UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23127)

The Goodhaven Funds Trust

(Exact name of registrant as specified in charter)

4940 SW 83rd Street

Miami, Florida 33143_

(Address of principal executive offices) (Zip code)

Larry Pitkowsky

4940 SW 83rd Street

Miami, Florida 33143

(Name and address of agent for service)

(305) 677-7650

Registrant's telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: November 30, 2016

Item 1. Report to Stockholders.

Annual Report

November 30, 2016

GoodHaven Fund

Ticker: GOODX

GoodHaven Capital Management, LLC

GoodHaven Fund

Table of Contents

| Shareholder Letter | | | 1 |

| Portfolio Management Discussion and Analysis | | | 12 |

| Sector Allocation | | | 17 |

| Historical Performance | | | 18 |

| Schedule of Investments | | | 19 |

| Schedule of Options Written | | | 21 |

| Statement of Assets and Liabilities | | | 22 |

| Statement of Operations | | | 23 |

| Statements of Changes in Net Assets | | | 24 |

| Financial Highlights | | | 25 |

| Notes to Financial Statements | | | 26 |

| Report of Independent Registered Public Accounting Firm | | | 36 |

| Expense Example | | | 37 |

| Trustees and Executive Officers | | | 39 |

| Additional Information | | | 41 |

| Privacy Notice | | | 42 |

GoodHaven Fund

| | | 1 Year | | Since | Since |

| | Calendar | Ended | 5 Years | Incept.1 | Incept.1 |

| | Year 2016 | 11/30/16 | Annualized | Cumulative | Annualized |

| GOODX | 20.13% | 13.89% | 4.75% | 29.41% | 4.67% |

S&P 500 Index2 | 11.96% | 8.06% | 14.45% | 86.91% | 11.71% |

| Wilshire 5000 Total Market Index | 10.67% | 6.15% | 11.89% | 62.85% | 9.01% |

HFRI Fundamental Growth Index3 | 4.07% | 2.78% | 3.55% | 3.47% | 0.60% |

HFRI Fundamental Value Index3 | 7.34% | 4.25% | 7.09% | 28.34% | 4.50% |

CS Hedge Fund Index3 | 1.25% | -0.57% | 4.09% | 16.84% | 2.78% |

1 | The Fund commenced operations on April 8, 2011. |

2 | with dividends reinvested |

3 | Hedge Fund Index performance figures are supplied on a month end basis and are provided for illustrative purposes as a broad equity alternative asset class only. Accordingly, “since inception” hedge fund index performance figures reflect a start date of 3/31/11. Source: Bloomberg Terminal |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling (855) OK-GOODX or (855) 654-6639. The Fund imposes a 2.00% redemption fee on shares redeemed within 60 days of purchase. Performance data for an individual shareholder will be reduced by redemption fees that apply, if any. Redemption fees are paid directly into the Fund and do not reduce overall performance of the Fund. The annualized gross expense ratio of the GoodHaven Fund is 1.10%.

January 4, 2017

To Our Fellow Shareholders of the GoodHaven Fund (the “Fund”):

Measured by either a calendar year or fiscal year basis, 2016 was a good year for the Fund. For the calendar year ended December 31, 2016, the Fund gained 20.13% compared to a gain of 11.96% for the S&P 500 Index. For the fiscal year ended November 30, 2016 (and after a rough first month of December), the Fund gained 13.89% compared to 8.06% for the S&P 500 Index.1

As discussed in prior letters, outlier declines in oil, gas, and metals in 2015 overshadowed some positives and led to unusual portfolio weakness throughout 2015

__________

1 | As a reminder, we use the S&P 500 as a point of comparison as it is a widely quoted index and somewhat representative of large company equity performance. Nevertheless, we provide a wide range of alternatives for comparison purposes in the performance table shown above as the Fund may invest in securities beyond equities, is not required to be fully invested at all times, and is not limited to large capitalization common shares. |

GoodHaven Fund

and early 2016, which affected our historical and relative results. This weakness appeared to end in February of 2016 and has been followed by a sharp recovery in some key investments. Most of the factors that resulted in the weak results of 2015 appear to have been attenuated or reversed.2 Throughout this unusual volatility, we did our best to behave consistently, did not overreact, and bought under pressure when our research told us that values were intact.

We continue to own a portfolio that we believe is materially less expensive than the S&P 500 as measured by some common historical valuation markers and remain disciplined when looking at potential new investments. The Fund also continues to hold cash, reflective of generally high valuations, which allows us to behave opportunistically. We try to invest to the extent that we find sensible things to do and remind our fellow shareholders that our personal stakes in the Fund are material. We are not willing to do something for you that we are unwilling to do for ourselves.

Perhaps more importantly, we are increasingly confident that some of our headwinds are turning into tailwinds as we enter 2017. The overall environment seems to be friendlier to our approach despite stretched index valuations. While we do not pretend to have a crystal ball that predicts future economic conditions or commodity prices, most market trends regress toward the mean over time. In other words, very expensive securities tend to become less expensive given time, while bargain securities tend to become less of a bargain, barring some permanent change in demand.3

In addition, many industries tend to have cycles. However, it usually pays to hang on to a good business through cyclical moves unless that business becomes materially overvalued. Here’s why: a good business run by smart people has the opportunity to significantly outperform its direct competition over an extended time period. In other words, you don’t want to overweight cyclical influences, especially when good capital allocators are running an enterprise.

In that vein, we note that several of our investee companies improved costs and operations in significant ways or re-allocated capital in a shareholder friendly manner. For example, Alphabet (formerly Google) adopted new financial discipline in pursuing its non-advertising “moonshot” venture investments (which currently cost shareholders about $3 billion annually, or a penalty of nearly $5 per share

__________

2 | Clearly, the timing of the Fund’s initial investments in Barrick Gold and WPX Energy was poor, and in 2015, commodity performance overshadowed material business progress in these companies. Our timing in adding to positions was better and aided 2016 performance. |

3 | As the advent of the automobile did a century ago, the Internet has disrupted many businesses, causing permanent shifts in demand while opening new opportunities. Ad salesmen at newspaper companies have been fighting an increasingly desperate battle – and losing. Sometimes, as with saddles, buggy whips, or advertising, change in demand is permanent and long-term trends are important. For example, we know that demand for energy grows with increases in population and living standards. However, the source of that energy is changing at the margin. Oil will be around for many years, but the alternatives are growing, and that trend bears scrutiny. |

GoodHaven Fund

pre-tax). Barrick Gold has reduced its “all-in-sustaining-costs” per ounce of gold from over $1,000 four years ago to just above $750 today while also reducing debt by over $4 billion in the last two years. WPX Energy reduced the cost to drill a well in the Bakken formation from $11 million a few years ago to about $5.5 million today and made a major acquisition in the Permian basin in 2015 that now appears to have been a huge bargain. White Mountains Insurance sold some subsidiaries and used a portion of the proceeds to repurchase shares at or near tangible book value. And Birchcliff Energy, already a low-cost operator, recently upgraded its asset base through a major acquisition of overlapping properties, which should improve efficiencies and reduce risk going forward.

These types of changes, when sensibly implemented, make these companies more valuable, irrespective of cyclical influences. Improving cost structures, reducing leverage, and making sensible capital allocation decisions all add to value. While volatility may result from changing economic conditions or commodity prices, we think the medium-term demand for products and services offered by these businesses will remain robust and that intrinsic values will grow. Generally speaking, these businesses have tremendous optionality.

In past letters we have cautioned that while we could not predict when, the likelihood of interest rates rising from at or below zero was a virtual certainty. Although a recent increase in the federal funds rate was indeed small, subsequent bond market losses exceeded a trillion dollars.4 While we cannot predict the timing, further increases seem likely over time, particularly if inflation starts to heat up. In addition to the recovery in energy and metals this year, higher interest rates should help some of our other investments going forward, like Leucadia National, Federated Investors, White Mountains Insurance, and Berkshire Hathaway.5

Over time, we prefer to invest in companies that not only appear to offer business value well in excess of recent market values, but which also have strong balance sheets and shareholder friendly management. We are continually looking to upgrade what we own – but only if we can buy at an advantageous price. We have identified a number of companies meeting these criteria that await prices offering potential returns higher than what exists today.

Currently our largest holdings are WPX Energy, Barrick Gold, Alphabet, Birchcliff Energy, White Mountains, and Leucadia. Somewhat smaller positions include Hewlett Packard Enterprise, Spectrum Brands, Federated Investors, Staples,

__________

4 | The federal funds rate is the interbank borrowing rate that is typically targeted by the Federal Reserve as its main lever to change short-term interest rates in the United States. It also uses other tools, such as interest on reserves. |

5 | Gold prices retreated materially late in the year. The bad news is that the price change hurt performance late this year as Barrick Gold declined about 30% from its summer highs. The good news is that the potential for future gain has materially increased. |

GoodHaven Fund

and Verizon. While we feel good about all of these companies we must continue to ensure that we are sizing the investments commensurate with their risks.

WPX had a good year, and began to reap the benefits of its extensive reorganization, its purchase of very valuable RKI in the Permian Basin, and a material recovery in the prices of oil and natural gas. While the investment community seems split as to whether prices will rise further or decline, our expectation is for limited downside and reasonable upside due to: a deep and pervasive decline in capital spending across the oil and gas industry over the last two years; the lowest rate of new oil discoveries in seventy years (according to consultant Wood McKenzie); producer nations whose economies are deeply stressed at lower price levels; a recent OPEC agreement to limit production; and domestic inventories that, while still high, appear to have peaked.

WPX weathered the staggeringly large decline in oil prices (from over $100 per barrel in mid-2014 to less than $30 per barrel in early-2016) with some dings, but emerging as a much better business. In early 2014, natural gas dominated the business and it had holdings in the eastern and western United States and Argentina, which included a bloated overhead structure, large and fixed natural gas transportation agreements, and other onerous expenses. After consummating a number of tough dispositions at reasonable prices during a difficult period, the company acquired a sizeable position in the Permian basin in mid-2015 – a deal our research suggests has added billions of dollars of value to the company.6

As a result, WPX has streamlined its holdings into three main areas – the Permian, the Bakken, and the San Juan – focused primarily on oil rather than gas. All of these properties are among the most productive and lowest cost within these basins. Under the leadership of Rick Muncrief, the company has cleverly reallocated capital and sharply reduced its overhead and drilling costs. With oil prices now above $50 per barrel and a decent hedge book for 2017 and part of 2018, the company is well positioned to take advantage of the opportunities it has created in recent years. According to a recent corporate presentation, WPX is projecting that its oil output will almost double in the next two years.

The Fund’s second largest investment, Barrick Gold, was similar in a number of ways to our previously successful investment in pre-split Hewlett-Packard (HP) where a low-cost producer and asset rich company generating significant cash flows became over-leveraged after overpaying for a large acquisition and borrowing to

__________

6 | The Permian basin shale formation was recently cited by the U.S. Department of Energy as the largest onshore discovery ever in the United States. Based on recent comparable transactions, the WPX purchase of Permian assets in 2015 was a great bargain. Despite significant capex, reserves of major oil companies have been declining. We suspect these large businesses will soon be forced to try to acquire reserves by purchasing independent producers with core holdings in the most prolific shale basins (i.e., companies like WPX). |

GoodHaven Fund

finance the deal. HP overpaid for a software company and Barrick for a copper miner. In both cases, the fall-out from bad deal-making resulted in major governance changes, with new management teams and significant board turnover.

In the case of Barrick, we became aggressive buyers due to several factors: new management and governance was focused on rapidly improving the balance sheet and per share free cash flow as primary objectives; the company’s low cost operations appear to have opportunities to drive costs even lower; there were non-core assets that could be used to reduce and restructure borrowings; per share cash flows could easily justify a much higher price; gold prices were far off the highs of just a few years earlier; and central bank reserves had exploded since 2008, suggesting that depreciation of fiat currencies was more likely down the road.

Since John Thornton took over as Chairman of the Board, the company has eliminated roughly $4.5 billion in debt, built significant liquidity, eliminated near-term debt repayments, and reduced “all-in-sustaining costs.” Just as impactful, it has also announced several important capital allocation decisions designed to rationalize its holdings and improve growth prospects – all of which were accomplished without touching the core mines owned by the company that are among the lowest cost operations in the world.7

As a commodity company that produces gold, silver, and copper, Barrick’s short-term results are clearly dependent on metals prices. On that subject, we are somewhat agnostic, believing that gold represents an alternate currency that is relatively rare and hard to depreciate through increased supply. Its main paper alternatives – dollars, yen, euro, renminbi – have seen supply multiply sharply since 2008. In 2011, the price of gold peaked at just over $1,900 per ounce, followed by a decline to below $1,100 per ounce in early 2016. During 2016, the price rose during the year to about $1,400 per ounce and then declined to a bit below $1,150 per ounce in recent days.8 We sold some shares near August highs to manage concentration risk that we recently began to repurchase.

In the last few weeks, headlines as well as Barrick’s stock price appear to be reflecting fears that an incipient chain of interest rate increases will crush gold prices. These fears appear overdone and are only espoused by those whose study of markets does not go back to the 1970s, when interest rates and metals prices both

__________

7 | “All-in sustaining costs” is a term used in the mining industry as a proxy for the per-ounce costs of operating a mining business at “steady-state.” Generally stated, the definition includes all normal operating costs as well as corporate G&A, reclamation, sustaining exploration and sustaining capital expenditures. Excluded are growth costs, income taxes, working capital changes, financing charges, business combination expenses, and impairments. |

8 | Recent weakness in gold prices may relate to the decision in India to replace “high value” bank notes – an act that has apparently caused tremendous economic dislocation in a country that is traditionally a large importer of gold. We also note that the performance of gold in currencies other than the U.S. Dollar can look very different. |

GoodHaven Fund

rose sharply in response to rising inflation. Although deflationary forces have abounded in recent years, we suspect, though we are not betting the farm, that the greater possibility today is that governments around the world continue to try to devalue their currencies in response to debt levels that are simply too high. If gold behaves as it has historically – as a hedge against currency depreciation – a significant price increase could occur. Alternatively, more monetary ease may reappear at the first sign of real economic weakness. Either way, with a talented management team, a better balance sheet, and a much lower cost structure, Barrick appears poised to prosper over time.

While hardly unknown, Alphabet continues to grow at a rapid rate for such a large company. Alphabet’s scale is staggering, with at least five applications used regularly by more than a billion people and the largest digital ad platform in the world. It also owns YouTube, which as a standalone business would be larger than most television networks, and Android, the most widely used operating system on smartphones and increasingly on other devices.

On an annual basis, the company is expected to generate close to $40 per share in earnings, despite still losing about $4 per share after-tax in its corporate venture capital investments. The stock is no longer cheap, but neither is it overpriced given its valuation, prospects for growth, and generation of free cash flow. Recently, for the first time, the company approved a significant share repurchase. With nearly $120 per share in cash and almost no debt, the company is in a unique position to be able to spend heavily to improve its business and benefit its shareholders at the same time. Its biggest threat would appear to be regulation rather than direct competition.

Among other holdings, Leucadia National appears to have seen its fortunes turn up after a tough period of softness at its largest subsidiaries. Both Jefferies and National Beef have seen large and positive swings in earnings in recent quarters and the company just announced the sale of a long-held subsidiary at a very attractive price (we added to our investment well below tangible book value during 2016). Federated Investors is currently somewhat out of favor as investors reacted negatively to recently implemented changes in regulatory rules governing its core money-market fund business, though we do not believe such changes are a major threat. Nevertheless, in a rising rate environment, we would expect assets to migrate back into money funds, increasing earnings power.

Staples was forced to call off its merger with rival Office Depot due to anti-trust issues, but still retains a significant scale advantage in its core business. The company has struggled in recent years in response to changes in technology and retail trends, but appears to be approaching an inflection point where growth may begin to resume – something we are watching carefully. Hewlett Packard Enterprise successfully completed one divestiture and announced two others – all have helped to move shares higher in 2016. During the year, we bought shares of Verizon when its stock price

GoodHaven Fund

weakened in response to a forecast of flat growth for a year or two. Over time, we expect the wireless business will remain incredibly stable, wireless spectrum will be a valuable asset, and the company will have significant embedded pricing power.

While the personal computer business at HP Inc. has improved, the company continues to struggle with the effects of a higher dollar and soft printer supplies revenue, though the overall business still generates large cash flows while trading at a low valuation. Spectrum Brands continues to offer price conscious consumers and retailers a value proposition that seems to resonate in today’s business climate. We admire the management and board of Spectrum in their ability to continue to identify and successfully integrate several acquisitions in recent years (as a reminder, we first bought Spectrum nearly five years ago at roughly one-fifth its current price).

Nevertheless, as in most sports, even good investment managers cannot avoid unforced errors. While renewing efforts to minimize process mistakes, we do own a few securities where the underlying businesses or management teams were unable to prove out our thesis in the last year. Some decisions on these must be made soon. Among these investments are Walter Investment Management, Dundee Corp., and Sears Holdings, which total less than 5% of the overall portfolio as we write.9 There is sometimes a small upside to mistakes – during the year and despite a significant overall economic gain, we were able to realize sufficient tax loss to avoid taxable distributions in 2016. While tax does not drive our investment decisions, we are aware that it does impact many of our shareholders. We try to manage these liabilities to benefit shareholders when such actions are not disruptive to the portfolio.

In today’s world, it’s worth reflecting a few thoughts on money flows in mutual funds (both specific to the GoodHaven Fund and to the industry generally). Most investors are emotional and a good number of the decisions they make turn out to be counterproductive. For example, in our first two to three years, our performance was solid and money poured into the Fund. In hindsight, it seems that many of these new shareholders represented “hot money” chasing recent performance. These investors did not think much (if at all) about business values or how we try to select businesses that have the potential to offer a competitive return on our capital going forward.

Following that period, we went through a roughly eighteen month performance lag, after which a cascade of money exited the Fund (the former hot money shareholders, mostly) with the crescendo of outflows occurring in late 2015 and early 2016 – just in time to miss a double digit performance rebound that handily exceeded the performance of many broad equity and debt indexes notwithstanding a healthy cash position that moderated risk.

__________

9 | Since our initial purchases of Sears, the company has distributed roughly $35 in value of additional securities that we have monetized or retained – value not reflected in the current price. |

GoodHaven Fund

Through these periods, we believe we have behaved consistently and overall turnover in the portfolio has been fairly low (our shareholders were trading us more than we were trading the portfolio). In effect, we went through a tough period where we were out of sync with markets – something that happens to all value investors from time to time – yet many decided that the short-term result was somehow a fatal flaw.

So why the large influx and outflow of shareholder money – which of course makes it more difficult to manage a portfolio? The answer is relatively simple – it’s human nature. Most people are not wired to behave in a way that really benefits from the volatility of markets. As Ben Graham once said, markets exist to serve you, not to educate you. It seems to us that a longer-term view and a tolerance for some volatility is becoming an increasingly valuable competitive advantage in the world of investing. Accordingly, we want to thank our like-minded shareholders for sticking with us and benefitting from our rebound this past year. Onwards!

Lastly on this subject of seemingly ill-timed cash flows, we want to draw your attention to the cascade of money that has poured out of actively managed funds and into passive vehicles, such as index funds. While the trend from active to passive has been in place for a while, the recent acceleration has been astonishing, with nearly half a trillion dollars moving in the last two years. In September 2016, the Illinois State Pension Board fired all active managers and switched roughly two-thirds of its total assets to passive equity index funds. In October 2016, the Wall Street Journal ran an article entitled “The Dying Business of Picking Stocks,” essentially arguing that passive investing had become institutionalized, a preferred strategy of institutional investors, and that active investing was going the way of the dodo.10

Our views on indexation are probably not controversial, but they are pointed. Indexation may make sense for a good number of investors when markets are moderately valued or cheap and when people have no time or inclination to seek out sensible managers or research for undervalued securities. We believe however, when broad indexes sell at or near record high valuation levels, you do not want your portfolio to closely resemble the index (ours does not!)

As writer Samuel Clemens (also known as Mark Twain) once was reputed to have said, “History does not repeat, but it does rhyme.” The decade following the end of the technology bubble that ended in March 2000 was a fruitful and productive period for value investors who had refused to buy overpriced merchandise from late 1998 through early 2000. Yet these same investors had to have been willing to suffer relative weakness during the last eighteen months of the bubble even as the speculative trading profits from money-losing businesses seemed endless.

__________

10 | The dodo, a flightless bird last living on the island of Mauritius, near Madagascar, was determined to have been made extinct in 1681. After presumably thousands of years of remaining undisturbed by natural predation, it was wiped out after Portuguese explorers began to hunt them for food and introduced unnatural predators into their environment. Within one hundred years of human interaction, it was rare; in less than two hundred, it was gone. |

GoodHaven Fund

In the near-term, we suspect that money-flows from active to passive have been driving recent index returns and that such flows may be topping out. Historically, owning indexes at current valuation levels is correlated to poor forward ten-year returns. We suspect today is little different. As one of our shareholders recently wrote to us, why in the world would anyone want to own a piece of every business in the S&P 500 when most of these businesses seem fully valued or worse? Put simply, we don’t. A good investor should be willing to trade the comfort of the index crowd for the prospect of better returns, so long as they can tolerate the volatility of sometimes standing alone.

Today, there are still plenty of reasons for caution. Worldwide debt levels are materially higher than when the 2008 financial crisis began. Recovery has been tepid. Bond yields may have bottomed but remain at very low levels even as stock indexes hit all-time highs. As one commentator joked, the definition of a looming economic black hole is when the stock market is near record highs, bond yields are near record lows, and nobody is happy.

But amid all the noise and while not easy, investing boils down to trying to do a few simple things well. First, we want to own securities priced to offer reasonable prospects for returns relative to their market prices, not when they are priced to perfection. Second, we need to constantly test our assumptions and adjust holdings when new developments are hostile to our thesis or valuation, based on in-depth fundamental research. Third, we want to have the courage of our convictions and not be easily swayed by external events, market volatility, political developments, or investment fads. Lastly, we believe it is important that we invest personally in the fund and have significant “skin in the game.”

Thank you for your patience – we are confident this past year represents a return to better days.

Sincerely,

|  |

| | |

| Larry Pitkowsky | Keith Trauner |

Mutual fund investing involves risk. Principal loss is possible. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund. The Fund invests in midcap and smaller capitalization companies, which involve additional risks such as limited liquidity and greater volatility. The Fund may invest in foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are enhanced in emerging markets. The Fund may invest in REITs, which are subject to additional

GoodHaven Fund

risks associated with direct ownership of real property including decline in value, economic conditions, operating expenses, and property taxes. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated, non-rated and distressed securities present a greater risk of loss to principal and interest than higher-rated securities.

The opinions expressed are those of Larry Pitkowsky and/or Keith Trauner through the end of the period for this report, are subject to change, and are not intended to be a forecast of future events, a guarantee of future results, nor investment advice. This material may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Fund, market or regulatory developments. The views expressed herein are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed herein are subject to change at any time based upon economic, market, or other conditions and GoodHaven undertakes no obligation to update the views expressed herein. While we have gathered this information from sources believed to be reliable, GoodHaven cannot guarantee the accuracy of the information provided. Any discussions of specific securities or sectors should not be considered a recommendation to buy or sell those securities. The views expressed herein (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information included herein is not an indication of the Fund’s future portfolio composition.

Must be preceded or accompanied by a prospectus. It is not possible to invest directly in an index.

Cash flow is generally defined as the cash a company generates from its business operations, before capital or securities investments.

Free cash flow is generally defined as cash revenues less all normal operating expenses (including interest expense) and less an estimate of the capital spending necessary to maintain the business in its current state.

Book Value represents the accounting value remaining after a corporation’s liabilities are subtracted from its assets.

Tangible Book Value represents the accounting value remaining after a corporation’s liabilities are subtracted from its assets (but excluding the value of any intangible assets, such as goodwill).

The S&P 500 Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure broad domestic securities markets.

The Wilshire 5000 Total Market Index (full-cap) measures the performance of all U.S. equity securities with readily available price data. Over 5,000 capitalization weighted security returns are used to adjust the index.

HFRI Fundamental Growth strategies employ analytical techniques in which the investment thesis is predicated on assessment of the valuation characteristics on the underlying companies which are expected to have prospects for earnings growth and capital appreciation exceeding those of the broader equity market. Investment theses are focused on characteristics of the firm’s financial statements in both an absolute sense and relative to other similar securities and more broadly, market indicators. Strategies employ investment processes designed to identify attractive opportunities in securities of companies which are experiencing or expected to experience abnormally high levels of growth compared with relevant benchmarks growth in earnings, profitability, sales or market share.

HFRI Fundamental Value Index strategies employ investment processes designed to identify attractive opportunities in securities of companies which trade a valuation metrics by which the manager determines them to be inexpensive and undervalued when compared with relevant benchmarks. Investment theses are focused on characteristics of the firm’s financial statements in both an absolute sense and relative to other similar securities and more broadly, market indicators. Relative to Fundamental Growth strategies, in

GoodHaven Fund

which earnings growth and capital appreciation is expected as a function of expanding market share & revenue increases, Fundamental Value strategies typically focus on equities which currently generate high cash flow, but trade at discounted valuation multiples, possibly as a result of limited anticipated growth prospects or generally out of favor conditions, which may be specific to sector or specific holding.

CS Hedge Fund Index is an asset-weighted hedge fund index derived from the TASS database of more than 5000 funds. The index consists of funds with a minimum of US $10 million under management and a current audited financial statement. Funds are separated into primary subcategories based on investment style. The index in all cases represents at least 85% of the assets under management in the universe. The index is rebalanced monthly, and funds are reselected on a quarterly basis. Index NAVs are updated on the 15th of each month.

GoodHaven Fund

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited) |

The Net Asset Value (“NAV”) of the GoodHaven Fund was $23.37 at November 30, 2016 based on 11,623,100 shares outstanding. This compares to the Fund’s NAV of $20.52 at November 30, 2015, an NAV of $21.63 at May 31, 2016, and an NAV of $20.00 at inception on April 8, 2011. Although the Fund did not pay a taxable distribution of capital gains or income in 2016, shareholders should be aware that the Fund has paid capital gains and income distributions in prior years that reduced NAV by the amount of a distribution on the ex-dividend date. Please note that except where otherwise indicated, discussions in this MD&A relate to the period ended November 30, 2016. The Fund’s performance for the period December 1, 2015 to November 30, 2016 was a gain of 13.89% compared to a gain of 8.06% for the S&P 500 Index. Since inception on April 8, 2011 and through November 30, 2016, the Fund’s annualized performance is a gain of 4.67% compared to an increase of 11.71% for the S&P 500 Index. The Fund gained 4.75% annualized for the five year period ending November 30, 2016 compared to 14.45% for the S&P 500 Index. Please see the portfolio manager’s letter to shareholders for additional information regarding performance and comparisons to other indexes. All comparisons assume reinvested dividends.

The performance data quoted above represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling (855) OK-GOODX or (855) 654-6639.

2016 was a good year for Fund performance as a number of important holdings rebounded from lows set early in the year. Still, it was a difficult year for many fund managers and the last two years have seen enormous industry reallocations away from actively managed mutual funds and into passively managed index funds (including ETFs). We believe the industry may be approaching an inflection point (at least in the intermediate term) where that trend will slow or perhaps reverse. As with almost all trends on Wall Street, we suspect the intense desire for index products is rearward looking, has gone too far, and may lead to significant investor losses in coming years.

The portfolio managers believe that short-term performance figures are less meaningful than a comparison of longer periods and that a long-term investment strategy should be properly judged over a period of years rather than weeks or months. Furthermore, the S&P 500 Index is an unmanaged index incurring no fees, expenses, or taxes and is shown solely for the purpose of comparing the Fund’s portfolio to an unmanaged and diversified index of large companies.

GoodHaven Fund

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited) (Continued) |

Below is a table of the Fund’s top ten holdings and categories as of November 30, 2016.1

Top 10 Holdings* | % | | Top Categories** | % |

| WPX Energy, Inc.*** | 14.8% | | Cash and Equivalents | 22.2% |

| Barrick Gold Corp. | 10.0% | | Oil & Gas Exploration | |

| Alphabet, Inc.*** | 5.8% | | & Production | 19.1% |

| Birchcliff Energy Ltd. | 4.3% | | Metals & Mining | 10.0% |

| White Mountains | | | Computers & | |

| Insurance Group | 4.1% | | Peripheral Equipment | 7.7% |

| Leucadia National Corp. | 3.9% | | Diversified Holding Companies | 7.2% |

| Hewlett Packard Enterprise Co. | 3.8% | | Property/Casualty Insurance | 5.9% |

| Walter Investment | | | Computer & Internet Software | 5.8% |

| Management Corp. | 3.4% | | Retailing | 4.3% |

| Spectrum Brands Holdings, Inc. | 3.3% | | Loan Servicing | 3.4% |

| Staples, Inc. | 3.3% | | Consumer Products | 3.3% |

| Total | 56.7% | | | 88.9% |

| * | | Top ten holdings excludes cash, money market funds and Government and Agency Obligations |

| ** | | Where applicable, includes money market funds and short-term Government and Agency Obligations |

| *** | | Issuer totals |

1 | | Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

While the Fund experienced significant net withdrawals late in 2015 and early 2016 that reduced assets, a combination of positive performance and modest inflows in recent weeks left assets roughly the same at fiscal year-end 2016 compared to 2015. Should relative performance continue to improve, we would expect the Fund to begin to draw new net inflows. Nevertheless, since inception of the Fund, there have been periods where there were large new shareholder subscriptions and periods with significant net withdrawals. We believe this is primarily caused by shareholders who are attracted by the potential for better performance in a concentrated value fund but which are negatively and emotionally affected by volatility in results – resulting in short-term behavior that tends to reduce returns among mutual fund investors. It may be interesting to note that neither of the portfolio managers of the Fund, whose shareholdings total in the millions of dollars, has ever sold shares of the Fund.

Material swings in shareholder subscriptions and redemptions can make management of the portfolio more difficult. During the most recent fiscal year, the portfolio managers were able to undertake actions to avoid creating taxable gains during 2016 without materially affecting portfolio values. The Fund’s investments are stated as of November 30, 2016, and the amounts and rankings of the Fund’s holdings today may vary significantly from the data disclosed above and the managers may have taken actions that would result in material changes to the portfolio.

GoodHaven Fund

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited) (Continued) |

The Fund’s investments having the most positive impact on portfolio performance for the annual period ended November 30, 2016 were WPX Energy, Barrick Gold, Birchcliff Energy, Hewlett Packard Enterprise, Spectrum Brands, HP Inc., and Leucadia National. WPX rose as oil prices rebounded and the company continued to make progress on its strategic and operational initiatives; Barrick rose in response to higher prices for both gold and copper, as well as further debt reduction and lowered operating costs; Hewlett Packard Enterprise increased in response to a number of capital transactions effecting spin-out mergers while also repurchasing shares; Spectrum rose as it continued its record of growth while offering value to consumers and retailers; HP Inc. increased as personal computer revenues stabilized even as printer sales and supplies were weak; and Leucadia rose in response to a turn-around at its two largest business units as well as a rate increase late in the year.

The Fund’s investments having the most negative impact on the portfolio for the annual period ended November 30, 2016 were Walter Investment Management, Sears Holdings, Staples, Inc., and miscellaneous securities not previously disclosed. During the year, Walter fell as it continued to struggle with high operating and regulatory costs, despite replacing key management and adding shareholders to the Board; Sears Holdings fell as it continued to experience dismal retail results despite additional capital transactions to increase liquidity; Staples fell after its transaction to acquire Office Depot was ruled a violation of anti-trust law; and the Fund also saw realized losses from a number of modestly sized hedge transactions intended to reduce overall market risk during the year.

During the period, the Fund disposed of its investments in Colfax Corporation within a few months of purchase as it rose sharply almost immediately after purchase early in 2016 and reached our estimate of fair value.

The managers of the Fund do not believe that a decline in a security price necessarily means that the security is a less attractive investment. The opposite may be the case in that price declines may represent significant investment opportunities. During fiscal 2016, the largest single factors affecting performance was a significant recovery in oil and metals prices, as well as fundamental developments related to specific holdings in these areas. These gains occurred despite a fairly rapid rise of the U.S. dollar during the year, which tends to depress commodity prices as well as the revenues of companies that generate significant sales in non-U.S. jurisdictions as well as translation losses from securities that are denominated in currencies other than the U.S. dollar. The portfolio managers generally do not try to predict macroeconomic or market swings and prefer instead to try to react to what happens.

The Fund’s turnover rate, a measure of how frequently assets within a fund are bought and sold by the managers, remains at reasonably low levels and is consistent with the strategies, generally long-term in nature, of GoodHaven Capital Management, the Fund’s investment advisor. Turnover rates in fiscal 2016 were

GoodHaven Fund

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited) (Continued) |

modestly influenced by the need to meet shareholder redemptions rather than a change in the portfolio strategy of the Fund. Compared to most funds, turnover remains low. Importantly, there may be times when turnover rates rise, however, we do not anticipate rapid turnover of the portfolio under normal circumstances.

The portfolio managers believe that a significant liquidity position is an important part of portfolio management. Since inception, the Fund has continued to have significant liquidity available both in cash holdings as well as short-term fixed income investments. As a result of shareholder redemptions, liquidity has been somewhat reduced from the high points of the last couple of years. In order to ensure that we have sufficient resources to behave opportunistically, the Fund has sold or reduced certain investments and may hold some modest hedges from time to time. There is no guarantee that such hedges will protect against loss and the Fund may lose money should volatility be reduced in future months. In the last year, the Fund experienced modest losses as a result of hedge transactions. Over time, we expect the Fund’s level of cash to vary significantly and could be higher or lower than shown on the most recent Schedule of Investments.

As of the end of the fiscal year, the Fund is operating with a significant position in cash and equivalent investments. This position reflects high average equity valuations, the opportunity set we see, and other factors. Additionally, the continued rise in general stock prices has made bargains more difficult to find and slowed reinvestment, with some measures of valuation bumping up against historic highs. We believe that having a cash cushion at a time of generally elevated prices and investor ebullience is a strategic and tactical advantage. Although not obvious in results, cash has allowed us to meet redemptions in an efficient manner while mostly avoiding forced liquidation of investments.

It is our intention to invest a significant portion of current liquidity in an opportunistic manner when bargains meeting our investment criteria appear. However, it is possible that the Fund may have a significant cash position for an extended period of time if, in the opinion of the portfolio managers, market conditions are unfavorable. At times when liquidity is high, the Fund may underperform a strongly rising stock market. We note that although the Fund had significant liquidity during the period from Inception in April 2011 through May of 2014 (including a sizeable amount related to a large cash influx due to new Fund share subscriptions), performance was still reasonable by relative and absolute standards over that time frame. In the last year, the Fund significantly outperformed most equity indexes, despite having significant liquidity during a period when indexes significantly appreciated. The portfolio managers’ letter to shareholders contains additional discussion about performance.

Generally, we do not expect significant realized capital gain or loss from any particular short-term, non-U.S. investments when viewed over an extended period. However, during fiscal 2016, the dollar strengthened and we own or have acquired a

GoodHaven Fund

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited) (Continued) |

number of equity investments domiciled outside of the U.S. or with significant non-U.S. revenues. A strong dollar typically results in currency translation losses and may serve to reduce reported earnings of companies with significant non-U.S. revenues when reported in dollar terms. Such reduced earnings could negatively affect those companies’ market prices, although we would expect such negative effects to be primarily a short-term phenomenon.

To reiterate our view on liquidity, the portfolio managers believe that a certain amount of liquidity may benefit shareholders in several ways – by preventing liquidation of securities to meet modest levels of redemptions, by providing ammunition to purchase existing or new holdings in declining markets without being forced to sell existing holdings, and by lessening the chance that shareholders will blindly seek liquidations during periods of market stress that could adversely impact the Fund. That said, if bargains meeting our criteria seem plentiful, we are likely to have significantly less liquidity under such conditions than has been the case since inception.

The Fund is subject to certain risks as disclosed in the Prospectus and Statement of Additional Information, both of which may be obtained from the Fund’s website at www.goodhavenfunds.com or by calling 1-855-654-6639. Some of these risks include, but are not limited to, adverse market conditions that negatively affect the price of securities owned by the Fund, a high level of cash, which may result in underperformance during periods of robust price appreciation, adverse movements in foreign currency relationships as a number of the Fund’s holdings have earnings resulting from operations outside the United States, and the fact that the Fund is non-diversified, meaning that its holdings are more concentrated than a diversified Fund and that adverse price movements in a particular security may affect the Fund’s Net Asset Value more negatively than would occur in a more diversified fund.

As of November 30, 2016, the members, officers, and employees of GoodHaven Capital Management, LLC, the investment advisor to the GoodHaven Fund, owned approximately 249,878 shares of the Fund. The portfolio managers added to personal holdings during the fiscal year. It is management’s intention to disclose such holdings (in the aggregate) in this section of the Fund’s Annual and Semi-Annual reports on an ongoing basis.

GoodHaven Fund

SECTOR ALLOCATION at November 30, 2016 (Unaudited) |

| | Sector | | % of Net Assets |

| | | | | |

| | Cash & Equivalents1 | | | 22.2 | % |

| | Oil & Gas Exploration & Production2 | | | 19.1 | % |

| | Metals & Mining | | | 10.0 | % |

| | Computers & Peripheral Equipment | | | 7.7 | % |

| | Diversified Holdings Companies | | | 7.2 | % |

| | Property/Casualty Insurance | | | 5.9 | % |

| | Computer & Internet Software | | | 5.8 | % |

| | Retailing | | | 4.3 | % |

| | Loan Servicing | | | 3.4 | % |

| | Consumer Products | | | 3.3 | % |

| | Financial Services | | | 2.9 | % |

| | Telecommunications | | | 2.8 | % |

| | Guernsey Investment Fund | | | 2.4 | % |

| | Marine Services & Equipment | | | 1.7 | % |

| | Real Estate Investment Trusts | | | 1.2 | % |

| | Miscellaneous | | | 0.1 | % |

| | Total | | | 100.0 | % |

1 | Represents cash and other assets in excess of liabilities. |

2 | Including Call Options Written, sector weighting is 19.0%. |

GoodHaven Fund

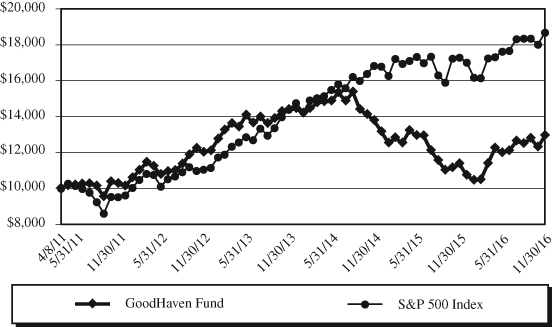

HISTORICAL PERFORMANCE (Unaudited) |

Value of $10,000 vs. S&P 500 Index

Average Annual Total Returns

Periods Ended November 30, 2016

| | | | | Annualized | Value of |

| | One | Three | Five | Since Inception | $10,000 |

| | Year | Year | Year | (4/8/2011) | (11/30/2016) |

| GoodHaven Fund | 13.89% | -3.46% | 4.75% | 4.67% | $12,940 |

| S&P 500 Index | 8.06% | 9.07% | 14.45% | 11.71% | $18,692 |

This chart illustrates the performance of a hypothetical $10,000 investment made on April 8, 2011 (the Fund’s inception) and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The chart assumes reinvestment of capital gains and dividends, but does not reflect redemption fees of 2.00% on shares held less than 60 days.

GoodHaven Fund

SCHEDULE OF INVESTMENTS at November 30, 2016 |

| Shares | | Common Stocks – 73.7% | | Value | |

| | | | | | |

| | | Computer & Internet Software – 5.8% | | | |

| | 9,000 | | Alphabet, Inc. – Class A1 | | $ | 6,982,920 | |

| | 11,500 | | Alphabet, Inc. – Class C1 | | | 8,717,460 | |

| | | | | | | 15,700,380 | |

| | | | | | | | |

| | | | Computers & Peripheral Equipment – 7.7% | | | | |

| | 433,400 | | Hewlett Packard Enterprise Co. | | | 10,314,920 | |

| | 498,400 | | HP Inc. | | | 7,675,360 | |

| | 343,742 | | Systemax, Inc.2 | | | 2,969,931 | |

| | | | | | | 20,960,211 | |

| | | | | | | | |

| | | | Consumer Products – 3.3% | | | | |

| | 75,000 | | Spectrum Brands Holdings, Inc. | | | 8,991,750 | |

| | | | | | | | |

| | | | Diversified Holding Companies – 7.2% | | | | |

| | 29,200 | | Berkshire Hathaway, Inc. – Class B1 | | | 4,597,248 | |

| | 1,035,320 | | Dundee Corp.1,2 | | | 4,454,813 | |

| | 477,512 | | Leucadia National Corp. | | | 10,514,814 | |

| | | | | | | 19,566,875 | |

| | | | | | | | |

| | | | Financial Services – 2.9% | | | | |

| | 290,300 | | Federated Investors, Inc. – Class B | | | 7,980,347 | |

| | | | | | | | |

| | | | Loan Servicing – 3.4% | | | | |

| | 1,613,429 | | Walter Investment Management Corp.1,3 | | | 9,196,545 | |

| | | | | | | | |

| | | | Marine Services & Equipment – 1.7% | | | | |

| | 376,694 | | Stolt-Nielsen Ltd.2 | | | 4,490,931 | |

| | | | | | | | |

| | | | Metals & Mining – 10.0% | | | | |

| | 1,802,150 | | Barrick Gold Corp. | | | 27,068,293 | |

| | | | | | | | |

| | | | Oil & Gas Exploration & Production – 18.7% | | | | |

| | 1,718,100 | | Birchcliff Energy Ltd.1 | | | 11,613,450 | |

| | 2,530,055 | | WPX Energy, Inc.1 | | | 39,317,055 | |

| | | | | | | 50,930,505 | |

| | | | | | | | |

| | | | Property/Casualty Insurance – 5.9% | | | | |

| | 8,482 | | Alleghany Corp.1 | | | 4,817,352 | |

| | 13,411 | | White Mountains Insurance Group | | | 11,224,605 | |

| | | | | | | 16,041,957 | |

| | | | | | | | |

| | | | Retailing – 4.3% | | | | |

| | 218,000 | | Sears Holdings Corp.1 | | | 2,807,840 | |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

SCHEDULE OF INVESTMENTS at November 30, 2016 (Continued) |

| Shares | | COMMON STOCKS – 73.7% (Continued) | | Value | |

| | | | | | |

| | | Retailing – 4.3% (Continued) | | | |

| | 921,900 | | Staples, Inc. | | $ | 8,914,773 | |

| | | | | | | 11,722,613 | |

| | | | | | | | |

| | | | Telecommunications – 2.8% | | | | |

| | 150,000 | | Verizon Communications, Inc. | | | 7,485,000 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $189,055,214) | | | 200,135,407 | |

| | | | | | | | |

| | | | GUERNSEY INVESTMENT FUND – 2.4% | | | | |

| | 1,036,487 | | JZ Capital Partners Limited2 | | | 6,575,065 | |

| | | | TOTAL GUERNSEY INVESTMENT FUND | | | | |

| | | | (Cost $5,910,842) | | | 6,575,065 | |

| | | | | | | | |

| | | | REAL ESTATE INVESTMENT TRUSTS – 1.2% | | | | |

| | 68,058 | | Seritage Growth Properties | | | 3,242,283 | |

| | | | TOTAL REAL ESTATE INVESTMENT TRUSTS | | | | |

| | | | (Cost $2,635,891) | | | 3,242,283 | |

| | | | | | | | |

| Principal | | | | | | |

| Amount | | CORPORATE BONDS – 0.4% | | | | |

| | | | | | | | |

| | | | Oil & Gas Exploration & Production – 0.4% | | | | |

| $ | 1,000,000 | | WPX Energy, Inc. 5.250% due 1/15/2017 | | | 1,001,875 | |

| | | | TOTAL CORPORATE BONDS | | | | |

| | | | (Cost $990,052) | | | 1,001,875 | |

| | | | | | | | |

| | | | MISCELLANEOUS SECURITIES – 0.1%1,4 | | | | |

| | | | TOTAL MISCELLANEOUS SECURITIES | | | | |

| | | | (Cost $754,410) | | | 331,500 | |

| | | | Total Investments | | | | |

| | | | (Cost $199,346,409) – 77.8% | | | 211,286,130 | |

| | | | Cash and Other Assets in | | | | |

| | | | Excess of Liabilities – 22.2% | | | 60,353,532 | |

| | | | TOTAL NET ASSETS – 100.0% | | $ | 271,639,662 | |

1 | Non-income producing security. |

2 | A portion of this security is considered illiquid. As of November 30, 2016, the total market value of illiquid securities was $14,462,195 or 5.3% of net assets. |

3 | Affiliated company as defined by the Investment Company Act of 1940. |

4 | Represents previously undisclosed securities which the Fund has held for less than one year. |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

SCHEDULE OF OPTIONS WRITTEN at November 30, 2016 |

| Contracts | | | | | |

| (100 shares | | | | | |

| per contract) | | CALL OPTIONS WRITTEN | | Value | |

| | | | | | |

| | | Oil & Gas Exploration & Production – 0.1% | | | |

| | 1,000 | | WPX Energy, Inc. Expiration: January 2017, | | | |

| | | | Exercise Price: $15.001 | | $ | 155,000 | |

| | | | TOTAL CALL OPTIONS WRITTEN | | | | |

| | | | (Proceeds $114,199) | | $ | 155,000 | |

Percentage based on net assets.

1 | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

STATEMENT OF ASSETS AND LIABILITIES at November 30, 2016 |

| ASSETS | | | |

| Investments in unaffiliated securities, at value | | | |

| (Cost $165,260,901) | | $ | 202,089,585 | |

| Investments in securities of affiliated issuers, at value | | | | |

| (Cost $34,085,508) | | | 9,196,545 | |

| Total investments, at value (Cost $199,346,409) (Note 2) | | | 211,286,130 | |

| | | | | |

| Cash | | | 60,167,006 | |

| Receivables: | | | | |

| Fund shares sold | | | 455,402 | |

| Dividends and interest | | | 239,065 | |

| Total assets | | | 272,147,603 | |

| | | | | |

| LIABILITIES | | | | |

| Options written, at value (Proceeds received $114,199) | | | 155,000 | |

| Payables: | | | | |

| Fund shares redeemed | | | 116,504 | |

| Management fees | | | 193,448 | |

| Support services fees | | | 42,989 | |

| Total liabilities | | | 507,941 | |

| | | | | |

| NET ASSETS | | $ | 271,639,662 | |

| | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| Paid-in capital | | $ | 262,761,153 | |

| Accumulated net investment loss | | | (1,137,293 | ) |

| Accumulated net realized loss on investments | | | (1,883,118 | ) |

| Net unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 11,939,721 | |

| Options written | | | (40,801 | ) |

| Net assets | | $ | 271,639,662 | |

| | | | | |

| Net Asset Value (unlimited shares authorized): | | | | |

| Net assets | | $ | 271,639,662 | |

| Shares of beneficial interest issued and outstanding | | | 11,623,100 | |

| Net asset value, offering and redemption price per share | | $ | 23.37 | |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

STATEMENT OF OPERATIONS For the Year Ended November 30, 2016 |

| INVESTMENT INCOME | | | |

| Dividends from unaffiliated securities | | | |

| (net of $22,196 in foreign withholding taxes) | | $ | 2,865,931 | |

| Interest | | | 164,765 | |

| Total investment income | | | 3,030,696 | |

| | | | | |

| EXPENSES | | | | |

| Management fees | | | 2,329,230 | |

| Support services fees | | | 517,607 | |

| Total expenses | | | 2,846,837 | |

| Net investment income | | | 183,859 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, | | | | |

| OPTIONS WRITTEN & FOREIGN CURRENCY | | | | |

| Net realized gain (loss) on transactions from: | | | | |

| Unaffiliated investments & foreign currency | | | 1,298,167 | |

| Affiliated investments | | | (2,113,819 | ) |

| Options written | | | 198,079 | |

| Net realized loss | | | (617,573 | ) |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments | | | 35,228,114 | |

| Options written | | | (40,801 | ) |

| Net unrealized appreciation | | | 35,187,313 | |

| Net realized and unrealized gain | | | 34,569,740 | |

| Net increase in net assets resulting from operations | | $ | 34,753,599 | |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | November 30, 2016 | | | November 30, 2015 | |

| INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | |

| | | | | | | |

| OPERATIONS | | | | | | |

| Net investment income | | $ | 183,859 | | | $ | 184,796 | |

| Net realized gain (loss) on unaffiliated | | | | | | | | |

| investments, affiliated investments, | | | | | | | | |

| options written & foreign currency | | | (617,573 | ) | | | 2,160,801 | |

| Change in unrealized appreciation/ | | | | | | | | |

| depreciation on investments, options | | | | | | | | |

| written & foreign currency | | | 35,187,313 | | | | (63,929,472 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | 34,753,599 | | | | (61,583,875 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net realized gain | | | — | | | | (25,958,120 | ) |

| Total distributions to shareholders | | | — | | | | (25,958,120 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Net decrease in net assets derived from | | | | | | | | |

net change in outstanding shares1 | | | (30,963,999 | ) | | | (88,302,552 | ) |

| Total increase (decrease) in net assets | | | 3,789,600 | | | | (175,844,547 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 267,850,062 | | | | 443,694,609 | |

| End of year | | $ | 271,639,662 | | | $ | 267,850,062 | |

| Accumulated net investment loss | | $ | (1,137,293 | ) | | $ | (2,537,749 | ) |

1 | Summary of capital share transactions is as follows: |

| | | | Year Ended | | | Year Ended | |

| | | | November 30, 2016 | | | November 30, 2015 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Shares sold | | | 2,248,759 | | | $ | 44,719,478 | | | | 5,005,468 | | | $ | 111,749,266 | |

| | Shares issued in | | | | | | | | | | | | | | | | |

| | reinvestment | | | | | | | | | | | | | | | | |

| | of distributions | | | — | | | | — | | | | 1,018,626 | | | | 24,956,339 | |

| | Shares redeemed2 | | | (3,678,675 | ) | | | (75,683,477 | ) | | | (9,544,663 | ) | | | (225,008,157 | ) |

| | Net decrease | | | (1,429,916 | ) | | $ | (30,963,999 | ) | | | (3,520,569 | ) | | $ | (88,302,552 | ) |

2 | Net of redemption fees of $8,723 and $87,839, respectively. |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each year |

| | | Year Ended November 30, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| Net asset value at | | | | | | | | | | | | | | | |

| beginning of year | | $ | 20.52 | | | $ | 26.77 | | | $ | 28.26 | | | $ | 24.00 | | | $ | 20.52 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment | | | | | | | | | | | | | | | | | | | | |

income (loss)1 | | | 0.02 | | | | 0.01 | | | | (0.03 | ) | | | 0.02 | | | | 0.21 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 2.83 | | | | (4.40 | ) | | | (1.16 | ) | | | 4.65 | | | | 3.29 | |

| Total from | | | | | | | | | | | | | | | | | | | | |

| investment operations | | | 2.85 | | | | (4.39 | ) | | | (1.19 | ) | | | 4.67 | | | | 3.50 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | — | | | | — | | | | — | | | | (0.32 | ) | | | (0.01 | ) |

| From net realized gain | | | — | | | | (1.87 | ) | | | (0.30 | ) | | | (0.09 | ) | | | (0.01 | ) |

| Total distributions | | | — | | | | (1.87 | ) | | | (0.30 | ) | | | (0.41 | ) | | | (0.02 | ) |

| Paid-in capital from | | | | | | | | | | | | | | | | | | | | |

| redemption fees | | | 0.00 | 2 | | | 0.01 | | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | | | | | | | |

| end of year | | $ | 23.37 | | | $ | 20.52 | | | $ | 26.77 | | | $ | 28.26 | | | $ | 24.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 13.89 | % | | | (17.49 | )% | | | (4.26 | )% | | | 19.74 | % | | | 17.08 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA/RATIOS | | | | | | | | | | | | | | | | | | | | |

| Net assets at end | | | | | | | | | | | | | | | | | | | | |

| of year (millions) | | $ | 271.6 | | | $ | 267.9 | | | $ | 443.7 | | | $ | 553.5 | | | $ | 223.7 | |

| Portfolio turnover rate | | | 8 | % | | | 18 | % | | | 37 | % | | | 12 | % | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % |

| Ratio of net investment | | | | | | | | | | | | | | | | | | | | |

| income (loss) | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 0.07 | % | | | 0.06 | % | | | (0.11 | )% | | | 0.08 | % | | | 0.92 | % |

1 | Calculated using the average shares outstanding method. |

2 | Amount does not round to $0.01 per share. |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

NOTES TO FINANCIAL STATEMENTS November 30, 2016 |

The GoodHaven Funds Trust (the “Trust”) was organized as a Delaware Statutory trust on December 18, 2015, and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a non-diversified, open-end management investment company. The GoodHaven Fund (the “Fund”), previously part of another investment company, Professionally Managed Portfolios, reorganized effective as of the close of business on March 30, 2016. See Note 2 for a discussion of the results of the special meeting of shareholders in which the reorganization was approved. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies.” The Fund commenced operations on April 8, 2011.

The Fund’s investment objective is to seek long-term growth of capital.

| NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

| | A. | Security Valuation. All equity securities that are traded on U.S. national or foreign securities exchanges, are valued at either the last reported sale price on the exchange on which the security is principally traded or the exchange’s official closing price, if applicable. If, on a particular day, an exchange-traded security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities that are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. If a non-exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used. |

| | | |

| | | Debt securities are valued by using the mean between the closing bid and asked prices provided by an independent pricing service. If the closing bid and asked prices are not readily available, the independent pricing service may provide a price determined by a matrix pricing method. These techniques generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings and general market conditions. In the absence of a price from a pricing service, securities are valued at their respective fair values in accordance with policies approved by the Valuation Committee of the Trust. |

| | | |

| | | Exchange traded options are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the |

GoodHaven Fund

NOTES TO FINANCIAL STATEMENTS November 30, 2016 (Continued) |

| | | highest bid price and lowest ask price across any of the exchanges on which an option is quoted, thus providing a view across the entire U.S. options marketplace. Composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded. |

| | | |

| | | Securities for which quotations are not readily available are valued at their respective fair values as determined in accordance with policies approved by the Valuation Committee of the Trust. When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the pricing procedures adopted by the Board of Trustees. Fair value pricing is an inherently subjective process, and no single standard exists for determining fair value. Different funds could reasonably arrive at different values for the same security. The use of fair value pricing by a fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without regard to such considerations. |

| | | |

| | | As described above, the Fund utilizes various methods to measure the fair value of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are: |

| | | Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | | | |

| | | Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | | | |

| | | Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

| | | The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. |

GoodHaven Fund

NOTES TO FINANCIAL STATEMENTS November 30, 2016 (Continued) |

| | | The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety. |

| | | |

| | | The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2016. See the Schedule of Investments for the industry breakouts. |

| | | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | Common Stocks | | $ | 200,135,407 | | | $ | — | | | $ | — | | | $ | 200,135,407 | |

| | | Guernsey | | | | | | | | | | | | | | | | |

| | | Investment Fund | | | 6,575,065 | | | | — | | | | — | | | | 6,575,065 | |

| | | Real Estate | | | | | | | | | | | | | | | | |

| | | Investment Trusts | | | 3,242,283 | | | | — | | | | — | | | | 3,242,283 | |

| | | Corporate Bonds | | | — | | | | 1,001,875 | | | | — | | | | 1,001,875 | |

| | | Miscellaneous | | | | | | | | | | | | | | | | |

| | | Securities | | | — | | | | 331,500 | | | | — | | | | 331,500 | |

| | | Total Investments | | $ | 209,952,755 | | | $ | 1,333,375 | | | $ | — | | | $ | 211,286,130 | |

| | | Liabilities | | | | | | | | | | | | | | | | |

| | | Call Options Written | | $ | — | | | $ | 155,000 | | | $ | — | | | $ | 155,000 | |

| | | It is the Fund’s policy to recognize transfers between levels at the end of the Fund’s reporting period. |

| | | |

| | | There were no transfers into or out of Level 1 or 2 during the year ended November 30, 2016. |

| | | |

| | | The Fund has adopted financial reporting rules and regulations that require enhanced disclosure regarding derivatives and hedging activity intending to improve financial reporting of derivative instruments by enabling investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivative instruments affect an entity’s results of operations and financial position. |

| | | |

| | | The Fund may invest, at the time of purchase, up to 10% of the Fund’s net assets in options, which are a type of derivative and employ specialized trading techniques such as options trading to increase the Fund’s exposure to certain selected securities. The Fund may employ these techniques as hedging tools as well as speculatively to enhance returns. Other than when used for hedging, these techniques may be riskier than many investment strategies and may result in greater volatility for the Fund, particularly in periods of market declines. As a hedging tool, options may help cushion the impact of market declines, but may reduce the Fund’s participation in a market advance. |

GoodHaven Fund

NOTES TO FINANCIAL STATEMENTS November 30, 2016 (Continued) |

| | | Balance Sheet |

| | | |

| | | Fair values of derivative instruments as of November 30, 2016: |

| | | | Asset Derivatives as of | | Liability Derivatives as of | |

| | | | November 30, 2016 | | November 30, 2016 | |

| | | Derivative | Balance Sheet | | Fair | | Balance Sheet | | Fair | |

| | | Instruments | Location | | Value | | Location | | Value | |

| | | Equity Contracts: | | | | | | | | |

| | | Call Options | | | | | Written Options, | | | |

| | | Written | None | | $ | — | | at value | | $ | 155,000 | |

| | | Put Options | Investments in | | | | | | | | | |

| | | Purchased | securities, at value | | | 331,500 | | None | | | — | |

| | | Total | | | $ | 331,500 | | | | $ | 155,000 | |

| | | Statement of Operations |

| | | |

| | | The effect of derivative instruments on the Statement of Operations for the year ended November 30, 2016: |

| | | | | | | Change in | |

| | Location of | | Realized | | | Unrealized | |

| | Gain (Loss) | | Gain (Loss) | | | Appreciation/ | |

| | on Derivatives | | on Derivatives | | | Depreciation | |

| Derivative | Recognized | | Recognized | | | on Derivatives | |

Instruments | in Income | | in Income | | | in Income | |

| Equity Contracts: | | | | | | | |

| Call Options | Realized and | | | | | | |

| Written | Unrealized | | | | | | |

| | Gain (Loss) | | | | | | |

| | on Investments, | | | | | | |

| | Options Written & | | | | | | |

| | Foreign Currency | | $ | 198,079 | | | $ | (40,801 | ) |

| | | | | | | | | | |

| Put Options | Realized and | | | | | | | | |

| Purchased | Unrealized | | | | | | | | |

| | Gain (Loss) on | | | | | | | | |

| | Investments, | | | | | | | | |

| | Options Purchased & | | | | | | | | |

| | Foreign Currency | | $ | (3,589,856 | ) | | $ | 256,070 | |

| | B. | Foreign Currency. Foreign currency amounts, other than the cost of investments, are translated into U.S. dollar values based upon the spot exchange rate prior to the close of regular trading. The cost of investments is translated at the rates of exchange prevailing on the dates the portfolio securities were acquired. The Fund includes foreign exchange gains and losses from dividends receivable and other foreign currency denominated |

GoodHaven Fund

NOTES TO FINANCIAL STATEMENTS November 30, 2016 (Continued) |

| | | payables and receivables in realized and unrealized gain (loss) on investments and foreign currency. The Fund does not isolate that portion of realized gain (loss) or unrealized gain (loss) on investments resulting from changes in foreign exchange rates on investments from fluctuations arising from changes in the market price of securities for financial reporting purposes. Fluctuations in foreign exchange rates on investments are thus included with net realized gain (loss) on investments and foreign currency and with net unrealized gain (loss) on investments and foreign currency. |

| | | |