UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23117

JPMorgan Trust IV

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: June 30

Date of reporting period: July 1, 2021 through December 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Report. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

Semi-Annual Report

J.P. Morgan Large Cap Funds

December 31, 2021 (Unaudited)

JPMorgan Equity Focus Fund

JPMorgan Equity Income Fund

JPMorgan Equity Premium Income Fund

JPMorgan Hedged Equity Fund

JPMorgan Hedged Equity 2 Fund

JPMorgan Hedged Equity 3 Fund

JPMorgan Large Cap Growth Fund

JPMorgan Large Cap Value Fund

JPMorgan U.S. Applied Data Science Value Fund

(formerly known as JPMorgan Intrepid Value Fund)

JPMorgan U.S. Equity Fund

JPMorgan U.S. GARP Equity Fund

JPMorgan U.S. Large Cap Core Plus Fund

JPMorgan U.S. Research Enhanced Equity Fund

JPMorgan U.S. Sustainable Leaders Fund

JPMorgan U.S. Value Fund

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

LETTER TO SHAREHOLDERS

FEBRUARY 8, 2022 (UNAUDITED)

Dear Shareholders,

U.S. equities led the year-long rally in developed market stocks as the global economic rebound advanced through 2021. While financial market volatility, a resurgence in the pandemic and accelerating inflation have carried into 2022, we believe that the outlook for the overall U.S. economy remains positive.

| | |

| | “Throughout the year ahead, J.P. Morgan Asset Management plans to seek to deliver superior client outcomes across a broad range of innovative solutions and risk management processes built on the same fundamental practices and principles that have driven our success for more than a century.” — Andrea L. Lisher |

A surge in U.S. consumer wealth — partly tied to rising values for homes and autos — and quarterly growth in corporate earnings have helped to bolster U.S. financial markets that were already well-supported by monetary and fiscal policies. Over the course of the past year, the U.S. jobless rate fell to pre-pandemic levels and reached 3.9% in December. At the same time, inflation has climbed significantly. The U.S. Federal Reserve (the “Fed”) has tapered its monthly asset purchasing program and indicated that it’s likely to raise interest rates as early as March 2022.

While rising interest rates may mark another phase of the economic cycle that presents financial markets with new challenges and opportunities, they may also signal a return to a

more normal economic environment following two years of historically low rates. Meanwhile, the path of the pandemic remains a factor in the U.S. economy. Recent data suggest the increase in new infections in late 2021 and into 2022 had some impact on the U.S. economy — though job growth remained strong — but there is hope that the latest pandemic wave may recede in coming months. Additionally, there is hope that rising prices on commodities and goods will moderate as supply chain constraints ease over time and the Fed moves generally to tamp down inflationary pressures. We expect the U.S. economy to continue expanding in 2022, even if the pace of the expansion eases from 2021.

Throughout the year ahead, J.P. Morgan Asset Management plans to seek to deliver superior client outcomes across a broad range of innovative solutions and risk management processes built on the same fundamental practices and principles that have driven our success for more than a century.

On behalf of J.P. Morgan Asset Management, thank you for entrusting us to manage your investment. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

Andrea L. Lisher

Head of Americas, Client

J.P. Morgan Asset Management

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 1 |

J.P. Morgan Large Cap Funds

MARKET OVERVIEW

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited)

Overall, U.S. equity markets generated post positive returns in the second half of 2021 with continued monetary and fiscal support as well as strong consumer spending and record corporate profits. Despite historically high equity valuations in the U.S., the S&P 500 Index posted at least one record-high closing in each month during the period. Notably, the emergence of the omicron variant of COVID-19 in the final months of 2021 led to higher volatility in financial markets and weighed on global petroleum prices.

The first months of the period saw strong upward momentum in U.S. equity prices after second quarter 2021 results showed record-high earnings and revenue from U.S. companies. However, equity markets ended the month of September lower amid investor concerns about global supply chain disruptions, inflationary pressure and the ongoing pandemic. Additionally, the U.S. Federal Reserve set an initial schedule for tapering off its monthly bond purchases and indicated it may raise interest rates in late 2022 or early 2023.

In October, oil prices began to rise and equity markets resumed their broad upward trajectory only to stall again in November and then ended December with higher returns. While a resurgence in pandemic infections raised investor concerns about the reimposition of some social restrictions and their potential impact on specific industries and individual companies, the economic backdrop remained positive overall with a strong labor market, surging corporate profits and a boom in U.S. consumer wealth.

Overall, the real estate and information technology sectors provided the largest returns during the six month period, while communication services and industrials sectors provided the smallest returns but were still positive for the period. Within large cap equity, growth stocks outperformed value stocks. For the six months ended December 31, 2021, the S&P 500 Index returned 11.67%; the Russell 1000 Index returned 10.01%, the Russell 1000 Growth Index returned 12.93% and the Russell 1000 Value Index returned 6.93%.

| | | | | | | | | | |

| | | | | |

| 2 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | DECEMBER 31, 2021 |

JPMorgan Equity Focus Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)* | | | 8.77% | |

| S&P 500 Index | | | 11.67% | |

| |

| Net Assets as of 12/31/2021 (In Thousands) | | | $144,338 | |

INVESTMENT OBJECTIVE**

The JPMorgan Equity Focus Fund (the “Fund”) seeks long term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the S&P 500 Index (the “Benchmark”) for the six months ended December 31, 2021.

The Fund’s security selection in the consumer discretionary and information technology sectors was the leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the health care and real estate sectors was the leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in Gap Inc. and Global Payments Inc. and its underweight position in Tesla Inc. Shares of Gap, a retailer of brand name apparel, fell after the company reported lower-than-expected earnings and revenue for the third quarter amid supply chain bottlenecks. Shares of Global Payments, a digital payments platform provider, fell amid a general pullback in financial technology subsector stocks and the company’s lower-than-expected forecast for full year 2021 results. Shares of Tesla, a producer of electric vehicles and battery systems, rose after the company reported better-than-expected production and deliveries during the period.

Leading individual contributors to relative performance included the Fund’s overweight positions in AutoZone Inc., Advanced Micro Devices Inc. and DexCom Inc. Shares of AutoZone, an automotive parts retailer, rose amid consecutive quarters of better-than-expected earnings and revenue, as well as large share repurchase programs during the period. Shares of Advanced Micro Devices, a semiconductor manufacturer, rose after the company reported better-than-expected earnings and sales for the third quarter of 2021 and issued a better-than-expected forecast for the fourth quarter of 2021. Shares of DexCom, a manufacturer of diabetes monitoring devices, rose after the company reported better-than-expected earnings and revenue for both the second and third quarters of 2021, as well as a better-than-expected forecast for full-year 2021 results.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up fundamental approach to stock selection. As a result of this approach to stock selection, the Fund’s largest positions were in the information technology and financials sectors and the Fund’s smallest positions were in the utilities and consumer staples sectors.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | 1. | | | Apple, Inc. | | | 6.3 | % |

| | 2. | | | Microsoft Corp. | | | 6.0 | |

| | 3. | | | Alphabet, Inc., Class C | | | 4.8 | |

| | 4. | | | Amazon.com, Inc. | | | 3.6 | |

| | 5. | | | Weyerhaeuser Co. | | | 3.3 | |

| | 6. | | | Loews Corp. | | | 3.3 | |

| | 7. | | | Berkshire Hathaway, Inc., Class B | | | 3.1 | |

| | 8. | | | Bank of America Corp. | | | 3.1 | |

| | 9. | | | UnitedHealth Group, Inc. | | | 3.0 | |

| | 10. | | | AutoZone, Inc. | | | 2.9 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

| Information Technology | | | 25.4 | % |

| Financials | | | 14.4 | |

| Health Care | | | 12.8 | |

| Consumer Discretionary | | | 12.2 | |

| Communication Services | | | 8.1 | |

| Industrials | | | 6.8 | |

| Real Estate | | | 4.9 | |

| Materials | | | 4.1 | |

| Energy | | | 3.8 | |

| Consumer Staples | | | 2.7 | |

| Utilities | | | 2.0 | |

| Short-Term Investments | | | 2.8 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 3 |

JPMorgan Equity Focus Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited) (continued)

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2021 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | July 29, 2011 | | | | | | | | | | | | | | | | |

With Sales Charge** | | | | | 2.91 | % | | | 18.97 | % | | | 17.43 | % | | | 16.13 | % |

Without Sales Charge | | | | | 8.61 | | | | 25.57 | | | | 18.70 | | | | 16.76 | |

CLASS C SHARES | | July 29, 2011 | | | | | | | | | | | | | | | | |

With CDSC*** | | | | | 7.34 | | | | 23.97 | | | | 18.12 | | | | 16.28 | |

Without CDSC | | | | | 8.34 | | | | 24.97 | | | | 18.12 | | | | 16.28 | |

CLASS I SHARES | | July 29, 2011 | | | 8.77 | | | | 25.90 | | | | 19.00 | | | | 17.05 | |

CLASS R6 SHARES | | October 1, 2018 | | | 8.91 | | | | 26.24 | | | | 19.20 | | | | 17.15 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

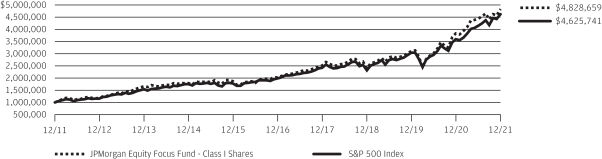

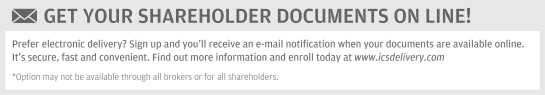

TEN YEAR PERFORMANCE (12/31/11 TO 12/31/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R6 Shares prior to their inception date are based on the performance of Class I Shares. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class I Shares.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Equity Focus Fund and the S&P 500 Index from December 31, 2011 to December 31, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of securities included in the benchmark, if applicable. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Subsequent to the inception date of the Fund and through July 31, 2013, the Fund did not experience any shareholder activity. If such shareholder activity had occurred, the Fund’s performance may have been impacted.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| 4 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | DECEMBER 31, 2021 |

JPMorgan Equity Income Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)* | | | 7.63% | |

| Russell 1000 Value Index | | | 6.93% | |

| |

| Net Assets as of 12/31/2021 (In Thousands) | | | $51,111,026 | |

INVESTMENT OBJECTIVE**

The JPMorgan Equity Income Fund (the “Fund”) seeks capital appreciation and current income.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares outperformed the Russell 1000 Value Index (the “Benchmark”) for the six months ended December 31, 2021.

The Fund’s security selection in the industrials sector and its underweight position in the communication services sector were leading contributors to performance relative to the Benchmark, while the Fund’s security selection in the health care sector and its underweight position in the real estate sector were leading detractors from relative performance.

Leading individual contributors to relative performance included the Fund’s out-of-Benchmark positions in Home Depot Inc. and Microsoft Corp., and its overweight position in Dover Corp. Shares of Home Depot, a home improvement retail chain, rose after the company reported strong sales growth and better-than-expected earnings and revenue for the third quarter of 2021. Shares of Microsoft, a software and technology services provider, rose amid investor demand for large technology companies during the period. Shares of Dover, a maker of industrial equipment and sensors, rose after the company reported better-than-expected earnings and revenue for the third quarter of 2021 and raised its forecast for full year 2021 results.

Leading individual detractors from relative performance included the Fund’s overweight positions in Gap Inc., Medtronic PLC and Bristol-Myers Squibb Co. Shares of Gap, a retailer of brand name apparel, fell after the company reported lower-than-expected earnings and revenue for the third quarter amid supply chain bottlenecks. Shares of Medtronic, a medical technology manufacturer, fell after the company reported lower-than-expected revenue for its fiscal second quarter of 2021 and disclosed it had received a warning letter from the U.S. Food and Drug Administration following the company’s recall of insulin infusion pumps. Shares of Bristol-Myers Squibb, a pharmaceutical manufacturer, fell amid investor expectations the company would seek to acquire Aurinia Pharmaceuticals Inc.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers’ focus remained on stock selection, as they believed that quality companies trading at

attractive valuations had the greatest potential to outperform in the long term. As the Fund aimed to purchase stocks with above average dividend yields, the research process was designed to identify companies with predictable and durable business models deemed capable of generating sustainable free cash flow.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | | | | | | | |

| | 1. | | | UnitedHealth Group, Inc. | | | 3.0 | % |

| | 2. | | | ConocoPhillips | | | 2.5 | |

| | 3. | | | Bank of America Corp. | | | 2.4 | |

| | 4. | | | BlackRock, Inc. | | | 2.3 | |

| | 5. | | | Comcast Corp., Class A | | | 2.1 | |

| | 6. | | | PNC Financial Services Group, Inc. (The) | | | 2.1 | |

| | 7. | | | Bristol-Myers Squibb Co. | | | 2.0 | |

| | 8. | | | CME Group, Inc. | | | 2.0 | |

| | 9. | | | Raytheon Technologies Corp. | | | 2.0 | |

| | 10. | | | Analog Devices, Inc. | | | 1.9 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

| Financials | | | 22.8 | % |

| Health Care | | | 16.6 | |

| Industrials | | | 14.6 | |

| Information Technology | | | 9.1 | |

| Consumer Staples | | | 8.8 | |

| Consumer Discretionary | | | 7.5 | |

| Energy | | | 5.7 | |

| Utilities | | | 4.0 | |

| Materials | | | 3.2 | |

| Communication Services | | | 2.9 | |

| Real Estate | | | 2.8 | |

| Short-Term Investments | | | 2.0 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 5 |

JPMorgan Equity Income Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited) (continued)

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2021 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 18, 1992 | | | | | | | | | | | | | | | | |

With Sales Charge** | | | | | 1.85 | % | | | 18.29 | % | | | 11.44 | % | | | 12.46 | % |

Without Sales Charge | | | | | 7.50 | | | | 24.82 | | | | 12.65 | | | | 13.07 | |

CLASS C SHARES | | November 4, 1997 | | | | | | | | | | | | | | | | |

With CDSC*** | | | | | 6.21 | | | | 23.24 | | | | 12.10 | | | | 12.62 | |

Without CDSC | | | | | 7.21 | | | | 24.24 | | | | 12.10 | | | | 12.62 | |

CLASS I SHARES | | July 2, 1987 | | | 7.63 | | | | 25.13 | | | | 12.96 | | | | 13.36 | |

CLASS R2 SHARES | | February 28, 2011 | | | 7.35 | | | | 24.52 | | | | 12.37 | | | | 12.78 | |

CLASS R3 SHARES | | September 9, 2016 | | | 7.50 | | | | 24.84 | | | | 12.67 | | | | 13.07 | |

CLASS R4 SHARES | | September 9, 2016 | | | 7.63 | | | | 25.14 | | | | 12.95 | | | | 13.36 | |

CLASS R5 SHARES | | February 28, 2011 | | | 7.70 | | | | 25.29 | | | | 13.13 | | | | 13.56 | |

CLASS R6 SHARES | | January 31, 2012 | | | 7.76 | | | | 25.44 | | | | 13.23 | | | | 13.64 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

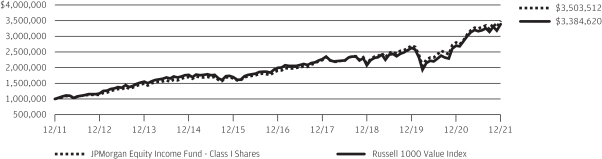

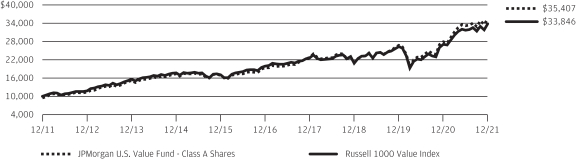

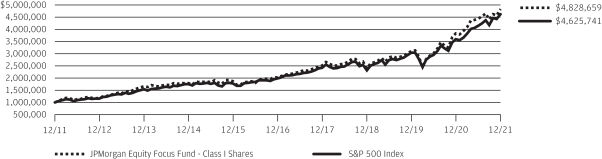

TEN YEAR PERFORMANCE (12/31/11 TO 12/31/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R4 Shares prior to their inception dates are based on the performance of Class I Shares. The actual returns for Class R4 Shares would have been similar to those shown because Class R4 Shares had similar expenses to Class I Shares.

Returns for Class R3 Shares prior to their inception date are based on the performance of Class A Shares. The actual returns for Class R3 Shares would have been similar than those shown because Class R3 Shares currently have the same expenses as Class A Shares.

Returns for Class R6 Shares prior to their inception date are based on the performance of Class R5 Shares and, prior to February 28, 2011, Class I Shares. The actual returns for Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class R5 and Class I Shares.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Equity Income Fund and the Russell 1000 Value

Index from December 31, 2011 to December 31, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell 1000 Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Russell 1000 Value Index is an unmanaged index which measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A Performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| 6 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | DECEMBER 31, 2021 |

JPMorgan Equity Premium Income Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class I Shares)* | | | 8.74% | |

| S&P 500 Index | | | 11.67% | |

| ICE BofAML 3-Month U.S. Treasury Bill Index | | | 0.02% | |

| |

| Net Assets as of 12/31/2021 (In Thousands) | | | $2,141,945 | |

INVESTMENT OBJECTIVE**

The JPMorgan Equity Premium Income Fund (the “Fund”) seeks current income while maintaining prospects for capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the S&P 500 Index (the “Benchmark”) and outperformed the ICE BofAML 3-Month U.S. Treasury Bill Index for the six months ended December 31, 2021.

The Fund’s underweight position in the information technology sector and its security selection in the consumer discretionary sector were leading detractors from performance relative to the Benchmark, while the Fund’s security selection in the industrials and financials sectors was a leading contributor to relative performance.

Leading individual detractors from performance relative to the Benchmark included the Fund’s underweight positions in Tesla Inc., Apple Inc. and Nvidia Corp. Shares of Tesla, a producer of electric vehicles and battery systems that was not held in the Fund, rose after the company reported better-than-expected production and deliveries during the period. Shares of Apple, a provider of computers, mobile devices and related services, rose amid consecutive quarters of record earnings and strong demand for mobile phones. Shares of Nvidia, a semiconductor maker not held in the Fund, rose after the company reported

better-than-expected earnings and revenue for the third quarter of 2021 amid growth in sales to the data center and gaming industries.

Leading individual contributors to relative performance included the Fund’s overweight position in Old Dominion Freight Line Inc. and its underweight positions in PayPal Holdings Inc. and Amazon.com Inc. Shares of Old Dominion Freight Inc., a trucking and transport provider, rose after the company reported better-than-expected earnings and revenue for the third quarter amid a surge in demand for its services. Shares of PayPal Holdings, a digital payments platform provider not held in the Fund, fell after the company issued a lower-than-expected earnings forecast for the third quarter of 2021 and amid general weakness in financial technology stocks. Shares of Amazon.com, an online retailer and services provider, fell after the company reported lower-than-expected earnings and revenue for the third quarter of 2021 and issued a lower-than-expected forecast for the fourth quarter of 2021.

HOW WAS THE FUND POSITIONED?

The Fund seeks to generate income through a combination of selling options and investing in large cap stocks and delivering monthly income from associated option premiums and stock dividends. The Fund’s portfolio managers employed a proprietary research process designed to identify what they believed were overvalued and undervalued stocks with attractive risk/return characteristics.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 7 |

JPMorgan Equity Premium Income Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited) (continued)

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | 1. | | | UBS AG, ELN, 40.24%, 2/7/2022, (linked to S&P 500 Index) (Switzerland) | | | 2.1 | % |

| | 2. | | | Credit Suisse AG, ELN, 42.00%, 2/4/2022, (linked to S&P 500 Index) (Switzerland) | | | 1.9 | |

| | 3. | | | Barclays Bank plc, ELN, 48.30%, 1/14/2022, (linked to S&P 500 Index) (United Kingdom) | | | 1.8 | |

| | 4. | | | Bank of Montreal, ELN, 47.00%, 1/18/2022, (linked to S&P 500 Index) (Canada) | | | 1.7 | |

| | 5. | | | Accenture plc, Class A | | | 1.7 | |

| | 6. | | | Old Dominion Freight Line, Inc. | | | 1.6 | |

| | 7. | | | Microsoft Corp. | | | 1.6 | |

| | 8. | | | GS Finance Corp., ELN, 50.02%, 1/31/2022, (linked to S&P 500 Index) | | | 1.6 | |

| | 9. | | | DTE Energy Co. | | | 1.6 | |

| | 10. | | | Alphabet, Inc., Class A | | | 1.6 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

| Health Care | | | 12.1 | % |

| Information Technology | | | 11.9 | |

| Industrials | | | 11.8 | |

| Consumer Staples | | | 10.8 | |

| Financials | | | 8.8 | |

| Consumer Discretionary | | | 7.6 | |

| Utilities | | | 7.2 | |

| Communication Services | | | 6.0 | |

| Materials | | | 3.4 | |

| Real Estate | | | 3.1 | |

| Energy | | | 0.7 | |

| Other*** | | | 16.3 | |

| Short-Term Investments | | | 0.3 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Equity-Linked Notes that are linked to the S&P 500 Index. |

| | | | | | | | | | |

| | | | | |

| 8 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2021 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | | 6 MONTH* | | | 1 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | | August 31, 2018 | | | | | | | | | | | | | |

With Sales Charge** | | | | | | | 2.92 | % | | | 14.64 | % | | | 9.67 | % |

Without Sales Charge | | | | | | | 8.60 | | | | 20.99 | | | | 11.45 | |

CLASS C SHARES | | | August 31, 2018 | | | | | | | | | | | | | |

With CDSC*** | | | | | | | 7.33 | | | | 19.39 | | | | 10.90 | |

Without CDSC | | | | | | | 8.33 | | | | 20.39 | | | | 10.90 | |

CLASS I SHARES | | | August 31, 2018 | | | | 8.74 | | | | 21.28 | | | | 11.71 | |

CLASS R5 SHARES | | | August 31, 2018 | | | | 8.82 | | | | 21.46 | | | | 11.87 | |

CLASS R6 SHARES | | | August 31, 2018 | | | | 8.87 | | | | 21.58 | | | | 11.99 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

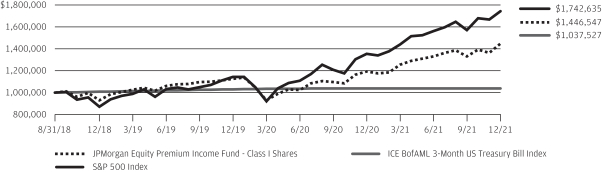

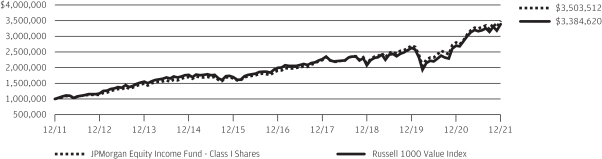

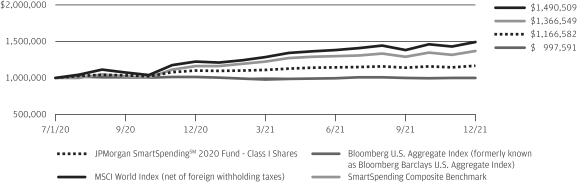

LIFE OF FUND PERFORMANCE (8/31/18 to 12/31/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on August 31, 2018.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Equity Premium Income Fund, the S&P 500 Index and the ICE BofAML 3-Month US Treasury Bill Index from August 31, 2018 to December 31, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index and the ICE BofAML 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable. These expenses are not identical to the expenses incurred by the Fund. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofAML 3-Month US Treasury Bill Index is comprised of a single issue purchased at the

beginning of the month and held for a full month. Each month the ICE BofAML 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Subsequent to the inception date of the Fund and through April 7, 2019, the Fund did not experience any shareholder activity. If such shareholder activity had occurred, the Fund’s performance may have been impacted.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 9 |

JPMorgan Hedged Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class I Shares)* | | | 4.32% | |

| S&P 500 Index | | | 11.67% | |

| |

| Net Assets as of 12/31/2021 (In Thousands) | | | $19,555,808 | |

INVESTMENT OBJECTIVE**

The JPMorgan Hedged Equity Fund (the “Fund”) seeks to provide capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the S&P 500 Index (the “Benchmark”) for the six months ended December 31, 2021. The Fund’s security selection in the pharmaceutical/medical technology and telecommunications sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the technology and media sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s underweight position in Pfizer Inc. and its overweight positions in Zimmer Biomet Holdings Inc. and Texas Instruments Inc. Shares of Pfizer, a pharmaceutical manufacturer, rose amid a resurgence in the pandemic in late 2021 and the U.S. Food and Drug Administration’s approval of the company’s COVID-19 pill. Shares of Zimmer Biomet Holdings, a medical device manufacturer, fell amid investor expectations that the resurgence of the pandemic in late 2021 may reduce demand for elective surgeries. Shares of Texas Instruments, a semiconductor manufacturer, fell after the company reported lower-than-expected revenue for the third quarter of 2021.

Leading individual contributors to relative performance included the Fund’s underweight positions in Adobe Inc., PayPal Holdings Inc. and Intel Corp. Shares of Adobe, a digital marketing and media provider not held in the Fund, fell after the company issued a weaker-than-expected forecast in December 2021. Shares of PayPal Holdings, a digital payments platform provider, fell after the company issued a lower-than-expected earnings forecast for the third quarter of 2021 and amid general weakness in financial technology stocks. Shares of Intel, a semiconductor manufacturer, fell after the company issued a weaker-than-expected earnings forecast with its third quarter 2021 results.

HOW WAS THE FUND POSITIONED?

The Fund used an enhanced index strategy that invests primarily in common stocks of large capitalization U.S. companies, while systematically purchasing and selling exchange-traded index put options and selling exchange-traded index call options. The option overlay is known as a Put/Spread Collar strategy. The combination of the diversified portfolio of equity securities,

downside protection from index put options and income from index call options provided the Fund with a portion of the returns associated with equity market investments while exposing the Fund to less risk than traditional long-only equity strategies.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | | | | | | | |

| | 1. | | | Microsoft Corp. | | | 6.6 | % |

| | 2. | | | Apple, Inc. | | | 6.4 | |

| | 3. | | | Amazon.com, Inc. | | | 3.7 | |

| | 4. | | | Alphabet, Inc., Class A | | | 2.6 | |

| | 5. | | | Alphabet, Inc., Class C | | | 1.9 | |

| | 6. | | | Tesla, Inc. | | | 1.9 | |

| | 7. | | | Meta Platforms, Inc., Class A | | | 1.9 | |

| | 8. | | | S&P 500 Index 3/31/2022 at USD 4,510.00, European Style | | | 1.7 | |

| | 9. | | | NVIDIA Corp. | | | 1.5 | |

| | 10. | | | UnitedHealth Group, Inc. | | | 1.3 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

| Information Technology | | | 26.6 | % |

| Consumer Discretionary | | | 12.9 | |

| Health Care | | | 12.3 | |

| Financials | | | 9.8 | |

| Communication Services | | | 9.2 | |

| Industrials | | | 7.6 | |

| Consumer Staples | | | 4.2 | |

| Energy | | | 2.5 | |

| Real Estate | | | 2.4 | |

| Utilities | | | 2.3 | |

| Materials | | | 2.2 | |

| Put Options Purchased | | | 1.7 | |

| Short-Term Investments | | | 6.3 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| 10 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2021 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | December 13, 2013 | | | | | | | | | | | | | | | | |

With Sales Charge** | | | | | (1.25 | )% | | | 7.21 | % | | | 8.95 | % | | | 7.83 | % |

Without Sales Charge | | | | | 4.20 | | | | 13.13 | | | | 10.14 | | | | 8.56 | |

CLASS C SHARES | | December 13, 2013 | | | | | | | | | | | | | | | | |

With CDSC*** | | | | | 2.93 | | | | 11.60 | | | | 9.59 | | | | 8.02 | |

Without CDSC | | | | | 3.93 | | | | 12.60 | | | | 9.59 | | | | 8.02 | |

CLASS I SHARES | | December 13, 2013 | | | 4.32 | | | | 13.43 | | | | 10.41 | | | | 8.83 | |

CLASS R5 SHARES | | December 13, 2013 | | | 4.42 | | | | 13.62 | | | | 10.59 | | | | 9.02 | |

CLASS R6 SHARES | | December 13, 2013 | | | 4.48 | | | | 13.72 | | | | 10.68 | | | | 9.10 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

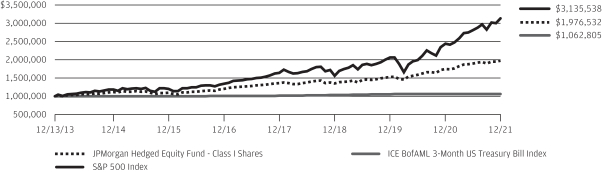

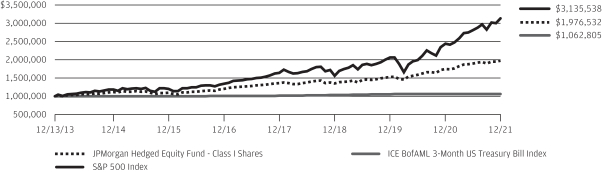

LIFE OF FUND PERFORMANCE (12/13/13 TO 12/31/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on December 13, 2013.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Hedged Equity Fund, the S&P 500 Index and the ICE BofAML 3-Month US Treasury Bill Index from December 13, 2013 to December 31, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index and the ICE BofAML 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofAML 3-Month US Treasury Bill Index is comprised of a single issue purchased at the

beginning of the month and held for a full month. Each month the ICE BofAML 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Subsequent to the inception date of the Fund and through May 30, 2014, the Fund did not experience any shareholder activity. If such shareholder activity had occurred, the Fund’s performance may have been impacted.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 11 |

JPMorgan Hedged Equity 2 Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class I Shares)* | | | 7.29% | |

| S&P 500 Index | | | 11.67% | |

| |

| Net Assets as of 12/31/2021 (In Thousands) | | | $3,893,228 | |

INVESTMENT OBJECTIVE**

The JPMorgan Hedged Equity 2 Fund (the “Fund”) seeks to provide capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the S&P 500 Index (the “Benchmark”) for the six months ended December 31, 2021.

The Fund’s security selection in the pharmaceutical/medical technology and telecommunications sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the technology and media sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s underweight position in Pfizer Inc. and its overweight positions in Zimmer Biomet Holdings Inc. and Texas Instruments Inc. Shares of Pfizer, a pharmaceutical manufacturer, rose amid a resurgence in the pandemic in late 2021 and the U.S. Food and Drug Administration’s approval of the company’s COVID-19 pill. Shares of Zimmer Biomet Holdings, a medical device manufacturer, fell amid investor expectations that the resurgence of the pandemic in late 2021 may reduce demand for elective surgeries. Shares of Texas Instruments, a semiconductor manufacturer, fell after the company reported lower-than-expected revenue for the third quarter of 2021.

Leading individual contributors to relative performance included the Fund’s underweight positions in Adobe Inc., PayPal Holdings Inc. and Intel Corp. Shares of Adobe, a digital marketing and media provider not held in the Fund, fell after the company issued a weaker-than-expected forecast in December 2021. Shares of PayPal Holdings, a digital payments platform provider, fell after the company issued a lower-than-expected earnings forecast for the third quarter of 2021 and amid general weakness in financial technology stocks. Shares of Intel, a semiconductor manufacturer, fell after the company issued a weaker-than-expected earnings forecast with its third quarter 2021 results.

HOW WAS THE FUND POSITIONED?

The Fund used an enhanced index strategy that invests primarily in common stocks of large capitalization U.S. companies, while systematically purchasing and selling exchange-traded index put options and selling exchange-traded index call options. The option overlay is known as a Put/Spread Collar

strategy. The combination of the diversified portfolio of equity securities, downside protection from index put options and income from index call options provided the Fund with a portion of the returns associated with equity market investments while exposing the Fund to less risk than traditional long-only equity strategies.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | | | | | | | |

| | 1. | | | Microsoft Corp. | | | 6.9 | % |

| | 2. | | | Apple, Inc. | | | 6.7 | |

| | 3. | | | Amazon.com, Inc. | | | 3.8 | |

| | 4. | | | Alphabet, Inc., Class A | | | 2.7 | |

| | 5. | | | Alphabet, Inc., Class C | | | 2.0 | |

| | 6. | | | Tesla, Inc. | | | 2.0 | |

| | 7. | | | Meta Platforms, Inc., Class A | | | 1.9 | |

| | 8. | | | NVIDIA Corp. | | | 1.6 | |

| | 9. | | | UnitedHealth Group, Inc. | | | 1.4 | |

| | 10. | | | Mastercard, Inc., Class A | | | 1.4 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

| Information Technology | | | 27.9 | % |

| Consumer Discretionary | | | 13.5 | |

| Health Care | | | 12.8 | |

| Financials | | | 10.3 | |

| Communication Services | | | 9.6 | |

| Industrials | | | 8.0 | |

| Consumer Staples | | | 4.4 | |

| Energy | | | 2.6 | |

| Real Estate | | | 2.5 | |

| Utilities | | | 2.4 | |

| Materials | | | 2.3 | |

| Put Options Purchased | | | 0.2 | |

| Short-Term Investments | | | 3.5 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| 12 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | |

TOTAL RETURNS AS OF DECEMBER 31, 2021 | |

| | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | SINCE

INCEPTION | |

CLASS A SHARES | | February 26, 2021 | | | | | | |

With Sales Charge** | | | | 1.53% | | | 14.13 | % |

Without Sales Charge | | | | 7.13 | | | 14.13 | |

CLASS C SHARES | | February 26, 2021 | | | | | | |

With CDSC*** | | | | 5.92 | | | 12.71 | |

Without CDSC | | | | 6.92 | | | 13.71 | |

CLASS I SHARES | | February 26, 2021 | | 7.29 | | | 14.41 | |

CLASS R5 SHARES | | February 26, 2021 | | 7.41 | | | 14.57 | |

CLASS R6 SHARES | | February 26, 2021 | | 7.46 | | | 14.71 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month period and 0% CDSC thereafter. |

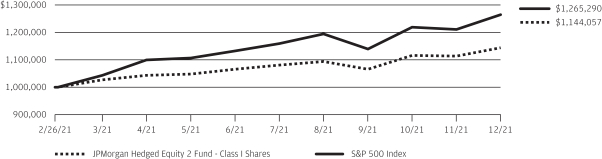

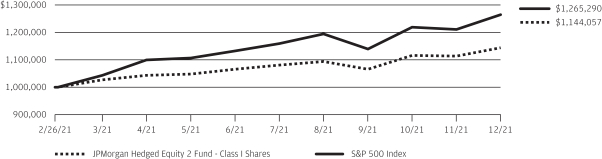

LIFE OF FUND PERFORMANCE (2/26/21 TO 12/31/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on February 26, 2021.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Hedged Equity 2 Fund and the S&P 500 Index from February 26, 2021 to December 31, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of

the securities included in the benchmarks, if applicable. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 13 |

JPMorgan Hedged Equity 3 Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class I Shares)* | | | 6.12% | |

| S&P 500 Index | | | 11.67% | |

| |

| Net Assets as of 12/31/2021 (In Thousands) | | | $2,317,080 | |

INVESTMENT OBJECTIVE**

The JPMorgan Hedged Equity 3 Fund (the “Fund”) seeks to provide capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the S&P 500 Index (the “Benchmark”) for the six months ended December 31, 2021.

The Fund’s security selection in the pharmaceutical/medical technology and telecommunications sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the technology and media sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s underweight position in Pfizer Inc. and its overweight positions in Zimmer Biomet Holdings Inc. and Texas Instruments Inc. Shares of Pfizer, a pharmaceutical manufacturer, rose amid a resurgence in the pandemic in late 2021 and the U.S. Food and Drug Administration’s approval of the company’s COVID-19 pill. Shares of Zimmer Biomet Holdings, a medical device manufacturer, fell amid investor expectations that the resurgence of the pandemic in late 2021 may reduce demand for elective surgeries. Shares of Texas Instruments, a semiconductor manufacturer, fell after the company reported lower-than-expected revenue for the third quarter of 2021.

Leading individual contributors to relative performance included the Fund’s underweight positions in Adobe Inc., PayPal Holdings Inc. and Intel Corp. Shares of Adobe, a digital marketing and media provider not held in the Fund, fell after the company issued a weaker-than-expected forecast in December 2021. Shares of PayPal Holdings, a digital payments platform provider, fell after the company issued a lower-than-expected earnings forecast for the third quarter of 2021 and amid general weakness in financial technology stocks. Shares of Intel, a semiconductor manufacturer, fell after the company issued a weaker-than-expected earnings forecast with its third quarter 2021 results.

HOW WAS THE FUND POSITIONED?

The Fund used an enhanced index strategy that invests primarily in common stocks of large capitalization U.S. companies, while systematically purchasing and selling exchange-traded index put options and selling exchange-traded index call options. The option overlay is known as a Put/Spread Collar

strategy. The combination of the diversified portfolio of equity securities, downside protection from index put options and income from index call options provided the Fund with a portion of the returns associated with equity market investments while exposing the Fund to less risk than traditional long-only equity strategies.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | |

| | 1. | | | Microsoft Corp. | | | 7.1 | % |

| | 2. | | | Apple, Inc. | | | 6.9 | |

| | 3. | | | Amazon.com, Inc. | | | 3.9 | |

| | 4. | | | Alphabet, Inc., Class A | | | 2.7 | |

| | 5. | | | Alphabet, Inc., Class C | | | 2.1 | |

| | 6. | | | Tesla, Inc. | | | 2.1 | |

| | 7. | | | Meta Platforms, Inc., Class A | | | 2.0 | |

| | 8. | | | NVIDIA Corp. | | | 1.6 | |

| | 9. | | | UnitedHealth Group, Inc. | | | 1.4 | |

| | 10. | | | Mastercard, Inc., Class A | | | 1.4 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

| Information Technology | | | 28.5 | % |

| Consumer Discretionary | | | 13.8 | |

| Health Care | | | 13.1 | |

| Financials | | | 10.5 | |

| Communication Services | | | 9.9 | |

| Industrials | | | 8.2 | |

| Consumer Staples | | | 4.5 | |

| Energy | | | 2.7 | |

| Real Estate | | | 2.6 | |

| Utilities | | | 2.5 | |

| Materials | | | 2.3 | |

| Put Options Purchased | | | 0.7 | |

| Short-Term Investments | | | 0.7 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| 14 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | |

TOTAL RETURNS AS OF DECEMBER 31, 2021 | |

| | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | SINCE

INCEPTION | |

CLASS A SHARES | | February 26, 2021 | | | | | | |

With Sales Charge** | | | | 0.44% | | | 12.86 | % |

Without Sales Charge | | | | 5.97 | | | 12.86 | |

CLASS C SHARES | | February 26, 2021 | | | | | | |

With CDSC*** | | | | 4.68 | | | 11.41 | |

Without CDSC | | | | 5.68 | | | 12.41 | |

CLASS I SHARES | | February 26, 2021 | | 6.12 | | | 13.16 | |

CLASS R5 SHARES | | February 26, 2021 | | 6.23 | | | 13.29 | |

CLASS R6 SHARES | | February 26, 2021 | | 6.29 | | | 13.38 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month period and 0% CDSC thereafter. |

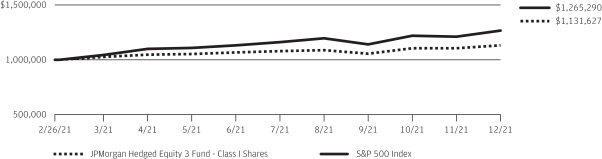

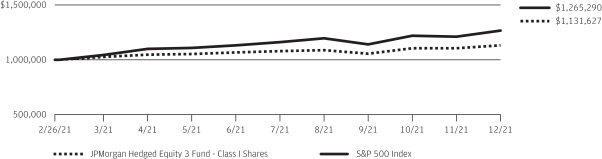

LIFE OF FUND PERFORMANCE (2/26/21 TO 12/31/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on February 26, 2021.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Hedged Equity 3 Fund and the S&P 500 Index from February 26, 2021 to December 31, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of

the securities included in the benchmarks, if applicable. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 15 |

JPMorgan Large Cap Growth Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)* | | | 8.65% | |

| Russell 1000 Growth Index | | | 12.93% | |

| |

| Net Assets as of 12/31/2021 (In Thousands) | | | $40,805,094 | |

INVESTMENT OBJECTIVE**

The JPMorgan Large Cap Growth Fund (the “Fund”) seeks long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the Russell 1000 Growth Index (the “Benchmark”) for the six months ended December 31, 2021.

The Fund’s overweight position and security selection in the communication services sector and its security selection and underweight position in the information technology sector were leading detractors from performance relative to the Benchmark, while the Fund’s security selection in the consumer discretionary and financials sectors was the leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s out-of-Benchmark position in Snap Inc., its underweight position in Apple Inc. and its overweight position in PayPal Holdings Inc. Shares of Snap, an online camera platform and social media provider, fell after the company reported third quarter 2021 results that were below analysts’ expectations. Shares of Apple, a provider of computers, mobile devices and relative services, rose amid consecutive quarter of record earnings and strong demand for mobile phones. Shares of PayPal Holdings, a digital payments platform provider, fell after the company issued a lower-than-expected earnings forecast for the third quarter of 2021 and amid general weakness in financial technology stocks.

Leading individual contributors to relative performance included the Fund’s underweight position in Amazon.com Inc. and its overweight positions in Advanced Micro Devices Inc. and Blackstone Inc. Shares of Amazon.com, an online retailer and services provider, fell after the company reported lower-than-expected earnings and revenue for the third quarter of 2021 and issued a lower-than-expected forecast for the fourth quarter of 2021. Shares of Advanced Micro Devices, a semiconductor manufacturer, rose after the company reported better-than-expected earnings and sales for the third quarter of 2021 and issued a better-than-expected forecast for the fourth quarter of 2021. Shares of Blackstone, an investment management company, rose after the company reported better-than-expected earnings and revenue for the third quarter of 2021.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, rigorously researching individual companies in an effort to construct portfolios of stocks that have strong fundamentals and positive price momentum. The Fund’s portfolio managers sought to invest in companies with attractive fundamentals that, in their view, possessed the potential to significantly exceed expectations for a prolonged period of time.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | |

| | 1. | | | Apple, Inc. | | | 9.2 | % |

| | 2. | | | Microsoft Corp. | | | 9.1 | |

| | 3. | | | Alphabet, Inc., Class C | | | 7.4 | |

| | 4. | | | Tesla, Inc. | | | 4.5 | |

| | 5. | | | Amazon.com, Inc. | | | 3.3 | |

| | 6. | | | Advanced Micro Devices, Inc. | | | 3.0 | |

| | 7. | | | NVIDIA Corp. | | | 3.0 | |

| | 8. | | | Blackstone, Inc. | | | 2.8 | |

| | 9. | | | Meta Platforms, Inc., Class A | | | 2.7 | |

| | 10. | | | Deere & Co. | | | 2.3 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

| Information Technology | | | 37.1 | % |

| Consumer Discretionary | | | 17.3 | |

| Communication Services | | | 13.4 | |

| Health Care | | | 9.9 | |

| Financials | | | 9.3 | |

| Industrials | | | 6.8 | |

| Materials | | | 2.6 | |

| Consumer Staples | | | 2.5 | |

| Short-Term Investments | | | 1.1 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| 16 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2021 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 22, 1994 | | | | | | | | | | | | | | | | |

With Sales Charge** | | | | | 2.82 | % | | | 11.99 | % | | | 27.21 | % | | | 19.10 | % |

Without Sales Charge | | | | | 8.52 | | | | 18.20 | | | | 28.59 | | | | 19.75 | |

CLASS C SHARES | | November 4, 1997 | | | | | | | | | | | | | | | | |

With CDSC*** | | | | | 7.24 | | | | 16.61 | | | | 27.95 | | | | 19.27 | |

Without CDSC | | | | | 8.24 | | | | 17.61 | | | | 27.95 | | | | 19.27 | |

CLASS I SHARES | | February 28, 1992 | | | 8.65 | | | | 18.49 | | | | 28.90 | | | | 19.99 | |

CLASS R2 SHARES | | November 3, 2008 | | | 8.39 | | | | 17.91 | | | | 28.26 | | | | 19.45 | |

CLASS R3 SHARES | | September 9, 2016 | | | 8.51 | | | | 18.20 | | | | 28.58 | | | | 19.72 | |

CLASS R4 SHARES | | September 9, 2016 | | | 8.65 | | | | 18.49 | | | | 28.90 | | | | 19.99 | |

CLASS R5 SHARES | | April 14, 2009 | | | 8.73 | | | | 18.66 | | | | 29.10 | | | | 20.20 | |

CLASS R6 SHARES | | November 30, 2010 | | | 8.79 | | | | 18.79 | | | | 29.23 | | | | 20.30 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

TEN YEAR PERFORMANCE (12/31/11 TO 12/31/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R3 and Class R4 Shares prior to their inception dates are based on the performance of Class I Shares. With respect to Class R3 Shares, prior class performance has been adjusted to reflect the differences in expenses between classes. The actual returns of Class R4 Shares would have been similar to those shown because Class R4 Shares had similar expenses to Class I Shares.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Large Cap Growth Fund and the Russell 1000 Growth Index from December 31, 2011 to December 31, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell 1000 Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect

reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Russell 1000 Growth Index is an unmanaged index which measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A Performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 17 |

JPMorgan Large Cap Value Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class I Shares)* | | | 1.94% | |

| Russell 1000 Value Index | | | 6.93% | |

| |

| Net Assets as of 12/31/2021 (In Thousands) | | | $3,113,172 | |

INVESTMENT OBJECTIVE**

The JPMorgan Large Cap Value Fund (the “Fund”) seeks capital appreciation with the incidental goal of achieving current income by investing primarily in equity securities.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the Russell 1000 Value Index (the “Benchmark”) for the six months ended December 31, 2021.

The Fund’s security selection in the industrials and consumer staples sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the materials and financials sector was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in Lamb Weston Holdings Inc., US Foods Holding Corp. and Zimmer Biomet Holdings Inc. Shares of Lamb Weston Holdings, a frozen foods and dairy products provider, fell amid increased input costs and reported lower-than-expected results for the company’s fiscal first quarter of 2021. Shares of U.S. Foods Holding, a distributor of goods to the food services industry, fell after the company reported lower-than-expected earnings for the third quarter of 2021 amid investor concerns about the impact on the restaurant industry of the omicron variant of COVID-19. Shares of Zimmer Biomet Holdings, a medical device manufacturer, fell amid investor expectations that the resurgence of the pandemic in late 2021 may reduce demand for elective surgeries.

Leading individual contributors to relative performance included the Fund’s overweight positions in Alcoa Corp. and Centene Corp. and its out-of-Benchmark position in Seagate Technology Holdings PLC. Shares of Alcoa, an aluminum producer, rose after the company reported better-than-expected earnings and revenue for both the second and third quarters of 2021 and the company was added to the S&P 400 Mid Cap Index late in the period. Shares of Centene, a health insurance provider, rose after the company issued a better-than-expected forecast for earnings and revenue for fiscal 2022. Shares of Seagate Technology Holdings, a data storage products manufacturer, rose after the company reported better-than-expected earnings and revenue for its fiscal second quarter.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio manager combined a bottom-up fundamental approach to security selection with a systematic valuation process. Overall, the Fund’s portfolio manager looked to take advantage of mispriced stocks that he believed appeared attractive relative to their fair value.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | |

| | 1. | | | Bank of America Corp. | | | 3.8 | % |

| | 2. | | | Wells Fargo & Co. | | | 3.8 | |

| | 3. | | | Centene Corp. | | | 3.6 | |

| | 4. | | | US Foods Holding Corp. | | | 3.4 | |

| | 5. | | | Royal Caribbean Cruises Ltd. | | | 3.2 | |

| | 6. | | | Chevron Corp. | | | 2.9 | |

| | 7. | | | Bristol-Myers Squibb Co. | | | 2.9 | |

| | 8. | | | Lamb Weston Holdings, Inc. | | | 2.8 | |

| | 9. | | | State Street Corp. | | | 2.8 | |

| | 10. | | | Seagate Technology Holdings plc | | | 2.6 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

| Financials | | | 21.1 | % |

| Health Care | | | 19.8 | |

| Industrials | | | 10.9 | |

| Consumer Discretionary | | | 9.8 | |

| Consumer Staples | | | 9.6 | |

| Materials | | | 8.7 | |

| Energy | | | 7.4 | |

| Communication Services | | | 3.4 | |

| Information Technology | | | 2.9 | |

| Utilities | | | 2.7 | |

| Real Estate | | | 2.5 | |

| Short-Term Investments | | | 1.2 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| 18 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2021 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 18, 1992 | | | | | | | | | | | | | | | | |

With Sales Charge** | | | | | (3.50 | )% | | | 16.95 | % | | | 10.25 | % | | | 13.36 | % |

Without Sales Charge | | | | | 1.83 | | | | 23.45 | | | | 11.45 | | | | 13.98 | |

CLASS C SHARES | | March 22, 1999 | | | | | | | | | | | | | | | | |

With CDSC*** | | | | | 0.57 | | | | 21.86 | | | | 10.90 | | | | 13.52 | |

Without CDSC | | | | | 1.57 | | | | 22.86 | | | | 10.90 | | | | 13.52 | |

CLASS I SHARES | | March 1, 1991 | | | 1.94 | | | | 23.73 | | | | 11.71 | | | | 14.19 | |

CLASS R2 SHARES | | November 3, 2008 | | | 1.68 | | | | 23.15 | | | | 11.15 | | | | 13.68 | |

CLASS R3 SHARES | | October 1, 2018 | | | 1.86 | | | | 23.46 | | | | 11.45 | | | | 13.98 | |

CLASS R4 SHARES | | October 1, 2018 | | | 1.96 | | | | 23.69 | | | | 11.71 | | | | 14.19 | |

CLASS R5 SHARES | | May 15, 2006 | | | 2.04 | | | | 23.92 | | | | 11.88 | | | | 14.40 | |

CLASS R6 SHARES | | November 30, 2010 | | | 2.06 | | | | 24.03 | | | | 11.98 | | | | 14.47 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

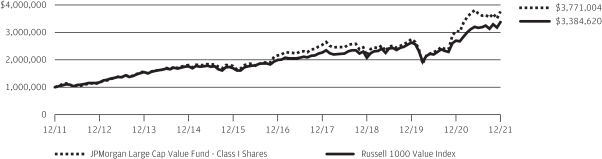

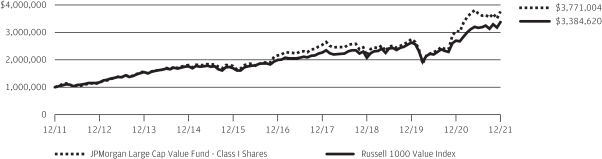

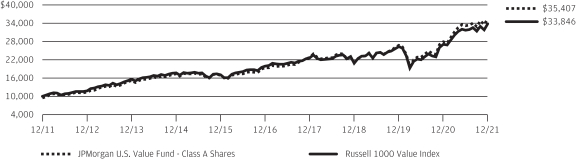

TEN YEAR PERFORMANCE (12/31/11 TO 12/31/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R3 Shares prior to their inception date are based on the performance of Class A Shares. The actual returns of Class R3 Shares would have been different than those shown because Class R3 Shares have different expenses than Class A Shares.

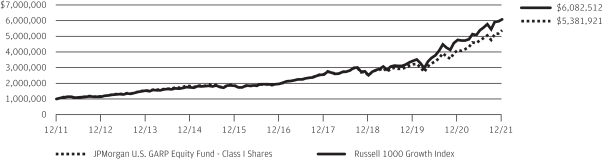

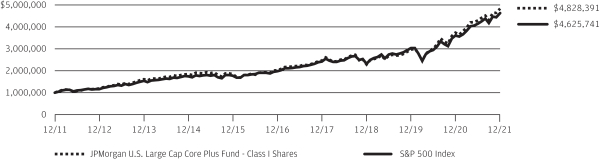

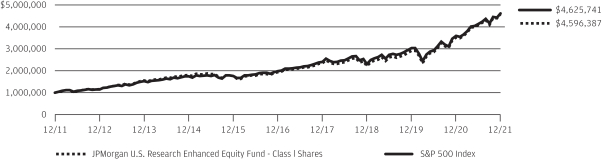

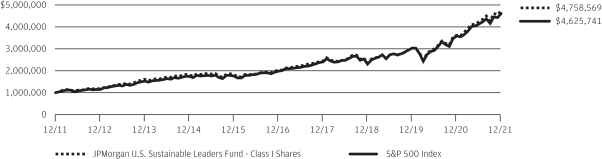

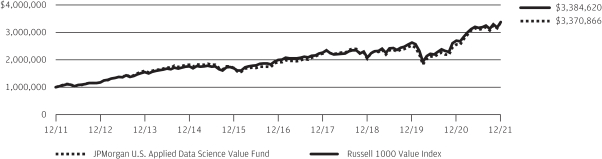

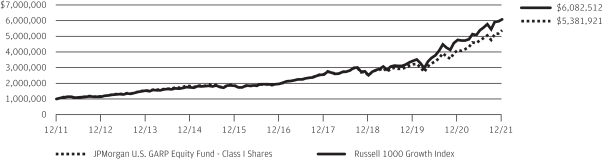

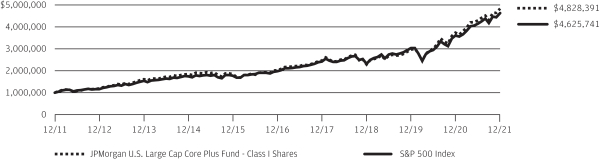

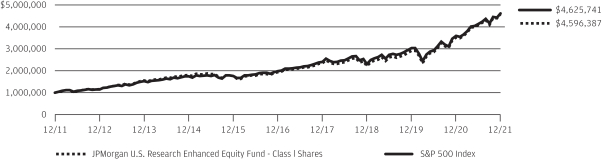

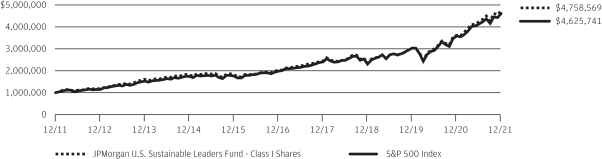

Returns for Class R4 Shares prior to their inception date are based on the performance of Class I Shares. The actual returns for Class R4 Shares would have been similar to those shown because Class R4 Shares have similar expenses than Class I Shares.