- ITRM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Iterum Therapeutics (ITRM) PRE 14APreliminary proxy

Filed: 2 Jun 23, 4:12pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☒ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

Iterum Therapeutics plc

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY COPY – Subject to Completion

[ ]

Dear Iterum Therapeutics plc Shareholder,

You are cordially invited to our Extraordinary General Meeting of Shareholders (“EGM”) to be held at 3 Dublin Landings, North Wall Quay, Dublin 1, Ireland on August 1, 2023 at 3.00 p.m., Irish time (10.00 a.m., Eastern Time).

The purpose of the EGM is to ask shareholders to grant the board of directors an updated power under Irish law to issue shares for cash without first having to offer those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance. This pre-emption opt-out proposal is required as a matter of Irish law and is not otherwise applicable to the non-Irish, Nasdaq listed companies with which we compete. Receipt of this authority would merely place us on par with other Nasdaq-listed companies and provide us with the flexibility to undertake the capital raising that we believe may be necessary from time to time to allow us to continue to execute on our business plans and strategy.

The enclosed Notice of EGM and the accompanying proxy statement set forth more detail on the proposal that will be presented at the meeting. Our board of directors unanimously recommends a vote “FOR” Proposal No. 1 as set forth in the proxy statement.

We hope that you will participate in the meeting by voting through acceptable means as described in this proxy statement as promptly as possible. Your vote is important – so please exercise your right.

Sincerely,

____________________________

Corey N. Fishman

President and Chief Executive Officer

This proxy statement and the enclosed proxy card are being made available to shareholders on or about [ ], 2023.

PRELIMINARY COPY – Subject to Completion

ITERUM THERAPEUTICS PLC

Fitzwilliam Court, 1st Floor

Leeson Close

Dublin 2

Ireland

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

to be held on August 1, 2023

An Extraordinary General Meeting of Shareholders (the “EGM”) of Iterum Therapeutics plc, an Irish public limited company (the “Company”), will be held on August 1, 2023, beginning at 3.00 p.m., Irish time (10.00 a.m., Eastern Time), at 3 Dublin Landings, North Wall Quay, Dublin 1, Ireland to consider and act upon the following matters:

Proposal No. 1 is a special resolution requiring at least 75% of the votes cast at the meeting to be approved. Proposal No.1 is more fully described in this proxy statement.

Shareholders of record at the close of business on June 12, 2023 will be entitled to notice of and to vote at the EGM or any adjournment or postponement thereof. Instead of mailing a printed copy of our proxy materials to all of our shareholders, we provide access to these materials to many of our shareholders via the Internet, in accordance with rules adopted by the Securities and Exchange Commission. If you received only a Notice of Internet Availability of Proxy Materials, ("Notice"), by mail or e-mail, you will not receive a paper copy of the proxy materials unless you request one. Instead, the Notice will provide you with instructions on how to access and view the proxy materials on the Internet. The Notice will also instruct you as to how you may access your proxy card to vote online or by telephone. If you received a Notice by mail or e-mail and would like to receive a paper copy of our proxy materials, free of charge, please follow the instructions included in the Notice. The Notice is being mailed to our shareholders on or about [ ] and sent by e-mail to our shareholders who have opted for such means of delivery on or about [ ].

By order of the Board of Directors,

_________________________

Louise Barrett

Secretary

Dublin, Ireland

[ ]

i

YOU MAY OBTAIN ADMISSION TO THE EGM BY IDENTIFYING YOURSELF AT THE EGM AS A SHAREHOLDER AS OF THE RECORD DATE. IF YOU ARE A RECORD OWNER, POSSESSION OF A COPY OF A PROXY CARD WILL BE ADEQUATE IDENTIFICATION. IF YOU ARE A BENEFICIAL (BUT NOT RECORD) OWNER, A "LEGAL PROXY" OR A COPY OF AN ACCOUNT STATEMENT FROM YOUR BANK, BROKER OR OTHER NOMINEE SHOWING SHARES HELD FOR YOUR BENEFIT ON JUNE 12, 2023 WILL BE ADEQUATE IDENTIFICATION.

WHETHER OR NOT YOU EXPECT TO ATTEND THE EGM, PLEASE SUBMIT YOUR VOTING INSTRUCTIONS VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS SET FORTH ON THE ENCLOSED PROXY CARD OR, IF YOU RECEIVED A PRINTED COPY OF THE PROXY MATERIALS, BY COMPLETING, DATING AND SIGNING THE ENCLOSED PROXY CARD AND MAILING IT PROMPTLY IN THE PROVIDED ENVELOPE. TO HELP ENSURE REPRESENTATION OF YOUR SHARES AT THE EGM, NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED STATES.

A SHAREHOLDER ENTITLED TO ATTEND AND VOTE AT THE EGM IS ENTITLED, USING THE PROXY CARD PROVIDED (OR IN THE FORM IN SECTION 184 OF THE IRISH COMPANIES ACT 2014), TO APPOINT ONE OR MORE PROXIES TO ATTEND, SPEAK AND VOTE INSTEAD OF HIM OR HER AT THE EGM. A PROXY NEED NOT BE A SHAREHOLDER OF RECORD.

ii

TABLE OF CONTENTS

| Page |

Information about the Extraordinary General Meeting and Voting | 1 |

3 | |

5 | |

8 |

iii

PRELIMINARY COPY – Subject to Completion

ITERUM THERAPEUTICS PLC

Fitzwilliam Court, 1PstP Floor

Leeson Close

Dublin 2

Ireland

PROXY STATEMENT FOR AN EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 1, 2023 AT 3 Dublin Landings, North Wall Quay, Dublin 1, IRELAND

Important Notice Regarding the Availability of Proxy Materials

for an Extraordinary General Meeting of Shareholders

to be held on August 1, 2023

This proxy statement is available at

https://central.proxyvote.com/pv/web

for viewing, downloading and printing.

Instead of mailing a printed copy of our proxy materials to all of our shareholders, we provide access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials as well as the costs associated with mailing these materials to all shareholders. Accordingly, on or about [ ], we will mail a Notice of Internet Availability of Proxy Materials ("Notice"), to our shareholders (other than those who previously requested electronic or paper delivery of proxy materials), directing shareholders to a website where they can access our proxy materials, including this proxy statement and view instructions on how to vote via the Internet or by telephone. If you would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice.

1

INFORMATION ABOUT AN Extraordinary General Meeting and voting

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors (the "board of directors" or the "board") of Iterum Therapeutics plc (the "Company," "Iterum," "we" or "us") for use at an Extraordinary General Meeting of Shareholders (the "EGM") to be held on August 1, 2023, beginning at 3.00 p.m., Irish time (10.00 a.m., Eastern Time), at 3 Dublin Landings, North Wall Quay, Dublin 1, Ireland and at any adjournment or postponement thereof. On June 12, 2023, the record date for the determination of shareholders entitled to vote at the EGM, there were issued, outstanding and entitled to vote an aggregate of [ ] of our ordinary shares, nominal value $0.01 per share ("ordinary shares"). Each ordinary share entitles the record holder thereof to one vote on each of the matters to be voted on at the EGM.

We have engaged Georgeson LLC, ("Georgeson"), to assist with the solicitation of proxies on our behalf. Please contact Georgeson with any queries at +1-800-457-0759.

Your vote is important no matter how many shares you own. Please take the time to vote. Take a moment to read the instructions below. Choose the way to vote that is easiest and most convenient for you and cast your vote as soon as possible.

If you are the "record holder" of your shares, meaning that you own your shares in your own name and not through a bank, broker or other nominee, you may vote in one of four ways:

All proxies that are executed and delivered by mail or in person or are otherwise submitted online or by telephone will be voted on the matters set forth in the accompanying Notice of Extraordinary General Meeting of Shareholders in accordance with the shareholders' instructions. However, if no choice is specified on a proxy as to one or more of the proposals, the proxy will be voted in accordance with the board of directors' recommendations on such proposals as set forth in this proxy statement. All proxies will be forwarded to the Company's registered office electronically.

After you have submitted a proxy, you may still change your vote and revoke your proxy prior to the EGM by doing any one of the following things:

Your attendance at the EGM alone will not revoke your proxy.

If the shares you own are held in "street name" by a bank, broker or other nominee record holder, which we collectively refer to in this proxy statement as "brokerage firms," your brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. To vote your shares, you will need to follow the directions your brokerage firm provides you. Many brokerage firms also offer the option of voting over the Internet or by telephone, instructions for which, if available, would be provided by your brokerage firm on the voting instruction form that it delivers to you. Because many brokerage firms are member organizations of the New York Stock Exchange (“NYSE”), the rules of the NYSE will likely govern how your brokerage firm would be permitted to vote your shares in the absence of instruction from you. Under the current rules of the NYSE, if you do not give instructions to your brokerage firm, it may still be able to vote your shares with respect to certain "discretionary" items. Proposal No. 1 is expected to be considered a discretionary item under NYSE rules and therefore your brokerage firm may be able to vote on that item even if it does not receive instruction from you, provided it holds your shares in its name. In the event a bank, broker or other nominee record holder determines that it does not have authority or otherwise does not exercise discretionary authority to vote on Proposal No. 1, it may deliver "broker non-votes" for such shares.

If your shares are held in street name, you must bring an account statement from your brokerage firm showing that you are the beneficial owner of the shares as of the record date (June 12, 2023) to be admitted to the EGM. To be able to vote your shares held in street name at the EGM, you will need to request a "legal proxy" from the bank, broker or nominee.

Votes Required

One or more Members (as defined in the Company’s Constitution) whose name is entered in the register of members of the Company as a registered holder of the Company's ordinary shares, present in person or by proxy (whether or not such Member actually exercises his voting rights in whole, in part or at all) holding not less than a majority of the issued and outstanding ordinary shares of the Company entitled to vote at the EGM, will constitute a quorum for the transaction of business at the EGM. Ordinary shares represented in person or by proxy (including any "broker non-votes" as described above) and shares which abstain or do not vote with respect to one or more of the matters presented for shareholder approval) will be counted for the purposes of determining whether a quorum is present at the EGM. The following votes are required for approval of the proposals being presented at the EGM:

Proposal No. 1: To grant the board of directors authority under Irish law to issue shares (including rights to acquire shares) for cash without first offering those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance. The affirmative vote of the holders of ordinary shares representing at least 75% of the votes cast on the matter and voting affirmatively or negatively is required in order to grant the board of directors authority under Irish law to issue shares (including rights to acquire shares) for cash without first offering those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance.

Shares that abstain from voting as to a particular matter and any broker non-votes will not be counted as votes in favor of such matter and will also not be counted as shares voting on such matter. Accordingly, abstentions and broker non-votes will have no effect on the voting on the proposal referenced above.

share ownership of certain beneficial owners and management

The following table sets forth information with respect to the beneficial ownership of our ordinary shares as of May 31, 2023 by:

Beneficial ownership is determined according to the rules of the Securities and Exchange Commission (the “SEC”) and generally means that a person has beneficial ownership of a security if he, she, or it possesses sole or shared voting or investment power of that security, including share options that are exercisable within 60 days of May 31, 2023, restricted share units that vest within 60 days of May 31, 2023, shares issuable upon exercise of warrants within 60 days of May 31, 2023, and shares issuable upon exchange of our outstanding 6.500% exchangeable senior subordinated notes due 2025 (the “Exchangeable Notes”) (assuming physical settlement), which are exchangeable within 60 days of May 31, 2023. Our ordinary shares issuable pursuant to share options, restricted share units, warrants and Exchangeable Notes, but not taking into account any additional ordinary shares issuable to satisfy accrued and unpaid interest due upon exchange of any Exchangeable Notes, are deemed outstanding for computing the percentage of the person holding such share options, restricted share units, warrants or Exchangeable Notes and the percentage of any group of which the person is a member, but are not deemed outstanding for computing the percentage of any other person. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons named in the table below have sole voting and investment power with respect to all ordinary shares shown that they beneficially own, subject to community property laws where applicable. The information does not necessarily indicate beneficial ownership for any other purpose, including for purposes of Section 13(d) and 13(g) of the Securities Act of 1933, as amended. Percentage ownership is based on 12,974,223 ordinary shares outstanding on May 31, 2023. Except as otherwise set forth below, the address of the beneficial owner is c/o Iterum Therapeutics plc, Fitzwilliam Court, 1st Floor, Leeson Close, Dublin 2, Ireland.

| Number of Shares Beneficially Owned |

|

| Percentage of Shares Beneficially Owned |

| ||

Directors and Named Executive Officers: |

|

|

|

|

| ||

Corey N. Fishman(1) |

| 48,805 |

|

| * |

| |

Michael Dunne, MD(2) |

| 58,344 |

|

| * |

| |

Judith M. Matthews(3) |

| 8,927 |

|

| * |

| |

Sailaja Puttagunta(4) |

| 52,469 |

|

| * |

| |

Mark Chin(5) |

| 18,306 |

|

| * |

| |

Beth P. Hecht(6) |

| 18,839 |

|

| * |

| |

Ronald M. Hunt(7) |

| 415,076 |

|

|

| 3.1 | % |

David G. Kelly(8) |

| 54,323 |

|

| * |

| |

All current executive officers and directors as a group (9 persons)(9) |

| 675,089 |

|

|

| 5.0 | % |

Principal Shareholders(10) | - |

|

| - |

| ||

|

|

|

|

|

| ||

* less than 1% |

|

|

|

|

| ||

(1) Consists of (a) 44,449 shares beneficially owned by Mr. Fishman, and (b) 4,356 shares issuable to Mr. Fishman pursuant to share options exercisable within 60 days of May 31, 2023. | |||||||

(2) Consists of (a) 37,635 shares beneficially owned by Dr. Dunne, (b) 3,077 shares issuable to Dr. Dunne pursuant to warrants exercisable within 60 days of May 31, 2023; and (c) 17,632 shares issuable to Dr. Dunne pursuant to restricted share units that vest within 60 days of May 31, 2023. | |||||||

(3) Consists of (a) 8,135 shares beneficially owned by Ms. Matthews, and (b) 792 shares issuable to Ms. Matthews pursuant to share options exercisable within 60 days of May 31, 2023. | |||||||

|

| ||||||

(4) Consists of (a) 4,969 shares beneficially owned by Dr. Puttagunta, and (b) 47,500 shares issuable to Dr. Puttagunta pursuant to share options exercisable within 60 days of May 31, 2023. |

| ||||||

(5) Consists of (a) 2,453 shares beneficially owned by Mr. Chin, and (b) 15,853 shares issuable to Mr. Chin pursuant to restricted share units that vest within 60 days of May 31, 2023. |

| ||||||

|

|

|

|

|

|

|

|

(6) Consists of (a) 2,986 shares beneficially owned by Ms. Hecht, and (b) 15,853 shares issuable to Ms. Hecht pursuant to restricted share units that vest within 60 days of May 31, 2023. |

| ||||||

|

|

|

|

|

|

|

|

(7) Consists of (a) 6,071 shares beneficially owned by Mr. Hunt, (b) 43,886 shares issuable to Mr. Hunt pursuant to share options exercisable within 60 days of May 31, 2023; (c) 2,796 shares issuable to Mr. Hunt pursuant to restricted share units that vest within 60 days of May 31, 2023; and (d) (i) 71,445 shares reported as beneficially owned by New Leaf Venture III, L.P. (“NLV-III”), New Leaf Venture Associates III, L.P. (“NLVA-III LP”) and New Leaf Venture Management III, L.L.C. (“NLVM-III LLC”), of which each such entity reports sole voting power with respect to 71,445 shares, shared voting power with respect to zero shares, sole dispositive power with respect to 71,445 shares and shared dispositive power with respect to zero shares, (ii) 25,641 shares held by New Leaf Biopharma Opportunities II, L.P. (“NBPO-II”), New Leaf BPO Associates II, L.P. (“NBPO-IIA”) and New Leaf BPO Management II, L.L.C. (“NBPO-IIM”), of which each such entity reports sole voting power with respect to 25,641 shares, shared voting power with respect to zero shares, sole dispositive power with respect to 25,641 shares and shared dispositive power with respect to zero shares, and (iii) 195,214 shares issuable to NLV-III and 70,023 shares issuable to NBPO-II on exchange of the Exchangeable Notes held by them and exchangeable within 60 days of May 31, 2023 (assuming physical settlement). NLVA-III LP is the general partner of NLV-III and NLVM-III LLC is the general partner of NLVA-III LP. NBPO-IIA is the general partner of NBPO-II and NBPO-IIM is the general partner of NBPO-IIA. Mr. Hunt, a member of our board of directors, and Vijay K. Lathi are individual managers of NLVM-III LLC and individual managers of NPBO-IIM, and as a result may be deemed to have shared power to vote and dispose of these shares. The address for each of the reporting persons other than Vijay K. Lathi is c/o New Leaf Venture Partners, 420 Lexington Avenue, Suite 408, New York, NY 10170. The address for Vijay K. Lathi is c/o New Leaf Venture Partners, 2730 Sand Hill Road, Suite 110, Menlo Park, CA 94025. We obtained certain of the information regarding beneficial ownership of these shares from Schedule 13D/A that was filed with the SEC on February 21, 2021. | |||||||

|

|

|

|

|

|

|

|

(8) Consists of (a) 2,473 shares beneficially owned by Mr. Kelly and (b) 51,850 shares issuable to Mr. Kelly pursuant to share options exercisable within 60 days of May 31, 2023. | |||||||

(9) Includes (a) 206,257 shares held by the current directors and executive officers and their affiliates, (b) 148,384 shares issuable to the current directors and executive officers pursuant to share options exercisable within 60 days of May 31, 2023, (c) 3,077 shares issuable to the current directors pursuant to warrants exercisable within 60 days of May 31, 2023, (d) 265,237 shares issuable to affiliates of current directors on exchange of the Exchangeable Notes within 60 days of May 31, 2023 (assuming physical settlement); and (e) 52,134 shares issuable to current directors and executive officers pursuant to restricted share units that vest within 60 days of May 31, 2023. | |||||||

(10) To our knowledge, except as noted above, no person or entity is the beneficial owner of more than 5% of the voting power of our ordinary shares as of May 31, 2023. | |||||||

MATTER TO BE VOTED ON

PROPOSAL 1: BOARD AUTHORITY TO ISSUE ORDINARY SHARES FOR CASH WITHOUT FIRST OFFERING ORDINARY SHARES TO EXISTING SHAREHOLDERS

We are asking our shareholders to empower the board to allot the authorized but unissued ordinary share capital of the Company for cash without having to offer them to all existing shareholders in accordance with the statutory pre-emption right under the Irish Companies Act 2014.

Overview

Certain Effects of this Proposal

If Proposal No. 1 is approved, it will renew the authority that enables us to have flexibility to issue shares, including through capital raises, and to fund our development operations.

If Proposal No. 1 is not approved, our ability to raise additional capital and continue growing our business would be severely limited.

The statutory pre-emption right applies only to share issuances for cash consideration; accordingly, it does not apply where we issue shares for non-cash consideration (such as in a share exchange transaction or in any transaction in which property other than cash is received by us in payment for shares) or, where we issue shares to employees pursuant to our employee equity compensation plans.

The text of the resolution in respect of this proposal is as follows:

“THAT the Company's directors be and are, with effect from the passing of this resolution, hereby empowered pursuant to Section 1023 of the Irish Companies Act 2014 to allot equity securities (including rights to acquire equity securities) within the meaning of the said Section 1023 for cash up to an aggregate nominal amount equal to the authorized but unissued share capital of the Company as if Section 1022 of the Irish Companies Act 2014 did not apply to any such allotment provided that this authority shall expire five years from the passing of this resolution and provided that the Company may before the expiry of such authority make an offer or agreement which would or might require equity securities to be allotted after such expiry and the Company's directors may allot equity securities in pursuance of such an offer or agreement as if the power conferred by this resolution had not expired.”

OUR BOARD OF DIRECTORS HAS UNANIMOUSLY DETERMINED THAT THIS PRE-EMPTION OPT-OUT PROPOSAL IS IN THE BEST INTERESTS OF THE COMPANY AND ITS SHAREHOLDERS AND RECOMMENDS THAT YOU VOTE FOR THE PRE-EMPTION OPT-OUT PROPOSAL.

OTHER MATTERS

The board of directors knows of no other business which will be presented to the EGM. If any other business is properly brought before the EGM, proxies will be voted in accordance with the judgment of the persons named therein.

Solicitation of Proxies

This proxy is solicited on behalf of our board of directors. We will bear the expenses connected with this proxy solicitation. In addition to the solicitation of proxies by mail, we expect to pay banks, brokers and other nominees their reasonable expenses for forwarding proxy materials and annual reports to principals and obtaining their voting instructions. In addition to the use of the mail, our directors, officers and employees may, without additional remuneration, solicit proxies in person or by use of other communications media. We have engaged Georgeson to solicit proxies from shareholders in connection with the EGM. We will pay Georgeson a fee of approximately $12,500, plus reasonable out of pocket fees and expenses for soliciting proxies. In addition, Georgeson and certain related persons will be indemnified against certain liabilities arising out of or in connection with the engagement. Proxies may be solicited by Georgeson by mail, telephone and e-mail.

Householding of Annual and Extraordinary Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of "householding" proxy statements. This means that unless otherwise instructed only one copy of our proxy statement or Notice of Internet Availability of Proxy Materials may have been sent to multiple shareholders in the same household. We will promptly deliver a separate copy of any such document to any shareholder upon request submitted in writing to us at Iterum Therapeutics plc, Fitzwilliam Court, 1st Floor, Leeson Close, Dublin 2, Ireland, Attention: Investor Relations, or orally by calling +353 1 9038354. Any shareholder who wants to receive separate copies of the proxy statement or Notice of Internet Availability of Proxy Materials in the future, or who is currently receiving multiple copies and would like to receive only one copy for his or her household, should contact his or her bank, broker or other nominee record holder, or contact us at the above address or phone number.

Shareholder Proposals for 2024 Annual General Meeting of Shareholders

Proposals of shareholders intended to be presented at our 2024 annual general meeting of shareholders pursuant to Rule 14a-8 promulgated under the Exchange Act must be received by us at our offices at c/o Secretary, Iterum Therapeutics plc, Fitzwilliam Court, 1st Floor, Leeson Close, Dublin 2, Ireland, no later than November 17, 2023, in order to be included in the proxy statement and proxy card relating to that meeting.

In addition, shareholders who intend to present matters for action at our 2024 annual general meeting or nominate directors for election to our board of directors (other than pursuant to Rule 14a-8) must comply with the requirements set forth in our Constitution. For such matters under our Constitution, proper written notice must be received by our secretary at our registered office at the address noted above, no earlier than November 17, 2023 and no later than December 17, 2023; except if the date of the 2024 annual general meeting is changed by more than thirty (30) days from the first anniversary date of the 2023 Annual General Meeting, the shareholder's notice must be so received not earlier than one hundred and twenty (120) days prior to such annual general meeting and not later than the close of business on the later of (i) the 90th day prior to such annual general meeting or (ii) the 10th day following the day on which a public announcement of the date of the annual general meeting is first made.

In addition to satisfying the requirements of the advance notice provisions of our Constitution, shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees at our 2024 annual general meeting must provide us with the information required by Rule 14a-19(b) under the Exchange Act. To be timely, such notice must be provided to our offices at c/o Secretary, Iterum Therapeutics plc, Fitzwilliam Court, 1st Floor, Leeson Close, Dublin 2, Ireland, no later than March 4, 2024; except if the date of the 2024 annual general meeting is changed by more than thirty (30) days from the first anniversary date of the 2023 Annual General Meeting, the shareholder's notice must be so received by the later of sixty (60) calendar days prior to the date of the 2024 annual meeting or the 10th calendar day following the day on which public announcement of the date of the 2024 annual meeting is first made by the Company.

Important Notice of the Internet Availability of Proxy Materials for the Extraordinary General Meeting:

The Notice and Proxy Statement are available at https://central.proxyvote.com/pv/web.

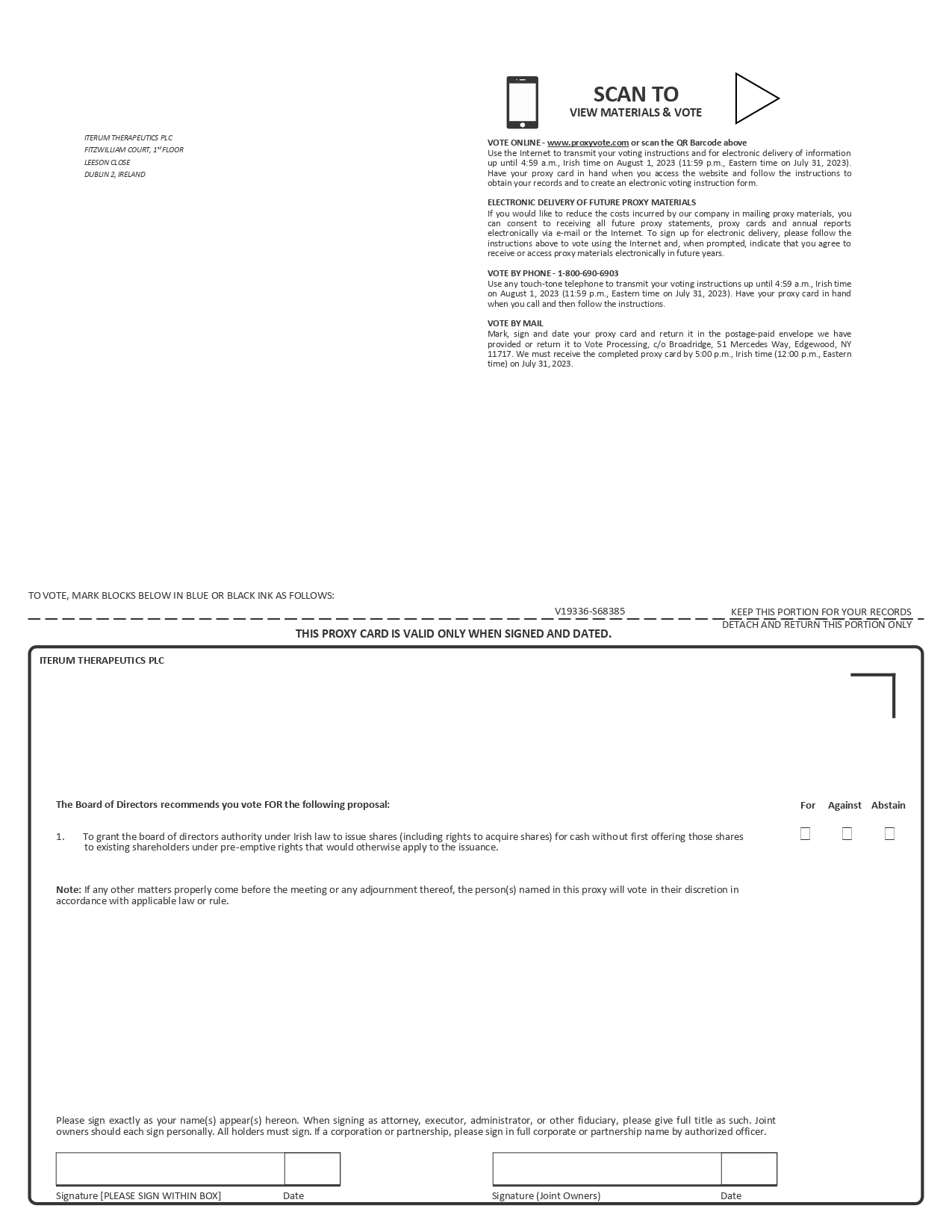

ITERUM THERAPEUTICS PLC FITZWILLIAM COURT, 1stFLOOR LEESON CLOSE DUBLIN 2, IRELAND SCAN TO VIEW MATERIALS & VOTE VOTE ONLINE - www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 4:59 a.m., Irish time on August 1, 2023 (11:59 p.m., Eastern time on July 31, 2023). Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 4:59 a.m., Irish time on August 1, 2023 (11:59 p.m., Eastern time on July 31, 2023). Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. We must receive the completed proxy card by 5:00 p.m., Irish time (12:00 p.m., Eastern time) on July 31, 2023. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS V19336-S68385 KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. ITERUM THERAPEUTICS PLC The Board of Directors recommends you vote FOR the following proposal: For Against Abstain 1. To grant the board of directors authority under Irish law to issue shares (including rights to acquire shares) for cash without first offering those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance. Note: If any other matters properly come before the meeting or any adjournment thereof, the person(s) named in this proxy will vote in their discretion in accordance with applicable law or rule For Against Abstain Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] DateSignature (Joint Owners) Date

Important Notice Regarding the Availability of Proxy Materials for the Extraordinary General Meeting: The Proxy Materials are available at www.proxyvote.com V19337-S68385 ITERUM THERAPEUTICS PLC Extraordinary General Meeting of Shareholders August 1, 2023 3:00 PM Irish time 3 Dublin Landings North Wall Quay Dublin 1, Ireland This proxy is solicited by the Board of Directors The undersigned shareholder(s), revoking all prior proxies, hereby appoint(s) David G. Kelly, Louise Barrett and Kevin Dalton, or any of them, as proxies, each with the power of substitution, and hereby authorise(s) them to represent and vote all of the ordinary shares of Iterum Therapeutics plc that the undersigned is/are entitled to vote, with all the powers which the undersigned would possess if personally present, at the Extraordinary General Meeting of Shareholders of Iterum Therapeutics plc to be held on August 1, 2023, or at any postponement or adjournment thereof. A shareholder entitled to attend and vote is entitled to appoint one or more proxies to attend, speak and vote instead of him or her at the Extraordinary General Meeting. A proxy need not be a shareholder of record. If you wish to nominate a proxy other than David G. Kelly or Louise Barrett or Kevin Dalton, please contact our Company Secretary. Any such nominated proxy must attend the Extraordinary General Meeting in person in order for your votes to be cast. Shares represented by this proxy will be voted by the Proxies in the manner directed. If no such directions are indicated, the Proxies will have authority to vote FOR the Proposal. In their discretion, the Proxies are authorised to vote upon such other business as may properly come up before the meeting and any adjournment or postponement thereof. Continued and to be signed on reverse side