UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-23124

Franklin Templeton ETF Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Alison E. Baur, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650 312-2000

Date of fiscal year end: 3/31

Date of reporting period: 03/31/22

The Registrant is filing this amendment to its Form N-CSR for the period ended March 31, 2022, as originally filed with the U.S. Securities and Exchange Commission on May 27, 2022 (Accession Number 0001193125-22-162279) (the “Original Filing”), for the sole purpose of amending Item 1 “Reports to Shareholders” to correct a typographical error regarding the distribution rate on page 48 and the related footnote on page 50 of the Franklin Liberty International Aggregate Bond ETF’s report to shareholders. Except for the correction described above and the inclusion of new certifications pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, this amendment does not amend, update or modify any other items or disclosures found in the Original Filing. In addition, this amendment does not reflect events or transactions occurring after the filing of the Original Filing. As a result, such information continues to speak as of the date of the Original Filing.

| Item 1. | Reports to Stockholders. |

ANNUAL REPORT

FRANKLIN TEMPLETON

ETF TRUST

March 31, 2022

|

Franklin Disruptive Commerce ETF |

Franklin Exponential Data ETF |

Franklin Genomic Advancements ETF |

Franklin Intelligent Machines ETF |

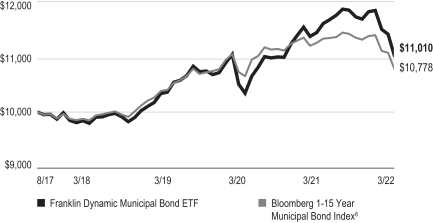

Franklin Dynamic Municipal Bond ETF Formerly, Franklin Liberty Federal Intermediate

Tax-Free Bond Opportunities ETF |

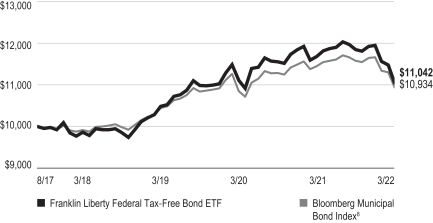

Franklin Liberty Federal Tax-Free Bond ETF |

Franklin Liberty High Yield Corporate ETF |

|

Franklin Liberty International Aggregate Bond ETF |

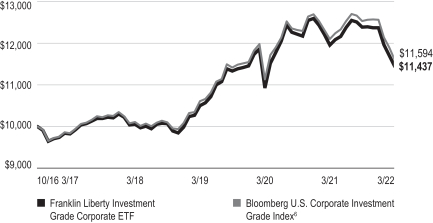

Franklin Liberty Investment Grade Corporate ETF |

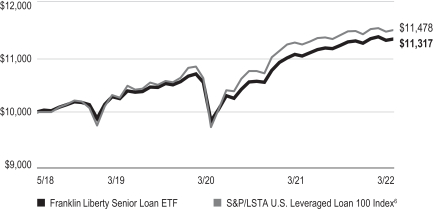

Franklin Liberty Senior Loan ETF |

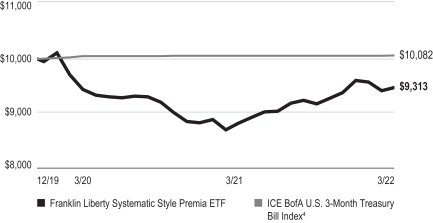

Franklin Liberty Systematic Style Premia ETF |

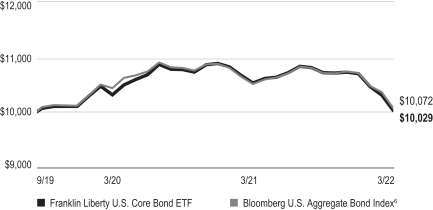

Franklin Liberty U.S. Core Bond ETF |

Franklin Liberty U.S. Low Volatility ETF |

Franklin Liberty U.S. Treasury Bond ETF |

Franklin Liberty Ultra Short Bond ETF |

| | | | | | | | |

| Not FDIC Insured | | | | | May Lose Value | | | | | No Bank Guarantee |

Visit franklintempleton.com for fund updates and documents, or to find helpful financial planning tools.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 1 |

ANNUAL REPORT

Franklin Disruptive Commerce ETF

This annual report for Franklin Disruptive Commerce ETF covers the fiscal year ended March 31, 2022.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in equity securities, predominantly common stock, of companies that are relevant to the Fund’s investment theme of disruptive commerce. These companies include those that are focused on, or that the investment manager believes will benefit from, electronic commerce, auctions, the sharing economy, electronic payment capabilities, drop shipping, direct marketing, significant decreases in transport and delivery costs and other activities or developments, as outlined in more detail in the Prospectus.

Performance Overview

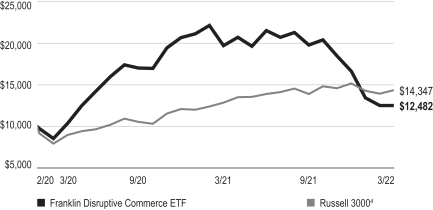

During the 12-month period, the Fund posted cumulative total returns of -36.61% based on market price and -36.59% based on net asset value (NAV). In comparison, the Russell 3000® Index, which measures the performance of the largest 3,000 U.S. companies representing the majority of the U.S. market’s total capitalization, posted a +11.92% cumulative total return for the same period.1 You can find more of the Fund’s performance data in the Performance Summary beginning on page 4.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Economic and Market Overview

U.S. equities, as measured by the Standard & Poor’s® 500 Index (S&P 500®), posted a +15.65% total return for the 12 months ended March 31, 2022.1 Stocks benefited from the continued economic recovery, implementation of COVID-19 vaccination programs and easing pandemic restrictions. Higher wages and strong household balance sheets contributed to

| | | | |

| Portfolio Composition | | | |

| |

| 3/31/22 | | | |

| |

| | | % of Total Net Assets | |

Internet & Direct Marketing Retail | | | 22.5% | |

IT Services | | | 17.6% | |

Software | | | 10.6% | |

Hotels, Restaurants & Leisure | | | 6.8% | |

Interactive Media & Services | | | 6.6% | |

Trading Companies & Distributors | | | 5.5% | |

Food & Staples Retailing | | | 4.9% | |

Specialty Retail | | | 4.6% | |

Entertainment | | | 4.2% | |

Equity Real Estate Investment Trusts (REITs) | | | 3.4% | |

Commercial Services & Supplies | | | 2.1% | |

Other | | | 8.8% | |

Short-Term Investments & Other Net Assets | | | 2.4% | |

increased consumer spending, particularly on goods. A rebound in corporate earnings and the passage of a bipartisan infrastructure bill further bolstered investor sentiment. However, elevated demand combined with supply chain disruptions led to the highest inflation since 1982. Russia’s invasion of Ukraine late in the 12-month period injected further uncertainty into financial markets, provoking significant volatility in commodity and equity prices. Rising interest rates also pressured stocks, as borrowing costs began to increase from historically low levels.

Gross domestic product growth was robust during most of the period, as strong consumer spending and business investment in growing inventories supported the economy. Both exports and imports increased significantly amid a recovery in industrial production. The continued growth of the economy helped the U.S. to surpass its pre-pandemic output in 2021’s second quarter. However, rising prices precipitated a notable decline in consumer confidence, despite high spending levels.

1. Source: Morningstar. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Schedule of Investments (SOI). The SOI begins on page 100.

| | | | | | | | | | |

| | | | | | |

| 2 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN DISRUPTIVE COMMERCE ETF

| | | | |

| Top 10 Holdings | | | |

| |

| 3/31/22 | | | |

| |

Company

Sector/Industry | | % of Total Net Assets | |

Amazon.com Inc.

Internet & Direct Marketing Retail | | | 11.7% | |

Shopify Inc., A

IT Services | | | 4.9% | |

Adyen NV, ADR

IT Services | | | 4.4% | |

ZoomInfo Technologies Inc., A

Interactive Media & Services | | | 4.1% | |

Costco Wholesale Corp.

Food & Staples Retailing | | | 3.8% | |

Airbnb Inc.

Hotels, Restaurants & Leisure | | | 3.6% | |

Prologis Inc.

Equity Real Estate Investment Trusts (REITs) | | | 3.4% | |

Mastercard Inc., A

IT Services | | | 3.1% | |

Fastenal Co.

Trading Companies & Distributors | | | 2.8% | |

Sea Ltd., ADR

Entertainment | | | 2.7% | |

The inflation rate was notably elevated during the 12-month period amid increased demand and supply chain bottlenecks. Consequently, the personal consumption expenditures index, a measure of inflation, surged during the period, representing the highest 12-month increase in decades. The unemployment rate declined from 6.0% in March 2021 to 3.6% in March 2022 as job openings increased, but a relative lack of available workers fueled wage growth, adding to some investors’ inflation concerns.

In an effort to control inflation, the U.S. Federal Reserve (Fed) raised the federal funds target rate to a range of 0.25%–0.50%, the first such increase since 2018. The Fed noted in its March 2022 meeting that strength in the U.S. job market and continued inflationary pressure, exacerbated by the war in Ukraine, meant it anticipated making further increases to the federal funds target rate. Furthermore, the Fed said it expected to begin reducing its bond holdings at a future meeting.

Investment Strategy

We use fundamental, bottom-up research analysis to identify companies positioned to capitalize on disruptive innovation or that are enabling the further development of the disruptive commerce themes in the markets in which they operate. We evaluate market segments, products, services and business models positioned to benefit significantly from disruptive innovations in commerce relative to broad securities markets,

and we seek to identify the primary beneficiaries of new trends or developments in commerce. We may invest in companies in any economic sector or of any market capitalization and may invest in companies both inside and outside of the U.S., including those in developing or emerging markets. Although we search for investments across a large number of sectors, we expect to concentrate our investments in consumer discretionary-related industries.

Manager’s Discussion

During the reporting period the information technology (IT), consumer discretionary and communication services sectors detracted from absolute performance. In IT, a host of internet commerce-enabling and payment platform companies were among the notable detractors, including Shopify, Block and Adyen. In consumer discretionary, detractors included online game platform and metaverse-based game creator ROBLOX, unique and creative goods global marketplace Etsy and online used car retailer Carvana. In communication services, Singapore-based consumer internet entertainment company Sea, media streaming service Netflix (not held at period-end) and online dating services company Match Group Holdings hurt results.

Turning to contributors, the consumer staples and materials sectors contributed to absolute performance. In consumer staples, contributors included discount retailers Costco Wholesale and Walmart. In materials, Packaging Corp. of America helped performance. Elsewhere, cybersecurity provider Crowdstrike Holdings and business intelligence data provider Zoominfo Technologies also aided results.

Thank you for your participation in Franklin Disruptive Commerce ETF. We look forward to serving your future investment needs.

Matthew J. Moberg, CPA

Portfolio Management Team

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2022, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 3 |

FRANKLIN DISRUPTIVE COMMERCE ETF

Performance Summary as of March 31, 2022

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (2/27/20), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 3/31/22

| | | | | | | | | | | | | | | | |

| | |

| | | Cumulative Total Return1 | | | Average Annual Total Return1 | |

| | | Based on

NAV2 | | | Based on market price3 | | | Based on

NAV2 | | | Based on market price3 | |

1-Year | | | -36.59% | | | | -36.61% | | | | -36.59% | | | | -36.61% | |

Since Inception (2/25/20) | | | +24.82% | | | | +24.94% | | | | +11.16% | | | | +11.21% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 6 for Performance Summary footnotes.

| | | | | | | | | | |

| | | | | | |

| 4 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN DISRUPTIVE COMMERCE ETF

PERFORMANCE SUMMARY

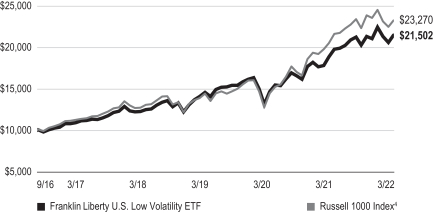

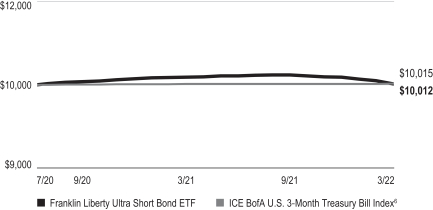

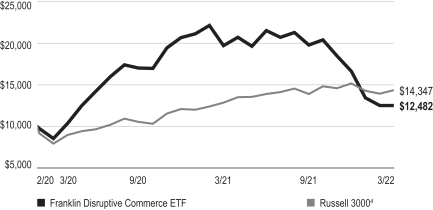

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

2/25/20–3/31/22

See page 6 for Performance Summary footnotes.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 5 |

FRANKLIN DISRUPTIVE COMMERCE ETF

PERFORMANCE SUMMARY

Distributions (4/1/21–3/31/22)

| | | | | | | | |

| | |

Short-Term

Capital Gains | | Long-Term

Capital Gains | | | Total | |

$0.295433 | | | $0.022502 | | | | $0.317935 | |

Total Annual Operating Expenses5

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund’s investment strategies incorporate the identification of thematic investment opportunities and its performance may be negatively impacted if the investment manager does not correctly identify such opportunities or if the theme develops in an unexpected manner. By focusing its investments in consumer discretionary related industries, the Fund carries much greater risks of adverse developments and price movements in such industries than a fund that invests in a wider variety of industries. Companies operating within consumer discretionary related industries could be affected by, among other things, overall economic conditions, interest rates, disposable income, fluctuating consumer confidence and consumer demand. Many of these companies compete aggressively on price, potentially affecting their long run profitability. Companies within consumer discretionary related industries may have extensive online operations, which could make these companies particularly vulnerable to cyber security risk. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. As a non-diversified fund, the Fund may invest in a relatively small number of issuers which may negatively impact the Fund’s performance and result in greater fluctuation in the value of the Fund’s shares. Events such as the spread of deadly diseases, disasters, and financial, political or social disruptions, may heighten risks and adversely affect performance. The Fund’s prospectus also includes a description of the main investment risks.

Russia’s military invasion of Ukraine in February 2022, the resulting responses by the United States and other countries, and the potential for wider conflict could increase volatility and uncertainty in the financial markets and adversely affect regional and global economies. The United States and other countries have imposed broad-ranging economic sanctions on Russia and certain Russian individuals, banking entities and corporations as a response to its invasion of Ukraine. The United States and other countries have also imposed economic sanctions on Belarus and may impose sanctions on other countries that support Russia’s military invasion. These sanctions, as well as any other economic consequences related to the invasion, such as additional sanctions, boycotts or changes in consumer or purchaser preferences or cyberattacks on governments, companies or individuals, may further decrease the value and liquidity of certain Russian securities and securities of issuers in other countries that are subject to economic sanctions related to the invasion.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will reduce returns.

1. Total return calculations represent the cumulative and average annual changes in value of an investment over the period indicated. Return for less than one year, if any, has not been annualized.

2. Assumes reinvestment of distributions based on net asset value.

3. Assumes reinvestment of distributions based on market price.

4. Source: Morningstar. The Russell 3000 Index is market capitalization-weighted and measures the performance of the largest 3,000 U.S. companies representing the majority of the U.S. market’s total capitalization.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | | | | | | | |

| | | | | | |

| 6 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN DISRUPTIVE COMMERCE ETF

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing Fund costs, including management fees and other Fund expenses. All funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 × $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different ETFs. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual (actual return after expenses) | | | Hypothetical (5% annual return before expenses) | | | | |

| | | | | |

Beginning

Account

Value 10/1/21 | | | Ending

Account

Value 3/31/22 | | | Expenses

Paid During

Period

10/1/21–3/31/221,2 | | | Ending

Account

Value 3/31/22 | | | Expenses

Paid During

Period

10/1/21–3/31/221,2 | | | Net Annualized

Expense Ratio2 | |

| | $1,000.00 | | | $ | 631.70 | | | $ | 2.03 | | | $ | 1,022.44 | | | $ | 2.52 | | | | 0.50 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 7 |

Franklin Exponential Data ETF

This annual report for Franklin Exponential Data ETF covers the fiscal year ended March 31, 2022.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in equity securities, predominantly common stock, of companies that are relevant to the Fund’s investment theme of exponential data. These companies include those that are focused on, or that the investment manager believes will benefit from, the use of large data sets and/or growth of data, including systems, services, hardware, software and other digital and physical infrastructure related to data products or services, as outlined in more detail in the Prospectus.

Performance Overview

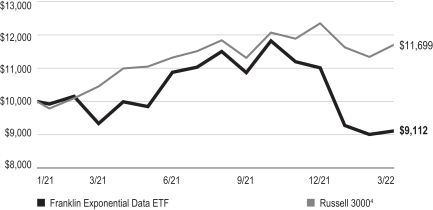

During the 12-month period, the Fund posted cumulative total returns of -2.40% based on market price and net asset value (NAV). In comparison, the Russell 3000® Index, which measures the performance of the largest 3,000 U.S. companies representing the majority of the U.S. market’s total capitalization, posted a +11.92% cumulative total return for the same period.1 You can find more of the Fund’s performance data in the Performance Summary beginning on page 10.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Economic and Market Overview

U.S. equities, as measured by the Standard & Poor’s 500 Index (S&P 500), posted a +15.65% total return for the 12 months ended March 31, 2022.1 Stocks benefited from the continued economic recovery, implementation of COVID-19 vaccination programs and easing pandemic restrictions. Higher wages and strong household balance sheets contributed to increased consumer spending, particularly on goods. A rebound in corporate earnings and the passage of a

| | | | |

| Portfolio Composition | | | |

| |

| 3/31/22 | | | |

| |

| | | % of Total Net Assets | |

Software | | | 46.2 | |

IT Services | | | 21.7 | |

Interactive Media & Services | | | 10.7 | |

Equity Real Estate Investment Trusts (REITs) | | | 7.6 | |

Capital Markets | | | 5.9 | |

Communications Equipment | | | 2.1 | |

Wireless Telecommunication Services | | | 2.0 | |

Other | | | 4.4 | |

Short-Term Investments & Other Net Assets | | | (0.6) | |

bipartisan infrastructure bill further bolstered investor sentiment. However, elevated demand combined with supply chain disruptions led to the highest inflation since 1982. Russia’s invasion of Ukraine late in the 12-month period injected further uncertainty into financial markets, provoking significant volatility in commodity and equity prices. Rising interest rates also pressured stocks, as borrowing costs began to increase from historically low levels.

Gross domestic product growth was robust during most of the period, as strong consumer spending and business investment in growing inventories supported the economy. Both exports and imports increased significantly amid a recovery in industrial production. The continued growth of the economy helped the U.S. to surpass its pre-pandemic output in 2021’s second quarter. However, rising prices precipitated a notable decline in consumer confidence, despite high spending levels.

The inflation rate was notably elevated during the 12-month period amid increased demand and supply chain bottlenecks. Consequently, the personal consumption expenditures index, a measure of inflation, surged during the period, representing the highest 12-month increase in decades. The unemployment rate declined from 6.0% in March 2021 to 3.6% in March 2022 as job openings increased, but a relative lack of available workers fueled wage growth, adding to some investors’ inflation concerns.

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Schedule of Investments (SOI). The SOI begins on page 104.

| | | | | | | | | | |

| | | | | | |

| 8 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN EXPONENTIAL DATA ETF

| | | | |

| Top 10 Holdings | | | |

| |

| 3/31/22 | | | |

| |

Company

Sector/Industry | | % of Total Net Assets | |

Alphabet Inc., A

Interactive Media & Services | | | 6.8% | |

Datadog Inc., A

Software | | | 5.8% | |

Microsoft Corp.

Software | | | 5.0% | |

MongoDB Inc.

IT Services | | | 4.9% | |

Fortinet Inc.

Software | | | 4.5% | |

Cloudflare Inc., A

IT Services | | | 4.3% | |

Zscaler Inc.

Software | | | 4.2% | |

Snowflake Inc., A

IT Services | | | 4.0% | |

ZoomInfo Technologies Inc., A

Interactive Media & Services | | | 3.8% | |

Palo Alto Networks Inc.

Software | | | 3.8% | |

In an effort to control inflation, the U.S. Federal Reserve (Fed) raised the federal funds target rate to a range of 0.25%–0.50%, the first such increase since 2018. The Fed noted in its March 2022 meeting that strength in the U.S. job market and continued inflationary pressure, exacerbated by the war in Ukraine, meant it anticipated making further increases to the federal funds target rate. Furthermore, the Fed said it expected to begin reducing its bond holdings at a future meeting.

Investment Strategy

We use fundamental, bottom-up research analysis to identify companies positioned to capitalize on innovations in or that are enabling the further development of the exponential data theme in the markets in which they operate. We evaluate market segments, products, services and business models positioned to benefit significantly from innovations in data products or services or the commercialization of data relative to the broad equities market, and we seek to identify the primary beneficiaries of new trends or developments in exponential data. We may invest in companies in any economic sector or of any market capitalization and may invest in companies both inside and outside of the U.S., including those in developing or emerging markets. Although we search for investments across a large number of sectors, we expect to concentrate our investments in information technology-related industries.

Manager’s Discussion

During the reporting period, the real estate sector contributed to absolute results. Within the sector, contributors included data center and communications infrastructure REITs SBA Communications, Equinix and Crown Castle International. Elsewhere, cybersecurity companies Fortinet and Palo Alto Networks also helped results.

Turning to detractors, the communication services, health care and information technology (IT) sectors hurt absolute performance. In communication services, detractors included social media company Pinterest (not held at period-end), digital entertainment company Roku (not held at period-end) and social media company Twitter (not held at period-end). In health care, chemical simulation software company Schrodinger (not held at period-end) and biosimulation software provider Certara hurt returns. In IT, detractors included online telecommunications company Twilio, software development platform provider Gitlab and collaboration and workflow tool provider Monday.com.

Thank you for your participation in Franklin Exponential Data ETF. We look forward to serving your future investment needs.

Matthew J. Moberg, CPA

Portfolio Manager

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2022, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 9 |

FRANKLIN EXPONENTIAL DATA ETF

Performance Summary as of March 31, 2022

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (1/14/21), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 3/31/22

| | | | | | | | | | | | | | | | |

| | |

| | | Cumulative Total Return1 | | | Average Annual Total Return1 | |

| | | Based on

NAV2 | | | Based on

market price3 | | | Based on

NAV2 | | | Based on

market price3 | |

1-Year | | | -2.40% | | | | -2.40% | | | | -2.40% | | | | -2.40% | |

Since Inception (1/12/21) | | | -8.88% | | | | -8.76% | | | | -7.38% | | | | -7.28% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 12 for Performance Summary footnotes.

| | | | | | | | | | |

| | | | | | |

| 10 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN EXPONENTIAL DATA ETF

PERFORMANCE SUMMARY

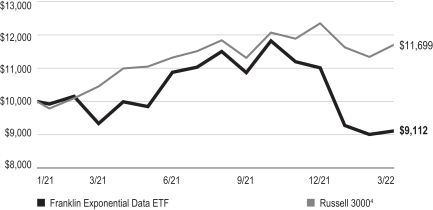

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

1/12/21–3/31/22

See page 12 for Performance Summary footnotes.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 11 |

FRANKLIN EXPONENTIAL DATA ETF

PERFORMANCE SUMMARY

Total Annual Operating Expenses5

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund’s investment strategies incorporate the identification of thematic investment opportunities and its performance may be negatively impacted if the investment manager does not correctly identify such opportunities or if the theme develops in an unexpected manner. By focusing its investments in information technology related industries, the Fund carries much greater risks of adverse developments and price movements in such industries than a Fund that invests in a wider variety of industries. Companies operating within information technology related industries may be affected by worldwide technological developments, the success of their products and services (which may be outdated quickly), anticipated products or services that are delayed or cancelled, and investor perception of the company and/or its products or services. These companies typically face intense competition and potentially rapid product obsolescence. They may also have limited product lines, markets, financial resources or personnel. Technology companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. There can be no assurance these companies will be able to successfully protect their intellectual property to prevent the misappropriation of their technology, or that competitors will not develop technology that is substantially similar or superior to such companies’ technology. These companies typically engage in significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Technology companies are also potential targets for cyberattacks, which can have a materially adverse impact on the performance of these companies. In addition, companies operating within the technology sector may develop and/or utilize artificial intelligence. Artificial intelligence technology could face increasing regulatory scrutiny in the future, which may limit the development of this technology and impede the growth of companies that develop and/or utilize this technology. Similarly, the collection of data from consumers and other sources could face increased scrutiny as regulators consider how the data is collected, stored, safeguarded and used. The customers and/or suppliers of technology companies may be concentrated in a particular country, region or industry. Any adverse event affecting one of these countries, regions or industries could have a negative impact on these companies. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. As a non-diversified fund, the Fund may invest in a relatively small number of issuers and, as a result, be subject to greater risk of loss with respect to its portfolio securities. Events such as the spread of deadly diseases, disasters, and financial, political or social disruptions, may heighten risks and adversely affect performance. The Fund’s prospectus also includes a description of the main investment risks.

Russia’s military invasion of Ukraine in February 2022, the resulting responses by the United States and other countries, and the potential for wider conflict could increase volatility and uncertainty in the financial markets and adversely affect regional and global economies. The United States and other countries have imposed broad-ranging economic sanctions on Russia and certain Russian individuals, banking entities and corporations as a response to its invasion of Ukraine. The United States and other countries have also imposed economic sanctions on Belarus and may impose sanctions on other countries that support Russia’s military invasion. These sanctions, as well as any other economic consequences related to the invasion, such as additional sanctions, boycotts or changes in consumer or purchaser preferences or cyberattacks on governments, companies or individuals, may further decrease the value and liquidity of certain Russian securities and securities of issuers in other countries that are subject to economic sanctions related to the invasion.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will reduce returns.

1. Total return calculations represent the cumulative and average annual changes in value of an investment over the period indicated. Return for less than one year, if any, has not been annualized.

2. Assumes reinvestment of distributions based on net asset value.

3. Assumes reinvestment of distributions based on market price.

4. Source: Morningstar. The Russell 3000 Index is market capitalization-weighted and measures the performance of the largest 3,000 U.S. companies representing the majority of the U.S. market’s total capitalization.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | | | | | | | |

| | | | | | |

| 12 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN EXPONENTIAL DATA ETF

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing Fund costs, including management fees and other Fund expenses. All funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual (actual return after expenses) | | | Hypothetical (5% annual return before expenses) | | | | |

| | | | | |

Beginning

Account

Value 10/1/21 | | | Ending

Account

Value 3/31/22 | | | Expenses

Paid During

Period

10/1/21–3/31/221,2 | | | Ending

Account

Value 3/31/22 | | | Expenses

Paid During

Period

10/1/21–3/31/221,2 | | | Net Annualized

Expense Ratio2 | |

| | $1,000.00 | | | $ | 838.70 | | | $ | 2.29 | | | $ | 1,022.44 | | | $ | 2.52 | | | | 0.50 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 13 |

Franklin Genomic Advancements ETF

This annual report for Franklin Genomic Advancements ETF covers the fiscal year ended March 31, 2022.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in equity securities, predominantly common stock, of companies that are relevant to the Fund’s investment theme of genomic advancements. These companies include those that are focused on, that the investment manager believes will benefit from, extending and enhancing the quality of human and animal life through technological or scientific advancements in such areas as genetic engineering, gene therapy, genome analysis and other uses, as outlined in more detail in the Prospectus.

Performance Overview

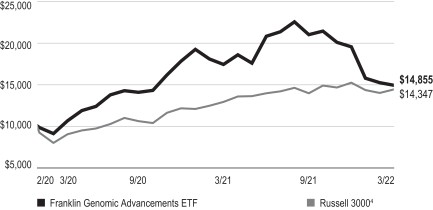

During the 12-month period, the Fund posted cumulative total returns of -14.64% based on market price and -14.26% based on net asset value (NAV). In comparison, the Russell 3000® Index, which measures the performance of the largest 3,000 U.S. companies representing the majority of the U.S. market’s total capitalization, posted a +11.92% cumulative total return for the same period.1 You can find more of the Fund’s performance data in the Performance Summary beginning on page 16.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Economic and Market Overview

U.S. equities, as measured by the Standard & Poor’s 500 Index (S&P 500), posted a +15.65% total return for the 12 months ended March 31, 2022.1 Stocks benefited from the continued economic recovery, implementation of COVID-19 vaccination programs and easing pandemic restrictions.

| | | | |

| Portfolio Composition | | | |

| |

| 3/31/22 | | | |

| |

| | | % of Total Net Assets | |

Life Sciences Tools & Services | | | 55.7% | |

Biotechnology | | | 16.7% | |

Pharmaceuticals | | | 12.5% | |

Health Care Equipment & Supplies | | | 3.1% | |

Semiconductors & Semiconductor Equipment | | | 2.9% | |

Equity Real Estate Investment Trusts (REITs) | | | 2.5% | |

Other | | | 3.5% | |

Short-Term Investments & Other Net Assets | | | 3.1% | |

Higher wages and strong household balance sheets contributed to increased consumer spending, particularly on goods. A rebound in corporate earnings and the passage of a bipartisan infrastructure bill further bolstered investor sentiment. However, elevated demand combined with supply chain disruptions led to the highest inflation since 1982. Russia’s invasion of Ukraine late in the 12-month period injected further uncertainty into financial markets, provoking significant volatility in commodity and equity prices. Rising interest rates also pressured stocks, as borrowing costs began to increase from historically low levels.

Gross domestic product growth was robust during most of the period, as strong consumer spending and business investment in growing inventories supported the economy. Both exports and imports increased significantly amid a recovery in industrial production. The continued growth of the economy helped the U.S. to surpass its pre-pandemic output in 2021’s second quarter. However, rising prices precipitated a notable decline in consumer confidence, despite high spending levels.

The inflation rate was notably elevated during the 12-month period amid increased demand and supply chain bottlenecks. Consequently, the personal consumption expenditures index, a measure of inflation, surged during the period, representing the highest 12-month increase in decades. The unemployment rate declined from 6.0% in March 2021 to 3.6% in

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Schedule of Investments (SOI). The SOI begins on page 107.

| | | | | | | | | | |

| | | | | | |

| 14 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN GENOMIC ADVANCEMENTS ETF

| | | | |

| Top 10 Holdings | | | |

| |

| 3/31/22 | | | |

| |

Company

Sector/Industry | | % of Total

Net Assets | |

Thermo Fisher Scientific Inc.

Life Sciences Tools & Services | | | 6.3% | |

Repligen Corp.

Life Sciences Tools & Services | | | 5.7% | |

Danaher Corp.

Life Sciences Tools & Services | | | 4.1% | |

AstraZeneca PLC, ADR

Pharmaceuticals | | | 4.0% | |

Intellia Therapeutics Inc.

Biotechnology | | | 4.0% | |

Catalent Inc.

Pharmaceuticals | | | 4.0% | |

Bruker Corp.

Life Sciences Tools & Services | | | 3.6% | |

Agilent Technologies Inc.

Life Sciences Tools & Services | | | 3.5% | |

Lonza Group AG

Life Sciences Tools & Services | | | 3.3% | |

Avantor Inc.

Life Sciences Tools & Services | | | 3.3% | |

March 2022 as job openings increased, but a relative lack of available workers fueled wage growth, adding to some investors’ inflation concerns.

In an effort to control inflation, the U.S. Federal Reserve (Fed) raised the federal funds target rate to a range of 0.25%–0.50%, the first such increase since 2018. The Fed noted in its March 2022 meeting that strength in the U.S. job market and continued inflationary pressure, exacerbated by the war in Ukraine, meant it anticipated making further increases to the federal funds target rate. Furthermore, the Fed said it expected to begin reducing its bond holdings at a future meeting.

Investment Strategy

We use fundamental, bottom-up research analysis to identify companies positioned to capitalize on disruptive innovation or are enabling the further development of the genomic advancements theme in the markets in which they operate. We evaluate market segments, products, services and business models positioned to benefit significantly from advancements in genomics relative to broad securities markets, and we seek to identify the primary beneficiaries of new trends or developments in genomics. We may invest in companies in any economic sector or of any market capitalization and may invest in companies both inside and outside of the U.S., including those in developing or emerging markets.

Although we search for investments across a large number of sectors, we expect to concentrate our investments in health care-related industries.

Manager’s Discussion

During the reporting period, the health care sector, which makes up a vast majority of the Fund’s portfolio, detracted from absolute performance. Within the sector, detractors included Natera (not held at period-end), a diagnostic company that develops and commercializes molecular testing services, Sartorius, a pharmaceutical and laboratory equipment supplier, and Guardant Health (not held at period-end), a cancer screening company. Repligen, which develops materials used in the manufacture of biological drugs, and Pacific Biosciences of California (not held at period-end), a gene sequencing equipment developer, also hurt results.

Turning to contributors, the information technology sector helped absolute returns due to the contribution of chipmaker NVIDIA. Elsewhere, contributors included therapeutics and vaccine developer Moderna, immunotherapy developer BioNTech and pharmaceuticals and biotechnology manufacturer Lonza Group.

Thank you for your participation in Franklin Genomic Advancements ETF. We look forward to serving your future investment needs.

Matthew J. Moberg, CPA

Portfolio Manager

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2022, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 15 |

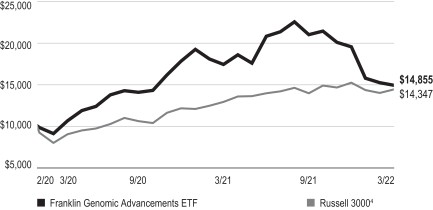

FRANKLIN GENOMIC ADVANCEMENTS ETF

Performance Summary as of March 31, 2022

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (2/27/20), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 3/31/22

| | | | | | | | | | | | | | | | |

| | |

| | | Cumulative Total Return1 | | | Average Annual Total Return1 | |

| | | Based on

NAV2 | | | Based on

market price3 | | | Based on

NAV2 | | | Based on

market price3 | |

1-Year | | | -14.26% | | | | -14.64% | | | | -14.26% | | | | -14.64% | |

Since Inception (2/25/20) | | | +48.55% | | | | +48.22% | | | | +20.78% | | | | +20.66% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 18 for Performance Summary footnotes.

| | | | | | | | | | |

| | | | | | |

| 16 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN GENOMIC ADVANCEMENTS ETF

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

2/25/20–3/31/22

See page 18 for Performance Summary footnotes.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 17 |

FRANKLIN GENOMIC ADVANCEMENTS ETF

PERFORMANCE SUMMARY

Distributions (4/1/21–3/31/22)

|

|

Net Investment

Income |

$0.118083 |

Total Annual Operating Expenses5

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund’s investment strategies incorporate the identification of thematic investment opportunities and its performance may be negatively impacted if the investment manager does not correctly identify such opportunities or if the theme develops in an unexpected manner. By focusing its investments in health care related industries, the Fund carries much greater risks of adverse developments and price movements in such industries than a fund that invests in a wider variety of industries. Companies operating within health care related industries face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. These companies typically engage in significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful, or that competitors will not develop technology that is substantially similar or superior to such companies’ technology. The field of genomic science could face increasing regulatory scrutiny in the future, which may limit the development of this technology and impede the growth of companies that develop and/or utilize this technology. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. As a non-diversified fund, the Fund may invest in a relatively small number of issuers which may negatively impact the Fund’s performance and result in greater fluctuation in the value of the Fund’s shares. Events such as the spread of deadly diseases, disasters, and financial, political or social disruptions, may heighten risks and adversely affect performance. The Fund’s prospectus also includes a description of the main investment risks.

Russia’s military invasion of Ukraine in February 2022, the resulting responses by the United States and other countries, and the potential for wider conflict could increase volatility and uncertainty in the financial markets and adversely affect regional and global economies. The United States and other countries have imposed broad-ranging economic sanctions on Russia and certain Russian individuals, banking entities and corporations as a response to its invasion of Ukraine. The United States and other countries have also imposed economic sanctions on Belarus and may impose sanctions on other countries that support Russia’s military invasion. These sanctions, as well as any other economic consequences related to the invasion, such as additional sanctions, boycotts or changes in consumer or purchaser preferences or cyberattacks on governments, companies or individuals, may further decrease the value and liquidity of certain Russian securities and securities of issuers in other countries that are subject to economic sanctions related to the invasion.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will reduce returns.

1. Total return calculations represent the cumulative and average annual changes in value of an investment over the period indicated. Return for less than one year, if any, has not been annualized.

2. Assumes reinvestment of distributions based on net asset value.

3. Assumes reinvestment of distributions based on market price.

4. Source: Morningstar. The Russell 3000 Index is market capitalization-weighted and measures the performance of the largest 3,000 U.S. companies representing the majority of the U.S. market’s total capitalization.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | | | | | | | |

| | | | | | |

| 18 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN GENOMIC ADVANCEMENTS ETF

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing Fund costs, including management fees and other Fund expenses. All funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual (actual return after expenses) | | | Hypothetical (5% annual return before expenses) | | | | |

| | | | | |

Beginning

Account

Value 10/1/21 | | | Ending

Account

Value 3/31/22 | | | Expenses

Paid During

Period

10/1/21–3/31/221,2 | | | Ending

Account

Value 3/31/22 | | | Expenses

Paid During

Period

10/1/21–3/31/221,2 | | | Net Annualized

Expense Ratio2 | |

| | $1,000.00 | | | $ | 709.60 | | | $ | 2.13 | | | $ | 1,022.44 | | | $ | 2.52 | | | | 0.50 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 19 |

Franklin Intelligent Machines ETF

This annual report for Franklin Intelligent Machines ETF covers the fiscal year ended March 31, 2022.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in equity securities, predominantly common stock, of companies that are relevant to the Fund’s investment theme of intelligent machines. These companies include those that are focused on, or that the investment manager believes will benefit from, the ongoing technology-driven transformation of products, software, systems and machinery as well as product design, manufacture, logistics, distribution and maintenance, including through developments in artificial intelligence, as outlined in more detail in the Prospectus.

Performance Overview

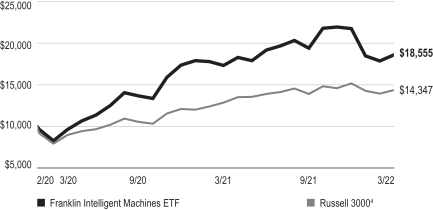

During the 12-month period, the Fund posted cumulative total returns of +6.80% based on market price and +7.27% based on net asset value (NAV). In comparison, the Russell 3000® Index, which measures the performance of the largest 3,000 U.S. companies representing the majority of the U.S. market’s total capitalization, posted a +11.92% cumulative total return for the same period.1 You can find more of the Fund’s performance data in the Performance Summary beginning on page 22.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Economic and Market Overview

U.S. equities, as measured by the Standard & Poor’s 500 Index (S&P 500), posted a +15.65% total return for the 12 months ended March 31, 2022.1 Stocks benefited from the continued economic recovery, implementation of COVID-19 vaccination programs and easing pandemic restrictions. Higher wages and strong household balance sheets

| | | | |

| Portfolio Composition | | | |

| |

| 3/31/22 | | | |

| |

| | | % of Total

Net Assets | |

Semiconductors & Semiconductor Equipment | | | 32.5% | |

Software | | | 16.4% | |

Health Care Equipment & Supplies | | | 13.3% | |

Electronic Equipment, Instruments & Components | | | 9.7% | |

Automobiles | | | 9.1% | |

Technology Hardware, Storage & Peripherals | | | 6.4% | |

Aerospace & Defense | | | 2.6% | |

Other | | | 7.5% | |

Short-Term Investments & Other Net Assets | | | 2.5% | |

contributed to increased consumer spending, particularly on goods. A rebound in corporate earnings and the passage of a bipartisan infrastructure bill further bolstered investor sentiment. However, elevated demand combined with supply chain disruptions led to the highest inflation since 1982. Russia’s invasion of Ukraine late in the 12-month period injected further uncertainty into financial markets, provoking significant volatility in commodity and equity prices. Rising interest rates also pressured stocks, as borrowing costs began to increase from historically low levels.

Gross domestic product growth was robust during most of the period, as strong consumer spending and business investment in growing inventories supported the economy. Both exports and imports increased significantly amid a recovery in industrial production. The continued growth of the economy helped the U.S. to surpass its pre-pandemic output in 2021’s second quarter. However, rising prices precipitated a notable decline in consumer confidence, despite high spending levels.

The inflation rate was notably elevated during the 12-month period amid increased demand and supply chain bottlenecks. Consequently, the personal consumption expenditures index, a measure of inflation, surged during the period, representing the highest 12-month increase in decades. The unemployment rate declined from 6.0% in March 2021 to 3.6% in

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Schedule of Investments (SOI). The SOI begins on page 110.

| | | | | | | | | | |

| | | | | | |

| 20 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN INTELLIGENT MACHINES ETF

| | | | |

| Top 10 Holdings | | | |

| |

| 3/31/22 | | | |

| |

Company

Sector/Industry | | % of Total

Net Assets | |

Tesla Inc.

Automobiles | | | 8.8% | |

NVIDIA Corp.

Semiconductors & Semiconductor Equipment | | | 6.9% | |

Apple Inc.

Technology Hardware, Storage & Peripherals | | | 6.4% | |

Intuitive Surgical Inc.

Health Care Equipment & Supplies | | | 5.7% | |

ASML Holding NV

Semiconductors & Semiconductor Equipment | | | 3.8% | |

Synopsys Inc.

Software | | | 3.5% | |

Taiwan Semiconductor Manufacturing Co. Ltd., Sponsored ADR

Semiconductors & Semiconductor Equipment | | | 3.0% | |

DexCom Inc.

Health Care Equipment & Supplies | | | 2.9% | |

The Descartes Systems Group Inc.

Software | | | 2.9% | |

Axon Enterprise Inc. Aerospace & Defense | | | 2.6% | |

March 2022 as job openings increased, but a relative lack of available workers fueled wage growth, adding to some investors’ inflation concerns.

In an effort to control inflation, the U.S. Federal Reserve (Fed) raised the federal funds target rate to a range of 0.25%–0.50%, the first such increase since 2018. The Fed noted in its March 2022 meeting that strength in the U.S. job market and continued inflationary pressure, exacerbated by the war in Ukraine, meant it anticipated making further increases to the federal funds target rate. Furthermore, the Fed said it expected to begin reducing its bond holdings at a future meeting.

Investment Strategy

We use fundamental, bottom-up research analysis to identify companies positioned to capitalize on disruptive innovation in or are enabling the further development of the intelligent machines theme in the markets in which they operate. We evaluate market segments, products, services and business models positioned to benefit significantly from disruptive innovations in intelligent products, design, manufacturing and/or predictive maintenance relative to broad securities markets, and we seek to identify the primary beneficiaries of new trends or developments in physical applications of these innovations. We may invest in companies in any economic

sector or of any market capitalization and may invest in companies both inside and outside of the U.S., including those in developing or emerging markets. Although we search for investments across a large number of sectors, we expect to have significant investments in particular sectors, including technology.

Manager’s Discussion

During the reporting period, sectors that contributed to the Fund’s absolute performance included information technology (IT), health care and consumer discretionary. In IT, contributors included semiconductor manufacturer NVIDIA, consumer technology firm Apple and semiconductor-design software company Synopsys. In health care, contributors included Intuitive Surgical, a robotic surgical tools manufacturer, DexCom, a blood sugar monitoring device company, and Inspire Medical Systems, a developer of implantable neurostimulation systems to treat obstructive sleep apnea. In consumer discretionary, electric vehicle maker Tesla helped returns.

Turning to detractors, the industrials and materials sectors detracted from absolute performance. In industrials, detractors included custom manufacturer Proto Labs (not held at period-end), autonomous freight network company Tusimple Holdings (not held at period-end) and unmanned aerial vehicle company Aerovironment (not held at period-end). In materials, chemicals company SK IE Technology (not held at period-end) hurt results. Elsewhere, electric vehicle maker and auto technology company Rivian Automotive (not held at period-end) also hurt performance.

Thank you for your participation in Franklin Intelligent Machines ETF. We look forward to serving your future investment needs.

Matthew J. Moberg, CPA

Portfolio Manager

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2022, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 21 |

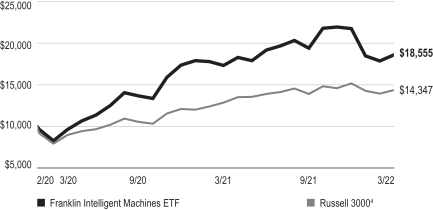

FRANKLIN INTELLIGENT MACHINES ETF

Performance Summary as of March 31, 2022

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (2/27/20), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 3/31/22

| | | | | | | | | | | | | | | | |

| | |

| | | Cumulative Total Return1 | | | Average Annual Total Return1 | |

| | | Based on

NAV2 | | | Based on

market price3 | | | Based on

NAV2 | | | Based on

market price3 | |

1-Year | | | +7.27% | | | | +6.80% | | | | +7.27% | | | | +6.80% | |

Since Inception (2/25/20) | | | +85.55% | | | | +84.87% | | | | +34.30% | | | | +34.07% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 24 for Performance Summary footnotes.

| | | | | | | | | | |

| | | | | | |

| 22 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN INTELLIGENT MACHINES ETF

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

2/25/20–3/31/22

See page 24 for Performance Summary footnotes.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 23 |

FRANKLIN INTELLIGENT MACHINES ETF

PERFORMANCE SUMMARY

Distributions (4/1/21–3/31/22)

| | | | | | | | |

| | |

Short-Term

Capital Gains | | Long-Term

Capital Gains | | | Total | |

$0.031956 | | | $0.062060 | | | | $0.094016 | |

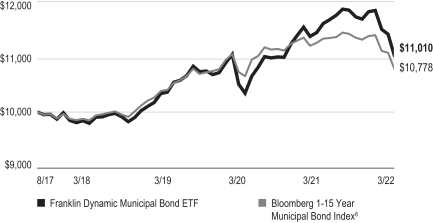

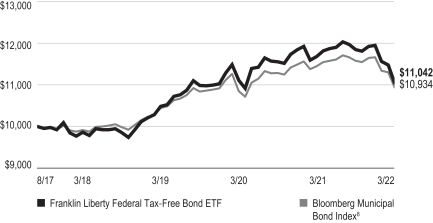

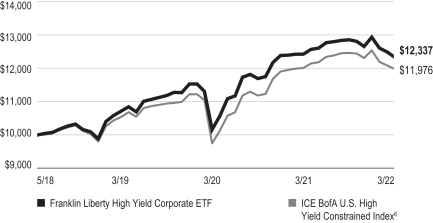

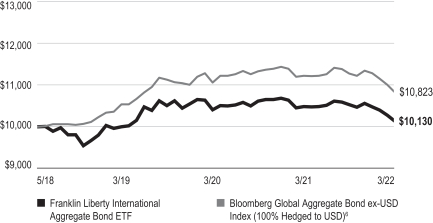

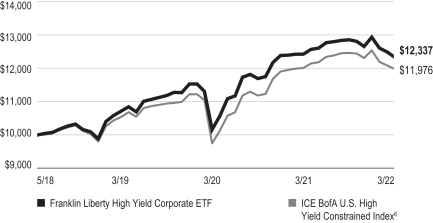

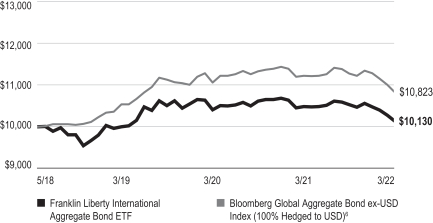

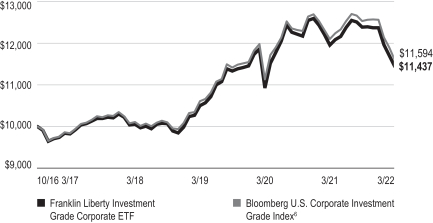

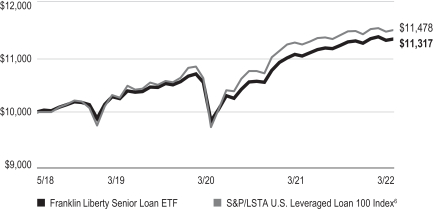

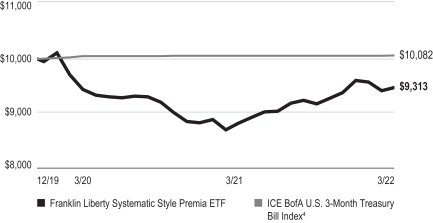

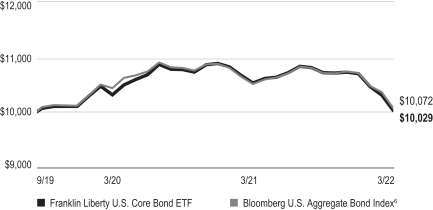

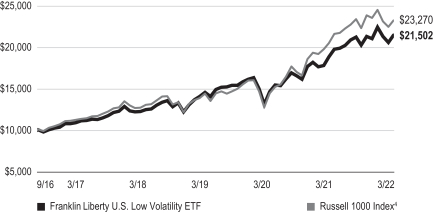

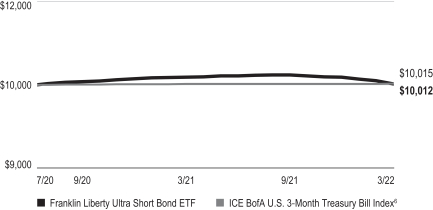

Total Annual Operating Expenses5