UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23124

Franklin Templeton ETF Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650 312-2000

Date of fiscal year end: 3/31

Date of reporting period: 03/31/21

| Item 1. | Reports to Stockholders. |

ANNUAL REPORT

FRANKLIN TEMPLETON

ETF TRUST

March 31, 2021

Franklin LibertyQ Emerging Markets ETF | Franklin LibertyQ Global Equity ETF | |

Franklin LibertyQ Global Dividend ETF | Franklin LibertyQ International Equity Hedged ETF |

Visit franklintempleton.com for fund updates and documents, or to find helpful financial planning tools.

| Not FDIC Insured | | | May Lose Value | | | No Bank Guarantee |

| franklintempleton.com | Annual Report | 1 | ||||||||

ANNUAL REPORT

Global developed and emerging market equities, as measured by the MSCI All Country World Index-NR (net of taxes on dividends), advanced strongly during the 12 months ended March 31, 2021. Following sharp declines in early 2020 amid the onset of the novel coronavirus (COVID-19) pandemic, global equities began to rebound in the spring amid monetary and fiscal stimulus measures, easing lockdown restrictions, and vaccine and treatment development. Stocks declined again in September and October, due to geopolitical tensions and rising infection rates, but began to rebound in November as successful trials of COVID-19 vaccines, the start of vaccination programs and expectations for additional fiscal stimulus led many equity markets to reach new highs. Indications of economic recovery in many countries also helped drive stocks higher.

In the U.S., equities rallied following the initial shock of pandemic-related restrictions and mass layoffs, which pushed the unemployment rate to 14.8% in April 2020.1 Equities began to rebound in the spring amid the government’s fiscal and monetary stimulus measures, partial economic reopening, rising retail sales and optimism about treatments and potential vaccines for COVID-19. Following a record annualized decline in the second-quarter 2020 gross domestic product (GDP), resilient consumer spending helped drive the third-quarter GDP to expand at a record annualized rate, although growth slowed in the fourth quarter. Equities continued to rise during the summer but declined in the fall due to concerns about possible new restrictions amid rising COVID-19 infection rates and uncertainties about additional fiscal stimulus and the U.S. presidential election. Investor sentiment improved beginning in November following the outcome of the U.S. presidential election, the start of COVID-19 vaccination programs and the passage of a new U.S. stimulus bill. The U.S. economy’s continued recovery, with the unemployment rate ending the period at 6.0%, helped drive U.S. equities, as measured by the Standard & Poor’s® 500 Index, to reach all-time price highs in March 2021.1

The U.S. Federal Reserve (Fed) kept the federal funds target rate at a record-low range of 0.00%–0.25% and continued its

program of open-ended bond purchases to help keep markets functioning. Furthermore, the Fed reiterated that interest rates would potentially remain low, even if inflation moderately exceeded the Fed’s 2% target.

In the eurozone, economic recovery remained uneven, as growth resumed in the third quarter of 2020 but contracted in the fourth quarter. GDP growth rates varied widely among the region’s largest economies amid renewed lockdowns and delays in COVID-19 vaccine distribution. Germany’s and Spain’s GDP expanded modestly in the fourth quarter, while France’s contracted. Despite investor concerns about rising infection rates and a slow vaccination rollout, general optimism that successful vaccine programs would lift global growth, along with a Brexit resolution, contributed to strong gains for European developed market equities, as measured by the MSCI Europe Index-NR.

Asian developed and emerging market equities, as measured by the MSCI All Country Asia Index-NR, advanced sharply for the period. China, a key driver of regional economies, began to recover in the second quarter of 2020 and was the only major global economy to post positive GDP growth for full-year 2020 amid strong manufacturing gains. Despite paring gains in March 2021, Asian equity markets finished the period sharply higher amid optimism that economic revitalization would be further spurred by COVID-19 vaccines.

Global emerging market stocks, as measured by the MSCI Emerging Markets Index-NR, also rose significantly for the period. Improving economic activity, stabilizing oil prices and U.S. dollar weakness supported emerging market equities. Despite higher COVID-19 cases in some countries, emerging market stocks rallied amid easing political uncertainty, commencement of COVID-19 vaccinations and rising commodity prices.

The foregoing information reflects our analysis and opinions as of March 31, 2021. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: U.S. Bureau of Labor Statistics.

See www.franklintempletondatasources.com for additional data provider information.

| 2 | Annual Report | franklintempleton.com | ||||||||

Franklin LibertyQ Emerging Markets ETF

This annual report for Franklin LibertyQ Emerging Markets ETF covers the fiscal year ended March 31, 2021.

Your Fund’s Goal and Main Investments

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ Emerging Markets (EM) Index (the Underlying Index).1 Under normal market conditions, the Fund invests at least 80% of its assets in the component securities of the Underlying Index and in depositary receipts representing such securities. The Underlying Index includes stocks from emerging market countries that have favorable exposure to four investment-style factors: quality, value, momentum and low volatility, subject to a maximum 1% per company weighting. The Underlying Index seeks to achieve a lower level of risk and higher risk-adjusted performance than the MSCI EM Index over the long term by selecting equity securities from the MSCI EM Index that have exposure to these investment-style factors.

Performance Overview

During the 12-month period, the Fund posted cumulative total returns of +44.24% based on market price and +42.57% based on net asset value (NAV). In comparison, the LibertyQ EM Index-NR posted a +43.27% total return for the same period, while the MSCI EM Index-NR posted a +58.39% total return.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 6.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

| Geographic Composition* | ||||

| 3/31/21 | ||||

| % of Total Net Assets | ||||

Asia | 67.2% | |||

Europe | 13.3% | |||

Middle East & Africa | 11.2% | |||

Latin America & Caribbean | 8.0% | |||

North America | 0.1% | |||

Short-Term Investments & Other Net Assets | 0.1% | |||

*Figures are stated as a percentage of total and may not equal 100% or may be negative due to rounding, use of any derivatives, unsettled trades or other factors.

Investment Strategy

The Fund, using a passive or indexing investment approach, seeks investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ EM Index. The investment manager seeks to achieve, over time, a correlation between the Fund’s performance, before fees and expenses, and that of the Underlying Index of 0.95 or better. A figure of 1.00 would indicate perfect correlation. The Fund’s portfolio is reconstituted semiannually following the semiannual reconstitution of the Underlying Index.

1. The LibertyQ EM Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI EM Index using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI EM Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of emerging markets.

2. Source: FactSet.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index. Net Returns (NR) include income net of tax withholding when dividends are paid.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 31.

| franklintempleton.com | Annual Report | 3 | ||||||||

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

| Top 10 Sectors/Industries | ||||

| 3/31/21 | ||||

% of Total Net Assets | ||||

Banks | 13.4% | |||

Oil, Gas & Consumable Fuels | 10.0% | |||

Metals & Mining | 8.8% | |||

Diversified Telecommunication Services | 4.7% | |||

Semiconductors & Semiconductor Equipment | 4.5% | |||

IT Services | 4.2% | |||

Wireless Telecommunication Services | 4.2% | |||

Food Products | 3.9% | |||

Technology Hardware, Storage & Peripherals | 3.9% | |||

Beverages | 3.6% | |||

| Top 10 Holdings | ||||

| 3/31/21 | ||||

Company Sector/Industry, Country | % of Total Net Assets | |||

| Vale SA Metals & Mining, Brazil | 1.3% | |||

| Country Garden Services Holdings Co. Ltd. Commercial Services & Supplies, China | 1.3% | |||

| Al-Rajhi Bank Banks, Saudi Arabia | 1.2% | |||

| Infosys Ltd. IT Services, India | 1.2% | |||

| Novatek Microelectronics Corp. Ltd. Semiconductors & Semiconductor Equipment, Taiwan | 1.2% | |||

| LUKOIL PJSC Oil, Gas & Consumable Fuels, Russia | 1.2% | |||

Gazprom PJSC Oil, Gas & Consumable Fuels, Russia | 1.2% | |||

Tata Consultancy Services Ltd. IT Services, India | 1.1% | |||

HCL Technologies Ltd. IT Services, India | 1.1% | |||

NetEase Inc. Entertainment, China | 1.1% | |||

| Top 10 Countries | ||||

| 3/31/21 | ||||

| % of Total Net Assets | ||||

China | 27.2% | |||

India | 12.8% | |||

Taiwan | 12.3% | |||

Russia | 11.3% | |||

South Korea | 8.3% | |||

Brazil | 4.1% | |||

Saudi Arabia | 4.1% | |||

South Africa | 3.7% | |||

Mexico | 2.7% | |||

Indonesia | 2.1% | |||

Manager’s Discussion

For the fiscal year ended March 31, 2021, individual holdings that lifted the Fund’s absolute return included Taiwan Semiconductor Manufacturing Co., Infosys and HCL Technologies. Individual holdings that hindered the Fund’s absolute return included China Mobile, Top Glove and China Minsheng Banking.

The Fund’s research-based selection process focuses on four investment factors: value, quality, momentum and low volatility. Of the four target-style factors, low volatility significantly detracted from the Fund’s relative performance for the reporting period, while value and quality also detracted. In contrast, the momentum factor was a marginal contributor to the Fund’s relative return.

| 4 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

Thank you for your participation in Franklin LibertyQ Emerging Markets ETF. We look forward to serving your future investment needs.

Dina Ting, CFA

Hailey Harris

Portfolio Management Team

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2021, the end of the reporting period. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

| franklintempleton.com | Annual Report | 5 | ||||||||

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

Performance Summary as of March 31, 2021

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (6/3/16), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 3/31/211

| Cumulative Total Return2 | Average Annual Total Return2 | |||||||||||||||

Based on NAV3 | Based on market price4 | Based on NAV3 | Based on market price4 | |||||||||||||

1-Year | +42.57% | +44.24% | +42.57% | +44.24% | ||||||||||||

3-Year | +4.76% | +3.60% | +1.56% | +1.19% | ||||||||||||

Since Inception (6/1/16) | +40.35% | +40.65% | +7.27% | +7.32% | ||||||||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 8 for Performance Summary footnotes.

| 6 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

PERFORMANCE SUMMARY

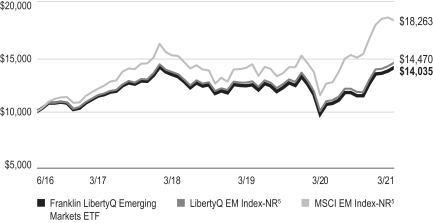

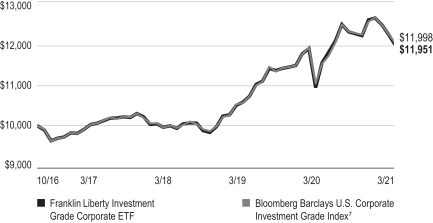

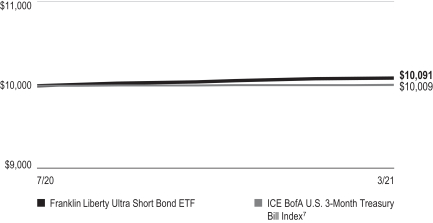

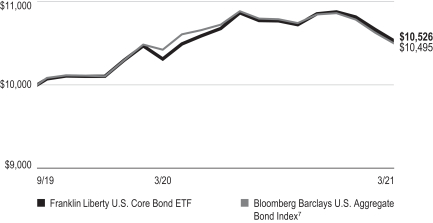

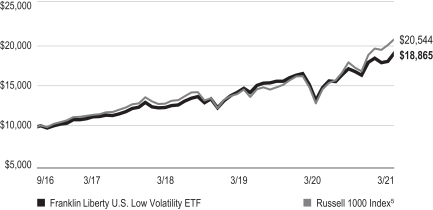

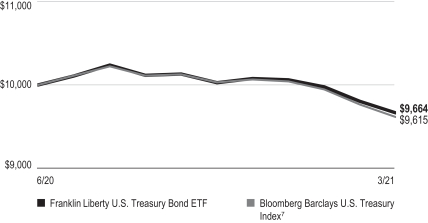

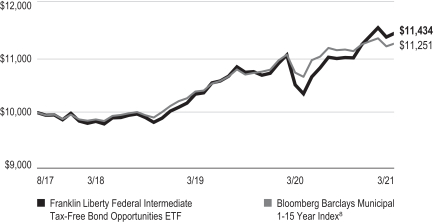

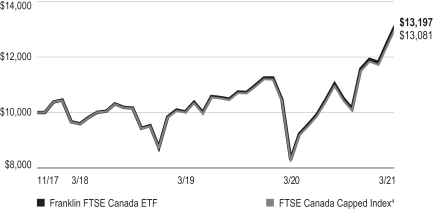

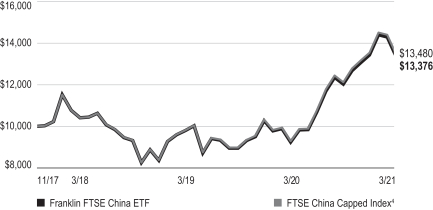

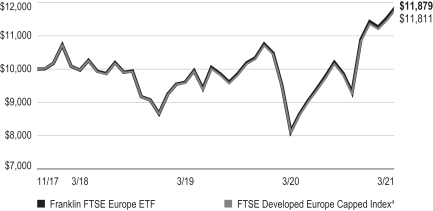

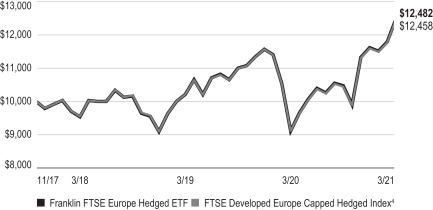

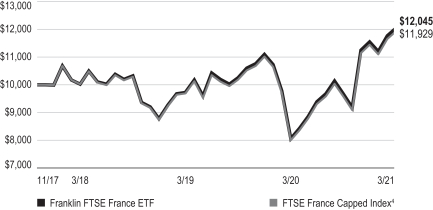

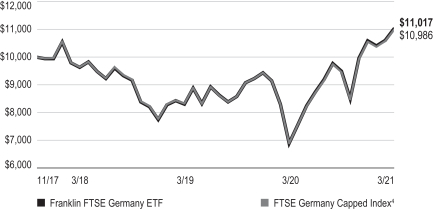

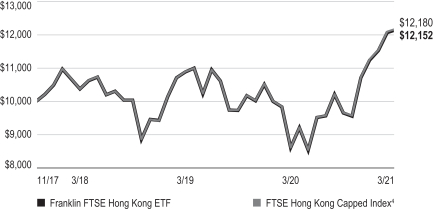

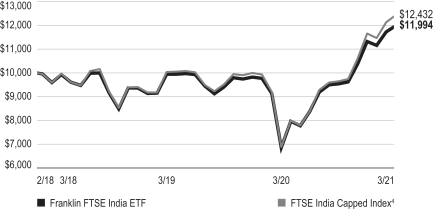

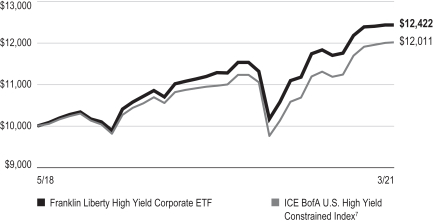

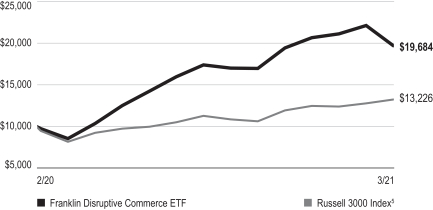

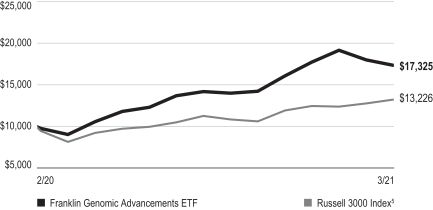

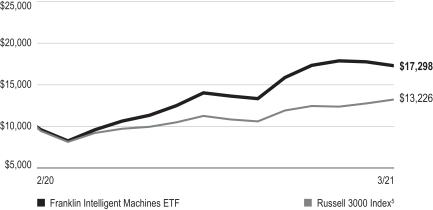

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

6/1/16–3/31/21

See page 8 for Performance Summary footnotes.

| franklintempleton.com | Annual Report | 7 | ||||||||

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

PERFORMANCE SUMMARY

Distributions (4/1/20–3/31/21)

| Net Investment Income |

$0.805252 |

Total Annual Operating Expenses6

0.45% |

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in developing markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. The Fund is designed for the aggressive portion of a well-diversified portfolio. There can be no assurance that the Fund’s multi-factor stock selection process will enhance performance. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. Performance of the Fund may vary significantly from the performance of an index, as a result of transaction costs, expenses and other factors. Events such as the spread of deadly diseases, disasters, and financial, political or social disruptions, may heighten risks and adversely affect performance. The Fund’s prospectus also includes a description of the main investment risks.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will reduce returns.

1. Effective December 1, 2017, the Fund adopted a unified fee structure whereby Management has agreed to reimburse the Fund’s acquired fund fees and expenses (if any) and pay all of the ordinary operating expenses of the Fund, including custody, transfer agency, and Trustee fees and expenses, among others, but excluding: (i) payments under the Fund’s Rule 12b-1 plan (if any); (ii) brokerage expenses (including any costs incidental to transactions in portfolio securities or instruments); (iii) taxes; (iv) interest (including borrowing costs and dividend expenses on securities sold short and overdraft charges); (v) litigation expenses (including litigation to which the Trust or a Fund may be a party and indemnification of the Trustees and officers with respect thereto); and (vi) other non-routine or extraordinary expenses.

2. Total return calculations represent the cumulative and average annual changes in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

3. Assumes reinvestment of distributions based on net asset value.

4. Assumes reinvestment of distributions based on market price.

5. Source: FactSet. The LibertyQ EM Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI EM Index using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI EM Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of emerging markets. The NR or Net Dividends Index reflects the deduction of withholding taxes on reinvested dividends.

6. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional provider information.

| 8 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing Fund costs, including management fees and other Fund expenses. All funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

Actual (actual return after expenses) | Hypothetical (5% annual return before expenses) | |||||||||||||||||||||

| Beginning Account Value 10/1/20 | Ending Account Value 3/31/21 | Expenses Paid During Period 10/1/20–3/31/211,2 | Ending Account Value 3/31/21 | Expenses Paid During Period 10/1/20–3/31/211,2 | Net Annualized Expense Ratio2 | |||||||||||||||||

| $1,000.00 | $ | 1,223.20 | $ | 2.49 | $ | 1,022.69 | $ | 2.27 | 0.45 | % | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements.

| franklintempleton.com | Annual Report | 9 | ||||||||

Franklin LibertyQ Global Dividend ETF

This annual report for Franklin LibertyQ Global Dividend ETF covers the fiscal year ended March 31, 2021.

Your Fund’s Goal and Main Investments

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ Global Dividend Index (the Underlying Index).1 Under normal market conditions, the Fund invests at least 80% of its assets in the component securities of the Underlying Index and in depositary receipts representing such securities. The Underlying Index includes stocks from developed and emerging market countries with high and persistent dividend income that have favorable exposure to a quality investment-style factor, subject to a maximum 2% per company weighting. The Underlying Index seeks to achieve a lower level of risk and higher risk-adjusted performance than the MSCI All Country World Index (ACWI) ex REITs Index over the long term by applying dividend persistence and yield screens and the quality factor selection process.

Performance Overview

For the 12-month period, the Fund posted cumulative total returns of +47.12% based on market price and +47.20% based on net asset value (NAV). In comparison, the LibertyQ Global Dividend Index-NR posted a +47.09% total return for the same period, while the MSCI ACWI ex REITs Index-NR posted a +55.12% total return for the same period.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 12.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

| Geographic Composition* | ||||

| 3/31/21 | ||||

| % of Total Net Assets | ||||

North America | 49.3% | |||

Europe | 21.7% | |||

Asia | 16.7% | |||

Australia & New Zealand | 5.7% | |||

Middle East & Africa | 4.6% | |||

Latin America & Caribbean | 1.7% | |||

Short-Term Investments & Other Net Assets | 0.3% | |||

*Figures are stated as a percentage of total and may not equal 100% or may be negative due to rounding, use of any derivatives, unsettled trades or other factors.

Investment Strategy

The Fund, using a passive or indexing investment approach, seeks investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ Global Dividend Index. The investment manager seeks to achieve, over time, a correlation between the Fund’s performance, before fees and expenses, and that of the Underlying Index of 0.95 or better. A figure of 1.00 would indicate perfect correlation. The Fund’s portfolio is reconstituted semiannually following the semiannual reconstitution of the Underlying Index.

1. The LibertyQ Global Dividend Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI ACWI ex REITs Index using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI ACWI ex REITs Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding REIT securities.

2. Source: FactSet.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index. Net Returns (NR) include income net of tax withholding when dividends are paid.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 41.

| 10 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ GLOBAL DIVIDEND ETF

| Top 10 Sectors/Industries | ||||

| 3/31/21 | ||||

| % of Total Net Assets | ||||

Banks | 15.5% | |||

Pharmaceuticals | 9.4% | |||

Insurance | 8.4% | |||

Semiconductors & Semiconductor Equipment | 6.1% | |||

Tobacco | 5.0% | |||

IT Services | 4.1% | |||

Diversified Telecommunication Services | 3.8% | |||

Machinery | 3.8% | |||

Capital Markets | 3.8% | |||

Household Products | 3.6% | |||

| Top 10 Holdings | ||||

| 3/31/21 | ||||

Company Sector/Industry, Country | % of Total Net Assets | |||

| Unilever PLC Personal Products, United Kingdom | 3.4% | |||

| Altria Group Inc. Tobacco, United States | 2.3% | |||

| Cisco Systems Inc. Communications Equipment, United States | 2.3% | |||

| The Toronto-Dominion Bank Banks, Canada | 2.3% | |||

| Target Corp. Multiline Retail, United States | 2.2% | |||

| Taiwan Semiconductor Manufacturing Co. Ltd. Semiconductors & Semiconductor Equipment, Taiwan | 2.2% | |||

| Emerson Electric Co. Electrical Equipment, United States | 2.2% | |||

| Royal Bank of Canada Banks, Canada | 2.1% | |||

| Commonwealth Bank of Australia Banks, Australia | 2.1% | |||

| Philip Morris International Inc. Tobacco, United States | 2.1% | |||

| Top 10 Countries | ||||

| 3/31/21 | ||||

| % of Total Net Assets | ||||

United States | 42.6% | |||

Japan | 8.3% | |||

United Kingdom | 7.5% | |||

Switzerland | 6.9% | |||

Canada | 6.7% | |||

Australia | 5.3% | |||

Finland | 2.9% | |||

Taiwan | 2.8% | |||

Germany | 2.6% | |||

Singapore | 2.5% | |||

Manager’s Discussion

For the fiscal year ended March 31, 2021, individual holdings that lifted the Fund’s absolute return included Taiwan Semiconductor Manufacturing Co., Macquarie Group and United Parcel Service. Individual holdings that hindered the Fund’s absolute return included Tryg, SATS and Lawson.

Thank you for your participation in Franklin LibertyQ Global Dividend ETF. We look forward to serving your future investment needs.

Dina Ting, CFA

Hailey Harris

Portfolio Management Team

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2021, the end of the reporting period. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| franklintempleton.com | Annual Report | 11 | ||||||||

FRANKLIN LIBERTYQ GLOBAL DIVIDEND ETF

Performance Summary as of March 31, 2021

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (6/3/16), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 3/31/211

| Cumulative Total Return2 | Average Annual Total Return2 | |||||||||||||||

| Based on NAV3 | Based on market price4 | Based on NAV3 | Based on market price4 | |||||||||||||

1-Year | +47.20% | +47.12% | +47.20% | +47.12% | ||||||||||||

3-Year | +30.51% | +29.72% | +9.28% | +9.06% | ||||||||||||

Since Inception (6/1/16) | +53.20% | +53.17% | +9.23% | +9.23% | ||||||||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 14 for Performance Summary footnotes.

| 12 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ GLOBAL DIVIDEND ETF

PERFORMANCE SUMMARY

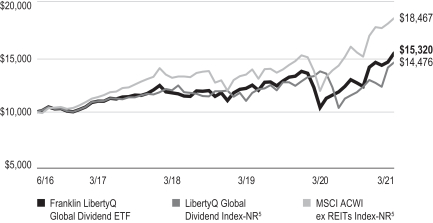

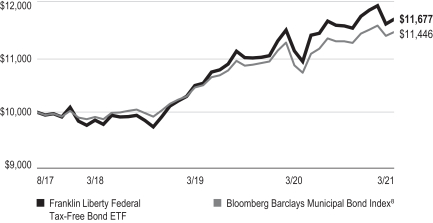

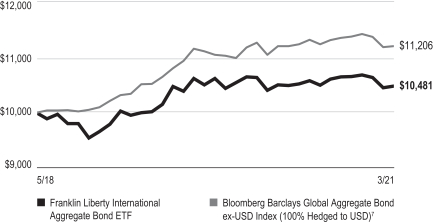

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

6/1/16–3/31/21

See page 14 for Performance Summary footnotes.

| franklintempleton.com | Annual Report | 13 | ||||||||

FRANKLIN LIBERTYQ GLOBAL DIVIDEND ETF

PERFORMANCE SUMMARY

Distributions (4/1/20–3/31/21)

| Net Investment Income |

$0.895677 |

Total Annual Operating Expenses6

0.45% |

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in emerging markets involve heightened risks related to the same factors. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. Companies that have historically paid regular dividends to shareholders may decrease or eliminate dividend payments in the future. A decrease in dividend payments by an issuer may result in a decrease in the value of the issuer’s stock and less available income for the Fund. There can be no assurance that the Fund’s quality factor stock selection process and dividend screens of the Underlying Index will enhance performance. Exposure to investment factors and the use of dividend screens may detract from performance in some market environments, perhaps for extended periods. Performance of the Fund may vary significantly from the performance of an index, as a result of transaction costs, expenses and other factors. Events such as the spread of deadly diseases, disasters, and financial, political or social disruptions, may heighten risks and adversely affect performance. The Fund’s prospectus also includes a description of the main investment risks.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will reduce returns.

1. Effective December 1, 2017, the Fund adopted a unified fee structure whereby Management has agreed to reimburse the Fund’s acquired fund fees and expenses (if any) and pay all of the ordinary operating expenses of the Fund, including custody, transfer agency, and Trustee fees and expenses, among others, but excluding: (i) payments under the Fund’s Rule 12b-1 plan (if any); (ii) brokerage expenses (including any costs incidental to transactions in portfolio securities or instruments); (iii) taxes; (iv) interest (including borrowing costs and dividend expenses on securities sold short and overdraft charges); (v) litigation expenses (including litigation to which the Trust or a Fund may be a party and indemnification of the Trustees and officers with respect thereto); and (vi) other non-routine or extraordinary expenses.

2. Total return calculations represent the cumulative and average annual changes in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

3. Assumes reinvestment of distributions based on net asset value.

4. Assumes reinvestment of distributions based on market price.

5. Source: FactSet. The LibertyQ Global Dividend Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI ACWI ex REITs Index using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI ACWI ex REITs Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding REIT securities. The NR or Net Dividends Index reflects the deduction of withholding taxes on reinvested dividends.

6. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional provider information.

| 14 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ GLOBAL DIVIDEND ETF

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing Fund costs, including management fees and other Fund expenses. All funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

Actual (actual return after expenses) | Hypothetical (5% annual return before expenses) | |||||||||||||||||||||

| Beginning Account Value 10/1/20 | Ending Account Value 3/31/21 | Expenses Paid During Period 10/1/20–3/31/211,2 | Ending Account Value 3/31/21 | Expenses Paid During Period 10/1/20–3/31/211,2 | Net Annualized Expense Ratio2 | |||||||||||||||||

| $1,000.00 | $ | 1,210.70 | $ | 2.48 | $ | 1,022.69 | $ | 2.27 | 0.45 | % | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements.

| franklintempleton.com | Annual Report | 15 | ||||||||

Franklin LibertyQ Global Equity ETF

This annual report for Franklin LibertyQ Global Equity ETF covers the fiscal year ended March 31, 2021.

Your Fund’s Goal and Main Investments

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ Global Equity Index (the Underlying Index).1 Under normal market conditions, the Fund invests at least 80% of its assets in the component securities of the Underlying Index and in depositary receipts representing such securities. The Underlying Index includes stocks from developed and emerging market countries that have favorable exposure to four investment-style factors: quality, value, momentum and low volatility, subject to a maximum 1% per company weighting. The Underlying Index seeks to achieve a lower level of risk and higher risk-adjusted performance than the MSCI All Country World Index (ACWI) over the long term by selecting equity securities from the MSCI ACWI that have exposure to these investment-style factors.

Performance Overview

During the 12-month period, the Fund posted cumulative total returns of +45.36% based on market price and +44.55% based on net asset value (NAV). In comparison, the LibertyQ Global Equity Index-NR posted a +44.39% total return for the same period, while the MSCI ACWI-NR posted a +54.60% total return.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 19.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

| Geographic Composition* | ||||

| 3/31/21 | ||||

% of Total Net Assets | ||||

North America | 58.2% | |||

Asia | 17.3% | |||

Europe | 17.1% | |||

Australia & New Zealand | 4.9% | |||

Middle East & Africa | 1.2% | |||

Latin America & Caribbean | 1.1% | |||

Short-Term Investments & Other Net Assets | 0.2% | |||

*Figures are stated as a percentage of total and may not equal 100% or may be negative due to rounding, use of any derivatives, unsettled trades or other factors.

Investment Strategy

The Fund, using a passive or indexing investment approach, seeks investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ Global Equity Index. The investment manager seeks to achieve, over time, a correlation between the Fund’s performance, before fees and expenses, and that of the Underlying Index of 0.95 or better. A figure of 1.00 would indicate perfect correlation. The Fund’s portfolio is reconstituted semiannually following the semiannual reconstitution of the Underlying Index.

1. The LibertyQ Global Equity Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI ACWI using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets.

2. Source: FactSet.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index. Net Returns (NR) include income net of tax withholding when dividends are paid.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 46.

| 16 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

| Top 10 Sectors/Industries | ||||

| 3/31/21 | ||||

% of Total Net Assets | ||||

| Pharmaceuticals | 9.2% | |||

| Semiconductors & Semiconductor Equipment | 9.0% | |||

| Metals & Mining | 5.3% | |||

| IT Services | 4.9% | |||

| Biotechnology | 4.8% | |||

| Software | 4.8% | |||

| Diversified Telecommunication Services | 3.7% | |||

| Tobacco | 3.2% | |||

| Technology Hardware, Storage & Peripherals | 3.0% | |||

| Banks | 2.6% | |||

| Top 10 Holdings | ||||

| 3/31/21 | ||||

Company Sector/Industry, Country | % of Total Net Assets | |||

| Intel Corp. Semiconductors & Semiconductor Equipment, United States | 1.3% | |||

| Eli Lilly and Co. Pharmaceuticals, United States | 1.2% | |||

| Cisco Systems Inc. Communications Equipment, United States | 1.1% | |||

| Texas Instruments Inc. Semiconductors & Semiconductor Equipment, United States | 1.1% | |||

| Unilever PLC Personal Products, United Kingdom | 1.1% | |||

| Taiwan Semiconductor Manufacturing Co. Ltd. Semiconductors & Semiconductor Equipment, Taiwan | 1.1% | |||

| Accenture PLC, A IT Services, United States | 1.1% | |||

| Lowe’s Cos. Inc. Specialty Retail, United States | 1.0% | |||

| Philip Morris International Inc. Tobacco, United States | 1.0% | |||

| Johnson & Johnson Pharmaceuticals, United States | 1.0% | |||

| Top 10 Countries | ||||

| 3/31/21 | ||||

% of Total Net Assets | ||||

| United States | 55.8% | |||

| Japan | 6.1% | |||

| United Kingdom | 5.9% | |||

| Australia | 4.7% | |||

| China | 3.6% | |||

| Switzerland | 3.5% | |||

| Canada | 2.4% | |||

| Taiwan | 2.2% | |||

| India | 2.0% | |||

| South Korea | 1.8% | |||

Manager’s Discussion

For the fiscal year ended March 31, 2021, individual holdings that lifted the Fund’s absolute return included Taiwan Manufacturing Semiconductor Co., Apple and Lowe’s. Individual holdings that hindered the Fund’s absolute return included Biogen, Gilead Sciences and Vertex Pharmaceuticals.

The Fund’s research-based selection process focuses on four investment factors: value, quality, momentum and low volatility. Of the four target-style factors, low volatility significantly detracted from the Fund’s relative performance for the reporting period, while value and quality also detracted. The momentum factor had no significant impact on the Fund’s relative return.

| franklintempleton.com | Annual Report | 17 | ||||||||

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

Thank you for your participation in Franklin LibertyQ Global Equity ETF. We look forward to serving your future investment needs.

Dina Ting, CFA

Hailey Harris

Portfolio Management Team

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2021, the end of the reporting period. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| 18 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

Performance Summary as of March 31, 2021

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (6/3/16), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 3/31/211

| Cumulative Total Return2 | Average Annual Total Return2 | |||||||||||||||

| Based on NAV3 | Based on market price4 | Based on NAV3 | Based on market price4 | |||||||||||||

1-Year | +44.55% | +45.36% | +44.55% | +45.36% | ||||||||||||

3-Year | +36.45% | +37.11% | +10.91% | +11.09% | ||||||||||||

Since Inception (6/1/16) | +70.78% | +71.12% | +11.72% | +11.76% | ||||||||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 21 for Performance Summary footnotes.

| franklintempleton.com | Annual Report | 19 | ||||||||

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

PERFORMANCE SUMMARY

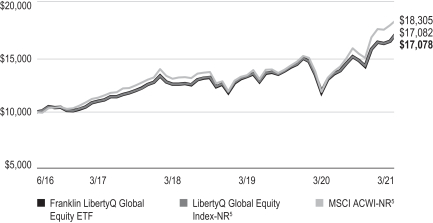

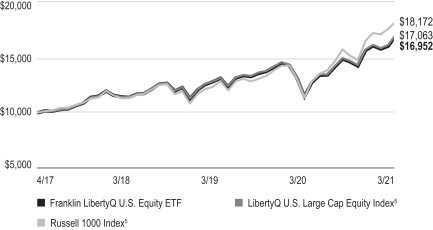

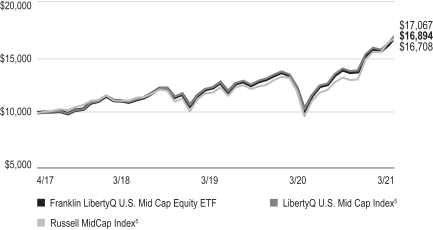

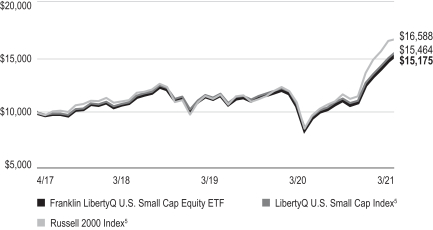

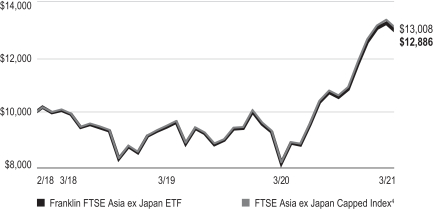

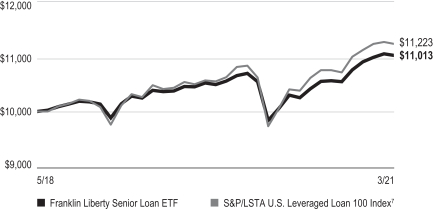

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

6/1/16–3/31/21

See page 21 for Performance Summary footnotes.

| 20 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

PERFORMANCE SUMMARY

Distributions (4/1/20–3/31/21)

| Net Investment Income |

$0.899661 |

Total Annual Operating Expenses6

0.35% |

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in emerging markets involve heightened risks related to the same factors. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. There can be no assurance that the Fund’s multi-factor stock selection process will enhance performance. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. Performance of the Fund may vary significantly from the performance of an index, as a result of transaction costs, expenses and other factors. Events such as the spread of deadly diseases, disasters, and financial, political or social disruptions, may heighten risks and adversely affect performance. The Fund’s prospectus also includes a description of the main investment risks.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will reduce returns.

1. Effective December 1, 2017, the Fund adopted a unified fee structure whereby Management has agreed to reimburse the Fund’s acquired fund fees and expenses (if any) and pay all of the ordinary operating expenses of the Fund, including custody, transfer agency, and Trustee fees and expenses, among others, but excluding: (i) payments under the Fund’s Rule 12b-1 plan (if any); (ii) brokerage expenses (including any costs incidental to transactions in portfolio securities or instruments); (iii) taxes; (iv) interest (including borrowing costs and dividend expenses on securities sold short and overdraft charges); (v) litigation expenses (including litigation to which the Trust or a Fund may be a party and indemnification of the Trustees and officers with respect thereto); and (vi) other non-routine or extraordinary expenses.

2. Total return calculations represent the cumulative and average annual changes in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

3. Assumes reinvestment of distributions based on net asset value.

4. Assumes reinvestment of distributions based on market price.

5. Source: FactSet. The LibertyQ Global Equity Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI ACWI Index using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI ACWI Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. The NR or Net Dividends Index reflects the deduction of withholding taxes on reinvested dividends.

6. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional provider information.

| franklintempleton.com | Annual Report | 21 | ||||||||

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing Fund costs, including management fees and other Fund expenses. All funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

Actual (actual return after expenses) | Hypothetical (5% annual return before expenses) | |||||||||||||||||||||

| Beginning Account Value 10/1/20 | Ending Account Value 3/31/21 | Expenses Paid During Period 10/1/20–3/31/211,2 | Ending Account Value 3/31/21 | Expenses Paid During Period 10/1/20–3/31/211,2 | Net Annualized Expense Ratio2 | |||||||||||||||||

| $1,000.00 | $ | 1,164.70 | $ | 1.83 | $ | 1,023.24 | $ | 1.72 | 0.34 | % | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements.

| 22 | Annual Report | franklintempleton.com | ||||||||

Franklin LibertyQ International Equity Hedged ETF

This annual report for Franklin LibertyQ International Equity Hedged ETF covers the fiscal year ended March 31, 2021.

Your Fund’s Goal and Main Investments

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ International Equity Hedged Index (the Underlying Index).1 Under normal market conditions, the Fund invests at least 80% of its assets in the component securities of the Underlying Index and in depositary receipts representing such securities. The Underlying Index includes stocks from developed market countries in Europe, Australasia and the Far East (EAFE) that have favorable exposure to four investment-style factors: quality, value, momentum and low volatility, subject to a maximum 2% per company weighting. The Underlying Index seeks to achieve a lower level of risk and higher risk-adjusted performance than the MSCI EAFE Index over the long term by selecting equity securities from the MSCI EAFE Index that have exposure to these investment-style factors. The Underlying Index incorporates a hedge against non-U.S. currency fluctuations by reflecting the impact of rolling monthly currency forward contracts on the currencies represented in the Underlying Index.

Performance Overview

During the 12-month period, the Fund posted cumulative total returns of +29.08% based on market price and +27.54% based on net asset value (NAV). In comparison, LibertyQ International Equity Hedged Index-NR posted a +27.91% total return for the same period, while the MSCI EAFE 100% Hedged to USD Index-NR posted a +37.75% total return.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 26.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Geographic Composition* | ||||

| 3/31/21 | ||||

| % of Total Net Assets | ||||

Europe | 54.3% | |||

Asia | 29.8% | |||

Australia & New Zealand | 15.2% | |||

Middle East & Africa | 0.5% | |||

Short-Term Investments & Other Net Assets | 0.2% | |||

*Figures are stated as a percentage of total and may not equal 100% or may be negative due to rounding, use of any derivatives, unsettled trades or other factors.

Investment Strategy

The Fund, using a passive or indexing investment approach, seeks investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ International Equity Hedged Index. The investment manager seeks to achieve, over time, a correlation between the Fund’s performance, before fees and expenses, and that of the Underlying Index of 0.95 or better. A figure of 1.00 would indicate perfect correlation. The Fund’s portfolio is reconstituted semiannually following the semiannual reconstitution of the Underlying Index.

1. The LibertyQ International Equity Hedged Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI EAFE Index using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI EAFE Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada.

2. Source: FactSet.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index. Net Returns (NR) include income net of tax withholding when dividends are paid.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 61.

| franklintempleton.com | Annual Report | 23 | ||||||||

FRANKLIN LIBERTYQ INTERNATIONAL EQUITY HEDGED ETF

| Top 10 Sectors/Industries | ||||

| 3/31/21 | ||||

| % of Total Net Assets | ||||

Pharmaceuticals | 11.7% | |||

Metals & Mining | 11.1% | |||

Diversified Telecommunication Services | 4.5% | |||

Personal Products | 4.3% | |||

Electric Utilities | 4.2% | |||

Tobacco | 3.6% | |||

Automobiles | 3.1% | |||

Food & Staples Retailing | 3.1% | |||

Health Care Equipment & Supplies | 2.8% | |||

Machinery | 2.8% | |||

| Top 10 Holdings | ||||

| 3/31/21 | ||||

Company Sector/Industry, Country | % of Total Net Assets | |||

| Unilever PLC Personal Products, United Kingdom | 3.5% | |||

| BHP Group Ltd. Metals & Mining, Australia | 2.4% | |||

| Rio Tinto PLC Metals & Mining, Australia | 2.3% | |||

| Toyota Motor Corp. Automobiles, Japan | 2.1% | |||

| Novo Nordisk AS, B Pharmaceuticals, Denmark | 1.9% | |||

| Tokyo Electron Ltd. Semiconductors & Semiconductor Equipment, Japan | 1.9% | |||

| British American Tobacco PLC Tobacco, United Kingdom | 1.9% | |||

| Novartis AG Pharmaceuticals, Switzerland | 1.9% | |||

| GlaxoSmithKline PLC Pharmaceuticals, United Kingdom | 1.8% | |||

Royal Dutch Shell PLC, A Oil, Gas & Consumable Fuels, United Kingdom | 1.8% | |||

| Top 10 Countries | ||||

| 3/31/21 | ||||

| % of Total Net Assets | ||||

Japan | 26.6% | |||

United Kingdom | 21.6% | |||

Australia | 14.5% | |||

Switzerland | 8.7% | |||

Spain | 4.8% | |||

Denmark | 3.7% | |||

Italy | 3.3% | |||

France | 3.2% | |||

Sweden | 3.1% | |||

Netherlands | 1.9% | |||

Manager’s Discussion

For the fiscal year ended March 31, 2021, individual holdings that lifted the Fund’s absolute return included BHP Group, Rio Tinto and Tokyo Electron. Individual holdings that hindered the Fund’s absolute return included KAO, M3 and a2 Milk. The Fund’s use of currency forward contracts—designed to offset the Fund’s exposure to the component currencies and replicate the hedge impact incorporated in the calculations of the Underlying Index—also detracted from the Fund’s absolute performance.

The Fund’s research-based selection process focuses on four investment factors: value, quality, momentum and low volatility. Of the four target-style factors, low volatility significantly detracted from the Fund’s relative performance for the reporting period, while quality, value and momentum also modestly detracted.

| 24 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ INTERNATIONAL EQUITY HEDGED ETF

Thank you for your participation in Franklin LibertyQ International Equity Hedged ETF. We look forward to serving your future investment needs.

Dina Ting, CFA

Hailey Harris

Portfolio Management Team

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2021, the end of the reporting period. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| franklintempleton.com | Annual Report | 25 | ||||||||

FRANKLIN LIBERTYQ INTERNATIONAL EQUITY HEDGED ETF

Performance Summary as of March 31, 2021

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (6/3/16), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 3/31/211

| Cumulative Total Return2 | Average Annual Total Return2 | |||||||||||||||

| Based on NAV3 | Based on market price4 | Based on NAV3 | Based on market price4 | |||||||||||||

1-Year | +27.54% | +29.08% | +27.54% | +29.08% | ||||||||||||

3-Year | +27.57% | +28.34% | +8.45% | +8.67% | ||||||||||||

Since Inception (6/1/16) | +42.77% | +44.09% | +7.65% | +7.86% | ||||||||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 28 for Performance Summary footnotes.

| 26 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ INTERNATIONAL EQUITY HEDGED ETF

PERFORMANCE SUMMARY

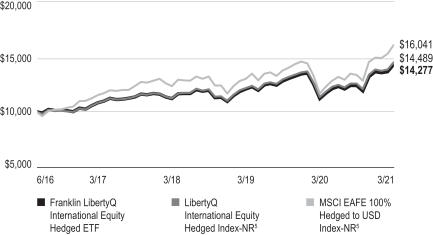

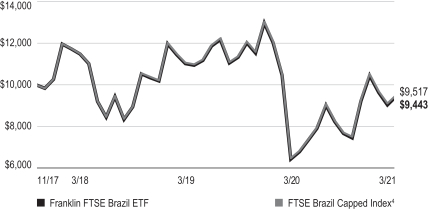

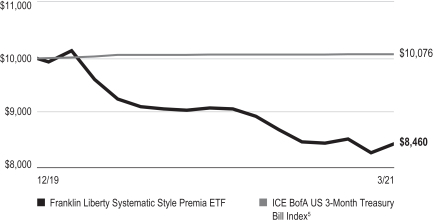

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

6/1/16–3/31/21

See page 28 for Performance Summary footnotes.

| franklintempleton.com | Annual Report | 27 | ||||||||

FRANKLIN LIBERTYQ INTERNATIONAL EQUITY HEDGED ETF

PERFORMANCE SUMMARY

Distributions (4/1/20–3/31/21)

Net Investment Income | Short-Term Capital Gain | Long-Term Capital Gain | Total | |||||||||

$0.910024 | $0.549235 | $0.574673 | $2.033932 | |||||||||

Total Annual Operating Expenses6

0.40% |

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in emerging markets involve heightened risks related to the same factors. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. The Fund will attempt to hedge the currency exposure of non-U.S. dollar denominated securities held in its portfolio by investing in foreign currency forward contracts. Foreign currency forward contracts do not eliminate movements in the value of non-U.S. currencies and securities but rather allow the Fund to establish a fixed rate of exchange for a future point in time. Investments in derivatives involve costs and create economic leverage, which may result in significant volatility and cause the Fund to participate in losses (as well as gains) that significantly exceed the Fund’s initial investment. Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager expects. There can be no assurance that the Fund’s multi-factor stock selection process will enhance performance. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. Performance of the Fund may vary significantly from the performance of an index, as a result of transaction costs, expenses and other factors. Events such as the spread of deadly diseases, disasters, and financial, political or social disruptions, may heighten risks and adversely affect performance. The Fund’s prospectus also includes a description of the main investment risks.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will reduce returns.

1. Effective December 1, 2017, the Fund adopted a unified fee structure whereby Management has agreed to reimburse the Fund’s acquired fund fees and expenses (if any) and pay all of the ordinary operating expenses of the Fund, including custody, transfer agency, and Trustee fees and expenses, among others, but excluding: (i) payments under the Fund’s Rule 12b-1 plan (if any); (ii) brokerage expenses (including any costs incidental to transactions in portfolio securities or instruments); (iii) taxes; (iv) interest (including borrowing costs and dividend expenses on securities sold short and overdraft charges); (v) litigation expenses (including litigation to which the Trust or a Fund may be a party and indemnification of the Trustees and officers with respect thereto); and (vi) other non-routine or extraordinary expenses.

2. Total return calculations represent the cumulative and average annual changes in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

3. Assumes reinvestment of distributions based on net asset value.

4. Assumes reinvestment of distributions based on market price.

5. Source: FactSet. The LibertyQ International Equity Hedged Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI EAFE Index using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI EAFE Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The NR or Net Dividends Index reflects the deduction of withholding taxes on reinvested dividends.

6. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional provider information.

| 28 | Annual Report | franklintempleton.com | ||||||||

FRANKLIN LIBERTYQ INTERNATIONAL EQUITY HEDGED ETF

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing Fund costs, including management fees and other Fund expenses. All funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

Actual (actual return after expenses) | Hypothetical (5% annual return before expenses) | |||||||||||||||||||||

| Beginning Account Value 10/1/20 | Ending Account Value 3/31/21 | Expenses Paid During Period 10/1/20–3/31/211,2 | Ending Account Value 3/31/21 | Expenses Paid During Period 10/1/20–3/31/211,2 | Net Annualized Expense Ratio2 | |||||||||||||||||

| $1,000.00 | $ | 1,154.60 | $ | 2.15 | $ | 1,022.94 | $ | 2.02 | 0.40 | % | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements.

| franklintempleton.com | Annual Report | 29 | ||||||||

FRANKLIN TEMPLETON ETF TRUST

Franklin LibertyQ Emerging Markets ETF

| Year Ended March 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017a | ||||||||||||||||

| Per share operating performance (for a share outstanding throughout the year) | ||||||||||||||||||||

Net asset value, beginning of year | $22.20 | $29.70 | $33.41 | $29.29 | $25.66 | |||||||||||||||

|

| |||||||||||||||||||