- ITRM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

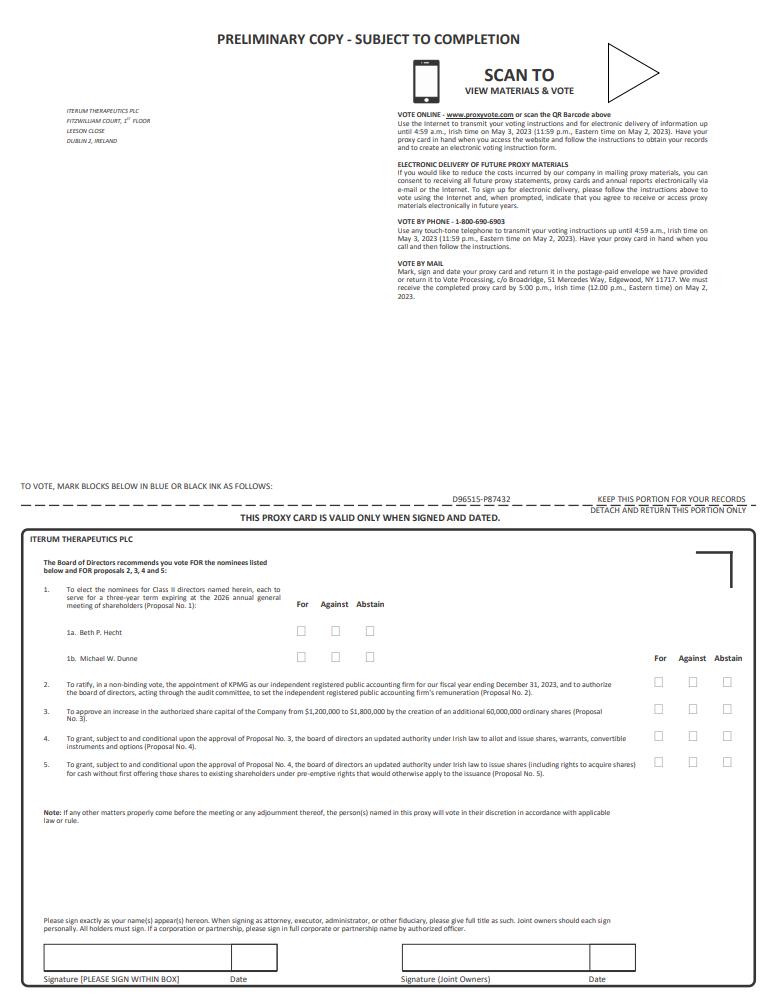

PRE 14A Filing

Iterum Therapeutics (ITRM) PRE 14APreliminary proxy

Filed: 6 Mar 23, 8:50am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ |

| Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box:

☒ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

Iterum Therapeutics plc

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY COPY – Subject to Completion

March [ ], 2023

Dear Iterum Therapeutics plc Shareholder,

You are cordially invited to the 2023 Annual General Meeting of Shareholders to be held at 3 Dublin Landings, North Wall Quay, Dublin 1, Ireland on May 3, 2023 at 3.00 p.m., Irish time (10.00 a.m., Eastern Time). The enclosed notice of Annual General Meeting of Shareholders sets forth the proposals that will be presented at the meeting, which are described in more detail in the proxy statement.

At this year’s Annual General Meeting, we will ask shareholders to:

Our board of directors unanimously recommends a vote “FOR” Proposal Nos. 1 to 5 as set forth in the proxy statement.

We hope that you will participate in the meeting by voting through acceptable means as described in this proxy statement as promptly as possible. Your vote is important – so please exercise your right.

Sincerely,

____________________________

Corey N. Fishman

President and Chief Executive Officer

This proxy statement, the enclosed proxy card, our 2022 annual report to shareholders and our Irish Statutory Financial Statements for the fiscal year ended December 31, 2022 are being made available to shareholders on or about March [ ], 2023.

PRELIMINARY COPY – Subject to Completion

ITERUM THERAPEUTICS PLC

Fitzwilliam Court, 1st Floor

Leeson Close

Dublin 2

Ireland

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be held on May 3, 2023

The 2023 Annual General Meeting of Shareholders (the “AGM”) of Iterum Therapeutics plc, an Irish public limited company (the “Company”), will be held on May 3, 2023, beginning at 3.00 p.m., Irish time (10.00 a.m., Eastern Time), at 3 Dublin Landings, North Wall Quay, Dublin 1, Ireland to consider and act upon the following matters:

Proposal Nos. 1, 2, 3, and 4 above are ordinary resolutions requiring a simple majority of the votes cast at the meeting to be approved. Proposal No. 5 above is a special resolution requiring at least 75% of the votes cast at the meeting to be approved. All proposals are more fully described in this proxy statement. There is no requirement under Irish law that the Company's Irish Statutory Financial Statements for the fiscal year ended December 31, 2022, or the directors' and auditor's reports thereon be approved by the shareholders, and no such approval will be sought at the AGM.

Shareholders of record at the close of business on March 13, 2023 will be entitled to notice of and to vote at the AGM or any adjournment or postponement thereof. Instead of mailing a printed copy of our proxy materials to all of our shareholders, we provide access to these materials to many of our shareholders via the Internet, in accordance with rules adopted by the Securities and Exchange Commission. If you received only a Notice of Internet Availability of Proxy Materials, or Notice, by mail or e-mail, you will not receive a paper copy of the proxy materials unless you request one. Instead, the Notice will provide you with instructions on how to access and view the proxy materials on the Internet. The Notice will also instruct you as to how you may access your proxy card to vote online or by telephone. If you received a Notice by mail or e-mail and would like to receive a paper copy of our proxy materials, free of charge, please follow the instructions included in the Notice. The Notice is being mailed to our shareholders on or about March [ ], 2023 and sent by e-mail to our shareholders who have opted for such means of delivery on or about March [ ], 2023.

By order of the Board of Directors,

_________________________

Louise Barrett

Secretary

Dublin, Ireland

March [ ], 2023

YOU MAY OBTAIN ADMISSION TO THE AGM BY IDENTIFYING YOURSELF AT THE AGM AS A SHAREHOLDER AS OF THE RECORD DATE. IF YOU ARE A RECORD OWNER, POSSESSION OF A COPY OF A PROXY CARD WILL BE ADEQUATE IDENTIFICATION. IF YOU ARE A BENEFICIAL (BUT NOT RECORD) OWNER, A "LEGAL PROXY" OR A COPY OF AN ACCOUNT STATEMENT FROM YOUR BANK, BROKER OR OTHER NOMINEE SHOWING SHARES HELD FOR YOUR BENEFIT ON MARCH 13, 2023 WILL BE ADEQUATE IDENTIFICATION.

WHETHER OR NOT YOU EXPECT TO ATTEND THE AGM, PLEASE SUBMIT YOUR VOTING INSTRUCTIONS VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS SET FORTH ON THE ENCLOSED PROXY CARD OR, IF YOU RECEIVED A PRINTED COPY OF THE PROXY MATERIALS, BY COMPLETING, DATING AND SIGNING THE ENCLOSED PROXY CARD AND MAILING IT PROMPTLY IN THE PROVIDED ENVELOPE. TO HELP ENSURE REPRESENTATION OF YOUR SHARES AT THE AGM, NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED STATES.

A SHAREHOLDER ENTITLED TO ATTEND AND VOTE AT THE AGM IS ENTITLED, USING THE PROXY CARD PROVIDED (OR IN THE FORM IN SECTION 184 OF THE IRISH COMPANIES ACT 2014), TO APPOINT ONE OR MORE PROXIES TO ATTEND, SPEAK AND VOTE INSTEAD OF HIM OR HER AT THE AGM. A PROXY NEED NOT BE A SHAREHOLDER OF RECORD.

TABLE OF CONTENTS

| Page |

8 | |

11 | |

13 | |

22 | |

30 | |

34 | |

35 | |

36 | |

39 | |

50 | |

50 | |

A-53 |

PRELIMINARY COPY – Subject to Completion

ITERUM THERAPEUTICS PLC

Fitzwilliam Court, 1PstP Floor

Leeson Close

Dublin 2

Ireland

PROXY STATEMENT FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 3, 2023 AT 3 Dublin Landings, North Wall Quay, Dublin 1, IRELAND

Important Notice Regarding the Availability of Proxy Materials

for the Annual General Meeting of Shareholders

to be held on May 3, 2023

This proxy statement, our 2022 annual report to shareholders

and our Irish Statutory Financial Statements for the year ended December 31, 2022 are available at

https://central.proxyvote.com/pv/web

for viewing, downloading and printing.

A copy of our Annual Report on Form 10-K for the year ended December 31, 2022 as filed with the Securities and Exchange Commission, or SEC, except for exhibits, and our Irish Statutory Financial Statements for the year ended December 31, 2022 will be furnished without charge to any shareholder upon written or oral request to the Company at Fitzwilliam Court, 1st Floor, Leeson Close, Dublin 2, Ireland, Attention: Secretary, Telephone: +353 1 9038354.

Instead of mailing a printed copy of our proxy materials to all of our shareholders, we provide access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials as well as the costs associated with mailing these materials to all shareholders. Accordingly, on or about March [ ], 2023, we will mail a Notice of Internet Availability of Proxy Materials, or Notice, to our shareholders (other than those who previously requested electronic or paper delivery of proxy materials), directing shareholders to a website where they can access our proxy materials, including this proxy statement, our 2022 annual report to shareholders and our Irish Statutory Financial Statements for the year ended December 31, 2022, and view instructions on how to vote via the Internet or by telephone. If you would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice.

INFORMATION ABOUT THE annual general meeting and voting

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors (the "board of directors" or the "board") of Iterum Therapeutics plc (the "Company," "Iterum," "we" or "us") for use at the Annual General Meeting of Shareholders (the "AGM") to be held on May 3, 2023, beginning at 3.00 p.m., Irish time (10.00 a.m., Eastern Time), at 3 Dublin Landings, North Wall Quay, Dublin 1, Ireland and at any adjournment or postponement thereof. On March 13, 2023, the record date for the determination of shareholders entitled to vote at the AGM, there were issued, outstanding and entitled to vote an aggregate of [ ] of our ordinary shares, nominal value $0.01 per share ("ordinary shares"). Each ordinary share entitles the record holder thereof to one vote on each of the matters to be voted on at the AGM.

We have engaged Georgeson LLC, ("Georgeson"), to assist with the solicitation of proxies on our behalf. Please contact Georgeson with any queries at +1-800-457-0759.

Your vote is important no matter how many shares you own. Please take the time to vote. Take a moment to read the instructions below. Choose the way to vote that is easiest and most convenient for you and cast your vote as soon as possible.

If you are the "record holder" of your shares, meaning that you own your shares in your own name and not through a bank, broker or other nominee, you may vote in one of four ways:

All proxies that are executed and delivered by mail or in person or are otherwise submitted online or by telephone will be voted on the matters set forth in the accompanying Notice of Annual General Meeting of Shareholders in accordance with the shareholders' instructions. However, if no choice is specified on a proxy as to one or more of the proposals, the proxy will be voted in accordance with the board of directors' recommendations on such proposals as set forth in this proxy statement. All proxies will be forwarded to the Company's registered office electronically.

After you have submitted a proxy, you may still change your vote and revoke your proxy prior to the AGM by doing any one of the following things:

Your attendance at the AGM alone will not revoke your proxy.

If the shares you own are held in "street name" by a bank, broker or other nominee record holder, which we collectively refer to in this proxy statement as "brokerage firms," your brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. To vote your shares, you will need to follow the directions your brokerage firm provides you. Many brokerage firms also offer the option of voting over the Internet or by telephone, instructions for which, if available, would be provided by your brokerage firm on the voting instruction form that it delivers to you. Because many brokerage firms are member organizations of the New York Stock Exchange (“NYSE”), the rules of the NYSE will likely govern how your brokerage firm would be permitted to vote your shares in the absence of instruction from you. Under the current rules of the NYSE, if you do not give instructions to your brokerage firm, it may still be able to vote your shares with respect to certain "discretionary" items but will not be allowed to vote your shares with respect to certain “non-discretionary” items. Proposal No. 2 (ratification of KPMG as our independent registered public accounting firm), Proposal No. 3 (authorized share capital increase), Proposal No. 4 (directors' allotment authority), and Proposal No. 5 (pre-emption rights opt-out proposal) are all discretionary items under NYSE rules and your brokerage firm may be able to vote on that item even if it does not receive instruction from you, so long as it holds your shares in its name. Proposal No. 1 (election of the Class II directors) is a “non-discretionary” item, meaning that if you do not instruct your brokerage firm on how to vote with respect to Proposal No. 1, your brokerage firm will not vote with respect to such proposal and your shares will be counted as “broker non-votes”. “Broker non-votes” are shares that are held in “street name” by a brokerage firm that indicates in its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

If your shares are held in street name, you must bring an account statement from your brokerage firm showing that you are the beneficial owner of the shares as of the record date (March 13, 2023) to be admitted to the AGM. To be able to vote your shares held in street name at the AGM, you will need to request a "legal proxy" from the bank, broker or nominee.

Votes Required

One or more Members (as defined in the Company’s Constitution) whose name is entered in the register of members of the Company as a registered holder of the Company's ordinary shares, present in person or by proxy (whether or not such Member actually exercises his voting rights in whole, in part or at all) holding not less than a majority of the issued and outstanding ordinary shares of the Company entitled to vote at the AGM, will constitute a quorum for the transaction of business at the AGM. Ordinary shares represented in person or by proxy (including “broker non-votes” (as described above) and shares which abstain or do not vote with respect to one or more of the matters presented for shareholder approval) will be counted for the purposes of determining whether a quorum is present at the AGM. The following votes are required for approval of the proposals being presented at the AGM:

Proposal No. 1: To elect the Class II directors. The affirmative vote of the holders of ordinary shares representing a majority of the votes cast on the matter and voting affirmatively or negatively is required for the election of a director nominee.

Proposal No. 2: To ratify, in a non-binding vote, the appointment of KPMG to serve as our independent registered public accounting firm for the fiscal year ended December 31, 2023 and to authorize the board of directors, acting through the audit committee, to set the independent registered public accounting firm’s remuneration. The affirmative vote of the holders of ordinary shares representing a majority of the votes cast on the matter and voting affirmatively or negatively is required for the ratification of the appointment of KPMG as our independent registered public accounting firm for the current fiscal year and to authorize the board of directors, acting through the audit committee, to set the independent registered public accounting firm’s remuneration.

Proposal No. 3: To approve an increase in the authorized share capital of the Company from $1,200,000 to $1,800,000 by the creation of an additional 60,000,000 ordinary shares. The affirmative vote of the holders of ordinary shares representing a majority of the votes cast on the matter and voting affirmatively or negatively is required for the approval of an increase in the authorized share capital of the Company from $1,200,000 to $1,800,000 by the creation of an additional 60,000,000 ordinary shares.

Proposal No. 4: If Proposal No. 3 is approved, to grant the board of directors an updated authority under Irish law to allot and issue shares, warrants, convertible instruments and options. The affirmative vote of the holders of ordinary shares representing a majority of the votes cast on the matter and voting affirmatively or negatively is required in order to grant the board of directors an updated authority under Irish law to allot and issue shares, warrants, convertible instruments and options.

Proposal No. 5: If Proposal No. 4 is approved, to grant the board of directors an updated authority under Irish law to issue shares (including rights to acquire shares) for cash without first offering those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance. The affirmative vote of the holders of ordinary shares representing at least 75% of the votes cast on the matter and voting affirmatively or negatively is required in order to grant the board of directors an updated authority under Irish law to issue shares (including rights to acquire shares) for cash without first offering those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance.

Shares that abstain from voting as to a particular matter and shares held in "street name" by brokerage firms who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter will not be counted as votes in favor of such matter and will also not be counted as shares voting on such matter. Accordingly, abstentions and "broker non-votes" will have no effect on the voting on the proposals referenced above.

share ownership of certain beneficial owners and management

The following table sets forth information with respect to the beneficial ownership of our ordinary shares as of February 28, 2023 by:

Beneficial ownership is determined according to the rules of the Securities and Exchange Commission (the “SEC”) and generally means that a person has beneficial ownership of a security if he, she, or it possesses sole or shared voting or investment power of that security, including share options that are exercisable within 60 days of February 28, 2023, restricted share units that vest within 60 days of February 28, 2023, shares issuable upon exercise of warrants within 60 days of February 28, 2023, and shares issuable upon exchange of our outstanding 6.500% exchangeable senior subordinated notes due 2025 (the “Exchangeable Notes”) (assuming physical settlement), which are exchangeable within 60 days of February 28, 2023. Our ordinary shares issuable pursuant to share options, restricted share units, warrants and Exchangeable Notes, but not taking into account any additional ordinary shares issuable to satisfy accrued and unpaid interest due upon exchange of any Exchangeable Notes, are deemed outstanding for computing the percentage of the person holding such share options, restricted share units, warrants or Exchangeable Notes and the percentage of any group of which the person is a member, but are not deemed outstanding for computing the percentage of any other person. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons named in the table below have sole voting and investment power with respect to all ordinary shares shown that they beneficially own, subject to community property laws where applicable. The information does not necessarily indicate beneficial ownership for any other purpose, including for purposes of Section 13(d) and 13(g) of the Securities Act of 1933, as amended. Percentage ownership is based on 12,705,961 ordinary shares outstanding on February 28, 2023. Except as otherwise set forth below, the address of the beneficial owner is c/o Iterum Therapeutics plc, Fitzwilliam Court, 1st Floor, Leeson Close, Dublin 2, Ireland.

| Number of Shares Beneficially Owned |

|

| Percentage of Shares Beneficially Owned |

| ||

Directors and Named Executive Officers: |

|

|

|

|

| ||

Corey N. Fishman(1) |

| 54,488 |

|

| * |

| |

Michael Dunne, MD(2) |

| 40,712 |

|

| * |

| |

Judith M. Matthews(3) |

| 11,810 |

|

| * |

| |

Sailaja Puttagunta(4) |

| 44,969 |

|

| * |

| |

Brenton K. Ahrens(5) |

| 16,747 |

|

| * |

| |

Mark Chin |

| 2,453 |

|

| * |

| |

Beth P. Hecht |

| 2,986 |

|

| * |

| |

Ronald M. Hunt(6) |

| 369,136 |

|

|

| 2.8 | % |

David G. Kelly(7) |

| 11,186 |

|

| * |

| |

All current executive officers and directors as a group (9 persons)(8)) |

| 554,487 |

|

|

| 4.2 | % |

Principal Shareholders(9) | - |

|

| - |

| ||

|

|

|

|

|

| ||

* less than 1% |

|

|

|

|

| ||

(1) Consists of (a) 35,799 shares beneficially owned by Mr. Fishman, (b) 4,356 shares issuable to Mr. Fishman pursuant to share options exercisable within 60 days of February 28, 2023; (c) 14,333 shares issuable to Mr. Fishman pursuant to restricted share units that vest within 60 days of February 28, 2023. |

| ||||||

|

|

|

|

|

|

|

|

(2) Consists of (a) 36,336 shares beneficially owned by Dr. Dunne, (b) 3,077 shares issuable to Dr. Dunne pursuant to warrants exercisable within 60 days of February 28, 2023; and (c) 1,299 shares issuable to Dr. Dunne pursuant to restricted share units that vest within 60 days of February 28, 2023. |

| ||||||

|

|

|

|

|

|

|

|

(3) Consists of (a) 4,352 shares beneficially owned by Ms. Matthews, (b) 792 shares issuable to Ms. Matthews pursuant to share options exercisable within 60 days of February 28, 2023; and (c) 6,666 shares issuable to Ms. Matthews pursuant to restricted share units that vest within 60 days of February 28, 2023. |

| ||||||

|

| ||||||

(4) Consists of (a) 4,969 shares beneficially owned by Dr. Puttagunta, and (b) 40,000 shares issuable to Dr. Puttagunta pursuant to share options exercisable within 60 days of February 28, 2023. |

| ||||||

|

|

|

|

|

|

|

|

(5) Consists of (a) 410 shares beneficially owned by Mr. Ahrens, and (b) 16,337 shares issuable to Mr. Ahrens pursuant to share options exercisable within 60 days of February 28, 2023. |

| ||||||

|

|

|

|

|

|

|

|

(6) Consists of (a) 4,030 shares beneficially owned by Mr. Hunt, (b) 749 shares issuable to Mr. Hunt pursuant to share options exercisable within 60 days of February 28, 2023; (c) 2,041 shares issuable to Mr. Hunt pursuant to restricted share units that vest within 60 days of February 28, 2023; and (d) (i) 71,445 shares reported as beneficially owned by New Leaf Venture III, L.P. (“NLV-III”), New Leaf Venture Associates III, L.P. (“NLVA-III LP”) and New Leaf Venture Management III, L.L.C. (“NLVM-III LLC”), of which each such entity reports sole voting power with respect to 71,445 shares, shared voting power with respect to zero shares, sole dispositive power with respect to 71,445 shares and shared dispositive power with respect to zero shares, (ii) 25,641 shares held by New Leaf Biopharma Opportunities II, L.P. (“NBPO-II”), New Leaf BPO Associates II, L.P. (“NBPO-IIA”) and New Leaf BPO Management II, L.L.C. (“NBPO-IIM”), of which each such entity reports sole voting power with respect to 25,641 shares, shared voting power with respect to zero shares, sole dispositive power with respect to 25,641 shares and shared dispositive power with respect to zero shares, and (iii) 195,209 shares issuable to NLV-III and 70,021 shares issuable to NBPO-II on exchange of the Exchangeable Notes held by them and exchangeable within 60 days of February 28, 2023 (assuming physical settlement). NLVA-III LP is the general partner of NLV-III and NLVM-III LLC is the general partner of NLVA-III LP. NBPO-IIA is the general partner of NBPO-II and NBPO-IIM is the general partner of NBPO-IIA. Mr. Hunt, a member of our board of directors, and Vijay K. Lathi are individual managers of NLVM-III LLC and individual managers of NPBO-IIM, and as a result may be deemed to have shared power to vote and dispose of these shares. The address for each of the reporting persons other than Vijay K. Lathi is c/o New Leaf Venture Partners, 420 Lexington Avenue, Suite 408, New York, NY 10170. The address for Vijay K. Lathi is c/o New Leaf Venture Partners, 2730 Sand Hill Road, Suite 110, Menlo Park, CA 94025. We obtained certain of the information regarding beneficial ownership of these shares from Schedule 13D/A that was filed with the SEC on February 21, 2021. |

| ||||||

|

|

|

|

|

|

|

|

(7) Consists of (a) 2,473 shares beneficially owned by Mr. Kelly and (b) 8,713 shares issuable to Mr. Kelly pursuant to share options exercisable within 60 days of February 28, 2023. |

| ||||||

|

|

|

|

|

|

|

|

(8) Includes (a) 190,894 shares held by the current directors and executive officers and their affiliates, (b) 70,947 shares issuable to the current directors and executive officers pursuant to share options exercisable within 60 days of February 28, 2023, (c) 3,077 shares issuable to the current directors pursuant to warrants exercisable within 60 days of February 28, 2023, (d) 265,230 shares issuable to affiliates of current directors on exchange of the Exchangeable Notes within 60 days of February 28, 2023 (assuming physical settlement); and (e) 24,339 shares issuable to current directors and executive officers pursuant to restricted share units that vest within 60 days of February 28, 2023. |

| ||||||

|

|

|

|

|

|

|

|

(9) To our knowledge, except as noted above, no person or entity is the beneficial owner of more than 5% of the voting power of our ordinary shares as of February 28, 2023. |

| ||||||

Management and CORPORATE GOVERNANCE matters

Board of Directors

Our business and affairs are managed under the direction of our board of directors. Our Articles of Association (the “Articles of Association”) provide that the number of directors shall not be less than two (2) nor more than thirteen (13), with the exact number to be determined by the board. Our board currently consists of seven (7) members divided among three classes with staggered three-year terms as follows:

In February 2023, our board of directors accepted the recommendation of the nominating and corporate governance committee and voted to nominate Ms. Hecht for election at the AGM for a term of three years to serve until the 2026 annual general meeting of shareholders subject to her earlier death, resignation, retirement, disqualification or removal. After discussion with Mr. Ahrens, our nominating and corporate governance committee chose not to recommend Mr. Ahrens, whose current term will expire at the AGM, for re-election due to Mr. Ahrens' other commitments outside of our Company and in the context of the time required to commit to service to our Company. The decision not to renominate Mr. Ahrens was not due to any disagreement with the Company or the refusal by Mr. Ahrens to stand for re-election.

To ensure that the number of directors in each class is maintained as equal as possible following the AGM, the board accepted the recommendation of the nominating and corporate governance committee to change Dr. Dunne's designation from Class III director to Class II director subject to Dr. Dunne’s election as a Class II director at the AGM and consequently the board of directors voted to nominate Dr. Dunne for election at the AGM for a term of three years to serve until the 2026 annual general meeting of shareholders subject to his earlier death, resignation, retirement, disqualification or removal. In connection with his nomination as a Class II director, Dr. Dunne will tender a conditional resignation as a Class III director, which will become effective only if he is elected as a Class II director at the AGM. If Dr. Dunne is not elected as a Class II director at the AGM, he will continue to serve as a Class III director until the annual meeting of shareholders to be held in 2024.

Continuing Members of and Current Members who are Nominated for Election to our Board of Directors

Set forth below are the names of each continuing member of, and the current members who are nominated for election to, our board of directors, their ages, their principal occupation and business experience for at least the past five years and the names of other public companies of which each director has served as a director during the past five years, in each case as of February 28, 2023. Additionally, set forth below is information about the specific experiences, qualifications, attributes or skills that led our board of directors to the conclusion on suitability of each person to serve as a director.

Name |

| Age |

| Position |

Corey N. Fishman |

| 58 |

| Director, President and Chief Executive Officer |

Mark Chin (1)(2) |

| 41 | | Director |

Michael W. Dunne |

| 63 |

| Director |

Ronald M. Hunt (1)(3) |

| 58 |

| Director |

David G. Kelly (2)(3) |

| 62 |

| Director |

Beth P. Hecht (1)(2) |

| 59 |

| Director |

(1) Member of the compensation committee | ||||

(2) Member of the audit committee | ||||

(3) Member of the nominating and corporate governance committee | ||||

Corey N. Fishman has served as our President and Chief Executive Officer and as a member of our board of directors since November 2015. From August 2010 to February 2015, Mr. Fishman served as chief operating officer of Durata Therapeutics, Inc., a pharmaceutical company acquired by Actavis plc, a pharmaceutical company, and he also served as chief financial officer of Durata Therapeutics, Inc., from June 2012 to February 2015. From 2008 to 2010, Mr. Fishman served as chief financial officer of GANIC Pharmaceuticals, Inc., a pharmaceutical company. From 2002 to 2008, Mr. Fishman served in a variety of roles

at MedPointe Healthcare, Inc., a specialty pharmaceutical company acquired by Meda AB, including as chief financial officer from 2006 to 2008. Mr. Fishman previously served on the board of directors of Momenta Pharmaceuticals, Inc., a biotechnology company, from September 2016 until June 2020 and BioSpecifics Technology Corporation, a biopharmaceutical company, from April 2020 until its acquisition by Endo International plc in December 2020. Mr. Fishman holds a B.A. in economics from the University of Illinois at Urbana-Champaign and an M.S.M. in finance from the Krannert School of Management at Purdue University. We believe Mr. Fishman is qualified to serve on our board of directors due to his role as a founder of our Company, his deep knowledge of our Company and his extensive background in the pharmaceutical industry.

Mark Chin has served as a member of our board of directors since May 2017. Since July 2021, Mr. Chin has served as a managing director at Arix Bioscience plc, a life science investment company. From August 2016 to April 2020, Mr. Chin served as an investment manager at Arix Bioscience plc, a life science investment company. From September 2012 to July 2016, Mr. Chin served as a principal at Longitude Capital LLC, a healthcare venture capital firm. From January 2011 to September 2012, Mr. Chin served as a consultant with the Boston Consulting Group. Mr. Chin currently serves on the board of Harpoon Therapeutics, Inc., a clinical-stage immunotherapy company and Disc Medicine, Inc., a clinical-stage biopharmaceutical company, and serves on a number of other private pharmaceutical and healthcare company boards. Mr. Chin served on the board of directors of Imara Inc., a clinical-stage hematology company, from March 2019 until February 2023 upon its acquisition by Enliven Inc. Mr. Chin has a B.S. in management science from the University of California at San Diego, an M.B.A. from the Wharton School at the University of Pennsylvania and an M.S. in biotechnology from the University of Pennsylvania. We believe Mr. Chin is qualified to serve on our board of directors due to his investment experience in biotechnology and medical technology industries.

Michael W. Dunne has served as a member of our board of directors since December 2020. Since December 2020 Dr. Dunne has served as the chief medical officer at the Gates Medical Research Institute. Previously, Dr. Dunne served as our chief scientific officer from November 2015 to December 2020 and served as a consultant for us until March 31, 2022 and has served as a consultant for one of our wholly-owned subsidiaries since December 2020. From November 2014 until September 2015, Dr. Dunne was vice president of research and development at Actavis plc. From September 2010 to October 2014, Dr. Dunne served as chief medical officer of Durata Therapeutics, Inc., where he previously served as acting chief medical officer on a consulting basis from December 2009 to September 2010. From 1992 to 2009, Dr. Dunne served in a variety of roles in connection with the clinical development of numerous infectious disease compounds at Pfizer Inc., a biopharmaceutical company, including as the vice president, therapeutic area head of development for infectious disease from 2001 to 2009. Dr. Dunne served as a member of the board of directors of Aviragen Therapeutics, Inc, a biotechnology company from 2015 to 2018. Dr. Dunne holds a B.A. in economics from Northwestern University and an M.D. from the State University of New York Health Sciences Center. He completed his internal medicine residency and fellowships in infectious diseases and pulmonary medicine at Yale University School of Medicine. We believe Dr. Dunne is qualified to serve on our board of directors due to his role as co-founder of the Company, his deep knowledge of our Company and his extensive background and medical experience in infectious disease.

Beth P. Hecht has served as a member of our board of directors since March 2021. Since October 2021, Ms. Hecht has served as chief legal officer and corporate secretary of Xeris Biopharma Holdings Inc., a specialty pharmaceutical company. From January 2019 to October 2021, Ms. Hecht served as senior vice president, general counsel and corporate secretary of Xeris Pharmaceuticals, Inc., a specialty pharmaceutical company. From October 2012 to December 2018, Ms. Hecht served as managing director and chief legal and administrative officer for Auven Therapeutics Management L.L.P., a global biotechnology and pharmaceutical private equity firm. Ms. Hecht previously served on the board of directors of Neos Therapeutics, Inc. a pharmaceutical company, from September 2015 until its acquisition by Aytu BioPharma Inc., formerly Aytu Bioscience, Inc., in March 2021 and also served on the board of directors of Aytu BioScience Inc. from March 2021 until May 2021. Ms. Hecht is a graduate of Amherst College and Harvard Law School and started her career as an attorney specializing in intellectual property and corporate transactions at Willkie Farr & Gallagher (New York) and then Kirkland & Ellis (New York). We believe Ms. Hecht is qualified to serve on our board of directors due to her extensive experience in the pharmaceutical industry and her service on the boards of directors of other pharmaceutical companies.

Ronald M. Hunt has served as a member of our board of directors since November 2015. Since 2005, Mr. Hunt has served as a managing director and member of New Leaf Venture Partners, L.L.C., a venture capital firm. Previously, Mr. Hunt served as a partner at the Sprout Group, a venture capital firm, and was a consultant with consulting firms Coopers & Lybrand Consulting and The Health Care Group. Mr. Hunt also previously served in various sales and marketing positions at Johnson & Johnson and SmithKline Beecham Pharmaceuticals. Mr. Hunt currently serves as a board member of Harpoon Therapeutics, Inc., a clinical-stage immunotherapy company and Rallybio Corporation, a clinical-stage biotechnology company, and on the boards of a number of

private pharmaceutical and healthcare companies. Mr. Hunt previously served on the board of directors of Neuronetics, Inc. from 2015 to May 2019. Mr. Hunt holds a B.S. from Cornell University and an M.B.A. from the Wharton School of the University of Pennsylvania. We believe Mr. Hunt is qualified to serve on our board of directors due to his investment experience, his experience in the pharmaceuticals industry and his service on the boards of directors of other biopharmaceutical companies.

David G. Kelly has served as a member of our board of directors since August 2016. From September 2014 to January 2020, Mr. Kelly served as the executive vice president, Ireland of Horizon Therapeutics, plc, a biopharmaceutical company. Mr. Kelly served as managing director, Ireland of Horizon Therapeutics, plc until July 2018. From February 2012 to September 2014, Mr. Kelly served as chief financial officer of Vidara Therapeutics Inc., a pharmaceutical company. From May 2005 to January 2012, Mr. Kelly served as chief financial officer of AGI Therapeutics plc, a pharmaceutical company. Mr. Kelly also served as senior vice president, finance and planning of Warner Chilcott plc (formerly Galen Holdings plc), a pharmaceutical company listed on the London Stock Exchange (LSE). In addition, Mr. Kelly held roles at Elan Corporation, a pharmaceutical company, and KPMG. Mr. Kelly holds a B.A. in economics from Trinity College, Dublin and is also a member of the Institute of Chartered Accountants in Ireland (ACA). We believe Mr. Kelly is qualified to serve on our board of directors due to his experience as a senior executive, particularly within the life science industry, including his experience in finance.

Non-Continuing Members of our Board of Directors

Brenton K. Ahrens has served as a member of our board of directors since November 2015 and currently serves on our audit and nominating and corporate governance committees. Mr. Ahrens' tenure on our board of directors will end at the AGM. Mr. Ahrens currently serves as a general partner with Canaan Partners LLP, a venture capital firm.

Composition of the Board of Directors and Meetings

As outlined above, our Articles of Association provide that the number of directors shall not be less than two (2) nor more than thirteen (13), with the exact number to be determined by the board, currently seven (7). Following the AGM, our board of directors will have one vacancy as a result of the expiration of Mr. Ahrens’ term at the AGM. The board of directors plans to reduce its size to six (6) members immediately after the AGM.

Under the Irish Companies Act 2014, and notwithstanding anything contained in our Articles of Association or in any agreement between us and any director, our shareholders may, by an ordinary resolution, remove a director from office before the expiration of his or her term, at a meeting held on no less than 28 days' notice and at which the director is entitled to be heard. Our Articles of Association also provide that the office of a director will be vacated in certain circumstances including if the director resigns his or her office by notice in writing or is requested to resign in writing by not less than a majority of the other directors. Under our Articles of Association, our board of directors has the authority to appoint directors to the board either to fill a vacancy or as an additional director. If the board fills a vacancy, the director will hold this position as a director for a term that will coincide with the remaining term of the relevant class of director.

Board Determination of Independence

Applicable rules of The Nasdaq Stock Market, or Nasdaq, require a majority of a listed company’s board of directors to be comprised of independent directors within one year of listing. In addition, the Nasdaq rules require that within one year of the date of the completion of an initial public offering, all the members of a listed company’s audit, compensation and nominating and corporate governance committees be independent under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Under applicable Nasdaq rules, a director will only qualify as an “independent director” if, in the opinion of the listed company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

In order to be considered independent for purposes of Rule 10A-3 under the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries.

In order to be considered independent for purposes of Rule 10C-1 under the Exchange Act, the board must consider, for each member of a compensation committee of a listed company, all factors specifically relevant to determining whether a director has a relationship to such company which is material to that director's ability to

be independent from management in connection with the duties of a compensation committee member, including, but not limited to: (1) the source of compensation of the director, including any consulting, advisory or other compensatory fee paid by such company to the director; and (2) whether the director is affiliated with the company or any of its subsidiaries or affiliates.

In February 2023, our board of directors undertook a review of the composition of our board of directors and its committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our board of directors has determined that none of Mr. Ahrens, Mr. Chin, Ms. Hecht, Mr. Hunt or Mr. Kelly, representing five of our seven current directors, has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under Rule 5605(a)(2) of the Nasdaq Listing Rules. Mr. Fishman is not an independent director under Rule 5605(a)(2) because he is our President and Chief Executive Officer. Dr. Dunne is not an independent director under Rule 5605(a)(2) because he was an employee of the Company during the prior three years and currently provides consultancy services to a wholly owned subsidiary of the Company. Our board of directors has also determined that Messrs. Kelly, Ahrens and Chin and Ms. Hecht, who comprise our audit committee, Messrs. Hunt and Chin and Ms. Hecht, who comprise our compensation committee, and Messrs. Ahrens, Hunt and Kelly, who comprise our nominating and corporate governance committee, satisfy the independence standards for such committees established by the SEC and Nasdaq. In making such determination, our board of directors considered the relationships that each such non-employee director has with our Company, including the transactions described below in “Certain Relationships and Related Party Transactions”, and all other facts and circumstances that our board of directors deemed relevant in determining his or her independence, including the beneficial ownership of our shares by each non-employee director as described above in “Share Ownership of Certain Beneficial Owners and Management”.

Nasdaq Diversity Matrix

In accordance with Nasdaq's Board Diversity Rule, we have included our board diversity matrix in this proxy statement as set forth below.

Board Diversity Matrix (as of March [ ], 2023) | ||||||||

Total Number of Directors |

| 7 | ||||||

Part I: Gender Identity |

| Female |

| Male |

| Non-Binary |

| Did Not Disclose Gender |

Directors |

| 1 |

| 6 |

| 0 |

| 0 |

Part II: Demographic Background | ||||||||

African American or Black |

| 0 |

| 0 |

|

|

|

|

Alaskan Native or Native American |

| 0 |

| 0 |

|

|

|

|

Asian |

| 0 |

| 1 |

|

|

|

|

Hispanic or Latinx |

| 0 |

| 0 |

|

|

|

|

Native Hawaiian or Pacific Islander |

| 0 |

| 0 |

|

|

|

|

White |

| 1 |

| 5 |

|

|

|

|

Two or More Races or Ethnicities |

| 0 |

| 0 |

|

|

|

|

LGBTQ+ |

| 0 |

| 0 |

|

|

|

|

Did Not Disclose Orientation |

| 0 |

| 0 |

|

|

|

|

Meetings of the Board of Directors

Our board holds at least four regular meetings each year. Directors are expected to attend all meetings of the board and any committees on which they serve.

Our Articles of Association provide that each director and the auditors are entitled to attend and speak at any general meetings of shareholders of the Company. All of our directors attended our annual general meeting of shareholders in 2022.

Our board of directors met 8 times during 2022 and acted by written consent 2 times. During 2022, no incumbent directors attended less than 75% of the aggregate of (i) the total number of meetings of the board and (ii) the total number of meetings of committees of the board on which he/she served, if any.

Board Leadership Structure

Brenton Ahrens, an independent director under applicable Nasdaq rules, currently serves as chairman of our board. Mr. Ahrens’ duties as chairman of the board include determining the frequency and length of board

meetings, recommending when special meetings of the board should be held, preparing or approving the agenda for each board meeting, chairing meetings of the board and of our independent directors, meeting with any director who is not adequately performing his or her duties as a member of the board or any committee of the board, facilitating communications between management and the board of directors, and assisting with other corporate governance matters.

Our board of directors believes that separating the duties of the chairman of the board from the duties of our chief executive officer enhances the board’s oversight of, and independence from, management, while also allowing our chief executive officer to focus on our day-to-day business operations instead of board administration.

Mr. Ahrens' term as director and chairman of our board will expire at the AGM. Ronald Hunt, a current member of our board, who is also an independent director under Nasdaq rules as described above, will fulfill the role of independent chairman following the expiration of Mr. Ahrens' term as director.

Committees of our Board of Directors

Our board of directors has established an audit committee, a compensation committee, and a nominating and corporate governance committee, each of which operates under a charter that has been approved by our board of directors. The charters for each of these committees are available on our website at www.iterumtx.com.

Audit Committee

Our audit committee, which was established in accordance with Section 3(a)(58)(A) of the Exchange Act, consists of David G. Kelly, Brenton K. Ahrens, Mark Chin and Beth P. Hecht. The chairperson of our audit committee is Mr. Kelly. Mr. Ahrens, whose term as director will expire at the AGM, will also cease to be a member of our audit committee after the AGM. The primary purpose of the audit committee is to discharge the responsibilities of our board of directors with respect to our accounting, financial, and other reporting and internal control practices and to oversee our independent registered public accounting firm. Specific responsibilities of our audit committee include:

Our board of directors has determined that Messrs. Kelly, Ahrens and Chin and Ms. Hecht each satisfy the independence standards for such committee established by the SEC and the Nasdaq Stock Market.

Our board of directors has determined that Mr. Kelly is an “audit committee financial expert” within the meaning of SEC regulations. Our board of directors has also determined that each member of our audit committee has the requisite financial expertise required under the applicable requirements of the Nasdaq Stock Market. In arriving at this determination, the board of directors has examined each audit committee member’s scope of experience and the nature of their employment in the corporate finance sector.

Our audit committee met 4 times in 2022.

Compensation Committee

Our compensation committee consists of Ronald M. Hunt, Mark Chin and Beth P. Hecht. The chairperson of our compensation committee is Mr. Hunt.

The primary purpose of our compensation committee is to discharge the responsibilities of our board of directors to oversee our compensation policies, plans and programs and to review and determine the compensation to be paid to our executive officers, directors and other senior management, as appropriate. Specific responsibilities of our compensation committee include:

Our compensation committee met 2 times in 2022 and acted by written consent 4 times in 2022.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Brenton K. Ahrens, Ronald M. Hunt and David G. Kelly. The chairperson of our nominating and corporate governance committee is Mr. Hunt. Mr. Ahrens, whose term as director will expire at the AGM, will also cease to be a member of our nominating and corporate governance committee after the AGM.

Specific responsibilities of our nominating and corporate governance committee include:

Our nominating and corporate governance committee acted by written consent 1 time in 2022.

Board Processes

Oversight of Risk

Our board of directors oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis. The role of our board and its committees is to oversee the risk management activities of management. They fulfill this duty by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices. In general, our board oversees risk management activities relating to business strategy, acquisitions, capital raising and allocation, organizational structure and certain operations risks; our audit committee oversees risk management activities related to financial risk exposures and the steps management has taken to monitor and control these exposures, as well as legal and compliance risks; our nominating and corporate governance committee oversees risk management activities relating to board composition and management succession planning and monitors the effectiveness of our corporate governance guidelines; and our compensation committee oversees risk management activities relating to our compensation policies and practices. Each committee reports to the full board on a regular basis, including reports with respect to the committee’s risk oversight activities as appropriate. In addition, since risk issues often overlap, committees from time to time request that the full board discuss such risks.

Director Nomination Process

Generally, the board will be responsible for nominating directors for election to the board by the Company’s shareholders at the annual general meeting of shareholders and the persons to be elected by the board to fill any vacancies on the board. The nominating and corporate governance committee is responsible for identifying, reviewing and evaluating and recommending to the board candidates to serve as directors of the Company, in accordance with its charter and consistent with the criteria set by the board in our corporate governance guidelines described below under “Corporate Governance Guidelines”. The board believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. In making such recommendations, the nominating and corporate governance committee shall consider candidates proposed by the Company’s shareholders and shall review and evaluate information available to it regarding such candidates and shall apply the same criteria and shall follow substantially the same process in considering them, as it does in considering other candidates. Shareholders may nominate individuals as potential director candidates by submitting their names, together with appropriate biographical information and background materials, and information with respect to the shareholder or group of shareholders making the nomination, including the number of ordinary shares owned by such shareholder or group of shareholders, in writing to the nominating and corporate governance committee, c/o Secretary, Iterum Therapeutics plc, Fitzwilliam Court, 1st Floor, Leeson Close, Dublin 2, Ireland. The nominating and corporate governance committee will evaluate shareholder-recommended candidates by following substantially the same process outlined above.

The nominating and corporate governance committee shall also administer the process outlined in our Articles of Association concerning shareholder nominations for director candidates. Shareholders must follow the formal procedures described in our Articles of Association and in “Shareholder Proposals for 2024 Annual General Meeting of Shareholders” below in connection with any such nomination.

The nominating and corporate governance committee has not adopted a formal diversity policy but will consider issues of diversity among its members in identifying and considering nominees for director as well as age, skill and such other factors as it deems appropriate given the current needs of the board and the Company, to maintain a balance of knowledge, experience and capability.

Corporate Governance Guidelines

Our board of directors has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interest of our Company and shareholders. The guidelines provide that:

A copy of the Corporate Governance Guidelines is publicly available on our website at https://www.iterumtx.com/.

Shareholder Communications to the Board of Directors

Shareholders who have questions or concerns should contact our Investor Relations department at +1 312 778 6073 or by email to IR@iterumtx.com. Shareholders who wish to address questions regarding our business directly with the board of directors, or any individual director, should direct his or her questions in writing to Board of Directors c/o Secretary, Iterum Therapeutics plc, Fitzwilliam Court, 1st Floor, Leeson Close, Dublin 2, Ireland. Communications will be distributed to the board of directors, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communications. Communications will be forwarded to other directors if they relate to substantive matters that the chairman of our board, in consultation with legal counsel, considers appropriate for attention by the other directors. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances or matters as to which we receive repetitive or duplicative communications.

Compensation Committee Interlocks and Insider Participation

During 2022, the members of our compensation committee were Ronald M. Hunt (Chairman), Mark Chin and Beth P. Hecht. No member of our compensation committee is, or has ever been, an officer or employee of our Company. None of our executive officers serve, or have served during the last year, as a member of the board of directors, compensation committee, or other board committee performing equivalent functions of any other entity that has one or more executive officers serving as one of our directors or on our compensation committee.

Executive Officers

The following table sets forth information regarding our executive officers as of February 28, 2023:

Name |

| Age |

| Position |

Corey N. Fishman |

| 58 |

| Director, President and Chief Executive Officer |

Sailaja Puttagunta |

| 54 |

| Chief Medical Officer |

Judith M. Matthews |

| 53 |

| Chief Financial Officer |

In addition to the biographical information for Mr. Fishman, which is set forth above, set forth below is certain biographical information about Dr. Puttagunta and Ms. Matthews:

Dr. Sailaja Puttagunta has served as our Chief Medical Officer since December 2021, and previously served as our Vice President of Clinical Development from January 2016 to December 2018. From October 2019 to December 2021, Dr. Puttagunta served as chief medical officer at BiomX Inc., a public biotechnology company, and from December 2018 to October 2019, she served as chief medical officer of BiomX Ltd. until its merger with BiomX, Inc. in October 2019. From January 2015 to January 2016, Dr. Puttagunta served as vice president of medical affairs at Allergan plc, formerly Actavis plc, a pharmaceutical company. From August 2014 to December 2014, Dr. Puttagunta served as vice president of development and medical affairs at Durata Therapeutics, Inc., a pharmaceutical company, and from June 2012 to July 2014, she served as Durata’s executive director of clinical and medical affairs. From 2006 to May 2012, Dr. Puttagunta served as a medical director at Pfizer Inc., a pharmaceutical company. Dr. Puttagunta graduated from Gandhi Medical College in Hyderabad, India and completed her residency in Internal Medicine and a fellowship in Infectious Diseases at Yale University School of Medicine. She also holds an M.S. in Biochemistry from the New York University School of Medicine.

Judith M. Matthews has served as our Chief Financial Officer since November 2015. From 2012 to February 2015, Ms. Matthews served as vice president of finance at Durata Therapeutics, Inc. From 2009 to 2012, Ms. Matthews served as head of financial planning & analysis at Bally Total Fitness Corporation, a fitness club chain. From 2004 to 2008, Ms. Matthews served as vice president of finance for the Sterno Group, a subsidiary of Blyth,

Inc., a home products company. Ms. Matthews holds a B.A. in accounting from the University of Illinois at Urbana-Champaign and a Master of Management in finance and marketing from the Kellogg School of Management at Northwestern University.

executive officer and director compensation

The following discussion provides details of the compensation and other benefits paid by us and our subsidiaries to certain executive officers for services provided for the years ended December 31, 2022 and 2021 and to the members of our board of directors for services provided for the year ended December 31, 2022.

Executive and Director Compensation Processes

Our executive compensation program is administered by our compensation committee, subject to oversight by our board of directors. Our compensation committee reviews our executive compensation practices on an annual basis and approves, or recommends for approval by the board, the compensation of the Company’s executives.

Our compensation committee periodically reviews and makes recommendations to the board of directors with respect to director compensation. As and when required, our Company has retained the services of Coda Advisors LLC, or Coda, as an independent compensation consultant to provide comparative data on executive compensation practices in our industry and to provide advice to the compensation committee in relation to our executive compensation program. While Coda has provided advice to the Company and the compensation committee in relation to such compensation practices, the compensation committee ultimately makes its own decisions with regard to our executive and director compensation programs.

For the year ended December 31, 2022, the compensation committee reviewed information regarding the independence and potential conflicts of interest of Coda, taking into account, among other things (i) the provision of other services to the Company by Coda; (ii) the amount of fees received by Coda from the Company as a percentage of its total revenue; (iii) Coda’s policies and procedures to prevent conflicts of interest; (iv) any business or personal relationships that Coda has with any member of the compensation committee; (v) any shares held by Coda in the Company; and (vi) any business or personal relationship Coda or Coda employees have with any executive officers of the Company. Based on this review, the compensation committee concluded that the engagement did not raise any conflict of interest.

Executive Officer Summary Compensation Table

The following table provides details of the compensation and other benefits paid or accrued by us and our subsidiaries to our named executive officers for the year ended December 31, 2022, who are our President and Chief Executive Officer, Corey N. Fishman, and our two next most highly compensated executive officers, Dr. Sailaja Puttagunta, our Chief Medical Officer, and Ms. Judith M. Matthews, our Chief Financial Officer:

Name and Principal Position | Year Ended December 31, | Salary |

| Bonus(1) |

| Share Awards(2) |

| Option Awards(2) |

| Non-Equity Incentive Plan Compensation(3) |

| All Other Compensation(4) |

| Total |

| |||||||

Corey N. Fishman | 2022 |

| 588,758 |

|

| 486,906 |

|

| — |

|

| — |

|

| 292,144 |

|

| 4,902 |

|

| 1,372,710 |

|

President and Chief Executive Officer | 2021 |

| 573,000 |

|

| 125,000 |

|

| 688,000 |

| 9,240,000(5) |

|

| 236,363 |

|

| 4,902 |

|

| 10,867,265 |

| |

Sailaja Puttagunta | 2022 |

| 475,000 |

|

| 86,000 |

|

| — |

|

| — |

|

| 192,375 |

|

| 2,519 |

|

| 755,894 |

|

Chief Medical Officer | 2021 |

| 39,583 |

|

| 86,000 |

|

| 240,000 |

|

| 810,000 |

|

| — |

|

| 207 |

|

| 1,175,790 |

|

Judith M. Matthews | 2022 |

| 395,395 |

|

| 238,000 |

|

| — |

|

| — |

|

| 142,800 |

|

| 2,622 |

|

| 778,817 |

|

Chief Financial Officer | 2021 |

| 381,410 |

|

| 50,000 |

|

| 320,000 |

| 3,388,000(5) |

|

| 100,120 |

|

| 2,315 |

|

| 4,241,845 |

| |

(1) The amounts reported in the "Bonus" column for Mr. Fishman and Ms. Matthews reflect certain discretionary cash bonuses paid to our executive officers to incentivize the continued dedication of executives during 2022 and 2021 and the amount reported in the "Bonus" column for Dr. Puttagunta reflects a bonus paid to Dr. Puttagunta within 30 days of the six month anniversary of her commencing employment in accordance with the terms of her offer letter with Iterum Therapeutics US Limited. |

|

(2) The amounts reported do not reflect the amounts actually received by our executive officers. Instead, these amounts reflect the aggregate grant date fair values of restricted share units and share options granted to each of our executive officers during the year ended December 31, 2021 as computed in accordance with Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, 718. Assumptions used in the calculation of these amounts are included in Note 13 to our audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2022. As required by SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. Our executive officers who have received share options will only realize compensation with regard to these share options to the extent the trading price of our ordinary shares is greater than the exercise price of such share options and such share options vest. |

|

(3) Amount represents cash bonuses earned for the 12-month periods ending December 31, 2022 and 2021, respectively. Amounts disclosed for the year ended December 31, 2022 exclude payments made in 2022 for 2021 bonuses. Amounts disclosed for the year ended December 31, 2021 exclude payments made in 2021 for 2020 bonuses. |

|

(4) Includes the dollar value of life insurance premiums paid by the company for the benefit of such executive. |

|

(5) The share options reported were canceled on July 7, 2022 pursuant to share option cancellation agreements entered into with each of Mr. Fishman and Ms. Matthews. |

|

Narrative Disclosure to Executive Officer Summary Compensation Table

Base Salary

During the year ended December 31, 2022, we paid annualized base salaries of $590,190 to Mr. Fishman, $475,000 to Dr. Puttagunta and $396,666 to Ms. Matthews. During the year ended December 31, 2021, we paid annualized base salaries of $573,000 to Mr. Fishman, $475,000 to Dr. Puttagunta and $381,410 to Ms. Matthews.

In January 2023, our compensation committee approved an increase to the annualized base salaries of our executive officers, effective February 1, 2023, as follows: $613,798 for Mr. Fishman, $494,000 for Dr. Puttagunta and $412,533 for Ms. Matthews.

None of the named executive officers are currently party to any employment arrangements that provide for automatic or scheduled increases in base salary.

Non-Equity Incentive Plan Compensation

Our named executive officers participate in a cash bonus program which is tied to the achievement of strategic and corporate goals of the Company, which are approved annually by our compensation committee. Our compensation committee determines the amount of these bonuses, if any, based on its assessment of the named executive officers’ performance and that of the Company against goals established annually.

Under their respective employment agreements, the annual target bonus for Mr. Fishman is 55% of his current base salary, the annual target bonus for Dr. Puttagunta is 45% of her current base salary and the annual target bonus for Ms. Matthews is 40% of her current base salary.

At the beginning of each year, our compensation committee reviews the accomplishments of the named executive officers as measured against the previous year’s goals, whether each goal had been achieved and the relative weight that should be given to each goal in determining the cash bonus payment for that year. Based on its review, the compensation committee recommended cash bonus payments of $292,144 to Mr. Fishman, $192,375 to Dr. Puttagunta and $142,800 to Ms. Matthews with respect to the year ended December 31, 2022. The compensation committee recommended cash bonus payments of $236,363 to Mr. Fishman and $100,120 to Ms. Matthews with respect to the year ended December 31, 2021.

Bonuses

During 2022, the compensation committee also recommended special retention bonus payments for executives of $486,906 to Mr. Fishman and $238,000 to Ms. Matthews on the achievement of certain milestones to incentivize the continued dedication of executives. In connection with her commencement of employment and pursuant to the terms of her employment agreement, Dr. Puttagunta was paid $86,000 within thirty days' of the six month anniversary of her start date.

Equity Incentive Awards

We believe that our ability to grant equity-based awards is a valuable and necessary compensation tool that aligns the long-term financial interests of our executive officers and our shareholders. In addition, we believe

that our ability to grant share options and other equity-based awards helps us to attract, retain and motivate our executive officers and encourages them to devote their best efforts to our business and financial success.

No equity-based awards were granted to executives in 2022. On July 7, 2022, we entered into share option cancellation agreements with each of Mr. Fishman and Ms. Matthews pursuant to which Mr. Fishman and Ms. Matthews agreed to the surrender and cancellation of certain previously granted share options to purchase ordinary shares in order to make available additional shares under our Amended and Restated 2018 Equity Incentive Plan, as amended (the "2018 Plan"). The aggregate number of shares underlying the options surrendered by each such officer was as follows: Mr. Fishman, 8,487 ordinary shares, at an exercise price of $195 per share, 10,000 ordinary shares, at an exercise price of $87 per share and 352,000 ordinary shares, at an exercise price of $30.15 per share; Ms. Matthews, 1,591 ordinary shares, at an exercise price of $195 per share, 2,000 ordinary shares, at an exercise price of $87 per share and 129,066 ordinary shares, at an exercise price of $30.15 per share.

In March 2021, pursuant to powers delegated to it by the board of directors, our compensation committee approved the grant of restricted share units ("RSUs"), under the 2018 Plan, to Mr. Fishman and Ms. Matthews in the following number for services provided: 28,666 to Mr. Fishman and 13,333 to Ms. Matthews. These RSUs vested in the following proportions: (i) 50% on March 11, 2022; and (ii) 50% on March 11, 2023, subject to each such named executive officer’s continued provision of services to us on each vesting date. In March 2021, the compensation committee also approved the grant of share options under the 2018 Plan to Mr. Fishman and Ms. Matthews to purchase the following number of ordinary shares, which grants became effective on June 23, 2021, and which had an exercise price of $30.15 per share: 352,000 to Mr. Fishman and 129,066 to Ms. Matthews. Such share options vest as to 25% of the ordinary shares underlying such share options on the first anniversary of the date of grant based on each such named executive officer’s continued service with us through that date and the remaining 75% of the ordinary shares underlying such share options vest in equal monthly instalments thereafter subject to each such named executive officer’s continued provision of services to us on each vesting date. Pursuant to the share option cancellation agreements described above, Mr. Fishman and Ms. Matthews agreed to the surrender and cancellation of these share options in July 2022.

In connection with Dr. Puttagunta’s employment commencement in December 2021, she was granted (i) an inducement share option award to purchase 120,000 ordinary shares on December 10, 2021, which vested as to 25% of the shares underlying the share option on December 1, 2022 and vests as to an additional 2.0833% of the shares underlying the share option at the end of each successive month following such date until December 1, 2025, and which has an exercise price of $7.27 per share and (ii) an inducement RSU award for 33,333 ordinary shares which vests as to 25% of the shares on each anniversary of the grant date through 2025. These awards were each made as an inducement to employment in accordance with Nasdaq Listing Rule 5635(c)(4) and were granted pursuant to our 2021 Inducement Equity Incentive Plan, (the "2021 Inducement Plan"), and not pursuant to the terms of our 2018 Plan.

In January 2023, the compensation committee approved the grant of share options under the 2018 Plan to Mr. Fishman, Dr. Puttagunta and Ms. Matthews to purchase the following number of ordinary shares, which grants will become effective as of March 31, 2023: 275,000 to Mr. Fishman, 75,000 to Dr. Puttagunta; and 100,000 to Ms. Matthews (the "2023 Share Options"). Such share options will vest as to 33.33% of the ordinary shares underlying such share options on the first anniversary of the date of grant based on each such named executive officer’s continued service with us through that date and the remaining ordinary shares vesting in 24 equal monthly instalments thereafter subject to each such named executive officer’s continued provision of services to us on each vesting date. The compensation committee also approved that in the event of a change of control, the vesting and exercisability of any then-unvested 2023 Share Options held by each of Mr. Fishman, Dr. Puttagunta and Ms. Matthews, will be accelerated in full.

Outstanding Equity Awards at December 31, 2022

The following table presents information regarding outstanding equity awards held by our named executive officers as of December 31, 2022. All equity awards were granted under our 2015 Equity Incentive Plan, our 2018 Plan and our 2021 Inducement Plan.

| Option Awards(1) |

|

| Share Awards(1) |

| ||||||||||||||

Name | Number of |

| Number of |

| Option |

| Option |

|

| Number of |

| Market value of shares or of stock other rights that have not vested ($) |

| ||||||

Corey N. Fishman | 4,356(3) |

|

| — |

| $ | 49.50 |

| 09/11/2027 |

|

|

| — |

|

| — |

| ||

|

| — |

|

| — |

|

| — |

|

| — |

|

| 14,333(4) |

| $ | 12,040 |

| |

Sailaja Puttagunta | 30,000(5) |

| 90,000(5) |

| $ | 7.27 |

| 12/9/2031 |

|

|

| — |

|

| — |

| |||

|

| — |

|

| — |

|

| — |

|

| — |

|

| 24,999(6) |

| 20,999 |

| ||

Judith M. Matthews | 792(3) |

|

| — |

| $ | 49.50 |

| 09/11/2027 |

|

|

| — |

|

| — |

| ||

|

| — |

|

| — |

|

| — |

|

| — |

|

| 6,666(4) |

| $ | 5,599 |

| |

(1) Pursuant to the equity agreements between the named executive officer and us, the vesting of such named executive officer’s share and option awards will accelerate under certain circumstances as described under the section titled “—Potential Payments Upon Termination or Change in Control" below. |

(2) The exercise price per share of the share options reflects the fair market value per ordinary share on the date of grant. |

(3) Share option that vested as to 25% of the ordinary shares underlying the share option on September 12, 2018 with the remaining ordinary shares vesting in equal monthly installments thereafter until September 12, 2021. |

(4) Restricted share units that vest 50% on March 11, 2022, and 50% on March 11, 2023, subject to continued service with us through each relevant vesting date. |

(5) Share option that vested as to 25% of the ordinary shares underlying the share option on December 1, 2022 with the remaining ordinary shares vesting in equal monthly installments thereafter until December 1, 2025, subject to continued service with us through each relevant vesting date. This award was granted under our 2021 Inducement Plan as an inducement material to Dr. Puttagunta's acceptance of employment with the Company in accordance with Nasdaq Listing Rule 5635(c)(4). |

(6) Restricted share units that vested as to 25% of the shares underlying the award on December 1, 2022 with the remaining shares scheduled to vest annually in three equal installments thereafter, subject to continued service with us through each relevant vesting date. This award was granted under our 2021 Inducement Incentive Plan as an inducement material to Dr. Puttagunta's acceptance of employment with the Company in accordance with Nasdaq Listing Rule 5635(c)(4). |

Employment Agreements with Executive Officers

We have entered into offer letters with each of our named executive officers. The offer letters generally provide for at-will employment and set forth the executive’s initial base salary, target variable compensation, eligibility for employee benefits, the terms of initial equity grants and severance benefits on a qualifying termination. Each of our named executive officers has also executed our standard form proprietary information agreement. Any potential payment and benefits due upon a termination of employment or change of control of us are further described below.

Corey N. Fishman serves as our President and Chief Executive Officer. On November 18, 2015, Mr. Fishman entered into an offer letter with Iterum Therapeutics US Limited, our indirect wholly owned subsidiary. The offer letter has no specific term and constitutes an at-will employment arrangement. On May 2, 2018, Mr. Fishman entered into an amended offer letter, which became effective upon the closing of our initial public offering pursuant to which Mr. Fishman’s base salary became $540,000, and his discretionary annual target performance bonus increased from 50% to 55% of his annual base salary. His base salary was reviewed in December 2020 and increased to $573,000, effective January 1, 2021. His base salary was reviewed in January 2022 and increased to $590,190, effective February 1, 2022. His base salary was reviewed in January 2023 and increased to $613,798, effective February 1, 2023.

Sailaja Puttagunta serves as our Chief Medical Officer. On October 27, 2021, Dr. Puttagunta entered into an offer letter with Iterum Therapeutics US Limited, our indirect wholly owned subsidiary. The offer letter has no specific term and constitutes an at-will employment arrangement. Dr. Puttagunta commenced employment on December 1, 2021. Dr. Puttagunta’s base salary is $475,000 and her discretionary annual target performance bonus is 45% of her annual base salary. Dr. Puttagunta was also entitled to an initial bonus payment of $86,000 within 30 days of commencing employment and a subsequent bonus payment of $86,000 within 30 days of the six-month anniversary of commencement of employment, conditioned upon Dr. Puttagunta’s continuing employment with the Company on such payment date. Dr. Puttagunta's base salary was reviewed in January 2023 and increased to $494,000, effective February 1, 2023.