Exhibit 99.3

Independent auditor’s report

To: the General Meeting of Shareholders and the Supervisory Board of Merus N.V.

Report on the accompanying financial statements 2016

Our opinion

In our opinion:

| • | | the accompanying consolidated financial statements give a true and fair view of the financial position of Merus N.V. as at December 31, 2016, and of its result and its cash flows for 2016 in accordance with International Financial Reporting Standards as adopted by the European Union(EU-IFRS) and with Part 9 of Book 2 of the Netherlands Civil Code; |

| • | | the accompanying company financial statements give a true and fair view of the financial position of Merus N.V. as at December 31, 2016, and of its result for 2016 in accordance with Part 9 of Book 2 of the Netherlands Civil Code. |

What we have audited

We have audited the financial statements 2016 of Merus N.V., based in Utrecht. The financial statements include the consolidated financial statements and the company financial statements.

The consolidated financial statements comprise:

| 1 | the consolidated statement of financial position as at December 31, 2016; |

| 2 | the following consolidated statements for 2016: the profit or loss and comprehensive loss, the statements of changes in equity and cash flows; and |

| 3 | the notes comprising a summary of the significant accounting policies and other explanatory information. |

The company financial statements comprise:

| 1 | the company statement of financial position as at December 31, 2016; |

| 2 | the company statement of profit or loss and comprehensive loss for 2016; and |

| 3 | the notes comprising a summary of the accounting policies and other explanatory information. |

Basis for our opinion

We conducted our audit in accordance with Dutch law, including the Dutch Standards on Auditing. Our responsibilities under those standards are further described in the ‘Our responsibilities for the audit of the financial statements’ section of our report.

We are independent of Merus N.V. in accordance with the Verordening inzake de onafhankelijkheid van accountants bij assurance-opdrachten (ViO, Code of Ethics for Professional Accountants, a regulation with respect to independence) and other relevant independence regulations in the Netherlands. Furthermore, we have complied with the Verordening gedrags- en beroepsregels accountants (VGBA, Dutch Code of Ethics).

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Audit approach

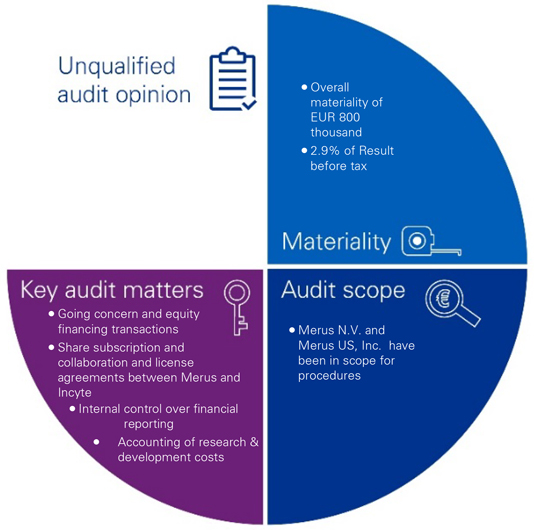

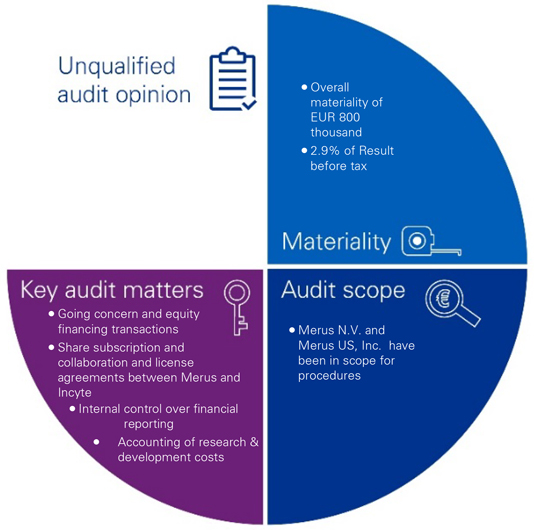

Summary

Materiality

Based on our professional judgment we determined the materiality for the financial statements as a whole at EUR 800 thousand (2015: EUR 600 thousand). The materiality is determined with reference to result before tax, adjusted for result from fair value changes of the derivative. Materiality represents 2.9% (2015: 2.6%) of the benchmark. We consider result before tax as the most appropriate benchmark as based on our consideration of the common information needs of users of the financial statements, we believe that result before tax is an important metric for the company in its development phase. We have also taken into account misstatements and/or possible misstatements that in our opinion are material for qualitative reasons for the users of the financial statements.

We agreed with the Audit Committee of the Supervisory Board that misstatements in excess of EUR 40 thousand, which are identified during the audit, would be reported to them, as well as smaller misstatements that in our view must be reported on qualitative grounds.

Scope of the group audit

Merus N.V. is head of a group of entities. The group consists of two entities Merus N.V. and Merus US, Inc. The financial information of this group is included in the consolidated financial statements of Merus N.V.

Because we are ultimately responsible for the opinion, we are also responsible for directing, supervising and performing the group audit. In this respect we have determined the nature and extent of the audit procedures to be carried out for group entities. Decisive were the size and/or the risk profile of the group entities or operations.

Our group audit is mainly focused on the significant entity Merus N.V., for which we perform a full scope audit. In addition, we have performed specified audit procedures on the financial information of Merus US, Inc. Accounting for the Group’s activities takes place at the headquarters in Utrecht, the Netherlands. As a consequence, we were able to perform all of the audit work for the Group. This resulted in a coverage of revenues of 100% and of the recurring total operating expenses of 99%.

By performing the combined procedures mentioned above, we have been able to obtain sufficient and appropriate audit evidence about the group’s financial information to provide an opinion about the financial statements.

Our key audit matters

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements. We have communicated the key audit matters to the Audit Committee of the Supervisory Board. The key audit matters are not a comprehensive reflection of all matters discussed.

These matters were addressed in the context of our audit of the financial statements as a whole and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

| | |

| Going concern and equity financing transactions | | |

Description | |  |

| The company is active in thebio-pharmaceutical research and development of bispecific antibody therapeutics in the field of immuno-oncology. Given the stage of development of the candidates, the company has incurred large research and development costs over the years and anticipates to spend more in the future before cash is generated from amongst others product sales. As a consequence, the Company is required to obtain funding in order to be able to continue the development activities to support the clinical studies. | |

In May 2016, the company completed an Initial Public Offering (IPO), collecting € 50.5 million net cash. Further, on December 20, 2016 share subscription and collaboration and license agreements with Incyte Corp. were signed resulting in additional new funding of € 190.5 million (US$ 200 million) paid to the Company in January 2017. Reference is made to the related key audit matter on the ‘Share subscription and collaboration and license agreements between Merus and Incyte’. |

Based on the funding obtained and the cash available, management concluded that the Company has sufficient cash to support the working capital needs for at least one year from the date of the Merus N.V. Annual Report 2016 and included a disclosure in the financial statements. |

As future funding is not guaranteed, the company is highly dependent on the progress and results of the research programs, other strategic partners, grants,co-funding and the capital markets appetite for such investments, an inherent risk for the company as a going concern exists in the longer term. |

Our response | |  |

We evaluated and challenged the Company’s future business plans, related cash flow forecasts and the process in which these were prepared. We evaluated the underlying key assumptions such as expected cash outflow for R&D expenses and other operating expenses and evaluated management’s ability to forecast through comparing actual cash outflows with prior years forecasts. | |

| We assessed the risk that a change in the assumptions either individually or collectively would lead to different conclusions. Further, as part of subsequent events we traced and agreed the € 190.5 |

|

| Going concern and equity financing transactions |

million (US$ 200 million) cash receipts to the Company’s bank statements. In order to corroborate management’s future business plans and to identify potential contradictory information we, among others, read the board minutes, supervisory board minutes and discussed the business plans with management and the Audit Committee. |

We evaluated the disclosure note 2 included in the financial statements as adequate. |

| | |

| Share subscription and collaboration and license agreements between Merus and Incyte | | |

Description | |  |

| The accounting for the share subscription and collaboration and license agreements was significant to our audit since the amounts involved were material, the accounting was complex and required judgment. The agreements were signed on December 20, 2016 and became effective on January 23, 2017. We considered the risk that the accounting, valuation and related disclosures for the various elements of the agreements are not appropriately stated. | |

With the assistance of outside technical accounting experts, management supported the accounting and relevant disclosures for the agreements with an extensive accounting position paper. Further, next to the accounting under the current accounting standards the Company also started the assessment for the accounting of the agreements under the new IFRS 15 standard (‘Revenue fromContracts with Customers’) mandatory for annual reporting periods starting from January 1, 2018. |

Our response | |  |

With the involvement of various technical accounting topic specialists, we evaluated the Company’s accounting position paper. We focused on the appropriateness of the accounting, valuation and disclosure for these agreements in the 2016 financial statements. In our evaluation we focused on compliance with the various relevant IFRS standards notably IAS 18 (‘Revenue’), IAS 32 (‘Financial instruments: presentation’) and IAS 39 (‘Financial instruments:Recognition and Measurement’). We also evaluated the status of management’s assessment under the new IFRS 15 standard. | |

| We further assessed the disclosure note 9, 13, 18, 20 and 24, as well as the initial IFRS 15 accounting evaluation which is disclosed in note 4, as adequate. |

| | |

| Internal control over financial reporting | | |

Description | |  |

In its review of the Company’s internal control over financial reporting in connection with the preparation of its financial statements, management identified the following material weaknesses: | |

a) Insufficient accounting resources required to fulfill IFRS and SEC reporting requirements; b) Insufficient comprehensive IFRS accounting policies and financial reporting procedures. | | |

| A material weakness is a deficiency, or a combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the company’s financial statements will not be prevented or detected on a timely basis. |

| | |

| Internal control over financial reporting | | |

Our response | |  |

We planned and performed our audit of the financial statements of Merus N.V. without reliance on internal controls over financial reporting. As such the audit is substantive in nature and in our risk assessment we considered the material weaknesses identified. | |

| Further, we evaluated management’s assessment of the severity of the control deficiencies that lead to the material weaknesses identified and we reviewed management’s disclosure in relation to the identified material weaknesses. |

| | |

| Accounting of research & development costs | | |

Description | |  |

Research and Development (R&D) costs incurred, amounting to € 21.2 million, relate to research projects which is the primary business of the company in its current development phase. | |

| As such, we have considered for this biotech company in the development phase the risk of inaccurate ornon-existent R&D costs recorded for development activities and inadequate presentation in the financial statements. |

Our response | |  |

| Our audit procedures included, among others, an assessment of the classification of operating expenses in order to determine whether the company’s accounting is in accordance with the reporting framework. Furthermore, we have used statistical sampling in order to verify the accuracy and existence of the recorded expenses. | |

Report on the other information included in the annual report

In addition to the financial statements and our auditor’s report thereon, the annual report contains other information that consists of:

| • | | Supervisory Board report; |

| • | | other information pursuant to Part 9 of Book 2 of the Netherlands Civil Code; |

Based on the below procedures performed, we conclude that the other information:

| • | | is consistent with the financial statements and does not contain material misstatements; |

| • | | contains the information as required by Part 9 of Book 2 of the Netherlands Civil Code. |

We have read the other information. Based on our knowledge and understanding obtained through our audit of the financial statements or otherwise, we have considered whether the other information contains material misstatements.

By performing these procedures, we comply with the requirements of Part 9 of Book 2 of the Netherlands Civil Code and the Dutch Standard 720. The scope of the procedures performed is substantially less than the scope of those performed in our audit of the financial statements.

Management is responsible for the preparation of the other information, including the directors’ report in accordance with Part 9 of Book 2 of the Netherlands Civil Code and other Information pursuant to Part 9 of Book 2 of the Netherlands Civil Code.

Report on other legal and regulatory requirements

Engagement

We were engaged by the management and supervisory board as auditor of Merus N.V. for the year 2016 on April 21, 2016, and have operated as auditor since the year 2009 and as statutory auditor as of 2014.

Description of the responsibilities for the financial statements

Responsibilities of the Management Board and Supervisory Board for the financial statements

The Management Board is responsible for the preparation and fair presentation of the financial statements in accordance withEU-IFRS and with Part 9 of Book 2 of the Netherlands Civil Code. Furthermore, the Management Board is responsible for such internal control as the Management Board determines is necessary to enable the preparation of the financial statements that are free from material misstatement, whether due to errors or fraud.

As part of the preparation of the financial statements, the Management Board is responsible for assessing the company’s ability to continue as a going concern. Based on the financial reporting framework mentioned, the Management Board should prepare the financial statements using the going concern basis of accounting unless the Management Board either intends to liquidate the company or to cease operations, or has no realistic alternative but to do so. The Management Board should disclose events and circumstances that may cast significant doubt on the company’s ability to continue as a going concern in the financial statements.

The Supervisory Board is responsible for overseeing the company’s financial reporting process.

Our responsibilities for the audit of financial statements

Our objective is to plan and perform the audit to obtain sufficient and appropriate audit evidence for our opinion. Our audit has been performed with a high, but not absolute, level of assurance, which means we may not have detected all material errors and fraud during the audit.

Misstatements can arise from fraud or error and are considered material if, individually or in aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. The materiality affects the nature, timing and extent of our audit procedures and the evaluation of the effect of identified misstatements on our opinion.

For a further description of our responsibilities in respect of an audit of financial statements we refer to the website of the professional body for accountants in the Netherlands (NBA)www.nba.nl/Engels_oob_2016.

Amstelveen, May 5, 2017

KPMG Accountants N.V.

B.S. Geerling RA