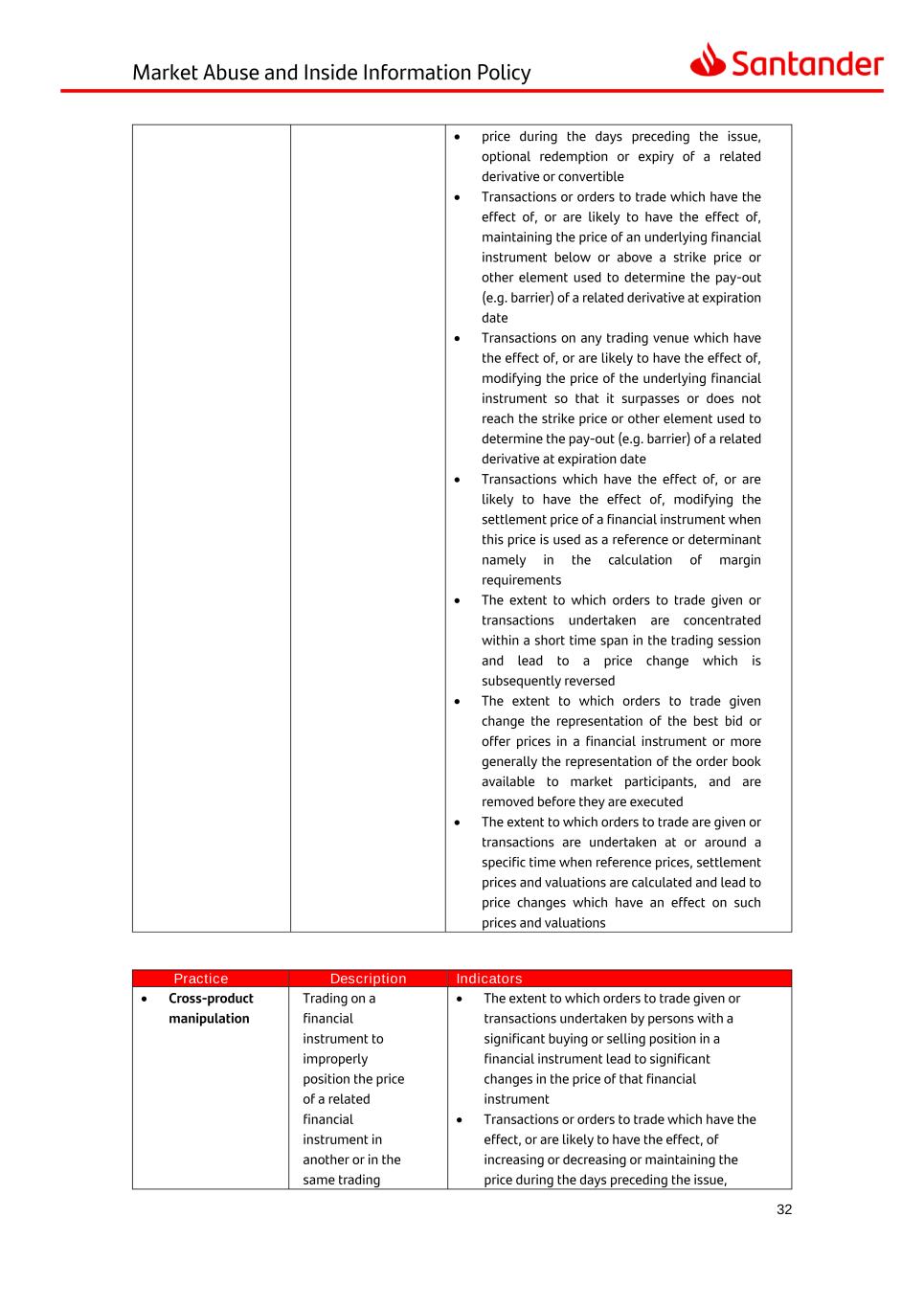

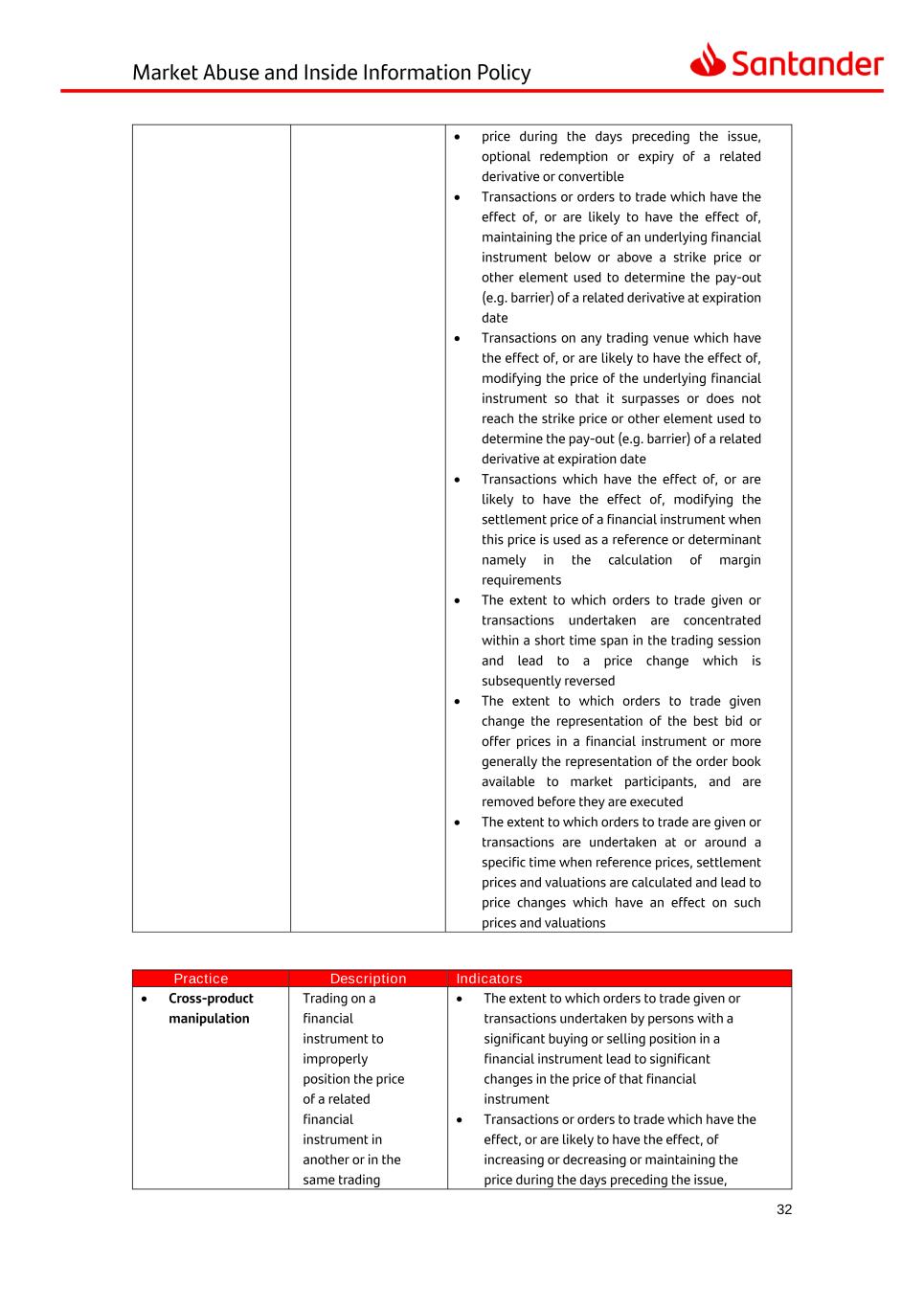

Market Abuse and Inside Information Policy 32 • price during the days preceding the issue, optional redemption or expiry of a related derivative or convertible • Transactions or orders to trade which have the effect of, or are likely to have the effect of, maintaining the price of an underlying financial instrument below or above a strike price or other element used to determine the pay-out (e.g. barrier) of a related derivative at expiration date • Transactions on any trading venue which have the effect of, or are likely to have the effect of, modifying the price of the underlying financial instrument so that it surpasses or does not reach the strike price or other element used to determine the pay-out (e.g. barrier) of a related derivative at expiration date • Transactions which have the effect of, or are likely to have the effect of, modifying the settlement price of a financial instrument when this price is used as a reference or determinant namely in the calculation of margin requirements • The extent to which orders to trade given or transactions undertaken are concentrated within a short time span in the trading session and lead to a price change which is subsequently reversed • The extent to which orders to trade given change the representation of the best bid or offer prices in a financial instrument or more generally the representation of the order book available to market participants, and are removed before they are executed • The extent to which orders to trade are given or transactions are undertaken at or around a specific time when reference prices, settlement prices and valuations are calculated and lead to price changes which have an effect on such prices and valuations Practice Description Indicators • Cross-product manipulation Trading on a financial instrument to improperly position the price of a related financial instrument in another or in the same trading • The extent to which orders to trade given or transactions undertaken by persons with a significant buying or selling position in a financial instrument lead to significant changes in the price of that financial instrument • Transactions or orders to trade which have the effect, or are likely to have the effect, of increasing or decreasing or maintaining the price during the days preceding the issue,

Market Abuse and Inside Information Policy 33 venue or outside a trading venue optional redemption or expiry of a related derivative or convertible • Transactions or orders to trade which have the effect of, or are likely to have the effect of, maintaining the price of an underlying financial instrument • Transactions on any trading venue which have the effect of, or are likely to have the effect of, modifying the price of the underlying financial instrument so that it surpasses or does not reach the strike price or other element used to determine the pay-out (e.g. barrier) of a related derivative at expiration date; • Transactions which have the effect of, or are likely to have the effect of, modifying the settlement price of a financial instrument when this price is used as a reference or determinant namely in the calculation of margin requirements. • Execution of a transaction, changing the bid- offer prices, when the spread between the bid and offer prices is a factor in the determination of the price of any other transaction whether or not on the same trading venue • The extent to which orders to trade given or transactions undertaken are concentrated within a short time span in the trading session and lead to a price change which is subsequently reversed • The extent to which orders to trade given change the representation of the best bid or offer prices in a financial instrument or more generally the representation of the order book available to market participants, and are removed before they are executed • The extent to which orders to trade are given or transactions are undertaken at or around a specific time when reference prices, settlement prices and valuations are calculated and lead to price changes which have an effect on such prices and valuations Practice Description Indicators • Improper matched orders Transactions carried out as a result of the entering of buy and sell orders to trade at or nearly at the same time, with very similar quantity and similar price, by the same • Whether transactions undertaken lead to no change in beneficial ownership of a financial instrument • Transactions or orders to trade which have the effect of, or are likely to have the effect of setting a market price when the liquidity or the depth of the order book is not sufficient to fix a price within the session

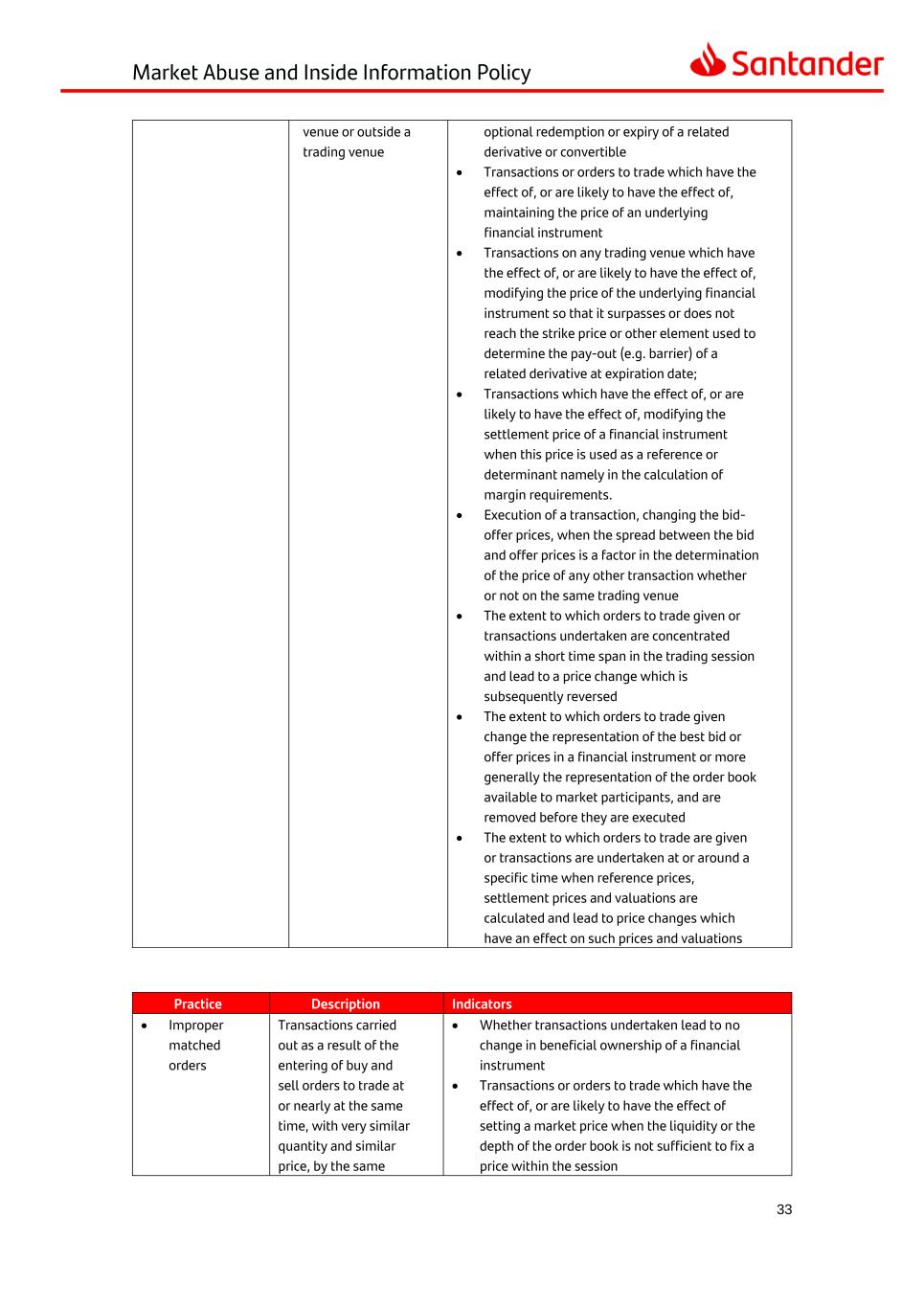

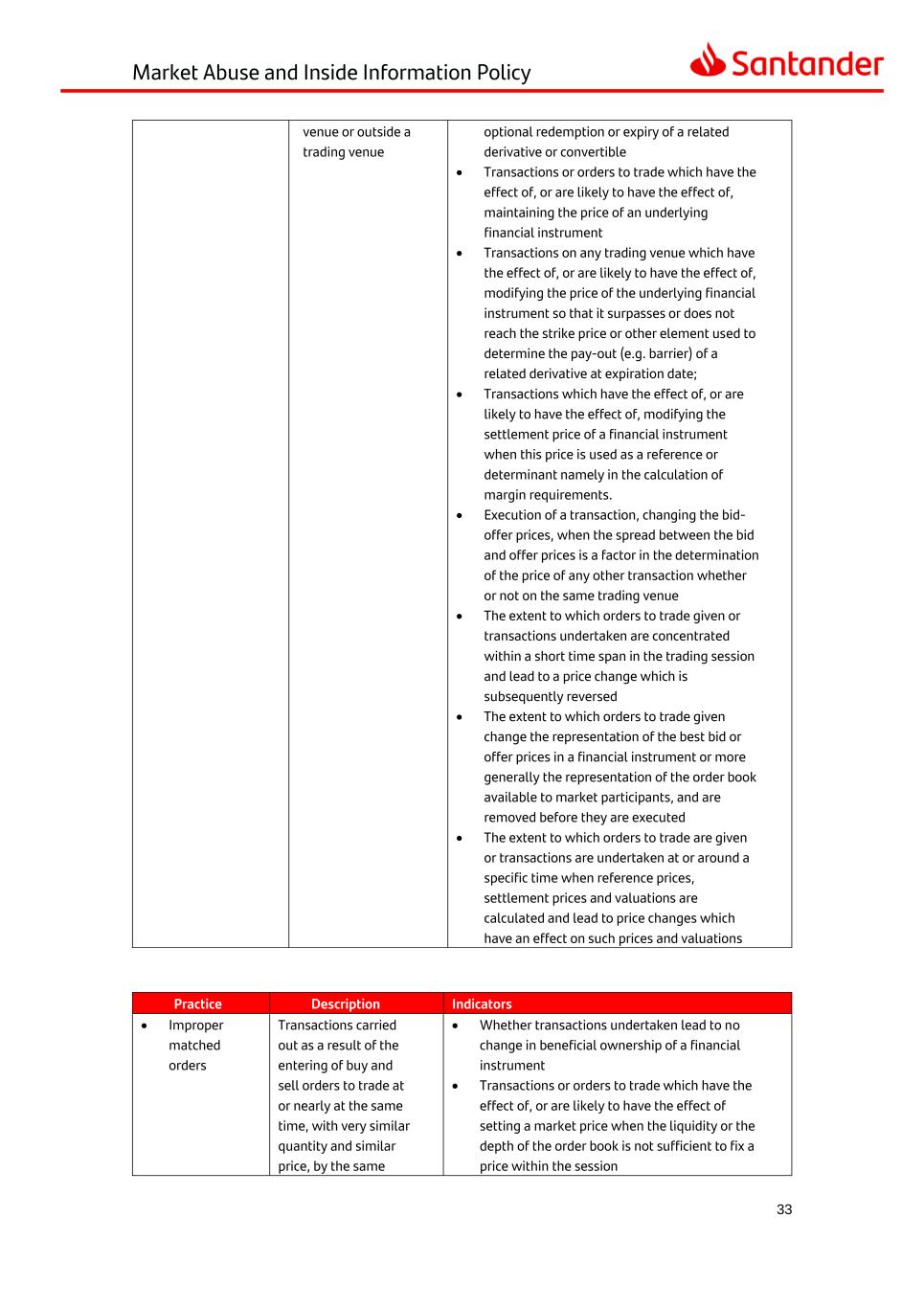

Market Abuse and Inside Information Policy 34 party or different but colluding parties • Unusual concentration of transactions and/or orders to trade, whether generally, or by only one person using one or different accounts, or by a limited number of persons • Unusual repetition of a transaction among a small number of parties over a certain period of time; • Transactions or orders to trade which modify, or are likely to modify, the valuation of a position while not decreasing/increasing the size of the position • The extent to which orders to trade given or transactions undertaken or orders cancelled include position reversals in a short period and represent a significant proportion of the daily volume of transactions in the relevant financial instrument with significant changes in the price of a financial instrument Practice Description Indicators • Quote stuffing Entering large number of orders to trade and/or cancellations and/or updates to orders to trade so as to create uncertainty for other participants, slowing down their process and/or to camouflage their own strategy • The extent to which orders to trade given or transactions undertaken or orders cancelled include position reversals in a short period and represent a significant proportion of the daily volume of transactions in the relevant financial instrument with significant changes in the price of a financial instrument • The extent to which orders to trade given or transactions undertaken are concentrated within a short time span in the trading session and lead to a price change which is subsequently reversed • The extent to which orders to trade given change the representation of the best bid or offer prices in a financial instrument or more generally the representation of the order book available to market participants, and are removed before they are executed Practice Description Indicators • Momentum ignition Entering orders to trade or a series of orders to trade, or executing transactions or series of transactions, likely to start or exacerbate a trend and to encourage other participants to accelerate or extend • The extent to which orders to trade given or transactions undertaken or orders cancelled include position reversals in a short period and represent a significant proportion of the daily volume of transactions in the relevant financial instrument with significant changes in the price of a financial instrument • The high ratio of cancelled orders (e.g. order to trade ratio) which may be combined with

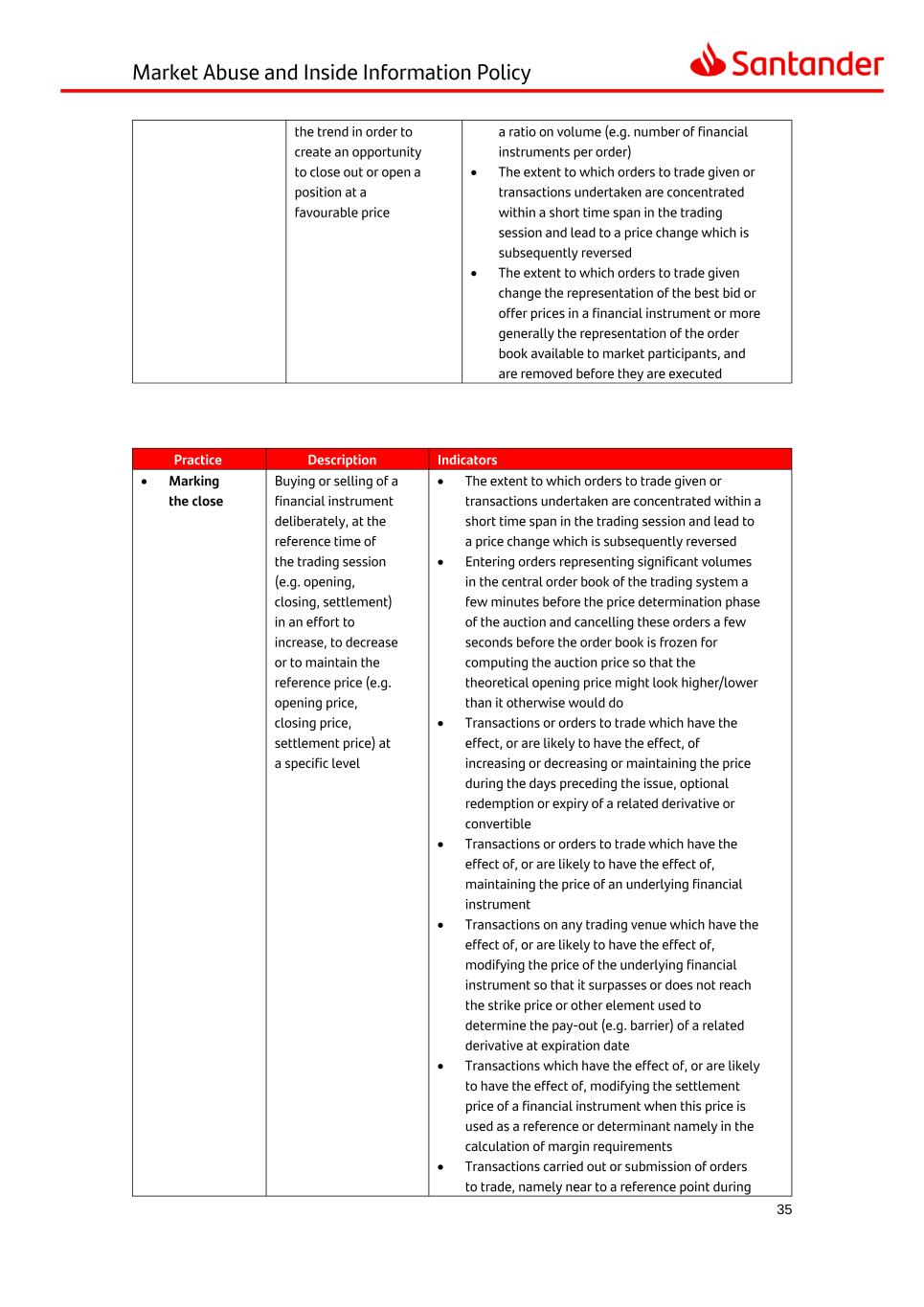

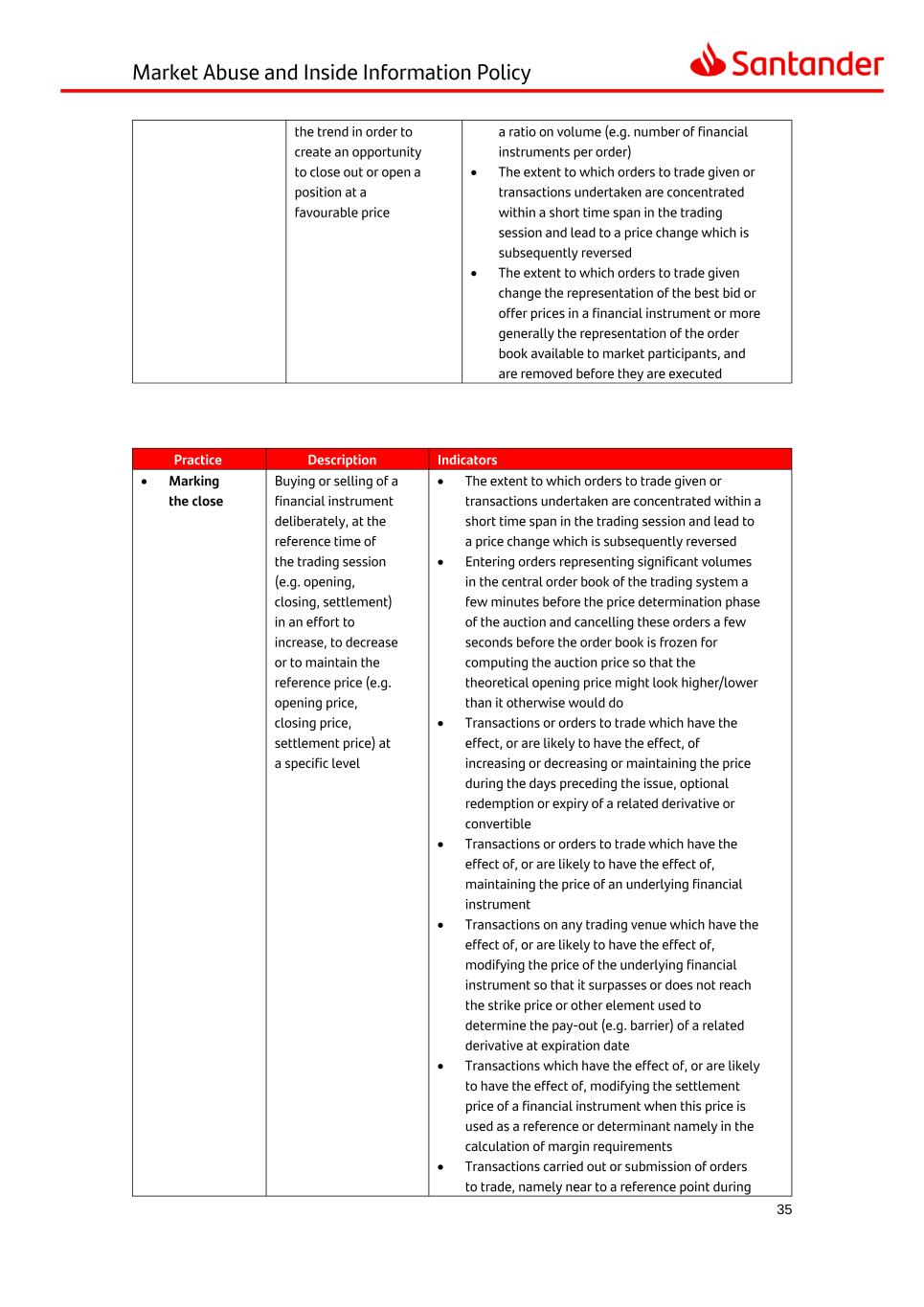

Market Abuse and Inside Information Policy 35 the trend in order to create an opportunity to close out or open a position at a favourable price a ratio on volume (e.g. number of financial instruments per order) • The extent to which orders to trade given or transactions undertaken are concentrated within a short time span in the trading session and lead to a price change which is subsequently reversed • The extent to which orders to trade given change the representation of the best bid or offer prices in a financial instrument or more generally the representation of the order book available to market participants, and are removed before they are executed Practice Description Indicators • Marking the close Buying or selling of a financial instrument deliberately, at the reference time of the trading session (e.g. opening, closing, settlement) in an effort to increase, to decrease or to maintain the reference price (e.g. opening price, closing price, settlement price) at a specific level • The extent to which orders to trade given or transactions undertaken are concentrated within a short time span in the trading session and lead to a price change which is subsequently reversed • Entering orders representing significant volumes in the central order book of the trading system a few minutes before the price determination phase of the auction and cancelling these orders a few seconds before the order book is frozen for computing the auction price so that the theoretical opening price might look higher/lower than it otherwise would do • Transactions or orders to trade which have the effect, or are likely to have the effect, of increasing or decreasing or maintaining the price during the days preceding the issue, optional redemption or expiry of a related derivative or convertible • Transactions or orders to trade which have the effect of, or are likely to have the effect of, maintaining the price of an underlying financial instrument • Transactions on any trading venue which have the effect of, or are likely to have the effect of, modifying the price of the underlying financial instrument so that it surpasses or does not reach the strike price or other element used to determine the pay-out (e.g. barrier) of a related derivative at expiration date • Transactions which have the effect of, or are likely to have the effect of, modifying the settlement price of a financial instrument when this price is used as a reference or determinant namely in the calculation of margin requirements • Transactions carried out or submission of orders to trade, namely near to a reference point during

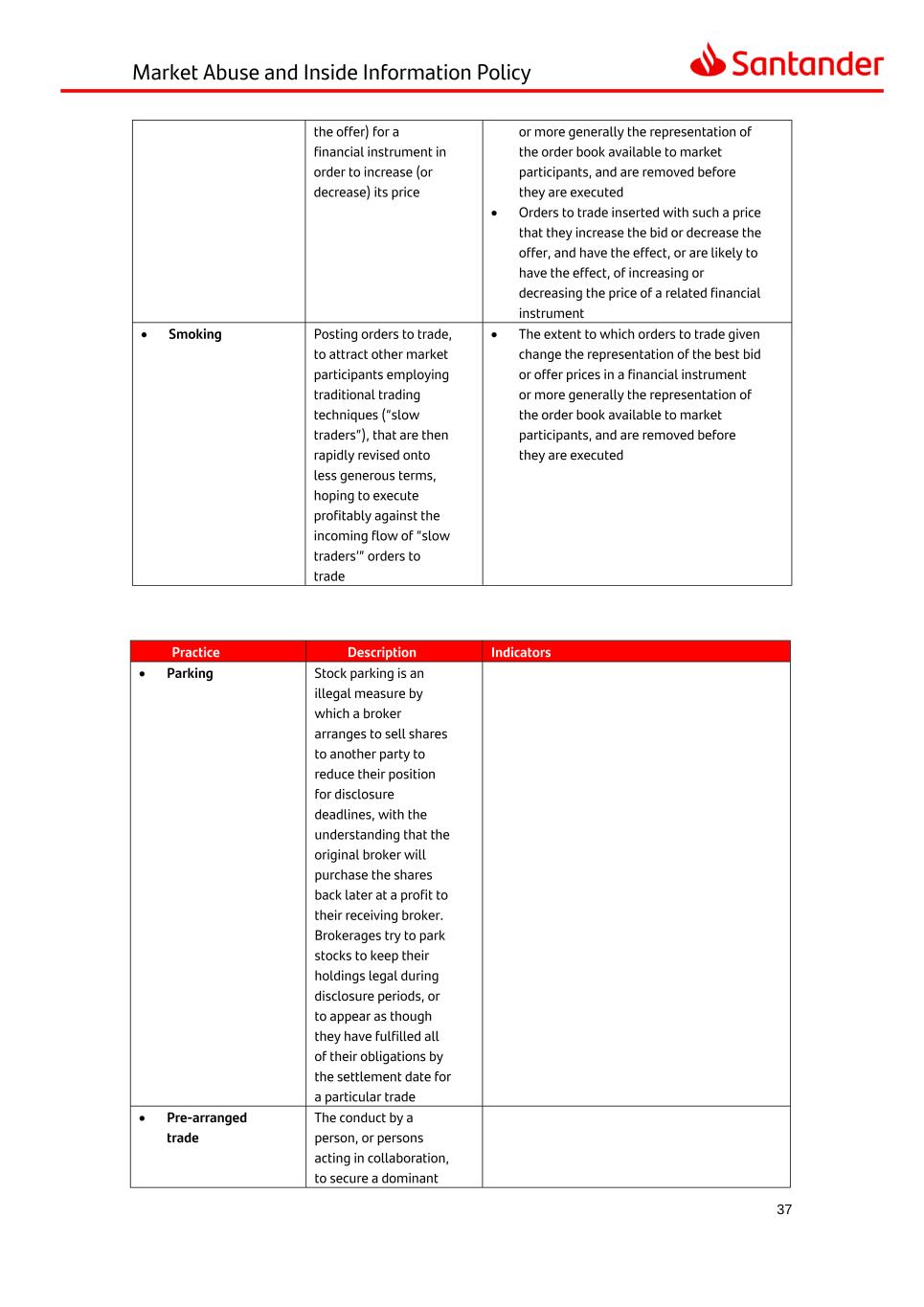

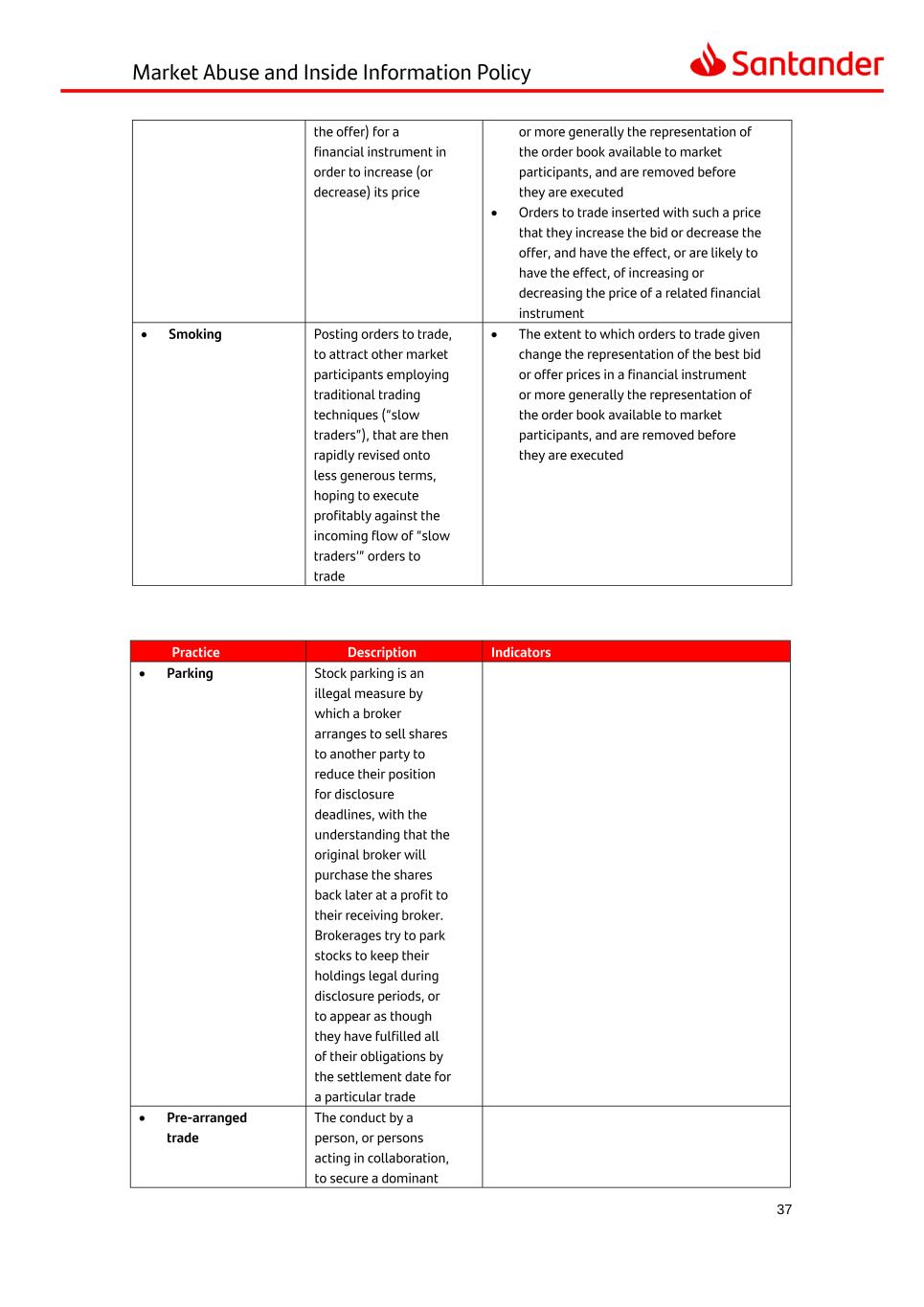

Market Abuse and Inside Information Policy 36 the trading day, which, because of their size in relation to the market, shall clearly have a significant impact on the supply of or demand for or the price or value • Transactions or orders to trade with no other apparent justification than to increase/decrease the price or to increase the volume of trading, namely near to a reference point during the trading day - e.g. at the opening or near the close • The extent to which orders to trade are given or transactions are undertaken at or around a specific time when reference prices, settlement prices and valuations are calculated and lead to price changes which have an effect on such prices and valuations Practice Description Indicators • Placing order with no intention of executing them Entering of orders which are withdrawn before execution, thus having the effect, or which are likely to have the effect, of giving a misleading impression that there is demand for or supply of a financial instrument at that price • The extent to which orders to trade given change the representation of the best bid or offer prices in a financial instrument or more generally the representation of the order book available to market participants, and are removed before they are executed • Orders to trade inserted with such a price that they increase the bid or decrease the offer, and have the effect, or are likely to have the effect, of increasing or decreasing the price of a related financial instrument • Excessive bid-offer spreads Moving the bid-offer spread to and/or maintaining it at artificial levels, by abusing of market power • The extent to which orders to trade given change the representation of the best bid or offer prices in a financial instrument or more generally the representation of the order book available to market participants, and are removed before they are executed • Transactions or orders to trade which have the effect of, or are likely to have the effect of bypassing the trading safeguards of the market (e.g. price limits, volume limits, bid/offer spread parameters, etc.) • Execution of a transaction, changing the bid- offer prices, when the spread between the bid and offer prices is a factor in the determination of the price of any other transaction whether or not on the same trading venue Practice Description Indicators • Advancing the bid Entering orders to trade which increase the bid (or decrease • The extent to which orders to trade given change the representation of the best bid or offer prices in a financial instrument

Market Abuse and Inside Information Policy 37 the offer) for a financial instrument in order to increase (or decrease) its price or more generally the representation of the order book available to market participants, and are removed before they are executed • Orders to trade inserted with such a price that they increase the bid or decrease the offer, and have the effect, or are likely to have the effect, of increasing or decreasing the price of a related financial instrument • Smoking Posting orders to trade, to attract other market participants employing traditional trading techniques (“slow traders”), that are then rapidly revised onto less generous terms, hoping to execute profitably against the incoming flow of “slow traders’” orders to trade • The extent to which orders to trade given change the representation of the best bid or offer prices in a financial instrument or more generally the representation of the order book available to market participants, and are removed before they are executed Practice Description Indicators • Parking Stock parking is an illegal measure by which a broker arranges to sell shares to another party to reduce their position for disclosure deadlines, with the understanding that the original broker will purchase the shares back later at a profit to their receiving broker. Brokerages try to park stocks to keep their holdings legal during disclosure periods, or to appear as though they have fulfilled all of their obligations by the settlement date for a particular trade • Pre-arranged trade The conduct by a person, or persons acting in collaboration, to secure a dominant

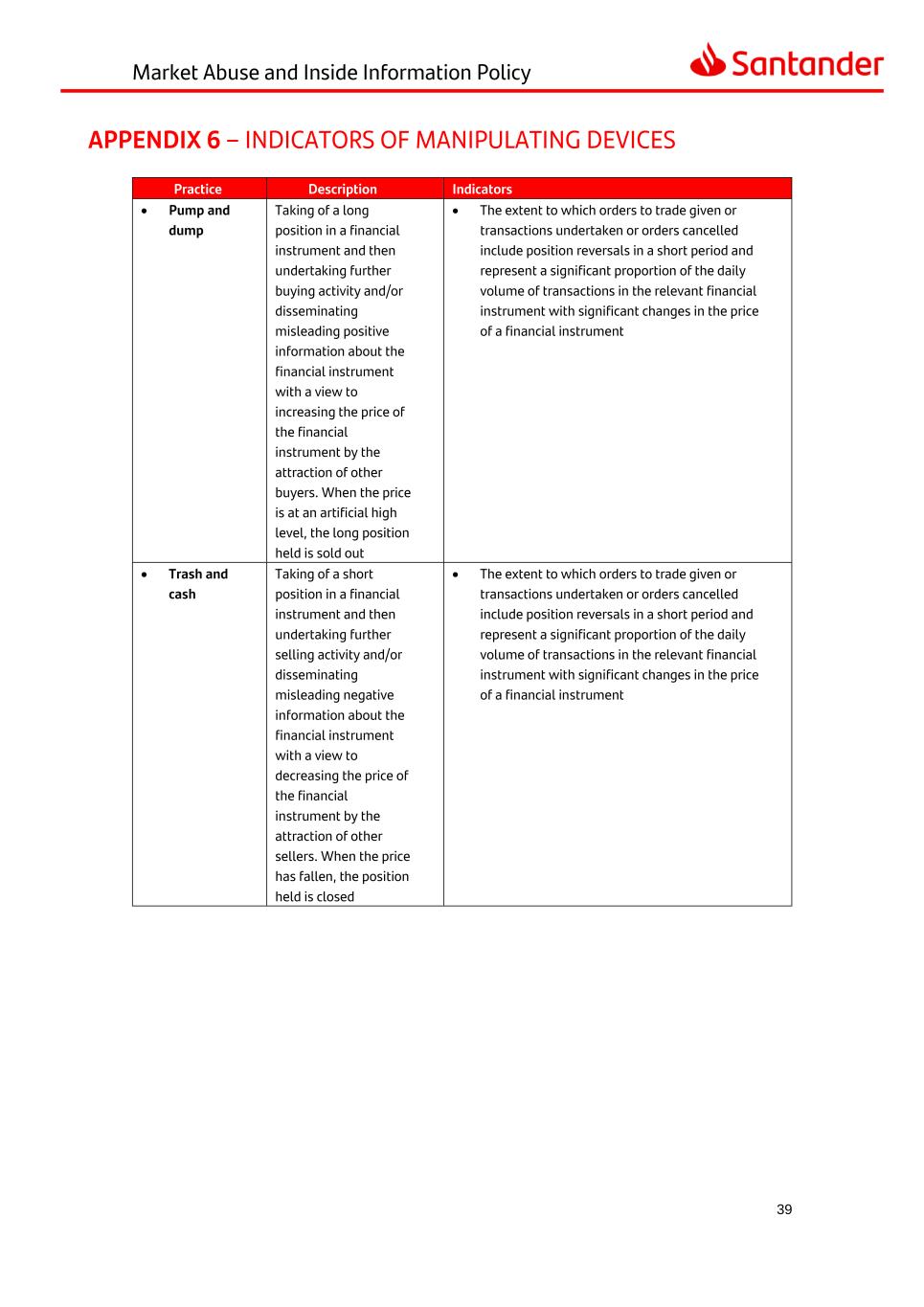

Market Abuse and Inside Information Policy 38 position over the supply of or demand for a financial instrument, which has, or is likely to have, the effect of fixing, directly or indirectly, purchase or sale prices or creates, or is likely to create, other unfair trading conditions Practice Description Indicators • Layering and spoofing Submitting multiple or large orders to trade often away from the touch on one side of the order book in order to execute a trade on the other side of the order book. Once the trade has taken place, the orders with no intention to be executed shall be removed • The extent to which orders to trade given or transactions undertaken are concentrated within a short time span in the trading session and lead to a price change which is subsequently reversed