UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23117

JPMorgan Trust IV

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: October 31

Date of reporting period: November 1, 2022 through April 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Report. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

Semi-Annual Report

J.P. Morgan International Equity Funds

April 30, 2023 (Unaudited)

JPMorgan Emerging Markets Equity Fund |

JPMorgan Emerging Markets Research Enhanced Equity Fund |

JPMorgan Europe Dynamic Fund |

JPMorgan International Equity Fund |

JPMorgan International Focus Fund |

JPMorgan International Hedged Equity Fund |

JPMorgan International Value Fund |

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Letter to Shareholders

June 15, 2023 (Unaudited)

Dear Shareholder,

Financial markets largely generated positive returns for the six months ended April 30, 2023, even as rising interest rates, weaker corporate earnings and geopolitical uncertainty weighed on global economic growth. Overall, global equity markets – led by European stocks – generally outperformed bond markets for the reporting period.

|

“While the effects of rising interest rates is likely to adversely impact economic growth in the months ahead, other factors may aid the global economic outlook, as energy prices have trended downward in recent months and the re-opening of China’s economy may provide support for increased global trade.” — Brian S. Shlissel

|

While economic growth has slowed in recent quarters, to date, the U.S. has avoided formal entry into a recession. Moreover, inflation has decelerated from last year’s historical highs as energy and electricity prices receded in 2023, allowing the U.S. Federal Reserve in June 2023 to refrain from further raising interest rates for the first time since January 2022, though the central bank stated it may find it necessary to raise rates in the future. The job market in the U.S. remained strong throughout the period as the reported monthly unemployment rate ranged between 3.6% and 3.4% for the six months ended April 30, 2023.

Across Europe, inflationary pressures remained high and both the European Central Bank and the Bank of England continued to raise interest rates during the period. Unemployment across the EU stood at 6%, while the U.K. jobless rate fell to 3.8% in

April 2023. Notably, European equity markets generally outperformed other developed markets during the period, potentially driven by more attractive valuations relative to U.S. companies.

The International Monetary Fund’s (IMF) April 2023 economic outlook warned that global output is likely to decline to 2.8% for 2023, amid weakness in parts of the financial sector, continued inflationary pressures and the ongoing war in Ukraine. Further, the IMF forecast developed market economies to decelerate at a faster pace than emerging market economies.

While the effects of rising interest rates is likely to adversely impact economic growth in the months ahead, other factors may aid the global economic outlook, as energy prices have trended downward in recent months and the re-opening of China’s economy may provide support for increased global trade. Regardless of the economic backdrop, we believe investors who hold a well-diversified portfolio and a long-term outlook may be better positioned to benefit from opportunities presented by global financial markets. Our suite of investment solutions seeks to provide investors with ability to build durable portfolios that can meet their financial goals.

Sincerely,

Brian S. Shlissel

President, J.P. Morgan Funds

J.P. Morgan Asset Management

1-800-480-4111 or www.jpmorganfunds.com for more information

| J.P. Morgan International Equity Funds | |

J.P. Morgan International Equity Funds

MARKET OVERVIEW

SIX MONTHS ENDED April 30, 2023 (Unaudited)

Global financial markets largely generated positive returns for the period and completed a rebound from the sell-offs that marked the middle of 2022. Developed markets equity generally outperformed emerging markets equity, while European equity markets outperformed U.S. equity.

However, equity markets performance was mixed on a month-to-month basis, even if the overall trend was upward. For the six months ended April 30, 2023, the MSCI EAFE Index returned 24.19%, the MSCI Emerging Markets Index returned 16.36% and the S&P 500 Index returned 8.63%.

Leading central banks continued to raise interest rates throughout the six-month period, though the size of increases narrowed in 2023 as the policy response to inflationary pressure grew less aggressive. Notably, the Bank of Japan maintained its negative interest rate policy amid weak consumption data and marginal economic growth.

While global inflation rates remained elevated during the period, they retreated from the 40-year highs reached in 2022, and price data in the U.S. and the Euro Area indicated a slowing trend. Though inflation in the U.K. declined in the final months of 2022, the U.K. consumer price index rose more than expected in 2023.

Lower energy prices were a leading contributor to declining global inflation in the second half of the period. Following Russia’s invasion of Ukraine in late February 2022, the European Union and the U.K. largely avoided an extended energy crisis by securing alternative sources to Russian natural gas and moved to build up reserves of both natural gas and petroleum ahead of the winter months.

Meanwhile, economic activity and aggregate demand in China accelerated after the country’s leadership lifted strict anti-pandemic policies in late 2022. The rebound in China helped to lift equity prices in China and its leading emerging market trading partners.

| J.P. Morgan International Equity Funds | |

JPMorgan Emerging Markets Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited)

| |

| |

MSCI Emerging Markets Index (net total return) | |

Net Assets as of 4/30/2023 (In Thousands) | |

INVESTMENT OBJECTIVE**

The JPMorgan Emerging Markets Equity Fund (the “Fund”) seeks to provide high total return.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class L Shares outperformed the MSCI Emerging Markets Index (the “Benchmark”) for the six months ended April 30, 2023.

The Fund’s security selection in the financials and consumer staples sectors was a leading contributor to performance relative to the Benchmark, while the Fund’s security selection in the information technology and energy sectors was a leading detractor form relative performance.

By country, the Fund’s security selection in Taiwan and underweight position in Saudi Arabia were leading contributors to performance relative to the Benchmark, while the Fund’s security selection in China and its out-of-Benchmark allocation to Belarus were leading detractors from relative performance.

Leading individual contributors to relative performance included the Fund’s out-of-Benchmark positions in AIA Group Ltd. and MercadoLibre Inc., and its overweight position in Taiwan Semiconductor Manufacturing Co. Shares of AIA Group, a Hong Kong investment holding company and life insurance provider, rose as business activity resumed in China following the end of strict anti-pandemic policies in the second half of 2022. Shares of MercadoLibre, an e-commerce provider based in Uruguay, rose after reporting consecutive quarters of better-than-expected earnings and revenue. Shares of Taiwan Semiconductor Manufacturing rose after the company reported better-than-expected earnings for the fourth quarter of 2022 and outlined plans to reduce spending in 2023.

Leading individual detractors from relative performance included the Fund’s out-of-Benchmark position in EPAM Systems Inc. and its overweight positions in JD.com Inc. and Infosys Inc. Shares of EPAM Systems, a global provider of software development and digital platform services that largely operates from Belarus, fell after the company issued a weaker-than-expected earnings forecast for 2023. Shares of JD.com, a Chinese e-commerce provider, fell after the company reported slowing growth in sales during the period. Shares of Infosys, an Indian digital services and consulting company, fell after the company reported lower-than-expected earnings and revenue for the fourth quarter of 2022.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed an active strategy in which portfolio construction was focused on the highest-conviction ideas found at the security level. The Fund’s portfolio managers used bottom-up fundamental research to determine the Fund’s security weightings, researching companies in an attempt to determine their underlying value and potential for future earnings growth.

As a result of this process, the Fund’s largest sector overweight allocations relative to the Benchmark during the period were in the information technology and consumer staples sectors and its largest relative underweight allocations were in the materials and communication services sectors. The Fund’s largest country overweight allocations relative to the Benchmark during the period were in India and Argentina and its largest relative underweight allocations were in Saudi Arabia

and South Korea.

| J.P. Morgan International Equity Funds | |

JPMorgan Emerging Markets Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited) (continued)

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR (Taiwan) | |

| Samsung Electronics Co. Ltd. (South Korea) | |

| Tencent Holdings Ltd. (China) | |

| MercadoLibre, Inc. (Brazil) | |

| | |

| Housing Development Finance Corp. Ltd. (India) | |

| AIA Group Ltd. (Hong Kong) | |

| Bank Rakyat Indonesia Persero Tbk. PT (Indonesia) | |

| Kotak Mahindra Bank Ltd. (India) | |

| Bank Central Asia Tbk. PT (Indonesia) | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

| J.P. Morgan International Equity Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF April 30, 2023

|

| |

| Sales Charge for Class A Shares is 5.25%. |

| Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

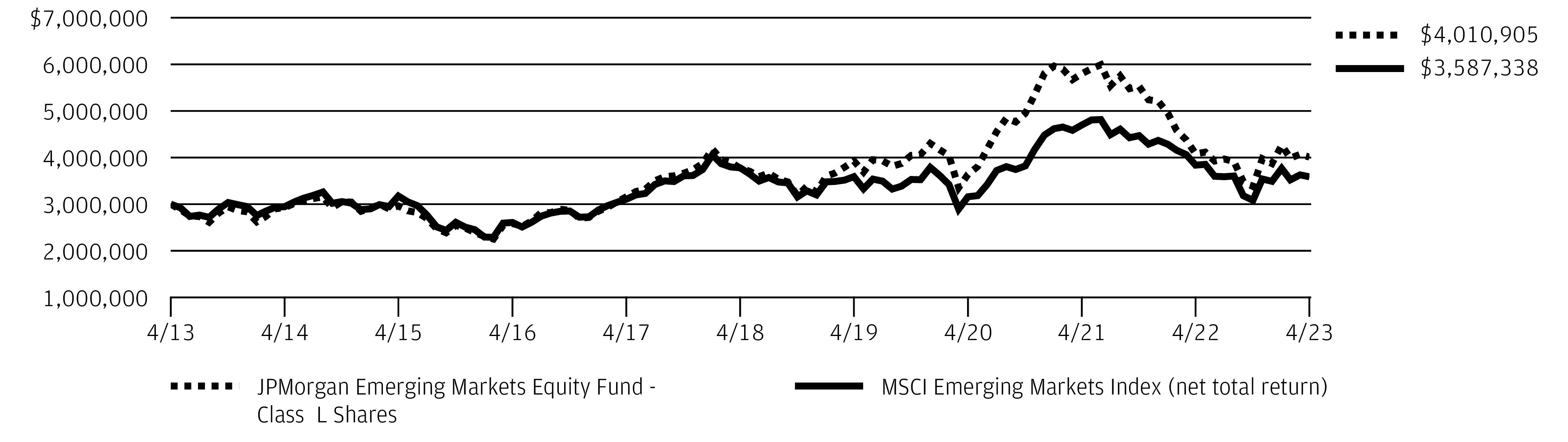

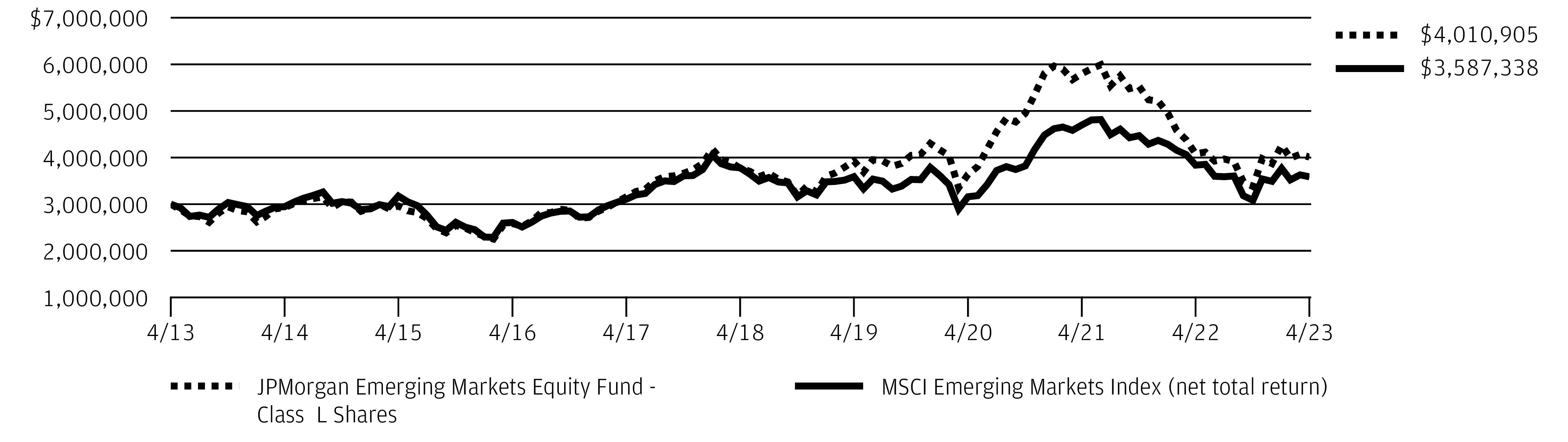

TEN YEAR FUND PERFORMANCE (4/30/13 TO 4/30/23)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-800-480-4111.

Returns for Class R5 Shares and Class R6 Shares prior to their inception dates are based on the performance of Class L Shares. The actual returns of Class R5 Shares and Class R6 Shares would have been different than those shown because Class R5 Shares and Class R6 Shares have different expenses than Class L Shares.

Returns shown for Class R2 Shares and Class R3 Shares prior to their inception dates are based on the performance of Class A Shares. The actual returns of Class R2 Shares and Class R3 Shares would have been lower than those shown because Class R2 Shares and Class R3 Shares have higher expenses than Class A Shares.

Returns for Class R4 Shares prior to its inception date are based on the performance of Class I Shares. The actual returns of Class R4 Shares would have been lower than those shown because Class R4 Shares have higher expenses than Class I Shares.

The graph illustrates comparative performance for $3,000,000 invested in Class L Shares of the JPMorgan Emerging Markets Equity Fund and the MSCI Emerging Markets Index (net total return) from April 30, 2013 to April 30, 2023. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI Emerging Markets Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and mid- cap stocks in emerging markets. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Class L Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

| J.P. Morgan International Equity Funds | |

JPMorgan Emerging Markets Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited) (continued)

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan International Equity Funds | |

JPMorgan Emerging Markets Research Enhanced Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited)

| |

| |

MSCI Emerging Markets Index (net total return) | |

Net Assets as of 4/30/2023 (In Thousands) | |

INVESTMENT OBJECTIVE**

The JPMorgan Emerging Markets Research Enhanced Equity Fund (the “Fund”) seeks to provide long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class R6 Shares outperformed the MSCI Emerging Markets Index (the “Benchmark”) for the six months ended April 30, 2023.

By sector, the Fund’s security selection in the financials and utilities sectors was a leading contributor to performance relative to the Benchmark, while the Fund’s security selection in the industrials and energy sectors was a leading detractor from relative performance.

By country, the Fund’s security selection in India and Taiwan was a leading contributor to relative performance, while the Fund’s security selection in China and Thailand was a leading detractor to relative performance.

Leading individual contributors to relative performance included the Fund’s underweight positions in Adani Total Gas Ltd. and Banco Bradesco S/A and its overweight position in Tencent Holdings Ltd. Shares of Adani Total Gas, an Indian natural gas utility not held in the Fund, fell sharply in the second half of the period amid investor concerns about business practices across the parent Adani Group of companies. Shares of Banco Bradesco, a Brazilian financial services company not held in the Fund, fell amid investor concerns about the economic outlook for Brazil. Shares of Tencent Holdings, a Chinese e-commerce provider, rose amid sales

growth and a broad rebound in China’s technology sector during the second half of the period.

Leading individual detractors from relative performance included the Fund’s overweight positions in Lojas Renner SA and Alinma Bank, and its underweight position in PetroChina Co. Shares of Lojas Renner, a Brazilian department store chain, fell amid investor concerns about the company’s outlook for growth. Shares of Alinma, a Saudi Arabian bank, fell after the company reported lower-than-expected growth in annual net income. Shares of PetroChina, a Chinese state-owned petroleum and natural gas producer not held in the Fund, rose amid investor demand for lower valuation stocks in the global energy sector.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a combination of a disciplined portfolio construction process with in-depth fundamental research into individual securities conducted by a global network of research analysts to identify what they believed to be their relative value.

As a result of this process, by sector, the Fund’s largest overweight allocations relative to the Benchmark during the period were in the financials and consumer staples sectors and its largest underweight allocations were in the health care and industrials sectors.

By country, the Fund’s largest overweight allocations relative to the Benchmark during the period were in Mexico and South Korea and its largest relative underweight allocations were in Turkey and Kuwait.

| J.P. Morgan International Equity Funds | |

JPMorgan Emerging Markets Research Enhanced Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited) (continued)

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | |

| Tencent Holdings Ltd. (China) | |

| Samsung Electronics Co. Ltd. (South Korea) | |

| Alibaba Group Holding Ltd. (China) | |

| Reliance Industries Ltd. (India) | |

| China Construction Bank Corp., Class H (China) | |

| | |

| Housing Development Finance Corp. Ltd. (India) | |

| Ping An Insurance Group Co. of China Ltd., Class H (China) | |

| | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

| J.P. Morgan International Equity Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF April 30, 2023

LIFE OF FUND PERFORMANCE (12/11/18 TO 4/30/23)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-800-480-4111.

The Fund commenced operations on December 11, 2018.

Returns for Class I Shares prior to its inception date are based on the performance of Class R6 Shares. The actual returns of Class I Shares would have been lower than those shown because Class I Shares have higher expenses than Class R6 Shares.

The graph illustrates comparative performance for $15,000,000 invested in Class R6 Shares of the JPMorgan Emerging Markets Research Enhanced Equity Fund and the MSCI Emerging Markets Index (net total return) from December 11, 2018 to April 30, 2023. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI Emerging Markets Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and mid- cap stocks in emerging markets. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Class R6 Shares have a $15,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date.

Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, noninfringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| J.P. Morgan International Equity Funds | |

JPMorgan Europe Dynamic Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited)

| |

Fund (Class A Shares, without a sales charge) * | |

MSCI Europe Index (net total return) | |

Net Assets as of 4/30/2023 (In Thousands) | |

INVESTMENT OBJECTIVE**

The JPMorgan Europe Dynamic Fund (the “Fund”) seeks total return from long-term capital growth. Total return consists of capital growth and current income.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class A Shares, without a sales charge, underperformed the MSCI Europe Index (net total return) (the “Benchmark”) for the six months ended April 30, 2023.

Relative to the Benchmark, the Fund’s security selection in the industrials and information technology sectors was a leading detractor from performance, while the Fund’s security selection in the financials and health care sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s out-of-Benchmark positions in Hexatronic Group AB and Verbio Vereinigte BioEnergie AG, and its overweight position in NN Group NV. Shares of Hexatronic, a Swedish fiber optic equipment provider, fell amid investor concerns about the broader fiber-optic sector’s ability to raise capital. Shares of Verbio Vereinigte BioEnergie, a German biofuels manufacturer, fell after the company lowered its earnings forecast amid lower prices for bioethanol and higher input costs during the period. Shares of NN Group, a Dutch insurance and financial services provider, fell after the company reported lower operating profit for the second half of its fiscal year.

Leading individual contributors to relative performance included the Fund’s overweight positions in UniCredit SpA, Novo Nordisk A/S and LVMH Moet Hennessey Louis Vuitton SE. Shares of UniCredit, an Italian banking and financial services company, rose after the company reported better-than-expected results for the first quarter of 2023. Shares of Novo Nordisk, a Danish pharmaceuticals and health care products provider, rose amid consumer demand for the company’s weight-loss drug and after the company reported revenue growth for the first quarter of 2023. Shares of LVMH Moet Hennessey Louis Vuitton, a luxury goods manufacturer, rose amid strong consumer demand and record revenue through the first quarter of 2023.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers believe that attractively valued, high quality securities with positive momentum have the potential to outperform the market. During the reporting period, the Fund’s portfolio managers invested in securities that they believed had these style characteristics. Portfolio positions were based on bottom-up security selection rather

than top-down asset allocation decisions.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| LVMH Moet Hennessy Louis Vuitton SE (France) | |

| Novo Nordisk A/S, Class B (Denmark) | |

| | |

| Novartis AG (Registered) (Switzerland) | |

| TotalEnergies SE (France) | |

| | |

| Siemens AG (Registered) (Germany) | |

| Allianz SE (Registered) (Germany) | |

| Koninklijke Ahold Delhaize NV (Netherlands) | |

| | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

| J.P. Morgan International Equity Funds | |

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan International Equity Funds | |

JPMorgan Europe Dynamic Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF April 30, 2023

|

| |

| Sales Charge for Class A Shares is 5.25%. |

| Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

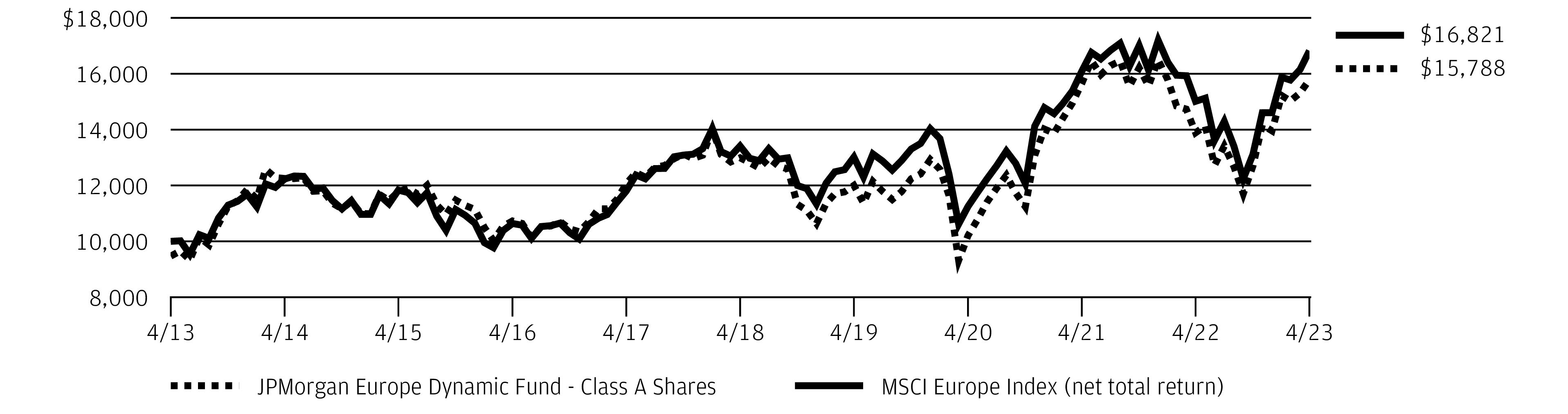

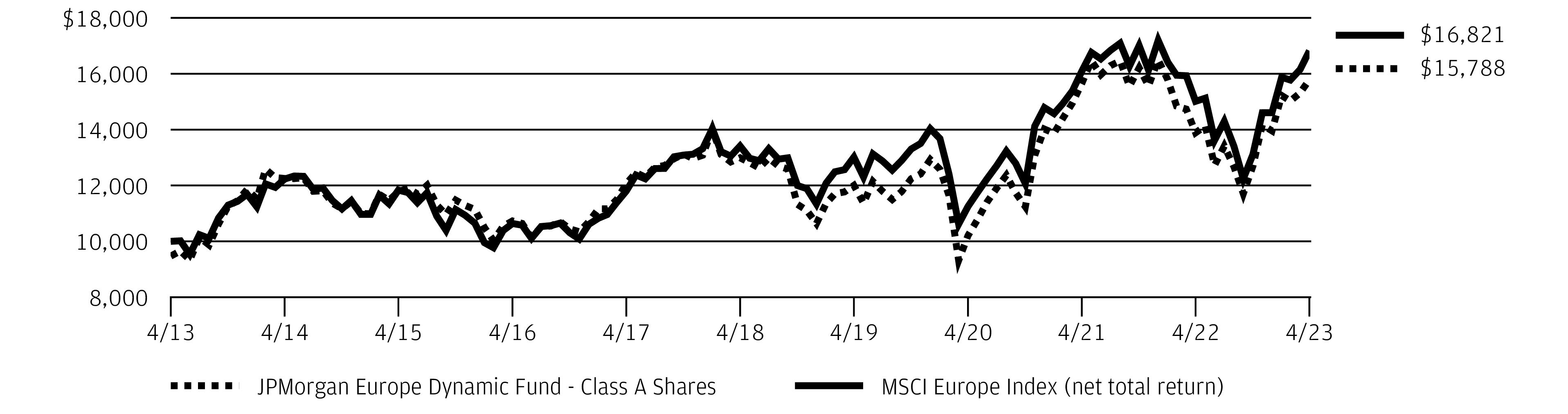

TEN YEAR FUND PERFORMANCE (4/30/13 TO 4/30/23)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-800-480-4111.

Returns for Class R6 Shares prior to its inception date are based on the performance of Class L Shares. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class L Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Europe Dynamic Fund and the MSCI Europe Index (net total return) from April 30, 2013 to April 30, 2023. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the MSCI Europe Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI Europe Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and mid- cap stocks in the developed markets countries in Europe. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors

who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan International Equity Funds | |

JPMorgan International Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited)

| |

| |

MSCI EAFE Index (net total return) | |

Net Assets as of 4/30/2023 (In Thousands) | |

INVESTMENT OBJECTIVE**

The JPMorgan International Equity Fund (the “Fund”) seeks total return from long-term capital growth and income. Total return consists of capital growth and current income.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares outperformed the MSCI EAFE Index (net of total return) (the “Benchmark”) for the six months ended April 30, 2023.

Relative to the Benchmark, the Fund’s security selection in the financials sector and its underweight position in the real estate sector, where the Fund had no holdings, were leading contributors to relative performance, while the Fund’s security selection in the industrials and utilities sectors was a leading detractor from relative performance.

By region, the Fund’s security selection in Europe, excluding the U.K., and in the Pacific, excluding Japan, was a leading contributor to performance. The Fund’s security selection in the U.K. and its out-of-Benchmark allocation to emerging markets were the leading detractors from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in Novo Nordisk A/S and LVMH Moet Hennessey Louis Vuitton SE, and its underweight position in Toyota Motor Corp. Shares of Novo Nordisk, a Danish pharmaceuticals and health care products provider, rose amid consumer demand for the company’s

weight-loss drug and after the company reported revenue growth for the first quarter of 2023. Shares of LVMH Moet Hennessey Louis Vuitton, a luxury goods manufacturer, rose amid strong consumer demand and record revenue through the first quarter of 2023. Shares of Toyota Motor, a Japanese automobile manufacturer, fell after the company named a new chief executive and chairman, and after it reported a decline in North American sales.

Leading individual detractors from relative performance included the Fund’s overweight positions in Roche Holding AG, DBS Group Holdings Ltd. and Kyowa Kirin Co. Shares of Roche Holdings, a Swiss pharmaceutical and diagnostics company, fell after the company forecast weaker earnings in 2023 amid a drop in sales of Covid treatments. Shares of DBS Group Holdings, a Singapore financial services provider, fell after the company reported a disruption in its digital services to customers. Shares of Kyowa Kirin, a Japanese maker of pharmaceuticals and other medical products, fell after the company lowered its forecast for 2023 earnings.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers continued to focus on security selection to build a portfolio of international equities. They used bottom-up fundamental research to identify what they believed were attractively priced securities of companies with solid financial positions that possessed the potential to increase their earnings faster than their industry peers.

| J.P. Morgan International Equity Funds | |

JPMorgan International Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited) (continued)

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| | |

| AstraZeneca plc (United Kingdom) | |

| LVMH Moet Hennessy Louis Vuitton SE (France) | |

| Novo Nordisk A/S, Class B (Denmark) | |

| TotalEnergies SE (France) | |

| | |

| ASML Holding NV (Netherlands) | |

| | |

| DBS Group Holdings Ltd. (Singapore) | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

| J.P. Morgan International Equity Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF April 30, 2023

|

| |

| Sales Charge for Class A Shares is 5.25%. |

| Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

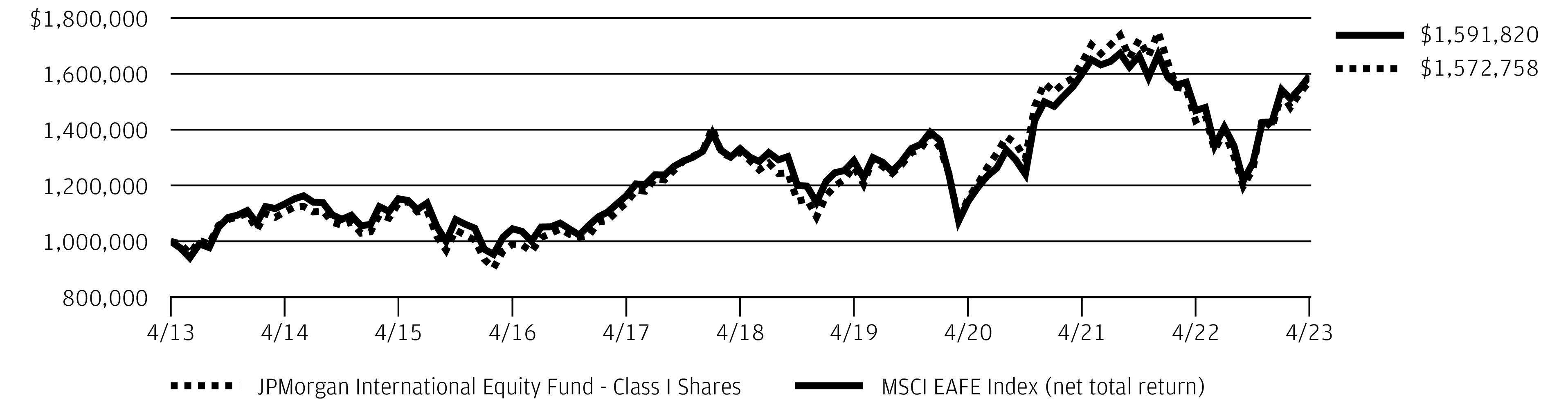

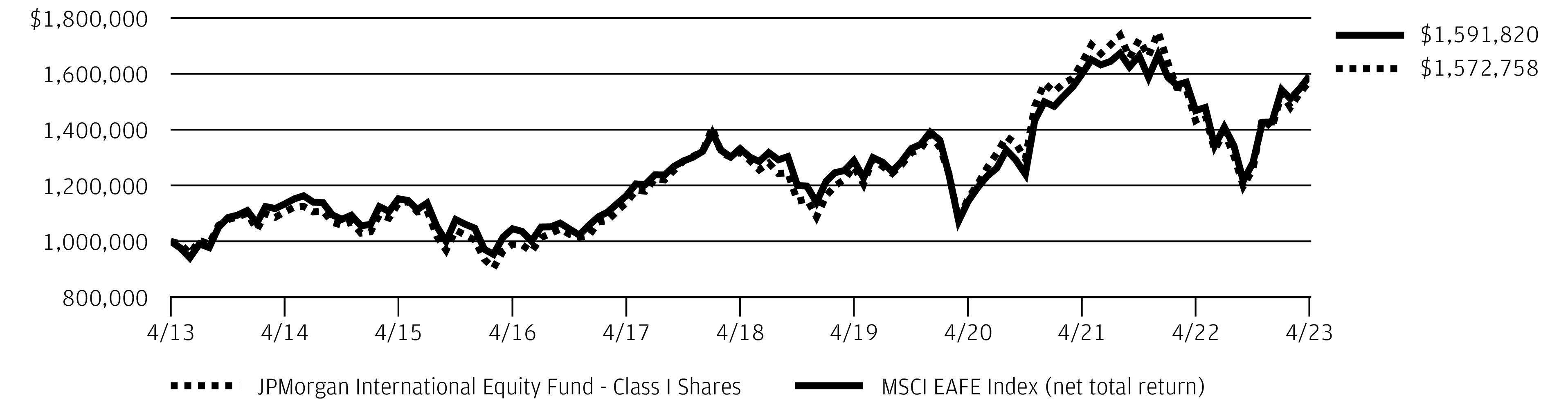

TEN YEAR FUND PERFORMANCE (4/30/13 TO 4/30/23)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-800-480-4111.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan International Equity Fund and the MSCI EAFE Index (net total return) from April 30, 2013 to April 30, 2023. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI EAFE Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and mid- cap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan International Equity Funds | |

JPMorgan International Focus Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited)

| |

| |

MSCI ACWI ex USA Index (net total return) | |

Net Assets as of 4/30/2023 (In Thousands) | |

INVESTMENT OBJECTIVE**

The JPMorgan International Focus Fund (the “Fund”) seeks to provide long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares outperformed the MSCI ACWI ex USA Index (net total return) (the “Benchmark”) for the six months ended April 30, 2023.

The Fund’s security selection in the communication services and consumer discretionary sectors was a leading contributor to performance relative to the Benchmark, while the Fund’s security selection in the consumer staples sector was the sole sector detractor from relative performance.

By region, the Fund’s security selection in emerging markets and continental Europe was a leading contributor to relative performance, while the Fund’s security selection in the U.K. and its overweight position in North America (Canada) were leading detractors from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in LVMH Moet Hennessey Louis Vuitton SE, Novo Nordisk AS and Tencent Holdings Ltd. Shares of LVMH Moet Hennessey Louis Vuitton, a luxury goods manufacturer, rose amid strong consumer demand and record revenue through the first quarter of 2023. Shares of Novo Nordisk, a Danish pharmaceuticals and health care products provider, rose amid consumer demand for the

company’s weight-loss drug and after the company reported revenue growth for the first quarter of 2023. Shares of Tencent Holdings, a Chinese e-commerce provider, rose after the company reported a surge in sales during the period and amid a broader economic recovery in China.

Leading individual detractors from relative performance included the Fund’s overweight positions in Toronto-Dominion Bank, Canadian National Railway Co. and Roche Holding AG. Shares of Toronto-Dominion, a Canadian banking and financial services provider, fell amid the company’s failed negotiations to acquire First Horizon Corp. Shares of Canadian National Railway, a freight rail operator, underperformed amid a retreat in commodities prices during the period and investor expectations for lower 2023 earnings among large freight railroads. Shares of Roche Holdings, a Swiss pharmaceutical and diagnostics company, fell after the company forecast weaker earnings in 2023 amid a drop in sales of Covid treatments.

HOW WAS THE FUND POSITIONED?

By harnessing their team’s global sector specialists, the Fund’s portfolio managers sought to build a high-conviction, benchmark-agnostic portfolio of growth, value and unique companies, whose future prospects, the portfolio managers believed, were under-appreciated by the market and thus possessed the potential to deliver higher-than-expected earnings that could have a positive effect on their share prices.

| J.P. Morgan International Equity Funds | |

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| | |

| Samsung Electronics Co. Ltd. (South Korea) | |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR (Taiwan) | |

| Allianz SE (Registered) (Germany) | |

| TotalEnergies SE (France) | |

| HDFC Bank Ltd., ADR (India) | |

| LVMH Moet Hennessy Louis Vuitton SE (France) | |

| Canadian National Railway Co. (Canada) | |

| ASML Holding NV (Netherlands) | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| J.P. Morgan International Equity Funds | |

JPMorgan International Focus Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF April 30, 2023

|

| |

| Sales Charge for Class A Shares is 5.25%. |

| Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

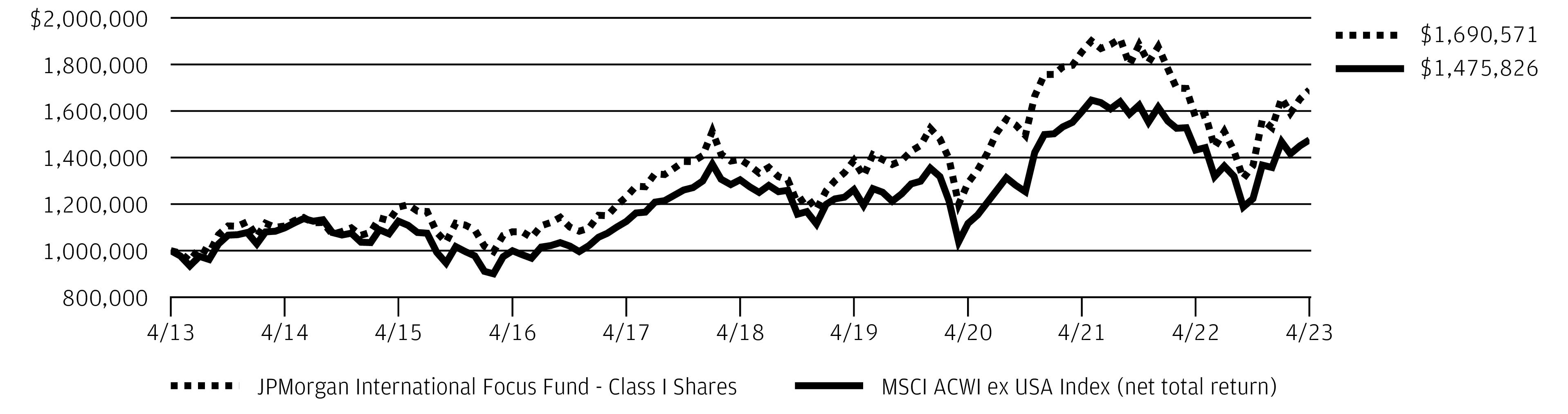

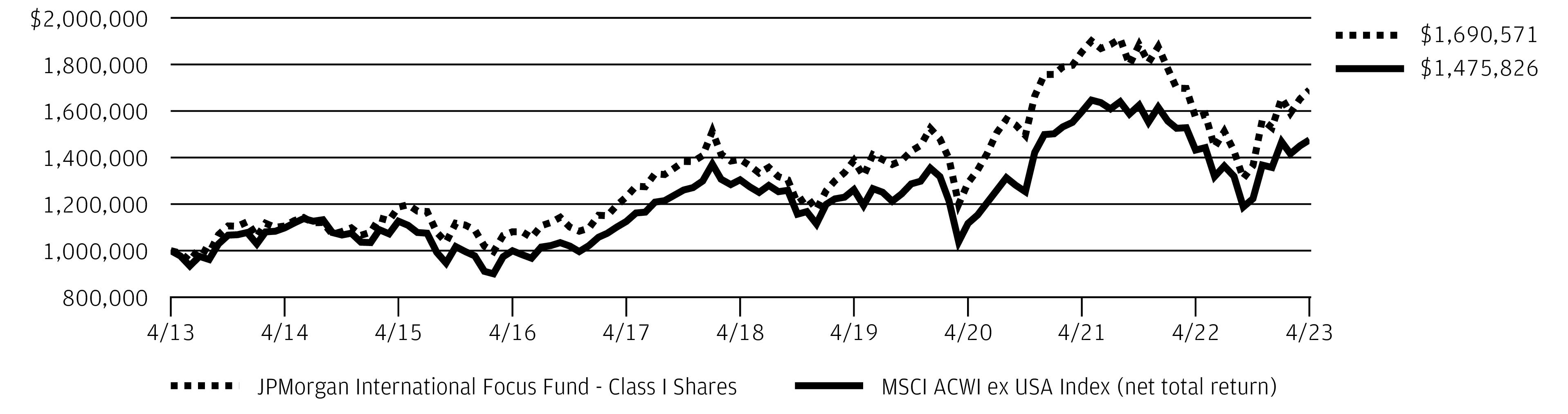

TEN YEAR FUND PERFORMANCE (4/30/13 TO 4/30/23)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-800-480-4111.

The Fund commenced operations on November 30, 2011.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan International Focus Fund and the MSCI ACWI ex USA Index (net total return) from April 30, 2013 to April 30, 2023. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI ACWI ex USA Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI ACWI ex USA Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and mid- cap stocks in developed and emerging markets, excluding the U.S. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Subsequent to the inception date of the Fund and through May 30, 2013, the Fund did not experience any shareholder activity. If such shareholder activity had occurred, the Fund’s performance may have been impacted.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan International Equity Funds | |

JPMorgan International Hedged Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited)

| |

| |

MSCI EAFE Index (net total return) | |

ICE BofA 3-Month US Treasury Bill Index | |

Net Assets as of 4/30/2023 (In Thousands) | |

INVESTMENT OBJECTIVE**

The JPMorgan International Hedged Equity Fund (the “Fund”) seeks to provide capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the MSCI EAFE Index (net total return) (the “Benchmark”) and outperformed the ICE BofA 3-Month U.S. Treasury Bill Index for the six months ended April 30, 2023. The Fund’s options hedge allowed the Fund to generally perform as designed during the reporting period with about 46% of the Benchmark’s volatility.

The Fund’s security selection in the pharmaceutical/medical technology and industrial cyclicals sectors was a leading detractor from performance relative to the Benchmark. The Fund’s security selection in the banks and financial services sectors was a leading contributor to relative performance.

By country, the Fund’s security selection in Switzerland and the Netherlands was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the U.K. and its overweight allocation to France were leading contributors to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in NN Group NV and Roche Holding AG, and its underweight position in HSBC Holdings PLC. Shares of NN Group, a Dutch insurance and

financial services provider, fell after the company reported lower operating profit for the second half of its fiscal year. Shares of Roche Holdings, a Swiss pharmaceutical and diagnostics company, fell after the company forecast weaker earnings in 2023 amid a drop in sales of Covid treatments. Shares of HSBC, a U.K. banking and financial services provider, underperformed amid investor concerns about the broader banking sector following the collapse of Credit Suisse.

Leading individual contributors to relative performance included the Fund’s overweight positions in 3i Group PLC, Novo Nordisk AS and L’Oreal SA. Shares of 3i Group, a U.K. private equity and venture capital investment company, rose amid positive performance from its portfolio holdings. Shares of Novo Nordisk, a Danish pharmaceuticals and health care products provider, rose amid consumer demand for the company’s weight-loss drug and after the company reported revenue growth for the first quarter of 2023. Shares of L’Oreal, a French hair products and cosmetics manufacturer, rose after the company reports strong sales growth during the period.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers continued to focus on security selection to build a portfolio of international equities. They used bottom-up fundamental research to identify what they believed were attractively priced securities of companies with solid financial positions that possessed the potential to increase

their earnings faster than their industry peers.

| J.P. Morgan International Equity Funds | |

JPMorgan International Hedged Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited) (continued)

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| LVMH Moet Hennessy Louis Vuitton SE (France) | |

| Novo Nordisk A/S, Class B (Denmark) | |

| ASML Holding NV (Netherlands) | |

| | |

| AstraZeneca plc (United Kingdom) | |

| | |

| Novartis AG (Registered) (Switzerland) | |

| | |

| | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

| J.P. Morgan International Equity Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF April 30, 2023

|

| |

| Sales Charge for Class A Shares is 5.25%. |

| Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

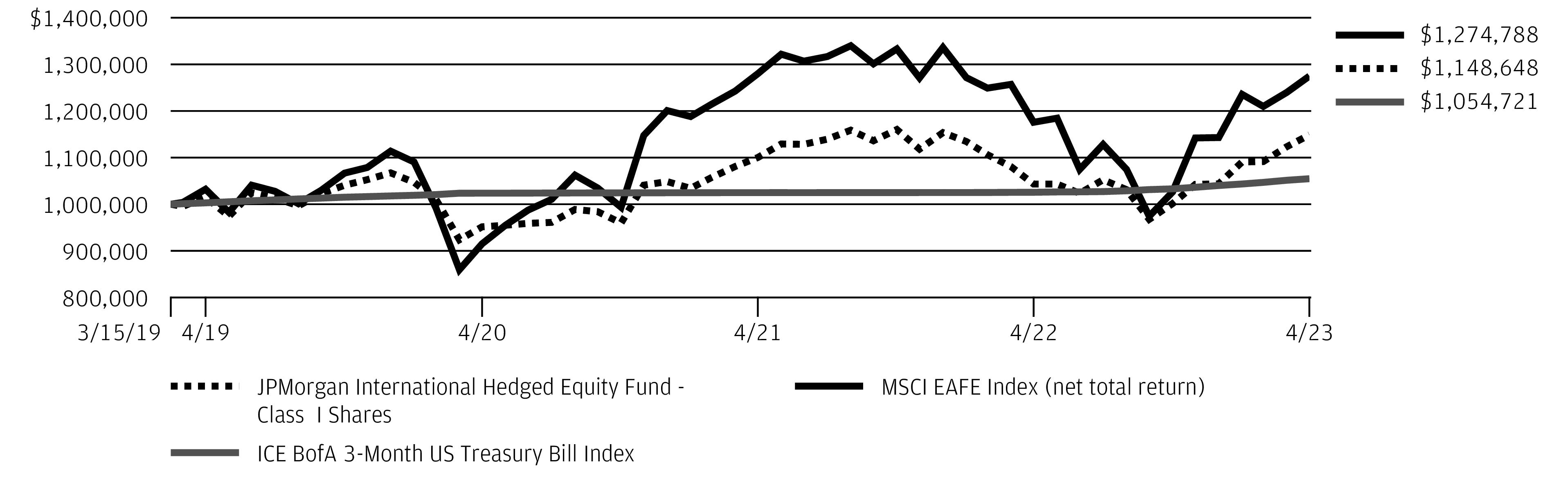

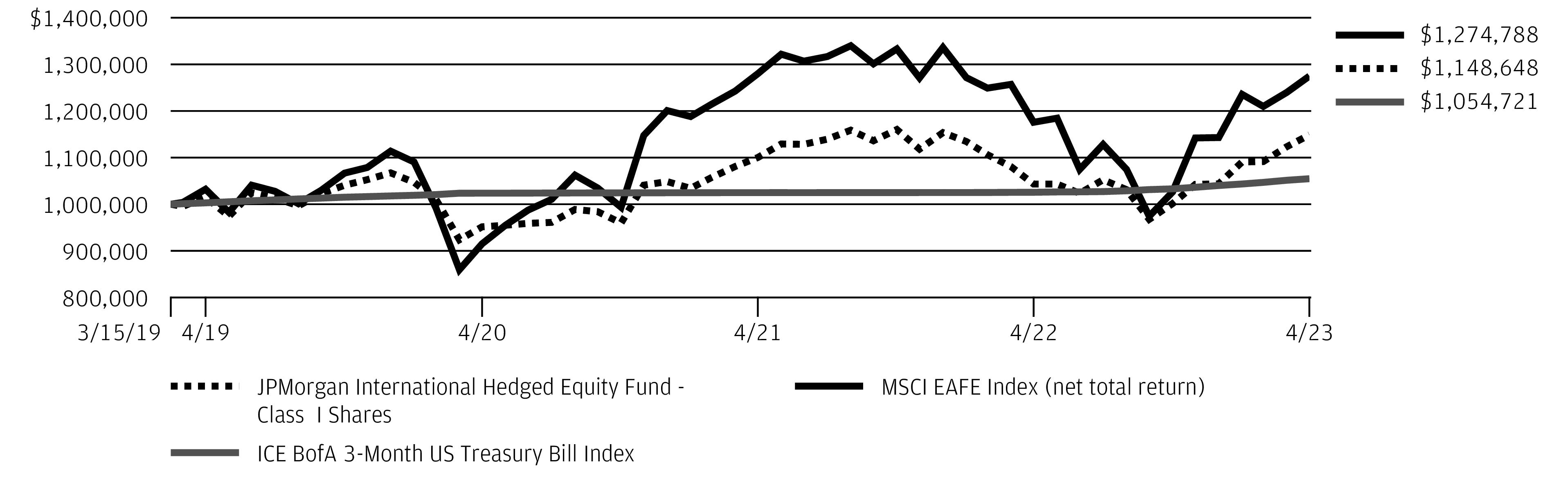

LIFE OF FUND PERFORMANCE (3/15/19 TO 4/30/23)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-800-480-4111.

The Fund commenced operations on March 15, 2019.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan International Hedged Equity Fund, the MSCI EAFE Index (net total return) and the ICE BofA 3-Month US Treasury Bill Index from March 15, 2019 to April 30, 2023. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The performance of the ICE BofA 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of securities included in the benchmarks, if applicable. The MSCI EAFE Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and mid- cap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors

who do not benefit from double taxation treaties. The ICE BofA 3-Month US Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for

| J.P. Morgan International Equity Funds | |

JPMorgan International Hedged Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited) (continued)

or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or

related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, noninfringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| J.P. Morgan International Equity Funds | |

JPMorgan International Value Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited)

| |

| |

MSCI EAFE Value Index (net total return) | |

Net Assets as of 4/30/2023 (In Thousands) | |

INVESTMENT OBJECTIVE**

The JPMorgan International Value Fund (the “Fund”) seeks to provide long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class L Shares outperformed the MSCI EAFE Value Index (net total return) (the “Benchmark”) for the six months ended April 30, 2023.

The Fund’s security selection in the telecommunications services and industrials sectors was a leading contributor to performance relative to the Benchmark, while the Fund’s overweight position in the energy sector and its underweight position in the utilities sector were leading detractors from relative performance.

By region, the Fund’s security selection in Japan and the U.K. was a leading contributor to performance relative to the Benchmark, while its security selection in continental Europe and the Pacific Rim was a leading detractor from relative performance.

Leading individual contributors to relative performance included the Fund’s underweight positions in Toyota Motor Corp., British American Tobacco PLC and Softbank Corp., Shares of Toyota Motor, a Japanese automobile manufacturer, fell after the company named a new chief executive and chairman, and after it reported a decline in North American sales. Shares of

British American Tobacco, a U.K. tobacco and nicotine products manufacturer not held in the Fund, fell amid increased U.S. regulatory efforts to reduce smoking and nicotine use. Shares of SoftBank, a Japanese investment company not held in the Fund, fell after the company reported a loss for its fiscal third quarter.

Leading individual detractors from relative performance included the Fund’s underweight positions in Enel SpA and SAP SE, and its overweight position in Equinor ASA. Shares of Enel, an Italian electricity and natural gas utility, rose after the company reported earnings and revenue growth during the period. Shares of SAP, a German software provider, rose after the company reported better-than-expected results during the period. Shares of Equinor, a Norwegian oil and gas producer, fell amid weaker global energy prices during the period.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed behavioral-based and quantitative screens in addition to conducting fundamental analysis to seek out companies that they believed had attractive valuations. As a result of this process, the Fund’s largest overweight positions relative to the Benchmark during the period were in the energy and banks sectors, while the largest underweight positions were in the food, beverage & tobacco sector and the utilities sector.

| J.P. Morgan International Equity Funds | |

JPMorgan International Value Fund

FUND COMMENTARY

SIX MONTHS ENDED April 30, 2023 (Unaudited) (continued)

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| Novartis AG (Registered) (Switzerland) | |

| | |

| TotalEnergies SE (France) | |

| BHP Group Ltd. (Australia) | |

| | |

| HSBC Holdings plc (United Kingdom) | |

| | |

| Allianz SE (Registered) (Germany) | |

| Mitsubishi UFJ Financial Group, Inc. (Japan) | |

| | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF April 30, 2023 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

| J.P. Morgan International Equity Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF April 30, 2023

|

| |

| Sales Charge for Class A Shares is 5.25%. |

| Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

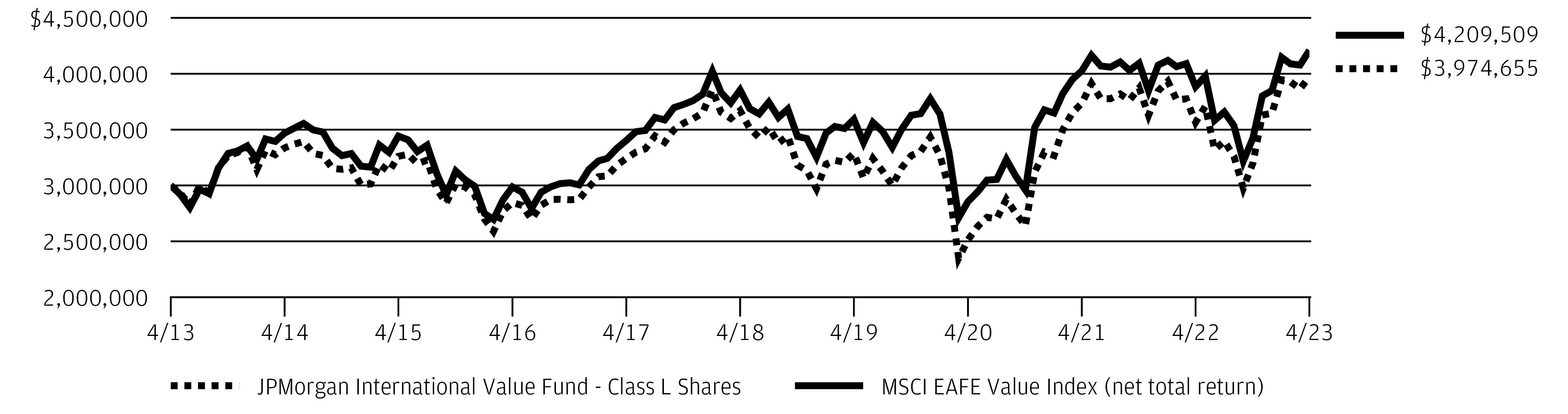

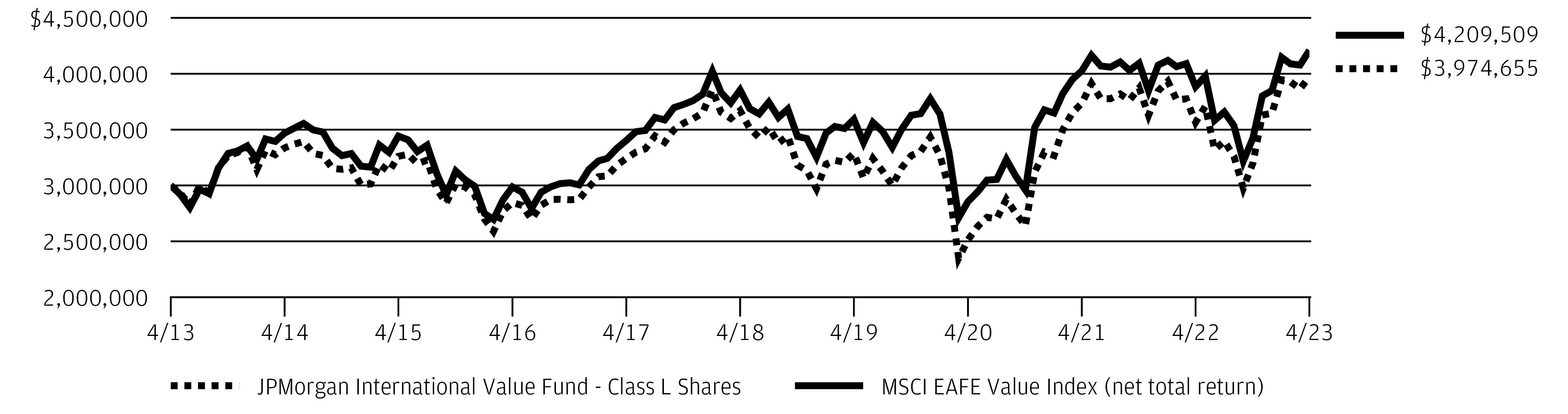

TEN YEAR FUND PERFORMANCE (4/30/13 TO 4/30/23)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111. Effective May 2018, some of the Fund’s investment strategies changed. The Fund’s past performance would have been different if the Fund was managed under the current strategies.

Returns for Class R5 Shares prior to its inception date are based on the performance of Class L Shares. The actual returns of Class R5 Shares would have been different than those shown because Class R5 Shares have different expenses than Class L Shares.

The graph illustrates comparative performance for $3,000,000 invested in Class L Shares of the JPMorgan International Value Fund and the MSCI EAFE Value Index (net total return) from April 30, 2013 to April 30, 2023. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Value Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI EAFE Value Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of value-oriented large- and mid- cap stocks in developed markets, excluding the U.S. and Canada. Net total return figures

assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Class L Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan International Equity Funds | |

JPMorgan Emerging Markets Equity Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF April 30, 2023 (Unaudited)

| | |

|

|

B3 SA - Brasil Bolsa Balcao | | |

Itau Unibanco Holding SA, ADR | | |

| | |

NU Holdings Ltd., Class A * | | |

| | |

| | |

| | |

|

Beijing Oriental Yuhong Waterproof Technology Co. Ltd., Class A * | | |

Budweiser Brewing Co. APAC Ltd. (a) | | |

| | |

Foshan Haitian Flavouring & Food Co. Ltd., Class A * | | |

Fuyao Glass Industry Group Co. Ltd., Class A * | | |

| | |

| | |

Jiangsu Hengli Hydraulic Co. Ltd., Class A * | | |

Kingdee International Software Group Co. Ltd. * | | |

| | |

Midea Group Co. Ltd., Class A | | |

| | |

| | |

Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Class A * | | |

Shenzhou International Group Holdings Ltd. | | |

| | |

| | |

Wanhua Chemical Group Co. Ltd., Class A * | | |

Wuliangye Yibin Co. Ltd., Class A | | |

WuXi AppTec Co. Ltd., Class A * | | |

Wuxi Biologics Cayman, Inc. * (a) | | |

| | |

| | |

|

| | |

Hong Kong Exchanges & Clearing Ltd. | | |

| | |

Techtronic Industries Co. Ltd. | | |

Techtronic Industries Co. Ltd. | | |

| | |

|

Apollo Hospitals Enterprise Ltd. | | |

| | |

|

|

| | |

Britannia Industries Ltd. | | |

| | |

| | |

HDFC Life Insurance Co. Ltd. * (a) | | |

| | |

Housing Development Finance Corp. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

Tata Consultancy Services Ltd. * | | |

| | |

|

Bank Central Asia Tbk. PT | | |

Bank Rakyat Indonesia Persero Tbk. PT | | |

| | |

|

| | |

|

Grupo Financiero Banorte SAB de CV, Class O | | |

Wal-Mart de Mexico SAB de CV | | |

| | |

|

Copa Holdings SA, Class A | | |

|

| | |

|

| | |

Capitec Bank Holdings Ltd. | | |

| | |

| | |

|

| | |

| | |

| | |

Samsung Electronics Co. Ltd. | | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan International Equity Funds | |

| | |

Common Stocks — continued |

|

Chailease Holding Co. Ltd. * | | |

Delta Electronics, Inc. * | | |

Realtek Semiconductor Corp. * | | |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | |

| | |

|

| | |

Estee Lauder Cos., Inc. (The), Class A | | |

| | |

JS Global Lifestyle Co. Ltd. * (a) | | |

| | |

Total Common Stocks

(Cost $7,041,777) | | |

Short-Term Investments — 0.0% ^ |

Investment Companies — 0.0% ^ |

JPMorgan Prime Money Market Fund Class Institutional Shares, 4.88% (b) (c)(Cost $5,306) | | |

Total Investments — 100.5%

(Cost $7,047,083) | | |

Liabilities in Excess of Other Assets — (0.5)% | | |

| | |

Percentages indicated are based on net assets. |

| |

| American Depositary Receipt |

| |

| Limited liability company |

| |

| Amount rounds to less than 0.1% of net assets. |

| Non-income producing security. | |

| Security exempt from registration pursuant to Regulation S under the Securities Act of 1933, as amended. Regulation S applies to securities offerings that are made outside of the United States and do not involve direct selling efforts in the United States and as such may have restrictions on resale. | |

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. | |

| The rate shown is the current yield as of April 30, 2023. | |

Summary of Investments by Industry, April 30, 2023

The following table represents the portfolio investments of the Fund by industry classifications as a percentage of total investments:

| PERCENT OF

TOTAL

INVESTMENTS |

| |

Semiconductors & Semiconductor Equipment | |

Technology Hardware, Storage & Peripherals | |

| |

Consumer Staples Distribution & Retail | |

| |

| |

| |

Interactive Media & Services | |

| |

Hotels, Restaurants & Leisure | |

| |

| |

| |

Oil, Gas & Consumable Fuels | |

| |

Life Sciences Tools & Services | |

| |

| |

Electronic Equipment, Instruments & Components | |

Textiles, Apparel & Luxury Goods | |

Health Care Equipment & Supplies | |

| |

| |

Health Care Providers & Services | |

Others (each less than 1.0%) | |

| |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan International Equity Funds | |

JPMorgan Emerging Markets Research Enhanced Equity Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF April 30, 2023 (Unaudited)

| | |

|

|

B3 SA - Brasil Bolsa Balcao | | |

Centrais Eletricas Brasileiras SA | | |

Cia Energetica de Minas Gerais (Preference) | | |

| | |

Itau Unibanco Holding SA (Preference) | | |

| | |

| | |

| | |

| | |

NU Holdings Ltd., Class A * | | |

Petroleo Brasileiro SA (Preference) | | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Banco Santander Chile, ADR | | |

| | |

| | |

|

Aier Eye Hospital Group Co. Ltd., Class A * | | |

Alibaba Group Holding Ltd. * | | |

Amoy Diagnostics Co. Ltd., Class A * | | |

Angel Yeast Co. Ltd., Class A * | | |

Anhui Conch Cement Co. Ltd., Class H | | |

ANTA Sports Products Ltd. | | |

| | |

| | |

Baoshan Iron & Steel Co. Ltd., Class A * | | |

| | |

| | |

Beijing Oriental Yuhong Waterproof Technology Co. Ltd., Class A * | | |

| | |

BOE Technology Group Co. Ltd., Class A * | | |

| | |

CGN Power Co. Ltd., Class H (b) | | |

Chacha Food Co. Ltd., Class A * | | |

China Construction Bank Corp., Class H | | |

China International Capital Corp. Ltd., Class H * (b) | | |

China Life Insurance Co. Ltd., Class H | | |

| | |

|

|

China Longyuan Power Group Corp. Ltd., Class H | | |

China Merchants Bank Co. Ltd., Class H * | | |

China Oilfield Services Ltd., Class H | | |

China Overseas Land & Investment Ltd. | | |

China Pacific Insurance Group Co. Ltd., Class H | | |

China Petroleum & Chemical Corp., Class H | | |

China Resources Land Ltd. | | |

China Resources Mixc Lifestyle Services Ltd. (b) | | |

China Vanke Co. Ltd., Class H * | | |

China Yangtze Power Co. Ltd., Class A * | | |

Chongqing Fuling Zhacai Group Co. Ltd., Class A * | | |

Country Garden Services Holdings Co. Ltd. | | |

CSPC Pharmaceutical Group Ltd. | | |

Dongguan Yiheda Automation Co. Ltd., Class A * | | |

| | |

Flat Glass Group Co. Ltd., Class H | | |

Foshan Haitian Flavouring & Food Co. Ltd., Class A * | | |

Fuyao Glass Industry Group Co. Ltd., Class H * (b) | | |

Ganfeng Lithium Group Co. Ltd. * (b) | | |

Guangzhou Automobile Group Co. Ltd., Class H * | | |

Guangzhou Kingmed Diagnostics Group Co. Ltd., Class A * | | |

| | |

Haier Smart Home Co. Ltd., Class H * | | |

Han's Laser Technology Industry Group Co. Ltd., Class A * | | |

Hefei Meiya Optoelectronic Technology, Inc., Class A * | | |

Huatai Securities Co. Ltd., Class H * (b) | | |

Huayu Automotive Systems Co. Ltd., Class A * | | |

Hundsun Technologies, Inc., Class A * | | |

Industrial & Commercial Bank of China Ltd., Class H | | |

Inner Mongolia Yili Industrial Group Co. Ltd., Class A * | | |

Jade Bird Fire Co. Ltd., Class A * | | |

JD Health International, Inc. * (b) | | |

| | |

| | |

Jiangsu Hengli Hydraulic Co. Ltd., Class A * | | |

Joinn Laboratories China Co. Ltd., Class H * (b) | | |

| | |

Kingdee International Software Group Co. Ltd. * | | |

| | |

Kweichow Moutai Co. Ltd., Class A * | | |

Laobaixing Pharmacy Chain JSC, Class A * | | |

LONGi Green Energy Technology Co. Ltd., Class A * | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan International Equity Funds | |

| | |

Common Stocks — continued |

|

| | |

Midea Group Co. Ltd., Class A | | |

| | |

Montage Technology Co. Ltd., Class A * | | |

NARI Technology Co. Ltd., Class A * | | |

| | |

| | |

| | |

Oppein Home Group, Inc., Class A * | | |

PDD Holdings, Inc., ADR * | | |

Pharmaron Beijing Co. Ltd., Class H * (b) | | |

PICC Property & Casualty Co. Ltd., Class H * | | |

Ping An Bank Co. Ltd., Class A * | | |

Ping An Insurance Group Co. of China Ltd., Class H | | |

Postal Savings Bank of China Co. Ltd., Class H (b) | | |

Qingdao Haier Biomedical Co. Ltd., Class A * | | |

Sany Heavy Industry Co. Ltd., Class A * | | |

Shanghai Baosight Software Co. Ltd., Class A * | | |

Shanghai Liangxin Electrical Co. Ltd., Class A | | |

Shanghai Putailai New Energy Technology Co. Ltd., Class A | | |

Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Class A * | | |

Shenzhou International Group Holdings Ltd. | | |

| | |

Skshu Paint Co. Ltd., Class A * | | |

StarPower Semiconductor Ltd., Class A * | | |

Sunny Optical Technology Group Co. Ltd. | | |

Suzhou Maxwell Technologies Co. Ltd., Class A * | | |

| | |

Tingyi Cayman Islands Holding Corp. | | |

Trip.com Group Ltd., ADR * | | |

| | |

Wanhua Chemical Group Co. Ltd., Class A * | | |

Wuliangye Yibin Co. Ltd., Class A | | |

WuXi AppTec Co. Ltd., Class H (b) | | |

Wuxi Biologics Cayman, Inc. * (b) | | |

Xinyi Solar Holdings Ltd. | | |

| | |

| | |

| | |

Zhejiang Dingli Machinery Co. Ltd., Class A * | | |

Zhejiang Jingsheng Mechanical & Electrical Co. Ltd., Class A * | | |

| | |

|

|