UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23100

BERNSTEIN FUND, INC.

(Exact name of registrant as specified in charter)

66 Hudson Boulevard East, New York, New York 10005

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

66 Hudson Boulevard East

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: September 30, 2024

Date of reporting period: September 30, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

Please scan QR code for

Fund Information

International Small Cap Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the International Small Cap Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/IRCYX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $121 | 1.07% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes of the Portfolio outperformed the Morgan Stanley Capital International ("MSCI") All Country World Index ("ACWI") ex USA Small Cap Index (net) (the "benchmark") and the Lipper International/Mid-Cap Core Funds Average. Stock selection and currency exposures contributed to performance, relative to the benchmark, while sector selection, as well as country allocation detracted from overall returns. Security selection within communication services, technology, and industrials contributed significantly due to strong earnings growth, while selection within consumer staples was the main detractor during the period.

Top contributors to performance:

Top detractors from performance:

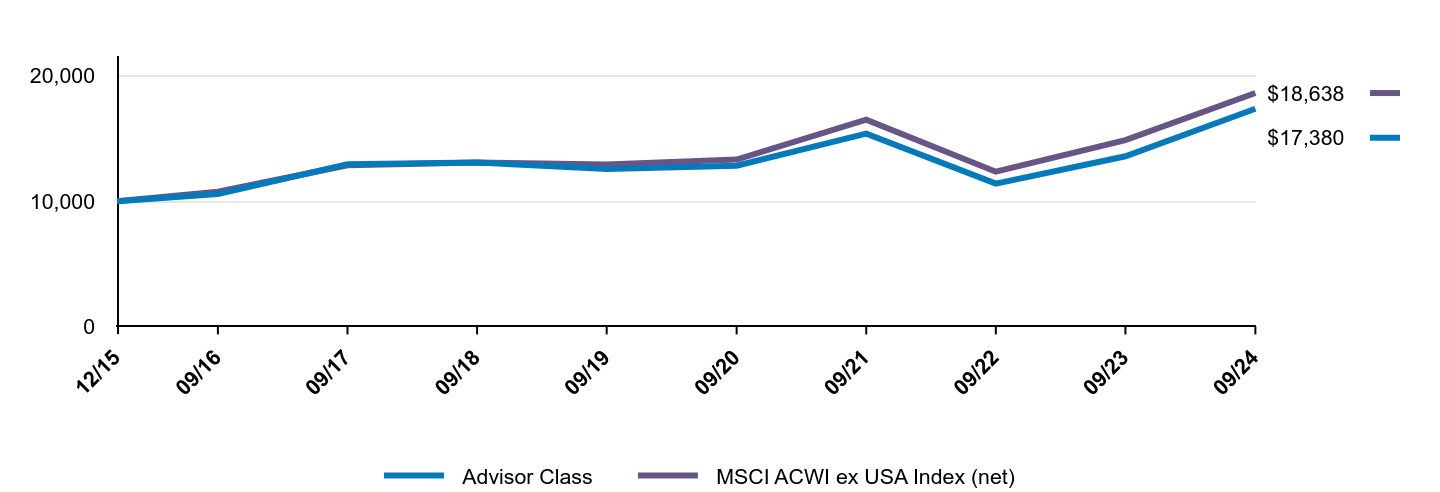

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Advisor Class | MSCI ACWI ex USA Index (net) | MSCI ACWI ex USA Small Cap Index (net) |

|---|

| 12/15 | $10,000 | $10,000 | $10,000 |

| 09/16 | $10,930 | $10,756 | $10,993 |

| 09/17 | $13,062 | $12,865 | $13,103 |

| 09/18 | $13,262 | $13,091 | $13,347 |

| 09/19 | $12,241 | $12,931 | $12,595 |

| 09/20 | $12,474 | $13,319 | $13,473 |

| 09/21 | $16,243 | $16,504 | $17,927 |

| 09/22 | $11,238 | $12,351 | $12,740 |

| 09/23 | $13,547 | $14,869 | $15,162 |

| 09/24 | $16,989 | $18,638 | $18,687 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 12/21/15 |

|---|

| Advisor Class | 25.41% | 6.77% | 6.22% |

| MSCI ACWI ex USA Index (net) | 25.35% | 7.59% | 7.35% |

| MSCI ACWI ex USA Small Cap Index (net) | 23.25% | 8.21% | 7.38% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/IRCYX-A for the most recent performance information.

| Net Assets | $1,150,383,961 |

| # of Portfolio Holdings | 279 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $10,709,170 |

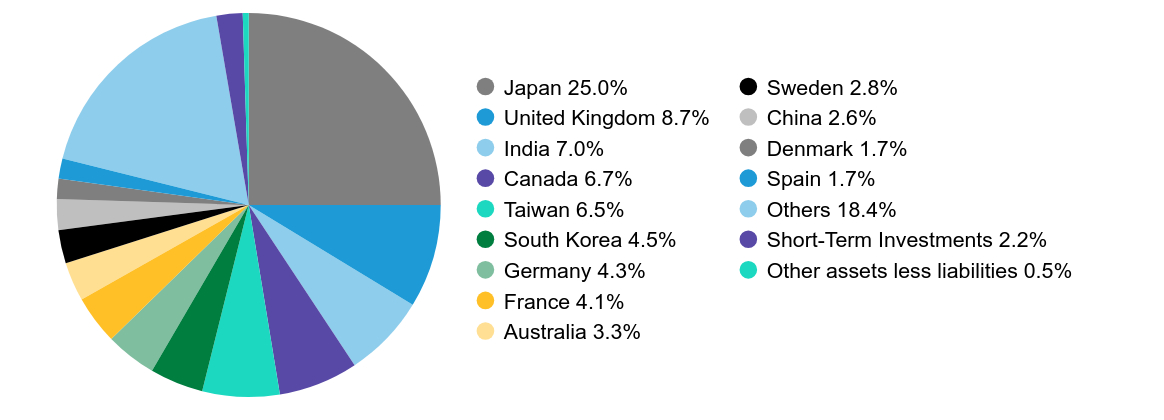

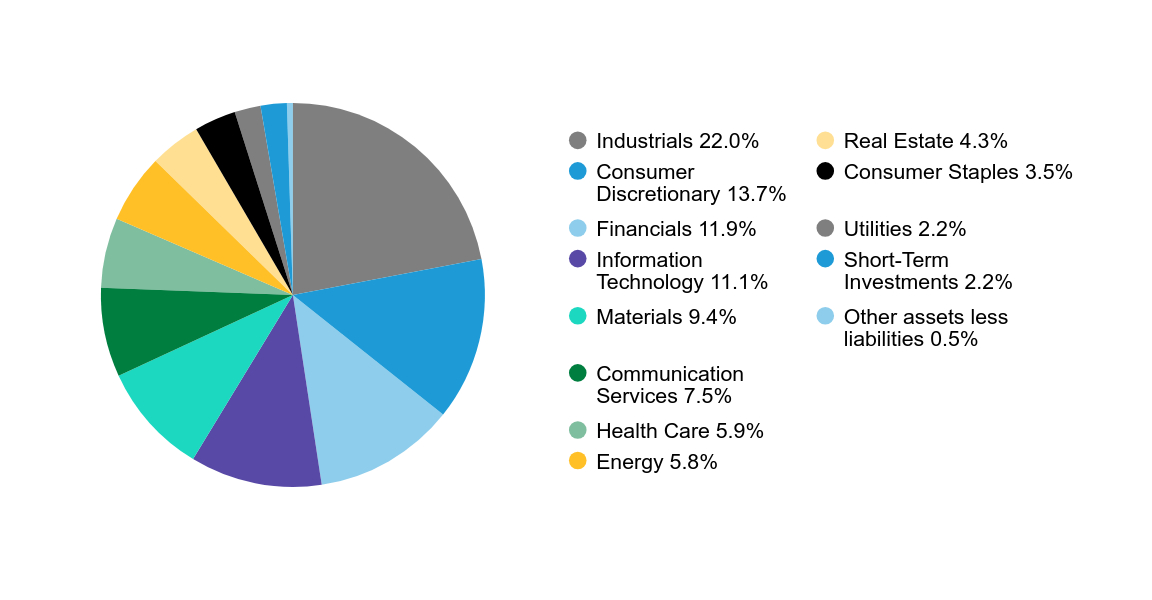

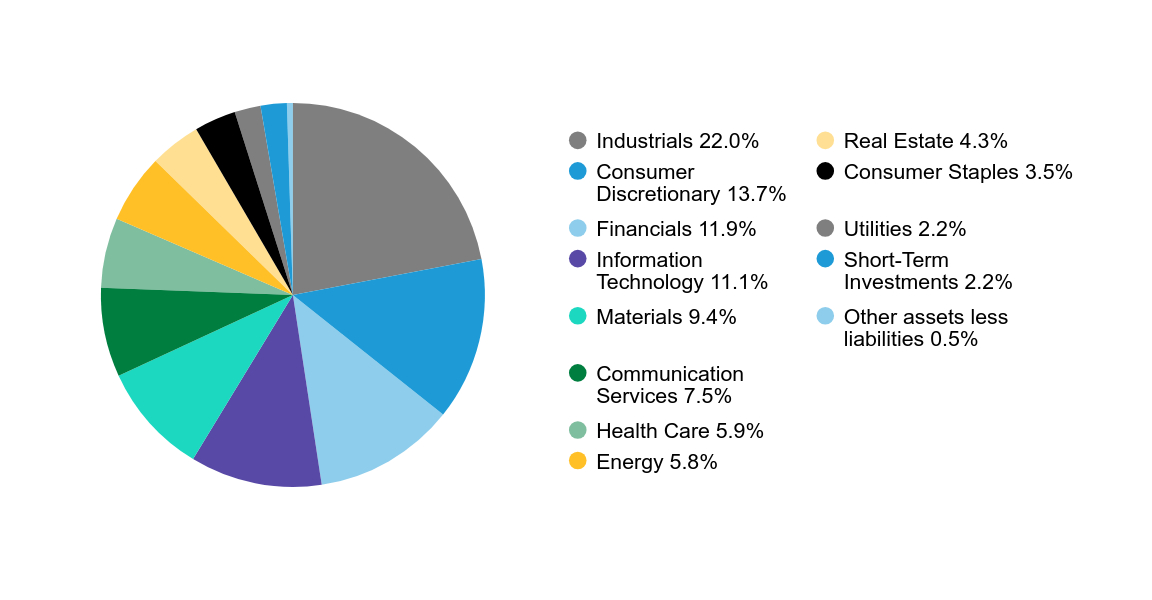

Graphical Representation of Holdings

| Value | Value |

|---|

| Industrials | 22.0% |

| Consumer Discretionary | 13.7% |

| Financials | 11.9% |

| Information Technology | 11.1% |

| Materials | 9.4% |

| Communication Services | 7.5% |

| Health Care | 5.9% |

| Energy | 5.8% |

| Real Estate | 4.3% |

| Consumer Staples | 3.5% |

| Utilities | 2.2% |

| Short-Term Investments | 2.2% |

| Other assets less liabilities | 0.5% |

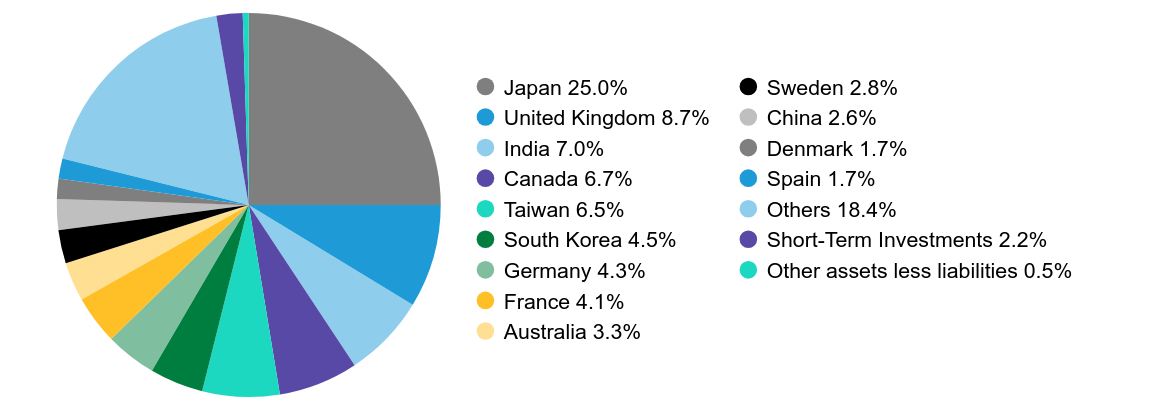

| Value | Value |

|---|

| Japan | 25.0% |

| United Kingdom | 8.7% |

| India | 7.0% |

| Canada | 6.7% |

| Taiwan | 6.5% |

| South Korea | 4.5% |

| Germany | 4.3% |

| France | 4.1% |

| Australia | 3.3% |

| Sweden | 2.8% |

| China | 2.6% |

| Denmark | 1.7% |

| Spain | 1.7% |

| Others | 18.4% |

| Short-Term Investments | 2.2% |

| Other assets less liabilities | 0.5% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/IRCYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/IRCYX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

International Small Cap Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the International Small Cap Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/IRCZX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class Z | $122 | 1.08% |

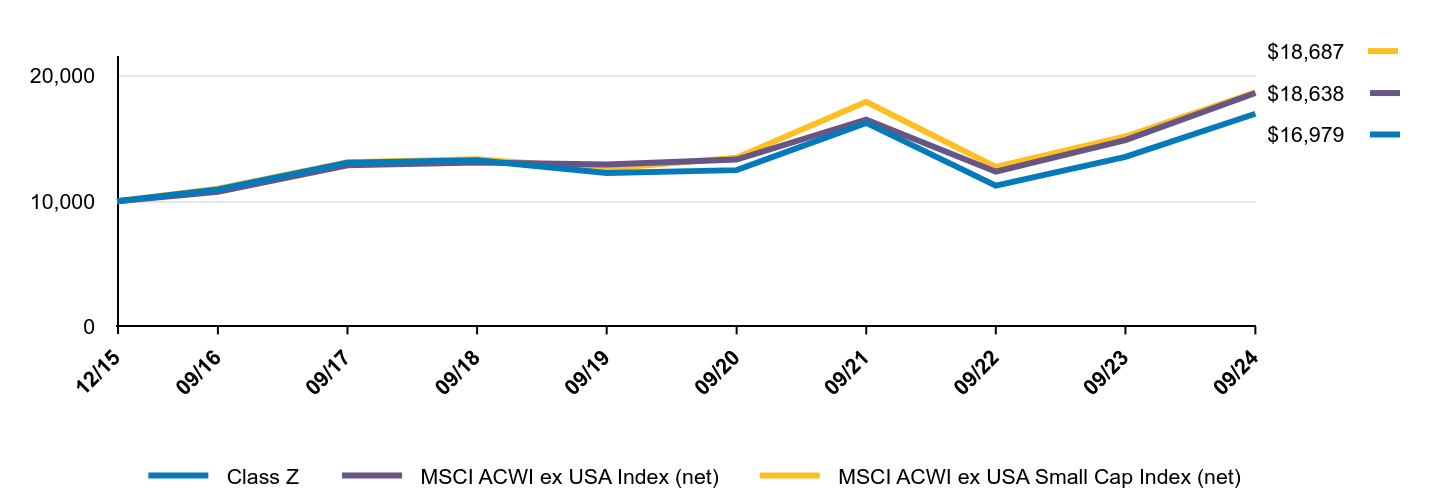

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes of the Portfolio outperformed the Morgan Stanley Capital International ("MSCI") All Country World Index ("ACWI") ex USA Small Cap Index (net) (the "benchmark") and the Lipper International/Mid-Cap Core Funds Average. Stock selection and currency exposures contributed to performance, relative to the benchmark, while sector selection, as well as country allocation detracted from overall returns. Security selection within communication services, technology, and industrials contributed significantly due to strong earnings growth, while selection within consumer staples was the main detractor during the period.

Top contributors to performance:

Top detractors from performance:

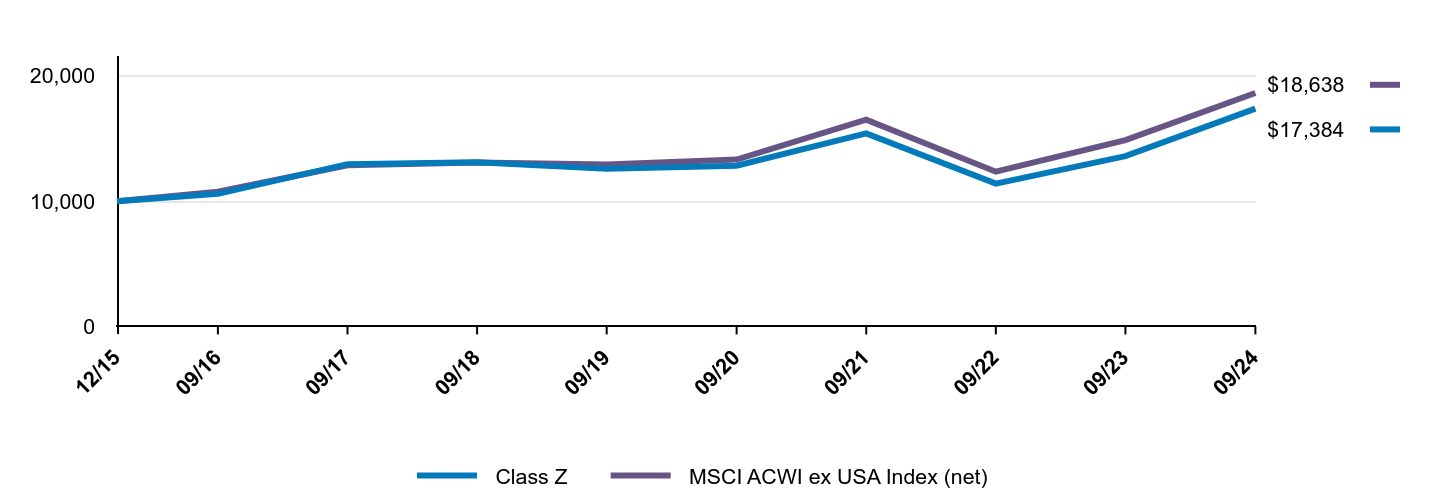

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class Z | MSCI ACWI ex USA Index (net) | MSCI ACWI ex USA Small Cap Index (net) |

|---|

| 12/15 | $10,000 | $10,000 | $10,000 |

| 09/16 | $10,930 | $10,756 | $10,993 |

| 09/17 | $13,063 | $12,865 | $13,103 |

| 09/18 | $13,264 | $13,091 | $13,347 |

| 09/19 | $12,243 | $12,931 | $12,595 |

| 09/20 | $12,477 | $13,319 | $13,473 |

| 09/21 | $16,248 | $16,504 | $17,927 |

| 09/22 | $11,242 | $12,351 | $12,740 |

| 09/23 | $13,538 | $14,869 | $15,162 |

| 09/24 | $16,979 | $18,638 | $18,687 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 12/21/15 |

|---|

| Class Z | 25.42% | 6.76% | 6.22% |

| MSCI ACWI ex USA Index (net) | 25.35% | 7.59% | 7.35% |

| MSCI ACWI ex USA Small Cap Index (net) | 23.25% | 8.21% | 7.38% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/IRCZX-A for the most recent performance information.

| Net Assets | $1,150,383,961 |

| # of Portfolio Holdings | 279 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $10,709,170 |

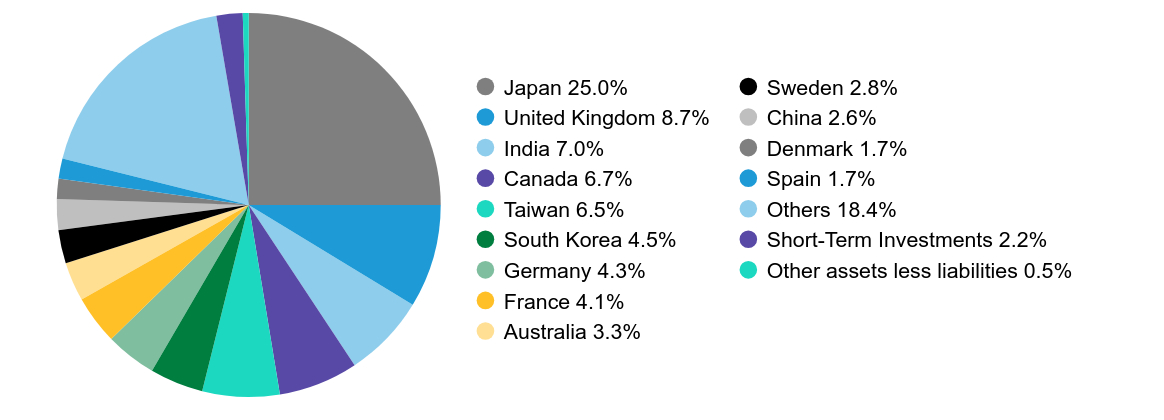

Graphical Representation of Holdings

| Value | Value |

|---|

| Industrials | 22.0% |

| Consumer Discretionary | 13.7% |

| Financials | 11.9% |

| Information Technology | 11.1% |

| Materials | 9.4% |

| Communication Services | 7.5% |

| Health Care | 5.9% |

| Energy | 5.8% |

| Real Estate | 4.3% |

| Consumer Staples | 3.5% |

| Utilities | 2.2% |

| Short-Term Investments | 2.2% |

| Other assets less liabilities | 0.5% |

| Value | Value |

|---|

| Japan | 25.0% |

| United Kingdom | 8.7% |

| India | 7.0% |

| Canada | 6.7% |

| Taiwan | 6.5% |

| South Korea | 4.5% |

| Germany | 4.3% |

| France | 4.1% |

| Australia | 3.3% |

| Sweden | 2.8% |

| China | 2.6% |

| Denmark | 1.7% |

| Spain | 1.7% |

| Others | 18.4% |

| Short-Term Investments | 2.2% |

| Other assets less liabilities | 0.5% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/IRCZX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/IRCZX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

International Small Cap Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the International Small Cap Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/IRCSX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SCB Class | $149 | 1.32% |

How did the Fund perform last year? What affected the Fund’s performance?

For the 12-month period, all share classes of the Portfolio outperformed the Morgan Stanley Capital International ("MSCI") All Country World Index ("ACWI") ex USA Small Cap Index (net) (the "benchmark") and the Lipper International/Mid-Cap Core Funds Average. Stock selection and currency exposures contributed to performance, relative to the benchmark, while sector selection, as well as country allocation detracted from overall returns. Security selection within communication services, technology, and industrials contributed significantly due to strong earnings growth, while selection within consumer staples was the main detractor during the period.

Top contributors to performance:

Top detractors from performance:

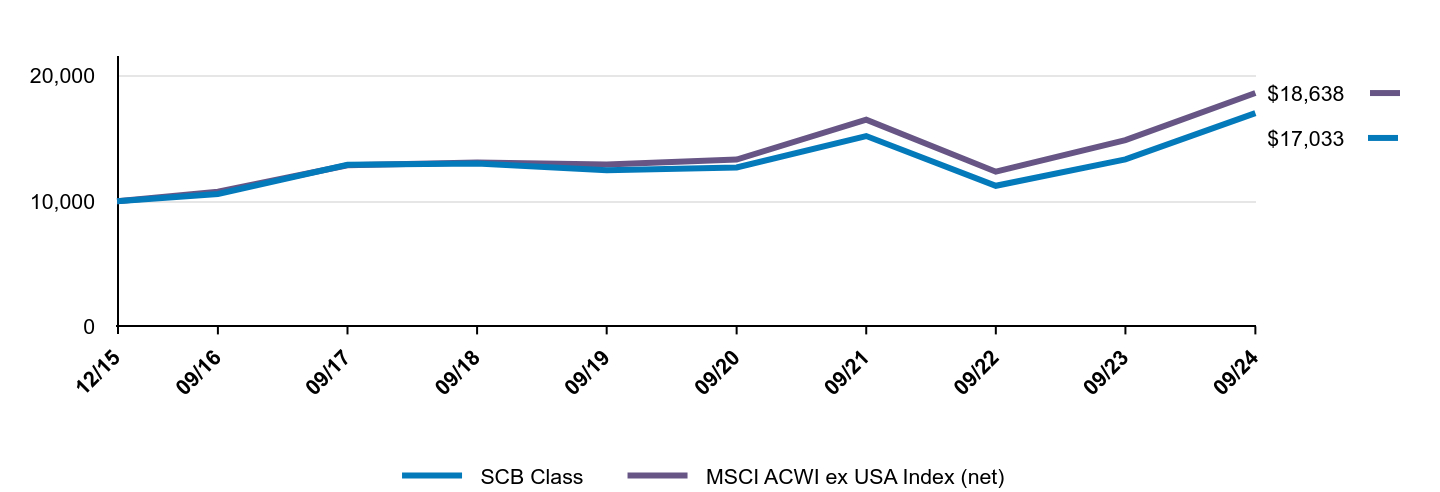

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| SCB Class | MSCI ACWI ex USA Index (net) | MSCI ACWI ex USA Small Cap Index (net) |

|---|

| 12/15 | $10,000 | $10,000 | $10,000 |

| 09/16 | $10,920 | $10,756 | $10,993 |

| 09/17 | $13,026 | $12,865 | $13,103 |

| 09/18 | $13,194 | $13,091 | $13,347 |

| 09/19 | $12,135 | $12,931 | $12,595 |

| 09/20 | $12,349 | $13,319 | $13,473 |

| 09/21 | $16,027 | $16,504 | $17,927 |

| 09/22 | $11,057 | $12,351 | $12,740 |

| 09/23 | $13,289 | $14,869 | $15,162 |

| 09/24 | $16,632 | $18,638 | $18,687 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 12/21/15 |

|---|

| SCB Class | 25.15% | 6.51% | 5.97% |

| MSCI ACWI ex USA Index (net) | 25.35% | 7.59% | 7.35% |

| MSCI ACWI ex USA Small Cap Index (net) | 23.25% | 8.21% | 7.38% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/IRCSX-A for the most recent performance information.

| Net Assets | $1,150,383,961 |

| # of Portfolio Holdings | 279 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $10,709,170 |

Graphical Representation of Holdings

| Value | Value |

|---|

| Industrials | 22.0% |

| Consumer Discretionary | 13.7% |

| Financials | 11.9% |

| Information Technology | 11.1% |

| Materials | 9.4% |

| Communication Services | 7.5% |

| Health Care | 5.9% |

| Energy | 5.8% |

| Real Estate | 4.3% |

| Consumer Staples | 3.5% |

| Utilities | 2.2% |

| Short-Term Investments | 2.2% |

| Other assets less liabilities | 0.5% |

| Value | Value |

|---|

| Japan | 25.0% |

| United Kingdom | 8.7% |

| India | 7.0% |

| Canada | 6.7% |

| Taiwan | 6.5% |

| South Korea | 4.5% |

| Germany | 4.3% |

| France | 4.1% |

| Australia | 3.3% |

| Sweden | 2.8% |

| China | 2.6% |

| Denmark | 1.7% |

| Spain | 1.7% |

| Others | 18.4% |

| Short-Term Investments | 2.2% |

| Other assets less liabilities | 0.5% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/IRCSX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/IRCSX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

International Strategic Equities Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the International Strategic Equities Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/STEYX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $76 | 0.67% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes of the Portfolio outperformed Morgan Stanley Capital International ("MSCI") All Country World Index ("ACWI") ex USA Index (net) (the "benchmark"). Sector selection was positive, relative to the benchmark, mainly from an overweight to the technology sector, which was boosted by AI-related sentiment, and an underweight to the materials sector, which was impacted by concerns about weaker demand especially from China. Country selection was positive, as overweights to the Netherlands and Taiwan, and an underweight to China, all contributed. Stock selection was also positive during the period.

Top contributors to performance:

Significant individual stock contributors during the period included Japanese semiconductor equipment company Screen Holdings, boosted by global investment into chip foundry capacity, Irish building materials company CRH, benefiting from US infrastructure-related demand and Italian cable manufacturer Prysmian, exposed to the growth in renewable energy.

Top detractors from performance:

Stock detractors during the period included Spanish refiner Repsol, impacted by a weaker oil price, Canadian copper producer First Quantum Minerals, which saw the forced closure of major mine in Panama following government intervention, and French luxury conglomerate Kering, affected by weaker global demand for luxury goods.

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Advisor Class | MSCI ACWI ex USA Index (net) |

|---|

| 12/15 | $10,000 | $10,000 |

| 09/16 | $10,575 | $10,756 |

| 09/17 | $12,942 | $12,865 |

| 09/18 | $13,095 | $13,091 |

| 09/19 | $12,570 | $12,931 |

| 09/20 | $12,825 | $13,319 |

| 09/21 | $15,393 | $16,504 |

| 09/22 | $11,396 | $12,351 |

| 09/23 | $13,584 | $14,869 |

| 09/24 | $17,380 | $18,638 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 12/21/15 |

|---|

| Advisor Class | 27.95% | 6.70% | 6.50% |

| MSCI ACWI ex USA Index (net) | 25.35% | 7.59% | 7.35% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/STEYX-A for the most recent performance information.

| Net Assets | $8,260,302,557 |

| # of Portfolio Holdings | 84 |

| Portfolio Turnover Rate | 69% |

| Total Advisory Fees Paid | $49,085,937 |

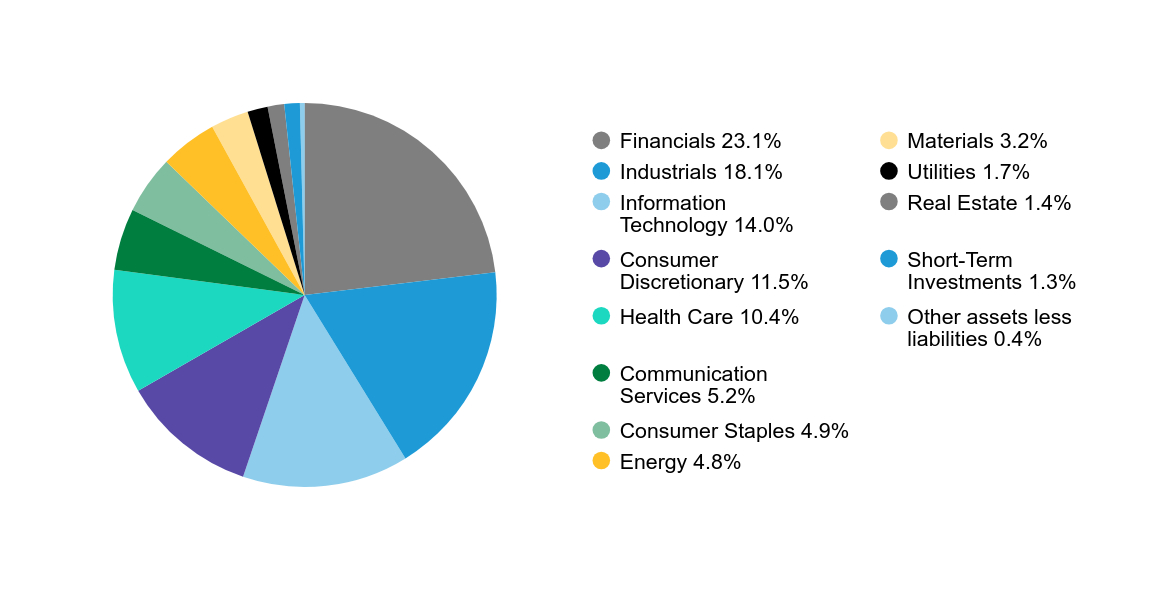

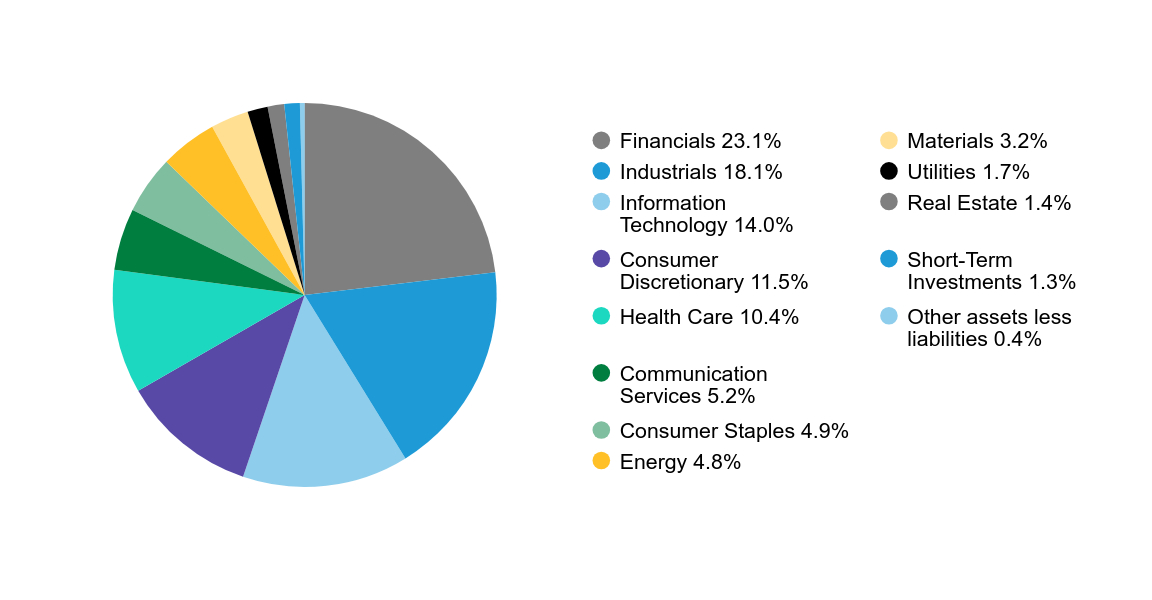

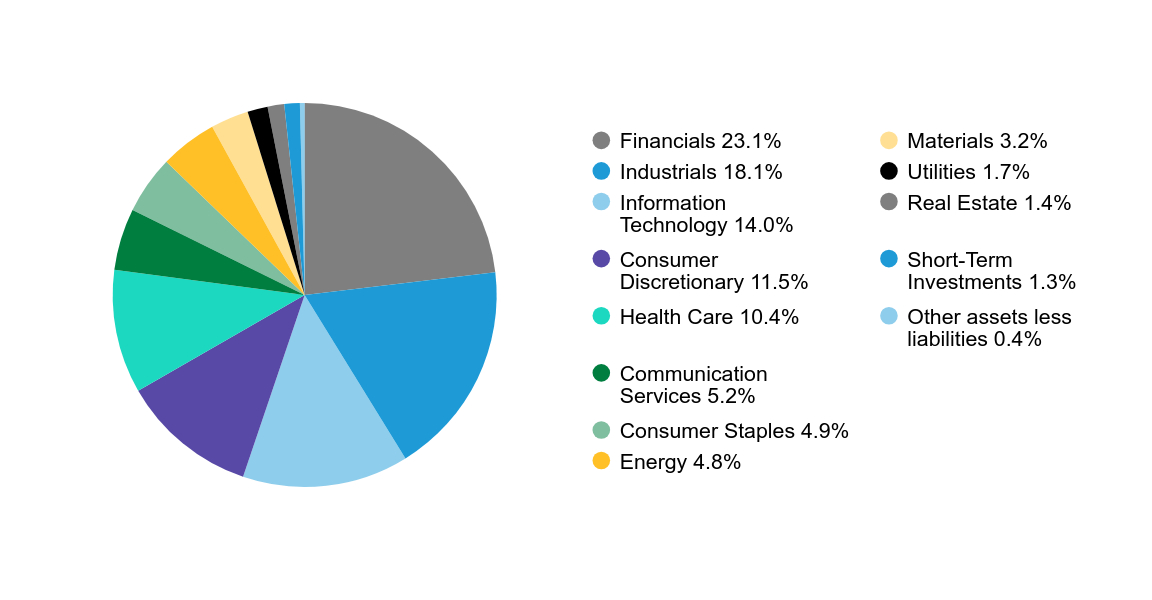

Graphical Representation of Holdings

| Value | Value |

|---|

| Financials | 23.1% |

| Industrials | 18.1% |

| Information Technology | 14.0% |

| Consumer Discretionary | 11.5% |

| Health Care | 10.4% |

| Communication Services | 5.2% |

| Consumer Staples | 4.9% |

| Energy | 4.8% |

| Materials | 3.2% |

| Utilities | 1.7% |

| Real Estate | 1.4% |

| Short-Term Investments | 1.3% |

| Other assets less liabilities | 0.4% |

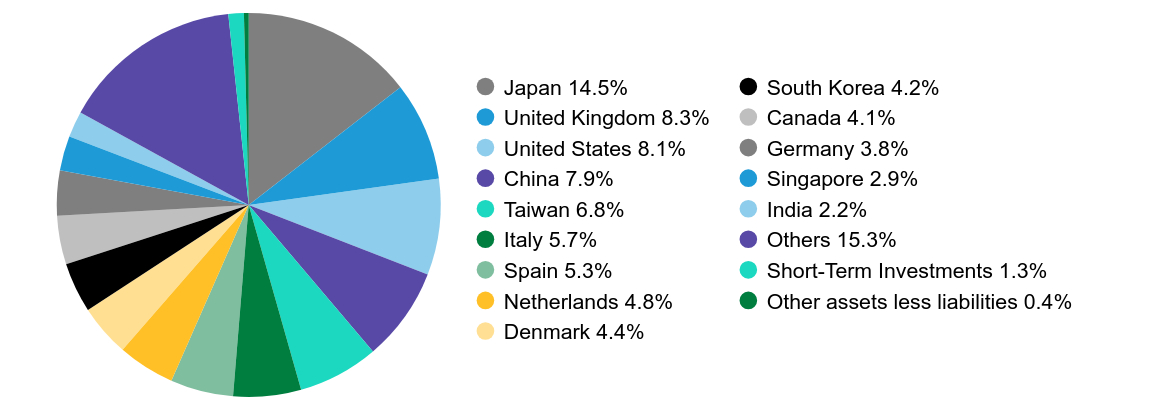

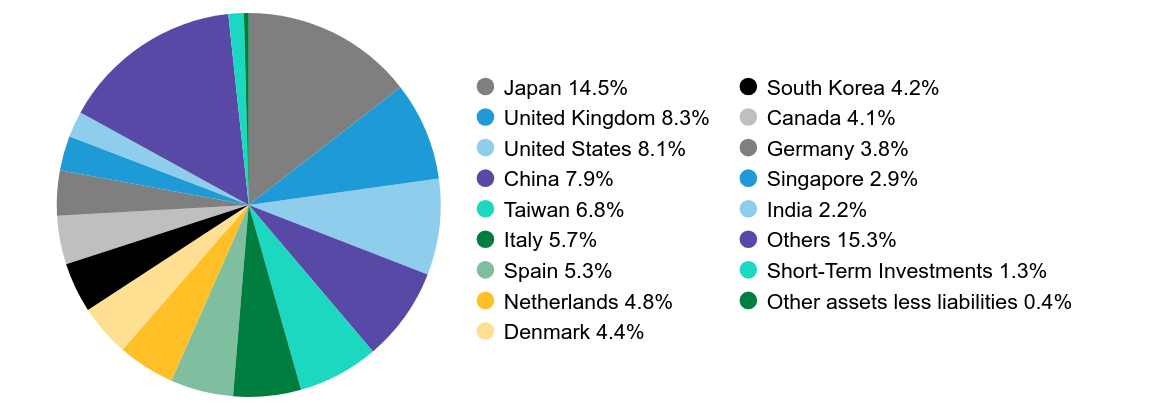

| Value | Value |

|---|

| Japan | 14.5% |

| United Kingdom | 8.3% |

| United States | 8.1% |

| China | 7.9% |

| Taiwan | 6.8% |

| Italy | 5.7% |

| Spain | 5.3% |

| Netherlands | 4.8% |

| Denmark | 4.4% |

| South Korea | 4.2% |

| Canada | 4.1% |

| Germany | 3.8% |

| Singapore | 2.9% |

| India | 2.2% |

| Others | 15.3% |

| Short-Term Investments | 1.3% |

| Other assets less liabilities | 0.4% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/STEYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/STEYX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

International Strategic Equities Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the International Strategic Equities Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/STEZX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class Z | $79 | 0.69% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes of the Portfolio outperformed Morgan Stanley Capital International ("MSCI") All Country World Index ("ACWI") ex USA Index (net) (the "benchmark"). Sector selection was positive, relative to the benchmark, mainly from an overweight to the technology sector, which was boosted by AI-related sentiment, and an underweight to the materials sector, which was impacted by concerns about weaker demand especially from China. Country selection was positive, as overweights to the Netherlands and Taiwan, and an underweight to China, all contributed. Stock selection was also positive during the period.

Top contributors to performance:

Significant individual stock contributors during the period included Japanese semiconductor equipment company Screen Holdings, boosted by global investment into chip foundry capacity, Irish building materials company CRH, benefiting from US infrastructure-related demand and Italian cable manufacturer Prysmian, exposed to the growth in renewable energy.

Top detractors from performance:

Stock detractors during the period included Spanish refiner Repsol, impacted by a weaker oil price, Canadian copper producer First Quantum Minerals, which saw the forced closure of major mine in Panama following government intervention, and French luxury conglomerate Kering, affected by weaker global demand for luxury goods.

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class Z | MSCI ACWI ex USA Index (net) |

|---|

| 12/15 | $10,000 | $10,000 |

| 09/16 | $10,585 | $10,756 |

| 09/17 | $12,951 | $12,865 |

| 09/18 | $13,104 | $13,091 |

| 09/19 | $12,577 | $12,931 |

| 09/20 | $12,831 | $13,319 |

| 09/21 | $15,407 | $16,504 |

| 09/22 | $11,400 | $12,351 |

| 09/23 | $13,594 | $14,869 |

| 09/24 | $17,384 | $18,638 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 12/21/15 |

|---|

| Class Z | 27.88% | 6.69% | 6.50% |

| MSCI ACWI ex USA Index (net) | 25.35% | 7.59% | 7.35% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/STEZX-A for the most recent performance information.

| Net Assets | $8,260,302,557 |

| # of Portfolio Holdings | 84 |

| Portfolio Turnover Rate | 69% |

| Total Advisory Fees Paid | $49,085,937 |

Graphical Representation of Holdings

| Value | Value |

|---|

| Financials | 23.1% |

| Industrials | 18.1% |

| Information Technology | 14.0% |

| Consumer Discretionary | 11.5% |

| Health Care | 10.4% |

| Communication Services | 5.2% |

| Consumer Staples | 4.9% |

| Energy | 4.8% |

| Materials | 3.2% |

| Utilities | 1.7% |

| Real Estate | 1.4% |

| Short-Term Investments | 1.3% |

| Other assets less liabilities | 0.4% |

| Value | Value |

|---|

| Japan | 14.5% |

| United Kingdom | 8.3% |

| United States | 8.1% |

| China | 7.9% |

| Taiwan | 6.8% |

| Italy | 5.7% |

| Spain | 5.3% |

| Netherlands | 4.8% |

| Denmark | 4.4% |

| South Korea | 4.2% |

| Canada | 4.1% |

| Germany | 3.8% |

| Singapore | 2.9% |

| India | 2.2% |

| Others | 15.3% |

| Short-Term Investments | 1.3% |

| Other assets less liabilities | 0.4% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/STEZX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/STEZX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

International Strategic Equities Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the International Strategic Equities Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/STESX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SCB Class | $105 | 0.92% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period, all share classes of the Portfolio outperformed Morgan Stanley Capital International ("MSCI") All Country World Index ("ACWI") ex USA Index (net) (the "benchmark"). Sector selection was positive, relative to the benchmark, mainly from an overweight to the technology sector, which was boosted by AI-related sentiment, and an underweight to the materials sector, which was impacted by concerns about weaker demand especially from China. Country selection was positive, as overweights to the Netherlands and Taiwan, and an underweight to China, all contributed. Stock selection was also positive during the period.

Top contributors to performance:

Significant individual stock contributors during the period included Japanese semiconductor equipment company Screen Holdings, boosted by global investment into chip foundry capacity, Irish building materials company CRH, benefiting from US infrastructure-related demand and Italian cable manufacturer Prysmian, exposed to the growth in renewable energy.

Top detractors from performance:

Stock detractors during the period included Spanish refiner Repsol, impacted by a weaker oil price, Canadian copper producer First Quantum Minerals, which saw the forced closure of major mine in Panama following government intervention, and French luxury conglomerate Kering, affected by weaker global demand for luxury goods.

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| SCB Class | MSCI ACWI ex USA Index (net) |

|---|

| 12/15 | $10,000 | $10,000 |

| 09/16 | $10,575 | $10,756 |

| 09/17 | $12,902 | $12,865 |

| 09/18 | $13,013 | $13,091 |

| 09/19 | $12,463 | $12,931 |

| 09/20 | $12,688 | $13,319 |

| 09/21 | $15,196 | $16,504 |

| 09/22 | $11,226 | $12,351 |

| 09/23 | $13,338 | $14,869 |

| 09/24 | $17,033 | $18,638 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 12/21/15 |

|---|

| SCB Class | 27.71% | 6.45% | 6.25% |

| MSCI ACWI ex USA Index (net) | 25.35% | 7.59% | 7.35% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/STESX-A for the most recent performance information.

| Net Assets | $8,260,302,557 |

| # of Portfolio Holdings | 84 |

| Portfolio Turnover Rate | 69% |

| Total Advisory Fees Paid | $49,085,937 |

Graphical Representation of Holdings

| Value | Value |

|---|

| Financials | 23.1% |

| Industrials | 18.1% |

| Information Technology | 14.0% |

| Consumer Discretionary | 11.5% |

| Health Care | 10.4% |

| Communication Services | 5.2% |

| Consumer Staples | 4.9% |

| Energy | 4.8% |

| Materials | 3.2% |

| Utilities | 1.7% |

| Real Estate | 1.4% |

| Short-Term Investments | 1.3% |

| Other assets less liabilities | 0.4% |

| Value | Value |

|---|

| Japan | 14.5% |

| United Kingdom | 8.3% |

| United States | 8.1% |

| China | 7.9% |

| Taiwan | 6.8% |

| Italy | 5.7% |

| Spain | 5.3% |

| Netherlands | 4.8% |

| Denmark | 4.4% |

| South Korea | 4.2% |

| Canada | 4.1% |

| Germany | 3.8% |

| Singapore | 2.9% |

| India | 2.2% |

| Others | 15.3% |

| Short-Term Investments | 1.3% |

| Other assets less liabilities | 0.4% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/STESX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/STESX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the Small Cap Core Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/SCRYX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $101 | 0.89% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period ended September 30, 2024, Advisor Class and Class Z shares of the Portfolio outperformed, while SCB Class shares underperformed the Russell 2000 Index (the "benchmark"). From a quantitative perspective, momentum and value factor exposures contributed to performance, relative to the benchmark. Conversely, the Portfolio’s exposure to companies with high profitability detracted from performance as low profitability companies outperformed during the period. Additionally, the Portfolio’s exposure to holdings with strong investor sentiment negatively impacted performance as companies with weaker historical investor sentiment outperformed.

Top contributors to performance:

During the 12-month period, from an industry perspective, an underweight exposure to oil and gas drilling and an overweight to homebuilders contributed. Additionally stock selection within the industrials and financials sectors was positive.

Top detractors from performance:

During the 12-month period, from an industry perspective, an overweight to oil, gas, and consumable fuels and an overweight to electric utilities detracted. Additionally, stock selection within the consumer staples and information technology sectors was negative.

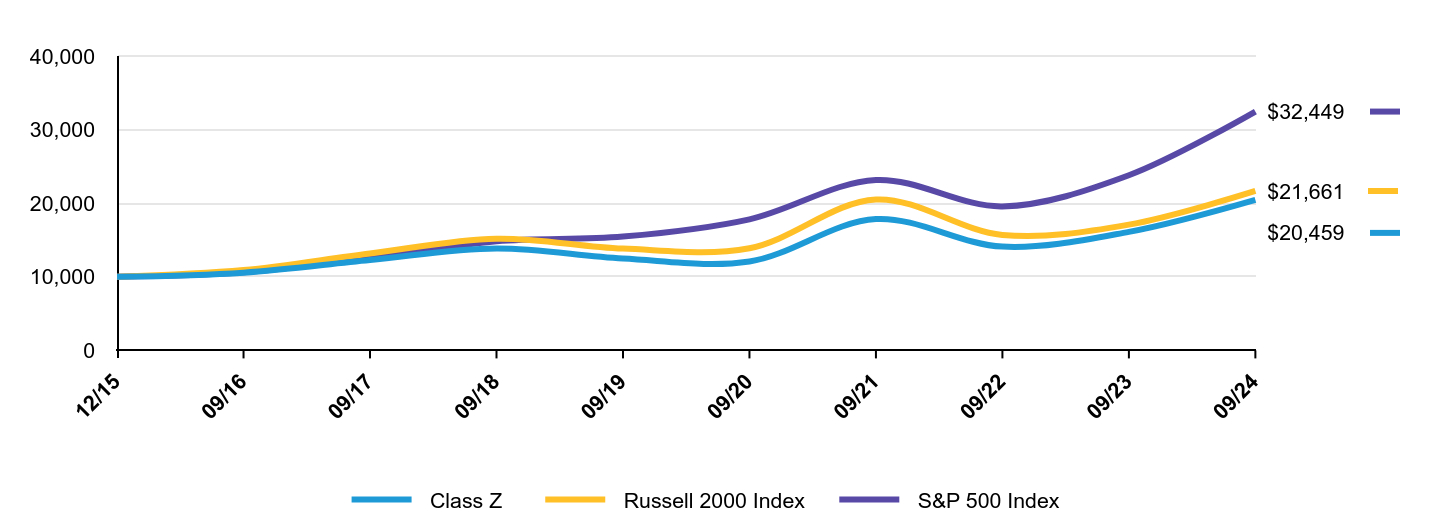

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Advisor Class | Russell 2000 Index | S&P 500 Index |

|---|

| 12/15 | $10,000 | $10,000 | $10,000 |

| 09/16 | $10,565 | $10,911 | $10,606 |

| 09/17 | $12,287 | $13,174 | $12,580 |

| 09/18 | $13,840 | $15,181 | $14,833 |

| 09/19 | $12,470 | $13,832 | $15,464 |

| 09/20 | $12,075 | $13,885 | $17,807 |

| 09/21 | $17,826 | $20,506 | $23,149 |

| 09/22 | $14,079 | $15,687 | $19,568 |

| 09/23 | $16,094 | $17,088 | $23,798 |

| 09/24 | $20,433 | $21,661 | $32,449 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 12/29/15 |

|---|

| Advisor Class | 26.96% | 10.38% | 8.50% |

| Russell 2000 Index | 26.76% | 9.39% | 9.22% |

| S&P 500 Index | 36.35% | 15.98% | 14.38% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/SCRYX-A for the most recent performance information.

| Net Assets | $742,166,244 |

| # of Portfolio Holdings | 229 |

| Portfolio Turnover Rate | 63% |

| Total Advisory Fees Paid | $5,416,981 |

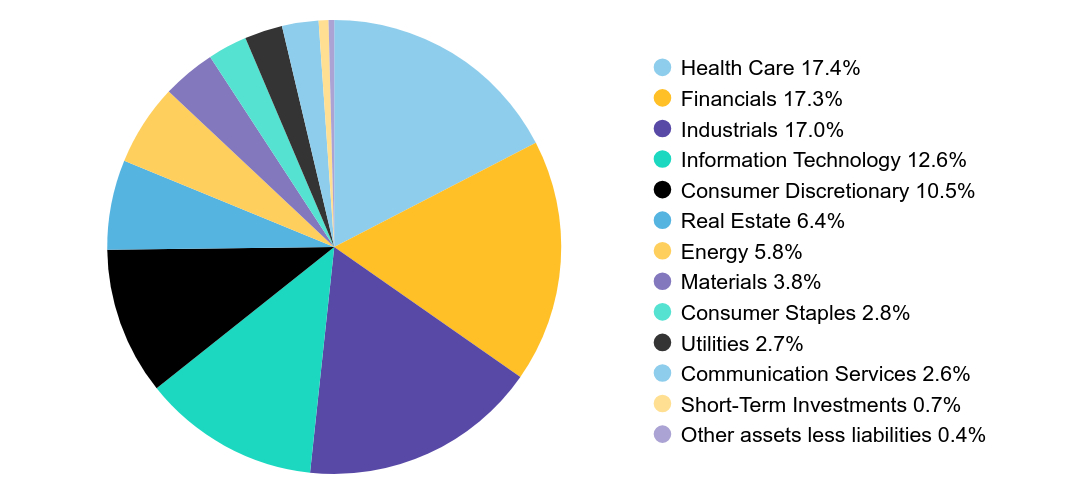

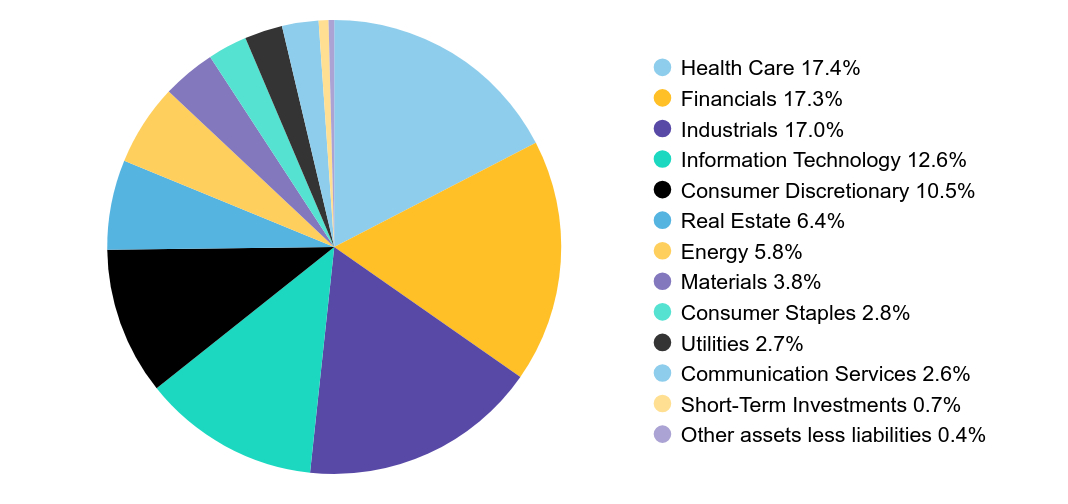

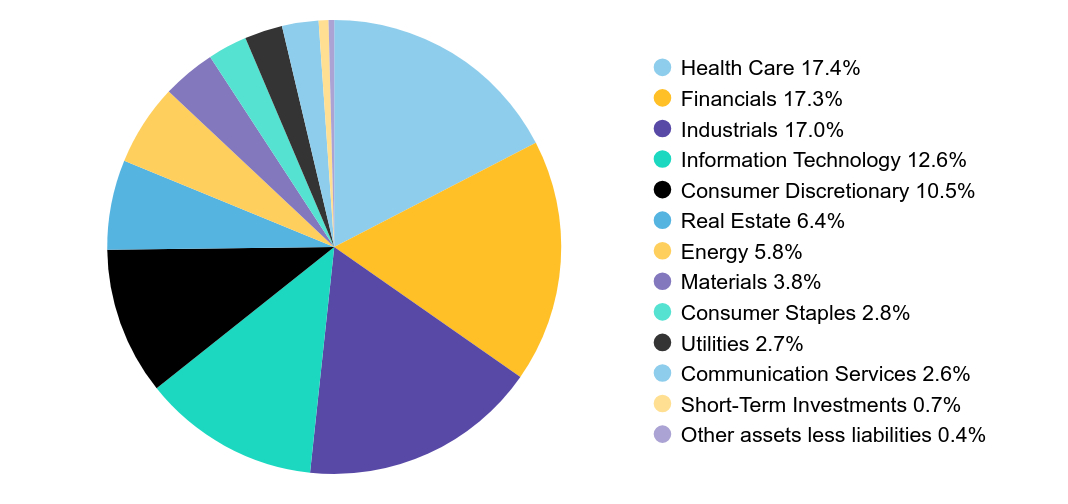

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| Vaxcyte, Inc. | $6,872,198 | 0.9% |

| Insmed, Inc. | $6,053,963 | 0.8% |

| Jackson Financial, Inc. - Class A | $5,885,612 | 0.8% |

| Fabrinet | $5,733,670 | 0.8% |

| Boot Barn Holdings, Inc. | $5,731,013 | 0.8% |

| Taylor Morrison Home Corp. | $5,626,491 | 0.8% |

| Powell Industries, Inc. | $5,607,245 | 0.8% |

| SPX Technologies, Inc. | $5,516,359 | 0.7% |

| ACI Worldwide, Inc. | $5,431,030 | 0.7% |

| SPS Commerce, Inc. | $5,378,509 | 0.7% |

| Total | $57,836,090 | 7.8% |

| Value | Value |

|---|

| Health Care | 17.4% |

| Financials | 17.3% |

| Industrials | 17.0% |

| Information Technology | 12.6% |

| Consumer Discretionary | 10.5% |

| Real Estate | 6.4% |

| Energy | 5.8% |

| Materials | 3.8% |

| Consumer Staples | 2.8% |

| Utilities | 2.7% |

| Communication Services | 2.6% |

| Short-Term Investments | 0.7% |

| Other assets less liabilities | 0.4% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/SCRYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/SCRYX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the Small Cap Core Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/SCRZX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class Z | $100 | 0.88% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period ended September 30, 2024, Advisor Class and Class Z shares of the Portfolio outperformed, while SCB Class shares underperformed the Russell 2000 Index (the "benchmark"). From a quantitative perspective, momentum and value factor exposures contributed to performance, relative to the benchmark. Conversely, the Portfolio’s exposure to companies with high profitability detracted from performance as low profitability companies outperformed during the period. Additionally, the Portfolio’s exposure to holdings with strong investor sentiment negatively impacted performance as companies with weaker historical investor sentiment outperformed.

Top contributors to performance:

During the 12-month period, from an industry perspective, an underweight exposure to oil and gas drilling and an overweight to homebuilders contributed. Additionally stock selection within the industrials and financials sectors was positive.

Top detractors from performance:

During the 12-month period, from an industry perspective, an overweight to oil, gas, and consumable fuels and an overweight to electric utilities detracted. Additionally, stock selection within the consumer staples and information technology sectors was negative.

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class Z | Russell 2000 Index | S&P 500 Index |

|---|

| 12/15 | $10,000 | $10,000 | $10,000 |

| 09/16 | $10,565 | $10,911 | $10,606 |

| 09/17 | $12,280 | $13,174 | $12,580 |

| 09/18 | $13,838 | $15,181 | $14,833 |

| 09/19 | $12,481 | $13,832 | $15,464 |

| 09/20 | $12,077 | $13,885 | $17,807 |

| 09/21 | $17,839 | $20,506 | $23,149 |

| 09/22 | $14,101 | $15,687 | $19,568 |

| 09/23 | $16,110 | $17,088 | $23,798 |

| 09/24 | $20,459 | $21,661 | $32,449 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 12/29/15 |

|---|

| Class Z | 26.99% | 10.39% | 8.52% |

| Russell 2000 Index | 26.76% | 9.39% | 9.22% |

| S&P 500 Index | 36.35% | 15.98% | 14.38% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/SCRZX-A for the most recent performance information.

| Net Assets | $742,166,244 |

| # of Portfolio Holdings | 229 |

| Portfolio Turnover Rate | 63% |

| Total Advisory Fees Paid | $5,416,981 |

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| Vaxcyte, Inc. | $6,872,198 | 0.9% |

| Insmed, Inc. | $6,053,963 | 0.8% |

| Jackson Financial, Inc. - Class A | $5,885,612 | 0.8% |

| Fabrinet | $5,733,670 | 0.8% |

| Boot Barn Holdings, Inc. | $5,731,013 | 0.8% |

| Taylor Morrison Home Corp. | $5,626,491 | 0.8% |

| Powell Industries, Inc. | $5,607,245 | 0.8% |

| SPX Technologies, Inc. | $5,516,359 | 0.7% |

| ACI Worldwide, Inc. | $5,431,030 | 0.7% |

| SPS Commerce, Inc. | $5,378,509 | 0.7% |

| Total | $57,836,090 | 7.8% |

| Value | Value |

|---|

| Health Care | 17.4% |

| Financials | 17.3% |

| Industrials | 17.0% |

| Information Technology | 12.6% |

| Consumer Discretionary | 10.5% |

| Real Estate | 6.4% |

| Energy | 5.8% |

| Materials | 3.8% |

| Consumer Staples | 2.8% |

| Utilities | 2.7% |

| Communication Services | 2.6% |

| Short-Term Investments | 0.7% |

| Other assets less liabilities | 0.4% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/SCRZX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/SCRZX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

Please scan QR code for

Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the Small Cap Core Portfolio (the “Portfolio”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/SCRSX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SCB Class | $129 | 1.14% |

How did the Fund perform last year? What affected the Fund’s performance?

During the 12-month period ended September 30, 2024, Advisor Class and Class Z shares of the Portfolio outperformed, while SCB Class shares underperformed the Russell 2000 Index (the "benchmark"). From a quantitative perspective, momentum and value factor exposures contributed to performance, relative to the benchmark. Conversely, the Portfolio’s exposure to companies with high profitability detracted from performance as low profitability companies outperformed during the period. Additionally, the Portfolio’s exposure to holdings with strong investor sentiment negatively impacted performance as companies with weaker historical investor sentiment outperformed.

Top contributors to performance:

During the 12-month period, from an industry perspective, an underweight exposure to oil and gas drilling and an overweight to homebuilders contributed. Additionally stock selection within the industrials and financials sectors was positive.

Top detractors from performance:

During the 12-month period, from an industry perspective, an overweight to oil, gas, and consumable fuels and an overweight to electric utilities detracted. Additionally, stock selection within the consumer staples and information technology sectors was negative.

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund's investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| SCB Class | Russell 2000 Index | S&P 500 Index |

|---|

| 12/15 | $10,000 | $10,000 | $10,000 |

| 09/16 | $10,545 | $10,911 | $10,606 |

| 09/17 | $12,230 | $13,174 | $12,580 |

| 09/18 | $13,751 | $15,181 | $14,833 |

| 09/19 | $12,356 | $13,832 | $15,464 |

| 09/20 | $11,933 | $13,885 | $17,807 |

| 09/21 | $17,579 | $20,506 | $23,149 |

| 09/22 | $13,856 | $15,687 | $19,568 |

| 09/23 | $15,792 | $17,088 | $23,798 |

| 09/24 | $20,004 | $21,661 | $32,449 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 12/29/15 |

|---|

| SCB Class | 26.67% | 10.12% | 8.24% |

| Russell 2000 Index | 26.76% | 9.39% | 9.22% |

| S&P 500 Index | 36.35% | 15.98% | 14.38% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/SCRSX-A for the most recent performance information.

| Net Assets | $742,166,244 |

| # of Portfolio Holdings | 229 |

| Portfolio Turnover Rate | 63% |

| Total Advisory Fees Paid | $5,416,981 |

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

|---|

| Vaxcyte, Inc. | $6,872,198 | 0.9% |

| Insmed, Inc. | $6,053,963 | 0.8% |

| Jackson Financial, Inc. - Class A | $5,885,612 | 0.8% |

| Fabrinet | $5,733,670 | 0.8% |

| Boot Barn Holdings, Inc. | $5,731,013 | 0.8% |

| Taylor Morrison Home Corp. | $5,626,491 | 0.8% |

| Powell Industries, Inc. | $5,607,245 | 0.8% |

| SPX Technologies, Inc. | $5,516,359 | 0.7% |

| ACI Worldwide, Inc. | $5,431,030 | 0.7% |

| SPS Commerce, Inc. | $5,378,509 | 0.7% |

| Total | $57,836,090 | 7.8% |

| Value | Value |

|---|

| Health Care | 17.4% |

| Financials | 17.3% |

| Industrials | 17.0% |

| Information Technology | 12.6% |

| Consumer Discretionary | 10.5% |

| Real Estate | 6.4% |

| Energy | 5.8% |

| Materials | 3.8% |

| Consumer Staples | 2.8% |

| Utilities | 2.7% |

| Communication Services | 2.6% |

| Short-Term Investments | 0.7% |

| Other assets less liabilities | 0.4% |

Availability of Additional Information

You can find additional information on the Fund’s website at https://www.abfunds.com/link/AB/SCRSX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/SCRSX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for

Fund Information

ITEM 2. CODE OF ETHICS.

(a) The registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer and principal accounting officer. A copy of the registrant’s code of ethics is filed herewith as Exhibit 19(a)(1).

(b) During the period covered by this report, no material amendments were made to the provisions of the code of ethics adopted in 2(a) above.

(c) During the period covered by this report, no implicit or explicit waivers to the provisions of the code of ethics adopted in 2(a) above were granted.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The registrant’s Board of Directors has determined that independent directors Donald K. Peterson, Debra Perry, R. Jay Gerken and Jeffrey R. Holland qualify as audit committee financial experts.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) - (c) The following table sets forth the aggregate fees billed* by the independent registered public accounting firm Ernst & Young LLP, for the Fund’s last two fiscal years, for professional services rendered for: (i) the audit of the Fund’s annual financial statements included in the Fund’s annual report to stockholders; (ii) assurance and related services that are reasonably related to the performance of the audit of the Fund’s financial statements and are not reported under (i), which include advice and education related to accounting and auditing issues, quarterly press release review (for those Funds that issue quarterly press releases), and preferred stock maintenance testing (for those Funds that issue preferred stock); and (iii) tax compliance, tax advice and tax return preparation.

| | | | | | | | | | | | | | | | |

| | | | | | Audit Fees | | | Audit-Related

Fees | | | Tax Fees* | |

Bernstein Fund Inc. Small Cap Core Portfolio | | | 2023 | | | $ | 22,785 | | | $ | 1,933 | | | $ | 24,794 | |

| | | | |

| | | 2024 | | | $ | 22,785 | | | $ | 1,176 | | | $ | 26,792 | |

| | | | |

Bernstein Fund Inc. International Small Cap Portfolio | | | 2023 | | | $ | 26,250 | | | $ | 1,933 | | | $ | 111,843 | |

| | | | |

| | | 2024 | | | $ | 26,250 | | | $ | 1,176 | | | $ | 60,056 | |

| | | | |

Bernstein Fund Inc. International Strategic Equities Portfolio | | | 2023 | | | $ | 26,250 | | | $ | 1,933 | | | $ | 127,459 | |

| | | | |

| | | 2024 | | | $ | 26,250 | | | $ | 1,176 | | | $ | 130,492 | |

| * | Paid to Ernst & Young LLP. |

(d) Not applicable.

(e) (1) Beginning with audit and non-audit service contracts entered into on or after May 6, 2003, the Fund’s Audit Committee policies and procedures require the pre-approval of all audit and non-audit services provided to the Fund by the Fund’s independent registered public accounting firm. The Fund’s Audit Committee policies and procedures also require pre-approval of all audit and non-audit services provided to the Adviser and Service Affiliates to the extent that these services are directly related to the operations or financial reporting of the Fund.

(e) (2) No percentage of services addressed by (b) and (c) of this Item 4 were approved pursuant to the waiver provision of paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. No amounts are reported for Item 4 (d).

(f) Not applicable.

(g) The following table sets forth the aggregate non-audit services provided to the Fund, the Fund’s Adviser and entities that control, are controlled by or under common control with the Adviser that provide ongoing services to the Fund: (“Service Affiliates”):

| | | | | | | | | | | | |

| | | | All Fees for

Non-Audit Services

Provided to the

Portfolio, the Adviser

and Service

Affiliates | | | Total Amount of

Foregoing Column Pre-

approved by the Audit

Committee

(Portion Comprised of

Audit Related Fees)

(Portion Comprised of

Tax Fees) | |

Bernstein Fund Inc. Small Cap Core Portfolio | | | 2023 | | | $ | 5,896,623 | | | $ | 26,727 | |

| | | | | | | | | | $ | (1,933 | ) |

| | | | | | | | | | $ | (24,794 | ) |

| | | |

| | | 2024 | | | $ | 4,438,852 | | | $ | 27,968 | |

| | | | | | | | | | $ | (1,176 | ) |

| | | | | | | | | | $ | (26,792 | ) |

| | | |

Bernstein Fund Inc. International Small Cap Portfolio | | | 2023 | | | $ | 5,983,672 | | | $ | 113,776 | |

| | | | | | | | | | $ | (1,933 | ) |

| | | | | | | | | | $ | (111,843 | ) |

| | | |

| | | 2024 | | | $ | 4,472,116 | | | $ | 61,232 | |

| | | | | | | | | | $ | (1,176 | ) |

| | | | | | | | | | $ | (60,056 | ) |

| | | |

Bernstein Fund Inc. International Strategic Equities Portfolio | | | 2023 | | | $ | 5,999,288 | | | $ | 129,392 | |

| | | | | | | | | | $ | (1,933 | ) |

| | | | | | | | | | $ | (127,459 | ) |

| | | |

| | | 2024 | | | $ | 4,542,552 | | | $ | 131,668 | |

| | | | | | | | | | $ | (1,176 | ) |

| | | | | | | | | | $ | (130,492 | ) |

(h) The Audit Committee of the Fund has considered whether the provision of any non-audit services not pre-approved by the Audit Committee provided by the Fund’s independent registered public accounting firm to the Adviser and Service Affiliates is compatible with maintaining the auditor’s independence.

(i) Not applicable.

(j) Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable to the registrant.

ITEM 6. INVESTMENTS.

Please see Schedule of Investments contained in the Report to Shareholders included under Item 1 of this Form N-CSR.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

BERNSTEIN FUND, INC.

Small Cap Core Portfolio

International Small Cap Portfolio

International Strategic Equities Portfolio

ANNUAL FINANCIAL STATEMENTS AND ADDITIONAL INFORMATION

SEPTEMBER 30, 2024

Table of Contents

Before investing in any portfolio of the Bernstein Fund, Inc., a prospective investor should consider carefully the portfolio’s investment objectives and policies, charges, expenses and risks. These and other matters of importance to prospective investors are contained in the portfolios’ prospectus, an additional copy of which may be obtained by visiting our website at www.Bernstein.com and clicking on “Investments”, found in the footer, then “Mutual Fund Information—Prospectuses, SAIs and Shareholder Reports” or by calling your financial advisor or by calling Bernstein’s mutual fund shareholder help line at 212.756.4097. Please read the prospectus carefully before investing.

For performance information current to the most recent month-end, please call (collect) 212.486.5800.

This shareholder report must be preceded or accompanied by the Bernstein Fund, Inc. prospectus for individuals who are not shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit www.AllianceBernstein.com, or go to the Securities and Exchange Commission’s website at www.sec.gov, or call AllianceBernstein at 800.227.4618.

The Fund will file its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov.

Investment Products Offered: · Are Not FDIC Insured · May Lose Value · Are Not Bank Guaranteed

Schedule of Investments

Bernstein Fund, Inc.

Schedule of Investments

Small Cap Core Portfolio

September 30, 2024

| | | | | | | | |

| | |

| Company | | Shares | | | U.S. $ Value | |

|

| COMMON STOCKS–98.9% | |

|

| Health Care–17.4% | |

| Biotechnology–8.8% | |

Apogee Therapeutics, Inc.(a) | | | 60,450 | | | $ | 3,550,833 | |

Ascendis Pharma A/S (ADR)(a) | | | 20,537 | | | | 3,066,379 | |

Blueprint Medicines Corp.(a) | | | 44,975 | | | | 4,160,187 | |

Bridgebio Pharma, Inc.(a) | | | 128,680 | | | | 3,276,193 | |

CG oncology, Inc.(a) | | | 74,670 | | | | 2,817,299 | |

Cullinan Therapeutics, Inc.(a) | | | 140,480 | | | | 2,351,635 | |

Cytokinetics, Inc.(a) | | | 80,160 | | | | 4,232,448 | |

Denali Therapeutics, Inc.(a) | | | 109,190 | | | | 3,180,705 | |

Halozyme Therapeutics, Inc.(a) | | | 91,472 | | | | 5,235,857 | |

Insmed, Inc.(a) | | | 82,931 | | | | 6,053,963 | |

Intellia Therapeutics, Inc.(a) | | | 112,710 | | | | 2,316,191 | |

Legend Biotech Corp. (ADR)(a) | | | 55,870 | | | | 2,722,545 | |

Merus NV(a) | | | 48,320 | | | | 2,414,067 | |

MoonLake Immunotherapeutics(a) | | | 53,850 | | | | 2,715,117 | |

Ultragenyx Pharmaceutical, Inc.(a) | | | 71,594 | | | | 3,977,047 | |

Vaxcyte, Inc.(a) | | | 60,140 | | | | 6,872,198 | |

Viking Therapeutics, Inc.(a) | | | 58,770 | | | | 3,720,729 | |

Viridian Therapeutics, Inc.(a) | | | 123,410 | | | | 2,807,578 | |

| | | | | | | | |

| | | | | | | 65,470,971 | |

| | | | | | | | |

| Health Care Equipment & Supplies–1.9% | | | | | |

AtriCure, Inc.(a) | | | 169,000 | | | | 4,738,760 | |

CONMED Corp. | | | 43,359 | | | | 3,118,379 | |

Integra LifeSciences Holdings Corp.(a) | | | 63,920 | | | | 1,161,426 | |

iRhythm Technologies, Inc.(a) | | | 18,360 | | | | 1,363,047 | |

OraSure Technologies, Inc.(a) | | | 825,088 | | | | 3,523,126 | |

| | | | | | | | |

| | | | | | | 13,904,738 | |

| | | | | | | | |

| Health Care Providers & Services–4.2% | |

AMN Healthcare Services, Inc.(a) | | | 53,055 | | | | 2,249,002 | |

Cross Country Healthcare, Inc.(a) | | | 196,920 | | | | 2,646,605 | |

Hims & Hers Health, Inc.(a) | | | 172,500 | | | | 3,177,450 | |

Inari Medical, Inc.(a) | | | 87,506 | | | | 3,608,747 | |

Option Care Health, Inc.(a) | | | 144,390 | | | | 4,519,407 | |

Owens & Minor, Inc.(a) | | | 218,090 | | | | 3,421,832 | |

Pediatrix Medical Group, Inc.(a) | | | 198,270 | | | | 2,297,949 | |

PetIQ, Inc.(a) | | | 153,940 | | | | 4,736,734 | |

PROCEPT BioRobotics Corp.(a) | | | 59,250 | | | | 4,747,110 | |

| | | | | | | | |

| | | | | | | 31,404,836 | |

| | | | | | | | |

| Health Care Technology–0.5% | |

Teladoc Health, Inc.(a) | | | 436,669 | | | | 4,008,621 | |

| | | | | | | | |

| Life Sciences Tools & Services–0.2% | |

Quanterix Corp.(a) | | | 84,490 | | | | 1,094,990 | |

| | | | | | | | |

| Pharmaceuticals–1.8% | |

Collegium Pharmaceutical, Inc.(a) | | | 66,120 | | | | 2,554,877 | |

Corcept Therapeutics, Inc.(a) | | | 68,724 | | | | 3,180,547 | |

Harmony Biosciences Holdings, Inc.(a) | | | 75,190 | | | | 3,007,600 | |

Intra-Cellular Therapies, Inc.(a) | | | 45,930 | | | $ | 3,360,698 | |

Rapport Therapeutics, Inc.(a) | | | 63,020 | | | | 1,290,649 | |

| | | | | | | | |

| | | | | | | 13,394,371 | |

| | | | | | | | |

| | | | | | | 129,278,527 | |

| | | | | | | | |

| | | | | | | | |

| | |

| Financials–17.3% | | | | | |

| Banks–9.7% | | | | | |

1st Source Corp. | | | 56,257 | | | | 3,368,669 | |

Associated Banc-Corp. | | | 198,190 | | | | 4,269,013 | |

Bank of Marin Bancorp | | | 88,110 | | | | 1,770,130 | |

BankUnited, Inc. | | | 116,599 | | | | 4,248,867 | |

Berkshire Hills Bancorp, Inc. | | | 141,410 | | | | 3,808,171 | |

Customers Bancorp, Inc.(a) | | | 66,020 | | | | 3,066,629 | |

First BanCorp./Puerto Rico | | | 210,760 | | | | 4,461,789 | |

First Bancorp/Southern Pines NC | | | 69,340 | | | | 2,883,851 | |

First Busey Corp. | | | 134,890 | | | | 3,509,838 | |

First Hawaiian, Inc. | | | 128,830 | | | | 2,982,414 | |

Heritage Financial Corp./WA | | | 162,710 | | | | 3,542,197 | |

International Bancshares Corp. | | | 67,830 | | | | 4,055,556 | |

Nicolet Bankshares, Inc. | | | 37,809 | | | | 3,615,675 | |

Northeast Bank | | | 49,111 | | | | 3,787,931 | |

Pacific Premier Bancorp, Inc. | | | 56,380 | | | | 1,418,521 | |

Peoples Bancorp, Inc./OH | | | 106,875 | | | | 3,215,869 | |

Premier Financial Corp. | | | 133,830 | | | | 3,142,328 | |

Republic Bancorp, Inc./KY–Class A | | | 38,350 | | | | 2,504,255 | |

Texas Capital Bancshares, Inc.(a) | | | 65,530 | | | | 4,682,774 | |

TriCo Bancshares | | | 80,633 | | | | 3,438,997 | |

WSFS Financial Corp. | | | 81,730 | | | | 4,167,413 | |

| | | | | | | | |

| | | | | | | 71,940,887 | |

| | | | | | | | |

| Capital Markets–1.5% | |

Federated Hermes, Inc. | | | 101,160 | | | | 3,719,653 | |

Hamilton Lane, Inc.–Class A | | | 19,410 | | | | 3,268,450 | |

Houlihan Lokey, Inc. | | | 24,516 | | | | 3,874,018 | |

| | | | | | | | |

| | | | | | | 10,862,121 | |

| | | | | | | | |

| Consumer Finance–0.8% | |

Nelnet, Inc.–Class A | | | 33,433 | | | | 3,787,291 | |

PROG Holdings, Inc. | | | 51,480 | | | | 2,496,265 | |

| | | | | | | | |

| | | | | | | 6,283,556 | |

| | | | | | | | |

| Financial Services–2.9% | |

Jackson Financial, Inc.–Class A | | | 64,514 | | | | 5,885,612 | |

Mr. Cooper Group, Inc.(a) | | | 56,351 | | | | 5,194,435 | |

NCR Atleos Corp.(a) | | | 139,018 | | | | 3,966,184 | |

Pagseguro Digital Ltd.–Class A(a) | | | 207,890 | | | | 1,789,933 | |

Payoneer Global, Inc.(a) | | | 322,632 | | | | 2,429,419 | |

Shift4 Payments, Inc.–Class A(a) | | | 21,890 | | | | 1,939,454 | |

| | | | | | | | |

| | | | | | | 21,205,037 | |

| | | | | | | | |

| Insurance–1.6% | |

Assured Guaranty Ltd. | | | 42,630 | | | | 3,389,938 | |

Genworth Financial, Inc.(a) | | | 659,090 | | | | 4,514,766 | |

Hanover Insurance Group, Inc. (The) | | | 27,108 | | | | 4,014,966 | |

| | | | | | | | |

| | | | | | | 11,919,670 | |

| | | | | | | | |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| Company | | Shares | | | U.S. $ Value | |

| Mortgage Real Estate Investment Trusts (REITs)–0.8% | |

Chimera Investment Corp. | | | 217,276 | | | $ | 3,439,479 | |

MFA Financial, Inc. | | | 176,790 | | | | 2,248,769 | |

| | | | | | | | |

| | | | | | | 5,688,248 | |

| | | | | | | | |

| | | | | | | 127,899,519 | |

| | | | | | | | |

| | | | | | | | |

| |

| Industrials–17.0% | |

| Aerospace & Defense–1.1% | |

AeroVironment, Inc.(a) | | | 10,810 | | | | 2,167,405 | |

Curtiss-Wright Corp. | | | 11,860 | | | | 3,898,264 | |

Leonardo DRS, Inc.(a) | | | 86,510 | | | | 2,441,312 | |

| | | | | | | | |

| | | | | | | 8,506,981 | |

| | | | | | | | |

| Air Freight & Logistics–0.3% | |

Radiant Logistics, Inc.(a) | | | 294,353 | | | | 1,892,690 | |

| | | | | | | | |

| Building Products–1.4% | |

American Woodmark Corp.(a) | | | 40,150 | | | | 3,752,018 | |

Gibraltar Industries, Inc.(a) | | | 60,371 | | | | 4,221,744 | |

UFP Industries, Inc. | | | 21,077 | | | | 2,765,513 | |

| | | | | | | | |

| | | | | | | 10,739,275 | |

| | | | | | | | |

| Commercial Services & Supplies–1.1% | |

Quad/Graphics, Inc. | | | 199,605 | | | | 906,207 | |

Steelcase, Inc.–Class A | | | 277,550 | | | | 3,744,149 | |

Tetra Tech, Inc. | | | 73,260 | | | | 3,454,942 | |

| | | | | | | | |

| | | | | | | 8,105,298 | |

| | | | | | | | |

| Construction & Engineering–3.2% | |

Comfort Systems USA, Inc. | | | 10,279 | | | | 4,012,408 | |

Construction Partners, Inc.–Class A(a) | | | 60,652 | | | | 4,233,510 | |

Fluor Corp.(a) | | | 106,920 | | | | 5,101,153 | |

Granite Construction, Inc. | | | 19,810 | | | | 1,570,537 | |

IES Holdings, Inc.(a) | | | 25,370 | | | | 5,064,359 | |

MasTec, Inc.(a) | | | 30,694 | | | | 3,778,431 | |

| | | | | | | | |

| | | | | | | 23,760,398 | |

| | | | | | | | |

| Electrical Equipment–0.8% | |

Powell Industries, Inc. | | | 25,259 | | | | 5,607,245 | |

| | | | | | | | |

| Ground Transportation–0.4% | |

ArcBest Corp. | | | 28,523 | | | | 3,093,319 | |

| | | | | | | | |

| Machinery–3.3% | |

Blue Bird Corp.(a) | | | 68,520 | | | | 3,286,219 | |

Gates Industrial Corp. PLC(a) | | | 205,351 | | | | 3,603,910 | |

Hillman Solutions Corp.(a) | | | 351,925 | | | | 3,716,328 | |

Mueller Industries, Inc. | | | 57,000 | | | | 4,223,700 | |

Shyft Group, Inc. (The) | | | 227,770 | | | | 2,858,514 | |

SPX Technologies, Inc.(a) | | | 34,594 | | | | 5,516,359 | |

Wabash National Corp. | | | 78,801 | | | | 1,512,191 | |

| | | | | | | | |

| | | | | | | 24,717,221 | |

| | | | | | | | |

| Marine Transportation–1.2% | |

Kirby Corp.(a) | | | 31,460 | | | | 3,851,648 | |

Matson, Inc. | | | 34,670 | | | | 4,944,635 | |

| | | | | | | | |

| | | | | | | 8,796,283 | |

| | | | | | | | |

| Professional Services–2.1% | |

FTI Consulting, Inc.(a) | | | 15,420 | | | $ | 3,508,975 | |

ICF International, Inc. | | | 21,270 | | | | 3,547,623 | |

Korn Ferry | | | 62,140 | | | | 4,675,414 | |

Legalzoomcom, Inc.(a) | | | 249,370 | | | | 1,583,500 | |

WNS Holdings Ltd.(a) | | | 38,652 | | | | 2,037,347 | |

| | | | | | | | |

| | | | | | | 15,352,859 | |

| | | | | | | | |

| Trading Companies & Distributors–2.1% | |

BlueLinx Holdings, Inc.(a) | | | 31,540 | | | | 3,324,947 | |

Boise Cascade Co. | | | 34,322 | | | | 4,838,716 | |

GMS, Inc.(a) | | | 44,411 | | | | 4,022,304 | |

MRC Global, Inc.(a) | | | 284,522 | | | | 3,624,810 | |

| | | | | | | | |

| | | | | | | 15,810,777 | |

| | | | | | | | |

| | | | | | | 126,382,346 | |

| | | | | | | | |

| | | | | | | | |

| | |

| Information Technology–12.6% | | | | | |

| Communications Equipment–0.6% | | | | | |

Calix, Inc.(a) | | | 108,450 | | | | 4,206,775 | |

| | | | | | | | |

| Electronic Equipment, Instruments & Components–2.8% | |

Avnet, Inc. | | | 60,930 | | | | 3,309,108 | |

Daktronics, Inc.(a) | | | 153,920 | | | | 1,987,107 | |

Fabrinet(a) | | | 24,250 | | | | 5,733,670 | |

Novanta, Inc.(a) | | | 16,970 | | | | 3,036,273 | |

Sanmina Corp.(a) | | | 64,736 | | | | 4,431,179 | |

TTM Technologies, Inc.(a) | | | 140,950 | | | | 2,572,338 | |

| | | | | | | | |

| | | | | | | 21,069,675 | |

| | | | | | | | |

| IT Services–0.7% | |

DigitalOcean Holdings, Inc.(a) | | | 58,470 | | | | 2,361,604 | |

Perficient, Inc.(a) | | | 35,286 | | | | 2,663,387 | |

| | | | | | | | |

| | | | | | | 5,024,991 | |

| | | | | | | | |

| Semiconductors & Semiconductor Equipment–2.4% | |

Axcelis Technologies, Inc.(a) | | | 19,140 | | | | 2,006,829 | |

Impinj, Inc.(a) | | | 10,340 | | | | 2,238,817 | |

MACOM Technology Solutions Holdings, Inc.(a) | | | 32,030 | | | | 3,563,658 | |

Onto Innovation, Inc.(a) | | | 11,850 | | | | 2,459,586 | |

Photronics, Inc.(a) | | | 81,690 | | | | 2,022,644 | |

Semtech Corp.(a) | | | 43,810 | | | | 2,000,365 | |

SMART Global Holdings, Inc.(a) | | | 154,890 | | | | 3,244,945 | |

| | | | | | | | |

| | | | | | | 17,536,844 | |

| | | | | | | | |

| Software–6.0% | |

A10 Networks, Inc. | | | 263,980 | | | | 3,811,871 | |

ACI Worldwide, Inc.(a) | | | 106,700 | | | | 5,431,030 | |

Altair Engineering, Inc.–Class A(a) | | | 56,110 | | | | 5,359,066 | |

Braze, Inc.–Class A(a) | | | 102,764 | | | | 3,323,388 | |

CommVault Systems, Inc.(a) | | | 30,918 | | | | 4,756,734 | |

Dave, Inc.(a) | | | 20,847 | | | | 833,046 | |

LiveRamp Holdings, Inc.(a) | | | 36,212 | | | | 897,333 | |

NCR Voyix Corp.(a) | | | 276,639 | | | | 3,753,991 | |

Progress Software Corp. | | | 73,701 | | | | 4,965,236 | |

Qualys, Inc.(a) | | | 32,700 | | | | 4,200,642 | |

SPS Commerce, Inc.(a) | | | 27,700 | | | | 5,378,509 | |

Xperi, Inc.(a) | | | 92,698 | | | | 856,530 | |

| | | | | | | | |

| | | |

| Company | | Shares | | | U.S. $ Value | |

Yext, Inc.(a) | | | 130,020 | | | $ | 899,739 | |

| | | | | | | | |

| | | | | | | 44,467,115 | |

| | | | | | | | |

| Technology Hardware, Storage & Peripherals–0.1% | |

Immersion Corp. | | | 124,651 | | | | 1,111,887 | |

| | | | | | | | |

| | | | | | | 93,417,287 | |

| | | | | | | | |

| | | | | | | | |

| |

| Consumer Discretionary–10.5% | |

| Automobile Components–0.7% | |

American Axle & Manufacturing Holdings, Inc.(a) | | | 479,150 | | | | 2,961,147 | |

Modine Manufacturing Co.(a) | | | 18,120 | | | | 2,406,155 | |

| | | | | | | | |

| | | | | | | 5,367,302 | |

| | | | | | | | |

| Automobiles–0.4% | |

Winnebago Industries, Inc. | | | 46,866 | | | | 2,723,383 | |

| | | | | | | | |

| Broadline Retail–0.4% | |

Dillard’s, Inc.–Class A | | | 7,690 | | | | 2,950,576 | |

| | | | | | | | |

| Diversified Consumer Services–1.0% | |

Perdoceo Education Corp. | | | 159,962 | | | | 3,557,555 | |

Stride, Inc.(a) | | | 41,310 | | | | 3,524,156 | |

| | | | | | | | |

| | | | | | | 7,081,711 | |

| | | | | | | | |

| Hotels, Restaurants & Leisure–1.9% | |

Accel Entertainment, Inc.(a) | | | 308,680 | | | | 3,586,862 | |

International Game Technology PLC | | | 81,330 | | | | 1,732,329 | |

PlayAGS, Inc.(a) | | | 133,404 | | | | 1,519,472 | |

Rush Street Interactive, Inc.(a) | | | 365,578 | | | | 3,966,521 | |

Travel + Leisure Co. | | | 72,641 | | | | 3,347,297 | |

| | | | | | | | |

| | | | | | | 14,152,481 | |

| | | | | | | | |

| Household Durables–2.5% | |

Hovnanian Enterprises, Inc.–Class A(a) | | | 14,310 | | | | 2,924,535 | |

KB Home | | | 61,430 | | | | 5,263,936 | |

Taylor Morrison Home Corp.(a) | | | 80,081 | | | | 5,626,491 | |

Tri Pointe Homes, Inc.(a) | | | 103,700 | | | | 4,698,647 | |

| | | | | | | | |

| | | | | | | 18,513,609 | |

| | | | | | | | |

| Specialty Retail–2.9% | |

Boot Barn Holdings, Inc.(a) | | | 34,260 | | | | 5,731,013 | |

Genesco, Inc.(a) | | | 62,760 | | | | 1,705,189 | |

Group 1 Automotive, Inc. | | | 13,700 | | | | 5,247,648 | |

Lands’ End, Inc.(a) | | | 149,410 | | | | 2,580,311 | |

Upbound Group, Inc. | | | 106,490 | | | | 3,406,615 | |

Wayfair, Inc.–Class A(a) | | | 55,580 | | | | 3,122,484 | |

| | | | | | | | |

| | | | | | | 21,793,260 | |

| | | | | | | | |

| Textiles, Apparel & Luxury Goods–0.7% | |

G-III Apparel Group Ltd.(a) | | | 83,370 | | | | 2,544,453 | |

Kontoor Brands, Inc. | | | 35,840 | | | | 2,930,995 | |

| | | | | | | | |

| | | | | | | 5,475,448 | |

| | | | | | | | |

| | | | | | | 78,057,770 | |

| | | | | | | | |

| | | | | | | | |

| | |

| Real Estate–6.4% | | | | | |

| Diversified REITs–0.8% | |

Broadstone Net Lease, Inc.–Class A | | | 105,660 | | | | 2,002,257 | |

Empire State Realty Trust, Inc.–Class A | | | 362,640 | | | $ | 4,018,051 | |

| | | | | | | | |

| | | | | | | 6,020,308 | |

| | | | | | | | |

| Health Care REITs–1.1% | |

Diversified Healthcare Trust | | | 820,520 | | | | 3,437,979 | |

Sabra Health Care REIT, Inc. | | | 264,660 | | | | 4,925,323 | |

| | | | | | | | |

| | | | | | | 8,363,302 | |

| | | | | | | | |

| Hotel & Resort REITs–0.6% | |

RLJ Lodging Trust | | | 391,439 | | | | 3,593,410 | |

Summit Hotel Properties, Inc. | | | 115,680 | | | | 793,565 | |

| | | | | | | | |

| | | | | | | 4,386,975 | |

| | | | | | | | |

| Industrial REITs–1.2% | |

First Industrial Realty Trust, Inc. | | | 41,766 | | | | 2,338,061 | |

Innovative Industrial Properties, Inc. | | | 25,210 | | | | 3,393,266 | |

STAG Industrial, Inc. | | | 74,304 | | | | 2,904,543 | |

| | | | | | | | |

| | | | | | | 8,635,870 | |

| | | | | | | | |

| Real Estate Management & Development–0.5% | |

Forestar Group, Inc.(a) | | | 111,060 | | | | 3,595,012 | |

| | | | | | | | |

| Retail REITs–1.9% | |

Acadia Realty Trust | | | 168,440 | | | | 3,954,971 | |

Macerich Co. (The) | | | 266,850 | | | | 4,867,344 | |

NETSTREIT Corp. | | | 97,680 | | | | 1,614,650 | |

Tanger, Inc. | | | 115,220 | | | | 3,823,000 | |

| | | | | | | | |

| | | | | | | 14,259,965 | |

| | | | | | | | |

| Specialized REITs–0.3% | |

National Storage Affiliates Trust | | | 46,930 | | | | 2,262,026 | |

| | | | | | | | |

| | | | | | | 47,523,458 | |

| | | | | | | | |

| | | | | | | | |

| | |

| Energy–5.8% | | | | | |

| Energy Equipment & Services–1.1% | |

Cactus, Inc.–Class A | | | 73,570 | | | | 4,389,922 | |

ChampionX Corp. | | | 128,890 | | | | 3,886,033 | |

| | | | | | | | |

| | | | | | | 8,275,955 | |

| | | | | | | | |

| Oil, Gas & Consumable Fuels–4.7% | |

Arch Resources, Inc. | | | 22,980 | | | | 3,174,917 | |

Ardmore Shipping Corp. | | | 95,400 | | | | 1,726,740 | |

CONSOL Energy, Inc. | | | 24,440 | | | | 2,557,646 | |

Gulfport Energy Corp.(a) | | | 16,630 | | | | 2,516,950 | |

HF Sinclair Corp. | | | 27,022 | | | | 1,204,371 | |

International Seaways, Inc. | | | 36,470 | | | | 1,880,393 | |

Magnolia Oil & Gas Corp.–Class A | | | 173,200 | | | | 4,229,544 | |

Matador Resources Co. | | | 52,730 | | | | 2,605,917 | |

Northern Oil and Gas, Inc. | | | 95,620 | | | | 3,385,904 | |

Par Pacific Holdings, Inc.(a) | | | 70,510 | | | | 1,240,976 | |

PBF Energy, Inc.–Class A | | | 72,420 | | | | 2,241,399 | |

Peabody Energy Corp. | | | 117,750 | | | | 3,125,085 | |

Scorpio Tankers, Inc. | | | 35,530 | | | | 2,533,289 | |

Teekay Tankers Ltd.–Class A | | | 34,555 | | | | 2,012,829 | |

| | | | | | | | |

| | | | | | | 34,435,960 | |

| | | | | | | | |

| | | | | | | 42,711,915 | |

| | | | | | | | |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| Company | | Shares | | | U.S. $ Value | |

| | |

| Materials–3.8% | | | | | |

| Chemicals–1.8% | |

AdvanSix, Inc. | | | 126,500 | | | $ | 3,843,070 | |

Ecovyst, Inc.(a) | | | 336,550 | | | | 2,305,368 | |

Element Solutions, Inc. | | | 113,550 | | | | 3,084,018 | |

Methanex Corp. | | | 47,260 | | | | 1,953,728 | |