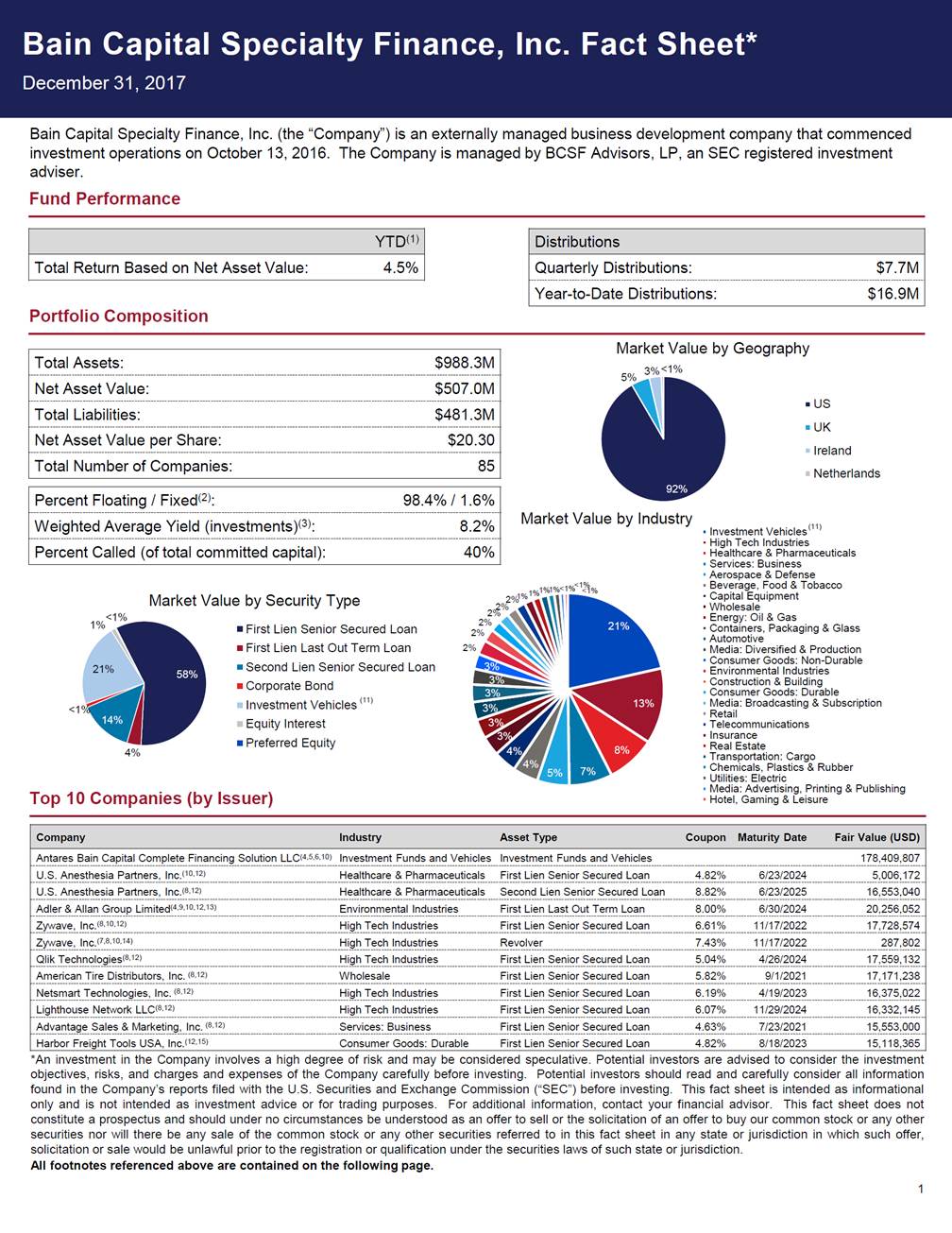

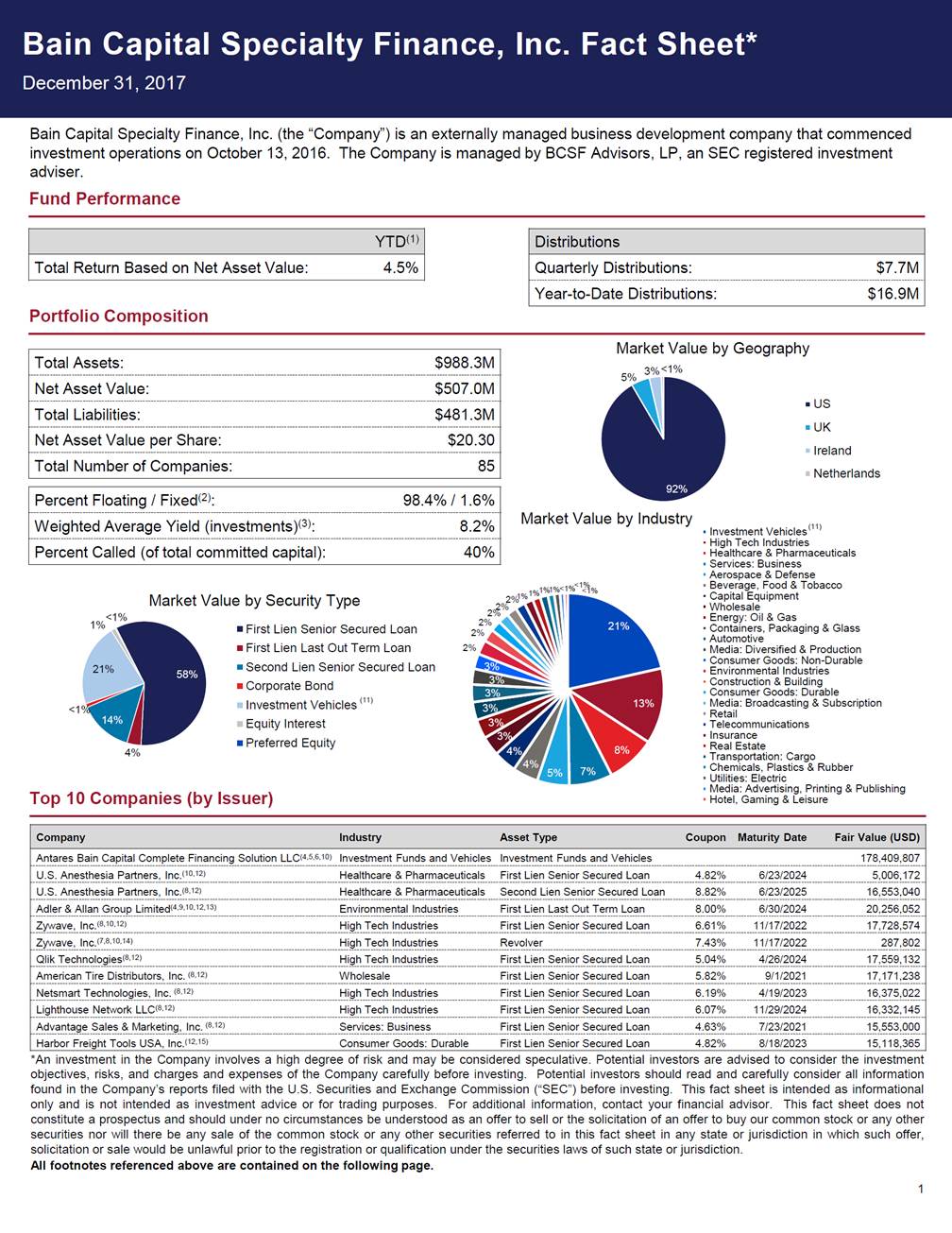

Bain Capital Specialty Finance, Inc. Fact Sheet* December 31, 2017 Bain Capital Specialty Finance, Inc. (the “Company”) is an externally managed business development company that commenced investment operations on October 13, 2016. adviser. Fund Performance The Company is managed by BCSF Advisors, LP, an SEC registered investment Portfolio Composition Market Value by Geography 5% 3% <1% US UK Ireland Netherlands 92% Market Value by Industry Investment Vehicles (11) High Tech Industries Healthcare & Pharmaceuticals Services: Business Aerospace & Defense Beverage, Food & Tobacco Capital Equipment Wholesale Energy: Oil & Gas Containers, Packaging & Glass 1%1%<1%<1% % <1 1% 2%1% Market Value by Security Type 2% 2% 2% 2% 2% <1% 1% 21% First Lien Senior Secured Loan First Lien Last Out Term Loan Second Lien Senior Secured Loan Corporate Bond Automotive Media: Diversified & Production Consumer Goods: Non-Durable Environmental Industries Construction & Building Consumer Goods: Durable Media: Broadcasting & Subscription Retail Telecommunications Insurance Real Estate Transportation: Cargo Chemicals, Plastics & Rubber Utilities: Electric Media: Advertising, Printing & Publishing Hotel, Gaming & Leisure 21% 58% 3% 3% (11) Investment Vehicles Equity Interest Preferred Equity <1% 14% 8% 4% 4% 7% 5% Top 10 Companies (by Issuer) *An investment in the Company involves a high degree of risk and may be considered speculative. Potential investors are advised to consider the investment objectives, risks, and charges and expenses of the Company carefully before investing. Potential investors should read and carefully consider all information found in the Company’s reports filed with the U.S. Securities and Exchange Commission (“SEC”) before investing. This fact sheet is intended as informational only and is not intended as investment advice or for trading purposes. For additional information, contact your financial advisor. This fact sheet does not constitute a prospectus and should under no circumstances be understood as an offer to sell or the solicitation of an offer to buy our common stock or any other securities nor will there be any sale of the common stock or any other securities referred to in this fact sheet in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. All footnotes referenced above are contained on the following page. 1 CompanyIndustryAsset TypeCoupon Maturity DateFair Value (USD) Antares Bain Capital Complete Financing Solution LLC(4,5,6,10) Investment Funds and Vehicles Investment Funds and Vehicles178,409,807 U.S. Anesthesia Partners, Inc.(10,12) Healthcare & Pharmaceuticals First Lien Senior Secured Loan4.82%6/23/20245,006,172 U.S. Anesthesia Partners, Inc.(8,12) Healthcare & Pharmaceuticals Second Lien Senior Secured Loan8.82%6/23/202516,553,040 Adler & Allan Group Limited(4,9,10,12,13) Environmental IndustriesFirst Lien Last Out Term Loan8.00%6/30/202420,256,052 Zywave, Inc.(8,10,12) High Tech IndustriesFirst Lien Senior Secured Loan6.61%11/17/202217,728,574 Zywave, Inc.(7,8,10,14) High Tech IndustriesRevolver7.43%11/17/2022287,802 Qlik Technologies(8,12)High Tech IndustriesFirst Lien Senior Secured Loan5.04%4/26/202417,559,132 American Tire Distributors, Inc. (8,12) WholesaleFirst Lien Senior Secured Loan5.82%9/1/202117,171,238 Netsmart Technologies, Inc. (8,12) High Tech IndustriesFirst Lien Senior Secured Loan6.19%4/19/202316,375,022 Lighthouse Network LLC(8,12) High Tech IndustriesFirst Lien Senior Secured Loan6.07%11/29/202416,332,145 Advantage Sales & Marketing, Inc. (8,12) Services: BusinessFirst Lien Senior Secured Loan4.63%7/23/202115,553,000 Harbor Freight Tools USA, Inc.(12,15) Consumer Goods: DurableFirst Lien Senior Secured Loan4.82%8/18/202315,118,365 Percent Floating / Fixed(2):98.4% / 1.6% Weighted Average Yield (investments)(3):8.2% Percent Called (of total committed capital):40% Total Assets:$988.3M Net Asset Value:$507.0M Total Liabilities:$481.3M Net Asset Value per Share:$20.30 Total Number of Companies:85 Distributions Quarterly Distributions:$7.7M Year-to-Date Distributions:$16.9M YTD(1) Total Return Based on Net Asset Value:4.5%